Filed with the Securities and Exchange Commission on February 22, 2018

1933 Act Registration File No. 033-20827

1940 Act File No. 811- 05518

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-1A

| REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | [X] | ||

| Pre-Effective Amendment No. | [ ] | ||

| Post-Effective Amendment No. | 239 | [X] | |

and/or

| REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 | [X] | ||

| Amendment No. | 241 | [X] | |

(Check Appropriate Box or Boxes)

THE RBB FUND, INC.

(Exact Name of Registrant as Specified in Charter)

| 615 East Michigan Street, |

| Milwaukee, Wisconsin 53202 |

(Address of Principal Executive Offices, including Zip Code)

Registrant’s Telephone Number, including Area Code: (302) 791-1851

Copies to:

| SALVATORE FAIA | MICHAEL P. MALLOY, ESQUIRE |

| The RBB Fund, Inc. | Drinker Biddle & Reath LLP |

| 615 East Michigan Street, | One Logan Square, Suite 2000 |

| Milwaukee, Wisconsin 53202 | Philadelphia, Pennsylvania 19103-6996 |

Approximate Date of Proposed Public Offering: As soon as practicable after the Registration Statement becomes effective.

| [X] | immediately upon filing pursuant to paragraph (b) |

| [ ] | on (date) pursuant to paragraph (b) |

| [ ] | 60 days after filing pursuant to paragraph (a)(1) |

| [ ] | on (date) pursuant to paragraph (a)(1) |

| [ ] | 75 days after filing pursuant to paragraph (a)(2) |

| [ ] | on (date) pursuant to paragraph (a)(2) of Rule 485. |

If appropriate, check the following box:

| [ ] | This post-effective amendment designates a new effective date for a previously filed post-effective amendment. |

Institutional

Class

Boston Partners Investment Funds

of The RBB Fund, Inc.

Prospectus February 22, 2018

Boston Partners Small Cap Value Fund II – BPSIX

Boston Partners All-Cap Value Fund – BPAIX

Boston Partners Long/Short Equity Fund – BPLSX

Boston Partners Long/Short Research Fund – BPIRX

WPG Partners Small/Micro Cap Value Fund – WPGTX

Boston Partners Global Equity Fund – BPGIX

Boston Partners Global Long/Short Fund – BGLSX

Boston Partners Emerging Markets Long/Short Fund – BELSX

Boston Partners Emerging Markets Fund – BPEMX

The securities described in this prospectus have been registered with the Securities and Exchange Commission ("SEC"). The SEC, however, has not judged these securities for their investment merit and has not determined the accuracy or adequacy of this prospectus. Anyone who tells you otherwise is committing a criminal offense.

Table of Contents

| SUMMARY SECTION — BOSTON PARTNERS SMALL CAP VALUE FUND II | 2 |

| SUMMARY SECTION — BOSTON PARTNERS ALL-CAP VALUE FUND | 7 |

| SUMMARY SECTION — BOSTON PARTNERS LONG/SHORT EQUITY FUND | 12 |

| SUMMARY SECTION — BOSTON PARTNERS LONG/SHORT RESEARCH FUND | 18 |

| SUMMARY SECTION — WPG PARTNERS SMALL/MICRO CAP VALUE FUND | 25 |

| SUMMARY SECTION — BOSTON PARTNERS GLOBAL EQUITY FUND | 30 |

| SUMMARY SECTION — BOSTON PARTNERS GLOBAL LONG/SHORT FUND | 36 |

| SUMMARY SECTION — BOSTON PARTNERS EMERGING MARKETS LONG/SHORT FUND | 44 |

| SUMMARY SECTION — BOSTON PARTNERS EMERGING MARKETS FUND | 52 |

| ADDITIONAL INFORMATION ABOUT THE FUNDS' INVESTMENTS AND RISKS | 58 |

| MANAGEMENT OF THE FUNDS | 63 |

| SHAREHOLDER INFORMATION | 70 |

| ADDITIONAL INFORMATION | 81 |

| APPENDIX A | 83 |

| APPENDIX B | 86 |

| APPENDIX C | 88 |

| FINANCIAL HIGHLIGHTS | 90 |

| FOR MORE INFORMATION: | Back Cover |

A look at the investment objectives, strategies, risks, expenses and financial history of each of the Boston Partners Investment Funds offered in this Prospectus.

Details about the Boston Partners Investment Funds' service providers offered in this Prospectus.

Policies and instructions for opening, maintaining and closing an account in any of the Boston Partners Investment Funds offered in this Prospectus.

SUMMARY SECTION — BOSTON PARTNERS SMALL CAP VALUE FUND II

Investment Objective

The Fund seeks to provide long-term growth of capital primarily through investment in equity securities. Current income is a secondary objective.

Expenses and Fees

This table describes the fees and expenses that you may pay if you buy and hold Institutional Class shares of the Fund.

| Institutional Class | |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |

| Management fees | 1.00% |

| Distribution and/or Service (12b-1) fees | None |

| Other expenses | 0.18% |

| Acquired fund fees and expenses(1) | 0.01% |

| Total annual Fund operating expenses | 1.19% |

| Fee waiver and/or expense reimbursement(2) | (0.09)% |

| Total annual Fund operating expenses after fee waiver and/or expense reimbursement | 1.10% |

| (1) | Acquired fund fees and expenses are indirect fees and expenses that the Fund incurs from investing in the shares of other mutual funds, including money market funds and exchange traded funds. Please note that the amount of Total annual Fund operating expenses and Total annual Fund operating expenses after fee waiver and/or expense reimbursement shown in the above table will differ from the “Financial Highlights” section of the prospectus, which reflects the operating expenses of the Fund and does not include indirect expenses such as acquired fund fees and expenses. |

| (2) | The Fund's investment adviser, Boston Partners Global Investors, Inc. (the "Adviser"), has contractually agreed to waive all or a portion of its advisory fee and/or reimburse expenses in an aggregate amount equal to the amount by which the Total annual Fund operating expenses (excluding certain items discussed below) for the Fund's Institutional Class shares exceeds 1.10% of the average daily net assets attributable to the Fund's Institutional Class shares. In determining the Adviser's obligation to waive advisory fees and/or reimburse expenses, the following expenses are not taken into account and could cause net Total annual Fund operating expenses to exceed 1.10%: short sale dividend expenses, brokerage commissions, extraordinary items, interest or taxes. This contractual limitation is in effect until February 28, 2019 and may not be terminated without the approval of the Board of Directors of The RBB Fund, Inc. If at any time the Fund's Total annual Fund operating expenses (not including short sale dividend expense, brokerage commissions, extraordinary items, interest or taxes) for a year are less than 1.10% or the expense cap then in effect, whichever is less, the Adviser is entitled to reimbursement by the Fund of the advisory fees forgone and other payments remitted by the Adviser to the Fund within three years from the date on which such waiver or reimbursement was made, provided such reimbursement does not cause the Fund to exceed expense limitations that were in effect at the time of the waiver or reimbursement. |

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $100,000 in the Fund for the time periods indicated and that you sell all of your shares at the end of the period. The Example also assumes that your investment has a 5% return each year and that the operating expenses of the Fund remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

2

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Institutional Class | $1,121 | $3,689 | $6,457 | $14,352 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Total annual Fund operating expenses or in the Example, affect the Fund's performance. During the fiscal year ended August 31, 2017, the portfolio turnover rate for the Fund was 24% of the average value of its portfolio.

