UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 20-F

(Mark one)

|

☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

|

☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission File Number: 001-31583

Nam Tai Property Inc.

(Exact name of registrant as specified in its charter)

British Virgin Islands

(Jurisdiction of incorporation or organization)

Nam Tai Estate, No. 2, Namtai Road, Gushu Community, Xixiang Township,

Baoan District, Shenzhen City, Guangdong Province, People’s Republic of China

(Address of principal executive offices)

Raymond Wen, Board Secretary and Head of Investor Relations

Tel:(852) 3955-2809

Fax: (86755) 2747-2636

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

|

|

|

|

Title of Each Class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common shares, $0.01 par value per share |

NTP |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act.

None.

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None.

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

As of December 31, 2019 there were 38,631,991 common shares of the registrant outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒ No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

Large accelerated |

☐ |

|

Accelerated filer |

☒ |

|

Non-accelerated filer |

☐ |

Emerging growth company |

☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

U.S. GAAP ☒ |

International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ |

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Exchange Act). ☐ Yes ☒ No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ☐ Yes ☐ No

|

3 |

||

|

|

|

|

|

3 |

||

|

|

|

|

|

3 |

||

|

|

|

|

|

4 |

||

|

|

|

|

|

ITEM 1. |

4 |

|

|

ITEM 2. |

4 |

|

|

ITEM 3. |

4 |

|

|

|

4 |

|

|

|

6 |

|

|

|

6 |

|

|

|

6 |

|

|

ITEM 4. |

19 |

|

|

|

19 |

|

|

|

20 |

|

|

|

43 |

|

|

|

44 |

|

|

ITEM 4A. |

45 |

|

|

ITEM 5. |

45 |

|

|

|

45 |

|

|

|

50 |

|

|

|

53 |

|

|

|

53 |

|

|

|

53 |

|

|

|

53 |

|

|

|

53 |

|

|

ITEM 6. |

54 |

|

|

|

54 |

|

|

|

55 |

|

|

|

57 |

|

|

|

58 |

|

|

|

59 |

|

|

ITEM 7. |

60 |

|

|

|

60 |

|

|

|

61 |

|

|

|

62 |

|

|

ITEM 8. |

62 |

|

|

|

62 |

|

|

|

64 |

|

|

ITEM 9. |

64 |

|

|

|

64 |

|

|

|

64 |

|

|

|

64 |

|

|

|

64 |

|

|

|

64 |

|

|

|

64 |

|

|

ITEM 10. |

64 |

|

|

|

64 |

|

|

|

64 |

|

|

|

71 |

|

|

|

72 |

|

|

|

72 |

|

|

|

77 |

|

|

|

77 |

|

|

|

77 |

|

|

|

77 |

|

|

ITEM 11. |

77 |

|

|

ITEM 12. |

79 |

|

|

|

|

|

|

80 |

||

|

|

|

|

1

|

80 |

||

|

ITEM 14. |

MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

80 |

|

ITEM 15. |

80 |

|

|

81 |

||

|

ITEM 16. |

82 |

|

|

ITEM 16A. |

82 |

|

|

ITEM 16B. |

82 |

|

|

ITEM 16C. |

82 |

|

|

ITEM 16D. |

83 |

|

|

ITEM 16E. |

PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

83 |

|

ITEM 16F. |

83 |

|

|

ITEM 16G. |

83 |

|

|

ITEM 16H. |

83 |

|

|

|

|

|

|

84 |

||

|

|

|

|

|

ITEM 17. |

84 |

|

|

ITEM 18. |

84 |

|

|

|

|

|

|

85 |

||

|

F-1 |

||

|

F-2 |

||

|

F-3 |

||

|

F-4 |

||

|

F-5 |

||

|

ITEM 19. |

|

|

2

NOTE REGARDING USE OF FORWARD LOOKING STATEMENTS

This Annual Report on Form 20-F (this “Report”) contains forward-looking statements. Words such as “aim”, “anticipate”, “aspire”, “assume”, “believe”, “consider”, “continue”, “envision”, “estimate”, “expect”, “forecast”, “going forward”, “intend”, “plan”, “potential”, “predict”, “project”, “propose”, “seek”, “target”, “can”, “could”, “may”, “might”, “will”, “would”, “shall”, “should”, and the negative forms of these words and other similar expressions are intended to identify forward-looking statements. Forward-looking statements include information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, and the effects of future regulation and the effects of competition. We have based these forward-looking statements largely on our current beliefs, expectations and projections about future events and financial trends affecting our business. These statements are subject to many important factors, certain risks and uncertainties that could cause actual results to differ materially from those anticipated in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in the section entitled “Risk Factors” under Item 3. Key Information. We operate in an evolving environment. New risks emerge from time to time and it is impossible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ from those contained in any forward-looking statement.

You should not place undue reliance on forward-looking statements, which reflect management’s view only as of the date of this Report. We undertake no duty to update any forward-looking statement to conform the statement to actual results or changes in management’s expectations. You should also carefully review the risk factors described in other documents we file from time to time with the U.S. Securities and Exchange Commission, or the SEC.

FINANCIAL STATEMENTS AND CURRENCY PRESENTATION

We prepare our consolidated financial statements in accordance with the accounting principles generally accepted in the United States of America, or U.S. GAAP, and publish our financial statements in U.S. dollars.

Except where the context otherwise requires and for purposes of this Report only:

|

|

• |

“we”, “us”, “our company”, “our”, the “Company” and “Nam Tai” refer to Nam Tai Property Inc. and, in the context of describing our operations, also includes our PRC operating companies; |

|

|

• |

“Board” and “Board of Directors” refers to our board of directors; |

|

|

• |

“common shares” or “shares” refer to our common shares, $0.01 par value per share; |

|

|

• |

“China” or “PRC” refers to the People’s Republic of China, excluding Taiwan, Hong Kong and Macao for purpose of this Report; |

|

|

• |

“Taiwan” refers to the Taiwan province of the People’s Republic of China; |

|

|

• |

“Hong Kong” refers to the Hong Kong Special Administrative Region of the People’s Republic of China; |

|

|

• |

“Macao” refers to the Macao Special Administrative Region of the People’s Republic of China; and |

|

|

• |

“HK$” or “Hong Kong dollars” refers to the legal currency of Hong Kong. “Renminbi”, “RMB” or “yuan” refers to the legal currency of China. “U.S. dollars”, “US$” or “$” refers to the legal currency of the United States. |

3

Not applicable.

Not applicable.

