The information in this preliminary pricing supplement is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. This preliminary pricing supplement and the accompanying index supplement, prospectus supplement and prospectus are not an offer to sell these securities, nor are they soliciting an offer to buy these securities, in any state where the offer or sale is not permitted. SUBJECT TO COMPLETION, DATED FEBRUARY 22, 2022 | |

| Citigroup Global Markets Holdings Inc. |

March , 2022 Medium-Term Senior Notes, Series N Pricing Supplement No. 2022-USNCH[ ] Filed Pursuant to Rule 424(b)(2) Registration Statement Nos. 333-255302 and 333-255302-03 |

Market-Linked Securities Linked to the Citi RadarSM 5 Excess Return Index Due April 3, 2029

| ▪ | The securities offered by this pricing supplement are unsecured debt securities issued by Citigroup Global Markets Holdings Inc. and guaranteed by Citigroup Inc. Unlike conventional debt securities, the securities do not pay interest. Instead, the securities offer the potential for a positive return at maturity based on the performance of the Index specified below from the initial index level to the final index level. |

| ▪ | If the Index appreciates from the initial index level to the final index level, you will receive a positive return at maturity equal to that appreciation multiplied by the upside participation rate specified below. However, if the Index remains the same or depreciates, you will be repaid the stated principal amount of your securities at maturity but will not receive any return on your investment. The securities are designed for investors who are willing to forgo interest on the securities and accept the risk of not receiving any return on the securities in exchange for the possibility of a positive return at maturity based on the performance of the Index. Even if the Index appreciates from the initial index level to the final index level, so that you do receive a positive return at maturity, there is no assurance that your total return at maturity on the securities will compensate you for the effects of inflation or be as great as the yield you could have achieved on a conventional debt security of ours of comparable maturity. |

| ▪ | In order to obtain the exposure to the Index that the securities provide, investors must be willing to accept (i) an investment that may have limited or no liquidity and (ii) the risk of not receiving any amount due under the securities if we and Citigroup Inc. default on our obligations. All payments on the securities are subject to the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc. |

| KEY TERMS | |||

| Issuer: | Citigroup Global Markets Holdings Inc., a wholly owned subsidiary of Citigroup Inc. | ||

| Guarantee: | All payments due on the securities are fully and unconditionally guaranteed by Citigroup Inc. | ||

| Index: | The Citi RadarSM 5 Excess Return Index (ticker symbol: “CIISRAD5”) | ||

| Aggregate stated principal amount: | $ | ||

| Stated principal amount: | $1,000 per security | ||

| Pricing date: | March 28, 2022 | ||

| Issue date: | March 31, 2022. See “Supplemental Plan of Distribution” in this pricing supplement for additional information. | ||

| Valuation date: | March 28, 2029, subject to postponement if such date is not an index business day | ||

| Maturity date: | April 3, 2029 | ||

| Payment at maturity: | You will receive at maturity for each security you then hold, the stated principal amount plus the return amount, which will be either zero or positive | ||

| Return amount: |

If the final index level is greater than the initial index level: $1,000 × the index return × the upside participation rate If the final index level is less than or equal to the initial index level: $0 | ||

| Initial index level: | , the closing level of the Index on the pricing date | ||

| Final index level: | The closing level of the Index on the valuation date | ||

| Upside participation rate: | 300.00% to 325.00%. The actual upside participation rate will be determined on the pricing date. | ||

| Index return: | (i) The final index level minus the initial index level, divided by (ii) the initial index level | ||

| Listing: | The securities will not be listed on any securities exchange | ||

| CUSIP / ISIN: | 17330AWG3 / US17330AWG39 | ||

| Underwriter: | Citigroup Global Markets Inc. (“CGMI”), an affiliate of the issuer, acting as principal | ||

| Underwriting fee and issue price: | Issue price(1) | Underwriting fee(2) | Proceeds to issuer(3) |

| Per security: | $1,000.00 | $41.00 | $959.00 |

| Total: | $ | $ | $ |

(1) Citigroup Global Markets Holdings Inc. currently expects that the estimated value of the securities on the pricing date will be at least $850.00 per security, which will be less than the issue price. The estimated value of the securities is based on CGMI’s proprietary pricing models and our internal funding rate. It is not an indication of actual profit to CGMI or other of our affiliates, nor is it an indication of the price, if any, at which CGMI or any other person may be willing to buy the securities from you at any time after issuance. See “Valuation of the Securities” in this pricing supplement.

(2) CGMI will receive an underwriting fee of up to $41.00 for each security sold in this offering. The total underwriting fee and proceeds to issuer in the table above give effect to the actual total underwriting fee. For more information on the distribution of the securities, see “Supplemental Plan of Distribution” in this pricing supplement. In addition to the underwriting fee, CGMI and its affiliates may profit from expected hedging activity related to this offering, even if the value of the securities declines. See “Use of Proceeds and Hedging” in the accompanying prospectus.

(3) The per security proceeds to issuer indicated above represent the minimum per security proceeds to issuer for any security, assuming the maximum per security underwriting fee. As noted above, the underwriting fee is variable.

Investing in the securities involves risks not associated with an investment in conventional debt securities. See “Summary Risk Factors” beginning on page PS-7.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or determined that this pricing supplement and the accompanying index supplement, prospectus supplement and prospectus are truthful or complete. Any representation to the contrary is a criminal offense.

You should read this pricing supplement together with the accompanying index supplement, prospectus supplement and prospectus, which can be accessed via the hyperlinks below:

Index Supplement No. IS-03-02 dated May 11, 2021 Prospectus Supplement and Prospectus each dated May 11, 2021

The securities are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations of, or guaranteed by, a bank.

| Citigroup Global Markets Holdings Inc. |

Additional Information

This pricing supplement is intended to be read together with the accompanying index supplement, prospectus supplement and prospectus, which are available via the hyperlinks on the cover page of this pricing supplement. The accompanying index supplement, prospectus supplement and prospectus contain important information that is not included in this pricing supplement, including:

| · | a more detailed description of the Index, beginning on page IS-22 of the accompanying index supplement; |

| · | more detailed risk factors relating to the Index, beginning on page IS-11 of the accompanying index supplement; |

| · | the Index rules that govern the calculation of the Index and the rules that govern the calculation of the U.S. Treasury note futures indices that are eligible for inclusion in the Index, found in Annexes A and B to the accompanying index supplement; |

| · | information about the equity sector ETFs that are eligible for inclusion in the Index, beginning on page IS-39 of the accompanying index supplement; |

| · | a description of the U.S. treasury note futures indices that are eligible for inclusion in the Index (together with the equity sector ETFs, the “Constituents”), beginning on page IS-47 of the accompanying index supplement; |

| · | general terms of the securities, including terms relating to the potential postponement of the determination of the final index level and the maturity date upon the occurrence of a market disruption event and terms specifying the consequences of the discontinuance of the Index, beginning on page IS-18 of the accompanying index supplement; and |

| · | considerations for certain employee benefit plans or investors that are investing with assets of such plans, beginning on page IS-53 of the accompanying index supplement. |

Certain terms used but not defined in this pricing supplement are defined in the accompanying index supplement.

