|

Citigroup Inc.

|

November 22, 2013

Medium-Term Senior Notes, Series H

Pricing Supplement No. 2013-CMTNH0226

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-172562

|

h

Non-Callable Fixed to Floating Rate Notes due November 27, 2018

From and including the original issue date to but excluding November 27, 2014, the notes will bear interest during each interest period at a per annum rate equal to 1.00%. From and including November 27, 2014 to but excluding the maturity date, the notes will bear interest during each interest period at a per annum rate equal to the floating interest rate commonly referred to as “3-month U.S. dollar LIBOR” determined on the second London business day prior to the first day of the applicable interest period plus a spread of 0.68%, subject to a minimum interest rate of 0.00% per annum for any interest period

The notes are unsecured senior debt obligations of Citigroup Inc. All payments due on the notes are subject to the credit risk of Citigroup Inc.

It is important for you to consider the information contained in this pricing supplement together with the information contained in the accompanying prospectus supplement and prospectus in connection with your investment in the notes. The description of the notes below supplements, and to the extent inconsistent with replaces, the description of the general terms of the notes set forth in the accompanying prospectus supplement and prospectus.

|

Issuer:

|

Citigroup Inc.

|

||

|

Issue price:

|

$1,000 per note

|

||

|

Stated principal amount:

|

$1,000 per note

|

||

|

Aggregate stated principal amount:

|

$6,350,000

|

||

|

Pricing date:

|

November 22, 2013

|

||

|

Original issue date:

|

November 27, 2013

|

||

|

Maturity date:

|

November 27, 2018. If the maturity date is not a business day, then the payment required to be made on the maturity date will be made on the next succeeding business day with the same force and effect as if it had been made on the maturity date. No additional interest will accrue as a result of delayed payment.

|

||

|

Principal due at maturity:

|

Full principal amount due at maturity

|

||

|

Payment at maturity:

|

$1,000 per note plus any accrued and unpaid interest

|

||

|

Interest rate per annum:

|

From and including the original issue date to but excluding November 27, 2014:

1.00%

From and including November 27, 2014 to but excluding the maturity date:

A floating rate equal to 3-month U.S. dollar LIBOR determined on the second London business day prior to the first day of the applicable interest period plus a spread of 0.68%, subject to a minimum interest rate of 0.00% per annum for any interest period

|

||

|

Interest period:

|

The period from the original issue date to but excluding the immediately following interest payment date, and each successive period from and including an interest payment date to but excluding the next interest payment date

|

||

|

Interest payment dates:

|

On the 27th day of each February, May, August and November of each year, commencing February 27, 2014 and ending on the maturity date, provided that if any such day is not a business day, the applicable interest payment will be made on the next succeeding business day. No additional interest will accrue on that succeeding business day. Interest will be payable to the persons in whose names the notes are registered at the close of business on the business day preceding each interest payment date, which we refer to as a regular record date, except that the interest payment due at maturity will be paid to the persons who hold the notes on the maturity date.

|

||

|

Day count convention:

|

30/360 Unadjusted. See “Determination of Interest Payments” in this pricing supplement.

|

||

|

Business day:

|

Any day that is not a Saturday or Sunday and that, in New York City, is not a day on which banking institutions are authorized or obligated by law or executive order to close

|

||

|

Business day convention:

|

Following

|

||

|

CUSIP:

|

1730T0C80

|

||

|

ISIN:

|

US1730T0C801

|

||

|

Listing:

|

The notes will not be listed on any securities exchange and, accordingly, may have limited or no liquidity. You should not invest in the notes unless you are willing to hold them to maturity.

|

||

|

Underwriter:

|

Citigroup Global Markets Inc. (“CGMI”), an affiliate of the issuer. See “General Information—Supplemental information regarding plan of distribution; conflicts of interest” in this pricing supplement.

|

||

|

Underwriting fee and issue price:

|

Price to public

|

Underwriting fee(1) (2)

|

Proceeds to issuer(2)

|

|

Per note:

|

$1,000

|

$3

|

$997

|

|

Total:

|

$6,350,000

|

$19,050

|

$6,330,950

|

(1) CGMI, an affiliate of Citigroup Inc. and the underwriter of the sale of the notes, is acting as principal and will receive an underwriting fee of up to $3 for each note sold in this offering. Additionally, it is possible that CGMI and its affiliates may profit from expected hedging activity related to this offering, even if the value of the notes declines. You should refer to “Risk Factors,” “General Information—Fees and selling concessions” and “General Information—Supplemental information regarding plan of distribution; conflicts of interest” in this pricing supplement for more information.

