If you receive your Nuveen Fund dividends and statements from your financial advisor or brokerage account.

If you receive your Nuveen Fund dividends and statements directly from Nuveen.

|

Table of Contents

|

|

|

Chairman's Letter to Shareholders

|

4

|

|

Portfolio Managers' Comments

|

5

|

|

Fund Leverage

|

8

|

|

Share Information

|

9

|

|

Risk Considerations

|

11

|

|

Performance Overview and Holding Summaries

|

12

|

|

Portfolios of Investments

|

20

|

|

Statement of Assets and Liabilities

|

66

|

|

Statement of Operations

|

67

|

|

Statement of Changes in Net Assets

|

68

|

|

Financial Highlights

|

70

|

|

Notes to Financial Statements

|

74

|

|

Additional Fund Information

|

85

|

|

Glossary of Terms Used in this Report

|

86

|

|

Reinvest Automatically, Easily and Conveniently

|

88

|

Chairman of the Board

June 23, 2017

Nuveen AMT-Free Municipal Value Fund (NUW)

Nuveen Municipal Income Fund, Inc. (NMI)

Nuveen Enhanced Municipal Value Fund (NEV)

|

As of April 30, 2017, the Funds' percentages of leverage are as shown in the accompanying table.

|

|

|

|

|

|

|

NUV

|

NUW

|

NMI

|

NEV

|

|

Effective Leverage*

|

0.92%

|

6.63%

|

6.00%

|

34.47%

|

|

|

Per Share Amounts

|

|||||||||||||||

|

Ex-Dividend Date

|

NUV

|

NUW

|

NMI

|

NEV

|

||||||||||||

|

November 2016

|

$

|

0.0325

|

$

|

0.0600

|

$

|

0.0415

|

$

|

0.0725

|

||||||||

|

December

|

0.0325

|

0.0600

|

0.0405

|

0.0680

|

||||||||||||

|

January

|

0.0325

|

0.0600

|

0.0405

|

0.0680

|

||||||||||||

|

February

|

0.0325

|

0.0600

|

0.0405

|

0.0680

|

||||||||||||

|

March

|

0.0325

|

0.0600

|

0.0405

|

0.0680

|

||||||||||||

|

April 2017

|

0.0325

|

0.0600

|

0.0405

|

0.0680

|

||||||||||||

|

Total Monthly Per Share Distributions

|

$

|

0.1950

|

$

|

0.3600

|

$

|

0.2440

|

$

|

0.4125

|

||||||||

|

Ordinary Income Distribution*

|

$

|

0.0022

|

$

|

0.0072

|

$

|

0.0020

|

$

|

0.0012

|

||||||||

|

Total Distributions from Net Investment Income

|

$

|

0.1972

|

$

|

0.3672

|

$

|

0.2460

|

$

|

0.4137

|

||||||||

|

Yields

|

||||||||||||||||

|

Market Yield**

|

3.90

|

%

|

4.22

|

%

|

3.95

|

%

|

5.69

|

%

|

||||||||

|

Taxable-Equivalent Yield**

|

5.42

|

%

|

5.86

|

%

|

5.49

|

%

|

7.90

|

%

|

||||||||

|

*

** |

Distribution paid in December 2016.

Market Yield is based on the Fund's current annualized monthly dividend divided by the Fund's current market price as of the end of the reporting period. Taxable-Equivalent Yield represents the yield that must be earned on a fully taxable investment in order to equal the yield of the Fund on an after-tax basis. It is based on a federal income tax rate of 28.0%. When comparing a Fund to investments that generate qualified dividend income, the Taxable-Equivalent Yield is lower. |

|

|

NUV

|

NUW

|

NEV

|

|

Additional authorized shares

|

19,600,000*

|

2,600,000

|

5,200,000

|

|

|

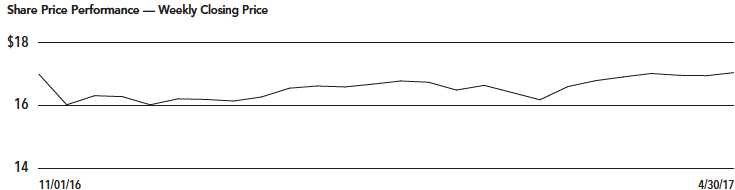

NUW

|

|||

|

Shares sold through shelf offering

|

123,474

|

|||

|

Weighted average premium to NAV per share sold

|

1.50

|

%

|

||

|

|

NUV

|

NUW

|

NMI

|

NEV

|

|

Shares cumulatively repurchased and retired

|

—

|

—

|

—

|

—

|

|

Shares authorized for repurchase

|

20,645,000

|

1,430,000

|

830,000

|

2,455,000

|

|

|

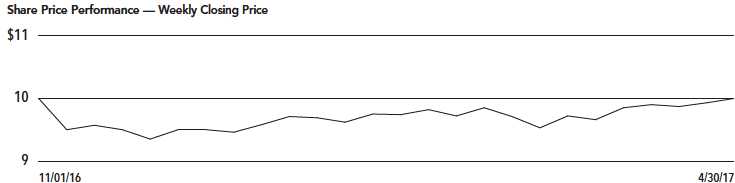

NUV

|

NUW

|

NMI

|

NEV

|

||||||||||||

|

NAV

|

$

|

10.14

|

$

|

16.79

|

$

|

11.31

|

$

|

14.86

|

||||||||

|

Share price

|

$

|

10.00

|

$

|

17.05

|

$

|

12.31

|

$

|

14.33

|

||||||||

|

Premium/(Discount) to NAV

|

(1.38

|

)%

|

1.55

|

%

|

8.84

|

%

|

(3.57

|

)%

|

||||||||

|

6-month average premium/(discount) to NAV

|

(3.73

|

)%

|

(0.89

|

)%

|

3.40

|

%

|

(4.04

|

)%

|

||||||||

Performance Overview and Holding Summaries as of April 30, 2017

|

|

Cumulative

|

Average Annual

|

||||||||||||||

|

|

6-Month

|

1-Year

|

5-Year

|

10-Year

|

||||||||||||

|

NUV at NAV

|

(0.47

|

)%

|

0.51

|

%

|

4.43

|

%

|

4.59

|

%

|

||||||||

|

NUV at Share Price

|

2.25

|

%

|

(1.19

|

)%

|

3.98

|

%

|

4.64

|

%

|

||||||||

|

S&P Municipal Bond Index

|

(0.41

|

)%

|

0.57

|

%

|

3.33

|

%

|

4.29

|

%

|

||||||||

|

Fund Allocation

|

|

|

(% of net assets)

|

|

|

Long-Term Municipal Bonds

|

98.8%

|

|

Corporate Bonds

|

0.0%

|

|

Short-Term Municipal Bonds

|

0.5%

|

|

Other Assets Less Liabilities

|

1.4%

|

|

Net Assets Plus Floating Rate

|

|

|

Obligations

|

100.7%

|

|

Floating Rate Obligations

|

(0.7)%

|

|

Net Assets

|

100%

|

|

Credit Quality

|

|

|

(% of total investment exposure)

|

|

|

AAA/U.S. Guaranteed

|

18.4%

|

|

AA

|

47.5%

|

|

A

|

14.0%

|

|

BBB

|

9.9%

|

|

BB or Lower

|

8.9%

|

|

N/R (not rated)

|

1.3%

|

|

Total

|

100%

|

|

Portfolio Composition

|

|

|

(% of total investments)

|

|

|

Tax Obligation/Limited

|

19.8%

|

|

Transportation

|

18.8%

|

|

Health Care

|

16.4%

|

|

U.S. Guaranteed

|

12.4%

|

|

Tax Obligation/General

|

11.5%

|

|

Consumer Staples

|

6.3%

|

|

Utilities

|

5.0%

|

|

Other

|

9.8%

|

|

Total

|

100%

|

|

States and Territories

|

|

|

(% of total municipal bonds)