Summary of Principal Investment Strategies

The Fund pursues its objective by investing, under normal circumstances, at least 80% of its net assets (including borrowings for investment purposes) in a diversified portfolio consisting primarily of equity securities, such as common stocks of issuers with small market capitalizations and identified by the Adviser as having value characteristics. A small market capitalization issuer generally is considered to be one whose market capitalization is, at the time the Fund makes the investment, similar to the market capitalization of companies in the Russell 2000® Value Index. The Russell 2000® Value Index is an unmanaged index that contains stocks from the Russell 2000® Index with less than average growth orientation. As of November 30, 2017, the median market capitalization of this index was $1.77 billion and the largest stock was $7.25 billion. Please note that this range is as of a particular point in time and is subject to change.

The Fund generally invests in the equity securities of small companies. The Adviser will seek to invest in companies it considers to be well managed and to have attractive fundamental financial characteristics. The Adviser believes greater potential for price appreciation exists among small companies since they tend to be less widely followed by other securities analysts and thus may be more likely to be undervalued by the market. The Fund may invest from time to time a portion of its assets, not to exceed 20% (under normal conditions) at the time of purchase, in companies with larger market capitalizations.

The Adviser examines various factors in determining the value characteristics of such issuers including price to book value ratios and price to earnings ratios. These value characteristics are examined in the context of the issuer's operating and financial fundamentals such as return on equity, earnings growth and cash flow. The Adviser selects securities for the Fund based on a continuous study of trends in industries and companies, earnings power and growth and other investment criteria.

The Adviser will sell a stock when it no longer meets one or more investment criteria, either through obtaining target value or due to an adverse change in fundamentals or business momentum. Each holding has a target valuation established at purchase, which the Adviser constantly monitors and adjusts as appropriate.

The Fund may also invest up to 25% of its total assets in non U.S. dollar-denominated securities.

The Fund may invest up to 15% of its net assets in illiquid securities, including securities that are illiquid by virtue of the absence of a readily available market or legal or contractual restrictions on resale.

The Fund may participate as a purchaser in initial public offerings of securities (“IPO”). An IPO is a company's first offering of stock to the public.

In general, the Fund's investments are broadly diversified over a number of industries and, as a matter of policy, the Fund is limited to investing a maximum of 25% of its total assets in any one industry.

While the Adviser intends to fully invest the Fund's assets at all times in accordance with the above-mentioned policies, the Fund reserves the right to hold up to 100% of its assets, as a temporary defensive measure, in cash and eligible U.S. dollar-denominated money market instruments and make investments inconsistent with its investment objective. The Adviser will determine when market conditions warrant temporary defensive measures.

3

Summary of Principal Risks

● Management Risk. The Fund is subject to the risk of poor stock selection. In other words, the individual stocks in the Fund may not perform as well as expected, and/or the Fund's portfolio management practices do not work to achieve their desired result.

● Market Risk. The net asset value ("NAV") of the Fund will change with changes in the market value of its portfolio positions. Investors may lose money. Although the Fund will invest in stocks the Adviser believes to be undervalued, there is no guarantee that the prices of these stocks will not move even lower.

● Foreign Securities Risk. International investing is subject to special risks, including, but not limited to, currency exchange rate volatility, political, social or economic instability, and differences in taxation, auditing and other financial practices.

● Small Cap Companies Risk. The Fund will invest in smaller issuers which are more volatile and less liquid than investments in issuers with a market capitalization greater than the market capitalization of companies in the Russell 2000® Value Index. Small market capitalization issuers are not as diversified in their business activities as issuers with market capitalizations greater than the market capitalization of companies in the Russell 2000® Value Index and are more susceptible to changes in the business cycle.

The small capitalization equity securities in which the Fund invests may be traded only in the over-the-counter market or on a regional securities exchange, may be listed only in the quotation service commonly known as the "pink sheets," and may not be traded every day or in the volume typical of trading on a national securities exchange. These securities may also be subject to wide fluctuations in market value. The trading market for any given small capitalization equity security may be sufficiently small as to make it difficult for the Fund to dispose of a substantial block of such securities. The sale by the Fund of portfolio securities to meet redemptions may require the Fund to sell its small capitalization securities at a discount from market prices or during periods when, in the Adviser's judgment, such sale is not desirable. Moreover, the lack of an efficient market for these securities may make them difficult to value.

● Illiquid Securities Risk. Investing in illiquid securities is subject to certain risks, such as limitations on resale and uncertainty in determining valuation. Limitations on resale may adversely affect the marketability of portfolio securities and the Fund might be unable to dispose of restricted or other illiquid securities promptly or at reasonable prices and might thereby experience difficulty satisfying redemptions within seven days. The Fund might, in order to dispose of restricted securities, have to register securities resulting in additional expense and delay. Adverse market conditions could impede such a public offering of such securities.

● IPO Risk. IPO risk is the risk that the market value of IPO shares will fluctuate considerably due to certain factors, such as the absence of a prior public market, unseasoned trading, the small number of shares available for trading and limited information about the issuer. The purchase of IPO shares may involve high transaction costs. IPO shares are subject to market risk and liquidity risk. When the Fund's asset base is small, a significant portion of the Fund's performance could be attributable to investments in IPOs, because such investments would have a magnified impact on the Fund. As the Fund's assets grow, the effect of the Fund's investments in IPOs on the Fund's performance probably will decline, which could reduce the Fund's performance. Because of the price volatility of IPO shares, the Fund may choose to hold IPO shares for a very short period of time. This may increase the turnover of the Fund's portfolio and may lead to increased expenses to the Fund, such as commissions and transaction costs. In addition, the Adviser cannot guarantee continued access to IPOs.

Performance Information

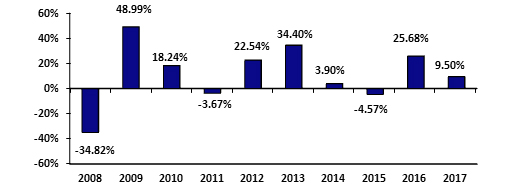

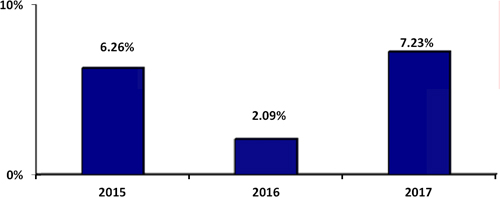

The bar chart and table below illustrate the long-term performance of the Boston Partners Small Cap Value Fund II's Institutional Class. The bar chart below shows you how the performance of the Fund’s Institutional Class has varied year by year and provides some indication of the risks of investing in the Fund. The bar chart assumes reinvestment of dividends and distributions. As with all such investments, past performance (before and after taxes) is not an indication of future results. Performance reflects fee waivers in effect. If fee waivers were not in place, the Fund's performance would be reduced. Updated performance information is available at www.boston-partners.com or 1-888-261-4073.

4

Total Returns for the Calendar Years Ended December 31

Best and Worst Quarterly Performance (for the periods reflected in the chart above):

| Best Quarter: | 29.32% (quarter ended June 30, 2009) |

| Worst Quarter: | -26.32% (quarter ended December 31, 2008) |

Average Annual Total Returns

The table below compares the average annual total returns for the Fund's Institutional Class both before and after taxes for the past calendar year, past five calendar years and past ten calendar years to the average annual total returns of a broad-based securities market index for the same periods.

| Average

Annual Total Returns for the Periods Ended December 31, 2017 |

|||

| 1 Year | 5 Years | 10 Years | |

| Boston Partners Small Cap Value Fund II | |||

| Returns Before Taxes | 9.78% |

13.19% | 9.81% |

| Returns After Taxes on Distributions (1) | 8.56% | 12.42% | 9.35% |

| Returns After Taxes on Distributions and Sale of Fund Shares | 6.38% | 10.46% | 8.01% |

| Russell 2000® Value Index (reflects no deduction for fees, expenses or taxes) | 7.84% | 13.01% | 8.17% |

| (1) | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

5

Management of the Fund

Investment Adviser

Boston

Partners Global Investors, Inc.

