Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 20-F

(Mark one)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission File Number: 001-31583

Nam Tai Property Inc.

(Exact name of registrant as specified in its charter)

British Virgin Islands

(Jurisdiction of incorporation or organization)

Gushu Community,

Xixiang Street,

Baoan, Shenzhen,

People’s Republic of China

(Address of principal executive offices)

Shan-Nen Bong, Chief Financial Officer

Gushu Community, Xixiang Street, Baoan, Shenzhen,

People’s Republic of China

Tel: (755) 2749 0666; Fax: (755) 2747 2636;

E-mail: snbong@namtai.com.cn

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of Each Class |

Name of each exchange on which registered | |

| Common shares, $0.01 par value per share | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act.

None.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None.

As of December 31, 2015 there were 36,699,572 common shares of the registrant outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ¨ Yes x No

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule12b-2 of the Exchange Act (Check one):

Large accelerated ¨ Accelerated filer x Non-accelerated filer ¨

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP x |

International Financial Reporting Standards as issued by the International Accounting Standards Board ¨ |

Other ¨ |

If “Other” has been checked, indicate by check mark which financial statement item the registrant has elected to follow: ¨ Item 17 ¨ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Exchange Act). ¨ Yes x No

Table of Contents

i

Table of Contents

NOTE REGARDING USE OF FORWARD LOOKING STATEMENTS

This Annual Report on Form 20-F (this “Report”) contains forward-looking statements. Words such as “aim”, “anticipate”, “believe”, “consider”, “continue”, “estimate”, “expect”, “forecast”, “going forward”, “intend”, “ought to”, “plan”, “predict”, “potential”, “project”, “propose”, “seek”, “may”, “might”, “can”, “could”, “will”, “would”, “shall”, “should”, “is / are likely to” and the negative forms of these words and other similar expressions are intended to identify forward-looking statements. Forward-looking statements include information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, and the effects of future regulation and the effects of competition. We have based these forward-looking statements largely on our current beliefs, expectations and projections about future events and financial trends affecting our business. These statements are subject to many important factors, certain risks and uncertainties that could cause actual results to differ materially from those anticipated in the forward-looking statements. Factors that might cause such a difference include, but are not limited to those discussed in the section entitled “Risk Factors” under ITEM 3. Key Information.

You should not place undue reliance on forward-looking statements, which reflect management’s view only as of the date of this Report. The Company undertakes no duty to update any forward-looking statement to conform the statement to actual results or changes in management’s expectations. You should also carefully review the risk factors described in other documents the Company files from time to time with the U.S. Securities and Exchange Commission, which we refer to in this Report as the SEC.

FINANCIAL STATEMENTS AND CURRENCY PRESENTATION

The Company prepares its consolidated financial statements in accordance with accounting principles generally accepted in the United States of America and publishes its financial statements in United States dollars.

Except where the context otherwise requires and for purposes of this Report only:

| • | “we”, “us”, “our company”, “our”, the “Company” and “Nam Tai” refer to Nam Tai Property Inc. and, in the context of describing our operations, also include our PRC operating companies; |

| • | “Board” and “Board of Directors” refers to the board of directors of our Company; |

| • | “shares” refer to our common shares, $0.01 par value; |

| • | “China” or “PRC” refers to the People’s Republic of China, excluding Taiwan, Hong Kong and Macao; |

| • | “Taiwan” refers to the Taiwan province of the People’s Republic of China; |

| • | “Hong Kong” refers to the Hong Kong Special Administrative Region of the People’s Republic of China and “HK$” refers to the legal currency of Hong Kong; |

| • | “Macao” refers to the Macao Special Administrative Region of the People’s Republic of China; and |

| • | all references to “Renminbi”, “RMB” or “yuan” are to the legal currency of China; all references to “U.S. dollars”, “US$” or “$” are to the legal currency of the United States. |

1

Table of Contents

| ITEM 1. | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS |

Not applicable to Nam Tai.

| ITEM 2. | OFFER STATISTICS AND EXPECTED TIMETABLE |

Not applicable to Nam Tai.

| ITEM 3. | KEY INFORMATION |

Our historical consolidated financial statements are prepared in accordance with generally accepted accounting principles in the United States, or U.S. GAAP, and are presented in U.S. dollars. The following selected consolidated statements of income data for each of the three years in the period ended December 31, 2015 and the consolidated balance sheets data as of December 31, 2014 and 2015 are derived from our consolidated financial statements and notes thereto included in this Report. The selected consolidated statements of comprehensive income data for each of the two-year periods ended December 31, 2011 and 2012 and the consolidated balance sheets data as of December 31, 2011, 2012 and 2013 were derived from our audited financial statements, which are not included in this Report. The following data should be read in conjunction with the Section of the Report entitled ITEM 5. Operating and Financial Review and Prospects and our consolidated financial statements including the related footnotes which are included in the F pages of this Report immediately following page 58.

2

Table of Contents

Selected Financial Information

| Year ended December 31, | ||||||||||||||||||||

| Consolidated statements of comprehensive income data(1): | 2011 | 2012 | 2013 | 2014 | 2015 | |||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Rental income |

$ | 27 | $ | 92 | $ | 136 | $ | 2,341 | $ | 2,978 | ||||||||||

| Rental expenses |

— | (62 | ) | (68 | ) | (1,073 | ) | (1,949 | ) | |||||||||||

| Net rental income |

27 | 30 | 68 | 1,268 | 1,029 | |||||||||||||||

| Cost and expenses: |

||||||||||||||||||||

| General and administrative expenses |

(7,290 | ) | (4,612 | ) | (7,465 | ) | (13,417 | ) | (13,862 | ) | ||||||||||

| Impairment loss on goodwill |

(2,951 | ) | — | — | — | — | ||||||||||||||

| Operating loss |

(10,214 | ) | (4,582 | ) | (7,397 | ) | (12,149 | ) | (12,833 | ) | ||||||||||

| Other income (expenses), net |

3,680 | 2,164 | 6,339 | (2,379 | ) | (7,389 | ) | |||||||||||||

| Interest income |

2,676 | 2,037 | 4,939 | 9,173 | 8,054 | |||||||||||||||

| Interest expenses |

— | — | — | (61 | ) | (360 | ) | |||||||||||||

| (Loss) income before income tax |

(3,858 | ) | (381 | ) | 3,881 | (5,416 | ) | (12,528 | ) | |||||||||||

| Income tax credit (expense) |

1,574 | (2,501 | ) | 1,378 | — | — | ||||||||||||||

| (Loss) income from continuing operations, net of income tax |

(2,284 | ) | (2,882 | ) | 5,259 | (5,416 | ) | (12,528 | ) | |||||||||||

| Income (loss) from discontinued operations, net of income tax |

2,789 | 69,803 | (4,962 | ) | (20,172 | ) | (630 | ) | ||||||||||||

| Consolidated net income (loss) attributable to Nam Tai shareholders |

505 | 66,921 | 297 | (25,588 | ) | (13,158 | ) | |||||||||||||

| Other comprehensive income |

— | — | — | — | — | |||||||||||||||

| Consolidated comprehensive income (loss) attributable to Nam Tai shareholders |

