0000826675DEF 14AFALSE00008266752023-01-012023-12-31dx:percentiso4217:USD00008266752022-01-012022-12-3100008266752021-01-012021-12-3100008266752020-01-012020-12-310000826675dx:AdjustmentForAmountsReportedUnderStockAwardsMemberecd:PeoMember2023-01-012023-12-310000826675ecd:NonPeoNeoMemberdx:AdjustmentForAmountsReportedUnderStockAwardsMember2023-01-012023-12-310000826675ecd:PeoMemberdx:AdjustmentForFairValueAtYearEndOfAwardsGrantedDuringYearAndUnvestedAtYearEndMember2023-01-012023-12-310000826675ecd:NonPeoNeoMemberdx:AdjustmentForFairValueAtYearEndOfAwardsGrantedDuringYearAndUnvestedAtYearEndMember2023-01-012023-12-310000826675dx:AdjustmentForFairValueAtVestingDateOfAwardsGrantedAndVestedDuringTheYearMemberecd:PeoMember2023-01-012023-12-310000826675dx:AdjustmentForFairValueAtVestingDateOfAwardsGrantedAndVestedDuringTheYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000826675dx:AdjustmentForChangeInFairValueFromPriorYearEndToCurrentYearEndOfStockAwardsGrantedInPriorYearsThatRemainUnvestedAtCurrentYearEndMemberecd:PeoMember2023-01-012023-12-310000826675dx:AdjustmentForChangeInFairValueFromPriorYearEndToCurrentYearEndOfStockAwardsGrantedInPriorYearsThatRemainUnvestedAtCurrentYearEndMemberecd:NonPeoNeoMember2023-01-012023-12-310000826675dx:AdjustmentForChangeInFairValueFromPriorYearEndToVestingDateOfAwardsGrantedInPriorYearsThatVestedDuringCurrentYearMemberecd:PeoMember2023-01-012023-12-310000826675dx:AdjustmentForChangeInFairValueFromPriorYearEndToVestingDateOfAwardsGrantedInPriorYearsThatVestedDuringCurrentYearMemberecd:NonPeoNeoMember2023-01-012023-12-310000826675dx:TotalEquityAwardAdjustmentsMemberecd:PeoMember2023-01-012023-12-310000826675ecd:NonPeoNeoMemberdx:TotalEquityAwardAdjustmentsMember2023-01-012023-12-310000826675dx:AdjustmentForAmountsReportedUnderStockAwardsMemberecd:PeoMember2022-01-012022-12-310000826675ecd:NonPeoNeoMemberdx:AdjustmentForAmountsReportedUnderStockAwardsMember2022-01-012022-12-310000826675ecd:PeoMemberdx:AdjustmentForFairValueAtYearEndOfAwardsGrantedDuringYearAndUnvestedAtYearEndMember2022-01-012022-12-310000826675ecd:NonPeoNeoMemberdx:AdjustmentForFairValueAtYearEndOfAwardsGrantedDuringYearAndUnvestedAtYearEndMember2022-01-012022-12-310000826675dx:AdjustmentForFairValueAtVestingDateOfAwardsGrantedAndVestedDuringTheYearMemberecd:PeoMember2022-01-012022-12-310000826675dx:AdjustmentForFairValueAtVestingDateOfAwardsGrantedAndVestedDuringTheYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000826675dx:AdjustmentForChangeInFairValueFromPriorYearEndToCurrentYearEndOfStockAwardsGrantedInPriorYearsThatRemainUnvestedAtCurrentYearEndMemberecd:PeoMember2022-01-012022-12-310000826675dx:AdjustmentForChangeInFairValueFromPriorYearEndToCurrentYearEndOfStockAwardsGrantedInPriorYearsThatRemainUnvestedAtCurrentYearEndMemberecd:NonPeoNeoMember2022-01-012022-12-310000826675dx:AdjustmentForChangeInFairValueFromPriorYearEndToVestingDateOfAwardsGrantedInPriorYearsThatVestedDuringCurrentYearMemberecd:PeoMember2022-01-012022-12-310000826675dx:AdjustmentForChangeInFairValueFromPriorYearEndToVestingDateOfAwardsGrantedInPriorYearsThatVestedDuringCurrentYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000826675dx:TotalEquityAwardAdjustmentsMemberecd:PeoMember2022-01-012022-12-310000826675ecd:NonPeoNeoMemberdx:TotalEquityAwardAdjustmentsMember2022-01-012022-12-310000826675dx:AdjustmentForAmountsReportedUnderStockAwardsMemberecd:PeoMember2021-01-012021-12-310000826675ecd:NonPeoNeoMemberdx:AdjustmentForAmountsReportedUnderStockAwardsMember2021-01-012021-12-310000826675ecd:PeoMemberdx:AdjustmentForFairValueAtYearEndOfAwardsGrantedDuringYearAndUnvestedAtYearEndMember2021-01-012021-12-310000826675ecd:NonPeoNeoMemberdx:AdjustmentForFairValueAtYearEndOfAwardsGrantedDuringYearAndUnvestedAtYearEndMember2021-01-012021-12-310000826675dx:AdjustmentForChangeInFairValueFromPriorYearEndToCurrentYearEndOfStockAwardsGrantedInPriorYearsThatRemainUnvestedAtCurrentYearEndMemberecd:PeoMember2021-01-012021-12-310000826675dx:AdjustmentForChangeInFairValueFromPriorYearEndToCurrentYearEndOfStockAwardsGrantedInPriorYearsThatRemainUnvestedAtCurrentYearEndMemberecd:NonPeoNeoMember2021-01-012021-12-310000826675dx:AdjustmentForChangeInFairValueFromPriorYearEndToVestingDateOfAwardsGrantedInPriorYearsThatVestedDuringCurrentYearMemberecd:PeoMember2021-01-012021-12-310000826675dx:AdjustmentForChangeInFairValueFromPriorYearEndToVestingDateOfAwardsGrantedInPriorYearsThatVestedDuringCurrentYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000826675dx:TotalEquityAwardAdjustmentsMemberecd:PeoMember2021-01-012021-12-310000826675ecd:NonPeoNeoMemberdx:TotalEquityAwardAdjustmentsMember2021-01-012021-12-310000826675dx:AdjustmentForAmountsReportedUnderStockAwardsMemberecd:PeoMember2020-01-012020-12-310000826675ecd:NonPeoNeoMemberdx:AdjustmentForAmountsReportedUnderStockAwardsMember2020-01-012020-12-310000826675ecd:PeoMemberdx:AdjustmentForFairValueAtYearEndOfAwardsGrantedDuringYearAndUnvestedAtYearEndMember2020-01-012020-12-310000826675ecd:NonPeoNeoMemberdx:AdjustmentForFairValueAtYearEndOfAwardsGrantedDuringYearAndUnvestedAtYearEndMember2020-01-012020-12-310000826675dx:AdjustmentForChangeInFairValueFromPriorYearEndToCurrentYearEndOfStockAwardsGrantedInPriorYearsThatRemainUnvestedAtCurrentYearEndMemberecd:PeoMember2020-01-012020-12-310000826675dx:AdjustmentForChangeInFairValueFromPriorYearEndToCurrentYearEndOfStockAwardsGrantedInPriorYearsThatRemainUnvestedAtCurrentYearEndMemberecd:NonPeoNeoMember2020-01-012020-12-310000826675dx:AdjustmentForChangeInFairValueFromPriorYearEndToVestingDateOfAwardsGrantedInPriorYearsThatVestedDuringCurrentYearMemberecd:PeoMember2020-01-012020-12-310000826675dx:AdjustmentForChangeInFairValueFromPriorYearEndToVestingDateOfAwardsGrantedInPriorYearsThatVestedDuringCurrentYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000826675dx:TotalEquityAwardAdjustmentsMemberecd:PeoMember2020-01-012020-12-310000826675ecd:NonPeoNeoMemberdx:TotalEquityAwardAdjustmentsMember2020-01-012020-12-31000082667512023-01-012023-12-31000082667522023-01-012023-12-31000082667532023-01-012023-12-31000082667542023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| | | | | | | | | | | | | | |

