Exhibit 99.2

Exhibit 99.2

Leading the Way in Electricity SM

First Quarter 2011 Financial Teleconference

May 2, 2011 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Forward-Looking Statements

Statements contained in this presentation about future performance, including, without limitation, earnings, asset and rate base growth, load growth, capital expenditures, and other statements that are not purely historical, are forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to update them to reflect new information, events or circumstances. Important factors that could cause different results are discussed under the headings “Risk Factors,” and “Management’s Discussion and Analysis” in Edison International’s 2010 Form 10-K, most recent Form 10-Q and other reports filed with the Securities and Exchange Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on historical and other factual data contained in this presentation.

May 2, 2011 1 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

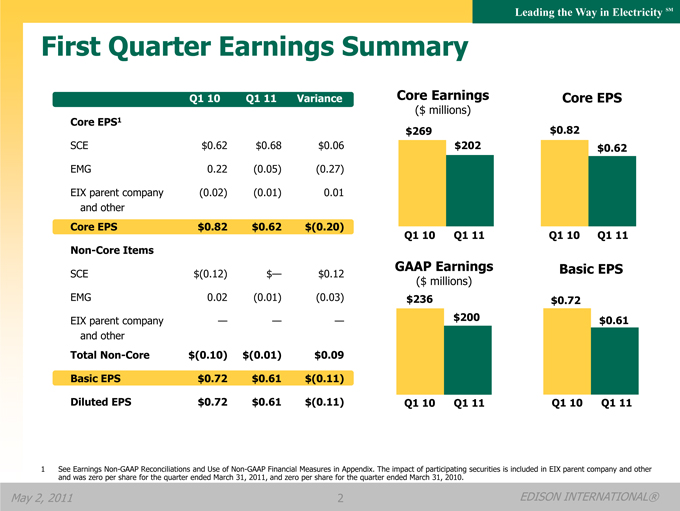

First Quarter Earnings Summary

Q1 10 Q1 11 Variance

Core EPS1

SCE $0.62 $0.68 $0.06

EMG 0.22 (0.05) (0.27)

EIX parent company (0.02) (0.01) 0.01

and other

Core EPS $0.82 $0.62 $(0.20)

Non-Core Items

SCE $(0.12) $— $0.12

EMG 0.02 (0.01) (0.03)

EIX parent company — — —and other

Total Non-Core $(0.10) $(0.01) $0.09

Basic EPS $0.72 $0.61 $(0.11)

Diluted EPS $0.72 $0.61 $(0.11)

Core Earnings Core EPS

($ millions)

$269 $0.82 $202 $0.62

Q1 10 Q1 11 Q1 10 Q1 11

GAAP Earnings Basic EPS

($ millions)

$236 $0.72 $200 $0.61

Q1 10 Q1 11 Q1 10 Q1 11

1 See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix. The impact of participating securities is included in EIX parent company and other and was zero per share for the quarter ended March 31, 2011, and zero per share for the quarter ended March 31, 2010.

May 2, 2011 2 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

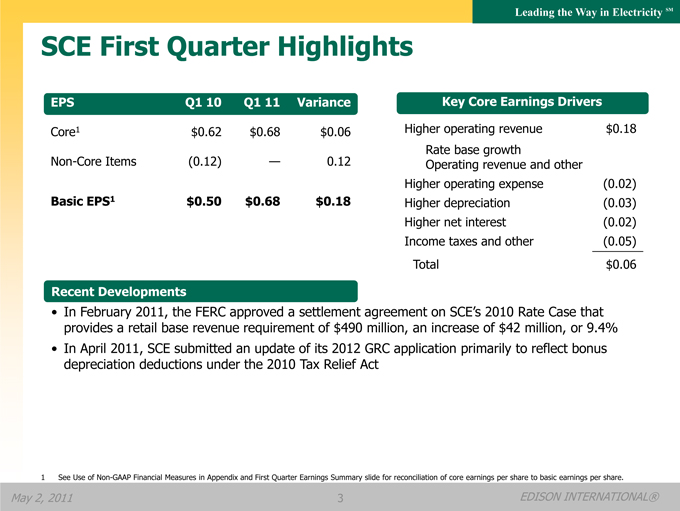

SCE First Quarter Highlights

EPS Q1 10 Q1 11 Variance

Core1 $0.62 $0.68 $0.06

Non-Core Items (0.12) — 0.12

Basic EPS1 $0.50 $0.68 $0.18

Key Core Earnings Drivers

Higher operating revenue $0.18

Rate base growth

Operating revenue and other

Higher operating expense (0.02)

Higher depreciation (0.03)

Higher net interest (0.02)

Income taxes and other (0.05)

Total $0.06

Recent Developments

• In February 2011, the FERC approved a settlement agreement on SCE’s 2010 Rate Case that provides a retail base revenue requirement of $490 million, an increase of $42 million, or 9.4%

• In April 2011, SCE submitted an update of its 2012 GRC application primarily to reflect bonus depreciation deductions under the 2010 Tax Relief Act

1 See Use of Non-GAAP Financial Measures in Appendix and First Quarter Earnings Summary slide for reconciliation of core earnings per share to basic earnings per share.

May 2, 2011 3 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

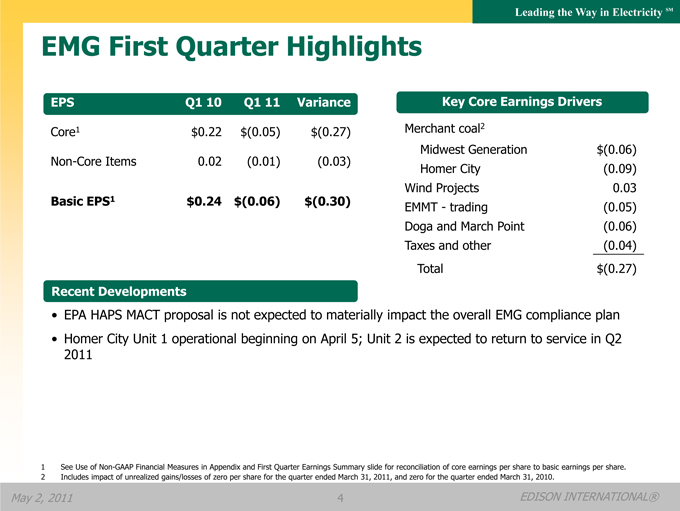

EMG First Quarter Highlights

EPS Q1 10 Q1 11 Variance

Core1 $0.22 $(0.05) $(0.27)

Non-Core Items 0.02 (0.01) (0.03)

Basic EPS1 $0.24 $(0.06) $(0.30)

Key Core Earnings Drivers

Merchant coal2

Midwest Generation $(0.06)

Homer City (0.09)

Wind Projects 0.03

EMMT - trading (0.05)

Doga and March Point (0.06)

Taxes and other (0.04)

Total $(0.27)

Recent Developments

• EPA HAPS MACT proposal is not expected to materially impact the overall EMG compliance plan

• Homer City Unit 1 operational beginning on April 5; Unit 2 is expected to return to service in Q2 2011

1 See Use of Non-GAAP Financial Measures in Appendix and First Quarter Earnings Summary slide for reconciliation of core earnings per share to basic earnings per share.

2 Includes impact of unrealized gains/losses of zero per share for the quarter ended March 31, 2011, and zero for the quarter ended March 31, 2010.

May 2, 2011 4 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

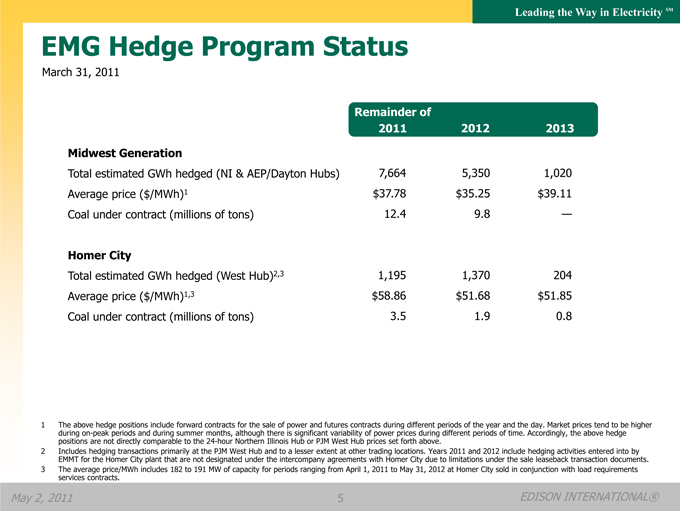

EMG Hedge Program Status

March 31, 2011

Midwest Generation

Total estimated GWh hedged (NI & AEP/Dayton Hubs) Average price ($/MWh)1 Coal under contract (millions of tons)

Homer City

Total estimated GWh hedged (West Hub)2,3 Average price ($/MWh)1,3 Coal under contract (millions of tons)

Remainder of

2011 2012 2013

7,664 5,350 1,020

$37.78 $35.25 $39.11

12.4 9.8 —

1,195 1,370 204

$58.86 $51.68 $51.85

3.5 1.9 0.8

1 The above hedge positions include forward contracts for the sale of power and futures contracts during different periods of the year and the day. Market prices tend to be higher during on-peak periods and during summer months, although there is significant variability of power prices during different periods of time. Accordingly, the above hedge positions are not directly comparable to the 24-hour Northern Illinois Hub or PJM West Hub prices set forth above.

2 Includes hedging transactions primarily at the PJM West Hub and to a lesser extent at other trading locations. Years 2011 and 2012 include hedging activities entered into by EMMT for the Homer City plant that are not designated under the intercompany agreements with Homer City due to limitations under the sale leaseback transaction documents.

3 The average price/MWh includes 182 to 191 MW of capacity for periods ranging from April 1, 2011 to May 31, 2012 at Homer City sold in conjunction with load requirements services contracts.

May 2, 2011 5 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

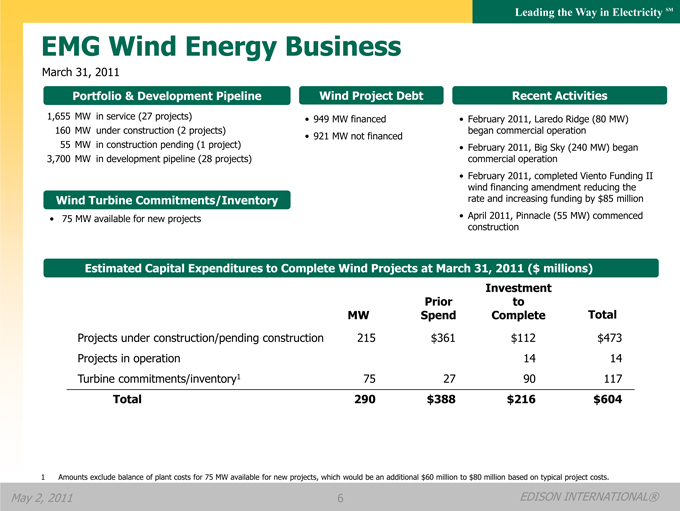

EMG Wind Energy Business

March 31, 2011

Portfolio & Development Pipeline

1,655 MW in service (27 projects) 160 MW under construction (2 projects)

55 MW in construction pending (1 project) 3,700 MW in development pipeline (28 projects)

Wind Turbine Commitments/Inventory

• 75 MW available for new projects

Wind Project Debt

• 949 MW financed

• 921 MW not financed

Recent Activities

February 2011, Laredo Ridge (80 MW) began commercial operation February 2011, Big Sky (240 MW) began commercial operation February 2011, completed Viento Funding II wind financing amendment reducing the rate and increasing funding by $85 million April 2011, Pinnacle (55 MW) commenced construction

Estimated Capital Expenditures to Complete Wind Projects at March 31, 2011 ($ millions)

Investment

Prior to

MW Spend Complete Total

Projects under construction/pending construction 215 $361 $112 $473

Projects in operation 14 14

Turbine commitments/inventory1 75 27 90 117

Total 290 $388 $216 $604

1 Amounts exclude balance of plant costs for 75 MW available for new projects, which would be an additional $60 million to $80 million based on typical project costs.

