As filed with the Securities and Exchange Commission on August 9 , 2017

Registration No. 333-215277

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 5

TO

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

PRESSURE BIOSCIENCES, INC.

(Exact name of registrant as specified in its charter)

| Massachusetts | 3826 | 04-2652826 | ||

| (State

or Other Jurisdiction of Incorporation or Organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S.

Employer Identification Number) |

14 Norfolk Avenue

South

Easton, Massachusetts 02375

(508) 230-1828

(Address, including zip code, and telephone number including

area code, of Registrant’s principal executive offices)

Richard T. Schumacher

President and Chief Executive Officer

Pressure BioSciences, Inc.

14 Norfolk Avenue

South Easton, Massachusetts 02375

(508) 230-1828

(Name,

address, including zip code, and telephone number

including area code, of agent for service)

With copies to:

Joseph

M. Lucosky, Esq. John

O’Leary, Esq. |

Mitchell

Nussbaum, Esq. Loeb

& Loeb LLP |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large-Accelerated Filer | [ ] | Accelerated Filer | [ ] |

| Non-Accelerated Filer | [ ] | Smaller Reporting Company | [X] |

| Emerging Growth Company | [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. [ ]

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed

Maximum Aggregate Offering Price (1) |

Amount

of Registration Fee (1) |

||||||

| Common Stock, par value $0.01 per share (2) (3) | $ | 14,375,000 | $ | 1,666.06 | ||||

| Warrants to Purchase Common Stock (4) | — | — | ||||||

| Representatives’ Warrant to Purchase Common Stock (4) | $ | N/A | $ | — | ||||

| Shares of Common Stock issuable upon exercise of the Warrants (2) (3) (5) | $ | 8,984,375 | $ | 1,041.29 | ||||

| Shares of Common Stock issuable upon exercise of Representatives’ Warrant (2) (6) | $ | 781,250 | $ | 90.55 | ||||

| Total | $ | 24,140,625 | $ | 2,797.90 | (7) | |||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | Pursuant to Rule 416, the securities being registered hereunder include such indeterminate number of additional securities as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions. |

| (3) | Includes shares of common stock which may be issued upon exercise of a 45-day option granted to the underwriters to cover over-allotments, if any. |

(4) |

A warrant to purchase one share of common stock will be issued for every two shares offered. The Warrants will cost $0.01 per Warrant. The maximum number of the Warrants and Representative’s warrants and the shares of the Registrant’s common stock underlying the Warrants and Representative’s warrants are being simultaneously registered hereunder. Consistent with the response to Question 240.06 of the Securities Act Rules Compliance and Disclosure Interpretations, the registration fee with respect to the Warrants and Representative’s warrants has been allocated to the shares of the Registrant’s common stock underlying the Warrants and Representative’s warrants and those shares are included in the registration fee. |

(5) |

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act. The warrants are exercisable at a per share price of 125% of the common stock public offering price. |

(6) |

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act. The warrants are exercisable at a per share exercise price equal to 125% of the public offering price excluding the over-allotment option. The proposed maximum aggregate offering price of the Representative’s warrants is $781,250 which is equal to 125% of $625,000 (5% of $12,500,000). |

(7) |

The registrant previously paid $3,357.49. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to said section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED AUGUST 9 , 2017 |

2,777,778 Shares of Common Stock

Warrants to Purchase up to 1,388,889 Shares of Common Stock

Pressure BioSciences, Inc.

We are offering an aggregate of 2,777,778 shares of our common stock, $0.01 par value per share, and warrants to purchase 1,388,889 shares of our common stock. We expect the public offering price will be between $4.0625 and $4.9375 per share. The warrants will have an exercise price per share equal to 125% of the public offering price and expire five years from the date of issuance. A warrant to purchase one share of common stock will accompany every two shares of common stock purchased. The shares and warrants will trade separately.

Our common stock is presently quoted on the OTCQB under the symbol “PBIO”. We applied to have our common stock and warrants listed on The NASDAQ Capital Market under the symbols “PBIO” and “PBIOW,” respectively. No assurance can be given that our application will be approved. On August 4 , 2017 the last reported sale price for our common stock on the OTCQB was $4.80 per share. There is no established public trading market for the warrants. No assurance can be given that a trading market will develop for the warrants.

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 19 of this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Per Warrant | Total | ||||||||||

| Public offering price | $ | $ | $ | |||||||||

| Underwriting discounts and commissions (1) | $ | $ | $ | |||||||||

| Proceeds to us, before expenses | $ | $ | $ | |||||||||

| (1) | We refer you to “Underwriting” beginning on page 80 of this prospectus for additional information regarding total underwriting compensation. |

We have granted a 45-day option to the representative of the underwriters to purchase up to 416,667 additional shares of our common stock at a public offering price of $___ per share and/or warrants to purchase 208,333 shares of our common stock at a public offering price of $0.01 per warrant, solely to cover over-allotments, if any.

The underwriters expect to deliver our shares and warrants to purchasers in the offering on or about , 2017.

Joseph Gunnar & Co.

The date of this prospectus is , 2017.

| 2 |

| 3 |

TABLE OF CONTENTS

You should rely only on information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with additional information or information different from that contained in this prospectus. We are not making an offer of these securities in any state or other jurisdiction where the offer is not permitted. The information in this prospectus may only be accurate as of the date on the front of this prospectus regardless of time of delivery of this prospectus or any sale of our securities.

No person is authorized in connection with this prospectus to give any information or to make any representations about us, the common stock hereby or any matter discussed in this prospectus, other than the information and representations contained in this prospectus. If any other information or representation is given or made, such information or representation may not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell, or a solicitation of an offer to buy our common stock in any circumstance under which the offer or solicitation is unlawful. Neither the delivery of this prospectus nor any distribution of our common stock in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since the date of this prospectus.

Neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourself about, and to observe any restrictions relating to, this offering and the distribution of this prospectus.

We have registered certain of our trademarks with the United States Patent and Trademark Office, including Barocycler®® and PULSE®®. XSTREAMPCTTM is registered in Europe and published in the USA. We also use certain trademarks, trade names, and logos that have not been registered including ProteoSolveTM, ProteoSolveLRSTM, the Power of PCTTM, the PCT ShredderTM, HUB440TM, HUB880TM, MicroPestleTM, PCT-HDTM, BarozymeTM, BaroFlexTM Strip, and Discovery Starts with Sample Preparation™.

| 4 |

This summary highlights selected information appearing elsewhere in this prospectus. While this summary highlights what we consider to be important information about us, you should carefully read this entire prospectus before investing in our common stock and warrants, especially the risks and other information we discuss under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and our consolidated financial statements and related notes beginning on page F-1. Our fiscal year end is December 31 and our fiscal years ended December 31, 2015, 2016, and 2017 are sometimes referred to herein as fiscal years 2015, 2016 and 2017, respectively. Some of the statements made in this prospectus discuss future events and developments, including our future strategy and our ability to generate revenue, income and cash flow. These forward-looking statements involve risks and uncertainties which could cause actual results to differ materially from those contemplated in these forward-looking statements. See “Cautionary Note Regarding Forward-Looking Statements”. Unless otherwise indicated or the context requires otherwise, the words “we,” “us,” “our”, the “Company” or “our Company” and “Pressure Biosciences” refer to Pressure Sciences, Inc., a Massachusetts corporation.

This prospectus assumes the over-allotment option of the underwriters has not been exercised, unless otherwise indicated. All share and per share information relating to our common stock in this prospectus has been adjusted to reflect a 1-for-30 reverse stock split of our common stock that took effect on June 5, 2017.

