UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

(Mark One)

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the fiscal year ended December 31 , 2020

or

| TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

For the transition period from __________________ to __________________________

Commission file number: 001-32442

| (Exact name of registrant as specified in its charter) | ||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

Registrant's telephone number, including area code (501 ) 205-8508

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Securities registered under Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☑ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☑ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☑ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☑ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ||||||||

| ☑ | Smaller reporting company | ||||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) ☐ Yes ☑ No

The aggregate market value of the outstanding common stock held by non-affiliates computed by reference to the price at which the common equity was last sold on June 30, 2020 (the last business day of the registrant’s most recently completed second quarter), as reported on the NYSE American, was approximately $34.2 million.

As of February 5, 2021, there were 118,515,644 shares of common stock of the registrant outstanding, including treasury shares but net of shares of common stock held by a subsidiary.

DOCUMENTS INCORPORATED BY REFERENCE

TABLE OF CONTENTS

| Page No. | ||||||||

| Part I | ||||||||

| Item 1. | Business. | |||||||

| Item 1A. | Risk Factors. | |||||||

| Item 1B. | Unresolved Staff Comments. | |||||||

| Item 2. | Properties. | |||||||

| Item 3. | Legal Proceedings. | |||||||

| Item 4. | Mine Safety Disclosures. | |||||||

| Part II | ||||||||

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | |||||||

| Item 6. | Selected Financial Data. | |||||||

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations. | |||||||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | |||||||

| Item 8. | Financial Statements and Supplementary Data. | |||||||

| Item 9. | Changes In and Disagreements With Accountants on Accounting and Financial Disclosure. | |||||||

| Item 9A. | Controls and Procedures. | |||||||

| Item 9B. | Other Information. | |||||||

| Part III | ||||||||

| Item 10. | Directors, Executive Officers and Corporate Governance. | |||||||

| Item 11. | Executive Compensation. | |||||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | |||||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | |||||||

| Item 14. | Principal Accountants Fees and Services. | |||||||

| Part IV | ||||||||

| Item 15. | Exhibits, Financial Statement Schedules. | |||||||

| Item 16. | Form 10-K Summary | |||||||

3

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the "Securities Act"), and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). These forward-looking statements are subject to known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “will,” “should,” “intend,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” or “continue,” or the negative of such terms or other comparable terminology. This report includes, among others, statements regarding our risks associated with:

•our history of losses and declining revenues;

•the on-going impact of the COVID-19 pandemic on our Company;

•our reliance on revenues from a limited number of customers;

•seasonality of our business which impacts our financial results and cash availability;

•dependence on our supply partners;

•our ability to acquire traffic in a profitable manner;

•failure to keep pace with technology changes;

•impact of possible interruption in our network infrastructure;

•dependence on our key personnel;

•regulatory and legal uncertainties;

•failure to comply with privacy and data security laws and regulations;

•third party infringement claims;

•publishers who could fabricate fraudulent clicks;

•our ability to continue to meet the NYSE American listing standards;

•the impact of quarterly results on our common stock price;

•dilution to our stockholders upon the exercise of outstanding common stock options and restricted stock unit grants; and

•our ability to identify, finance, complete, and successfully integrate future acquisitions.

These forward-looking statements were based on various factors and were derived utilizing numerous assumptions and other factors that could cause our actual results to differ materially from those in the forward-looking statements. Most of these factors are difficult to predict accurately and are generally beyond our control. You should consider the areas of risk described in connection with any forward-looking statements that may be made herein. Readers are cautioned not to place undue reliance on these forward-looking statements and readers should carefully review this report in its entirety, including the risks described in Item 1A - Risk Factors appearing in this report.

Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this report, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

OTHER PERTINENT INFORMATION

Unless specifically set forth to the contrary, when used in this report the terms "Inuvo," the “Company,” "we," "us," "our" and similar terms refer to Inuvo, Inc., a Nevada corporation, and its subsidiaries. When used in this report, “2019” means the fiscal year ended December 31, 2019, "2020" means the fiscal year ended December 31, 2020, and “2021” means the fiscal year ending December 31, 2021. The information which appears on our corporate website at www.inuvo.com and our social media platforms is not part of this report.

4

PART I

ITEM 1. BUSINESS.

Company Overview

Inuvo is a technology company that develops and sells information technology solutions for marketing. These platforms predictively identify and message online audiences for any product or service across devices, channels and formats, including video, mobile, connected TV, display, social and native. These capabilities allow Inuvo’s clients to engage with their customers and prospects in a manner that drives engagement from the first contact with the consumer. Inuvo facilitates the delivery of hundreds of millions of marketing messages to consumers every single month and counts among its clients numerous world- renowned names in industries that have included retail, automotive, insurance, health care, technology, telecommunications and finance.

The Inuvo solution incorporates a proprietary form of artificial intelligence, or AI, branded the IntentKey. This sophisticated machine learning technology uses interactions with Internet content as a source of information from which to predict consumer intent. The AI includes a continually updated database of over 500 million machine profiles which Inuvo utilizes to deliver highly aligned online audiences to its clients. Inuvo earns revenue when consumers view or click on its client’s messages.

The Inuvo business scales through account management activity with existing clients and by adding new clients through sales activity.

As part of the Inuvo technology strategy, it owns a collection of websites including alot.com and earnspendlive.com, where Inuvo creates content in health, finance, travel, careers, auto, education and living categories. These sites provide the means to test the Inuvo technologies, while also delivering high quality consumers to clients through the interaction with proprietary content in the form of images, videos, slideshows and articles.

There are many barriers to entry associated with the Inuvo business model, including a proficiency in large scale information processing, predictive software development, marketing data products, analytics, artificial intelligence, integration to the internet of things ("IOT"), and the relationships required to execute within the IOT. Inuvo's intellectual property is protected by 18 issued and seven pending patents.

Products and Services

The Inuvo platforms allow advertisers and publishers the opportunity to buy and sell advertising space in real time and include the following products and services:

•ValidClick: A marketing service provided to Yahoo!, Google and other consolidators of advertising demand comprising hundreds of thousands of merchants where a collection of data, analytics and software gets used to align merchant advertising messages with anonymous consumers across various websites online. The service includes Think Relevant, a wholly owned marketing agency and alot.com, a wholly owned collection of websites; and

•IntentKey: An artificial intelligence based consumer intent recognition system designed to reach highly targeted mobile and desktop In- Market audiences with precision. The platform can serve multiple creative formats including display, video, audio and native across multiple device types including desktop, mobile, tablet, connected/smart TV and game consoles. The product is sold as both a fully managed service and/or a Software as a Service ("SaaS") solution.

Key Relationships

We maintain long-standing relationships with Yahoo! and Google who provide access to hundreds of thousands of advertisers from which a majority of our ValidClick revenue originates. When an advertisement is clicked, we effectively sell that click to these partners who then sell it to the advertisers. We maintain multi-year service contracts with these companies. In 2020, these customers accounted for 60.5% of our total revenue as compared to 78.5% in 2019. We also have major contracts with Xandr, Inc. who, in exchange for a fee, provides access to advertisers and publishers for the IntentKey.

In addition to our key customer relationships, we maintain important distribution relationships with owners and publishers of websites and mobile applications. We provide these partners with advertisements which they use to monetize their websites and mobile applications. We continuously monitor consumer traffic with a variety of proprietary and patent protected software tools

5

that can determine the quality of the traffic viewing and clicking on Inuvo served advertisements as a part of our service to our biggest clients.

Strategy

Our business strategy has been to develop data processing and product technologies that can displace intermediaries within the online advertising ecosystem, while cultivating relationships that can provide access to media spend (advertisers) and media inventory (websites). In this regard, we have proprietary demand (media spend) and supply side (media inventory) technologies, targeting technologies, on-page or in-app ad-unit technologies, proprietary data and data management technologies, and advertising fraud detection technologies. We have both direct and indirect relationships at some of the largest media buyers and/or consolidators in the industry. For the ValidClick platform, the immediate strategy is to maintain the business at current levels by working with existing partners. For the IntentKey platform, the immediate strategy is to scale through the hiring of additional sales professionals, growing existing accounts and expanding the market size by launching a SaaS version of the IntentKey in 2021.

