Document

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark one)

| |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2016

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _________.

Commission File No. 0-25121

SELECT COMFORT CORPORATION

(Exact name of registrant as specified in its charter)

|

| | |

MINNESOTA | | 41-1597886 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

|

| | |

9800 59th Avenue North | | |

Minneapolis, Minnesota | | 55442 |

(Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (763) 551-7000

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | | Name of each exchange on which registered |

Common Stock, par value $0.01 per share | | The NASDAQ Stock Market LLC |

| | (NASDAQ Global Select Market) |

|

|

Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. YES ý NO o

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES o NO ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ý NO o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ý NO o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | |

Large accelerated filer | ý | | | Accelerated filer o |

Non-accelerated filer | o | (Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES o NO ý

The aggregate market value of the common stock held by non-affiliates of the Registrant as of July 2, 2016, was $747,344,000 (based on the last reported sale price of the Registrant’s common stock on that date as reported by NASDAQ).

As of January 28, 2017, there were 42,950,000 shares of the Registrant’s Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement to be furnished to shareholders in connection with its 2017 Annual Meeting of Shareholders are incorporated by reference in Part III, Items 10-14 of this Annual Report on Form 10-K.

As used in this Form 10-K, the terms “we,” “us,” “our,” the “Company,” and “Select Comfort” mean Select Comfort Corporation and its subsidiaries and the term “common stock” means our common stock, par value $0.01 per share.

As used in this Form 10-K, the term “bedding” includes mattresses, box springs and foundations.

Sleep Number®, Select Comfort®, SleepIQ®, the Double Arrow logo, AirFit®, Bam LABS®, the “B” logo, Comfortaire®,ComfortFit®, Comfort.Individualized.®, the DualTemp logo, the DualAir Technology Inside logo, FlexTop®, IndividualFit®, Individualized Sleep Experiences®, Know Better Sleep®, Pillow[ology]®, PillowFit®, Probably the Best Bed in the World®, Sleep Number Inner Circle®, Tech-e®, Smart Bed Technology®, The Only Bed That Knows You®, We Make BedsSmart®, What’s Your Sleep Number?®, SleepIQ Kids™, SleepIQ LABS™, Sleep For The FutureSM, Smart Bed For Smart Kids™, It™, The It Bed™, The Only Bed That Grows With Them™, Tonight Bedtime. Tomorrow The World™, ActiveComfort™, Auto Snore™, CoolFit™, DualAir™, DualTemp™, Firmness Control™, FlexFit™, In Balance™, PartnerSnore™, Rapid Sleep Onset™, Responsive Air™, Sleep Number 360™, The Bed Reborn™, the SleepIQ LABS logo, The Bed That Moves You™, our bed model names, and our other marks and stylized logos are trademarks and/or service marks of Select Comfort. This Form 10-K may also contain trademarks, trade names and service marks that are owned by other persons or entities.

Our fiscal year ends on the Saturday closest to December 31, and, unless the context otherwise requires, all references to years in this Form 10-K refer to our fiscal years. Our fiscal year is based on a 52- or 53-week year. All years presented in this Form 10-K are 52 weeks, except for the 2014 fiscal year ended January 3, 2015, which is a 53-week year.

TABLE OF CONTENTS

|

| | | |

PART I | |

| | | |

| Item 1. | | |

| | | |

| Item 1A. | | |

| | | |

| Item 1B. | | |

| | | |

| Item 2. | | |

| | | |

| Item 3. | | |

| | | |

| Item 4. | | |

| | | |

PART II | |

| | | |

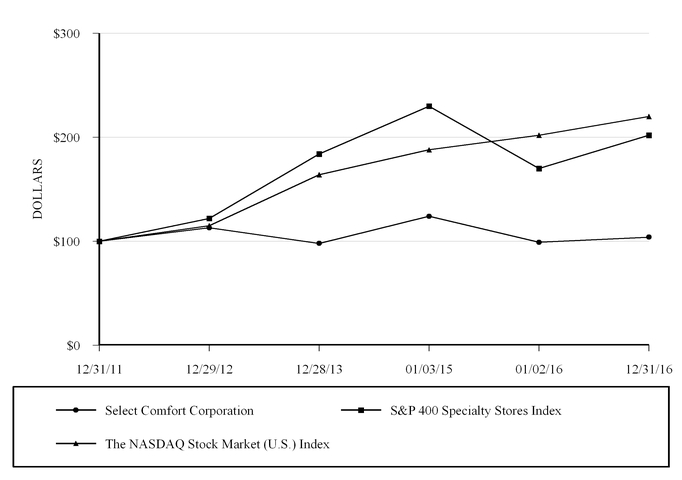

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | |

| | | |

| Item 6. | | |

| | | |

| Item 7. | | |

| | | |

| Item 7A. | | |

| | | |

| Item 8. | | |

| | | |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

| | | |

| Item 9A. | | |

| | | |

| Item 9B. | | |

| | | |

PART III | |

| | | |

| Item 10. | | |

| | | |

| Item 11. | | |

| | | |

| Item 12. | | |

| | | |

| Item 13. | | |

| | | |

| Item 14. | | |

| | | |

PART IV | |

| | | |

| Item 15. | | |

PART I

This Annual Report on Form 10-K contains or incorporates by reference certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. For this purpose, any statements contained in or incorporated by reference into this Annual Report on Form 10-K that are not statements of historical fact may be deemed to be forward-looking statements, including but not limited to projections of revenues, results of operations, financial condition or other financial items; any statements of plans, strategies and objectives of management for future operations; any statements regarding proposed new products, services or developments; any statements regarding future economic conditions, prospects or performance; statements of belief and any statement or assumptions underlying any of the foregoing. In addition, we or others on our behalf may make forward-looking statements from time to time in oral presentations, including telephone conferences and/or Webcasts open to the public, in press releases or reports, on our Internet Website or otherwise. We try to identify forward-looking statements in this report and elsewhere by using words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “predict,” “intend,” “potential,” “continue” or the negative of these or similar terms.

Our forward-looking statements speak only as of the date made and by their nature involve substantial risks and uncertainties. Our actual results may differ materially depending on a variety of factors, including the items discussed in greater detail below under the caption “Risk Factors.” These risks and uncertainties are not exclusive and further information concerning the Company and our business, including factors that potentially could materially affect our financial results or condition, may emerge from time to time, including factors that we may consider immaterial or do not anticipate at this time.

We wish to caution readers not to place undue reliance on any forward-looking statement and to recognize that forward-looking statements are predictions of future results, which may not occur as anticipated. We assume no obligation to update forward-looking statements to reflect actual results or changes in factors or assumptions affecting such forward-looking statements. We advise you, however, to review and consider any further disclosures we make on related subjects in our quarterly reports on Form 10-Q and current reports on Form 8-K that we file with or furnish to the Securities and Exchange Commission.

ITEM 1. BUSINESS

Overview

Select Comfort Corporation, based in Minneapolis, Minnesota, was founded in 1987. In 1998, Select Comfort became a publicly traded company. We are listed on The NASDAQ Stock Market LLC (NASDAQ Global Select Market) under the symbol “SCSS.” When used herein, the terms “Select Comfort,” “Company,” “we,” “us” and “our” refer to Select Comfort Corporation, including consolidated subsidiaries.

Our mission is to improve lives by individualizing sleep experiences. Our vision is to become one of the world's most beloved brands by delivering an unparalleled sleep experience. We plan to achieve this by offering benefit-driven, innovative sleep solutions to our customers through an unmatched retail experience and a carefree ownership experience.

