February 22, 2017

Business Update

February 2017

Exhibit 99.1

February 22, 2017 1

Statements contained in this presentation about future performance, including, without limitation, operating results, capital

expenditures, rate base growth, dividend policy, financial outlook, and other statements that are not purely historical, are

forward-looking statements. These forward-looking statements reflect our current expectations; however, such statements

involve risks and uncertainties. Actual results could differ materially from current expectations. These forward-looking

statements represent our expectations only as of the date of this presentation, and Edison International assumes no duty to

update them to reflect new information, events or circumstances. Important factors that could cause different results include,

but are not limited to the:

• ability of SCE to recover its costs in a timely manner from its customers through regulated rates, including costs related to

San Onofre and proposed spending on grid modernization;

• decisions and other actions by the CPUC, the FERC, the NRC and other regulatory authorities, including the determinations

of authorized rates of return or return on equity, approval of proposed spending on grid modernization, the outcome of

San Onofre CPUC proceedings, and delays in regulatory actions;

• risks associated with cost allocation, including the potential movement of costs to certain customers, caused by the ability

of cities, counties and certain other public agencies to generate and/or purchase electricity for their local residents and

businesses, along with other possible customer bypass or departure due to increased adoption of distributed energy

resources or technological advancements in the generation, storage, transmission, distribution and use of electricity, and

supported by public policy, government regulations and incentives;

• risks inherent in the construction of SCE’s transmission and distribution infrastructure investment program, including those

related to project site identification, public opposition, environmental mitigation, construction, permitting, power

curtailment costs (payments due under power contracts in the event there is insufficient transmission to enable acceptance

of power delivery), and governmental approvals;

• ability to obtain sufficient insurance, including insurance relating to SCE's nuclear facilities and wildfire-related liability, and

to recover the costs of such insurance or in the absence of insurance the ability to recover uninsured losses; and

• risks associated with the decommissioning of San Onofre, including those related to public opposition, permitting,

governmental approvals, and cost overruns.

Other important factors are discussed under the headings “Risk Factors” and “Management’s Discussion and Analysis” in

Edison International’s Form 10-K, most recent Form 10-Q, and other reports filed with the Securities and Exchange

Commission, which are available on our website: www.edisoninvestor.com. These filings also provide additional information on

historical and other factual data contained in this presentation.

Forward-Looking Statements

February 22, 2017 2

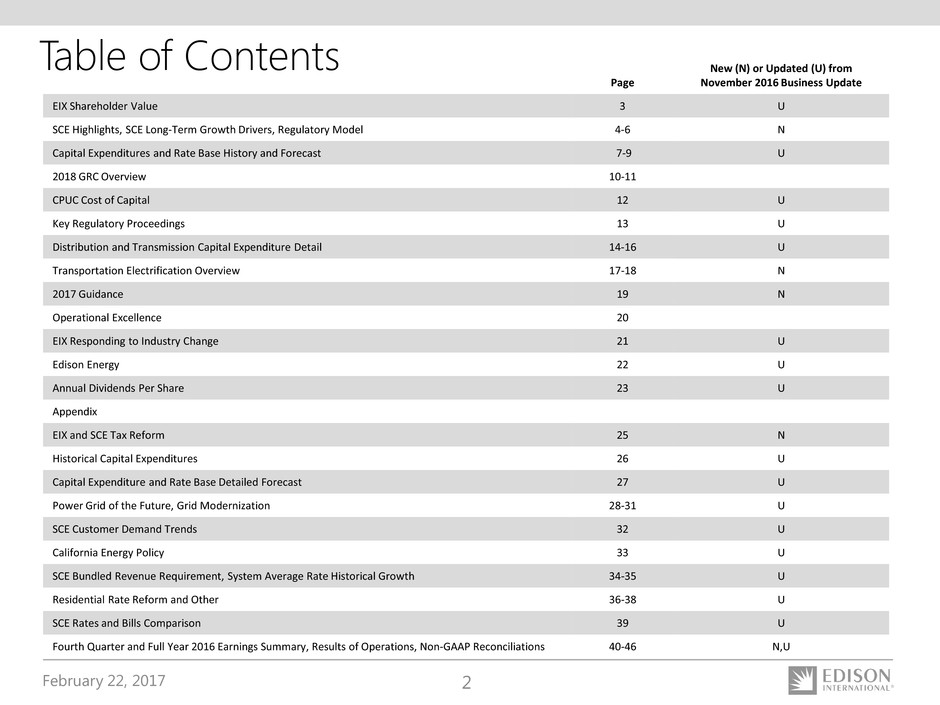

Page

New (N) or Updated (U) from

November 2016 Business Update

EIX Shareholder Value 3 U

SCE Highlights, SCE Long-Term Growth Drivers, Regulatory Model 4-6 N

Capital Expenditures and Rate Base History and Forecast 7-9 U

2018 GRC Overview 10-11

CPUC Cost of Capital 12 U

Key Regulatory Proceedings 13 U

Distribution and Transmission Capital Expenditure Detail 14-16 U

Transportation Electrification Overview 17-18 N

2017 Guidance 19 N

Operational Excellence 20

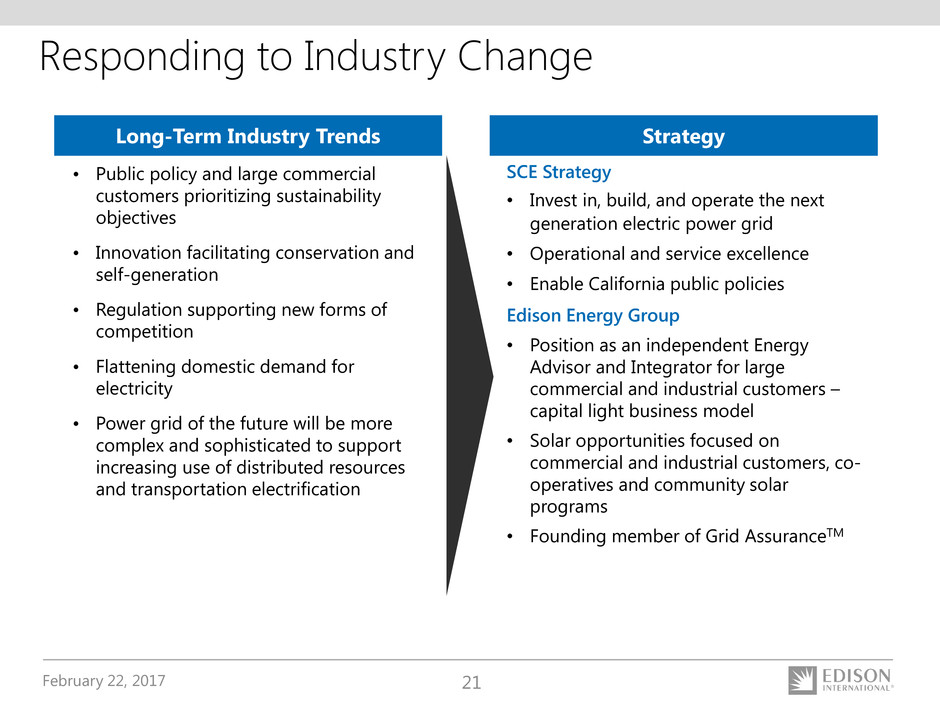

EIX Responding to Industry Change 21 U

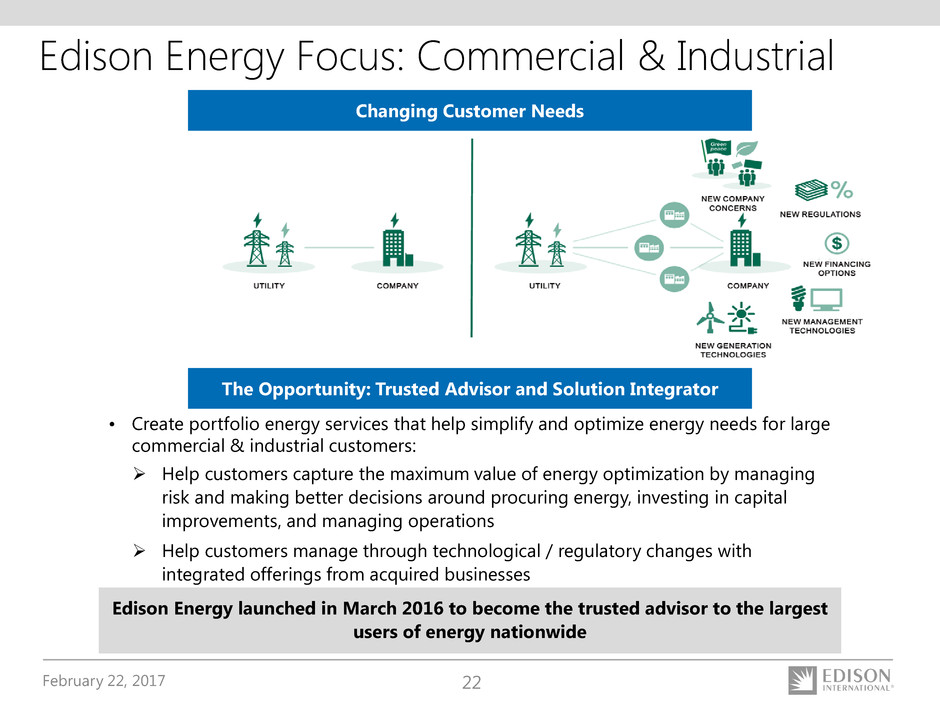

Edison Energy 22 U

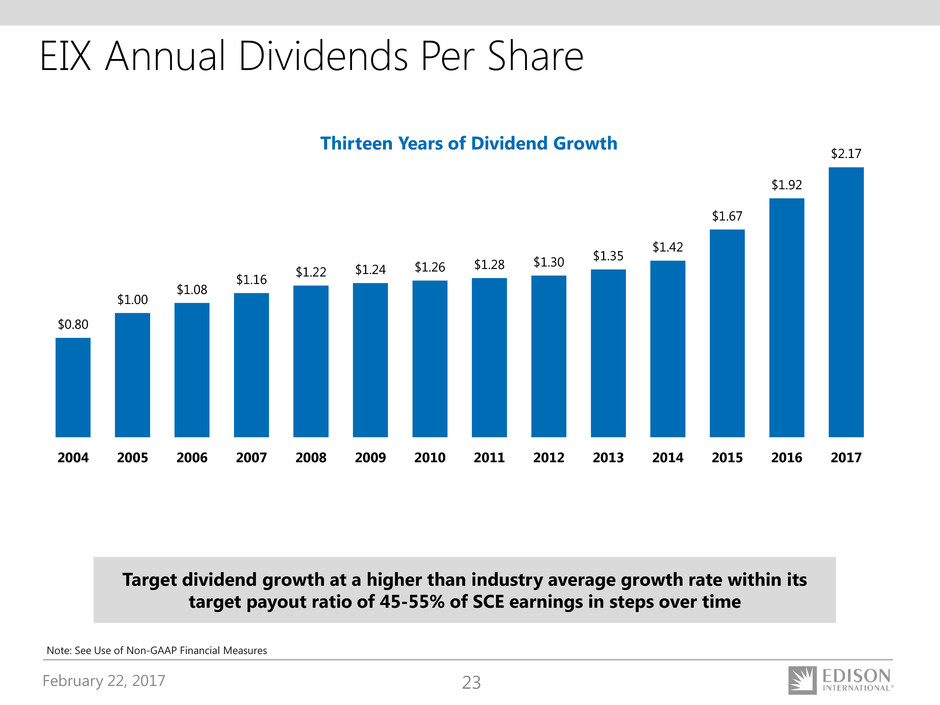

Annual Dividends Per Share 23 U

Appendix

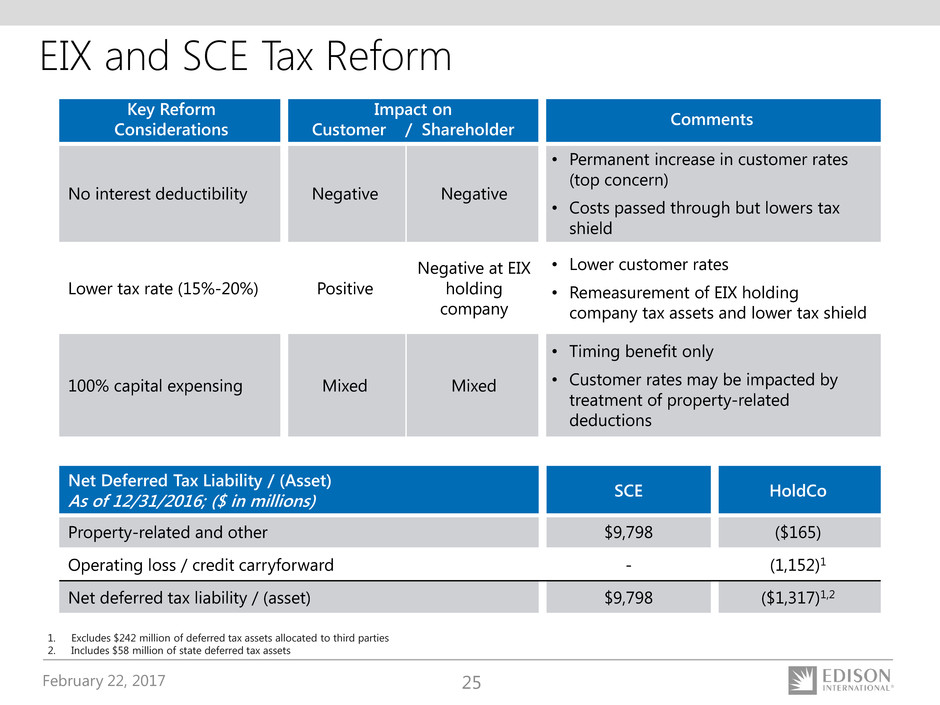

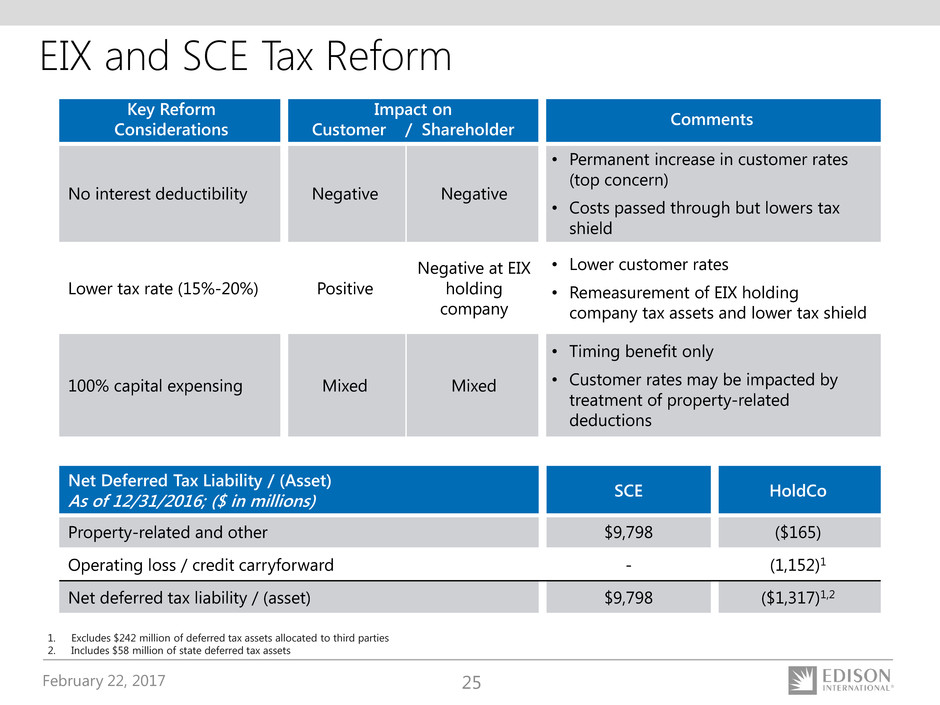

EIX and SCE Tax Reform 25 N

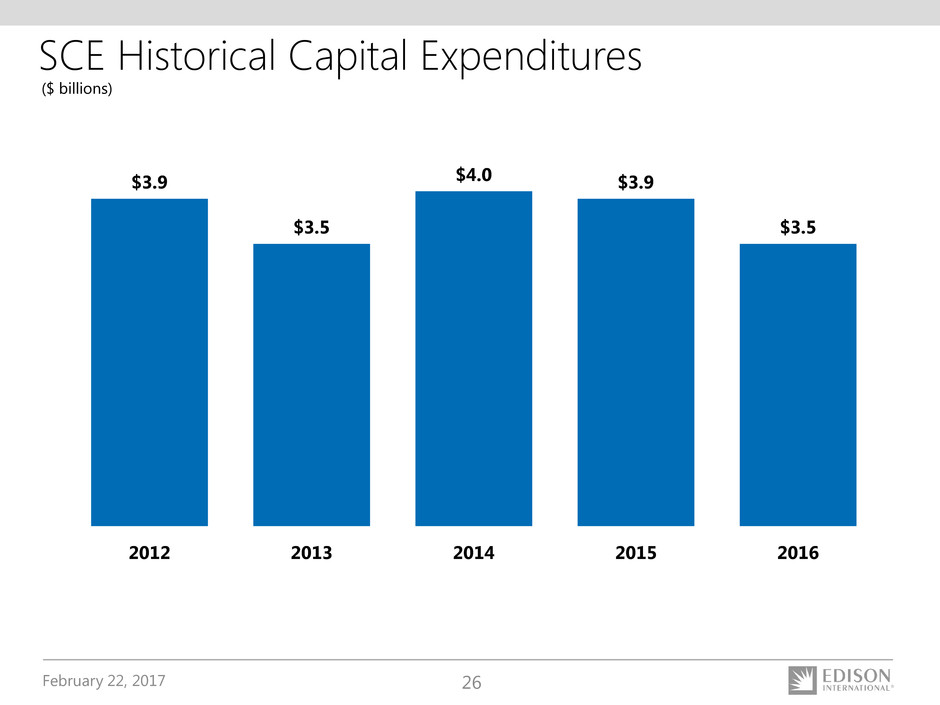

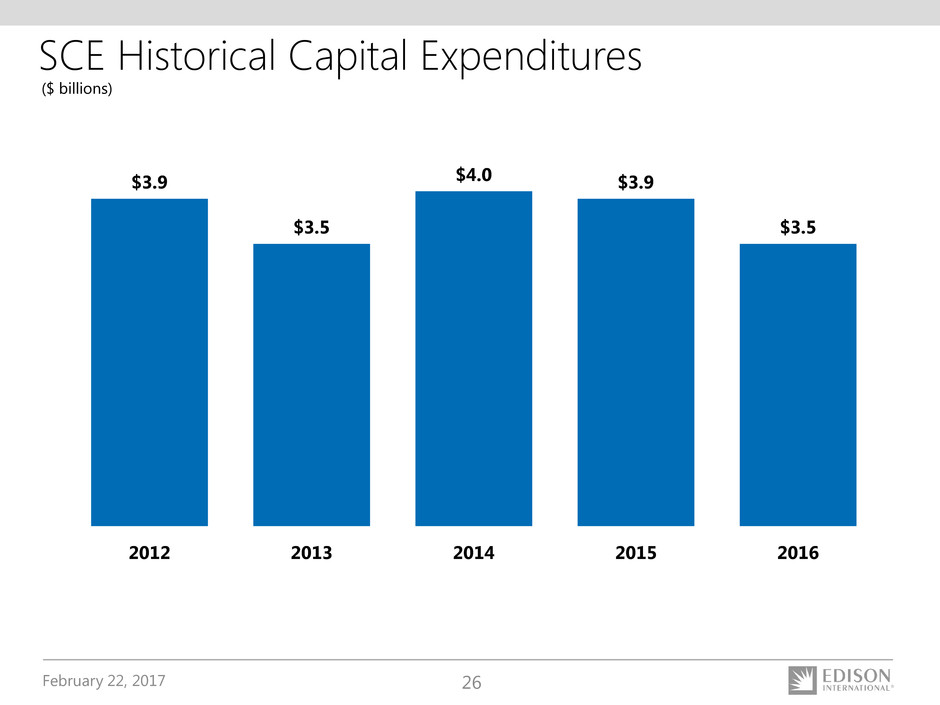

Historical Capital Expenditures 26 U

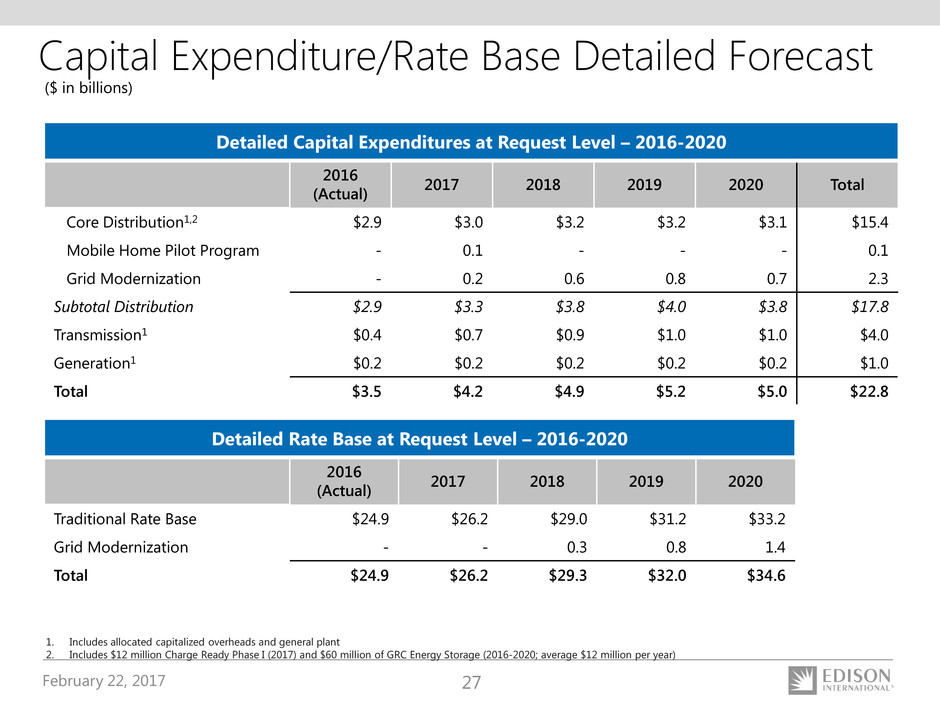

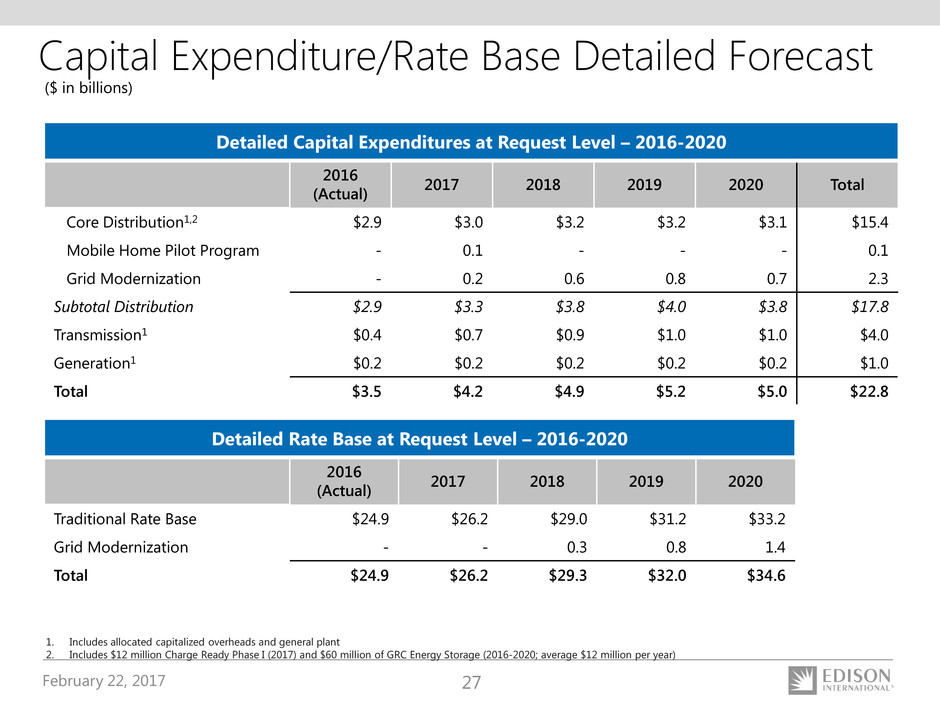

Capital Expenditure and Rate Base Detailed Forecast 27 U

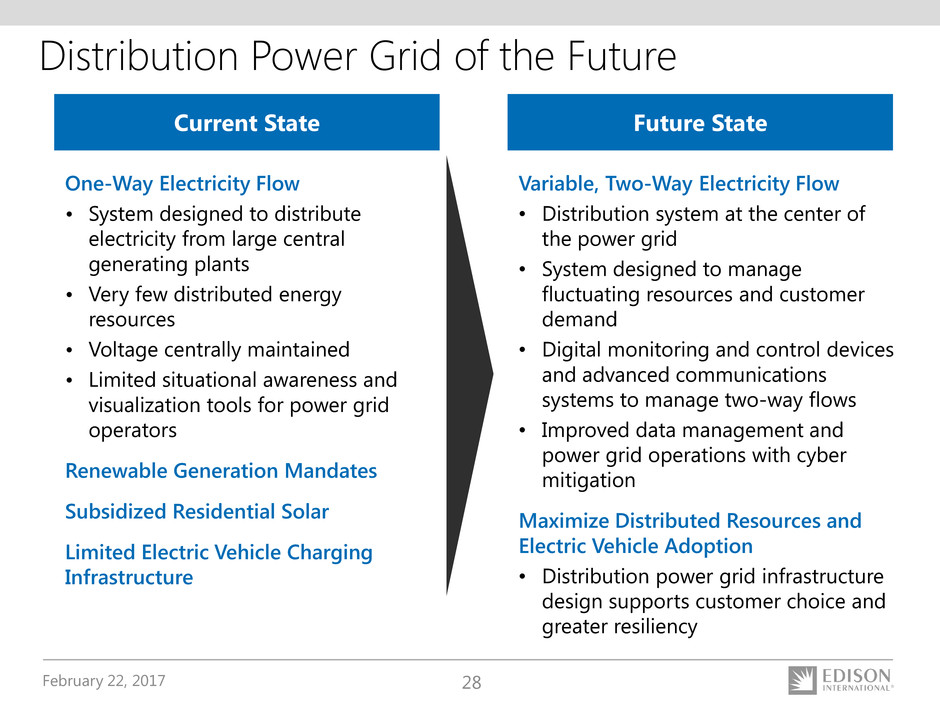

Power Grid of the Future, Grid Modernization 28-31 U

SCE Customer Demand Trends 32 U

California Energy Policy 33 U

SCE Bundled Revenue Requirement, System Average Rate Historical Growth 34-35 U

Residential Rate Reform and Other 36-38 U

SCE Rates and Bills Comparison 39 U

Fourth Quarter and Full Year 2016 Earnings Summary, Results of Operations, Non-GAAP Reconciliations 40-46 N,U