May 2, 2011 6 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

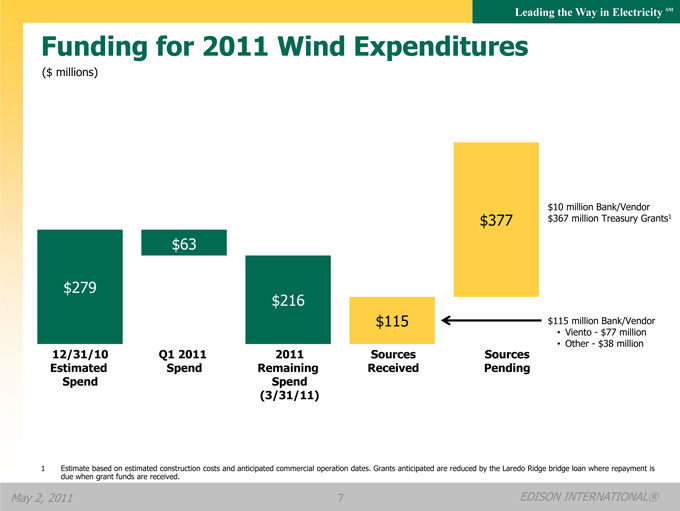

Funding for 2011 Wind Expenditures

($ millions)

$279

12/31/10 Estimated Spend

$63

Q1 2011 Spend

$216

2011 Remaining Spend (3/31/11)

$115

Sources Received

$10 million Bank/Vendor $377 $367 million Treasury Grants1

$115 million Bank/Vendor

• Viento - $77 million Sources • Other - $38 million

Pending

1 Estimate based on estimated construction costs and anticipated commercial operation dates. Grants anticipated are reduced by the Laredo Ridge bridge loan where repayment is due when grant funds are received.

May 2, 2011 7 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

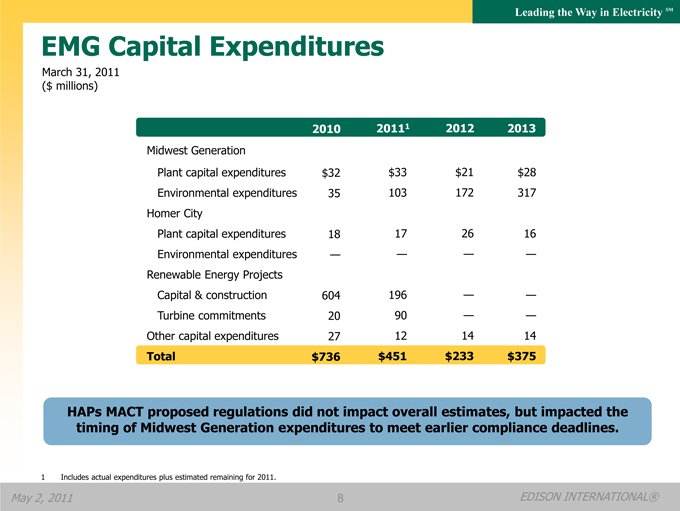

EMG Capital Expenditures

March 31, 2011 ($ millions)

2010 20111 2012 2013

Midwest Generation

Plant capital expenditures $32 $33 $21 $28

Environmental expenditures 35 103 172 317

Homer City

Plant capital expenditures 18 17 26 16

Environmental expenditures — — — —

Renewable Energy Projects

Capital & construction 604 196 — —

Turbine commitments 20 90 — —

Other capital expenditures 27 12 14 14

Total $736 $451 $233 $375

HAPs MACT proposed regulations did not impact overall estimates, but impacted the timing of Midwest Generation expenditures to meet earlier compliance deadlines.

| 1 |

|

Includes actual expenditures plus estimated remaining for 2011. |

May 2, 2011 8 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

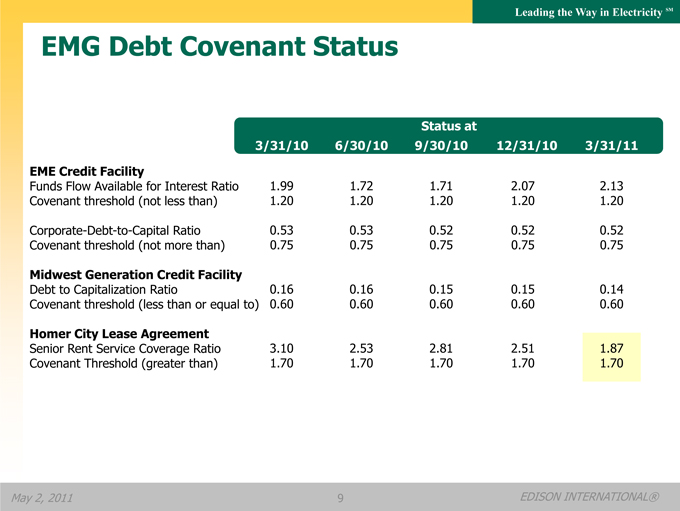

EMG Debt Covenant Status

Status at

3/31/10 6/30/10 9/30/10 12/31/10 3/31/11

EME Credit Facility

Funds Flow Available for Interest Ratio 1.99 1.72 1.71 2.07 2.13

Covenant threshold (not less than) 1.20 1.20 1.20 1.20 1.20

Corporate-Debt-to-Capital Ratio 0.53 0.53 0.52 0.52 0.52

Covenant threshold (not more than) 0.75 0.75 0.75 0.75 0.75

Midwest Generation Credit Facility

Debt to Capitalization Ratio 0.16 0.16 0.15 0.15 0.14

Covenant threshold (less than or equal to) 0.60 0.60 0.60 0.60 0.60

Homer City Lease Agreement

Senior Rent Service Coverage Ratio 3.10 2.53 2.81 2.51 1.87

Covenant Threshold (greater than) 1.70 1.70 1.70 1.70 1.70

May 2, 2011 9 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

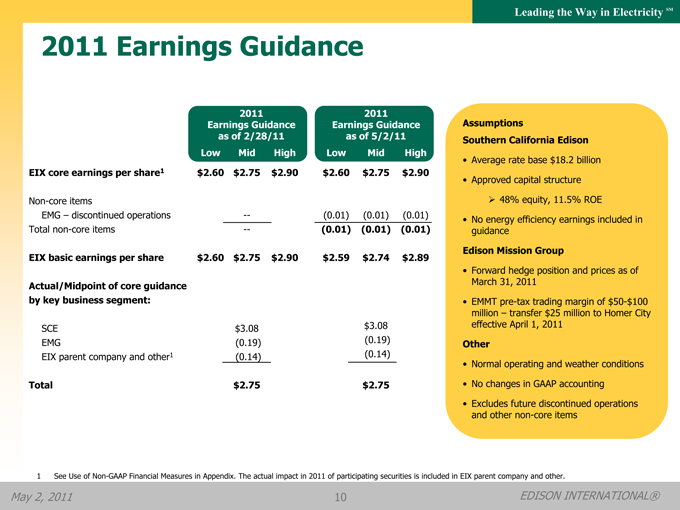

2011 Earnings Guidance

2011 Earnings Guidance as of 2/28/11

2011 Earnings Guidance as of 5/2/11

Low Mid High Low Mid High

EIX core earnings per share1 $2.60 $2.75 $2.90 $2.60 $2.75 $2.90

Non-core items

EMG – discontinued operations —(0.01)(0.01)(0.01)

Total non-core items —(0.01)(0.01)(0.01)

EIX basic earnings per share $2.60 $2.75 $2.90 $2.59 $2.74 $2.89

Actual/Midpoint of core guidance

by key business segment:

SCE $3.08 $3.08

EMG(0.19)(0.19)

EIX parent company and other1(0.14)(0.14)

Total $2.75 $2.75

Assumptions

Southern California Edison

Average rate base $18.2 billion

Approved capital structure

48% equity, 11.5% ROE

No energy efficiency earnings included in guidance

Edison Mission Group

Forward hedge position and prices as of March 31, 2011

EMMT pre-tax trading margin of $50-$100 million – transfer $25 million to Homer City effective April 1, 2011

Other

Normal operating and weather conditions

No changes in GAAP accounting

Excludes future discontinued operations and other non-core items

1 See Use of Non-GAAP Financial Measures in Appendix. The actual impact in 2011 of participating securities is included in EIX parent company and other.

May 2, 2011 10 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Appendix

May 2, 2011 11 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Updates Since Our Last Presentation

Q1 11 results and standard information

Funding for 2011 Wind Expenditures (p. 7)

EMG Capital Expenditures (p. 8)

SCE 2012 CPUC General Rate Case (p. 28)

California Renewable Policy (p. 29)

May 2, 2011 12 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Delivering Superior and Sustained Value

Edison International

• A diversified and flexible platform best positions EIX in an industry undergoing unprecedented change

• Leverage regulated and competitive businesses

• Positioned for long-term earnings and dividend growth

Southern

California Edison

• Balance electric reliability, rates and public policy needs to assure long-term sustainable growth

• Focus on grid reliability and transmission expenditures

• Establish foundation for technology expenditures

• Decoupled regulatory model mitigates demand and fuel cost risks

Edison Mission Group

• Achieve durable coal fleet environmental solutions

• Effectively manage merchant coal margins

• Develop wind projects for existing turbine commitments

• Emphasize liquidity management

Our key operating principles emphasize financial discipline, superior execution and innovative solutions to the challenges of today and tomorrow

May 2, 2011 13 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

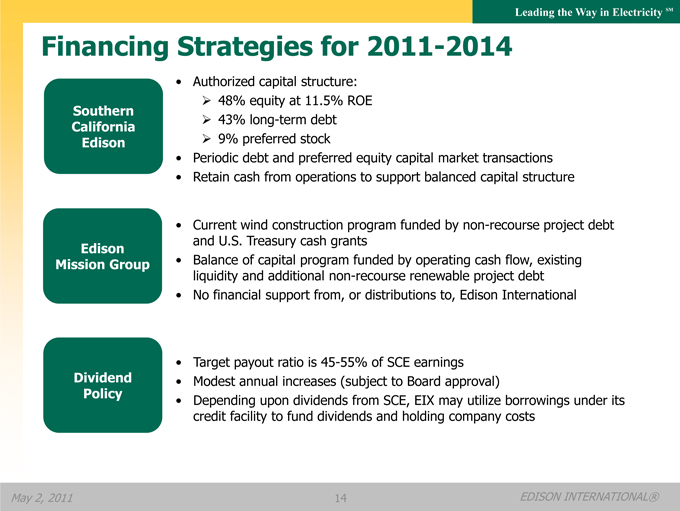

Financing Strategies for 2011-2014

Southern

California Edison

• Authorized capital structure:

48% equity at 11.5% ROE

43% long-term debt

9% preferred stock

• Periodic debt and preferred equity capital market transactions

• Retain cash from operations to support balanced capital structure

Edison Mission Group

• Current wind construction program funded by non-recourse project debt and U.S. Treasury cash grants

• Balance of capital program funded by operating cash flow, existing liquidity and additional non-recourse renewable project debt

• No financial support from, or distributions to, Edison International

Dividend Policy

• Target payout ratio is 45-55% of SCE earnings

• Modest annual increases (subject to Board approval)

• Depending upon dividends from SCE, EIX may utilize borrowings under its credit facility to fund dividends and holding company costs

May 2, 2011 14 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

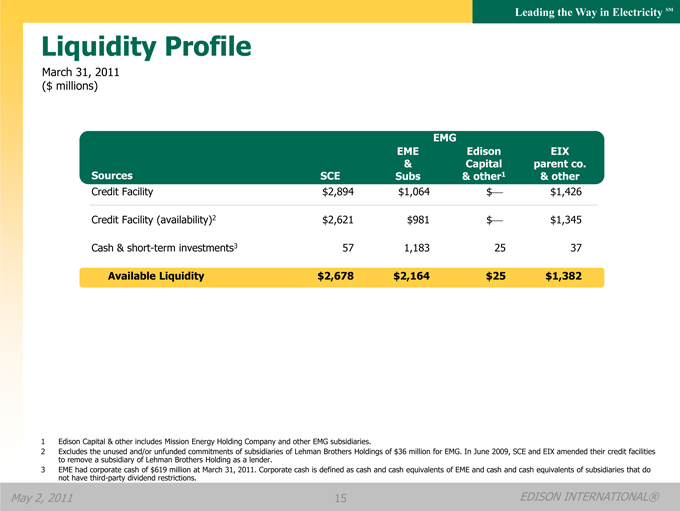

Liquidity Profile

March 31, 2011 ($ millions)

EMG

EME Edison EIX

& Capital parent co.

Sources SCE Subs & other1 & other

Credit Facility $2,894 $1,064 $— $1,426

Credit Facility (availability)2 $2,621 $981 $— $1,345

Cash & short-term investments3 57 1,183 25 37

Available Liquidity $2,678 $2,164 $25 $1,382

| 1 |

|

Edison Capital & other includes Mission Energy Holding Company and other EMG subsidiaries. |

2 Excludes the unused and/or unfunded commitments of subsidiaries of Lehman Brothers Holdings of $36 million for EMG. In June 2009, SCE and EIX amended their credit facilities to remove a subsidiary of Lehman Brothers Holding as a lender.

3 EME had corporate cash of $619 million at March 31, 2011. Corporate cash is defined as cash and cash equivalents of EME and cash and cash equivalents of subsidiaries that do not have third-party dividend restrictions.

May 2, 2011 15 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

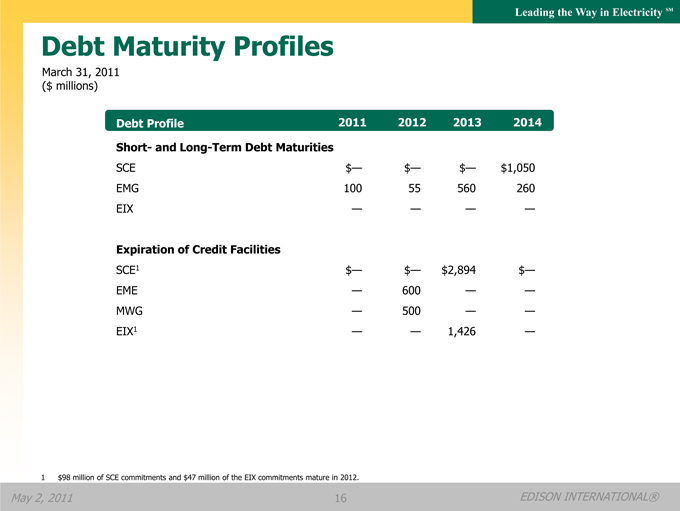

Debt Maturity Profiles

March 31, 2011 ($ millions)

Debt Profile 2011 2012 2013 2014

Short- and Long-Term Debt Maturities

SCE $— $— $— $1,050

EMG 100 55 560 260

EIX — — — —

Expiration of Credit Facilities

SCE1 $— $— $2,894 $—

EME — 600 — —

MWG — 500 — —

EIX1 — — 1,426 —

1 $98 million of SCE commitments and $47 million of the EIX commitments mature in 2012.

May 2, 2011 16 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Earnings Non-GAAP Reconciliations

($ millions)

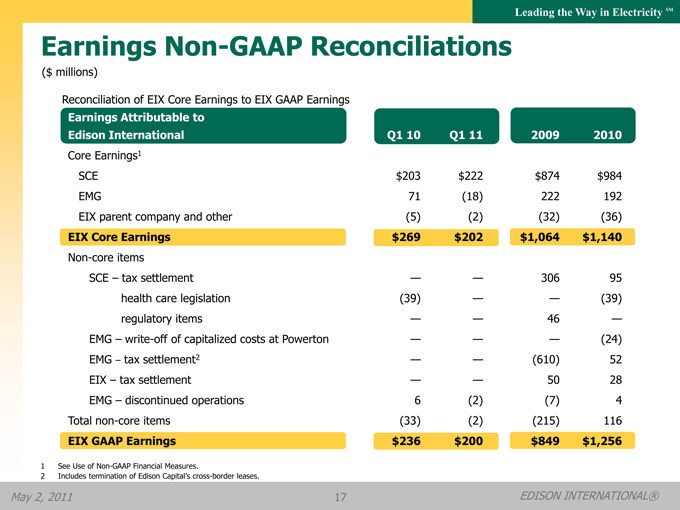

Reconciliation of EIX Core Earnings to EIX GAAP Earnings

Earnings Attributable to

Edison International Q1 10 Q1 11 2009 2010

Core Earnings1

SCE $203 $222 $874 $984

EMG 71(18) 222 192

EIX parent company and other(5)(2)(32)(36)

EIX Core Earnings $269 $202 $1,064 $1,140

Non-core items

SCE – tax settlement — — 306 95

health care legislation(39) — —(39)

regulatory items — — 46 —

EMG – write-off of capitalized costs at Powerton — — —(24)

EMG – tax settlement2 — —(610) 52

EIX – tax settlement — — 50 28

EMG – discontinued operations 6(2)(7) 4

Total non-core items(33)(2)(215) 116

EIX GAAP Earnings $236 $200 $849 $1,256

| 1 |

|

See Use of Non-GAAP Financial Measures. |

| 2 |

|

Includes termination of Edison Capital’s cross-border leases. |

May 2, 2011

17

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

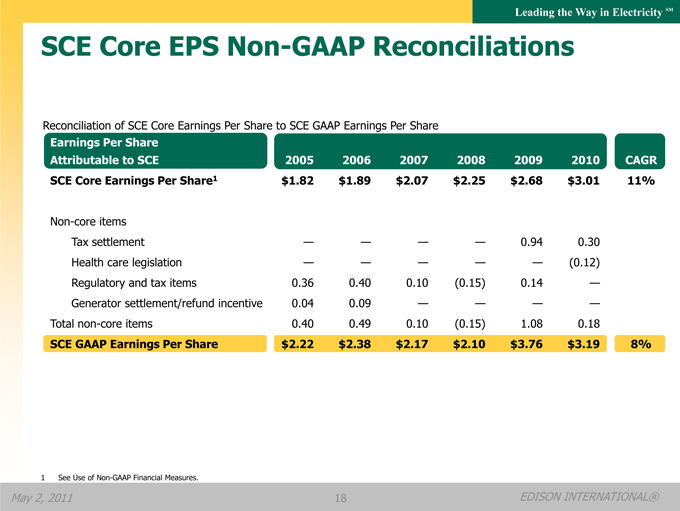

SCE Core EPS Non-GAAP Reconciliations

Reconciliation of SCE Core Earnings Per Share to SCE GAAP Earnings Per Share

Earnings Per Share Attributable to SCE

SCE Core Earnings Per Share1

Non-core items Tax settlement Health care legislation Regulatory and tax items

Generator settlement/refund incentive Total non-core items

SCE GAAP Earnings Per Share

2005 2006 2007 2008 2009 2010 CAGR

$1.82 $1.89 $2.07 $2.25 $2.68 $3.01 11%

— — — — 0.94 0.30

— — — — — (0.12)

0.36 0.40 0.10 (0.15) 0.14 —

0.04 0.09 — — — —

0.40 0.49 0.10 (0.15) 1.08 0.18

$2.22 $2.38 $2.17 $2.10 $3.76 $3.19 8%

| 1 |

|

See Use of Non-GAAP Financial Measures. |

May 2, 2011 18 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

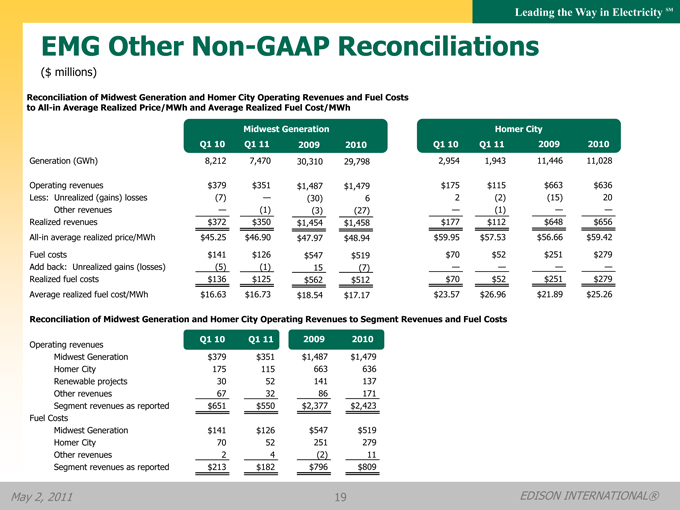

EMG Other Non-GAAP Reconciliations

($ millions)

Reconciliation of Midwest Generation and Homer City Operating Revenues and Fuel Costs to All-in Average Realized Price/MWh and Average Realized Fuel Cost/MWh

Midwest Generation Homer City

Q1 10 Q1 11 2009 2010 Q1 10 Q1 11 2009 2010

Generation (GWh) 8,212 7,470 30,310 29,798 2,954 1,943 11,446 11,028

Operating revenues $379 $351 $1,487 $1,479 $175 $115 $663 $636

Less: Unrealized (gains) losses(7) —(30) 6 2(2)(15) 20

Other revenues —(1)(3)(27) —(1) — —

Realized revenues $372 $350 $1,454 $1,458 $177 $112 $648 $656

All-in average realized price/MWh $45.25 $46.90 $47.97 $48.94 $59.95 $57.53 $56.66 $59.42

Fuel costs $141 $126 $547 $519 $70 $52 $251 $279

Add back: Unrealized gains (losses)(5)(1) 15(7) — — — —

Realized fuel costs $136 $125 $562 $512 $70 $52 $251 $279

Average realized fuel cost/MWh $16.63 $16.73 $18.54 $17.17 $23.57 $26.96 $21.89 $25.26