Overview

We are focused on solving the challenging problems inherent in biological sample preparation, a crucial laboratory step performed by scientists worldwide working in biological life sciences research. Sample preparation is a term that refers to a wide range of activities that precede most forms of scientific analysis. Sample preparation is often complex, time-consuming and, in our belief, one of the most error-prone steps of scientific research. It is a widely-used laboratory undertaking – the requirements of which drive what we believe is a large and growing worldwide market. We have developed and patented a novel, enabling technology platform that can control the sample preparation process. It is based on harnessing the unique properties of high hydrostatic pressure. This process, which we refer to as Pressure Cycling Technology, or PCT, uses alternating cycles of hydrostatic pressure between ambient and ultra-high levels i.e., 20,000 psi or greater to safely, conveniently and reproducibly control the actions of molecules in biological samples, such as cells and tissues from human, animal, plant and microbial sources.

PCT is an enabling platform technology based on a physical process that had not previously been used to control bio-molecular interactions. PCT uses internally developed instrumentation that is capable of cycling pressure between ambient and ultra-high levels at controlled temperatures and specific time intervals, to rapidly and repeatedly control the interactions of bio-molecules, such as proteins, DNA, RNA, lipids and small molecules. Our laboratory instrument family, the Barocycler®, and our internally developed consumables product line, which include our unique MicroTubes, MicroCaps, MicroPestles, BaroFlex and PULSE® (Pressure Used to Lyse Samples for Extraction) Tubes, and application specific kits (containing consumable products and reagents), together make up our PCT Sample Preparation System (“PCT SPS”).

In 2015, together with an investment bank, we formed a subsidiary called Pressure BioSciences Europe (“PBI Europe”) in Poland. We have 49% ownership interest with the investment bank retaining 51%. Throughout 2016, PBI Europe did not have any operating activities in 2016 and we cannot reasonably predict when operations will commence. Because we don’t have control of the subsidiary, we did not consolidate them in our financial statements.

| 5 |

Patents

PBI has 14 United States granted patents and one foreign granted patent (Japan: 5587770, EXTRACTION AND PARTITIONING OF MOLECULES) covering multiple applications of PCT in the life sciences field. PBI also has 19 pending patents in the USA, Canada, Europe, Australia, China, Japan, and Taiwan. PCT employs a unique approach that we believe has the potential for broad use in a number of established and emerging life sciences areas, which include, but are not limited to:

| ● | biological sample preparation – including but not limited to sample extraction, homogenization, and digestion - in such study areas as genomic, proteomic, lipidomic, metabolomic and small molecule; | |

| ● | pathogen inactivation; | |

| ● | protein purification; | |

| ● | control of chemical reactions, particularly enzymatic; and | |

| ● | immunodiagnostics. |

We are also the exclusive distributor, throughout the Americas, for Constant Systems, Ltd.,’s (“CS”) cell disruption equipment, parts, and consumables. CS, a British company located several hours northwest of London, England, has been providing niche biomedical equipment, related consumable products, and services to a global client base since 1989. CS designs, develops, and manufactures high pressure cell disruption equipment required by life sciences laboratories worldwide, particularly disruption systems for the extraction of proteins. The CS equipment provides a constant and controlled cell disruptive environment, giving the user constant and reproducible results whatever the application. CS has over 900 units installed in over 40 countries worldwide. The CS cell disruption equipment extracts cellular components, such as protein from yeast, bacteria, mammalian cells, and other sample types.

The CS pressure-based cell disruption equipment and our PCT-based instrumentation complement each other in several important ways. While both the CS and our technologies are based on high pressure, each product line has fundamental scientific capabilities that the other does not offer. Our PCT Platform uses certain patented pressure mechanisms to achieve small-scale, molecular level effects. CS’s technology uses different, proprietary pressure mechanisms for larger-scale, non-molecular level processing. In a number of routine laboratory applications, such as protein extraction, both effects can be critical to success. Therefore, for protein extraction and a number of other important scientific applications, we believe laboratories will benefit by using the CS and our products, either separately or together.

Primary Fields of Use and Applications for PCT

Sample preparation is widely regarded as a significant impediment to research and discovery and sample extraction is generally regarded as one of the key parts of sample preparation. The process of preparing samples for genomic, proteomic, lipidomic, and small molecule studies includes a crucial step called sample extraction or sample disruption. This is the process of extracting biomolecules such as nucleic acid i.e., DNA and/or RNA, as well as proteins, lipids, or small molecules from the plant or animal cells and tissues that are being studied. Our current commercialization efforts are based upon our belief that pressure cycling technology provides a superior solution for sample extraction when compared to other available technologies or procedures and thus might significantly improve the quality of sample preparation, and thus the quality of the test result.

Within the broad field of biological sample preparation, in particular sample extraction, we focus the majority of our PCT and constant pressure (“CP”) product development efforts in three specific areas: biomarker discovery (primarily through mass spectrometric analysis), forensics and histology. We believe that our existing PCT and CP-based instrumentation and related consumable products fill an important and growing need in the sample preparation market for the safe, rapid, versatile, reproducible and quality extraction of nucleic acids, proteins, lipids, and small molecules from a wide variety of plant, animal, and microbiological cells and tissues.

| 6 |

Biomarker Discovery - Mass Spectrometry

A biomarker is any substance (e.g., protein, DNA) that can be used as an indicator of the presence or absence of a particular disease-state or condition, and/or to measure the progression and effects of therapy. Biomarkers can help in the diagnosis, prognosis, therapy, prevention, surveillance, control, and cure of diseases and medical conditions.

A mass spectrometer is a laboratory instrument used in the analysis of biological samples, often focused on proteins, in life sciences research. It is frequently used to help discover biomarkers. According to a recently published market report by Transparency Market Research, the global spectrometry market was worth $10.2 billion in 2011 and is expected to reach $15.2 billion in 2017, growing at a compound annual growth rate of 6.9% from 2011 to 2017. In the overall global market, the North American market is expected to maintain its lead position in terms of revenue until 2017 and is expected to have approximately 36.2% of the market revenue share in 2017, followed next by Europe. We believe PCT and CP-based products offer significant advantages in speed and quality compared with current techniques used in the preparation of samples for mass spectrometry analysis.

Forensics

The detection of DNA has become a part of the analysis of forensic samples by laboratories and criminal justice agencies worldwide in their efforts to identify the perpetrators of violent crimes and missing persons. Scientists from the University of North Texas (UNT) and Florida International University (FIU) have published a paper regarding DNA yield from forensic samples (e.g., bone and hair) when using the PCT platform in the sample preparation process. A copy of the paper may be accessed through our website.

Pressure cycling technology (PCT) reduces effects of inhibitors of the PCR

Pamela L. Marshall & Jonathan L. King & Nathan P. Lawrence & Alexander Lazarev & Vera S. Gross & Bruce Budowle

We also believe that there are many completed rape kits that remain untested for reasons such as cost, time and quality of results. We further believe that the ability to differentially extract DNA from sperm and not epithelial cells could reduce the cost of such testing, while increasing the quality, safety and speed of the testing process.

We believe that PCT may be capable of differentially extracting DNA from sperm cells and female epithelial cells captured in swabs collected from rape victims and subsequently stored in rape kits. Data from the laboratory of Dr. Bruce McCord (FIU) was published in a paper that may be accessed through our website.

| 7 |

Histology

The most commonly used technique worldwide for the preservation of cancer and other tissues for subsequent pathology evaluation is formalin-fixation followed by paraffin-embedding, or FFPE. We believe that the quality and analysis of FFPE tissues is highly problematic, and that PCT offers significant advantages over current processing methods, including standardization, speed, biomolecule recovery, and safety.

Company Products

We believe our PCT and CP products allow researchers to improve scientific research studies in the life sciences field. Our products are developed with the expectation of meeting or exceeding the needs of research scientists while enhancing the safety, speed and quality that is available to them with existing sample preparation methods.

Barocycler® Instrumentation

Our Barocycler® product line consists of laboratory instrumentation that subjects a sample to cycles of pressure from ambient to ultra-high levels (20,000 psi or greater) and then back to ambient, in a precisely controlled manner.