We have both direct and indirect relationships at some of the largest media buyers and/or consolidators in the industry. For the ValidClick platform, the immediate strategy is to maintain the business at current levels by working with existing partners where the cash generated from the business can be used to accelerate growth of the IntentKey. For the IntentKey platform, the immediate strategy is to scale through the hiring of additional sales professionals, growing existing accounts and expanding the market size by concurrently selling the SaaS version of the IntentKey beginning in 2021.

Our business strategy is focused on providing differentiation through the AI analytics and data products we own and protect through patents. For the marketing and advertising industries we serve, this strategy aligns with the components of the value chain that are the principal drivers of value to our clients. As part of our growth strategy, we evaluate acquisition candidates from time to time as opportunities arise with a focus on companies that have either advertisers or advertising relationships we do not possess or publishers or publishing partners who have content we do not possess.

Sales and Marketing

We drive general awareness of our brands through various marketing channels including our websites, social media, blogs, public relations, trade shows and conferences. Sales and marketing for our products differs based on whether they are demand or supply facing.

The demand side of our business includes sales executives who create interest from agencies, trading desks and brands directly. Leveraging our IntentKey technology to highlight our differentiation, our sales executives explain how we identify the most relevant audiences so we can, on behalf of our clients, target those audiences at a time when they are most prone to engage / respond / subscribe / tune-in or watch our clients' message.

The supply side of our business includes sales executives who sell to publishers directly. Creating differentiation, they explain our unique ability to create incremental revenue streams for publishers through our custom placements and unique approach to maximizing yield while preserving user experience.

Both demand and supply relationships require account management/campaign management, plus operations teams, who ensure that publisher implementations are successful, advertising campaigns deliver anticipated results and clients’ expectations are exceeded.

Competition

We face significant competition in our industry. Competitors continue to increase their suite of offerings across marketing channels to better compete for total advertising dollars. There are many barriers to entry to Inuvo’s business that would require proficiency in large scale data center management, software development, data products, analytics, artificial intelligence, integration to the internet of things, or IOT, the relationships required to execute within the IOT and the ability to process tens of billions of transactions daily.

We compete, both directly and indirectly with companies who offer demand side platforms (DSP’s), direct marketing platforms (DMP’s), Data Suppliers and Aggregators, Media Planners and various Measurement and Analytics companies. The companies within these categories are defined by LUMA @ https://lumapartners.com/content/lumascapes/display-ad-tech-lumascape.

6

Our primary competitive advantages include: patented, proprietary technology for the categorization and storage of consumer intent (data used to discover and match online audiences to product or service); real time visibility of a marketing event (recognizing that there is currently a transaction where a match exists between our advertising clients and an interested party for their product on a website) where our technology is capable of responding to over 200,000 events per second; and patented advertising fraud prevention. Many competitors have greater name recognition and are better capitalized than we are. Our ability to remain competitive in our market segment depends upon our ability to be innovative and to efficiently provide unique solutions to our demand and supply customers. There are no assurances we will be able to remain competitive in our markets in the future.

Technology Platforms

Our proprietary applications are constructed from established, readily available technologies. Some of the basic elements of our products are built on components from leading software and hardware providers such as Oracle, Microsoft, Sun, Dell, EMC, and Cisco, while some components are constructed from leading open-source software projects such as Apache Web Server, Apache Spark, HAProxy, MySQL, Java, Perl, and Linux. By seeking to strike the proper balance between using commercially available software and open-source software, our technology expenditures are directed toward maintaining our technology platforms while minimizing third-party technology supplier costs.

We strive to build high-performance, availability and reliability into our product offerings. We safeguard against the potential for service interruptions at our third-party technology vendors by engineering controls into our critical components. We deliver our hosted solutions from facilities, geographically disbursed throughout the United States and maintain ready, on-demand services through third-party cloud providers Microsoft Azure and Amazon Web Services to enhance our business continuity. Our applications are monitored 24 hours a day, 365 days a year by specialized monitoring systems that aggregate alarms to a human-staffed network operations center. If a problem occurs, appropriate engineers are notified, and corrective action is taken.

Intellectual Property Rights

We own intellectual property (IP) and related IP rights that relate to our products, services and assets. Our IP portfolio includes patents, trade secrets and trademarks. We actively seek to protect our IP rights and to deter unauthorized use of our IP and other assets. While our IP rights are important to our success, our business as a whole is not significantly dependent on any single patent, trademark, or other IP right.

Our trademarks include the U.S. Federal Registration for our consumer facing brand ALOT® in the United States. Our intellectual property portfolio includes 18 patents issued by the United States Patent and Trademark Office (“USPTO”) and seven pending patent applications.

To distinguish our products and services from our competitors’ products, we have obtained trademarks and trade names for our products. We also protect details about our processes, products, and strategies as trade secrets, keeping confidential the information that we believe provides us with a competitive advantage.

Employees

As of January 31, 2021, we had 71 full-time employees, none of which are covered by a collective bargaining agreement.

Seasonality

Our future results of operations may be subject to fluctuation because of seasonality. Historically, the second half of the year is typically stronger than the first half as a result of the changes in demand for marketing placements leading into the holiday season. If we are not able to appropriately adjust to seasonal or other factors, it could have a material adverse effect on our financial results.