|

|

|

Illinois

|

14.8%

|

|

Texas

|

12.8%

|

|

California

|

12.3%

|

|

Colorado

|

6.1%

|

|

Florida

|

5.6%

|

|

Ohio

|

5.3%

|

|

New York

|

4.8%

|

|

New Jersey

|

4.0%

|

|

Michigan

|

3.9%

|

|

Wisconsin

|

3.6%

|

|

Nevada

|

3.0%

|

|

Indiana

|

2.3%

|

|

Washington

|

2.2%

|

|

Other

|

19.3%

|

|

Total

|

100%

|

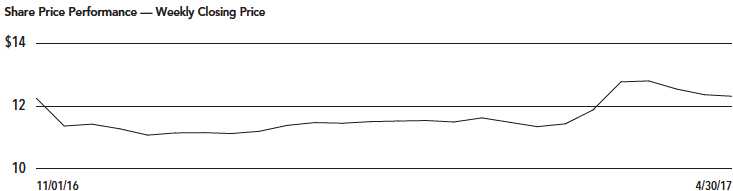

Performance Overview and Holding Summaries as of April 30, 2017

|

|

Cumulative

|

Average Annual

|

||||||||||||||

|

|

Since

|

|||||||||||||||

|

|

6-Month

|

1-Year

|

5-Year

|

Inception

|

||||||||||||

|

NUW at NAV

|

(0.33

|

)%

|

0.28

|

%

|

4.36

|

%

|

7.18

|

%

|

||||||||

|

NUW at Share Price

|

2.78

|

%

|

0.82

|

%

|

5.00

|

%

|

6.85

|

%

|

||||||||

|

S&P Municipal Bond Index

|

(0.41

|

)%

|

0.57

|

%

|

3.33

|

%

|

5.16

|

%

|

||||||||

|

Fund Allocation

|

|

|

(% of net assets)

|

|

|

Long-Term Municipal Bonds

|

98.1%

|

|

Other Assets Less Liabilities

|

4.8%

|

|

Net Assets Plus Floating Rate

|

|

|

Obligations

|

102.9%

|

|

Floating Rate Obligations

|

(2.9)%

|

|

Net Assets

|

100%

|

|

Credit Quality

|

|

|

(% of total investment exposure)

|

|

|

AAA/U.S. Guaranteed

|

34.6%

|

|

AA

|

30.4%

|

|

A

|

14.0%

|

|

BBB

|

12.5%

|

|

BB or Lower

|

7.2%

|

|

N/R (not rated)

|

1.3%

|

|

Total

|

100%

|

|

Portfolio Composition

|

|

|

(% of total investments)

|

|

|

U.S. Guaranteed

|

30.4%

|

|

Tax Obligation/General

|

11.6%

|

|

Transportation

|

11.4%

|

|

Utilities

|

11.1%

|

|

Tax Obligation/Limited

|

10.3%

|

|

Health Care

|

7.5%

|

|

Consumer Staples

|

7.2%

|

|

Education and Civic Organizations

|

3.2%

|

|

Other

|

7.3%

|

|

Total

|

100%

|

|

States and Territories

|

|

|

(% of total municipal bonds)

|

|

|

California

|

13.3%

|

|

Illinois

|

12.0%

|

|

Florida

|

8.6%

|

|

Texas

|

6.8%

|

|

Ohio

|

6.2%

|

|

Wisconsin

|

5.9%

|

|

New Jersey

|

5.4%

|

|

Colorado

|

5.3%

|

|

Indiana

|

5.3%

|

|

Nevada

|

4.0%

|

|

New York

|

3.6%

|

|

Louisiana

|

3.6%

|

|

Other

|

20.0%

|

|

Total

|

100%

|

Performance Overview and Holding Summaries as of April 30, 2017

|

|

Cumulative

|

Average Annual

|

||||||||||||||

|

|

6-Month

|

1-Year

|

5-Year

|

10-Year

|

||||||||||||

|

NMI at NAV

|

(0.43

|

)%

|

0.83

|

%

|

4.77

|

%

|

5.35

|

%

|

||||||||

|

NMI at Share Price

|

3.08

|

%

|

4.20

|

%

|

5.78

|

%

|

6.39

|

%

|

||||||||

|

S&P Municipal Bond Index

|

(0.41

|

)%

|

0.57

|

%

|

3.33

|

%

|

4.29

|

%

|

||||||||

|

Fund Allocation

|

|

|

(% of net assets)

|

|

|

Long-Term Municipal Bonds

|

98.4%

|

|

Other Assets Less Liabilities

|

1.6%

|

|

Net Assets

|

100%

|

|

Credit Quality

|

|

|

(% of total investment exposure)

|

|

|

AAA/U.S. Guaranteed

|

14.1%

|

|

AA

|

24.7%

|

|

A

|

25.1%

|

|

BBB

|

23.6%

|

|

BB or Lower

|

8.2%

|

|

N/R (not rated)

|

4.3%

|

|

Total

|

100%

|

|

Portfolio Composition

|

|

|

(% of total investments)

|

|

|

Health Care

|

21.9%

|

|

Tax Obligation/General

|

13.4%

|

|

Tax Obligation/Limited

|

10.8%

|

|

U.S. Guaranteed

|

10.3%

|

|

Transportation

|

9.9%

|

|

Education and Civic Organizations

|

9.5%

|

|

Utilities

|

7.3%

|

|

Consumer Staples

|

5.4%

|

|

Long-Term Care

|

4.0%

|

|

Other

|

7.5%

|

|

Total

|

100%

|

|

States and Territories

|

|

|

(% of total municipal bonds)

|

|

|

California

|

17.7%

|

|

Illinois

|

10.4%

|

|

Texas

|

10.3%

|

|

Colorado

|

8.7%

|

|

Wisconsin

|

5.8%

|

|

Florida

|

5.6%

|

|

Ohio

|

4.8%

|

|

Missouri

|

4.1%

|

|

New York

|

3.7%

|

|

Pennsylvania

|

3.5%

|

|

Tennessee

|

2.4%

|

|

Kentucky

|

2.3%

|

|

Georgia

|

2.3%

|

|

Other

|

18.4%

|

|

Total

|

100%

|

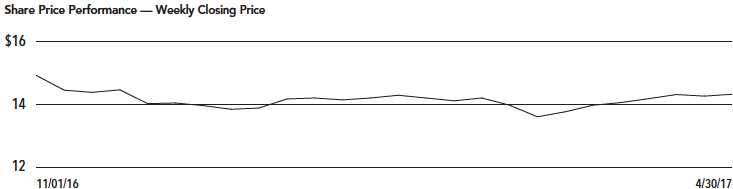

Performance Overview and Holding Summaries as of April 30, 2017

|

|

Cumulative

|

Average Annual

|

||||||||||||||

|

|

Since

|

|||||||||||||||

|

|

6-Month

|

1-Year

|

5-Year

|

Inception

|

||||||||||||

|

NEV at NAV

|

(1.90

|

)%

|

(0.85

|

)%

|

5.92

|

%

|

6.95

|

%

|

||||||||

|

NEV at Share Price

|

0.02

|

%

|

(5.82

|

)%

|

5.10

|

%

|

5.93

|

%

|

||||||||

|

S&P Municipal Bond Index

|

(0.41

|

)%

|

0.57

|

%

|

3.33

|

%

|

4.23

|

%

|

||||||||

|

Fund Allocation

|

|

|

(% of net assets)

|

|

|

Long-Term Municipal Bonds

|

108.8%

|

|

Common Stocks

|

0.6%

|

|

Short-Term Municipal Bonds

|

0.8%

|

|

Other Assets Less Liabilities

|

2.9%

|

|

Net Assets Plus Floating Rate

|

|

|

Obligations

|

113.1%

|

|

Floating Rate Obligations

|

(13.1)%

|

|

Net Assets

|

100%

|

|

Credit Quality

|

|

|

(% of total investment exposure)

|

|

|

AAA/U.S. Guaranteed

|

20.1%

|

|

AA

|

33.4%

|

|

A

|

16.4%

|

|

BBB

|

14.5%

|

|

BB or Lower

|

9.7%

|

|

N/R (not rated)

|

5.5%

|

|

N/A (not applicable)

|

0.4%

|

|

Total

|

100%

|

|

Portfolio Composition

|

|

|

(% of total investments)

|

|

|

Tax Obligation/Limited

|

21.2%

|

|

Health Care

|

20.7%

|

|

Transportation

|

12.4%

|

|

U.S. Guaranteed

|

9.9%

|

|

Education and Civic Organizations

|

6.5%

|

|

Utilities

|

6.2%

|

|

Tax Obligation/General

|

6.1%

|

|

Consumer Staples

|

5.6%

|

|

Industrials

|

3.2%

|

|

Other

|

8.2%

|

|

Total

|

100%

|

|

States and Territories

|

|

|

(% of total municipal bonds)

|

|

|

California

|

14.3%

|

|

Illinois

|

13.3%

|

|

Ohio

|

9.6%

|

|

Wisconsin

|

9.2%

|

|

Pennsylvania

|

6.0%

|

|

Florida

|

5.3%

|

|

Georgia

|

4.1%

|

|

Washington

|

4.0%

|

|

New Jersey

|

3.8%

|

|

Louisiana

|

3.3%

|

|

Texas

|

3.2%

|

|

New York

|

3.2%

|

|

Colorado

|

3.1%

|

|

Other

|

17.6%

|

|

Total

|

100%

|

|

NUV

|

|

|

|

||

|

|

|||||

|

Nuveen Municipal Value Fund, Inc.