Our instruments (the Barocycler® 2320EXTREME (the “2320EXT”), the Barozyme-HT48, the Barocycler® NEP3229, the HUB440 and the HUB880) use cycles of high, hydrostatic pressure to quickly and efficiently break up the cellular structures of a specimen to release proteins, nucleic acids, lipids and small molecules from the specimen into our consumable processing tubes, referred to as our PULSE® Tubes and MicroTubes. Our instruments have temperature control options (on-board heating or chilling and heating via external circulating water-bath), automatic fill and dispensing valves, and an integrated micro-processor keypad or a laptop computer. The microprocessor or laptop computer are capable of saving specific PCT protocols, so the researcher can achieve maximum reproducibility for the preparation of nucleic acids, proteins, lipids, or small molecules from various biological samples. Our Barocycler® instruments and our consumable products make up our PCT Sample Preparation System.

Barocycler® 2320EXT - The Barocycler® 2320EXT weighs approximately 80lbs, has a maximum pressure of 45,000 psi, and can process either up to 16 MicroTubes simultaneously or 1 PULSE® Tube. The working temperature range is 4 – 95ºC and is controlled via an on-board electric heating jacket or external circulating water bath. All tests are entered and recorded on a touch screen interface. Information from each test runs (pressure profile, cycle number, and temperature) is recorded and can be stored on the instrument, on a USB drive, or networked into the user’s lab. Pressure profiles can be manipulated in a number of ways, including static high pressure holds and pressure ramp programs. The Barocycler® 2320EXT is pneumatic, and requires an input air source of 110 psi to reach and cycle at high pressure.

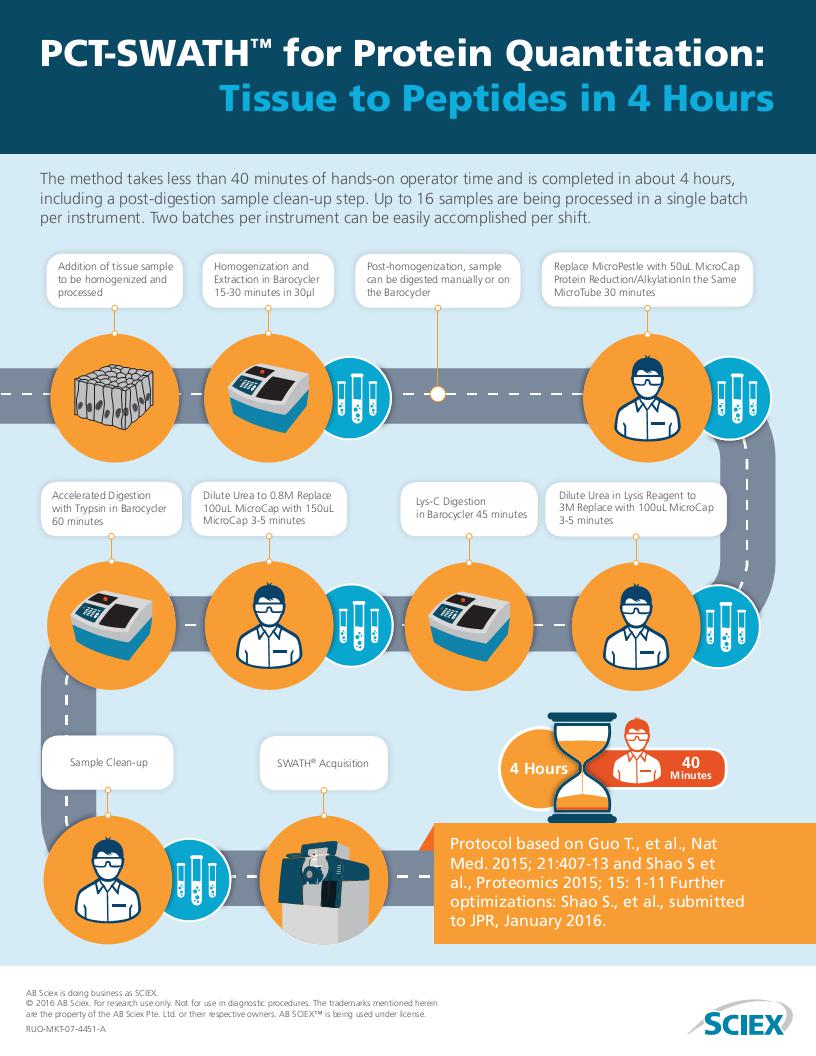

The Barocycler® 2320EXT was developed to support the PCT-HD/PCT-SWATH application. PCT-HD enables faster, less cumbersome and higher quality processing of biopsy tissues. With homogenization, extraction, and digestion of proteins occurring in a single PCT MicroTube under high pressure. This protocol can yield analytical results in under 4 hours from the start of processing tissues. PCT-HD was developed by our scientists and engineers in collaboration with Professor Ruedi Aebersold and Dr. Tiannan Guo of the Institute of Molecular Systems Biology, ETH Zurich, and the University of Zurich, both in Zurich, Switzerland. Drs. Aebersold and Guo combined PCT-HD with SCIEX’s SWATH-Mass Spectrometry – calling the resulting method “PCT-SWATH”.

Barocycler® NEP3229 – The Barocycler® NEP3229 contains two units – a user interface and a power source – comprised primarily of a 1.5 horsepower motor and pump assembly (hydraulic). Combined, the two components of the NEP3229 weigh approximately 350 pounds. The Barocycler® NEP3229 is capable of processing up to three samples simultaneously using our specially designed, single-use PULSE® Tubes and up to 48 samples simultaneously using our specially-designed MicroTubes.

| 8 |

Barozyme HT48 - The Barozyme HT48 is a high throughput, bench-top instrument designed for accelerated enzymatic digestion of proteins at high pressure. A typical protein digestion time using the enzyme trypsin (a common yet important laboratory procedure) can be reduced from often requiring an overnight incubation to get to completion to under one hour when the digestion procedure is carried out under PCT. The Barozyme HT48 uses an air-pressure-to-liquid-pressure proprietary intensifier system, with a pressure amplification ratio of 160:1, to reach an output pressure of 20,000 psi. The Barozyme HT48 is capable of processing up to 48 samples at a time in six single-use BaroFlex 8-well Strips in the Barozyme Sample Carrier.

Barocycler® HUB440 –We believe the Barocycler® HUB440 is the first portable, ready to use, “plug-and-play” high pressure generator for the laboratory bench. The Barocycler® HUB440 is capable of creating and controlling hydrostatic pressure from 500 psi to 58,000 psi. It is computer controlled and runs on software that was specially-written by us in LabVIEW (software from National Instruments Corporation). We own the rights and have a license to use the specialty LabVIEW software. We believe that over the coming years, the Barocycler® HUB440 may become the main instrument in our pressure-based instrument line.

Barocycler® HUB880 - The Barocycler® HUB880 is one of our new instruments; it is expected to be available for sale during the first six months of 2017. It is a compact, portable, bench-top, ultra-high pressure generator that uses an air pressure-to-liquid pressure intensifier allowing the user to generate fluid pressure as high as 90,000 psi with input air pressure of just 126 psi. The HUB880 can be operated through a simple front panel or controlled using an optional external Data Acquisition and Control Module for dynamic pressure control. We believe that the HUB880 will be well accepted by scientists that need to achieve super high pressure, such as those working in the food safety and vaccine industries.

The Shredder SG3 –The Shredder SG3 is a low shear mechanical homogenization system for use with tough, fibrous and other difficult-to-disrupt tissues and organisms. The Shredder SG3 System uses a variety of Shredder PULSE® Tubes to directly and rapidly grind a biological sample which, when combined with selected buffers, can provide effective extraction of proteins, DNA, RNA, lipids and small molecules from tissues and organisms. The Shredder SG3 is also used to isolate intact and functional mitochondria from tissues. The Shredder SG3 features a three position force setting lever, which enables the operator to select and apply reproducible force to the sample during the shredding process and eliminates the need for the operator to exert force for long periods when processing one or more samples.