The following table presents the selected consolidated financial information of our company. Our historical consolidated financial statements are prepared in accordance with U.S. GAAP and are presented in U.S. dollars. The following selected consolidated statements of comprehensive income (loss) income data for each of the three years ended December 31, 2019 and the consolidated balance sheet data as of December 31, 2018 and 2019 are derived from our consolidated financial statements and notes thereto included elsewhere in this Report. The selected consolidated statements of comprehensive (loss) income data for years ended December 31, 2015 and 2016 and the consolidated balance sheet data as of December 31, 2015, 2016 and 2017 have been derived from our audited consolidated financial statements not included in this Report. Our historical results do not necessarily indicate results to be expected in any future period. The following data should be read in conjunction with, and are qualified in their entirety by reference to, our audited consolidated financial statements and related notes and “Item 5. Operating and Financial Review and Prospects”.

4

Our Selected Consolidated Financial Information

|

|

|

Year ended December 31, |

|

|||||||||||||||||

|

Consolidated statements of comprehensive (loss) income data: |

|

2015 |

|

|

2016 |

|

|

2017 |

|

|

2018 |

|

|

2019 |

|

|||||

|

|

|

(in thousands of U.S. dollars, except per share data) |

|

|||||||||||||||||

|

Revenue |

|

$ |

2,978 |

|

|

$ |

2,508 |

|

|

$ |

1,851 |

|

|

$ |

493 |

|

|

$ |

2,965 |

|

|

Cost of revenue |

|

|

(1,949 |

) |

|

|

(740 |

) |

|

|

— |

|

|

|

(73 |

) |

|

|

(1,356 |

) |

|

Gross profit |

|

|

1,029 |

|

|

|

1,768 |

|

|

|

1,851 |

|

|

|

420 |

|

|

|

1,609 |

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses |

|

|

(13,862 |

) |

|

|

(8,359 |

) |

|

|

(9,450 |

) |

|

|

(20,402 |

) |

|

|

(12,484 |

) |

|

Selling and marketing expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(813 |

) |

|

|

(6,460 |

) |

|

Net loss from operations |

|

|

(12,833 |

) |

|

|

(6,591 |

) |

|

|

(7,599 |

) |

|

|

(20,795 |

) |

|

|

(17,335 |

) |

|

Other (expenses) income, net |

|

|

(8,379 |

) |

|

|

(8,497 |

) |

|

|

8,495 |

|

|

|

(714 |

) |

|

|

(253 |

) |

|

Interest income |

|

|

8,054 |

|

|

|

5,554 |

|

|

|

7,621 |

|

|

|

5,601 |

|

|

|

2,357 |

|

|

Write off of demolished building |

|

|

— |

|

|

|

— |

|

|

|

(4,573 |

) |

|

|

(35 |

) |

|

|

— |

|

|

Loss on demolished building facilities |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4,074 |

) |

|

|

— |

|

|

Gain on disposal of property |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6,763 |

|

|

|

— |

|

|

(Loss) income before income tax |

|

|

(13,158 |

) |

|

|

(9,534 |

) |

|

|

3,944 |

|

|

|

(13,254 |

) |

|

|

(15,231 |

) |

|

Deferred income tax benefit |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,040 |

|

|

Consolidated net (loss) income |

|

|

(13,158 |

) |

|

|

(9,534 |

) |

|

|

3,944 |

|

|

|

(13,254 |

) |

|

|

(13,191 |

) |

|

Other comprehensive (loss) income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

|

(4,417 |

) |

|

|

(7,736 |

) |

|

|

6,311 |

|

|

|

(10,437 |

) |

|

|

(3,136 |

) |

|

Consolidated comprehensive (loss) income |

|

|

(17,575 |

) |

|

|

(17,270 |

) |

|

|

10,255 |

|

|

|

(23,691 |

) |

|

|

(16,327 |

) |

|

Weighted average number of shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

40,549 |

|

|

|

36,673 |

|

|

|

36,807 |

|

|

|

37,826 |

|

|

|

38,331 |

|

|

Diluted |

|

|

40,549 |

|

|

|

36,673 |

|

|

|

37,492 |

|

|

|

37,826 |

|

|

|

38,331 |

|

|

(Loss) earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net (loss) earnings per share |

|

$ |

(0.32 |

) |

|

$ |

(0.26 |

) |

|

$ |

0.11 |

|

|

$ |

(0.35 |

) |

|

$ |

(0.34 |

) |

|

Diluted net (loss) earnings per share |

|

$ |

(0.32 |

) |

|

$ |

(0.26 |

) |

|

$ |

0.11 |

|

|

$ |

(0.35 |

) |

|

$ |

(0.34 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated balance sheet data: |

|

2015 |

|

|

2016 |

|

|

2017 |

|

|

2018 |

|

|

2019 |

|

|||||

|

|

|

(in thousands of U.S. dollars, except per share data) |

|

|||||||||||||||||

|

Cash and cash equivalents |

|

|

157,371 |

|

|

|

94,558 |

|

|

|

165,173 |

|

|

|

62,919 |

|

|

|

130,218 |

|

|

Short term investments |

|

|

49,983 |

|

|

|

89,624 |

|

|

|

— |

|

|

|

46,952 |

|

|

|

2,166 |

|

|

Working capital (1) |

|

|

226,568 |

|

|

|

194,731 |

|

|

|

152,554 |

|

|

|

26,398 |

|

|

|

28,374 |

|

|

Land use rights, property, plant and equipment, net and real estate properties under development, net |

|

|

38,884 |

|

|

|

41,514 |

|

|

|

89,436 |

|

|

|

199,052 |

|

|

|

277,635 |

|

|

Right of use assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,078 |

|

|

Deferred income tax assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,011 |

|

|

Total assets |

|

|

271,480 |

|

|

|

248,801 |

|

|

|

262,077 |

|

|

|

318,107 |

|

|

|

430,410 |

|

|

Short term bank loan |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,410 |

|

|

Current portion of lease liabilities |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

529 |

|

|

Current portion of long term bank loans |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,081 |

|

|

Noncurrent portion of lease liabilities |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,642 |

|

|

Long term bank loans |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

93,861 |

|

|

Total shareholders’ equity |

|

|

265,565 |

|

|

|

236,346 |

|

|

|

244,358 |

|

|

|

227,891 |

|

|

|

214,738 |

|

|

Common shares |

|

|

367 |

|

|

|

364 |

|

|

|

376 |

|

|

|

382 |

|

|

|

386 |

|

|

Total dividend per share(2) |

|

|

0.08 |

|

|

|

0.28 |

|

|

|

0.28 |

|

|

|

n/a |

|

|

n/a |

|

|

|

Total number of common shares issued |

|

|

36,700 |

|

|

|

36,447 |

|

|

|

37,551 |

|

|

|

38,187 |

|

|

|

38,632 |

|

Notes:

|

(1) |

Working Capital represents the excess of current assets over current liabilities. |