Table of Contents

February 22, 2017 3

EIX Strategy Should Produce Superior Value

Sustained Earnings and Dividend

Growth Led by SCE

Positioned for

Transformative Change

SCE Rate Base Growth Drives Earnings

• 8.6% average annual rate base

growth through 2020 at request level

• SCE earnings should track rate base

growth

Constructive Regulatory Structure

• Decoupling of electricity sales

• Balancing accounts

• Forward-looking ratemaking

Sustainable Dividend Growth

• Target dividend growth at a higher

than industry average within target

payout ratio of 45-55% of SCE

earnings

Wires-Focused SCE Strategy

• Infrastructure replacement –safety and

reliability

• Grid modernization –California’s low-

carbon goals

• Operational excellence

Edison Energy Group Strategy

• Energy as a service for large

commercial and industrial customers -

capital light business model

• Pursuing solar and competitive

transmission in select markets

February 22, 2017 4

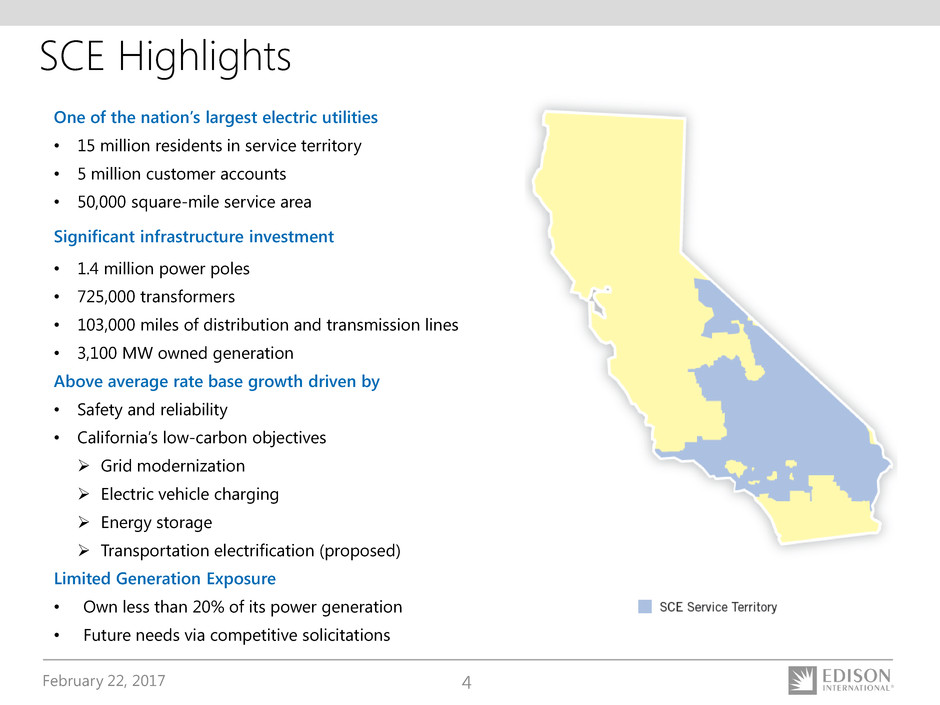

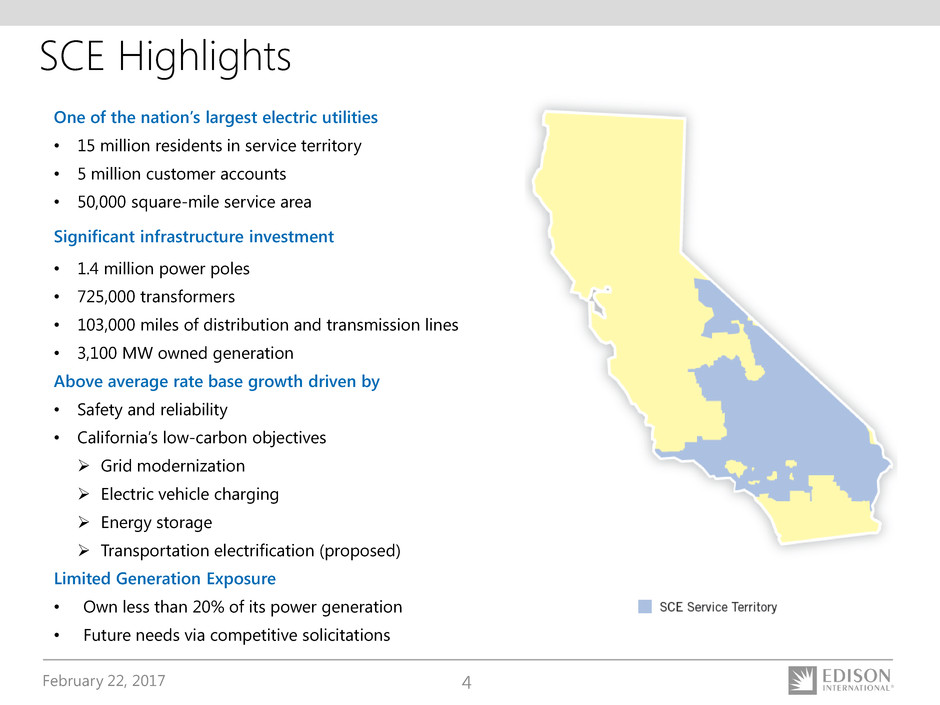

One of the nation’s largest electric utilities

• 15 million residents in service territory

• 5 million customer accounts

• 50,000 square-mile service area

Significant infrastructure investment

• 1.4 million power poles

• 725,000 transformers

• 103,000 miles of distribution and transmission lines

• 3,100 MW owned generation

Above average rate base growth driven by

• Safety and reliability

• California’s low-carbon objectives

Grid modernization

Electric vehicle charging

Energy storage

Transportation electrification (proposed)

Limited Generation Exposure

• Own less than 20% of its power generation

• Future needs via competitive solicitations

SCE Highlights

February 22, 2017 5

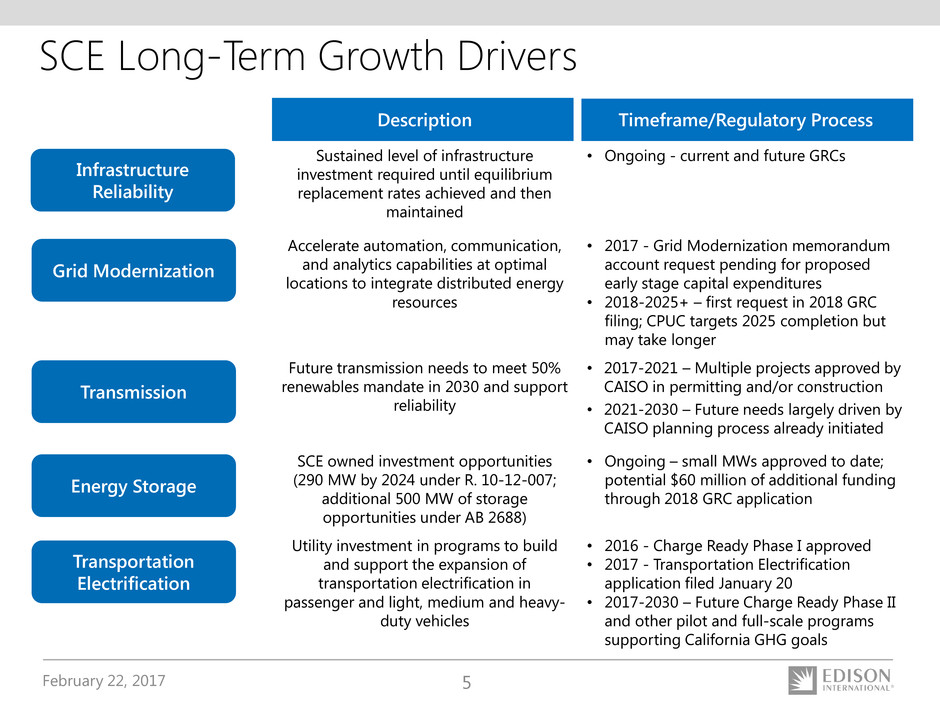

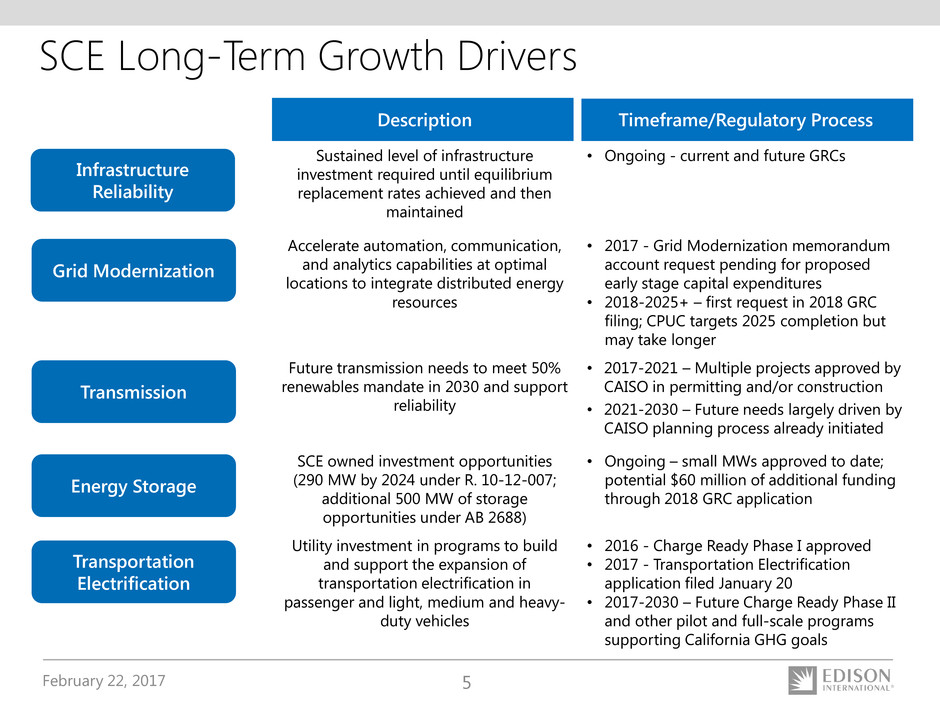

SCE Long-Term Growth Drivers

Description Timeframe/Regulatory Process

Sustained level of infrastructure

investment required until equilibrium

replacement rates achieved and then

maintained

• Ongoing - current and future GRCs

Accelerate automation, communication,

and analytics capabilities at optimal

locations to integrate distributed energy

resources

• 2017 - Grid Modernization memorandum

account request pending for proposed

early stage capital expenditures

• 2018-2025+ – first request in 2018 GRC

filing; CPUC targets 2025 completion but

may take longer

Future transmission needs to meet 50%

renewables mandate in 2030 and support

reliability

• 2017-2021 – Multiple projects approved by

CAISO in permitting and/or construction

• 2021-2030 – Future needs largely driven by

CAISO planning process already initiated

SCE owned investment opportunities

(290 MW by 2024 under R. 10-12-007;

additional 500 MW of storage

opportunities under AB 2688)

• Ongoing – small MWs approved to date;

potential $60 million of additional funding

through 2018 GRC application

Utility investment in programs to build

and support the expansion of

transportation electrification in

passenger and light, medium and heavy-

duty vehicles

• 2016 - Charge Ready Phase I approved

• 2017 - Transportation Electrification

application filed January 20

• 2017-2030 – Future Charge Ready Phase II

and other pilot and full-scale programs

supporting California GHG goals

Infrastructure

Reliability

Grid Modernization

Transportation

Electrification

Energy Storage

Transmission

February 22, 2017 6

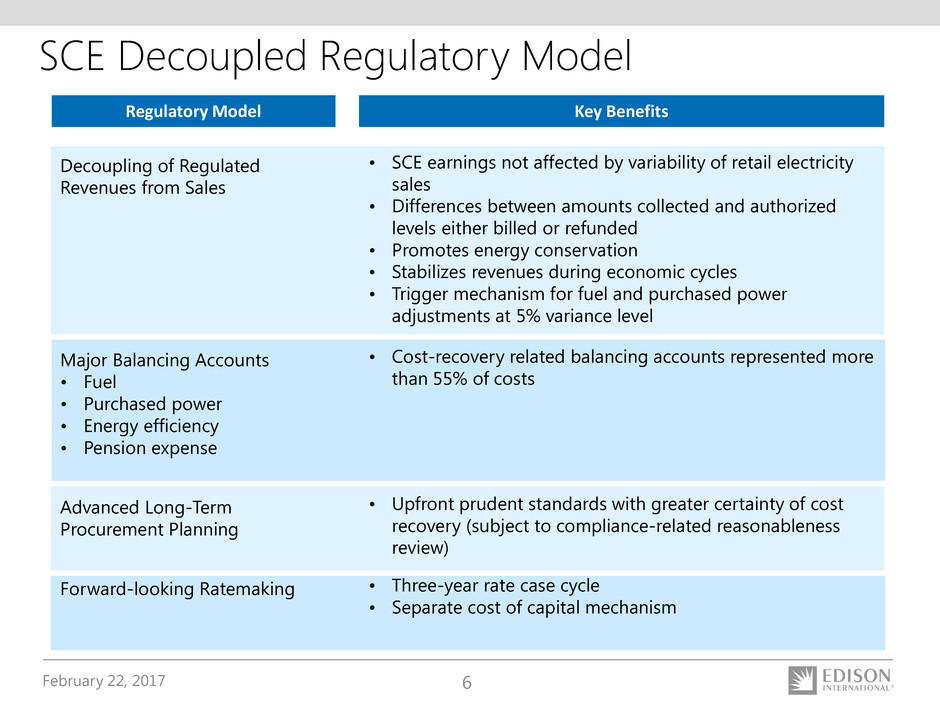

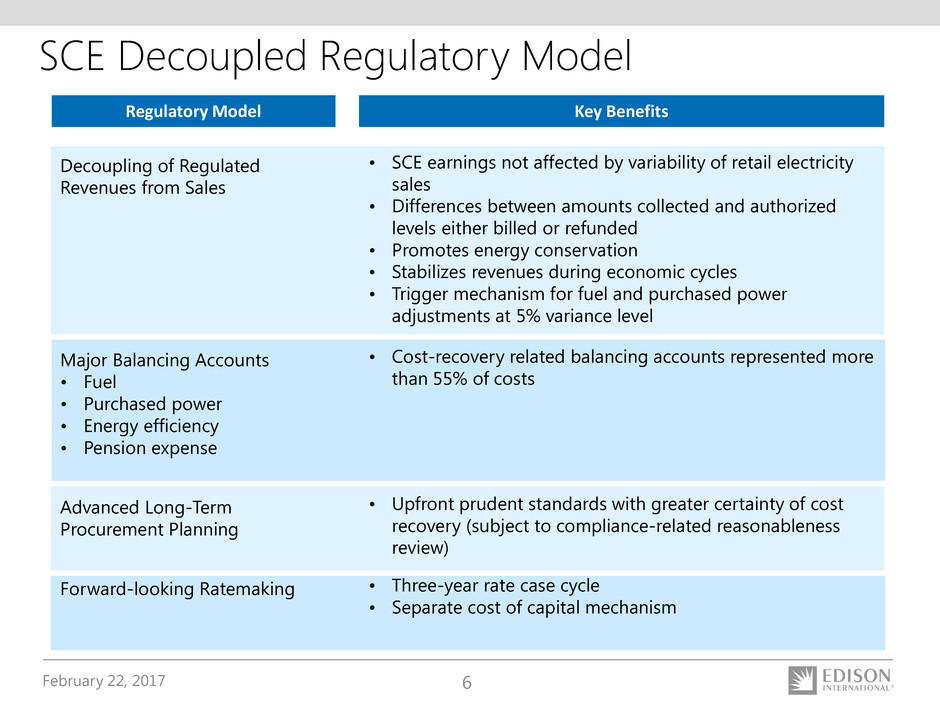

SCE Decoupled Regulatory Model

Decoupling of Regulated

Revenues from Sales

Major Balancing Accounts

• Fuel

• Purchased power

• Energy efficiency

• Pension expense

Advanced Long-Term

Procurement Planning

Forward-looking Ratemaking

• SCE earnings not affected by variability of retail electricity

sales

• Differences between amounts collected and authorized

levels either billed or refunded

• Promotes energy conservation

• Stabilizes revenues during economic cycles

• Trigger mechanism for fuel and purchased power

adjustments at 5% variance level

• Cost-recovery related balancing accounts represented more

than 55% of costs

• Upfront prudent standards with greater certainty of cost

recovery (subject to compliance-related reasonableness

review)

• Three-year rate case cycle

• Separate cost of capital mechanism

Regulatory Model Key Benefits

February 22, 2017 7

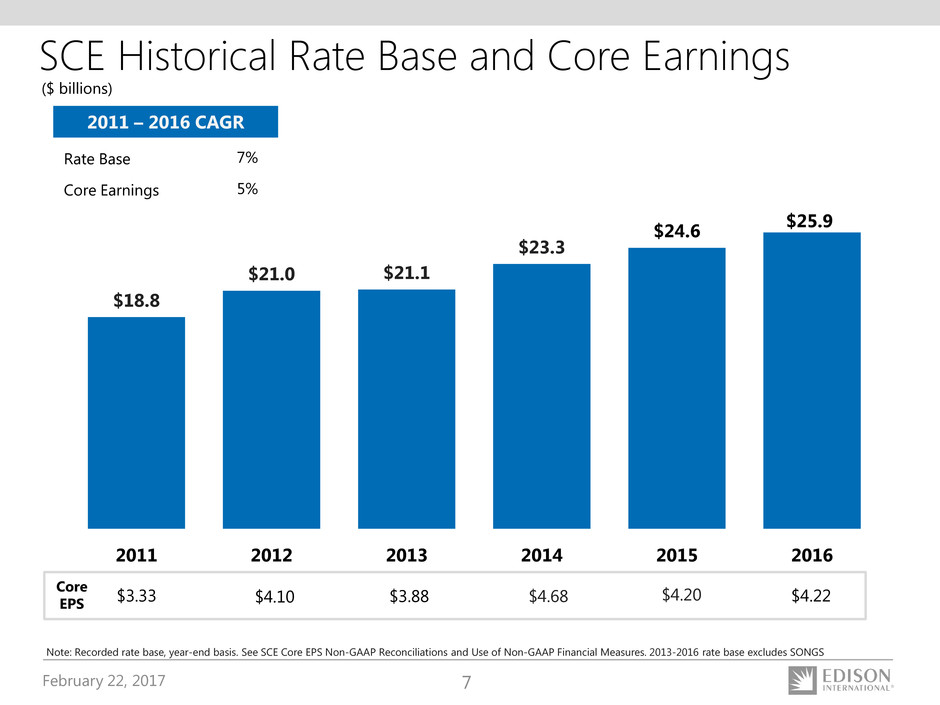

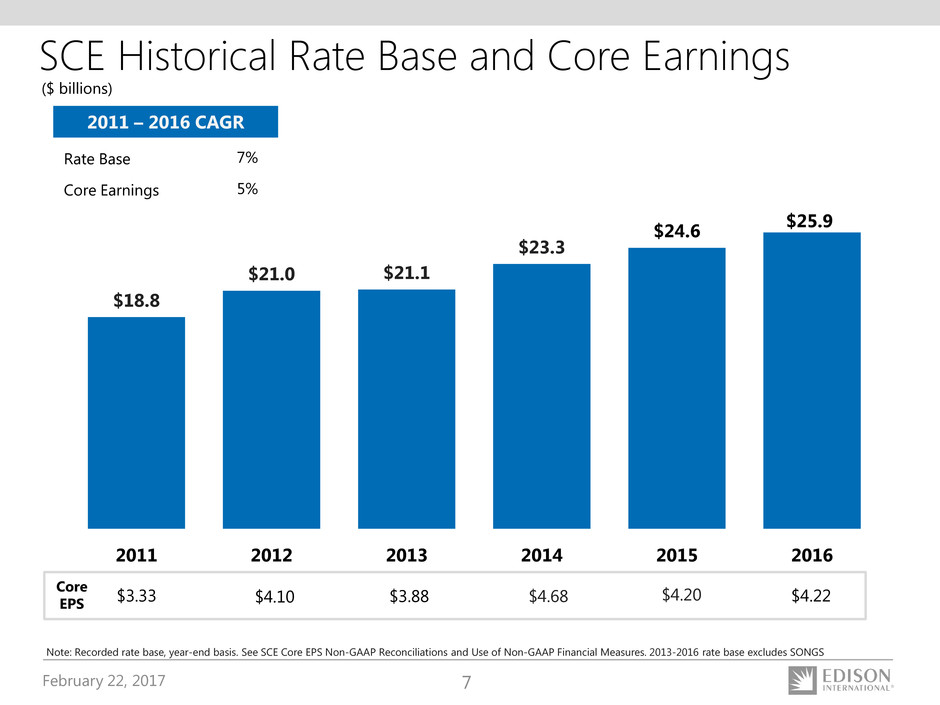

SCE Historical Rate Base and Core Earnings

Rate Base

Core Earnings

7%

5%

2011 – 2016 CAGR

($ billions)

Note: Recorded rate base, year-end basis. See SCE Core EPS Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures. 2013-2016 rate base excludes SONGS

$18.8

$21.0 $21.1

$23.3

$24.6 $25.9

2011 2012 2013 2014 2015 2016

$4.20$4.68$3.33 $4.10 $3.88

Core

EPS $4.22

February 22, 2017 8

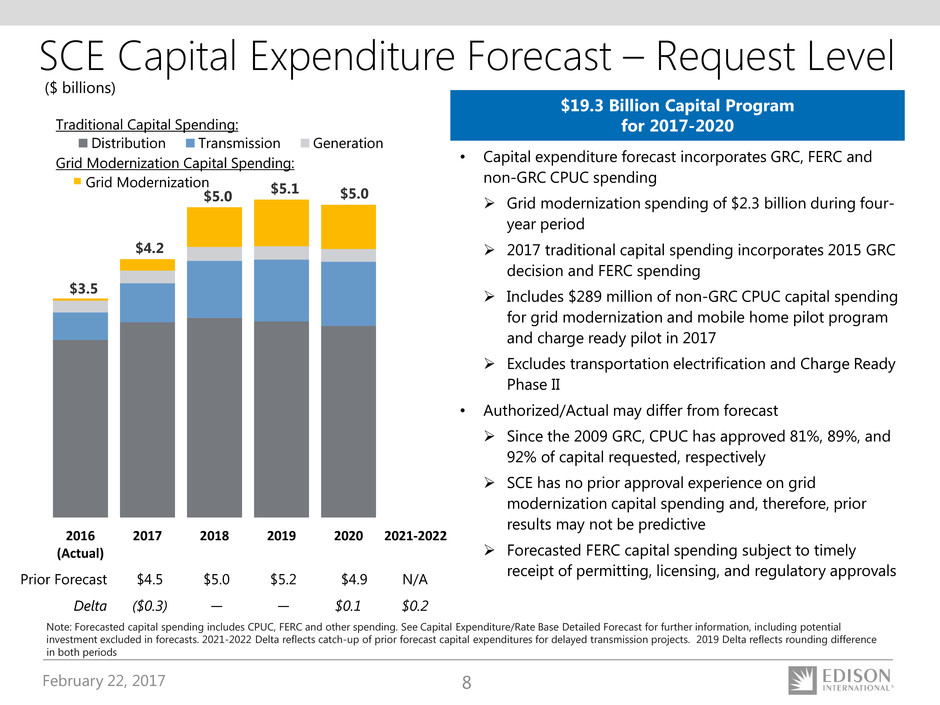

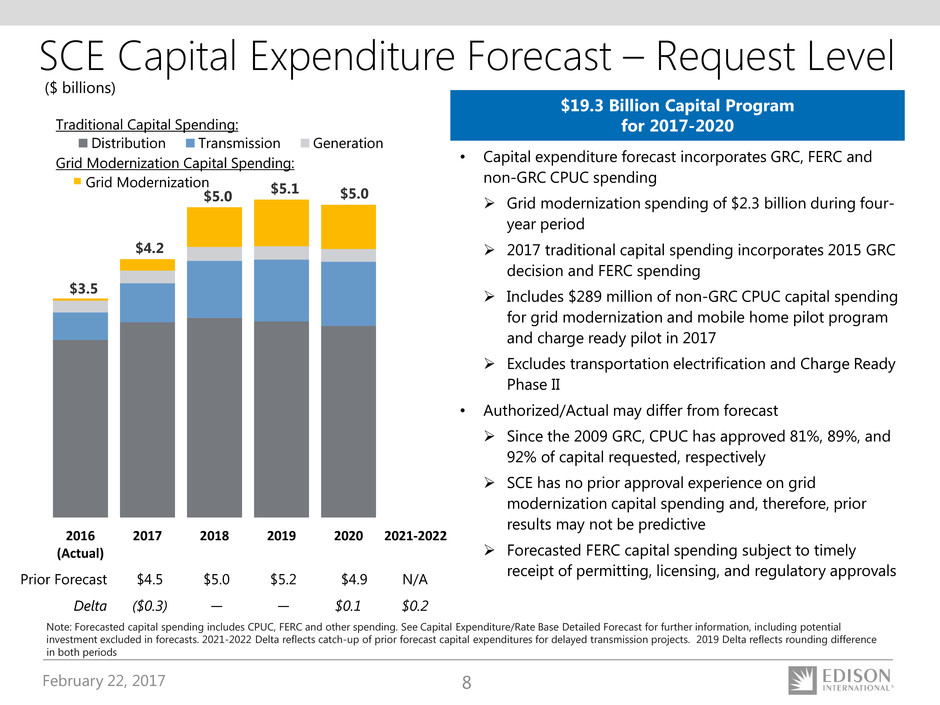

SCE Capital Expenditure Forecast – Request Level

Note: Forecasted capital spending includes CPUC, FERC and other spending. See Capital Expenditure/Rate Base Detailed Forecast for further information, including potential

investment excluded in forecasts. 2021-2022 Delta reflects catch-up of prior forecast capital expenditures for delayed transmission projects. 2019 Delta reflects rounding difference

in both periods

($ billions)

$19.3 Billion Capital Program

for 2017-2020

• Capital expenditure forecast incorporates GRC, FERC and

non-GRC CPUC spending

Grid modernization spending of $2.3 billion during four-

year period

2017 traditional capital spending incorporates 2015 GRC

decision and FERC spending

Includes $289 million of non-GRC CPUC capital spending

for grid modernization and mobile home pilot program

and charge ready pilot in 2017

Excludes transportation electrification and Charge Ready

Phase II

• Authorized/Actual may differ from forecast

Since the 2009 GRC, CPUC has approved 81%, 89%, and

92% of capital requested, respectively

SCE has no prior approval experience on grid

modernization capital spending and, therefore, prior

results may not be predictive

Forecasted FERC capital spending subject to timely

receipt of permitting, licensing, and regulatory approvalsPrior Forecast $4.5 $5.0 $5.2 $4.9 N/A

Delta ($0.3) — — $0.1 $0.2

$3.5

$4.2

$5.0 $5.1 $5.0

2016

(Actual)

2017 2018 2019 2020 2021-2022

Distribution Transmission Generation

Traditional Capital Spending:

Grid Modernization Capital Spending:

Grid Modernization

February 22, 2017 9

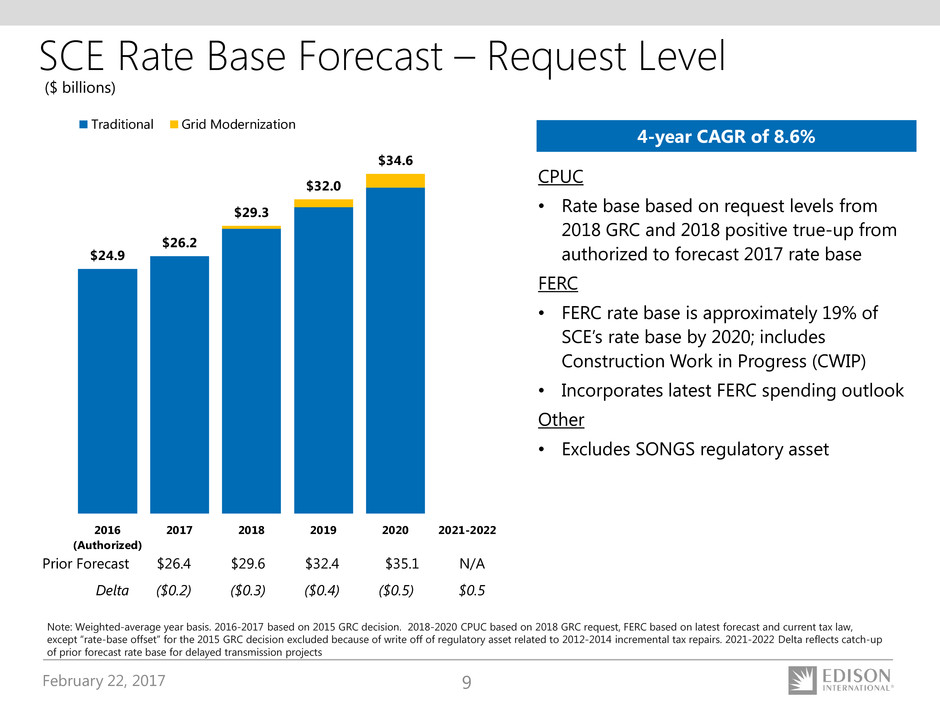

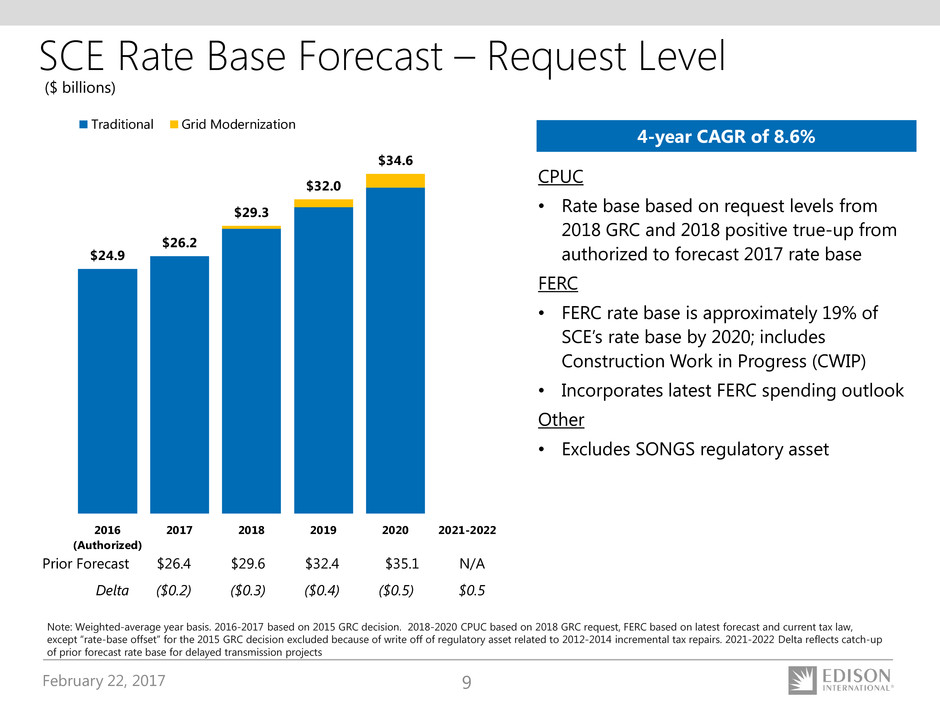

SCE Rate Base Forecast – Request Level

CPUC

• Rate base based on request levels from

2018 GRC and 2018 positive true-up from

authorized to forecast 2017 rate base

FERC

• FERC rate base is approximately 19% of

SCE’s rate base by 2020; includes

Construction Work in Progress (CWIP)