History

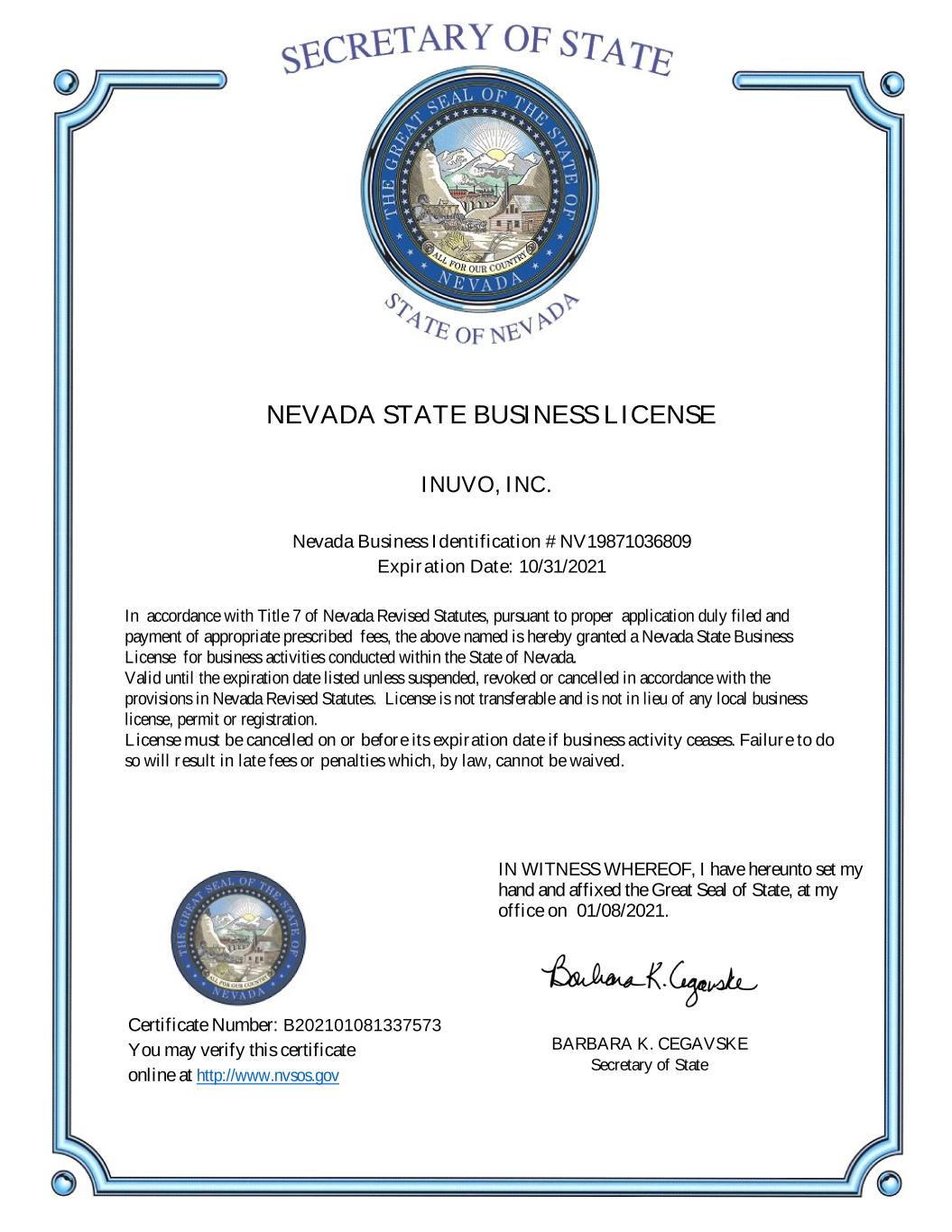

The business was incorporated under the laws of the state of Nevada in October 1987 and originally operated within the oil and gas industry. This endeavor was not profitable, and as a result from 1993 to 1997 the Company had essentially no operations. In 1997, the business was reorganized and through 2006 a number of companies were acquired from within the advertising and internet marketing industry. In 2009, following the weakness in the economy, a new team was called in to assess the array of businesses that had been acquired in the preceding years and as a result between 2009 and 2011, that team sold and/or retired eleven businesses as a part of the restructure.

7

In March 2012, as part of a longer-term strategy, the Company acquired Vertro, Inc., which owned and operated the ALOT product portfolio. That acquisition included the ALOT brand, as well as a long-standing relationship with Google. In 2013, with a grant funded by the State of Arkansas, the Company moved its headquarters to Arkansas where we have remained.

In February 2017, the Company entered into an asset purchase agreement with NetSeer, Inc. which advanced the Company's technology strategy while also increasing the number of advertiser and publisher relationships. We exchanged 3,529,000 shares of Inuvo common stock and assumed approximately $6.8 million of specified liabilities in this business combination.

More Information

Our website address is www.inuvo.com. We file with, or furnish to, the Securities and Exchange Commission (the "SEC") annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, and amendments to those reports, as well as various other information. This information can be found on the SEC website at www.sec.gov. In addition, we make available free of charge through the Investor Relations page of our website our annual reports, quarterly reports, and current reports, and all amendments to any of those reports, as soon as reasonably practicable after providing such reports to the SEC.

ITEM 1A. RISK FACTORS.

An investment in our common stock involves a significant degree of risk. Many of the risk factors are, and will continue to be, exacerbated by the COVID-19 pandemic and any worsening of the economic environment. You should not invest in our common stock unless you can afford to lose your entire investment. You should consider carefully the following risk factors and other information in this report before deciding to invest in our common stock. If any of the following risks and uncertainties develops into actual events, our business, financial condition or results of operations could be materially adversely affected and you could lose your entire investment in our Company.

We have a history of losses, and our revenues declined in 2020 from 2019. We cannot anticipate with any degree of certainty what our revenues will be in future periods. While our gross profit margin increased to 81.4% in 2020 from 63.1% in 2019, our revenues declined approximately 27% in 2020 as compared to 2019. We reported an operating loss of approximately $8,048,581 million in 2020 as compared to an operating loss of approximately $7,738,193 million in 2019. The lower revenue in 2020 as compared to 2019 was due primarily to the ValidClick operations where monetization from advertising inventory sold to our largest demand partners was lower in 2020 in part due to the COVID-19 pandemic. The higher gross margin in 2020 was primarily due to the change of revenue mix within the ValidClick business. Since our credit facility is dependent upon receivables, and we do not know when, if ever, that our revenues will return to historic levels or if we will be able to replace those lost revenues with revenues from other sources, the combination of lower credit availability and recent negative cash flows generated from operating activities introduces potential risk of an interruption to operating activities.

The COVID-19 pandemic could have a material adverse impact on our business, results of operations and financial condition. In December 2019, a novel strain of coronavirus disease (“COVID-19”) was first reported in Wuhan, China. Less than four months later, on March 11, 2020, the World Health Organization declared COVID-19 a pandemic—the first pandemic caused by a coronavirus. The outbreak has resulted in the implementation of significant governmental measures, including lockdowns, closures, quarantines and travel bans, intended to control the spread of the virus. The COVID-19 outbreak has already caused severe global disruptions. Beginning in late April 2020, we experienced a significant reduction in demand (marketing budgets) within the ValidClick platform and a modest decline in demand within the IntentKey platform, the combination of which has resulted in a significant reduction in our revenue run rate. Generally, marketing budgets tend to decline in times of a recession. We have curtailed expenses, including compensation and travel and we have issued a work from home policy to protect our employees and their families from virus transmission associated with co-workers. We began to experience interruptions in our daily operations, as a result of these policies. The revenue impact on our industry could vary dramatically by vertical. For example, we experienced less advertising demand from the travel, leisure and hospitality verticals. We also maintain long-standing relationships with Yahoo! and Google that provide access to hundreds of thousands of advertisers from which most of our ValidClick and digital publishing revenue originates. Any adverse impact on the operations of those companies would have a correspondingly adverse impact on our revenues in future periods. We will continue to assess the impact of the COVID-19 pandemic on our Company, however, at this time we are unable to predict all possible impacts on our Company, operations and revenues. Should revenues continue to turn downwards or fail to return to historical levels, we may not be able to offset expenses quickly enough which could have a material adverse effect on our business, results of operations, financial condition and cash flows and adversely impact the trading price of our common stock.

We rely on two customers for a significant portion of our revenues. We are reliant upon Yahoo! and Google for most of our revenue. During 2020 they accounted for 33.3%, and 27.2% of our revenues, respectively. In 2019, Yahoo! and Google accounted for 64.4% and 14.1% of our revenues, respectively. The amount of revenue we receive from these customers is

8

dependent on a number of factors outside of our control, including the amount they charge for advertisements, the depth of advertisements available from them, and their ability to display relevant ads in response to end-user queries. We would likely experience a significant decline in revenue and our business operations could be significantly harmed if these customers do not approve our new websites and applications, or if we violate their guidelines or they change their guidelines. In addition, if any of these preceding circumstances were to occur, we may not be able to find a suitable alternate paid search results provider or otherwise replace the lost revenues. The loss of any of these customers or a material change in the revenue or gross profit they generate would have a material adverse impact on our business, results of operations and financial condition in future periods.

Ability to maintain our credit facility could impact our ability to access capital in the future. On March 12, 2020 we closed a Loan and Security Agreement with Hitachi Capital America Corp. ("Hitachi") the terms of which are described in this report which replaced our credit facility with Western Alliance Bank. Under the terms of the Loan and Security Agreement, Hitachi has provided us with a $5,000,000 line of credit commitment which permits us to borrow against eligible accounts receivable and unbilled receivables. The Hitachi Loan and Security Agreement contains certain affirmative and negative covenants to which we are subject. As of December 31, 2020, we were in compliance or obtained a waiver for these covenants. There are no assurances that we will be able to comply with all the covenants. In the event we violate a covenant, Hitachi may limit or demand all amounts due under the credit facility at any time, including upon an event of default outstanding, if any, to be due and payable. If this occurs and if we have outstanding obligations and are not able to repay, Hitachi could require us to apply all of our available cash to repay the debt amounts and could then proceed against the underlying collateral. Should this occur, we cannot assure you that our assets would be sufficient to repay our debt in full, we would be able to borrow sufficient funds to refinance the debt. In such an event, our ability to conduct our business as it is currently conducted would be in jeopardy.