Summary Index Description

The Index is published by Citigroup Global Markets Limited (the “Index Administrator”), which is an affiliate of ours. The Index tracks the hypothetical performance of a rules-based investment methodology premised on the idea that there is a relationship between the prevailing interest rate environment in the United States and the relative performance of different sectors of the U.S. equity and Treasury markets. Based on that premise, the Index seeks to determine on a daily basis whether the United States is in a “Rising” interest rate environment or a “Not Rising” interest rate environment. If the Index determines that there is a “Rising” interest rate environment, the Index will allocate exposure to exchange-traded funds (“ETFs”) representing sectors of the U.S. equity market that, according to the Index’s investment thesis, may outperform the broader market in a rising interest rate environment. If, on the other hand, the Index determines that there is a “Not Rising” interest rate environment, the Index will allocate exposure to different ETFs representing sectors of the U.S. equity market that, according to the Index’s investment thesis, may outperform the broader market in a falling or flat interest rate environment. In an attempt to maintain a volatility target of 5%, the Index will also allocate exposure to U.S. Treasury note futures and, potentially, to uninvested cash. Collectively, these allocations – to the selected equity sector ETFs, U.S. Treasury note futures and uninvested cash – make up a hypothetical investment portfolio. The performance of the Index will reflect the performance of that hypothetical investment portfolio, as adjusted daily in response to the observed interest rate environment and pursuant to the volatility targeting feature described below, and subject to the excess return deduction and index fee described below.

The Index determines whether the prevailing interest rate environment is “Rising” or “Not Rising” on each day by observing the average rate of 3-month U.S. dollar LIBOR for each month in the immediately preceding four months (the “Rates Signal”). If the average rate of 3-month U.S. dollar LIBOR increased from each month to the next in that four-month period, then the Index will determine that there is a “Rising” interest rate environment. In all other circumstances, the Index will determine that there is a “Not Rising” interest rate environment.

There is uncertainty about the future of 3-month U.S. dollar LIBOR. If the Index Administrator determines that 3-month U.S. dollar LIBOR has been discontinued or is no longer widely relied upon by market participants as a benchmark interest rate, the Index Administrator may select a successor rate to be substituted for 3-month U.S. dollar LIBOR in the calculation of the Rates Signal. In that event, the successor rate chosen by the Index Administrator may differ in important ways from 3-month U.S. dollar LIBOR, and Index performance based on the successor rate may be less favorable than it would have been had the Rates Signal continued to be based on 3-month U.S. dollar LIBOR.

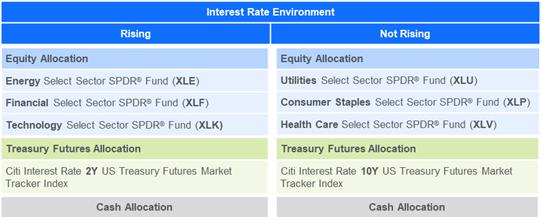

The following table lists the equity sector ETFs and U.S. Treasury note futures index to which the Index will allocate exposure in each observed interest rate environment. The table also indicates that the Index may allocate exposure to uninvested cash.

| PS-2 |

| Citigroup Global Markets Holdings Inc. |

We refer to the hypothetical investment portfolio tracked by the Index at any given time as the “Selected Portfolio” at that time. The selected equity sector ETFs together make up a hypothetical “Equity Allocation” in the Selected Portfolio and will be equally weighted with each other. The applicable U.S. Treasury note futures index makes up a hypothetical “Treasury Futures Allocation”. We refer to the overall allocation to the Equity Allocation and the Treasury Futures Allocation together as the “Invested Allocation” within the Selected Portfolio. In addition to these allocations, the Selected Portfolio may have a hypothetical allocation to uninvested cash, which we refer to as the “Cash Allocation”. No interest or other return will accrue on the Cash Allocation.

The Index determines how much exposure to allocate to each of the Equity Allocation, the Treasury Futures Allocation and the Cash Allocation on a daily basis in a manner designed to maintain a target volatility of the Index of 5%. This volatility-targeting feature is applied in two stages. First, the Index will allocate exposure between the Equity Allocation and the Treasury Futures Allocation within the Invested Allocation based on the volatility of the current Equity Allocation over the prior six months, with higher volatility resulting in a lower Equity Allocation, and vice versa. Second, the Index will allocate exposure between the Invested Allocation and the Cash Allocation based on the volatility of the Invested Allocation over the prior one month. In this second stage, the Index will, if necessary, reduce exposure to the Invested Allocation and increase exposure to the Cash Allocation (which has no volatility) in an attempt to maintain a rolling one-month Selected Portfolio volatility of 5%.

The chart below illustrates the composition of four hypothetical Selected Portfolios, assuming various combinations of the Rates Signal, the trailing six-month volatility of the current Equity Allocation and the trailing one-month volatility of the Invested Allocation. The chart is intended solely for the purpose of illustrating how various allocations together make up a Selected Portfolio, depending on the Rates Signal, the trailing six-month volatility of the current Equity Allocation and the trailing one-month volatility of the Invested Allocation. It is not an indication of what the composition of the Selected Portfolio may be at any given point in time. The chart refers to each equity sector ETF by its ticker symbol, which can be found in the table above.

Each U.S. Treasury note futures index tracks the performance of a hypothetical investment, rolled quarterly, in a near-maturity U.S. Treasury note futures contract. A U.S. Treasury note futures contract is a contract for the purchase of U.S. Treasury notes with maturities falling within a specified range on a fixed date in the future. Accordingly, the value of a U.S. Treasury note futures contract will fluctuate with changes in the

| PS-3 |

| Citigroup Global Markets Holdings Inc. |

market value of the underlying U.S. Treasury notes. In general, the value of a U.S. Treasury note will fall as market interest rates rise, and rise as market interest rates fall. However, the value of a U.S. Treasury note futures contract will also fluctuate based on factors that are unique to a futures contract, such as supply and demand in the futures market, the time remaining to the maturity of the futures contract and market interest rates over the term of the contract. These factors are likely to cause a position in a U.S. Treasury note futures contract to reflect an implicit financing cost, which will lower the return on the futures contract as compared to a direct investment in the underlying U.S. Treasury notes. Accordingly, we expect the performance of each U.S. Treasury note futures index to generally reflect changes in the value of the underlying U.S. Treasury notes, as reduced by an implicit financing cost. We expect the implicit financing cost to rise if market interest rates rise.

In determining the performance of the Index, a rate equal to the federal funds effective rate will be deducted from the daily performance of each equity sector ETF. We refer to this deduction, together with the implicit financing cost reflected in each U.S. Treasury note futures index, as the “excess return deduction”. The excess return deduction is likely to cause the performance of the Selected Portfolio as measured for purposes of the Index to be significantly less than the actual performance of the equity sector ETFs and the U.S. Treasury notes underlying the U.S. Treasury futures that make up the Selected Portfolio. The impact of the excess return deduction will increase if market interest rates rise. The performance of the Index will also be reduced on a daily basis by an index fee of 0.75% per annum.

This section contains only a summary description of the Index and does not describe all of its important features in detail. Before investing in the securities, you should carefully review the more detailed description of the Index contained in the section “Description of the Citi RadarSM 5 Excess Return Index” in the accompanying index supplement.