• Incorporates latest FERC spending outlook

Other

• Excludes SONGS regulatory asset

($ billions)

Note: Weighted-average year basis. 2016-2017 based on 2015 GRC decision. 2018-2020 CPUC based on 2018 GRC request, FERC based on latest forecast and current tax law,

except “rate-base offset” for the 2015 GRC decision excluded because of write off of regulatory asset related to 2012-2014 incremental tax repairs. 2021-2022 Delta reflects catch-up

of prior forecast rate base for delayed transmission projects

4-year CAGR of 8.6%

Prior Forecast $26.4 $29.6 $32.4 $35.1 N/A

Delta ($0.2) ($0.3) ($0.4) ($0.5) $0.5

$24.9

$26.2

$29.3

$32.0

$34.6

2016

(Authorized)

2017 2018 2019 2020 2021-2022

Traditional Grid Modernization

February 22, 2017 10

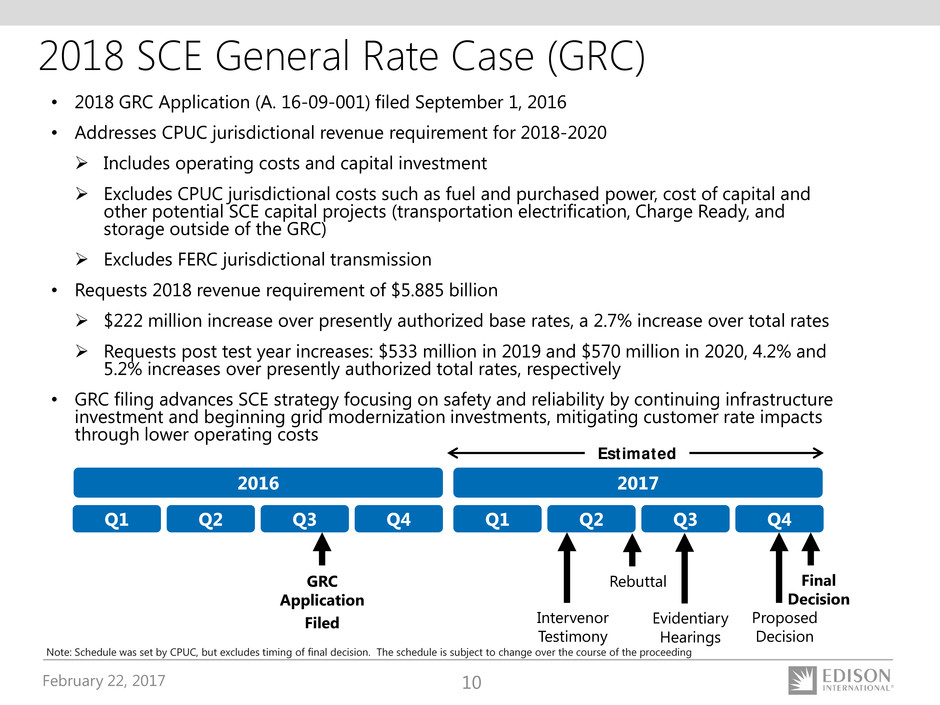

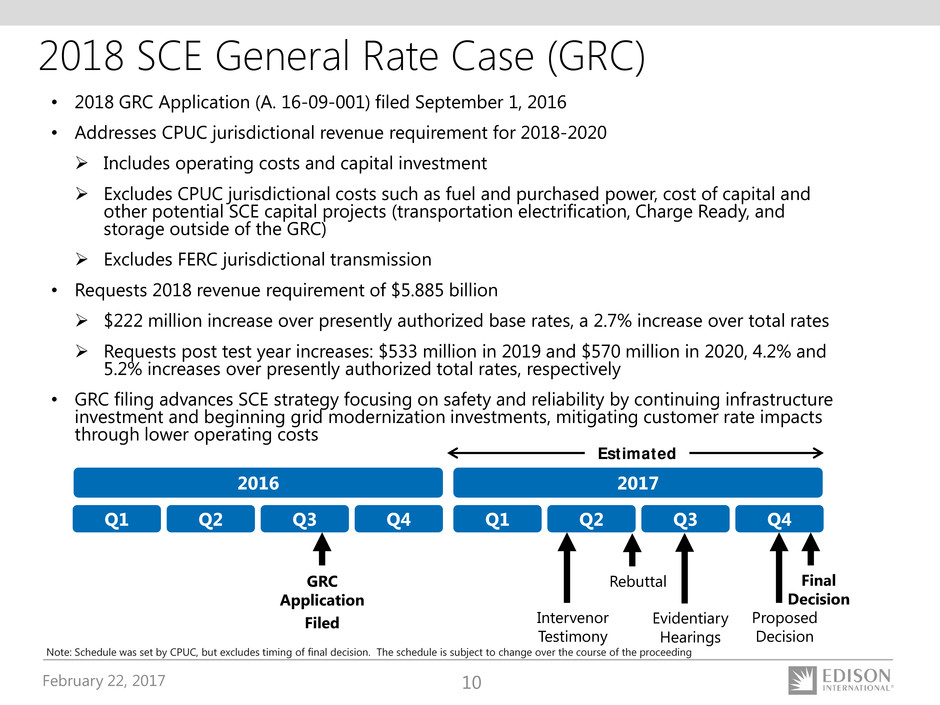

• 2018 GRC Application (A. 16-09-001) filed September 1, 2016

• Addresses CPUC jurisdictional revenue requirement for 2018-2020

Includes operating costs and capital investment

Excludes CPUC jurisdictional costs such as fuel and purchased power, cost of capital and

other potential SCE capital projects (transportation electrification, Charge Ready, and

storage outside of the GRC)

Excludes FERC jurisdictional transmission

• Requests 2018 revenue requirement of $5.885 billion

$222 million increase over presently authorized base rates, a 2.7% increase over total rates

Requests post test year increases: $533 million in 2019 and $570 million in 2020, 4.2% and

5.2% increases over presently authorized total rates, respectively

• GRC filing advances SCE strategy focusing on safety and reliability by continuing infrastructure

investment and beginning grid modernization investments, mitigating customer rate impacts

through lower operating costs

GRC

Application

Filed

Rebuttal Final

Decision

2016 2017

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Estimated

Intervenor

Testimony

Proposed

Decision

2018 SCE General Rate Case (GRC)

Evidentiary

Hearings

Note: Schedule was set by CPUC, but excludes timing of final decision. The schedule is subject to change over the course of the proceeding

February 22, 2017 11

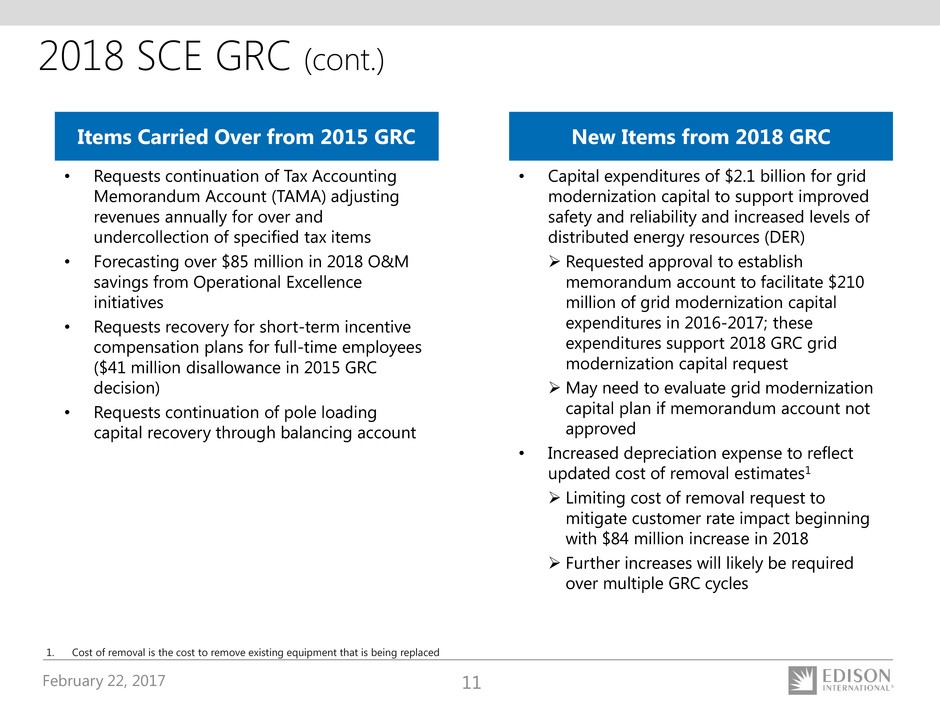

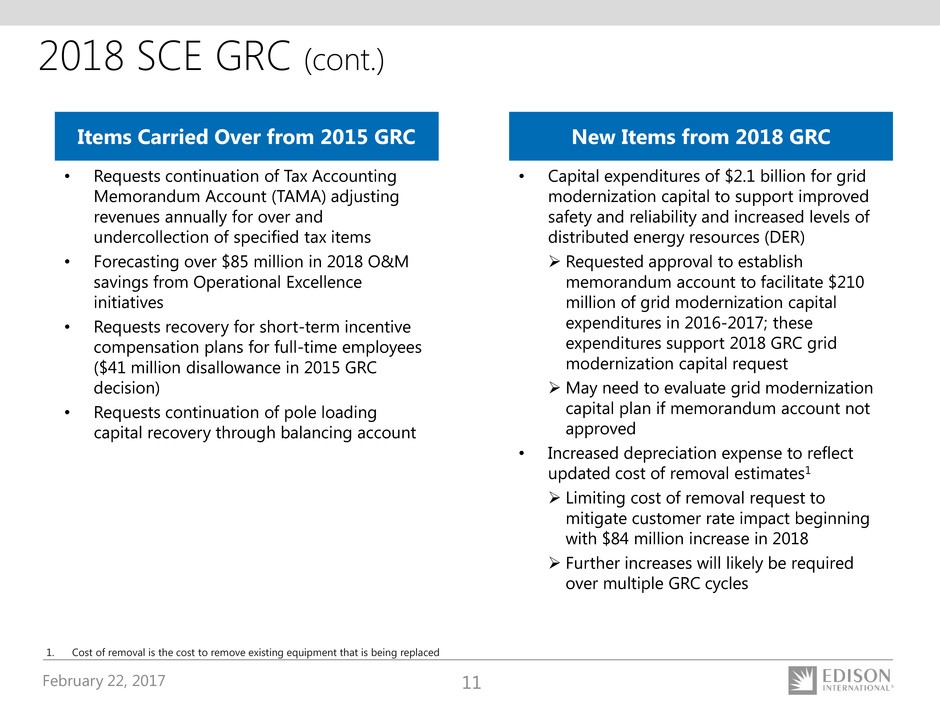

• Capital expenditures of $2.1 billion for grid

modernization capital to support improved

safety and reliability and increased levels of

distributed energy resources (DER)

Requested approval to establish

memorandum account to facilitate $210

million of grid modernization capital

expenditures in 2016-2017; these

expenditures support 2018 GRC grid

modernization capital request

May need to evaluate grid modernization

capital plan if memorandum account not

approved

• Increased depreciation expense to reflect

updated cost of removal estimates1

Limiting cost of removal request to

mitigate customer rate impact beginning

with $84 million increase in 2018

Further increases will likely be required

over multiple GRC cycles

Items Carried Over from 2015 GRC New Items from 2018 GRC

• Requests continuation of Tax Accounting

Memorandum Account (TAMA) adjusting

revenues annually for over and

undercollection of specified tax items

• Forecasting over $85 million in 2018 O&M

savings from Operational Excellence

initiatives

• Requests recovery for short-term incentive

compensation plans for full-time employees

($41 million disallowance in 2015 GRC

decision)

• Requests continuation of pole loading

capital recovery through balancing account

1. Cost of removal is the cost to remove existing equipment that is being replaced

2018 SCE GRC (cont.)

February 22, 2017 12

3

4

5

6

7

10/1/12 10/1/13 10/1/14 10/1/15 10/1/16 10/1/17 10/1/18 10/1/19

R

at

e

(%

)

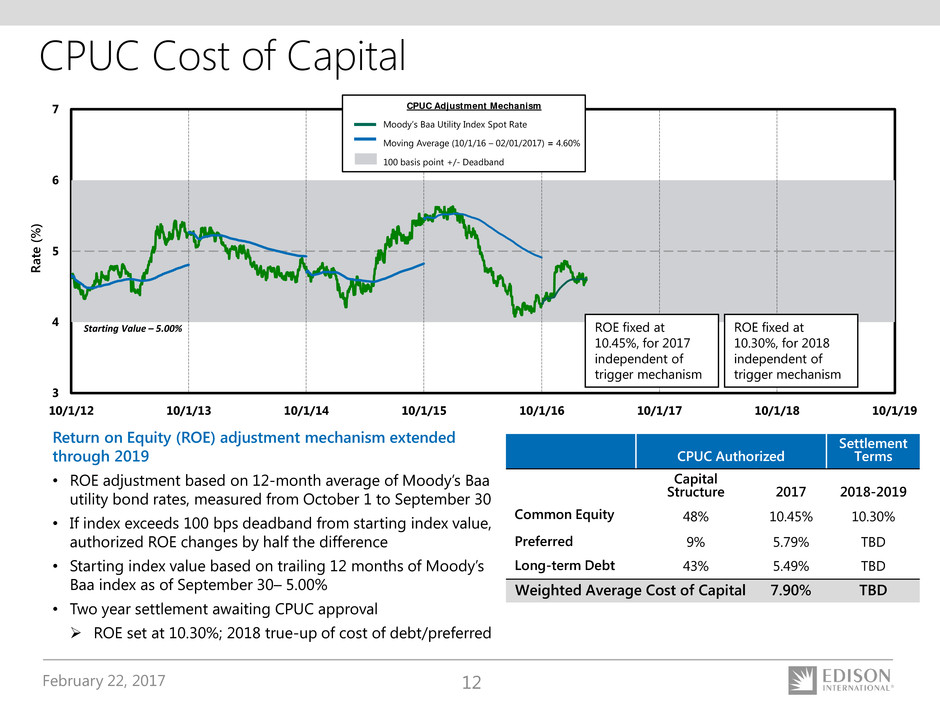

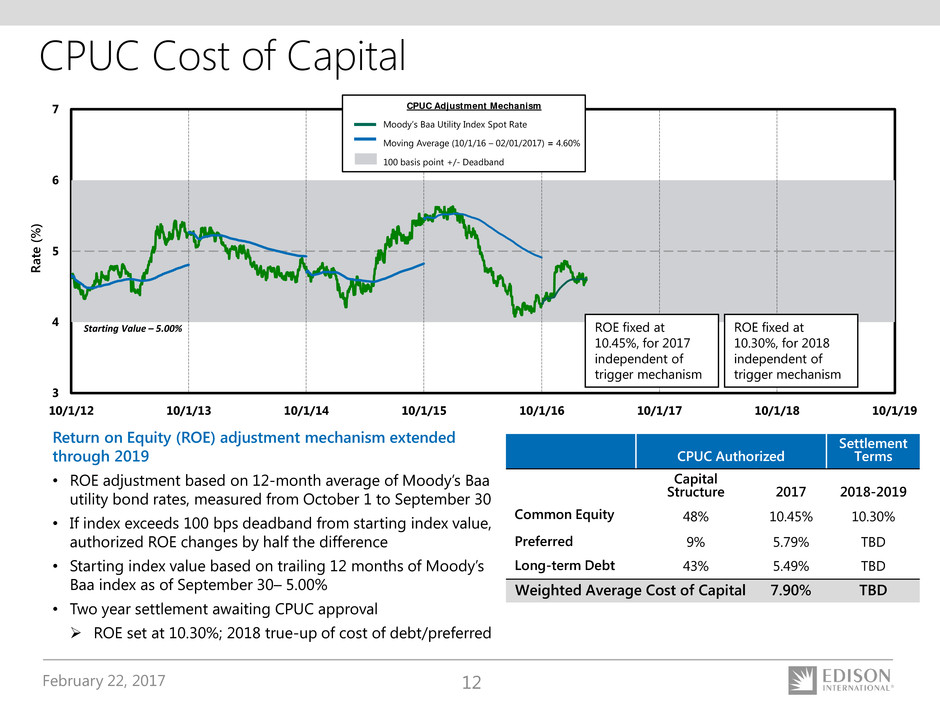

CPUC Cost of Capital

CPUC Adjustment Mechanism

Moody’s Baa Utility Index Spot Rate

Moving Average (10/1/16 – 02/01/2017) = 4.60%

100 basis point +/- Deadband

Starting Value – 5.00%

Return on Equity (ROE) adjustment mechanism extended

through 2019

• ROE adjustment based on 12-month average of Moody’s Baa

utility bond rates, measured from October 1 to September 30

• If index exceeds 100 bps deadband from starting index value,

authorized ROE changes by half the difference

• Starting index value based on trailing 12 months of Moody’s

Baa index as of September 30– 5.00%

• Two year settlement awaiting CPUC approval

ROE set at 10.30%; 2018 true-up of cost of debt/preferred

CPUC Authorized

Settlement

Terms

Capital

Structure 2017 2018-2019

Common Equity 48% 10.45% 10.30%

Preferred 9% 5.79% TBD

Long-term Debt 43% 5.49% TBD

Weighted Average Cost of Capital 7.90% TBD

ROE fixed at

10.30%, for 2018

independent of

trigger mechanism

ROE fixed at

10.45%, for 2017

independent of

trigger mechanism

February 22, 2017 13

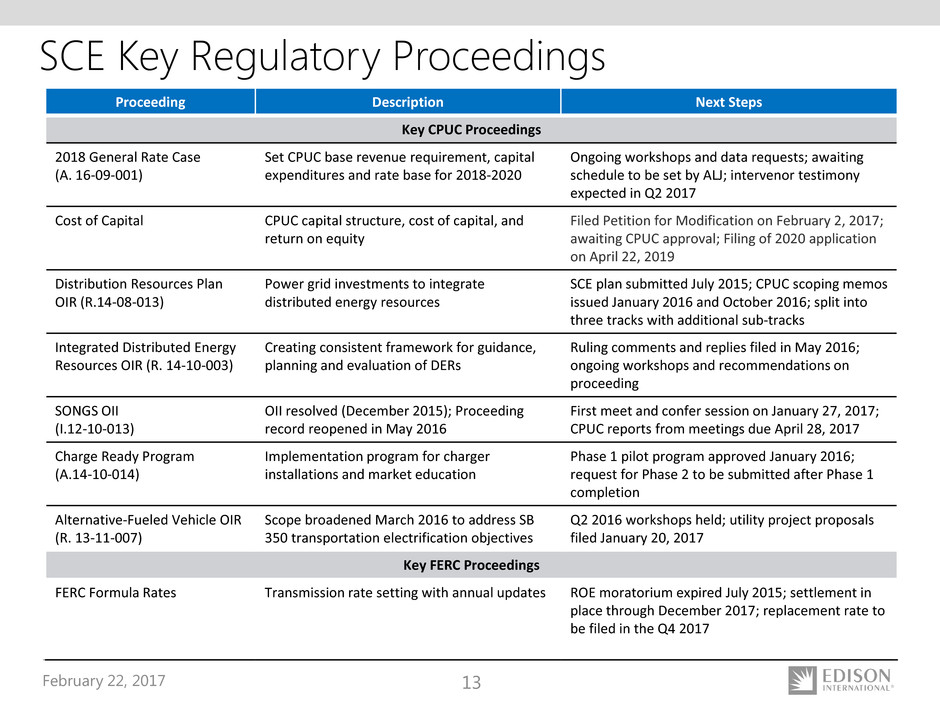

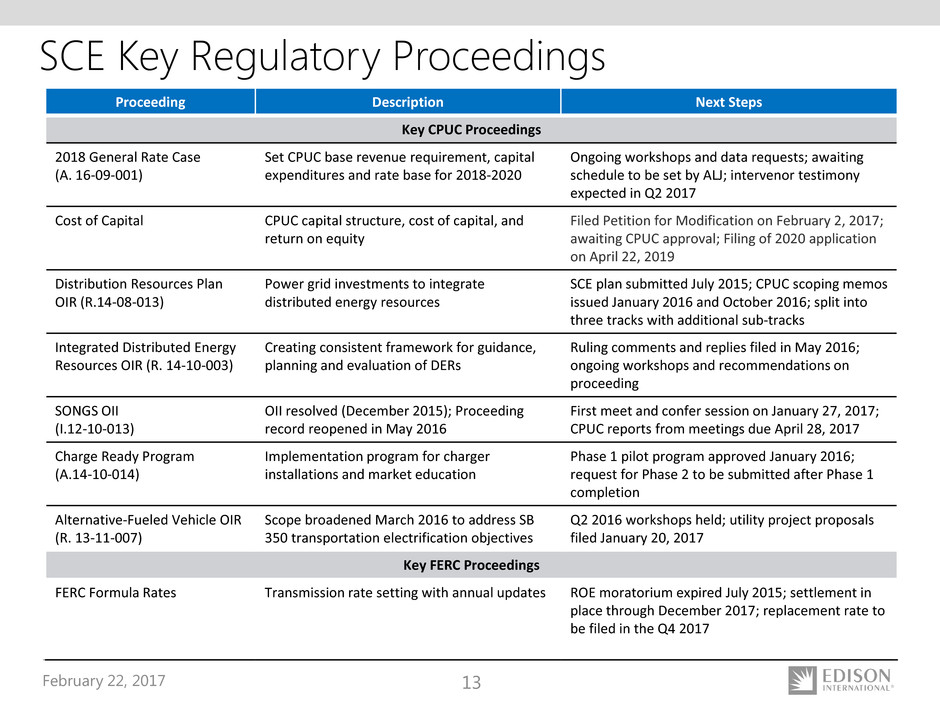

SCE Key Regulatory Proceedings

Proceeding Description Next Steps

Key CPUC Proceedings

2018 General Rate Case

(A. 16-09-001)

Set CPUC base revenue requirement, capital

expenditures and rate base for 2018-2020

Ongoing workshops and data requests; awaiting

schedule to be set by ALJ; intervenor testimony

expected in Q2 2017

Cost of Capital CPUC capital structure, cost of capital, and

return on equity

Filed Petition for Modification on February 2, 2017;

awaiting CPUC approval; Filing of 2020 application

on April 22, 2019

Distribution Resources Plan

OIR (R.14-08-013)

Power grid investments to integrate

distributed energy resources

SCE plan submitted July 2015; CPUC scoping memos

issued January 2016 and October 2016; split into

three tracks with additional sub-tracks

Integrated Distributed Energy

Resources OIR (R. 14-10-003)

Creating consistent framework for guidance,

planning and evaluation of DERs

Ruling comments and replies filed in May 2016;

ongoing workshops and recommendations on

proceeding

SONGS OII

(I.12-10-013)

OII resolved (December 2015); Proceeding

record reopened in May 2016

First meet and confer session on January 27, 2017;

CPUC reports from meetings due April 28, 2017

Charge Ready Program

(A.14-10-014)

Implementation program for charger

installations and market education

Phase 1 pilot program approved January 2016;

request for Phase 2 to be submitted after Phase 1

completion

Alternative-Fueled Vehicle OIR

(R. 13-11-007)

Scope broadened March 2016 to address SB

350 transportation electrification objectives

Q2 2016 workshops held; utility project proposals

filed January 20, 2017

Key FERC Proceedings

FERC Formula Rates Transmission rate setting with annual updates ROE moratorium expired July 2015; settlement in

