UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended September 29, 2013

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to .

Commission File Number: 0-20322

Starbucks Corporation

(Exact Name of Registrant as Specified in its Charter)

Washington | 91-1325671 | |

(State of Incorporation) | (IRS Employer ID) | |

2401 Utah Avenue South, Seattle, Washington 98134

(206) 447-1575

(Address of principal executive offices, zip code, telephone number)

Securities Registered Pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock, $0.001 par value per share | Nasdaq Global Select Market | |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation of S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer | x | Accelerated filer | ¨ |

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting stock held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter, based upon the closing sale price of the registrant’s common stock on March 29, 2013 as reported on the NASDAQ Global Select Market was $41 billion. As of November 8, 2013, there were 753.6 million shares of the registrant’s Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement for the registrant’s Annual Meeting of Shareholders to be held on March 19, 2014 have been incorporated by reference into Part III of this Annual Report on Form 10-K.

STARBUCKS CORPORATION

Form 10-K

For the Fiscal Year Ended September 29, 2013

TABLE OF CONTENTS

PART I | ||

Item 1 | ||

Item 1A | ||

Item 1B | ||

Item 2 | ||

Item 3 | ||

Item 4 | ||

PART II | ||

Item 5 | ||

Item 6 | ||

Item 7 | ||

Item 7A | ||

Item 8 | ||

Item 9 | ||

Item 9A | ||

Item 9B | ||

PART III | ||

Item 10 | ||

Item 11 | ||

Item 12 | ||

Item 13 | ||

Item 14 | ||

PART IV | ||

Item 15 | ||

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include words such as “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “seeks” or words of similar meaning, or future or conditional verbs, such as “will,” “should,” “could,” “may,” “aims,” “intends,” or “projects.” A forward-looking statement is neither a prediction nor a guarantee of future events or circumstances, and those future events or circumstances may not occur. You should not place undue reliance on forward-looking statements, which speak only as of the date of this Annual Report on Form 10-K. These forward-looking statements are all based on currently available operating, financial and competitive information and are subject to various risks and uncertainties. Our actual future results and trends may differ materially depending on a variety of factors, including, but not limited to, the risks and uncertainties discussed under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. Given these risks and uncertainties, you should not rely on forward-looking statements as a prediction of actual results. Any or all of the forward-looking statements contained in this Annual Report on Form 10-K and any other public statement made by us, including by our management, may turn out to be incorrect. We are including this cautionary note to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for forward-looking statements. We expressly disclaim any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

1

PART I

Item 1. | Business |

General

Starbucks is the premier roaster, marketer and retailer of specialty coffee in the world, operating in 62 countries. Formed in 1985, Starbucks Corporation’s common stock trades on the NASDAQ Global Select Market (“NASDAQ”) under the symbol “SBUX.” We purchase and roast high-quality coffees that we sell, along with handcrafted coffee, tea and other beverages and a variety of fresh food items, through company-operated stores. We also sell a variety of coffee and tea products and license our trademarks through other channels such as licensed stores, grocery and national foodservice accounts. In addition to our flagship Starbucks brand, our portfolio also includes goods and services offered under these brands: Teavana, Tazo, Seattle’s Best Coffee, Starbucks VIA, Starbucks Refreshers, Evolution Fresh, La Boulange and Verismo.

Our objective is to maintain Starbucks standing as one of the most recognized and respected brands in the world. To achieve this, we are continuing the disciplined expansion of our global store base. In addition, by leveraging the experience gained through our traditional store model, we continue to offer consumers new coffee and other products in a variety of forms, across new categories, and through diverse channels. Starbucks Global Responsibility strategy and commitments related to coffee and the communities we do business in, as well as our focus on being an employer of choice, are also key complements to our business strategies.

In this Annual Report on Form 10-K (“10-K” or “Report”) for the fiscal year ended September 29, 2013 (“fiscal 2013”), Starbucks Corporation (together with its subsidiaries) is referred to as “Starbucks,” the “Company,” “we,” “us” or “our.”

Segment Financial Information

We have four reportable operating segments: 1) Americas, inclusive of the US, Canada, and Latin America; 2) Europe, Middle East, and Africa ("EMEA"); 3) China / Asia Pacific (“CAP”) and 4) Channel Development. Segment revenues as a percentage of total net revenues for fiscal year 2013 were as follows: Americas (74%), EMEA (8%), CAP (6%), Channel Development (9%), and all other segments (3%).

Our Americas, EMEA, and CAP segments include both company-operated and licensed stores. Our Americas segment is our most mature business and has achieved significant scale. Certain markets within our EMEA and CAP operations are still in the early stages of development and require a more extensive support organization, relative to their current levels of revenue and operating income, than our Americas operations. The Americas and EMEA segments also include certain foodservice accounts, primarily in Canada and the UK. Our Americas segment also includes our La Boulange® retail stores.

Our Channel Development segment includes whole bean and ground coffees, premium Tazo® teas, Starbucks- and Tazo-branded single serve products, a variety of ready-to-drink beverages, such as Starbucks Refreshers™ beverages, and other branded products sold worldwide through channels such as grocery stores, warehouse clubs, specialty retailers, convenience stores, and US foodservice accounts.

Our other, non-reportable, operating segments include the operating results from Teavana, Seattle's Best Coffee, Evolution Fresh, and our Digital Ventures business. These other operating segments are referred to as All Other Segments.

Effective at the beginning of fiscal 2013, we decentralized certain leadership functions in the areas of retail marketing and category management, global store development and partner resources to support and align with the respective operating segment presidents. In conjunction with these moves, certain general and administrative and depreciation and amortization expenses associated with these functions, which were previously reported as unallocated corporate expenses within "Other," are now reported within the respective reportable operating segments to align with the regions they support.

Beginning in the second quarter of fiscal 2013, we changed the presentation of our unallocated corporate expenses, which were previously combined with our non-reportable operating segments in "Other". Unallocated corporate operating expenses pertain primarily to corporate administrative functions that support the operating segments but are not specifically attributable to or managed by any segment. These expenses are now presented as a reconciling item between total segment operating results and consolidated operating results.

Concurrent with the reporting changes noted above, we revised our prior period financial information to reflect comparable financial information. Historical financial information presented herein reflects these changes. There was no impact on consolidated net revenues, total operating expenses, operating income, or net earnings as a result of these changes.

Starbucks segment information is included in Note 16 to the consolidated financial statements included in Item 8 of Part II of this 10-K.

2

Revenue Components

We generate nearly all of our revenues through company-operated stores, licensed stores, consumer packaged goods ("CPG") and foodservice operations.

Company-operated and Licensed Store Summary as of September 29, 2013

Americas | As a% of Total Americas Stores | EMEA | As a% of Total EMEA Stores | CAP | As a% of Total CAP Stores | All Other Segments | As a% of Total All Other Segments Stores | Total | As a% of Total Stores | ||||||||||||||||||||

Company-operated stores | 8,078 | 60 | % | 853 | 43 | % | 906 | 23 | % | 357 | 84 | % | 10,194 | 52 | % | ||||||||||||||

Licensed stores | 5,415 | 40 | % | 1,116 | 57 | % | 2,976 | 77 | % | 66 | 16 | % | 9,573 | 48 | % | ||||||||||||||

Total | 13,493 | 100 | % | 1,969 | 100 | % | 3,882 | 100 | % | 423 | 100 | % | 19,767 | 100 | % | ||||||||||||||

The mix of company-operated versus licensed stores in a given market will vary based on several factors, including our ability to access desirable local retail space, the complexity and expected ultimate size of the market for Starbucks, and our ability to leverage the support infrastructure in an existing geographic region.

Company-operated Stores

Revenue from company-operated stores accounted for 79% of total net revenues during fiscal 2013. Our retail objective is to be the leading retailer and brand of coffee in each of our target markets by selling the finest quality coffee and related products, and by providing each customer a unique Starbucks Experience. The Starbucks Experience is built upon superior customer service, as well as clean and well-maintained company-operated stores that reflect the personalities of the communities in which they operate, thereby building a high degree of customer loyalty.

