Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File No. 1-14771

MicroFinancial Incorporated

(Exact name of Registrant as Specified in its Charter)

| Massachusetts | 04-2962824 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 16 New England Executive Park, Suite 200, Burlington, MA |

01803 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (781) 994-4800

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Shares, $0.01 par value per share | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period than the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (check one).

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

Indicate by check mark if the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s voting and non-voting common equity held by non-affiliates of the registrant as of June 30, 2013, the last day of the registrant’s most recently completed second fiscal quarter, was approximately $69,742,148 computed by reference to the closing price of such stock as of such date.

As of March 17, 2014, 14,417,185 shares of the registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s proxy statement to be filed pursuant to Regulation 14A within 120 days after the Registrant’s fiscal year end of December 31, 2013, are incorporated by reference in Part III hereof.

Table of Contents

| Description |

Page Number |

|||||

| PART I | ||||||

| Item 1. |

2 | |||||

| Item 1A. |

7 | |||||

| Item 2. |

12 | |||||

| Item 3. |

13 | |||||

| Item 4. |

13 | |||||

| PART II | ||||||

| Item 5. |

14 | |||||

| Item 6. |

16 | |||||

| Item 7. |

19 | |||||

| Item 7A. |

32 | |||||

| Item 8. |

32 | |||||

| Item 9. |

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure |

32 | ||||

| Item 9A. |

32 | |||||

| Item 9B. |

33 | |||||

| PART III | ||||||

| Item 10. |

34 | |||||

| Item 11. |

34 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

34 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

35 | ||||

| Item 14. |

35 | |||||

| PART IV | ||||||

| Item 15. |

36 | |||||

| SIGNATURES | 40 | |||||

-1-

Table of Contents

PART I

| ITEM 1. | BUSINESS |

General

MicroFinancial Incorporated (referred to as “MicroFinancial,” “we,” “us” or “our”) was formed as a Massachusetts corporation on January 27, 1987. We operate primarily through our wholly-owned subsidiaries, TimePayment Corp. (“TimePayment”) and LeaseComm Corporation (“LeaseComm”). TimePayment is a specialized commercial/consumer finance company that leases and rents equipment and provides other financing services, with a primary focus on the “microticket market”. LeaseComm originated leases from January 1986 through October 2002, and continues to service its remaining contract portfolio. TimePayment commenced originating contracts in July 2004. Using proprietary software, we have developed a sophisticated, multi-level pricing model and automated our credit approval and collection systems, including a fully-automated Internet-based application, credit scoring and approval process.

We provide financing alternatives to a wide range of lessees ranging from start-up businesses to established enterprises. We primarily lease and rent low-priced commercial equipment, which is used by these lessees in their daily operations. We do not market our services directly to lessees. We primarily source our originations through a nationwide network of independent equipment vendors, independent sales organizations, brokers and other dealer-based origination networks (to whom we refer collectively in this report as “dealers”). We fund our operations through cash provided by operating activities and borrowings under our revolving line of credit.

TimePayment finances a wide variety of products, including, but not limited to, water filtration systems, food service equipment, security equipment, point of sale (POS) cash registers, salon equipment, copiers, health care and fitness equipment and automotive repair equipment. Water filtration systems represented approximately 25% of our outstanding lease receivables as of December 31, 2013. No other single product represented more than 10% of our outstanding lease receivables as of December 31, 2013.

We finance the origination of our leases and contracts primarily through cash provided by operating activities and borrowings under our revolving line of credit. We entered into the revolving line of credit in August 2007 with a bank syndicate led by Santander Bank (formerly known as Sovereign Bank) (Santander) based on qualified TimePayment lease receivables. The total commitment under the facility, originally $30 million, has been increased at various times, most recently in December 2012, from $100 million to $150 million. Outstanding borrowings are collateralized by eligible lease contracts and a security interest in all of our other assets.

The following table demonstrates the total commitment under the revolving credit facility with the associated rate options in effect during the three years ended December 31, 2013. As of December 31, 2013, the total commitment under the facility was $150 million.

| Amendment Date |

Total |

Rate options(1) |

Minimum |

Facility Expiration | ||||||||

| July 2010 |

$100 | Prime plus 1.25% | or | LIBOR plus 3.25% | None | August 2013 | ||||||

| October 2011 |

100 | Prime plus 0.75% | or | LIBOR plus 2.75% | None | August 2014 | ||||||

| December 2012 |

150 | Base(2) plus 0.75% | or | LIBOR plus 2.50% | None | December 2016 | ||||||

| (1) | Under the terms of the facility, loans are Base Rate Loans (or prior to December 2012, Prime Rate Loans), unless we elect LIBOR Loans. If a LIBOR Loan is not renewed at maturity, it automatically converts to a Base Rate Loan. |

| (2) | The “Base Rate” is the highest of the prime rate established by the Agent, or one-month LIBOR plus 1%, or the federal funds effective rate plus 0.5%. |

-2-

Table of Contents

At December 31, 2013, $65.0 million of our loans were LIBOR Loans and $7.6 million of our loans were Base Rate Loans. As of December 31, 2013, the qualified lease receivables eligible under the borrowing base computation were approximately $129.9 million.

Leasing, Servicing and Financing Programs

We originate leases for products that typically have limited distribution channels and are costly to sell. We facilitate sales of such products by allowing dealers to make them available to their customers for a small monthly lease payment rather than a higher initial purchase price. We primarily lease and rent low-priced commercial equipment to small merchants. In addition, we have acquired service contracts and contracts in certain other financing markets and continue to look for opportunities to invest in these types of assets. Our current portfolio also includes consumer financings which consist of service contracts from dealers that primarily provide residential security monitoring services, as well as consumer leases for a wide range of consumer products.

We originate and continue to service contracts in all 50 states, the District of Columbia and Puerto Rico. The concentration of leases in certain states as of the end of each of the past three years, as a percentage of our total portfolio, is reflected below. No other state accounted for more than five percent of such total.

| Year Ended December 31, |

Florida |

California |

Texas |

New York | ||||

| 2011 |

13% | 11% | 8% | 9% | ||||

| 2012 |

13% | 12% | 8% | 8% | ||||

| 2013 |

13% | 12% | 9% | 8% |

Terms of Equipment Leases

Substantially all equipment leases originated or acquired by us are non-cancelable. We generally originate leases on transactions referred to us by a dealer where we buy the underlying equipment from the referring dealer upon funding the approved application. Leases are structured with limited recourse to the dealer, with risk of loss in the event of default by the lessee residing with us in most cases. We perform all the processing, billing and collection functions under our leases.

During the term of a typical lease, we receive payments sufficient, in the aggregate, to cover our borrowing cost and the cost of the underlying equipment, and to provide us with an appropriate profit. Throughout the term of the lease, we charge late fees, prepayment penalties, loss and damage waiver fees and other service fees, when applicable. Initial terms of the leases we funded in 2013 generally range from 12 to 60 months, with an average initial term of 41 months.