(2) The per note proceeds to Citigroup Inc. indicated above represent the minimum per note proceeds to Citigroup Inc. for any note, assuming the maximum per note underwriting fee of $3. As noted in footnote (1), the underwriting fee is variable. The total underwriting fee and proceeds to Citigroup Inc. shown above give effect to the actual amount of this variable underwriting fee. You should refer to “Risk Factors,” “General Information—Fees and selling concessions” and “General Information—Supplemental information regarding plan of distribution; conflicts of interest” in this pricing supplement for more information.

Investing in the notes involves risks not associated with an investment in conventional fixed rate debt securities. See “Risk Factors” beginning on page PS-2.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes or determined that this pricing supplement and the accompanying prospectus supplement and prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

You should read this pricing supplement together with the accompanying prospectus supplement and prospectus, each of which can be accessed via the hyperlink below, in connection with your investment in the notes.

The notes are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, nor are they obligations of, or guaranteed by, a bank.

|

Citigroup Inc.

|

|

Non-Callable Fixed to Floating Rate Notes due November 27, 2018

|

Risk Factors

The following is a non-exhaustive list of certain key risk factors for investors in the notes. You should read the risk factors below together with the risk factors included in the documents incorporated by reference in the accompanying prospectus, including our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q, which describe risks relating to our business more generally. We also urge you to consult your investment, legal, tax, accounting and other advisers in connection with your investment in the notes.

|

§

|

The amount of interest payable on the notes will vary. The notes differ from conventional fixed-rate debt securities in that the interest payable on the notes will vary after the first twelve months of the term of the notes based on the level of 3-month U.S. dollar LIBOR. From and including November 27, 2014 to but excluding the maturity date, the notes will bear interest during each interest period at a per annum rate equal to the level of 3-month U.S. dollar LIBOR determined on the second London business day prior to the first day of the applicable interest period plus a spread of 0.68%, subject to a minimum interest rate of 0.00% per annum for any interest period. The per annum interest rate that is determined on the relevant interest determination date will apply to the entire interest period following that interest determination date, even if 3-month U.S. dollar LIBOR increases during that interest period, but is applicable only to that interest period; interest payments for any other interest period will vary.

|

|

§

|

The yield on the notes may be lower than the yield on a standard debt security of comparable maturity. During the first twelve months of the term of the notes, the notes will bear interest at a per annum rate of 1.00%. From and including November 27, 2014 to but excluding the maturity date, the notes will bear interest during each interest period at a per annum rate equal to the level of 3-month U.S. dollar LIBOR determined on the second London business day prior to the first day of the applicable interest period plus a spread of 0.68%, subject to a minimum interest rate of 0.00% per annum for any interest period. As a result, the effective yield on your notes may be less than that which would be payable on a conventional fixed-rate, non-callable debt security of Citigroup Inc. of comparable maturity.

|

|

§

|

The notes are subject to the credit risk of Citigroup Inc., and any actual or anticipated changes to its credit ratings or credit spreads may adversely affect the value of the notes. You are subject to the credit risk of Citigroup Inc. If Citigroup Inc. defaults on its obligations under the notes, your investment would be at risk and you could lose some or all of your investment. As a result, the value of the notes will be affected by changes in the market’s view of Citigroup Inc.’s creditworthiness. Any decline, or anticipated decline, in Citigroup Inc.’s credit ratings or increase, or anticipated increase, in the credit spreads charged by the market for taking Citigroup Inc. credit risk is likely to adversely affect the value of the notes.

