SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Exact name of registrant as specified in charter)

(Address of principal executive offices) (Zip code)

(Name and address of agent for service)

|

2017

YTD |

Sept. 1, 2016 to

Aug. 31, 2017

|

Sept. 1, 2015 to

Aug. 31, 2016

|

Annualized Since Inception on July 1, 2014 to Aug. 31, 2017

|

|

|

Class I Shares

|

-3.53%

|

-5.00%

|

-1.68%

|

4.41%

|

|

Class A Shares*

|

-3.63%

|

-5.18%

|

-1.94%

|

4.16%*

|

|

Class A Shares (max load)*

|

-9.19%

|

-10.65%

|

-7.56%

|

2.23%*

|

|

Class C Shares**

|

-4.17%

|

-5.89%

|

-2.64%

|

3.39%**

|

|

BofA Merrill Lynch 3-Month T-Bill Index

|

0.48%

|

0.62%

|

0.23%

|

0.28%

|

|

S&P 500® Total Return Index

|

11.93%

|

16.23%

|

12.55%

|

9.90%

|

|

Barclay CTA Index

|

-0.54%

|

-2.14%

|

0.21 %

|

1.09%

|

|

*

|

Performance figures for Class A Shares include the performance of Class I Shares from July 1, 2014 to August 29, 2014, adjusted for the fees and expenses of Class A Shares. Returns for Class A Shares with load reflect a deduction for the maximum front-end sales charge of 5.75%.

|

|

**

|

Class C Shares performance prior to its inception on October 6, 2015, is the performance of Class I Shares, adjusted for the Class C Shares expense ratio.

|

|

Key to Currency Abbreviations

|

|

|

AUD

|

Australian Dollar

|

|

BRL

|

Brazilian Real

|

|

CAD

|

Canadian Dollar

|

|

CHF

|

Swiss Franc

|

|

EUR

|

Euro

|

|

GBP

|

British Pound Sterling

|

|

JPY

|

Japanese Yen

|

|

MXN

|

Mexican Peso

|

|

NOK

|

Norwegian Krone

|

|

PLN

|

Polish Zloty

|

|

TRY

|

Turkish Lira

|

|

USD

|

US Dollar

|

|

ZAR

|

South African Rand

|

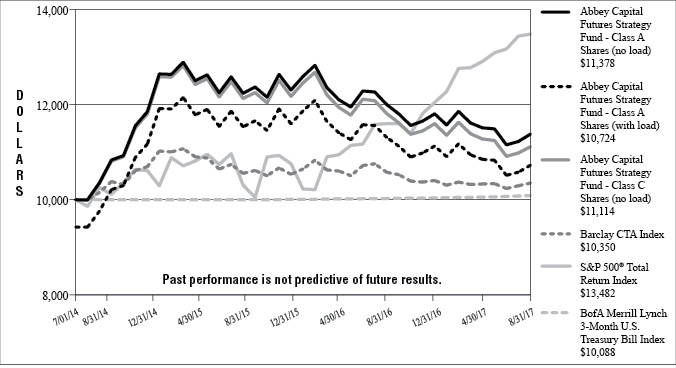

vs. BofA Merrill Lynch 3-Month U.S. Treasury Bill Index, S&P 500® Total Return Index and Barclay CTA Index

|

Average Annual Total Returns for the Periods Ended August 31, 2017

|

||||

|

One

Year |

Three

Year |

Since

Inception† |

||

|

Abbey Capital Futures Strategy Fund, Class A Shares (without sales charge)

(Pro forma July 1, 2014 to August 29, 2014)

|

-5.18%

|

3.19%

|

4.16%*

|

|

|

Abbey Capital Futures Strategy Fund, Class A Shares (with sales charge)

(Pro forma July 1, 2014 to August 29, 2014) |

-10.65%

|

1.18%

|

2.23%*

|

|

|

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index

|

0.62%

|

0.29%

|

0.28%**

|

|

|

S&P 500® Total Return Index

|

16.23%

|

9.54%

|

9.90%**

|

|

|

Barclay CTA Index

|

-2.14%

|

0.64%

|

1.09%**

|

|

|

Abbey Capital Futures Strategy Fund, Class C Shares

(Pro forma July 1, 2014 to October 6, 2015) |

-5.89%

|

N/A

|

3.39%***

|

|

|

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index

|

0.62%

|

0.29%

|

0.28%**

|

|

|

S&P 500® Total Return Index

|

16.23%

|

9.54%

|

9.90%**

|

|

|

Barclay CTA Index

|

-2.14%

|

0.64%

|

1.09%**

|

|

|

†

|

Inception dates of Class A Shares and Class C Shares of the Fund were August 29, 2014 and October 6, 2015, respectively.

|

|

*

|

Class A Shares performance prior to its inception on August 29, 2014 is the performance of Class I Shares, adjusted for the Class A Shares expense ratio.

|

|

**

|

Performance is from the inception date of the Fund and is not the inception date of the index itself. The above is shown for illustrative purposes only the Fund is not benchmarked against any of the indices referenced.

|

|

***

|

Class C Shares performance prior to its inception on October 6, 2015 is the performance of Class I Shares, adjusted for the Class C Shares expense ratio.

|

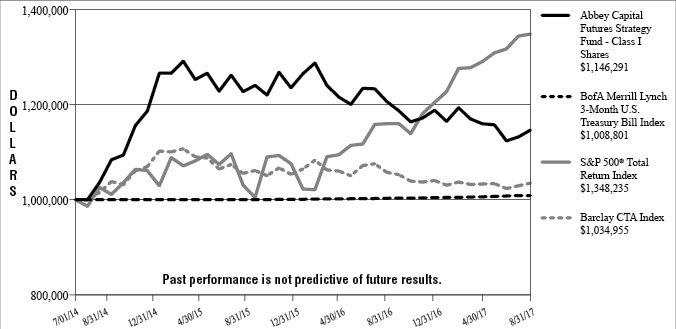

vs. BofA Merrill Lynch 3-Month U.S. Treasury Bill Index, S&P 500® Total Return Index and Barclay CTA Index

|

Average Annual Total Returns for the Periods Ended August 31, 2017

|

||||

|

One

Year |

Three

Year |

Since

Inception† |

||

|

Abbey Capital Futures Strategy Fund, Class I Shares

|

-5.00%

|

3.43%

|

4.41%

|

|

|

BofA Merrill Lynch 3-Month U.S. Treasury Bill Index

|

0.62%

|

0.29%

|

0.28%*

|

|

|

S&P 500® Total Return Index

|

16.23%

|

9.54%

|

9.90%*

|

|

|

Barclay CTA Index

|

-2.14%

|

0.64%

|

1.09%*

|

|

|

†

|

Inception date of Class I Shares of the Fund was July 1, 2014.

|

|

*

|

Benchmark performance is from the inception date of Class I Shares only and is not the inception date of the benchmark itself.

|

|

Class A Shares

|

|||

|

Beginning

Account Value March 1, 2017 |

Ending

Account Value August 31, 2017 |

Expenses Paid

During Period* |

|

|

Actual

|

$1,000.00

|

$ 959.60

|

$10.08

|

|

Hypothetical (5% return before expenses)

|

1,000.00

|

1,014.92

|

10.36

|

|

Class I Shares

|

|||

|

Beginning

Account Value March 1, 2017 |

Ending

Account Value August 31, 2017 |

Expenses Paid

During Period** |

|

|

Actual

|

$1,000.00

|

$ 960.60

|

$8.85

|

|

Hypothetical (5% return before expenses)

|

1,000.00

|

1,016.18

|

9.10

|

|

Class C Shares

|

|||

|

Beginning

Account Value March 1, 2017 |

Ending

Account Value August 31, 2017 |

Expenses Paid

During Period*** |

|

|

Actual

|

$1,000.00

|

$ 955.80

|

$13.75

|

|

Hypothetical (5% return before expenses)

|

1,000.00

|

1,011.14

|

14.14

|

|

*

|

Expenses are equal to an annualized expense ratio for the period March 1, 2017 to August 31, 2017 of 2.04% for the Class A Shares of the Fund, which includes waived fees or reimbursed expenses (including interest expense), multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184) then divided by 365 to reflect the one-half year period. The Fund’s ending account value on the first line in the table is based on the actual six-month return for the Class A Shares of the Fund of (4.04%).