909 Third Avenue, 32nd Floor, New York, New York 10022

Portfolio Managers

David

M. Dabora, Senior Portfolio Manager since 2000

George Gumpert, Portfolio Manager since 2005

Purchase and Sale of Fund Shares

Minimum

Initial Investment: $100,000

Minimum Additional Investment: $5,000

You can only purchase and redeem Institutional Class shares of the Fund on days the New York Stock Exchange is open. Institutional Class shares of the Fund may be available through certain brokerage firms, financial institutions and other industry professionals (collectively, "Service Organizations"). Shares of the Fund may also be purchased and redeemed directly through The RBB Fund, Inc. by the means described below.

| Purchase

and Redemption By Mail: Boston Partners Small Cap Value Fund II c/o U.S. Bancorp Fund Services, LLC P.O. Box 701 Milwaukee, WI 53201-0701 |

Purchase

and Redemption By Wire: Request routing instructions by calling the Fund's transfer agent at 1-888-261-4073. |

Redemption By Telephone: If you select the option on your account application, you may call the Fund's transfer agent at 1-888-261-4073.

Taxes

The Fund intends to make distributions that generally may be taxed at ordinary income or capital gains rates.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund Shares and other related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

6

SUMMARY SECTION — BOSTON PARTNERS ALL-CAP VALUE FUND

Investment Objective

The Fund seeks to provide long-term growth of capital primarily through investment in equity securities. Current income is a secondary objective.

Expenses and Fees

This table describes the fees and expenses that you may pay if you buy and hold Institutional Class shares of the Fund.

| Institutional Class | |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |

| Management fees(1) | 0.70% |

| Distribution and/or Service (12b-1) fees | None |

| Other expenses | 0.18% |

| Acquired fund fees and expenses(2) | 0.01% |

| Total annual Fund operating expenses | 0.89% |

| Fee waiver and/or expense reimbursement(3) | (0.09)% |

| Total annual Fund operating expenses after fee waiver and/or expense reimbursement | 0.80% |

| (1) | Prior to February 28, 2017, the management fee was 0.80%. |

| (2) | Acquired fund fees and expenses are indirect fees and expenses that the Fund incurs from investing in the shares of other mutual funds, including money market funds and exchange traded funds. Please note that the amount of Total annual Fund operating expenses and Total annual Fund operating expenses after fee waiver and/or expense reimbursement shown in the above table will differ from the “Financial Highlights” section of the prospectus, which reflects the operating expenses of the Fund and does not include indirect expenses such as acquired fund fees and expenses. |

| (3) | The Fund's Adviser has contractually agreed to waive all or a portion of its advisory fee and/or reimburse expenses in an aggregate amount equal to the amount by which the Total annual Fund operating expenses (excluding certain items discussed below) for the Fund's Institutional Class shares exceeds 0.80% of the average daily net assets attributable to the Fund's Institutional Class shares. In determining the Adviser's obligation to waive advisory fees and/or reimburse expenses, the following expenses are not taken into account and could cause net Total annual Fund operating expenses to exceed 0.80%: short sale dividend expenses, brokerage commissions, extraordinary items, interest or taxes. This contractual limitation is in effect until February 28, 2019 and may not be terminated without the approval of the Board of Directors of The RBB Fund, Inc. The Adviser may not recoup any of its waived investment advisory fees. |

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $100,000 in the Fund for the time periods indicated and that you sell all of your shares at the end of the period. The Example also assumes that your investment has a 5% return each year and that the operating expenses of the Fund remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Institutional Class | $817 | $2,749 | $4,842 | $10,878 |

7

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Total annual Fund operating expenses or in the Example, affect the Fund's performance. During the fiscal year ended August 31, 2017, the portfolio turnover rate for the Fund was 27% of the average value of its portfolio.

Summary of Principal Investment Strategies

The Fund pursues its objective by investing, under normal circumstances, at least 80% of its net assets (including borrowings for investment purposes) in a diversified portfolio consisting primarily of equity securities, such as common stocks of issuers across the capitalization spectrum and identified by the Adviser as having value characteristics.

The Adviser examines various factors in determining the value characteristics of such issuers including price to book value ratios and price to earnings ratios. These value characteristics are examined in the context of the issuer's operating and financial fundamentals, such as return on equity and earnings growth and cash flow. The Adviser selects securities for the Fund based on a continuous study of trends in industries and companies, earnings power and growth and other investment criteria.

The Adviser will sell a stock when it no longer meets one or more investment criteria, either through obtaining target value or due to an adverse change in fundamentals or business momentum. Each holding has a target valuation established at purchase, which the Adviser constantly monitors and adjusts as appropriate.

The Fund may also invest up to 20% of its total assets in non U.S. dollar-denominated securities.

The Fund may invest up to 15% of its net assets in illiquid securities, including securities that are illiquid by virtue of the absence of a readily available market or legal or contractual restrictions on resale.

The Fund may participate as a purchaser in initial public offerings of securities ("IPO"). An IPO is a company's first offering of stock to the public.

The Fund may invest up to 10% of its net assets in securities that can be converted into common stock, such as certain debt securities and preferred stock.

The Fund may hedge overall portfolio exposure up to 40% of its net assets through the purchase and sale of index and individual put and call options.

In general, the Fund's investments are broadly diversified over a number of industries and, as a matter of policy, the Fund is limited to investing less than 25% of its total assets in any one industry.

While the Adviser intends to fully invest the Fund's assets at all times in accordance with the above-mentioned policies, the Fund reserves the right to hold up to 100% of its assets, as a temporary defensive measure, in cash and eligible U.S. dollar-denominated money market instruments and make investments inconsistent with its investment objective. The Adviser will determine when market conditions warrant temporary defensive measures.

Summary of Principal Risks

● Management Risk. The Fund is subject to the risk of poor stock selection. In other words, the individual stocks in the Fund may not perform as well as expected, and/or the Fund's portfolio management practices do not work to achieve their desired result.

● Market Risk. The net asset value ("NAV") of the Fund will change with changes in the market value of its portfolio positions. Investors may lose money. Although the Fund will invest in stocks the Adviser believes to be undervalued, there is no guarantee that the prices of these stocks will not move even lower.

8

● Foreign Securities Risk. International investing is subject to special risks, including, but not limited to, currency exchange rate volatility, political, social or economic instability, and differences in taxation, auditing and other financial practices.

● Micro-Cap Companies Risk. Micro-cap stocks may be very sensitive to changing economic conditions and market downturns because the issuers often have narrow markets for their products or services, fewer product lines, and more limited managerial and financial resources than larger issuers. The stocks of micro-cap companies may therefore be more volatile and the ability to sell them at a desirable time or price may be more limited.

● Small-Cap Companies Risk. The stocks of smaller companies may be subject to more abrupt, erratic market movements than stocks of larger, more established companies. Small companies may have limited product lines or financial resources, or may be dependent on a small or inexperienced management group, and their securities may trade less frequently and in lower volume than securities of larger companies, which could lead to higher transaction costs. Generally, the smaller the company size, the greater the risk.