Our strategy for expanding our global retail business is to increase our market share in a disciplined manner, by selectively opening additional stores in new and existing markets, as well as increasing sales in existing stores, to support our long-term strategic objective to maintain Starbucks standing as one of the most recognized and respected brands in the world. Store growth in specific existing markets will vary due to many factors, including the maturity of the market.

3

Company-operated store data for the year-ended September 29, 2013:

Stores Open as of | Stores Open as of | |||||||||||||

Sep 30, 2012 | Opened | Closed | Net | Sep 29, 2013 | ||||||||||

Americas(1): | ||||||||||||||

US | 6,856 | 231 | (38 | ) | 193 | 7,049 | ||||||||

Canada | 874 | 69 | (3 | ) | 66 | 940 | ||||||||

Brazil | 53 | 18 | (1 | ) | 17 | 70 | ||||||||

Puerto Rico | 19 | 1 | (1 | ) | — | 19 | ||||||||

Total Americas | 7,802 | 319 | (43 | ) | 276 | 8,078 | ||||||||

EMEA(2): | ||||||||||||||

UK | 593 | 6 | (50 | ) | (44 | ) | 549 | |||||||

Germany | 157 | 9 | (9 | ) | — | 157 | ||||||||

France | 67 | 7 | (2 | ) | 5 | 72 | ||||||||

Switzerland | 50 | 4 | (2 | ) | 2 | 52 | ||||||||

Austria | 12 | 4 | — | 4 | 16 | |||||||||

Netherlands | 3 | 4 | — | 4 | 7 | |||||||||

Total EMEA | 882 | 34 | (63 | ) | (29 | ) | 853 | |||||||

CAP: | ||||||||||||||

China | 408 | 209 | (3 | ) | 206 | 614 | ||||||||

Thailand | 155 | 22 | (3 | ) | 19 | 174 | ||||||||

Singapore | 80 | 20 | (6 | ) | 14 | 94 | ||||||||

Australia | 23 | 1 | — | 1 | 24 | |||||||||

Total CAP | 666 | 252 | (12 | ) | 240 | 906 | ||||||||

All Other Segments: | ||||||||||||||

Teavana(3) | — | 340 | (2 | ) | 338 | 338 | ||||||||

Seattle's Best Coffee | 12 | 11 | (8 | ) | 3 | 15 | ||||||||

Evolution Fresh | 2 | 2 | — | 2 | 4 | |||||||||

Total All Other Segments | 14 | 353 | (10 | ) | 343 | 357 | ||||||||

Total company-operated | 9,364 | 958 | (128 | ) | 830 | 10,194 | ||||||||

(1) | Americas store data has been adjusted for the sale of store locations in Chile to a joint venture partner in the fourth quarter of fiscal 2013 by reclassifying historical information from company-operated stores to licensed stores, and to exclude Seattle's Best Coffee and Evolution Fresh, which are now reported within All Other Segments. |

(2) | EMEA store data has been adjusted for the transfer of certain company-operated stores to licensees in the fourth quarter of fiscal 2012. |

(3) | Acquired during the second quarter of fiscal 2013. |

Starbucks® company-operated stores are typically located in high-traffic, high-visibility locations. Our ability to vary the size and format of our stores allows us to locate them in or near a variety of settings, including downtown and suburban retail centers, office buildings, university campuses, and in select rural and off-highway locations. To provide a greater degree of access and convenience for non-pedestrian customers, we continue to expand development of Drive Thru stores.

Starbucks® stores offer a choice of coffee and tea beverages, distinctively packaged roasted whole bean and ground coffees, a variety of premium single serve products, juices and bottled water. Starbucks® stores also offer an assortment of fresh food offerings, including selections focusing on high-quality ingredients, nutritional value and great flavor. A focused selection of beverage-making equipment and accessories are also sold in our stores. Each Starbucks® store varies its product mix depending upon the size of the store and its location. To complement the in-store experience, our company-operated Starbucks® stores in the US, Canada, and certain other international markets also provide customers free access to wireless internet.

4

Retail sales mix by product type for company-operated stores:

Fiscal Year Ended | Sep 29, 2013 | Sep 30, 2012 | Oct 2, 2011 | |||||

Beverages | 74 | % | 75 | % | 75 | % | ||

Food | 20 | % | 19 | % | 19 | % | ||

Packaged and single serve coffees | 3 | % | 4 | % | 4 | % | ||

Coffee-making equipment and other merchandise | 3 | % | 2 | % | 2 | % | ||

Total | 100 | % | 100 | % | 100 | % | ||

Starbucks Card

The Starbucks stored value card program is designed to provide convenience, support gifting, and increase the frequency of store visits by cardholders. Starbucks Cards are sold in company-operated and most licensed stores in North America, as well as on-line and in other retail locations. The cards are also sold in a number of other international locations. Customers may access their card balances by utilizing their Starbucks Card or mobile app in retail stores. Customers who register their card in the US, Canada, and certain other countries are automatically enrolled in the My Starbucks Rewards™ program and can receive various benefits depending on the number of reward points (“Stars”) earned in a 12-month period.

Licensed Stores

Product sales to and royalty and license fee revenues from our licensed stores accounted for 9% of total net revenues in fiscal 2013. In our licensed store operations, we leverage the expertise of our local partners and share our operating and store development experience. Licensees provide improved, and at times the only, access to desirable retail space. Most licensees are prominent retailers with in-depth market knowledge and access. As part of these arrangements, we receive royalties and license fees and sell coffee, tea and related products for resale in licensed locations. Employees working in licensed retail locations are required to follow our detailed store operating procedures and attend training classes similar to those given to employees in company-operated stores. For Teavana and Seattle's Best Coffee, as well as Starbucks in the UK, we also use traditional franchising.

5

Licensed store data for the year-ended September 29, 2013:

Stores Open as of | Stores Open as of | |||||||||||||

Sep 30, 2012 | Opened | Closed | Net | Sep 29, 2013 | ||||||||||

Americas(1): | ||||||||||||||

US | 4,189 | 281 | (62 | ) | 219 | 4,408 | ||||||||

Mexico | 356 | 48 | (1 | ) | 47 | 403 | ||||||||

Canada | 300 | 98 | (1 | ) | 97 | 397 | ||||||||

Other | 166 | 41 | — | 41 | 207 | |||||||||

Total Americas | 5,011 | 468 | (64 | ) | 404 | 5,415 | ||||||||

EMEA(2): | ||||||||||||||

UK | 168 | 48 | (1 | ) | 47 | 215 | ||||||||

Turkey | 171 | 26 | (4 | ) | 22 | 193 | ||||||||

United Arab Emirates | 99 | 9 | (1 | ) | 8 | 107 | ||||||||

Spain | 78 | 4 | — | 4 | 82 | |||||||||

Kuwait | 65 | 6 | (2 | ) | 4 | 69 | ||||||||

Saudi Arabia | 64 | 6 | (8 | ) | (2 | ) | 62 | |||||||

Russia | 60 | 8 | (3 | ) | 5 | 65 | ||||||||

Other | 282 | 54 | (13 | ) | 41 | 323 | ||||||||

Total EMEA | 987 | 161 | (32 | ) | 129 | 1,116 | ||||||||

CAP: | ||||||||||||||

Japan | 965 | 49 | (14 | ) | 35 | 1,000 | ||||||||

China | 292 | 116 | (5 | ) | 111 | 403 | ||||||||

South Korea | 467 | 108 | (16 | ) | 92 | 559 | ||||||||

Taiwan | 271 | 33 | (7 | ) | 26 | 297 | ||||||||

Philippines | 201 | 18 | (3 | ) | 15 | 216 | ||||||||

Other | 432 | 87 | (18 | ) | 69 | 501 | ||||||||

Total CAP | 2,628 | 411 | (63 | ) | 348 | 2,976 | ||||||||

All Other Segments: | ||||||||||||||

Teavana(3) | — | 28 | — | 28 | 28 | |||||||||

Seattle's Best Coffee | 76 | 1 | (39 | ) | (38 | ) | 38 | |||||||

Total All Other Segments | 76 | 29 | (39 | ) | (10 | ) | 66 | |||||||

Total licensed | 8,702 | 1,069 | (198 | ) | 871 | 9,573 | ||||||||

(1) | Americas store data has been adjusted for the sale of store locations in Chile to a joint venture partner in the fourth quarter of fiscal 2013 by reclassifying historical information from company-operated stores to licensed stores, and to exclude Seattle's Best Coffee and Evolution Fresh, which are now reported within All Other Segments. |

(2) | EMEA store data has been adjusted for the transfer of certain company-operated stores to licensees in the fourth quarter of fiscal 2012. |

(3) | Acquired during the second quarter of fiscal 2013. |

Consumer Packaged Goods

Consumer packaged goods includes both domestic and international sales of packaged coffee and tea as well as a variety of ready-to-drink beverages and single-serve coffee and tea products to grocery, warehouse club and specialty retail stores. It also includes revenues from product sales to and licensing revenues from manufacturers that produce and market Starbucks and Seattle’s Best Coffee branded products through licensing agreements. Revenues from sales of consumer packaged goods comprised 7% of total net revenues in fiscal 2013.