Barocycler® Consumable Products

PCT MicroTubes – PCT MicroTubes are made from a unique fluoropolymer, fluorinated ethylene propylene (FEP). FEP is highly inert and retains its integrity within an extremely wide temperature range (-200oC to +100oC). MicroTubes hold a maximum total volume of 150 microliters. PCT MicroTubes must be used with either PCT-MicroCaps or PCT-MicroPestles.

PCT-MicroCaps – PCT MicroCaps are made from polytetraflouroethylene (PTFE). The PCT MicroCaps are available in three sizes to accommodate total sample volume: 50, 100 and 150uL. 50uL MicroCaps are used with samples ≤50uL, 100uL MicroCaps are used with samples between 50-100uL, and 150uL MicroCaps are used with samples between 100-150uL.

PCT-Micro-Pestle (“μPestles”) - PCT μPestles are made from Polytetrafluoroethylene (PTFE), a synthetic fluoropolymer of tetrafluoroethylene, also known as Teflon (by DuPont Co). PTFE is practically inert; the only chemicals known to affect it are certain alkali metals and most highly-reactive fluorinating agents. PCT μPestles, in conjunction with PCT MicroTubes, are designed to enhance the extraction of protein, DNA, RNA and small molecules from minute amounts (0.5 – 3.0 mg) of solid tissue in extraction reagent volumes as low as 20-30 μL. PCT MicroTubes and PCT μPestles use Pressure Cycling Technology (PCT) to effectively disrupt soft tissues and lyse their cells. As a result, the tissue sample trapped between the MicroTube end and the μPestles tip is crushed on every pressure cycle. This mechanical action, combined with the extraction ability of the buffer under high pressure, results in highly effective tissue homogenization and extraction.

| 9 |

PCT μPestles and PCT MicroTubes, together with a PBI Barocycler®, comprise the PCT Micro-Pestle System, which provides a fast, safe, and efficient means of extraction from extremely small amounts of solid samples such as soft animal tissues or biopsies. The PCT μPestle System can be used in any PBI Barocycler®.

BaroFlex 8-well Processing Strips - BaroFlex 8-well Strips are used in the Barozyme HT48 (for pressure-enhanced enzymatic digestion at 20,000 psi). BaroFlex 8-well Strips are made of special high density polyethylene (HDPE) and hold up to 140µl when capped with the BaroFlex Cap Strips or Mats. BaroFlex 8-Cap Strips and BaroFlex 24-Cap Mats are made of silicone. These single-use caps are designed to seal BaroFlex 8-well Strips tightly and to prevent fluid exchange between the sample and the Barozyme chamber fluid during pressure cycling. The silicone caps are available as strips of 8, or mats of 24 caps.

We believe our development of these various consumable products has helped, and will continue to help, drive the adoption of PCT within the life sciences market.

Customers

Our customers include researchers at academic laboratories, government agencies, biotechnology companies, pharmaceutical companies and other life science institutions in the United States, Europe, and in Asia. Our goal is to continue aggressive market penetration in these target groups. We also believe that there is a significant opportunity to sell and/or lease additional Barocycler® instrumentation to additional laboratories at current customer institutions.

If we are successful in commercializing PCT in applications beyond our current focus area of genomic, proteomic, lipidomic, and small molecule sample preparation, and if we are successful in our attempts to attract additional capital, our potential customer base could expand to include hospitals, reference laboratories, pharmaceutical manufacturing plants and other sites involved in each specific application. If we are successful in forensics, our potential customers could be forensic laboratories, military and other government agencies. If we are successful in histology (extraction of biomolecules from FFPE tissues), our potential customers could be pharmaceutical companies, hospitals, and laboratories focused on drug discovery or correlation of disease states.

Growth Strategy

Our growth strategy includes:

| ● | Expanding our United States salesforce. | |

| ● | Aggressively promoting the PCT-HD System, which includes the Barocycler® 2320EXT, MicroTube System, and MicroPestles. | |

| ● | Expanding our number of International Distributers. | |

| ● | Actively promoting our other Barocycler® products, accessories, and consumables, including but not limited to, the Barozyme, the HUB440, and HUB880. | |

| ● | Development of new applications for the Barocycler® 2320EXT, such as, but not limited to, clinical applications. | |

| ● | Development of new high-pressure applications for industries outside of biotechnology, such as, but not limited to, food science. | |

| ● | Development of new high-pressure instruments, devices, and consumables to meet the growing demand for pressure-based technology. |

| 10 |

Competitive Advantages/Operational Strengths

Our platforms are based on our patented and proprietary Pressure Cycling Technology (PCT). We believe the PCT platform provides distinct and important competitive advantages over other sample preparation methods, as it:

| ● | is proprietary to PBI | |

| ● | has been shown to extract more classes of proteins from tissues and cells than many other current sample, preparation methods. We believe this claim is supported by several publications and presentations available on our website most notably by Dr. R. Aebersold, Professor at the Institute of Molecular Systems Biology, ETH-Zurich. Dr. Aebersold’s publications include: |

| ● | can accelerate enzymatic digestion of proteins for analysis by mass spectrometry from overnight to under an hour. We believe this claim is supported by several experiments. For example, Dr. A. Ivanov published a paper available on our website. |

| ● | enables efficient sample prep workflows for processing minute amounts of tissue with excellent yields and reproducibility for researchers in the growing precision and translational medicine fields. |

| 11 |

Our Risks and Challenges

An investment in our securities involves a high degree of risk including risks related to the following:

| ● | We have received an opinion from our independent registered public accounting firm expressing substantial doubt regarding our ability to continue as a going concern. | |

| ● | We have a history of operating losses, anticipate future losses and may never be profitable. | |

| ● | We may be unable to obtain market acceptance of our pressure cycling technology products and services. | |

| ● | The sales cycle of our pressure cycling technology products is lengthy. We have incurred and may continue to incur significant expenses and we may not generate any significant revenue related to those products. | |

| ● | Our reliance on a single third party for all of our manufacturing, and certain of our engineering, and other related services could harm our business. | |

| ● | Our instrumentation operates at high pressures and may therefore become subject to certain regulations in the European Community. Regulation of high pressure equipment may limit or hinder our development and sale of future instrumentation. | |

| ● | We expect that we will be subject to regulation in the United States, such as the Food and Drug Administration (the “FDA”), and overseas, if and when we begin to invest more resources in the development and commercialization of PCT in applications outside of sample preparation for the research field. |

Recent Developments

Conversion of Series D Preferred Stock

On June 8, 2017, the Company entered into a letter agreement with a private investor (the “BG Preferred Stock Letter Agreement”), whereby the private investor agreed to convert 75 shares of Series D Preferred Stock (the “BG Preferred Stock”) of the Company owned by him into common stock of the Company. Pursuant to the BG Preferred Stock Letter Agreement, the BG Preferred Stock will automatically convert upon consummation of this offering into 6,250 restricted shares of the Company’s common stock and warrants to purchase 9,945 shares of the Company’s common stock with an exercise price of $8.40 substantially in the form of the warrants included in this offering except such warrants will be restricted securities and will not publicly trade on NASDAQ. As an inducement to enter into the BG Preferred Stock Letter Agreement, the private investor will receive 3,750 restricted shares of common stock upon the closing of the offering. The private investor has entered into a lock-up agreement prohibiting the sale or other transfer of all securities of the Company owned by him for a period of 90 days from the closing of the offering.