The terms and conditions of all of our contracts are substantially similar. In most cases, the contracts require lessees to: (i) maintain, service and operate the equipment in accordance with the manufacturer’s and government-mandated procedures; (ii) insure the equipment against property and casualty loss; (iii) pay all taxes associated with the equipment; and (iv) make all scheduled contract payments regardless of the performance of the equipment. Our standard lease forms provide that in the event of a default by the lessee, we can require payment of liquidated damages and can seize and remove the equipment for sale, refinancing or other disposal at our discretion. Any additions, modifications or upgrades to the equipment, regardless of the source of payment, are automatically incorporated into, and deemed a part of, the equipment financed.

We seek to protect ourselves from credit exposure relating to dealers by entering into limited recourse agreements with our dealers, under which the dealer agrees to reimburse us for defaulted contracts under certain circumstances, primarily upon evidence of dealer errors or misrepresentations in originating a lease or contract.

-3-

Table of Contents

Residual Interests in Underlying Equipment

We typically own a residual interest in the equipment covered by our leases. The value of such interest is estimated at inception of the lease based upon our estimate of the fair market value of the asset at lease maturity. At the end of the lease term, the lessee has the option to buy the equipment at the fair market value, return the equipment or continue to rent the equipment on a month-to-month basis.

Dealers

We provide financing to obligors under leases and contracts through a nationwide network of dealers, including equipment vendors, independent sales organizations and brokers. We do not sign exclusive agreements with our dealers. Dealers interact directly with potential lessees and typically market not only their products and services, but also the financing arrangements offered through us. During 2013, we had over 1,150 different dealers originating leases and contracts.

During the years ended December 31, 2013, 2012 and 2011, our top dealer accounted for 13.8%, 4.4% and 3.3%, respectively, of the value of leases originated. The top dealer during this three-year period was a lease broker who represents a number of equipment vendors financing a wide breadth of different equipment segments and operates on a nationwide scope.

Use of Technology

Our business is operationally intensive, due in part to the small average amount financed. Accordingly, technology and automated processes are critical in keeping servicing costs to a minimum while providing quality customer service.

We have developed TimePaymentDirect, an Internet-based application processing, credit approval and dealer information tool. Using TimePaymentDirect, a dealer can input an application and obtain an almost instantaneous credit decision automatically over the Internet, all without any contact with our employees. We also offer Instalease®, a program that allows a dealer to submit applications to us by telephone, telecopy or e-mail, receive approval, and complete a sale from a lessee’s location. By assisting the dealers in providing timely, convenient and competitive financing for their equipment contracts and offering dealers a variety of value-added services, we simultaneously promote equipment contract sales and the utilization of TimePayment as the preferred finance provider, thus differentiating us from our competitors.

We have used our proprietary software to develop a multidimensional credit-scoring model which generates pricing of our leases and contracts commensurate with the risk assumed. This software does not produce a binary “yes or no” decision, but rather, for a “yes” decision, determines the price at which the lease or contract might be profitably underwritten. We use this credit scoring model in most, but not all, of our credit decisions.

Underwriting

The nature of our business requires that the underwriting process perform two levels of review: the first focused on the ultimate end-user of the equipment or service and the second focused on the dealer. The approval process begins with the submission by telephone, facsimile or electronic transmission of a credit application by the dealer. Upon submission, we either manually or through TimePaymentDirect conduct our own independent credit investigation of the lessee using our proprietary database. In order to facilitate this process, we will use recognized commercial credit reporting agencies such as Dun & Bradstreet, Paynet and Experian. Our software evaluates this information on a two-dimensional scale, examining both credit depth (how much information exists on an applicant) and credit quality (credit performance, including past payment history). We use this information to underwrite a broad range of credit risks and provide financing in situations where our competitors may be unwilling to provide such financing. The credit-scoring model is complex and automatically adjusts for different transactions. In situations where the amount financed is over $10,000, we may go beyond our own

-4-

Table of Contents

database and recognized commercial credit reporting agencies to obtain information from less readily available sources such as banks. In certain instances, we will require the lessee to provide verification of employment and salary.

The second aspect of the credit decision involves an assessment of the originating dealer. Dealers undergo both an initial screening process and ongoing evaluation, including an examination of dealer portfolio credit quality and performance, lessee complaints, cases of fraud or misrepresentation, aging studies, application activity and conversion rates for applications. This ongoing assessment enables us to manage our dealer relationships, and in some instances, may result in ending our relationships with poorly performing dealers.

Upon credit approval, we require receipt of a signed lease on our standard or other pre-approved lease form. After the equipment is shipped and installed, the dealer invoices us and we verify that the lessee has received and accepted the equipment. Upon the completion of a satisfactory verification with the lessee, the lease is forwarded to our funding and documentation department for payment to the dealer and the establishment of the accounting and billing procedures for the transaction.

Service Contracts

We also acquire service contracts under which a homeowner purchases a security system and simultaneously signs a contract with the dealer for the monitoring of that system for a monthly fee. Upon approval of the monitoring application and verification with the homeowner that the system is installed, we purchase the right to the payment stream under the monitoring service contract from the dealer at a negotiated multiple of the monthly payments. In years prior to 2012, our service contract revenue was derived from our LeaseComm portfolio, for which we have not purchased any new security service contracts since 2002. Consequently, our service contract revenue from LeaseComm represents a less significant portion of our revenue stream over time. Beginning in the second quarter of 2012, TimePayment began purchasing service contracts.

Bulk and Portfolio Acquisitions

In addition to originating leases through our dealer relationships, from time to time we have also purchased lease portfolios from dealers or other sources. While certain of these leases may not have met our underwriting standards at inception, we will purchase the leases once the lessee demonstrates a satisfactory payment history. We prefer to acquire these smaller lease portfolios in situations where the seller will continue to act as a dealer following the acquisition. We did not purchase any material portfolios in the three most recent fiscal years.

Servicing and Collections

We perform all the servicing functions on our leases and contracts through our automated servicing and collection system. Servicing responsibilities generally include billing, processing payments, remitting payments to dealers, paying taxes and insurance and performing collection and liquidation functions.

Our automated lease administration system handles application tracking, invoicing, payment processing, automated collection queuing, portfolio evaluation and report writing. The system is linked with our bank accounts for payment processing and also provides for direct withdrawal of lease and contract payments from a lessee’s bank account. We monitor delinquent accounts using our automated collection process. We use several computerized processes in our customer service and collection efforts, including the generation of daily priority call lists and scrolling for daily delinquent account servicing, generation and mailing of delinquency letters, and routing of incoming customer service calls to appropriate employees with instant computerized access to account details. Our collection efforts include sending collection letters, making collection calls, reporting delinquent accounts to credit reporting agencies, and litigating delinquent accounts when necessary to obtain and enforce judgments.

-5-

Table of Contents

Competition

The microticket leasing and financing industry is highly competitive. We compete for customers with a number of national, regional and local banks and finance companies. Our competitors also include equipment manufacturers that lease or finance the sale of their own products. While the market for microticket financing has traditionally been fragmented, we could also be faced with competition from small or large-ticket leasing companies that could use their expertise in those markets to enter and compete in the microticket financing market. Our competitors include larger, more established companies, some of which may possess substantially greater financial, marketing and operational resources than us, including a lower cost of funds and access to capital markets and other funding sources which may be unavailable to us.

Employees

As of December 31, 2013, we had 155 full-time employees, of whom 60 were engaged in sales and underwriting activities and dealer service, 65 were engaged in servicing and collection activities, and 30 were engaged in general administrative activities. We believe that our relationship with our employees is good. None of our employees are members of a collective bargaining unit in connection with their employment with us.