|

|

|

|

||

|

Portfolio of Investments

|

April 30, 2017 (Unaudited)

|

||||

|

|

|||||

|

|

|||||

|

Principal

|

|

Optional Call

|

|

|

|

|

Amount (000)

|

Description (1)

|

Provisions (2)

|

Ratings (3)

|

Value

|

|

|

|

LONG-TERM INVESTMENTS – 98.8%

|

|

|

|

|

|

|

MUNICIPAL BONDS – 98.8%

|

|

|

|

|

|

|

Alaska – 0.1%

|

|

|

|

|

|

$ 2,710

|

Northern Tobacco Securitization Corporation, Alaska, Tobacco Settlement Asset-Backed Bonds,

|

7/17 at 100.00

|

B3

|

$ 2,635,990

|

|

|

|

Series 2006A, 5.000%, 6/01/32

|

|

|

|

|

|

|

Arizona – 0.8%

|

|

|

|

|

|

2,500

|

Phoenix Civic Improvement Corporation, Arizona, Airport Revenue Bonds, Senior Lien Series

|

7/18 at 100.00

|

AA–

|

2,605,075

|

|

|

|

2008A, 5.000%, 7/01/38

|

|

|

|

|

|

2,575

|

Quechan Indian Tribe of the Fort Yuma Reservation, Arizona, Government Project Bonds, Series

|

12/17 at 102.00

|

B–

|

2,388,776

|

|

|

|

2008, 7.000%, 12/01/27

|

|

|

|

|

|

5,600

|

Salt Verde Financial Corporation, Arizona, Senior Gas Revenue Bonds, Citigroup Energy Inc.

|

No Opt. Call

|

BBB+

|

6,562,416

|

|

|

|

Prepay Contract Obligations, Series 2007, 5.000%, 12/01/37

|

|

|

|

|

|

4,240

|

Scottsdale Industrial Development Authority, Arizona, Hospital Revenue Bonds, Scottsdale

|

9/20 at 100.00

|

AA

|

4,555,074

|

|

|

|

Healthcare, Series 2006C. Re-offering, 5.000%, 9/01/35 – AGC Insured

|

|

|

|

|

|

14,915

|

Total Arizona

|

|

|

16,111,341

|

|

|

|

Arkansas – 0.3%

|

|

|

|

|

|

1,150

|

Benton Washington Regional Public Water Authority, Arkansas, Water Revenue Bonds, Refunding &

|

10/17 at 100.00

|

A (4)

|

1,169,056

|

|

|

|

Improvement Series 2007, 4.750%, 10/01/33 (Pre-refunded 10/01/17) – SYNCORA GTY Insured

|

|

|

|

|

|

5,650

|

Fayetteville, Arkansas, Sales and Use Tax Revenue Bonds, Series 2006A, 4.750%, 11/01/18 –

|

7/17 at 100.00

|

AA

|

5,667,289

|

|

|

|

AGM Insured

|

|

|

|

|

|

6,800

|

Total Arkansas

|

|

|

6,836,345

|

|

|

|

California – 12.1%

|

|

|

|

|

|

5,000

|

Alameda Corridor Transportation Authority, California, Revenue Bonds, Refunding Second

|

10/26 at 100.00

|

BBB+

|

5,593,300

|

|

|

|

Subordinate Lien Series 2016B, 5.000%, 10/01/36

|

|

|

|

|

|

4,615

|

Anaheim Public Financing Authority, California, Lease Revenue Bonds, Public Improvement

|

No Opt. Call

|

AA

|

3,945,133

|

|

|

|

Project, Series 1997C, 0.000%, 9/01/23 – AGM Insured

|

|

|

|

|

|

5,000

|

Bay Area Toll Authority, California, Revenue Bonds, San Francisco Bay Area Toll Bridge, Series

|

4/23 at 100.00

|

AA–

|

5,634,450

|

|

|

|

2013S-4, 5.000%, 4/01/38

|

|

|

|

|

|

4,800

|

California County Tobacco Securitization Agency, Tobacco Settlement Asset-Backed Bonds, Gold

|

7/17 at 100.00

|

CCC

|

1,906,752

|

|

|

|

Country Settlement Funding Corporation, Refunding Series 2006, 0.000%, 6/01/33

|

|

|

|

|

|

|

California County Tobacco Securitization Agency, Tobacco Settlement Asset-Backed Bonds, Los

|

|

|

|

|

|

|

Angeles County Securitization Corporation, Series 2006A:

|

|

|

|

|

|

3,275

|

5.450%, 6/01/28

|

12/18 at 100.00

|

B3

|

3,323,044

|

|

|

4,200

|

5.600%, 6/01/36

|

12/18 at 100.00

|

B3

|

4,275,096

|

|

|

1,175

|

California Department of Water Resources, Central Valley Project Water System Revenue Bonds,

|

12/26 at 100.00

|

AAA

|

1,408,590

|

|

|

|

Refunding Series 2016AW, 5.000%, 12/01/33

|

|

|

|

|

|

10,000

|

California Health Facilities Financing Authority, California, Revenue Bonds, Sutter Health,

|

11/26 at 100.00

|

AA–

|

11,191,100

|

|

|

|

Refunding Series 2016B, 5.000%, 11/15/46

|

|

|

|

|

|

15,000

|

California Health Facilities Financing Authority, Revenue Bonds, Kaiser Permanente System,

|

No Opt. Call

|

AA–

|

18,578,998

|

|

|

|

Series 2017A-2, 5.000%, 11/01/47 (WI/DD, Settling 5/03/17)

|

|

|

|

|

|

3,850

|

California Health Facilities Financing Authority, Revenue Bonds, Saint Joseph Health System,

|

7/23 at 100.00

|

AA–

|

4,359,779

|

|

|

|

Series 2013A, 5.000%, 7/01/33

|

|

|

|

|

|

2,335

|

California Municipal Finance Authority, Revenue Bonds, Eisenhower Medical Center, Series

|

7/20 at 100.00

|

Baa2

|

2,539,803

|

|

|

|

2010A, 5.750%, 7/01/40

|

|

|

|

|

|

2,130

|

California Pollution Control Financing Authority, Revenue Bonds, Pacific Gas and Electric

|

6/17 at 100.00

|

A3 (4)

|

2,136,688

|

|

|

|

Company, Series 2004C, 4.750%, 12/01/23 (Pre-refunded 6/01/17) – FGIC Insured (Alternative

|

|

|

|

|

|

|

Minimum Tax)

|

|

|

|

|

|

Principal

|

|

Optional Call

|

|

|

|

|

Amount (000)

|

Description (1)

|

Provisions (2)

|

Ratings (3)

|

Value

|

|

|

|

California (continued)

|

|

|

|

|

|

$ 1,625

|

California State Public Works Board, Lease Revenue Bonds, Various Capital Projects, Series

|

11/23 at 100.00

|

A+

|

$ 1,825,038

|

|

|

|

2013I, 5.000%, 11/01/38

|

|

|

|

|

|

1,620

|

California State, General Obligation Bonds, Refunding Series 2007, 4.500%, 8/01/30

|

7/17 at 100.00

|

AA–

|

1,624,147

|

|

|

|

California State, General Obligation Bonds, Various Purpose Series 2007:

|

|

|

|

|

|

9,730

|

5.000%, 6/01/37 (Pre-refunded 6/01/17)

|

6/17 at 100.00

|

Aaa

|

9,768,044

|

|

|

6,270

|

5.000%, 6/01/37 (Pre-refunded 6/01/17)

|

6/17 at 100.00

|

Aaa

|

6,294,516

|

|

|

5,000

|

California State, General Obligation Bonds, Various Purpose Series 2011, 5.000%, 10/01/41