6

Foodservice

Revenues from foodservice accounts comprised 4% of total net revenues in fiscal 2013. We sell Starbucks® and Seattle’s Best Coffee® whole bean and ground coffees, a selection of premium Tazo® teas, Starbucks VIA® Ready Brew, and other coffee and tea related products to institutional foodservice companies that service business and industry, education, healthcare, office coffee distributors, hotels, restaurants, airlines and other retailers. We also sell our Seattle’s Best Coffee® through arrangements with national accounts. The majority of the sales in this channel come through national broadline distribution networks with SYSCO Corporation, US Foodservice™, and other distributors.

Product Supply

Starbucks is committed to selling only the finest whole bean coffees and coffee beverages. To ensure compliance with our rigorous coffee standards, we control coffee purchasing, roasting and packaging, and the global distribution of coffee used in our operations. We purchase green coffee beans from multiple coffee-producing regions around the world and custom roast them to our exacting standards for our many blends and single origin coffees.

The price of coffee is subject to significant volatility. Although most coffee trades in the commodity market, high-altitude arabica coffee of the quality sought by Starbucks tends to trade on a negotiated basis at a premium above the “C” coffee commodity price. Both the premium and the commodity price depend upon the supply and demand at the time of purchase. Supply and price can be affected by multiple factors in the producing countries, including weather, natural disasters, crop disease, general increase in farm inputs and costs of production, inventory levels and political and economic conditions. Price is also impacted by trading activities in the arabica coffee futures market, including hedge funds and commodity index funds. In addition, green coffee prices have been affected in the past, and may be affected in the future, by the actions of certain organizations and associations that have historically attempted to influence prices of green coffee through agreements establishing export quotas or by restricting coffee supplies.

We buy coffee using fixed-price and price-to-be-fixed purchase commitments, depending on market conditions, to secure an adequate supply of quality green coffee. Price-to-be-fixed contracts are purchase commitments whereby the quality, quantity, delivery period, and other negotiated terms are agreed upon, but the date, and therefore the price, at which the base “C” coffee commodity price component will be fixed has not yet been established. For these types of contracts, either Starbucks or the seller has the option to select a date on which to “fix” the base “C” coffee commodity price prior to the delivery date. Until prices are fixed, we estimate the total cost of these purchase commitments. Total green coffee purchase commitments as of September 29, 2013 were $882 million, comprised of $588 million under fixed-price contracts and an estimated $294 million under price-to-be-fixed contracts. As of September 29, 2013, approximately $0.3 million of our price-to-be-fixed contracts were effectively fixed through the use of futures contracts. All price-to-be-fixed contracts as of September 29, 2013 were at the Company’s option to fix the base “C” coffee commodity price component. Total purchase commitments, together with existing inventory, are expected to provide an adequate supply of green coffee through fiscal 2014.

We depend upon our relationships with coffee producers, outside trading companies and exporters for our supply of green coffee. We believe, based on relationships established with our suppliers, the risk of non-delivery on such purchase commitments is remote.

To help ensure the future supply of high-quality green coffees, and to reinforce our leadership role in the coffee industry, Starbucks operates farmer support centers in six countries. The farmer support centers are staffed with agronomists and sustainability experts who work with coffee farming communities to promote best practices in coffee production designed to improve both coffee quality and yields.

In addition to coffee, we also purchase significant amounts of dairy products, particularly fluid milk, to support the needs of our company-operated stores. We believe, based on relationships established with our dairy suppliers, that the risk of non-delivery of sufficient fluid milk to support our stores is remote.

Products other than whole bean coffees and coffee beverages sold in Starbucks® stores include tea and a number of ready-to-drink beverages that are purchased from several specialty suppliers, usually under long-term supply contracts. Food products, such as La Boulange™ pastries, breakfast sandwiches and lunch items, are purchased from national, regional and local sources. We also purchase a broad range of paper and plastic products, such as cups and cutlery, from several companies to support the needs of our retail stores as well as our manufacturing and distribution operations. We believe, based on relationships established with these suppliers and manufacturers, that the risk of non-delivery of these items is remote.

7

Competition

Our primary competitors for coffee beverage sales are quick-service restaurants and specialty coffee shops. In almost all markets in which we do business, there are numerous competitors in the specialty coffee beverage business. We believe that our customers choose among specialty coffee retailers primarily on the basis of product quality, service and convenience, as well as price. We continue to experience direct competition from large competitors in the US quick-service restaurant sector and the US ready-to-drink coffee beverage market, in addition to well-established companies in many international markets. We also compete with restaurants and other specialty retailers for prime retail locations and qualified personnel to operate both new and existing stores.

Our coffee and tea products sold through our Channel Development segment compete directly against specialty coffees and teas sold through grocery stores, warehouse clubs, specialty retailers, convenience stores, and US foodservice accounts and compete indirectly against all other coffees and teas on the market.

Patents, Trademarks, Copyrights and Domain Names

Starbucks owns and has applied to register numerous trademarks and service marks in the US and in additional countries throughout the world. Some of our trademarks, including Starbucks, the Starbucks logo, Tazo, Seattle’s Best Coffee, Teavana, Frappuccino, Starbucks VIA, Evolution Fresh and La Boulange are of material importance. The duration of trademark registrations varies from country to country. However, trademarks are generally valid and may be renewed indefinitely as long as they are in use and/or their registrations are properly maintained.

We own numerous copyrights for items such as product packaging, promotional materials, in-store graphics and training materials. We also hold patents on certain products, systems and designs. In addition, Starbucks has registered and maintains numerous Internet domain names, including “Starbucks.com,” “Starbucks.net,” "Tazo.com," “Seattlesbest.com" and “Teavana.com.”

Seasonality and Quarterly Results

Our business is subject to seasonal fluctuations, including fluctuations resulting from the holiday season in December. Our cash flows from operations are considerably higher in the first fiscal quarter than the remainder of the year. This is largely driven by cash received as Starbucks Cards are purchased and loaded during the holiday season. Since revenues from Starbucks Cards are recognized upon redemption and not when purchased, seasonal fluctuations on the consolidated statements of earnings are much less pronounced. Quarterly results are also affected by the timing of the opening of new stores and the closing of existing stores. For these reasons, results for any quarter are not necessarily indicative of the results that may be achieved for the full fiscal year.

Employees

Starbucks employed approximately 182,000 people worldwide as of September 29, 2013. In the US, Starbucks employed approximately 137,000 people, with 129,000 in company-operated stores and the remainder in support facilities, store development, and roasting and warehousing operations. Approximately 45,000 employees were employed outside of the US, with 43,000 in company-operated stores and the remainder in regional support operations. The number of Starbucks employees represented by unions is not significant. We believe our current relations with our employees are good.