Executive Officers

| Name and Age of Executive Officers |

Title | |

| Richard F. Latour, 60 |

Director, President, Chief Executive Officer, Treasurer, Clerk and Secretary | |

| James R. Jackson, Jr., 52 |

Senior Vice President and Chief Financial Officer | |

| Steven J. LaCreta, 54 |

Vice President, Lessee Relations and Legal | |

| Stephen J. Constantino, 48 |

Vice President, Human Resources | |

| Vartan Hagopian, 56 |

Vice President, Sales (TimePayment Corp.) |

Richard F. Latour has served as our President, Chief Executive Officer, Treasurer, Clerk and Secretary since October 2002. Prior to becoming Chief Executive Officer, he served as President, Chief Operating Officer, Treasurer, Clerk and Secretary from February 2002, since which time he has also been a director. From 1995 to January 2002, he served as Executive Vice President, Chief Operating Officer, Chief Financial Officer, Treasurer, Clerk and Secretary. From 1986 to 1995 Mr. Latour served as Vice President of Finance and Chief Financial Officer. Prior to joining us, Mr. Latour was Vice President of Finance with Trak Incorporated, an international manufacturer and distributor of consumer goods, where he was responsible for all financial and operational functions. Mr. Latour earned a B.S. in accounting from Bentley College in Waltham, Massachusetts.

James R. Jackson Jr. served as our Vice President and Chief Financial Officer from April 2002 until February 2014, when he was promoted to Senior Vice President and Chief Financial Officer. Prior to joining us, from 1999 to 2001, Mr. Jackson was Vice President of Finance for Deutsche Financial Services Technology Leasing Group. From 1992 to 1999, Mr. Jackson held positions as Manager of Pricing and Structured Finance and Manager of Business Planning with AT&T Capital Corporation.

Steven J. LaCreta has served as our Vice President, Lessee Relations and Legal since May 2005. From May 2000 to May 2005, Mr. LaCreta served as Vice President, Lessee Relations. From November 1996 to May 2000, Mr. LaCreta served as our Director of Lessee Relations. Prior to joining us, Mr. LaCreta was a Leasing Collection Manager with Bayer Corporation.

Stephen J. Constantino has served as our Vice President, Human Resources since May 2000. From 1994 to May 2000, Mr. Constantino served as our Director of Human Resources. From 1992 to 1994, Mr. Constantino served as our Controller. From 1991 to 1992, Mr. Constantino served as our Accounting Manager.

Vartan Hagopian was appointed Vice President of Sales of our primary subsidiary, TimePayment Corp., in December 2011. Prior to joining us, from 1998 to 2007, Mr. Hagopian served in senior sales leadership roles at

-6-

Table of Contents

Monster Worldwide, Inc. After Monster, Mr. Hagopian served in senior sales leadership roles at Yodle, Inc. from 2007 to 2008 and Health Diagnostics, LLC from 2008 to 2009. He established a sales strategy consulting practice for startup companies from 2009 to 2011.

Availability of Information

We maintain an Internet website at http://www.microfinancial.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to such reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as well as Section 16 reports on Form 3, 4, or 5, are available free of charge on this site as soon as is reasonably practicable after they are filed or furnished with the Securities and Exchange Commission (“SEC”). Our Guidelines on Corporate Governance, our Code of Business Conduct and Ethics and the charters for the Audit Committee, Nominating and Corporate Governance Committee, Compensation and Benefits Committee, Credit Policy Committee and Strategic Planning Committee of our Board of Directors are also available on our Internet site. The Guidelines, Code of Ethics and charters are also available in print to any shareholder upon request. Requests for such documents should be directed to Richard F. Latour, Chief Executive Officer, at 16 New England Executive Park Suite 200, Burlington, MA 01803. Our Internet site and the information contained therein or connected thereto are not incorporated by reference into this Form 10-K. Our filings with the SEC are also available on the SEC’s website at http://www.sec.gov.

| ITEM 1A. | RISK FACTORS |

Set forth below and elsewhere in this report and in other documents we file with the Securities and Exchange Commission are risks and uncertainties that could cause our actual results to differ materially from the results contemplated by the forward-looking statements contained in this report and other periodic statements we make.

We depend on external financing to fund leases and contracts, and adequate financing may not be available to us in amounts that are sufficient, together with our cash flow, to originate new leases.

Our lease and finance business is capital intensive and requires access to substantial short-term and long-term credit to fund leases and contracts. We will continue to require significant additional capital to maintain and expand our funding of leases and contracts, as well as to fund any future acquisitions of leasing companies or portfolios. Our uses of cash include the origination and acquisition of leases and contracts, payment of interest and principal on borrowings, payment of selling, general and administrative expenses, income taxes, capital expenditures and dividends.

Since August 2007, we have had a revolving line of credit with a bank syndicate led by Santander based on qualified TimePayment lease receivables. The total commitment under the facility is currently $150 million and the maturity date is December 2016. At December 31, 2013, $72.6 million was outstanding under the facility. Outstanding borrowings are collateralized by eligible lease contracts and a security interest in all of our other assets.

Our ability to draw down amounts under our credit facility is potentially restricted by a borrowing base calculated with respect to our eligible receivables ($129.9 million at December 31, 2013), and our revolving line of credit has financial covenants that we must comply with to obtain funding and avoid an event of default. Our credit facility contains certain provisions which limit our ability to incur indebtedness from other sources. Any credit facility we enter into upon renewal or replacement of our existing credit facility may have similar or additional financial covenants or restrictions. Any default or other interruption of our external funding could have a material negative effect on our ability to fund new leases and contracts, and could, as a consequence, have an adverse effect on our financial results.

-7-

Table of Contents

A protracted economic downturn may cause an increase in defaults under our leases and lower demand for the commercial equipment we lease.

A protracted economic downturn, similar to the one the United States and other nations experienced in recent years, could result in a decline in the demand for some of the types of equipment or services we finance, which could lead to a decline in originations. A protracted economic downturn may slow the development and continued operation of small commercial businesses, which are the primary market for the commercial equipment leased by us. Such a downturn could also adversely affect our ability to obtain capital to fund lease and contract originations or acquisitions, or to complete securitizations. In addition, a protracted downturn could result in an increase in delinquencies and defaults by our lessees and other obligors, which could have an adverse effect on our cash flow and earnings, as well as on our ability to securitize leases. These factors could have a material adverse effect on our business, financial condition and results of operations.

Additionally, as of December 31, 2013, leases in the states of Florida, California, Texas and New York collectively accounted for approximately 42% of our portfolio. Economic conditions in these states may affect the level of collections from, as well as delinquencies and defaults by, these obligors and may thus have a disproportionate effect on our operations compared to economic conditions in other states or regions.

We experience a significant rate of default under our leases, and a higher than expected default rate would have an adverse effect on our cash flow and earnings.

