Exhibit 4.01

This Note is a Global Security within the meaning of the Indenture hereinafter referred to and is registered in the name of the Depository named below or a nominee of the Depository. This Note is not exchangeable for Notes registered in the name of a Person other than the Depository or its nominee except in the limited circumstances described herein and in the Indenture, and no transfer of this Note (other than a transfer of this Note as a whole by the Depository to a nominee of the Depository or by a nominee of the Depository to the Depository or another nominee of the Depository) may be registered except in the limited circumstances described herein.

Unless this certificate is presented by an authorized representative of The Depository Trust Company, a New York corporation (the “Depository”), to the Company or its agent for registration of transfer, exchange, or payment, and any certificate issued is registered in the name of Cede & Co. or in such other name as is requested by an authorized representative of the Depository (and any payment is made to Cede & Co. or to such other entity as is requested by an authorized representative of the Depository), ANY TRANSFER, PLEDGE, OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL inasmuch as the registered owner hereof, Cede & Co., has an interest herein.

CITIGROUP INC.

5.449% Fixed Rate / Floating Rate Callable Senior Notes due June 11, 2035

| REGISTERED | REGISTERED | |

| CUSIP: 172967PL9 | ||

| ISIN: US172967PL97 | ||

| No. R-00* | $* | |

CITIGROUP INC., a Delaware corporation (the “Company”, which term includes any successor Person under the Indenture), for value received, hereby promises to pay to Cede & Co., or registered assigns, the principal sum of $* on June 11, 2035 (the “Maturity Date”) and to pay interest thereon from and including June 11, 2024 or from the most recent Interest Payment Date to which interest has been paid or duly provided for. The Company shall pay interest (i) from June 11, 2024 to, but excluding, June 11, 2034 (the “Fixed Rate Period”) at a fixed rate of 5.449% per annum semi-annually, on June 11th and December 11th of each year (each such date, a “Fixed Rate Period Interest Payment Date”), commencing December 11, 2024 and (ii) from, and including, June 11, 2034 (the “Floating Rate Period”), at an annual rate equal to Compounded SOFR (and defined on the reverse hereof) plus 1.447% quarterly, on the second business day following each Interest Period End Date (each such business day, a “Floating Rate Period Interest Payment Date” and together with any Fixed Rate Period Payment Date, an “Interest Payment Date”), commencing September 13, 2034, until the principal hereof is paid or made available for payment and provided that the Interest Payment Date with respect to the final Interest Period will be a redemption date or the Maturity Date. An Interest Period End Date is the 11th of each March, June, September, and December, beginning on September 11, 2034 and ending on a redemption date or

the Maturity Date. The interest so payable, and punctually paid or duly provided for, on any Interest Payment Date will, as provided in the Indenture, be paid to the Person in whose name this Note is registered at the close of business on the Record Date for such interest, which shall be the Business Day immediately preceding such Interest Payment Date. Any such interest not so punctually paid or duly provided for will forthwith cease to be payable to the holder on such Record Date and may either be paid to the Person in whose name this Note is registered at the close of business on a subsequent Record Date, such subsequent Record Date to be not less than ten days prior to the date of payment of such defaulted interest, notice whereof shall be given to holders of Notes of this series not less than ten days prior to such subsequent Record Date, or be paid at any time in any other lawful manner not inconsistent with the requirements of any securities exchange on which the Notes of this series may be listed, and upon such notice as may be required by such exchange, all as more fully provided in the Indenture.

During the Fixed Rate Period, interest hereon will be calculated on the basis of a 360-day year comprised of twelve 30-day months, and an Interest Period shall be the period from and including an Interest Payment Date (or June 11, 2024 in the case of the first Interest Period) to and including the day immediately preceding the next Interest Payment Date. During the Fixed Rate Period, if an Interest Payment Date falls on a day that is not a Business Day, such Interest Payment Date will be the next succeeding Business Day, and no further interest will accrue in respect of such postponement. For these purposes, “Business Day” means any day on which commercial banks settle payments and are open for general business in The City of New York.