We offer consumers high-quality, individualized sleep solutions and services, which include a complete line of Sleep Number beds, bases and bedding accessories. Our business has three significant competitive advantages: proprietary sleep innovations, ongoing customer relationships and exclusive retail distribution.

We have a vertically integrated business model and are the exclusive designer, manufacturer, marketer, retailer and servicer of a complete line of Sleep Number beds. We are the pioneer in biometric sleep tracking and adjustability. Only the Sleep Number bed offers SleepIQ technology - proprietary sensor technology that works directly with the bed’s DualAir system to track each individual’s sleep. SleepIQ technology communicates how you slept and what adjustments you can make to optimize your sleep and improve your daily life. Select Comfort also offers FlextFit adjustable bases, and Sleep Number pillows, sheets and other bedding products. As a specialty mattress retailer with stores across the nation, we offer consumers a unique, value-added retail experience at one of the more than 540 Sleep Number stores across the country, online at SleepNumber.com or via phone at (800) 753-3768.

We are committed to delivering superior shareholder value through three primary drivers of earnings per share growth: increasing demand, leveraging our business model and deploying our capital efficiently. We are the sleep innovation leader and drive growth through effective brand marketing and a differentiated retail experience.

In fiscal 2016 we generated net sales of $1.3 billion with $77 million of operating income. In 2012, 2013, 2014 and 2015, we generated operating income of $120 million, $91 million, $102 million and $75 million, respectively. We have transformed the

business with $427 million of capital investments over five years through 2016. This effort positions us for accelerated profits and cash generation long-term.

In September 2015, we completed the acquisition of BAM Labs, Inc. (now operating as SleepIQ LABS), the leading provider of biometric sensor and sleep monitoring for data-driven health and wellness. The addition of SleepIQ LABS strengthens Sleep Number’s leadership in sleep innovation, adjustability and individualization. The acquisition broadens and deepens electrical, biomedical, software and backend capabilities - API (application program interface) and bio-signal analysis. Our ownership and control of biometric data advances smart, connected products that empower our customers to experience quality sleep.

In the fourth quarter of 2015, we replaced our nearly 20-year-old legacy computer systems with a new vertically integrated Enterprise Resource Planning (ERP) system. We completed our ERP implementation by the end of the first quarter of 2016. Implementation issues negatively affected fourth-quarter 2015 net sales and profits, and to a lesser degree, first-quarter and second-quarter 2016 net sales and profits. The new operating platform enables operational efficiencies, improved customer convenience and supports the growth of our business.

Proprietary Sleep Innovations

Sleep Number® Bed

Unlike the “one-size-fits-all” solution offered by other mattress brands, the Sleep Number bed offers individualized comfort that is adjustable on each side of the bed. Our proprietary DualAir technology, which features two independent air chambers, allows couples to adjust firmness to their own individual preference at the touch of a button. Sleepers can each enjoy their ideal firmness, support and pressure-relieving comfort - their Sleep Number setting - for deep, restful sleep.

The benefits of our proprietary Sleep Number bed have been validated through clinical sleep research, which has shown that participants who slept on a Sleep Number bed generally fell asleep faster, experienced more deep sleep with fewer disturbances and experienced greater relief from back pain than those sleeping on a traditional innerspring mattress.

We offer Sleep Number beds in good, better and best price ranges within the premium mattress category, and in a broad range of sizes, including twin, full, queen, eastern king and California king.

| |

• | The Classic Series offers Sleep Number adjustability starting at $799 for a queen mattress. The series includes the Sleep Number c2 and c4 beds. |

| |

• | The Performance Series includes our most popular mattresses with a perfect balance of softness and pressure-relieving support. The series includes the Sleep Number p5 and p6 beds. |

| |

• | The Memory Foam Series is breathable and contouring. The series includes the Sleep Number m7 bed. |

| |

• | The Innovation Series is the ultimate in individualized comfort and temperature-balancing innovation. The series includes the Sleep Number i8 and i10 beds. |

In November 2016, J.D. Power announced that Sleep Number ranked highest in customer satisfaction with mattresses for the second consecutive year. The reports measured customer satisfaction with mattress purchases based on seven factors: comfort, price, support, durability, warranty, features and customer service. In 2016 Sleep Number achieved an overall satisfaction index score of 887, which is 32 points above the industry average of 855. In addition, Sleep Number achieved the highest score in the warranty and features study factors.

SleepIQ® Technology

SleepIQ technology is a touchless, biometric sensor technology that tracks sleep during the night. Launched by Select Comfort in 2014, SleepIQ technology tracks the user's sleep by gathering hundreds of readings per second continuously (heart rate, motion and breathing). Based on that data, a proprietary algorithm delivers a personal SleepIQ score, from 1 to 100, to consumers each morning. The Sleep Number bed is the only bed that lets you track and optimize your sleep with SleepIQ technology. SleepIQ also connects with leading health, fitness and sleep environment apps - including FitBit®, Nest Learning Thermostat™, MapMyRun™ and Withings Health Mate™ - to show a holistic view of how lifestyle choices may affect sleep. It empowers the sleeper to achieve their best possible sleep each night. SleepIQ technology is included on our Memory Foam and Innovation series, and available for purchase on all other Sleep Number beds. In addition, SleepIQ can be added to Sleep Number beds purchased after 2008.

SleepIQ Kids™ Bed

In 2015, we introduced the SleepIQ Kids bed, which extends Sleep Number’s core DualAir adjustability and SleepIQ technology to the children’s mattress market. It is the only bed that adjusts with children as they grow. Through a combination of sleep knowledge powered by SleepIQ technology and adjustability powered by Sleep Number DualAir technology, the SleepIQ Kids bed empowers parents or children to adjust the bed for individualized comfort.

The it™ bed

In September 2016 our latest innovation, the "it bed," became available for sale. The "it bed" is compressed into a sleek box and delivered directly to the customer's doorsteps. Designed for today's connected lifestyles, the "it bed" is adjustable on each side and features SleepIQ technology. The "it bed" received four technology and innovation awards at CES in 2016.

Select Comfort developed the new "it bed" brand for first-time bed buyers and tech-savvy individuals who recognize that quality sleep is essential to their life. It effortlessly quantifies your sleep, connects to select applications and has predictive modeling that makes suggestions to improve your sleep. The "it bed" is exclusive to Select Comfort and is available online at itbed.com and in select Sleep Number stores priced at $1,099 for a queen mattress. The "it bed" features the latest release of SleepIQ technology, which uses adaptive algorithms and predictive modeling to recommend adjustments to daily habits and sleep environment. It also features ActiveComfort technology - the "it bed" has dual, foam-filled air chambers that respond to individuals’ constantly changing needs and adjusts to an ideal level of comfort, firmness and support.

The Sleep Number 360™ smart bed product line

In January 2017 at CES, Select Comfort introduced the Sleep Number 360 smart bed product line, one of the most significant innovations in our 30-year history. The Sleep Number 360 smart bed won 13 awards at CES, including being named the Best of Innovation Honoree in the Home Appliances category. Powered by SleepIQ technology, the Sleep Number 360 smart beds will intuitively sense and automatically adjust comfort to keep both partners sleeping soundly all night. The SleepIQ technology platform integrates hardware, software and design to deliver effortless adjustability, sleep tracking and connectivity.