Reconciliation of Midwest Generation and Homer City Operating Revenues to Segment Revenues and Fuel Costs

Operating revenues Q1 10 Q1 11 2009 2010

Midwest Generation $379 $351 $1,487 $1,479

Homer City 175 115 663 636

Renewable projects 30 52 141 137

Other revenues 67 32 86 171

Segment revenues as reported $651 $550 $2,377 $2,423

Fuel Costs

Midwest Generation $141 $126 $547 $519

Homer City 70 52 251 279

Other revenues 2 4(2) 11

Segment revenues as reported $213 $182 $796 $809

May 2, 2011

19

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

Our Shareholder Value Proposition

• Dual platform operating across the full spectrum of the electricity industry

• Southern California Edison

Among the best domestic electric utility growth platforms

Supportive regulatory framework

Leadership in renewable energy, energy efficiency, electric vehicles and smart grid development

• Edison Mission Group

See real equity value in the portfolio

Working coal fleet environmental compliance issues

Current wind construction program is self-funding

• Commitment to long-term shareholder value creation

• Incentive compensation and stock ownership guidelines consistent with shareholder interests

• Edison people committed to safety, customer service and operational excellence

May 2, 2011 20 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

SCE Appendix

May 2, 2011 21 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

SCE Highlights

• One of the nation’s largest electric utilities

Over 13 million residents in service territory

4.9 million customer accounts

50,000 square-mile service area

Over 110,000 miles of distribution and transmission lines

• 9-11% four-year average annual rate base growth driven by $15.6 billion—$17.5 billion capital program

System reliability expenditures

Smart grid technology

California Renewable Portfolio Standard

May 2, 2011 22 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

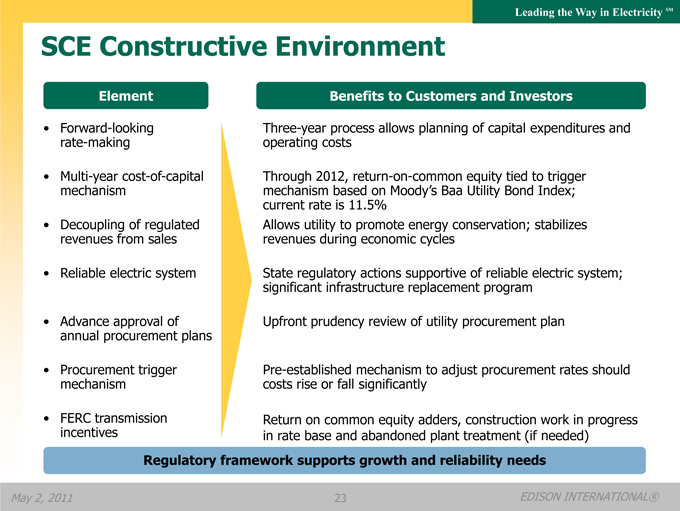

SCE Constructive Environment

Element Benefits to Customers and Investors

• Forward-looking Three-year process allows planning of capital expenditures and rate-making operating costs

• Multi-year cost-of-capital Through 2012, return-on-common equity tied to trigger mechanism mechanism based on Moody’s Baa Utility Bond Index; current rate is 11.5%

• Decoupling of regulated Allows utility to promote energy conservation; stabilizes revenues from sales revenues during economic cycles

• Reliable electric system State regulatory actions supportive of reliable electric system; significant infrastructure replacement program

• Advance approval of Upfront prudency review of utility procurement plan annual procurement plans

• Procurement trigger Pre-established mechanism to adjust procurement rates should mechanism costs rise or fall significantly

• FERC transmission Return on common equity adders, construction work in progress incentives in rate base and abandoned plant treatment (if needed)

Regulatory framework supports growth and reliability needs

May 2, 2011 23 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

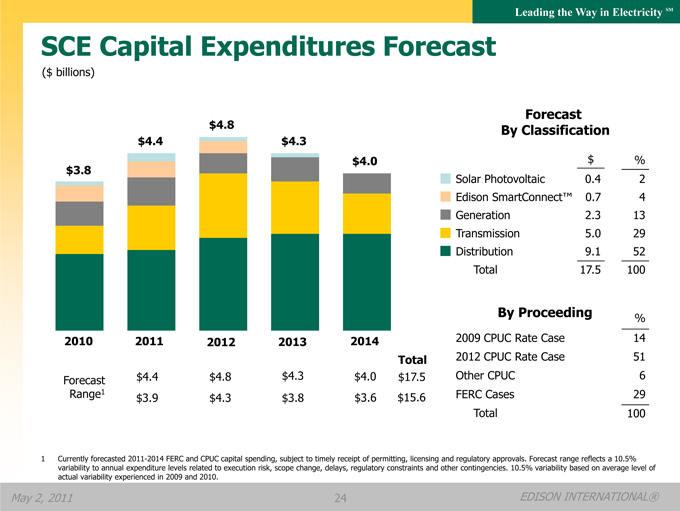

SCE Capital Expenditures Forecast

($ billions)

$4.8

$4.4 $4.3

$4.0

$3.8

2010 2011 2012 2013 2014

Total

Forecast $4.4 $4.8 $4.3 $4.0 $17.5

Range1 $3.9 $4.3 $3.8 $3.6 $15.6

Forecast

By Classification

$ %

Solar Photovoltaic 0.4 2

Edison SmartConnect™ 0.7 4

Generation 2.3 13

Transmission 5.0 29

Distribution 9.1 52

Total 17.5 100

By Proceeding %

2009 CPUC Rate Case 14

2012 CPUC Rate Case 51

Other CPUC 6

FERC Cases 29

Total 100

1 Currently forecasted 2011-2014 FERC and CPUC capital spending, subject to timely receipt of permitting, licensing and regulatory approvals. Forecast range reflects a 10.5% variability to annual expenditure levels related to execution risk, scope change, delays, regulatory constraints and other contingencies. 10.5% variability based on average level of actual variability experienced in 2009 and 2010.

May 2, 2011 24 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

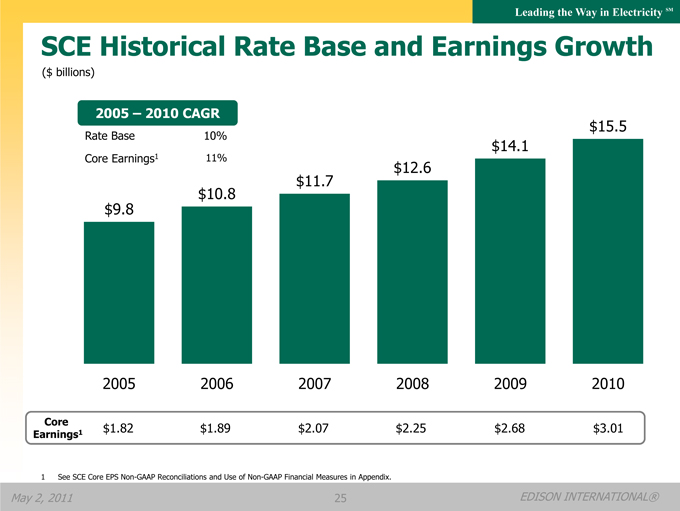

SCE Historical Rate Base and Earnings Growth

($ billions)

2005 – 2010 CAGR

Rate Base 10% Core Earnings1 11%

$9.8

$10.8

$11.7

$12.6

$14.1

$15.5

2005

2006

2007

2008

2009

2010

Core $1.82 $1.89 $2.07 $2.25 $2.68 $3.01

Earnings1

1 See SCE Core EPS Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix.

May 2, 2011

25

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

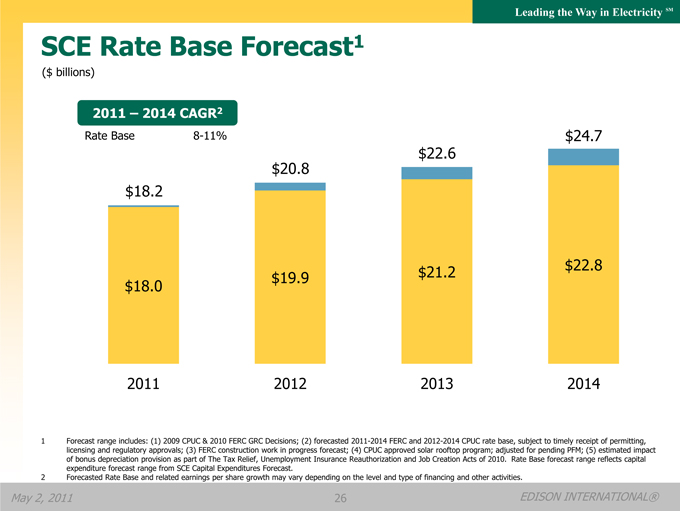

SCE Rate Base Forecast1

($ billions)

2011 – 2014 CAGR2

Rate Base 8-11%

$18.2

$20.8

$22.6

$24.7

$18.0

$19.9

$21.2

$22.8

2011

2012

2013

2014

1 Forecast range includes: (1) 2009 CPUC & 2010 FERC GRC Decisions; (2) forecasted 2011-2014 FERC and 2012-2014 CPUC rate base, subject to timely receipt of permitting, licensing and regulatory approvals; (3) FERC construction work in progress forecast; (4) CPUC approved solar rooftop program; adjusted for pending PFM; (5) estimated impact of bonus depreciation provision as part of The Tax Relief, Unemployment Insurance Reauthorization and Job Creation Acts of 2010. Rate Base forecast range reflects capital expenditure forecast range from SCE Capital Expenditures Forecast.

2 Forecasted Rate Base and related earnings per share growth may vary depending on the level and type of financing and other activities.