| Filed by the Registrant | ☒ | | Filed by a party other than the Registrant | ☐ |

| | | | | |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

Dynex Capital, Inc.

(Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | |

Payment of Filing Fee (Check all boxes that apply): |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials: |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | | |

2024 | NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS AND

PROXY STATEMENT |

| |

|

Annual Meeting of Shareholders

May 17, 2024 |

TO OUR COMMON SHAREHOLDERS:

March 28, 2024

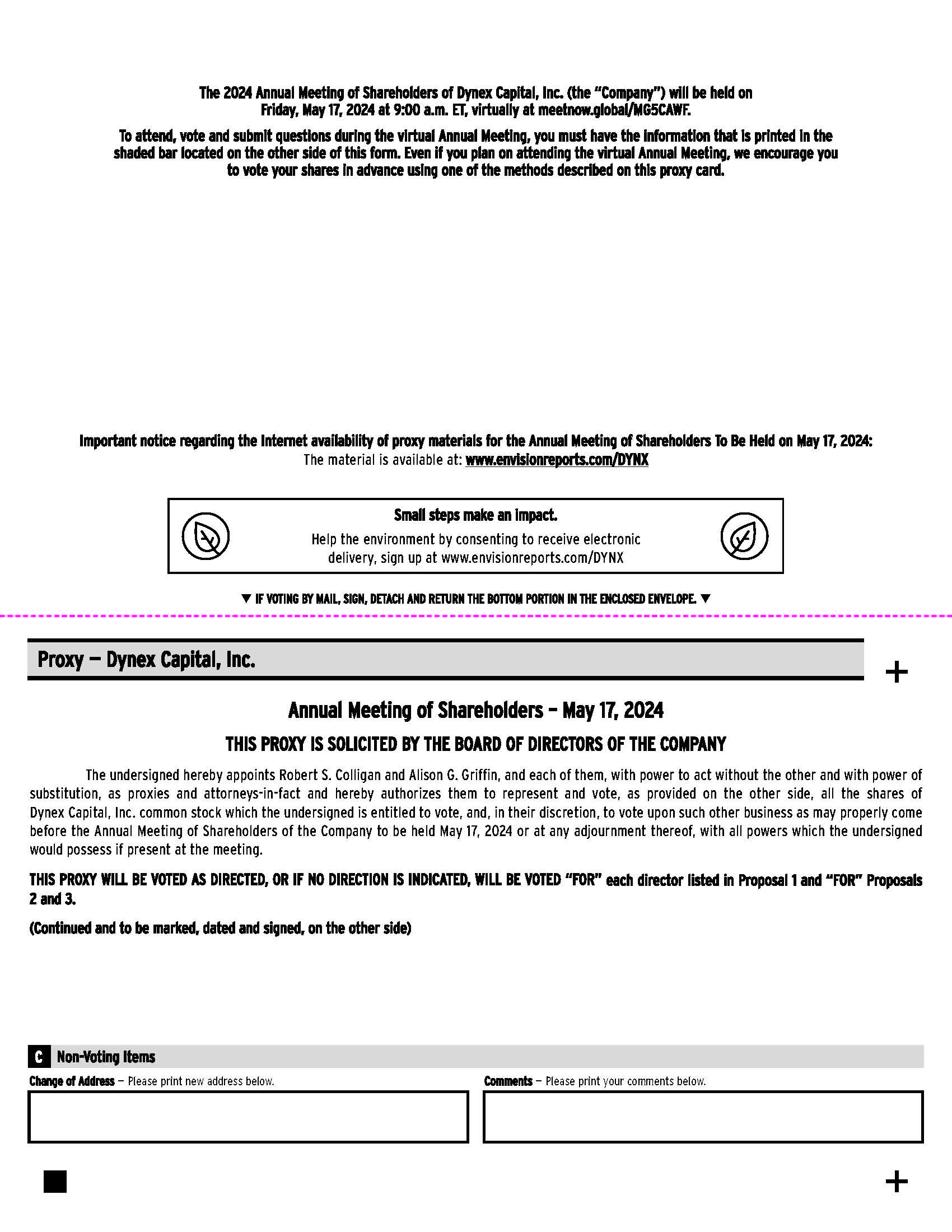

You are cordially invited to attend the Annual Meeting of Shareholders of Dynex Capital, Inc. (the “Company”) on Friday, May 17, 2024 beginning at 9:00 a.m. Eastern Daylight Time. As with last year’s annual meeting, we will use a virtual meeting format, which means that you may attend virtually by accessing www.meetnow.global/MG5CAWF. We believe that this format facilitates expanded shareholder access and participation.