Executive Officers of the Registrant

Name | Age | Position | ||

Howard Schultz | 60 | chairman, president and chief executive officer | ||

Cliff Burrows | 54 | group president, Americas and US, EMEA and Teavana | ||

John Culver | 53 | group president, China & Asia Pacific, Channel Development and Emerging Brands | ||

Jeff Hansberry | 49 | president, China & Asia Pacific | ||

Troy Alstead | 50 | chief financial officer and group president, Global Business Services | ||

Lucy Lee Helm | 56 | executive vice president, general counsel and secretary | ||

8

Howard Schultz is the founder of Starbucks Corporation and serves as the chairman, president and chief executive officer. Mr. Schultz has served as chairman of the board of directors since Starbucks inception in 1985, and in January 2008, he reassumed the role of president and chief executive officer. From June 2000 to February 2005, Mr. Schultz also held the title of chief global strategist. From November 1985 to June 2000, he served as chairman of the board and chief executive officer. From November 1985 to June 1994, Mr. Schultz also served as president. From January 1986 to July 1987, Mr. Schultz was the chairman of the board, chief executive officer and president of Il Giornale Coffee Company, a predecessor to the Company. From September 1982 to December 1985, Mr. Schultz was the director of retail operations and marketing for Starbucks Coffee Company, a predecessor to the Company.

Cliff Burrows joined Starbucks in April 2001 and has served as group president, Americas and US, EMEA (Europe, Middle East and Africa) and Teavana since May 2013. Mr. Burrows served as president, Starbucks Coffee Americas and US from October 2011 to May 2013 and as president, Starbucks Coffee US from March 2008 to October 2011. He served as president, Europe, Middle East and Africa (EMEA) from April 2006 to March 2008. He served as vice president and managing director, UK prior to April 2006. Prior to joining Starbucks, Mr. Burrows served in various management positions with Habitat Designs Limited, a furniture and house wares retailer.

John Culver joined Starbucks in August 2002 and has served as group president, China & Asia Pacific, Channel Development (CPG) and Emerging Brands since May 2013. Mr. Culver served as president, Starbucks Coffee China and Asia Pacific from October 2011 to May 2013. From December 2009 to October 2011, he served as president, Starbucks Coffee International. Mr. Culver served as executive vice president; president, Global Consumer Products, Foodservice and Seattle’s Best Coffee from February 2009 to September 2009, and then as president, Global Consumer Products and Foodservice from October 2009 to November 2009. He previously served as senior vice president; president, Starbucks Coffee Asia Pacific from January 2007 to February 2009, and vice president; general manager, Foodservice from August 2002 to January 2007.

Jeff Hansberry joined Starbucks in June 2010 and has served as president, China and Asia Pacific since May 2013. Mr. Hansberry served as president, Channel Development and Emerging Brands from June 2012 to May 2013. From October 2011 to June 2012, he served as president, Channel Development and president, Seattle’s Best Coffee. From June 2010 to October 2011, he served as president, Global Consumer Products and Foodservice. Prior to joining Starbucks, Mr. Hansberry served as vice president and general manager, Popular BU for E. & J. Gallo Winery, a family-owned winery, from November 2008 to May 2010. From September 2007 to November 2008, Mr. Hansberry served as vice president and general manager, Value BU, and from April 2005 to August 2007, he served as vice president and general manager Asia, for E. & J. Gallo Winery. Prior to E. & J. Gallo, Mr. Hansberry held various positions with Procter & Gamble.

Troy Alstead joined Starbucks in 1992 and has served as chief financial officer and group president, Global Business Services since September 2013. Mr. Alstead previously served as chief financial officer and chief administrative officer from November 2008 to September 2013, as chief operating officer, Starbucks Greater China from April 2008 to October 2008, senior vice president, Global Finance and Business Operations from August 2007 to April 2008, and senior vice president, Corporate Finance from September 2004 to August 2007. Mr. Alstead served in a number of other senior positions with Starbucks prior to 2004.

Lucy Lee Helm joined Starbucks in September 1999 and has served as executive vice president, general counsel and secretary since May 2012. She served as senior vice president and deputy general counsel from October 2007 to April 2012 and served as interim general counsel and secretary from April 2012 to May 2012. Ms. Helm previously served as vice president, assistant general counsel from June 2002 to September 2007 and as director, corporate counsel from September 1999 to May 2002. During her tenure at Starbucks, Ms. Helm has led various teams of the Starbucks legal department, including the Litigation and Brand protection team, the Global Business (Commercial) team and the Litigation and Employment team. Prior to joining Starbucks, Ms. Helm was a principal at the Seattle law firm of Riddell Williams P.S. from 1990 to 1999, where she was a trial lawyer specializing in commercial, insurance coverage and environmental litigation.

Global Responsibility

We are committed to being a deeply responsible company in the communities where we do business. Our focus is on ethically sourcing high-quality coffee, reducing our environmental impacts and contributing positively to communities around the world. Starbucks Global Responsibility strategy and commitments are integral to our overall business strategy. As a result, we believe we deliver benefits to our stakeholders, including employees, business partners, customers, suppliers, shareholders, community members and others. For an overview of Starbucks Global Responsibility strategy and commitments, please visit www.starbucks.com.

9

Available Information

Starbucks 10-K reports, along with all other reports and amendments filed with or furnished to the Securities and Exchange Commission (“SEC”), are publicly available free of charge on the Investor Relations section of our website at investor.starbucks.com or at www.sec.gov as soon as reasonably practicable after these materials are filed with or furnished to the SEC. Our corporate governance policies, code of ethics and Board committee charters and policies are also posted on the Investor Relations section of Starbucks website at investor.starbucks.com. The information on our website is not part of this or any other report Starbucks files with, or furnishes to, the SEC.

Item 1A. Risk Factors

You should carefully consider the risks described below. If any of the risks and uncertainties described in the cautionary factors described below actually occurs, our business, financial condition and results of operations, and the trading price of our common stock could be materially and adversely affected. Moreover, we operate in a very competitive and rapidly changing environment. New factors emerge from time to time and it is not possible to predict the impact of all these factors on our business, financial condition or results of operation.

• | Economic conditions in the US and certain international markets could adversely affect our business and financial results. |

As a retailer that is dependent upon consumer discretionary spending, our results of operations are sensitive to changes in macro-economic conditions. Our customers may have less money for discretionary purchases and may stop or reduce their purchases of our products or trade down to Starbucks or competitors' lower priced products as a result of job losses, foreclosures, bankruptcies, increased fuel and energy costs, higher interest rates, higher taxes, reduced access to credit and lower home prices. Decreases in customer traffic and/or average value per transaction will negatively impact our financial performance as reduced revenues without a corresponding decrease in expenses result in sales de-leveraging, which creates downward pressure on margins and also negatively impacts comparable store sales, net revenues, operating income and earnings per share. There is also a risk that if negative economic conditions persist for a long period of time or worsen, consumers may make long-lasting changes to their discretionary purchasing behavior, including less frequent discretionary purchases on a more permanent basis.

• | We may not be successful in implementing important strategic initiatives or effectively managing growth, which may have an adverse impact on our business and financial results. |

There is no assurance that we will be able to implement important strategic initiatives in accordance with our expectations, which may result in an adverse impact on our business and financial results. These strategic initiatives are designed to create growth, improve our results of operations and drive long-term shareholder value, and include:

• | successfully leveraging Starbucks brand portfolio outside the company-operated store base, including our increased focus on international licensed stores; |

• | focusing on relevant product innovation and profitable new growth platforms, including retail tea, and achieving customer acceptance of these new products and platforms while maintaining demand for our current offerings; |

• | continuing to accelerate the growth of our Channel Development business; |

• | balancing disciplined global store growth and existing store renovation while meeting target store-level unit economics in a given market; |

• | timely completion of certain supply chain capacity expansion initiatives, including increased roasting capacity and construction of a new soluble products plant; |

• | executing a multi-channel advertising and marketing campaign to effectively communicate our message directly to Starbucks consumers and employees; and |

• | strategic acquisitions, divestitures or joint ventures. |

In addition to other factors listed in this risk factors section, factors that may adversely affect the successful implementation of these initiatives, which could adversely impact our business and financial results, include construction cost increases associated with new store openings and remodeling of existing stores; delays in store openings for reasons beyond our control or a lack of desirable real estate locations available for lease at reasonable rates, either of which could keep us from meeting annual store opening targets in the US and internationally; lack of customer acceptance of new products due to price increases necessary to cover the costs of new products or higher input costs; the degree to which we enter into, maintain, develop and are able to negotiate appropriate terms and conditions of, and enforce, commercial and other agreements; not successfully consummating favorable strategic transactions or integrating acquired businesses; or the deterioration in our credit ratings, which could limit the availability of additional financing and increase the cost of obtaining financing to fund our initiatives.