|

10/21 at 100.00

|

AA–

|

5,569,250

|

|

|

3,500

|

California Statewide Communities Development Authority, California, Revenue Bonds, Loma Linda

|

6/26 at 100.00

|

BB

|

3,720,010

|

|

|

|

University Medical Center, Series 2016A, 5.000%, 12/01/46

|

|

|

|

|

|

3,125

|

California Statewide Community Development Authority, Revenue Bonds, Methodist Hospital

|

8/19 at 100.00

|

N/R (4)

|

3,522,188

|

|

|

|

Project, Series 2009, 6.750%, 2/01/38 (Pre-refunded 8/01/19)

|

|

|

|

|

|

3,600

|

California Statewide Community Development Authority, Revenue Bonds, St. Joseph Health System,

|

7/18 at 100.00

|

AA– (4)

|

3,805,740

|

|

|

|

Series 2007A, 5.750%, 7/01/47 (Pre-refunded 7/01/18) – FGIC Insured

|

|

|

|

|

|

6,120

|

Chino Valley Unified School District, San Bernardino County, California, General Obligation

|

8/17 at 53.63

|

Aa2

|

3,250,271

|

|

|

|

Bonds, Series 2006D, 0.000%, 8/01/30

|

|

|

|

|

|

5,000

|

Coast Community College District, Orange County, California, General Obligation Bonds, Series

|

8/18 at 100.00

|

AA+ (4)

|

5,264,800

|

|

|

|

2006C, 5.000%, 8/01/32 (Pre-refunded 8/01/18) – AGM Insured

|

|

|

|

|

|

4,505

|

Covina-Valley Unified School District, Los Angeles County, California, General Obligation

|

No Opt. Call

|

AA–

|

3,190,441

|

|

|

|

Bonds, Series 2003B, 0.000%, 6/01/28 – FGIC Insured

|

|

|

|

|

|

16,045

|

Desert Community College District, Riverside County, California, General Obligation Bonds,

|

8/17 at 42.63

|

AA

|

6,821,371

|

|

|

|

Election 2004 Series 2007C, 0.000%, 8/01/33 – AGM Insured

|

|

|

|

|

|

2,180

|

Foothill/Eastern Transportation Corridor Agency, California, Toll Road Revenue Bonds,

|

1/31 at 100.00

|

BBB–

|

1,802,577

|

|

|

|

Refunding Series 2013A, 6.850%, 1/15/42

|

|

|

|

|

|

30,000

|

Foothill/Eastern Transportation Corridor Agency, California, Toll Road Revenue Bonds, Series

|

No Opt. Call

|

AAA

|

27,975,598

|

|

|

|

1995A, 0.000%, 1/01/22 (ETM)

|

|

|

|

|

|

|

Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Asset-Backed

|

|

|

|

|

|

|

Bonds, Series 2007A-1:

|

|

|

|

|

|

14,475

|

5.000%, 6/01/33

|

6/17 at 100.00

|

B+

|

14,554,613

|

|

|

1,500

|

5.125%, 6/01/47

|

6/17 at 100.00

|

B–

|

1,499,895

|

|

|

2,545

|

Golden State Tobacco Securitization Corporation, California, Tobacco Settlement Asset-Backed

|

6/17 at 100.00

|

N/R (4)

|

2,553,526

|

|

|

|

Bonds, Series 2007A-1, 4.500%, 6/01/27 (Pre-refunded 6/01/17)

|

|

|

|

|

|

|

Merced Union High School District, Merced County, California, General Obligation Bonds,

|

|

|

|

|

|

|

Series 1999A:

|

|

|

|

|

|

2,500

|

0.000%, 8/01/23 – FGIC Insured

|

No Opt. Call

|

AA–

|

2,188,775

|

|

|

2,555

|

0.000%, 8/01/24 – FGIC Insured

|

No Opt. Call

|

AA–

|

2,150,927

|

|

|

2,365

|

Montebello Unified School District, Los Angeles County, California, General Obligation Bonds,

|

No Opt. Call

|

AA–

|

1,751,188

|

|

|

|

Election 1998 Series 2004, 0.000%, 8/01/27 – FGIC Insured

|

|

|

|

|

|

|

Mount San Antonio Community College District, Los Angeles County, California, General

|

|

|

|

|

|

|

Obligation Bonds, Election of 2008, Series 2013A:

|

|

|

|

|

|

3,060

|

0.000%, 8/01/28 (5)

|

2/28 at 100.00

|

Aa1

|

2,832,917

|

|

|

2,315

|

0.000%, 8/01/43 (5)

|

8/35 at 100.00

|

Aa1

|

1,713,656

|

|

|

3,550

|

M-S-R Energy Authority, California, Gas Revenue Bonds, Citigroup Prepay Contracts, Series

|

No Opt. Call

|

A

|

4,944,440

|

|

|

|

2009C, 6.500%, 11/01/39

|

|

|

|

|

|

|

Napa Valley Community College District, Napa and Sonoma Counties, California, General

|

|

|

|

|

|

|

Obligation Bonds, Election 2002 Series 2007C:

|

|

|

|

|

|

7,200

|

0.000%, 8/01/29 – NPFG Insured

|

8/17 at 54.45

|

Aa2

|

3,906,144

|

|

|

11,575

|

0.000%, 8/01/31 – NPFG Insured

|

8/17 at 49.07

|

Aa2

|

5,656,355

|

|

|

2,350

|

Palomar Pomerado Health Care District, California, Certificates of Participation, Series 2009,

|

11/19 at 100.00

|

Ba1 (4)

|

2,682,619

|

|

|

|

6.750%, 11/01/39 (Pre-refunded 11/01/19)

|

|

|

|

|

|

10,150

|

Placer Union High School District, Placer County, California, General Obligation Bonds, Series

|

No Opt. Call

|

AA

|

5,539,160

|

|

|

|

2004C, 0.000%, 8/01/33 – AGM Insured

|

|

|

|

|

NUV

|

Nuveen Municipal Value Fund, Inc.

|

|

|

|

Portfolio of Investments (continued)

|

April 30, 2017 (Unaudited)

|

|

Principal

|

|

Optional Call

|

|

|

|

|

Amount (000)

|

Description (1)

|

Provisions (2)

|

Ratings (3)

|

Value

|

|

|

|

California (continued)

|

|

|

|

|

|

$ 4,000

|

Rancho Mirage Joint Powers Financing Authority, California, Revenue Bonds, Eisenhower Medical

|

7/17 at 100.00

|

Baa2

|

$ 4,015,360

|

|

|

|

Center, Refunding Series 2007A, 5.000%, 7/01/47

|

|

|

|

|

|

15,505

|

Riverside Public Financing Authority, California, Tax Allocation Bonds, University

|

8/17 at 100.00

|

AA–

|

15,625,629

|

|

|

|

Corridor/Sycamore Canyon Merged Redevelopment Project, Arlington Redevelopment

|

|

|

|

|

|

|

Project, Hunter Park/Northside Redevelopment Project, Magnolia Center Redevelopment

|

|

|

|

|

|

|

Project, 5.000%, 8/01/37 – NPFG Insured

|

|

|

|

|

|

|

San Bruno Park School District, San Mateo County, California, General Obligation Bonds,

|

|

|

|

|

|

|

Series 2000B:

|

|

|

|

|

|

2,575

|

0.000%, 8/01/24 – FGIC Insured

|

No Opt. Call

|

AA

|

2,183,394

|

|

|

2,660

|

0.000%, 8/01/25 – FGIC Insured

|

No Opt. Call

|

AA

|

2,152,791

|

|

|

250

|

San Francisco Redevelopment Financing Authority, California, Tax Allocation Revenue Bonds,

|

2/21 at 100.00

|

BBB+ (4)

|

302,898

|

|

|

|

Mission Bay South Redevelopment Project, Series 2011D, 7.000%, 8/01/41 (Pre-refunded 2/01/21)

|

|

|

|

|

|

12,095

|

San Joaquin Hills Transportation Corridor Agency, Orange County, California, Toll Road Revenue

|

No Opt. Call

|

AA–

|

9,181,435

|

|

|

|

Bonds, Refunding Series 1997A, 0.000%, 1/15/25 – NPFG Insured

|

|

|

|

|

|

13,220

|

San Mateo County Community College District, California, General Obligation Bonds, Series