Even in times of general economic growth, the credit characteristics of our lessee base correspond to a high incidence of delinquencies, which in turn may lead to significant levels of defaults. The credit profile of our lessees heightens the importance of both pricing our leases and contracts for the risk assumed, as well as maintaining an adequate allowance for losses. Our lessees, moreover, have been affected by the recent economic downturn, like many small businesses. Significant defaults by lessees in excess of those we anticipate in setting our prices and allowance levels may adversely affect our cash flow and earnings. Reduced cash flow and earnings could limit our ability to repay debt and obtain financing, which could have a material adverse effect on our business, financial condition and results of operations.

In addition to our usual practice of originating leases through our dealer relationships, from time to time we have purchased lease portfolios from dealers. While certain of these leases at inception would not have met our underwriting standards, we will purchase leases once the lessee demonstrates a payment history. We prefer to acquire these smaller lease portfolios in situations where the company selling the portfolio will continue to act as a dealer following the acquisition. Despite the demonstrated payment history, such leases may experience a higher rate of default than leases that meet our origination standards.

Our allowance for credit losses may prove to be inadequate to cover future credit losses.

We maintain an allowance for credit losses on our investments in leases, service contracts and rental contracts at an amount we believe is sufficient to provide adequate protection against losses in our portfolio. We cannot be sure that our allowance for credit losses will be adequate over time to cover losses caused by adverse economic factors, or unfavorable events affecting specific leases, industries or geographic areas. Losses in excess of our allowance for credit losses may have a material adverse effect on our business, financial condition and results of operations.

We are vulnerable to changes in the demand for the types of equipment we lease or price reductions in such equipment.

Our portfolio is comprised of a wide variety of equipment including, but not limited to, water filtration systems, food service equipment, security equipment, point of sale (POS) cash registers, salon equipment, copiers, health care and fitness equipment and automotive repair equipment. As of December 31, 2013, water filtration systems represented approximately 25% of the amount financed by TimePayment. Reduced demand for

-8-

Table of Contents

financing of the types of equipment we lease could adversely affect our lease origination volume, which in turn could have a material adverse effect on our business, financial condition and results of operations. Technological advances may lead to a decrease in the price of these types of systems or equipment and a consequent decline in the need for financing of such equipment. These changes could reduce the need for outside financing sources that would reduce our lease financing opportunities and origination volume in such products. These types of equipment are often leased by small commercial businesses which may be particularly susceptible to economic downturn, which may also affect demand for these products.

In the event that demand for financing the types of equipment that we lease declines, we will need to expand our efforts to provide lease financing for other products. There can be no assurance, however, that we will be able to do so successfully. Because many dealers specialize in particular products, we may not be able to capitalize on our current dealer relationships in the event we shift our business focus to originating leases of other products. Our failure to successfully enter into new relationships with dealers of other products or to extend existing relationships with such dealers in the event of reduced demand for financing of the systems and equipment we currently lease would have a material adverse effect on us.

We may face adverse consequences of litigation, including consequences of using litigation as part of our collection policy.

Our use of litigation as a means of collection of unpaid receivables exposes us to counterclaims on our suits for collection, to class action lawsuits and to negative publicity surrounding our leasing and collection policies. We have been a defendant in attempted class action suits as well as counterclaims filed by individual obligors in attempts to dispute the enforceability of the lease or contract. This type of litigation may be time consuming and expensive to defend, even if not meritorious, may result in the diversion of management’s time and attention, and may subject us to significant liability for damages or result in invalidation of our proprietary rights. We believe our collection policies and use of litigation comply fully with all applicable laws. Because of our persistent enforcement of our leases and contracts through the use of litigation, we may have created ill will toward us on the part of certain lessees and other obligors who were defendants in such lawsuits. Our litigation strategy has also generated adverse publicity in certain circumstances. Adverse publicity could negatively impact public perception of our business and may materially impact the price of our common stock. In addition to legal proceedings that may arise out of our collection activities, we may face other litigation arising in the ordinary course of business. Any of these factors could adversely affect our business, financial condition and results of operations.

Increased interest rates may make our leases or contracts less profitable.

Since we generally fund our leases and contracts through our credit facilities or from working capital, our operating margins could be adversely affected by an increase in interest rates. As of December 31, 2013, the applicable interest rate for borrowings under our credit facility is, at our option, the “base rate” plus 0.75% per annum or LIBOR plus 2.50%. The “base rate” is the highest of the prime rate established by the Agent, or one-month LIBOR plus 1%, or the federal funds effective rate plus 0.5%. The implicit yield on all of our leases and contracts is fixed due to the leases and contracts having scheduled payments that are fixed at the time of origination. When we originate or acquire leases or contracts, we base our pricing in part on the “spread” we expect to achieve between the implicit yield on each lease or contract and the effective interest cost we expect to pay when we finance such leases and contracts. Increases in interest rates during the term of each lease or contract could narrow or eliminate the spread or result in a negative spread to the extent such lease or contract was financed with variable-rate funding. We may undertake to hedge against the risk of interest rate increases, based on the size and interest rate profile of our portfolio. Such hedging activities, however, would limit our ability to participate in the benefits of lower interest rates with respect to the hedged portfolio. In addition, our hedging activities may not protect us from interest rate-related risks in all interest rate environments. Adverse developments resulting from changes in interest rates or hedging transactions could have a material adverse effect on our business, financial condition and results of operations. We do not currently have any hedging arrangements with respect to interest rate changes.

-9-

Table of Contents

We may not be able to realize our entire investment in the residual interests in the equipment covered by our leases.

At the inception of a lease, we record a residual value for the lease equipment as an asset based upon an estimate of the fair market value of the equipment at lease maturity. There can be no assurance that our estimated residual values will be realized due to technological or economic obsolescence, unusual wear or tear on the equipment, or other factors. Failures to realize the recorded residual values may have a material adverse effect on our business, financial condition and results of operations.

We face intense competition, which could cause us to lower our lease rates, hurt our origination volume and strategic position and adversely affect our financial results.

The microticket leasing and financing industry is highly competitive. We compete for customers with a number of national, regional and local banks and finance companies. Our competitors also include equipment manufacturers that lease or finance the sale of their own products. While the market for microticket financing has traditionally been fragmented, we could also be faced with competition from small or large-ticket leasing companies that could use their expertise in those markets to enter and compete in the microticket financing market. Our competitors include larger, more established companies, some of which may possess substantially greater financial, marketing and operational resources than us, including lower cost of funds and access to capital markets and other funding sources which may be unavailable to us. If a competitor were to lower its lease rates, we could be forced to follow suit or be unable to regain origination volume, either of which would have a material adverse effect on our business, financial condition and results of operations. In addition, competitors may seek to replicate the automated processes used by us to monitor dealer performance, evaluate lessee credit information, appropriately apply risk-adjusted pricing, and efficiently service a nationwide portfolio. The development of computer software similar to that developed by us may jeopardize our strategic position and allow our competitors to operate more efficiently than we do.

Recently proposed accounting changes may negatively impact the demand for equipment leases.