Additionally, effectively managing growth can be challenging, particularly as we continue to expand into new channels outside the retail store model, increase our focus on our Channel Development business, and expand into new markets internationally

10

where we must balance the need for flexibility and a degree of autonomy for local management against the need for consistency with our goals, philosophy and standards. Growth can make it increasingly difficult to ensure a consistent supply of high-quality raw materials, to locate and hire sufficient numbers of key employees, to maintain an effective system of internal controls for a globally dispersed enterprise and to train employees worldwide to deliver a consistently high quality product and customer experience.

• | We face intense competition in each of our channels and markets, which could lead to reduced profitability. |

The specialty coffee market is intensely competitive, including with respect to product quality, innovation, service, convenience, and price, and we face significant and increasing competition in all these areas in each of our channels and markets. Accordingly, we do not have leadership positions in all channels and markets. In the US, the ongoing focus by large competitors in the quick-service restaurant sector on selling high-quality specialty coffee beverages could lead to decreases in customer traffic to Starbucks® stores and/or average value per transaction adversely affecting our sales and results of operations. Similarly, continued competition from well-established competitors in our international markets could hinder growth and adversely affect our sales and results of operations in those markets. Increased competition in the US packaged coffee and tea and single-serve and ready-to-drink coffee beverage markets, including from new and large entrants to this market, could adversely affect the profitability of the Channel Development segment. Additionally, declines in general consumer demand for specialty coffee products for any reason, including due to consumer preference for other products, could have a negative effect on our business.

• | We are highly dependent on the financial performance of our Americas operating segment. |

Our financial performance is highly dependent on our Americas operating segment, as it comprised approximately 74% of consolidated total net revenues in fiscal 2013. If the Americas operating segment revenue trends slow or decline our other segments may be unable to make up any significant shortfall and our business and financial results could be adversely affected. And because the Americas segment is relatively mature and produces the large majority of our operating cash flows, such a slowdown or decline could result in reduced cash flows for funding the expansion of our international business and other initiatives and for returning cash to shareholders.

• | We are increasingly dependent on the success of our EMEA and CAP operating segments in order to achieve our growth targets. |

Our future growth increasingly depends on the growth and sustained profitability of our EMEA and CAP operating segments. Some or all of our international market business units (“MBUs”), which we generally define by the countries in which they operate, may not be successful in their operations or in achieving expected growth, which ultimately requires achieving consistent, stable net revenues and earnings. The performance of these international operations may be adversely affected by economic downturns in one or more of our large MBUs. In particular, our China MBU contributes meaningfully to both net revenues and earnings for our CAP segment and our Japan MBU contributes significantly to earnings in that segment. In the EMEA segment, our UK MBU accounts for a significant portion of the net revenues. A decline in performance of any of these MBUs could have a material adverse impact on the results of our international operations.

Additionally, some factors that will be critical to the success of the EMEA and CAP segments are different than those affecting our US stores and licensees. Tastes naturally vary by region, and consumers in some MBUs may not embrace our products to the same extent as consumers in the US or other international markets. Occupancy costs and store operating expenses can be higher internationally than in the US due to higher rents for prime store locations or costs of compliance with country-specific regulatory requirements. Because many of our international operations are in an early phase of development, operating expenses as a percentage of related revenues are often higher compared to more developed operations, such as in the US. Additionally, our international joint venture partners or licensees may face capital constraints or other factors that may limit the speed at which they are able to expand and develop in a certain market.

Our international operations are also subject to additional inherent risks of conducting business abroad, such as:

• | foreign currency exchange rate fluctuations, or requirements to transact in specific currencies; |

• | changes or uncertainties in economic, legal, regulatory, social and political conditions in our markets; |

• | interpretation and application of laws and regulations; |

• | restrictive actions of foreign or US governmental authorities affecting trade and foreign investment, especially during periods of heightened tension between the US and such foreign governmental authorities, including protective measures such as export and customs duties and tariffs, government intervention favoring local competitors, and restrictions on the level of foreign ownership; |

• | import or other business licensing requirements; |

• | the enforceability of intellectual property and contract rights; |

11

• | limitations on the repatriation of funds and foreign currency exchange restrictions due to current or new US and international regulations; |

• | in developing economies, the growth rate in the portion of the population achieving targeted levels of disposable income may not be as fast as we forecast; |

• | difficulty in staffing, developing and managing foreign operations and supply chain logistics, including ensuring the consistency of product quality and service, due to distance, language and cultural differences, as well as challenges in recruiting and retaining high quality employees in local markets; |

• | local laws that make it more expensive and complex to negotiate with, retain or terminate employees; |

• | delays in store openings for reasons beyond our control, competition with locally relevant competitors or a lack of desirable real estate locations available for lease at reasonable rates, any of which could keep us from meeting annual store opening targets and, in turn, negatively impact net revenues, operating income and earnings per share; and |

• | disruption in energy supplies affecting our markets. |

Moreover, many of the foregoing risks are particularly acute in developing countries, which are important to our long-term growth prospects.

• | Our success depends substantially on the value of our brands and failure to preserve their value, either through our actions or those of our business partners, could have a negative impact on our financial results. |

We believe we have built an excellent reputation globally for the quality of our products, for delivery of a consistently positive consumer experience and for our corporate social responsibility programs. Our brand is recognized throughout the world and we have received high ratings in global brand value studies. To be successful in the future, particularly outside of US, where the Starbucks brand and our other brands are less well-known, we believe we must preserve, grow and leverage the value of our brands across all sales channels. Brand value is based in part on consumer perceptions on a variety of subjective qualities.

Additionally, our business strategy, including our plans for new stores, foodservice, branded products and other initiatives, relies significantly on a variety of business partners, including licensee and partnership relationships, particularly in our international markets. Licensees and food service operators are often authorized to use our logos and provide branded beverages, food and other products directly to customers. We provide training and support to, and monitor the operations of, certain of these business partners, but the product quality and service they deliver may be diminished by any number of factors beyond our control, including financial pressures. We believe customers expect the same quality of products and service from our licensees and food services providers as they do from us and we strive to ensure customers receive the same quality products and service experience whether they visit a company-operated store, licensed store or food service location. We also source our food, beverage and other products from a wide variety of domestic and international business partners in our supply chain operations, and in certain cases such products are produced or sourced by our licensees directly.

Business incidents, whether isolated or recurring and whether originating from us or our business partners, that erode consumer trust, such as contaminated food, recalls or actual or perceived breaches of privacy, particularly if the incidents receive considerable publicity or result in litigation, can significantly reduce brand value and have a negative impact on our financial results. Consumer demand for our products and our brand equity could diminish significantly if we or our licensees or other business partners fail to preserve the quality of our products, are perceived to act in an unethical or socially irresponsible manner, fail to comply with laws and regulations or fail to deliver a consistently positive consumer experience in each of our markets. Additionally, inconsistent uses of our brand and other of our intellectual property assets, as well as failure to protect our intellectual property, including from unauthorized uses of our brand or other of our intellectual property assets, can erode consumer trust and our brand value and have a negative impact on our financial results.