5

Our financial statements and other financial data included in this annual report are presented in U.S. dollars. Our business and operations are primarily conducted in China through our PRC subsidiaries. The functional currency of our PRC subsidiaries is RMB. The financial statements of our PRC subsidiaries are translated into U.S. dollars using published exchange rates in China, based on (i) year-end exchange rates for assets and liabilities and (ii) average yearly exchange rates for revenues and expenses. Capital accounts are translated at historical exchange rates when the transactions occurred. Unless otherwise noted, all translations from RMB to U.S. dollars and from U.S. dollars to RMB in this annual report (i) for assets and liabilities were made at a rate of RMB6.50, RMB6.94, RMB6.52, RMB6.86 and RMB6.98 to US$1.00 for each of the financial year 2015, 2016, 2017, 2018 and 2019, respectively, and (ii) for revenue and expenses were made at a rate of RMB6.2513, RMB6.6340, RMB6.7770, RMB6.5974 and RMB6.8829 to US$1.00 for each of the financial year 2015, 2016, 2017, 2018 and 2019, respectively. The effects of foreign currency translation adjustments are included as a component of accumulated other comprehensive income in our shareholders’ equity. We make no representation that any RMB or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or RMB at any particular rate.

The RMB is not freely convertible into foreign currency. The PRC government imposes control over its foreign currency reserves in part through direct regulation of the conversion of the RMB into foreign exchange and through restrictions on foreign trade. Since 2005, the People’s Bank of China, or the PBOC, has allowed the RMB to fluctuate within a narrow and managed band against a basket of foreign currencies, according to market demand and supply conditions. The PBOC announces the RMB closing price each day and that rate serves as the mid-point of the next day’s trading band.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

Investing in our company involves a high degree of risk. You should carefully consider the following risks, as well as other information contained in this annual report, before making an investment in our company. The risks discussed below could materially and adversely affect our business, prospects, financial condition, results of operations, cash flows, ability to pay dividends and the trading price of our common shares. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business, prospects, financial condition, results of operations, cash flows and ability to pay dividends, and you may lose all or part of your investment.

We are heavily dependent on China’s economy and the performance of the PRC real estate market, particularly in the Guangdong-Hong Kong-Macao Greater Bay Area, or the GBA.

Our major real estate development, leasing and sales operations are located in China, particular in Shenzhen and the GBA. Compared with traditional homebuilders, we are more focused on the development of industrial land, and our target clients are enterprises. Therefore, our business prospects significantly depend on the performance of the general economy and the real estate market in China, particularly in the GBA.

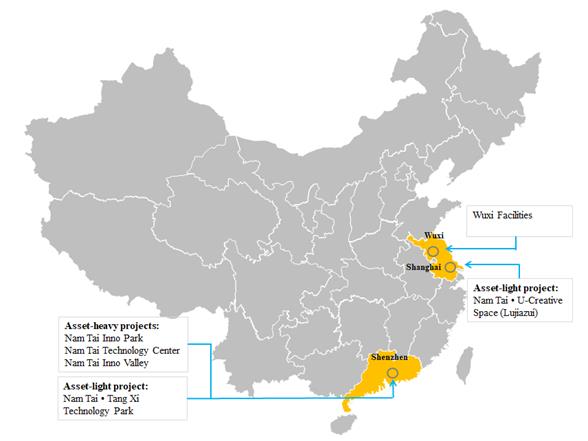

As of January 31, 2020, we had four projects located in the GBA and two in the Yangtze River Delta Economic Zone, among which the development projects in Shenzhen, including Nam Tai Inno Park, Nam Tai Technology Center and Nam Tai Inno Valley were most significant. We also intend to enter into other regions and cities in China. In the event that the general economic conditions in the cities and regions we operate or intend to operate are not performing as expected, demand for office or commercial properties may decrease, which could adversely affect our business, operating results and financial position.

The real estate market in China is highly cyclical and the supply and demand of the real estate market are affected by changes in the economic, social and political conditions, regulatory, environmental and other factors that are outside of our control. We cannot assure you that there will not be over supply of properties in the GBA or other parts of China where we operate or intend to expand into. In the event of an oversupply of properties, property prices in the markets may decline. Any market downturn in the cities or regions where we operate could adversely affect our business, results of operations and financial condition.

We may not be able to obtain land reserves at commercially acceptable prices, or at all.

We derive our revenue principally from the sale and leasing of properties that we have developed. We must maintain or increase our land reserves in strategic locations in order to ensure sustainable business growth. Our ability to identify and acquire suitable development sites is subject to many different factors, some of which are beyond our control.

6

The supply of land in China is substantially controlled by the PRC government. The land supply policies adopted by the PRC government directly impact our ability and costs to acquire land use rights for development. In recent years, the PRC government has implemented various measures to regulate the means by which property developers may obtain land. The PRC government also controls land supply through zoning, land usage regulations and other means. All these measures further intensify the competition for land in China among property developers. The implementation of these measures may increase land transfer prices and require property developers to maintain a higher level of working capital. See “Item 4. Information on the Company—B. Business Overview—PRC Regulations on Real Estate Development and Management” for information on the regulatory procedures and restrictions relating to land acquisition in PRC.

In addition, we cannot assure you that the parcels of land we have acquired to date will appreciate in value, or that we will continue to be able to acquire land of sufficient size and with an appropriate scope of usage in desirable locations at commercially acceptable prices, or at all. If we fail to acquire sufficient land reserves in a timely manner and on acceptable terms, or at all, our business, results of operations, financial condition and prospects may be materially and adversely affected.

Our results of operations may vary significantly from period to period.

We derive the majority of our revenue from the sale and leasing of properties that we have developed. Our results of operations tend to fluctuate from period to period due to various factors, including the overall schedule of our property development projects, the timing of the sale and leasing of properties that we have developed, the size of our land bank, our revenue recognition policies and changes in costs and expenses, such as land acquisition and construction costs. The number of properties that we can develop or complete during any particular period is limited due to the size of our land bank, the substantial capital required for land acquisition and construction, as well as the development periods required before positive cash flows may be generated. At the same time, the sales and leasing of real estate will be affected by the market conditions.

In addition, our projects under development including Nam Tai Inno Park and Nam Tai Technology Center are large scale and developed in multiple phases over the course of several years. The selling or leasing prices of the office and commercial units in larger scale property developments tend to vary over time, which may impact our sales proceeds and rental income, and accordingly our revenues for any given period.

Our financial condition and results of operations may fluctuate significantly due to seasonality, and our quarterly financial results may not fully reflect the underlying performance of our business.