During the Floating Rate Period, interest hereon will be calculated on the basis of the actual number of days elapsed in an interest period and a 360-day year, and an Interest Period shall be the period from and including an Interest Period End Date (or June 11, 2034 in the case of the first Interest Period during the Floating Rate Period) to, but excluding, the next succeeding Interest Period End Date; provided that the Interest Period following an election by the Company to redeem the Notes and the final Interest Period will be the period from, and including, the immediately preceding Interest Period End Date to, but excluding, the redemption date or the Maturity Date; and provided further that SOFR for each calendar day from, and including, the Rate Cut-Off Date (as defined on the reverse hereof) to, but excluding, the redemption date or the Maturity Date will equal SOFR in respect of the Rate Cut-Off Date. In the event that any Interest Period End Date (other than a redemption date or the Maturity Date) is not a Business Day, then such date will be postponed to the next succeeding Business Day, unless that day falls in the next calendar month, in which case the interest period end date will be the immediately preceding Business Day. For these purposes, “Business Day” means any day on which commercial banks settle payments and are open for general business in The City of New York and a U.S. Government Securities Business Day (as defined on the reverse hereof).

Dollar amounts resulting from such calculations will be rounded to the nearest cent, with one-half cent being rounded upward. In the event that the Maturity Date or a redemption date is not a Business Day, then such date will be postponed to the next succeeding Business Day, and no further interest will accrue with respect to such postponement. No interest will accrue on any amounts payable for the period from and after the due date for payment of such principal or interest.

Payment of the principal of and interest on this Note will be made at the office or agency of the paying agent maintained for that purpose in The City of New York.

Reference is hereby made to the further provisions of this Note set forth on the reverse hereof, which further provisions shall for all purposes have the same effect as if set forth at this place.

Unless the certificate of authentication hereon has been executed by the Trustee or by an authenticating agent on behalf of the Trustee by manual signature, this Note shall not be entitled to any benefit under the Indenture or be valid or obligatory for any purpose.

IN WITNESS WHEREOF, the Company has caused this instrument to be duly executed under its corporate seal.

Dated: June 11, 2024

| CITIGROUP INC. | ||

| By: | ||

| ATTEST: | ||

| By: | ||

This is one of the Notes of the series issued under the within-mentioned Indenture.

Dated: June 11, 2024

| THE BANK OF NEW YORK MELLON, as Trustee | ||

| By: | ||

| Name: | ||

| Title: | ||

| -or- | ||

| CITIBANK, N.A., as Authenticating Agent | ||

| By: | ||

| Name: | ||

| Title: | ||

This Note is one of a duly authorized issue of Securities of the Company (the “Notes”), issued and to be issued in one or more series under the senior debt indenture, dated as of November 13, 2013 (as amended and supplemented from time to time, the “Indenture”), between the Company and The Bank of New York Mellon, as trustee (the “Trustee”, which term includes any successor trustee under the Indenture), to which Indenture and all indentures supplemental thereto reference is hereby made for a statement of the respective rights, limitations of rights, duties and immunities thereunder of the Company, the Trustee and the holders of the Notes and of the terms upon which the Notes are, and are to be, authenticated and delivered. This Note is one of the series designated on the face hereof, initially limited in aggregate principal to $2,500,000,000.

During the Floating Rate Period, this Note will bear interest for each Interest Period at a rate determined by Citibank, N.A., London Branch, acting as Calculation Agent. The interest rate on this Note for a particular Interest Period during the Floating Rate Period will be a per annum rate equal to Compounded SOFR (as defined below) plus 1.447%. Interest during the Floating Rate Period will be calculated by multiplying the principal amount of the Notes by the product of (i) Compounded SOFR plus 1.447% multiplied by (ii) the quotient of actual number of calendar days in such interest period divided by 360; provided that in no event will the interest payable on the Notes be less than zero. Promptly upon determination, the Calculation Agent will inform the Trustee and the Company of the interest rate for the next Interest Period. Absent manifest error, the determination of the interest rate by the Calculation Agent shall be binding and conclusive on the holders of Notes, the Trustee and the Company.