We are dependent upon relationships with and the success of our supply partners. Our supply partners are very important to our success. We must recruit and maintain partners who are able to drive traffic successfully to their websites and mobile applications, resulting in clicks on advertisements we have delivered. These partners may experience difficulty in attracting and maintaining users for a number of reasons, including competition, rapidly changing markets and technology, industry consolidation and changing consumer preferences. We have experienced a decrease in the number of supply partners and quantity of Internet traffic from supply partners within ValidClick beginning in late April 2020. Additionally, we are experiencing turnover in our supply partner network and there can be no assurance traffic levels will increase to prior levels or that we will be able to replace supply partners that have left our network. Further, we may not be able to further develop and maintain relationships with distribution partners. They may be able to make their own deals directly with advertisers, may view us as competitors or may find our competitors offerings more desirable. Any of these potential events could have a material adverse effect on our business, financial position and results of operations.

The success of our owned sites is dependent on our ability to acquire traffic in a profitable manner. Our ALOT-branded websites are dependent on our ability to attract traffic in a profitable manner. We use a predictive model to calculate the rate of return for marketing campaigns, which includes estimates and assumptions. If these estimates and assumptions are not accurate, we may not be able to effectively manage our marketing decisions and could acquire traffic in an unprofitable manner. In addition, we may not be able to maintain and grow our traffic for a number of reasons, including, but not limited to, acceptance of our websites by consumers, the availability of advertising to promote our websites, competition, and sufficiency of capital to purchase advertising. We advertise on search engine websites to drive traffic to our owned and operated websites. Our keyword advertising is done primarily with Google and Facebook, but also with Yahoo!. If we are unable to maintain and grow traffic to our sites in a profitable manner, it could have a material adverse effect on our business, financial condition, and results of operations.

Our business must keep pace with rapid technological change to remain competitive. Our business operates in a market characterized by rapidly changing technology, evolving industry standards, frequent new product and service announcements, enhancements, and changing customer demands. We must adapt to rapidly changing technologies and industry standards and continually improve the speed, performance, features, ease of use and reliability of our services. This includes making our products and services compatible and maintaining compatibility with multiple operating systems, desktop and mobile devices, and evolving network infrastructure. If we fail to do this, our results of operations and financial position could be adversely affected.

Our services may be interrupted if we experience problems with our network infrastructure. The performance of our network infrastructure is critical to our business and reputation. Because our services are delivered solely through the Internet, our network infrastructure could be disrupted by a number of factors, including, but not limited to:

•unexpected increases in usage of our services;

•computer viruses and other security issues;

•interruption or other loss of connectivity provided by third-party Internet service providers;

•natural disasters or other catastrophic events; and

•server failures or other hardware problems.

9

While we have data centers in multiple, geographically dispersed locations and active back-up and disaster recovery plans, we cannot assure you that serious interruptions will not occur in the future. If our services were to be interrupted, it could cause loss of users, customers and business partners, which could have a material adverse effect on our results of operations and financial position.

Regulatory and legal uncertainties could harm our business. While there are currently relatively few laws or regulations directly applicable to Internet-based commerce or commercial search activity, there is increasing awareness of such activity and interest from state and federal lawmakers in regulating these services. New regulation of activities in which we are involved or the extension of existing laws and regulations to Internet-based services could have a material adverse effect on our business, results of operations and financial position.

Failure to comply with federal, state and international privacy and data security laws and regulations, or the expansion of current or the enactment of new privacy and data security laws or regulations, could adversely affect our business. A variety of federal, state and international laws and regulations govern the collection, use, retention, sharing and security of consumer data. In addition, various federal, state and foreign legislative and regulatory bodies may expand current or enact new laws regarding privacy matters. For example, recently there have been Congressional hearings and increased attention to the capture and use of location-based information relating to users of smartphones and other mobile devices, and internationally the European Union’s General Data Protection Regulation (GDPR) went into effect in May 2018. We have posted privacy policies and practices concerning the collection, use and disclosure of subscriber data on our websites and applications. The existing and soon to be enacted privacy and data security related laws and regulations are evolving and subject to potentially differing interpretations. Several Internet companies have incurred penalties for failing to abide by the representations made in their privacy policies and practices. In addition, several states have adopted legislation that requires businesses to implement and maintain reasonable security procedures and practices to protect sensitive personal information and to provide notice to consumers in the event of a security breach. Any failure, or perceived failure, by us to comply with our posted privacy policies or with any data-related consent orders, Federal Trade Commission requirements or orders or other federal, state or international privacy or consumer protection-related laws, including the GDPR, regulations or industry self-regulatory principles could result in claims, proceedings or actions against us by governmental entities or others or other liabilities, which could adversely affect our business.

We may face third party intellectual property infringement claims that could be costly to defend and result in the loss of significant rights. From time to time third parties have asserted infringement claims against us including copyright, trademark and patent infringement, among other things. While we believe that we have defenses to these types of claims under appropriate intellectual property laws, we may not prevail in our defenses to any intellectual property infringement claims. In addition, we may not be adequately insured for any judgments awarded in connection with any litigation. Any such claims and resulting litigation could subject us to significant liability for damages or result in the invalidation of our proprietary rights, which would have a material adverse effect on our business, financial condition, and results of operations. Even if we were to prevail, these claims could be time-consuming, expensive to defend, and could result in the diversion of management's time and attention.

We are subject to risks from publishers who could fabricate clicks either manually or technologically. Our business involves the establishment of relationships with website owners and publishers. In exchange for their consumer traffic, we provide an advertising placement service and share a portion of the revenue we collect with that website publisher. Although we have click fraud detection software in place, we cannot guarantee that we will identify all fraudulent clicks or be able to recover funds distributed for fabricated clicks. This risk could materially impact our ability to borrow, our cash flow and the stability of our business.

Our business is seasonal and our financial results may vary significantly from period to period. Our future results of operations may vary significantly from quarter to quarter and year to year because of numerous factors, including seasonality. Historically, in the later part of the fourth quarter and the earlier part of the first quarter we experience lower Revenue Per Click (“RPC”) due to a decline in demand for inventory on website and app space and the recalibrating of advertiser’s marketing budgets after the holiday selling season. If we are not able to appropriately adjust to seasonal or other factors, it could have a material adverse effect on our financial results.

Failure to comply with the covenants and restrictions in our grant agreement with the State of Arkansas could result in the repayment of a portion of the grant, which we may not be able to repay or finance on favorable terms. In January 2013, we entered into an agreement with the State of Arkansas whereby we were granted $1,750,000 for the relocation of the Company to Arkansas and for the purchase of equipment. The grant was contingent upon us having at least 50 full-time equivalent permanent positions within four years, maintaining at least 50 full-time equivalent permanent positions for the following six years and paying those positions an average total compensation of $90,000 per year. As of December 31, 2020, we had 38 full-time employees located in Arkansas. Failure to meet the requirements of the grant after the initial four-year period, may require

10

us to repay a portion of the grant, up to but not to exceed the full amount of the grant. At December 31, 2020, we accrued a contingent liability of $60,000 for the lower than required employment.

We are subject to the continued listing standards of the NYSE American and our failure to satisfy these criteria may result in delisting of our common stock. Our common stock is listed on the NYSE American. In order to maintain this listing, we must maintain a certain share price, financial and share distribution targets, including maintaining a minimum amount of shareholders’ equity and a minimum number of public shareholders. In addition to these objective standards, the NYSE American may delist the securities of any issuer (i) if, in its opinion, the issuer’s financial condition and/or operating results appear unsatisfactory; (ii) if it appears that the extent of public distribution or the aggregate market value of the security has become so reduced as to make continued listing on the NYSE American inadvisable; (iii) if the issuer sells or disposes of principal operating assets or ceases to be an operating company; (iv) if an issuer fails to comply with the NYSE American’s listing requirements; (v) if an issuer’s securities sell at what the NYSE American considers a “low selling price” which the exchange generally considers $0.20 per share and the issuer fails to correct this via a reverse split of shares after notification by the NYSE American; or (vi) if any other event occurs or any condition exists which makes continued listing on the NYSE American, in its opinion, inadvisable. There are no assurances how the market price of our common stock will be impacted in future periods as a result of the general uncertainties in the capital markets and any specific impact on our Company as a result of the coronavirus. If the NYSE American delists our common stock, investors may face material adverse consequences, including, but not limited to, a lack of trading market for our common stock, reduced liquidity, decreased analyst coverage of our common stock, and an inability for us to obtain any additional financing to fund our operations that we may need.