place through December 2017; replacement rate to

be filed in the Q4 2017

February 22, 2017 14

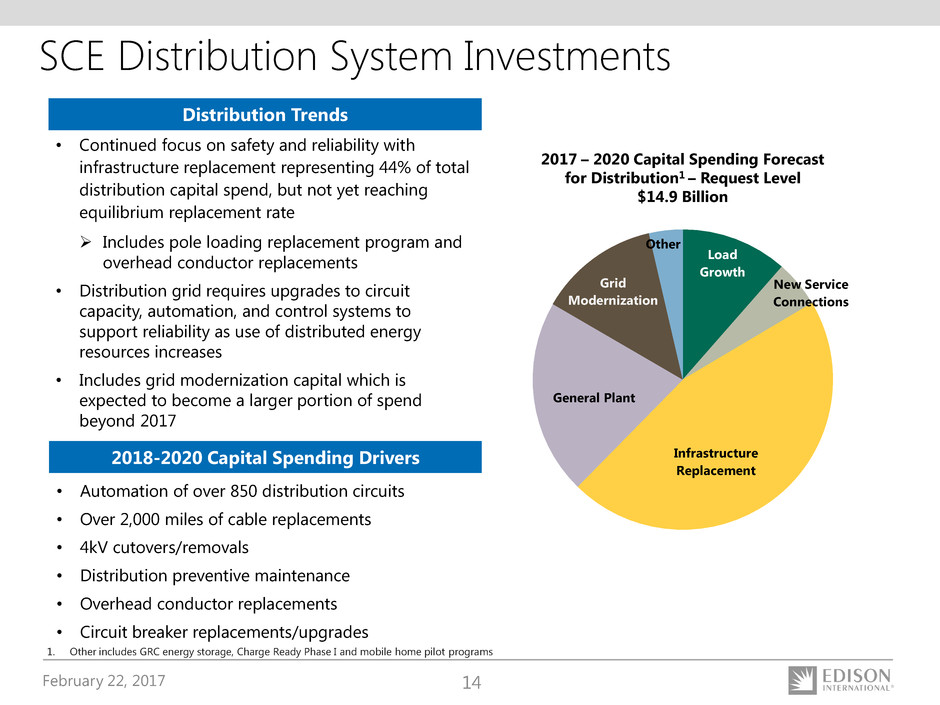

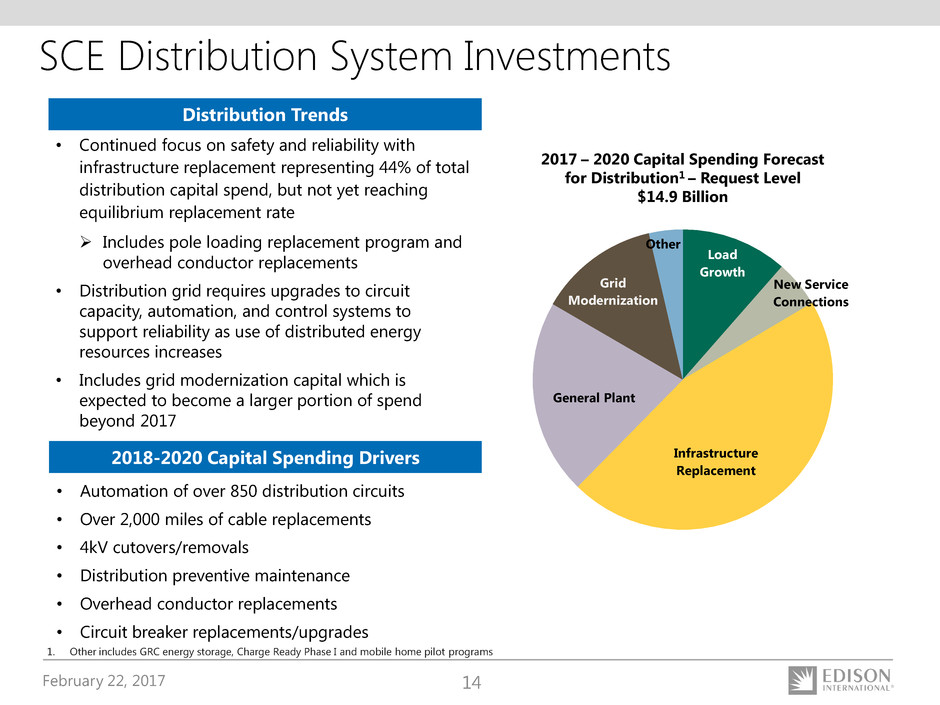

SCE Distribution System Investments

1. Other includes GRC energy storage, Charge Ready Phase I and mobile home pilot programs

Distribution Trends

• Continued focus on safety and reliability with

infrastructure replacement representing 44% of total

distribution capital spend, but not yet reaching

equilibrium replacement rate

Includes pole loading replacement program and

overhead conductor replacements

• Distribution grid requires upgrades to circuit

capacity, automation, and control systems to

support reliability as use of distributed energy

resources increases

• Includes grid modernization capital which is

expected to become a larger portion of spend

beyond 2017

2017 – 2020 Capital Spending Forecast

for Distribution1 – Request Level

$14.9 Billion

2018-2020 Capital Spending Drivers

• Automation of over 850 distribution circuits

• Over 2,000 miles of cable replacements

• 4kV cutovers/removals

• Distribution preventive maintenance

• Overhead conductor replacements

• Circuit breaker replacements/upgrades

Load

Growth

New Service

Connections

Infrastructure

Replacement

General Plant

Grid

Modernization

Other

February 22, 2017 15

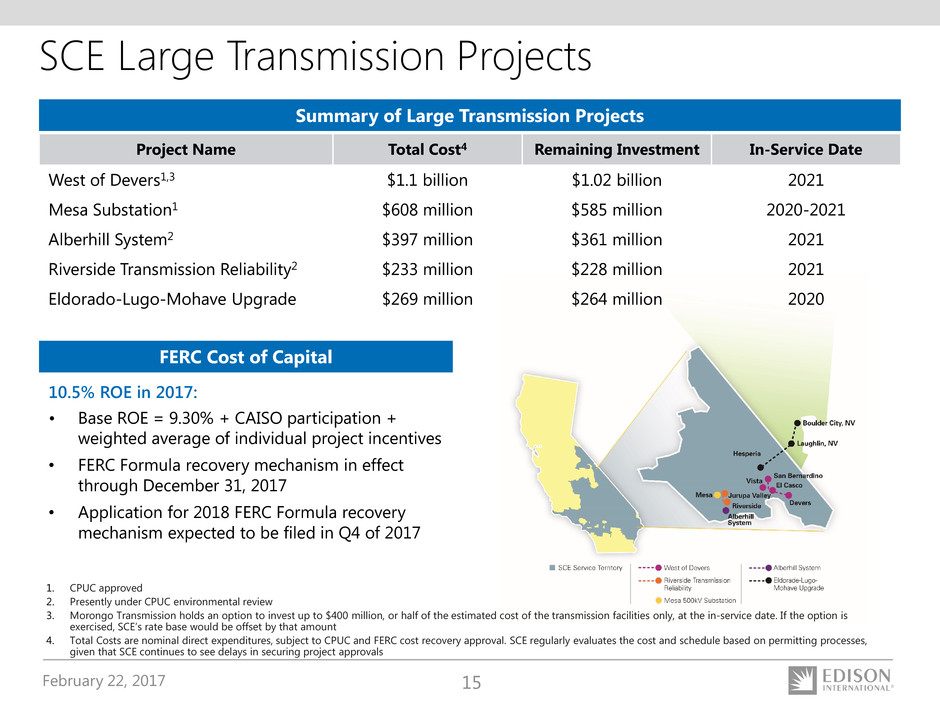

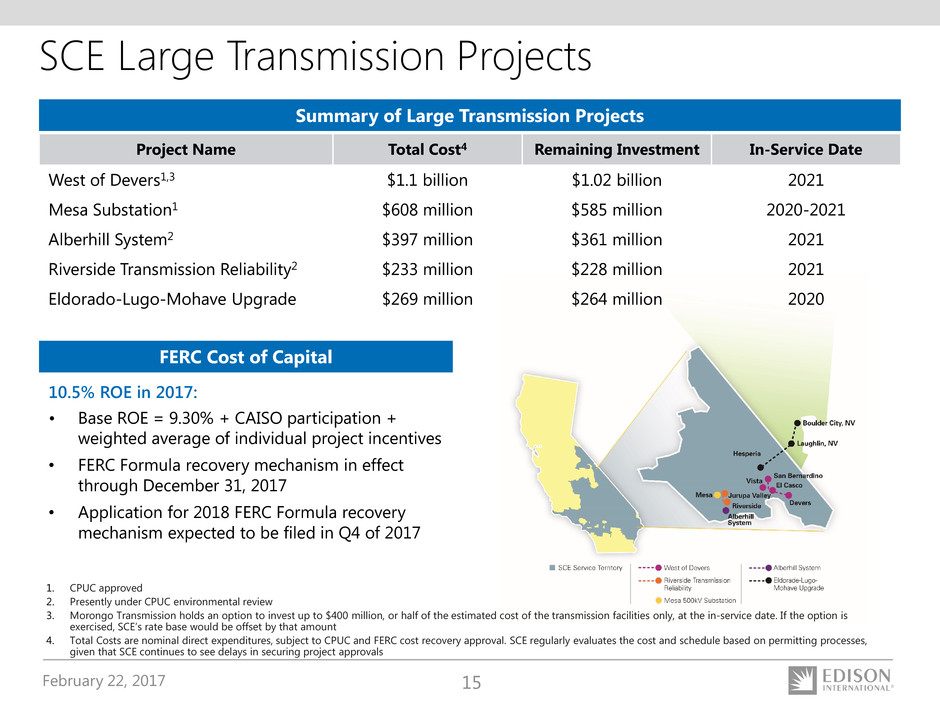

SCE Large Transmission Projects

1. CPUC approved

2. Presently under CPUC environmental review

3. Morongo Transmission holds an option to invest up to $400 million, or half of the estimated cost of the transmission facilities only, at the in-service date. If the option is

exercised, SCE’s rate base would be offset by that amount

4. Total Costs are nominal direct expenditures, subject to CPUC and FERC cost recovery approval. SCE regularly evaluates the cost and schedule based on permitting processes,

given that SCE continues to see delays in securing project approvals

FERC Cost of Capital

10.5% ROE in 2017:

• Base ROE = 9.30% + CAISO participation +

weighted average of individual project incentives

• FERC Formula recovery mechanism in effect

through December 31, 2017

• Application for 2018 FERC Formula recovery

mechanism expected to be filed in Q4 of 2017

Summary of Large Transmission Projects

Project Name Total Cost4 Remaining Investment In-Service Date

West of Devers1,3 $1.1 billion $1.02 billion 2021

Mesa Substation1 $608 million $585 million 2020-2021

Alberhill System2 $397 million $361 million 2021

Riverside Transmission Reliability2 $233 million $228 million 2021

Eldorado-Lugo-Mohave Upgrade $269 million $264 million 2020

February 22, 2017 16

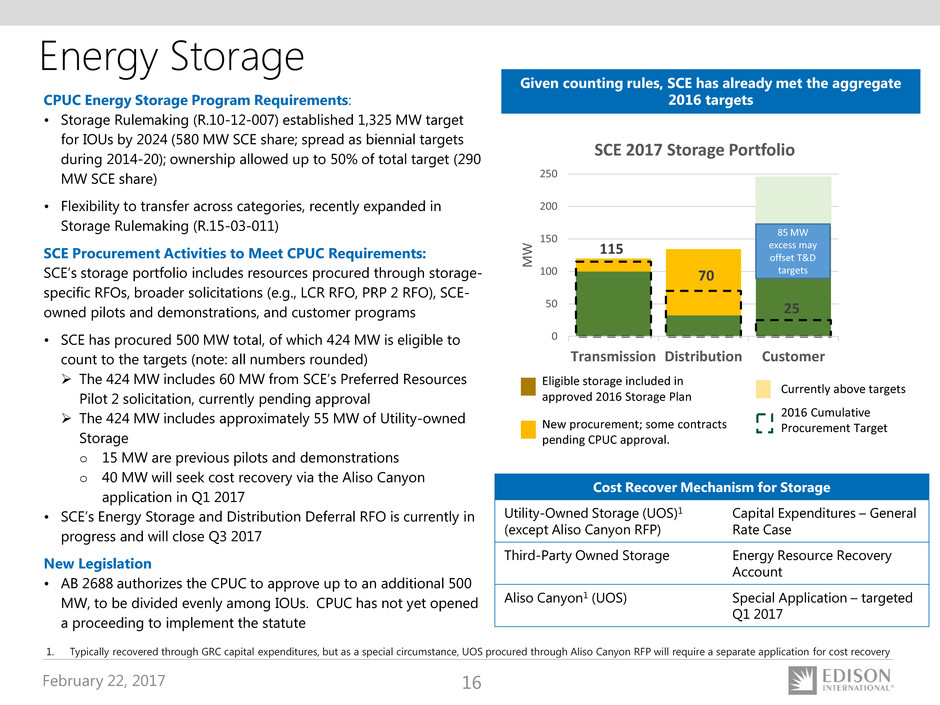

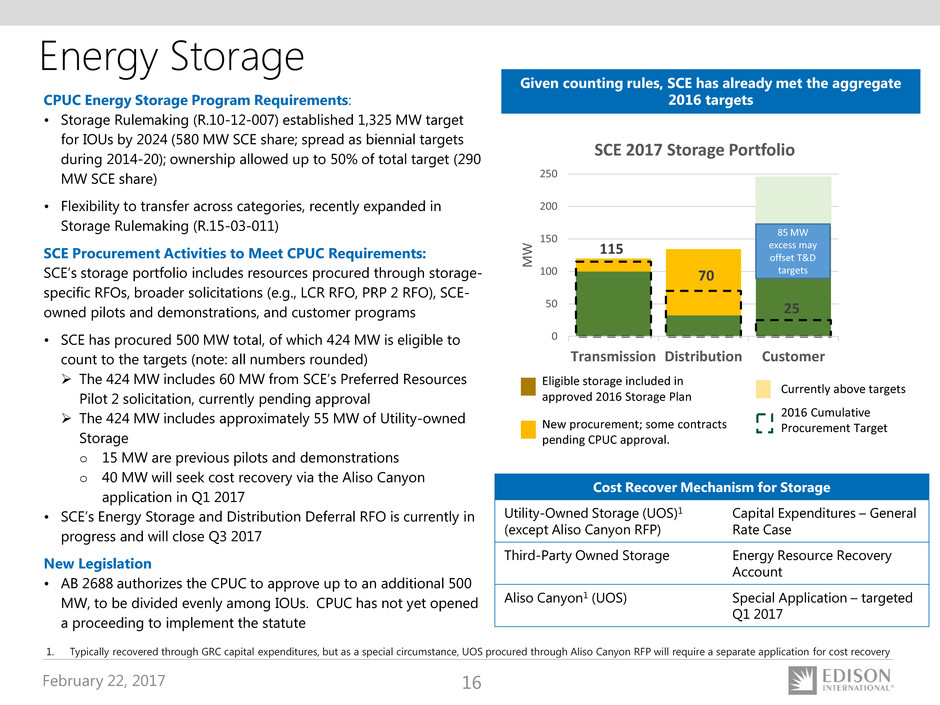

Energy Storage

Given counting rules, SCE has already met the aggregate

2016 targetsCPUC Energy Storage Program Requirements:

• Storage Rulemaking (R.10-12-007) established 1,325 MW target

for IOUs by 2024 (580 MW SCE share; spread as biennial targets

during 2014-20); ownership allowed up to 50% of total target (290

MW SCE share)

• Flexibility to transfer across categories, recently expanded in

Storage Rulemaking (R.15-03-011)

SCE Procurement Activities to Meet CPUC Requirements:

SCE’s storage portfolio includes resources procured through storage-

specific RFOs, broader solicitations (e.g., LCR RFO, PRP 2 RFO), SCE-

owned pilots and demonstrations, and customer programs

• SCE has procured 500 MW total, of which 424 MW is eligible to

count to the targets (note: all numbers rounded)

The 424 MW includes 60 MW from SCE’s Preferred Resources

Pilot 2 solicitation, currently pending approval

The 424 MW includes approximately 55 MW of Utility-owned

Storage

o 15 MW are previous pilots and demonstrations

o 40 MW will seek cost recovery via the Aliso Canyon

application in Q1 2017

• SCE’s Energy Storage and Distribution Deferral RFO is currently in

progress and will close Q3 2017

New Legislation

• AB 2688 authorizes the CPUC to approve up to an additional 500

MW, to be divided evenly among IOUs. CPUC has not yet opened

a proceeding to implement the statute

Cost Recover Mechanism for Storage

Utility-Owned Storage (UOS)1

(except Aliso Canyon RFP)

Capital Expenditures – General

Rate Case

Third-Party Owned Storage Energy Resource Recovery

Account

Aliso Canyon1 (UOS) Special Application – targeted

Q1 2017

1. Typically recovered through GRC capital expenditures, but as a special circumstance, UOS procured through Aliso Canyon RFP will require a separate application for cost recovery

115

70

25

0

50

100

150

200

250

Transmission Distribution Customer

M

W

SCE 2017 Storage Portfolio

85 MW

excess may

offset T&D

targets

Eligible storage included in

approved 2016 Storage Plan

New procurement; some contracts

pending CPUC approval.

Currently above targets

2016 Cumulative

Procurement Target

February 22, 2017 17

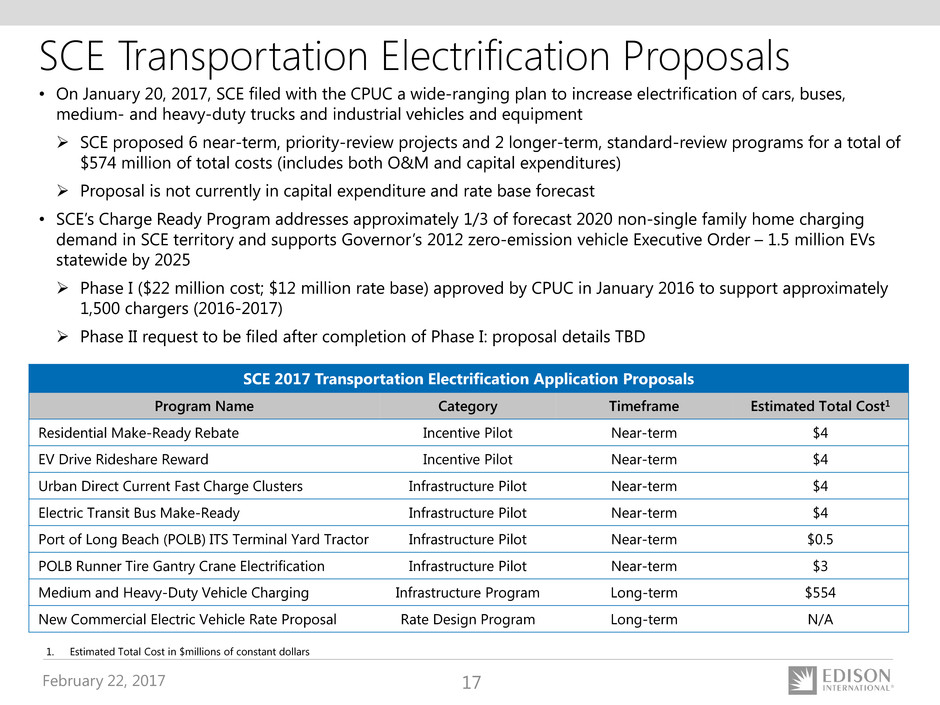

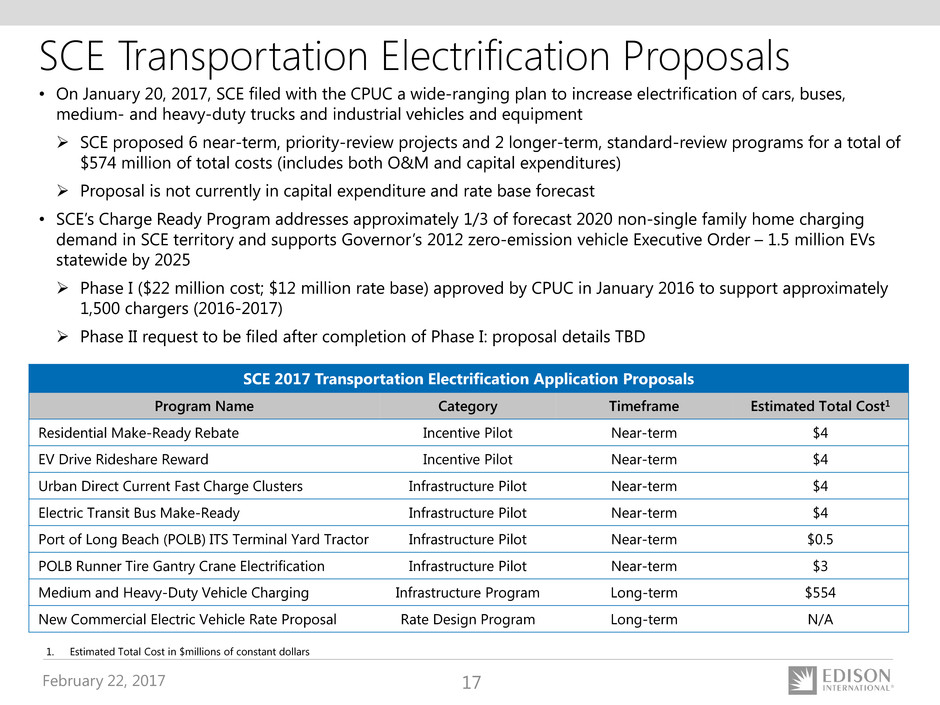

SCE Transportation Electrification Proposals

• On January 20, 2017, SCE filed with the CPUC a wide-ranging plan to increase electrification of cars, buses,

medium- and heavy-duty trucks and industrial vehicles and equipment

SCE proposed 6 near-term, priority-review projects and 2 longer-term, standard-review programs for a total of

$574 million of total costs (includes both O&M and capital expenditures)

Proposal is not currently in capital expenditure and rate base forecast

• SCE’s Charge Ready Program addresses approximately 1/3 of forecast 2020 non-single family home charging

demand in SCE territory and supports Governor’s 2012 zero-emission vehicle Executive Order – 1.5 million EVs

statewide by 2025

Phase I ($22 million cost; $12 million rate base) approved by CPUC in January 2016 to support approximately

1,500 chargers (2016-2017)

Phase II request to be filed after completion of Phase I: proposal details TBD

SCE 2017 Transportation Electrification Application Proposals

Program Name Category Timeframe Estimated Total Cost1

Residential Make-Ready Rebate Incentive Pilot Near-term $4

EV Drive Rideshare Reward Incentive Pilot Near-term $4

Urban Direct Current Fast Charge Clusters Infrastructure Pilot Near-term $4

Electric Transit Bus Make-Ready Infrastructure Pilot Near-term $4

Port of Long Beach (POLB) ITS Terminal Yard Tractor Infrastructure Pilot Near-term $0.5

POLB Runner Tire Gantry Crane Electrification Infrastructure Pilot Near-term $3

Medium and Heavy-Duty Vehicle Charging Infrastructure Program Long-term $554

New Commercial Electric Vehicle Rate Proposal Rate Design Program Long-term N/A

1. Estimated Total Cost in $millions of constant dollars

February 22, 2017 18

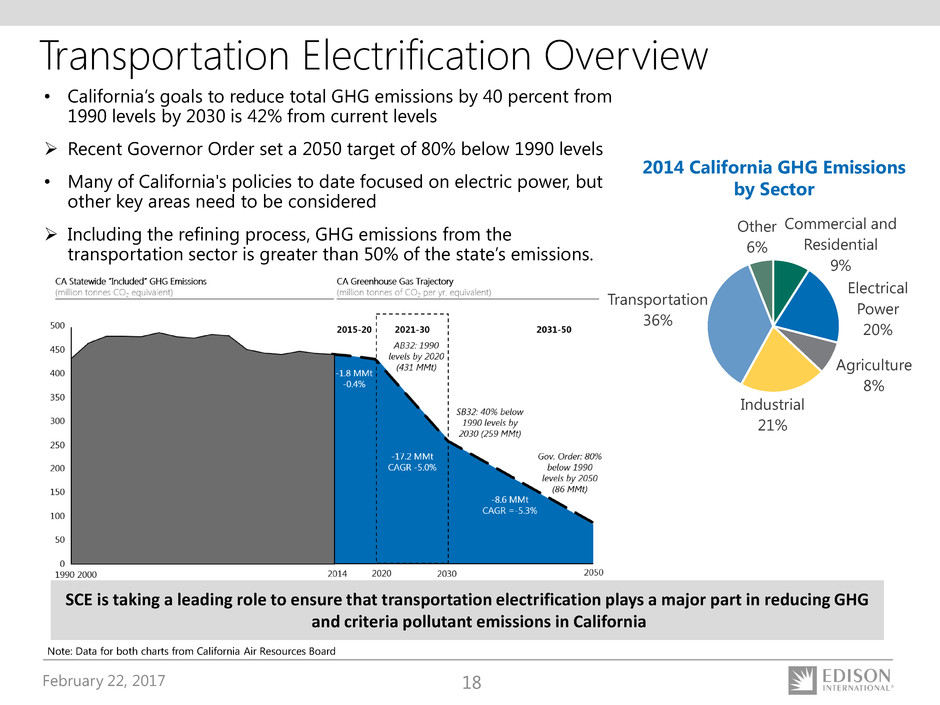

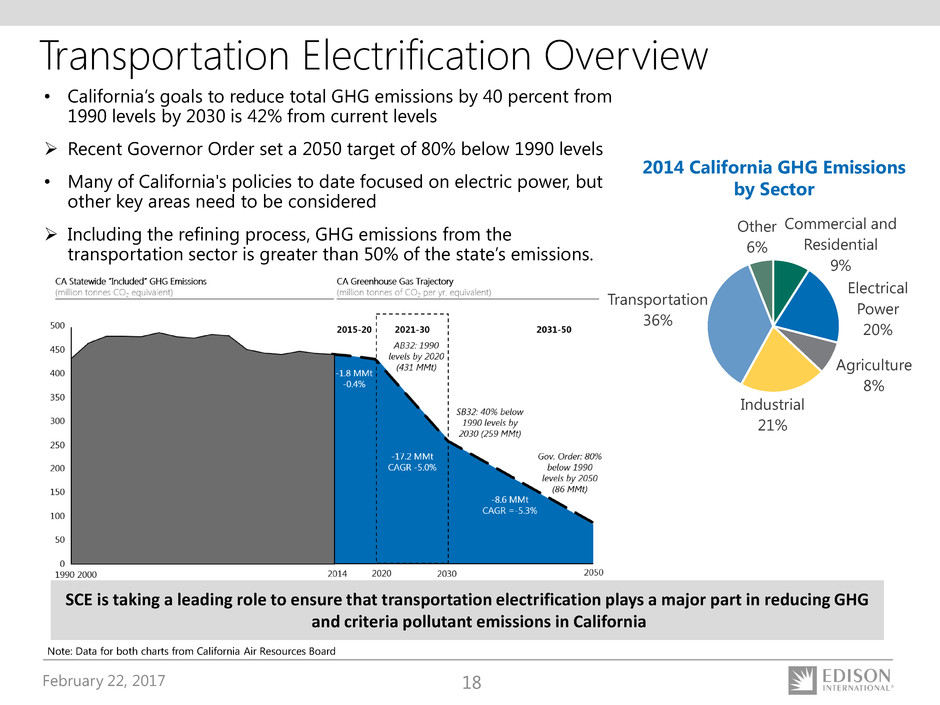

Transportation Electrification Overview

• California’s goals to reduce total GHG emissions by 40 percent from

1990 levels by 2030 is 42% from current levels

Recent Governor Order set a 2050 target of 80% below 1990 levels

• Many of California's policies to date focused on electric power, but

other key areas need to be considered

Including the refining process, GHG emissions from the

transportation sector is greater than 50% of the state’s emissions.

Commercial and

Residential

9%

Electrical

Power

20%

Agriculture

8%

Industrial

21%

Transportation

36%

Other

6%

SCE is taking a leading role to ensure that transportation electrification plays a major part in reducing GHG

and criteria pollutant emissions in California

2014 California GHG Emissions

by Sector

Note: Data for both charts from California Air Resources Board

February 22, 2017 19

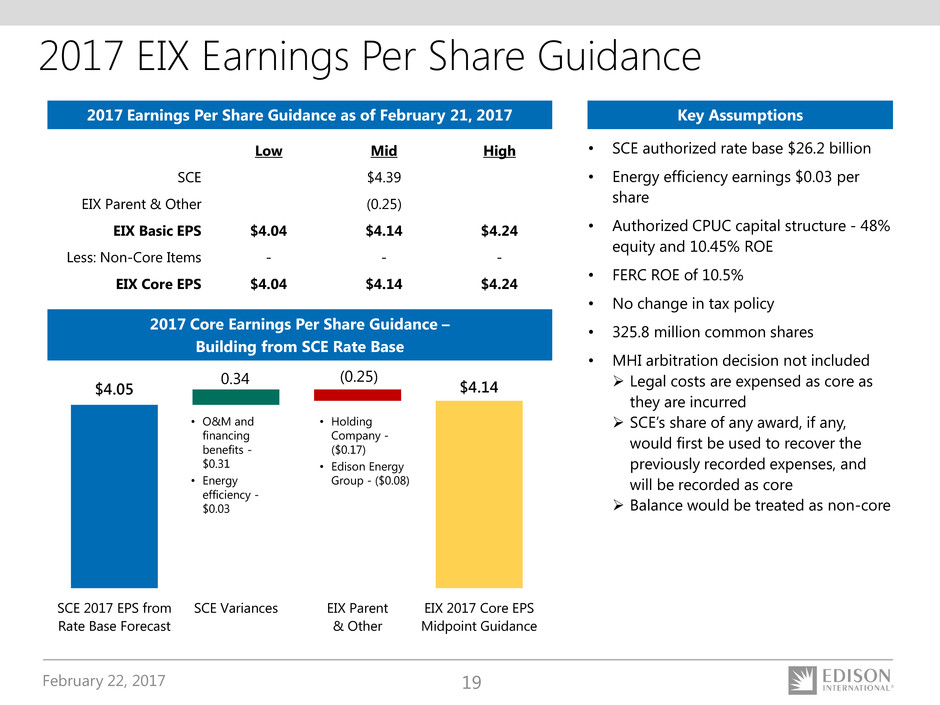

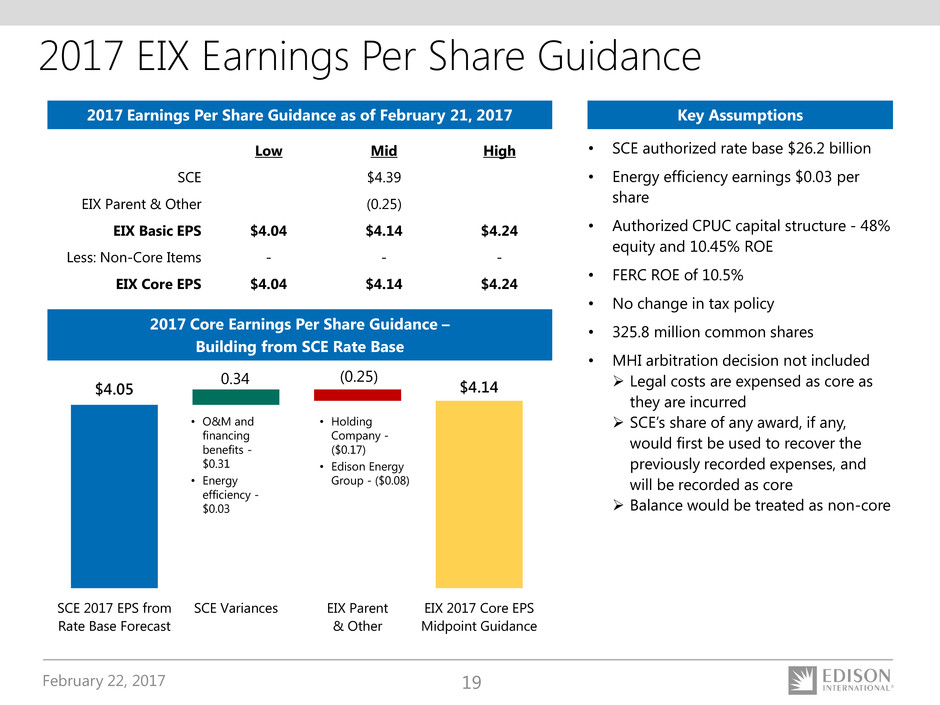

$4.05 $4.14

(0.25)0.34

SCE 2017 EPS from

Rate Base Forecast

SCE Variances EIX Parent

& Other

EIX 2017 Core EPS

Midpoint Guidance

• O&M and

financing

benefits -

$0.31

• Energy

efficiency -

$0.03

2017 Core Earnings Per Share Guidance –

Building from SCE Rate Base

• SCE authorized rate base $26.2 billion

• Energy efficiency earnings $0.03 per

share

• Authorized CPUC capital structure - 48%

equity and 10.45% ROE

• FERC ROE of 10.5%

• No change in tax policy

• 325.8 million common shares

• MHI arbitration decision not included

Legal costs are expensed as core as

they are incurred

SCE’s share of any award, if any,

would first be used to recover the

previously recorded expenses, and

will be recorded as core

Balance would be treated as non-core

Key Assumptions

Low Mid High

SCE $4.39

EIX Parent & Other (0.25)

EIX Basic EPS $4.04 $4.14 $4.24

Less: Non-Core Items - - -

EIX Core EPS $4.04 $4.14 $4.24

• Holding

Company -

($0.17)

• Edison Energy

Group - ($0.08)