|

No Opt. Call

|

AAA

|

9,569,033

|

|

|

|

2006A, 0.000%, 9/01/28 – NPFG Insured

|

|

|

|

|

|

5,000

|

San Mateo Union High School District, San Mateo County, California, General Obligation Bonds,

|

No Opt. Call

|

Aaa

|

4,268,250

|

|

|

|

Election of 2000, Series 2002B, 0.000%, 9/01/24 – FGIC Insured

|

|

|

|

|

|

5,815

|

San Ysidro School District, San Diego County, California, General Obligation Bonds, Refunding

|

No Opt. Call

|

AA

|

1,211,613

|

|

|

|

Series 2015, 0.000%, 8/01/48

|

|

|

|

|

|

2,000

|

Tobacco Securitization Authority of Northern California, Tobacco Settlement Asset-Backed

|

6/17 at 100.00

|

B+

|

1,999,940

|

|

|

|

Bonds, Refunding Series 2005A-2, 5.400%, 6/01/27

|

|

|

|

|

|

|

University of California, General Revenue Bonds, Series 2009O:

|

|

|

|

|

|

370

|

5.250%, 5/15/39 (Pre-refunded 5/15/19)

|

5/19 at 100.00

|

N/R (4)

|

401,687

|

|

|

720

|

5.250%, 5/15/39 (Pre-refunded 5/15/19)

|

5/19 at 100.00

|

AA (4)

|

781,661

|

|

|

210

|

5.250%, 5/15/39 (Pre-refunded 5/15/19)

|

5/19 at 100.00

|

N/R (4)

|

227,984

|

|

|

290,260

|

Total California

|

|

|

253,222,614

|

|

|

|

Colorado – 6.1%

|

|

|

|

|

|

5,000

|

Arkansas River Power Authority, Colorado, Power Revenue Bonds, Series 2006, 5.250%, 10/01/40 –

|

7/17 at 100.00

|

BBB–

|

5,008,250

|

|

|

|

SYNCORA GTY Insured

|

|

|

|

|

|

5,200

|

Colorado Health Facilities Authority, Colorado, Revenue Bonds, Catholic Health Initiatives,

|

7/17 at 100.00

|

BBB+

|

5,212,064

|

|

|

|

Series 2006A, 4.500%, 9/01/38

|

|

|

|

|

|

7,105

|

Colorado Health Facilities Authority, Colorado, Revenue Bonds, Catholic Health Initiatives,

|

1/23 at 100.00

|

BBB+

|

7,419,467

|

|

|

|

Series 2013A, 5.250%, 1/01/45

|

|

|

|

|

|

1,700

|

Colorado Health Facilities Authority, Colorado, Revenue Bonds, Poudre Valley Health System,

|

9/18 at 102.00

|

AA

|

1,790,865

|

|

|

|

Series 2005C, 5.250%, 3/01/40 – AGM Insured

|

|

|

|

|

|

2,845

|

Colorado Health Facilities Authority, Colorado, Revenue Bonds, Sisters of Charity of

|

1/20 at 100.00

|

AA–

|

3,121,591

|

|

|

|

Leavenworth Health Services Corporation, Refunding Composite Deal Series 2010B, 5.000%, 1/01/21

|

|

|

|

|

|

15,925

|

Colorado Health Facilities Authority, Colorado, Revenue Bonds, Sisters of Charity of

|

1/20 at 100.00

|

AA–

|

17,016,657

|

|

|

|

Leavenworth Health Services Corporation, Series 2010A, 5.000%, 1/01/40

|

|

|

|

|

|

2,000

|

Colorado State Board of Governors, Colorado State University Auxiliary Enterprise System

|

3/22 at 100.00

|

Aa2

|

2,217,940

|

|

|

|

Revenue Bonds, Series 2012A, 5.000%, 3/01/41

|

|

|

|

|

|

|

Denver City and County, Colorado, Airport System Revenue Bonds, Series 2012B:

|

|

|

|

|

|

2,750

|

5.000%, 11/15/25

|

11/22 at 100.00

|

A+

|

3,174,490

|

|

|

2,200

|

5.000%, 11/15/29

|

11/22 at 100.00

|

A+

|

2,527,162

|

|

|

5,160

|

Denver City and County, Colorado, Airport System Revenue Bonds, Subordinate Lien Series 2013B,

|

11/23 at 100.00

|

A

|

5,704,638

|

|

|

|

5.000%, 11/15/43

|

|

|

|

|

|

2,000

|

Denver Convention Center Hotel Authority, Colorado, Revenue Bonds, Convention Center Hotel,

|

12/26 at 100.00

|

Baa2

|

2,209,960

|

|

|

|

Refunding Senior Lien Series 2016, 5.000%, 12/01/35

|

|

|

|

|

Principal

|

|

Optional Call

|

|

|

|

|

Amount (000)

|

Description (1)

|

Provisions (2)

|

Ratings (3)

|

Value

|

|

|

|

Colorado (continued)

|

|

|

|

|

|

|

E-470 Public Highway Authority, Colorado, Senior Revenue Bonds, Series 2000B:

|

|

|

|

|

|

$ 9,660

|

0.000%, 9/01/29 – NPFG Insured

|

No Opt. Call

|

AA–

|

$ 6,135,549

|

|

|

24,200

|

0.000%, 9/01/31 – NPFG Insured

|

No Opt. Call

|

AA–

|

13,975,984

|

|

|

17,000

|

0.000%, 9/01/32 – NPFG Insured

|

No Opt. Call

|

AA–

|

9,364,110

|

|

|

7,600

|

E-470 Public Highway Authority, Colorado, Toll Revenue Bonds, Refunding Series 2006B, 0.000%,

|

9/26 at 52.09

|

AA–

|

2,654,528

|

|

|

|

9/01/39 – NPFG Insured

|

|

|

|

|

|

|

E-470 Public Highway Authority, Colorado, Toll Revenue Bonds, Series 2004B:

|

|

|

|

|

|

7,700

|

0.000%, 9/01/27 – NPFG Insured

|

9/20 at 67.94

|

AA–

|

4,689,762

|

|

|

10,075

|

0.000%, 3/01/36 – NPFG Insured

|

9/20 at 41.72

|

AA–

|

3,648,158

|

|

|

5,000

|

Ebert Metropolitan District, Colorado, Limited Tax General Obligation Bonds, Series 2007,

|

12/17 at 100.00

|

AA (4)

|

5,132,400

|

|

|

|

5.350%, 12/01/37 (Pre-refunded 12/01/17) – RAAI Insured

|

|

|

|

|

|

8,000

|

Public Authority for Colorado Energy, Natural Gas Purchase Revenue Bonds, Colorado Springs

|

No Opt. Call

|

A

|

11,012,720

|

|

|

|

Utilities, Series 2008, 6.500%, 11/15/38

|

|

|

|

|

|

5,000

|

Rangely Hospital District, Rio Blanco County, Colorado, General Obligation Bonds, Refunding

|

11/21 at 100.00

|

Baa1

|

5,742,450

|

|

|

|

Series 2011, 6.000%, 11/01/26

|

|

|

|

|

|

3,750

|

Regional Transportation District, Colorado, Denver Transit Partners Eagle P3 Project Private

|

7/20 at 100.00

|

BBB+

|

4,143,563

|

|

|

|

Activity Bonds, Series 2010, 6.000%, 1/15/41

|

|

|

|

|

|

4,945

|

Regional Transportation District, Colorado, Sales Tax Revenue Bonds, Fastracks Project, Series

|

11/26 at 100.00

|

AA+

|

5,691,646

|

|

|

|

2017A, 5.000%, 11/01/40

|

|

|

|

|

|

154,815

|

Total Colorado

|

|

|

127,593,954

|

|

|

|

Connecticut – 0.1%

|

|

|

|

|

|

1,500

|

Connecticut Health and Educational Facilities Authority, Revenue Bonds, Hartford HealthCare,

|

7/21 at 100.00

|

A

|

1,596,825

|

|

|

|

Series 2011A, 5.000%, 7/01/41

|

|

|

|

|

|

8,959

|

Mashantucket Western Pequot Tribe, Connecticut, Special Revenue Bonds, Subordinate Series

|

No Opt. Call

|

N/R

|

347,620

|

|

|

|

2013A, 0.240%, 7/01/31, PIK, (6)