|

|

**

|

Expenses are equal to an annualized expense ratio for the period March 1, 2017 to August 31, 2017 of 1.79% for the Class I Shares of the Fund, which includes waived fees or reimbursed expenses (including interest expense), multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184) then divided by 365 to reflect the one-half year period. The Fund’s ending account value on the first line in the table is based on the actual six-month return for the Class I Shares of the Fund of (3.94%).

|

|

***

|

Expenses are equal to an annualized expense ratio for the period March 1, 2017 to August 31, 2017 of 2.79% for the Class C Shares of the Fund, which includes waived fees or reimbursed expenses (including interest expense), multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184) then divided by 365 to reflect the one-half year period. The Fund’s ending account value on the first line in the table is based on the actual six-month return for the Class C Shares of the Fund of (4.42%).

|

|

% of Net

Assets |

Value

|

|||||||

|

SHORT-TERM INVESTMENTS:

|

||||||||

|

U.S. Treasury Obligations

|

82.9

|

%

|

$

|

660,664,950

|

||||

|

PURCHASED OPTIONS

|

0.1

|

588,470

|

||||||

|

OTHER ASSETS IN EXCESS OF LIABILITIES

|

||||||||

|

(including futures, forward foreign currency contracts and written options)

|

17.0

|

136,022,533

|

||||||

|

NET ASSETS

|

100.0

|

%

|

$

|

797,275,953

|

||||

|

Coupon*

|

Maturity Date

|

Par

(000’s) |

Value

|

||||||||

|

Short-Term Investments — 82.9%

|

|||||||||||

|

U.s. Treasury Obligations — 82.9%

|

|||||||||||

|

U.S. Treasury Bills

|

0.855

|

%

|

09/07/17

|

$

|

48,838

|

$

|

48,830,872

|

||||

|

U.S. Treasury Bills

|

0.885

|

%

|

09/28/17

|

28,209

|

28,189,430

|

||||||

|

U.S. Treasury Bills

|

0.925

|

%

|

10/05/17

|

18,480

|

18,460,889

|

||||||

|

U.S. Treasury Bills

|

0.924

|

%

|

10/12/17

|

2,139

|

2,136,284

|

||||||

|

U.S. Treasury Bills

|

0.975

|

%

|

10/26/17

|

3,600

|

3,594,445

|

||||||

|

U.S. Treasury Bills

|

1.039

|

%

|

11/16/17

|

53,676

|

53,571,576

|

||||||

|

U.S. Treasury Bills

|

1.065

|

%

|

11/24/17

|

64,823

|

64,677,518

|

||||||

|

U.S. Treasury Bills

|

1.082

|

%

|

11/30/17

|

72,108

|

71,929,880

|

||||||

|

U.S. Treasury Bills

|

1.094

|

%

|

12/07/17

|

8,475

|

8,452,827

|

||||||

|

U.S. Treasury Bills

|

1.088

|

%

|

12/14/17

|

20,587

|

20,531,676

|

||||||

|

U.S. Treasury Bills

|

1.080

|

%

|

12/21/17

|

59,243

|

59,062,953

|

||||||

|

U.S. Treasury Bills

|

1.105

|

%

|

01/04/18

|

19,870

|

19,799,196

|

||||||

|

U.S. Treasury Bills

|

1.100

|

%

|

01/11/18

|

5,066

|

5,047,610

|

||||||

|

U.S. Treasury Bills

|

1.116

|

%

|

01/18/18

|

78,939

|

78,633,065

|

||||||

|

U.S. Treasury Bills

|

1.116

|

%

|

01/25/18

|

73,361

|

73,058,189

|

||||||

|

U.S. Treasury Bills

|

1.126

|

%

|

02/01/18

|

32,465

|

32,321,677

|

||||||

|

U.S. Treasury Bills

|

1.105

|

%

|

02/08/18

|

44,600

|

44,394,344

|

||||||

|

U.S. Treasury Bills

|

1.074

|

%

|

02/15/18

|

12,703

|

12,641,347

|

||||||

|

U.S. Treasury Bills

|

1.071

|

%

|

02/22/18

|

15,409

|

15,331,172

|

||||||

|

660,664,950

|

|||||||||||

|

TOTAL SHORT-TERM INVESTMENTS

|

|||||||||||

|

(Cost $660,530,537)

|

660,664,950

|

||||||||||

|

Total Purchased Options — 0.1%**

|

|||||||||||

|

(Cost $944,457)

|

588,470

|

||||||||||

|

Total Investments — 83.0%

|

|||||||||||

|

(Cost $661,474,994)

|

661,253,420

|

||||||||||

|

Other Assets in Excess of Liabilities — 17.0%

|

136,022,533

|

||||||||||

|

Net Assets — 100.0%

|

$

|

797,275,953

|

|||||||||

|

*

|

Short-term investments reflect the annualized effective yield on the date of purchase for discounted investments.

|

|

**

|

See page 21 for detailed information regarding the Purchased Options.

|

|

Long Contracts

|

Expiration Date

|

Number of Contracts

|

Notional

Amount |

Value and

Unrealized Appreciation (Depreciation) |

||||||||

|

10-Year Mini Japanese Government Bond Futures

|

Sep-17

|

117

|

$

|

10,642,652

|

$

|

7,504

|

||||||

|

2-Year Euro Swapnote Futures

|

Sep-17

|

93

|

11,071,165

|

6,988

|

||||||||

|

3-Month Euro Euribor

|

Dec-17

|

47

|

13,987,762

|

4,702

|

||||||||

|

3-Month Euro Euribor

|

Mar-18

|

39

|

11,606,867

|

3,512

|

||||||||

|

3-Month Euro Euribor

|

Jun-18

|

1,430

|

425,585,105

|

320,275

|

||||||||

|

3-Month Euro Euribor

|

Sep-18

|

100

|

29,761,196

|

12,753

|

||||||||

|

3-Month Euro Euribor

|

Dec-18

|

1,319

|

392,550,177

|

220,620

|

||||||||

|

3-Month Euro Euribor

|

Mar-19

|

112

|

33,332,540

|

10,402

|

||||||||

|

3-Month Euro Euribor

|

Jun-19

|

107

|

31,844,480

|

11,964

|

||||||||

|

3-Month Euro Euribor

|

Sep-19

|

18

|

5,357,015

|

3,170

|

||||||||

|

3-Month Euro Euribor

|

Mar-20

|

3

|

892,836

|

74

|

||||||||

|

3-Month Euro Euribor

|

Jun-20

|

2

|

595,224

|

(30

|

)

|

|||||||

|

3-Month Euro Yen

|

Jun-18

|

1

|

227,407

|

(34

|

)

|

|||||||

|

5-Year Euro Swapnote Futures

|

Sep-17

|

16

|

1,904,717

|

548

|

||||||||

|

90-DAY Bank Bill

|

Dec-17

|

12

|

953,941

|

(894

|

)

|

|||||||

|

90-DAY Bank Bill

|

Mar-18

|

62

|

4,928,693

|

(9,889

|

)

|

|||||||

|

90-DAY Bank Bill

|

Jun-18

|

14

|

1,112,931

|

(3,418

|

)

|

|||||||

|

90-DAY Bank Bill

|

Sep-18

|

7

|

556,465

|

(2,039

|

)