May 2, 2011

26

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

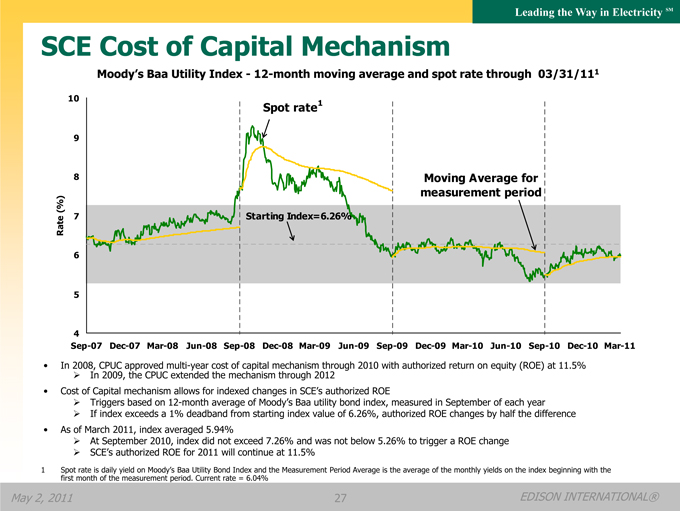

SCE Cost of Capital Mechanism

Moody’s Baa Utility Index—12-month moving average and spot rate through 03/31/111

10

9

8

(%) 7 Rate 6

5

4

Spot rate1

Starting Index=6.26%

Moving Average for measurement period

Sep-07 Dec-07 Mar-08 Jun-08 Sep-08 Dec-08 Mar-09 Jun-09 Sep-09 Dec-09 Mar-10 Jun-10 Sep-10 Dec-10 Mar-11

• In 2008, In CPUC 2009, approved the CPUC multi extended -year cost the mechanism of capital mechanism through 2012 through 2010 with authorized return on equity (ROE) at 11.5%

• Cost of Capital mechanism allows for indexed changes in SCE’s authorized ROE

Triggers based on 12-month average of Moody’s Baa utility bond index, measured in September of each year

If index exceeds a 1% deadband from starting index value of 6.26%, authorized ROE changes by half the difference

• As of March 2011, index averaged 5.94%

At September 2010, index did not exceed 7.26% and was not below 5.26% to trigger a ROE change

SCE’s authorized ROE for 2011 will continue at 11.5%

1 Spot rate is daily yield on Moody’s Baa Utility Bond Index and the Measurement Period Average is the average of the monthly yields on the index beginning with the first month of the measurement period. Current rate = 6.04%

May 2, 2011

27

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

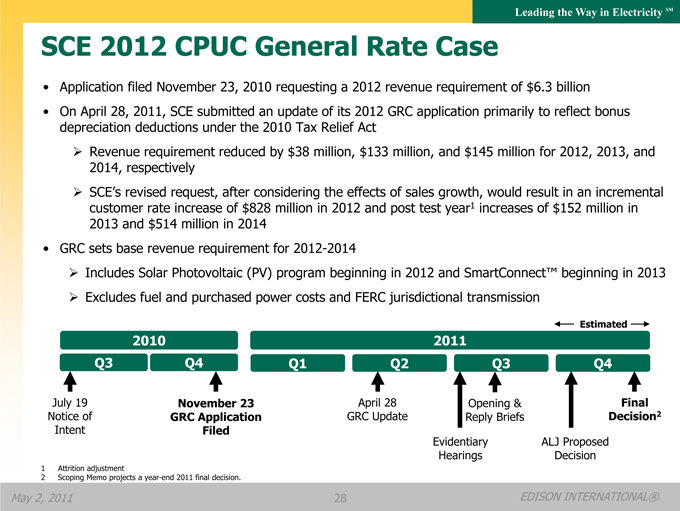

SCE 2012 CPUC General Rate Case

Application filed November 23, 2010 requesting a 2012 revenue requirement of $6.3 billion

On April 28, 2011, SCE submitted an update of its 2012 GRC application primarily to reflect bonus depreciation deductions under the 2010 Tax Relief Act

Revenue requirement reduced by $38 million, $133 million, and $145 million for 2012, 2013, and 2014, respectively

SCE’s revised request, after considering the effects of sales growth, would result in an incremental customer rate increase of $828 million in 2012 and post test year1 increases of $152 million in 2013 and $514 million in 2014

GRC sets base revenue requirement for 2012-2014

Includes Solar Photovoltaic (PV) program beginning in 2012 and SmartConnect™ beginning in 2013

Excludes fuel and purchased power costs and FERC jurisdictional transmission

2010 2011

Q3 Q4 Q1 Q2 Q3 Q4 Estimated

July 19 November 23 April 28 Opening & Final Notice of GRC Application GRC Update Reply Briefs Decision2 Intent Filed Evidentiary ALJ Proposed Hearings Decision

1 Attrition adjustment

2 Scoping Memo projects a year-end 2011 final decision.

May 2, 2011 28 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

California Renewable Policy

• In April 2011, Governor Brown signed a new RPS law which

Includes multi year targets (20% in 2011-2013; reasonable progress to 25% in 2016; reasonable progress to 33% in 2020, and 33% annually thereafter)

Includes flexible compliance for transmission or generation delay, economic curtailment, and provisions for banking of certain resources

Includes authority to use RECs and firmed and shaped resources, in addition to generation directly connected to California

Implementation issues remain to be addressed by the CPUC

Interaction with previous RES issued pursuant to Governor’s Executive Order remains unclear

SCE is taking a proactive approach towards environmental stewardship policy formulation

May 2, 2011

29

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

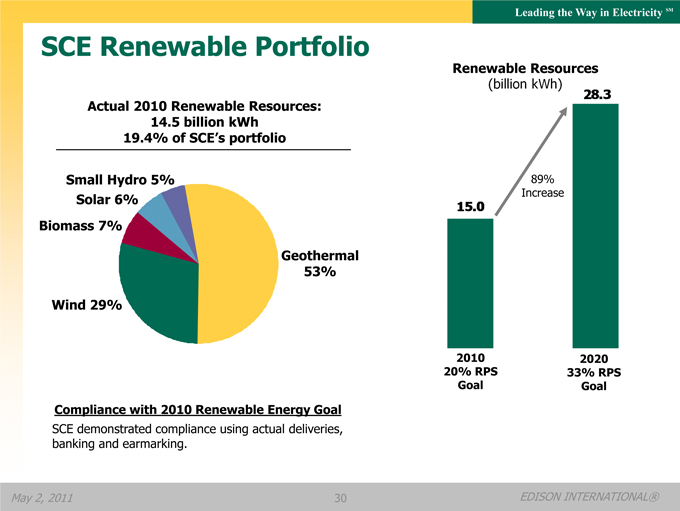

SCE Renewable Portfolio

Actual 2010 Renewable Resources: 14.5 billion kWh 19.4% of SCE’s portfolio

Small Hydro 5% Solar 6% Biomass 7%

Geothermal 53%

Wind 29%

Renewable Resources

(billion kWh)

89% Increase

15.0

28.3

2010 2020 20% RPS 33% RPS

Goal Goal

Compliance with 2010 Renewable Energy Goal

SCE demonstrated compliance using actual deliveries, banking and earmarking.

May 2, 2011

30

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

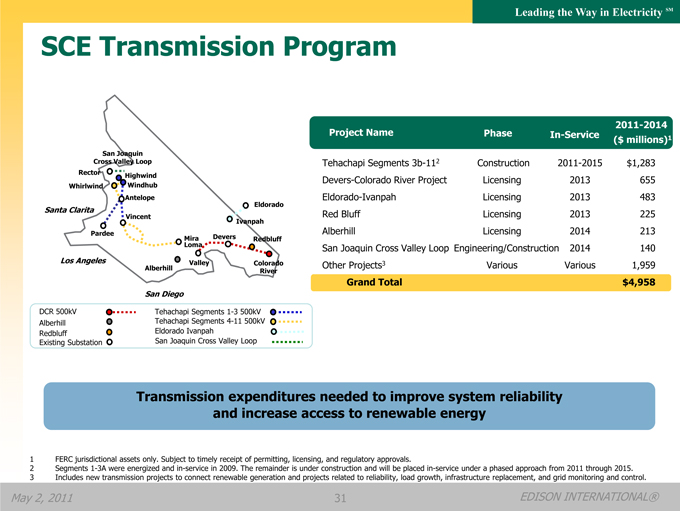

SCE Transmission Program

San Joaquin Cross Valley Loop

Rector Highwind Whirlwind Windhub

Antelope Eldorado

Santa Clarita

Vincent

Ivanpah Pardee MiraLoma Devers Redbluff Los Angeles Valley Colorado Alberhill River

San Diego

DCR 500kV Tehachapi Segments 1-3 500kV Alberhill Tehachapi Segments 4-11 500kV Redbluff Eldorado Ivanpah Existing Substation San Joaquin Cross Valley Loop

2011-2014

Project Name Phase In-Service ($ millions)1

Tehachapi Segments 3b-112 Construction 2011-2015 $1,283

Devers-Colorado River Project Licensing 2013 655

Eldorado-Ivanpah Licensing 2013 483

Red Bluff Licensing 2013 225

Alberhill Licensing 2014 213

San Joaquin Cross Valley Loop Engineering/Construction 2014 140

Other Projects3 Various Various 1,959

Grand Total $4,958

Transmission expenditures needed to improve system reliability and increase access to renewable energy

1 FERC jurisdictional assets only. Subject to timely receipt of permitting, licensing, and regulatory approvals.

2 Segments 1-3A were energized and in-service in 2009. The remainder is under construction and will be placed in-service under a phased approach from 2011 through 2015.

3 Includes new transmission projects to connect renewable generation and projects related to reliability, load growth, infrastructure replacement, and grid monitoring and control.

May 2, 2011

31

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

SCE Distribution Program

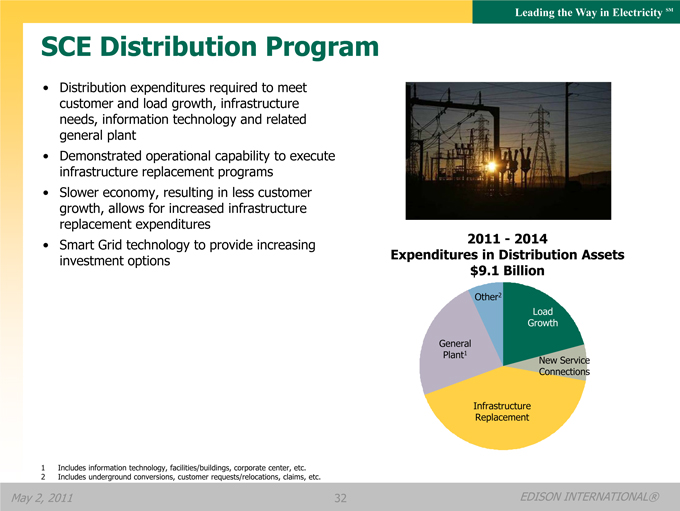

• Distribution expenditures required to meet customer and load growth, infrastructure needs, information technology and related general plant

• Demonstrated operational capability to execute infrastructure replacement programs

• Slower economy, resulting in less customer growth, allows for increased infrastructure replacement expenditures

• Smart Grid technology to provide increasing investment options

2011 - 2014

Expenditures in Distribution Assets $9.1 Billion

Other2

Load Growth General Plant1 New Service Connections

Infrastructure Replacement

1 Includes information technology, facilities/buildings, corporate center, etc.

2 Includes underground conversions, customer requests/relocations, claims, etc.

May 2, 2011 32 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

SCE Solar Photovoltaic Program

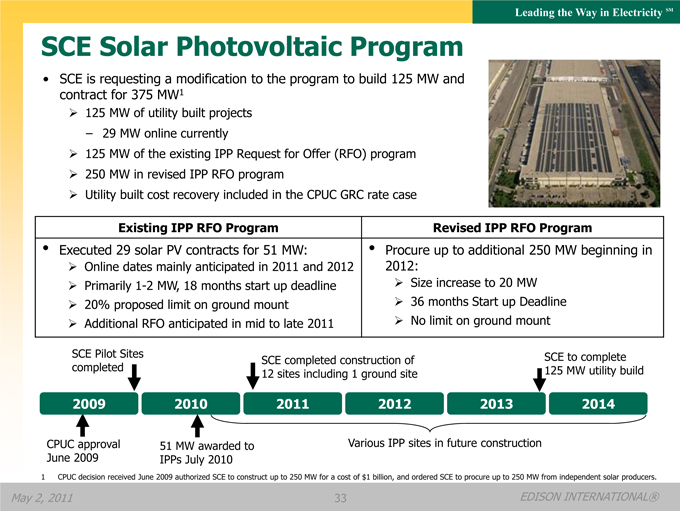

• SCE is requesting a modification to the program to build 125 MW and contract for 375 MW1

125 MW of utility built projects

– 29 MW online currently

125 MW of the existing IPP Request for Offer (RFO) program

250 MW in revised IPP RFO program

Utility built cost recovery included in the CPUC GRC rate case

Existing IPP RFO Program Revised IPP RFO Program

• Executed 29 solar PV contracts for 51 MW: • Procure up to additional 250 MW beginning in

Online dates mainly anticipated in 2011 and 2012 2012:

Primarily 1-2 MW, 18 months start up deadline Size increase to 20 MW

20% proposed limit on ground mount 36 months Start up Deadline

Additional RFO anticipated in mid to late 2011 No limit on ground mount

SCE Pilot Sites SCE to complete SCE completed construction of completed 125 MW utility build 12 sites including 1 ground site

2009 2010 2011 2012 2013 2014

CPUC approval 51 MW awarded to Various IPP sites in future construction June 2009 IPPs July 2010

1 CPUC decision received June 2009 authorized SCE to construct up to 250 MW for a cost of $1 billion, and ordered SCE to procure up to 250 MW from independent solar producers.