|

|

|

|

|

|

10,459

|

Total Connecticut

|

|

|

1,944,445

|

|

|

|

District of Columbia – 0.6%

|

|

|

|

|

|

15,000

|

District of Columbia Tobacco Settlement Corporation, Tobacco Settlement Asset-Backed Bonds,

|

7/17 at 100.00

|

N/R

|

2,102,700

|

|

|

|

Series 2006A, 0.000%, 6/15/46

|

|

|

|

|

|

10,000

|

Washington Convention Center Authority, District of Columbia, Dedicated Tax Revenue Bonds,

|

7/17 at 100.00

|

AA+

|

10,022,300

|

|

|

|

Senior Lien Refunding Series 2007A, 4.500%, 10/01/30 – AMBAC Insured

|

|

|

|

|

|

25,000

|

Total District of Columbia

|

|

|

12,125,000

|

|

|

|

Florida – 5.6%

|

|

|

|

|

|

3,000

|

Cape Coral, Florida, Water and Sewer Revenue Bonds, Refunding Series 2011, 5.000%, 10/01/41 –

|

10/21 at 100.00

|

AA

|

3,356,670

|

|

|

|

AGM Insured

|

|

|

|

|

|

565

|

Florida Development Finance Corporation, Educational Facilities Revenue Bonds, Renaissance

|

6/25 at 100.00

|

N/R

|

575,492

|

|

|

|

Charter School Income Projects, Series 2015A, 6.000%, 6/15/35

|

|

|

|

|

|

2,845

|

Greater Orlando Aviation Authority, Florida, Airport Facilities Revenue Bonds, Refunding

|

10/19 at 100.00

|

AA– (4)

|

3,111,548

|

|

|

|

Series 2009C, 5.000%, 10/01/34 (Pre-refunded 10/01/19)

|

|

|

|

|

|

2,290

|

Hillsborough County Aviation Authority, Florida, Revenue Bonds, Tampa International Airport,

|

10/24 at 100.00

|

A+

|

2,554,037

|

|

|

|

Subordinate Lien Series 2015B, 5.000%, 10/01/40

|

|

|

|

|

|

5,000

|

Marion County Hospital District, Florida, Revenue Bonds, Munroe Regional Medical Center,

|

10/17 at 100.00

|

BBB+ (4)

|

5,088,550

|

|

|

|

Refunding and Improvement Series 2007, 5.000%, 10/01/34 (Pre-refunded 10/01/17)

|

|

|

|

|

|

5,090

|

Miami-Dade County Expressway Authority, Florida, Toll System Revenue Bonds, Series 2010A,

|

7/20 at 100.00

|

A

|

5,567,238

|

|

|

|

5.000%, 7/01/40

|

|

|

|

|

|

9,500

|

Miami-Dade County Health Facility Authority, Florida, Hospital Revenue Bonds, Miami Children's

|

8/21 at 100.00

|

A+

|

11,319,535

|

|

|

|

Hospital, Series 2010A, 6.000%, 8/01/46

|

|

|

|

|

|

2,000

|

Miami-Dade County, Florida, Aviation Revenue Bonds, Miami International Airport, Refunding

|

10/24 at 100.00

|

A

|

2,234,800

|

|

|

|

Series 2014B, 5.000%, 10/01/37

|

|

|

|

|

NUV

|

Nuveen Municipal Value Fund, Inc.

|

|

|

|

Portfolio of Investments (continued)

|

April 30, 2017 (Unaudited)

|

|

Principal

|

|

Optional Call

|

|

|

|

|

Amount (000)

|

Description (1)

|

Provisions (2)

|

Ratings (3)

|

Value

|

|

|

|

Florida (continued)

|

|

|

|

|

|

$ 6,000

|

Miami-Dade County, Florida, Aviation Revenue Bonds, Miami International Airport, Series 2009B,

|

10/19 at 100.00

|

A (4)

|

$ 6,629,160

|

|

|

|

5.500%, 10/01/36 (Pre-refunded 10/01/19)

|

|

|

|

|

|

4,000

|

Miami-Dade County, Florida, Aviation Revenue Bonds, Miami International Airport, Series 2010B,

|

10/20 at 100.00

|

A

|

4,454,280

|

|

|

|

5.000%, 10/01/29

|

|

|

|

|

|

4,000

|

Miami-Dade County, Florida, Transit System Sales Surtax Revenue Bonds, Refunding Series 2012,

|

7/22 at 100.00

|

AA

|

4,447,080

|

|

|

|

5.000%, 7/01/42

|

|

|

|

|

|

9,590

|

Miami-Dade County, Florida, Water and Sewer System Revenue Bonds, Series 2010, 5.000%,

|

10/20 at 100.00

|

AA

|

10,579,496

|

|

|

|

10/01/39 – AGM Insured

|

|

|

|

|

|

10,725

|

Orlando, Florida, Contract Tourist Development Tax Payments Revenue Bonds, Series 2014A,

|

5/24 at 100.00

|

AA+ (4)

|

12,991,085

|

|

|

|

5.000%, 11/01/44 (Pre-refunded 5/01/24)

|

|

|

|

|

|

3,250

|

Palm Beach County Health Facilities Authority, Florida, Revenue Bonds, Jupiter Medical Center,

|

11/22 at 100.00

|

BBB+

|

3,394,528

|

|

|

|

Series 2013A, 5.000%, 11/01/43

|

|

|

|

|

|

9,440

|

Port Saint Lucie, Florida, Special Assessment Revenue Bonds, Southwest Annexation District 1,

|

7/17 at 100.00

|

AA– (4)

|

9,509,101

|

|

|

|

Series 2007B, 5.000%, 7/01/40 (Pre-refunded 7/01/17) – NPFG Insured

|

|

|

|

|

|

2,500

|

Seminole Tribe of Florida, Special Obligation Bonds, Series 2007A, 144A, 5.250%, 10/01/27

|

10/17 at 100.00

|

BBB

|

2,527,850

|

|

|

6,865

|

South Broward Hospital District, Florida, Hospital Revenue Bonds, Refunding Series 2015,

|

5/25 at 100.00

|

AA

|

7,025,710

|

|

|

|

4.000%, 5/01/34

|

|

|

|

|

|

|

South Miami Health Facilities Authority, Florida, Hospital Revenue, Baptist Health System

|

|

|

|

|

|

|

Obligation Group, Refunding Series 2007:

|

|

|

|

|

|

3,035

|

5.000%, 8/15/19

|

8/17 at 100.00

|

AA–

|

3,070,874

|

|

|

14,730

|

5.000%, 8/15/42 (UB) (7)

|

8/17 at 100.00

|

AA–

|

14,828,249

|

|

|

3,300

|

Tampa, Florida, Health System Revenue Bonds, Baycare Health System, Series 2012A,

|

5/22 at 100.00

|

Aa2

|

3,672,306

|

|

|

|

5.000%, 11/15/33

|

|

|

|

|

|

107,725

|

Total Florida

|

|

|

116,937,589

|

|

|

|

Georgia – 0.3%

|

|

|

|

|

|

3,325

|

Atlanta, Georgia, Water and Wastewater Revenue Bonds, Refunding Series 2015, 5.000%, 11/01/40

|

5/25 at 100.00

|

Aa2

|

3,800,375

|

|

|

2,000

|

Private Colleges and Universities Authority, Georgia, Revenue Bonds, Emory University,

|

10/26 at 100.00

|

AA+

|

2,292,620

|

|

|

|

Refunding Series 2016A, 5.000%, 10/01/46

|

|

|

|

|

|

5,325

|

Total Georgia

|

|

|

6,092,995

|

|

|

|

Guam – 0.0%

|

|

|

|

|

|

330

|

Guam International Airport Authority, Revenue Bonds, Series 2013C, 6.375%, 10/01/43

|

10/23 at 100.00

|

BBB

|

376,415

|

|

|

|

(Alternative Minimum Tax)

|

|

|

|

|

|

|

Hawaii – 0.2%

|

|

|

|

|

|

3,625

|

Honolulu City and County, Hawaii, General Obligation Bonds, Refunding Series 2009A, 5.250%,

|

4/19 at 100.00

|

Aa1 (4)

|

3,918,009

|

|

|

|

4/01/32 (Pre-refunded 4/01/19)

|

|

|

|

|

|

|

Illinois – 14.7%

|

|

|

|

|

|

5,000

|

Chicago Board of Education, Illinois, General Obligation Bonds, Dedicated Capital Improvement