|

|||||||

|

90-DAY Eurodollar Futures

|

Mar-18

|

34

|

8,500,000

|

963

|

||||||||

|

90-DAY Eurodollar Futures

|

Sep-18

|

143

|

35,750,000

|

26,388

|

||||||||

|

90-DAY Eurodollar Futures

|

Dec-18

|

721

|

180,250,000

|

93,975

|

||||||||

|

90-DAY Eurodollar Futures

|

Mar-19

|

164

|

41,000,000

|

46,138

|

||||||||

|

90-DAY Eurodollar Futures

|

Jun-19

|

240

|

60,000,000

|

71,063

|

||||||||

|

90-DAY Eurodollar Futures

|

Sep-19

|

31

|

7,750,000

|

7,838

|

||||||||

|

90-DAY Eurodollar Futures

|

Dec-19

|

23

|

5,750,000

|

6,475

|

||||||||

|

90-DAY Eurodollar Futures

|

Mar-20

|

16

|

4,000,000

|

6,063

|

||||||||

|

90-DAY Eurodollar Futures

|

Jun-20

|

96

|

24,000,000

|

28,538

|

||||||||

|

90-DAY Eurodollar Futures

|

Sep-20

|

30

|

7,500,000

|

13,513

|

||||||||

|

90-DAY Eurodollar Futures

|

Dec-20

|

16

|

4,000,000

|

7,900

|

||||||||

|

90-DAY Eurodollar Futures

|

Mar-21

|

15

|

3,750,000

|

6,963

|

||||||||

|

90-DAY Sterling Futures

|

Sep-17

|

26

|

4,202,550

|

1,439

|

||||||||

|

90-DAY Sterling Futures

|

Dec-17

|

69

|

11,152,921

|

3,169

|

||||||||

|

90-DAY Sterling Futures

|

Mar-18

|

66

|

10,668,011

|

2,020

|

||||||||

|

90-DAY Sterling Futures

|

Jun-18

|

891

|

144,018,155

|

214,556

|

||||||||

|

90-DAY Sterling Futures

|

Sep-18

|

148

|

23,922,208

|

3,685

|

||||||||

|

90-DAY Sterling Futures

|

Dec-18

|

573

|

92,617,736

|

(695

|

)

|

|||||||

|

90-DAY Sterling Futures

|

Mar-19

|

134

|

21,659,296

|

3,251

|

||||||||

|

90-DAY Sterling Futures

|

Jun-19

|

207

|

33,458,763

|

4,801

|

||||||||

|

90-DAY Sterling Futures

|

Sep-19

|

32

|

5,172,369

|

695

|

||||||||

|

90-DAY Sterling Futures

|

Dec-19

|

14

|

2,262,912

|

113

|

||||||||

|

90-DAY Sterling Futures

|

Mar-20

|

5

|

808,183

|

48

|

||||||||

|

90-DAY Sterling Futures

|

Jun-20

|

83

|

13,415,833

|

1,505

|

||||||||

|

Amsterdam Index Futures

|

Sep-17

|

65

|

7,982,429

|

(110,012

|

)

|

|||||||

|

AUD/USD Currency Futures

|

Sep-17

|

295

|

23,451,039

|

76,046

|

||||||||

|

Australian 10-Year Bond Futures

|

Sep-17

|

197

|

15,660,524

|

(297,987

|

)

|

|||||||

|

Bank Acceptance Futures

|

Jun-18

|

1,079

|

216,016,016

|

65,918

|

||||||||

|

Bank Acceptance Futures

|

Sep-18

|

1

|

200,200

|

(1,181

|

)

|

|||||||

|

Bank Acceptance Futures

|

Dec-18

|

1

|

200,200

|

40

|

||||||||

|

Long Contracts

|

Expiration Date

|

Number of Contracts

|

Notional

Amount |

Value and

Unrealized Appreciation (Depreciation) |

||||||||

|

Brent Crude Futures

|

Nov-17

|

1

|

$

|

52,860

|

$

|

(29,490

|

)

|

|||||

|

Brent Crude Futures

|

Dec-17

|

1

|

52,840

|

(1,010

|

)

|

|||||||

|

CAC40 10 Euro Futures

|

Sep-17

|

226

|

13,679,401

|

(137,348

|

)

|

|||||||

|

CAD Currency Futures

|

Sep-17

|

507

|

40,600,601

|

255,595

|

||||||||

|

Canola Futures (Winnipeg Commodity Exchange)

|

Nov-17

|

144

|

1,152,000

|

(38,722

|

)

|

|||||||

|

Canola Futures (Winnipeg Commodity Exchange)

|

Jan-18

|

113

|

914,135

|

(15,475

|

)

|

|||||||

|

Canola Futures (Winnipeg Commodity Exchange)

|

Mar-18

|

90

|

736,577

|

(12,324

|

)

|

|||||||

|

Cattle Feeder Futures

|

Nov-17

|

3

|

215,515

|

(3,263

|

)

|

|||||||

|

CHF Currency Futures

|

Sep-17

|

138

|

17,988,425

|

(80,350

|

)

|

|||||||

|

Coffee Robusta Futures

|

Nov-17

|

21

|

434,490

|

(12,770

|

)

|

|||||||

|

Coffee Robusta Futures

|

Jan-18

|

30

|

613,200

|

(17,930

|

)

|

|||||||

|

Coffee Robusta Futures

|

Mar-18

|

1

|

20,340

|

(110

|

)

|

|||||||

|

COP/USD Futures

|

Sep-17

|

100

|

3,395,713

|

19,218

|

||||||||

|

Copper Futures

|

Dec-17

|

167

|

12,936,238

|

416,600

|

||||||||

|

Copper Futures

|

Mar-18

|

33

|

2,571,525

|

222,275

|

||||||||

|

Copper Futures

|

May-18

|

13

|

1,016,113

|

10,600

|

||||||||

|

DAX Index Futures

|

Sep-17

|

44

|

15,800,338

|

(410,734

|

)

|

|||||||

|

DJIA Mini E-CBOT

|

Sep-17

|

257

|

28,205,750

|

541,535

|

||||||||

|

EUR Foreign Exchange Currency Futures

|

Sep-17

|

169

|

25,148,211

|

(427,893

|

)

|

|||||||

|

Euro BUXL 30-Year Bond Futures

|

Dec-17

|

3

|

357,134

|

(1,143

|

)

|

|||||||

|

Euro E-Mini Futures

|

Sep-17

|

48

|

4,254,184

|

150,150

|

||||||||

|

Euro STOXX 50

|

Sep-17

|

369

|

15,040,785

|

(346,027

|

)

|

|||||||

|

Euro/JPY Futures

|

Sep-17

|

9

|

1,339,286

|

79,308

|

||||||||

|

Euro-Bobl Futures

|

Sep-17

|

517

|

61,546,154

|

214,185

|

||||||||

|

Euro-Bobl Futures

|

Dec-17

|

401

|

47,736,959

|

(16,512

|

)

|

|||||||

|

Euro-BTP Futures

|

Sep-17

|

64

|

7,618,866

|

26,595

|

||||||||

|

Euro-Bund Futures

|

Sep-17

|

1,123

|

133,687,293

|

1,556,999

|

||||||||

|

Euro-Bund Futures

|

Dec-17

|

171

|

20,356,658

|

(8,083

|

)

|

|||||||

|

Euro-Oat Futures

|

Sep-17

|

71

|

8,452,180

|

68,677

|

||||||||

|

Euro-Oat Futures

|

Dec-17

|

7

|

1,301,886

|

214

|

||||||||

|

Euro-Schatz Futures

|

Sep-17

|

525

|

62,498,512

|

69,480

|

||||||||

|

Euro-Schatz Futures

|

Dec-17

|

14

|

1,666,627

|

(71

|

)