505 | 66,921 | 297 | (25,588 | ) | (13,158 | ) | |||||||||||||

| Earnings per share: |

||||||||||||||||||||

| Basic earnings per share |

||||||||||||||||||||

| Basic (loss) earnings per share from continuing operations |

$ | (0.05 | ) | $ | (0.06 | ) | $ | 0.12 | $ | (0.12 | ) | $ | (0.31 | ) | ||||||

| Basic earnings (loss) per share from discontinued operations |

$ | 0.06 | $ | 1.55 | $ | (0.11 | ) | $ | (0.46 | ) | $ | (0.01 | ) | |||||||

| Basic earnings (loss) per share |

$ | 0.01 | $ | 1.49 | $ | 0.01 | $ | (0.58 | ) | $ | (0.32 | ) | ||||||||

| Diluted earnings per share |

||||||||||||||||||||

| Diluted (loss) earnings per share from continuing operations |

$ | (0.05 | ) | $ | (0.06 | ) | $ | 0.12 | $ | (0.12 | ) | $ | (0.31 | ) | ||||||

| Diluted earnings (loss) per share from discontinued operations |

$ | 0.06 | $ | 1.54 | $ | (0.11 | ) | $ | (0.46 | ) | $ | (0.01 | ) | |||||||

| Diluted net earnings (loss) per share |

$ | 0.01 | $ | 1.48 | $ | 0.01 | $ | (0.58 | ) | $ | (0.32 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Consolidated balance sheet data: | 2011 | 2012 | 2013 | 2014 | 2015 | |||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||

| Cash and cash equivalents |

118,510 | 157,838 | 68,707 | 212,760 | 157,371 | |||||||||||||||

| Short term investments |

34,825 | 49,824 | 201,565 | 85,295 | 49,983 | |||||||||||||||

| Working capital(2) |

275,651 | 313,909 | 316,478 | 280,159 | 226,568 | |||||||||||||||

| Land use rights and property, plant and equipment, net |

45,203 | 41,382 | 41,818 | 35,590 | 38,392 | |||||||||||||||

| Current assets of discontinued operations |

255,378 | 373,974 | 124,783 | 630 | 106 | |||||||||||||||

| Total assets |

457,743 | 636,044 | 494,419 | 367,753 | 271,480 | |||||||||||||||

| Short-term debts |

— | — | — | 40,000 | — | |||||||||||||||

| Current liabilities of discontinued operations |

119,492 | 243,760 | 126,412 | 173 | 160 | |||||||||||||||

| Total shareholders’ equity |

322,206 | 362,792 | 363,390 | 316,952 | 265,565 | |||||||||||||||

| Common shares |

448 | 448 | 453 | 426 | 367 | |||||||||||||||

| Total dividend per share(3) |

0.28 | 0.60 | 0.08 | 0.08 | 0.08 | |||||||||||||||

| Total number of common shares issued |

44,804 | 44,804 | 45,273 | 42,618 | 36,700 | |||||||||||||||

| (1) | The Company’s consolidated statements of comprehensive income from 2011 to 2013 have been adjusted according to the reclassified profit and loss resulting from discontinued operations. |

| (2) | Working Capital represents the excess of current assets over current liabilities. |

| (3) | For 2011, 2012, 2013, 2014 and 2015, the Company declared a dividend payable quarterly in 2012, 2013, 2014, 2015 and 2016, respectively. See the table entitled “Dividends declared for 2016” in ITEM 8. Financial Information – Dividends on page 44 of this Report for the schedule of dividend payments for 2016. |

3

Table of Contents

Risk Factors

We may from time to time make written or oral forward-looking statements. Written forward-looking statements may appear in this document and other documents filed with the SEC, in press releases, in reports to shareholders, on our website, and other documents. The Private Securities Reform Act of 1995 contains a safe harbor for forward-looking statements on which the Company relies in making such disclosures. In connection with this “safe harbor”, we are hereby identifying important factors that could cause actual results to differ materially from those contained in any forward-looking statements made by us or on our behalf. Any such statements are qualified by reference to the following cautionary statements.

You should carefully consider each of the following risks and uncertainties associated with our company and the ownership of our securities. You should pay particular attention to the fact that we conduct substantially all of our operations in China and are governed by a legal and regulatory environment that differs significantly from that of the United States. Additional risks referred to elsewhere in this annual report, and other risks which are not currently known to us or that we currently deem immaterial may also have a material adverse impact on our business operations and financial condition.

Risks Related to Our Business

A slow-down of economic growth in China may adversely affect our growth and financial performance.

Our business is sensitive to the current China economic downturn. In recent years, the PRC economy has seen a slowdown related to the international financial crisis in 2008, and a slower growth in 2013, 2014 and 2015. For 2016, China’s economic conditions remain uncertain and unpredictable. With the government lowering economic growth targets, some forecasters are predicting a significant slowdown.

The PRC economy also faces challenges in the short to medium term. Continued turbulence in the international markets and prolonged declines in consumer spending as well as any slowdown of economic growth in China may adversely affect our liquidity and financial condition, and significantly affect the demand for our commercial and residential units. A wide spread change in spending habits may also lead to tighter credit markets, drops in business and consumer confidence and dramatic changes in business and consumer behaviors. In response to the perceived uncertainty in China’s economic conditions, commercial tenants could delay, reduce or cancel rental of office space, and homebuyers could also defer, reduce or cancel purchases of residential units, and thereby adversely affect our results of operations

We may encounter difficulties in transforming our core business, which could adversely affect our growth and business prospects.

We are a property development and management company located in Shenzhen, China. Prior to becoming a property development and management company, we were an electronic manufacturing service (EMS) company. In April 2014, we ceased our liquid crystal display modules (LCM) manufacturing business and turned our focus to re-developing two parcels of land in Gushu and Guangming, Shenzhen, China, by converting these two parcels of land that formally housed our manufacturing facilities into high-end commercial complexes.

Currently we focus our efforts on redeveloping these two parcels of land under the theme of “Smart Complex” where innovative intelligent equipment and facilities along with up-to-date technologies will be deployed for the buildings within the two complexes designated as “Namtai Inno City” and “Namtai Inno Park”, respectively. Upon the completion of the development, we will become the landlord and manager of the commercial complexes and, as a result of which, our core business will be transformed from the EMS industry to property development and management. During this transition development period, all overheads expenses, development costs and dividend will be funded from interest income, rental income together with our cash on hand and bank facilities, which we believe will be sufficient. Subsequently, we believe our principal income in the future will be derived from the rental income from the commercial complexes.

We cannot assure you that we will be able to obtain all requisite permits and approvals from relevant government authorities in relation to the redevelopment of the land, or to successfully redevelop the two parcels of land and the development of these real estate projects is subject to significant risks and uncertainties, including without limitation the following:

| • | we do not currently have strong brand recognition or relationships in the real estate development and management business; |

| • | we may not be able to obtain all necessary government approvals or all requisite permits and approvals from relevant government authorities in relation to the redevelopment of the land, or to successfully redevelop the two parcels of land for our property development projects in a timely manner or at all; |

| • | we face intense competition from real estate developers that are already in the business for years; |

4

Table of Contents

| • | our experience and expertise gained from EMS business may not be highly relevant or applicable to real estate development and management business; and |

| • | we may not be able to generate enough revenues to offset our costs in our real estate development and management business. |

If we are not successful in development of our two property development projects, our growth, business, financial condition and results of operations could be adversely affected.

We may not be able to compete successfully against our current or future competitors.

Some of our current and future competitors have competitive advantages over us, including more well-known brands, new and different business models, lower cost, larger customer bases, more experience in real estate development and greater financial, marketing, technology, human resources, and other expertise and resources. We cannot assure that we will always be able to successfully compete against our current or future competitors. If we are unable to compete successfully with our current or future competitors, our business, financial condition and results of operations could be adversely affected.