For the purposes of calculating interest with respect to any Interest Period during the Floating Rate Period:

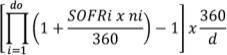

“Compounded SOFR” means a rate of return of a daily compounded interest investment calculated in accordance with the formula below, with the resulting percentage being rounded, if necessary, to the nearest one hundred-thousandth of a percentage point (0.00000005 being rounded upwards) :

where

“do”, for any Interest Period, is the number of U.S. Government Securities Business Days in the relevant Interest Period.

“i” is a series of whole numbers from one to do, each representing the relevant U.S. Government Securities Business Days in chronological order from, and including, the first U.S. Government Securities Business Day in the relevant Interest Period.

“SOFRi”, for any day “i” in the relevant Interest Period, is a reference rate equal to SOFR in respect of that day.

“ni”, for any day “i” in the relevant Interest Period, is the number of calendar days from, and including, such U.S. Government Securities Business Day “i” to, but excluding, the following U.S. Government Securities Business Day.

“d” is the number of calendar days in the relevant Interest Period.

“U.S. Government Securities Business Day” means any day except for a Saturday, Sunday or a day on which the Securities Industry and Financial Markets Association (SIFMA) recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities.

“SOFR” means, with respect to any day, the rate determined by the Calculation Agent in accordance with the following provisions:

(1) the Secured Overnight Financing Rate for trades made on such day that appears at approximately 3:00 p.m. (New York City time) on the NY Federal Reserve’s Website on the U.S. Government Securities Business Day immediately following such day (“SOFR Determination Time”); or

(2) if the rate specified in (1) above does not so appear, unless a Benchmark Transition Event and its related Benchmark Replacement Date have occurred as described in (3) below, the Secured Overnight Financing Rate published on the NY Federal Reserve’s Website for the first preceding U.S. Government Securities Business Day for which the Secured Overnight Financing Rate was published on the NY Federal Reserve’s Website; or

(3) if a Benchmark Transition Event and its related Benchmark Replacement Date have occurred prior to the relevant interest period end date, the Calculation Agent will use the Benchmark Replacement to determine the rate and for all other purposes relating to the Notes.

In connection with the Compounded SOFR definition above, the following definitions apply:

“Benchmark” means, initially, Compounded SOFR; provided that if the Company (or one of its affiliates) determines that on or prior to the Reference Time that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to Compounded SOFR or the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement.

“Benchmark Replacement” means the first alternative set forth in the order below that can be determined by Citigroup (or one of its affiliates) as of the Benchmark Replacement Date:

(1) the sum of: (a) the alternate rate of interest that has been selected or recommended by the Relevant Governmental Body as the replacement for the then-current Benchmark and (b) the Benchmark Replacement Adjustment; or

(2) the sum of: (a) the ISDA Fallback Rate and (b) the Benchmark Replacement Adjustment; or

(3) the sum of: (a) the alternate rate of interest that has been selected by the Company (or one of its affiliates) as the replacement for the then-current Benchmark giving due consideration to any industry-accepted rate of interest as a replacement for the then-current Benchmark for U.S. dollar-denominated floating rate notes at such time and (b) the Benchmark Replacement Adjustment.

“Benchmark Replacement Adjustment” means the first alternative set forth in the order below that can be determined by the Company (or one of its affiliates) as of the Benchmark Replacement Date:

(1) the spread adjustment, or method for calculating or determining such spread adjustment, (which may be a positive or negative value or zero) that has been selected or recommended by the Relevant Governmental Body for the applicable Unadjusted Benchmark Replacement;

(2) if the applicable Unadjusted Benchmark Replacement is equivalent to the ISDA Fallback Rate, then the ISDA Fallback Adjustment;

(3) the spread adjustment (which may be a positive or negative value or zero) that has been selected by the Company (or one of its affiliates) giving due consideration to any industry-accepted spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of the then-current Benchmark with the applicable Unadjusted Benchmark Replacement for U.S. dollar-denominated floating rate notes at such time.