• | Increases in the cost of high-quality arabica coffee beans or other commodities or decreases in the availability of high-quality arabica coffee beans or other commodities could have an adverse impact on our business and financial results. |

We purchase, roast, and sell high-quality whole bean arabica coffee beans and related coffee products. The price of coffee is subject to significant volatility and, although coffee prices have come down from their near-record highs of 2011, they may again increase significantly due to factors described below. The high-quality arabica coffee of the quality we seek tends to trade on a negotiated basis at a premium above the “C” price. This premium depends upon the supply and demand at the time of purchase and the amount of the premium can vary significantly. Increases in the “C” coffee commodity price do increase the price of high-quality arabica coffee and also impact our ability to enter into fixed-price purchase commitments. We frequently enter into supply contracts whereby the quality, quantity, delivery period, and other negotiated terms are agreed upon, but the date, and therefore price, at which the base “C” coffee commodity price component will be fixed has not yet been established. These are known as price-to-be-fixed contracts. The supply and price of coffee we purchase can also be affected by multiple factors in the producing countries, including weather, natural disasters, crop disease, general increase in farm inputs and costs of production, inventory levels and political and economic conditions, as well as the actions of certain organizations and associations that have historically

12

attempted to influence prices of green coffee through agreements establishing export quotas or by restricting coffee supplies. Speculative trading in coffee commodities can also influence coffee prices. Because of the significance of coffee beans to our operations, combined with our ability to only partially mitigate future price risk through purchasing practices and hedging activities, increases in the cost of high-quality arabica coffee beans could have an adverse impact on our profitability. In addition, if we are not able to purchase sufficient quantities of green coffee due to any of the above factors or to a worldwide or regional shortage, we may not be able to fulfill the demand for our coffee, which could have an adverse impact on our profitability.

In addition to coffee, we also purchase significant amounts of dairy products, particularly fluid milk, to support the needs of our company-operated retail stores. Although less significant to our operations than coffee or dairy, other commodities including but not limited to those related to food inputs, such as tea, produce, baking ingredients, and energy, are important to our operations. Increases in the cost of dairy products and other commodities could have an adverse impact on our profitability.

• | Our financial condition and results of operations are sensitive to, and may be adversely affected by, a number of factors, many of which are largely outside our control. |

Our operating results have been in the past and will continue to be subject to a number of factors, many of which are largely outside our control. Any one or more of the factors listed below or described elsewhere in this risk factors section could adversely impact our business, financial condition and/or results of operations:

• | declines in general consumer demand for specialty coffee products; |

• | increases in labor costs such as increased health care costs, general market wage levels and workers' compensation insurance costs; |

• | adverse outcomes of current or future litigation; |

• | especially in our larger or fast growing markets, labor discord, war, terrorism (including incidents targeting us), political instability, boycotts, social unrest, and natural disasters, including health pandemics that lead to avoidance of public places or restrictions on public gatherings such as in our stores. |

• | Interruption of our supply chain could affect our ability to produce or deliver our products and could negatively impact our business and profitability. |

Any material interruption in our supply chain, such as material interruption of roasted coffee supply due to the casualty loss of any of our roasting plants, interruptions in service by our third party logistic service providers or common carriers that ship goods within our distribution channels, trade restrictions, such as increased tariffs or quotas, embargoes or customs restrictions, or natural disasters that cause a material disruption in our supply chain could negatively impact our business and our profitability.

Additionally, our food, beverage and other products are sourced from a wide variety of domestic and international business partners in our supply chain operations, and in certain cases are produced or sourced by our licensees directly. We rely on these suppliers and vendors to provide high quality products and to comply with applicable laws. Our ability to find qualified suppliers and vendors who meet our standards and supply products in a timely and efficient manner is a significant challenge, especially with respect to goods sourced from outside the US. A vendor's or supplier's failure to meet our standards, provide products in a timely and efficient manner, and comply with applicable laws is beyond our control. These issues could negatively impact our business and profitability.

• | Failure to meet market expectations for our financial performance will likely adversely affect the market price and volatility of our stock. |

Failure to meet market expectations going forward, particularly with respect to operating margins, earnings per share, comparable store sales, operating cash flows, and net revenues, will likely result in a decline and/or increased volatility in the market price of our stock. In addition, price and volume fluctuations in the stock market as a whole may affect the market price of our stock in ways that may be unrelated to our financial performance.

• | The loss of key personnel or difficulties recruiting and retaining qualified personnel could adversely impact our business and financial results. |

Much of our future success depends on the continued availability and service of senior management personnel. The loss of any of our executive officers or other key senior management personnel could harm our business. We must continue to recruit, retain and motivate management and other employees sufficiently, both to maintain our current business and to execute our strategic initiatives, some of which involve ongoing expansion in business channels outside of our traditional company-operated store model. Our success also depends substantially on the contributions and abilities of our retail store employees whom we rely on to give customers a superior in-store experience. Accordingly, our performance depends on our ability to recruit and retain high quality employees to work in and manage our stores, both domestically and internationally. If we are unable to recruit, retain and motivate employees sufficiently to maintain our current business and support our projected growth, our business and financial performance may be adversely affected.

13

• | Adverse public or medical opinions about the health effects of consuming our products, as well as reports of incidents involving food-borne illnesses, food tampering or food contamination, whether or not accurate, could harm our business. |

Some of our products contain caffeine, dairy products, sugar and other compounds, the health effects of which are the subject of public scrutiny, including the suggestion that excessive consumption of caffeine, dairy products, sugar and other compounds can lead to a variety of adverse health effects. Particularly in the US, there is increasing consumer awareness of health risks, including obesity, due in part to increased publicity and attention from health organizations, as well as increased consumer litigation based on alleged adverse health impacts of consumption of various food products. While we have a variety of beverage and food items, including items that are coffee-free and have reduced calories, an unfavorable report on the health effects of caffeine or other compounds present in our products, whether accurate or not, or negative publicity or litigation arising from certain health risks could significantly reduce the demand for our beverages and food products.

Similarly, instances or reports, whether true or not, of unclean water supply, food-borne illnesses, food tampering and food contamination, either during growing, manufacturing, packaging or preparation, have in the past severely injured the reputations of companies in the food processing, grocery and quick-service restaurant sectors and could affect us as well. Any report linking us to the use of unclean water, food-borne illnesses or food tampering or contamination could damage our brand value and severely hurt sales of our beverages and food products, and possibly lead to product liability claims, litigation (including class actions) or damages. Clean water is critical to the preparation of coffee and tea beverages and our ability to ensure a clean water supply to our stores can be limited, particularly in some international locations. If customers become ill from food-borne illnesses, tampering or contamination, we could also be forced to temporarily close some stores and/or supply chain facilities. In addition, instances of food-borne illnesses, food tampering or food contamination, even those occurring solely at the restaurants or stores of competitors, could, by resulting in negative publicity about the foodservice industry, adversely affect our sales on a regional or global basis. A decrease in customer traffic as a result of these health concerns or negative publicity, or as a result of a temporary closure of any of our stores, as well as adverse results of claims or litigation, could materially harm our business and results of operations.

• | We rely heavily on information technology in our operations, and any material failure, inadequacy, interruption or security failure of that technology could harm our ability to effectively operate our business and expose us to potential liability and loss of revenues. |

We rely heavily on information technology systems across our operations, including for administrative functions, point-of-sale processing and payment in our stores and online, management of our supply chain, Starbucks Cards, online business and various other processes and transactions. Our ability to effectively manage our business and coordinate the production, distribution and sale of our products depends significantly on the reliability, integrity and capacity of these systems. We also rely on third party providers for some of these information technology systems and support. The failure of these systems to operate effectively, problems with transitioning to upgraded or replacement systems, or a breach in security of these systems, including through cyber terrorism, could cause material negative impacts to our product sales, the efficiency of our operations and our financial results. Significant capital investments and other expenditures could be required to remedy the problem. Furthermore, security breaches of our employees' or customers' private data could result in a violation of applicable US and international privacy and other laws, loss of revenues from the potential adverse impact to our reputation and our ability to retain or attract new customers, and could result in litigation, potential liability and the imposition of penalties.