The Index is subject to important risks, including the following:

| · | The Index is premised on a particular investment thesis about the relationship between the prevailing interest rate environment and the relative performance of different sectors of the U.S. equity market. That investment thesis may be wrong. The assumed relationship may not in fact exist, or if it exists it may be too weak to be meaningful. If the Index’s investment thesis is wrong or too weak to be meaningful, the Index’s Equity Allocation may perform no better than, and in fact may materially underperform, any other allocation that could be made among the equity sector ETFs or the broader market. Our offering of the securities is not an expression of our view about the validity of the Index’s investment thesis. You should form your own independent view about the validity of the Index’s investment thesis in connection with your evaluation of an investment in the securities. |

| · | Even if a meaningful relationship exists between the prevailing interest rate environment and the relative performance of different sectors of the U.S. equity market, the particular rules that make up the Index methodology may not effectively capitalize on that relationship. |

| · | The Index only seeks to partially implement its investment thesis. At any point in time, the Index is likely to have a significant allocation to the Treasury Futures Allocation and/or the Cash Allocation. That allocation is intended to help the Index maintain its volatility target of 5%, and is not in furtherance of its investment thesis. In fact, because the U.S. Treasury note futures indices are likely to be adversely affected by rising interest rates, the allocation to the Treasury Futures Allocation may run counter to the Index’s investment thesis in a Rising interest rate environment. |

| · | The Index is likely to significantly underperform the equity markets in a rising equity market, because the Index is likely to have a significant allocation to the Treasury Futures Allocation and/or Cash Allocation at all times. |

| · | The Index will likely have significant exposure at all times to one of two U.S. Treasury note futures indices. Each U.S. Treasury note futures index has limited return potential and significant downside potential, particularly in a “Rising” interest rate environment. |

| · | The excess return deduction and index fee will place a drag on the performance of the Index, offsetting any appreciation of the U.S. Treasury notes underlying the applicable U.S. Treasury note futures index and the equity sector ETFs that make up the Equity Allocation, exacerbating any depreciation and causing the level of the Index to decline steadily if the value of those U.S. Treasury notes and/or equity sector ETFs remains relatively constant. |

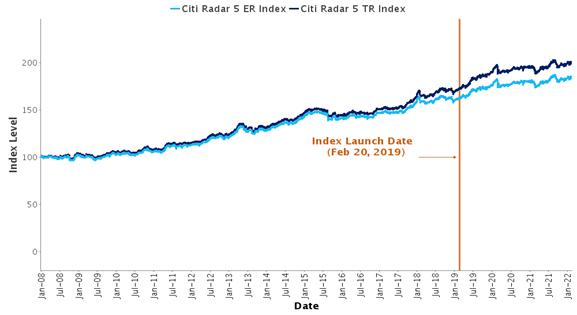

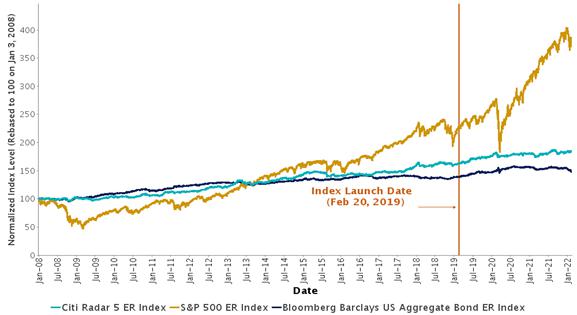

| · | The Index was launched on February 20, 2019 and, therefore, has a limited performance history. |

For more information about the important risks affecting the Index, you should carefully read the section “Summary Risk Factors—Key Risks Relating to the Index” in this pricing supplement and “Risk Factors Relating to the Index” in the accompanying index supplement.

The Selected Portfolio is a hypothetical investment portfolio. There is no actual portfolio of assets to which any investor is entitled or in which any investor has any ownership or other interest. The Index is merely a mathematical calculation that is performed by reference to hypothetical positions in the Equity Allocation, Treasury Futures Allocation and Cash Allocation and the other Index rules.

| PS-4 |

| Citigroup Global Markets Holdings Inc. |

Payout Diagram

The diagram below illustrates your payment at maturity for a range of hypothetical index returns. The diagram assumes that the upside participation rate will be set at the lowest value indicated on the cover page of this pricing supplement. The actual upside participation rate will be determined on the pricing date.

| Payout Diagram | |

| |

| n The Securities | n The Index |

| PS-5 |

| Citigroup Global Markets Holdings Inc. |

Hypothetical Examples

The examples below illustrate how to determine the payment at maturity on the securities, assuming the various hypothetical final index levels indicated below. The examples are solely for illustrative purposes, do not show all possible outcomes and are not a prediction of what the actual payment at maturity on the securities will be. The actual payment at maturity will depend on the actual final index level.

The examples below are based on a hypothetical initial index level of 100.00 and do not reflect the actual initial index level. For the actual initial index level, see the cover page of this pricing supplement. We have used this hypothetical value, rather than the actual value, to simplify the calculations and aid understanding of how the securities work. However, you should understand that the actual payment at maturity on the securities will be calculated based on the actual initial index level, and not this hypothetical value. For ease of analysis, figures below have been rounded. The examples below assume that the upside participation rate will be set at the lowest value indicated on the cover page of this pricing supplement. The actual upside participation rate will be determined on the pricing date.

Example 1—Upside Scenario. The final index level is 105.00, resulting in a 5.00% index return. In this example, the final index level is greater than the initial index level.

Payment at maturity per security = $1,000 + the return amount

= $1,000 + ($1,000 × the index return × the upside participation rate)

= $1,000 + ($1,000 × 5.00% × 300.00%)

= $1,000 + $150.00

= $1,150.00

In this scenario, the Index has appreciated from the initial index level to the final index level, and your total return at maturity would equal the index return multiplied by the upside participation rate.

Example 2—Par Scenario. The final index level is 95.00, resulting in a -5.00% index return. In this example, the final index level is less than the initial index level.

Payment at maturity per security = $1,000 + the return amount

= $1,000 + $0

= $1,000.00

In this scenario, the Index has depreciated from the initial index level to the final index level. As a result, the payment at maturity per security would equal the $1,000 stated principal amount per security and you would not receive any positive return on your investment.

| PS-6 |

| Citigroup Global Markets Holdings Inc. |

Summary Risk Factors

An investment in the securities is significantly riskier than an investment in conventional debt securities. The securities are subject to all of the risks associated with an investment in our conventional debt securities (guaranteed by Citigroup Inc.), including the risk that we and Citigroup Inc. may default on our obligations under the securities, and are also subject to risks associated with the Index. Accordingly, the securities are suitable only for investors who are capable of understanding the complexities and risks of the securities. You should consult your own financial, tax and legal advisors as to the risks of an investment in the securities and the suitability of the securities in light of your particular circumstances.

The following is a summary of certain key risk factors for investors in the securities. You should read this summary together with the more detailed description of risks relating to an investment in the securities contained in the section “Risk Factors Relating to the Notes” beginning on page IS-8 in the accompanying index supplement. You should also carefully read the risk factors included in the accompanying prospectus supplement and in the documents incorporated by reference in the accompanying prospectus, including Citigroup Inc.’s most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q, which describe risks relating to the business of Citigroup Inc. more generally.