Our quarterly operating results have fluctuated in the past and will fluctuate in the future due to seasonality. We generally rent out a higher number of units during spring and fall. We typically experience a lower level of rental in the summer and winter months especially around lunar year-end when large number of workers return to their hometowns to celebrate the Chinese New Year. It generally picks up after the Chinese New Year when these workers return to work and factories re-open. As a result of these factors, our revenues may vary from quarter to quarter, and you may not be able to predict our annual results of operations based on a quarter-to-quarter comparison of our results of operations. The quarterly fluctuations in our revenues and results of operations could result in volatility and cause the price of our common shares to fall. As our revenues grow, these seasonal fluctuations may become more pronounced.

We may face intense competition from other developers.

The property industry in the PRC is highly competitive. In 2019, the total floor area and the vacancy rate of office properties in Shenzhen and Shanghai increased while the rental rate declined. We are exposed to such risk and that property prices may fall drastically and significantly and adversely affect our revenue and profitability.

Also, there was an increase in the number of competing projects in proximity, which could intensify the competition among property developers, and force us to reduce prices or incur additional costs to make our properties more attractive. Moreover, as Shenzhen transforms from a labor-intensive electronic manufacturing hub to a research and development based innovation center, many factories located on industrial lands are being converted to technology parks similar to our development projects, such as Nam Tai Inno Park and Nam Tai Technology Center.

Some of our competitors have competitive advantages over us, including greater economies of scale, more well-known brands, new and different business models, lower cost, larger customer bases, more experience in real estate development and greater financial, marketing, technology, human resources, and other expertise and resources. Furthermore, property developers that are better capitalized than we are may be more competitive in acquiring land through the auction process. We cannot assure you that we will always be able to successfully compete against our competitors. In addition, competition among property developers may result increase in costs, shortage of raw materials, oversupply of properties, and difficulty in hiring or retaining qualified personnel, any of which may adversely affect our business, financial condition and results of operations.

7

Our business may be materially and adversely affected by government measures affecting China’s real estate industry, especially in industrial real estate industry.

The real estate industry, especially in industrial real estate industry in China is subject to government regulations, including measures that are intended to curtail rapid price increases and property speculation, as well as stabilize the cost of housing for enterprises. To achieve these aims, the Chinese government tightened its real estate policies, implementing measures and policies intended to promote the healthy development of the real estate industry.

The regulations at both central government level and local government level change from time to time, to either stimulate or depress the real estate market, and it is difficult to foresee the timing or direction of regulatory changes. Since 2016, many local governments in both first-tier and second-tier cities issued notices to restrict purchases of houses, including Beijing, Shanghai, Shenzhen, Guangzhou and Tianjin. The restrictive measures include, but are not limited to, an adjustment to the percentage of required down payment, more restrictive eligibility requirement imposed on purchasers and a limit on the maximum number of houses one may purchase. It is uncertain for how long these measures will remain in effect, and whether the central or local governments will further tighten their policies or adopt new measures that are less restrictive.

In May 2018, the PRC Ministry of Housing and Urban-Rural Development, or MOHURD, issued a circular, or the May Circular, intended to increase supply of property and further provides that banks should strictly examine the mortgagor’s loan repayment capacity before granting any mortgages, that enterprises must only use their own funds to purchase land (as opposed to borrowed funds), and that the source of such funds would be under stringent supervision.

In July 2018, the People’s Government of Shenzhen City issued a circular, or the July Circular, intended to further strengthen the regulation of and promote the steady and healthy development of the real estate market in Shenzhen. The July Circular includes restrictions on transfer of residences and commercial apartments that are built on land zoned as either residential, commercial or mixed-use.

These measures and policies principally apply to residences and commercial apartments that are built on land zoned as residential, commercial or mixed-use. Our development projects, Nam Tai Inno Park, Nam Tai Technology Center and Nam Tai Inno Valley, are built on land zoned as industrial, so most of these measures and policies do not directly apply to the projects. However, these measures and policies may depress the PRC real estate market and Shenzhen real estate prices in particular, dissuade would-be buyers from making purchases, reduce transaction volume, and cause decline in average selling prices, any of which could affect the selling or rental prices that we may charge.

MOHURD, National Development and Reform Commission, or NDRC, Ministry of Public Security, China Quality Certification Center, the China Banking and Insurance Regulatory Commission and Cyberspace Administration of China also issued the “Opinions on Rectifying and Regulating the Order of the Housing Rental Market”, or the Opinions, in December 2019. The Opinions stipulated requirements for the management of lease registration and the control of rent financing business. Stricter control imposed in the leasing industry may increase our costs to comply with the requirements and adversely affect our business operations and financial position.

See “Item 4. Information on the Company—B. Business Overview—PRC Regulations on Real Estate Development and Management” for additional information.

In addition, we cannot assure you that the PRC government or the Shenzhen City government will not adopt new measures in the future that may result in lower growth in the real estate industry. Frequent changes in government policies may also create uncertainty that could discourage investment in real estate. If we fail to comply with these measures, we may face penalty or sanction from the government. Our operation result and financial position may be significantly and adversely affected.

A severe or prolonged downturn in the global or Chinese economy could materially and adversely affect our business, financial condition, results of operations and prospects.

The global macroeconomic environment is facing challenges, including the global pandemic of the COVID-19, the production conflicts among major oil producers in the world, the economic slowdown in the Eurozone since 2014 and uncertainties over the impact of Brexit. The Chinese economy has shown slower growth compared to the previous decade since 2012 and the trend may continue. There is considerable uncertainty over the long-term effects of the expansionary monetary and fiscal policies adopted by the central banks and financial authorities of some of the world’s leading economies, including the United States and China. There have been concerns over unrest and terrorist threats in the Middle East, Europe and Africa, which have resulted in market volatility. There have also been concerns over the relationship between China and other countries, including the surrounding Asian countries. Recent international trade disputes, including tariff actions announced by the United States, China and certain other countries, and the uncertainties created by such disputes may cause disruptions in the international flow of goods and services and may adversely affect the Chinese economy as well as global markets and economic conditions. Economic conditions in China are sensitive to global economic conditions, as well as changes in domestic economic and political policies and the expected or perceived overall economic growth rate in China. Any severe or prolonged slowdown in the global or Chinese economy may materially and adversely affect our business, financial condition, results of operations and prospects.

8

We may fail to obtain, or experience material delays in obtaining, requisite licenses, certificates, permits or governmental approvals for our technology park development projects, and as a result, our development plans, business, results of operations and financial condition may be materially and adversely affected.

