| Institutional Class Prospectus | Boston Partners Small Cap Value Fund II | ||||||||||||||||||||||||||||

SUMMARY SECTION — BOSTON PARTNERS SMALL CAP VALUE FUND II | ||||||||||||||||||||||||||||

Investment Objective | ||||||||||||||||||||||||||||

The Fund seeks to provide long-term growth of capital primarily through investment in equity securities. | ||||||||||||||||||||||||||||

Current income is a secondary objective. | ||||||||||||||||||||||||||||

Expenses and Fees | ||||||||||||||||||||||||||||

This table describes the fees and expenses that you may pay if you buy and hold Institutional Class shares of the Fund. | ||||||||||||||||||||||||||||

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

Example | ||||||||||||||||||||||||||||

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $100,000 in the Fund for the time periods indicated and that you sell all of your shares at the end of the period. The Example also assumes that your investment has a 5% return each year and that the operating expenses of the Fund remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

Portfolio Turnover | ||||||||||||||||||||||||||||

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Total annual Fund operating expenses or in the Example, affect the Fund's performance. During the fiscal year ended August 31, 2017, the portfolio turnover rate for the Fund was 24% of the average value of its portfolio. | ||||||||||||||||||||||||||||

Summary of Principal Investment Strategies | ||||||||||||||||||||||||||||

The Fund pursues its objective by investing, under normal circumstances, at least 80% of its net assets (including borrowings for investment purposes) in a diversified portfolio consisting primarily of equity securities, such as common stocks of issuers with small market capitalizations and identified by the Adviser as having value characteristics. A small market capitalization issuer generally is considered to be one whose market capitalization is, at the time the Fund makes the investment, similar to the market capitalization of companies in the Russell 2000® Value Index. The Russell 2000® Value Index is an unmanaged index that contains stocks from the Russell 2000® Index with less than average growth orientation. As of November 30, 2017, the median market capitalization of this index was $1.77 billion and the largest stock was $7.25 billion. Please note that this range is as of a particular point in time and is subject to change.

The Fund generally invests in the equity securities of small companies. The Adviser will seek to invest in companies it considers to be well managed and to have attractive fundamental financial characteristics. The Adviser believes greater potential for price appreciation exists among small companies since they tend to be less widely followed by other securities analysts and thus may be more likely to be undervalued by the market. The Fund may invest from time to time a portion of its assets, not to exceed 20% (under normal conditions) at the time of purchase, in companies with larger market capitalizations.

The Adviser examines various factors in determining the value characteristics of such issuers including price to book value ratios and price to earnings ratios. These value characteristics are examined in the context of the issuer's operating and financial fundamentals such as return on equity, earnings growth and cash flow. The Adviser selects securities for the Fund based on a continuous study of trends in industries and companies, earnings power and growth and other investment criteria.

The Adviser will sell a stock when it no longer meets one or more investment criteria, either through obtaining target value or due to an adverse change in fundamentals or business momentum. Each holding has a target valuation established at purchase, which the Adviser constantly monitors and adjusts as appropriate.

The Fund may also invest up to 25% of its total assets in non U.S. dollar-denominated securities.

The Fund may invest up to 15% of its net assets in illiquid securities, including securities that are illiquid by virtue of the absence of a readily available market or legal or contractual restrictions on resale.

The Fund may participate as a purchaser in initial public offerings of securities ("IPO"). An IPO is a company's first offering of stock to the public.

In general, the Fund's investments are broadly diversified over a number of industries and, as a matter of policy, the Fund is limited to investing a maximum of 25% of its total assets in any one industry.

While the Adviser intends to fully invest the Fund's assets at all times in accordance with the above-mentioned policies, the Fund reserves the right to hold up to 100% of its assets, as a temporary defensive measure, in cash and eligible U.S. dollar-denominated money market instruments and make investments inconsistent with its investment objective. The Adviser will determine when market conditions warrant temporary defensive measures. | ||||||||||||||||||||||||||||

Summary of Principal Risks | ||||||||||||||||||||||||||||

• Management Risk. The Fund is subject to the risk of poor stock selection. In other words, the individual stocks in the Fund may not perform as well as expected, and/or the Fund's portfolio management practices do not work to achieve their desired result.

• Market Risk. The net asset value ("NAV") of the Fund will change with changes in the market value of its portfolio positions. Investors may lose money. Although the Fund will invest in stocks the Adviser believes to be undervalued, there is no guarantee that the prices of these stocks will not move even lower.