“Benchmark Replacement Conforming Changes” means, with respect to any Benchmark Replacement, any technical, administrative or operational changes that the Company (or one of its affiliates) decides may be appropriate to reflect the adoption of such Benchmark Replacement in a manner substantially consistent with market practice (or, if the Company (or such affiliate) decides that adoption of any portion of such market practice is not administratively feasible or if the Company (or such affiliate) determines that no market practice for use of the Benchmark Replacement exists, in such other manner as the Company (or such affiliate) determines is reasonably necessary).

“Benchmark Replacement Date” means the earliest to occur of the following events with respect to the then-current Benchmark:

(1) in the case of clause (1) or (2) of the definition of “Benchmark Transition Event,” the later of (a) the date of the public statement or publication of information referenced therein and (b) the date on which the administrator of the Benchmark permanently or indefinitely ceases to provide the Benchmark; or

(2) in the case of clause (3) of the definition of “Benchmark Transition Event,” the date of the public statement or publication of information referenced therein.

For the avoidance of doubt, if the event giving rise to the Benchmark Replacement Date occurs on the same day as, but earlier than, the Reference Time in respect of any determination, the Benchmark Replacement Date will be deemed to have occurred prior to the Reference Time for such determination.

“Benchmark Transition Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark:

(1) a public statement or publication of information by or on behalf of the administrator of the Benchmark announcing that such administrator has ceased or will cease to provide the Benchmark, permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark;

(2) a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark, the central bank for the currency of the Benchmark, an insolvency official with jurisdiction over the administrator for the Benchmark, a resolution authority with jurisdiction over the administrator for the Benchmark or a court or an entity with similar insolvency or resolution authority over the administrator for the Benchmark, which states that the administrator of the Benchmark has ceased or will cease to provide the Benchmark permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark; or

(3) a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark announcing that the Benchmark is no longer representative.

“Business Day” means any weekday that is not a legal holiday in New York City and is not a day on which banking institutions in New York City are authorized or required by law or regulation to be closed and is a U.S. Government Securities Business Day.

“ISDA” means the International Swaps and Derivatives Association, Inc. or any successor thereto.

“ISDA Definitions” means the 2006 ISDA Definitions published by ISDA, as amended or supplemented from time to time, or any successor definitional booklet for interest rate derivatives published from time to time.

“ISDA Fallback Adjustment” means the spread adjustment (which may be a positive or negative value or zero) that would apply for derivatives transactions referencing the ISDA Definitions to be determined upon the occurrence of an index cessation event with respect to the Benchmark for the applicable tenor.

“ISDA Fallback Rate” means the rate that would apply for derivatives transactions referencing the ISDA Definitions to be effective upon the occurrence of an index cessation date with respect to the Benchmark for the applicable tenor excluding the applicable ISDA Fallback Adjustment.

“NY Federal Reserve” means the Federal Reserve Bank of New York.

“NY Federal Reserve’s Website” means the website of the NY Federal Reserve, currently at http://www.newyorkfed.org, or any successor website of the NY Federal Reserve or the website of any successor administrator of the Secured Overnight Financing Rate.

“Rate Cut-Off Date” means the second U.S. Government Securities Business Day prior to a redemption date or the Maturity Date.

“Reference Time” with respect to any determination of the Benchmark means (1) if the Benchmark is Compounded SOFR, the SOFR Determination Time and (2) if the Benchmark is not Compounded SOFR, the time determined by Citigroup (or one of its affiliates) in accordance with the Benchmark Replacement Conforming Changes.

“Relevant Governmental Body” means the Federal Reserve Board and/or the NY Federal Reserve, or a committee officially endorsed or convened by the Federal Reserve Board and/or the NY Federal Reserve or any successor thereto.

“Unadjusted Benchmark Replacement” means the Benchmark Replacement excluding the Benchmark Replacement Adjustment.

Upon request from any Noteholder, the Calculation Agent will provide the interest rate in effect on this Note for the current Interest Period during the Floating Rate Period and, if it has been determined, the interest rate to be in effect for the next Interest Period during the Floating Rate Period.