2017 Earnings Per Share Guidance as of February 21, 2017

2017 EIX Earnings Per Share Guidance

February 22, 2017 20

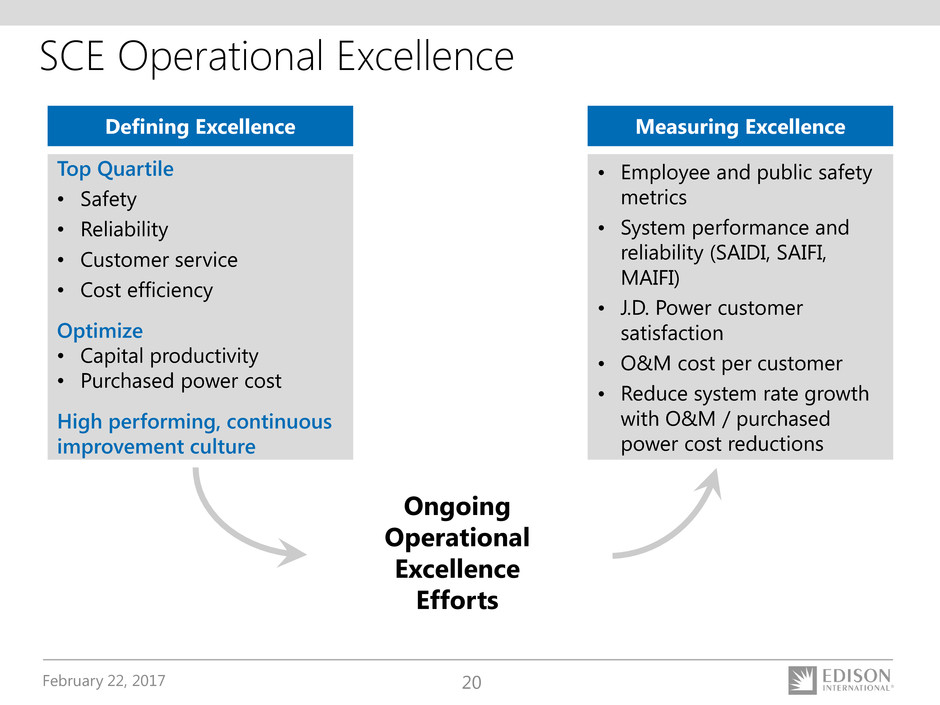

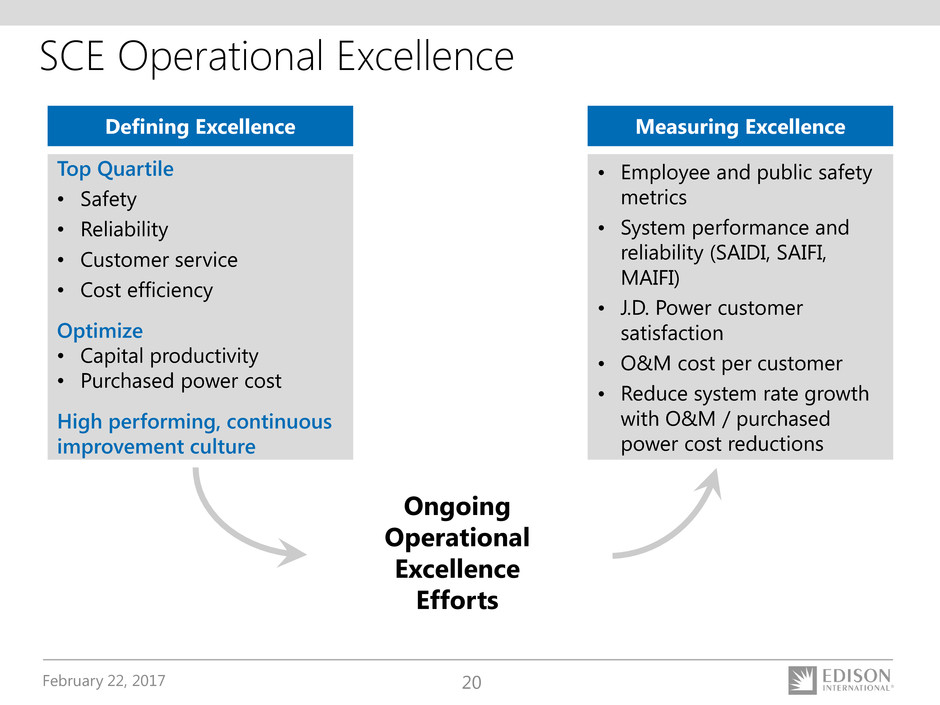

SCE Operational Excellence

Top Quartile

• Safety

• Reliability

• Customer service

• Cost efficiency

Optimize

• Capital productivity

• Purchased power cost

High performing, continuous

improvement culture

Defining Excellence Measuring Excellence

• Employee and public safety

metrics

• System performance and

reliability (SAIDI, SAIFI,

MAIFI)

• J.D. Power customer

satisfaction

• O&M cost per customer

• Reduce system rate growth

with O&M / purchased

power cost reductions

Ongoing

Operational

Excellence

Efforts

February 22, 2017 21

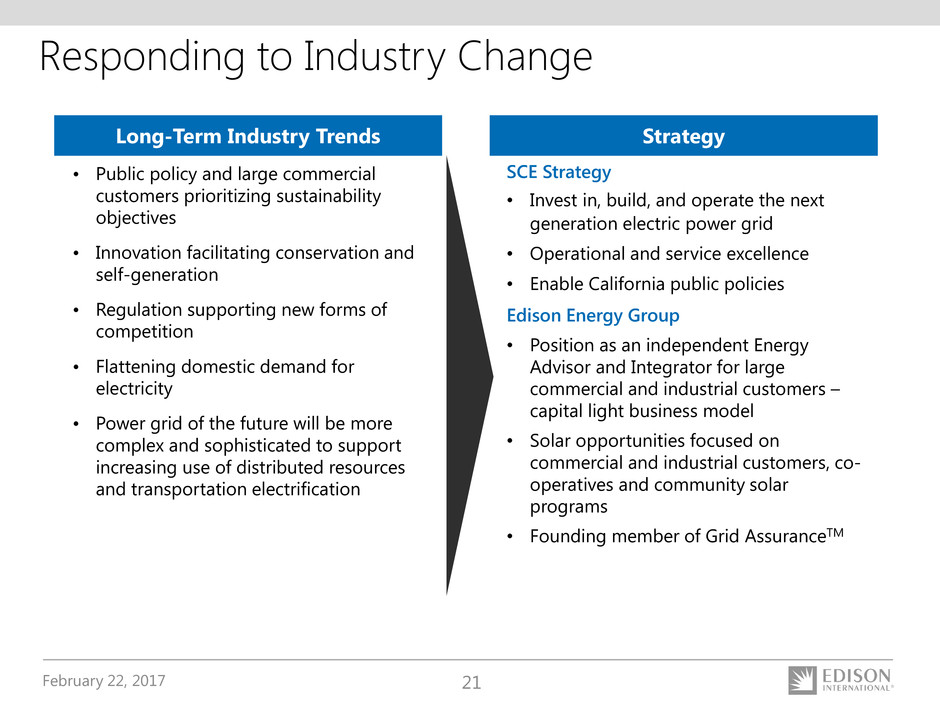

Responding to Industry Change

• Public policy and large commercial

customers prioritizing sustainability

objectives

• Innovation facilitating conservation and

self-generation

• Regulation supporting new forms of

competition

• Flattening domestic demand for

electricity

• Power grid of the future will be more

complex and sophisticated to support

increasing use of distributed resources

and transportation electrification

SCE Strategy

• Invest in, build, and operate the next

generation electric power grid

• Operational and service excellence

• Enable California public policies

Edison Energy Group

• Position as an independent Energy

Advisor and Integrator for large

commercial and industrial customers –

capital light business model

• Solar opportunities focused on

commercial and industrial customers, co-

operatives and community solar

programs

• Founding member of Grid AssuranceTM

Long-Term Industry Trends Strategy

February 22, 2017 22

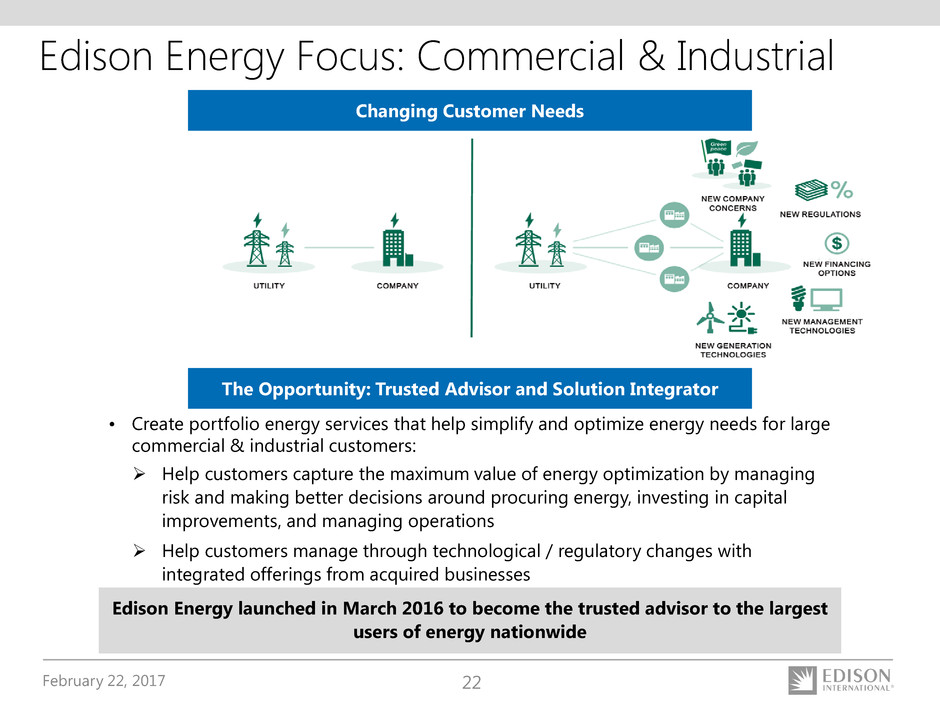

• Create portfolio energy services that help simplify and optimize energy needs for large

commercial & industrial customers:

Help customers capture the maximum value of energy optimization by managing

risk and making better decisions around procuring energy, investing in capital

improvements, and managing operations

Help customers manage through technological / regulatory changes with

integrated offerings from acquired businesses

Edison Energy launched in March 2016 to become the trusted advisor to the largest

users of energy nationwide

Changing Customer Needs

The Opportunity: Trusted Advisor and Solution Integrator

Edison Energy Focus: Commercial & Industrial

February 22, 2017 23

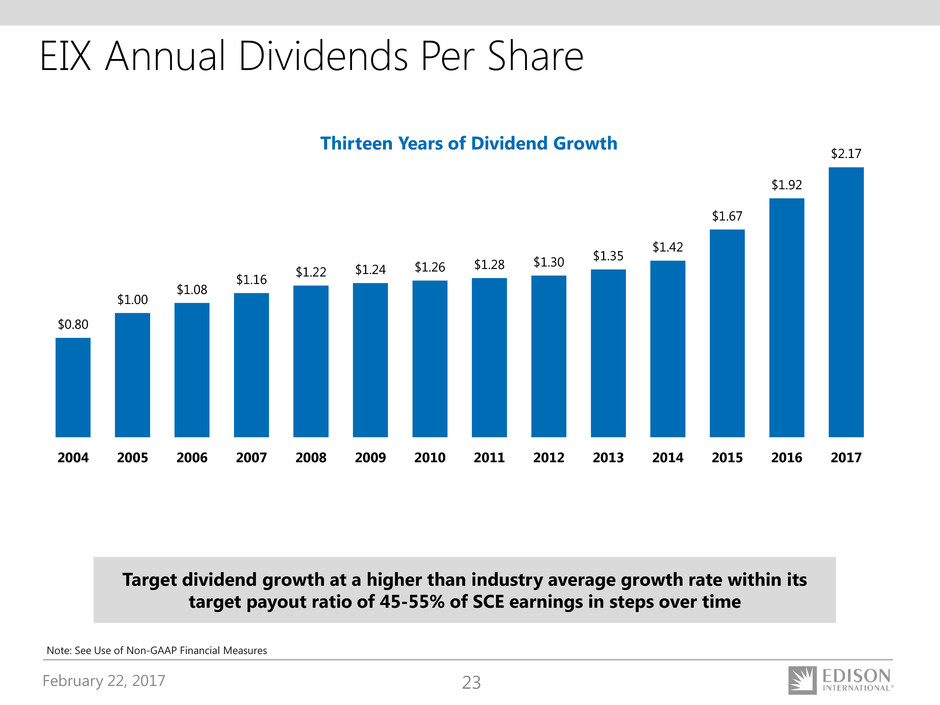

EIX Annual Dividends Per Share

$0.80

$1.00

$1.08

$1.16 $1.22

$1.24 $1.26 $1.28 $1.30

$1.35

$1.42

$1.67

$1.92

$2.17

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017

Note: See Use of Non-GAAP Financial Measures

Thirteen Years of Dividend Growth

Target dividend growth at a higher than industry average growth rate within its

target payout ratio of 45-55% of SCE earnings in steps over time

February 22, 2017 24

Appendix

February 22, 2017 25

Key Reform

Considerations

Impact on

Customer / Shareholder

Comments

No interest deductibility Negative Negative

• Permanent increase in customer rates

(top concern)

• Costs passed through but lowers tax

shield

Lower tax rate (15%-20%) Positive

Negative at EIX

holding

company

• Lower customer rates

• Remeasurement of EIX holding

company tax assets and lower tax shield

100% capital expensing Mixed Mixed

• Timing benefit only

• Customer rates may be impacted by

treatment of property-related

deductions

Net Deferred Tax Liability / (Asset)

As of 12/31/2016; ($ in millions) SCE HoldCo

Property-related and other $9,798 ($165)

Operating loss / credit carryforward - (1,152)1

Net deferred tax liability / (asset) $9,798 ($1,317)1,2

1. Excludes $242 million of deferred tax assets allocated to third parties

2. Includes $58 million of state deferred tax assets

EIX and SCE Tax Reform

February 22, 2017 26

SCE Historical Capital Expenditures

($ billions)

$3.9

$3.5

$4.0 $3.9

$3.5

2012 2013 2014 2015 2016

February 22, 2017 27

Detailed Capital Expenditures at Request Level – 2016-2020

2016

(Actual)

2017 2018 2019 2020 Total

Core Distribution1,2 $2.9 $3.0 $3.2 $3.2 $3.1 $15.4

Mobile Home Pilot Program - 0.1 - - - 0.1

Grid Modernization - 0.2 0.6 0.8 0.7 2.3

Subtotal Distribution $2.9 $3.3 $3.8 $4.0 $3.8 $17.8

Transmission1 $0.4 $0.7 $0.9 $1.0 $1.0 $4.0

Generation1 $0.2 $0.2 $0.2 $0.2 $0.2 $1.0

Total $3.5 $4.2 $4.9 $5.2 $5.0 $22.8

Capital Expenditure/Rate Base Detailed Forecast

Detailed Rate Base at Request Level – 2016-2020

2016

(Actual) 2017 2018 2019 2020

Traditional Rate Base $24.9 $26.2 $29.0 $31.2 $33.2

Grid Modernization - - 0.3 0.8 1.4

Total $24.9 $26.2 $29.3 $32.0 $34.6

1. Includes allocated capitalized overheads and general plant

2. Includes $12 million Charge Ready Phase I (2017) and $60 million of GRC Energy Storage (2016-2020; average $12 million per year)

($ in billions)

February 22, 2017 28

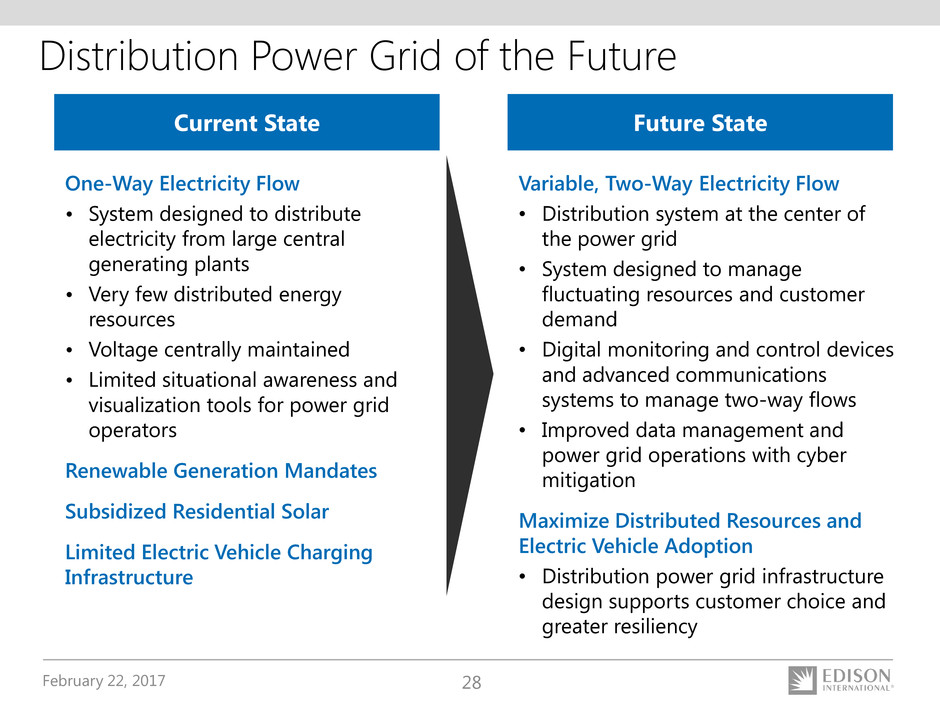

Distribution Power Grid of the Future

One-Way Electricity Flow

• System designed to distribute

electricity from large central

generating plants

• Very few distributed energy

resources

• Voltage centrally maintained

• Limited situational awareness and

visualization tools for power grid

operators

Renewable Generation Mandates

Subsidized Residential Solar

Limited Electric Vehicle Charging

Infrastructure

Variable, Two-Way Electricity Flow

• Distribution system at the center of

the power grid

• System designed to manage

fluctuating resources and customer

demand

• Digital monitoring and control devices

and advanced communications

systems to manage two-way flows

• Improved data management and

power grid operations with cyber

mitigation

Maximize Distributed Resources and

Electric Vehicle Adoption

• Distribution power grid infrastructure

design supports customer choice and

greater resiliency

Current State Future State

February 22, 2017 29

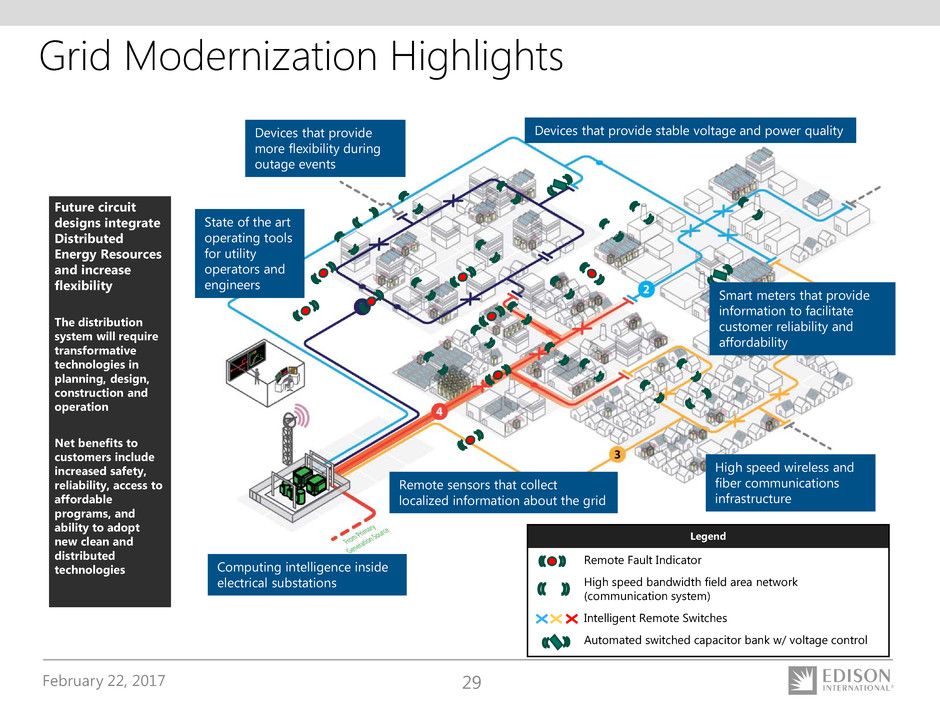

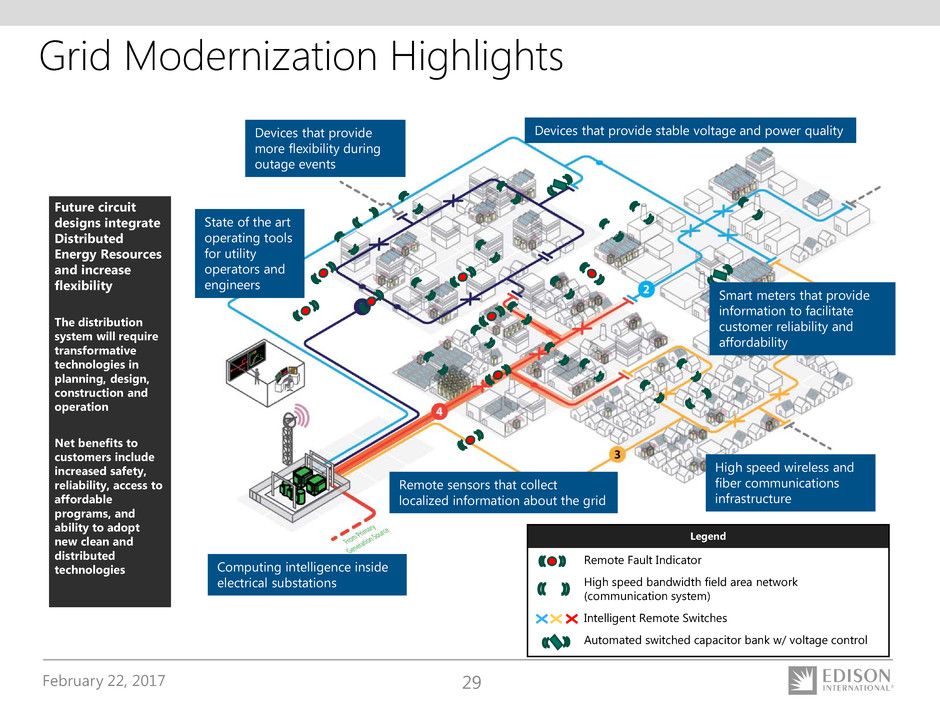

Computing intelligence inside

electrical substations

Future circuit

designs integrate

Distributed

Energy Resources

and increase

flexibility

The distribution

system will require

transformative

technologies in

planning, design,

construction and

operation

Net benefits to

customers include

increased safety,

reliability, access to

affordable

programs, and

ability to adopt

new clean and

distributed

technologies

State of the art

operating tools

for utility

operators and

engineers

Remote sensors that collect

localized information about the grid

Devices that provide

more flexibility during

outage events

Devices that provide stable voltage and power quality

High speed wireless and

fiber communications

infrastructure

Smart meters that provide

information to facilitate

customer reliability and

affordability

Grid Modernization Highlights

Legend

Remote Fault Indicator

High speed bandwidth field area network

(communication system)

Intelligent Remote Switches

Automated switched capacitor bank w/ voltage control

February 22, 2017 30

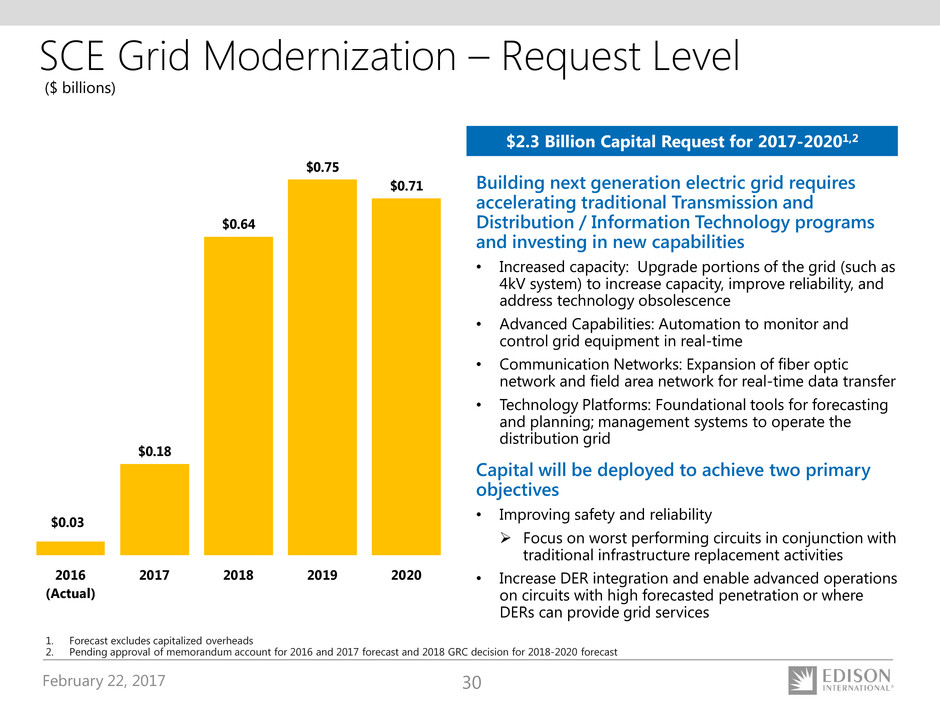

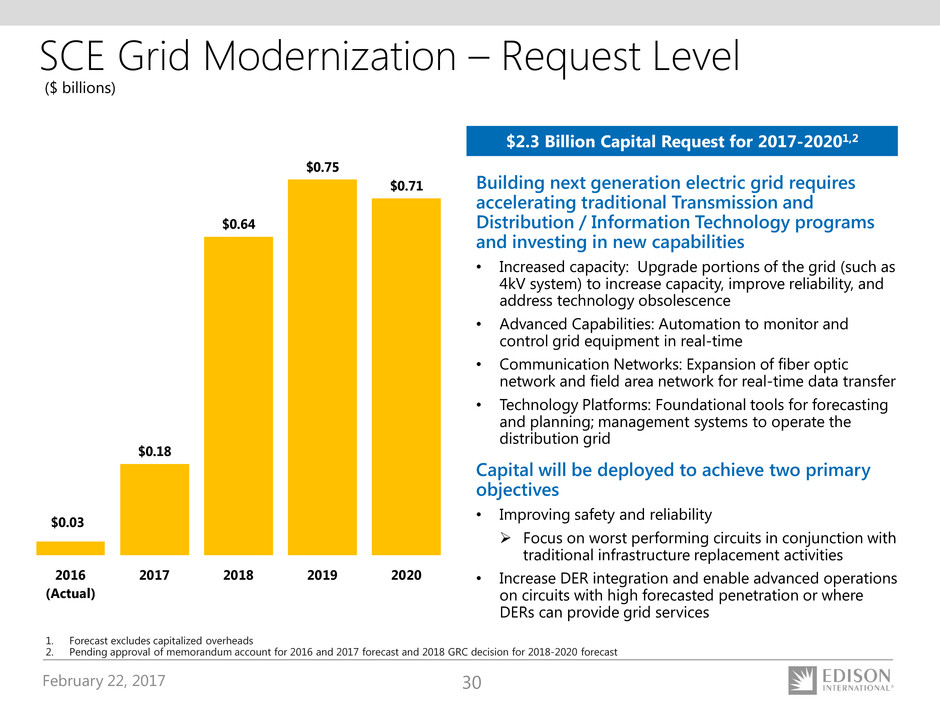

$0.03

$0.18

$0.64

$0.75

$0.71

2016

(Actual)

2017 2018 2019 2020

Building next generation electric grid requires

accelerating traditional Transmission and

Distribution / Information Technology programs

and investing in new capabilities

• Increased capacity: Upgrade portions of the grid (such as

4kV system) to increase capacity, improve reliability, and

address technology obsolescence

• Advanced Capabilities: Automation to monitor and

control grid equipment in real-time

• Communication Networks: Expansion of fiber optic

network and field area network for real-time data transfer

• Technology Platforms: Foundational tools for forecasting

and planning; management systems to operate the

distribution grid

Capital will be deployed to achieve two primary

objectives

• Improving safety and reliability

Focus on worst performing circuits in conjunction with

traditional infrastructure replacement activities

• Increase DER integration and enable advanced operations

on circuits with high forecasted penetration or where

DERs can provide grid services

1. Forecast excludes capitalized overheads

2. Pending approval of memorandum account for 2016 and 2017 forecast and 2018 GRC decision for 2018-2020 forecast

SCE Grid Modernization – Request Level

($ billions)