● Mid-Cap Companies Risk. The stocks of mid-sized companies may be subject to more abrupt or erratic market movements than stocks of larger, more established companies.

● Convertible Securities Risk. Securities that can be converted into common stock, such as certain securities and preferred stock, are subject to the usual risks associated with fixed income investments, such as interest rate risk and credit risk. In addition, because they react to changes in the value of the equity securities into which they will convert, convertible securities are also subject to the risks associated with equity securities.

● Options Risk. An option is a type of derivative instrument that gives the holder the right (but not the obligation) to buy (a "call") or sell (a "put") an asset in the near future at an agreed upon price prior to the expiration date of the option. The Fund may "cover" a call option by owning the security underlying the option or through other means. The value of options can be highly volatile, and their use can result in loss if the Adviser is incorrect in its expectation of price fluctuations.

● Illiquid Securities Risk. Investing in illiquid securities is subject to certain risks, such as limitations on resale and uncertainty in determining valuation. Limitations on resale may adversely affect the marketability of portfolio securities and the Fund might be unable to dispose of restricted or other illiquid securities promptly or at reasonable prices and might thereby experience difficulty satisfying redemptions within seven days. The Fund might, in order to dispose of restricted securities, have to register securities resulting in additional expense and delay. Adverse market conditions could impede such a public offering of such securities.

● IPO Risk. IPO risk is the risk that the market value of IPO shares will fluctuate considerably due to certain factors, such as the absence of a prior public market, unseasoned trading, the small number of shares available for trading and limited information about the issuer. The purchase of IPO shares may involve high transaction costs. IPO shares are subject to market risk and liquidity risk. When the Fund's asset base is small, a significant portion of the Fund's performance could be attributable to investments in IPOs, because such investments would have a magnified impact on the Fund. As the Fund's assets grow, the effect of the Fund's investments in IPOs on the Fund's performance probably will decline, which could reduce the Fund's performance. Because of the price volatility of IPO shares, the Fund may choose to hold IPO shares for a very short period of time. This may increase the turnover of the Fund's portfolio and may lead to increased expenses to the Fund, such as commissions and transaction costs. In addition, the Adviser cannot guarantee continued access to IPOs.

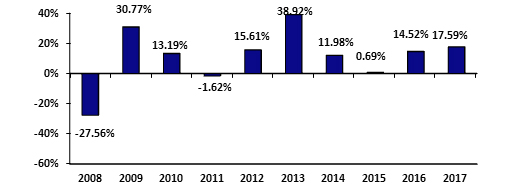

Performance Information

The bar chart and table below illustrate the long-term performance of the Boston Partners All-Cap Value Fund's Institutional Class. The bar chart below shows you how the performance of the Fund’s Institutional Class has varied year by year and provides some indication of the risks of investing in the Fund. The bar chart assumes reinvestment of dividends and distributions. As with all such investments, past performance (before and after taxes) is not an indication of future results. Performance reflects fee waivers in effect. If fee waivers were not in place, the Fund's performance would be reduced. Updated performance information is available at www.boston-partners.com or 1-888-261-4073.

9

Total Returns for the Calendar Years Ended December 31

Best and Worst Quarterly Performance (for the periods reflected in the chart above):

| Best Quarter: | 18.60% (quarter ended June 30, 2009) |

| Worst Quarter: | -17.49% (quarter ended September 30, 2011) |

Average Annual Total Returns

The table below compares the average annual total returns for the Fund's Institutional Class both before and after taxes for the past calendar year, past five calendar years and past ten calendar years to the average annual total returns of a broad-based securities market index for the same periods.

| Average

Annual Total Returns for the Periods Ended December 31, 2017 |

|||

| 1 Year | 5 Years | 10 Years | |

| Boston Partners All-Cap Value Fund | |||

| Returns Before Taxes | 17.87% |

16.36% | 10.17% |

| Returns After Taxes on Distributions (1) | 16.69% | 15.02% | 9.27% |

| Returns After Taxes on Distributions and Sale of Fund Shares | 11.05% | 12.95% | 8.18% |

| Russell 3000® Value Index (reflects no deduction for fees, expenses or taxes) | 13.19% | 13.95% | 7.19% |

| (1) | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

10

Management of the Fund

Investment Adviser

Boston

Partners Global Investors, Inc.

909 Third Avenue, 32nd Floor, New York, New York 10022

Portfolio Manager

Duilio Ramallo, Senior Portfolio Manager since 2007

Purchase and Sale of Fund Shares

Minimum

Initial Investment: $100,000

Minimum Additional Investment: $5,000

You can only purchase and redeem Institutional Class shares of the Fund on days the New York Stock Exchange is open. Institutional Class shares of the Fund may be available through certain brokerage firms, financial institutions and other industry professionals (collectively, "Service Organizations"). Shares of the Fund may also be purchased and redeemed directly through The RBB Fund, Inc. by the means described below.

| Purchase

and Redemption By Mail: Boston Partners All Cap Value Fund c/o U.S. Bancorp Fund Services, LLC P.O. Box 701 Milwaukee, WI 53201-0701 |

Purchase

and Redemption By Wire: Request routing instructions by calling the Fund's transfer agent at 1-888-261-4073. |

Redemption By Telephone: If you select the option on your account application, you may call the Fund's transfer agent at 1-888-261-4073.

Taxes

The Fund intends to make distributions that generally may be taxed at ordinary income or capital gains rates.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and other related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

11

SUMMARY SECTION — BOSTON PARTNERS LONG/SHORT EQUITY FUND

Investment Objective

The Fund seeks long-term capital appreciation while reducing exposure to general equity market risk. The Fund seeks a total return greater than that of the S&P 500® Index over a full market cycle.

Expenses and Fees

This table describes the fees and expenses that you may pay if you buy and hold Institutional Class shares of the Fund.

| Institutional Class | |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |

| Management fees | 2.25% |

| Distribution and/or Service (12b-1) fees | None |

| Other Expenses | 0.14% |

| Acquired fund fees and expenses(1) | 0.01% |

| Short Sales Expenses: | |

| Dividend expense on short sales | 0.16% |

| Interest expense on borrowings | 0.25% |

| Total annual Fund operating expenses(2) | 2.81% |

| (1) | Acquired fund fees and expenses are indirect fees and expenses that the Fund incurs from investing in the shares of other mutual funds, including money market funds and exchange traded funds. Please note that the amount of Total annual Fund operating expenses shown in the above table will differ from the “Financial Highlights” section of the prospectus, which reflects the operating expenses of the Fund and does not include indirect expenses such as acquired fund fees and expenses. |

| (2) | The Fund's Adviser has contractually agreed to waive all or a portion of its advisory fee and/or reimburse expenses in an aggregate amount equal to the amount by which the Total annual Fund operating expenses (other than short sale dividend expenses, brokerage commissions, extraordinary items, interest or taxes) for the Fund's Institutional Class exceeds 2.50% of the average daily net assets attributable to the Fund's Institutional Class shares. Because dividend expenses on short sales, brokerage commissions, extraordinary items, interest and taxes are excluded from the expense limitation, Total annual Fund operating expenses (after fee waivers and expense reimbursements) are expected to exceed 2.50%. This contractual limitation is in effect until February 28, 2019 and may not be terminated without the approval of the Board of Directors of The RBB Fund, Inc. The Adviser may not recoup any of its waived investment advisory fees. |

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $100,000 in the Fund for the time periods indicated and that you sell all of your shares at the end of the period. The Example also assumes that your investment has a 5% return each year and that the operating expenses of the Fund remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

12

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Institutional Class | $2,841 | $8,710 | $14,840 | $31,377 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Total annual Fund operating expenses or in the Example, affect the Fund's performance. During the fiscal year ended August 31, 2017, the portfolio turnover rate for the Fund was 63% of the average value of its portfolio.