On August 17, 2010, the International Accounting Standards Board (IASB) and Financial Accounting Standards Board (FASB) released a joint exposure draft that would dramatically change lease accounting for both lessees and lessors by requiring balance sheet recognition of all leases. At their June 13, 2012, joint board meeting, the International Accounting Standards Board (IASB) and the FASB (collectively, the Boards) agreed on an approach for the accounting for lease expenses as part of their joint project to revise lease accounting. In September 2012, the Boards reached tentative decisions regarding sale and leaseback transactions and other lease accounting issues. The Boards published their revised joint proposals on leases in May 2013, consisting of the revised proposed FASB Accounting Standards Update, Leases (Topic 842) and the IASB’s Exposure Draft, Leases. Following several public roundtable meetings on the revised joint proposals, the Boards plan to consider all feedback and begin re-deliberations of all significant issues during 2014. If these accounting changes are adopted in a form that makes equipment leasing less attractive to small business owners, it could result in a reduction in the demand for equipment leases, and could have an adverse effect on our results of operations and financial condition.

Government regulation could restrict our business.

Our leasing business is not currently subject to extensive federal or state regulation. While we are not aware of any proposed legislation, the enactment of, or a change in the interpretation of, certain federal or state laws affecting our ability to price, originate or collect on receivables (such as the application of usury laws to our leases and contracts) could negatively affect the collection of income on our leases and contracts, as well as the collection of fee income. Any such legislation or change in interpretation, particularly in Massachusetts, whose laws govern the majority of our leases and contracts, could have a material adverse effect on our ability to originate leases and contracts at current levels of profitability, which in turn could have a material adverse effect

-10-

Table of Contents

on our business, financial condition or results of operations. Changes to the bankruptcy laws that would make it easier for lessees to file for bankruptcy could increase delinquency and defaults on the existing portfolio.

We may face risks in acquiring other portfolios and companies, including risks relating to how we finance any such acquisition or how we are able to assimilate any portfolios or operations we acquire.

In addition to organic growth a portion of our growth strategy may involve acquisitions of leasing companies or portfolios from time to time. Our inability to identify suitable acquisition candidates or portfolios, or to complete acquisitions on favorable terms, could limit our ability to grow our business. Any major acquisition would require a significant portion of our resources. The timing, size and success, if at all, of our acquisition efforts and any associated capital commitments cannot be readily predicted. We may finance future acquisitions by using shares of our common stock, cash or a combination of the two. Any acquisition we make using common stock would result in dilution to existing stockholders. If the common stock does not maintain a sufficient market value, or if potential acquisition candidates are otherwise unwilling to accept common stock as part or all of the consideration for the sale of their businesses, we may be required to utilize more of our cash resources, if available, or to incur additional indebtedness in order to initiate and complete acquisitions. Additional debt, or intangible assets incurred as a result of any such acquisition, could have a material adverse effect on our business, financial condition or results of operations. In addition, our credit facilities contain covenants that place significant restrictions on our ability to acquire all or substantially all of the assets or securities of another company. These provisions could prevent us from making an acquisition we may otherwise see as attractive, whether by using shares of our common stock as consideration or by using cash.

We also may experience difficulties in the assimilation of the operations, services, products and personnel of acquired companies, an inability to sustain or improve the historical revenue levels of acquired companies, the diversion of management’s attention from ongoing business operations, and the potential loss of key employees of such acquired companies. Any of the foregoing could have a material adverse effect on our business, financial condition or results of operations.

If we were to lose key personnel, our operating results may suffer or it may cause a default under our debt facilities.

Our success depends to a large extent upon the abilities and continued efforts of Richard Latour, President and Chief Executive Officer and James R. Jackson, Jr., Senior Vice President and Chief Financial Officer, and our other senior management. We have entered into employment agreements with Mr. Latour and Mr. Jackson, as well as other members of our senior management. The loss of the services of one or more of the key members of our senior management before we are able to attract and retain qualified replacement personnel could have a material adverse effect on our financial condition and results of operations. In addition, under our Santander credit facility, an event of default would arise if Mr. Latour or Mr. Jackson were to leave their positions as our Chief Executive Officer or Chief Financial Officer, respectively, unless replacements suitable to the majority of the lenders under the credit facility were appointed within 90 days. Our failure to comply with these provisions could have a material adverse effect on our business, financial condition or results of operations.

Certain provisions of our articles and bylaws may have the effect of discouraging a change in control or acquisition of the company.

Our restated articles of organization and restated bylaws contain certain provisions that may have the effect of discouraging, delaying or preventing a change in control or unsolicited acquisition proposals that a stockholder might consider favorable, including: (i) provisions authorizing the issuance of “blank check” preferred stock; (ii) providing for a Board of Directors with staggered terms; (iii) requiring super-majority or class voting to effect certain amendments to the articles and bylaws and to approve certain business combinations; (iv) limiting the persons who may call special stockholders’ meetings and; (v) establishing advance notice requirements for nominations for election to the Board of Directors or for proposing matters that can be acted upon at

-11-

Table of Contents

stockholders’ meetings. In addition, certain provisions of Massachusetts law to which we are subject may have the effect of discouraging, delaying or preventing a change in control or an unsolicited acquisition proposal.

Our stock price may be volatile, which could limit our access to the equity markets and could cause you to incur losses on your investment.

If our revenues do not grow or grow more slowly than we anticipate, or if operating expenditures exceed our expectations or cannot be adjusted accordingly, the market price of our common stock could be materially and adversely affected. In addition, the market price of our common stock has been in the past, and could be in the future, materially and adversely affected for reasons unrelated to our specific business or results of operations. General market price declines or volatility in the future could adversely affect the price of our common stock. In addition, short-term trading strategies of certain investors can also have a significant effect on the price of specific securities. In addition, the trading price of the common stock may be influenced by a number of factors, including the liquidity of the market for the common stock, investor perceptions of us and the equipment financing industry in general, variations in our quarterly operating results, interest rate fluctuations and general economic and other conditions. Also, the volatility of the stock market could adversely affect the market price of our common stock and our ability to raise funds in the public markets.

There is no assurance that we will continue to pay dividends on our common stock in the future.

We declared dividends of $0.25, $0.24 and $0.21 per share during 2013, 2012 and 2011, respectively. Future dividend payments are subject to ongoing review and evaluation by our Board of Directors. The decision as to the amount and timing of future dividends we may pay, if any, will be made in light of our financial condition, capital requirements and growth plans, as well as our external financing arrangements and any other factors our Board of Directors may deem relevant. We can give no assurance as to the amount and timing of the payment of future dividends.

Our business operations could be disrupted if our information technology systems fail to perform adequately.

Given the number of transactions we process each year, our business is heavily dependent on our information technology systems. We rely on our information systems to effectively manage our business data, perform underwriting functions, perform billing cycles, process cash collections, perform tax compliance functions, and other vital business processes. Our business system stores the confidential information of our customers, suppliers and employees, including personal identification information, credit card data, and other information. We have taken steps to secure our management information systems.

Our information technology systems may be vulnerable to cyber-attacks or viruses, security breaches, theft of information, interruptions or other damages from circumstances beyond our control including natural disasters and errors from our employees. Cyber-attacks could result in the loss or misuse of information, damage to our reputation, litigation, fines and other potential liabilities. If we encounter damage to our systems, a security breach of our systems or difficulty maintaining or upgrading current systems, our business operations could be disrupted and it could have a material adverse effect on our business.

| ITEM 2. | PROPERTIES |

At December 31, 2013, our corporate headquarters and operations center occupied approximately 24,000 square feet of office space at New England Executive Park in Burlington, Massachusetts 01803. The lease for this space expires on July 31, 2017. In addition, at December 31, 2013, we occupied 4,986 square feet of office space at 2801 Townsgate Road, Thousand Oaks, CA 91361. The lease for this space expires on June 30, 2018.