|

|

§

|

The notes will not be listed on any securities exchange and you may not be able to sell the notes prior to maturity. The notes will not be listed on any securities exchange. Therefore, there may be little or no secondary market for the notes. CGMI currently intends to make a secondary market in relation to the notes and to provide an indicative bid price for the notes on a daily basis. Any indicative bid price for the notes provided by CGMI will be determined in CGMI’s sole discretion, taking into account prevailing market conditions and other relevant factors, and will not be a representation by CGMI that the notes can be sold at that price or at all. CGMI may suspend or terminate making a market and providing indicative bid prices without notice, at any time and for any reason. If CGMI suspends or terminates making a market, there may be no secondary market at all for the notes because it is likely that CGMI will be the only broker-dealer that is willing to buy your notes prior to maturity. Accordingly, an investor must be prepared to hold the notes until maturity.

|

|

§

|

Immediately following issuance, any secondary market bid price provided by CGMI, and the value that will be indicated on any brokerage account statements prepared by CGMI or its affiliates, will reflect a temporary upward adjustment. The amount of this temporary upward adjustment will steadily decline to zero over the temporary adjustment period. See “General Information—Temporary adjustment period” in this pricing supplement.

|

|

§

|

Secondary market sales of the notes may result in a loss of principal. You will be entitled to receive at least the full stated principal amount of your notes, subject to the credit risk of Citigroup Inc., only if you hold the notes to maturity. If you are able to sell your notes in the secondary market prior to maturity, you are likely to receive less than the stated principal amount of the notes.

|

|

§

|

The inclusion of underwriting fees and projected profit from hedging in the issue price is likely to adversely affect secondary market prices. Assuming no changes in market conditions or other relevant factors, the price, if any, at which CGMI may be willing to purchase the notes in secondary market transactions will likely be lower than the issue price since the issue price of the notes includes, and secondary market prices are likely to exclude, underwriting fees paid with respect to the notes, as well as the cost of hedging our obligations under the notes. The cost of hedging includes the projected profit that our affiliates may realize in consideration for assuming the risks inherent in managing the hedging transactions. The secondary market prices for the notes are also likely to be reduced by the costs of unwinding the related hedging transactions. Our affiliates may realize a profit from the expected hedging activity even if the value of the notes declines. In addition, any secondary market prices for the notes may differ from values determined by pricing models used by CGMI, as a result of dealer discounts, mark-ups or other transaction costs.

|

|

November 2013

|

PS-2

|

|

Citigroup Inc.

|

|

Non-Callable Fixed to Floating Rate Notes due November 27, 2018

|

|

§

|

The price at which you may be able to sell your notes prior to maturity will depend on a number of factors and may be substantially less than the amount you originally invest. A number of factors will influence the value of the notes in any secondary market that may develop and the price at which CGMI may be willing to purchase the notes in any such secondary market, including: the level and volatility of 3-month U.S. dollar LIBOR, interest rates in the market, the time remaining to maturity of the notes, hedging activities by our affiliates, fees and projected hedging fees and profits and any actual or anticipated changes in the credit ratings, financial condition and results of Citigroup Inc. The value of the notes will vary and is likely to be less than the issue price at any time prior to maturity, and sale of the notes prior to maturity may result in a loss.

|

|

§

|

The calculation agent, which is an affiliate of the issuer, will make determinations with respect to the notes. Citibank, N.A., the calculation agent for the notes, is an affiliate of ours. As calculation agent, Citibank, N.A. will determine, among other things, the level of 3-month U.S. dollar LIBOR and will calculate the interest payable to you on each interest payment date. Any of these determinations or calculations made by Citibank, N.A. in its capacity as calculation agent, including with respect to the calculation of the level of 3-month U.S. dollar LIBOR in the event of the unavailability of the level of 3-month U.S. dollar LIBOR, may adversely affect the amount of one or more interest payments to you.

|

|

§

|

Hedging and trading activity by Citigroup Inc. could result in a conflict of interest. One or more of our affiliates have entered into hedging transactions. This hedging activity likely involves trading in instruments, such as options, swaps or futures, based upon 3-month U.S. dollar LIBOR. This hedging activity may present a conflict between your interest in the notes and the interests our affiliates have in executing, maintaining and adjusting their hedge transactions because it could affect the price at which our affiliate CGMI may be willing to purchase your notes in the secondary market. Because hedging our obligations under the notes involves risk and may be influenced by a number of factors, it is possible that our affiliates may profit from the hedging activity, even if the value of the notes declines.