Key Risks Relating to the Securities

| § | You may not receive any return on your investment in the securities. You will receive a positive return on your investment in the securities only if the Index appreciates from the initial index level to the final index level. If the final index level is less than or equal to the initial index level, you will receive only the stated principal amount of $1,000 for each security you hold at maturity. As the securities do not pay any interest, even if the Index appreciates from the initial index level to the final index level, there is no assurance that your total return on the securities will be as great as could have been achieved on our conventional debt securities of comparable maturity. |

| § | Although the securities provide for the repayment of the stated principal amount at maturity, you may nevertheless suffer a loss on your investment in real value terms if the Index declines or does not appreciate sufficiently from the initial index level to the final index level. This is because inflation may cause the real value of the stated principal amount to be less at maturity than it is at the time you invest, and because an investment in the securities represents a forgone opportunity to invest in an alternative asset that does generate a positive real return. This potential loss in real value terms is significant given the term of the securities. You should carefully consider whether an investment that may not provide for any return on your investment, or may provide a return that is lower than the return on alternative investments, is appropriate for you. |

| § | The securities do not pay interest. Unlike conventional debt securities, the securities do not pay interest or any other amounts prior to maturity. You should not invest in the securities if you seek current income during the term of the securities. |

| § | Your payment at maturity depends on the closing level of the Index on a single day. Because your payment at maturity depends on the closing level of the Index solely on the valuation date, you are subject to the risk that the closing level of the Index on that day may be lower, and possibly significantly lower, than on one or more other dates during the term of the securities. If you had invested in another instrument linked to the Index that you could sell for full value at a time selected by you, or if the payment at maturity were based on an average of closing levels of the Index, you might have achieved better returns. |

| § | The securities are subject to the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc. If we default on our obligations under the securities and Citigroup Inc. defaults on its guarantee obligations, you may not receive anything owed to you under the securities. |

| § | The securities are riskier than securities with a shorter term. The securities are relatively long-dated. Because the securities are relatively long-dated, many of the risks of the securities are heightened as compared to securities with a shorter term, because you will be subject to those risks for a longer period of time. In addition, the value of a longer-dated security is typically less than the value of an otherwise comparable security with a shorter term. |

| § | The securities will not be listed on any securities exchange and you may not be able to sell them prior to maturity. The securities will not be listed on any securities exchange. Therefore, there may be little or no secondary market for the securities. CGMI currently intends to make a secondary market in relation to the securities and to provide an indicative bid price for the securities on a daily basis. Any indicative bid price for the securities provided by CGMI will be determined in CGMI’s sole discretion, taking into account prevailing market conditions and other relevant factors, and will not be a representation by CGMI that the securities can be sold at that price, or at all. CGMI may suspend or terminate making a market and providing indicative bid prices without notice, at any time and for any reason. If CGMI suspends or terminates making a market, there may be no secondary market at all for the securities because it is likely that CGMI will be the only broker-dealer that is willing to buy your securities prior to maturity. Accordingly, an investor must be prepared to hold the securities until maturity. |

| § | Sale of the securities prior to maturity may result in a loss of principal. You will be entitled to receive at least the full stated principal amount of your securities, subject to the credit risk of Citigroup Global Markets Holdings Inc. and Citigroup Inc., only if you hold the securities to maturity. The value of the securities may fluctuate during the term of the securities, and if you are able to sell your securities prior to maturity, you may receive less than the full stated principal amount of your securities. |

| § | Because the securities provide for repayment of the principal amount at maturity regardless of the performance of the Index, you may not receive a meaningful incremental benefit from the Index’s volatility-targeting feature even though you will be subject to its significant drawbacks. One potential benefit of the Index’s volatility-targeting feature is that it may reduce the potential for large Index declines in volatile equity markets. However, that reduced potential for large Index declines comes at a price: as discussed in more detail below, the volatility-targeting feature is likely to result in a significant allocation to the Treasury Futures Allocation and/or the Cash Allocation, significantly reducing the potential for Index gains in rising equity markets. Because the securities provide for repayment of the principal amount at maturity even if the Index experiences a large decline, any reduced potential for large Index declines resulting from the volatility-targeting feature may not provide a meaningful incremental benefit to an investor in the securities. Investors in the securities will, however, be fully subject to the drawbacks of the volatility-targeting feature, in the form of the reduced participation in rising |

| PS-7 |

| Citigroup Global Markets Holdings Inc. |

equity markets and the other risks described below under “—Key Risks Relating to the Index”. As a result, you should understand that any benefit you receive from the Index’s volatility-targeting feature may be outweighed by its drawbacks.

| § | The estimated value of the securities on the pricing date, based on CGMI’s proprietary pricing models and our internal funding rate, is less than the issue price. The difference is attributable to certain costs associated with selling, structuring and hedging the securities that are included in the issue price. These costs include (i) any selling concessions or other fees paid in connection with the offering of the securities, (ii) hedging and other costs incurred by us and our affiliates in connection with the offering of the securities and (iii) the expected profit (which may be more or less than actual profit) to CGMI or other of our affiliates in connection with hedging our obligations under the securities. These costs adversely affect the economic terms of the securities because, if they were lower, the economic terms of the securities would be more favorable to you. The economic terms of the securities are also likely to be adversely affected by the use of our internal funding rate, rather than our secondary market rate, to price the securities. See “The estimated value of the securities would be lower if it were calculated based on our secondary market rate” below. |

| § | The estimated value of the securities was determined for us by our affiliate using proprietary pricing models. CGMI derived the estimated value disclosed on the cover page of this pricing supplement from its proprietary pricing models. In doing so, it may have made discretionary judgments about the inputs to its models, such as the volatility of the Index and interest rates. CGMI’s views on these inputs may differ from your or others’ views, and as an underwriter in this offering, CGMI’s interests may conflict with yours. Both the models and the inputs to the models may prove to be wrong and therefore not an accurate reflection of the value of the securities. Moreover, the estimated value of the securities set forth on the cover page of this pricing supplement may differ from the value that we or our affiliates may determine for the securities for other purposes, including for accounting purposes. You should not invest in the securities because of the estimated value of the securities. Instead, you should be willing to hold the securities to maturity irrespective of the initial estimated value. |

| § | The estimated value of the securities would be lower if it were calculated based on our secondary market rate. The estimated value of the securities included in this pricing supplement is calculated based on our internal funding rate, which is the rate at which we are willing to borrow funds through the issuance of the securities. Our internal funding rate is generally lower than our secondary market rate, which is the rate that CGMI will use in determining the value of the securities for purposes of any purchases of the securities from you in the secondary market. If the estimated value included in this pricing supplement were based on our secondary market rate, rather than our internal funding rate, it would likely be lower. We determine our internal funding rate based on factors such as the costs associated with the securities, which are generally higher than the costs associated with conventional debt securities, and our liquidity needs and preferences. Our internal funding rate is not an interest rate that is payable on the securities. |

Because there is not an active market for traded instruments referencing our outstanding debt obligations, CGMI determines our secondary market rate based on the market price of traded instruments referencing the debt obligations of Citigroup Inc., our parent company and the guarantor of all payments due on the securities, but subject to adjustments that CGMI makes in its sole discretion. As a result, our secondary market rate is not a market-determined measure of our creditworthiness, but rather reflects the market’s perception of our parent company’s creditworthiness as adjusted for discretionary factors such as CGMI’s preferences with respect to purchasing the securities prior to maturity.

| § | The estimated value of the securities is not an indication of the price, if any, at which CGMI or any other person may be willing to buy the securities from you in the secondary market. Any such secondary market price will fluctuate over the term of the securities based on the market and other factors described in the next risk factor. Moreover, unlike the estimated value included in this pricing supplement, any value of the securities determined for purposes of a secondary market transaction will be based on our secondary market rate, which will likely result in a lower value for the securities than if our internal funding rate were used. In addition, any secondary market price for the securities will be reduced by a bid-ask spread, which may vary depending on the aggregate stated principal amount of the securities to be purchased in the secondary market transaction, and the expected cost of unwinding related hedging transactions. As a result, it is likely that any secondary market price for the securities will be less than the issue price. |

| § | The value of the securities prior to maturity will fluctuate based on many unpredictable factors. The value of your securities prior to maturity will fluctuate based on the closing level of the Index, the volatility of the closing level of the Index and a number of other factors, including general market interest rates, the time remaining to maturity of the securities and our and Citigroup Inc.’s creditworthiness, as reflected in our secondary market rate. Changes in the closing level of the Index may not result in a comparable change in the value of your securities. You should understand that the value of your securities at any time prior to maturity may be significantly less than the issue price. |