$2.3 Billion Capital Request for 2017-20201,2

February 22, 2017 31

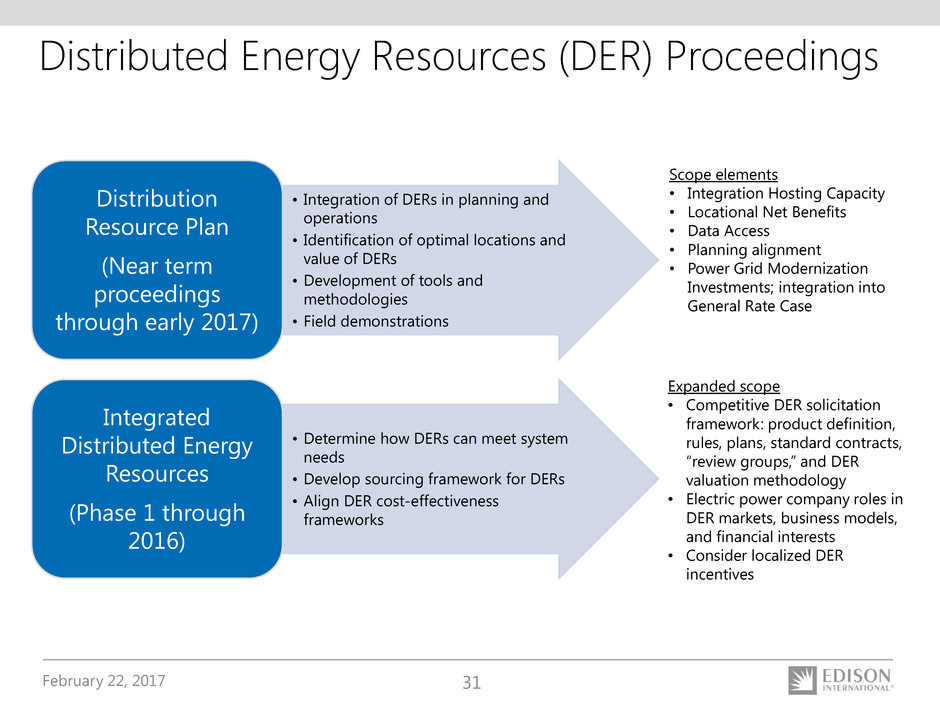

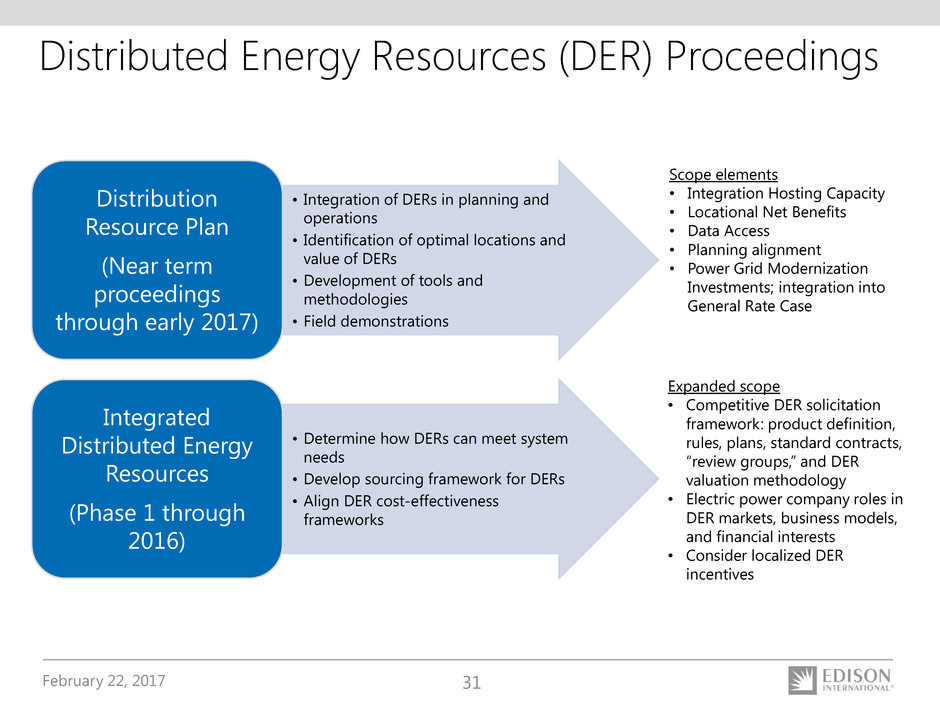

Distributed Energy Resources (DER) Proceedings

Expanded scope

• Competitive DER solicitation

framework: product definition,

rules, plans, standard contracts,

“review groups,” and DER

valuation methodology

• Electric power company roles in

DER markets, business models,

and financial interests

• Consider localized DER

incentives

Scope elements

• Integration Hosting Capacity

• Locational Net Benefits

• Data Access

• Planning alignment

• Power Grid Modernization

Investments; integration into

General Rate Case

• Integration of DERs in planning and

operations

• Identification of optimal locations and

value of DERs

• Development of tools and

methodologies

• Field demonstrations

Distribution

Resource Plan

(Near term

proceedings

through early 2017)

• Determine how DERs can meet system

needs

• Develop sourcing framework for DERs

• Align DER cost-effectiveness

frameworks

Integrated

Distributed Energy

Resources

(Phase 1 through

2016)

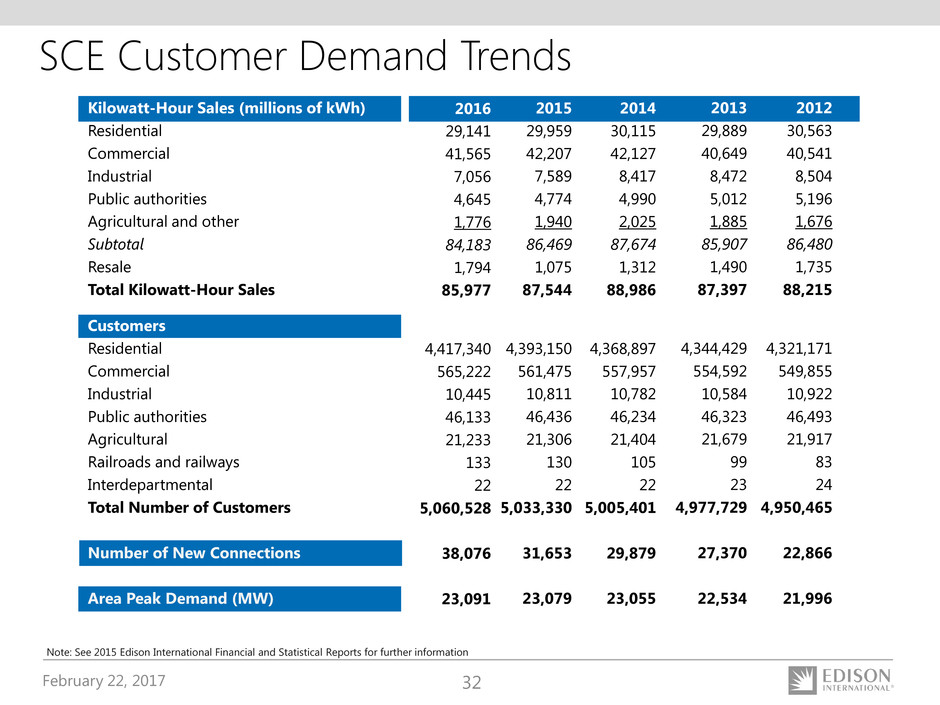

February 22, 2017 32

2016

29,141

41,565

7,056

4,645

1,776

84,183

1,794

85,977

4,417,340

565,222

10,445

46,133

21,233

133

22

5,060,528

38,076

23,091

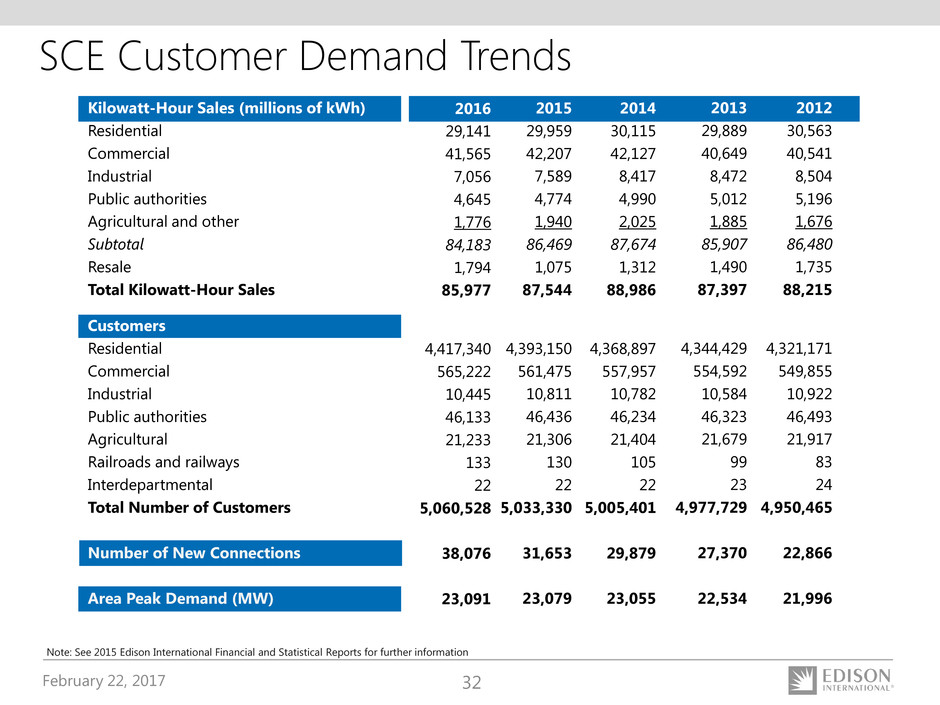

SCE Customer Demand Trends

Kilowatt-Hour Sales (millions of kWh)

Residential

Commercial

Industrial

Public authorities

Agricultural and other

Subtotal

Resale

Total Kilowatt-Hour Sales

Customers

Residential

Commercial

Industrial

Public authorities

Agricultural

Railroads and railways

Interdepartmental

Total Number of Customers

Number of New Connections

Area Peak Demand (MW)

2012

30,563

40,541

8,504

5,196

1,676

86,480

1,735

88,215

4,321,171

549,855

10,922

46,493

21,917

83

24

4,950,465

22,866

21,996

2013

29,889

40,649

8,472

5,012

1,885

85,907

1,490

87,397

4,344,429

554,592

10,584

46,323

21,679

99

23

4,977,729

27,370

22,534

Note: See 2015 Edison International Financial and Statistical Reports for further information

2014

30,115

42,127

8,417

4,990

2,025

87,674

1,312

88,986

4,368,897

557,957

10,782

46,234

21,404

105

22

5,005,401

29,879

23,055

2015

29,959

42,207

7,589

4,774

1,940

86,469

1,075

87,544

4,393,150

561,475

10,811

46,436

21,306

130

22

5,033,330

31,653

23,079

February 22, 2017 33

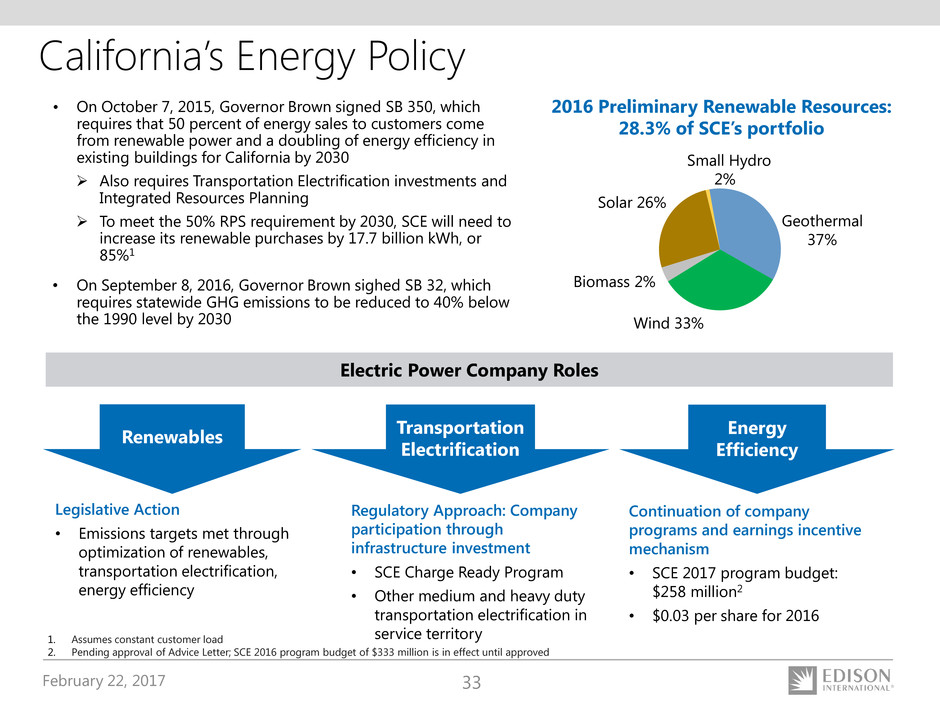

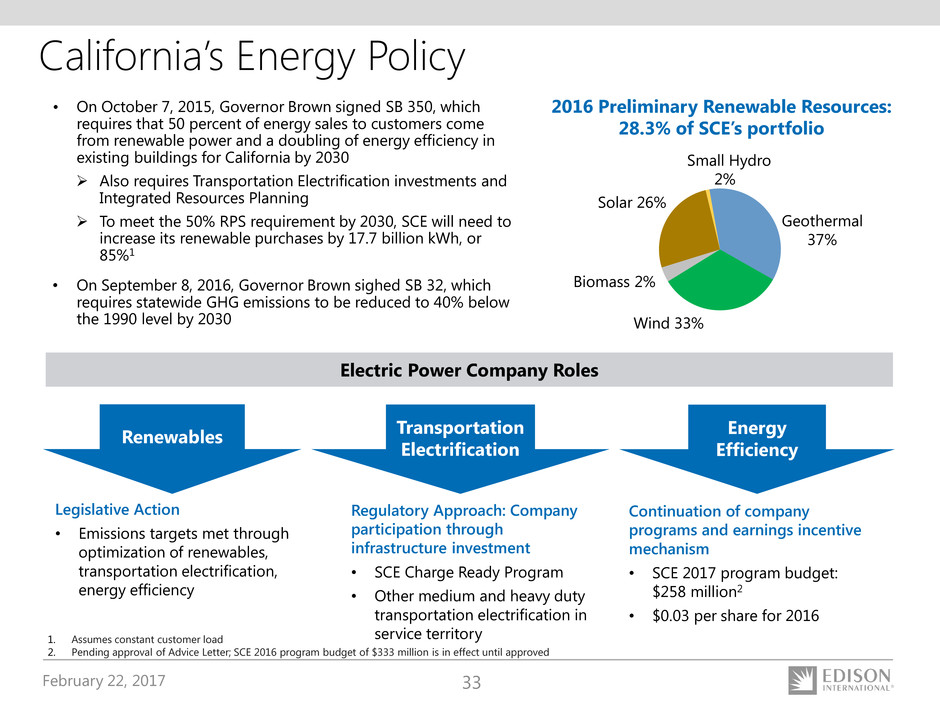

California’s Energy Policy

• On October 7, 2015, Governor Brown signed SB 350, which

requires that 50 percent of energy sales to customers come

from renewable power and a doubling of energy efficiency in

existing buildings for California by 2030

Also requires Transportation Electrification investments and

Integrated Resources Planning

To meet the 50% RPS requirement by 2030, SCE will need to

increase its renewable purchases by 17.7 billion kWh, or

85%1

• On September 8, 2016, Governor Brown sighed SB 32, which

requires statewide GHG emissions to be reduced to 40% below

the 1990 level by 2030

Renewables Transportation

Electrification

Energy

Efficiency

Legislative Action

• Emissions targets met through

optimization of renewables,

transportation electrification,

energy efficiency

Regulatory Approach: Company

participation through

infrastructure investment

• SCE Charge Ready Program

• Other medium and heavy duty

transportation electrification in

service territory

Continuation of company

programs and earnings incentive

mechanism

• SCE 2017 program budget:

$258 million2

• $0.03 per share for 2016

Electric Power Company Roles

Solar 26%

Small Hydro

2%

Geothermal

37%

Wind 33%

2016 Preliminary Renewable Resources:

28.3% of SCE’s portfolio

Biomass 2%

1. Assumes constant customer load

2. Pending approval of Advice Letter; SCE 2016 program budget of $333 million is in effect until approved

February 22, 2017 34

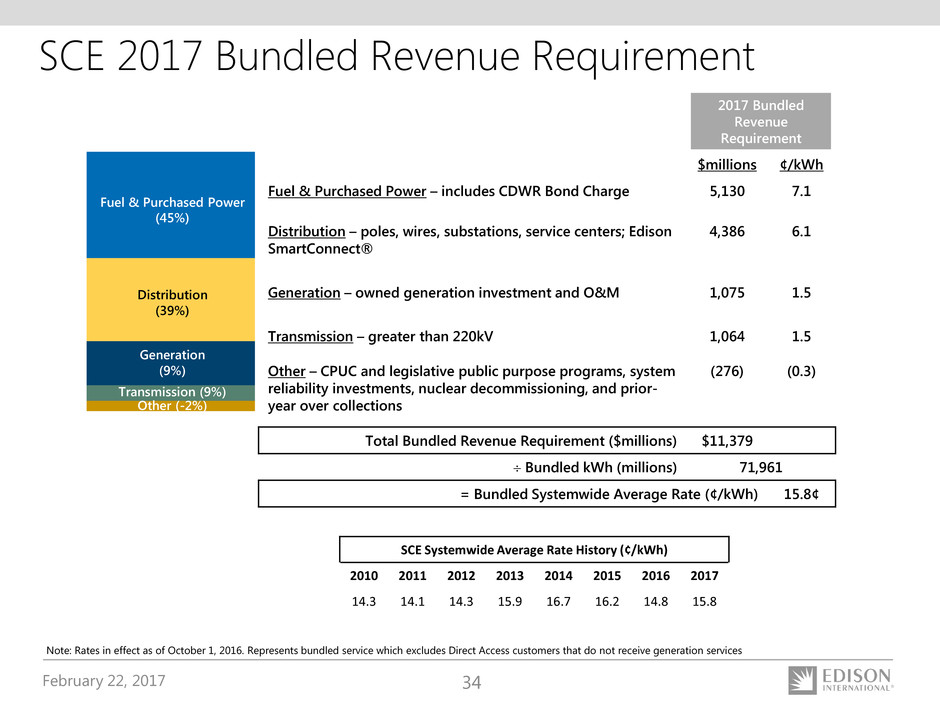

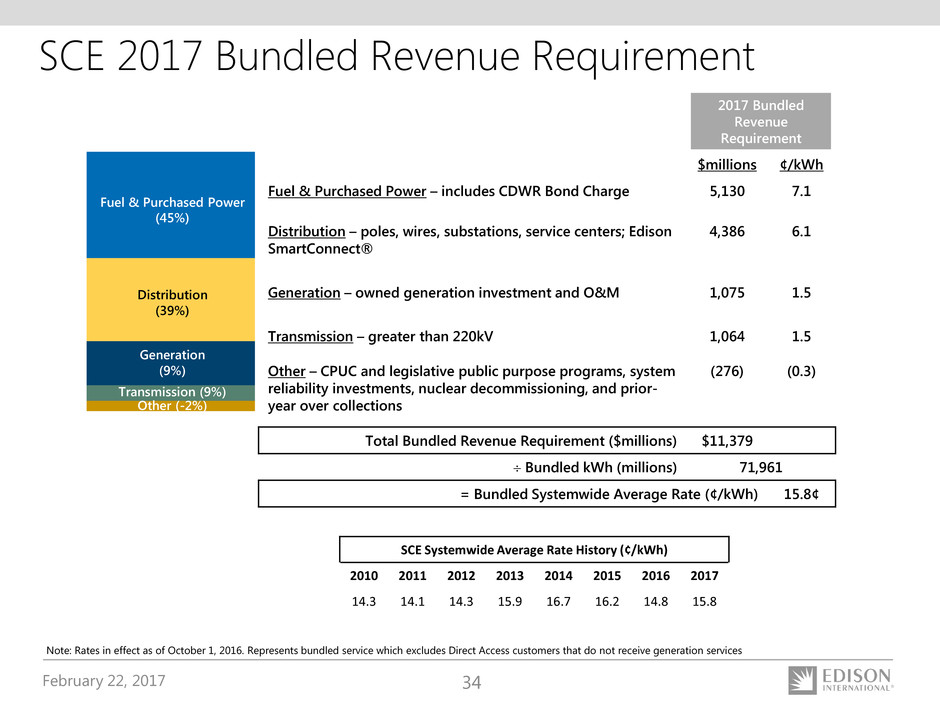

SCE 2017 Bundled Revenue Requirement

Note: Rates in effect as of October 1, 2016. Represents bundled service which excludes Direct Access customers that do not receive generation services

SCE Systemwide Average Rate History (¢/kWh)

2010 2011 2012 2013 2014 2015 2016 2017

14.3 14.1 14.3 15.9 16.7 16.2 14.8 15.8

Fuel & Purchased Power

(45%)

Distribution

(39%)

Transmission (9%)

Generation

(9%)

Other (-2%)

2017 Bundled

Revenue

Requirement

$millions ¢/kWh

Fuel & Purchased Power – includes CDWR Bond Charge 5,130 7.1

Distribution – poles, wires, substations, service centers; Edison

SmartConnect®

4,386 6.1

Generation – owned generation investment and O&M 1,075 1.5

Transmission – greater than 220kV 1,064 1.5

Other – CPUC and legislative public purpose programs, system

reliability investments, nuclear decommissioning, and prior-

year over collections

(276) (0.3)

Total Bundled Revenue Requirement ($millions) $11,379

÷ Bundled kWh (millions) 71,961

= Bundled Systemwide Average Rate (¢/kWh) 15.8¢

February 22, 2017 35

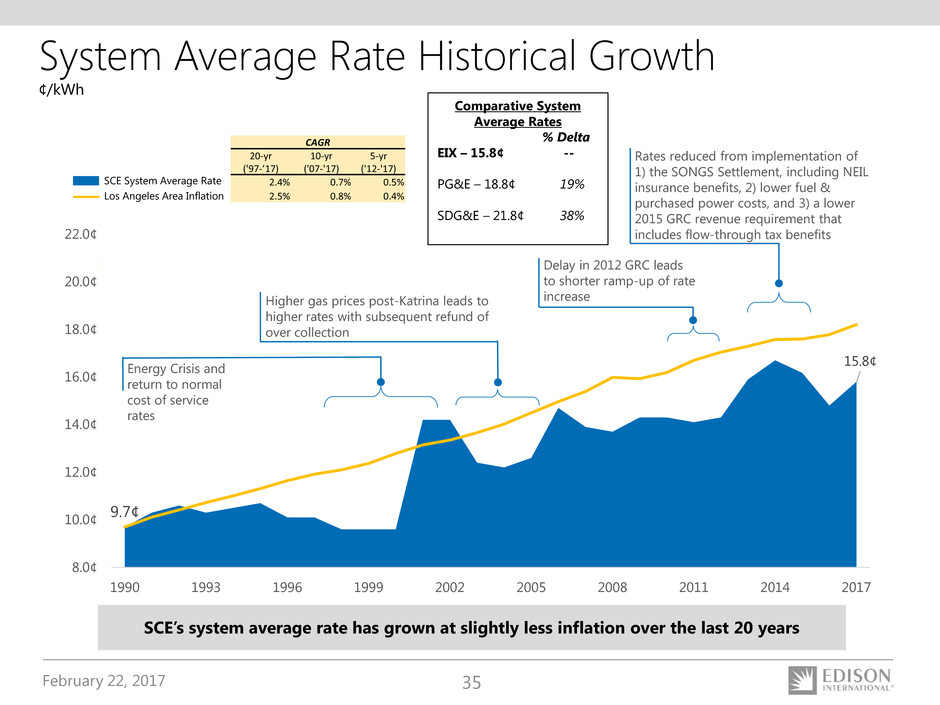

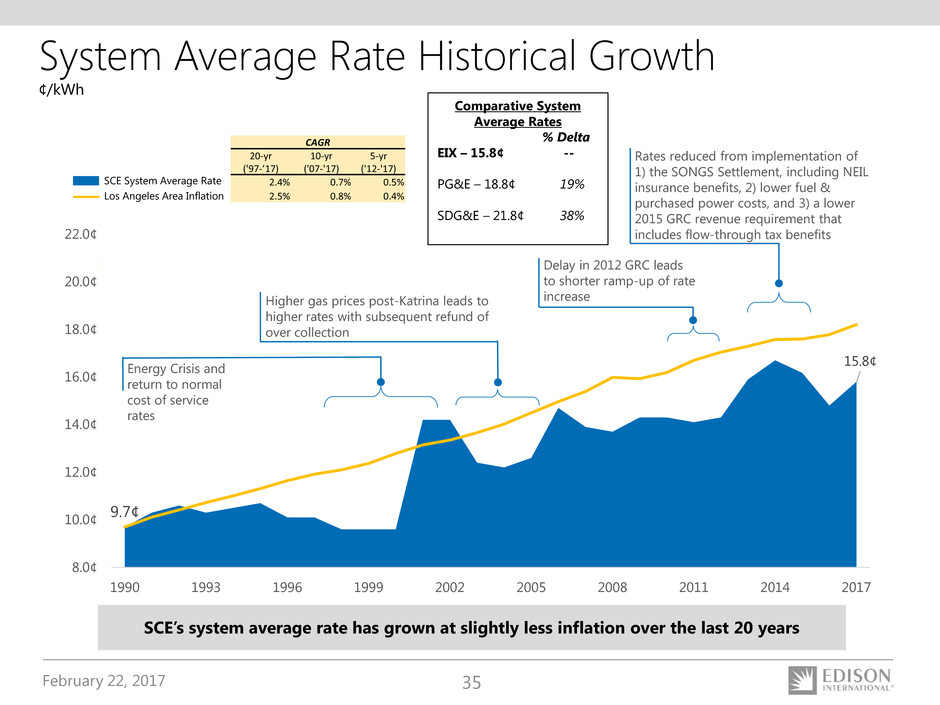

9.7¢

15.8¢

8.0¢

10.0¢

12.0¢

14.0¢

16.0¢

18.0¢

20.0¢

22.0¢

1990 1993 1996 1999 2002 2005 2008 2011 2014 2017

Energy Crisis and

return to normal

cost of service

rates

Higher gas prices post-Katrina leads to

higher rates with subsequent refund of

over collection

Delay in 2012 GRC leads

to shorter ramp-up of rate

increase

¢/kWh

Rates reduced from implementation of

1) the SONGS Settlement, including NEIL

insurance benefits, 2) lower fuel &

purchased power costs, and 3) a lower

2015 GRC revenue requirement that

includes flow-through tax benefits

System Average Rate Historical Growth

SCE’s system average rate has grown at slightly less inflation over the last 20 years

SCE System Average Rate

Los Angeles Area Inflation

Comparative System

Average Rates

% Delta

EIX – 15.8¢ --

PG&E – 18.8¢ 19%

SDG&E – 21.8¢ 38%

CAGR

20-yr

('97-’17)

10-yr

('07-'17)

5-yr

('12-'17)

2.4% 0.7% 0.5%

2.5% 0.8% 0.4%

February 22, 2017 36

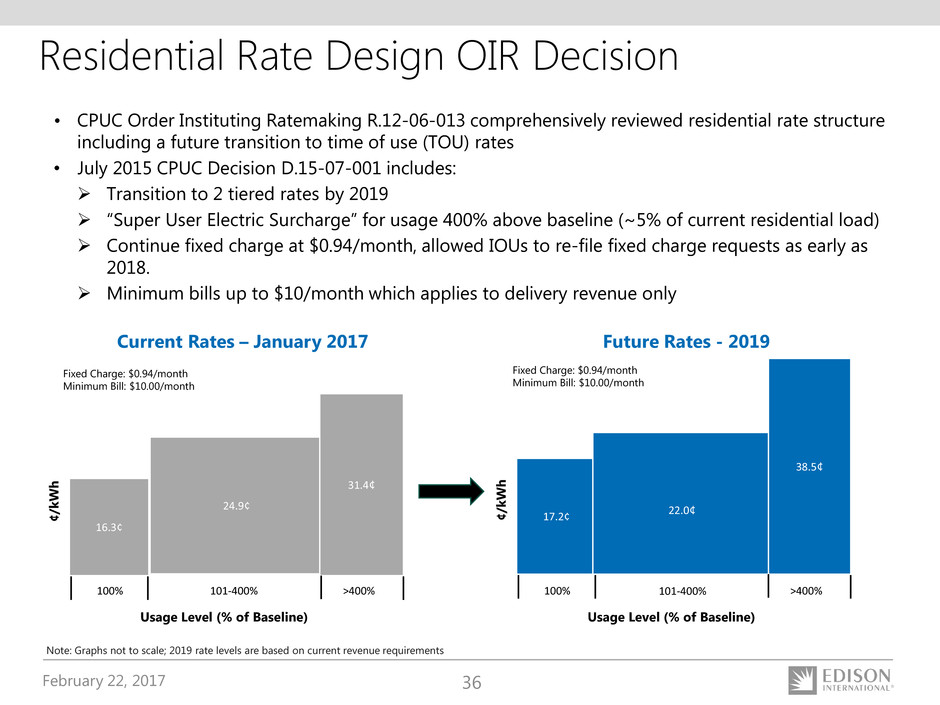

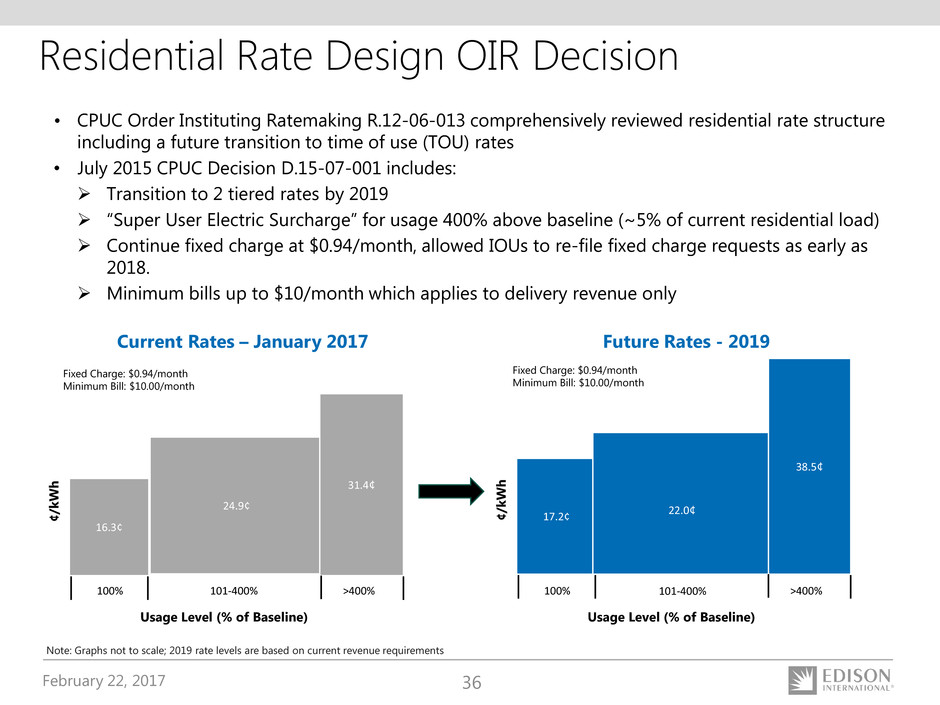

Residential Rate Design OIR Decision

• CPUC Order Instituting Ratemaking R.12-06-013 comprehensively reviewed residential rate structure

including a future transition to time of use (TOU) rates

• July 2015 CPUC Decision D.15-07-001 includes:

Transition to 2 tiered rates by 2019

“Super User Electric Surcharge” for usage 400% above baseline (~5% of current residential load)

Continue fixed charge at $0.94/month, allowed IOUs to re-file fixed charge requests as early as

2018.