Conversion of Convertible Debentures

On June 16, 2017, the Company entered into letter agreements (together the “Debenture Holder Letter Agreements”), as amended, with 34 investors (each a “Debenture Holder” and together the “Debenture Holders”) holding convertible debentures (collectively the “Debentures”) and warrants to purchase common stock (the “Debenture Warrants”) whereby the Debenture Holders agreed to convert all monies due them under the Debentures into restricted shares of common stock (the “Debenture Conversion Shares”), all contingent upon the completion of this offering. As of March 31, 2017, the Debenture Holders were due the aggregate sum of $1,587,706, including principal and interest. This sum, along with the additional interest due from April 1 through the date of the consummation of the offering, is referred to herein as the “Debenture Obligation”. Pursuant to the Debenture Holder Letter Agreements, the Debenture Obligation will automatically convert upon consummation of this offering into the Debenture Conversion Shares at a price equal to the lower of $8.40 or the price per share paid by investors in this offering. The Debenture Holders will be issued amended Debenture Warrants such that the exercise price will be the same as the exercise price of the warrants being included in this offering and the Debenture Warrants will no longer have a “Subsequent Equity Sales” provision that lowers the exercise price of the Debenture Warrants upon any future dilutive issuance of shares. As a result of the foregoing, the Company will issue at least 352,824 Debenture Conversion Shares for principal and interest through March 31, 2017 upon the consummation of this Offering in consideration of the conversion of their Debenture Obligation assuming a conversion price of $4.50, which is the mid-point of the estimated offering price range on the cover of this prospectus . Each person entering into the Debenture Holder Letter Agreements have entered into lock-up agreements prohibiting the sale or other transfer of any securities of the Company owned by such persons for a period of 3 months except for 5,262 shares of unrestricted common stock the Debenture Holders own as of the date of their letter agreements due to issuances by the Company of interest earned on the Debenture in the form of “payment in kind” shares of common stock.

| 12 |

On June 16, 2017, the Company entered into letter agreements (together the “Debenture and Fall 2016 Holder Letter Agreements”), with two (2) investors (each a “Debenture and Fall 2016 Holder” and collectively the “Debenture and Fall 2016 Holders”). The Debenture and Fall 2016 Holders invested in both the Company’s offering of the Debentures and Debenture Warrants as well as the Company’s offering of restricted common stock and common stock purchase warrants (the “Fall 2016 Warrants”). Pursuant to the Debenture and Fall 2016 Holder Letter Agreements, the Debenture and Fall 2016 Holders agreed to convert all monies due them under the Debentures into restricted shares of common stock (the “Debenture and Fall 2016 Conversion Shares”) contingent upon the completion of this offering. As of March 31, 2017, the Debenture and Fall 2016 Holders were due the aggregate sum of $779,930, including principal and interest. This sum, along with the additional interest due from April 1 through the date of the consummation of the offering, is referred to herein as the “Debenture and Fall 2016 Obligation”. As an inducement to enter into the Debenture and Fall 2016 Holder Letter Agreements, the Debenture and Fall 2016 Holders will receive an aggregate of 17,334 shares of the Company’s common stock. Pursuant to the Debenture and Fall 2016 Holder Letter Agreements, the Debenture and Fall 2016 Obligation will automatically convert upon consummation of this offering into the Debenture and Fall 2016 Conversion Shares at a price equal to the lower of $8.40 or the price per share paid by investors in this offering and their Debenture Warrants will be amended to reflect an exercise price equal to the lower of $12.00 or the exercise price per share of the warrants sold in this offering. In addition, the Debenture Warrants will no longer have a “Subsequent Equity Sales” provision that lowers the exercise price of the Debenture Warrants upon any future dilutive issuance of shares. Additionally, the Fall 2016 Warrants shall be amended to reflect an exercise price equal to the lower of $12.00 or the exercise price per share of the warrants sold in this offering. As a result of the foregoing, the Company will issue at least 173,318 Debenture and Fall 2016 Conversion Shares for principal and interest through March 31, 2017 to the Debenture and Fall 2016 Holders upon the consummation of this Offering in consideration of the conversion of their Debenture Obligation assuming a conversion price of $4.50, which is the mid-point of the estimated offering price range on the cover of this prospectus . Each person entering into the Debenture and Fall 2016 Holder Letter Agreements have entered into lock-up agreements prohibiting the sale or other transfer of any securities of the Company owned by such persons for a period of 3 months except for 2,287 shares of unrestricted common stock the Debenture and Fall 2016 Holders own as of the date of their letter agreements due to issuances by the Company of interest earned on the Debenture in the form of “payment in kind” shares of common stock.

On June 16, 2017, the Company entered into a letter agreement (the “Accredited Investor Letter Agreement” together with the Debenture Holder Letter Agreement and Debenture and Fall 2016 Letter Agreement, the “Letter Agreements”) with an accredited investor (the “Accredited Investor”). The Accredited Investor currently holds Debentures pursuant to which he is owed, as of March 31, 2017, principal and interest equal to $4,741,609. This sum, along with the additional interest due from April 1 through the date of the consummation of the offering, is referred to herein as the “Accredited Investor Debenture Obligation”. The Accredited Investor also currently holds (i) Debenture Warrants, (ii) Fall 2016 Warrants, (iii) a promissory note issued in his favor in October 2016 in the principal amount of $3,000,000 (the “Line of Credit Obligation”) and warrants to purchase common stock in connection therewith (the “Line of Credit Warrants”), and (iv) shares of the Company’s Series D, Series G, Series J, Series K, Series H1, and Series H2 Preferred Stock (collectively, the “Preferred Stock”). Pursuant to the letter agreement, the Accredited Investor agreed to convert all shares of Preferred Stock, into 493,557 shares of the Company’s common stock. The Accredited Investor Debenture Obligation will automatically convert upon consummation of this offering into 1,053,691 shares at a price equal to the lower of $8.40 or the price per share paid by investors in this offering. The Line of Credit Obligation will automatically convert upon consummation of this offering into shares at a conversion price equal to 80% of the price per share of common stock paid by investors in this offering along with a new warrant substantially similar to the warrants being included in this offering, except such new warrants will have a cashless exercise provision, and will have an exercise price equal to 80% of the exercise price per share of the warrants issued to the investors in this offering, will be restricted securities, and will not trade on NASDAQ. As inducement to enter into the Accredited Investor Letter Agreement, the Accredited Investor’s Debenture Warrants, the Fall 2016 Warrants, and the Line of Credit Warrants shall be amended such that the exercise price of such warrant shall be the lower of $12.00 and the exercise price of the warrants being sold to investors in this offering. In addition, the Debenture Warrants will no longer have a “Subsequent Equity Sales” provision that lowers the exercise price of the Debenture Warrants upon any future dilutive issuance of shares. The Accredited Investor will also be issued new warrants to purchase 29,833 shares of common stock at an exercise price of $8.40 substantially in the form of the warrants being sold to investors in this offering, except such warrants will be restricted securities and will not publicly trade on NASDAQ. The Accredited Investor has entered into a lock-up agreement prohibiting the sale or other transfer of any securities of the Company owned by such person, with the exception of 31,070 shares of restricted common stock previously issued, for a period of 6 months.