|

|||||||

|

FTSE 100 Index Futures

|

Sep-17

|

681

|

65,450,287

|

211,576

|

||||||||

|

FTSE 250 Index Futures

|

Sep-17

|

81

|

4,138,820

|

16,164

|

||||||||

|

FTSE/JSE TOP 40

|

Sep-17

|

165

|

6,320,450

|

128,537

|

||||||||

|

FTSE/MIB Index Futures

|

Sep-17

|

55

|

7,091,885

|

71,635

|

||||||||

|

Gasoline RBOB Futures

|

Nov-17

|

45

|

3,034,962

|

140,574

|

||||||||

|

Gasoline RBOB Futures

|

Dec-17

|

12

|

774,446

|

29,518

|

||||||||

|

Gasoline RBOB Futures

|

Jan-18

|

7

|

445,851

|

11,302

|

||||||||

|

Gold 100 Oz Futures

|

Oct-17

|

23

|

3,032,550

|

96,050

|

||||||||

|

Gold 100 Oz Futures

|

Dec-17

|

260

|

34,377,200

|

944,260

|

||||||||

|

Gold 100 Oz Futures

|

Feb-18

|

23

|

3,049,570

|

94,570

|

||||||||

|

Hang Seng Index Futures

|

Sep-17

|

220

|

39,268,696

|

543,149

|

||||||||

|

H-Shares Index Futures

|

Sep-17

|

125

|

9,002,332

|

31,792

|

||||||||

|

IBEX 35 Index Futures

|

Sep-17

|

32

|

3,924,859

|

(86,081

|

)

|

|||||||

|

INR/USD Futures

|

Sep-17

|

404

|

12,638,745

|

(1,026

|

)

|

|||||||

|

JPN 10-Year Bond (Osaka Securities Exchange)

|

Sep-17

|

213

|

193,750,853

|

902,078

|

||||||||

|

Long Contracts

|

Expiration Date

|

Number of Contracts

|

Notional

Amount |

Value and

Unrealized Appreciation (Depreciation) |

||||||||

|

JPY E-Mini Futures

|

Sep-17

|

60

|

$

|

3,411,107

|

$

|

(1,481

|

)

|

|||||

|

LME Aluminum Forward

|

Sep-17

|

29

|

1,524,857

|

1,900,437

|

||||||||

|

LME Aluminum Forward

|

Oct-17

|

119

|

6,277,250

|

398,820

|

||||||||

|

LME Aluminum Forward

|

Nov-17

|

77

|

4,073,300

|

189,835

|

||||||||

|

LME Aluminum Forward

|

Dec-17

|

556

|

29,488,850

|

1,021,388

|

||||||||

|

LME Copper Forward

|

Sep-17

|

15

|

2,536,313

|

2,966,312

|

||||||||

|

LME Copper Forward

|

Oct-17

|

61

|

10,331,112

|

871,040

|

||||||||

|

LME Copper Forward

|

Nov-17

|

16

|

2,714,600

|

140,550

|

||||||||

|

LME Copper Forward

|

Dec-17

|

140

|

23,794,750

|

1,319,744

|

||||||||

|

LME Lead Forward

|

Sep-17

|

10

|

592,875

|

(13,917

|

)

|

|||||||

|

LME Lead Forward

|

Oct-17

|

25

|

1,488,750

|

27,691

|

||||||||

|

LME Lead Forward

|

Nov-17

|

17

|

1,015,856

|

4,369

|

||||||||

|

LME Nickel Forward

|

Sep-17

|

7

|

493,563

|

(149,075

|

)

|

|||||||

|

LME Nickel Forward

|

Oct-17

|

24

|

1,694,880

|

108,077

|

||||||||

|

LME Nickel Forward

|

Nov-17

|

13

|

919,737

|

80,238

|

||||||||

|

LME Nickel Forward

|

Dec-17

|

25

|

1,772,025

|

83,195

|

||||||||

|

LME Zinc Forward

|

Sep-17

|

14

|

1,099,962

|

517,466

|

||||||||

|

LME Zinc Forward

|

Oct-17

|

28

|

2,200,100

|

246,738

|

||||||||

|

LME Zinc Forward

|

Nov-17

|

19

|

1,493,875

|

92,381

|

||||||||

|

LME Zinc Forward

|

Dec-17

|

56

|

4,405,100

|

40,619

|

||||||||

|

Long Gilt Futures

|

Dec-17

|

623

|

80,559,650

|

215,313

|

||||||||

|

Low Sulphur Gasoil G Futures

|

Sep-17

|

4

|

201,900

|

8,125

|

||||||||

|

Low Sulphur Gasoil G Futures

|

Oct-17

|

42

|

2,113,650

|

89,700

|

||||||||

|

Low Sulphur Gasoil G Futures

|

Nov-17

|

22

|

1,092,850

|

37,800

|

||||||||

|

Low Sulphur Gasoil G Futures

|

Dec-17

|

18

|

882,000

|

21,550

|

||||||||

|

Mini HSI Index Futures

|

Sep-17

|

105

|

3,748,376

|

13,436

|

||||||||

|

Mini MSCI EAFE Index Futures

|

Sep-17

|

76

|

7,352,240

|

18,215

|

||||||||

|

Mini MSCI Emerging Markets Index Future

|

Sep-17

|

189

|

10,264,590

|

427,700

|

||||||||

|

MSCI Singapore Exchange ETS

|

Sep-17

|

140

|

3,771,157

|

24,123

|

||||||||

|

MSCI Taiwan Index

|

Sep-17

|

145

|

5,744,900

|

13,645

|

||||||||

|

MXN Futures

|

Sep-17

|

282

|

7,892,792

|

113,655

|

||||||||

|

Nasdaq 100 E-Mini

|

Sep-17

|

384

|

46,008,960

|

992,979

|

||||||||

|

Natural Gas Futures

|

May-18

|

1

|

28,900

|

420

|

||||||||

|

Natural Gas Futures

|

Jun-18

|

10

|

291,300

|

2,860

|

||||||||

|

NY Harbor Ultra-Low Sulfur Diesel Futures

|

Nov-17

|

29

|

2,095,447

|

64,818

|

||||||||

|

NY Harbor Ultra-Low Sulfur Diesel Futures

|

Dec-17

|

20

|

1,429,344

|

37,598

|

||||||||

|

NY Harbor Ultra-Low Sulfur Diesel Futures

|

Jan-18

|

8

|

568,478

|

13,511

|

||||||||

|

Nikkei 225 (Chicago Mercantile Exchange)

|

Sep-17

|

3

|

295,125

|

(2,925

|

)

|

|||||||

|

Nikkei 225 (Singapore Exchange)

|

Sep-17

|

146

|

13,078,046

|

(25,731

|

)

|

|||||||

|

Nikkei 225 Mini

|

Sep-17

|

467

|

8,364,242

|

(61,677

|

)

|

|||||||

|

Nikkie 225 (Osaka Securities Exchange)

|

Sep-17

|

33

|

5,910,492

|

(181,289

|

)

|

|||||||

|

NZD Currency Futures

|

Sep-17

|

22

|

1,578,985

|

(35,405

|

)

|

|||||||

|

Palladium Futures

|

Dec-17

|

22

|

2,050,950

|

5,690

|

||||||||

|

Platinum Futures

|

Oct-17

|

33

|

1,647,525

|

17,420

|

||||||||

|

PLN/USD Futures

|

Sep-17

|

31

|

4,348,680

|

149,710

|

||||||||

|

Rapeseed Euro

|

Feb-18

|

1

|

22,112

|

(45

|

)

|

|||||||

|

Red Wheat Futures (Minneapolis Grain Exchange)

|

Mar-18

|

2

|

65,100

|

(13,650

|

)

|

|||||||

|

Red Wheat Futures (Minneapolis Grain Exchange)

|

May-18

|

1

|

32,400

|

(1,338

|

)