The business of the meeting is to consider and act upon the election of directors; to approve, in an advisory and non-binding vote, the compensation of our named executive officers; and to ratify the selection of the auditors of the Company.

As permitted by rules adopted by the Securities and Exchange Commission (the “SEC”), we are furnishing our proxy statement and 2023 Annual Report to Shareholders over the Internet to most of our shareholders, on or about March 28, 2024. This means that most of our shareholders will initially receive only a notice containing instructions on how to access the proxy materials over the Internet. This approach lowers the cost of delivering the annual meeting materials and reduces the environmental impact of the meeting. If you would like to receive a paper copy of the proxy materials, the notice contains instructions on how you can request copies of these documents.

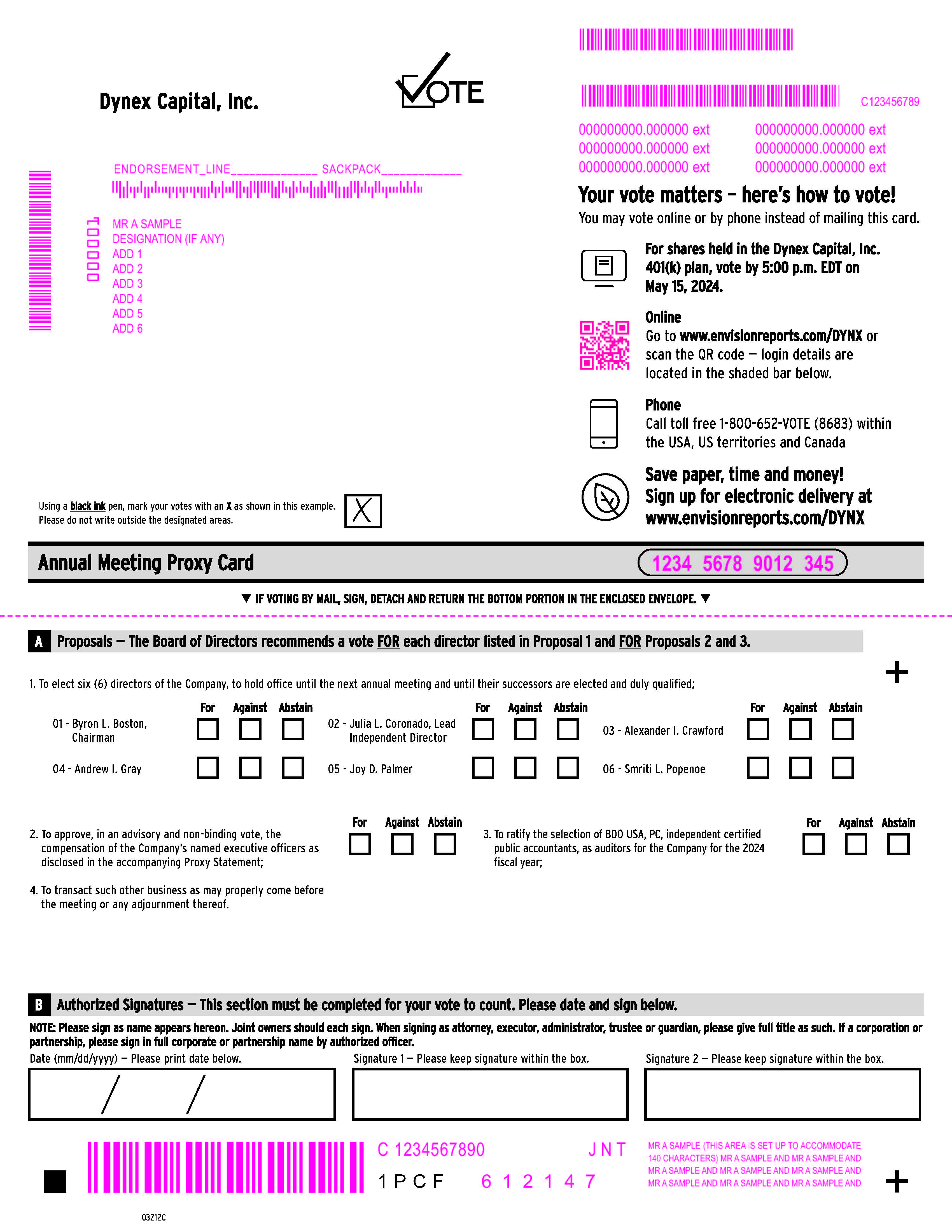

Whether or not you plan to attend the meeting, your vote is important, and we encourage you to vote promptly. You may vote your shares via a toll-free telephone number or over the Internet. If you receive your proxy materials by mail, you may instead sign, date and mail the proxy card in the postage-paid envelope provided. Instructions

regarding all three methods of voting are contained in the proxy card. If you mail the proxy card and desire to vote your shares of common stock in accordance with management’s recommendations, you need not mark your votes on the proxy but need only sign, date and return the proxy card in the envelope provided in order to record your vote.

Sincerely,

Byron L. Boston

Chairman of the Board

| | | | | | | | |

| DYNEX CAPITAL, INC. | | 2024 PROXY STATEMENT |

| | | | | | | | | | | | | | |

NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS | | |

|

|

| | | | 4991 Lake Brook Drive, Suite 100

Glen Allen, Virginia 23060

(804) 217-5800 |

| | | | | | | | | | | | | | | | | |

TO OUR COMMON SHAREHOLDERS: | | | |

| WHEN: | | WHERE: | | RECORD DATE: |

Friday, May 17, 2024

9:00 a.m. Eastern Daylight Time | The Annual Meeting will be a virtual meeting which means that shareholders may attend virtually by accessing www.meetnow.global/MG5CAWF | Shareholders of record at the close of business on Thursday, March 14, 2024 are entitled to vote. |