Minimum bills up to $10/month which applies to delivery revenue only

Current Rates – January 2017 Future Rates - 2019

Fixed Charge: $0.94/month

Minimum Bill: $10.00/month

Note: Graphs not to scale; 2019 rate levels are based on current revenue requirements

17.2¢

38.5¢

100% 101-400% >400%

22.0¢

Usage Level (% of Baseline)

¢/

kW

h

Usage Level (% of Baseline)

16.3¢

24.9¢

31.4¢

100% 101-400% >400%

¢/

kW

h

Fixed Charge: $0.94/month

Minimum Bill: $10.00/month

February 22, 2017 37

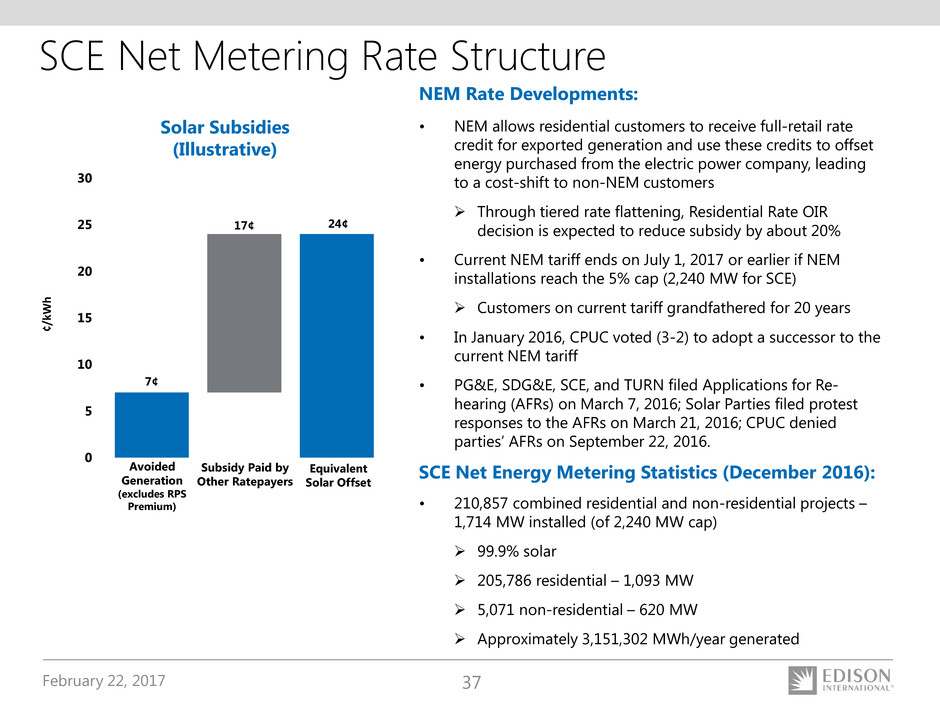

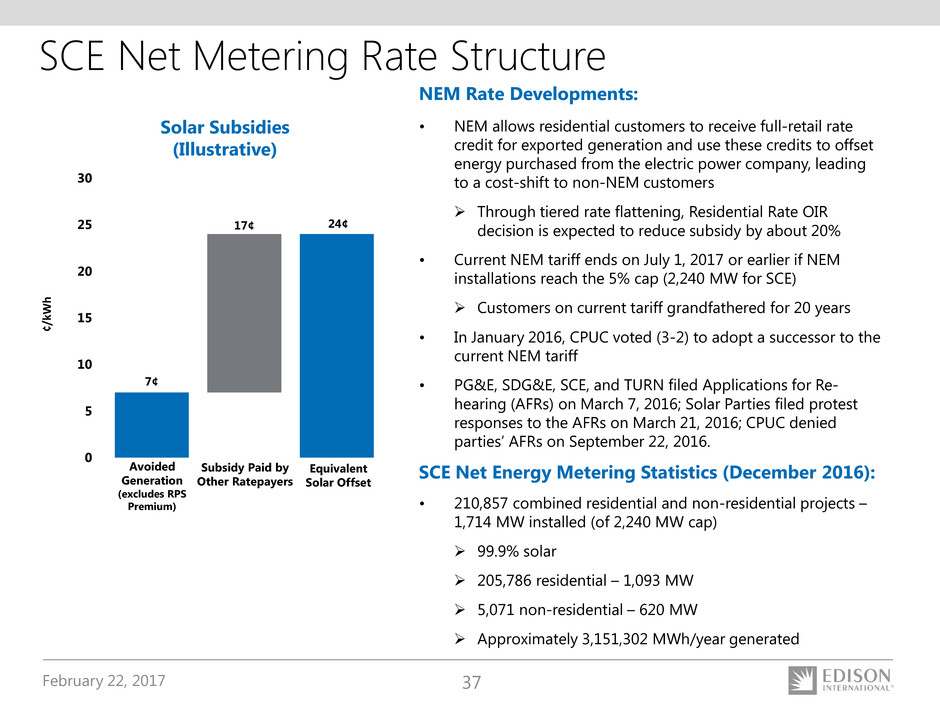

SCE Net Metering Rate Structure

7¢

24¢17¢

0

5

10

15

20

25

30

¢/

kW

h

Solar Subsidies

(Illustrative)

Avoided

Generation

(excludes RPS

Premium)

Subsidy Paid by

Other Ratepayers

Equivalent

Solar Offset

NEM Rate Developments:

• NEM allows residential customers to receive full-retail rate

credit for exported generation and use these credits to offset

energy purchased from the electric power company, leading

to a cost-shift to non-NEM customers

Through tiered rate flattening, Residential Rate OIR

decision is expected to reduce subsidy by about 20%

• Current NEM tariff ends on July 1, 2017 or earlier if NEM

installations reach the 5% cap (2,240 MW for SCE)

Customers on current tariff grandfathered for 20 years

• In January 2016, CPUC voted (3-2) to adopt a successor to the

current NEM tariff

• PG&E, SDG&E, SCE, and TURN filed Applications for Re-

hearing (AFRs) on March 7, 2016; Solar Parties filed protest

responses to the AFRs on March 21, 2016; CPUC denied

parties’ AFRs on September 22, 2016.

SCE Net Energy Metering Statistics (December 2016):

• 210,857 combined residential and non-residential projects –

1,714 MW installed (of 2,240 MW cap)

99.9% solar

205,786 residential – 1,093 MW

5,071 non-residential – 620 MW

Approximately 3,151,302 MWh/year generated

February 22, 2017 38

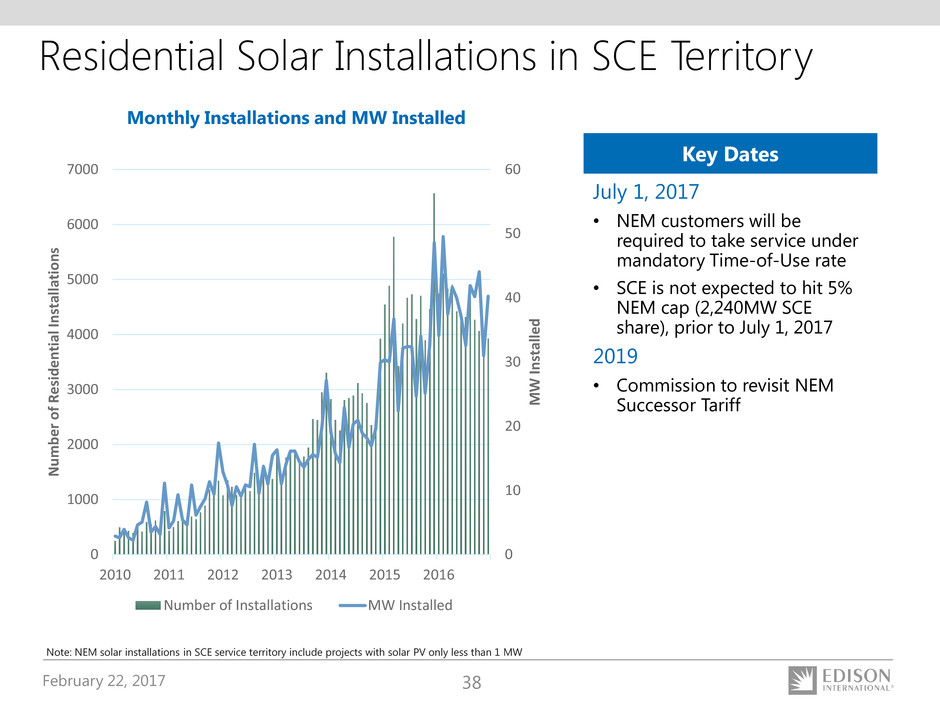

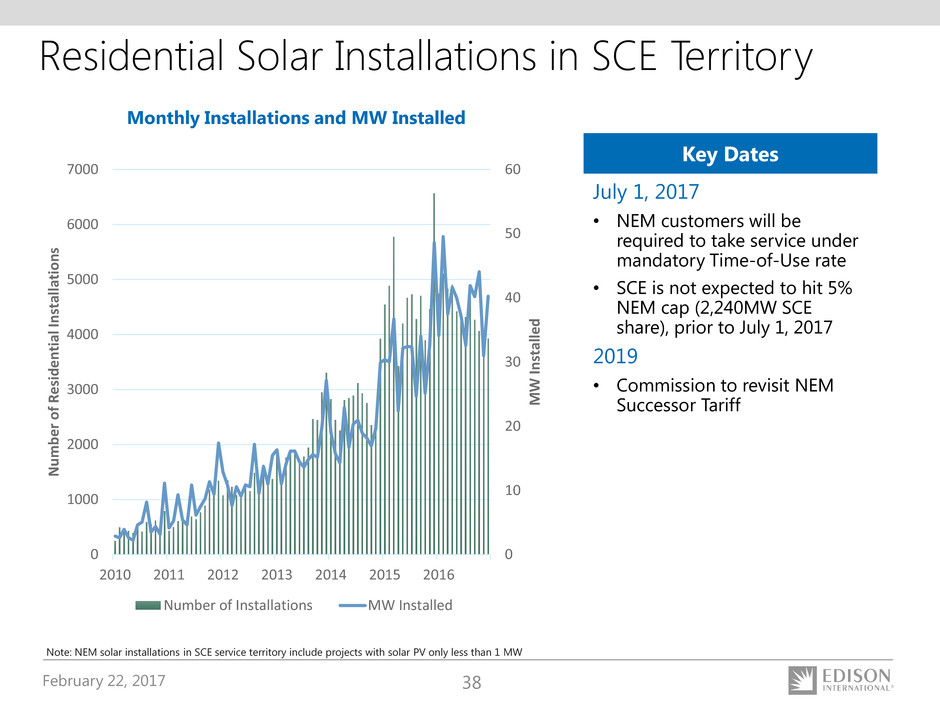

Note: NEM solar installations in SCE service territory include projects with solar PV only less than 1 MW

Residential Solar Installations in SCE Territory

July 1, 2017

• NEM customers will be

required to take service under

mandatory Time-of-Use rate

• SCE is not expected to hit 5%

NEM cap (2,240MW SCE

share), prior to July 1, 2017

2019

• Commission to revisit NEM

Successor Tariff

Key Dates

Monthly Installations and MW Installed

0

10

20

30

40

50

60

0

1000

2000

3000

4000

5000

6000

7000

2010 2011 2012 2013 2014 2015 2016

M

W

In

st

al

le

d

N

um

be

r

of

R

es

id

en

ti

al

In

st

al

la

ti

on

s

Number of Installations MW Installed

February 22, 2017 39

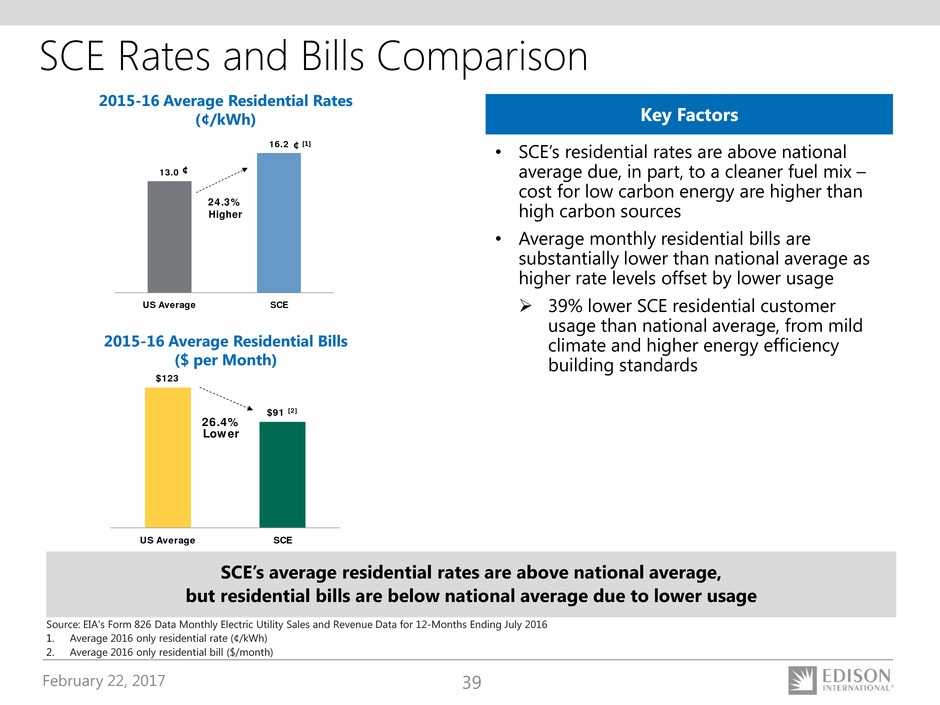

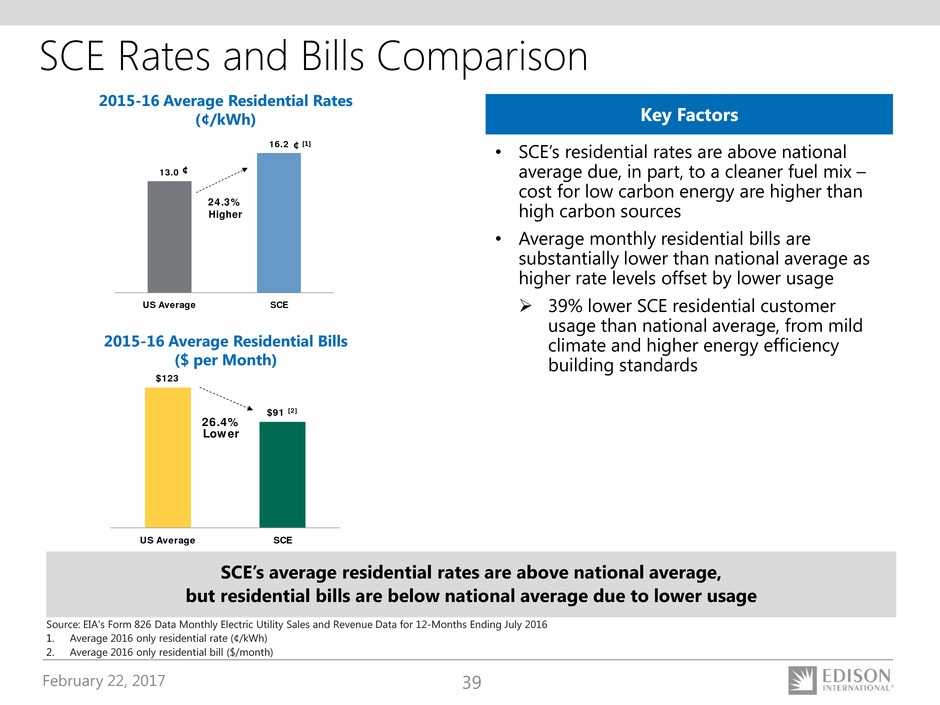

SCE Rates and Bills Comparison

SCE’s average residential rates are above national average,

but residential bills are below national average due to lower usage

• SCE’s residential rates are above national

average due, in part, to a cleaner fuel mix –

cost for low carbon energy are higher than

high carbon sources

• Average monthly residential bills are

substantially lower than national average as

higher rate levels offset by lower usage

39% lower SCE residential customer

usage than national average, from mild

climate and higher energy efficiency

building standards

Key FactorsKey Factors

Source: EIA's Form 826 Data Monthly Electric Utility Sales and Revenue Data for 12-Months Ending July 2016

1. Average 2016 only residential rate (¢/kWh)

2. Average 2016 only residential bill ($/month)

13.0

16.2

US Average SCE

24.3%

Higher

2015-16 Average Residential Rates

(¢/kWh)

2015-16 Average Residential Bills

($ per Month)

$123

$91 [2]

US Average SCE

26.4%

Lower

¢

¢ [1]

February 22, 2017 40

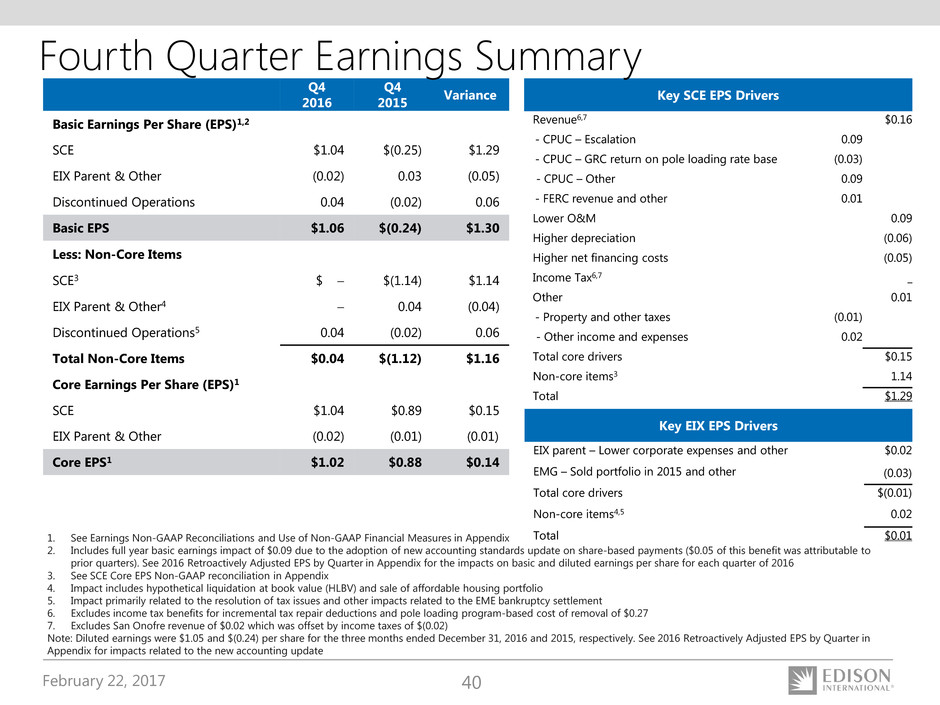

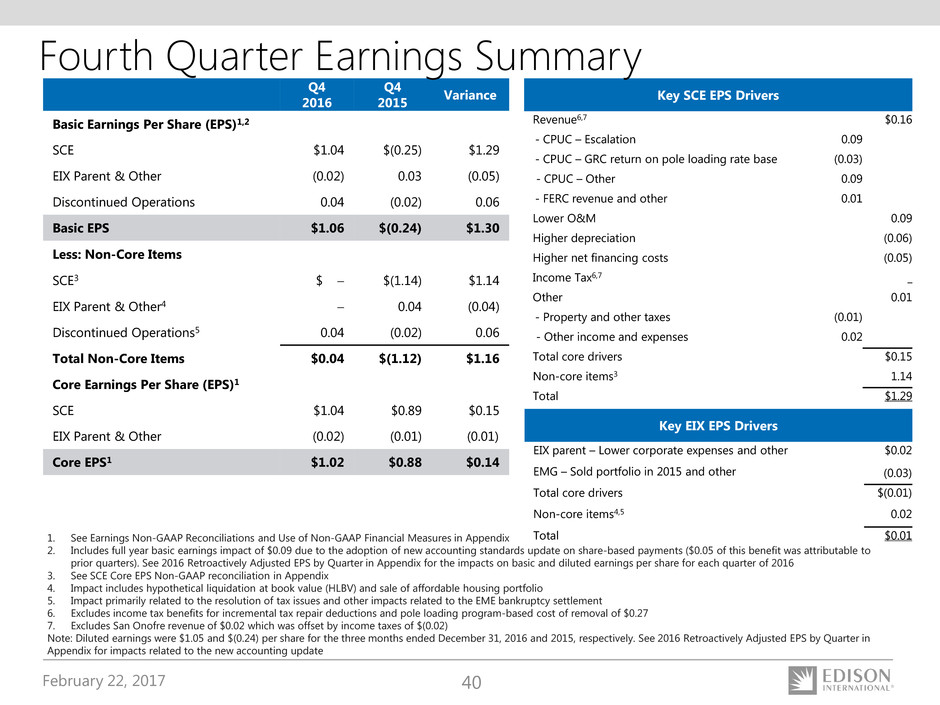

Q4

2016

Q4

2015

Variance

Basic Earnings Per Share (EPS)1,2

SCE $1.04 $(0.25) $1.29

EIX Parent & Other (0.02) 0.03 (0.05)

Discontinued Operations 0.04 (0.02) 0.06

Basic EPS $1.06 $(0.24) $1.30

Less: Non-Core Items

SCE3 $ − $(1.14) $1.14

EIX Parent & Other4 − 0.04 (0.04)

Discontinued Operations5 0.04 (0.02) 0.06

Total Non-Core Items $0.04 $(1.12) $1.16

Core Earnings Per Share (EPS)1

SCE $1.04 $0.89 $0.15

EIX Parent & Other (0.02) (0.01) (0.01)

Core EPS1 $1.02 $0.88 $0.14

Key SCE EPS Drivers

Revenue6,7 $0.16

- CPUC – Escalation 0.09

- CPUC – GRC return on pole loading rate base (0.03)

- CPUC – Other 0.09

- FERC revenue and other 0.01

Lower O&M 0.09

Higher depreciation (0.06)

Higher net financing costs (0.05)

Income Tax6,7 _

Other 0.01

- Property and other taxes (0.01)

- Other income and expenses 0.02

Total core drivers $0.15

Non-core items3 1.14

Total $1.29

Fourth Quarter Earnings Summary

Key EIX EPS Drivers

EIX parent – Lower corporate expenses and other $0.02

EMG – Sold portfolio in 2015 and other (0.03)

Total core drivers $(0.01)

Non-core items4,5 0.02

Total $0.011. See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix

2. Includes full year basic earnings impact of $0.09 due to the adoption of new accounting standards update on share-based payments ($0.05 of this benefit was attributable to

prior quarters). See 2016 Retroactively Adjusted EPS by Quarter in Appendix for the impacts on basic and diluted earnings per share for each quarter of 2016

3. See SCE Core EPS Non-GAAP reconciliation in Appendix

4. Impact includes hypothetical liquidation at book value (HLBV) and sale of affordable housing portfolio

5. Impact primarily related to the resolution of tax issues and other impacts related to the EME bankruptcy settlement

6. Excludes income tax benefits for incremental tax repair deductions and pole loading program-based cost of removal of $0.27

7. Excludes San Onofre revenue of $0.02 which was offset by income taxes of $(0.02)

Note: Diluted earnings were $1.05 and $(0.24) per share for the three months ended December 31, 2016 and 2015, respectively. See 2016 Retroactively Adjusted EPS by Quarter in

Appendix for impacts related to the new accounting update

February 22, 2017 41

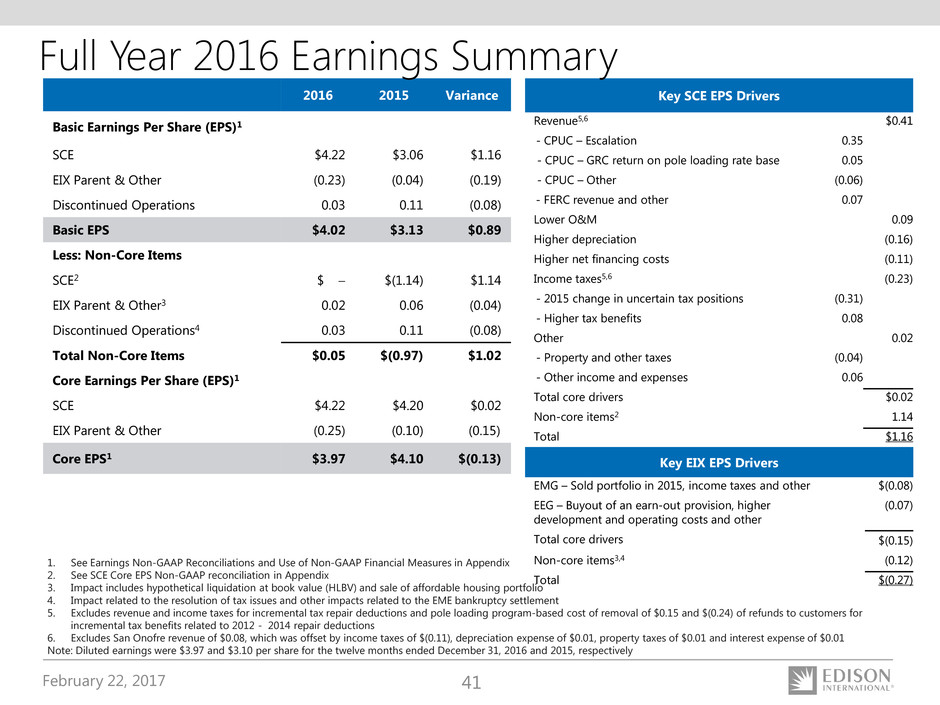

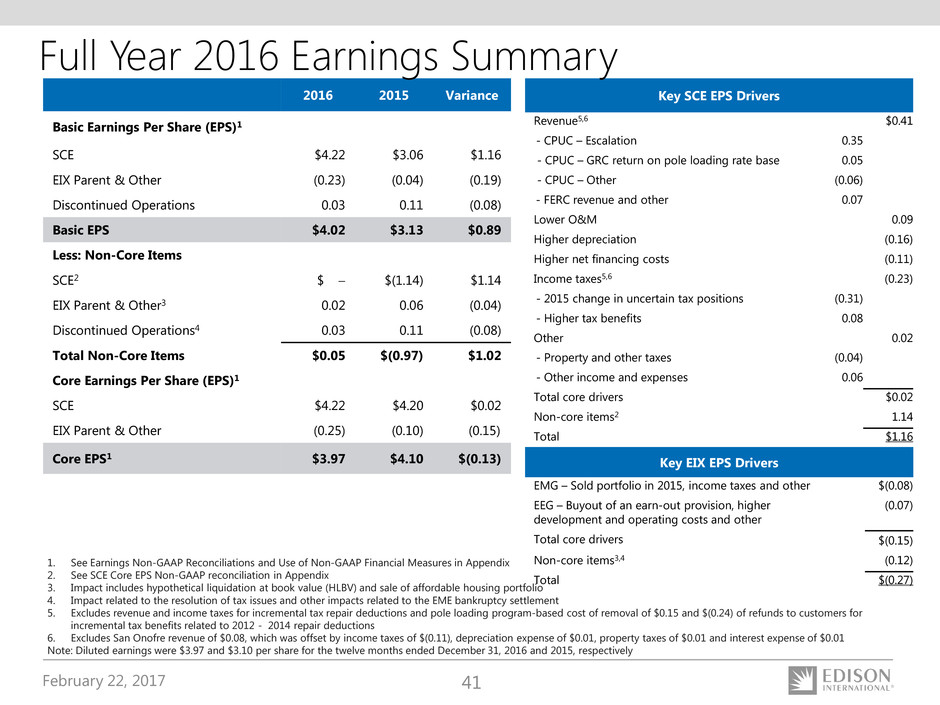

2016 2015 Variance

Basic Earnings Per Share (EPS)1

SCE $4.22 $3.06 $1.16

EIX Parent & Other (0.23) (0.04) (0.19)