If an event of default (as defined in the Indenture) with respect to Notes of this series shall occur and be continuing, the principal of the Notes of this series may be declared due and payable in the manner and with the effect provided in the Indenture.

Sections 12.02 and 12.03 of the Indenture containing provisions for defeasance apply to this Note. At any time the entire indebtedness of this Note may be defeased upon compliance by the Company with certain conditions set forth in Section 12.04 of the Indenture.

The Indenture contains provisions permitting the Company and the Trustee, without the consent of the holders of the Securities, to establish, among other things, the form and terms of any series of Securities issuable thereunder by one or more supplemental indentures, and, with the consent of the holders of a majority in aggregate principal amount of Securities at the time outstanding which are affected thereby, to modify the Indenture or any supplemental indenture or the rights of the holders of Securities of such series to be affected, provided that no such modification will (i) extend the fixed maturity of any Securities, reduce the rate or extend the time of payment of interest thereon, reduce the principal amount thereof or the premium, if any, thereon, reduce the amount of the principal of Original Issue Discount Securities payable on any date, change the currency in which Securities are payable, or impair the right to institute suit for the enforcement of any such payment on or after the maturity thereof, without the consent of the holder of each Security so affected, or (ii) reduce the aforesaid percentage of Securities of any series the consent of the holders of which is required for any such modification without the consent of the holders of all Securities of such series then outstanding, or (iii) modify the rights, duties or immunities of the Trustee unless the Trustee agrees to such modification.

No reference herein to the Indenture and no provision of this Note or of the Indenture shall alter or impair the obligation of the Company, which is absolute and unconditional, to pay the principal of and interest on this Note at the times, place and rate, and in the coin or currency, herein prescribed.

This Note is a Global Security registered in the name of a nominee of the Depository. This Note is exchangeable for Notes registered in the name of a person other than the Depository or its nominee only in the limited circumstances hereinafter described. Unless and until it is exchanged in whole or in part for definitive Notes in certificated form, this Note may not be transferred except as a whole by the Depository to a nominee of the Depository or by a nominee of the Depository to the Depository or another nominee of the Depository.

The Notes represented by this Global Security are exchangeable for definitive Notes in certificated form of like tenor as such Notes in denominations of $1,000 and whole multiples of $1,000 in excess thereof only if (i) the Depository notifies the Company that it is unwilling or unable to continue as Depository for the Notes and the Company is unable to appoint a successor depository or (ii) the Depository ceases to be a clearing agency registered under the Securities Exchange Act of 1934, as amended, or (iii) the Company in its sole discretion decides to allow the Notes to be exchanged for definitive Notes in registered form. Any Notes that are exchangeable pursuant to the preceding sentence are exchangeable for certificated Notes issuable in authorized denominations and registered in such names as the Depository shall direct. As provided in the Indenture and subject to certain limitations therein set forth, the transfer of definitive Notes in certificated form is registrable in the register maintained by the Company in The City of New York for such purpose, upon surrender of the definitive Note for registration of transfer at the office or agency of the registrar, duly endorsed by, or accompanied by a written instrument of transfer in form satisfactory to the Company and the registrar duly executed by, the holder thereof or his attorney duly authorized in writing, and thereupon one or more new Notes of this series and of like tenor, of authorized denominations and for the same aggregate principal amount, will be issued to the designated transferee or transferees. Subject to the foregoing, this Note is not exchangeable, except for a Global Security or Global Securities of this issue of the same principal amount to be registered in the name of the Depository or its nominee.

No service charge shall be made for any such registration of transfer or exchange, but the Company may require payment of a sum sufficient to cover any tax or other governmental charge payable in connection therewith.

Prior to due presentment of this Note for registration of transfer, the Company, the Trustee and any agent of the Company or the Trustee may treat the Person in whose name this Note is registered as the owner hereof for all purposes, whether or not this Note be overdue, and neither the Company, the Trustee nor any such agent shall be affected by notice to the contrary.