|

|

§

|

The historical performance of 3-month U.S. dollar LIBOR is not an indication of its future performance. The historical performance of 3-month U.S. dollar LIBOR, which is included in this pricing supplement, should not be taken as an indication of the future performance of 3-month U.S. dollar LIBOR during the term of the notes. Changes in the level of 3-month U.S. dollar LIBOR will affect the value of the notes, but it is impossible to predict whether the level of 3-month U.S. dollar LIBOR will rise or fall.

|

|

§

|

3-month U.S. dollar LIBOR and the manner in which it is calculated may change in the future. The method by which 3-month U.S. dollar LIBOR is calculated may change in the future, as a result of governmental actions, actions by the publisher of 3-month U.S. dollar LIBOR or otherwise. We cannot predict whether the method by which 3-month U.S. dollar LIBOR is calculated will change or what the impact of any such change might be. Any such change could affect the level of 3-month U.S. dollar LIBOR in a way that has a significant adverse effect on the notes.

|

|

§

|

You will have no rights against the publishers of 3-month U.S. dollar LIBOR. You will have no rights against the publishers of 3-month U.S. dollar LIBOR even though the amount you receive on each interest payment date after the first twelve months of the term of the notes will depend upon the level of 3-month U.S. dollar LIBOR. The publishers of 3-month U.S. dollar LIBOR are not in any way involved in this offering and have no obligations relating to the notes or the holders of the notes.

|

|

November 2013

|

PS-3

|

|

Citigroup Inc.

|

|

Non-Callable Fixed to Floating Rate Notes due November 27, 2018

|

|

General Information

|

|

|

Temporary adjustment period:

|

For a period of approximately four months following issuance of the notes, the price, if any, at which CGMI would be willing to buy the notes from investors, and the value that will be indicated for the notes on any brokerage account statements prepared by CGMI or its affiliates (which value CGMI may also publish through one or more financial information vendors), will reflect a temporary upward adjustment from the price or value that would otherwise be determined. This temporary upward adjustment represents a portion of the hedging profit expected to be realized by CGMI or its affiliates over the term of the notes. The amount of this temporary upward adjustment will decline to zero on a straight-line basis over the four-month temporary adjustment period.

|

|

U.S. federal income tax considerations:

|

In the opinion of our counsel, Davis Polk & Wardwell LLP, which is based on current market conditions, the notes should be treated as “variable rate debt instruments” that provide for a single “qualified floating rate” for U.S. federal income tax purposes and are issued without original issue discount. Under this treatment, stated interest on the notes will be taxable to a U.S. Holder (as defined in the accompanying prospectus supplement) as ordinary interest income at the time it accrues or is received in accordance with the holder’s method of tax accounting.

Upon the sale or other taxable disposition of a note, a U.S. Holder generally will recognize capital gain or loss equal to the difference between the amount realized on the disposition (other than any amount attributable to accrued interest, which will be treated as a payment of interest) and the holder’s tax basis in the note. A U.S. Holder’s tax basis in a note should equal the cost of the note to the holder. Such gain or loss generally will be long-term capital gain or loss if the U.S. Holder has held the note for more than one year at the time of disposition.

Non-U.S. Holders (as defined in the accompanying prospectus supplement) generally will not be subject to U.S. federal withholding or income tax with respect to interest paid on and amounts received on the sale, exchange or retirement of the notes if they fulfill certain certification requirements. Special rules apply to Non-U.S. Holders whose income on the notes is effectively connected with the conduct of a U.S. trade or business or who are individuals present in the United States for 183 days or more in a taxable year.

Both U.S. and non-U.S. persons considering an investment in the notes should read the section entitled “United States Federal Tax Considerations” in the accompanying prospectus supplement. The preceding discussion, when read in combination with that section, constitutes the full opinion of Davis Polk & Wardwell LLP regarding the material U.S. federal income tax consequences of owning and disposing of the notes.