We may not have adequate financing, whether through bank loans or other arrangements, to fund our property developments, and such capital resources may not be available on commercially reasonable terms, or at all.

As we transform our core business from the EMS industry to property development and management, we must make significant investments in property developments. Property development is capital intensive. We plan to finance our property developments with interest income together with our cash on hand and bank facilities. We cannot assure you that we will be able to generate sufficient interest income or those banks or other lenders will grant us sufficient financings in the future as we expect. There are certain PRC laws and regulations which govern financing policies on PRC financial institutions for the property development sector and tighten the criteria for banks to provide loans to property development enterprises. The PRC government may further tighten financing policies on PRC financial institutions for the property development sector. These property-related financing policies may limit our ability and flexibility to use bank borrowings to finance our property development projects and therefore may require us to maintain a relatively high level of internally generated cash.

We may fail to obtain, or experience material delays in obtaining, requisite certificates, licenses, permits or governmental approvals for our property developments, and as a result our development plans, business, results of operations and financial condition may be materially and adversely affected.

Currently, we have two properties planned for development, including: (i) the site of our existing Shenzhen manufacturing facilities in Gushu of approximately 0.6 million square feet, which we have named “Namtai Inno City”; and (ii) the raw land of approximately 1.1 million square feet in the Guangming Hi-Tech Industrial Park, which we have named “Namtai Inno Park”. We plan to develop them under the theme of “Smart Complex” where innovative intelligent equipment and facilities along with up-to-date technologies will be deployed for the buildings within the complexes. Upon the completion of development of these two parcels of land, we will become the landlord and manager of the commercial complexes and, as a result of which, our core business will be transformed from the EMS industry to property development and management.

Property development in the PRC is heavily regulated. Property developers in China must abide by various laws and regulations, including implementation rules promulgated by local governments to enforce these laws and regulations. During various stages of our property development projects, we are required to obtain and maintain various certificates, licenses, permits, certificates and governmental approvals, including but not limited to qualification certificates, land use rights certificates, construction land planning permits, construction work planning permits, construction works commencement permits, pre-sale permits and completion certificates. Before the government authorities issue any certificate, license or permit, we must also meet specific conditions. We cannot assure you that we will be able to adapt to new PRC land policies that may come into effect from time to time with respect to the property development industry or that we will not encounter other material delays or difficulties in fulfilling the necessary conditions to obtain all necessary certificates, licenses or permits for our property developments in a timely manner, or at all, in the future. If we fail to obtain or encounter significant delays in obtaining the necessary certificates, licenses or permits we will not be able to continue with our development plans, and our business, results of operations and financial condition may be adversely affected.

We may be unable to complete our property developments on time or at all.

The progress and costs for a development project can be adversely affected by many factors, including, without limitation:

| • | delays in obtaining necessary licenses, permits or approvals from government agencies or authorities; |

| • | failure by our third-party contractors to comply with our designs, specifications or standards; |

| • | difficult geological situations or other geotechnical issues; |

5

Table of Contents

| • | onsite labor disputes or work accidents; and |

| • | natural catastrophes or adverse weather conditions, including strong winds, storms, floods, and earthquakes. |

Any construction delays, or failure to complete a project according to our planned specifications or budget, may delay our property leasing timetable, which could adversely affect our revenues, cash flows and our reputation.

Increases in the price of raw materials or labor costs and the fluctuation of real estate prices in China, generally, and in Shenzhen, particularly may increase our cost of sales and reduce our revenues and earnings.

We outsource the design and construction of our projects to third-party service providers or contractors. Any increase in labor costs or other construction related costs may result in an increase in our construction costs. In the event that the price of any raw materials, including cement, concrete blocks and bricks, increase in the future, such increase could be passed on to us by our contractors, and our construction costs would increase accordingly. The increase in construction cost will inevitably increase our cost of sales which in turn will reduce our earnings from both renting or selling of the properties in the future. Our future revenues and earnings from renting or selling of properties are subject to the fluctuation of the real estate prices in China, in particularly in Shenzhen.

We may be required to write down our long-lived assets and assets held for sale, which could result in a significant impairment charge that would adversely affect our operating results.

As of December 31, 2015, we had $38.4 million in long-lived assets and $20.3 million in assets held for sale on our balance sheet. The valuation of our long-lived assets and assets held for sale requires us to make assumptions about future interest income. Our assumptions are used to forecast future undiscounted cash flows . Given the current economic environment, uncertainties regarding the duration and severity of these conditions, forecasting future business is difficult and subject to modification. If actual market conditions differ or our forecasts change, we may be required to reassess long-lived assets and we may have to record an impairment charge. Any impairment charge relating to long-lived assets would have the effect of decreasing our earnings or increasing our losses in such period. If we are required to take a substantial impairment charge, our operating results could be materially adversely affected in the periods and year in which the charge is incurred.

Our insurance coverage may not be sufficient to cover our potential liability or losses and as a result our business, results of operations and financial condition may be materially and adversely affected.

We face risks during our transition to the property development and management business. Although we currently maintain property insurance for our buildings in the PRC and public liability insurance for our Shenzhen manufacturing facilities and our Wuxi manufacturing facilities, these insurances may not be adequate for either our existing core business or the business we plan to enter into in the future. In the event of certain incidents such as major earthquakes, hurricanes, tsunamis, war, acts of terrorism, pandemics and flood, and their consequences, we may not be covered adequately, or at all, by our insurance, as a result of which our business, results of operations and financial condition may be materially and adversely affected.

The PRC legal system has inherent uncertainties that could materially and adversely impact our ability to enforce the agreements governing our properties and their development and to do business.

We occupy our manufacturing facilities under China land use agreements with agencies of the PRC government. Our operations depend on our relationship with the local governments in the regions which our facilities are located. Our operations and prospects could be materially and adversely affected by the failure of the local government to honor these agreements or an adverse change in the law governing them. In the event of a dispute, enforcement of these agreements could be difficult in China. Unlike the United States, China has a civil law system based on written statutes in which judicial decisions have limited precedential value. The government of China has enacted laws and regulations dealing with economic matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. However, its experience in implementing, interpreting and enforcing these laws and regulations is limited, and our ability to enforce commercial claims or to resolve commercial disputes in China is unpredictable. These matters may be subject to the exercise of considerable discretion by agencies of the PRC government, and forces and factors unrelated to the legal merits of a particular matter or dispute may influence their determination.

Changes to PRC tax laws and heightened efforts by the PRC’s tax authorities to increase revenues have subjected us to greater taxes.

Under PRC law before 2008, we were afforded a number of tax concessions by, and tax refunds from, China’s tax authorities on a substantial portion of our operations in China by reinvesting all or part of the profits attributable to our PRC manufacturing operations. However, on March 16, 2007, the PRC government enacted a unified enterprise income tax law or EIT, which became effective on January 1, 2008. Prior to the EIT, as a foreign invested enterprise, or “FIE”, located in Shenzhen, China, our PRC subsidiaries enjoyed a national income tax rate of 15% and were exempted from the 3% local income tax. The preferential tax treatment given to our subsidiaries in the PRC as a result of reinvesting their profits earned in previous years in the PRC also expired on January 1, 2008. Under the EIT, most domestic enterprises and FIEs are subject to a single PRC enterprise income tax rate of 25% from 2012 onwards. For information on the EIT rates as announced by the PRC’s State Council for the transition period until year 2013, please see the table in ITEM 5. Operating and Financial Review and Prospects on page 22 of this Report.