The Company will pay additional amounts (“Additional Amounts”) to the beneficial owner of any Note that is a non-United States person in order to ensure that every net payment on such Note will not be less, due to payment of U.S. withholding tax, than the amount then due and payable. For this purpose, a “net payment” on a Note means a payment by the Company or a paying agent, including payment of principal and interest, after deduction for any present or future tax, assessment or other governmental charge of the United States. These Additional Amounts will constitute additional interest on the Note.

The Company will not be required to pay Additional Amounts, however, in any of the circumstances described in items (1) through (13) below.

(1) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any tax, assessment or other governmental charge that is imposed or withheld solely by reason of the beneficial owner:

(a) having a relationship with the United States as a citizen, resident or otherwise;

(b) having had such a relationship in the past; or

(c) being considered as having had such a relationship.

(2) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any tax, assessment or other governmental charge that is imposed or withheld solely by reason of the beneficial owner:

(a) being treated as present in or engaged in a trade or business in the United States;

(b) being treated as having been present in or engaged in a trade or business in the United States in the past; or

(c) having or having had a permanent establishment in the United States.

(3) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any tax, assessment or other governmental charge that is imposed or withheld in whole or in part by reason of the beneficial owner being or having been any of the following (as such terms are defined in the Internal Revenue Code of 1986, as amended):

(a) personal holding company;

(b) foreign private foundation or other foreign tax-exempt organization;

(c) passive foreign investment company;

(d) controlled foreign corporation; or

(e) corporation which has accumulated earnings to avoid United States federal income tax.

(4) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any tax, assessment or other governmental charge that is imposed or withheld solely by reason of the beneficial owner owning or having owned, actually or constructively, 10 percent or more of the total combined voting power of all classes of stock of the Company entitled to vote or by reason of the beneficial owner being a bank that has invested in a Note as an extension of credit in the ordinary course of its trade or business.

For purposes of items (1) through (4) above, “beneficial owner” means a fiduciary, settlor, beneficiary, member or shareholder of the holder if the holder is an estate, trust, partnership, limited liability company, corporation or other entity, or a person holding a power over an estate or trust administered by a fiduciary holder.

(5) Additional Amounts will not be payable to any beneficial owner of a Note that is a:

(a) fiduciary;

(b) partnership;

(c) limited liability company; or

(d) other fiscally transparent entity

or that is not the sole beneficial owner of the Note, or any portion of the Note. However, this exception to the obligation to pay Additional Amounts will only apply to the extent that a beneficiary or settlor in relation to the fiduciary, or a beneficial owner or member of the partnership, limited liability company or other fiscally transparent entity, would not have been entitled to the payment of an Additional Amount had the beneficiary, settlor, beneficial owner or member received directly its beneficial or distributive share of the payment.

(6) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any tax, assessment or other governmental charge that is imposed or withheld solely by reason of the failure of the beneficial owner or any other person to comply with applicable certification, identification, documentation or other information reporting requirements. This exception to the obligation to pay Additional Amounts will only apply if compliance with such reporting requirements is required by statute or regulation of the United States or by an applicable income tax treaty to which the United States is a party as a precondition to exemption from such tax, assessment or other governmental charge.

(7) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any tax, assessment or other governmental charge that is collected or imposed by any method other than by withholding from a payment on a Note by the Company or a paying agent.

(8) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any tax, assessment or other governmental charge that is imposed or withheld by reason of a change in law, regulation, or administrative or judicial interpretation that becomes effective more than 15 days after the payment becomes due or is duly provided for, whichever occurs later.

(9) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any tax, assessment or other governmental charge that is imposed or withheld by reason of the presentation by the beneficial owner of a Note for payment more than 30 days after the date on which such payment becomes due or is duly provided for, whichever occurs later.

(10) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any:

(a) estate tax;

(b) inheritance tax;

(c) gift tax;

(d) sales tax;

(e) excise tax;

(f) transfer tax;

(g) wealth tax;

(h) personal property tax; or

(i) any similar tax, assessment, withholding, deduction or other governmental charge.

(11) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any tax, assessment, or other governmental charge required to be withheld by any paying agent from a payment of principal or interest on a Note if such payment can be made without such withholding by any other paying agent.