The new Sleep Number 360 smart mattresses and adjustable bases will include these new features:

| |

• | Self-adjusting comfort throughout the night. As sleep positions change during the night, Responsive Air technology will adjust the bed’s comfort in real time via the two air chambers inside the mattress. |

| |

• | Foot-warming feature to fall asleep faster. It’s clinically proven that people fall asleep faster when their feet are warmed. SleepIQ technology knows the sleepers’ bedtime routines and warms the foot of the bed automatically before bedtime with Rapid Sleep Onset technology. |

| |

• | Auto Snore detection and adjustment. Responding to SleepIQ biometrics, the 360 Smart Bed will automatically adjust to each sleeper’s ideal position. |

| |

• | Smart alarm feature will awaken sleepers at the optimal moment. SleepIQ technology knows each sleeper's desired wake-up window and an alarm will sound when they are in their lightest stage of sleep during this window. |

The Sleep Number 360 smart bed line will replace the current Sleep Number line. The phased implementation is planned to begin in the second quarter of 2017 and will be exclusively available in all Sleep Number stores and online.

FlexFit™ Adjustable Base Technology

We offer a full line of exclusive FlexFit adjustable bases that enable customers to raise the head or foot of the bed, and to experience the comfort of massage. Our PartnerSnore technology lets a user gently raise their partner’s head to relieve common snoring.

In conjunction with the 360 smart beds, we will introduce a new line of FlexFit adjustable bases in 2017. This new series will replace our existing FlexFit models and will integrate with SleepIQ technology to deliver the new features and functionality.

Sleep Number® Bedding Collection

Our exclusive Sleep Number bedding collection comprises a full line of sleep products that are designed to solve sleep issues. Select Comfort has a wide assortment of pillows designed to fit each individual's size, shape and sleeping position for more comfortable sleep. Our innovative bedding features make it easier to make your bed: our SmartFit design keeps sheets securely in place and Logic Label takes the guesswork out of making your bed. We also offer a wide assortment of temperature-balancing products.

In 2013, we introduced the DualTemp layer, a new sleep innovation that addresses one of the most significant sleep issues experienced by customers: sleeping too hot or sleeping too cold. The DualTemp layer features active air technology that allows each person to select his or her ideal temperature at the simple touch of a button. The DualTemp layer can be used with any mattress brand or adjustable base.

Exclusive Distribution

Unlike traditional mattress manufacturers, which primarily sell through third-party retailers, nearly 98% of our net sales are direct to consumers through our Sleep Number stores, online at SleepNumber.com or via phone.

Since 2012, we rebuilt our store portfolio and expanded our national footprint. This strategy has included repositioning a large percentage of our mall stores to stronger off-mall locations, improving the size and positioning within malls and adding stores in both existing and new trade areas. Going forward, we anticipate a total store count of 600 to 650 stores by 2019. We are well positioned with a retail store portfolio that is healthy and productive. As of year-end 2016, approximately 80% of our stores are less than five years old.

We target high-quality, convenient, visible store locations based on several factors, including each market’s overall sales potential, store geographic location, demographics and proximity to other specialty retail stores. As the exclusive distributor of Sleep Number products, we target one store per 350,000 - 500,000 people. This places our stores within an average radius of 10 miles, or 20-minute drive times, for most of our target customers.

Our award-winning store design and improved real estate locations support our value-added retail experience, which results in high store productivity and profitability. Our sales-per-square-foot productivity ranks in the top 10 of U.S. specialty retail brands, at nearly $1,000 per foot and we average approximately $650,000 in annual net sales per full-time retail employee. Since 2011, we have increased our average store size by more than 66% to 2,538 square feet.

As of December 31, 2016, we had 540 retail stores in 49 U.S. states, 53% of which were in non-mall locations. We expect to grow our retail store portfolio by 3% to 4% during 2017.

In addition, we have a robust online experience that helps customers easily engage in relevant content, research our products and solutions, transact online and find post-sales support. Our online experience expands our digital brand and connections with consumers, driving deeper awareness, consideration and engagement.

We have adopted an agile development approach to our online initiatives. This means we deploy rapid experimentation and iterations of our digital experiences. Results include faster time-to-market of online improvements to drive store traffic and online conversion. All Sleep Number products are available exclusively at SleepNumber.com or Sleep Number stores.

Our retail stores accounted for 91% of our net sales in 2016. Average annual net sales per comparable store were $2.4 million in 2016, $2.4 million in 2015 and $2.3 million in 2014. In 2016, 98% of our stores open for a full year generated net sales over $1.0 million and 61% of our stores open for a full year generated net sales over $2.0 million. We now have more than 20% of our store base delivering greater than $3 million in annual net sales. Our online and phone sales accounted for 7% of our net sales in 2016.

Marketing

We use a variety of marketing and advertising vehicles to drive customer traffic to our brand, to educate and to acquire new customers. Our marketing efforts target a broad customer demographic: 30-54 years old with greater than $75,000 household income for our core line of products. Our customers care about their own and their family's health and well-being, and know that quality sleep is a key factor.

Marketing drives growth in our business by building consumer awareness and consideration of our sleep innovations, and increasing traffic to our website and stores, while building our brand image. Our advertising communications target our existing customers for repeat and referral purchases and potential new customers through a mix of national and local marketing. Television is our most efficient media, followed by digital. We continue to build our in-house digital capabilities and data-driven tools to make deeper connections with our customers, increase demand and improve media efficiency. In 2016, media expense represented 14.5% of net sales.

Operations

Manufacturing and Distribution

We have two manufacturing plants located in Irmo, South Carolina and Salt Lake City, Utah, which distribute Sleep Number products. The manufacturing operations in South Carolina and Utah consist of quilting and sewing of the fabric covers for our beds, and final assembly and packaging of mattresses and bases. In addition, our electrical Firmness Control systems are assembled in our Utah plant.

We obtain all of the raw materials and components used to produce our beds from outside sources. A number of components, including our proprietary air chambers, our proprietary blow-molded foundations, our adjustable foundations, various components for our Firmness Control systems, as well as fabrics and zippers, are sourced from suppliers who currently serve as our sole or primary source of supply for these components. We believe we can obtain these raw materials and components from other sources of supply, although we could experience some short-term disruption in our ability to fulfill orders in the event of an unexpected loss of supply from one of the primary suppliers. We utilize dual sourcing on targeted components when effective.

We have taken, and continue to take, various measures to mitigate the potential impact of an unexpected disruption in supply from any sole-source suppliers, including increasing safety stocks and identifying potential secondary sources of supply. All of the suppliers that produce unique or proprietary products for us have in place either contingency or disaster recovery plans or redundant production capabilities in other locations in order to safeguard against any unforeseen disasters. We review these plans and sites on a regular basis to ensure the supplier's ability to maintain an uninterrupted supply of materials and components.

Historically, we manufactured beds primarily on a just-in-time basis to fulfill orders rather than stocking inventory, which enabled us to maintain lower levels of finished goods inventory and operate with limited regional warehousing. Over the last two years, we have migrated our fulfillment process to a hybrid "make-to-stock" model, wherein our best selling products are forward stocked in distribution centers closer to customers. Together with our new ERP system, this hybrid model will enable us to improve our customer experience with shorter delivery times. Products are generally received by the customer within five to 14 days from the date of order.

Home Delivery Service

We offer Comfort ServiceSM home delivery and setup, which includes assembly and mattress removal. In selected markets, we provide home delivery, assembly and mattress removal services through third-party providers. Over 80% of beds sold are delivered by our full-service home delivery team or by our third-party service providers.