6

Table of Contents

We base our tax position upon the anticipated nature and conduct of our business and upon our understanding of the tax laws of the various administrative regions and countries in which we have assets or conduct activities; however, our tax position is subject to review and possible challenge by taxing authorities and to possible changes in law, which may have retroactive effect. According to Circular of the State Administration of Taxation on Issues Related to the End of Various Preferential Tax Policies for Foreign and Foreign-Invested Enterprises (STA [2008] No. 23) published by the State Administration of Taxation of the PRC) on February 27, 2008, a FIE may be required to pay back the taxes previously exempted as a result of the preferential tax treatment enjoyed in accordance with the Income Tax Law of People’s Republic of China for Foreign Investment Enterprises and Foreign Enterprise, if such FIE no longer meets the conditions for preferential tax treatment after 2008 due to a change in its nature of business or if the term of its business operation is determined to be less than ten years since its inception. As we have ceased our production operations at all our manufacturing facilities and are transforming from the EMS industry to property development and management, our tax position may be subject to review by relevant taxing authorities, and we cannot determine in advance whether, or the extent to which such tax policy may require us to pay taxes or make payments in lieu of taxes.

We may be deemed to be an investment company under the United States Investment Company Act of 1940, which could have a significant negative impact on our results of operations.

We may be deemed to be an investment company under the United States Investment Company Act of 1940 (the “1940 Act”), and may suffer adverse consequences as a result. Generally, the 1940 Act provides that a company is an investment company if the company (i) is, holds itself out as or proposes to be engaged primarily in the business of investing, reinvesting or trading in securities or (ii) is engaged or proposes to engage in the business of investing, reinvesting, owning, holding or trading in securities and owns or proposes to acquire “investment securities” having a value exceeding 40% of the value of its total assets (exclusive of U.S. government securities or cash items) on an unconsolidated basis. For purposes of the foregoing test, investment securities include, among other things, securities of non-majority owned businesses.

Due to deteriorating business condition, we ceased our original core business of LCM production in April 2014, and we transformed our core business from the EMS industry to property development and management. In addition, we also completed the sale of all of our EMS manufacturing equipment as of September 2014 to third parties and our last remaining production line in Wuxi had been removed in September 2014. As a result of these transactions, we have a significant amount of cash. See ITEM 4. Information on the Company — Historical Business Overview for additional information. Consequently, there is a risk that we could be deemed to be an investment company.

We intend to continue to conduct our businesses and operations so as to avoid being deemed to be an investment company. If, nevertheless, we were deemed to be an investment company, because we are a foreign company, in the absence of a grant by SEC of an exemptive order permitting us to register under the 1940 Act, the 1940 Act would prohibit us and any person deemed to be an underwriter of our securities from offering for sale, selling or delivering after sale, in connection with a public offering, any security issued by the Company in the United States. Additionally, we may be unable to continue operating as we currently do and might need to acquire or sell assets that we would not otherwise acquire or sell in order to avoid being treated as an “investment company” as defined under the 1940 Act. We may incur significant costs and management time in this regard, which could have a significant negative impact on our results of operations.

We believe we were a passive foreign investment company for 2015 and we may be a passive foreign investment company for 2016, which could result in adverse U.S. federal income tax consequences for U.S. investors.

The determination of whether we are a passive foreign investment company, or PFIC, in any taxable year is made on an annual basis after the close of that year and depends on the composition of our income and the nature and value of our assets, including goodwill. Specifically, we will be classified as a PFIC if, after applying relevant look-through rules with respect to the income and assets of subsidiaries, either (i) 75% or more of our gross income for such taxable year is passive income (the “PFIC income test”), or (ii) 50% or more of the value of our assets (based on an average of the quarterly values of the assets during such year) is attributable to assets that either produce passive income or are held for the production of passive income (the “PFIC asset test”).

7

Table of Contents

We believe we were a PFIC for U.S. federal income tax purposes for 2015 based on both the PFIC income test and the PFIC asset test. The PFIC asset test requires a determination of the fair market value of each asset and a determination of whether such asset produces or is held for the production of passive income and involves complex legal issues. We have not made a determination of the fair market value of our assets for 2015 or currently in 2016, and we cannot anticipate our market capitalization for 2016. Accordingly, we may be treated as a PFIC for 2016 under the PFIC asset test, or under the PFIC income test, or both. Our characterization as a PFIC during any year could result in adverse U.S. federal income tax consequences for U.S. investors. For example, if we were a PFIC in 2015 or in any other taxable year, U.S. investors who owned our common shares generally would be subject to increased U.S. tax liabilities and reporting requirements.

Given the complexity of the issues regarding our classification as a PFIC, U.S. investors are urged to consult their own tax advisors for guidance as to our PFIC status. For further discussion of the adverse U.S. federal income tax consequences arising from the classification as a PFIC see “Taxation—United States Federal Income Tax Consequences” beginning on page 48 of this Report.

Changes in foreign exchange regulations of China could adversely affect our operating results.

Some of our earnings are denominated in yuan, the base unit of the RMB. The People’s Bank of China and the State Administration of Foreign Exchange (“SAFE”) regulate the conversion of RMB into foreign currencies. Under the current unified floating exchange rate system, the People’s Bank of China publishes a daily exchange rate for RMB based on the previous day’s dealings in the inter-bank foreign exchange market. Financial institutions may enter into foreign exchange transactions at exchange rates within an authorized range above or below the exchange rate published by the People’s Bank of China according to the market conditions. Since 1996, the PRC government has issued a number of rules, regulations and notices regarding foreign exchange control designed to provide for greater convertibility of RMB. Under such regulations, any FIE must establish a “current account” and a “capital account” with a bank authorized to deal in foreign exchange. Currently, FIEs are able to exchange RMB into foreign exchange currencies at designated foreign exchange banks for settlement of current account transactions, which include payment of dividends based on the board resolutions authorizing the distribution of profits or dividends of the company concerned, without the approval of SAFE. Conversion of RMB into foreign currencies for capital account transactions, which include the receipt and payment of foreign currencies for loans and capital contributions, continues to be subject to limitations and requires the approval of SAFE. There can be no assurance that we will be able to obtain sufficient foreign currencies to make relevant payments or satisfy other foreign currency requirements in the future.

Changes in currency exchange rates involving the RMB have and could continue to significantly affect our financial results.

For the year of 2014 and earlier, our functional currencies are U.S. dollars and Hong Kong dollars. Our financial results have been affected by currency fluctuations, resulting in total foreign exchange gains and losses.

Effective from April 1, 2015, the Company’s subsidiaries in China changed their functional currency from the U.S. dollar to the Renminbi. This change was made upon the progress of the property development projects in China causing the Company’s subsidiaries primary operating activities to be in Renminbi and making the entities primarily generate and expend cash in Renminbi. The reporting currency is U.S. dollars. The fluctuation of foreign exchange rate will affect the amount for translation the financial statement in function currency to reporting currency and the impact was recorded in other comprehensive income (loss) in the equity.

Our declaration and payment of dividends is not assured. Although our Board has decided dividends for 2012, 2013, 2014, 2015 and 2016, we may not declare or pay dividends thereafter.