| | | | | | | | | | | | | | | | | |

| ITEMS OF BUSINESS | | | |

| Proposal | Board Recommendation | See Page |

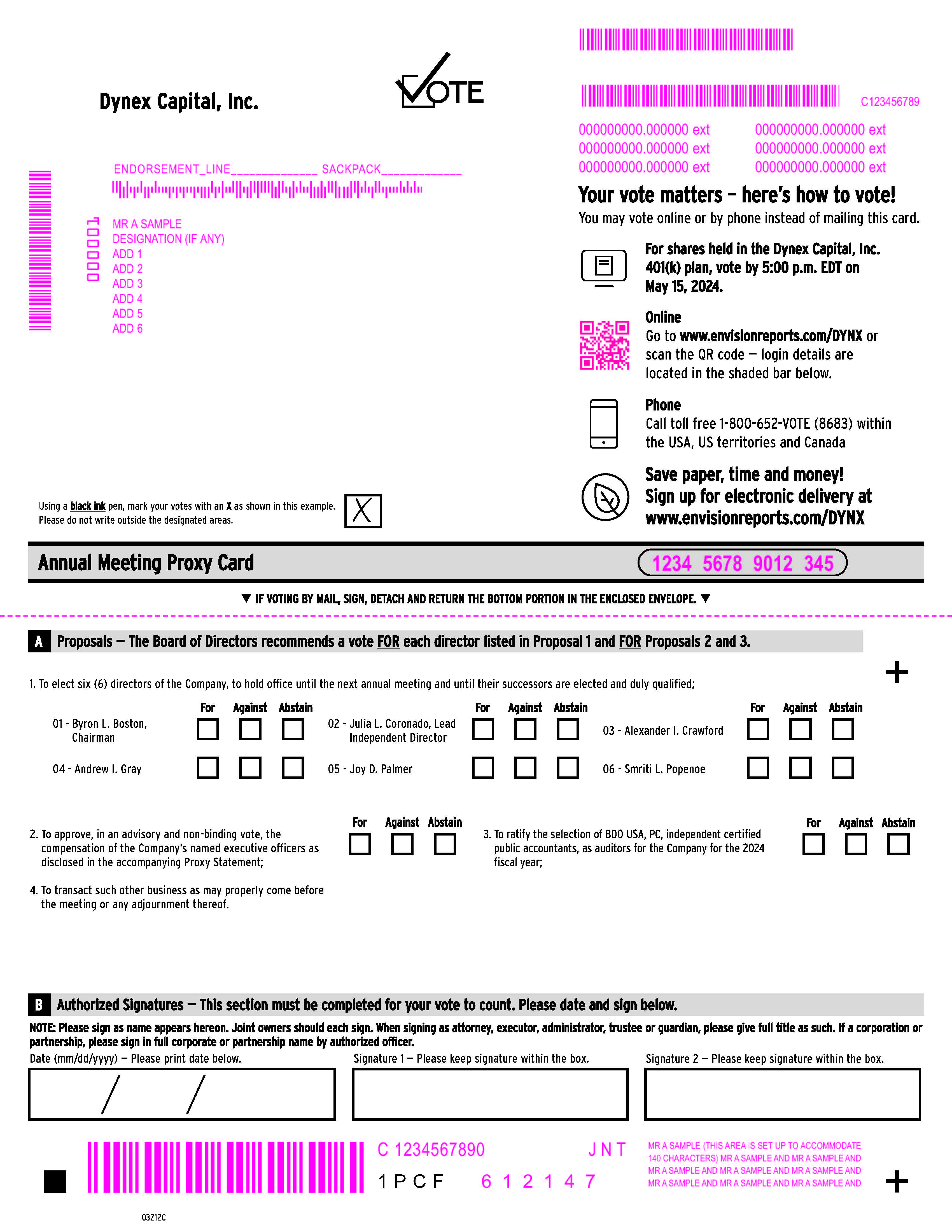

1 | To elect six (6) directors of the Company, to hold office until the next annual meeting and until their successors are elected and duly qualified; | | | For each director | |

2 | To approve, in an advisory and non-binding vote, the compensation of the Company’s named executive officers as disclosed in the accompanying Proxy Statement; | | | | |

3 | To ratify the selection of BDO USA, PC, independent certified public accountants, as auditors for the Company for the 2024 fiscal year; and | | | | |

4 | To transact such other business as may properly come before the meeting or any adjournment thereof. | | | | |

| | | | | | | | |

2024 PROXY STATEMENT | | DYNEX CAPITAL, INC. |

The Annual Meeting will be a virtual meeting, which means that shareholders may attend by accessing www.meetnow.global/MG5CAWF. Shareholders will be able to listen, vote and submit questions during the Annual Meeting online. There will be no physical location for shareholders to attend the Annual Meeting.

Only shareholders of record of our common stock at the close of business on March 14, 2024, the record date, will be entitled to vote at the Annual Meeting.

Management desires to have maximum representation at the Annual Meeting. Whether or not you plan to attend the meeting, we urge you to vote your shares via the toll-free telephone number or over the Internet, as described in the accompanying Proxy Statement. If you receive these materials by mail, you may instead sign, date and mail the proxy card in the postage-paid envelope provided. A proxy may be revoked by a shareholder prior to its use by notice in writing to the Secretary of the Company, by submitting a later-dated proxy to the Secretary of the Company,