Property development in the PRC, and in Shenzhen in particular, is a heavily regulated, long and complicated process, generally requiring large amounts of capital and involving numerous parties, including designers, construction material suppliers, general- and sub-contractors, and potential purchasers and tenants. At various stages of our technology park development projects, we are required to obtain and maintain certain licenses, certificates, permits and governmental approvals, including, but not limited to, qualification certificates, land use rights certificates, land use permits, construction planning permits, construction permits, pre-sale permits, construction acceptance certificates and property ownership certificates. Before government authorities will issue any license, certificate or permit, we must also satisfy specific conditions and requirements. We cannot assure you that we will not encounter material delays or difficulties in fulfilling the necessary conditions to obtain all necessary licenses, certificates or permits for our technology park developments in a timely manner, or at all.

The site of Nam Tai Inno Valley is on industrial land within the designated industrial block lines. Pursuant to the Measures on Administration for Industrial Block of Shenzhen promulgated by the Shenzhen Government, the government strictly controls the ratio of the site that can be re-designated from “M-1” to “M-0” and will need to approve the ratio. The re-designation ratio, floor area ratio and the gross floor area (“GFA”) of our Nam Tai Inno Valley are still subject to the approvals of the Shenzhen Government. We cannot assure you that the final GFA of Nam Tai Inno Valley as approved by the government will be the same as we expected. See “Item 4. Information on the Company—B. Business Overview—PRC Regulations on Real Estate Development and Management for more information.

The leasing model of the Nam Tai Inno Park project is relatively new and may not receive a wide-scale acceptance.

The units in the Nam Tai Inno Park are offered for lease since we are not permitted to subdivide the title pursuant to the land use rights assignment agreement we entered into with the local government in 2007 and its subsequent amendments, in which the industrial land was zoned M-1 with 50 years of land use rights from 2007. In our leasing model, the lease terms could range from one year to up to the expiry of our land use rights. For short-term leases, the rent and management fee would be collected on a monthly basis. For long-term leases, we would also offer the lessees a leasing option where the total lease payment for the entire lease period is collected upfront, with management fees to be paid monthly.

Upfront lease payment for industrial properties is a relatively new leasing model that has not been widely adopted. Our cash flow could be enhanced significantly and the stable leasing demand of leases could be satisfied with the upfront payment option. We cannot assure you that the upfront payment arrangement will not be challenged or further regulated by the relevant governmental authorities. If new laws, regulations or rules are enacted to restrict or prohibit such arrangement, we will have to change our leasing model and may need to find alternative sources of capital. Failure to do so could adversely affect our business, financial condition and results of operations and cash flows.

We may not have adequate financing to fund our currently planned or future technology park developments.

Property development is capital intensive and we need significant capital resources to fund our existing and future construction and technology park development activities. PRC laws and regulations that govern financing policies of PRC banks with respect to the property development sector impose stringent requirements on banks providing loans to property development enterprises, and we cannot assure you that the PRC government will not further tighten such restrictions. These restrictions imposed on property-related financing may limit our ability and flexibility to use the financings we have obtained or enter into credit facilities with banks to finance our technology park development projects, we cannot assure you that we would be able to generate sufficient cash from our operations to meet our funding needs.

Failure to repay our debt timely or comply with the restrictive covenants imposed by our credit facilities could restrict future borrowings or cause our debt to become immediately due and payable.

We have entered into loan agreements with certain commercial banks. We will be in default under the loan agreements if we fail to pay principal or interest when it is due (subject in some instances to grace periods) or to comply with certain restrictive covenants. Certain loan agreements contain covenants providing that, among other matters, our relevant PRC subsidiaries may not enter into mergers, joint ventures, restructurings, engage in material investments, capital reduction, equity transfers, transfer of material assets, substantially increase our indebtedness, or distribute dividends without the relevant lenders’ prior written consent or we may need to fully settle the outstanding amounts under the relevant loan agreements. In addition, certain of our loan agreements or notes contain cross-default clauses. If any cross default occurs, these banks are entitled to accelerate payment of all or any part of the loan under their relevant loan agreements and/or to enforce all or any of the security for such loans. This could reduce our available funds at a time when we are having difficulty generating enough funds from our operations or raising financing in the capital markets. Any default will restrict our ability to obtain financing in the future, which could seriously and adversely impact our financial condition.

9

We may not successfully market the Nam Tai Inno Park to our targeted clients.

We are targeting companies in the AI, new technology and new material industries as potential tenants for the Nam Tai Inno Park. Given the large scope of the Nam Tai Inno Park, especially in the area where it is located, we cannot guarantee to achieve the ideal rental rate in a short period of time. We may have to adjust our target tenants based on market demand. To better serve our tenants and attract target tenants, we will need to integrate a number of advanced network systems in the Nam Tai Inno Park to create an intelligent platform and provide a business-friendly environment with high efficiency. Moreover, target tenants of our technology parks may also make relocation decisions based on factors such as our ability to successfully attract a group of innovative businesses, availability of government subsidies and public or private financial supports, as well as a number of other external factors specific to their unique situations. If we fail to provide proper network integration, create an intelligent platform, or clear paths for our target tenants to receive competitive supports, these potential tenants may not choose our technology park.

We cannot guarantee our success in new investments.

Since the second half of 2019, we have started to operate commercial properties owned by third parties, mainly including offices. We may face challenges in attracting tenants and catering to their needs, such as building a more competitive operation system and enhancing the efficiency of our sales and operation teams. We may also be subject to additional compliance requirements. If we fail to attract tenants successfully and reach a satisfactory rental rate, we may suffer a loss in the operation of these properties at the early stage. In addition, we may invest in new real estate properties through bidding, acquisition and urban renewal in 2020 and will have additional capital needs for the acquisition of the land use rights and the development, construction, and sale or lease of such properties.

As the new investment is subject to various risk factors, we cannot guarantee their success. Failure to develop these projects successfully may adversely affect our revenue, earnings and cash flow.

Increases in the rate of cancellations of leasing agreements could have an adverse effect on our business.

We have signed lease agreements with tenants and received the advance payments from them for some of the units in Nam Tai Inno Park. In some cases, the upfront long-term lessees may cancel the lease agreement and receive a complete or partial refund of the advance for reasons such as changes in state and local laws and regulations, the lessee’s inability to obtain mortgage financing, or our inability to complete and deliver the units within the specified time. If there is a downturn in the real estate market, or if mortgage financing becomes less available than expected, more lessees may cancel their lease agreements with us, which would have an adverse effect on our business and results of operations.

We may be unable to complete our technology park development projects on time and within budget.

The progress and costs for a project in development can be adversely affected by many factors, including:

•delays in obtaining necessary licenses, certificates, permits or approvals from government agencies or authorities;

•shortage of materials, equipment, contractors and skilled labor or increased labor or raw material costs;

•failure by our third-party contractors to comply with our designs, specifications or standards;

•onsite labor disputes or work accidents;

•natural catastrophes or adverse weather conditions, including strong winds, storms, floods, and earthquakes;

•changes in government practices and policies, including reclamation of land for public works or facilities; and

•other unforeseen problems or circumstances.