Customer Service

We have an in-house customer service department staffed by teams of specialists that provide service and support via phone, email, “live chat” and social media. Direct access to our customers is a unique advantage that also provides insights and identifies emerging trends as we strive to continuously improve our product and service quality and advance our product innovation.

Research and Development

As a consumer-driven innovation company, Select Comfort conducts extensive research to understand consumer needs. This research informs the design and delivery of our sleep innovations and our customer experience. We have a robust product development organization that fuels our innovations, and in 2015 we acquired BAM Labs, Inc. (now operating as SleepIQ LABS), a leading provider of biometric sensor and sleep monitoring for data-driven health and wellness. This is significant as consumers are rapidly adopting new digital tools and using their personal data to improve health and wellness. Technology that improves the quality of sleep and overall wellness will continue to be a top priority for Select Comfort. Our research and development expenses were $28.0 million in 2016, $16.0 million in 2015 and $8.2 million in 2014.

Management Information Systems

We use information technology systems to operate, analyze and manage our business, to reduce operating costs and to enhance our customers' experience. Our major systems include an in-store order entry system, a retail portal system, a payment processing system, in-bound and out-bound telecommunications systems for direct marketing, delivery scheduling and customer service, e-commerce systems, a data warehouse system and an enterprise resource planning system. These systems are primarily comprised of packaged applications licensed from various software vendors plus a limited number of internally developed programs. In October 2015, we completed a multi-year project to upgrade our core information technology systems. Please refer to the information set forth in "Part I, Item 1A. Risk Factors" for a discussion of certain risks that may be encountered in connection with the our management information systems.

Intellectual Property

We hold various U.S. and foreign patents and patent applications regarding certain elements of the design and function of our products, including air control systems, remote control systems, air chamber features, mattress construction, foundation systems, sensing systems, as well as other technology. We have numerous U.S. patents, expiring at various dates between July 2017 and February 2035, and numerous U.S. patent applications pending. We also have numerous foreign patents and patent applications pending. Notwithstanding these patents and patent applications, we cannot ensure that these patent rights will provide substantial protection or that others will not be able to develop products that are similar to or competitive with our products.

We have a number of trademarks and service marks registered with the U.S. Patent and Trademark Office, including Sleep Number®, Select Comfort®, SleepIQ®, the Double Arrow logo, AirFit®, Bam LABS®, the “B” logo, Comfortaire®, ComfortFit®, Comfort.Individualized.®, the DualTemp logo, the DualAir Technology Inside logo, FlexTop®, IndividualFit®, Individualized Sleep Experiences®, Know Better Sleep®, Pillow[ology]®, PillowFit®, Probably the Best Bed in the World®, Sleep Number Inner Circle®, Tech-e®, Smart Bed Technology®, The Only Bed That Knows You®, We Make Beds Smart®, and What’s Your Sleep Number?®. We have several trademarks that are the subject of pending applications, including SleepIQ Kids™, SleepIQ LABS™, Sleep for the FutureSM, Smart Bed For Smart Kids™, It™, The It Bed™, The Only Bed That Grows With Them™, and Tonight Bedtime. Tomorrow The World™. Each registered mark is renewable indefinitely as long as the mark remains in use and/or is not deemed to be invalid or canceled. We also have a number of common law trademarks, including ActiveComfort™, Auto Snore™, CoolFit™, DualAir™, DualTemp™, Firmness Control™, FlexFit™, In Balance™, PartnerSnore™, Rapid Sleep Onset™, Responsive Air™, Say Hello to It™, Sleep Number 360™, the SleepIQ LABS logo, The Bed Reborn™, The Bed That Moves You™ and our bed model names. Several of our trademarks have been registered, or are the subject of pending applications for registration, in various foreign countries. We also have other intellectual property rights related to our products, processes and technologies, including trade secrets, trade dress and copyrights. We protect and enforce our intellectual property rights, including through litigation as necessary.

Industry and Competition

The U.S. bedding industry is a mature and generally stable industry. According to the International Sleep Products Association (ISPA), the industry has grown by approximately 5% over last 20 years and at an estimated 6%, on average, over the past six years. We believe that industry unit growth has been primarily driven by population growth, an increase in the number of homes (including secondary residences) and the increased size of homes. We believe growth in average wholesale prices resulted from a shift to both larger and higher-quality beds, which are typically more expensive. According to ISPA, industry wholesale shipments of mattresses and foundations (excluding adjustable bases) were estimated to be $8.2 billion in 2016 compared to $8.0 billion in 2015. We estimate that traditional innerspring mattresses represent approximately 73% of total U.S. bedding sales (based on 2015 sales). Furniture/Today, a furniture industry trade publication, has ranked Select Comfort as the 5th largest mattress manufacturer and 3rd largest U.S. bedding retailer for 2015, with a 5.0% market share of industry revenue.

Manufacturers in the bedding industry compete on price, quality, brand name recognition, product availability and product performance, including the perceived levels of comfort and support provided by a mattress. There is a high degree of concentration among manufacturers, who produce innerspring, memory foam and hybrid beds, under nationally recognized brand names, including Tempur Sealy, Stearns & Foster, Serta and Simmons. Recently, numerous (greater than 50) direct-to-consumer companies have entered the market, offering “bed-in-a-box” products to consumers primarily through the Internet. These companies market directly to consumers, competing primarily on convenience of online shopping and speed of delivery. Their products are generally foam-based and undifferentiated in terms of sleep benefits. Select Comfort is differentiated from competitors through its consumer innovation strategy and direct-to-consumer model with 540 Sleep Number stores nationwide. We compete with our proprietary innovations, including our signature Sleep Number adjustability and SleepIQ Technology, that provide meaningful sleep benefits for our customers.

The retail bedding industry is fragmented and also highly competitive. Our Company-Controlled distribution channel is exclusive, and we compete against regional and local specialty bedding retailers, home furnishing stores, mass merchants, national discount stores and online marketers. Our exclusive distribution is highly differentiated, and offers a retail-leading customer experience.

Governmental Regulation and Compliance

As a vertically integrated manufacturer and retailer, we are subject to extensive federal, state and local laws and regulations affecting all aspects of our business.

As a manufacturer, we are committed to product quality and safety, including adherence to all applicable laws and regulations affecting our products. Compliance with federal fire retardant standards developed by the U.S. Consumer Product Safety Commission, including rigorous and costly testing, has increased the cost and complexity of manufacturing our products and may adversely impact the speed and cost of product development efforts. Further, our manufacturing and other business operations and facilities are or may

become subject to additional federal, state or local laws or regulations relating to supply chain transparency, conflict minerals sourcing and disclosure, end-of-life disposal and recycling requirements and other laws or regulations relating to environmental protection and health and safety requirements. We are not aware of any national or local environmental laws or regulations that may require material capital expenditures or which may materially affect our competitive position or our operational results, financial position or cash flows.

As a retailer, we are subject to additional laws and regulations that apply to retailers generally and govern the marketing and sale of our products and the operation of both our retail stores and our e-commerce activities. Many of the statutory and regulatory requirements which impact our retail and e-commerce operations are consumer-focused and pertain to activities such as the advertising and selling of credit-based promotional offers, truth-in-advertising, privacy, “do not call/mail” requirements, warranty disclosure, delivery timing requirements, accessibility and similar requirements.

All of our operations are or may become subject to federal, state and local labor laws including, but not limited to, those relating to occupational health and safety, employee privacy, wage and hour, overtime pay, harassment and discrimination, equal opportunity and employee leaves and benefits. We are also subject to existing and emerging federal and state laws relating to data security.