| § | Immediately following issuance, any secondary market bid price provided by CGMI, and the value that will be indicated on any brokerage account statements prepared by CGMI or its affiliates, will reflect a temporary upward adjustment. The amount of this temporary upward adjustment will steadily decline to zero over the temporary adjustment period. See “Valuation of the Securities” in this pricing supplement. |

| § | Our affiliates may have published research, expressed opinions or provided recommendations that are inconsistent with investing in the securities and may do so in the future, and any such research, opinions or recommendations could adversely affect the level of the Index. CGMI and other of our affiliates may publish research from time to time relating to the financial markets, any of the Constituents of the Index or the hypothetical investment methodology of the Index. Any research, opinions or recommendations provided by CGMI may influence the price or level of any Constituent of the Index, and they may be inconsistent with purchasing or holding the securities. CGMI and other of our affiliates may have published or may publish research or other opinions that call into question the investment view implicit in an investment in the securities. Any research, opinions or recommendations expressed by such affiliates of ours may not be consistent with each other and may be modified from time to time without notice. Investors should make their own independent investigation of the Constituents of the Index, the Index itself and the merits of investing in the securities. |

| PS-8 |

| Citigroup Global Markets Holdings Inc. |

| § | The price or level of a Constituent or of the Index may be affected by our or our affiliates’ hedging and other trading activities. In anticipation of the sale of the securities, we expect to hedge our obligations under the securities directly or through one of our affiliates, which may involve taking positions directly in the Constituents of the Index or other instruments that may affect the values of the Constituents of the Index. We or our counterparties may also adjust this hedge during the term of the securities and close out or unwind this hedge on or before the valuation date, which may involve, among other things, us or our counterparties purchasing or selling such Constituents or other instruments. This hedging activity on or prior to the pricing date could potentially affect the values of the Constituents of the Index on the pricing date and, accordingly, potentially increase the initial index level, which may adversely affect your return on the securities. Additionally, this hedging activity during the term of the securities, including on or near the valuation date, could negatively affect the level of the Index and, therefore, adversely affect your payment at maturity on the securities. This hedging activity may present a conflict of interest between your interests as a holder of the securities and the interests we and/or our counterparties, which may be our affiliates, have in executing, maintaining and adjusting hedging transactions. These hedging activities could also affect the price, if any, at which CGMI or, if applicable, any other entity may be willing to purchase your securities in a secondary market transaction. |

We and our affiliates may also trade the Constituents of the Index and/or other instruments that may affect the values of the Constituents of the Index on a regular basis (taking long or short positions or both), for our or their accounts, for other accounts under management or to facilitate transactions, including block transactions, on behalf of customers. As with our or our affiliates’ hedging activity, this trading activity could affect the prices or levels of the Constituents of the Index on the valuation date and, therefore, adversely affect the performance of the Index and the securities.

It is possible that these hedging or trading activities could result in substantial returns for us or our affiliates while the value of the securities declines.

| § | We and our affiliates may have economic interests that are adverse to those of the holders of the securities as a result of our or our affiliates’ business activities. We or our affiliates may currently or from time to time engage in business with the issuers of the stocks that are held by the equity sector ETFs, including extending loans to, making equity investments in or providing advisory services to such issuers. In the course of this business, we or our affiliates may acquire non-public information about such issuers, which we will not disclose to you. We do not make any representation or warranty to any purchaser of the securities with respect to any matters whatsoever relating to our or our affiliates’ business with any such issuer. Moreover, if we or any of our affiliates are or become a creditor of any such issuer or otherwise enter into any transaction with any such issuer in the regular course of business, we or such affiliate may exercise any remedies against such issuer that are available to them without regard to the impact on your interests as a holder of the securities. |

| § | The notes calculation agent, which is an affiliate of ours, will make important determinations with respect to the securities. If certain events occur, CGMI, as notes calculation agent, will be required to make discretionary judgments that could significantly affect your payment at maturity. In making these judgments, the notes calculation agent’s interests as an affiliate of ours could be adverse to your interests as a holder of the securities. Such judgments could include, among other things: |

| § | determining whether a market disruption event exists on the valuation date with respect to any Constituent of the Index then included in the Index; |

| § | if the Index Level is not published by the Index Calculation Agent or if a market disruption event exists with respect to any Constituent of the Index then included in the Index on the valuation date, determining the closing level of the Index with respect to that date, which may require us to make a good faith estimate of the value of one or more Constituents of the Index if the market disruption event is continuing on the Backstop Date; and |

| § | selecting a Successor Index or performing an alternative calculation of the closing level of the Index if the Index is discontinued. |

Any of these determinations made by our affiliate, in its capacity as notes calculation agent, may adversely affect any payment owed to you under the securities.

| § | Discontinuance of the Index could adversely affect the value of the securities. The Index Administrator is not required to publish the Index throughout the term of the securities. The Index Administrator may determine to discontinue the Index, among other reasons, as a result of the occurrence of a material Regulatory Event. See “Description of the Citi RadarSM 5 Excess Return Index” in the accompanying index supplement for more information. If the Index is discontinued, the notes calculation agent will have the sole discretion to substitute a successor index that is comparable to the discontinued Index and is not precluded from considering other indices that are calculated and published by the notes calculation agent or any of its affiliates. Any such successor index may not perform favorably. |

If the notes calculation agent does not select a successor index, then the closing level of the Index will be calculated from and after the time of discontinuance based solely on the Selected Portfolio tracked by the Index at the time of discontinuance, without any rebalancing after such discontinuance even if there is a change in the Market Regime. In such an event, the substitute level that is used as the closing level of the Index will cease to reflect the Index’s portfolio selection methodology and instead will track the performance of a fixed portfolio of notional assets, which will consist of the Selected Portfolio tracked by the Index (or the Selected Portfolio that would have been tracked by the Index but for the event that resulted in such discontinuance of the Index) immediately prior to such discontinuance. That level may perform unfavorably after the discontinuance. For example, if the Selected Portfolio at the time of discontinuance is the Treasury Portfolio, the substitute closing level of the Index will reflect only the performance of the treasury portfolio thereafter and will not reflect any exposure to the U.S. Equity Futures Constituent even if there is a bull market in equities. Alternatively, if the Selected Portfolio at the time of discontinuance is the Equity-Focused Portfolio, the substitute closing level of the Index will reflect significant exposure to equities

| PS-9 |

| Citigroup Global Markets Holdings Inc. |

thereafter even if there is a significant equity market decline. In such an event, even though the Index will no longer apply its portfolio selection methodology, the index fee will continue to be deducted.

