|

Citigroup Global Markets Holdings Inc. Fully and Unconditionally Guaranteed by Citigroup Inc. |

|

Term Sheet No. 2023–USNCH[ ] Dated

March 24, 2023 relating to dated March 24, 2023 Registration Statement Nos. 333-255302 and 333-255302-03 Filed Pursuant to Rule 433 |

|

Market Linked Securities—Auto-Callable with Contingent Downside Principal at Risk Securities Linked to the Lowest Performing of the Dow Jones Industrial AverageTM, the Russell 2000® Index and the Nasdaq-100 Index® due April 6, 2026 Term Sheet to Preliminary Pricing Supplement No. 2023-USNCH[ ] dated March 24, 2023 |

Summary of Terms

| Issuer and Guarantor: | Citigroup Global Markets Holdings Inc. (issuer) and Citigroup Inc. (guarantor) |

| Underlyings: | Dow Jones Industrial AverageTM, Russell 2000® Index and Nasdaq-100 Index® (each an “underlying” and collectively the “underlyings”) |

| Pricing Date*: | March 29, 2023 |

| Issue Date*: | April 3, 2023 |

| Stated Principal Amount: | $1,000 per security |

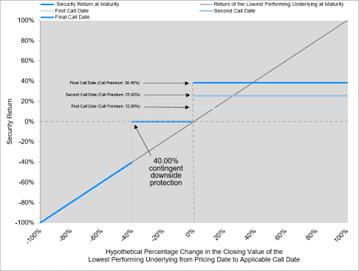

| Automatic Call: | If the closing value of the lowest performing underlying on any call date (including the final calculation day) is greater than or equal to its starting value, the securities will be automatically called for redemption on the related call settlement date for an amount in cash per security equal to $1,000 plus the call premium applicable to that call date. |

| Call Dates* and Call Premiums: |

The call premium applicable to each call date will be determined on the pricing date and will be at least the value indicated below. |

| Call Date | Call Premium (% of the stated principal amount) | |

| April 3, 2024 | 12.80% | |

| April 3, 2025 | 25.60% | |

| March 30, 2026 (the “final calculation day”) | 38.40% |

| Maturity Payment Amount (per security): |

If the securities are not automatically called for redemption prior to or at maturity, and, accordingly, the ending value of the lowest performing underlying on the final calculation day is less than its starting value, you will receive a maturity payment amount for each $1,000 stated principal amount security you hold at maturity: · if the ending value of the lowest performing underlying on the final calculation day is greater than or equal to its threshold value: $1,000; or · if the ending value of the lowest performing underlying on the final calculation day is less than its threshold value: $1,000 × the performance factor of the lowest performing underlying on the final calculation day |

| Call Settlement Dates: | For any call date, the fifth business day after such call date, except that the call settlement date for the final calculation day shall be the maturity date. |

| Maturity Date*: | April 6, 2026 |

| Lowest Performing Underlying: | For any call date, the underlying with the lowest performance factor determined as of that call date |

| Performance Factor: | For each underlying on any call date, its closing value on that call date divided by its starting value |

| Starting Value: | For each underlying, its closing value on the pricing date |

| Threshold Value: | For each underlying, 60% of its starting value |

| Ending Value: | For each underlying, its closing value on the final calculation day |

|

* subject to change ** In addition, CGMI may pay a fee of up to 0.30% to selected securities

dealers in consideration for marketing and other services in connection with the distribution of

| |

Summary of Terms (continued)

| Calculation Agent: | Citigroup Global Markets Inc. (“CGMI”), an affiliate of Citigroup Global Markets Holdings Inc. |

| Denominations: | $1,000 and any integral multiple of $1,000 |

| Agent Discount**: | Up to 2.575%; dealers, including those using the trade name Wells Fargo Advisors (“WFA”), may receive a selling concession of 2.00% and WFA may receive a distribution expense fee of 0.075%. |

| CUSIP / ISIN: | 17331HA71 / US17331HA716 |

| United States Federal Tax Considerations: | See the preliminary pricing supplement. |

Hypothetical Payout Profile***

***assumes call premiums equal to the lowest possible call premiums that may be determined on the pricing date

Any positive return on the securities will be limited to the applicable call premium, even if the closing value of the lowest performing underlying on the applicable call date significantly exceeds its starting value. You will not participate in any appreciation of any underlying beyond the applicable call premium.

If the securities are not automatically called for redemption prior to or at maturity, and the ending value of the lowest performing underlying on the final calculation day is less than its threshold value, you will have full downside exposure to the decrease in the value of the lowest performing underlying from its starting value and you will receive significantly less than the stated principal amount of your securities, and possibly nothing, at maturity.

On the date of the related preliminary pricing supplement, Citigroup Global Markets Holdings Inc. expects that the estimated value of the securities on the pricing date will be at least $904.50 per security, which will be less than the public offering price. The estimated value of the securities is based on CGMI’s proprietary pricing models and Citigroup Global Markets Holdings Inc.’s internal funding rate. It is not an indication of actual profit to CGMI or other of Citigroup Global Markets Holdings Inc.’s affiliates, nor is it an indication of the price, if any, at which CGMI or any other person may be willing to buy the securities from you at any time after issuance. See “Valuation of the Securities” in the accompanying preliminary pricing supplement.

Preliminary Pricing Supplement: https://www.sec.gov/Archives/edgar/data/200245/0000950103230046

44/dp191168_424b2-us2323486.htm

The securities have complex features and investing in the securities involves risks not associated with an investment in conventional debt securities. See “Summary Risk Factors” in this term sheet and the accompanying preliminary pricing supplement and “Risk Factors” in the accompanying product supplement.