May 2, 2011 33 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

SCE SmartConnectTM Program

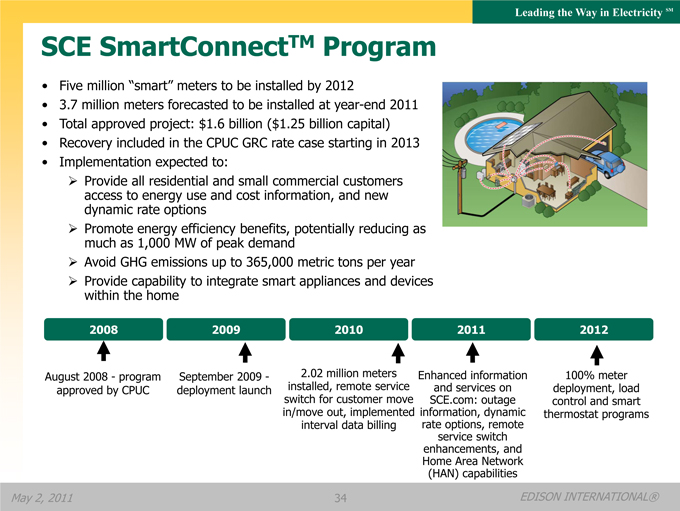

• Five million “smart” meters to be installed by 2012

• 3.7 million meters forecasted to be installed at year-end 2011

• Total approved project: $1.6 billion ($1.25 billion capital)

• Recovery included in the CPUC GRC rate case starting in 2013

• Implementation expected to:

Provide all residential and small commercial customers access to energy use and cost information, and new dynamic rate options

Promote energy efficiency benefits, potentially reducing as much as 1,000 MW of peak demand

Avoid GHG emissions up to 365,000 metric tons per year

Provide capability to integrate smart appliances and devices within the home

2008 2009 2010 2011 2012

August 2008 - program approved by CPUC

September 2009 - deployment launch

2.02 million meters installed, remote service switch for customer move in/move out, implemented interval data billing

Enhanced information and services on SCE.com: outage information, dynamic rate options, remote service switch enhancements, and Home Area Network (HAN) capabilities

100% meter deployment, load control and smart thermostat programs

May 2, 2011 34 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

SCE Rates and Bills Comparison

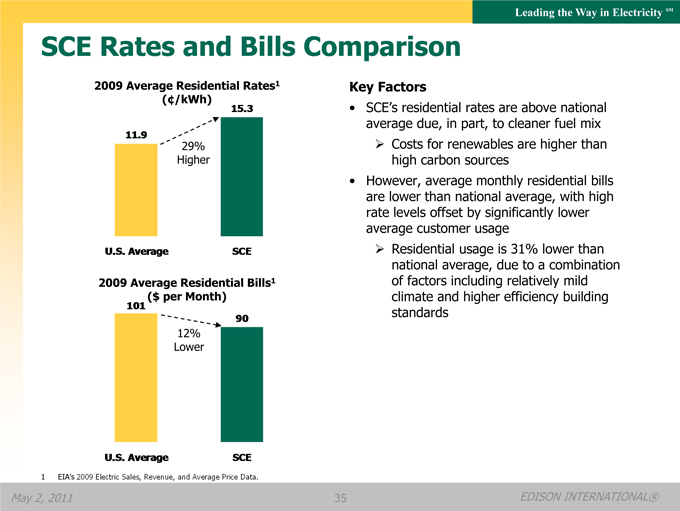

2009 Average Residential Rates1 (¢/kWh)

11.9

15.3

29% Higher

U.S. Average SCE

2009 Average Residential Bills1 ($ per Month)

101 90

12% Lower

U.S. Average SCE

Key Factors

• SCE’s residential rates are above national average due, in part, to cleaner fuel mix

Costs for renewables are higher than high carbon sources

• However, average monthly residential bills are lower than national average, with high rate levels offset by significantly lower average customer usage

Residential usage is 31% lower than national average, due to a combination of factors including relatively mild climate and higher efficiency building standards

1 EIA’s 2009 Electric Sales, Revenue, and Average Price Data.

May 2, 2011 35 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

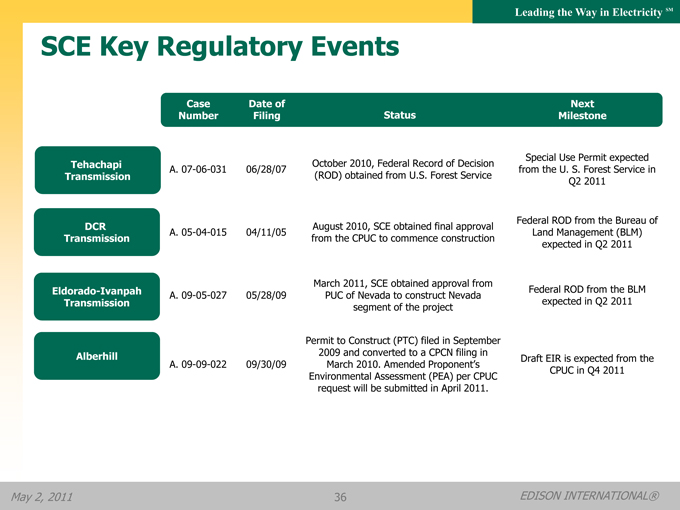

SCE Key Regulatory Events

Case Date of Next

Number Filing Status Milestone

Tehachapi October 2010, Federal Record of Decision Special Use Permit expected

A. 07-06-031 06/28/07 from the U. S. Forest Service in

Transmission(ROD) obtained from U.S. Forest Service Q2 2011

DCR August 2010, SCE obtained final approval Federal ROD from the Bureau of

A. 05-04-015 04/11/05 Land Management (BLM)

Transmission from the CPUC to commence construction expected in Q2 2011

March 2011, SCE obtained approval from

Eldorado-Ivanpah A. 09-05-027 05/28/09 PUC of Nevada to construct Nevada Federal ROD from the BLM

Transmission segment of the project expected in Q2 2011

Permit to Construct (PTC) filed in September

Alberhill 2009 and converted to a CPCN filing in Draft EIR is expected from the

A. 09-09-022 09/30/09 March 2010. Amended Proponent’s

Environmental Assessment (PEA) per CPUC CPUC in Q4 2011

request will be submitted in April 2011.

May 2, 2011

EDISON INTERNATIONAL®

36

Leading the Way in Electricity SM

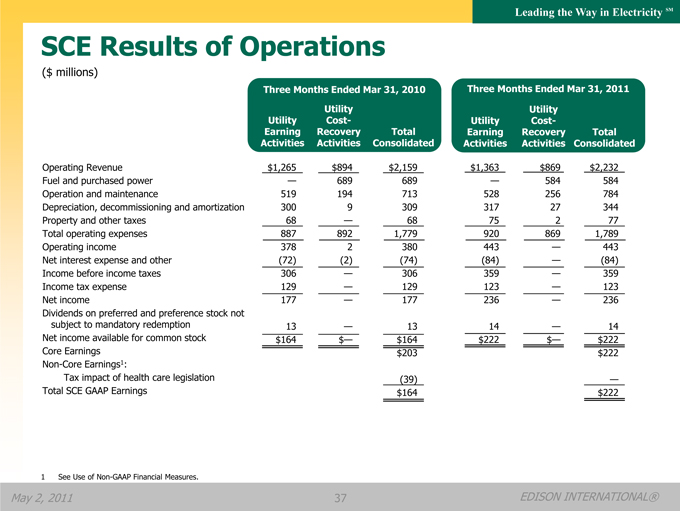

SCE Results of Operations

($ millions)

Three Months Ended Mar 31, 2010 Three Months Ended Mar 31, 2011

Utility Earning Activities Activities Consolidated Utility Cost- Recovery Activities Total Activities Consolidated Utility Earning Utility Cost- Recovery Total

Operating Revenue $1,265 $894 $2,159 $1,363 $869 $2,232

Fuel and purchased power — 689 689 — 584 584

Operation and maintenance 519 194 713 528 256 784

Depreciation, decommissioning and amortization 300 9 309 317 27 344

Property and other taxes 68 — 68 75 2 77

Total operating expenses 887 892 1,779 920 869 1,789

Operating income 378 2 380 443 — 443

Net interest expense and other(72)(2)(74)(84) —(84)

Income before income taxes 306 — 306 359 — 359

Income tax expense 129 — 129 123 — 123

Net income 177 — 177 236 — 236

Dividends on preferred and preference stock not

subject to mandatory redemption 13 — 13 14 — 14

Net income available for common stock $164 $— $164 $222 $— $222

Core Earnings $203 $222

Non-Core Earnings1:

Tax impact of health care legislation(39) —

Total SCE GAAP Earnings $164 $222

1 See Use of Non-GAAP Financial Measures.

May 2, 2011 37 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

EMG Appendix

May 2, 2011 38 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

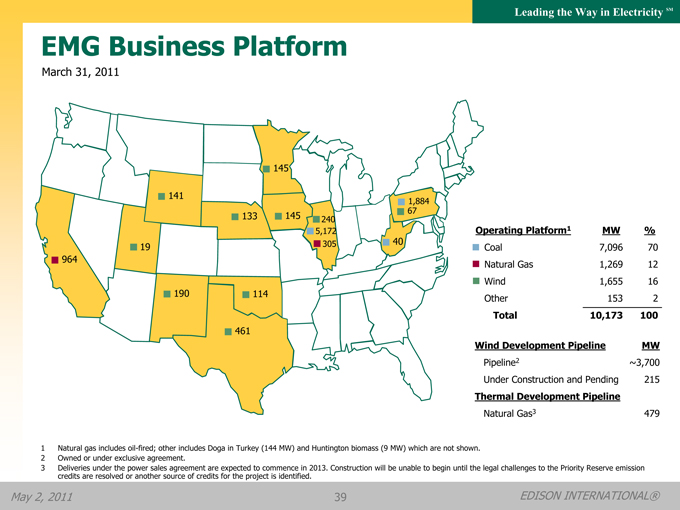

EMG Business Platform

145 141 1,884 133 145 240 67 5,172 305 40 964 190 114 461 19

Operating Platform1 MW%

Coal 7,096 70

Natural Gas 1,269 12

Wind 1,655 16

Other 153 2

Total 10,173 100

Wind Development Pipeline MW

Pipeline2 ~3,700

Under Construction and Pending 215

Thermal Development Pipeline

Natural Gas3 479

1 Natural gas includes oil-fired; other includes Doga in Turkey (144 MW) and Huntington biomass (9 MW) which are not shown.