It is our policy and practice to comply with all legal and regulatory requirements and our procedures and internal controls are designed to promote such compliance.

Customers

No single customer accounts for 10% or more of our net sales.

Seasonality

Our business is modestly impacted by seasonal influences inherent in the U.S. bedding industry and general retail shopping patterns. The U.S. bedding industry generally experiences lower sales in the second quarter of the calendar year and increased sales during selected holiday or promotional periods.

Working Capital

We are able to operate with minimal working capital requirements because we sell directly to customers, utilize a primarily hybrid "make-to-stock" production process and operate retail stores that serve mainly as showrooms. We have historically generated sufficient cash flows to self-fund operations through an accelerated cash-conversion cycle. As of December 31, 2016, we had $150 million net aggregate availability under our $150 million credit facility. Our credit facility contains an accordion feature that allows us to increase the amount of the line up to $200 million in total availability, subject to lender approval.

Qualified customers are offered revolving credit to finance purchases through a private-label consumer credit facility provided by Synchrony Bank. Approximately 45% of our net sales in 2016 were financed by Synchrony Bank. Our current agreement with Synchrony Bank expires December 31, 2020, subject to earlier termination upon certain events and subject to automatic extensions. We pay Synchrony Bank a fee for extended credit promotional financing offers. Under the terms of our agreement, Synchrony Bank sets the minimum acceptable credit ratings, the interest rates, fees and all other terms and conditions of the customer accounts, including collection policies and procedures. As the receivables are owned by Synchrony Bank, at no time are the receivables purchased or acquired from us. We are not liable to Synchrony Bank for our customers' credit defaults. In connection with all purchases financed under these arrangements, Synchrony Bank pays us an amount equal to the total amount of such purchases, net of promotional related discounts, upon delivery to the customer. Customers that do not qualify for credit under our agreement with Synchrony Bank may apply for credit under a secondary program that we offer through another provider.

Employees

At December 31, 2016, we employed 3,768 persons, including 2,033 retail sales and support employees, 293 customer service employees, 969 manufacturing and logistics employees, and 473 management and administrative employees. Approximately 110 of our employees were employed on a part-time or temporary basis at December 31, 2016. Except for managerial employees and professional support staff, all of our employees are paid on an hourly basis (plus commissions for sales professionals). Additionally, we provide various broad-participation incentive compensation programs tied to various performance objectives. None of our employees are represented by a labor union or covered by a collective bargaining agreement. In recent periods, we have focused on improving our employee engagement levels, which we believe are important to driving both organizational productivity and customer satisfaction.

Executive Officers of the Registrant

SHELLY R. IBACH, 57

President and Chief Executive Officer (Joined the Company in April 2007 and was promoted to President and CEO in June 2012)

Shelly R. Ibach, Sleep Number® setting 40, serves as the President and Chief Executive Officer (CEO) for Select Comfort (NASDAQ: SCSS). From June 2011 to June 2012, Ms. Ibach served as the company’s Executive Vice President and Chief Operating Officer and from October 2008 to June 2011, she served as Executive Vice President, Sales & Merchandising. Ms. Ibach joined the company in April 2007 as Senior Vice President of U.S. sales for company-owned channels. Before joining the company, Ms. Ibach was Senior Vice President and General Merchandise Manager for Macy’s home division. From 1982 to 2005, Ms. Ibach held various leadership and executive positions within Department Stores at Target Corporation.

MELISSA BARRA, 45

Senior Vice President, Chief Strategy and Customer Relationship Officer (Joined the Company in 2013 and was promoted to current role in January 2015)

Melissa Barra, Sleep Number® setting 30, serves as the Senior Vice President, Chief Strategy and Customer Relationship Officer. Ms. Barra was Vice President, Consumer Insights and Strategy from February 2013 to January 2015. Prior to joining Select Comfort in February 2013, Ms. Barra was Vice President, Process Reengineering Officer for Best Buy Co., Inc. from 2011 to 2012. In a dual role, she also served as Vice President, Finance, New Business Customer Solutions Group from 2010 to 2012. From 2005 to 2010, she held leadership positions in Strategic Alliances and Corporate Development for Best Buy. Prior to Best Buy, Ms. Barra held corporate finance and strategy leadership roles in companies in the U.S. and internationally, including Grupo Futuro S.A., Citibank and GE Capital.

ANNIE L. BLOOMQUIST, 47

Senior Vice President and Chief Product Officer (Joined the Company in 2008 and was promoted to current role in June 2012)

Annie L. Bloomquist, Sleep Number® setting 25, serves as the Senior Vice President and Chief Product Officer for Select Comfort and leads product innovation including product management, development, merchandise buying, planning and R&D for all Sleep Number products, including SleepIQ Labs. Ms. Bloomquist was the Chief Product and Merchandising Officer from June 2011 to June 2012. Ms. Bloomquist joined Select Comfort in May 2008 as Vice President and General Merchandise Manager. Prior to joining Select Comfort, Ms. Bloomquist held leadership positions in product and merchandising at Macy’s and Marshall Field’s Department Stores for Target Corporation from 1996 to 2008.

KEVIN K. BROWN, 48

Senior Vice President and Chief Marketing Officer (Joined the Company in 2013)

Kevin K. Brown, Sleep Number® setting 35, serves as the Senior Vice President and Chief Marketing Officer for Select Comfort. Prior to joining Select Comfort in January 2014, Mr. Brown served as Group Vice President, Chief Marketing Officer for Meijer, Inc., a regional chain of retail supercenters, from 2011 to 2013. From 2007 to 2011, Mr. Brown held executive marketing leadership roles at Sears Holdings Corporation, including Vice President, Chief Marketing Officer for the home appliances business unit. Previously, Mr. Brown held the position of Senior Vice President, Marketing for Jo-Ann Stores, Inc., from 2004 to 2006. Prior to Jo-Ann Stores, he was an associate partner for Accenture.

DAVID R. CALLEN, 50

Senior Vice President and Chief Financial Officer (Joined the Company in 2014)

David R. Callen, Sleep Number® setting 40, serves as the Senior Vice President and Chief Financial Officer for Select Comfort. Prior to joining Select Comfort in April 2014, Mr. Callen served as the Principal Financial Officer, Vice President, Finance and Treasurer for Ethan Allen Interiors, Inc., from 2007 to 2014. Previously, Mr. Callen served for more than 15 years in increasingly responsible international financial management positions, emphasizing brand support and manufacturing across industries including automotive, dental, outdoor recreational products, high tech and public accounting.

ANDY P. CARLIN, 53

Senior Vice President and Chief Sales and Services Officer (Joined the Company in 2008 and was promoted to current role in April 2016)

Andy P. Carlin, Sleep Number® setting 55, serves as the Executive Vice President and Chief Sales and Service Officer for Select Comfort and leads all sales channels, real estate and home delivery operations. From June 2012 to April 2016, Mr. Carlin was Senior Vice President and Chief Sales Officer; from May 2011 to June 2012, Mr. Carlin was the Vice President and Chief Sales Officer; and from January 2009 to May 2011, he was the Vice President of U.S. Retail Sales. Mr. Carlin joined Select Comfort in January 2008 as Regional Vice President, East Region. Prior to joining Select Comfort, Mr. Carlin spent more than 20 years in sales leadership roles for companies including Senior Vice President of Store Operations at Gander Mountain from 2003 to 2008, Kohl’s Department Stores from 1995 to 2003 and the department store division of Target Corporation from 1986 to 1995.