Our quarterly operating results can be difficult to predict and can fluctuate substantially, which could result in volatility in the price of our common stock. Our quarterly revenues and other operating results have varied in the past and are likely to continue to vary significantly from quarter to quarter. Our agreements with distribution partners and key customers do not require minimum levels of usage or payments, and our revenues therefore fluctuate based on the actual usage of our service each quarter by existing and new distribution partners. In addition to the impact of the COVID-19 pandemic on our revenues, quarterly fluctuations in our operating results also might be due to numerous other factors, including:

•our ability to attract new distribution partners, including the length of our sales cycles, or to sell increased usage of our service to existing distribution partners;

•technical difficulties or interruptions in our services;

•changes in privacy protection and other governmental regulations applicable to our industry;

•changes in our pricing policies or the pricing policies of our competitors;

•the financial condition and business success of our distribution partners;

•purchasing and budgeting cycles of our distribution partners;

•acquisitions of businesses and products by us or our competitors;

•competition, including entry into the market by new competitors or new offerings by existing competitors;

•discounts offered to advertisers by upstream advertising networks;

•our history of litigation;

•our ability to hire, train and retain sufficient sales, client management and other personnel;

•timing of development, introduction and market acceptance of new services or service enhancements by us or our competitors;

•concentration of marketing expenses for activities such as trade shows and advertising campaigns;

•expenses related to any new or expanded data centers; and

•general economic and financial market conditions.

Significant dilution will occur when outstanding restricted stock unit grants vest. As of December 31, 2020, we had 1,930,526 restricted stock units outstanding. If the restricted stock units vest, dilution will occur to our stockholders, which may be significant.

Our financial condition may be adversely affected if we are unable to identify and complete future acquisitions, fail to successfully integrate acquired assets or businesses, or are unable to obtain financing for acquisitions on acceptable terms. The acquisition of assets or businesses that we believe to be complementary to our business is an important component of our strategy. We believe that acquisition opportunities may arise from time to time, and that any such acquisitions could be significant. At any given time, discussions with one or more potential sellers may be at different stages. However, any such discussions may not result in the consummation of an acquisition transaction, and we may not be able to identify or complete any acquisitions. We cannot predict the effect, if any, that any announcement or consummation of an acquisition would have on the trading price of our ordinary shares. Our business is capital intensive and any such transactions could involve the payment by us of a substantial amount of cash and/or equity securities. We may need to raise additional capital through public or private debt or equity financings to execute our growth strategy and to fund acquisitions. Adequate sources of capital may not be available when needed on favorable terms. If we raise additional capital by issuing additional equity securities or use equity securities for acquisitions, existing shareholders may be diluted. If our capital resources are insufficient at any time in the

11

future, we may be unable to fund acquisitions, take advantage of business opportunities or respond to competitive pressures, any of which could harm our business. Any usage of capital to fund an acquisition could lead to a decrease in liquidity.

Any future acquisitions could present a number of risks, including:

•the risk of using management time and resources to pursue acquisitions that are not successfully completed;

•the risk of incorrect assumptions regarding the future results of acquired operations;

•the risk that the amount and timing of the expected benefits of any acquisition, including potential synergies, are subject to uncertainties;

•the risk of unexpected losses of key employees, customers and suppliers of the acquired business;

•the risk of increasing the scope, geographic diversity, and complexity of our business;

•the risk of unfavorable accounting treatment and unexpected increases in taxes;

•the risk of difficulty in conforming standards, controls, procedures, policies, business cultures, and compensation structures;

•the risk of failing to integrate the operations or management of any acquired operations or assets successfully and in a timely manner; and

•the risk of diversion of management’s attention from existing operations or other priorities.

If we are unsuccessful in completing acquisitions of other operations or assets, our financial condition could be adversely affected and we may be unable to implement an important component of our business strategy successfully. In addition, if we are unsuccessful in integrating our acquisitions in a timely and cost-effective manner, our financial condition and results of operations could be adversely affected.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Not applicable to a smaller reporting company.

ITEM 2. PROPERTIES.

Our corporate headquarters are located in Little Rock, Arkansas where we entered into a five-year agreement to lease office space on October 1, 2015 and amended the lease as of February 1, 2021. The amended lease is for 7,831 square feet and expires on January 31, 2024. We also have office space in San Jose, CA where in June 2017, we entered into a five-year agreement to lease 4,801 square feet of office space. In July 2020, the lease was amended and renewed for an additional three years.

In addition to our office space, we maintain data center operations in third-party collocation facilities in Little Rock, AR, Los Angeles, CA, San Jose, CA and Secaucus, NJ.

ITEM 3. LEGAL PROCEEDINGS.

We are not party to any pending legal proceedings.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Market Information

Our common stock is listed on the NYSE American LLC under the symbol "INUV.” As of February 5, 2021, there were approximately 421 record owners of our common stock. This amount does not reflect persons or entities that hold our common stock in nominee or “street” name through various brokerage firms.

12

Dividends

We have not declared or paid cash dividends on our common stock since our inception. Under Nevada law, we are prohibited from paying dividends if the distribution would result in our Company not being able to pay its debts as they become due in the normal course of business if our total assets would be less than the sum of our total liabilities plus the amount that would be needed to pay the dividends, or if we were to be dissolved at the time of distribution to satisfy the preferential rights upon dissolution of stockholders whose preferential rights are superior to those receiving the distribution. Our board of directors has complete discretion on whether to pay dividends subject to compliance with applicable Nevada law. Even if our board of directors decides to pay dividends, the form, the frequency, and the amount will depend upon our future operations and earnings, capital requirements and surplus, general financial condition, contractual restrictions and other factors that the board of directors may deem relevant. While our board of directors will make any future decisions regarding dividends, as circumstances surrounding us change, it currently does not anticipate that we will pay any cash dividends in the foreseeable future.

Recent Sales of Unregistered Securities

None, except as previously reported.

Repurchases of Equity Securities by the Issuer and Affiliated Purchasers

None

ITEM 6. SELECTED FINANCIAL DATA.

Not applicable to a smaller reporting company.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of our financial condition and results of operations for 2020 and 2019 should be read in conjunction with the consolidated financial statements and the notes to those statements that are included elsewhere in this report. Our discussion includes forward-looking statements based upon current expectations that involve risks and uncertainties, such as our plans, objectives, expectations and intentions. Actual results and the timing of events could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those set forth under Cautionary Statements Regarding Forward-Looking Information, Part I. Item 1. Business and Item 1A. Risk Factors. We use words such as "anticipate," "estimate," "plan," "project," "continuing," "ongoing," "expect," "believe," "intend," "may," "will," "should," "could," and similar expressions to identify forward-looking statements.

Company Overview

Inuvo is a technology company that develops and sells information technology solutions for marketing. These platforms predictively identify and message online audiences for any product or service across devices, channels and formats, including video, mobile, connected TV, display, social and native. These capabilities allow Inuvo's clients to engage with their customers and prospects in a manner that drives engagement from the first contact with the consumer. Inuvo facilitates the delivery of hundreds of millions of marketing messages to consumers every single month and counts among its clients, numerous world- renowned names in industries that have included retail, automotive, insurance, health care, technology, telecommunications and finance.

The Inuvo solution incorporates a proprietary form of artificial intelligence, or AI, branded the IntentKey. This sophisticated machine learning technology uses interactions with Internet content as a source of information from which to predict consumer intent. The AI includes a continually updated database of over 500 million machine profiles which Inuvo utilizes to deliver highly aligned online audiences to its clients. Inuvo earns revenue when consumers view or click on its client’s messages.

The Inuvo business scales through account management activity with existing clients and by adding new clients through sales activity.