Key Risks Relating to the Index

The following is a summary of key risks relating to the Index. The summary below should be read together with the more detailed risk factors relating to the Index described in “Risk Factors Relating to the Notes” in the accompanying index supplement. The following discussion of risks should also be read together with the section “Description of the Citi RadarSM 5 Excess Return Index” in the accompanying index supplement, which defines and further describes a number of the terms and concepts referred to below.

| § | The Index may not be successful and may underperform alternative investment strategies. There can be no assurance that the Index will achieve positive returns over any period. The Index tracks the hypothetical performance of a rules-based investment methodology that selects a hypothetical investment portfolio (the Selected Portfolio) to track on a daily basis based on a measure of the prevailing interest rate environment in the United States (the Rates Signal). The performance of the Index over any period will depend on the performance of the Selected Portfolio over that time period, as adjusted daily in response to the observed interest rate environment and pursuant to a volatility targeting feature, and subject to the excess return deduction and index fee, all as more fully described in the section “Description of the Citi RadarSM 5 Excess Return Index” in the accompanying index supplement. In general, if the equity sector ETFs and the U.S. Treasury notes underlying the U.S. Treasury note futures that make up the Selected Portfolio appreciate over a period by more than the excess return deduction and index fee, the level of the Index will increase, and if they depreciate over that period or appreciate by less than the excess return deduction and index fee, the level of the Index will decrease. The performance of the Index may be less favorable than alternative investment strategies that could have been implemented, including an investment in a passive index fund. |

| § | There is uncertainty about the future of 3-month U.S. dollar LIBOR, and if 3-month U.S. dollar LIBOR is discontinued or is no longer widely relied upon by market participants as a benchmark interest rate, the Index may be adversely affected. On March 5, 2021, the U.K. Financial Conduct Authority (the “FCA”), which regulates LIBOR, announced that 3-month U.S. dollar LIBOR will either cease to be provided by any administrator or no longer be representative after June 30, 2023. It is impossible to predict whether and to what extent banks will continue to provide LIBOR submissions to the administrator of LIBOR, whether LIBOR rates will cease to be published or supported before or after June 30, 2023 or whether any additional reforms to LIBOR may be enacted in the United Kingdom or elsewhere. At this time, no consensus exists as to what rate or rates may become accepted alternatives to LIBOR. |

If 3-month U.S. dollar LIBOR is discontinued or is permanently no longer published or is no longer widely relied upon by market participants as a benchmark interest rate (other than for legacy financial instruments linked to 3-month U.S. dollar LIBOR), the Index Administrator may select a substitute or successor rate that it has determined (after consulting any source that it deems reasonable) is (1) the industry-accepted substitute or successor rate or (2) if there is no such industry-accepted substitute or successor rate, a substitute or successor rate which is the most comparable to 3-month U.S. dollar LIBOR (as 3-month U.S. dollar LIBOR exists as of the launch date of the Index). Upon selection of a substitute or successor rate, the Index Administrator may determine (after consulting any source that it deems reasonable) any adjustment factor it determines is needed to make such substitute or successor rate comparable to 3-month U.S. dollar LIBOR, in a manner which is consistent with any industry-standard practice for such substitute or successor rate. In this circumstance, the successor rate chosen by the Index Administrator may differ in important ways from 3-month U.S. dollar LIBOR, and the Rates Signal determined on the basis of the successor rate may be less effective at identifying the prevailing interest rate environment in the United States. As a result, Index performance based on a successor rate may be less favorable than it would have been had the Rates Signal continued to be based on 3-month U.S. dollar LIBOR.

| § | The Index’s investment thesis may be wrong. The Index methodology is premised on the idea that there is a relationship between the prevailing interest rate environment in the United States and the relative performance of different sectors of the U.S. equity market. Specifically, the Index methodology seeks to implement the thesis that the energy, financials and information technology sectors of the U.S. equity markets may outperform the broader market in a rising interest rate environment, and that the utilities, consumer staples and health care sectors may outperform the broader market in a falling or flat interest rate environment. That investment thesis may be wrong. The assumed relationship may not in fact exist. Even if a relationship did exist at points in the past, it may not exist in the future. If the Index’s investment thesis is wrong, the Index’s Equity Allocation may perform no better than, and in fact may materially underperform, any other allocation that could be made among the equity sector ETFs or the broader market. Our offering of the securities is not an expression of our view about the validity of the Index’s investment thesis. You should form your own independent view about the validity of the Index’s investment thesis in connection with your evaluation of any investment linked to the Index. |

| § | Even if the Index’s investment thesis has merit, the effects of the relationship between the prevailing interest rate environment and different sectors of the U.S. equity market may be weak. At best, interest rates are only one factor of many that may relate to the performance of different sectors of the U.S. equity market. Even if there is a relationship between the prevailing interest rate environment and the relative performance of different sectors of the U.S. equity market, the resulting effects on the performance of the relevant equity sectors would hold true only if all other factors were held constant. In reality, other factors are not held constant, and other factors may overwhelm these effects. For example, even at a time of rising interest rates and strong economic growth, commodity prices may fall |

| PS-10 |

| Citigroup Global Markets Holdings Inc. |

dramatically as a result of oversupply, causing the energy sector to perform poorly. Or even at a time of falling interest rates, the consumer staples sector may perform poorly because it is adversely affected by weak economic conditions.

| § | Furthermore, as described in “Description of the Citi RadarSM 5 Excess Return Index—Investment Thesis” in the accompanying index supplement, the Index’s investment thesis is predicated in part on an assumption about the relationship between the prevailing interest rate environment, on the one hand, and economic growth and consumer sentiment, on the other—namely, that a Rising interest rate environment is associated with economic growth and improving consumer sentiment, and that a Not Rising interest rate environment is associated with slowing economic growth and declining consumer sentiment. If that relationship is weak, then the relationship between the prevailing interest rate environment and the performance of certain selected sectors of the U.S. equity market may also be weak. |

| § | There are reasons to expect that the assumed relationship between the prevailing interest rate environment and economic growth may not necessarily hold. For example, there have been many instances historically when there was strong economic growth and consumer sentiment even at a time of stable interest rates. In that environment, the Index would allocate exposure to the utilities, consumer staples and health care sectors, and those sectors may fail to benefit as much as other sectors from strong economic growth and consumer sentiment. Moreover, changes in interest rates may be a lagging indicator of economic conditions. When the Federal Reserve changes its interest rate policies, it is likely to have done so after many months of economic data indicating a change in economic conditions. This time lag is in addition to the time lag inherent in the calculation of the Rates Signal. For all of these reasons, there may be a lengthy period of disconnect between economic conditions and the prevailing interest rate environment identified by the Rates Signal. |

| § | If the relationship between the prevailing interest rate environment and the performance of the selected equity sector ETFs is weak, the selected equity sector ETFs included in the Index’s Equity Allocation may fail to meaningfully outperform, and may in fact materially underperform, any other allocation that could be made among the sectors of the U.S. equity market. At the same time, the Index would be subject to the negative effects of the excess return deduction and index fee. Those negative effects may be significantly greater than any positive effects resulting from the implementation of the Index’s investment thesis. |

| § | Even if the Index’s investment thesis has merit, the Index may not effectively implement that thesis. Even if a relationship exists between the prevailing interest rate environment and the relative performance of different sectors of the U.S. equity market, the particular rules that make up the Index methodology may not effectively capitalize on that relationship. The following is a non-exhaustive list of reasons why the Index may not effectively implement its investment thesis. |

| § | The Index methodology does not distinguish between a falling and a flat interest rate environment, which are both subsumed within a “Not Rising” interest rate environment for purposes of the Index. Even if the Index’s investment thesis has merit in a rising interest rate environment and a falling interest rate environment, it may fail to have merit in a flat interest rate environment. The Index’s rationale for allocating exposure to the utilities, consumer staples and health care sectors in a “Not Rising” interest rate environment is, in part, that these sectors provide basic necessities and so may be less sensitive than other sectors to an economic downturn that may accompany a falling interest rate environment. That rationale is less applicable in a flat interest rate environment, which may not be accompanied by an economic downturn. If a flat interest rate environment prevails for an extended period of time and is accompanied by strong economic growth, the utilities, consumer staples and health care sectors that make up the Equity Allocation in that environment may significantly underperform the broader market. |

| § | Even if the Index’s investment thesis is correct with respect to some of the six equity sector ETFs that are eligible to be included in the Equity Allocation, its failure to be correct about other equity sector ETFs, or even just one equity sector ETF, may be enough to cause poor performance. |