by changing your vote via the toll-free telephone number or over the Internet or by attending and voting during the Annual Meeting (provided that, if you hold your shares through a bank, broker or other holder of record and you wish to vote during the Annual Meeting, you must register prior to the Annual Meeting, as described in the Proxy Statement).

By Order of the Board of Directors

Robert S. Colligan

Executive Vice President, Chief Financial Officer and Secretary

Dated: March 28, 2024

| | | | | | | | |

| DYNEX CAPITAL, INC. | | 2024 PROXY STATEMENT |

TABLE OF CONTENTS

| | | | | | | | |

2024 PROXY STATEMENT | | DYNEX CAPITAL, INC. |

| | | | | | | | |

PROXY STATEMENT

ANNUAL MEETING OF

SHAREHOLDERS | | |

| | 4991 Lake Brook Drive, Suite 100 Glen Allen, Virginia 23060 (804) 217-5800 |

To be held on May 17, 2024

TO OUR COMMON SHAREHOLDERS:

This Proxy Statement is furnished to the holders of the common stock of Dynex Capital, Inc. (the “Company”) in connection with the solicitation by the Company’s Board of Directors (the “Board”) of proxies to be used at the Annual Meeting of Shareholders of the Company to be held virtually on Friday, May 17, 2024 , at 9:00 a.m. Eastern Daylight Time (the “Annual Meeting”). Shareholders may attend the Annual Meeting by accessing www.meetnow.global/MG5CAWF and following the instructions in the beginning of this Proxy Statement. Shareholders will be able to listen, vote and submit questions during the Annual Meeting online. There will be no physical location for shareholders to attend the Annual Meeting.