As part of the Inuvo technology strategy, it owns a collection of websites including alot.com and earnspendlive.com, where Inuvo creates content in health, finance, travel, careers, auto, education and living categories. These sites provide the means to test the Inuvo technologies, while also delivering high quality consumers to clients through the interaction with proprietary content in the form of images, videos, slideshows and articles.

13

There are many barriers to entry associated with the Inuvo business model, including a proficiency in large scale information processing, predictive software development, marketing data products, analytics, artificial intelligence, integration to the internet of things (IOT), and the relationships required to execute within the IOT. Inuvo's intellectual property is protected by 18 issued and seven pending patents.

Mergers Termination

On June 20, 2019, Inuvo entered into an Agreement and Plan of Merger Termination Agreement (the “Merger Termination Agreement”) with ConversionPoint Technologies Inc., a Delaware corporation (“CPT”), ConversionPoint Holdings, Inc., a Delaware corporation (“Parent”), CPT Merger Sub, Inc., a Delaware corporation, (“CPT Merger Sub”), and CPT Cigar Merger Sub, Inc., a Nevada corporation (“Inuvo Merger Sub”), which, among other things, (1) terminated the Agreement and Plan of Merger, dated November 2, 2018, by and among Inuvo, CPT, Parent, CPT Merger Sub, and Inuvo Merger Sub, as amended (the “Merger Agreement”), pursuant to which Inuvo would have merged with and into Inuvo Merger Sub and become a wholly-owned subsidiary of Parent, and CPT would have merged with and into CPT Merger Sub and become a wholly-owned subsidiary of Parent (the “Mergers”), and (2) terminated each of the Support Agreements that were entered into by certain officers and directors of Inuvo and the parties to the Merger Agreement. The Merger Agreement was terminated as a result of Parent’s inability to fulfill the closing condition of the Mergers that Parent raise $36,000,000 in gross proceeds from an equity, debt, or equity-linked offering of its securities which no longer obligated Inuvo to consummate the Mergers contemplated by the Merger Agreement.

Concurrently with the execution of the Merger Termination Agreement, CPT Investments, LLC, a California limited liability company and an affiliate of CPT (“CPT Investments”), and Inuvo entered into a certain Inuvo Note Termination Agreement (the “Note Termination Agreement”) and agreed to (1) terminate and cancel the 10% Senior Unsecured Subordinated Convertible Promissory Note, dated November 1, 2018, executed by Inuvo in favor of CPT Investments (the “CPTI Note”), which as of June 20, 2019, had $1,063,288 in accrued principal and interest outstanding (the “Outstanding Indebtedness”) by July 20, 2019, (2) effective immediately, terminate all conversion rights under the CPTI Note to convert amounts outstanding into shares of Inuvo’s common stock, (3) terminate the Securities Purchase Agreement, dated November 1, 2018, by and between Inuvo and CPT Investments (the “Securities Purchase Agreement”), and (4) terminate the Registration Rights Agreement, dated November 1, 2018, by and between Inuvo and CPT Investments.

The Merger Termination Agreement provided that the termination fee of $2,800,000 to be paid to Inuvo (the “Termination Fee”) for failure to fulfill the Financing Condition would be satisfied as follows:

(1) $1,063,288 of the Termination Fee was satisfied in consideration of the termination and cancellation of the Outstanding Indebtedness pursuant to the CPTI Note Termination Agreement that was approved by CPT’s senior lenders Montage Capital II, L.P. and Partners for Growth IV, L.P. and CPT’s issuance of a replacement note to CPT Investments that was entered into in July 2019;

(2) $1,611,712 of the Termination Fee was satisfied by CPT transferring all of the assets related to CPT’s programmatic and RTB advertising solutions business conducted through managed services and a proprietary SaaS solution (the “ReTargeter Business”), free and clear of all liabilities, encumbrances, or liens, to Inuvo; and

(3) CPT paid $125,000 to Inuvo on September 15, 2019 to be contributed to the settlement of ongoing litigation with respect to the Mergers.

On September 30, 2019, Inuvo paid its obligation of $250,000 under a confidential settlement agreement that it entered into on June 20, 2019 resolving certain outstanding litigation related to the Mergers. Under the Merger Termination Agreement, CPT and Inuvo agreed to mutually release all claims that each party had against the other, as well as certain affiliated entities of each. Inuvo, however, will be able to pursue any claims against CPT and its affiliates for breaches of the Merger Termination Agreement.

An independent valuation of the ReTargeter Business was completed as of September 30, 2019. The enterprise valuation of the ReTargeter Business was determined to be $2.57 million.

Hitachi Credit Agreement

On March 12, 2020 Inuvo, Inc. closed a Loan and Security Agreement dated February 28, 2020 by and between our Company and our subsidiaries and Hitachi. Under the terms of the Loan and Security Agreement Hitachi has provided us with a $5,000,000 line of credit commitment. We are permitted to borrow (i) 90% of the aggregate Eligible Accounts Receivable, plus

14

(i) the lesser of 75% of the aggregate Unbilled Accounts Receivable (as those terms are defined in the Loan and Security Agreement) or 50% of the amount available to borrow under (i), up to the maximum credit commitment. On March 12, 2020 we drew $5,000,000 under this agreement, using $2,959,573 of these proceeds to satisfy our obligations to Western Alliance Bank under our credit agreement with it and the balance was used for working capital at the time. Following the satisfaction of our obligations to Western Alliance Bank, all agreements with that entity were terminated.

We will pay Hitachi monthly interest at the rate of 2% in excess of the Wall Street Journal Prime Rate, with a minimum rate of 6.75% per annum, on outstanding amounts. The principal and all accrued but unpaid interest are due on demand. In the event of a default under the terms of the Loan and Security Agreement, the interest rate increases to 6% greater than the interest rate in effect from time to time prior to a default. The Loan and Security Agreement contains certain affirmative and negative covenants to which we are also subject.

We agreed to pay Hitachi a commitment fee of $50,000, with one half due upon the execution of the agreement and the balance due six months thereafter. Thereafter, we are obligated to pay Hitachi a commitment fee of $15,000 annually. We are also obligated to pay Hitachi a quarterly service fee of 0.30% on the monthly unused amount of the maximum credit line. In addition to a $2,000 document fee we have paid to Hitachi, if we should exit the Agreement before March 1, 2022, we are obligated to pay Hitachi an exit fee of $50,000.

2020 Overview

We entered 2020 with two product lines, ValidClick and IntentKey, the latter having been launched through an integration with Xandr at the end of 2018. For ValidClick, our objective was to keep the business steady while diversifying revenue within the product line. With the termination of the Merger Agreement with CPT in June 2019, we began to reassess our strategy. The integration of the IntentKey to Xandr leading into 2019 provided a means to distribute our IntentKey product. We had conducted an extensive evaluation of potential partners in late 2018 having ultimately selected Xandr due to their scale and the immediate fit of their technology. This relationship allowed our proprietary data, which is manufactured by our patented artificial intelligence, to become available for sale by Inuvo as a service to online advertisers, thousands of which use the Xandr platform to execute their campaigns.

This year, 2020, has been an extraordinary year that could not have been predicted at the time it was forecasted. The COVID-19 pandemic resulted in the implementation of significant governmental measures, including lockdowns, closures, quarantines and travel bans, intended to control the spread of the virus. Beginning in late April 2020, we experienced a significant reduction in demand (marketing budgets) within the ValidClick business and a modest decline in demand within the IntentKey business, the combination of which has resulted in a significant reduction in our revenue run rate. Generally, marketing budgets tend to decline in times of a recession. We curtailed expenses, including compensation and travel and we issued a work from home policy to protect our employees and their families from virus transmission between co-workers. We began to experience interruptions in our daily operations, as a result of these policies. The revenue impact on our industry could vary dramatically by vertical. For example, we experienced less advertising demand from the travel, leisure and hospitality verticals. We also maintain long-standing relationships with Yahoo! and Google that provide access to hundreds of thousands of advertisers from which most of our ValidClick and digital publishing revenue originates. We continue to assess the impact of the COVID-19 pandemic on our Company.