| § | Because of the way the Rates Signal is calculated, the Index may fail to identify a Rising interest rate environment until long after other measures would have indicated that interest rates are rising. The Rates Signal will not identify a Rising interest rate environment unless there have been three consecutive month-over-month increases in the average daily rate of 3-month U.S. dollar LIBOR for the applicable month. Accordingly, even if there has been a sharp increase in interest rates in the last two months, the Rates Signal will not identify a Rising interest rate until there have been three consecutive month-over-month increases. |

| § | The Index only seeks to identify whether interest rates are Rising or Not Rising. It does not seek to identify whether interest rates are high or low. It may be that identifying interest rates as high or low would have been a more effective way of identifying the prevailing interest rate environment in the United States than the method used by the Index. |

| § | The Index only seeks to partially implement its investment thesis, and as a result may perform poorly even if its investment thesis proves correct. At any point in time, the Index is likely to have a significant allocation to the Treasury Futures Allocation and/or the Cash Allocation. That allocation is intended to help the Index maintain its volatility target of 5%, and is not in furtherance of its investment thesis. In fact, because the U.S. Treasury note futures indices are likely to be adversely affected by rising interest rates, the allocation to the Treasury Futures Allocation may run counter to the Index’s investment thesis. For example, in a Rising interest rate environment, even if the equity sector ETFs that are included in the Selected Portfolio perform favorably, that performance is likely to be offset, and perhaps more than offset, by the decline in the level of the applicable U.S. Treasury note futures index that would result from the rise in interest rates. As a result, even if the Index’s investment thesis proves to be correct, the Index may have poor performance or even decline as a result of its significant allocation to the Treasury Futures Allocation and/or Cash Allocation. |

| PS-11 |

| Citigroup Global Markets Holdings Inc. |

| § | The Index is likely to significantly underperform equities in rising equity markets. The Index is likely to have a significant allocation to the Treasury Futures Allocation and/or Cash Allocation at all times. Only a portion of the Selected Portfolio will be allocated to the Equity Allocation at any point in time. As a result, even if the Index’s investment thesis is correct, and even if the Index effectively implements that thesis at a time when equity markets are rising, the Index may nevertheless materially underperform an alternative investment in the equity sector ETFs that is not based on that thesis but that is fully allocated to the equity sector ETFs. We expect that it will frequently be the case that the allocations to the Treasury Futures Allocation and/or Cash Allocation within the Selected Portfolio will be greater than the allocation to the Equity Allocation. |

| § | The equity sector ETFs that may be included in the Equity Allocation do not cover all sectors or segments of the U.S. equity market. The Global Industry Classification Standard (“GICS”), which defines the sectors tracked by the equity sector ETFs, divides the U.S. equity market into eleven sectors. Only six equity sector ETFs are eligible to be included in the Equity Allocation. Moreover, the equity sector ETFs that are eligible to be included in the Equity Allocation only include stocks from the large capitalization segment of the U.S. equity market, as represented by the S&P 500® Index. As a result, a significant portion of the U.S. equity market is not eligible for inclusion in the Equity Allocation. The sectors represented by the six equity sector ETFs that are eligible for inclusion in the Equity Allocation may not exhibit as strong a relationship with the prevailing interest rate environment as the GICS sectors that are not eligible for inclusion or as the small capitalization segment of the U.S. equity market, and those other equity sectors or the small capitalization segment may have better performance than the six large capitalization sectors that are eligible for inclusion. |

| § | The equity sector ETFs in the Equity Allocation may offset each other. At any given time, the Equity Allocation will consist of three equity sector ETFs. Even if the relationships posited by the Index’s investment thesis exist between the prevailing interest rate environment and one or two of the equity sectors represented in the Equity Allocation, that relationship may not exist for the other equity sector(s). Even if one or two of those equity sector ETFs performs favorably, one or two others may perform unfavorably, partially or fully offsetting, or more than offsetting, the performance of the favorably performing equity sector ETF(s). The Index might have performed more favorably if it included fewer equity sector ETFs in the Equity Allocation. |

| § | The Index is likely to have significant exposure to the Treasury Futures Allocation, which has limited return potential and significant downside potential, particularly in times of rising interest rates. Each U.S. Treasury note futures index has limited return potential, which in turn limits the return potential of the Index. However, each U.S. Treasury note futures index has significant downside potential, particularly in a “Rising” interest rate environment. Although U.S. Treasury notes themselves are generally viewed as safe assets, each U.S. Treasury note futures index tracks the value of a futures contract on U.S. Treasury notes, which may be subject to significant fluctuations and declines. In particular, the value of a futures contract on a U.S. Treasury note is likely to decline if there is a general rise in interest rates, as the rise in interest rates would reduce the value of the underlying U.S. Treasury notes. In addition, the value of a futures contract on U.S. Treasury notes is likely to decline by more than the decline in the value of the underlying U.S. Treasury notes at a time of rising interest rates, because the futures contract will also be adversely affected by an increase in the implicit financing cost discussed above. As a result, even if the Index’s investment thesis were correct and the equity sector ETFs selected in a “Rising” interest rate environment perform favorably in that environment, that favorable performance is likely to be at least partially offset, and may be more than offset, by unfavorable performance of the applicable U.S. Treasury note futures index. |

| § | The Index may have significant exposure to the Cash Allocation, on which no interest or other return will accrue. At any time when the Selected Portfolio has less than a 100% allocation to the Invested Allocation, the difference will be hypothetically allocated to uninvested cash (the Cash Allocation) and will not accrue any interest or other return. A significant allocation to the Cash Allocation will significantly reduce the Index’s potential for gains. In addition, the index fee will be deducted from the entire Index, including the portion allocated to the Cash Allocation. As a result, after taking into account the deduction of the index fee, any portion of the Index that is allocated to the Cash Allocation will experience a net decline at a rate equal to the index fee. In general, the Cash Allocation is likely to be greatest at a time when the one-month volatility of the equity sector ETFs making up the actual Equity Allocation over the preceding month has increased significantly from the six-month volatility of the current Equity Allocation. |

| § | The excess return deduction will be a significant drag on Index performance. The performance of each U.S. Treasury note futures index is expected to reflect changes in the value of the underlying U.S. Treasury notes, as reduced by an implicit financing cost. In addition, for purposes of the Index, the performance of each equity sector ETF will be calculated on a daily basis after deducting a rate equal to the federal funds effective rate from its actual total return performance. We refer to this deduction, together with the implicit financing cost in the performance of each U.S. Treasury note futures index, as the “excess return deduction”. The excess return deduction will cause the performance of each U.S. Treasury note futures index to be significantly less than the performance of the underlying U.S. Treasury notes, and will cause the performance of each equity sector ETF, as measured for purposes of the Index, to be significantly less than its actual performance. The excess return deduction means that the Selected Portfolio will not have positive returns unless the relevant U.S. Treasury notes and/or equity sector ETFs appreciate sufficiently to offset the excess return deduction. Because of the excess return deduction, the Selected Portfolio may have negative returns even if the relevant U.S. Treasury notes and/or equity sector ETFs appreciate. |

The excess return deduction will place a drag on the performance of the Index, offsetting any appreciation of the U.S. Treasury notes underlying the applicable U.S. Treasury note futures index and the equity sector ETFs that make up the Equity Allocation, exacerbating any depreciation and causing the value of the Selected Portfolio to decline steadily if the value of those U.S. Treasury notes and/or equity sector ETFs remains relatively constant.