• Foreign Securities Risk. International investing is subject to special risks, including, but not limited to, currency exchange rate volatility, political, social or economic instability, and differences in taxation, auditing and other financial practices.

• Small Cap Companies Risk. The Fund will invest in smaller issuers which are more volatile and less liquid than investments in issuers with a market capitalization greater than the market capitalization of companies in the Russell 2000® Value Index. Small market capitalization issuers are not as diversified in their business activities as issuers with market capitalizations greater than the market capitalization of companies in the Russell 2000® Value Index and are more susceptible to changes in the business cycle.

The small capitalization equity securities in which the Fund invests may be traded only in the over-the-counter market or on a regional securities exchange, may be listed only in the quotation service commonly known as the "pink sheets," and may not be traded every day or in the volume typical of trading on a national securities exchange. These securities may also be subject to wide fluctuations in market value. The trading market for any given small capitalization equity security may be sufficiently small as to make it difficult for the Fund to dispose of a substantial block of such securities. The sale by the Fund of portfolio securities to meet redemptions may require the Fund to sell its small capitalization securities at a discount from market prices or during periods when, in the Adviser's judgment, such sale is not desirable. Moreover, the lack of an efficient market for these securities may make them difficult to value.

• Illiquid Securities Risk. Investing in illiquid securities is subject to certain risks, such as limitations on resale and uncertainty in determining valuation. Limitations on resale may adversely affect the marketability of portfolio securities and the Fund might be unable to dispose of restricted or other illiquid securities promptly or at reasonable prices and might thereby experience difficulty satisfying redemptions within seven days. The Fund might, in order to dispose of restricted securities, have to register securities resulting in additional expense and delay. Adverse market conditions could impede such a public offering of such securities.

• IPO Risk. IPO risk is the risk that the market value of IPO shares will fluctuate considerably due to certain factors, such as the absence of a prior public market, unseasoned trading, the small number of shares available for trading and limited information about the issuer. The purchase of IPO shares may involve high transaction costs. IPO shares are subject to market risk and liquidity risk. When the Fund's asset base is small, a significant portion of the Fund's performance could be attributable to investments in IPOs, because such investments would have a magnified impact on the Fund. As the Fund's assets grow, the effect of the Fund's investments in IPOs on the Fund's performance probably will decline, which could reduce the Fund's performance. Because of the price volatility of IPO shares, the Fund may choose to hold IPO shares for a very short period of time. This may increase the turnover of the Fund's portfolio and may lead to increased expenses to the Fund, such as commissions and transaction costs. In addition, the Adviser cannot guarantee continued access to IPOs. | ||||||||||||||||||||||||||||

Performance Information | ||||||||||||||||||||||||||||

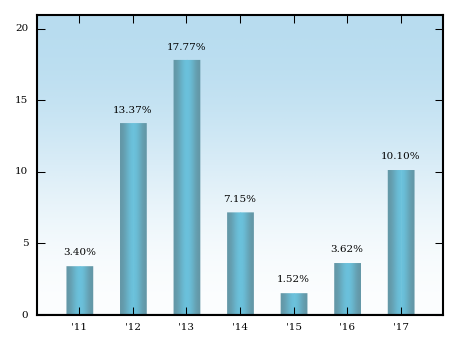

The bar chart and table below illustrate the long-term performance of the Boston Partners Small Cap Value Fund II's Institutional Class. The bar chart below shows you how the performance of the Fund's Institutional Class has varied year by year and provides some indication of the risks of investing in the Fund. The bar chart assumes reinvestment of dividends and distributions. As with all such investments, past performance (before and after taxes) is not an indication of future results. Performance reflects fee waivers in effect. If fee waivers were not in place, the Fund's performance would be reduced. Updated performance information is available at www.boston-partners.com or 1-888-261-4073. | ||||||||||||||||||||||||||||

Total Returns for the Calendar Years Ended December 31 | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

Best and Worst Quarterly Performance (for the periods reflected in the chart above):

| ||||||||||||||||||||||||||||

Average Annual Total Returns for the Periods Ended | ||||||||||||||||||||||||||||

The table below compares the average annual total returns for the Fund's Institutional Class both before and after taxes for the past calendar year, past five calendar years and past ten calendar years to the average annual total returns of a broad-based securities market index for the same periods. | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||