|

|||||||

|

Long Contracts

|

Expiration Date

|

Number of Contracts

|

Notional

Amount |

Value and

Unrealized Appreciation (Depreciation) |

||||||||

|

RUB Futures

|

Sep-17

|

66

|

$

|

2,844,131

|

$

|

46,388

|

||||||

|

Russell 2000 Mini

|

Sep-17

|

89

|

6,249,580

|

12,580

|

||||||||

|

S&P 500 E-Mini Futures

|

Sep-17

|

798

|

98,556,990

|

864,802

|

||||||||

|

S&P Mid 400 E-Mini

|

Sep-17

|

27

|

4,672,080

|

(67,100

|

)

|

|||||||

|

SGX Nifty 50

|

Sep-17

|

143

|

2,842,268

|

7,248

|

||||||||

|

Silver Futures

|

Mar-18

|

3

|

265,000

|

680

|

||||||||

|

Silver Futures

|

May-18

|

2

|

177,300

|

(495

|

)

|

|||||||

|

Soybean Oil Futures

|

Oct-17

|

12

|

250,632

|

1,560

|

||||||||

|

Soybean Oil Futures

|

Dec-17

|

4

|

84,144

|

(58,452

|

)

|

|||||||

|

Soybean Oil Futures

|

Jan-18

|

29

|

612,654

|

4,416

|

||||||||

|

SPI 200 Futures

|

Sep-17

|

53

|

5,991,224

|

(6,220

|

)

|

|||||||

|

Swiss Federal Bond Futures

|

Sep-17

|

27

|

2,815,579

|

(657

|

)

|

|||||||

|

Topix Index Futures

|

Sep-17

|

150

|

22,117,615

|

127,430

|

||||||||

|

TRY/USD Futures

|

Sep-17

|

39

|

5,650,700

|

165,780

|

||||||||

|

U.S. Treasury 10-Year Notes (Chicago Board of Trade)

|

Dec-17

|

1,103

|

113,059,475

|

289,204

|

||||||||

|

U.S. Treasury 2-Year Notes (Chicago Board of Trade)

|

Dec-17

|

64

|

12,879,073

|

5,297

|

||||||||

|

U.S. Treasury 5-Year Notes (Chicago Board of Trade)

|

Dec-17

|

832

|

83,793,341

|

103,039

|

||||||||

|

U.S. Treasury Long Bond (Chicago Board of Trade)

|

Dec-17

|

300

|

39,162,373

|

241,500

|

||||||||

|

U.S. Treasury Ultra Long Bond (Chicago Board of Trade)

|

Dec-17

|

7

|

836,455

|

3,765

|

||||||||

|

$

|

19,607,110

|

|||||||||||

|

Short Contracts

|

Expiration Date

|

Number of Contracts

|

Notional

Amount

|

Value and

Unrealized Appreciation (Depreciation) |

||||||||

|

3-Month Euro Euribor

|

Dec-19

|

921

|

$

|

(274,100,617

|

)

|

$

|

(178,032

|

)

|

||||

|

90-DAY Eurodollar Futures

|

Dec-17

|

2,510

|

(627,500,000

|

)

|

3,716,977

|

|||||||

|

90-DAY Eurodollar Futures

|

Jun-18

|

2,211

|

(552,750,000

|

)

|

(426,925

|

)

|

||||||

|

Australian 3-Year Bond Futures

|

Sep-17

|

111

|

(8,823,950

|

)

|

3,452

|

|||||||

|

Bank Acceptance Futures

|

Sep-17

|

34

|

(6,806,807

|

)

|

6,637

|

|||||||

|

Bank Acceptance Futures

|

Dec-17

|

130

|

(26,026,026

|

)

|

34,024

|

|||||||

|

Bank Acceptance Futures

|

Mar-18

|

129

|

(25,825,826

|

)

|

39,429

|

|||||||

|

BP Currency Futures

|

Sep-17

|

130

|

(10,506,375

|

)

|

(52,911

|

)

|

||||||

|

Brent Crude Futures

|

Jan-18

|

1

|

(52,910

|

)

|

(2,030

|

)

|

||||||

|

Canadian 10-Year Bond Futures

|

Dec-17

|

826

|

(66,146,146

|

)

|

(312,424

|

)

|

||||||

|

Cattle Feeder Futures

|

Sep-17

|

5

|

(356,440

|

)

|

(3,925

|

)

|

||||||

|

Cattle Feeder Futures

|

Oct-17

|

2

|

(143,300

|

)

|

375

|

|||||||

|

CBOE VIX Futures

|

Sep-17

|

2

|

(25,250

|

)

|

2,800

|

|||||||

|

CBOE VIX Futures

|

Oct-17

|

8

|

(109,800

|

)

|

3,600

|

|||||||

|

Cocoa Futures

|

Sep-17

|

10

|

(194,352

|

)

|

(1,746

|

)

|

||||||

|

Cocoa Futures

|

Dec-17

|

127

|

(2,499,470

|

)

|

43,293

|

|||||||

|

Cocoa Futures

|

Dec-17

|

54

|

(1,040,040

|

)

|

(29,560

|

)

|

||||||

|

Cocoa Futures

|

Mar-18

|

54

|

(1,075,336

|

)

|

(10,267

|

)

|

||||||

|

Cocoa Futures

|

Mar-18

|

62

|

(1,204,660

|

)

|

(22,270

|

)

|

||||||

|

Cocoa Futures

|

May-18

|

54

|

(1,055,700

|

)

|

(16,040

|

)

|

||||||

|

Coffee 'C' Futures

|

Dec-17

|

143

|

(6,936,394

|

)

|

152,306

|

|||||||

|

Coffee 'C' Futures

|

Mar-18

|

20

|

(996,375

|

)

|

(3,188

|

)

|

||||||

|

Short Contracts

|

Expiration Date

|

Number of Contracts

|

Notional

Amount

|

Value and

Unrealized Appreciation (Depreciation) |

||||||||

|

Coffee 'C' Futures

|

May-18

|

17

|

$

|

(861,900

|

)

|

$

|

(2,400

|

)

|

||||

|

Corn Futures

|

Dec-17

|

1,243

|

(22,234,163

|

)

|

(283,575

|

)

|

||||||

|

Corn Futures

|

Mar-18

|

69

|

(1,278,225

|

)

|

42,713

|

|||||||

|

Corn Futures

|

May-18

|

68

|

(1,284,350

|

)

|

34,350

|

|||||||

|

Corn Futures

|

Jul-18

|

55

|

(1,056,000

|

)

|

(17,788

|

)

|

||||||

|

Cotton No.2 Futures

|

Oct-17

|

1

|

(35,740

|

)

|

(700

|

)

|

||||||

|

Cotton No.2 Futures

|

Dec-17

|

62

|

(2,198,830

|

)

|

(98,155

|

)

|

||||||

|

Cotton No.2 Futures

|

Mar-18

|

29

|

(1,016,595

|

)

|

(41,680

|

)

|

||||||

|

Dollar Index

|

Sep-17

|

164

|

(16,400,000

|

)

|

398,936

|

|||||||

|

E-Mini Crude Oil

|

Nov-17

|

4

|

(95,920

|

)

|

(2,620

|

)

|

||||||

|

E-Mini Crude Oil

|

Dec-17

|

4

|

(97,120

|

)

|

(1,583

|

)

|

||||||

|

E-Mini Natural Gas

|

Oct-17

|

45

|

(342,000

|

)

|

(14,538

|

)

|

||||||

|

E-Mini Natural Gas

|

Nov-17

|

89

|

(690,200

|

)

|

(33,070

|

)

|

||||||

|

E-Mini Natural Gas

|

Dec-17

|

54

|

(436,325

|

)

|

(14,145

|

)

|

||||||

|

Euro BUXL 30-Year Bond Futures

|

Sep-17

|

6

|

(714,269

|

)

|

(10,762

|

)