We decided the payment of quarterly dividends of $0.07, $0.15, $0.02, $0.02 and $0.02 per share for 2012, 2013, 2014, 2015 and 2016, respectively. The payment of dividends in 2012, 2013, 2014, 2015 and 2016 does not necessarily mean that dividend payments will continue thereafter. Whether future dividends after 2016 will be declared will depend on our future growth and earnings at each relevant period, of which there can be no assurance, and our cash flow needs for our business transformation. Accordingly, there can be no assurance that cash dividends on the Company’s common shares will be declared beyond those declared for 2016, what the amounts of such dividends will be or whether such dividends, once declared for a specific period, will continue for any future period, or at all. For additional information on the dividends we have declared for 2015 and historically, please see ITEM 8. Financial Information — Dividends on page 44 of this Report.

Payment of dividends by our subsidiaries in the PRC to our subsidiaries outside of the PRC and to us, as the ultimate parent, is subject to restrictions under PRC law. If we determine to continue our payment of dividends to our shareholders, the PRC tax law could force us to reduce the amount of dividends we have historically paid to our shareholders or possibly eliminate our ability to pay any dividends at all.

Under PRC law, dividends may only be paid out of distributable profits. Distributable profits with respect to our subsidiaries in the PRC refers to after-tax profits as determined in accordance with accounting principles and financial regulations applicable to PRC enterprises (“PRC GAAP”) less any recovery of accumulated losses and allocations to statutory funds that we are required to make. Any distributable profits that are not distributed in a given year are retained and available for distribution in subsequent years. The calculation of distributable profits under PRC GAAP differs in many respects from the calculation under U.S. GAAP. As a result, our subsidiaries in PRC may not be able to pay a dividend in a given year as determined under U.S. GAAP. China’s tax authorities may also change the determination of income which would limit our PRC subsidiaries’ ability to pay dividends and make other distributions.

8

Table of Contents

Prior to the EIT law, which became effective on January 1, 2008, PRC-organized companies were exempt from withholding taxes with respect to earnings distributions, or dividends, paid to shareholders of PRC companies outside the PRC. However, under the new EIT Law, dividends payable to foreign investors which are derived from sources within the PRC will be subject to income tax at the rate of 5% to 15% by way of withholding unless the foreign investors are companies incorporated in countries which have tax treaty agreements with the PRC and then the rate agreed by both parties will be applied. For example, under the terms of the tax treaty between Hong Kong and the PRC, which became effective in December 2006, distributions from our PRC subsidiaries to our Hong Kong subsidiary, will be subject to a withholding tax at a rate ranging from 5% to 10%, depending on the extent of ownership of equity interests held by our Hong Kong subsidiary in our PRC enterprises. As a result of this new PRC withholding tax, amounts available to us in earnings distributions from our PRC enterprises will be reduced. Since we derive most of our profits from our subsidiaries in PRC, the reduction in amounts available for distribution from our PRC enterprises could, depending on the income generated by our PRC subsidiaries, force us to reduce, or possibly eliminate, the dividends we have paid to our shareholders historically. For this reason, or other factors, we may decide not to declare dividends in the future. If we do pay dividends, we will determine the amounts when they are declared and even if we do declare dividends in the future, we may not continue them in any future period.

The market price of our shares will likely be subject to substantial price and volume fluctuations.

The markets for equity securities have been volatile and the price of our common shares has been and could continue to be subject to wide fluctuations in response to variations in our operating results, news announcements, trading volume, sales of common shares by our officers, directors and our principal shareholders, customers, suppliers or other publicly traded companies, general market trends both domestically and internationally, currency movements and interest rate fluctuations. Other events, such as the issuance of common shares upon the exercise of our outstanding stock options could also materially and adversely affect the prevailing market price of our common shares.

Further, the stock markets have often experienced extreme price and volume fluctuations that have affected the market prices of the equity securities of many companies and that have been unrelated or disproportionate to the operating performance of such companies. These fluctuations may materially and adversely affect the market price of our common shares.

Our senior management owns a large portion of our common stock allowing them to control or substantially influence the outcome of matters requiring shareholder approval.

On January 31, 2016, members of our senior management and our Board of Directors as a group beneficially owned approximately 36.4% of our common shares. As a result, acting together, they may be able to control and substantially influence the outcome of all matters requiring approval by our shareholders, including the election of directors and approval of significant corporate transactions. This ability may have the effect of delaying or preventing a change in control of Nam Tai, or causing a change in control of Nam Tai that may not be favored by our other shareholders.

Regulatory initiatives in the United States, such as the Dodd-Frank Act and the Sarbanes-Oxley Act have increased, and may continue to increase the time and costs of being a U.S. public company and any further changes would likely continue to increase our costs.

In the United States, changes in corporate governance practices due to the Dodd-Frank Act and the Sarbanes-Oxley Act, changes in the continued listing rules of the New York Stock Exchange, new accounting pronouncements and new regulatory legislation, rules or accounting changes have increased our cost of being a U.S. public company and may have an adverse impact on our future financial position and operating results. These regulatory changes and other legislative initiatives have made some activities more time-consuming and have increased financial compliance and administrative costs for public companies, including foreign private issuers like us. In addition, any future changes in regulatory legislation, rules or accounting may cause our legal and accounting costs to further increase. These new rules and regulations require increasing time commitments and resource commitments from our company, including from senior management. This increased cost could negatively impact our earnings and have a material adverse effect on our financial position results of operations.

9

Table of Contents

Due to inherent limitations, there can be no assurance that our system of disclosure and internal controls and procedures will be successful in preventing all errors or fraud, or in informing management of all material information in a timely manner.

Our management, including the Chief Executive Officer and the Chief Financial Officer, does not expect that our disclosure controls and internal controls and procedures will prevent all errors and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system reflects that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company have been or will be detected. These inherent limitations include the realities that judgments in decision-making can be faulty and that breakdowns can occur simply because of error or mistake. Additionally, controls can be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the control.

The design of any system of controls is also based in part upon certain assumptions about the likelihood of future events. There can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Over time, a control may become inadequate because of changes in conditions, or the degree of compliance with the policies or procedures may deteriorate. Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur or may not be detected.

There are inherent uncertainties involved in estimates, judgments and assumptions used in the preparation of financial statements in accordance with U.S. GAAP. Any changes in estimates, judgments and assumptions could have a material adverse effect on our business, financial position and results of operations.

The consolidated financial statements included in the periodic reports we file with the SEC are prepared in accordance with U.S. GAAP. The preparation of financial statements in accordance with U.S. GAAP involves making estimates, judgments and assumptions that affect reported amounts of assets (including intangible assets), liabilities and related reserves, revenues, expenses and income. Estimates, judgments and assumptions are inherently subject to changes in the future, and any such changes could result in corresponding changes to the amounts of assets, liabilities, revenues, expenses and income. Any such changes could have a material adverse effect on our financial position and results of operation.

It may be difficult to serve us with legal process or enforce judgments against our management or us.

We are a British Virgin Islands holding corporation with subsidiaries in Hong Kong and China. Substantially, all of our assets are located in the PRC. In addition, most of our directors and executive officers reside within the PRC or Hong Kong, and substantially all of the assets of these persons are located within the PRC or Hong Kong. It may not be possible to affect service of process within the United States or elsewhere outside the PRC or Hong Kong upon our directors, or executive officers, including effecting service of process with respect to matters arising under United States federal securities laws or applicable state securities laws. The PRC does not have treaties providing for the reciprocal recognition and enforcement of judgments of courts with the United States and many other countries. As a result, recognition and enforcement in the PRC of judgments of a court in the United States or many other jurisdictions in relation to any matter, including securities laws, may be difficult or impossible. An original action may be brought against our assets and our subsidiaries, our directors and executive officers in the PRC only if the actions are not required to be arbitrated by PRC law and only if the facts alleged in the complaint give rise to a cause of action under PRC law. In connection with any such original action, a PRC court may award civil liability, including monetary damages.