Summary of Principal Investment Strategies

The Fund invests in long positions in stocks identified by the Adviser as undervalued and takes short positions in stocks that the Adviser has identified as overvalued. The cash proceeds from short sales will be invested in short-term cash instruments to produce a return on such proceeds just below the federal funds rate. Short sales are considered speculative transactions and a form of leverage. The Fund invests, both long and short, in securities principally traded in the United States markets. The Fund may invest in securities of companies operating for three years or less ("unseasoned issuers"). The Adviser will determine the size of each long or short position by analyzing the tradeoff between the attractiveness of each position and its impact on the risk of the overall portfolio. The Fund seeks to construct a portfolio that has less volatility than the United States equity market generally. The Adviser examines various factors in determining the value characteristics of such issuers including price-to-book value ratios and price-to-earnings ratios. These value characteristics are examined in the context of the issuer's operating and financial fundamentals such as return on equity, earnings growth and cash flow. The Adviser selects securities for the Fund based on a continuous study of trends in industries and companies, earnings power and growth and other investment criteria.

The Fund intends, under normal circumstances, to invest at least 80% of its net assets (including borrowings for investment purposes) in equity securities. Under normal circumstances, the Adviser expects that the Fund's long positions will not exceed approximately 125% of the Fund's net assets.

The Fund's long and short positions may involve (without limit) equity securities of foreign issuers that are traded in the markets of the United States. The Fund may also invest up to 20% of its total assets directly in equity securities of foreign issuers.

To meet margin requirements, redemptions or pending investments, the Fund may also temporarily hold a portion of its assets in full faith and credit obligations of the United States government and in short-term notes, commercial paper or other money market instruments.

The Adviser will sell a stock when it no longer meets one or more investment criteria, either through obtaining target value or due to an adverse change in fundamentals or business momentum. Each holding has a target valuation established at purchase, which the Adviser constantly monitors and adjusts as appropriate.

The Fund may participate as a purchaser in initial public offerings of securities ("IPO"). An IPO is a company's first offering of stock to the public.

The Fund may invest from time to time a significant portion of its assets in smaller issuers which are more volatile and less liquid than investments in issuers with larger market capitalizations.

The Fund may invest up to 15% of its net assets in illiquid securities, including securities that are illiquid by virtue of the absence of a readily available market or legal or contractual restrictions on resale.

In general, the Fund's investments are broadly diversified over a number of industries and, as a matter of policy, the Fund is limited to investing a maximum of 25% of its total assets in any one industry.

13

The Fund may invest up to 20% of its net assets in high yield debt obligations, such as bonds and debentures, used by corporations and other business organizations. High yield debt obligations are referred to as "junk bonds" and are not considered to be investment grade.

While the Adviser intends to fully invest the Fund's assets at all times in accordance with the above-mentioned policies, the Fund reserves the right to hold up to 100% of its assets, as a temporary defensive measure, in cash and eligible U.S. dollar-denominated money market instruments and make investments inconsistent with its investment objective. The Adviser will determine when market conditions warrant temporary defensive measures.

Summary of Principal Risks

• Market Risk. The net asset value ("NAV") of the Fund will change with changes in the market value of its portfolio positions. Investors may lose money. Although the long portfolio of the Fund will invest in stocks the Adviser believes to be undervalued, there is no guarantee that the prices of these stocks will not move even lower.

• High Yield Debt Obligations Risk. The Fund may invest up to 20% of its net assets in high yield debt obligations, such as bonds and debentures, issued by corporations and other business organizations. An issuer of debt obligations may default on its obligation to pay interest and repay principal. Also, changes in the financial strength of an issuer or changes in the credit rating of a security may affect its value. Such high yield debt obligations are referred to as "junk bonds" and are not considered to be investment grade.

• Foreign Securities Risk. International investing is subject to special risks, including, but not limited to, currency exchange rate volatility, political, social or economic instability, and differences in taxation, auditing and other financial practices.

• Management Risk. The Fund is subject to the risk of poor stock selection. In other words, the Adviser may not be successful in its strategy of taking long positions in stocks the manager believes to be undervalued and short positions in stocks the manager believes to be overvalued. Further, since the Adviser will manage both a long and a short portfolio, there is the risk that the Adviser may make more poor investment decisions than an adviser of a typical stock mutual fund with only a long portfolio may make.

• Short Sales Risk. Short sales of securities may result in gains if a security's price declines, but may result in losses if a security's price rises.

• Unseasoned Issuers Risk. Unseasoned issuers may not have an established financial history and may have limited product lines, markets or financial resources. Unseasoned issuers may depend on a few key personnel for management and may be susceptible to losses and risks of bankruptcy. As a result, such securities may be more volatile and difficult to sell.

• Small-Cap Companies Risk. The small capitalization equity securities in which the Fund may invest may be traded only in the over-the-counter market or on a regional securities exchange, may be listed only in the quotation service commonly known as the "pink sheets," and may not be traded every day or in the volume typical of trading on a national securities exchange. These securities may also be subject to wide fluctuations in market value. The trading market for any given small capitalization equity security may be sufficiently small as to make it difficult for the Fund to dispose of a substantial block of such securities. The sale by the Fund of portfolio securities to meet redemptions may require the Fund to sell its small capitalization securities at a discount from market prices or during periods when, in the Adviser's judgment, such sale is not desirable. Moreover, the lack of an efficient market for these securities may make them difficult to value.

• Portfolio Turnover Risk. If the Fund frequently trades its portfolio securities, the Fund will incur higher brokerage commissions and transaction costs, which could lower the Fund's performance. In addition to lower performance, high portfolio turnover could result in taxable capital gains. A portfolio turnover rate of 100% is considered to be high. The annual portfolio turnover rate for the Fund is not expected to exceed 400%; however, it may be higher if the Adviser believes it will improve the Fund's performance.

• Segregated Account Risk. A security held in a segregated account cannot be sold while the position it is covering is outstanding, unless it is replaced with a similar security. As a result, there is a possibility that segregation of a large percentage of the Fund's assets could impede portfolio management or the Fund's ability to meet redemption requests or other current obligations.

14

• Illiquid Securities Risk. Investing in illiquid securities is subject to certain risks, such as limitations on resale and uncertainty in determining valuation. Limitations on resale may adversely affect the marketability of portfolio securities and the Fund might be unable to dispose of restricted or other illiquid securities promptly or at reasonable prices and might thereby experience difficulty satisfying redemptions within seven days. The Fund might, in order to dispose of restricted securities, have to register securities resulting in additional expense and delay. Adverse market conditions could impede such a public offering of such securities.

• IPO Risk. IPO risk is the risk that the market value of IPO shares will fluctuate considerably due to certain factors, such as the absence of a prior public market, unseasoned trading, the small number of shares available for trading and limited information about the issuer. The purchase of IPO shares may involve high transaction costs. IPO shares are subject to market risk and liquidity risk. When the Fund's asset base is small, a significant portion of the Fund's performance could be attributable to investments in IPOs, because such investments would have a magnified impact on the Fund. As the Fund's assets grow, the effect of the Fund's investments in IPOs on the Fund's performance probably will decline, which could reduce the Fund's performance. Because of the price volatility of IPO shares, the Fund may choose to hold IPO shares for a very short period of time. This may increase the turnover of the Fund's portfolio and may lead to increased expenses to the Fund, such as commissions and transaction costs. In addition, the Adviser cannot guarantee continued access to IPOs.