|

||||||

|

Euro/CHF 3-Month Futures ICE

|

Sep-17

|

11

|

(2,867,720

|

)

|

26

|

|||||||

|

Euro/CHF 3-Month Futures ICE

|

Dec-17

|

47

|

(12,252,985

|

)

|

(1,147

|

)

|

||||||

|

Euro/CHF 3-Month Futures ICE

|

Mar-18

|

34

|

(8,863,862

|

)

|

(2,451

|

)

|

||||||

|

Euro/CHF 3-Month Futures ICE

|

Jun-18

|

54

|

(14,077,898

|

)

|

(4,354

|

)

|

||||||

|

Euro/CHF 3-Month Futures ICE

|

Sep-18

|

3

|

(782,105

|

)

|

(156

|

)

|

||||||

|

Gasoline RBOB Futures

|

Oct-17

|

67

|

(5,006,669

|

)

|

(401,234

|

)

|

||||||

|

ILS/USD Futures

|

Sep-17

|

4

|

(1,118,600

|

)

|

(11,420

|

)

|

||||||

|

JPY Currency Futures

|

Sep-17

|

148

|

(16,828,126

|

)

|

24,674

|

|||||||

|

Kansas City Hard Red Winter Wheat Futures

|

Dec-17

|

133

|

(2,901,063

|

)

|

172,925

|

|||||||

|

Kansas City Hard Red Winter Wheat Futures

|

Mar-18

|

37

|

(839,900

|

)

|

72,363

|

|||||||

|

Kansas City Hard Red Winter Wheat Futures

|

May-18

|

19

|

(444,362

|

)

|

(6,863

|

)

|

||||||

|

Lean Hogs Futures

|

Oct-17

|

4

|

(98,240

|

)

|

(18,550

|

)

|

||||||

|

Lean Hogs Futures

|

Dec-17

|

18

|

(417,780

|

)

|

(9,120

|

)

|

||||||

|

Lean Hogs Futures

|

Feb-18

|

14

|

(350,840

|

)

|

(5,900

|

)

|

||||||

|

Live Cattle Futures

|

Oct-17

|

29

|

(1,222,640

|

)

|

35,170

|

|||||||

|

Live Cattle Futures

|

Dec-17

|

8

|

(349,120

|

)

|

(450

|

)

|

||||||

|

Mill Wheat Euro

|

Sep-17

|

1

|

(9,271

|

)

|

461

|

|||||||

|

Mill Wheat Euro

|

Dec-17

|

133

|

(1,278,511

|

)

|

51,085

|

|||||||

|

Mill Wheat Euro

|

Mar-18

|

132

|

(1,310,147

|

)

|

40,416

|

|||||||

|

Natural Gas Futures

|

Oct-17

|

167

|

(5,076,800

|

)

|

(236,640

|

)

|

||||||

|

Natural Gas Futures

|

Nov-17

|

67

|

(2,078,400

|

)

|

(54,230

|

)

|

||||||

|

Natural Gas Futures

|

Dec-17

|

25

|

(808,000

|

)

|

(25,240

|

)

|

||||||

|

Natural Gas Futures

|

Jan-18

|

22

|

(731,700

|

)

|

(21,580

|

)

|

||||||

|

Natural Gas Futures

|

Feb-18

|

23

|

(763,800

|

)

|

(23,240

|

)

|

||||||

|

Natural Gas Futures

|

Mar-18

|

1

|

(32,800

|

)

|

(1,000

|

)

|

||||||

|

Natural Gas Futures

|

Apr-18

|

3

|

(87,800

|

)

|

(3,570

|

)

|

||||||

|

NY Harbor Ultra-Low Sulfur Diesel Futures

|

Oct-17

|

13

|

(951,077

|

)

|

(85,567

|

)

|

||||||

|

OMX Stockholm 30 Index Futures

|

Sep-17

|

4

|

(77,752

|

)

|

(5,839

|

)

|

||||||

|

Rapeseed Euro

|

Nov-17

|

1

|

(21,993

|

)

|

(119

|

)

|

||||||

|

Rapeseed Euro

|

May-18

|

12

|

(266,779

|

)

|

(2,381

|

)

|

||||||

|

Red Wheat Futures (Minneapolis Grain Exchange)

|

Dec-17

|

4

|

(128,100

|

)

|

2,550

|

|||||||

|

S&P/TSX 60 IX Futures

|

Sep-17

|

55

|

(7,848,649

|

)

|

(57,880

|

)

|

||||||

|

Silver Futures

|

Dec-17

|

1

|

(87,900

|

)

|

(58,315

|

)

|

||||||

|

Short Contracts

|

Expiration Date

|

Number of Contracts

|

Notional

Amount

|

Value and

Unrealized Appreciation (Depreciation) |

||||||||

|

Soybean Futures

|

Nov-17

|

191

|

$

|

(9,027,137

|

)

|

$

|

(50,837

|

)

|

||||

|

Soybean Futures

|

Jan-18

|

36

|

(1,718,550

|

)

|

(2,213

|

)

|

||||||

|

Soybean Futures

|

Mar-18

|

26

|

(1,253,525

|

)

|

(9,613

|

)

|

||||||

|

Soybean Futures

|

May-18

|

16

|

(778,200

|

)

|

(5,400

|

)

|

||||||

|

Soybean Meal Futures

|

Oct-17

|

51

|

(1,512,150

|

)

|

36,040

|

|||||||

|

Soybean Meal Futures

|

Dec-17

|

114

|

(3,414,300

|

)

|

66,150

|

|||||||

|

Soybean Meal Futures

|

Jan-18

|

42

|

(1,264,620

|

)

|

(5,660

|

)

|

||||||

|

Sugar No. 11 (World)

|

Oct-17

|

6

|

(96,768

|

)

|

(18,390

|

)

|

||||||

|

Sugar No. 11 (World)

|

Mar-18

|

187

|

(3,137,411

|

)

|

(80,550

|

)

|

||||||

|

Sugar No. 11 (World)

|

May-18

|

55

|

(935,704

|

)

|

(56,515

|

)

|

||||||

|

USD/CZK Futures

|

Sep-17

|

38

|

(3,800,000

|

)

|

153,687

|

|||||||

|

USD/HUF Futures

|

Sep-17

|

37

|

(3,700,000

|

)

|

182,671

|

|||||||

|

USD/NOK Futures

|

Sep-17

|

31

|

(3,100,000

|

)

|

170,864

|

|||||||

|

USD/SEK Futures

|

Sep-17

|

39

|

(3,900,000

|

)

|

218,301

|

|||||||

|

Wheat (Chicago Board of Trade)

|

Dec-17

|

782

|

(16,988,950

|

)

|

62,325

|

|||||||

|

Wheat (Chicago Board of Trade)

|

Mar-18

|

40

|

(914,000

|

)

|

54,150

|

|||||||

|

Wheat (Chicago Board of Trade)

|

May-18

|

23

|

(541,075

|

)

|

(3,762

|

)

|

||||||

|

White Sugar ICE

|

Oct-17

|

40

|

(773,800

|

)

|

49,550

|

|||||||

|

White Sugar ICE

|

Dec-17

|

64

|

(1,248,000

|

)

|

96,305

|

|||||||

|

White Sugar ICE

|

Mar-18

|

61

|

(1,216,035

|

)

|

(28,715

|

)

|

||||||

|

WTI Crude Futures

|

Oct-17

|

193

|

(9,115,390

|

)

|

54,100

|

|||||||

|

WTI Crude Futures

|

Nov-17

|

30

|

(1,438,800

|

)

|

(27,640

|

)

|

||||||

|

WTI Crude Futures

|

Dec-17

|

2

|

(97,120

|

)

|

(2,480

|

)

|

||||||

|

WTI Crude Futures

|

Jan-18

|

6

|

(294,000

|

)

|

(2,670

|

)