| PS-12 |

| Citigroup Global Markets Holdings Inc. |

| § | The index fee will adversely affect Index performance. An index fee of 0.75% per annum is deducted in the calculation of the Index. The negative effects of the index fee on Index performance will be in addition to the negative effects of the excess return deduction described above. |

| § | The Index may fail to maintain its volatility target and may experience large declines as a result. The Index adjusts the Selected Portfolio’s exposure between the Equity Allocation and the Treasury Futures Allocation, and between the Invested Allocation and the Cash Allocation, as often as daily in an attempt to maintain a trailing one-month volatility target of 5%. Because this exposure adjustment is backward-looking based on historical volatility, there may be a significant time lag before a sudden increase in volatility of the Equity Allocation is sufficiently reflected in the trailing volatility measures used by the Index to result in a meaningful reduction in exposure to the Equity Allocation. In the meantime, the Index may experience significantly more than 5% volatility and, if the increase in volatility is accompanied by a decline in the value of the Invested Allocation, the Index may incur significant losses. |

| § | The daily volatility-targeting feature may cause the Index to perform poorly in temporary market crashes. A temporary market crash is an event in which the volatility of the Equity Allocation spikes suddenly and its value declines sharply over a short period of time, but the decline is short-lived and the Equity Allocation soon recovers its losses. In this circumstance, although the value of the Equity Allocation after the recovery may return to its value before the crash, the level of the Index may not fully recover its losses. This is because of the time lag that results from using a look-back period in the second stage of the Index’s volatility-targeting feature of one month. Because of the time lag, the Index may not meaningfully reduce its exposure to the Invested Allocation until the crash has already occurred, and by the time the reduced exposure does take effect, the recovery may have already begun. For example, if the Index has 50% exposure to the decline in the Invested Allocation, and then reduces its exposure so that it has only 20% exposure to the recovery, the Index will end up significantly lower after the crash and recovery than it was before the crash. |

| § | The performance of the Index will be highly sensitive to the specific parameters by which it is calculated. The Index is calculated pursuant to a rules-based methodology that contains a number of specific parameters. These parameters will be significant determinants of the performance of the Index. There is nothing inherent in any of these specific parameters that necessarily makes them the right specific parameters to use for the Index. If the Index had used different parameters, the Index might have achieved significantly better returns. |

| § | The Index will be calculated pursuant to a set of fixed rules and will not be actively managed. If the Index performs poorly, the Index Administrator will not change the rules in an attempt to improve performance. The Index tracks the hypothetical performance of the rules-based investment methodology described under “Description of the Citi RadarSM 5 Excess Return Index” in the accompanying index supplement. The Index will not be actively managed. If the rules-based investment methodology tracked by the Index performs poorly, the Index Administrator will not change the rules in an attempt to improve performance. Accordingly, an investment linked to the Index is not like an investment in a mutual fund. Unlike a mutual fund, which could be actively managed by the fund manager in an attempt to maximize returns in changing market conditions, the Index rules will remain unchanged, even if those rules might prove to be ill-suited to future market conditions. |

| § | The Index has limited actual performance information. The Index launched on February 20, 2019. Accordingly, the Index has limited actual performance data. Because the Index is of recent origin with limited performance history, an investment linked to the Index may involve a greater risk than an investment linked to one or more indices with an established record of performance. A longer history of actual performance may have provided more reliable information on which to assess the validity of the Index’s hypothetical investment methodology. However, any historical performance of the Index is not an indication of how the Index will perform in the future. |

| § | Hypothetical back-tested Index performance information is subject to significant limitations. All information regarding the performance of the Index prior to February 20, 2019 is hypothetical and back-tested, as the Index did not exist prior to that time. It is important to understand that hypothetical back-tested Index performance information is subject to significant limitations, in addition to the fact that past performance is never a guarantee of future performance. In particular: |

| § | The Index Administrator developed the rules of the Index with the benefit of hindsight—that is, with the benefit of being able to evaluate how the Index rules would have caused the Index to perform had it existed during the hypothetical back-tested period. The fact that the Index generally appreciated over the hypothetical back-tested period may not therefore be an accurate or reliable indication of any fundamental aspect of the Index methodology. |

| § | The hypothetical back-tested performance of the Index might look different if it covered a different historical period. The market conditions that existed during the historical period covered by the hypothetical back-tested Index performance information are not necessarily representative of the market conditions that will exist in the future. |

| § | As described in more detail in the section “Description of the Citi RadarSM 5 Excess Return Index—Hypothetical Back-Tested Index Performance Information” in the accompanying index supplement, two of the equity sector ETFs have been affected by significant changes in the way the sectors they track are defined. Hypothetical back-tested performance information for the Index has been calculated based on the actual historical closing prices of all equity sector ETFs. For all periods prior to these changes, the closing prices for the two affected equity sector ETFs are likely to have been different than they would have been had these equity sector ETFs tracked their target sectors as currently defined. As a result, the hypothetical back-tested Index performance information may not reflect how the Index would have performed if the two equity sector ETFs had tracked their target sectors as currently defined. |

| § | The U.S. Treasury note futures indices were first published on April 28, 2017. For all periods prior to that date, the hypothetical back-tested performance of the Index has been calculated based on the hypothetical back-tested performance of the U.S. Treasury note futures indices. |

| PS-13 |

| Citigroup Global Markets Holdings Inc. |

It is impossible to predict whether the Index will rise or fall. The actual future performance of the Index may bear no relation to the historical or hypothetical back-tested levels of the Index.

| § | Changes to the GICS sectors upon which the equity sector ETFs are based may adversely affect the performance of the Index. Changes are made from time to time to the GICS sector classification system, which is used to define the sector that each equity sector ETF tracks. Any changes made in the future could materially change the composition of the sector tracked by one or more equity sector ETFs, which could result in materially worse Index performance than if the change had not been made. |

| § | There are drawbacks associated with tracking the value of ETFs rather than the underlying indices that the ETFs seek to track. The Equity Allocation will be composed of ETFs. Each ETF seeks to track the performance of its underlying index before giving effect to fees and expenses of the ETF. After giving effect to these fees and expenses, the performance of each ETF is likely to be less favorable than the performance of the underlying index that it tracks. In addition, the price of the shares of each ETF may not perfectly track the performance of its underlying index or its net asset value per share. |

| § | The Index Administrator and Index Calculation Agent, which is our affiliate, may exercise judgments under certain circumstances in the calculation of the Index. Although the Index is rules-based, there are certain circumstances under which the Index Administrator or Index Calculation Agent may be required to exercise judgment in calculating the Index, including the following: |

| · | The Index Administrator will determine whether an ambiguity, error or omission has arisen and the Index Administrator may resolve such ambiguity, error or omission, using Expert Judgment, and may amend the Index rules to reflect the resolution of the ambiguity, error or omission. |

| · | The Index Calculation Agent will determine if any Index Business Day is a Disrupted Day with respect to any Constituent and, if so, may publish its good faith estimate of the Index Level for such Index Business Day, using its good faith estimate of the value of the Constituent(s) affected by the Disrupted Day. |

| · | If an Adjustment Event occurs with respect to a Constituent, the Index Calculation Agent will determine whether to replace such Constituent and may adjust the Index rules accordingly, and the Index Administrator will determine whether to discontinue the Index. |

| · | The Index Calculation Agent will determine whether a Regulatory Event occurs and whether such event has a material effect on the Index. Following the occurrence of a material Regulatory Event, the Index Administrator will determine whether to amend the Index rules or discontinue and cancel the Index. Following the occurrence of a nonmaterial Regulatory Event, the Index Calculation Agent will determine whether to replace the affected Constituent. |