No treaty exists between Hong Kong or the British Virgin Islands and the United States providing for the reciprocal enforcement of foreign judgments. However, the courts of Hong Kong and the British Virgin Islands are generally prepared to accept a foreign judgment as evidence of a debt due. An action may then be commenced in Hong Kong or the British Virgin Islands for recovery of this debt. A Hong Kong or British Virgin Islands court will only accept a foreign judgment as evidence of a debt due if:

| • | the judgment is for a liquidated amount in a civil matter; |

| • | the judgment is final and conclusive; |

| • | the judgment is not, directly or indirectly, for the payment of foreign taxes, penalties, fines or charges of a like nature (in this regard, a Hong Kong court is unlikely to accept a judgment for an amount obtained by doubling, trebling or otherwise multiplying a sum assessed as compensation for the loss or damage sustained by the person in whose favor the judgment was given); |

| • | the judgment was not obtained by actual or constructive fraud or duress; |

| • | the foreign court has taken jurisdiction on grounds that are recognized by the common law rules as to conflict of laws in Hong Kong or the British Virgin Islands; |

| • | the proceedings in which the judgment was obtained were not contrary to natural justice (i.e. the concept of fair adjudication); |

10

Table of Contents

| • | the proceedings in which the judgment was obtained, the judgment itself and the enforcement of the judgment are not contrary to the public policy of Hong Kong or the British Virgin Islands; |

| • | the person against whom the judgment is given is subject to the jurisdiction of a foreign court; and |

| • | the judgment is not on a claim for contribution in respect of damages awarded by a judgment, which fall under Section 7 of the Protection of Trading Interests Ordinance, Chapter 7 of the Laws of Hong Kong. |

Enforcement of a foreign judgment in Hong Kong or the British Virgin Islands may also be limited or affected by applicable bankruptcy, insolvency, liquidation, arrangement and moratorium, or similar laws relating to or affecting creditors’ rights generally, and will be subject to a statutory limitation of time within which proceedings may be brought.

Future issuances of preference shares could materially and adversely affect the holders of our common shares or delay or prevent a change of control.

Our board of directors may amend our Memorandum and Articles of Association without shareholder approval to create from time to time, and issue, one or more classes of preference shares (which are analogous to preferred stock of corporations organized in the United States). While we have never issued any preference shares and we have none outstanding, we could issue preference shares in the future. Future issuance of preference shares could materially and adversely affect the rights of the holders of our common shares, or delay or prevent a change of control.

Our status as a foreign private issuer in the United States exempts us from certain of the reporting requirements under the Securities Exchange Act of 1934, and corporate governance standards of the New York Stock Exchange, or NYSE limiting the protections and information afforded to investors.

We are a foreign private issuer with the meaning of the rules under the Securities Exchange Act of 1934, as such we are exempt from certain provisions applicable to U.S. domestic public company.

Because we qualify as a foreign private issuer under the Securities Exchange Act of 1934, we are exempt from certain provisions of the securities rules and regulations in the United States that are application to U.S. domestic issuers, including :

| • | the rules under the Securities Exchange Act of 1934 requiring the filing with the SEC of quarterly reports on Form 10-Q, current reports on Form 8-K or annual reports on Form 10-K; |

| • | the section of the Securities Exchange Act of 1934 regulating the solicitation of proxies, consents or authorizations respect of a security registered under the Exchange Act; |

| • | the section of the Securities Exchange Act of 1934 requiring directors, officers and 10% holders to file public reporting of their stock ownership and trading activities and imposing liability on insiders who profit from trades made in a short period of time; |

| • | the selective disclosure rules under Regulation FD restricting issuers from selectively disclosing material nonpublic information; and |

| • | the sections of the Securities Exchange Act of 1934 requiring insiders to file public reports of their stock ownership and trading activities and establishing insider liability for profits realized from any “short-swing” trading transaction (i.e. a purchase and sale, or sale and purchase, of the issuer’s equity securities within less than six months). |

In addition, because the Company is a foreign private issuer, certain corporate governance standards of the NYSE that are applied to domestic companies listed on that exchange may not be applicable to us. For information regarding whether our corporate governance standards differ from those applied to U.S. domestic issuers, see the discussion under “NYSE listed Company Manual Disclosure” in ITEM 6. Directors and Senior Management of this Report.

Because of these exemptions, investors are not afforded the same protections or information generally available to investors holding shares in public companies organized in the United States or traded on the NYSE. See footnote “*” on page 34 of this Report under the heading “Compensation on an Individual Basis” for information and risks associated with disclosures we have made in this Report or may make in our proxy statements regarding compensation we have paid to our directors and senior managers on an individual basis.

11

Table of Contents

PRC Regulations on Real Estate Development and Management

The PRC government regulates the real estate industry. This section summarizes the principal PRC regulations relating to our business.

We operate our business in China under a legal regime consisting of the National People’s Congress, State Council, which is the highest authority of the executive branch of the PRC central government, and several ministries and agencies under its authority, including the Ministry of Housing and Urban-Rural Development, or the MOHURD, the Ministry of Land and Resources, or the MLR, the Ministry of Commerce, or the MOFCOM, the National Development and Reform Commission, or the NDRC, the State Administration for Industry and Commerce, or the SAIC, and the State Administration of Foreign Exchange, or the SAFE, and their respective authorized local counterparts.

Regulations on Land

The Law of the PRC on Land Administration, promulgated on June 25, 1986 and amended on August 28, 2004 by the Standing Committee of National People’s Congress, distinguishes between the ownership of land and the right to use land. All land in the PRC is either state-owned or collectively-owned, depending on location. Generally, land in urban areas within a city or town is state-owned, and all land in the rural areas of a city or town and all rural land, unless otherwise specified by law, are collectively-owned.

Although all land in the PRC is owned by the governments or by the collectives, private individuals and businesses are permitted to hold, lease and develop land for a specified term without ever owning the land, the duration of which depends on the use purpose of the land. These rights to use land are termed land use rights.

Under the Interim Regulations of the PRC on Grant and Transfer of the Right to Use State-owned Land in Urban Areas, promulgated on and effective as of May 19, 1990 by the State Council, enterprises, companies and other organizations who intend to hold, lease and develop the land, or Land Users, pay a premium to the government as consideration for the grant of the land use rights on terms of use prescribed by the government, and a Land User may transfer, lease and mortgage or otherwise commercially exploit the land use rights within such terms of use. The land administration authority enters into a contract with the Land User for grant of the land use rights. The Land User pays the grant premium as stipulated in the grant contract. After paying the grant premium in full, the Land User registers with the land administration authority and obtains a land use rights certificate. The certificate evidences the acquisition of the land use rights.