|

||||||

|

WTI Crude Futures

|

Feb-18

|

6

|

(295,800

|

)

|

(6,940

|

)

|

||||||

|

WTI Crude Futures

|

Mar-18

|

7

|

(346,500

|

)

|

(9,360

|

)

|

||||||

|

WTI Crude Futures

|

Apr-18

|

6

|

(297,840

|

)

|

(7,450

|

)

|

||||||

|

$

|

3,086,930

|

|||||||||||

|

Total Futures Contracts

|

$

|

22,694,040

|

||||||||||

|

Currency Purchased

|

Currency Sold

|

Expiration

|

Counterparty

|

Unrealized Appreciation (Depreciation)

|

|||||||||||

|

AUD

|

2,869,452

|

USD

|

2,269,478

|

Sep 01 2017

|

BOA

|

$

|

11,572

|

||||||||

|

AUD

|

7,475,919

|

USD

|

5,916,757

|

Sep 05 2017

|

BOA

|

25,942

|

|||||||||

|

AUD

|

18,285,000

|

USD

|

14,441,613

|

Sep 08 2017

|

BOA

|

92,889

|

|||||||||

|

AUD

|

64,294,407

|

USD

|

49,884,584

|

Sep 20 2017

|

BOA

|

1,214,338

|

|||||||||

|

AUD

|

70,656,000

|

USD

|

54,692,349

|

Sep 22 2017

|

BOA

|

1,461,105

|

|||||||||

|

AUD

|

4,917,000

|

USD

|

3,915,432

|

Sep 28 2017

|

BOA

|

(7,974

|

)

|

||||||||

|

BRL

|

27,231,671

|

USD

|

8,356,340

|

Sep 20 2017

|

BOA

|

268,243

|

|||||||||

|

CAD

|

6,446,044

|

USD

|

5,138,503

|

Sep 01 2017

|

BOA

|

23,536

|

|||||||||

|

CAD

|

4,057,607

|

USD

|

3,205,000

|

Sep 08 2017

|

BOA

|

44,554

|

|||||||||

|

CAD

|

95,219,216

|

USD

|

74,544,850

|

Sep 20 2017

|

BOA

|

1,722,268

|

|||||||||

|

CAD

|

57,065,000

|

USD

|

44,170,590

|

Sep 22 2017

|

BOA

|

1,537,428

|

|||||||||

|

CAD

|

8,041,000

|

USD

|

6,446,498

|

Sep 28 2017

|

BOA

|

(5,367

|

)

|

||||||||

|

CHF

|

8,600,798

|

USD

|

8,960,000

|

Sep 08 2017

|

BOA

|

13,747

|

|||||||||

|

Currency Purchased

|

Currency Sold

|

Expiration

|

Counterparty

|

Unrealized Appreciation (Depreciation)

|

|||||||||||

|

CHF

|

17,011,000

|

USD

|

17,738,933

|

Sep 22 2017

|

BOA

|

$

|

26,568

|

||||||||

|

CHF

|

5,852,000

|

USD

|

6,139,468

|

Sep 28 2017

|

BOA

|

(25,420

|

)

|

||||||||

|

CLP

|

3,073,362,180

|

USD

|

4,766,126

|

Sep 20 2017

|

BOA

|

146,871

|

|||||||||

|

CNH

|

15,049,889

|

USD

|

2,250,000

|

Sep 20 2017

|

BOA

|

30,158

|

|||||||||

|

DKK

|

283,271

|

USD

|

45,000

|

Sep 08 2017

|

BOA

|

362

|

|||||||||

|

EUR

|

300,000

|

HUF

|

92,889,312

|

Sep 20 2017

|

BOA

|

(4,522

|

)

|

||||||||

|

EUR

|

19,365,000

|

JPY

|

2,510,913,360

|

Sep 08 2017

|

BOA

|

214,691

|

|||||||||

|

EUR

|

1,257,000

|

JPY

|

165,263,824

|

Sep 28 2017

|

BOA

|

(6,616

|

)

|

||||||||

|

EUR

|

6,400,000

|

NOK

|

61,022,019

|

Sep 20 2017

|

BOA

|

(242,234

|

)

|

||||||||

|

EUR

|

1,250,000

|

PLN

|

5,321,932

|

Sep 20 2017

|

BOA

|

(2,341

|

)

|

||||||||

|

EUR

|

2,500,000

|

SEK

|

24,274,555

|

Sep 20 2017

|

BOA

|

(79,196

|

)

|

||||||||

|

EUR

|

996,509

|

USD

|

1,186,743

|

Sep 01 2017

|

BOA

|

(392

|

)

|

||||||||

|

EUR

|

449,403

|

USD

|

534,227

|

Sep 05 2017

|

BOA

|

896

|

|||||||||

|

EUR

|

31,170,000

|

USD

|

36,967,892

|

Sep 08 2017

|

BOA

|

153,249

|

|||||||||

|

EUR

|

78,124,862

|

USD

|

89,089,984

|

Sep 20 2017

|

BOA

|

4,013,076

|

|||||||||

|

EUR

|

34,101,000

|

USD

|

38,973,445

|

Sep 22 2017

|

BOA

|

1,669,970

|

|||||||||

|

EUR

|

9,083,000

|

USD

|

10,880,653

|

Sep 28 2017

|

BOA

|

(51,423

|

)

|

||||||||

|

GBP

|

11,800,000

|

JPY

|

1,671,268,320

|

Sep 08 2017

|

BOA

|

55,110

|

|||||||||

|

GBP

|

1,187,339

|

USD

|

1,534,124

|

Sep 01 2017

|

BOA

|

1,264

|

|||||||||

|

GBP

|

2,587,477

|

USD

|

3,331,171

|

Sep 05 2017

|

BOA

|

15,217

|

|||||||||

|

GBP

|

6,550,000

|

USD

|

8,432,340

|

Sep 08 2017

|

BOA

|

39,639

|

|||||||||

|

GBP

|

49,766,932

|

USD

|

64,731,673

|

Sep 20 2017

|

BOA

|

(333,506

|

)

|

||||||||

|

GBP

|

40,512,000

|

USD

|

52,714,368

|

Sep 22 2017

|

BOA

|

(288,233

|

)

|

||||||||

|

HUF

|

887,108,850

|

EUR

|

2,900,000

|

Sep 20 2017

|

BOA

|

1,537

|

|||||||||

|

HUF

|

1,562,805,895

|

USD

|

5,804,202

|

Sep 20 2017

|

BOA

|

286,872

|

|||||||||

|

ILS

|

15,209,229

|

USD

|

4,300,000

|

Sep 20 2017

|

BOA

|

(53,282

|

)

|

||||||||

|

INR

|

706,579,487

|

USD

|

10,926,119

|

Sep 20 2017

|

BOA

|

100,739

|

|||||||||

|

JPY

|

2,627,966,110

|

EUR

|

20,225,000

|

Sep 08 2017

|

BOA

|

(173,788

|

)

|

||||||||

|

JPY

|

1,953,714,625

|

GBP

|

13,815,000

|

Sep 08 2017

|

BOA

|

(91,309

|

)

|

||||||||

|

JPY

|

171,984,711

|

USD

|

1,560,525

|

Sep 01 2017

|

BOA

|

3,960

|

|||||||||

|

JPY

|

329,805,334

|

USD

|

2,993,414

|

Sep 05 2017

|

BOA

|

7,196

|

|||||||||

|

JPY

|

870,058,853

|

USD

|

7,985,000

|

Sep 08 2017

|

BOA

|

(68,066

|

)

|

||||||||

|

JPY

|

8,147,493,490

|

USD

|

74,147,763

|

Sep 20 2017

|

BOA

|

32,888

|

|||||||||

|

JPY

|

4,647,799,670

|

USD

|

42,404,860

|

Sep 22 2017

|

BOA

|

(83,748

|

)