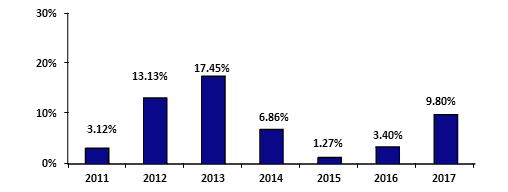

Performance Information

The bar chart and table below illustrate the long-term performance of the Boston Partners Long/Short Equity Fund's Institutional Class. The bar chart below shows you how the performance of the Fund’s Institutional Class has varied year by year and provides some indication of the risks of investing in the Fund. The bar chart assumes reinvestment of dividends and distributions. As with all such investments, past performance (before and after taxes) is not an indication of future results. Performance reflects fee waivers in effect. If fee waivers were not in place, the Fund's performance would be reduced. Updated performance information is available at www.boston-partners.com or 1-888-261-4073.

Total Returns for the Calendar Years Ended December 31

Best and Worst Quarterly Performance (for the periods reflected in the chart above):

| Best Quarter: | 38.60% (quarter ended June 30, 2009) | ||

| Worst Quarter: | -19.45% (quarter ended December 31, 2008) |

15

Average Annual Total Returns

The table below compares the average annual total returns for the Fund's Institutional Class both before and after taxes for the past calendar year, past five calendar years and past ten calendar years to the average annual total returns of a broad-based securities market index for the same periods. Although the Fund compares its average total return to a broad-based securities market index, the Fund seeks returns that are not correlated to securities market returns. The Fund seeks to achieve a 12-15% return over a full market cycle; however, there can be no guarantee that such returns will be achieved.

| Average

Annual Total Returns for the Periods Ended December 31, 2017 | |||

| 1 Year | 5 Years | 10 Years | |

| Boston Partners Long/Short Equity Fund | |||

| Returns Before Taxes | 2.77% | 7.06% | 11.79% |

| Returns After Taxes on Distributions (1) | 2.58% | 5.87% | 9.63% |

| Returns After Taxes on Distributions and Sale of Fund Shares | 1.71% | 5.35% | 8.84% |

| S&P 500® Index (reflects no deduction for fees, expenses or taxes) | 21.83% | 15.79% | 8.50% |

| (1) | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

Management of the Fund

Investment Adviser

Boston

Partners Global Investors, Inc.

909 Third Avenue, 32nd Floor, New York, New

York 10022

Portfolio Managers

Robert T. Jones, Senior Portfolio Manager since 1995

Purchase and Sale of Fund Shares

Minimum

Initial Investment: $100,000

Minimum Additional Investment: $5,000

The Fund is currently closed due to concerns that a significant increase in the size of the Fund may adversely affect the implementation of the Fund's strategy. The Fund will still be offered to existing shareholders of the Fund and certain other persons, as described in the section entitled "Purchase of Fund Shares" in this prospectus.

You can only purchase and redeem Institutional Class shares of the Fund on days the New York Stock Exchange is open. Institutional Class shares of the Fund may be available through certain brokerage firms, financial institutions and other industry professionals (collectively, "Service Organizations"). Shares of the Fund may also be purchased and redeemed directly through The RBB Fund, Inc. by the means described below.

16

Purchase

and Redemption By Mail: P.O.

Box 701 |

Purchase

and Redemption By Wire: Request routing instructions by calling the Fund's transfer agent at 1-888-261-4073. |

Redemption By Telephone: If you select the option on your account application, you may call the Fund's transfer agent at 1-888-261-4073.

Taxes

The Fund intends to make distributions that generally may be taxed at ordinary income or capital gains rates.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and other related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

17

SUMMARY SECTION — BOSTON PARTNERS LONG/SHORT RESEARCH FUND

Investment Objective

The Fund seeks to provide long-term total return.

Expenses and Fees

This table describes the fees and expenses that you may pay if you buy and hold Institutional Class shares of the Fund.

| Institutional Class | |

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | |

| Management fees | 1.25% |

| Distribution and/or Service (12b-1) fees | None |

| Other expenses | 0.12% |

| Acquired fund fees and expenses(1) | 0.01% |

| Short Sales Expenses: | |

| Dividend expense on short sales | 0.80% |

| Interest expense on borrowings | 0.06% |

| Total annual Fund operating expenses(2) | 2.24% |

| (1) | Acquired fund fees and expenses are indirect fees and expenses that the Fund incurs from investing in the shares of other mutual funds, including money market funds and exchange traded funds. Please note that the amount of Total annual Fund operating expenses shown in the above table will differ from the “Financial Highlights” section of the prospectus, which reflects the operating expenses of the Fund and does not include indirect expenses such as acquired fund fees and expenses. |

| (2) | The Fund's Adviser has contractually agreed to forgo all or a portion of its advisory fee and/or reimburse expenses in an aggregate amount equal to the amount by which the Total annual Fund operating expenses (other than short sale dividend expenses, brokerage commissions, extraordinary items, interest or taxes) exceeds 1.50% of the average daily net assets attributable to the Fund's Institutional Class shares. Because short sale dividend expenses, brokerage commissions, extraordinary items, interest and taxes are excluded from the expense limitation, Total annual Fund operating expenses (after fee waivers and expense reimbursements) are expected to exceed 1.50%. This contractual limitation is in effect until at least February 28, 2019 and may not be terminated without Board approval. If at any time the Fund's Total annual Fund operating expenses (not including short sale dividend expense, brokerage commissions, extraordinary items, interest or taxes) for a year are less than 1.50% or the expense cap then in effect, whichever is less, the Adviser is entitled to reimbursement by the Fund of the advisory fees forgone and other payments remitted by the Adviser to the Fund within three years from the date on which such waiver or reimbursement was made, provided such reimbursement does not cause the Fund to exceed expense limitations that were in effect at the time of the waiver or reimbursement. |

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $100,000 in the Fund for the time periods indicated and that you sell all of your shares at the end of the period. The Example also assumes that your investment has a 5% return each year and that the operating expenses of the Fund remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

18

| 1 Year | 3 Years | 5 Years | 10 Years | |

| Institutional Class | $2,271 | $7,002 | $11,999 | $25,748 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in Total annual Fund operating expenses or in the Example, affect the Fund's performance. During the fiscal year ended August 31, 2017, the portfolio turnover rate for the Fund was 54% of the average value of its portfolio.

Summary of Principal Investment Strategies

The Fund uses a hedged strategy. The Fund actively invests in long positions in stocks identified by the Adviser as undervalued and takes short positions in stocks that the Adviser has identified as overvalued. The cash proceeds from short sales (i.e. sales of securities the Fund does not own) are invested in short-term cash instruments to produce a return on such proceeds just below the federal funds rate. Short sales are considered speculative transactions and a form of leverage.