As an added inducement for investors to enter into the Letter Agreements, the Company agreed that until the earlier of (i) twelve (12) months after the closing of this offering in the event that the Company raises at least $11,000,000 by virtue of the sale of securities hereunder or (ii) ten (10) months after the closing of this offering in the event that the Company raises less than $11,000,000 by virtue of the sale of the Company’s securities hereunder; the Company shall not issue or sell common stock, or grant any option to purchase, or sell or grant any right to reprice, or otherwise dispose of or issue (or announce any offer, sale, grant or any option to purchase or other disposition) any common stock (including pursuant to the terms of any outstanding securities issued prior to the date hereof (including, but not limited to, warrants, convertible notes, or other agreements) or any security entitling the holder thereof to acquire common stock, including, without limitation, any debt, preferred stock, right, option, warrant or other instrument that is convertible into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive common stock (a “Common Stock Equivalent”) at an effective price per share less than price per share of common stock sold in this offering without the prior written consent of the Debenture Holders who hold at least 80% of the shares represented by the as-converted Debentures as of May 30, 2017, which such consent shall not be unreasonably withheld; provided however, that such issuances will not apply to Excepted Issuances. Excepted Issuance means (i) the Company’s issuance of common stock in full or partial consideration in connection with a strategic merger, acquisition, consolidation or purchase of substantially all of the securities or assets of a corporation or other entity, so long as such issuances are not for the purpose of raising capital, (ii) the Company’s issuances of common stock or the issuances or grants of options to purchase common stock to employees, directors, and consultants, pursuant to the Company’s stock option plan at or above fair market value, or (iii) securities upon the exercise or exchange of or conversion of any securities exercisable or exchangeable for or convertible into shares of common stock issued and outstanding as of June 15, 2017.

| 13 |

We reported a number of accomplishments in 2016:

On January 12, 2016 SCIEX, a global leader in life science analytical technologies (Framingham, MA) and a wholly-owned subsidiary of Danaher Corporation (NYSE: DHR), announced an exclusive co-marketing agreement with us to improve protein quantification in complex samples.

On February 3, 2016 SCIEX and Children’s Medical Research Institute (Sydney, Australia) announced they had joined forces to advance the promise of precision medicine. The partners stated they would benefit from SCIEX’s exclusive collaborators, including Pressure BioSciences, and our PCT platform for increased protein quantitation and reproducibility.

On March 31, 2016, in connection with the seventh and final closing (the “Final Closing”) of a private placement debt financing pursuant to the Subscription Agreements, dated as of January, 11, 2016, January 20, 2016, January 29, 2016, February 26, 2016, March 10, 2016, March 17, 2016, March 24, 2016 and March 31, 2016 by and among us and various individuals (each, a “Purchaser” and together “Purchasers”), including all five members of our Board of Directors, we sold and issued to the Purchasers Senior Secured Convertible Debentures (the “Debentures”) and warrants to purchase shares of common stock equal to 50% of the number of shares issuable pursuant to the subscription amount (the “Warrants”) for an aggregate purchase price of $1,419,549 (the “Purchase Price”) for the Final Closing, bringing the total raised in the Offering to $6,329,549. For the Final Closing, we netted $1,304,049 in cash after taking into account fees related to the offering. Of this amount, an aggregate of $164,549 was invested by the five members of our Board of Directors. For the entire private placement offering, we netted an aggregate of $5,101,049 in cash in the aggregate after subtracting $568,000 in fees and $660,000 in debt conversions into this private placement.

On July 13, 2016, we announced the unveiling of the newest addition to our product line based on our powerful PCT platform, the 2320EXT. The product unveiling took place during the recent annual conference of the American Society for Mass Spectrometry (“ASMS”) in San Antonio, Texas.

On July 21, 2016, we announced the initial shipment of our 2320EXT instrument to an Australian cancer research group (ProCan) named by the White House as a collaborator in the U.S.’s “Cancer Moonshot” initiative.

| 14 |

On October 28, 2016, an accredited investor (the “Investor”) purchased from us a promissory note in the aggregate principal amount of up to $2,000,000 (the “Revolving Note”) due and payable on the earlier of October 28, 2017 (the “Maturity Date”) or on the seventh business day after the closing of a Qualified Offering (as defined in the Revolving Note). Although the Revolving Note is dated October 26, 2016, the transaction did not close until October 28, 2016, when we received its initial $250,000 advance pursuant to the Revolving Note. As a result, on the same day and pursuant to the Revolving Note, we issued to the Investor a Common Stock Purchase Warrant to purchase 20,834 shares of our common stock at an exercise price per share equal to $12.00 per share. The Investor is obligated to provide us with advances of $250,000 under the Revolving Note, but the Investor shall not be required to advance more than $250,000 in any individual fifteen (15) day period and no more than $500,000 in the thirty (30) day period immediately following the date of the initial advance. Notwithstanding the fifteen (15) day period limitation, on November 2, 2016, November 23, 2016, December 6, 2016, and December 16, 2016, we received $1,000,000 pursuant to the Revolving Note and we issued to the Investor additional warrants to purchase a total of 83,334 shares of our common stock at $12.00 per share (each warrant gives the Investor the right to purchase 20,834 shares of our common stock. The terms of the Warrants are identical except for the exercise date, issue date, and termination date. Interest on the principal balance of the Revolving Note shall be paid in full on the Maturity Date, unless otherwise paid prior to the Maturity Date.

Corporate Information

We were incorporated in the Commonwealth of Massachusetts in August 1978 as Boston Biomedica, Inc. In September 2004, we completed the sale of Boston Biomedica’s core business units and began to focus exclusively on the development and commercialization of the PCT platform. Following this change in business strategy, we changed our legal name from Boston Biomedica, Inc. to Pressure BioSciences, Inc. (“PBI”). We began operations as PBI in February 2005, research and development activities in April 2006, early marketing and selling activities of our Barocycler® instruments in late 2007, and active marketing and selling of our PCT-based instrument platform in 2012.

Where You Can Find More Information

Our website address is www.pressurebiosciences.com. We do not intend for our website address to be an active link or to otherwise incorporate by reference the contents of the website into this prospectus. The public may read and copy any materials the Company files with the U.S. Securities and Exchange Commission (the “SEC”) at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0030. The SEC maintains an Internet website (http://www.sec.gov) that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC.

| 15 |

THE OFFERING

| Securities offered by us: | An aggregate of 2,777,778 shares of our common stock and warrants to purchase 1,388,889 shares of our common stock. Each warrant will have a per share exercise price of $5.625 per share, is exercisable immediately and will expire five years from the date of issuance. A warrant to purchase one share of common stock will accompany every two shares of common stock purchased. The shares and warrants will trade separately. | |

| Common stock outstanding before the offering | 1,101,884 Shares (1) | |

| Common stock to be outstanding after the offering | 3,879,662 Shares (1) | |

| Option to purchase additional shares | We have granted the underwriters a 45-day option to purchase up to 416,667 additional shares of our common stock and/or warrants to purchase 208,333 additional shares to cover allotments, if any. | |

| Description of the warrants offered hereby | The warrants will have a per share exercise price of $5.625 . The warrants are exercisable immediately and expire five years from the date of issuance. The exercise price and the number of shares of common stock purchasable upon the exercise of the warrants are subject to adjustment upon the occurrence of specific events, including stock dividends, stock splits, combinations and reclassifications of our common stock. | |

| Use of proceeds | We intend to use the net proceeds of this offering for: the repayment of liabilities; research and development for new products and improvements to existing products, upgrading sales and marketing capabilities, the purchase of raw materials and labor for manufacturing our products, upgrading our operations capabilities, and for general working capital purposes. See “Use of Proceeds.” | |

| Risk factors | Investing in our securities is highly speculative and involves a high degree of risk. You should carefully consider the information set forth in the “Risk Factors” section beginning on page 19 before deciding to invest in our securities. | |

| Trading Symbols | Our common stock is currently quoted on the OTCQB under the trading symbol “PBIO”. We applied to the NASDAQ Capital Market to list our common stock under the symbol “PBIO” and our warrants under the symbol “PBIOW” and expect such listings to occur concurrently with this offering. However, there is no guarantee that our applications will be granted. | |

| Lock-up | We and our directors, officers and any other 5% or greater holder of outstanding shares of our common stock have agreed with the underwriters not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our common stock or securities convertible into common stock for a period of (i) six month after the date of this prospectus in the case of our directors and officers and (ii) three months after the date of this prospectus in the case of the Company and any other 5% or greater holder of our outstanding securities, without the prior written consent of the representative. See “Underwriting” section on page 80. |

NASDAQ listing requirements include, among other things, a stock price threshold. This prospectus reflects and assumes a 1-for-30 reverse stock split of our common stock that took effect on June 5, 2017.