Prospective investors in the notes should consult their tax advisers regarding all aspects of the U.S. federal income tax consequences of an investment in the notes and any tax consequences arising under the laws of any state, local or foreign taxing jurisdiction.

|

|

Trustee:

|

The Bank of New York Mellon (as trustee under an indenture dated March 15, 1987, as amended) will serve as trustee for the notes.

|

|

Use of proceeds and hedging:

|

The net proceeds received from the sale of the notes will be used for general corporate purposes and, in part, in connection with hedging our obligations under the notes through one or more of our affiliates.

Hedging activities related to the notes by one or more of our affiliates likely involve trading in one or more instruments, such as options, swaps and/or futures, based on 3-month U.S. dollar LIBOR and/or taking positions in any other available securities or instruments that we may wish to use in connection with such hedging. It is possible that our affiliates may profit from this hedging activity, even if the value of the notes declines. Profit or loss from this hedging activity could affect the price at which Citigroup Inc.’s affiliate, CGMI, may be willing to purchase your notes in the secondary market. For further information on our use of proceeds and hedging, see “Use of Proceeds and Hedging” in the accompanying prospectus.

|

|

ERISA and IRA purchase considerations:

|

Please refer to “Benefit Plan Investor Considerations” in the accompanying prospectus supplement for important information for investors that are ERISA or other benefit plans or whose underlying assets include assets of such plans.

|

|

November 2013

|

PS-4

|

|

Citigroup Inc.

|

|

Non-Callable Fixed to Floating Rate Notes due November 27, 2018

|

|

Fees and selling concessions:

|

CGMI, an affiliate of Citigroup Inc. and the underwriter of the sale of the notes, is acting as principal and will receive an underwriting fee of up to $3 for each note sold in this offering. The actual underwriting fee per note will be equal to $3 for each note sold by CGMI directly to the public and will otherwise equal the selling concession provided to selected dealers, as described in this paragraph. From this underwriting fee, certain broker-dealers affiliated with CGMI, including Citi International Financial Services, Citigroup Global Markets Singapore Pte. Ltd. and Citigroup Global Markets Asia Limited, will receive a fixed concession, and financial advisors employed by CGMI or such broker-dealers will receive a fixed sales commission, of $3 for each note they sell. CGMI will pay selected dealers not affiliated with CGMI a selling concession of up to $3 for each $1,000 note they sell.

Additionally, it is possible that CGMI and its affiliates may profit from expected hedging activity related to this offering, even if the value of the notes declines. You should refer to “Risk Factors” above and the section “Use of Proceeds and Hedging” in the accompanying prospectus.

Selling concessions allowed to dealers in connection with the offering may be reclaimed by the underwriter if, within 30 days of the offering, the underwriter repurchases the notes distributed by such dealers.

|

|

Supplemental information regarding plan of distribution; conflicts of interest:

|

The terms and conditions set forth in the Global Selling Agency Agreement dated December 20, 2012 among Citigroup Inc. and the agents named therein, including CGMI, govern the sale and purchase of the notes.

CGMI, acting as principal, has agreed to purchase from Citigroup Inc., and Citigroup Inc. has agreed to sell to CGMI, $6,350,000 aggregate stated principal amount of the notes (6,350 notes) for a minimum of $997 per note. CGMI proposes to offer the notes in part directly to the public at $1,000 per note and in part to selected dealers at $1,000 per note less a selling concession as described under “—Fees and selling concessions” above.

The notes will not be listed on any securities exchange.

In order to hedge its obligations under the notes, Citigroup Inc. has entered into one or more swaps or other derivatives transactions with one or more of its affiliates. You should refer to the sections “Risk Factors—Hedging and trading activity by Citigroup Inc. could result in a conflict of interest,” and “General Information—Use of proceeds and hedging” in this pricing supplement and the section “Use of Proceeds and Hedging” in the accompanying prospectus.

CGMI is an affiliate of Citigroup Inc. Accordingly, the offering of the notes will conform with the requirements addressing conflicts of interest when distributing the securities of an affiliate set forth in Rule 5121 of the Conduct Rules of the Financial Industry Regulatory Authority, Inc. Client accounts over which Citigroup Inc., its subsidiaries or affiliates of its subsidiaries have investment discretion are not permitted to purchase the notes, either directly or indirectly, without the prior written consent of the client. See “Plan of Distribution; Conflicts of Interest” in the accompanying prospectus supplement for more information.