PATRICIA A. DIRKS, 60

Senior Vice President and Chief Human Capital Officer (Joined the Company in 2014)

Patricia A. Dirks (Tricia), Sleep Number® setting 35, serves as the Senior Vice President and Chief Human Capital Officer for Select Comfort and leads all human capital functions. Prior to joining Select Comfort in April 2014, Ms. Dirks served as Senior Vice President of Organizational Effectiveness for Target Corporation. From 2004 to 2011, Ms. Dirks was Vice President Human Resources for Target Corporation. Prior to 2004, Ms. Dirks held various human resources leadership positions at Marshall Field’s Department Stores for Target Corporation, including Senior Vice President of Human Resources.

MARK A. KIMBALL, 58

Senior Vice President and Chief Legal and Risk Officer and Secretary (Joined the Company in 1999)

Mark A. Kimball, Sleep Number® setting 55, serves as the Senior Vice President, Chief Legal and Risk Officer and Secretary. From August 2003 to June 2011, Mr. Kimball held the position of Senior Vice President, General Counsel, Chief Administrative Officer and Secretary. From July 2000 to August 2003, Mr. Kimball served as Senior Vice President, Human Resources and Legal, General Counsel, Chief Administrative Officer and Secretary. From May 1999 to July 2000, Mr. Kimball served as the company’s Senior Vice President, Chief Administrative Officer, General Counsel and Secretary. For more than five years prior to joining Select Comfort, Mr. Kimball was a partner in the law firm of Oppenheimer Wolff & Donnelly LLP practicing in the area of corporate finance.

SURESH KRISHNA, 48

Senior Vice President and Chief Operations, Supply Chain and Lean Officer (Joined the Company in 2016)

Suresh Krishna, Sleep Number® setting 40, serves as the Senior Vice President and Chief Operations, Supply Chain and Lean Officer of Select Comfort. Prior to joining Select Comfort, Mr. Krishna served as Vice President of Global Operations and Integration at Polaris from 2010 to 2014, leading a 6,500+ person operations organization and driving a culture change to embrace lean across the entire enterprise. In July 2014, he was promoted to Vice President and Business Unit Head of Europe Middle East & Africa (EMEA) for Polaris, where he was responsible for a full P&L with factories, R&D centers, subsidiaries, distributors and dealer networks across more than 60 countries. From 2007 to 2010, he served as Vice President Global Operations, Supply Chain and IT at a division of UTC Fire & Security. Krishna also served in a variety of roles for Diageo, including Vice President of Supply Chain, North America; as a Program Director for an ERP implementation; and as a Director of Strategic Planning and Finance. Earlier in his career he was an associate at Booz Allen & Hamilton.

J. HUNTER SAKLAD, 47

Senior Vice President, Chief Information Officer (Joined the Company in 2004 and was promoted to current role in December 2012)

Hunter Saklad, Sleep Number® setting 50, serves as the Senior Vice President and Chief Information Officer at Select Comfort. From June 2011 to December 2012, he served as the Vice President, Consumer Insight and Strategy at Select Comfort. From March 2006 to June 2011, he was Vice President of Finance and held a variety of positions across Finance serving business partners in marketing, sales, supply chain, FP&A, investor relations and treasury. Mr. Saklad joined Select Comfort in October 2004 as Sr. Director of Finance. Prior to joining Select Comfort, Mr. Saklad held finance leadership roles at Ford Motor Company and Visteon.

Available Information

We are subject to the reporting requirements of the Exchange Act and its rules and regulations. The Exchange Act requires us to file reports, proxy statements and other information with the Securities and Exchange Commission (SEC). Copies of our reports, proxy statements and other information can be read and copied at:

SEC Public Reference Room

100 F Street NE

Washington, D.C. 20549

Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC maintains a website that contains reports, proxy statements and other information regarding issuers that file electronically with the SEC. These materials may be obtained electronically by accessing the SEC’s home page at http://www.sec.gov.

Our corporate Internet website is www.SleepNumber.com. Through a link to a third-party content provider, our corporate website provides free access to our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 as soon as reasonably practicable after electronic filing with the SEC. These documents are posted on our website at www.SleepNumber.com — select the "About" link, the “Investor Relations” link and then the “SEC Filings” link. The information contained on our website or connected to our website is not incorporated by reference into this Form 10-K and should not be considered part of this report.

We also make available, free of charge on our website, the charters of the Audit Committee, Management Development and Compensation Committee, and Corporate Governance and Nominating Committee as well as our Code of Business Conduct (including any amendment to, or waiver from, a provision of our Code of Business Conduct) adopted by our Board. These documents are posted on our website — select the "About" link, the “Investor Relations” link and then the “Corporate Governance” link.

Copies of any of the above referenced information will also be made available, free of charge, upon written request to:

Select Comfort Corporation

Investor Relations Department

9800 59th Avenue North

Minneapolis, MN 55442

ITEM 1A. RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the specific risks set forth below and other matters described in this Annual Report on Form 10-K before making an investment decision. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties, including risks and uncertainties not presently known to us or that we currently see as immaterial, may also harm our business. If any of these risks occur, our business, results of operations, cash flows and financial condition could be materially and adversely affected.

Current and future economic conditions could materially adversely affect our sales, profitability, cash flows and financial condition.

Our success depends significantly upon discretionary consumer spending, which is influenced by a number of general economic factors, including without limitation economic growth, consumer confidence, the housing market, employment and income levels, interest rates, inflation, taxation and the level of customer traffic in malls and shopping centers. Adverse trends in any of these economic factors may adversely affect our sales, profitability, cash flows and financial condition.

Our future growth and profitability depends upon the effectiveness and efficiency of our marketing programs.

We are highly dependent on the effectiveness of our marketing messages and the efficiency of our advertising expenditures in generating consumer awareness and sales of our products. We continue to evolve our marketing strategies, adjusting our messages, the amount we spend on advertising and where we spend it. We may not always be successful in developing effective messages, as the consumer and competition changes, and in achieving efficiency in our advertising expenditures.

Consumers are increasingly using digital tools as a part of their shopping experience. As a result, our future growth and profitability will depend in part on (i) the effectiveness and efficiency of our on-line experience including advertising and search optimization programs in generating consumer awareness and sales of our products, (ii) our ability to prevent confusion among consumers that can result from search engines that allow competitors to use or bid on our trademarks to direct consumers to competitors’ websites, (iii) our ability to prevent Internet publication of false or misleading information regarding our products or our competitors’ products; (iv) the nature and tone of consumer sentiment published on various social media sites; and (v) the stability of our website. In recent periods, a number of direct-to-consumer, Internet-based retailers have emerged and have driven up the cost of basic search terms, which has and may continue to increase the cost of our Internet-based marketing programs.

If our marketing messages are ineffective or our advertising expenditures and other marketing programs, including digital programs, are inefficient in creating awareness and consideration of our products and brand name, in driving consumer traffic to our website or stores, our sales, profitability, cash flows and financial condition may be adversely impacted. In addition, if we are not effective in preventing the publication of confusing, false or misleading information regarding our brand or our products, or if there was significant negative consumer sentiment on social media regarding our brand or our products, our sales, profitability, cash flows and financial condition may be adversely impacted.

Our future growth and profitability depends on our ability to execute our Company-Controlled distribution strategy.