2 Owned or under exclusive agreement.

3 Deliveries under the power sales agreement are expected to commence in 2013. Construction will be unable to begin until the legal challenges to the Priority Reserve emission credits are resolved or another source of credits for the project is identified.

May 2, 2011 39 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

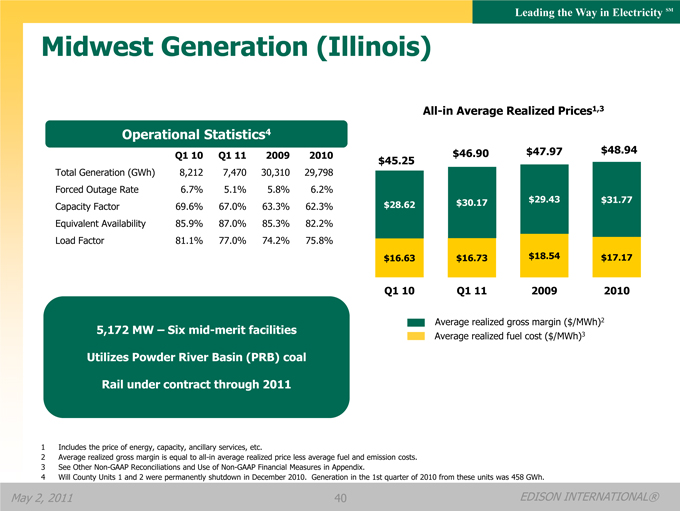

Midwest Generation (Illinois)

Operational Statistics4

Q1 10 Q1 11 2009 2010

Total Generation (GWh) 8,212 7,470 30,310 29,798

Forced Outage Rate 6.7% 5.1% 5.8% 6.2%

Capacity Factor 69.6% 67.0% 63.3% 62.3%

Equivalent Availability 85.9% 87.0% 85.3% 82.2%

Load Factor 81.1% 77.0% 74.2% 75.8%

All-in Average Realized Prices1,3

$45.25 $46.90 $47.97 $48.94

$30.17 $29.43 $31.77 $28.62

$16.63 $16.73 $18.54 $17.17

Q1 10 Q1 11 2009 2010

Average realized gross margin ($/MWh)2 Average realized fuel cost ($/MWh)3

5,172 MW – Six mid-merit facilities Utilizes Powder River Basin (PRB) coal Rail under contract through 2011

1 Includes the price of energy, capacity, ancillary services, etc.

2 Average realized gross margin is equal to all-in average realized price less average fuel and emission costs.

3 See Other Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix.

4 Will County Units 1 and 2 were permanently shutdown in December 2010. Generation in the 1st quarter of 2010 from these units was 458 GWh.

May 2, 2011 40 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

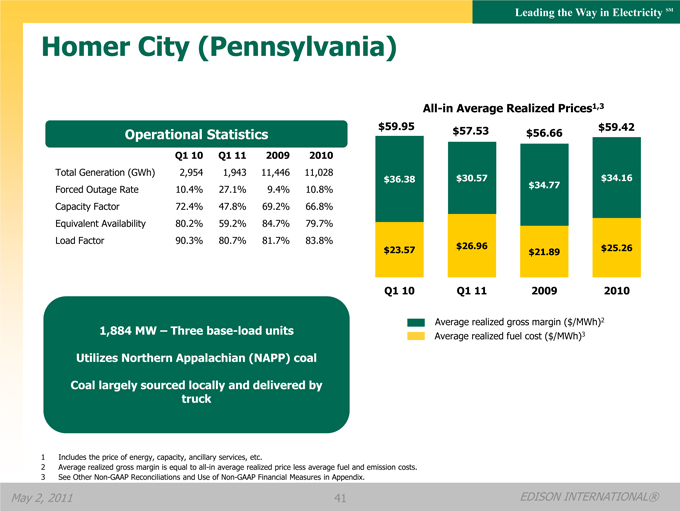

Homer City (Pennsylvania)

Operational Statistics

Q1 10 Q1 11 2009 2010

Total Generation (GWh) 2,954 1,943 11,446 11,028

Forced Outage Rate 10.4% 27.1% 9.4% 10.8%

Capacity Factor 72.4% 47.8% 69.2% 66.8%

Equivalent Availability 80.2% 59.2% 84.7% 79.7%

Load Factor 90.3% 80.7% 81.7% 83.8%

All-in Average Realized Prices1,3 $59.95 $57.53 $59.42 $56.66

$36.38 $30.57 $34.16 $34.77

$23.57 $26.96 $25.26 $21.89

Q1 10 Q1 11 2009 2010

Average realized gross margin ($/MWh)2 Average realized fuel cost ($/MWh)3

1,884 MW – Three base-load units

Utilizes Northern Appalachian (NAPP) coal

Coal largely sourced locally and delivered by truck

1 Includes the price of energy, capacity, ancillary services, etc.

2 Average realized gross margin is equal to all-in average realized price less average fuel and emission costs.

3 See Other Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix.

May 2, 2011 41 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

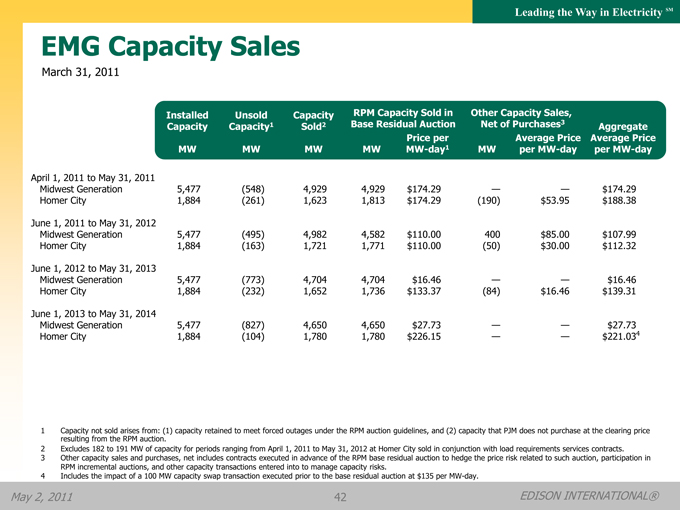

EMG Capacity Sales

March 31, 2011

Installed Unsold Capacity RPM Capacity Sold in Other Capacity Sales,

Capacity Capacity1 Sold2 Base Residual Auction Net of Purchases3 Aggregate

Price per Average Price Average Price

MW MW MW MW MW-day1 MW per MW-day per MW-day

April 1, 2011 to May 31, 2011

Midwest Generation 5,477(548) 4,929 4,929 $174.29 — — $174.29

Homer City 1,884(261) 1,623 1,813 $174.29(190) $53.95 $188.38

June 1, 2011 to May 31, 2012

Midwest Generation 5,477(495) 4,982 4,582 $110.00 400 $85.00 $107.99

Homer City 1,884(163) 1,721 1,771 $110.00(50) $30.00 $112.32

June 1, 2012 to May 31, 2013

Midwest Generation 5,477(773) 4,704 4,704 $16.46 — — $16.46

Homer City 1,884(232) 1,652 1,736 $133.37(84) $16.46 $139.31

June 1, 2013 to May 31, 2014

Midwest Generation 5,477(827) 4,650 4,650 $27.73 — — $27.73

Homer City 1,884(104) 1,780 1,780 $226.15 — — $221.03 4

1 Capacity not sold arises from: (1) capacity retained to meet forced outages under the RPM auction guidelines, and (2) capacity that PJM does not purchase at the clearing price resulting from the RPM auction.

2 Excludes 182 to 191 MW of capacity for periods ranging from April 1, 2011 to May 31, 2012 at Homer City sold in conjunction with load requirements services contracts.

3 Other capacity sales and purchases, net includes contracts executed in advance of the RPM base residual auction to hedge the price risk related to such auction, participation in RPM incremental auctions, and other capacity transactions entered into to manage capacity risks.

4 Includes the impact of a 100 MW capacity swap transaction executed prior to the base residual auction at $135 per MW-day.

May 2, 2011

42

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

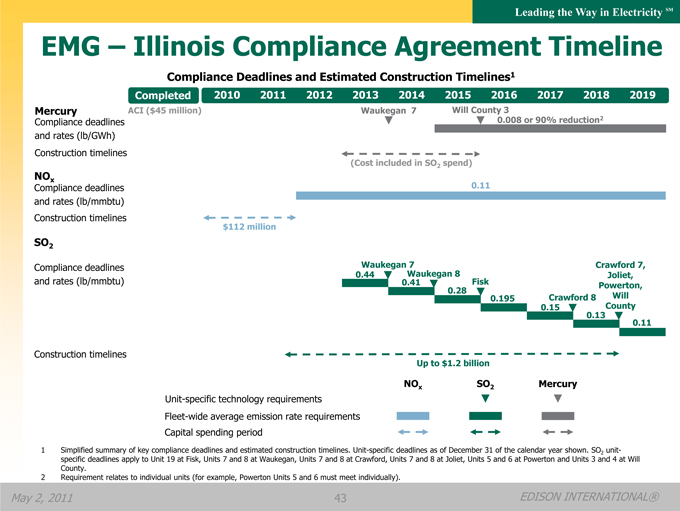

EMG – Illinois Compliance Agreement Timeline

Compliance Deadlines and Estimated Construction Timelines1

Completed 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Mercury ACI ($45 million) Waukegan 7 Will County 3

Compliance deadlines 0.008 or 90% reduction2

and rates (lb/GWh)

Construction timelines

(Cost included in SO2 spend)

NOx

Compliance deadlines 0.11

and rates (lb/mmbtu)

Construction timelines

$112 million

SO2

Compliance deadlines Waukegan 7 Crawford 7,

0.44 Waukegan 8 Joliet,

and rates (lb/mmbtu) 0.41 Fisk Powerton,

0.28 0.195 Crawford 8 Will County

0.15

0.13

0.11

Construction timelines

Up to $1.2 billion

NOx SO2 Mercury

Unit-specific technology requirements

Fleet-wide average emission rate requirements Capital spending period

1 Simplified summary of key compliance deadlines and estimated construction timelines. Unit-specific deadlines as of December 31 of the calendar year shown. SO2 unit-specific deadlines apply to Unit 19 at Fisk, Units 7 and 8 at Waukegan, Units 7 and 8 at Crawford, Units 7 and 8 at Joliet, Units 5 and 6 at Powerton and Units 3 and 4 at Will County.