Certain Additional Selling Restrictions

Chile

The notes are being offered as of the date hereof solely to Qualified Investors (Inversionistas Calificados) pursuant to the private placement exemption provided by General Rule No. 336 of the Superintendencia de Valores Y Seguros (the “SVS”). The offering of the notes has not been and will not be registered with the Chilean Securities Registry or the Registry of Foreign Securities of the SVS and, therefore, the notes are not subject to oversight by the SVS and may not be sold publicly in Chile. The issuer of the notes is not obligated to make information available publicly in Chile regarding the notes. The notes may not be subject to a public offer until they are registered in the corresponding Securities Registry.

Peru

The information contained in this pricing supplement has not been reviewed by the Superintendencia del Mercado de Valores (Peruvian Securities Market Superintendency or SMV; formerly, the Comisión Nacional Supervisora de Empresas y Valores or CONASEV). Neither the Regulations for Initial Offers and Sale of Securities (CONASEV Resolution 141-98-EF/94.10) nor the obligations regarding the information applicable to securities registered with the Registro

|

|

November 2013

|

PS-5

|

|

Citigroup Inc.

|

|

Non-Callable Fixed to Floating Rate Notes due November 27, 2018

|

|

Público del Mercado de Valores (Peruvian Stock Market Public Registry) apply to this private offering.

Uruguay

In Uruguay, the notes are being placed relying on a private placement (“oferta privada”) pursuant to section 2 of law 18.627, as amended. The notes are not and will not be registered with the Central Bank of Uruguay to be publicly offered in Uruguay.

|

|

|

Calculation agent:

|

Citibank, N.A., an affiliate of Citigroup Inc., will serve as calculation agent for the notes. All determinations made by the calculation agent will be at the sole discretion of the calculation agent and will, in the absence of manifest error, be conclusive for all purposes and binding on Citigroup Inc. and the holders of the notes. Citibank, N.A. is obligated to carry out its duties and functions as calculation agent in good faith and using its reasonable judgment.

|

|

Paying agent:

|

Citibank, N.A. will serve as paying agent and registrar and will also hold the global security representing the notes as custodian for The Depository Trust Company (“DTC”).

|

|

Contact:

|

Clients may contact their local brokerage representative. Third party distributors may contact Citi Structured Investment Sales at (212) 723-7005.

|

We encourage you to also read the accompanying prospectus supplement and prospectus, which can be accessed via the hyperlink on the front page of this pricing supplement, in connection with your investment in the notes.

Determination of Interest Payments

During each interest period, interest payments will be calculated on the basis of a 360-day year consisting of twelve 30-day months. The amount of each interest payment, if any, will equal (i) the stated principal amount of the notes multiplied by the interest rate in effect during the applicable interest period divided by (ii) 4.

Determination of 3-month U.S. Dollar LIBOR

3-month U.S. dollar LIBOR is a daily reference rate fixed in U.S. dollars based on the interest rates at which banks borrow funds from each other for a term of three months, in marketable size, in the London interbank market. For any relevant date, 3-month U.S. dollar LIBOR will equal the rate for 3-month U.S. dollar LIBOR appearing on Reuters page “LIBOR01” (or any successor page as determined by the calculation agent) as of 11:00 am (London time) on that date.

If a rate for 3-month U.S. dollar LIBOR is not published on Reuters page “LIBOR01” (or any successor page as determined by the calculation agent) on any day on which the rate for 3-month U.S. dollar LIBOR is required, then the calculation agent will request the principal London office of each of five major reference banks in the London interbank market, selected by the calculation agent, to provide such bank’s offered quotation to prime banks in the London interbank market for deposits in U.S. dollars in an amount that is representative of a single transaction in that market at that time (a “Representative Amount”) and for a term of three months as of 11:00 am (London time) on such day. If at least two such quotations are so provided, the rate for 3-month U.S. dollar LIBOR will be the arithmetic mean of such quotations. If fewer than two such quotations are provided, the calculation agent will request each of three major banks in New York City to provide such bank’s rate to leading European banks for loans in U.S. dollars in a Representative Amount and for a term of three months as of approximately 11:00 am (New York City time) on such day. If at least two such rates are so provided, the rate for 3-month U.S. dollar LIBOR will be the arithmetic mean of such rates. If fewer than two such rates are so provided, then the rate for 3-month U.S. dollar LIBOR will be 3-month U.S. dollar LIBOR in effect as of 11:00 am (New York City time) on the immediately preceding London business day.