(12) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any withholding, deduction, tax, duty assessment or other governmental charge that would not have been imposed but for a failure by the holder or beneficial owner of a Note (or any financial institution through which the holder or beneficial owner holds the Note or through which payment on the Note is made) to take any action (including entering into an agreement with the Internal Revenue Service, or a governmental authority of another jurisdiction if the holder is entitled to the benefits of an intergovernmental agreement between that jurisdiction and the United States) or to comply with any applicable certification, documentation, information or other reporting requirement or agreement concerning accounts maintained by the holder or beneficial owner (or any such financial institution), or concerning ownership of the holder or beneficial owner, or any substantially similar requirement or agreement.

(13) Additional Amounts will not be payable if a payment on a Note is reduced as a result of any combination of items (1) through (12) above.

Except as specifically provided herein, the Company will not be required to make any payment of any tax, assessment or other governmental charge imposed by any government or a political subdivision or taxing authority of such government.

As used in this Note, “United States person” means:

| (a) | any individual who is a citizen or resident of the United States; |

| (b) | any corporation, partnership or other entity created or organized in or under the laws of the United States or any political subdivision thereof; |

| (c) | any estate if the income of such estate falls within the federal income tax jurisdiction of the United States regardless of the source of such income; and |

| (d) | any trust if (i) a United States court is able to exercise primary supervision over its administration and one or more United States persons have the authority to control all of the substantial decisions of the trust; or (ii) it has a valid election in effect under applicable United States Treasury regulations to be treated as a United States person. |

Additionally, “non-United States person” means a person who is not a United States person, and “United States” means the states of the United States of America and the District of Columbia, but excluding its territories and its possessions.

Except as provided below, the Notes may not be redeemed prior to maturity.

| (1) | The Company may, at its option, redeem the Notes if: |

| (a) | the Company becomes or will become obligated to pay Additional Amounts as described above; |

| (b) | the obligation to pay Additional Amounts arises as a result of any change in the laws, regulations or rulings of the United States, or an official position regarding the application or interpretation of such laws, regulations or rulings, which change is announced or becomes effective on or after June 4, 2024; and |

| (c) | the Company determines, in its business judgment, that the obligation to pay such Additional Amounts cannot be avoided by the use of reasonable measures available to it, other than substituting the obligor under the Notes or taking any action that would entail a material cost to the Company. |

| (2) | The Company may also redeem the Notes, at its option, if: |

| (a) | any act is taken by a taxing authority of the United States on or after June 4, 2024 whether or not such act is taken in relation to the Company or any subsidiary, that results in a substantial probability that the Company will or may be required to pay Additional Amounts as described above; |

| (b) | the Company determines, in its business judgment, that the obligation to pay such Additional Amounts cannot be avoided by the use of reasonable measures available to it, other than substituting the obligor under the Notes or taking any action that would entail a material cost to the Company; and |

| (c) | the Company receives an opinion of independent counsel to the effect that an act taken by a taxing authority of the United States results in a substantial probability that the Company will or may be required to pay the Additional Amounts described above, and delivers to the Trustee a certificate, signed by a duly authorized officer, stating that based on such opinion the Company is entitled to redeem the Notes pursuant to their terms. |

Any redemption of the Notes as set forth in clauses (1) or (2) above shall be in whole, and not in part, and will be made at a redemption price equal to 100% of the principal amount of the Notes outstanding plus accrued and unpaid interest thereon to the date of redemption.

| (3) | The Company may also redeem the Notes, at its option, in whole at any time or in part from time to time, on or after December 11, 2024 (or, if additional notes are issued after June 11, 2024, beginning six months after the issue date of such additional notes) and prior to June 11, 2034, at a redemption price (expressed as a percentage of principal amount and rounded to three decimal places) equal to the greater of (1) (a) the sum of the present values of the remaining scheduled payments of principal and interest thereon discounted to the redemption date on a semiannual basis (assuming a 360-day year consisting of twelve 30-day months) at the Treasury Rate plus 20 basis points less (b) interest accrued to the date of redemption, and (2) 100% of the principal amount of the Notes being redeemed, plus, in either case, accrued and unpaid interest thereon to, but excluding, the date of redemption. |

| • | “Treasury Rate” means, with respect to any redemption date, the yield determined by the Company in accordance with the following two paragraphs. |