We reported lower revenue for the year ended December 31, 2020 as compared to 2019 due predominately to the impact of the COVID-19 pandemic on customer advertising budgets. Gross margins improved significantly in 2020 compared to 2019. We reported gross margins of 81.4% in 2020 compared to 63.1% in the prior year due to reducing outsourced campaign management for the ValidClick platform as well as growing acceptance of the IntentKey.

Impact of COVID-19 Pandemic

First identified in late 2019 and known now as COVID-19, the outbreak has impacted millions of individuals and businesses worldwide. In response, many countries have implemented measures to combat the outbreak which has had an unprecedented economic consequence. We did not experience an impact from COVID-19 through the end of fiscal year 2019 and had only minor impact from COVID-19 in the first quarter of 2020. Because we operate in the digital advertising industry, unlike a brick and mortar-based company, predicting the impact of the coronavirus pandemic on our Company is difficult. Beginning in late April 2020, we experienced a significant reduction in marketing budgets and a decrease in monetization rates which impacted ValidClick more severely than the IntentKey. This resulted in a significant reduction in our overall revenue run rates within the year with the low point having occurred in May.

15

In response to COVID-19, we curtailed expenses, including compensation and travel throughout the year in addition to the other actions described above. Additionally, in April 2020, we obtained an unsecured Paycheck Protection Program ("PPP") loan under the Coronavirus Aid, Relief and Economic Security ("CARES") Act of $1.1 million which we used primarily for payroll costs. The loan was fully forgiven by the Small Business Administration (SBA) on November 2, 2020.

Beginning mid-June 2020, we began to experience an improvement in overall daily revenue, but because of the unprecedented sustainability of COVID-19 on our business, we are unable at this time to predict with any certainty how our clients will adapt their business strategies within the context of COVID-19 and therefore how our revenue run rate will change as a result. As a result of this uncertainty, we are focusing our resources on areas we believe could have more immediate revenue potential, attempting to reduce expenses and raising additional capital so as to mitigate operating disruptions while the impact of COVID-19 abates.

Our net working capital was a positive $5.9 million as of December 31, 2020. During January 2021, the Company raised approximately $14.3 million, before expenses, through the sale of our securities in two offerings. During the second and third quarters of 2020, we raised approximately $16.5 million, before expenses, through the sale of our securities and in April 2020, we obtained a $1.1 million loan under the Paycheck Protection Program established by the Coronavirus Aid, Relief, and Economic Security (CARES) Act of 2020 (“PPP Loan”). With the reduction in our revenue run rate, there is an increased need for working capital to fund our operations. There is no assurance that we will be successful in obtaining additional funding to continue operations, particularly in light of the current impact of COVID-19 on the U.S. capital markets, but believe we have sufficient capital to operate during the next twelve months.

Critical Accounting Policies and Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, the disclosure of contingent assets and liabilities and the reported amounts of revenue and expenses during the reported periods. The more critical accounting estimates include estimates related to revenue recognition and accounts receivable allowances. We also have other key accounting policies, which involve the use of estimates, judgments and assumptions that are significant to understanding our results, which are described in Note 2 to our audited consolidated financial statements for 2020 and 2019 appearing elsewhere in this report. The estimates and assumptions that management makes affect the reported amounts of assets, liabilities, net revenues and expenses and disclosure of contingent assets and liabilities. The estimates and assumptions used are based upon management’s regular evaluation of the relevant facts and circumstances as of the date of the consolidated financial statements. We regularly evaluate estimates and assumptions related to allowances for doubtful accounts, goodwill and purchased intangible asset valuations, valuation of long-lived assets, income tax valuation allowance and derivative liability. Actual results may differ from the estimates and assumptions used in preparing the accompanying consolidated financial statements, and such differences could be material.

Results of Operations

| For the Years Ended December 31, | |||||||||||||||||||||||

| 2020 | 2019 | Change | % Change | ||||||||||||||||||||

| Net Revenue | $ | 44,640,007 | $ | 61,525,214 | $ | (16,885,207) | (27.4) | % | |||||||||||||||

| Cost of Revenue | 8,296,483 | 22,700,873 | (14,404,390) | (63.5) | % | ||||||||||||||||||

| Gross Profit | $ | 36,343,524 | $ | 38,824,341 | (2,480,817) | (6.4) | % | ||||||||||||||||

Net Revenue

We experienced lower year over year revenue for the year ended December 31, 2020 as compared to the same period in 2019. Revenue declined within the ValidClick platform where COVID-19 had a material impact on advertising budgets. The renegotiation of payment terms and conditions with marketing partners in the quarter ended June 30, 2020 also contributed to the lower ValidClick revenue as a trade off for higher gross margins. The IntentKey platform grew 22.2% for the year ended December 31, 2020 over the prior year.

Cost of Revenue

Cost of revenue is primarily generated by payments to website publishers and app developers that host advertisements we serve through ValidClick and to ad exchanges that provide access to a supply of advertising inventory where we serve advertisements

16

using information predicted by the IntentKey. The decrease in the cost of revenue for the year ended December 31, 2020 compared to the same time period in 2019 was due primarily to the decline in ValidClick revenue as described in the Net Revenue section and the decision to reduce certain historically outsourced campaign management tasks.

Operating Expenses

| For the Year Ended December 31, | |||||||||||||||||||||||

| 2020 | 2019 | Change | % Change | ||||||||||||||||||||

| Marketing costs (TAC) | $ | 27,410,284 | $ | 30,135,991 | $ | (2,725,707) | (9.0 | %) | |||||||||||||||

| Compensation | 9,350,831 | 7,753,528 | 1,597,303 | 20.6 | % | ||||||||||||||||||

| Selling, general and administrative | 7,630,990 | 8,673,015 | (1,042,025) | (12.0 | %) | ||||||||||||||||||

| Operating expenses | $ | 44,392,105 | $ | 46,562,534 | $ | (2,170,429) | (4.7 | %) | |||||||||||||||

Marketing costs or TAC include those expenses required to attract an audience to the ValidClick owned and operated web properties. The decrease in marketing costs for the year ended December 31, 2020 compared to the same period in 2019 was due primarily to the decline in revenue as described in the Net Revenue section, the decision to reduce the use of outside agencies for traffic acquisition and due to renegotiating payment terms and conditions with a ValidClick marketing partner in the second quarter.

Compensation expense was higher for the year ended December 31, 2020 compared to the same time period in 2019 due primarily to higher employee salary expense, commissions, stock-based compensation and accrued incentive pay. Our total employment, both full and part-time, was 75 at December 31, 2020 compared to 65 at December 31, 2019. The higher head count at the end of 2020, as described above, was primarily the result of a decision to reduce the use of outside agencies for traffic acquisition and take the function in-house.

Selling, general and administrative costs were lower for the year ended December 31, 2020 compared to the same time period in 2019 due primarily to approximately $1 million in legal and professional fees related to the terminated Merger in 2019.

Interest Expense, net

Interest expense, net, which represents interest expense on financed receivables, finance lease obligations and PPP loan, was approximately $254 thousand for the year ended December 31, 2020.

Interest expense, net, was approximately $482 thousand for the year ended December 31, 2019. The higher amounts were primarily due to increased borrowings from financed receivables.

Other income, net

Other income, net, of $997 thousand in 2020 was primarily due to the $1.1 million PPP loan being fully forgiven on November 2, 2020. The PPP loan helped fund compensation expenses. Partially offsetting the PPP loan was a $103 thousand other expense due to the change of the fair market value of the derivative liability associated with convertible promissory notes that were extinguished by May 2020.

Other income, net, of $3.4 million in 2019 is due primarily to the Termination Fee of $2.8 million and the excess fair value over assets received for ReTargeter of $967 thousand (see Mergers Termination above), offset by approximately $191 thousand due to the change of the fair market value of the derivative liability associated with convertible promissory notes and to $255 thousand due to the conversion of a portion of the convertible promissory notes (as described in Note 7).