A “business day” means any day that is not a Saturday or Sunday and that, in New York City, is not a day on which banking institutions are authorized or obligated by law or executive order to close.

A “London business day” means any day on which dealings in deposits in U.S. dollars are transacted in the London interbank market.

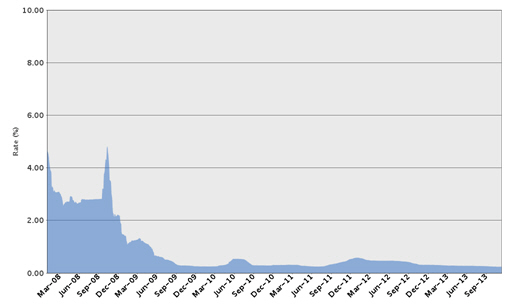

Historical Information on 3-month U.S. Dollar LIBOR

The following table sets forth, for each of the periods indicated, the high and low 3-month U.S. dollar LIBOR as reported on Bloomberg. The historical 3-month U.S. dollar LIBOR should not be taken as an indication of the future performance of 3-month U.S. dollar LIBOR. Any historical upward or downward trend in 3-month U.S. dollar LIBOR during any period set forth below is not an indication that 3-month U.S. dollar LIBOR is more or less likely to increase or decrease at any time during the term of the notes.

|

November 2013

|

PS-6

|

|

Citigroup Inc.

|

|

Non-Callable Fixed to Floating Rate Notes due November 27, 2018

|

|

Historical 3-month U.S. Dollar LIBOR

|

High

|

Low

|

||

|

2008

|

||||

|

First Quarter

|

4.68063%

|

2.54188%

|

||

|

Second Quarter

|

2.92000%

|

2.63813%

|

||

|

Third Quarter

|

4.05250%

|

2.78500%

|

||

|

Fourth Quarter

|

4.81875%

|

1.42500%

|

||

|

2009

|

||||

|

First Quarter

|

1.42125%

|

1.08250%

|

||

|

Second Quarter

|

1.17688%

|

0.59500%

|

||

|

Third Quarter

|

0.58750%

|

0.28250%

|

||

|

Fourth Quarter

|

0.28438%

|

0.24875%

|

||

|

2010

|

||||

|

First Quarter

|

0.29150%

|

0.24875%

|

||

|

Second Quarter

|

0.53925%

|

0.29150%

|

||

|

Third Quarter

|

0.53363%

|

0.28938%

|

||

|

Fourth Quarter

|

0.30375%

|

0.28438%

|

||

|

2011

|

||||

|

First Quarter

|

0.31400%

|

0.30281%

|

||

|

Second Quarter

|

0.30100%

|

0.24500%

|

||

|

Third Quarter

|

0.37433%

|

0.24575%

|

||

|

Fourth Quarter

|

0.58100%

|

0.37761%

|

||

|

2012

|

||||

|

First Quarter

|

0.58250%

|

0.46815%

|

||

|

Second Quarter

|

0.46915%

|

0.46060%

|

||

|

Third Quarter

|

0.46060%

|

0.35850%

|

||

|

Fourth Quarter

|

0.35525%

|

0.30600%

|

||

|

2013

|

||||

|

First Quarter

|

0.30500%

|

0.27960%

|

||

|

Second Quarter

|

0.28210%

|

0.27175%

|

||

|

Third Quarter

|

0.27390%

|

0.24760%

|

||

|

Fourth Quarter (through November 22, 2013)

|

0.24605%

|

0.23585%

|

The rate for 3-month U.S. dollar LIBOR for November 22, 2013 was 0.23660%.