-12-

Table of Contents

| ITEM 3. | LEGAL PROCEEDINGS |

We are involved from time to time in litigation incidental to the conduct of our business. Although we do not expect that the outcome of any of these matters, individually or collectively, will have a material adverse effect on our financial condition or results of operations, litigation is inherently unpredictable. Therefore, judgments could be rendered or settlements entered, that could adversely affect our operating results or cash flows in a particular period. We routinely assess all of our litigation and threatened litigation as to the probability of ultimately incurring a liability, and record our best estimate of the ultimate loss in situations where we assess the likelihood of loss as probable.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

-13-

Table of Contents

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

Market Information

Our common stock, par value $0.01 per share is currently listed on the Nasdaq Global Market under the symbol “MFI.” The following chart shows the high and low sales price of our common stock in each quarter over the past two fiscal years.

| 2013 | 2012 | |||||||||||||||||||||||||||||||

| First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter |

First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter |

|||||||||||||||||||||||||

| Stock Price |

||||||||||||||||||||||||||||||||

| High |

$ | 8.80 | $ | 8.58 | $ | 9.30 | $ | 9.05 | $ | 7.11 | $ | 8.46 | $ | 9.96 | $ | 9.48 | ||||||||||||||||

| Low |

$ | 6.66 | $ | 6.77 | $ | 7.47 | $ | 7.77 | $ | 5.66 | $ | 6.19 | $ | 7.86 | $ | 6.51 | ||||||||||||||||

Holders

We believe there were approximately 800 stockholders of MicroFinancial, Inc. as of March 15, 2014, including beneficial owners who hold through a broker or other nominee. As of the same date, there were 40 stockholders of record.

Dividends

Dividends declared and paid or payable in the two most recently completed fiscal years were as follows:

| 2013 |

||||||||

| Date Declared |

Record Date | Payment Date | Dividend per Share | |||||

| January 29, 2013 |

February 8, 2013 | February 15, 2013 | $ | 0.06 | ||||

| April 23, 2013 |

May 3, 2013 | May 15, 2013 | 0.06 | |||||

| July 17, 2013 |

July 30, 2013 | August 15, 2013 | 0.06 | |||||

| October 24, 2013 |

November 4, 2013 | November 15, 2013 | 0.07 | |||||

|

|

|

|||||||

| Total |

$ | 0.25 | ||||||

|

|

|

|||||||

| 2012 |

||||||||

| Date Declared |

Record Date | Payment Date | Dividend per Share | |||||

| January 31, 2012 |

February 10, 2012 | February 15, 2012 | $ | 0.06 | ||||

| April 19, 2012 |

April 30, 2012 | May 15, 2012 | 0.06 | |||||

| July 19, 2012 |

July 30, 2012 | August 15, 2012 | 0.06 | |||||

| October 18, 2012 |

October 31, 2012 | November 15, 2012 | 0.06 | |||||

|

|

|

|||||||

| Total |

$ | 0.24 | ||||||

|

|

|

|||||||

Future dividend payments are subject to ongoing review and evaluation by our Board of Directors. The decision as to the amount and timing of future dividends, if any, will be made in light of our financial condition, capital requirements and growth plans, as well as our external financing arrangements and any other factors our Board of Directors may deem relevant. We can give no assurance as to the amount and timing of future dividends.

Our credit facility also restricts the amount of cash that TimePayment can dividend up to MicroFinancial during any year to 50% of consolidated net income for the immediately preceding year.

-14-

Table of Contents

Repurchases

On August 10, 2010, our Board of Directors approved a common stock repurchase program under which we were authorized to purchase up to 250,000 of our outstanding shares from time to time. The repurchases were allowed to take place in either the open market or through block trades. The repurchase program was funded by our working capital and could be suspended or discontinued at any time.

During 2013, we repurchased a total of 97,153 shares of our common stock at an average price per share of $7.28. The total cost of the shares repurchased was approximately $708,000. No repurchases were made during the fourth quarter of fiscal 2013. From January 1, 2014 through March 3, 2014, we repurchased an additional 66,552 shares of our common stock at an average price per share of $8.07. The total cost of the shares repurchased during this period was approximately $537,000.

Since the program’s inception, we have repurchased a total of 250,000 shares of our common stock (which represents the total authorized under this program) at a total cost of approximately $1.6 million.

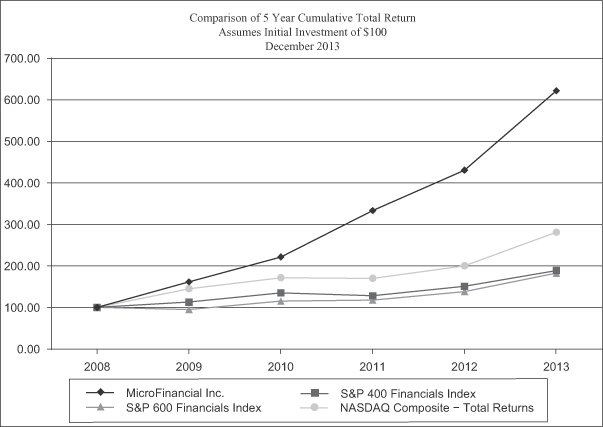

Performance Graph

The following graph compares our cumulative total stockholder return since December 31, 2008, with the S&P 400 Mid-Cap Financials Index, the S&P Small Cap 600 Financials Index and the NASDAQ Composite. Cumulative total stockholder return shown in the performance graph is measured assuming an initial investment of $100 on December 31, 2008, and the reinvestment of dividends. The historic stock price performance information shown in this graph may not be indicative of current stock price levels or future stock price performance.

-15-

Table of Contents

The information under the caption “Performance Graph” above is not deemed to be “filed” as part of this Annual Report, and is not subject to the liability provisions of Section 18 of the Securities Exchange Act of 1934. Such information will not be deemed to be incorporated by reference into any filing we make under the Securities Act of 1933 unless we explicitly incorporate it into such a filing at the time.

| ITEM 6. | SELECTED FINANCIAL DATA |

The following tables set forth selected consolidated financial and operating data for the periods and at the dates indicated. The selected consolidated financial data were derived from our financial statements and accounting records. The data presented below should be read in conjunction with the consolidated financial statements, related notes and other financial information included herein.

| Year Ended December 31, | ||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

| Income Statement Data: |

(Amounts in thousands, except share and per share data) | |||||||||||||||||||

| Revenues: |

||||||||||||||||||||

| Income on financing leases |

$ | 41,153 | $ | 40,008 | $ | 37,032 | $ | 34,398 | $ | 29,415 | ||||||||||

| Rental income |

10,534 | 9,737 | 8,574 | 7,773 | 8,584 | |||||||||||||||

| Income on service contracts |

936 | 388 | 398 | 512 | 676 | |||||||||||||||

| Other income(1) |

9,895 | 9,183 | 8,669 | 8,246 | 7,490 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenues |

62,518 | 59,316 | 54,673 | 50,929 | 46,165 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Expenses: |

||||||||||||||||||||

| Selling, general and administrative |

18,514 | 17,466 | 15,873 | 13,839 | 13,371 | |||||||||||||||

| Provision for credit losses |

19,530 | 19,490 | 18,250 | 23,148 | 22,039 | |||||||||||||||

| Depreciation and amortization |

5,448 | 4,355 | 3,270 | 2,212 | 1,628 | |||||||||||||||

| Interest |

2,703 | 2,639 | 2,661 | 3,150 | 2,769 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total expenses |

46,195 | 43,950 | 40,054 | 42,349 | 39,807 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income before provision for income taxes |

16,323 | 15,366 | 14,619 | 8,580 | 6,358 | |||||||||||||||

| Provision for income taxes |

6,560 | 6,015 | 5,628 | 3,284 | 2,231 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income |

$ | 9,763 | $ | 9,351 | $ | 8,991 | $ | 5,296 | $ | 4,127 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income per common share: |

||||||||||||||||||||

| Basic |

$ | 0.68 | $ | 0.65 | $ | 0.63 | $ | 0.37 | $ | 0.29 | ||||||||||

| Diluted |

0.66 | 0.64 | 0.62 | 0.37 | 0.29 | |||||||||||||||

| Weighted-average shares: |

||||||||||||||||||||

| Basic |

14,460,613 | 14,321,815 | 14,247,413 | 14,240,308 | 14,147,436 | |||||||||||||||

| Diluted |

14,774,529 | 14,689,531 | 14,525,566 | 14,466,266 | 14,261,644 | |||||||||||||||

| Dividends declared per common share |

$ | 0.25 | $ | 0.24 | $ | 0.21 | $ | 0.20 | $ | 0.15 | ||||||||||

-16-

Table of Contents

| December 31, | ||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

| (Dollars in thousands) | ||||||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 2,246 | $ | 3,557 | $ | 2,452 | $ | 1,528 | $ | 391 | ||||||||||

| Restricted cash |

1,107 | 1,213 | 382 | 753 | 834 | |||||||||||||||

| Gross investment in leases(2) |

237,698 | 237,642 | 223,786 | 212,899 | 194,629 | |||||||||||||||

| Unearned income |

(58,772 | ) | (62,244 | ) | (59,946 | ) | (59,245 | ) | (55,821 | ) | ||||||||||

| Allowance for credit losses |

(15,379 | ) | (14,038 | ) | (13,180 | ) | (13,132 | ) | (13,856 | ) | ||||||||||

| Investment in service contracts, net |

2,058 | 797 | — | — | — | |||||||||||||||

| Investment in rental contracts, net |

1,059 | 1,037 | 898 | 461 | 379 | |||||||||||||||

| Total assets |

173,052 | 169,629 | 155,342 | 143,605 | 127,097 | |||||||||||||||

| Revolving line of credit |

72,566 | 70,380 | 62,740 | 62,650 | 51,906 | |||||||||||||||

| Total liabilities |

84,572 | 87,237 | 79,619 | 74,118 | 60,332 | |||||||||||||||

| Total stockholders’ equity |

88,480 | 82,392 | 75,723 | 69,487 | 66,765 | |||||||||||||||

| December 31, | ||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

| (Dollars in thousands, except statistical data) | ||||||||||||||||||||

| Other Data: |

||||||||||||||||||||

| Operating Data: |

||||||||||||||||||||

| Value of leases originated(3) |

$ | 126,216 | $ | 131,375 | $ | 114,435 | $ | 116,052 | $ | 113,987 | ||||||||||

| Investment in lease and service contracts(4) |

89,710 | 90,777 | 77,684 | 77,794 | 76,306 | |||||||||||||||

| Average yield on leases(5) |

27.3 | % | 27.6 | % | 27.4 | % | 27.8 | % | 27.7 | % | ||||||||||

| Cash Flows From (Used In): |

||||||||||||||||||||

| Operating activities |

$ | 92,182 | $ | 90,781 | $ | 83,468 | $ | 73,714 | $ | 57,897 | ||||||||||

| Investing activities |

(91,540 | ) | (92,593 | ) | (79,635 | ) | (79,635 | ) | (77,969 | ) | ||||||||||

| Financing activities |

(1,953 | ) | 2,917 | (2,909 | ) | 7,058 | 15,416 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net change in cash and cash equivalents |

$ | (1,311 | ) | $ | 1,105 | $ | 924 | $ | 1,137 | $ | (4,656 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Selected Ratios: |

||||||||||||||||||||

| Return on average assets |

5.70 | % | 5.75 | % | 6.02 | % | 3.91 | % | 3.56 | % | ||||||||||

| Return on average stockholders’ equity |

11.43 | 11.83 | 12.38 | 7.77 | 6.30 | |||||||||||||||

| Operating margin(6) |

57.35 | 58.76 | 60.12 | 62.30 | 61.51 | |||||||||||||||

| Credit Quality Statistics: |

||||||||||||||||||||

| Net charge-offs |

$ | 18,189 | $ | 18,632 | $ | 18,202 | $ | 23,872 | $ | 19,906 | ||||||||||

| Net charge-offs as a percentage of average gross investment(7) |

7.65 | % | 8.08 | % | 8.34 | % | 11.72 | % | 11.28 | % | ||||||||||

| Provision for credit losses as a percentage of average gross investment(7) |

8.22 | 8.45 | 8.36 | 11.36 | 12.49 | |||||||||||||||

| Allowance for credit losses as a percentage of gross investment(7) |

6.47 | 5.91 | 5.89 | 6.17 | 7.12 | |||||||||||||||

| (1) | Includes loss and damage waiver fees, service fees, interest income, and miscellaneous revenue. |

| (2) | Consists of receivables due in installments and estimated residual value. |

| (3) | Represents the amount paid to dealers upon funding of leases plus the associated unearned income. |

| (4) | Represents the net amount paid to dealers upon funding of leases and service contracts. |

-17-

Table of Contents

| (5) | Represents the aggregate of the implied interest rate on each lease originated during the period weighted by the amount funded. |

| (6) | Represents income before provision for income taxes and provision for credit losses as a percentage of total revenues. |

| (7) | Represents a percentage of average gross investment in leases. |

-18-

Table of Contents

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS, INCLUDING SELECTED QUARTERLY FINANCIAL DATA |

(UNAUDITED)

The following discussion includes forward-looking statements (as such term is defined in the Private Securities Litigation Reform Act of 1995). When used in this discussion, the words “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “continue,” “plan” and similar expressions are intended to identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors that could cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking statements are subject to risks, uncertainties and assumptions, including, among other things, those associated with:

| • | the demand for the equipment types we finance; |

| • | our significant capital requirements; |

| • | our ability or inability to obtain the financing we need, or to use internally generated funds, in order to continue originating contracts; |

| • | the risks of defaults on our leases; |

| • | our provision for credit losses; |

| • | our residual interests in underlying equipment; |

| • | possible adverse consequences associated with our collection policy; |

| • | the effect of higher interest rates on our portfolio; |

| • | increasing competition; |

| • | increased governmental regulation of the rates and methods we use in financing and collecting on our leases and contracts; |

| • | acquiring other portfolios or companies; |

| • | dependence on key personnel; |

| • | changes to accounting standards for equipment leases; |

| • | adverse results in litigation and regulatory matters, or promulgation of new or enhanced legislation or regulations; |

| • | general economic and business conditions; and |

| • | information technology systems disruptions or security breaches. |

The risk factors above and those under “Risk Factors” beginning on page 7, as well as any other cautionary language included herein, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we described in our forward-looking statements. Many of these factors are significantly beyond our control. We expressly disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based. In light of these risks and uncertainties, there can be no assurance that the forward-looking information contained herein will in fact transpire.