The Annual Meeting is being held for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders.

As permitted by rules adopted by the SEC, the Company is making this Proxy Statement and its 2023 Annual Report to Shareholders available to most of our shareholders electronically over the Internet. On March 28, 2024, we commenced mailing to our shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access this Proxy Statement and our Annual Report and vote over the Internet.

Most shareholders will not receive a printed copy of the proxy materials in the mail, unless specifically requested. Instead, the Notice of Internet Availability of Proxy Materials instructs you on how to access and review over the Internet all of the important information contained in the Proxy Statement and Annual Report and on how you may submit your proxy over the Internet. If you would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice of Internet Availability of Proxy Materials.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting to Be Held on Friday, May 17, 2024

The Proxy Statement and 2023 Annual Report to Shareholders are available online by visiting www.envisionreports.com/DYNX.

| | | | | | | | | | | | | | |

| DYNEX CAPITAL, INC. | | 2024 PROXY STATEMENT | | 1 |

INFORMATION ABOUT

THE ANNUAL MEETING AND VOTING

The Board believes that a virtual meeting format will provide the opportunity for full and equal participation by all shareholders, from any location around the world. A virtual meeting also substantially reduces the costs associated with hosting an in-person meeting.

We have sought to design our virtual meeting format to enhance shareholder access, participation and communication. Shareholders will be able to listen, vote and submit questions online during the Annual Meeting. The Company believes its virtual Annual Meeting will afford a greater number of our shareholders the opportunity to attend the Annual Meeting while affording shareholders the same rights they would have had at an in-person meeting.

If you plan to attend the virtual Annual Meeting, please follow the instructions in the following Questions and Answers:

Q: How can I attend the Annual Meeting?

A: The Annual Meeting will be a virtual meeting of shareholders, which means that you may attend the meeting by accessing www.meetnow.global/MG5CAWF to log-in on the day of the meeting and enter your control number located on your Notice of Internet Availability of Proxy Materials or proxy card. There will be no physical location for shareholders to attend the Annual Meeting.

You are entitled to attend, vote and submit questions prior to and during the Annual Meeting if you were a shareholder of the Company as of the close of business on March 14, 2024, the record date, or if you hold a valid proxy for the Annual Meeting.

Guests may join the Annual Meeting in a listen-only mode.

The Annual Meeting will begin promptly at 9:00 a.m. Eastern Daylight Time. We encourage you to access the meeting prior to the start time to leave ample time to log into the meeting and test your computer audio system. You should ensure that you have a strong Internet connection to support your virtual attendance at the Annual Meeting.

Please follow the instructions as outlined below.

Q: Do I need to register to attend the Annual Meeting?

A: Registered Shareholders. If you are a registered shareholder (i.e., you hold your shares through our transfer agent, Computershare), then you do not need to register to attend the Annual Meeting.

Beneficial Shareholders. If your shares are held in “street name” (i.e., you hold your shares through an intermediary, such as a bank or broker), then you must register in advance to attend the Annual Meeting.

To register to attend the Annual Meeting you must submit proof of your proxy power (such as a legal proxy or broker’s proxy card) reflecting your common stock holdings, along with your name and email address to Computershare. Requests for registration should be directed to Computershare by email to legalproxy@computershare.com (forwarding the email from your broker, or attaching an image of your legal proxy) or by mail to:

Computershare

Dynex Capital, Inc. Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

Requests for registration must be labeled as “Legal Proxy” and be received on or before May 15, 2024.

You will receive a confirmation of your registration by email (or by mail, if no email address is provided) after Computershare receives your registration materials.

Q: How do I ask questions during the Annual Meeting?

A: Shareholders of record may submit questions prior to or during the Annual Meeting by visiting www.meetnow.global/MG5CAWF and entering your control number located on your Notice of Internet Availability of Proxy Materials or proxy card, and then following the instructions to submit a question.