Any construction delays or failure to complete a project according to our planned specifications or budget may delay our property leasing timetable, which could adversely affect our revenues, cash flows and our reputation. We may also be penalized by the local authority if we fail to complete our projects on time. See “Item 4. Information on the Company—B. Business Overview—PRC Regulations on Real Estate Development and Management” for information on the regulatory procedures and restrictions relating to delay of construction acceptance in PRC.

We may be required to write off our long-lived assets, which could result in an impairment charge that would adversely affect our operating results.

We plan to write off the existing buildings located on Nam Tai Inno Valley when they are demolished in preparation of re-construction. The valuation of our long-lived assets requires us to make assumptions about future interest income. Our assumptions are used to forecast future undiscounted cash flows. Given the volatile and uncertain nature of the current economic environment and, uncertainties regarding the duration and severity of these conditions, forecasting future business is difficult and subject to modification. If actual market conditions differ or our forecasts change, we may be required to reassess long-lived assets and we may have to record an impairment charge. Any impairment charge relating to long-lived assets would adversely affect our operating results.

10

We might not be able to carry all of our operating losses forward.

Our operating activities in the short term will consist principally of leasing and sale of properties. Certain operating losses may be carried forward as tax benefits in future years. If there are changes in the relevant PRC tax policy with respect to the real estate industry, we may not be able to carry all of our operating losses forward and our forecasted profits in the future may also be affected.

We rely on the support of our key management members and Kaisa.

We have commenced certain strategic cooperation with Kaisa Group Holdings Limited, or Kaisa or Kaisa Group, including hiring a number of real estate engineers and professionals from Kaisa to join us as officers and employees. Our shareholders have elected Mr. Ying Chi Kwok, one of Kaisa’s founders, as a director of our company. Our Board of Directors has elected Mr. Kwok as its chairman and appointed him as our chief executive officer, together with the appointments of certain Kaisa affiliates to senior management positions, such as the appointments of Mr. Hao Xu as our non-executive director and Ms. Yu Zhang as our chief financial officer. We also expect to continue to consult with Kaisa from time to time, leveraging Kaisa’s knowledge and experience in the areas of real estate development. We depend on the services provided by these key management members. In particular, we are highly dependent on Mr. Ying Chi Kwok, our chairman and chief executive officer. In the event that we lose the services of any key management member, we may be unable to identify and recruit suitable successors from the market in a timely manner. Competition for management talent is intense in the property development sector in the PRC, especially in industrial property development where comprehensive industry knowledge and well-rounded abilities are required. If we cannot attract and retain suitable talent, especially at senior management level, our business and ability to complete our projects on time may be adversely affected.

The interests of our major shareholders may not be aligned with the interests of our other shareholders.

As of January 31, 2020, our top four largest shareholders, namely Kaisa Group Holdings Limited, Mr. Peter R. Kellogg, IsZo Capital LP and Kahn Brothers LLC, beneficially owned approximately 54.9% of our common shares, collectively. If acting together, they may be able to control and substantially influence the outcome of all matters requiring approval by our shareholders, including the election of directors and approval of significant corporate transactions. This concentration of ownership may also discourage, delay or prevent a change in control of our company, which could deprive our shareholders of an opportunity to receive a premium for their shares as part of a sale of our company and might reduce the price of the shares. These actions may be taken even if they are opposed by our other shareholders. In addition, our largest shareholder, Kaisa also engages in the real estate business in Shenzhen, China. We cannot assure you that Kaisa, the companies controlled by Kaisa or its affiliates will not engage in activities that may compete directly with our major development projects including the Nam Tai Inno Park and the Nam Tai Technology Center.

We face risks related to the outbreak of COVID-19 and other local and global public health emergencies, natural disasters and other catastrophic events.

Our business could be adversely affected by the effects of Covid-19—Corona Virus Disease, 2019 (COVID-19), avian influenza, severe acute respiratory syndrome (SARS), the influenza A virus, Ebola virus, or other epidemics and outbreaks. Health or other government regulations adopted in response to such emergencies or epidemics, natural disasters such as earthquakes, tsunamis, storms, floods or hazardous air pollution, or other catastrophic events may require temporary suspension of part or all of our operations. Such suspension may disrupt our business and adversely affect the results of our operations and our financial conditions. Moreover, these types of events could negatively impact the economy and the business of our tenants, which would in turn adversely impact our business and our results of operations and financial conditions could suffer.

The recent outbreak of COVID-19 has and is continuing to spread rapidly throughout China and other parts of the world after first being discovered in Wuhan, China in December 2019. On March 11, 2020, the World Health Organization declared the outbreak a pandemic. The COVID-19 outbreak in China recently has caused us to temporarily close our offices and project sites in early and mid. February 2020, which may cause a delay on our project schedules. In addition, many businesses and social activities in China have been severely disrupted, including those of our tenants, contractors and suppliers. We have experienced certain delays caused by some of our contractors and agreed to reduce the rent for certain of our tenants. Such disruptions have not had a material adverse effect on our business but no assurance can be given that they will not have such an effect. Our business operation could also be disrupted if any of our employees or workers on our properties has contracted or is suspected of having contracted any contagious disease or condition, since it could require our employees and workers to be quarantined or our offices to be closed down and disinfected. In addition, before the COVID-19 outbreak is under control, the commercial markets are likely to be distressed as short - to medium-term outlook may be unclear. Enterprises are also sensitive on leasing cost and cautious about relocating and expanding office space, which could reduce the demand on the office and commercial space of our projects and cause a significant negative impact on our operating results and financial condition. The COVID-19 outbreak continues to spread as of the date of this annual report and as a result, we cannot assure you that we or our business partners or tenants will not experience further disruptions and the potential slowdown of China’s economy in 2020 and beyond and the changes in the outlook of the property market will not have a material adverse effect on our results of operations and financial condition. We are uncertain as to when the outbreak of COVID-19 will be contained and if the impact will be short-lived or long-lasting, accordingly, we cannot yet predict the extent to which the COVID-19 outbreak will ultimately affect our business, results of operations or financial condition.

Other natural disasters and catastrophic events, such as fire, floods, typhoons, earthquakes, power loss, telecommunications failures, wars, riots, terrorist attacks or similar events, could also cause severe disruption of our operations or those of our contractors, suppliers or tenants, which could materially and adversely affect our results of operations and financial condition.

11

We may be adversely affected by the performance of third-party contractors.