2 Requirement relates to individual units (for example, Powerton Units 5 and 6 must meet individually).

May 2, 2011 43 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

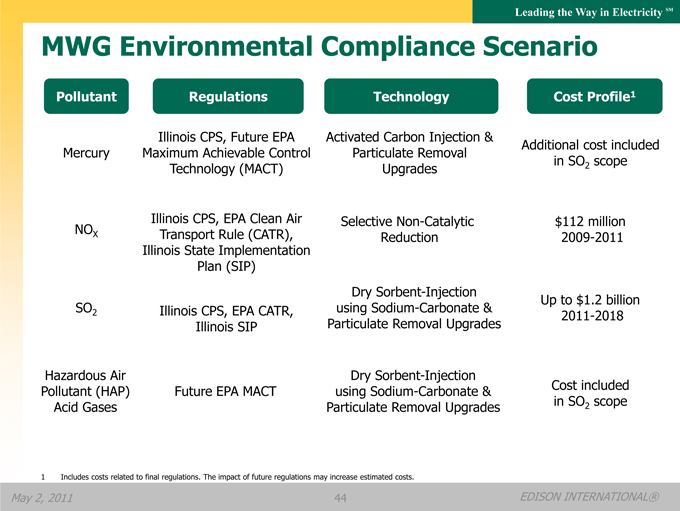

MWG Environmental Compliance Scenario

Pollutant Regulations Technology Cost Profile1

Mercury Illinois CPS, Future EPA Maximum Achievable Control Technology (MACT) Activated Carbon Injection & Particulate Removal Upgrades Additional cost included in SO 2 scope

NO X Illinois CPS, EPA Clean Air Transport Rule (CATR), Illinois State Implementation Plan (SIP) Selective Non-Catalytic Reduction $112 million 2009-2011

SO2 Illinois CPS, EPA CATR, Illinois SIP Dry Sorbent-Injection using Sodium-Carbonate & Particulate Removal Upgrades Up to $1.2 billion 2011-2018

Hazardous Air Pollutant (HAP) Acid Gases Future EPA MACT Dry Sorbent-Injection using Sodium-Carbonate & Particulate Removal Upgrades Cost included in SO2 scope

1 Includes costs related to final regulations. The impact of future regulations may increase estimated costs.

May 2, 2011 44 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

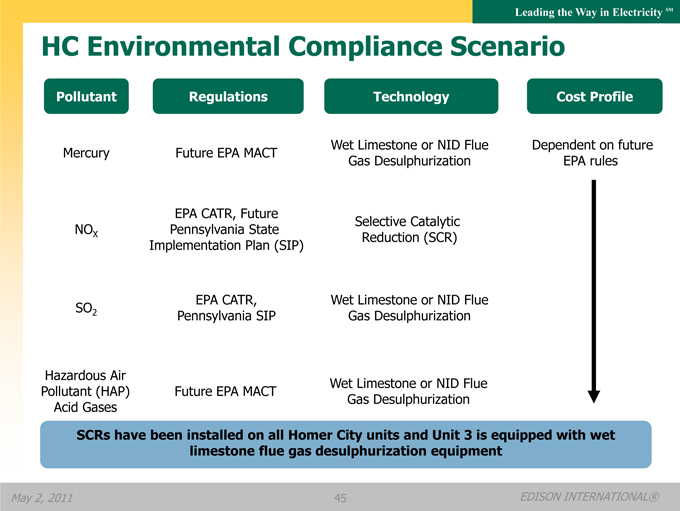

HC Environmental Compliance Scenario

Pollutant Regulations Technology Cost Profile

Mercury Future EPA MACT Wet Limestone or NID Flue Gas Desulphurization Dependent on future EPA rules

NO X EPA CATR, Future Pennsylvania State Implementation Plan (SIP) Selective Catalytic Reduction (SCR)

SO2 EPA CATR, Pennsylvania SIP Wet Limestone or NID Flue Gas Desulphurization

Hazardous Air Pollutant (HAP) Acid Gases Future EPA MACT Wet Limestone or NID Flue Gas Desulphurization

SCRs have been installed on all Homer City units and Unit 3 is equipped with wet limestone flue gas desulphurization equipment

May 2, 2011 45 EDISON INTERNATIONAL®

Leading the Way in Electricity SM

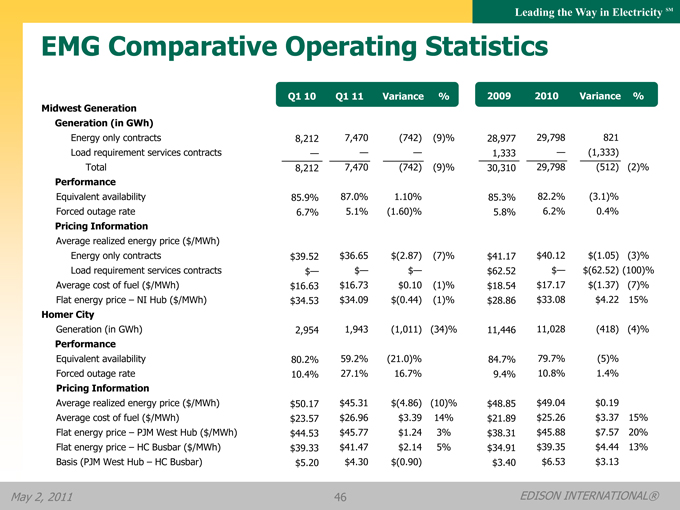

EMG Comparative Operating Statistics

Q1 10 Q1 11 Variance% 2009 2010 Variance%

Midwest Generation

Generation (in GWh)

Energy only contracts 8,212 7,470(742)(9)% 28,977 29,798 821

Load requirement services contracts — — — 1,333 —(1,333)

Total 8,212 7,470(742)(9)% 30,310 29,798(512)(2)%

Performance

Equivalent availability 85.9% 87.0% 1.10% 85.3% 82.2%(3.1)%

Forced outage rate 6.7% 5.1%(1.60)% 5.8% 6.2% 0.4%

Pricing Information

Average realized energy price ($/MWh)

Energy only contracts $39.52 $36.65 $(2.87)(7)% $41.17 $40.12 $(1.05)(3)%

Load requirement services contracts $— $— $— $62.52 $— $(62.52)(100)%

Average cost of fuel ($/MWh) $16.63 $16.73 $0.10(1)% $18.54 $17.17 $(1.37)(7)%

Flat energy price – NI Hub ($/MWh) $34.53 $34.09 $(0.44)(1)% $28.86 $33.08 $4.22 15%

Homer City

Generation (in GWh) 2,954 1,943(1,011)(34)% 11,446 11,028(418)(4)%

Performance

Equivalent availability 80.2% 59.2%(21.0)% 84.7% 79.7%(5)%

Forced outage rate 10.4% 27.1% 16.7% 9.4% 10.8% 1.4%

Pricing Information

Average realized energy price ($/MWh) $50.17 $45.31 $(4.86)(10)% $48.85 $49.04 $0.19

Average cost of fuel ($/MWh) $23.57 $26.96 $3.39 14% $21.89 $25.26 $3.37 15%

Flat energy price – PJM West Hub ($/MWh) $44.53 $45.77 $1.24 3% $38.31 $45.88 $7.57 20%

Flat energy price – HC Busbar ($/MWh) $39.33 $41.47 $2.14 5% $34.91 $39.35 $4.44 13%

Basis (PJM West Hub – HC Busbar) $5.20 $4.30 $(0.90) $3.40 $6.53 $3.13

May 2, 2011

46

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

EMG – Adjusted EBITDA

March 31, 2011 ($ millions)

Reconciliation to Earnings1Q1 10 Q111 2009 2010 2011E3

Earnings $77 $(20) $(395) $224 $(63)

Addback (Deduct):

Discontinued operations(6) 2 7 (4) —

Income from continuing operations 71(18) (388) 220 (63)

Interest expense 68 80 306 264 321

Interest income(3)(1)(23)(9)(1)

Income taxes (benefits) 25(46)(284)(36)(157)

Depreciation and amortization 59 73 240 249 302

EBITDA2 $220 $88 $(149) $688 $402

Production tax credits 14 18 56 62 63

Addback:

Gain on sale/disposal of assets 4 — — — —

Lease termination & other — — 889 48 —

Adjusted EBITDA $238 $106 $796 $798 $465

| 1 |

|

Earnings refer to net income attributable to Edison Mission Group. |

| 2 |

|

See Use of Non-GAAP Financial Measures. |

| 3 |

|

Adjusted EBITDA guidance for 2011. |

May 2, 2011

47

EDISON INTERNATIONAL®

Leading the Way in Electricity SM

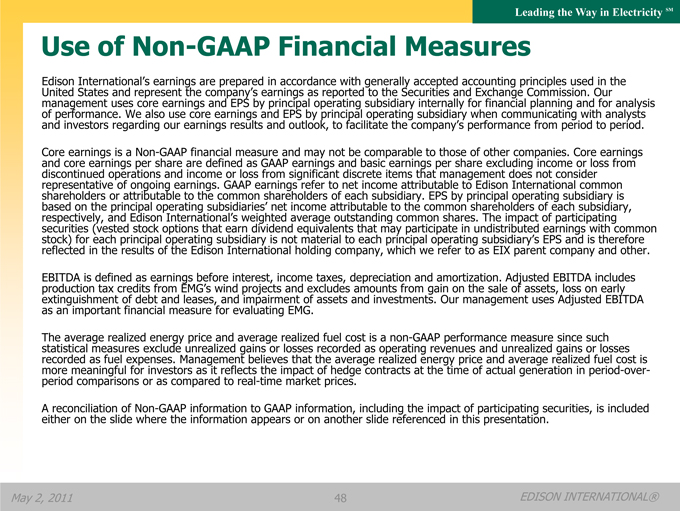

Use of Non-GAAP Financial Measures

Edison International’s earnings are prepared in accordance with generally accepted accounting principles used in the United States and represent the company’s earnings as reported to the Securities and Exchange Commission. Our management uses core earnings and EPS by principal operating subsidiary internally for financial planning and for analysis of performance. We also use core earnings and EPS by principal operating subsidiary when communicating with analysts and investors regarding our earnings results and outlook, to facilitate the company’s performance from period to period.

Core earnings is a Non-GAAP financial measure and may not be comparable to those of other companies. Core earnings and core earnings per share are defined as GAAP earnings and basic earnings per share excluding income or loss from discontinued operations and income or loss from significant discrete items that management does not consider representative of ongoing earnings. GAAP earnings refer to net income attributable to Edison International common shareholders or attributable to the common shareholders of each subsidiary. EPS by principal operating subsidiary is based on the principal operating subsidiaries’ net income attributable to the common shareholders of each subsidiary, respectively, and Edison International’s weighted average outstanding common shares. The impact of participating securities (vested stock options that earn dividend equivalents that may participate in undistributed earnings with common stock) for each principal operating subsidiary is not material to each principal operating subsidiary’s EPS and is therefore reflected in the results of the Edison International holding company, which we refer to as EIX parent company and other.

EBITDA is defined as earnings before interest, income taxes, depreciation and amortization. Adjusted EBITDA includes production tax credits from EMG’s wind projects and excludes amounts from gain on the sale of assets, loss on early extinguishment of debt and leases, and impairment of assets and investments. Our management uses Adjusted EBITDA as an important financial measure for evaluating EMG.

The average realized energy price and average realized fuel cost is a non-GAAP performance measure since such statistical measures exclude unrealized gains or losses recorded as operating revenues and unrealized gains or losses recorded as fuel expenses. Management believes that the average realized energy price and average realized fuel cost is more meaningful for investors as it reflects the impact of hedge contracts at the time of actual generation in period-over-period comparisons or as compared to real-time market prices.

A reconciliation of Non-GAAP information to GAAP information, including the impact of participating securities, is included either on the slide where the information appears or on another slide referenced in this presentation.