The vast majority of our sales occur through our Company-Controlled distribution channel, including our retail stores, and this Company-Controlled distribution channel represents our largest opportunity for growth in sales and improvement in profitability. Our retail stores carry significant fixed costs. We also make significant capital expenditures as we open new stores and remodel or reposition existing stores. We are highly dependent on our ability to maintain and increase sales per store to cover these fixed expenses, provide a return on our capital investments and improve our operating margins.

Many of our stores are mall-based. We depend on the continued popularity of malls as shopping destinations and the ability of mall anchor tenants and other attractions to generate customer traffic for our retail stores. Any decrease in mall traffic could adversely affect our sales, profitability, cash flows and financial condition.

Our Company-Controlled distribution strategy results in relatively few points of distribution, including 540 retail stores in 49 U.S. states as of the end of 2016. Several of the mattress manufacturers and retailers with which we compete have significantly more points of distribution than we do, which makes us highly dependent on our ability to drive consumers to our points of distribution in order to gain market share.

Our longer term Company-Controlled distribution strategy is also dependent on our ability to renew existing store leases and to secure suitable locations for new store openings, in each case on a cost-effective basis. We may encounter higher than anticipated rents and other costs in connection with managing our retail store base, or may be unable to find or obtain suitable new locations.

Failure to achieve and maintain a high level of product quality could negatively impact our sales, profitability, cash flows and financial condition.

Our products are highly differentiated from traditional innerspring mattresses and from viscoelastic foam mattresses, which have little or no technology and do not rely on electronics and air control systems. As a result, our beds may be susceptible to failures that do not exist with traditional or viscoelastic foam mattresses. Failure to achieve and maintain acceptable quality standards could impact consumer acceptance of our products or could result in negative media and Internet reports or owner dissatisfaction that could negatively impact our brand image and sales levels.

In addition, a decline in product quality could result in an increase in return rates and a corresponding decrease in sales, or an increase in product warranty claims in excess of our warranty reserves. An unexpected increase in return rates or warranty claims could harm our sales, profitability, cash flows and financial condition.

As a consumer innovation company with differentiated products, we face an inherent risk of exposure to product liability claims if the use of our products is alleged to have resulted in personal injury or property damage. If any of our products proves to be defective, we may be required to recall or redesign such products. We have at times experienced increased returns and adverse impacts on sales, as well as product liability litigation, as a result of media reports related to the alleged propensity of our products to develop mold. We may experience additional adverse impacts on sales and additional litigation if any similar media reports were to occur in the future. We maintain insurance against some forms of product liability claims, but such coverage may not be adequate for liabilities actually incurred. A successful claim brought against us in excess of available insurance coverage, or any claim or product recall that results in significant adverse publicity against us, may have a material adverse effect on our sales, profitability, cash flows and financial condition.

Our future growth and profitability depends in part on our ability to continue to improve and expand our product line and to successfully execute new product introductions.

As described in greater detail below, the mattress industry, as well as the market for sleep monitoring products, are both highly competitive, and our ability to compete effectively and to profitably grow our market share depends in part on our ability to continue to improve and expand our product line of adjustable firmness air beds, SleepIQ technology and related accessory products. We incur significant research and development and other expenditures in the pursuit of improvements and additions to our product line. If these efforts do not result in meaningful product improvements or new product introductions, or if we are not able to gain widespread consumer acceptance of product improvements or new product introductions, our sales, profitability, cash flows and financial condition may be adversely affected. In addition, if any significant product improvements or new product introductions are not successful, our reputation and brand image may be adversely affected.

Beginning in 2017, we plan to introduce a new line of mattresses to replace our current line of mattresses. This new product launch will result in significant transition costs in our supply chain and retail stores. If we are not able to gain widespread consumer acceptance of this new product line, or if we do not successfully execute the new product introduction effectively and efficiently, our sales, profitability, cash flows and financial condition may be adversely affected.

Significant competition could adversely affect our business.

Because of the vertical integration of our business model, our products and distribution channels face significant competition from both manufacturers of different types of mattresses and a variety of retailers. Our SleepIQ technology also faces significant competition from various manufacturers and retailers of sleep tracking and monitoring products.

The mattress industry is characterized by a high degree of concentration among the largest manufacturers of innerspring mattresses and viscoelastic foam mattresses and one dominant national mattress retailer. Many newer competitors (approximately 50 to 100) in the mattress industry have begun to offer “bed-in-a-box” or similar products directly to consumers through the Internet and other distribution channels.

A variety of sleep tracking and monitoring products that compete with our SleepIQ technology have been introduced by various manufacturers and retailers, both within and outside of the traditional mattress industry.

Some of the manufacturers that we compete with have substantially greater financial, marketing and manufacturing resources and greater brand name recognition than we do and sell products through broader and more established distribution channels. Our national, exclusive distribution competes with other retailers who generally provide a wider selection of mattress alternatives than we offer. A number of these retailers also have more points of distribution and greater brand name recognition than we do. In recent periods, a number of direct-to-consumer, Internet-based retailers have emerged and have driven up the cost of basic search terms, which has and may continue to increase the cost of our Internet-based marketing programs.

These manufacturing and retailing competitors, or new entrants into the market, may compete aggressively and gain market share with existing or new products, and may pursue or expand their presence in the adjustable firmness air bed segment of the market as well as in the market for sleep tracking and monitoring products. We have limited ability to anticipate the timing and scale of new product introductions, advertising campaigns or new pricing strategies by our competitors, which could inhibit our ability to retain or increase market share, or to maintain our product margins.

If we are unable to effectively compete with other manufacturers and retailers of mattress and sleep tracking and monitoring products, our sales, profitability, cash flows and financial condition may be adversely impacted.

Our intellectual property rights may not prevent others from using our technology or trademarks in connection with the sale of competitive products. We may be subject to claims that our products, processes or trademarks infringe intellectual property rights of others.

We own various U.S. and foreign patents and patent applications related to certain elements of the design and function of our beds and related products. We own numerous registered and unregistered trademarks and trademark applications, including in particular our Sleep Number and SleepIQ trademarks, as well as other intellectual property rights, including trade secrets, trade dress and copyrights, which we believe have significant value and are important to the marketing of our products. These intellectual property rights may not provide sufficient protection against infringement or piracy, may not prevent competitors from developing and marketing products that are similar to or competitive with our beds or other products, and may be costly and time-consuming to protect and enforce. Our patents are also subject to varying expiration dates. In particular, one of our U.S. patents related to a firmness control system for use with an adjustable air mattress will expire in July of 2017. In addition, the laws of some foreign countries may not protect our intellectual property rights and confidential information to the same extent as the laws of the United States. If we are unable to protect and enforce our intellectual property, we may be unable to prevent other companies from using our technology or trademarks in connection with competitive products, which could adversely affect our sales, profitability, cash flows and financial condition.

We may be subject to claims that our products, processes or trademarks infringe the intellectual property rights of others. The defense of these claims, even if we are ultimately successful, may result in costly litigation, and if we are not successful in our defense, we could be subject to injunctions, liability for damages or royalty obligations and our sales, profitability, cash flows and financial condition could be adversely affected.

A reduction in the availability of credit to consumers generally or under our existing consumer credit programs could harm our sales, profitability, cash flows and financial condition.

A significant percentage of our sales are made under consumer credit programs through third parties. The amount of credit available to consumers may be adversely impacted by macroeconomic factors that affect the financial position of consumers and as suppliers of credit adjust their lending criteria. In addition, changes in federal regulations effective in 2010 placed additional restrictions on all consumer credit programs, including limiting the types of promotional credit offerings that may be offered to consumers.