We engage third-party contractors to provide various services, including design, pile setting, foundation digging, construction, equipment installation, interior decoration, electromechanical engineering, pipeline engineering and elevator installation. Our principal third-party contractors carry out property construction and may subcontract various works to independent subcontractors. We endeavor to employ contractors with good reputations, strong track records, and adequate financial resources. We also adopt and follow our own quality control procedures and routinely monitor works performed by third-party contractors. However, we cannot assure you that all work performed by third-party contractors will meet our quality standard and that expensive and time-costly replacement or remedial actions may have to be deployed with our project schedules delayed. As we are expanding into new regional markets in China, we may not be able to recruit sufficient qualified contractors. Contractors may also undertake projects for other developers, engage in risky or unsound practices, or encounter financial and other difficulties, any of which may adversely affect their ability to complete their work for us on time and within budget.

Injuries or damages may arise from construction accidents.

Risks related to injuries or damages arising from construction accidents are inherent in our business. As a policy, we require and uphold high construction safety standards within our project construction teams, in line with those set by reputable industry organizations in China. We also endeavor to instill the highest applicable safety standards and ensure all of our, our contractors’ and our subcontractors’ personnel comply with such safety standards through training, supervision and monitoring. However, we cannot assure you that there will be no construction accidents and related third party claims for damages. We may also be subject to claims from customers or other third parties, resulting from the use of our properties. Any substantial accident or harm caused to third parties during the construction of our projects could damage our reputation and relationship with regulators and customers, and adversely affect our business operations.

We face litigation risks and regulatory disputes in the course of our business.

In the ordinary course of our business, claims and disputes involving project owners, customers, labor, subcontractors, suppliers, business partners and regulatory authorities may be brought against us and by us. Claims may be brought against us for alleged defective or incomplete work, liabilities for defective products, related personal injuries and death, damage to or destruction of property, breaches of warranty and late completion of the project, as well as claims relating to taxes, among others. Such claims could involve actual and liquidated damages. We may also engage in disputes with regulatory authorities on taxation and matters in connection with our business and operations. Negotiation and legal processes for claims and disputes may be lengthy and costly, and result in adverse impact on our business, financial condition and results of operations.

Damage to or other potential losses involving our assets and business may not be covered by insurance.

We maintain property and liability insurance policies with coverage features and insured limits that we believe are consistent with market practice in the property development sector in Shenzhen, China. Nonetheless, the scope of insurance coverage that we can obtain may be limited as we have to consider the commercial reasonableness of the insurance cost. There are also certain types of losses that are currently uninsurable in China. Our contractors may not be sufficiently insured themselves or have the financial ability to absorb any losses that arise with respect to our projects or settle any claims we may have against them. We generally do not maintain any business disruption insurance or key-man insurance. As such, certain types of losses, generally of an unforeseen or catastrophic nature, such as those caused by the outbreak of COVID-19 or other infectious diseases, fires, natural disasters, terrorist acts, , may not be sufficiently, or at all, covered by insurance. If we incur any loss that is not covered by our insurance policies, or the compensated amount is significantly less than our actual loss, our business, financial conditions and results of operations, could be materially and adversely affected.

We are subject to potential environmental liability.

We are subject to a variety of laws and regulations concerning the protection of health and the environment. Environmental laws and regulations that apply to any given development site vary significantly according to the site’s location, environmental condition, the present and former uses of the site and the nature of the adjoining properties. Compliance with environmental laws and regulations may result in delays, may cause us to incur substantial compliance and other costs and can prohibit or severely restrict project development activities. Although we have received environmental assessments by the local PRC environmental regulatory authorities that we are permitted to proceed with our projects, it is possible that these reviews did not reveal all environmental liabilities and the PRC environmental regulatory authorities could in the future curtail our operations. In addition, we also cannot assure you that the PRC government will not change the existing laws and regulations or impose additional or stricter laws or regulations, the compliance of which may cause us to incur significant capital expenditures.

The property development business is subject to claims under statutory quality warranties.

Under PRC law, all property developers in the PRC must provide certain quality warranties for the properties they construct or sell. We will be required to provide these warranties to our tenants and customers. Generally, we receive quality warranties from our third-party contractors with respect to our development projects, which we are permitted to rely upon. If a significant number of claims were brought against us under our warranties and if we were unable to obtain reimbursement for such claims from our third-party contractors in a timely manner or at all, or if the money retained by us to cover our payment obligations under the quality warranties was not sufficient, we could incur significant expenses to resolve such claims or face delays in remedying the related defects, which could in turn harm our reputation, and materially adversely affect our business, financial condition and results of operations.

12

Risks Related to Regulatory Oversight

We may be classified as a passive foreign investment company for U.S. federal income tax purposes, which could result in adverse U.S. federal income tax consequences to U.S. investors.

We are classified as a passive foreign investment company, or a PFIC, for any taxable year if either: (a) at least 75% of our gross income is “passive income” for purposes of the PFIC rules or (b) at least 50% of our assets (determined on the basis of a quarterly average) is attributable to assets that produce or are held for the production of passive income. Passive income for this purpose generally includes dividends, interest, royalties, rent and capital gains. However, rents and gains derived in the active conduct of a trade or business in certain circumstances are considered active income. In applying these tests, we are treated as owning our proportionate share of the assets and earning our proportionate share of the income of any other corporation in which we own, directly or indirectly, 25% or more (by value) of the equity interests.

We believe we were likely classified as a PFIC for the taxable year ending December 31, 2018 and maybe certain other taxable years preceding such taxable year. Based on, among other matters, the historic, current and anticipated composition of our income, assets and operations, certain proposed Treasury Regulations and our market capitalization, however, we do not expect to be classified as a PFIC for the taxable year ending December 31, 2019 or in the foreseeable future. Whether we are classified as a PFIC is a factual determination that depends on, among other matters, the ownership and the composition of the income and assets, as well as the value of the assets (which may fluctuate with our market capitalization) of our group from time to time. Moreover, the application of the PFIC rules with respect to us is unclear in certain respects. The United States Internal Revenue Service, or the IRS, or a court may disagree with our determinations, including the manner in which we determine the value of our assets and the percentage of our assets that are passive assets under the PFIC rules. For example, based on the current and anticipated structure and operations of our group, as well as rules contained in proposed U.S. Treasury Regulations, we intend to treat certain rents and gains from any real property that we hold directly or that is held directly by our subsidiaries as active income. The application of the rules addressing active rental income to our facts is complex, however, and it is possible that final U.S. Treasury Regulations may adversely change these rules or the IRS may not agree with our conclusions. As a result, there can be no assurance that we will not be classified as a PFIC for the taxable year ending December 31, 2019 or for any future taxable year.