The Fund invests, both long and short, in equity securities issued by large-, mid- and small (or "micro") cap companies, as well as other instruments that are convertible into equity securities. Selling securities short is a form of leverage. Equity securities in which the Fund may invest include exchange-traded and over-the-counter common and preferred stocks, warrants, rights, convertible securities, depositary receipts and shares, trust certificates, limited partnership interests, shares of other investment companies and real estate investment trusts ("REITs"), and equity participations. An equity participation is a type of loan that gives the lender a portion of equity ownership in a property, in addition to principal and interest payments. A convertible security is a bond, debenture, note, preferred stock or other security that may be converted into or exchanged for a prescribed amount of common stock of the same or a different issuer within a particular period of time at a specified price or formula. The Fund may invest in securities of companies operating for three years or less ("unseasoned issuers"). The Fund may also invest in depositary receipts and equity securities of foreign companies (denominated in either U.S. dollars or foreign currencies), put and call options, futures, indexed securities and fixed-income securities (including bonds, notes, asset-backed securities, convertible securities, Eurodollar and Yankee dollar instruments, preferred stocks and money market instruments) and high yield securities (commonly referred to as "junk bonds"). Fixed income securities in which the Fund invests include those rated between AAA and D by a nationally recognized statistical rating organization, or deemed of comparable quality by the Adviser. The Adviser may also temporarily invest uninvested cash in money market funds and similar collective investment vehicles. The Fund may also seek to increase its income by lending portfolio securities.

The Adviser determines the size of each long or short position by analyzing the tradeoff between the attractiveness of each position and its impact on the risk of the overall portfolio. The Fund seeks to construct a portfolio that has less volatility than the U.S. equity market by investing less than 100% of its assets in net long positions. Selection of individual securities to be held long or sold short will be based on a mix of quantitative techniques and fundamental security analysis. The Adviser selects stocks on the basis of three criteria: value, fundamental business strength and momentum. The Adviser examines various factors in determining the value characteristics of such issuers including price-to-book value ratios and price-to-earnings ratios. These value characteristics are examined in the context of the issuer's operating and financial fundamentals such as return on equity, earnings growth and cash flow. The Adviser selects securities for the Fund based on a continuous study of trends in industries and companies, earnings power and growth and other investment criteria.

Although the Fund seeks to follow a hedged strategy, there can be no assurance that the Fund's portfolio or investments will be insulated from market moves or effectively hedged against risk.

In general, the Fund's investments are broadly diversified over a number of industries and, as a matter of policy, the Fund is limited to investing less than 25% of its total assets in any one industry, except that the Fund may invest in exchange traded funds to the extent permitted by the Investment Company Act of 1940, as amended (“1940 Act”), and applicable SEC orders.

19

The Fund may invest up to 15% of its net assets in illiquid securities, including securities that are illiquid by virtue of the absence of a readily available market or legal or contractual restrictions on resale.

The Adviser will sell a stock when it no longer meets one or more investment criteria, either through obtaining target value or due to an adverse change in fundamentals or business momentum. Each holding has a target valuation established at purchase, which the Adviser constantly monitors and adjusts as appropriate.

The principal derivative instruments in which the Fund invests are futures and options on securities, securities indices or currencies, options on these futures, forward foreign currency contracts and interest rate or currency swaps. The Fund's investments in derivative instruments may be leveraged and result in losses exceeding the amounts invested.

While the Adviser intends to fully invest the Fund's assets at all times in accordance with the above-mentioned policies, the Fund reserves the right to hold up to 100% of its assets, as a temporary defensive measure, in cash and eligible U.S. dollar-denominated money market instruments and make investments inconsistent with its investment objective. The Adviser will determine when market conditions warrant temporary defensive measures.

Summary of Principal Risks

• Market Risk. The net asset value ("NAV") of the Fund will change with changes in the market value of its portfolio positions. Investors may lose money. Although the long portfolio of the Fund will invest in stocks the Adviser believes to be undervalued, there is no guarantee that the price of these stocks will not move even lower.

• High Yield Debt Obligations Risk. The Fund may invest up to 20% of its net assets in high yield debt obligations (of any rating, including defaulted securities and unrated securities), including bonds and debentures, issued by corporations and business organizations. An issuer of debt obligations may default on its obligation to pay interest and repay principal. Also, changes in the financial strength of an issuer or changes in the credit rating of a security may affect its value. Such high yield debt obligations are referred to as "junk bonds" and are not considered to be investment grade.

• Foreign Securities Risk. International investing is subject to special risks, including currency exchange rate volatility, political, social or economic instability, and differences in taxation, auditing and financial practices.

• Currency Risk. Investment in foreign securities also involves currency risk associated with securities that trade or are denominated in currencies other than the U.S. dollar and which may be affected by fluctuations in currency exchange rates. An increase in the strength of the U.S. dollar relative to a foreign currency may cause the U.S. dollar value of an investment in that country to decline. Foreign currencies also are subject to risks caused by inflation, interest rates, budget deficits and low savings rates, political factors and government controls.

• Management Risk. The Fund is subject to the risk of poor stock selection. The Adviser may be incorrect in the stocks it buys and believes to be undervalued and in stocks it sells short and believes to be overvalued. Further, since the Adviser will manage both a long and a short portfolio, there is the risk that the Adviser may make more poor investment decisions than an adviser of a typical stock mutual fund with only a long portfolio.

• Short Sales Risk. Short sales of securities may result in gains if a security's price declines, but may result in losses if a security's price rises. In a rising market, short positions may be more likely to result in losses because securities sold short may be more likely to increase in value. Short selling also involves the risks of: increased leverage, and its accompanying potential for losses; the potential inability to reacquire a security in a timely manner, or at an acceptable price; the possibility of the lender terminating the loan at any time, forcing the Fund to close the transaction under unfavorable circumstances; the additional costs that may be incurred; and the potential loss of investment flexibility caused by the Fund's obligations to provide collateral to the lender and set aside assets to cover the open position. Short sales "against the box" may protect the Fund against the risk of losses in the value of a portfolio security because any decline in value of the security should be wholly or partially offset by a corresponding gain in the short position. Any potential gains in the security, however, would be wholly or partially offset by a corresponding loss in the short position. Short sales that are not "against the box" involve a form of investment leverage, and the amount of the Fund's loss on a short sale is potentially unlimited.

20

• Unseasoned Issuers Risk. Unseasoned issuers may not have an established financial history and may have limited product lines, markets or financial resources. Unseasoned issuers may depend on a few key personnel for management and may be susceptible to losses and risks of bankruptcy. As a result, such securities may be more volatile and difficult to sell.

• Small-Cap Companies Risk. The small capitalization equity securities in which the Fund may invest may be traded only in the over-the-counter market or on a regional securities exchange, may be listed only in the quotation service commonly known as the "pink sheets," and may not be traded every day or in the volume typical of trading on a national securities exchange. These securities may also be subject to wide fluctuations in market value. The trading market for any given small capitalization equity security may be sufficiently small as to make it difficult for the Fund to dispose of a substantial block of such securities. The sale by the Fund of portfolio securities to meet redemptions may require the Fund to sell its small capitalization securities at a discount from market prices or during periods when, in the Adviser's judgment, such sale is not desirable. Moreover, the lack of an efficient market for these securities may make them difficult to value.

• REITs Risk. REITs may be affected by economic forces and other factors related to the real estate industry. These risks include possible declines in the value of real estate, possible lack of availability of mortgage funds and unexpected vacancies of properties. REITs that invest in real estate mortgages are also subject to prepayment risk. Investing in REITs may involve risks similar to those associated with investing in small capitalization companies. REITs may have limited financial resources, may trade less frequently and in a limited volume and may be subject to more abrupt or erratic price movements than larger company securities. Historically, small capitalization stocks, such as REITs, have been more volatile in price than the larger capitalization stocks included in the S&P 500® Index.