Overview

We are a specialized commercial/consumer finance company that provides equipment leasing and other financing services, with a primary focus on the microticket market. Our wholly-owned operating subsidiary,

-19-

Table of Contents

TimePayment Corp, was established in June 2004. Our portfolio consists of, but is not limited to, water filtration systems, food service equipment, security equipment, point of sale (POS) cash registers, salon equipment, copiers, health care, fitness equipment and automotive repair equipment.

We derive the majority of our revenues from leases originated and held by us, payments on service and rental contracts and fee income.

We finance the origination of our leases and contracts primarily through cash provided by operating activities and borrowings under our revolving line of credit. We entered into the revolving line of credit in August 2007 with a bank syndicate led by Santander based on qualified TimePayment lease receivables. The total commitment under the facility, originally $30 million, has been increased at various times, most recently in December 2012, when it was increased from $100 million to $150 million. The December 2012 amendment permits further increases in the total commitment under an accordion feature, to $175 million, with the agreement of the Agent and, as applicable, a new or existing Lender, under certain conditions. Outstanding borrowings are collateralized by eligible lease contracts and a security interest in all of our other assets. (See “Borrowings” in the “Liquidity and Capital Resources” section below for additional information.)

In a typical lease transaction, we originate a lease through our nationwide network of equipment vendors, independent sales organizations and brokers. Upon our approval of a lease application and verification that the lessee has received the equipment and signed the lease, we pay the dealer for the cost of the equipment, plus the dealer’s profit margin.

Substantially all leases originated or acquired by us are non-cancelable. During the term of the lease, we are scheduled to receive payments sufficient to cover our borrowing costs and the cost of the underlying equipment and to provide us with an appropriate profit. We pass along some of the costs of our leases and contracts by charging late fees, prepayment penalties, loss and damage waiver fees and other service fees, when applicable. Collection fees are imposed based on our estimate of the cost of collection. The loss and damage waiver fees are charged if a customer fails to provide proof of insurance and are reasonably related to the cost of replacing the lost or damaged equipment or product. The initial non-cancelable term of the lease is equal to or less than the equipment’s estimated economic life and often provides us with additional revenues based on the residual value of the equipment at the end of the lease. Initial terms of the leases in our portfolio generally range from 12 to 60 months, with an average initial term of 41 months as of December 31, 2013.

We also acquire service contracts under which a homeowner purchases a security system and simultaneously signs a contract with the dealer for the monitoring of that system for a monthly fee. Upon approval of the monitoring application and verification with the homeowner that the system is installed, we purchase the right to the payment stream under the monitoring service contract from the dealer at a negotiated multiple of the monthly payments. In years prior to 2012, our service contract revenue was derived from our LeaseComm portfolio, for which we have not purchased any new security service contracts since 2002. Consequently, our service contract revenue from LeaseComm represents a less significant portion of our revenue stream over time. Beginning in the second quarter of 2012, TimePayment began acquiring service contracts.

Operating Data

Dealer funding was $90.6 million during the year ended December 31, 2013; a decrease of $1.1 million or 1.2%, compared to the year ended December 31, 2012. Originations declined as a result of lower average contract amounts, which decreased from $5,100 during 2012 to $4,800 during 2013. In part, the reduction in the average contract amount was due to the increase in the number of service contract originations, for which the average amount funded was approximately $1,200.

We continue to concentrate on our business development efforts, which include increasing the size of our vendor base and sourcing a larger number of applications from those vendors. We funded these contracts using

-20-

Table of Contents

cash provided by operating activities as well as net borrowings of $2.2 million against our revolving line of credit. Receivables due in installments, estimated residual values, and gross investment in rental equipment and service contracts increased from $242.3 million at December 31, 2012 to $243.8 million at December 31, 2013, an increase of $1.5 million, or 0.6%. Unearned income decreased by $3.4 million, or 5.6%, from $62.2 million at December 31, 2012, to $58.8 million at December 31, 2013. Net cash provided by operating activities increased by $1.4 million, or 1.5%, to $92.2 million during the year ended December 31, 2013, from the year ended December 31, 2012.

Dealer fundings were $91.7 million during the year ended December 31, 2012, an increase of $13.5 million or 17.3%, compared to the year ended December 31, 2011. We funded contracts in 2012 using cash provided by operating activities as well as net borrowings of $7.6 million against our revolving line of credit. Receivables due in installments, estimated residual values, and gross investment in rental equipment and service contracts increased from $227.6 million at December 31, 2011, to $242.3 million at December 31, 2012, an increase of $14.7 million, or 6.4%. Unearned income increased by $2.3 million, or 3.8%, from $59.9 million at December 31, 2011, to $62.2 million at December 31, 2012. This increase was due to the $91.7 million in originations in 2012. Net cash provided by operating activities increased by $7.3 million, or 8.8%, to $90.8 million during the year ended December 31, 2012, from the year ended December 31, 2011.

Critical Accounting Policies

We consider certain of our accounting policies to be the most critical to our financial condition and results of operations in the sense that they involve the most complex or subjective decisions or assessments. We have identified our most critical accounting policies as those policies related to revenue recognition, the allowance for credit losses, income taxes and accounting for share-based compensation. These accounting policies are discussed below as well as within the notes to our consolidated financial statements.

Revenue Recognition

Our lease contracts are accounted for as financing leases. At origination, we record the gross lease receivable, the estimated residual value of the leased equipment, initial direct costs incurred and the unearned lease income. Unearned lease income is the amount by which the gross lease receivable plus the estimated residual value exceeds the cost of the equipment. Unearned lease income and initial direct costs incurred are amortized over the related lease term using the interest method. Amortization of unearned lease income and initial direct costs is suspended if, in our opinion, full payment of the contractual amount due under the lease agreement is doubtful. In conjunction with the origination of leases, we may retain a residual interest in the underlying equipment upon termination of the lease. The value of such interest is estimated at inception of the lease and evaluated periodically for impairment. At the end of the lease term, the lessee has the option to buy the equipment at the fair market value, return the equipment or continue to rent the equipment on a month-to-month basis. If the lessee continues to rent the equipment, we record our investment in the rental contract at its estimated residual value. Rental and service contract revenue are recognized based on the methodologies described below. Other revenues, such as loss and damage waiver fees and service fees relating to the leases and contracts, are recognized as they are earned.

Our investments in service contracts are recorded at cost and amortized over the expected life of the contract. Income on service contracts from monthly billings is recognized as the related services are provided. Our investment in rental contracts is either recorded at estimated residual value and depreciated using the straight-line method over a period of 12 months, or at the acquisition cost and depreciated using the straight line method over a period of 36 months. Rental income from monthly billings is recognized as the customer continues to rent the equipment. We periodically evaluate whether events or circumstances have occurred that may affect the estimated useful life or recoverability of our investments in service and rental contracts.

-21-

Table of Contents

Allowance for Credit Losses