| (1) | Based on an assumed offering price of $4.50 which represents $4.49 per share and $0.01 per warrant and is the mid-point of the estimated offering price range on the cover of this prospectus. The actual number of shares we will offer will be determined based on the actual public offering price. |

| The common stock to be outstanding before and after this offering is based on 1,101,884 shares outstanding as of August 4 , 2017, and excludes the following as of such date: |

| ● | 250,109 shares issuable upon exercise of outstanding options with a weighted average exercise price of $10.95; | |

| ● | 2,915,436 shares remaining for issuance pursuant to 2013 Equity Incentive Plan; | |

| ● | 4,870,063 shares remaining for issuance pursuant to 2015 Nonqualified Stock Option Plan; | |

| ● | 890,048 shares issuable upon exercise of outstanding warrants with a weighted average exercise price of $12.13; | |

| ● | 55,833 shares issuable per a letter agreement with certain accredited investors; | |

| ● | 493,557 shares issuable upon the conversion of Preferred Stock; | |

| ● | 1,547,224 shares issuable upon the conversion of outstanding convertible notes (including convertible debentures); | |

| ● | 833,334 shares issuable upon the conversion of the Revolving Note; | |

| ● | 1,388,889 shares of common stock underlying the warrants to be issued to investors in connection with this offering; | |

| ● | ____ shares of common stock underlying the warrants to be issued to the underwriters in connection with this offering. |

| 16 |

SUMMARY CONSOLIDATED FINANCIAL INFORMATION

The following summary consolidated statements of operations data for the years ended December 31, 2016 and 2015 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated statements of operations data for the three month periods ended March 31, 2017 and 2016 and the consolidated balance sheets data as of March 31, 2017 are derived from our unaudited consolidated financial statements that are included elsewhere in this prospectus. The historical financial data presented below is not necessarily indicative of our financial results in future periods, and the results for the three-month period ended March 31, 2017 are not necessarily indicative of our operating results to be expected for the full fiscal year ending December 31, 2017 or any other period. You should read the summary consolidated financial data in conjunction with those financial statements and the accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Our consolidated financial statements are prepared and presented in accordance with United States generally accepted accounting principles, or U.S. GAAP. Our unaudited consolidated financial statements have been prepared on a basis consistent with our audited financial statements and include all adjustments, consisting of normal and recurring adjustments that we consider necessary for a fair presentation of the financial position and results of operations as of and for such periods.

SUMMARY OPERATING DATA

| For the Three Months | ||||||||||||||||

| Ended March 31, | Fiscal Years Ended | |||||||||||||||

| (unaudited) | (unaudited) | December 31, | ||||||||||||||

| 2017 | 2016 | 2016 | 2015 | |||||||||||||

| Total Revenue | $ | 551,357 | $ | 510,478 | $ | 1,976,487 | $ | 1,797,691 | ||||||||

| Costs and expenses: | ||||||||||||||||

| Cost of products and services | 235,997 | 221,699 | 834,012 | 609,054 | ||||||||||||

| Research and development | 263,456 | 335,270 | 1,183,011 | 1,105,295 | ||||||||||||

| Selling and marketing | 213,009 | 191,236 | 872,365 | 745,574 | ||||||||||||

| General and administrative | 837,998 | 808,218 | 2,822,752 | 2,902,950 | ||||||||||||

| Total Operating Costs and Expenses | 1,550,460 | 1,556,423 | 5,712,140 | 5,362,873 | ||||||||||||

| Operating Loss | (999,103 | ) | (1,045,945 | ) | (3,735,653 | ) | (3,565,182 | |||||||||

| Total other (expense) income | (4,595,412 | ) | (4,904,446 | ) | 1,028,669 | (3,850,116 | ||||||||||

| Accrued dividends on convertible preferred stock | - | - | - | (23,194 | ||||||||||||

| Net loss applicable to common shareholders | (5,594,515 | ) | (5,950,391 | ) | (2,706,984 | ) | (7,438,492 | |||||||||

| Net loss per share attributable to common stockholders – basic and diluted | $ | (5.38 | ) | $ | (7.70 | ) | $ | (2.97 | ) | $ | (10.77 | ) | ||||

| Weighted average common stock shares outstanding used in the basic and diluted net loss per share calculation: | 1,040,769 | 773,279 | 911,312 | 690,873 | ||||||||||||

| 17 |

The following table presents consolidated balance sheet data as of March 31, 2017 on:

| ● | an actual basis; | |

| ● | an as adjusted basis, giving effect to (i) advances from the Revolving Note in the amount of $750,000, less financing fees of $60,000, pursuant to the Revolving Loan in May 2017 and June 2017; (ii) promissory note of $630,000 (iii) payment in full of a promissory note of $589,189; (iv) net proceeds of $327,731 in merchant loans; (v) 20,000 shares issuable per agreements with third parties; (vi) $149,164 from warrant exercises and | |

| ● | a pro forma, as adjusted basis, giving effect to (i) the issuance of the Revolving Note in the amount of $750,000, less financing fees of $60,000, (ii) promissory note of $630,000 (iii) payment in full of a promissory note of $589,189 (iv) the conversion of 300 shares of Series D Preferred Stock into approximately 25,000 shares of common stock, the conversion of 86,570 shares of Series G Preferred Stock into approximately 28,857 shares of common stock, the conversion of 10,000 shares of Series H Preferred Stock into approximately 33,334 shares of common stock, the conversion of 21 shares of Series H2 Preferred Stock into approximately 70,000 shares of common stock, the conversion of 3,521 shares of Series J Preferred Stock into approximately 117,367 shares of common stock and the conversion of 6,816 shares of Series K Preferred Stock into approximately 227,200 shares of common stock, (v) the conversion of $6,962,504 of outstanding convertible notes (including convertible debentures) into approximately 1,547,224 shares of common stock and (vi) the sale by us of shares of common stock and warrants in this offering at an assumed public offering price of $4.50 which represents $4.49 per share and $0.01 per warrant after deducting underwriting discounts and commissions and estimated offering expenses, (vii) net proceeds of $327,731 in merchant loans, and (viii) 20,000 shares issuable per agreements with third parties; (ix) $149,164 from warrant exercises. |

The pro forma as adjusted information set forth below is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering determined at pricing.

| As of March 31, 2017 | ||||||||||||

| Actual | As Adjusted | Pro Forma, As Adjusted |

||||||||||

| Consolidated Balance Sheets Data: | ||||||||||||

| Cash and cash equivalents | $ | 121,438 | $ | 1,329,144 | $ | 12,556,952 | ||||||

| Total assets | 1,838,065 | 3,045,771 | 14,273,579 | |||||||||

| Total liabilities | 15,302,548 | 16,211,090 | 3,774,763 | |||||||||

| Total stockholders’ deficit | (13,464,483 | ) | (13,165,319 | ) | 10,498,816 | |||||||

| (1) | A $1.00 increase or decrease in the assumed public offering price per share would increase or decrease our cash and cash equivalents, working capital, total assets and total stockholders’ equity by approximately $ 2 ,800,000, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the underwriting discount and estimated offering expenses payable by us. |

| 18 |

Investing in our securities involves a great deal of risk. Careful consideration should be made of the following factors as well as other information included in this prospectus before deciding to purchase our securities. There are many risks that affect our business and results of operations, some of which are beyond our control. Our business, financial condition or operating results could be materially harmed by any of these risks. This could cause the trading price of our securities to decline, and you may lose all or part of your investment. Additional risks that we do not yet know of or that we currently think are immaterial may also affect our business and results of operations.

Risks Related To Our COMPANY

We have received an opinion from our independent registered public accounting firm expressing substantial doubt regarding our ability to continue as a going concern.