The Property Law of the PRC, or the Property Law, promulgated on March 16, 2007 and effective as of October 1, 2007, further clarified land use rights in the PRC with the following rules:

| • | the land use rights for residences will be automatically renewed upon expiry; |

| • | the car parks and garages within the building area planned for vehicle parks must be used to meet the needs of the owners who live in the building first; |

| • | the construction of buildings must abide by relevant laws and regulations with regard to the construction planning and may not affect the ventilation of or lighting to the neighboring buildings; and |

| • | where the land use rights for construction use are transferred, exchanged, used as a capital contribution, donated to others or mortgaged, an application for modification registration must be filed with the registration department. |

Regulations on Development of a Real Estate Project

Commencement of a Real Estate Project and the Idle Land

According to the Circular on the Implementation of the Catalog for Restricted Land Use Projects (2012 Edition) and the Catalogue for Prohibited Land Use Projects (2012 Edition) promulgated by the MLR and the NDRC in May 2012, the area of a plot of land to be granted for residential use may not exceed (i) seven hectares for small cities and towns, (ii) 14 hectares for medium-sized cities or (iii) 20 hectares for large cities. The plot area ratio for residential land should not be lower than 1.0. However, no land may be granted for “villa” real estate projects.

Under the Urban Real Estate Law, those who have obtained the land use rights through grant must develop the land in accordance with the terms of use and within the period of commencement prescribed in the contract for the land use rights grant.

12

Table of Contents

According to the Measures on Disposing Idle Land promulgated by the MLR and effective as of April 28, 1999, as amended on May 22, 2012 and effective July 1, 2012, with regards to the land for a real estate project that is obtained by grant and is within the scope of city planning, if the construction work has not been commenced within one year upon the commencement date as set forth in the land use rights grant contract, or the construction and development has been started but the area of land that is under construction and development is less than one third of the total area of land that should have been under construction and development, or the invested amount is less than 25% of the total investment, and the construction and development of which has been suspended for more than one year, a surcharge on idle land equivalent to 20% of the grant premium may be levied; if the construction work has not been commenced within two years, the land can be confiscated without any compensation, unless the delay is caused by force majeure, or the acts of government or acts of other relevant departments under the government, or by indispensable preliminary work.

The Emergency Notice on Further Tightening the Administration on Real Estate Land Use and Reinforcing the Control Results of Real Estate Market promulgated on July 19, 2012, requires that the Measures on Disposing Idle Land be strictly implemented, and the land authority dispose of, case by case, idle land and publish related information on the website designated by the MLR. With regard to land users who have committed acts such as failing to make payments for land grants, leaving land idle, hoarding land, land speculation, developing land in excess of its actual development capacity, or failing to fulfill the land use contract, they may be prohibited by the land authority from participating in land auctions for a certain period of time.

Planning of a Real Estate Project

The Law of the PRC on Urban and Rural Planning, promulgated by the National People’s Congress on October 28, 2007 and effective as of January 1, 2008, replacing the previous City Planning Law of the PRC, provides that a developer who has obtained land use rights by grant must, after obtaining approval for a construction project and signing a land use rights grant contract, apply to the city planning authority for the Permit for Construction Site Planning.

It further provides that a developer who has a proposed construction project within the planning area of a city or town must, after obtaining a Permit for Construction Site Planning, prepare the necessary planning and design work, and submit the detailed planning and design report, together with the land use rights certificate, to the city planning authority or the town government designated by the provincial government, and apply for the Permit for Construction Work Planning.

Construction of a Real Estate Project

On June 25, 2014, the MOHURD promulgated the Measures for the Administration of Construction Permits for Construction Projects, superseding its 1999 version. Under the new measures, after having obtained a Permit for Construction Work Planning, a developer needs to file an application for a Construction Permit with the local construction authority above the county level.

Completion of a Real Estate Project

According to the Development Regulations and the Interim Provisions on the Acceptance Examination Upon the Completion of construction work and Municipal Infrastructure promulgated on June 30, 2000 by the MOHURD and effective as of June 30, 2000, as amended on October 19, 2009, and the Interim Measures for Reporting Details Regarding Acceptance Examination Upon Completion of construction work and Municipal Infrastructure promulgated on April 7, 2000 by the MOHURD and amended on October 19, 2009, a real estate project must comply with the relevant laws and other regulations, requirements on construction quality, safety standards and technical guidance on survey, design and construction work, as well as provisions of the relevant construction contract.

After the completion of works for a project, the developer must apply for an acceptance examination to the construction authority and must also report details of the acceptance examination to the construction authority. A real estate development project may only be delivered after passing the inspection and acceptance examination.

Lease

Under the Urban Real Estate Law and the Measures for Administration of Leases of Commodity Properties promulgated by the MOHURD on December 1, 2010 and effective as of February 1, 2011, the parties to a lease of a building are required to enter into a lease contract in writing. When a lease contract is signed, amended or terminated, the parties must register the details with the real estate administration authority in which the building is situated.

13

Table of Contents

Regulations on Environmental Protection in Construction Projects

Under the Regulations on the Administration of Environmental Protection in Construction Project, or Environmental Regulations, promulgated by the State Council on November 29, 1998 and effective as of the same date, each construction project is subject to an environmental impact assessment by the relevant authorities.

According to the Environmental Regulations, a developer is required to submit an environmental impact report, or an environmental impact report form, or an environmental impact registration form (as the case may be) to the relevant environmental protection administration for approval during the project’s feasibility analysis stage. In the meantime, if any ancillary environmental protection facilities are necessary in the construction project, such facilities are required to be designed, constructed and used in conjunction with the main project. After completion of the project, the developers are required to apply to the relevant environmental protection administrations for final acceptance examination in respect of any ancillary environmental protection facilities. Construction projects are approved for use after passing the said acceptance examination.

The Environmental Impact Assessment Law, promulgated by the National People’s Congress on October 28, 2002 and effective as of September 1, 2003, provides that if the environmental impact assessment documents of a construction project have not been examined by the relevant environmental protection administrations or are not approved after examination, the authority in charge of examination and approval of the project may not approve construction on the project, and the construction work unit may not commence work.

On July 6, 2006, the State Environmental Protection Administration issued its Circular on Strengthening the Environmental Protection Examination and Approval and Strictly Controlling New Construction Project, which provides for stringent examination and approval procedures for various real estate development projects. It also stipulates that no approvals may be issued for new residential projects or extensions in industry development zones, areas impacted by industrial enterprises or areas where such development poses potential harm to residents’ health.

Regulations on Establishment of a Real Estate Development Enterprise

Pursuant to the Law of the PRC on Administration of Urban Real Estate, or Urban Real Estate Law, promulgated by the Standing Committee of the National People’s Congress on July 5, 1994 and amended on August 30, 2007 and on August 27, 2009, a developer is defined as “an enterprise that engages in the development and sale of real estate for the purposes of making profits.”

Under the Regulations on Administration of Development and Operation of Urban Real Estate, or Development Regulation, promulgated by the State Council on July 20, 1998 and amended on January 8, 2011, a real estate development enterprise must satisfy the following requirements:

| • | has a registered capital of not less than RMB1 million; and |

| • | has four or more full time professional real estate/construction technicians and two or more full time accounting officers, each of whom must hold the relevant qualifications. |

The Development Regulations also allow people’s governments of the provinces, autonomous regions and/or municipalities directly under the central government to impose more stringent requirements regarding the registered capital and qualifications of professional personnel of a real estate development enterprise according to the local circumstances.

To establish a real estate development enterprise, the developer is required to apply for registration with the department of administration of industry and commerce. The developer must also report its establishment to the real estate administration authority in the location of the registration authority within 30 days upon receipt of its business license.