• | Failure to comply with applicable laws and regulations could harm our business and financial results. |

Our policies and procedures are designed to comply with all applicable laws, accounting and reporting requirements, tax rules and other regulations and requirements, including those imposed by the SEC, NASDAQ, and foreign countries, as well as applicable trade, labor, healthcare, privacy, food, anti-bribery and corruption and merchandise laws. The complexity of the regulatory environment in which we operate and the related cost of compliance are both increasing due to additional or changing legal and regulatory requirements, our ongoing expansion into new markets and new channels, and the fact that foreign laws occasionally conflict with domestic laws. In addition to potential damage to our reputation and brand, failure to comply with the various laws and regulations as well as changes in laws and regulations or the manner in which they are interpreted or applied, may result in litigation, civil and criminal liability, damages, fines and penalties, increased cost of regulatory compliance and restatements of our financial statements.

Item 1B. | Unresolved Staff Comments |

None.

14

Item 2. | Properties |

The significant properties used by Starbucks in connection with its roasting, distribution and corporate administrative operations, serving all segments, are as follows:

Location | Approximate Size in Square Feet | Purpose | ||

Rancho Cucamonga, CA | 265,000 | Manufacturing | ||

Atlanta, GA | 87,000 | Warehouse and distribution | ||

Augusta, GA | 131,000 | Manufacturing | ||

Carson Valley, NV | 360,000 | Roasting and distribution | ||

York County, PA | 888,000 | Roasting, distribution and warehouse | ||

Sandy Run, SC | 117,000 | Roasting and distribution | ||

Lebanon, TN | 680,000 | Distribution center | ||

Auburn, WA | 490,000 | Warehouse and distribution | ||

Kent, WA | 332,000 | Roasting and distribution | ||

Seattle, WA | 1,000,000 | Corporate administrative | ||

Amsterdam, Netherlands | 97,000 | Roasting and distribution | ||

We own our roasting facilities and lease the majority of our warehousing and distribution locations. As of September 29, 2013, Starbucks had 10,194 company-operated stores, almost all of which are leased. We also lease space in various locations worldwide for regional, district and other administrative offices, training facilities and storage.

Item 3. | Legal Proceedings |

See Note 15 to the consolidated financial statements included in Item 8 of Part II of this 10-K for information regarding certain legal proceedings in which we are involved.

Item 4. | Mine Safety Disclosures |

Not applicable.

15

PART II

Item 5. | Market for the Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities |

SHAREHOLDER INFORMATION

MARKET INFORMATION AND DIVIDEND POLICY

Starbucks common stock is traded on NASDAQ, under the symbol “SBUX.”

The following table shows the quarterly high and low sale prices per share of Starbucks common stock as reported by NASDAQ for each quarter during the last two fiscal years and the quarterly cash dividend declared per share of our common stock during the periods indicated:

High | Low | Cash Dividends Declared | |||||||||

2013: | |||||||||||

Fourth Quarter | $ | 77.84 | $ | 65.82 | $ | 0.26 | |||||

Third Quarter | 67.48 | 56.65 | 0.21 | ||||||||

Second Quarter | 58.97 | 52.39 | 0.21 | ||||||||

First Quarter | 54.90 | 44.27 | 0.21 | ||||||||

2012: | |||||||||||

Fourth Quarter | $ | 54.28 | $ | 43.04 | $ | 0.21 | |||||

Third Quarter | 62.00 | 51.03 | 0.17 | ||||||||

Second Quarter | 56.55 | 45.28 | 0.17 | ||||||||

First Quarter | 46.50 | 35.12 | 0.17 | ||||||||

As of November 8, 2013, we had approximately 18,470 shareholders of record. This does not include persons whose stock is in nominee or “street name” accounts through brokers.

Future decisions to pay cash dividends continue to be at the discretion of the Board of Directors and will be dependent on our operating performance, financial condition, capital expenditure requirements, and other such factors that the Board of Directors considers relevant.

ISSUER PURCHASES OF EQUITY SECURITIES

Starbucks did not repurchase any shares during the fourth quarter of fiscal 2013. As of the end of the quarter, the maximum number of shares that may yet be purchased under our current share repurchase program was 26,359,511 shares. The share repurchase program is conducted under authorizations made from time to time by our Board of Directors. On November 3, 2011, we publicly announced the authorization of up to an additional 20 million shares, and on November 15, 2012, we publicly announced the authorization of up to an additional 25 million shares. These authorizations have no expiration date.

16

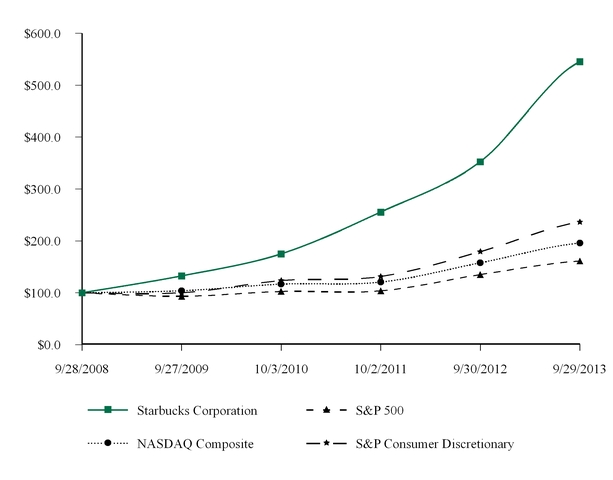

Performance Comparison Graph

The following graph depicts the total return to shareholders from September 28, 2008 through September 29, 2013, relative to the performance of the Standard & Poor’s 500 Index, the NASDAQ Composite Index, and the Standard & Poor’s 500 Consumer Discretionary Sector, a peer group that includes Starbucks. All indices shown in the graph have been reset to a base of 100 as of September 28, 2008, and assume an investment of $100 on that date and the reinvestment of dividends paid since that date. The stock price performance shown in the graph is not necessarily indicative of future price performance.

Sep 28, 2008 | Sep 27, 2009 | Oct 3, 2010 | Oct 2, 2011 | Sep 30, 2012 | Sep 29, 2013 | ||||||||||||

Starbucks Corporation | 100.00 | 132.55 | 175.02 | 255.59 | 352.59 | 545.34 | |||||||||||

S&P 500 | 100.00 | 93.09 | 102.55 | 103.72 | 135.05 | 161.17 | |||||||||||

NASDAQ Composite | 100.00 | 103.76 | 116.52 | 120.44 | 157.60 | 195.67 | |||||||||||

S&P Consumer Discretionary | 100.00 | 99.94 | 123.56 | 131.19 | 179.25 | 236.32 | |||||||||||

17

Item 6. | Selected Financial Data |

The following selected financial data are derived from the consolidated financial statements. The data below should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Risk Factors,” and the consolidated financial statements and notes.

Financial Information (in millions, except per share data):

As of and for the Fiscal Year Ended(1) | Sep 29, 2013 (52 Wks) | Sep 30, 2012 (52 Wks) | Oct 2, 2011 (52 Wks) | Oct 3, 2010 (53 Wks) | Sep 27, 2009 (52 Wks) | |||||||||||||||

Results of Operations | ||||||||||||||||||||

Net revenues: | ||||||||||||||||||||

Company-operated stores | $ | 11,793.2 | $ | 10,534.5 | $ | 9,632.4 | $ | 8,963.5 | $ | 8,180.1 | ||||||||||

Licensed stores(2) | 1,360.5 | 1,210.3 | 1,007.5 | 875.2 | 795.0 | |||||||||||||||

CPG, foodservice and other(2) | 1,738.5 | 1,554.7 | 1,060.5 | 868.7 | 799.5 | |||||||||||||||

Total net revenues | $ | 14,892.2 | $ | 13,299.5 | $ | 11,700.4 | $ | 10,707.4 | $ | 9,774.6 | ||||||||||

Operating income/(loss)(3,4) | $ | (325.4 | ) | $ | 1,997.4 | $ | 1,728.5 | $ | 1,419.4 | $ | 562.0 | |||||||||

Net earnings including noncontrolling interests(3,4) | 8.8 | 1,384.7 | 1,248.0 | 948.3 | 391.5 | |||||||||||||||

Net earnings attributable to noncontrolling interests | 0.5 | 0.9 | 2.3 | 2.7 | 0.7 | |||||||||||||||

Net earnings attributable to Starbucks(3,4) | 8.3 | 1,383.8 | 1,245.7 | 945.6 | 390.8 | |||||||||||||||