This introductory term sheet does not provide all of the information that an investor should consider prior to making an investment decision.

Investors should carefully review the accompanying preliminary pricing supplement, product supplement, underlying supplement, prospectus supplement and prospectus before making a decision to invest in the securities.

NOT A BANK DEPOSIT AND NOT INSURED OR GUARANTEED BY THE FDIC OR

ANY OTHER GOVERNMENTAL AGENCY

Summary Risk Factors

The risks set forth below are discussed in detail in the “Summary Risk Factors” section in the accompanying preliminary pricing supplement and the “Risk Factors” section in the accompanying product supplement. Please review those risk disclosures carefully.

| · | You May Lose Some Or All Of Your Investment. |

| · | The Securities Do Not Pay Interest. |

| · | Your Potential Return On The Securities Is Limited. |

| · | Higher Call Premiums Are Associated With Greater Risk. |

| · | The Securities Are Subject To Heightened Risk Because They Have Multiple Underlyings. |

| · | The Securities Are Subject To The Risks Of Each Of The Underlyings And Will Be Negatively Affected If Any One Underlying Performs Poorly, Regardless Of The Performance Of Any Other Underlying. |

| · | You Will Not Benefit In Any Way From The Performance Of Any Better Performing Underlying. |

| · | You Will Be Subject To Risks Relating To The Relationship Between The Underlyings. |

| · | You May Not Be Adequately Compensated For Assuming The Downside Risk Of The Lowest Performing Underlying. |

| · | The Securities May Be Automatically Called For Redemption Prior To Maturity, Limiting The Term Of The Securities. |

| · | The Securities Offer Downside Exposure To The Lowest Performing Underlying, But No Upside Exposure To Any Underlying. |

| · | You Will Not Receive Dividends Or Have Any Other Rights With Respect To The Securities Included In Any Underlying. |

| · | The Performance Of The Securities Will Depend On The Closing Values Of The Underlyings Solely On The Call Dates, Which Makes The Securities Particularly Sensitive To Volatility In The Closing Values Of The Underlyings On Or Near The Call Dates. |

| · | The Securities Are Subject To The Credit Risk Of Citigroup Global Markets Holdings Inc. And Citigroup Inc. |

| · | The Securities Will Not Be Listed On Any Securities Exchange And You May Not Be Able To Sell Them Prior To Maturity. |

| · | The Estimated Value Of The Securities On The Pricing Date, Based On CGMI’s Proprietary Pricing Models And Our Internal Funding Rate, Will Be Less Than The Public Offering Price. |

| · | The Estimated Value Of The Securities Was Determined For Us By Our Affiliate Using Proprietary Pricing Models. |

| · | The Estimated Value Of The Securities Would Be Lower If It Were Calculated Based On Wells Fargo’s Determination Of The Secondary Market Rate With Respect To Us. |

| · | The Estimated Value Of The Securities Is Not An Indication Of The Price, If Any, At Which Any Person May Be Willing To Buy The Securities From You In The Secondary Market. |

| · | The Value Of The Securities Prior To Maturity Will Fluctuate Based On Many Unpredictable Factors. |

| · | We Have Been Advised That, Immediately Following Issuance, Any Secondary Market Bid Price Provided By Wells Fargo, And The Value That Will Be Indicated On Any Brokerage Account Statements Prepared By Wells Fargo Or Its Affiliates, Will Reflect A Temporary Upward Adjustment. |

| · | The Russell 2000® Index Is Subject To Risks Associated With Small Capitalization Stocks. |

| · | Our Offering Of The Securities Is Not A Recommendation Of Any Underlying. |

| · | The Closing Value Of An Underlying May Be Adversely Affected By Our Or Our Affiliates’, Or By Wells Fargo And Its Affiliates’, Hedging And Other Trading Activities. |

| · | We And Our Affiliates And Wells Fargo And Its Affiliates May Have Economic Interests That Are Adverse To Yours As A Result Of Our And Their Respective Business Activities. |

| · | The Calculation Agent, Which Is An Affiliate Of Ours, Will Make Important Determinations With Respect To The Securities. |

| · | Changes That Affect The Underlyings May Affect The Value Of Your Securities. |

| · | A Call Settlement Date Or The Stated Maturity Date May Be Postponed If A Call Date is Postponed. |

| · | The U.S. Federal Tax Consequences Of An Investment In The Securities Are Unclear. |

Citigroup Global Markets Holdings Inc. and Citigroup Inc. have filed a registration statement (including a related preliminary pricing supplement, an accompanying product supplement, underlying supplement, prospectus supplement and prospectus) with the Securities and Exchange Commission (“SEC”) for the offering to which this communication relates. You should read the related preliminary pricing supplement and the accompanying product supplement, underlying supplement, prospectus supplement and prospectus in that registration statement (File Nos. 333-255302 and 333-255302-03) and the other documents Citigroup Global Markets Holdings Inc. and Citigroup Inc. have filed with the SEC for more complete information about Citigroup Global Markets Holdings Inc., Citigroup Inc. and this offering. You may get these documents for free by visiting EDGAR on the SEC’s website at www.sec.gov. Alternatively, you can request the related preliminary pricing supplement, accompanying product supplement, underlying supplement, prospectus supplement and prospectus by calling toll-free 1-800-831-9146.

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, members SIPC, separate registered broker-dealers and non-bank affiliates of Wells Fargo Finance LLC and Wells Fargo & Company.

2