Regulations on Foreign-Invested Real Estate Enterprise

Industrial Restriction

Under Catalogue 2015, the development of tracts of land, the construction and operation of high-end hotels, office buildings, international conference centers, and real estate intermediary/agency business have been removed from the category under which foreign investment is restricted, with the construction and operation of large-scale scheme parks remaining in the category. The construction and operation of golf courses and villas falls within the category under which foreign investment is prohibited. The development and construction of ordinary residential properties, together with other types of real estate-related business, are not specifically mentioned in the catalogue.

14

Table of Contents

Regulations on Property Ownership Certificates

Under the Measures for Administration of Sale of Commodity Properties, developers must submit the documents relating to the application for property ownership certificates to the local real estate administration authorities within 60 days after the delivery of property to customers. The developers are required to assist customers in applying for amendments in the procedures for land use rights and registration procedures for property ownership.

In accordance with the Pre-completion Sale Measures, the purchasers must apply for property ownership certificates to the local real estate administration authorities within 90 days after the delivery of pre-sale property to purchasers. The developers are required to assist and provide the purchasers with necessary verifying documents. Where the purchasers fail to obtain the property ownership certificates within 90 days thereafter due to the developer’s fault, unless otherwise provided between the developers and the purchasers, the developers will be liable for the breach of contract.

Regulations on Property Management

The Property Management Rules, amended by the State Council on August 26, 2007 and effective as of October 1, 2007, provide that property owners have the right to appoint and dismiss property service enterprises. The rules also establish a regulatory system for property service enterprises, which encompasses the following regulations:

| • | the Measures for the Administration of Qualifications of Property Service Enterprises amended by the MOHURD and effective as of November 26, 2007, provide that property service enterprises must apply to the local branch of the MOHURD and undertake a qualification examination to obtain a Property Service Qualification Certificate. A property service enterprise must pass the Property Service Qualification, or PSQ examination, in order to engage in property management. Property service enterprises are classified as Class I, II or III. Different classes of service enterprises have different establishment requirements and may manage different types of premises. |

| • | The Provisional Measures on the Administration of Initial Property Management Bid-inviting and Bidding, promulgated on June 26, 2003 by the MOHURD, provide that prior to the selection of the Property Owners’ Committee, or the POC, the property developer must select a property service enterprise to provide property management services. |

| • | the NDRC and the MOHURD jointly promulgated the Rules on Property Management Service Fees on November 13, 2003, which provide that property management fees shall be determined by mutual consent between the POC and the property service enterprise, and set forth in writing in the property management service contract. |

The Phases of PRC Real Estate Development Projects

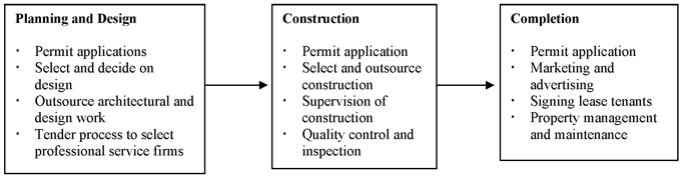

Planning and Design

We outsource our design work to reputable professional architectural design firms to ensure that our designs comply with PRC laws and regulations, and meet our design objectives, and thereafter work on the design of the mixed-use style development for the next stage of this project. Our management team is also actively involved in the process, especially in the master planning and architectural design of the projects and monitors the progress and quality of the design firms to ensure that they meet our requirements. For Phase 1 of Namtai Inno Park located on our Guangming, Shenzhen, premises, we have obtained the Permit for Construction Site Planning, where we are now allowed to start planning for the work at the site. We have appointed an internationally renowned and award winning professional architectural design firm, Ronald Lu and Partners (Hong Kong) Ltd., to work on the design of the mixed-use development for the next stage. To assist us in better managing, monitoring and controlling all external professional agents and firms throughout different stages of the Guangming project development, we have appointed WSP Parsons Brinckerhoff, an international reputable professional firm, as our Project Management Company (PMC). For quantity surveyor (QS), we have appointed Currie & Brown, another international reputable professional firm, to provide the quantity surveying / cost management service for the development of Namtai Inno Park.

15

Table of Contents

Construction

We have obtained the Permit for Construction Site Planning where we are now allowed to start planning for the work at the site. It is our plan to outsource all of our construction work to independent construction companies that are selected mainly through our invitation to tender bids for the project. We consider the construction companies’ professional qualifications, reputation, track record, and financial condition and resources when inviting candidates to bid. We plan to closely supervise and manage the entire project construction process.

Completion

Prior to the completion of the construction phase, we would start working with external agents on the leasing of the properties. The properties can only be leased out after passing the acceptance examination. We plan to outsource the property management work to external professional firms for services such as leasing, security, landscaping, building management and management of public facilities, and additional services, such as housekeeping, repair and maintenance.

| ITEM 4. | INFORMATION ON THE COMPANY |

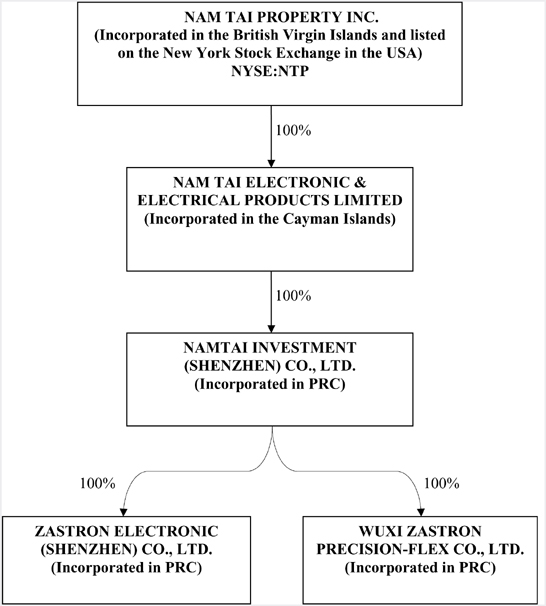

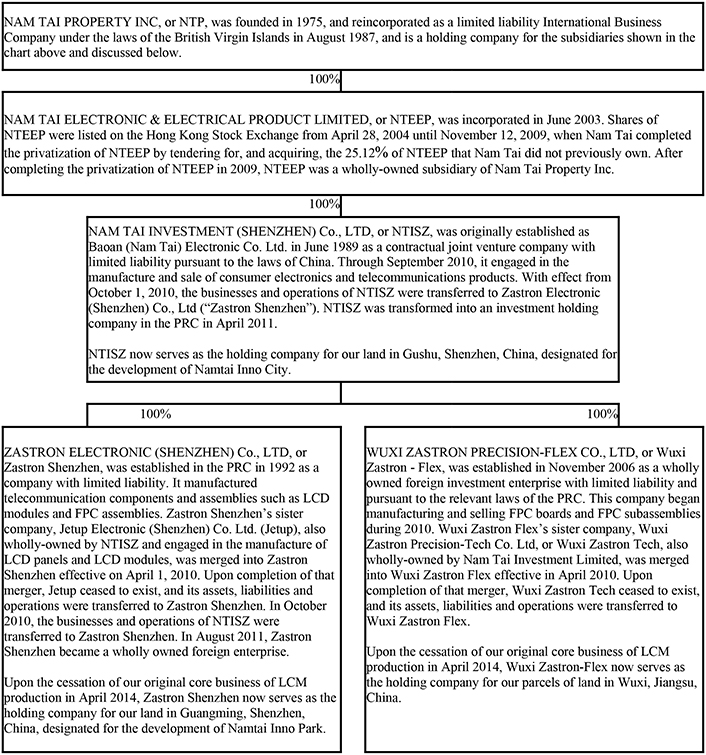

Corporate Information