Discontinued Operations 0.03 0.11 (0.08)

Basic EPS $4.02 $3.13 $0.89

Less: Non-Core Items

SCE2 $ − $(1.14) $1.14

EIX Parent & Other3 0.02 0.06 (0.04)

Discontinued Operations4 0.03 0.11 (0.08)

Total Non-Core Items $0.05 $(0.97) $1.02

Core Earnings Per Share (EPS)1

SCE $4.22 $4.20 $0.02

EIX Parent & Other (0.25) (0.10) (0.15)

Core EPS1 $3.97 $4.10 $(0.13)

Key SCE EPS Drivers

Revenue5,6 $0.41

- CPUC – Escalation 0.35

- CPUC – GRC return on pole loading rate base 0.05

- CPUC – Other (0.06)

- FERC revenue and other 0.07

Lower O&M 0.09

Higher depreciation (0.16)

Higher net financing costs (0.11)

Income taxes5,6 (0.23)

- 2015 change in uncertain tax positions (0.31)

- Higher tax benefits 0.08

Other 0.02

- Property and other taxes (0.04)

- Other income and expenses 0.06

Total core drivers $0.02

Non-core items2 1.14

Total $1.16

Full Year 2016 Earnings Summary

Key EIX EPS Drivers

EMG – Sold portfolio in 2015, income taxes and other $(0.08)

EEG – Buyout of an earn-out provision, higher

development and operating costs and other

(0.07)

Total core drivers $(0.15)

Non-core items3,4 (0.12)

Total $(0.27)

1. See Earnings Non-GAAP Reconciliations and Use of Non-GAAP Financial Measures in Appendix

2. See SCE Core EPS Non-GAAP reconciliation in Appendix

3. Impact includes hypothetical liquidation at book value (HLBV) and sale of affordable housing portfolio

4. Impact related to the resolution of tax issues and other impacts related to the EME bankruptcy settlement

5. Excludes revenue and income taxes for incremental tax repair deductions and pole loading program-based cost of removal of $0.15 and $(0.24) of refunds to customers for

incremental tax benefits related to 2012 - 2014 repair deductions

6. Excludes San Onofre revenue of $0.08, which was offset by income taxes of $(0.11), depreciation expense of $0.01, property taxes of $0.01 and interest expense of $0.01

Note: Diluted earnings were $3.97 and $3.10 per share for the twelve months ended December 31, 2016 and 2015, respectively

February 22, 2017 42

$6,305

—

1,977

1,915

334

—

4,226

2,079

(525)

64

1,618

507

1,111

113

$998

$5,180

4,266

913

—

—

—

5,179

1

(1)

—

—

—

—

—

$—

$11,485

4,266

2,890

1,915

334

—

9,405

2,080

(526)

64

1,618

507

1,111

113

$998

(370)

$1,368

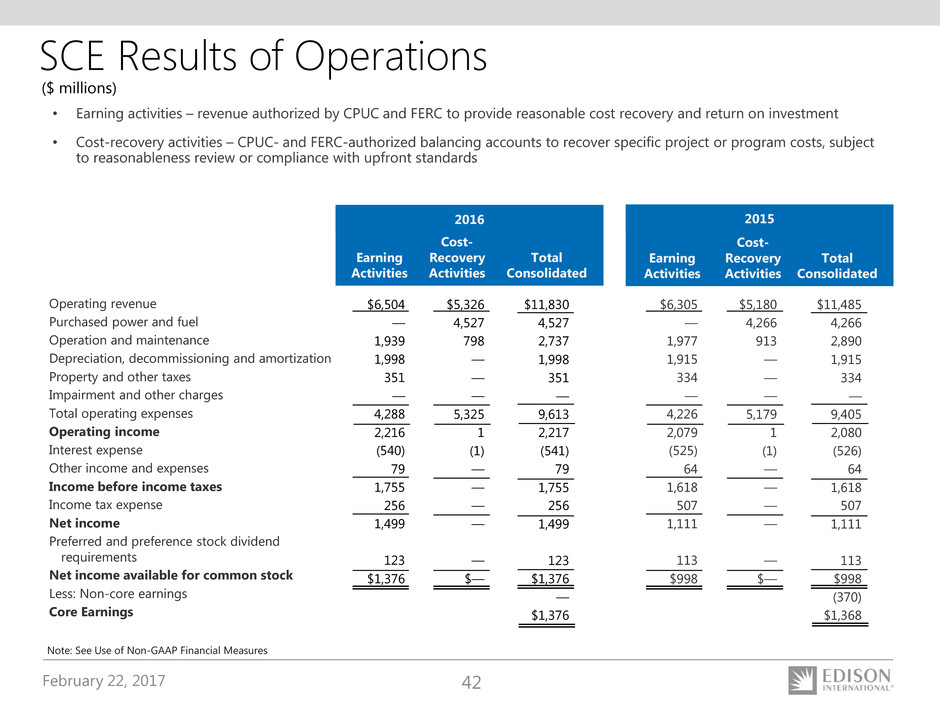

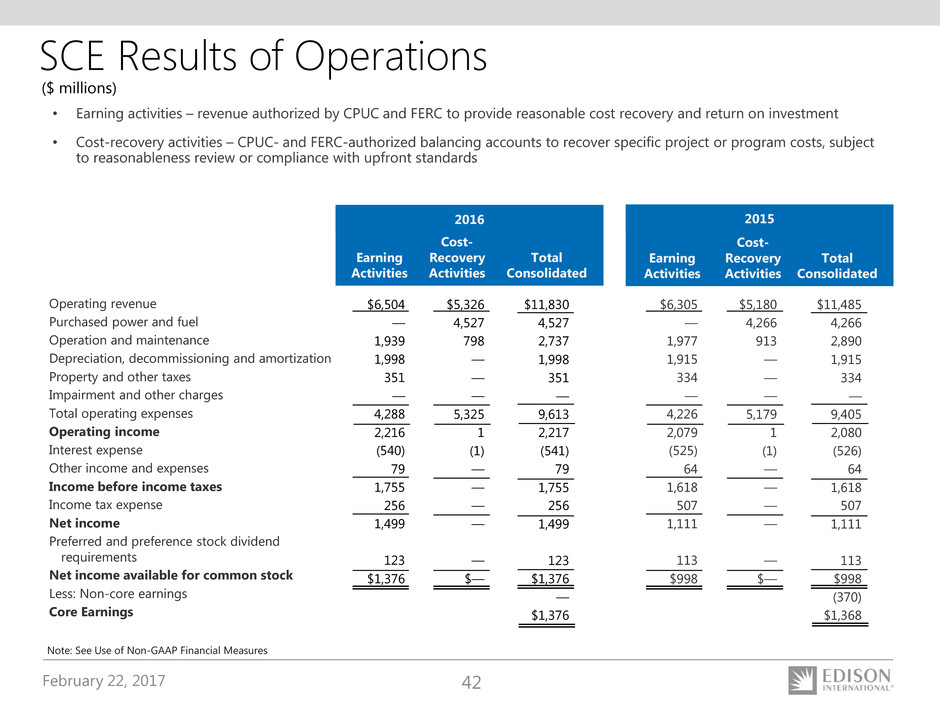

SCE Results of Operations

• Earning activities – revenue authorized by CPUC and FERC to provide reasonable cost recovery and return on investment

• Cost-recovery activities – CPUC- and FERC-authorized balancing accounts to recover specific project or program costs, subject

to reasonableness review or compliance with upfront standards

Earning

Activities

Cost-

Recovery

Activities

Total

Consolidated

2016

Earning

Activities

Cost-

Recovery

Activities

Total

Consolidated

2015

Operating revenue

Purchased power and fuel

Operation and maintenance

Depreciation, decommissioning and amortization

Property and other taxes

Impairment and other charges

Total operating expenses

Operating income

Interest expense

Other income and expenses

Income before income taxes

Income tax expense

Net income

Preferred and preference stock dividend

requirements

Net income available for common stock

Less: Non-core earnings

Core Earnings

Note: See Use of Non-GAAP Financial Measures

($ millions)

$6,504

—

1,939

1,998

351

—

4,288

2,216

(540)

79

1,755

256

1,499

123

$1,376

$5,326

4,527

798

—

—

—

5,325

1

(1)

—

—

—

—

—

$—

$11,830

4,527

2,737

1,998

351

—

9,613

2,217

(541)

79

1,755

256

1,499

123

$1,376

—

$1,376

February 22, 2017 43

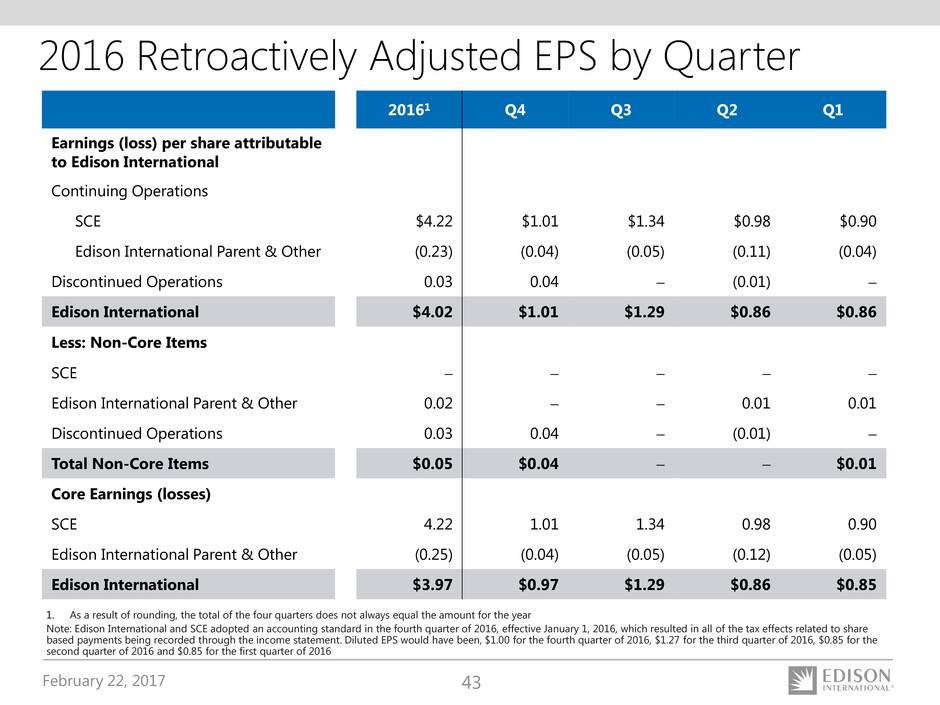

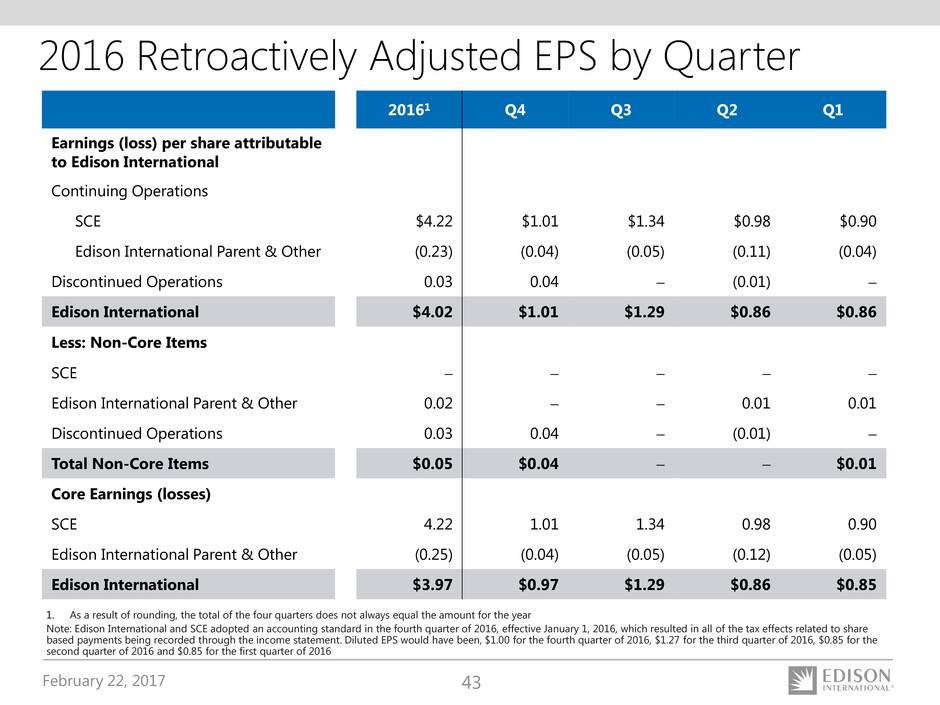

2016 Retroactively Adjusted EPS by Quarter

20161 Q4 Q3 Q2 Q1

Earnings (loss) per share attributable

to Edison International

Continuing Operations

SCE $4.22 $1.01 $1.34 $0.98 $0.90

Edison International Parent & Other (0.23) (0.04) (0.05) (0.11) (0.04)

Discontinued Operations 0.03 0.04 − (0.01) −

Edison International $4.02 $1.01 $1.29 $0.86 $0.86

Less: Non-Core Items

SCE − − − − −

Edison International Parent & Other 0.02 − − 0.01 0.01

Discontinued Operations 0.03 0.04 − (0.01) −

Total Non-Core Items $0.05 $0.04 − − $0.01

Core Earnings (losses)

SCE 4.22 1.01 1.34 0.98 0.90

Edison International Parent & Other (0.25) (0.04) (0.05) (0.12) (0.05)

Edison International $3.97 $0.97 $1.29 $0.86 $0.85

1. As a result of rounding, the total of the four quarters does not always equal the amount for the year

Note: Edison International and SCE adopted an accounting standard in the fourth quarter of 2016, effective January 1, 2016, which resulted in all of the tax effects related to share

based payments being recorded through the income statement. Diluted EPS would have been, $1.00 for the fourth quarter of 2016, $1.27 for the third quarter of 2016, $0.85 for the

second quarter of 2016 and $0.85 for the first quarter of 2016

February 22, 2017 44

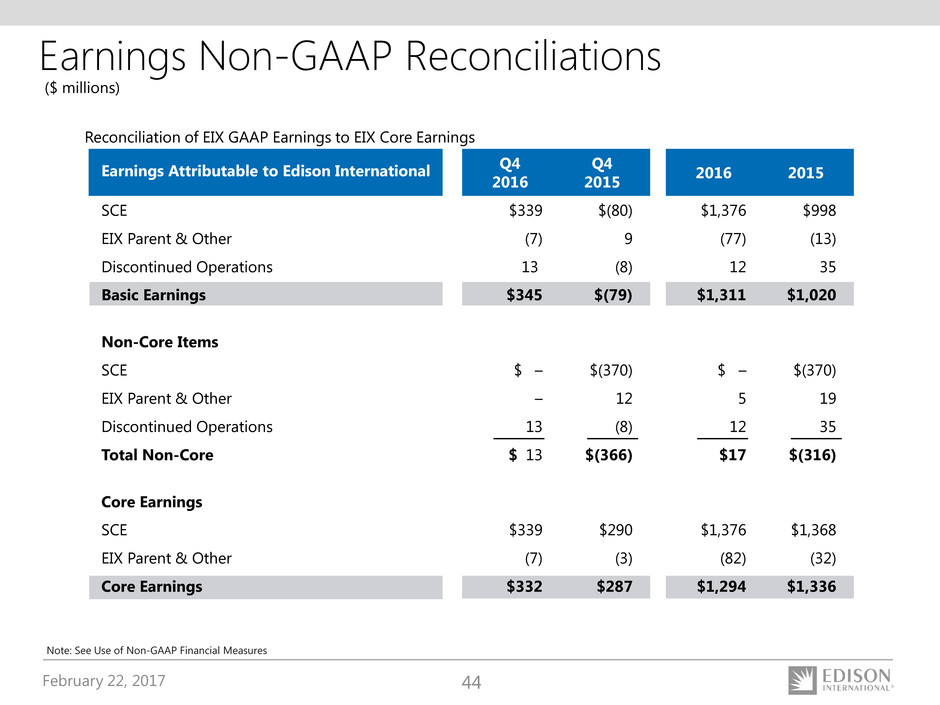

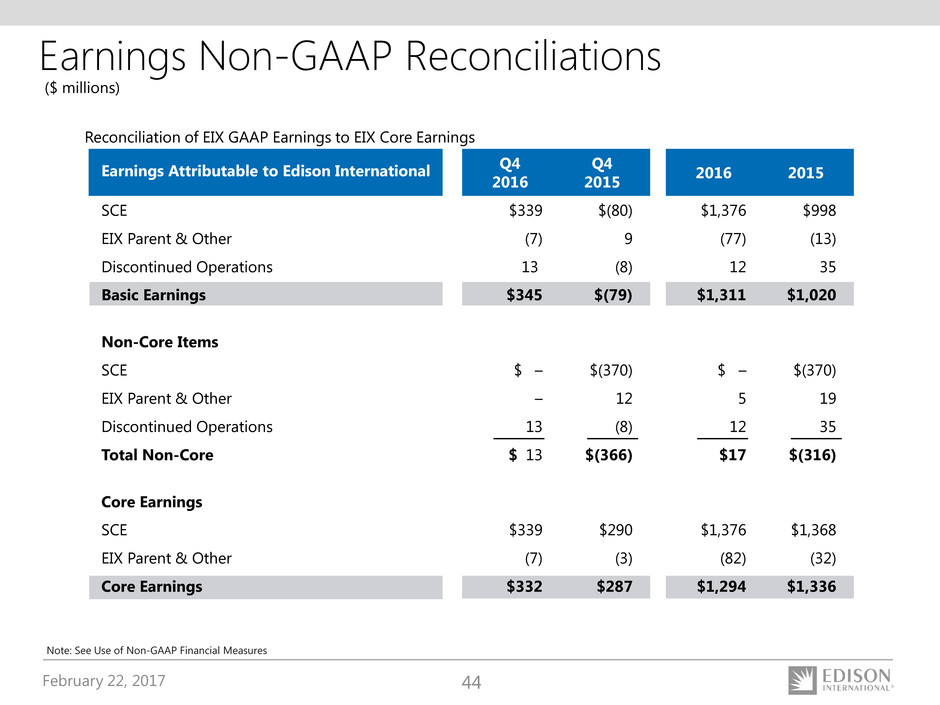

Earnings Non-GAAP Reconciliations

Note: See Use of Non-GAAP Financial Measures

($ millions)

Reconciliation of EIX GAAP Earnings to EIX Core Earnings

SCE

EIX Parent & Other

Discontinued Operations

Basic Earnings

Non-Core Items

SCE

EIX Parent & Other

Discontinued Operations

Total Non-Core

Core Earnings

SCE

EIX Parent & Other

Core Earnings

$(80)

9

(8)

$(79)

$(370)

12

(8)

$(366)

$290

(3)

$287

$339

(7)

13

$345

$ –

–

13

$ 13

$339

(7)

$332

Q4

2015

Q4

2016

Earnings Attributable to Edison International

$998

(13)

35

$1,020

$(370)

19

35

$(316)

$1,368

(32)

$1,336

$1,376

(77)

12

$1,311

$ –

5

12

$17

$1,376

(82)

$1,294

20152016

February 22, 2017 45

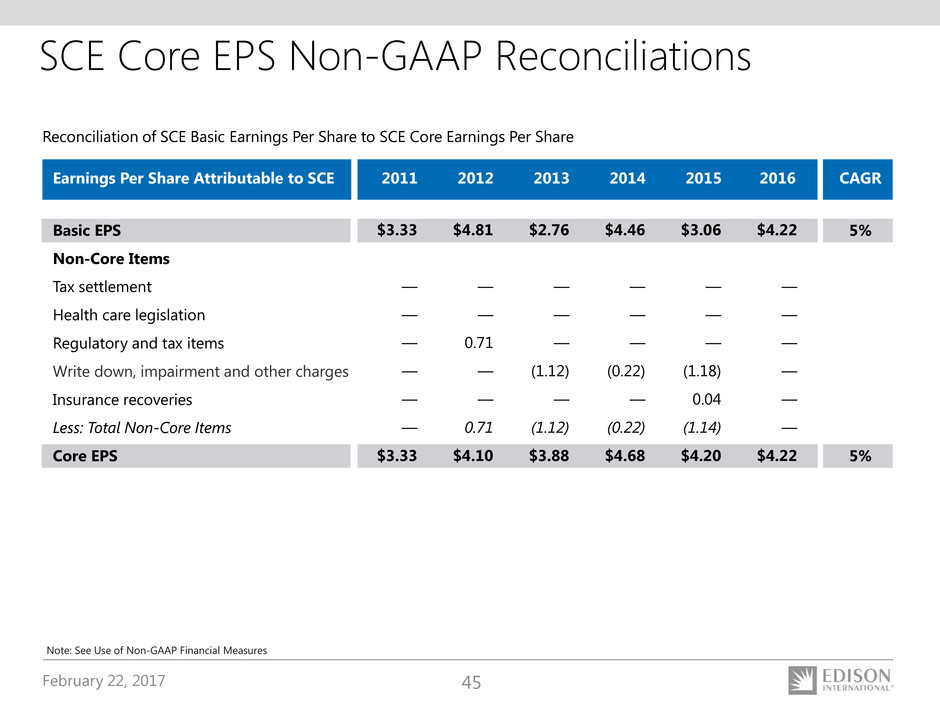

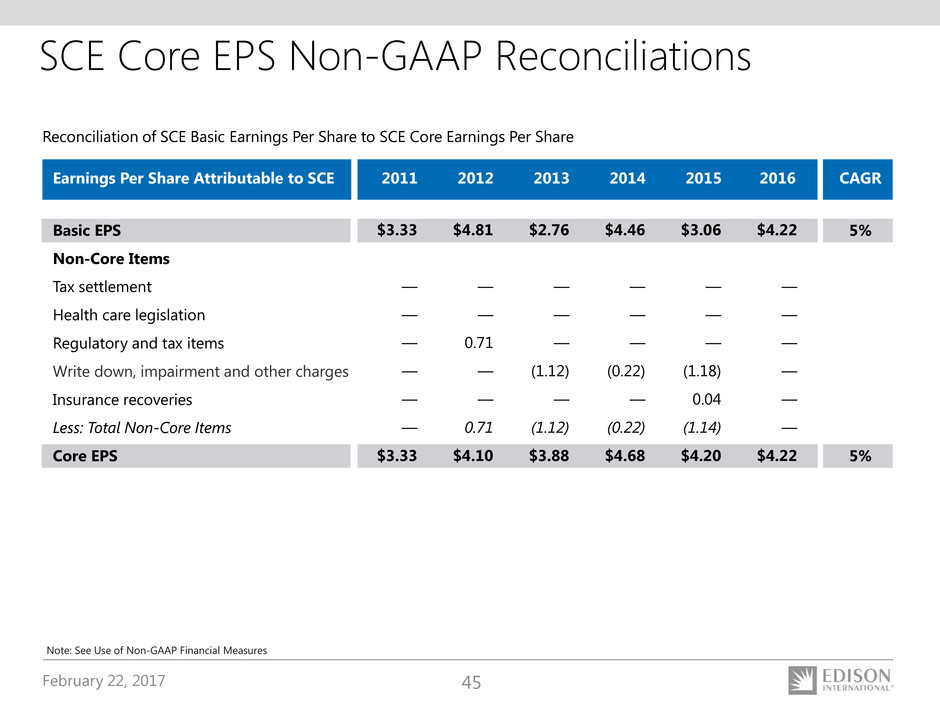

SCE Core EPS Non-GAAP Reconciliations

Basic EPS

Non-Core Items

Tax settlement

Health care legislation

Regulatory and tax items

Write down, impairment and other charges

Insurance recoveries

Less: Total Non-Core Items

Core EPS

Reconciliation of SCE Basic Earnings Per Share to SCE Core Earnings Per Share

5%

5%

$3.33

—

—

—

—

—

—

$3.33

$4.81

—

—

0.71

—

—

0.71

$4.10

$2.76

—

—

—

(1.12)

—

(1.12)

$3.88

Note: See Use of Non-GAAP Financial Measures

$4.46

—

—

—

(0.22)

—

(0.22)

$4.68

$3.06

—

—

—

(1.18)

0.04

(1.14)

$4.20

Earnings Per Share Attributable to SCE CAGR2011 2012 2013 2014 2015

$4.22

—

—

—

—

—

—

$4.22

2016

February 22, 2017 46

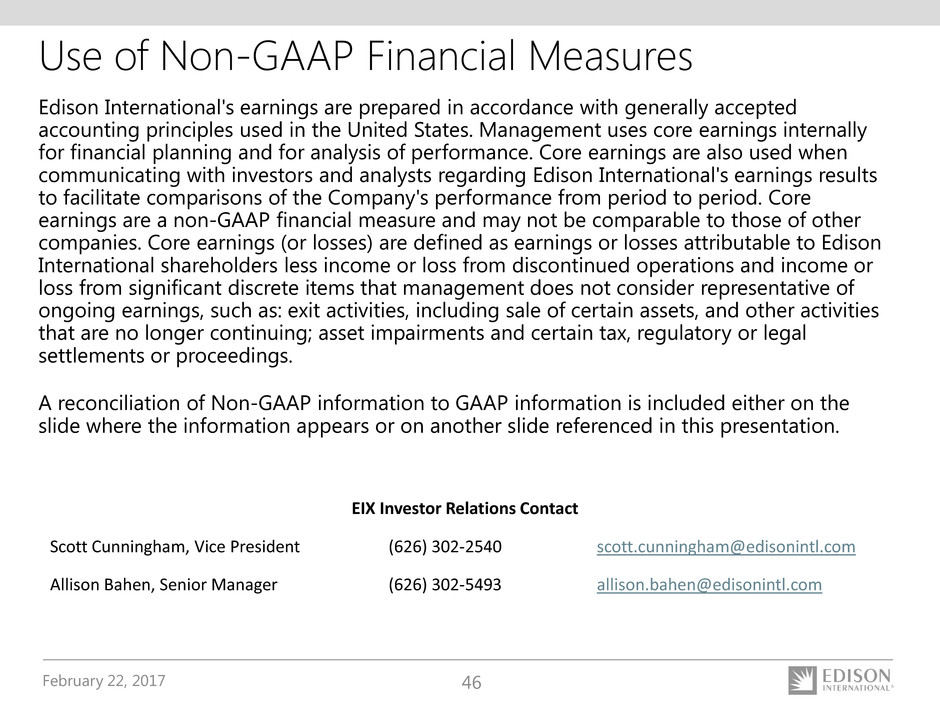

Use of Non-GAAP Financial Measures

Edison International's earnings are prepared in accordance with generally accepted

accounting principles used in the United States. Management uses core earnings internally

for financial planning and for analysis of performance. Core earnings are also used when

communicating with investors and analysts regarding Edison International's earnings results

to facilitate comparisons of the Company's performance from period to period. Core

earnings are a non-GAAP financial measure and may not be comparable to those of other

companies. Core earnings (or losses) are defined as earnings or losses attributable to Edison

International shareholders less income or loss from discontinued operations and income or

loss from significant discrete items that management does not consider representative of

ongoing earnings, such as: exit activities, including sale of certain assets, and other activities

that are no longer continuing; asset impairments and certain tax, regulatory or legal

settlements or proceedings.

A reconciliation of Non-GAAP information to GAAP information is included either on the

slide where the information appears or on another slide referenced in this presentation.

EIX Investor Relations Contact

Scott Cunningham, Vice President (626) 302-2540 scott.cunningham@edisonintl.com

Allison Bahen, Senior Manager (626) 302-5493 allison.bahen@edisonintl.com