|

4/27 at 100.00

|

A

|

5,173,550

|

|

|

|

Revenues, Series 2016, 6.000%, 4/01/46

|

|

|

|

|

|

5,000

|

Chicago Board of Education, Illinois, General Obligation Bonds, Dedicated Revenues, Series

|

12/25 at 100.00

|

B

|

4,839,700

|

|

|

|

2016A, 7.000%, 12/01/44

|

|

|

|

|

|

2,945

|

Chicago Board of Education, Illinois, General Obligation Bonds, Dedicated Revenues, Series

|

12/26 at 100.00

|

B

|

2,735,993

|

|

|

|

2016B, 6.500%, 12/01/46

|

|

|

|

|

|

17,725

|

Chicago Board of Education, Illinois, Unlimited Tax General Obligation Bonds, Dedicated Tax

|

No Opt. Call

|

AA–

|

13,250,501

|

|

|

|

Revenues, Series 1998B-1, 0.000%, 12/01/24 – FGIC Insured

|

|

|

|

|

|

7,495

|

Chicago Board of Education, Illinois, Unlimited Tax General Obligation Bonds, Dedicated Tax

|

No Opt. Call

|

AA–

|

3,744,727

|

|

|

|

Revenues, Series 1999A, 0.000%, 12/01/31 – FGIC Insured

|

|

|

|

|

|

1,500

|

Chicago Park District, Illinois, General Obligation Bonds, Limited Tax Series 2011A,

|

1/22 at 100.00

|

AA+

|

1,576,350

|

|

|

|

5.000%, 1/01/36

|

|

|

|

|

Principal

|

|

Optional Call

|

|

|

|

|

Amount (000)

|

Description (1)

|

Provisions (2)

|

Ratings (3)

|

Value

|

|

|

|

Illinois (continued)

|

|

|

|

|

|

|

Chicago, Illinois, General Obligation Bonds, Project & Refunding Series 2006A:

|

|

|

|

|

|

$ 2,750

|

4.750%, 1/01/30 – AGM Insured

|

7/17 at 100.00

|

AA

|

$ 2,756,710

|

|

|

5,000

|

4.625%, 1/01/31 – AGM Insured

|

7/17 at 100.00

|

AA

|

5,011,550

|

|

|

285

|

Chicago, Illinois, General Obligation Bonds, Series 2002A, 5.625%, 1/01/39 – AMBAC Insured

|

7/17 at 100.00

|

AA–

|

285,767

|

|

|

7,750

|

Chicago, Illinois, General Obligation Bonds, Series 2004A, 5.000%, 1/01/34 – AGM Insured

|

7/17 at 100.00

|

AA

|

7,770,228

|

|

|

5,000

|

Chicago, Illinois, Motor Fuel Tax Revenue Bonds, Series 2008A, 5.000%, 1/01/38 – AGC Insured

|

1/18 at 100.00

|

AA

|

5,104,700

|

|

|

3,320

|

Cook and DuPage Counties Combined School District 113A Lemont, Illinois, General Obligation

|

No Opt. Call

|

AA–

|

3,110,807

|

|

|

|

Bonds, Series 2002, 0.000%, 12/01/20 – FGIC Insured

|

|

|

|

|

|

8,875

|

Cook County, Illinois, General Obligation Bonds, Refunding Series 2010A, 5.250%, 11/15/33

|

11/20 at 100.00

|

AA–

|

9,419,126

|

|

|

3,260

|

Cook County, Illinois, Recovery Zone Facility Revenue Bonds, Navistar International

|

10/20 at 100.00

|

B–

|

3,332,111

|

|

|

|

Corporation Project, Series 2010, 6.500%, 10/15/40

|

|

|

|

|

|

5,000

|

Cook County, Illinois, Sales Tax Revenue Bonds, Series 2012, 5.000%, 11/15/37

|

11/22 at 100.00

|

AAA

|

5,382,900

|

|

|

13,070

|

Illinois Development Finance Authority, Local Government Program Revenue Bonds, Kane, Cook

|

No Opt. Call

|

Aa3

|

12,661,432

|

|

|

|

and DuPage Counties School District U46 – Elgin, Series 2002, 0.000%, 1/01/19 – AGM Insured

|

|

|

|

|

|

14,960

|

Illinois Development Finance Authority, Local Government Program Revenue Bonds, Kane, Cook

|

No Opt. Call

|

Aa3 (4)

|

14,675,461

|

|

|

|

and DuPage Counties School District U46 – Elgin, Series 2002, 0.000%, 1/01/19 –

|

|

|

|

|

|

|

AGM Insured (ETM)

|

|

|

|

|

|

1,800

|

Illinois Development Finance Authority, Local Government Program Revenue Bonds, Winnebago

|

No Opt. Call

|

A2

|

1,740,096

|

|

|

|

and Boone Counties School District 205 – Rockford, Series 2000, 0.000%, 2/01/19 – AGM Insured

|

|

|

|

|

|

1,875

|

Illinois Finance Authority, Revenue Bonds, Central DuPage Health, Series 2009B,

|

11/19 at 100.00

|

AA+

|

2,056,031

|

|

|

|

5.500%, 11/01/39

|

|

|

|

|

|

3,000

|

Illinois Finance Authority, Revenue Bonds, Central DuPage Health, Series 2009, 5.250%, 11/01/39

|

11/19 at 100.00

|

AA+

|

3,208,440

|

|

|

1,415

|

Illinois Finance Authority, Revenue Bonds, OSF Healthcare System, Refunding Series 2010A,

|

5/20 at 100.00

|

A

|

1,558,113

|

|

|

|

6.000%, 5/15/39

|

|

|

|

|

|

3,110

|

Illinois Finance Authority, Revenue Bonds, OSF Healthcare System, Refunding Series 2010A,

|

5/20 at 100.00

|

N/R (4)

|

3,544,063

|

|

|

|

6.000%, 5/15/39 (Pre-refunded 5/15/20)

|

|

|

|

|

|

|

Illinois Finance Authority, Revenue Bonds, Provena Health, Series 2009A:

|

|

|

|

|

|

45

|

7.750%, 8/15/34 (Pre-refunded 8/15/19)

|

8/19 at 100.00

|

N/R (4)

|

51,705

|

|

|

4,755

|

7.750%, 8/15/34 (Pre-refunded 8/15/19)

|

8/19 at 100.00

|

BBB– (4)

|

5,463,495

|

|

|

|

Illinois Finance Authority, Revenue Bonds, Resurrection Health Care System, Series 1999B:

|

|

|

|

|

|

70

|

5.000%, 5/15/19 (Pre-refunded 5/15/18) – AGM Insured

|

5/18 at 100.00

|

AA (4)

|

73,015

|

|

|

1,930

|

5.000%, 5/15/19 (Pre-refunded 5/15/18) – AGM Insured

|

5/18 at 100.00

|

AA (4)

|

2,012,295

|

|

|

5,000

|

Illinois Finance Authority, Revenue Bonds, Rush University Medical Center Obligated Group,

|

5/25 at 100.00

|

A+

|

5,430,600

|

|

|

|

Series 2015A, 5.000%, 11/15/38

|

|

|

|

|

|

4,260

|

Illinois Finance Authority, Revenue Bonds, Sherman Health Systems, Series 2007A, 5.500%,

|

8/17 at 100.00

|

N/R (4)

|

4,310,183

|

|

|

|

8/01/37 (Pre-refunded 8/01/17)

|

|

|

|

|

|

4,475

|

Illinois Finance Authority, Revenue Bonds, Silver Cross Hospital and Medical Centers,

|

8/18 at 100.00

|

BBB+

|

4,615,963

|

|

|

|

Refunding Series 2008A, 5.500%, 8/15/30

|

|

|

|

|

|

|

Illinois Finance Authority, Revenue Bonds, Silver Cross Hospital and Medical Centers,

|

|

|

|

|

|

|

Refunding Series 2015C:

|

|

|

|

|

|

560

|

5.000%, 8/15/35

|

8/25 at 100.00

|

Baa1

|

605,752

|

|

|

825

|

5.000%, 8/15/44

|

8/25 at 100.00

|

Baa1

|

871,382

|

|

|

2,500

|

Illinois Finance Authority, Revenue Bonds, The University of Chicago Medical Center, Series

|

2/21 at 100.00

|

AA– (4)