The Treasury Rate shall be determined by the Company after 4:15 p.m., New York City time (or after such time as yields on U.S. government securities are posted daily by the Board of Governors of the Federal Reserve System), on the third business day preceding the redemption date based upon the yield or yields for the most recent day that appear after such time on such day in the most recent statistical release published by the Board of Governors of the Federal Reserve System designated as “Selected Interest Rates (Daily) - H.15” (or any successor designation or publication) (“H.15”) under the caption “U.S. government securities–Treasury constant maturities–Nominal” (or any successor caption or heading). In determining the Treasury Rate, the Company shall select, as applicable: (1) the yield for the Treasury constant maturity on H.15 exactly equal to the period from the redemption date to the maturity date of the Notes (the “Remaining Life”); or (2) if there is no such Treasury constant maturity on H.15 exactly equal to the Remaining Life, the two yields – one yield corresponding to the Treasury constant maturity on H.15 immediately shorter than and one yield corresponding to the Treasury constant maturity on H.15 immediately longer than the Remaining Life – and shall interpolate to the maturity date of the Notes on a straight-line basis (using the actual number of days) using such yields and rounding the result to three decimal places; or (3) if there is no such Treasury constant maturity on H.15 shorter than or longer than the Remaining Life, the yield for the single Treasury constant maturity on H.15 closest to the Remaining Life. For purposes of this paragraph, the applicable Treasury constant maturity or maturities on H.15 shall be deemed to have a maturity date equal to the relevant number of months or years, as applicable, of such Treasury constant maturity from the redemption date.

If on the third business day preceding the redemption date H.15 or any successor designation or publication is no longer published, the Company shall calculate the Treasury Rate based on the rate per annum equal to the semi-annual equivalent yield to maturity at 11:00 a.m., New York City time, on the second business day preceding such redemption date of the United States Treasury security maturing on, or with a maturity that is closest to, the maturity date of the Notes, as applicable. If there is no United States Treasury security maturing on the maturity date of the Notes but there are two or more United States Treasury securities with a maturity date equally distant from the maturity date of the Notes, one with a maturity date preceding the maturity date of the Notes and one with a maturity date following the maturity date of the Notes, the Company shall select the United States Treasury security with a maturity date preceding the maturity date of the Notes. If there are two or more United States Treasury securities maturing on the maturity date of the Notes or two or more United States Treasury securities meeting the criteria of the preceding sentence, the Company shall select from among these two or more United States Treasury securities the United States Treasury security that is trading closest to par based upon the average of the bid and asked prices for such United States Treasury securities at 11:00 a.m., New York City time. In determining the Treasury Rate in accordance with the terms of this paragraph, the semi-annual yield to maturity of the applicable United States Treasury security shall be based upon the average of the bid and asked prices (expressed as a percentage of principal amount) at 11:00 a.m., New York City time, of such United States Treasury security, and rounded to three decimal places.

| (4) | The Company may also redeem the Notes, at its option, (i) in whole, but not in part, on June 11, 2034, or (ii) in whole at any time or in part from time to time, |

on or after May 11, 2035 at a redemption price equal to 100% of the principal amount of the Notes being redeemed plus accrued and unpaid interest thereon to, but excluding, the date of redemption. Holders shall be given not less than 15 days’ nor more than 60 days’ prior notice by the Trustee of the date fixed for such redemption described in (1) and (2) above. Holders shall be given not less than 5 days’ nor more than 30 days’ prior notice by the Trustee of the date fixed for such redemption described in (3) and (4) above.

All terms used in this Note which are defined in the Indenture shall have the meanings assigned to them in the Indenture. The Notes are governed by the laws of the State of New York.

Schedule 1

Redemptions and Amount of Securities

| Date of partial redemption |

Aggregate principal amount of Securities then redeemed |

Remaining principal amount of this Global Security |

Authorized Signature |