The following graph shows the published daily rate for 3-month U.S. dollar LIBOR in the period from January 2, 2008 through November 22, 2013. Past movements of 3-month U.S. dollar LIBOR are not indicative of the future 3-month U.S. dollar LIBOR. Changes in 3-month U.S. dollar LIBOR will affect the value of the notes and the interest payments on the notes after the first twelve months of the term of the notes, but it is impossible to predict whether 3-month U.S. dollar LIBOR will rise or fall.

|

November 2013

|

PS-7

|

|

Citigroup Inc.

|

|

Non-Callable Fixed to Floating Rate Notes due November 27, 2018

|

|

Historical 3-month U.S. Dollar LIBOR

|

|

Additional Information

We reserve the right to withdraw, cancel or modify any offering of the notes and to reject orders in whole or in part prior to their issuance.

Validity of the Notes

In the opinion of Davis Polk & Wardwell LLP, as special products counsel to Citigroup Inc., when the notes offered by this pricing supplement have been executed and issued by Citigroup Inc. and authenticated by the trustee pursuant to the indenture, and delivered against payment therefor, such notes will be valid and binding obligations of Citigroup Inc., enforceable in accordance with their terms, subject to applicable bankruptcy, insolvency and similar laws affecting creditors' rights generally, concepts of reasonableness and equitable principles of general applicability (including, without limitation, concepts of good faith, fair dealing and the lack of bad faith), provided that such counsel expresses no opinion as to the effect of fraudulent conveyance, fraudulent transfer or similar provision of applicable law on the conclusions expressed above. This opinion is given as of the date of this pricing supplement and is limited to the laws of the State of New York, except that such counsel expresses no opinion as to the application of state securities or Blue Sky laws to the notes.

In giving this opinion, Davis Polk & Wardwell LLP has assumed the legal conclusions expressed in the opinion set forth below of Michael J. Tarpley, Associate General Counsel–Capital Markets of Citigroup Inc. In addition, this opinion is subject to the assumptions set forth in the letter of Davis Polk & Wardwell LLP dated January 17, 2013, which has been filed as an exhibit to a Current Report on Form 8-K filed by Citigroup Inc. on January 17, 2013, that the indenture has been duly authorized, executed and delivered by, and is a valid, binding and enforceable agreement of the trustee and that none of the terms of the notes nor the issuance and delivery of the notes, nor the compliance by Citigroup Inc. with the terms of the notes, will result in a violation of any provision of any instrument or agreement then binding upon Citigroup Inc. or any restriction imposed by any court or governmental body having jurisdiction over Citigroup Inc.

In the opinion of Michael J. Tarpley, Associate General Counsel–Capital Markets of Citigroup Inc., (i) the terms of the notes offered by this pricing supplement have been duly established under the indenture and the Board of Directors (or a duly authorized committee thereof) of Citigroup Inc. has duly authorized the issuance and sale of such notes and such authorization has not been modified or rescinded; (ii) Citigroup Inc. is validly existing and in good standing under the laws of the State of Delaware; (iii) the indenture has been duly authorized, executed, and delivered by Citigroup Inc.; and (iv) the execution and delivery of such indenture and of the notes offered by this pricing supplement by Citigroup Inc., and the performance by Citigroup Inc. of its obligations thereunder, are within its corporate powers and do not contravene its certificate of incorporation or bylaws or other constitutive documents. This opinion is given as of the date of this pricing supplement and is limited to the General Corporation Law of the State of Delaware.

|

November 2013

|

PS-8

|

|

Citigroup Inc.

|

|

Non-Callable Fixed to Floating Rate Notes due November 27, 2018

|

Michael J. Tarpley, or other internal attorneys with whom he has consulted, has examined and is familiar with originals, or copies certified or otherwise identified to his satisfaction, of such corporate records of Citigroup Inc., certificates or documents as he has deemed appropriate as a basis for the opinions expressed above. In such examination, he or such persons has assumed the legal capacity of all natural persons, the genuineness of all signatures (other than those of officers of Citigroup Inc.), the authenticity of all documents submitted to him or such persons as originals, the conformity to original documents of all documents submitted to him or such persons as certified or photostatic copies and the authenticity of the originals of such copies.

© 2013 Citigroup Global Markets Inc. All rights reserved. Citi and Citi and Arc Design are trademarks and service marks of Citigroup Inc. or its affiliates and are used and registered throughout the world.

|

November 2013

|

PS-9

|