|

||||||||

|

JPY

|

887,083,000

|

USD

|

8,170,275

|

Sep 28 2017

|

BOA

|

(90,429

|

)

|

||||||||

|

KRW

|

17,065,715,254

|

USD

|

15,105,358

|

Sep 20 2017

|

BOA

|

31,874

|

|||||||||

|

MXN

|

322,419,338

|

USD

|

17,673,432

|

Sep 20 2017

|

BOA

|

299,054

|

|||||||||

|

NOK

|

78,604,825

|

EUR

|

8,400,000

|

Sep 20 2017

|

BOA

|

126,227

|

|||||||||

|

NOK

|

5,345,659

|

USD

|

685,578

|

Sep 01 2017

|

BOA

|

3,493

|

|||||||||

|

NOK

|

1,998,143

|

USD

|

254,643

|

Sep 05 2017

|

BOA

|

2,948

|

|||||||||

|

NOK

|

168,793,891

|

USD

|

20,671,255

|

Sep 20 2017

|

BOA

|

1,095,991

|

|||||||||

|

NOK

|

508,430,463

|

USD

|

64,000,000

|

Sep 22 2017

|

BOA

|

1,568,820

|

|||||||||

|

NZD

|

1,793,435

|

USD

|

1,292,816

|

Sep 01 2017

|

BOA

|

(5,153

|

)

|

||||||||

|

NZD

|

1,280,795

|

USD

|

916,242

|

Sep 05 2017

|

BOA

|

3,291

|

|||||||||

|

NZD

|

1,150,000

|

USD

|

839,615

|

Sep 08 2017

|

BOA

|

(14,027

|

)

|

||||||||

|

NZD

|

45,914,191

|

USD

|

33,433,732

|

Sep 20 2017

|

BOA

|

(479,409

|

)

|

||||||||

|

NZD

|

70,615,000

|

USD

|

51,441,005

|

Sep 22 2017

|

BOA

|

(759,937

|

)

|

||||||||

|

PHP

|

37,795,878

|

USD

|

750,000

|

Sep 20 2017

|

BOA

|

(12,204

|

)

|

||||||||

|

PLN

|

8,233,811

|

EUR

|

1,950,000

|

Sep 20 2017

|

BOA

|

(15,525

|

)

|

||||||||

|

PLN

|

55,733,072

|

USD

|

15,114,817

|

Sep 20 2017

|

BOA

|

509,834

|

|||||||||

|

RUB

|

140,172,698

|

USD

|

2,350,000

|

Sep 20 2017

|

BOA

|

57,238

|

|||||||||

|

Currency Purchased

|

Currency Sold

|

Expiration

|

Counterparty

|

Unrealized Appreciation (Depreciation)

|

|||||||||||

|

SEK

|

140,026,725

|

EUR

|

14,687,000

|

Sep 07 2017

|

BOA

|

$

|

139,334

|

||||||||

|

SEK

|

23,092,175

|

EUR

|

2,400,000

|

Sep 20 2017

|

BOA

|

49,393

|

|||||||||

|

SEK

|

2,428,648

|

USD

|

304,443

|

Sep 01 2017

|

BOA

|

1,227

|

|||||||||

|

SEK

|

157,865,250

|

USD

|

18,839,884

|

Sep 20 2017

|

BOA

|

1,050,519

|

|||||||||

|

SGD

|

2,591,308

|

USD

|

1,900,000

|

Sep 20 2017

|

BOA

|

11,285

|

|||||||||

|

SGD

|

11,174,662

|

USD

|

8,148,713

|

Sep 20 2017

|

BOA

|

93,442

|

|||||||||

|

SGD

|

19,757,600

|

USD

|

14,601,171

|

Sep 28 2017

|

BOA

|

(27,948

|

)

|

||||||||

|

THB

|

132,615,087

|

USD

|

3,950,000

|

Sep 20 2017

|

BOA

|

44,336

|

|||||||||

|

TRY

|

48,660,073

|

USD

|

13,592,001

|

Sep 20 2017

|

BOA

|

417,031

|

|||||||||

|

TWD

|

31,745,226

|

USD

|

1,050,955

|

Sep 20 2017

|

BOA

|

1,790

|

|||||||||

|

USD

|

2,275,528

|

AUD

|

2,869,452

|

Sep 01 2017

|

BOA

|

(5,522

|

)

|

||||||||

|

USD

|

5,901,870

|

AUD

|

7,475,919

|

Sep 05 2017

|

BOA

|

(40,828

|

)

|

||||||||

|

USD

|

17,387,112

|

AUD

|

21,980,000

|

Sep 08 2017

|

BOA

|

(84,495

|

)

|

||||||||

|

USD

|

42,820,471

|

AUD

|

54,862,314

|

Sep 20 2017

|

BOA

|

(782,157

|

)

|

||||||||

|

USD

|

33,050,405

|

AUD

|

42,854,000

|

Sep 22 2017

|

BOA

|

(1,007,569

|

)

|

||||||||

|

USD

|

3,874,989

|

AUD

|

4,917,000

|

Sep 28 2017

|

BOA

|

(32,469

|

)

|

||||||||

|

USD

|

4,451,080

|

BRL

|

14,563,340

|

Sep 20 2017

|

BOA

|

(161,297

|

)

|

||||||||

|

USD

|

5,099,531

|

CAD

|

6,446,044

|

Sep 01 2017

|

BOA

|

(62,508

|

)

|

||||||||

|

USD

|

4,315,000

|

CAD

|

5,435,399

|

Sep 08 2017

|

BOA

|

(37,965

|

)

|

||||||||

|

USD

|

52,001,785

|

CAD

|

66,393,450

|

Sep 20 2017

|

BOA

|

(1,176,946

|

)

|

||||||||

|

USD

|

29,073,312

|

CAD

|

38,503,101

|

Sep 22 2017

|

BOA

|

(1,766,966

|

)

|

||||||||

|

USD

|

6,402,233

|

CAD

|

8,041,000

|

Sep 28 2017

|

BOA

|

(38,898

|

)

|

||||||||

|

USD

|

9,710,000

|

CHF

|

9,348,276

|

Sep 08 2017

|

BOA

|

(43,637

|

)

|

||||||||

|

USD

|

3,996,116

|

CHF

|

3,833,000

|

Sep 22 2017

|

BOA

|

(6,892

|

)

|

||||||||

|

USD

|

6,062,703

|

CHF

|

5,852,000

|

Sep 28 2017

|

BOA

|

(51,345

|

)

|

||||||||

|

USD

|

204,374

|

CLP

|

136,489,722

|

Sep 20 2017

|

BOA

|

(13,814

|

)

|

||||||||

|

USD

|

250,000

|

CNH

|

1,698,115

|

Sep 20 2017

|

BOA

|

(7,276

|

)

|

||||||||

|

USD

|

1,190,297

|

EUR

|

996,509

|

Sep 01 2017

|

BOA

|

3,947

|

|||||||||

|

USD

|

532,204

|

EUR

|

449,403

|

Sep 05 2017

|

BOA

|

(2,918

|

)

|

||||||||

|

USD

|

44,927,070

|

EUR

|

37,880,000

|

Sep 08 2017

|

BOA

|

(185,179

|

)

|

||||||||

|

USD

|

55,986,978

|

EUR

|

49,043,213

|

Sep 20 2017

|

BOA

|

(2,458,862

|

)

|

||||||||

|

USD

|

61,350,406

|

EUR

|

52,238,000

|

Sep 22 2017

|

BOA

|

(909,665

|

)

|

||||||||

|

USD

|

1,532,971

|

GBP

|

1,187,339

|

Sep 01 2017

|

BOA

|

(2,418

|

)

|

||||||||

|

USD

|

3,334,658

|

GBP

|

2,587,477

|

Sep 05 2017

|

BOA

|

(11,729

|

)

|

||||||||

|