• Portfolio Turnover Risk. If the Fund frequently trades its portfolio securities, the Fund will incur higher brokerage commissions and transaction costs, which could lower the Fund's performance. In addition to lower performance, high portfolio turnover could result in taxable capital gains. A portfolio turnover rate of 100% is considered to be high. The annual portfolio turnover rate for the Fund is not expected to exceed 300%; however, it may be higher if the Adviser believes it will improve the Fund's performance.

• Illiquid Securities Risk. Investing in illiquid securities is subject to certain risks, such as limitations on resale and uncertainty in determining valuation. Limitations on resale may adversely affect the marketability of portfolio securities and the Fund might be unable to dispose of restricted or other illiquid securities promptly or at reasonable prices and might thereby experience difficulty satisfying redemptions within seven days.

• Derivatives Risk. The Fund's investments in derivative instruments, which include futures and options on securities, securities indices or currencies, options on these futures, forward foreign currency contracts and interest rate or currency swaps, may be leveraged and result in losses exceeding the amounts invested.

• Indexed Securities Risk. The Fund may invest in indexed securities whose value is linked to securities indices. Most such securities have values that rise and fall according to the change in one or more specified indices and may have characteristics similar to direct investments in the underlying securities. Depending on the index, such securities may have greater volatility than the market as a whole.

• Securities Lending Risk. The Fund may lend portfolio securities to institutions, such as certain broker-dealers. The Fund may experience a loss or delay in the recovery of its securities if the borrowing institution breaches its agreement with the Fund.

• Exchange-Traded Fund Risk. Exchange-traded funds ("ETFs") are a type of investment company bought and sold on a securities exchange. An ETF typically represents a fixed portfolio of securities designed to track a particular market index. The risks of owning an ETF generally reflect the risks of owning the underlying securities that they are designed to track, although lack of liquidity in an ETF could result in its being more volatile. Some ETFs are actively-managed by an investment adviser and/or sub-advisers. Actively-managed ETFs are subject to the risk of poor investment selection. The Fund may incur brokerage fees in connection with its purchase of ETF shares. The purchase of shares of ETFs may result in duplication of expenses, including advisory fees, in addition to the Fund's own expenses.

21

Performance Information

The bar chart and table below illustrate the long-term performance of the Boston Partners Long/Short Research Fund's Institutional Class. The bar chart below shows you how the performance of the Fund’s Institutional Class has varied year by year and provides some indication of the risks of investing in the Fund. The bar chart assumes reinvestment of dividends and distributions. As with all such investments, past performance (before and after taxes) is not an indication of future results. Performance reflects fee waivers in effect. If fee waivers were not in place, the Fund's performance would be reduced. Updated performance information is available at www.boston-partners.com or 1-888-261-4073.

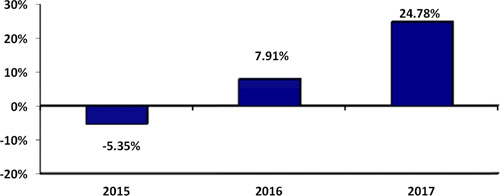

Total Returns for the Calendar Years Ended December 31

Best and Worst Quarterly Performance (for the periods reflected in the chart above):

| Best Quarter: | 8.37% (quarter ended December 31, 2011) | ||

| Worst Quarter: | -9.89% (quarter ended September 30, 2011) |

Average Annual Total Returns

The table below compares the average annual total returns for the Fund's Institutional Class both before and after taxes for the past calendar year, past five calendar years and since inception to the average annual total returns of a broad-based securities market index for the same periods.

22

| Average

Annual Total Returns for the Periods Ended December 31, 2017 | |||

| 1 Year | 5 Years | Since Inception (September 30, 2010) | |

| Boston Partners Long/Short Research Fund | |||

| Returns Before Taxes | 10.10% | 7.89% | 8.70% |

| Returns After Taxes on Distributions (1) | 10.10% | 7.60% | 8.46% |

| Returns After Taxes on Distributions and Sale of Fund Shares | 5.71% | 6.18% | 6.98% |

| S&P 500® Index (reflects no deduction for fees, expenses or taxes) | 21.83% | 15.79% | 14.86% |

| (1) | After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns shown are not relevant to investors who hold their Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts. |

Management of the Fund

Investment Adviser

Boston

Partners Global Investors, Inc.

909 Third Avenue, 32nd Floor, New York, New

York 10022

Portfolio Managers

Joseph

F. Feeney, Jr., Chief Investment Officer of Boston Partners, Portfolio Manager since inception of the Fund

Eric Connerly, Director of Research-Quantitative, Portfolio

Manager since inception of the Fund

Purchase and Sale of Fund Shares

Minimum

Initial Investment: $100,000

Minimum Additional Investment: $5,000

You can only purchase and redeem Institutional Class shares of the Fund on days the New York Stock Exchange is open. Institutional Class shares of the Fund may be available through certain brokerage firms, financial institutions and other industry professionals (collectively, "Service Organizations"). Shares of the Fund may also be purchased and redeemed directly through The RBB Fund, Inc. by the means described below.

23

| Purchase

and Redemption By Mail: Boston Partners Long/Short Research Fund c/o U.S. Bancorp Fund Services, LLC P.O. Box 701 Milwaukee, WI 53201-0701 |

Purchase

and Redemption By Wire: Request routing instructions by calling the Fund's transfer agent at 1-888-261-4073. |

Redemption By Telephone: If you selected the option on your account application, you may call the Fund's transfer agent at 1-888-261-4073.

Taxes

The Fund intends to make distributions that generally may be taxed at ordinary income or capital gains rates.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and other related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary's website for more information.

24

SUMMARY SECTION — WPG PARTNERS SMALL/MICRO CAP VALUE FUND

Investment Objective

The Fund seeks capital appreciation by investing primarily in common stocks, securities convertible into common stocks and in special situations.

Expenses and Fees

This table describes the fees and expenses that you may pay if you buy and hold Institutional Class shares of the Fund.

| Institutional Class | ||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||

| Management fees | 0.80 | % | ||

| Distribution and/or Service (12b-1) fees | None | |||

| Other expenses | 0.49 | % | ||

| Total annual Fund operating expenses | 1.29 | % | ||

| Fee waiver and/or expense reimbursement(1) | (0.19) | % | ||

| Total annual Fund operating expenses after fee waiver and/or expense reimbursement | 1.10 | % | ||

| (1) | The Fund's Adviser has contractually agreed to waive all or a portion of its advisory fee and/or reimburse expenses in an aggregate amount equal to the amount by which the Total annual Fund operating expenses (excluding certain items discussed below) for the Fund's Institutional Class shares exceeds 1.10% of the average daily net assets attributable to the Fund's Institutional Class shares. In determining the Adviser's obligation to waive advisory fees and/or reimburse expenses, the following expenses are not taken into account and could cause net Total annual Fund operating expenses to exceed 1.10%: short sale dividend expenses, brokerage commissions, extraordinary items, interest or taxes. This contractual limitation is in effect until February 28, 2019 and may not be terminated without the approval of the Board of Directors of The RBB Fund, Inc. If at any time, the Fund’s total annual fund operating expenses (not including short sale dividend expense, brokerage commissions, extraordinary items, interest or taxes) for a year are less than 1.10% or the expense cap then in effect, whichever is less, the Adviser is entitled to reimbursement by the Fund of the advisory fees forgone and other payments remitted by the Adviser to the Fund within three years from the date on which such waiver or reimbursement was made, provided such reimbursement does not cause the Fund to exceed expense limitations that were in effect at the time of the waiver or reimbursement. |

Example