Synchrony Bank provides credit to our customers through a private label credit card agreement that is currently scheduled to expire on December 31, 2020, subject to earlier termination upon certain events. Synchrony Bank has discretion to control the content of financing offers to our customers and to set minimum credit standards under which credit is extended to customers.

Reduction of credit availability due to changing economic conditions, changes in credit standards under our private label credit card program or changes in regulatory requirements, or the termination of our agreement with Synchrony Bank, could harm our sales, profitability, cash flows and financial condition.

We utilize “just-in-time” manufacturing processes with minimal levels of inventory, which could leave us vulnerable to shortages in supply of components that may harm our ability to satisfy consumer demand and may adversely impact our sales and profitability.

A significant percentage of our products are assembled after we receive orders from customers utilizing “just-in-time” manufacturing processes with minimal levels of raw materials, work-in-process inventories and finished goods inventories. Lead times for ordered components may vary significantly. In addition, some components used to manufacture our products are provided on a sole source basis. Any unexpected shortage of materials caused by any disruption of supply or an unexpected increase in the demand for our products, could lead to delays in shipping our beds to customers. Any such delays could adversely affect our sales, customer satisfaction, profitability, cash flows and financial condition.

We rely upon several key suppliers that are, in some instances, the only source of supply currently used by us for particular materials, components or services. A disruption in the supply or substantial increase in cost of any of these products or services could harm our sales, profitability, cash flows and financial condition.

We currently obtain all of the materials and components used to produce our beds from outside sources including some who are located outside the United States. In several cases, including our proprietary air chambers, our proprietary blow-molded foundations, our adjustable foundations, various components for our Firmness Control systems, as well as fabrics and zippers, we have chosen to obtain these materials and components from suppliers who serve as the only source of supply, or who supply the vast majority of our needs of the particular material or component. While we believe that these materials and components, or suitable replacements, could be obtained from other sources, in the event of a disruption or loss of supply of relevant materials or components for any reason, we may not be able to find alternative sources of supply, or if found, may not be found on comparable terms. If our relationship with the primary supplier of our air chambers, the supplier of our blow-molded foundations or the supplier of our adjustable foundations is terminated, we could have difficulty in replacing these sources since there are relatively few other suppliers presently capable of manufacturing these components.

Similarly, we rely on UPS and other carriers to deliver some of our products to customers on a timely and cost-effective basis. Any significant delay in deliveries to our customers could lead to increased returns and cause us to lose sales. Any increase in freight charges could increase our costs of doing business and harm our sales, profitability, cash flows and financial condition.

Fluctuations in commodity prices could result in an increase in component costs and/or delivery costs.

Our business is subject to significant increases or volatility in the prices of certain commodities, including but not limited to fuel, oil, natural gas, rubber, cotton, plastic resin, steel and chemical ingredients used to produce foam. Increases in prices of these commodities or other inflationary pressures may result in significant cost increases for our raw materials and product components, as well as increases in the cost of delivering our products to our customers. To the extent we are unable to offset any such increased costs through value engineering and similar initiatives, or through price increases, our profitability, cash flows and financial condition may be adversely impacted. If we choose to increase prices to offset the increased costs, our sales volumes could be adversely impacted.

Our business is subject to risks inherent in global sourcing activities.

Our air chambers and some of our other components are manufactured outside the United States, and therefore are subject to risks associated with foreign sourcing of materials, including but not limited to:

| |

• | Political instability resulting in disruption of trade; |

| |

• | Existing or potential duties, tariffs or quotas on certain types of goods that may be imported into the United States; |

| |

• | Disruptions in transportation due to acts of terrorism, shipping delays, foreign or domestic dock strikes, customs inspections or other factors; |

| |

• | Foreign currency fluctuations; and |

| |

• | Economic uncertainties, including inflation. |

These factors could increase our costs of doing business with foreign suppliers, lead to inadequate inventory levels or delays in shipping beds to our customers, which could harm our sales, customer satisfaction, profitability, cash flows and financial condition.

Disruption of operations in either of our two main manufacturing facilities could increase our costs of doing business or lead to delays in shipping our beds.

We have two main manufacturing plants, which are located in Irmo, South Carolina and Salt Lake City, Utah. A significant percentage of our products are assembled to fulfill orders rather than stocking finished goods inventory in our plants or stores. Therefore, the

disruption of operations of either of our two main manufacturing facilities for a significant period of time may increase our costs of doing business and lead to delays in shipping our beds to customers. Such delays could adversely affect our sales, customer satisfaction, profitability, cash flows and financial condition.

Our business is subject to a wide variety of government laws and regulations. These laws and regulations, as well as any new or changed laws or regulations, could disrupt our operations or increase our compliance costs. Failure to comply with such laws and regulations could have further adverse impact.

We are subject to a wide variety of laws and regulations relating to the bedding industry or to various aspects of our business. Laws and regulations at the federal, state and local levels frequently change and we cannot always reasonably predict the impact from, or the ultimate cost of compliance with, future regulatory or administrative changes. Changes in law, the imposition of new or additional regulations or the enactment of any new or more stringent legislation that impacts employment and labor, trade, advertising and marketing practices, pricing, consumer credit offerings, product testing and safety, transportation and logistics, health care, tax, accounting, privacy and data security, health and safety or environmental issues, among others, could require us to change the way we do business and could have a material adverse impact on our sales, profitability, cash flows and financial condition. New or different laws or regulations could increase direct compliance costs for us or may cause our vendors to raise the prices they charge us because of increased compliance costs. Further, the adoption of a multi-layered regulatory approach to any one of the state or federal laws or regulations to which we are currently subject, particularly where the layers are in conflict, could require alteration of our manufacturing processes or operational parameters which may adversely impact our business.

Legislative or regulatory changes that impact our relationship with our workforce, such as minimum wage requirements or health insurance or other employee benefits mandates, could increase our expenses and adversely affect our operations.

While it is our policy and practice to comply with legal and regulatory requirements and our procedures and internal controls are designed to promote such compliance, we cannot assure that all of our operations will comply with all such legal and regulatory requirements. Further, laws and regulations change over time and we may be required to incur significant expenses and/or to modify our operations in order to ensure compliance. This could harm our profitability or financial condition. If we are found to be in violation of any laws or regulations, we could become subject to fines, penalties, damages or other sanctions as well as potential adverse publicity or litigation exposure. This could adversely impact our business, reputation, sales, profitability, cash flows or financial condition.

Regulatory requirements related to flammability standards for mattresses may increase our product costs and increase the risk of disruption to our business.

The federal Consumer Product Safety Commission adopted new flammability standards and related regulations which became effective nationwide in July 2007 for mattresses and mattress and foundation sets. Compliance with these requirements has resulted in higher materials and manufacturing costs for our products, and has required modifications to our information systems and business operations, further increasing our costs and negatively impacting our capacity.

These regulations require manufacturers to implement quality assurance programs and encourage manufacturers to conduct random testing of products. These regulations also require maintenance and retention of compliance documentation. These quality assurance and documentation requirements are costly to implement and maintain. If any product testing, other evidence, or regulatory inspections yield results indicating that any of our products may not meet the flammability standards, we may be required to temporarily cease production and distribution and/or to recall products from the field, and we may be subject to fines or penalties, any of which outcomes could harm our business, reputation, sales, profitability, cash flows and financial condition.

Pending or unforeseen litigation and the potential for adverse publicity associated with litigation could adversely impact our business, reputation, financial results or financial condition.