EPS — diluted(3,4) | 0.01 | 1.79 | 1.62 | 1.24 | 0.52 | |||||||||||||||

Cash dividends declared per share | 0.89 | 0.72 | 0.56 | 0.36 | — | |||||||||||||||

Net cash provided by operating activities | 2,908.3 | 1,750.3 | 1,612.4 | 1,704.9 | 1,389.0 | |||||||||||||||

Capital expenditures (additions to property, plant and equipment) | 1,151.2 | 856.2 | 531.9 | 440.7 | 445.6 | |||||||||||||||

Balance Sheet | ||||||||||||||||||||

Total assets | $ | 11,516.7 | $ | 8,219.2 | $ | 7,360.4 | $ | 6,385.9 | $ | 5,576.8 | ||||||||||

Long-term debt (including current portion) | 1,299.4 | 549.6 | 549.5 | 549.4 | 549.5 | |||||||||||||||

Shareholders’ equity | 4,480.2 | 5,109.0 | 4,384.9 | 3,674.7 | 3,045.7 | |||||||||||||||

(1) | Our fiscal year ends on the Sunday closest to September 30. The fiscal year ended on October 3, 2010 included 53 weeks with the 53rd week falling in our fourth fiscal quarter. |

(2) | Includes the revenue reclassification described in Note 1. For fiscal years 2010 and 2009, we reclassified $465.7 million and $427.3 million, respectively, from “Licensed stores” revenue to “CPG, foodservice and other” revenue. |

(3) | Fiscal 2010 and 2009 results include pretax restructuring charges of $53.0 million and $332.4 million, respectively. |

(4) | Fiscal 2013 results include a pretax charge of $2,784.1 million resulting from the conclusion of our arbitration with Kraft Foods Global, Inc. The impact of this charge to net earnings attributable to Starbucks and diluted EPS, net of the related tax benefit, was $1,713.1 million and $2.25 per share, respectively. |

18

Comparable Store Sales:

Fiscal Year Ended | Sep 29, 2013 (52 Wks) | Sep 30, 2012 (52 Wks) | Oct 2, 2011 (52 Wks) | Oct 3, 2010 (53 Wks) | Sep 27, 2009 (52 Wks) | ||||||||||

Percentage change in comparable store sales(5) | |||||||||||||||

Americas | |||||||||||||||

Sales growth | 7 | % | 8 | % | 8 | % | 7 | % | (6 | )% | |||||

Change in transactions | 5 | % | 6 | % | 5 | % | 3 | % | (4 | )% | |||||

Change in ticket | 2 | % | 2 | % | 2 | % | 3 | % | (2 | )% | |||||

EMEA | |||||||||||||||

Sales growth | — | % | — | % | 3 | % | 5 | % | (3 | )% | |||||

Change in transactions | 2 | % | — | % | 3 | % | 6 | % | — | % | |||||

Change in ticket | (2 | )% | — | % | — | % | (1 | )% | (3 | )% | |||||

China / Asia Pacific | |||||||||||||||

Sales growth | 9 | % | 15 | % | 22 | % | 11 | % | 2 | % | |||||

Change in transactions | 7 | % | 11 | % | 20 | % | 9 | % | — | % | |||||

Change in ticket | 2 | % | 3 | % | 2 | % | 2 | % | 2 | % | |||||

Consolidated | |||||||||||||||

Sales growth | 7 | % | 7 | % | 8 | % | 7 | % | (6 | )% | |||||

Change in transactions | 5 | % | 6 | % | 6 | % | 4 | % | (4 | )% | |||||

Change in ticket | 2 | % | 1 | % | 2 | % | 3 | % | (2 | )% | |||||

(5) | Includes only Starbucks® company-operated stores open 13 months or longer. For fiscal year 2010, comparable store sales percentages were calculated excluding the 53rd week. Comparable store sales exclude the effect of fluctuations in foreign currency exchange rates. |

19

Store Count Data:

As of and for the Fiscal Year Ended | Sep 29, 2013 (52 Wks) | Sep 30, 2012 (52 Wks) | Oct 2, 2011 (52 Wks) | Oct 3, 2010 (53 Wks) | Sep 27, 2009 (52 Wks) | ||||||||||

Net stores opened (closed) during the year: | |||||||||||||||

Americas(6) | |||||||||||||||

Company-operated stores | 276 | 228 | 32 | (32 | ) | (419 | ) | ||||||||

Licensed stores | 404 | 280 | 215 | 101 | 110 | ||||||||||

EMEA(7) | |||||||||||||||

Company-operated stores | (29 | ) | 10 | 25 | (64 | ) | 20 | ||||||||

Licensed stores | 129 | 101 | 79 | 100 | 98 | ||||||||||

China / Asia Pacific | |||||||||||||||

Company-operated stores | 240 | 154 | 73 | 30 | 24 | ||||||||||

Licensed stores | 348 | 294 | 193 | 79 | 129 | ||||||||||

All Other Segments (8) | |||||||||||||||

Company-operated stores | 343 | — | 6 | (1 | ) | (2 | ) | ||||||||

Licensed stores(9) | (10 | ) | (4 | ) | (478 | ) | 10 | (5 | ) | ||||||

Total | 1,701 | 1,063 | 145 | 223 | (45 | ) | |||||||||

Stores open at year end: | |||||||||||||||

Americas (6) | |||||||||||||||

Company-operated stores | 8,078 | 7,802 | 7,574 | 7,542 | 7,574 | ||||||||||

Licensed stores | 5,415 | 5,011 | 4,731 | 4,516 | 4,415 | ||||||||||

EMEA(7) | |||||||||||||||

Company-operated stores | 853 | 882 | 872 | 847 | 911 | ||||||||||

Licensed stores | 1,116 | 987 | 886 | 807 | 707 | ||||||||||

China / Asia Pacific | |||||||||||||||

Company-operated stores | 906 | 666 | 512 | 439 | 409 | ||||||||||

Licensed stores | 2,976 | 2,628 | 2,334 | 2,141 | 2,062 | ||||||||||

All Other Segments (8) | |||||||||||||||

Company-operated stores | 357 | 14 | 14 | 8 | 9 | ||||||||||

Licensed stores (9) | 66 | 76 | 80 | 558 | 548 | ||||||||||

Total | 19,767 | 18,066 | 17,003 | 16,858 | 16,635 | ||||||||||

(6) | Americas store data has been adjusted for the sale of store locations in Chile to a joint venture partner in the fourth quarter of fiscal 2013 by reclassifying historical information from company-operated stores to licensed stores, and to exclude Seattle's Best Coffee and Evolution Fresh, which are now reported within All Other Segments. |

(7) | EMEA store data has been adjusted for the acquisition of store locations in Austria and Switzerland in the fourth quarter of fiscal 2011 by reclassifying historical information from licensed stores to company-operated stores, and the transfer of certain company-operated stores to licensees in the fourth quarter of fiscal 2012. |

(8) | Includes 366 Teavana stores added in fiscal 2013. |

(9) | Includes the closure of 475 licensed Seattle’s Best Coffee® locations in Borders Bookstores during fiscal 2011. |

20

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

General

Our fiscal year ends on the Sunday closest to September 30. The fiscal years ended on September 29, 2013, September 30, 2012 and October 2, 2011 all included 52 weeks. All references to store counts, including data for new store openings, are reported net of related store closures, unless otherwise noted.

Financial Highlights

• | Total net revenues increased 12.0% to $14.9 billion in fiscal 2013 compared to $13.3 billion in fiscal 2012. |

• | Global comparable store sales grew 7% driven by a 5% increase in the number of transactions and a 2% increase in average ticket. |

• | Consolidated operating income decreased to $(0.3) billion in fiscal 2013 compared to $2.0 billion in fiscal 2012 and fiscal 2013 operating margin was (2.2)% compared to 15.0% in fiscal 2012. The declines were due to the litigation charge noted below. |

• | EPS for fiscal 2013 decreased to $0.01, compared to EPS of $1.79 in fiscal 2012. The decline was due to the litigation charge noted below. |