The audit report issued by our independent registered public accounting firm on our audited consolidated financial statements for the fiscal year ended December 31, 2016 contains an explanatory paragraph regarding our ability to continue as a going concern. The audit report states that our auditing firm has substantial doubt in our ability to continue as a going concern due to the risk that we may not have sufficient cash and liquid assets at December 31, 2016 to cover our operating and capital requirements for the next twelve-month period; and if sufficient cash cannot be obtained, we would have to substantially alter, or possibly even discontinue, operations. The accompanying consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Management has developed a plan to continue operations. This plan includes continued control of expenses and obtaining equity or debt financing. Although we have successfully completed equity financings and reduced expenses in the past, we cannot assure you that our plans to address these matters in the future will be successful.

The factors described above could adversely affect our ability to obtain additional financing on favorable terms, if at all, and may cause investors to have reservations about our long-term prospects, and may adversely affect our relationships with customers. There can be no assurance that our auditing firm will not issue the same opinion in the future. If we cannot successfully continue as a going concern, our stockholders may lose their entire investment.

Our revenue is dependent upon acceptance of our products by the market. The failure of such acceptance will cause us to curtail or cease operations.

Our revenue comes from the sale of our products. As a result, we will continue to incur operating losses until such time as sales of our products reach a mature level and we are able to generate sufficient revenue from the sale of our products to meet our operating expenses. There can be no assurance that customers will adopt our technology and products, or that businesses and prospective customers will agree to pay for our products. In the event that we are not able to significantly increase the number of customers that purchase our products, or if we are unable to charge the necessary prices, our financial condition and results of operations will be materially and adversely affected.

| 19 |

Our business could be adversely affected if we fail to implement and maintain effective disclosure controls and procedures and internal control over financial reporting.

We concluded that as of December 31, 2016, our disclosure controls and procedures and our internal control over financial reporting were not effective. We have determined that we have limited resources for adequate personnel to prepare and file reports under the Securities Exchange Act of 1934 within the required time periods and that material weaknesses in our internal control over financial reporting exist relating to our accounting for complex equity transactions. If we are unable to implement and maintain effective disclosure controls and procedures and remediate the material weaknesses in a timely manner, or if we identify other material weaknesses in the future, our ability to produce accurate and timely financial statements and public reports could be impaired, which could adversely affect our business and financial condition. We identified a lack of sufficient segregation of duties. Specifically, this material weakness is such that the design over these areas relies primarily on detective controls and could be strengthened by adding preventive controls to properly safeguard assets. In addition, investors may lose confidence in our reported information and the market price of our common stock may decline.

We have a history of operating losses, anticipate future losses and may never be profitable.

We have experienced significant operating losses in each period since we began investing resources in PCT and CP. These losses have resulted principally from research and development, sales and marketing, and general and administrative expenses associated with the development of our PCT business. During the three months ended March 31, 2017, we recorded a net loss applicable to common shareholders of $5,594,515, or ($5.38) per share, as compared with $5,950,391, or ($7.70) per share, of the corresponding period in 2016. We expect to continue to incur operating losses until sales of PCT and CP products increase substantially. We cannot be certain when, if ever, we will become profitable. Even if we were to become profitable, we might not be able to sustain such profitability on a quarterly or annual basis.

If we are unable to obtain additional financing, business operations will be harmed and if we do obtain additional financing then existing shareholders may suffer substantial dilution.

We need substantial capital to implement our sales distribution strategy for our current products and to develop and commercialize future products using our pressure cycling technology products and services in the sample preparation area, as well as for applications in other areas of life sciences. Our capital requirements will depend on many factors, including but not limited to:

| ● | the problems, delays, expenses, and complications frequently encountered by early-stage companies; | |

| ● | market acceptance of our pressure cycling technology products and services for sample preparation; | |

| ● | the success of our sales and marketing programs; and | |

| ● | changes in economic, regulatory or competitive conditions in the markets we intend to serve. |

We expect the net proceeds from this offering, along with our current cash position, will enable us to fund our operating expenses and capital expenditure requirements for at least the next 24 months. Thereafter, unless we achieve profitability, we anticipate that we will need to raise additional capital to fund our operations and to otherwise implement our overall business strategy. We currently do not have any contracts or commitments for additional financing. There can be no assurance that financing will be available in amounts or on terms acceptable to us, if at all. Any additional equity financing may involve substantial dilution to then existing shareholders.

| 20 |

If adequate funds are not available or if we fail to obtain acceptable additional financing, we may be required to:

| ● | severely limit or cease our operations or otherwise reduce planned expenditures and forego other business opportunities, which could harm our business; | |

| ● | obtain financing with terms that may have the effect of substantially diluting or adversely affecting the holdings or the rights of the holders of our capital stock; or | |

| ● | obtain funds through arrangements with future collaboration partners or others that may require us to relinquish rights to some or all of our technologies or products. |

Our financial results depend on revenues from our pressure cycling technology products and services, and from government grants.

We currently rely on revenues from PCT and CP technology products and services in the sample preparation area and from revenues derived from grants awarded to us by governmental agencies, such as the National Institutes of Health. We have been unable to achieve market acceptance of our product offerings to the extent necessary to achieve significant revenue. Competition for government grants is very intense, and we can provide no assurance that we will continue to be awarded grants in the future. If we are unable to increase revenues from sales of our pressure cycling technology products and services and government grants, our business will fail.

We may be unable to obtain market acceptance of our pressure cycling technology products and services.

Many of our initial sales of our pressure cycling technology products and services have been to our collaborators, following their use of our products in studies undertaken in sample preparation for genomics, proteomics and small molecules studies. Later sales have been to key opinion leaders. Our technology requires scientists and researchers to adopt a method of sample extraction that is different than existing techniques. Our PCT sample preparation system is also more costly than existing techniques. Our ability to obtain market acceptance will depend, in part, on our ability to demonstrate to our potential customers that the benefits and advantages of our technology outweigh the increased cost of our technology compared with existing methods of sample extraction. If we are unable to demonstrate the benefits and advantages of our products and technology as compared with existing technologies, we will not gain market acceptance and our business will fail.

Our business may be harmed if we encounter problems, delays, expenses, and complications that often affect companies that have not achieved significant market acceptance.

Our pressure cycling technology business continues to face challenges in achieving market acceptance. If we encounter problems, delays, expenses and complications, many of which may be beyond our control or may harm our business or prospects. These include:

| ● | availability of adequate financing; | |

| ● | unanticipated problems and costs relating to the development, testing, production, marketing, and sale of our products; | |

| ● | delays and costs associated with our ability to attract and retain key personnel; and | |

| ● | competition. |

The sales cycle of our pressure cycling technology products is lengthy. We have incurred and may continue to incur significant expenses and we may not generate any significant revenue related to those products.

Many of our current and potential customers have required between three and six months or more to test and evaluate our pressure cycling technology products. This increases the possibility that a customer may decide to cancel its order or otherwise change its plans, which could reduce or eliminate our sales to that potential customer. As a result of this lengthy sales cycle, we have incurred and may continue to incur significant research and development, selling and marketing, and general and administrative expense related to customers from whom we have not yet generated any revenue from our products, and from whom we may never generate the anticipated revenue if a customer is not satisfied with the results of the evaluation of our products or if a customer cancels or changes its plans.

| 21 |

Our business could be harmed if our products contain undetected errors or defects.

We are continuously developing new and improving our existing, pressure cycling technology products in sample preparation and we expect to do so in other areas of life sciences depending upon the availability of our resources. Newly introduced products can contain undetected errors or defects. In addition, these products may not meet their performance specifications under all conditions or for all applications. If, despite internal testing and testing by our collaborators, any of our products contain errors or defects or fail to meet customer specifications, then we may be required to enhance or improve those products or technologies. We may not be able to do so on a timely basis, if at all, and may only be able to do so at considerable expense. In addition, any significant reliability problems could result in adverse customer reaction, negative publicity or legal claims and could harm our business and prospects.

Our success may depend on our ability to manage growth effectively.