Liquidity and Capital Resources

The change in cash flows from operating activities during 2020 was a use of cash of $5,599,335 primarily due to a net loss of $7,304,569, a decrease in the accounts payable balance by $2,271,578, the benefit of $1,260,978 from a contract cancellation and $1,109,000 from the forgiveness of the PPP loan, partially offset by the decrease in the accounts receivable balance of $1,317,508 and the increase in accrued expenses and other liabilities balance by $623,576. Our terms are such that we generally collect receivables prior to paying trade payables. Media sales typically have slower payment terms than the terms of related payables.

17

Our principal sources of liquidity are the sale of our common stock, our borrowings under our credit facility with Hitachi, described in Note 6, and borrowings from non-bank financial institutions (see Note 7). During March 2020 and April 2020, we raised approximately $1.5 million in gross proceeds, before expenses, through sales of our common stock and in April 2020 we received a $1.1 million PPP Loan. On June 8, 2020, we raised an additional $5.5 million in gross proceeds, before expenses, through the sale of our common stock and on July 27, 2020, we raised an additional $10.75 million in gross proceeds, before expenses, through sales of our common stock. On January 19, 2021, we raised an additional $8 million in gross proceeds, before expenses, through the sale of our common stock, and on January 22, 2021, we raised an additional $6.25 million in gross proceeds, before expenses, through sales of our common stock.

We have focused our resources behind a plan to grow our AI technology, the IntentKey, where we have a technology advantage and higher margins. If we are successful in implementing our plan, we expect to return to a positive cash flow from operations. However, there is no assurance that we will be able to achieve this objective.

Though we believe our current cash position and credit facility will be sufficient to sustain operations for the next twelve months, if our plan to grow the IntentKey business is unsuccessful, we may need to fund operations through private or public sales of securities, debt financings or partnering/licensing transactions.

In April 2020, the Company experienced a significant reduction in advertiser marketing budgets across both the ValidClick and IntentKey platforms as a direct consequence of COVID-19. These reductions continued to adversely impact overall revenue throughout the year. While COVID-19 is still present, we are at this time, unable to quantify the long-term impacts on our Company. As a result, in May 2020 and June 2020 we implemented a temporary compensation change for senior officers and certain other highly compensated employees. We also curtailed expenses, including compensation and travel for the months of May and June, and we issued a work from home policy to protect our employees and their families from virus transmission associated with co-workers. As a result of this uncertainty, we continue to focus our resources on areas we believe have immediate revenue potential while concurrently reducing expenses where necessary with an objective to minimize daily operating disruptions.

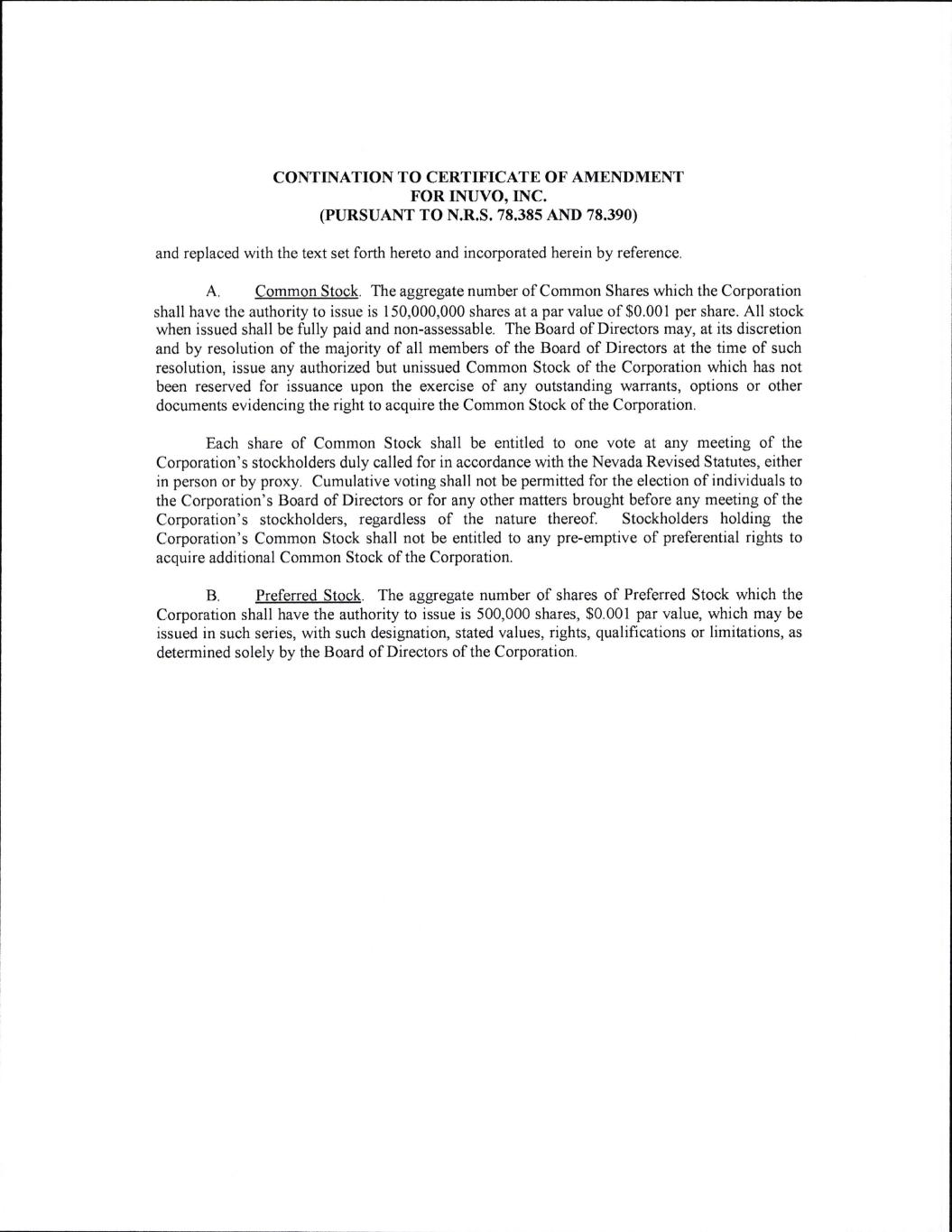

On October 7, 2020, we held a Special Meeting of Stockholders for the purpose of approving and adopting the ratification and validation of the amendment to our articles of incorporation to increase the number of authorized shares of common stock that we may issue from 60,000,000 to 100,000,000. The proposal was approved.

On December 16, 2020, stockholders approved an amendment to our articles of incorporation increasing the number of authorized shares of common stock, $0.001 par value per share from 100,000,000 to 150,000,000.

Cash Flows

The table below sets forth a summary of our cash flows for the years ended 2020 and 2019:

2020 | 2019 | |||||||

Net cash used in operating activities | $5,559,335 | $5,338,383 | ||||||

Net cash used in investing activities | $1,185,335 | $1,194,164 | ||||||

Net cash provided by financing activities | $14,302,346 | $6,676,580 | ||||||

Cash Flows - Operating

Net cash used in operating activities was $5,599,335 during 2020. We reported a net loss of $7,304,569, which included non-cash expenses; depreciation and amortization of $3,237,930, amortization of right of use assets $367,981 and stock-based compensation of $858,683. The change in operating assets and liabilities was a net use of cash of $506,196 primarily due to a decrease in the accounts payable balance by $2,271,578, offset by a decrease in the accounts receivable balance by $1,317,508. Our terms are such that we generally collect receivables prior to paying trade payables. Media sales typically have slower payment terms than the terms of related payables.

During 2019, cash used in operating activities was $5,338,383. We reported a net loss of $4,488,107. Additional non-cash expenses included the non-cash expenses of depreciation and amortization of $3,422,385 and stock-based compensation expenses of $789,914. The change in operating assets and liabilities was a net use of cash of $1,583,570.

18

Cash Flows - Investing

Net cash used in investing activities was $1,185,335 and $1,194,164 for 2020 and 2019, respectively. Cash used in investing activities in both years has primarily consisted of capitalized internal development costs.

Cash Flows - Financing