|

2,891,025

|

|

|

|

2011C, 5.500%, 8/15/41 (Pre-refunded 2/15/21)

|

|

|

|

|

|

3,000

|

Illinois Finance Authority, Revenue Bonds, University of Chicago, Series 2012A,

|

10/21 at 100.00

|

AA+

|

3,231,690

|

|

|

|

5.000%, 10/01/51

|

|

|

|

|

|

5,245

|

Illinois Finance Authority, Revenue Bonds, University of Chicago, Tender Option Bond Trust

|

7/17 at 100.00

|

AA+ (4)

|

5,322,521

|

|

|

|

2015-XF0248, 8.526%, 7/01/46 (Pre-refunded 7/01/17) (IF) (7)

|

|

|

|

|

|

620

|

Illinois Health Facilities Authority, Revenue Bonds, South Suburban Hospital, Series 1992,

|

No Opt. Call

|

N/R (4)

|

646,815

|

|

|

|

7.000%, 2/15/18 (ETM)

|

|

|

|

|

|

3,750

|

Illinois Sports Facility Authority, State Tax Supported Bonds, Series 2001, 5.500%, 6/15/30 –

|

7/17 at 100.00

|

BBB–

|

3,840,713

|

|

|

|

AMBAC Insured

|

|

|

|

|

NUV

|

Nuveen Municipal Value Fund, Inc.

|

|

|

|

Portfolio of Investments (continued)

|

April 30, 2017 (Unaudited)

|

|

Principal

|

|

Optional Call

|

|

|

|

|

Amount (000)

|

Description (1)

|

Provisions (2)

|

Ratings (3)

|

Value

|

|

|

|

Illinois (continued)

|

|

|

|

|

|

$ 1,755

|

Illinois State, General Obligation Bonds, October Series 2016, 5.000%, 2/01/29

|

2/27 at 100.00

|

BBB

|

$ 1,814,319

|

|

|

655

|

Illinois State, General Obligation Bonds, Refunding Series 2012, 5.000%, 8/01/25

|

8/22 at 100.00

|

BBB

|

678,881

|

|

|

5,590

|

Illinois Toll Highway Authority, Toll Highway Revenue Bonds, Senior Lien Series 2013A,

|

1/23 at 100.00

|

AA–

|

6,178,403

|

|

|

|

5.000%, 1/01/38

|

|

|

|

|

|

5,000

|

Lombard Public Facilities Corporation, Illinois, First Tier Conference Center and Hotel

|

7/17 at 100.00

|

N/R

|

4,248,500

|

|

|

|

Revenue Bonds, Series 2005A-2, 5.500%, 1/01/36 – ACA Insured (6)

|

|

|

|

|

|

16,800

|

Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion

|

No Opt. Call

|

AA–

|

14,691,600

|

|

|

|

Project, Refunding Series 1996A, 0.000%, 12/15/21 – NPFG Insured

|

|

|

|

|

|

|

Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion

|

|

|

|

|

|

|

Project, Refunding Series 2002B:

|

|

|

|

|

|

3,070

|

5.500%, 6/15/20 – NPFG Insured

|

6/17 at 101.00

|

AA–

|

3,118,383

|

|

|

3,950

|

5.550%, 6/15/21 – NPFG Insured

|

6/17 at 101.00

|

AA–

|

4,012,450

|

|

|

|

Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion

|

|

|

|

|

|

|

Project, Refunding Series 2002B:

|

|

|

|

|

|

705

|

5.500%, 6/15/20 (Pre-refunded 6/15/17) – NPFG Insured

|

6/17 at 101.00

|

AA– (4)

|

716,372

|

|

|

1,765

|

5.550%, 6/15/21 (Pre-refunded 6/15/17) – NPFG Insured

|

6/17 at 101.00

|

AA– (4)

|

1,793,575

|

|

|

|

Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion

|

|

|

|

|

|

|

Project, Series 1993A:

|

|

|

|

|

|

9,415

|

0.000%, 6/15/17 – NPFG Insured

|

No Opt. Call

|

AA–

|

9,397,865

|

|

|

9,270

|

0.010%, 6/15/18 – FGIC Insured

|

No Opt. Call

|

AA–

|

9,070,788

|

|

|

2,905

|

Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion

|

No Opt. Call

|

AA– (4)

|

2,901,514

|

|

|

|

Project, Series 1993A, 0.000%, 6/15/17 – NPFG Insured (ETM)

|

|

|

|

|

|

|

Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion

|

|

|

|

|

|

|

Project, Series 1994B:

|

|

|

|

|

|

7,250

|

0.000%, 6/15/18 – NPFG Insured

|

No Opt. Call

|

AA–

|

7,094,198

|

|

|

3,635

|

0.000%, 6/15/21 – NPFG Insured

|

No Opt. Call

|

AA–

|

3,236,786

|

|

|

5,190

|

0.000%, 6/15/28 – NPFG Insured

|

No Opt. Call

|

AA–

|

3,295,546

|

|

|

11,670

|

0.000%, 6/15/29 – FGIC Insured

|

No Opt. Call

|

AA–

|

7,026,157

|

|

|

|

Metropolitan Pier and Exposition Authority, Illinois, Revenue Bonds, McCormick Place Expansion

|

|

|

|

|

|

|

Project, Series 2002A:

|

|

|

|

|

|

10,000

|

0.000%, 6/15/24 – NPFG Insured (5)

|

6/22 at 101.00

|

AA–

|

11,245,000

|

|

|

4,950

|

0.000%, 12/15/32 – NPFG Insured

|

No Opt. Call

|

AA–

|

2,482,227

|

|

|

21,375

|

0.000%, 6/15/34 – NPFG Insured

|

No Opt. Call

|

AA–

|

9,799,155

|

|

|

21,000

|

0.000%, 12/15/35 – NPFG Insured

|

No Opt. Call

|

AA–

|

8,877,960

|

|

|

21,970

|

0.000%, 6/15/36 – NPFG Insured

|

No Opt. Call

|

AA–

|

8,991,442

|

|

|

10,375

|

0.000%, 12/15/36 – NPFG Insured

|

No Opt. Call

|

AA–

|

4,148,029

|

|

|

10,000

|

0.000%, 12/15/37 – NPFG Insured

|

No Opt. Call

|

AA–

|

3,777,500

|

|

|

25,825

|

0.000%, 6/15/39 – NPFG Insured

|

No Opt. Call

|

AA–

|

8,971,605

|

|

|

6,095

|

Regional Transportation Authority, Cook, DuPage, Kane, Lake, McHenry and Will Counties,

|

No Opt. Call

|

AA

|

8,159,803

|

|

|

|

Illinois, General Obligation Bonds, Series 2002A, 6.000%, 7/01/32 – NPFG Insured

|

|

|

|

|

|

5,020

|

Southwestern Illinois Development Authority, Local Government Revenue Bonds, Edwardsville

|

No Opt. Call

|

AA

|

4,150,185

|

|

|

|

Community Unit School District 7 Project, Series 2007, 0.000%, 12/01/23 – AGM Insured

|

|

|

|

|

|

615

|

University of Illinois, Health Services Facilities System Revenue Bonds, Series 2013,

|

10/23 at 100.00

|

A

|

698,972

|

|

|

|

6.000%, 10/01/42

|

|

|

|

|

|

1,575

|

Will County Community School District 161, Summit Hill, Illinois, Capital Appreciation School

|

No Opt. Call

|

A3

|

1,554,667

|

|

|

|

Bonds, Series 1999, 0.000%, 1/01/18 – FGIC Insured

|

|

|

|

|

|

720

|

Will County Community School District 161, Summit Hill, Illinois, Capital Appreciation School

|

No Opt. Call

|

A3 (4)

|

715,457

|

|

|

|

Bonds, Series 1999, 0.000%, 1/01/18 – FGIC Insured (ETM)

|

|

|

|

|

|

2,550

|

Will County Community Unit School District 201U, Crete-Monee, Illinois, General Obligation

|

No Opt. Call

|

AA–

|

2,209,550

|

|

|

|

Bonds, Capital Appreciation Series 2004, 0.000%, 11/01/22 – NPFG Insured

|

|

|

|

|

|

780

|

Will County Community Unit School District 201U, Crete-Monee, Illinois, General Obligation

|

No Opt. Call

|

AA– (4)

|

708,864

|

|

|

|