If we are or become a PFIC for U.S. federal income tax purposes, U.S. investors may become subject to increased income tax liabilities and burdensome reporting requirements under U.S. federal income tax laws. In particular, because we believe we were likely a PFIC prior to the taxable year ending December 31, 2019, for a U.S. investor who has held our common shares from the period during which we were considered a PFIC, we may continue to be treated as a PFIC even if we cease to be a PFIC unless such investor makes certain “deemed sale” election. See “Item 10. Additional Information—E. Taxation—Certain U.S. Federal Income Tax Considerations—Passive Foreign Investment Company Considerations.”

Regulatory initiatives in the United States, such as the Dodd-Frank Act and the Sarbanes-Oxley Act have increased, and may continue to increase the time and costs of being a U.S. public company and any further changes would likely continue to increase our costs.

In the United States, changes in corporate governance practices due to the Dodd-Frank Act and the Sarbanes-Oxley Act, changes in the continued listing rules of the New York Stock Exchange, or the NYSE, new accounting pronouncements and new regulatory legislation, rules or accounting changes have increased our cost of being a U.S. public company and may have an adverse impact on our future financial position and operating results. These regulatory changes and other legislative initiatives have made some activities more time-consuming and have increased financial compliance and administrative costs for public companies, including foreign private issuers like us. In addition, any future changes in regulatory legislation, rules or accounting may cause our legal and accounting costs to further increase. These new rules and regulations require increasing time commitments and resource commitments from our company, including from senior management. This increased cost could negatively impact our earnings and have a material adverse effect on our financial position results of operations.

The BVI Economic Substance Act may affect our operations.

The British Virgin Islands has recently enacted the Economic Substance (Companies and Limited Partnerships) Act, 2018, or the BVI Economic Substance Act. We are required to comply with the BVI Economic Substance Act. As we are a British Virgin Islands company, compliance obligations include filing notifications and reports for the Company, which need to state whether we are carrying out any relevant activities and if we have satisfied economic substance tests to the extent required under the BVI Economic Substance Act. As it is a new regime, it is anticipated that the BVI Economic Substance Act will evolve and be subject to further clarifications and amendments. We may need to allocate additional resources to keep updated with these developments and may have to make changes to our operations in order to comply with all requirements under the BVI Economic Substance Law. Failure to satisfy these requirements may subject us to penalties under the BVI Economic Substance Act.

13

It may be difficult to serve us with legal process or enforce judgments against our management or us.

We are a British Virgin Islands holding corporation with subsidiaries in Hong Kong and mainland China. Substantially, all of our assets are located in the PRC. In addition, most of our directors and executive officers reside within the PRC or Hong Kong, and substantially all of the assets of these persons are located within the PRC or Hong Kong. It may not be possible to affect service of process within the United States or elsewhere outside the PRC or Hong Kong upon our directors, or executive officers, including effecting service of process with respect to matters arising under United States federal securities laws or applicable state securities laws. The PRC does not have treaties providing for the reciprocal recognition and enforcement of judgments of courts with the United States and many other countries. As a result, recognition and enforcement in the PRC of judgments of a court in the United States or many other jurisdictions in relation to any matter, including securities laws, may be difficult or impossible. An original action may be brought against our assets and our subsidiaries, our directors and executive officers in the PRC only if the actions are not required to be arbitrated by PRC law and only if the facts alleged in the complaint give rise to a cause of action under PRC law. In connection with any such original action, a PRC court may award civil liability, including monetary damages.

No treaty exists between Hong Kong or the British Virgin Islands and the United States providing for the reciprocal enforcement of foreign judgments. However, the courts of Hong Kong and the British Virgin Islands are generally prepared to accept a foreign judgment as evidence of a debt due. An action may then be commenced in Hong Kong or the British Virgin Islands for recovery of this debt. A Hong Kong or British Virgin Islands court will only accept a foreign judgment as evidence of a debt due if:

|

|

• |

the judgment is for a liquidated amount in a civil matter; |

|

|

• |

the judgment is final and conclusive; |

|

|

• |

the judgment is not, directly or indirectly, for the payment of foreign taxes, penalties, fines or charges of a like nature (in this regard, a Hong Kong court is unlikely to accept a judgment for an amount obtained by doubling, trebling or otherwise multiplying a sum assessed as compensation for the loss or damage sustained by the person in whose favor the judgment was given); |

|

|

• |

the judgment was not obtained by actual or constructive fraud or duress; |

|

|

• |

the foreign court has taken jurisdiction on grounds that are recognized by the common law rules as to conflict of laws in Hong Kong or the British Virgin Islands; |

|

|

• |

the proceedings in which the judgment was obtained were not contrary to natural justice (i.e. the concept of fair adjudication); |

|

|

• |

the proceedings in which the judgment was obtained, the judgment itself and the enforcement of the judgment are not contrary to the public policy of Hong Kong or the British Virgin Islands; |

|

|

• |

the person against whom the judgment is given is subject to the jurisdiction of a foreign court; and |

|

|

• |

the judgment is not on a claim for contribution in respect of damages awarded by a judgment, which fall under Section 7 of the Protection of Trading Interests Ordinance, Chapter 7 of the Laws of Hong Kong. |

Enforcement of a foreign judgment in the PRC, Hong Kong or the British Virgin Islands may also be limited or affected by applicable bankruptcy, insolvency, liquidation, arrangement and moratorium, or similar laws relating to or affecting creditors’ rights generally, and will be subject to a statutory limitation of time within which proceedings may be brought.

Our status as a foreign private issuer in the United States exempts us from certain of the reporting requirements under the Securities Exchange Act of 1934, and corporate governance standards of the NYSE, limiting the protections and information afforded to investors.

We are a foreign private issuer within the meaning of the rules under the Securities Exchange Act of 1934. As such, we are exempt from certain provisions applicable to U.S. domestic public companies, including:

|

|

• |

the rules under the Securities Exchange Act of 1934 requiring the filing with the SEC of quarterly reports on Form 10-Q, current reports on Form 8-K and annual reports on Form 10-K; |

|

|

• |

the section of the Securities Exchange Act of 1934 regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; |

|

|

• |

the section of the Securities Exchange Act of 1934 requiring directors, officers and 10% holders to file public reporting of their stock ownership and trading activities and imposing liability on insiders who profit from trades made in a short period of time; |

|

|

• |

the selective disclosure rules under Regulation FD restricting issuers from selectively disclosing material nonpublic information; and |

|

|

• |

the sections of the Securities Exchange Act of 1934 requiring insiders to file public reports of their stock ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction (i.e., a purchase and sale, or sale and purchase, of the issuer’s equity securities within less than six months). |

14