Questions submitted in advance of and during the meeting that are pertinent to meeting matters will be answered during the meeting, subject to time limitations. Substantially similar questions will be answered once to avoid repetition and allow for more time for other questions. If there are pertinent questions submitted that cannot be answered during the

| | | | | | | | | | | | | | |

2 | | 2024 PROXY STATEMENT | | DYNEX CAPITAL, INC. |

meeting due to time limitations, management will post answers to a representative set of such questions (after consolidating questions) to our website at www.dynexcapital.com under “Investor Center – Proxy Materials.”

Q: What if I have trouble accessing the Annual Meeting?

A: If you have technical difficulties logging into the Annual Meeting or while in attendance, you can use the technical resources available on the log-in page at www.meetnow.global/MG5CAWF, which will be available beginning at 8:30 a.m. Eastern Daylight Time on May 17, 2024 or contact 1-888-724-2416 for further assistance.

If there are any technical issues in convening or hosting the Annual Meeting, we will promptly post information to our website at www.dynexcapital.com under “Investor Center – Proxy Materials,” including information on when the meeting will be reconvened.

SOLICITATION

You have received these proxy materials because the Board is soliciting your proxy to vote your shares at the Annual Meeting. The costs of this solicitation will be borne by the Company.

Proxy solicitations will be made by the Internet and mail, and also may be made by personal interview, telephone and e-mail by directors and officers of the Company, acting without compensation other than their regular compensation. Brokerage houses and nominees will be requested to forward the proxy soliciting material to the beneficial owners of shares of common stock and to obtain authorization for the execution of proxies. The Company will, upon request, reimburse such parties for their reasonable expenses in forwarding these proxy materials to such beneficial owners.

VOTING RIGHTS

Our common stock is the Company’s only class of capital stock entitled to vote at the Annual Meeting. Holders of shares of common stock at the close of business on March 14, 2024, the record date, are entitled to notice of, and to vote at, the Annual Meeting. On that date, 59,129,820 shares of common stock were outstanding, with each outstanding share of common stock entitled to one vote for each of the six directors nominated and one vote on each other matter presented at the Annual Meeting.

QUORUM AND BROKER NON-VOTES

The presence of a majority of the outstanding shares of common stock entitled to vote, in person or by proxy, will constitute a quorum for all matters presented at the Annual Meeting. Shares represented in person or by proxy at the Annual Meeting, including shares represented by proxies that reflect abstentions, will be counted as present in the determination of a quorum. Virtual attendance at the Annual Meeting constitutes presence “in person” for purposes of a quorum at the meeting. “Broker non-votes” (which are shares held by brokers or nominees as to which (i) instructions have not been received from the beneficial owner or the persons entitled to vote the shares, and (ii) the broker does not have discretionary voting power on a particular matter) will be treated in the same manner as abstentions for purposes of a quorum. The election of directors and the advisory vote to approve the compensation of the Company’s named executive officers, are not considered routine matters and, therefore, brokers do not have discretionary voting power with respect to these proposals. The ratification of the selection of BDO USA, PC as the Company’s auditors for the 2024 fiscal year is considered a routine matter under the NYSE rules and, therefore, brokers do have discretionary voting power with respect to this proposal.

VOTE REQUIRED

Under the Company’s “majority vote” standard for uncontested director elections, with respect to each nominee, votes may be cast for or against, or you may abstain from voting. Cumulative voting is not permitted. If a quorum is present, in order for a nominee to be elected in an uncontested election, the votes cast for such nominee’s election must exceed the votes cast against such nominee’s election. Abstentions or broker non-votes will not count as votes cast and will have no effect on the outcome of the election. If a nominee who is an incumbent director is not elected to the Board, he or she must offer his or her resignation promptly to the Board, which will then determine whether to accept or reject the offered resignation, or whether to take other action. The Company maintains a “plurality vote” standard in contested director elections (where the number of nominees exceeds the number of directors to be elected).

For the advisory vote to approve the compensation of the Company’s named executive officers and the ratification of the selection of BDO USA, PC as the Company’s auditors for the 2024 fiscal year, votes may be cast for or against, or you may abstain from voting. For these proposals, if a quorum is present, approval of the proposal requires that the number of votes cast for the

| | | | | | | | | | | | | | |

| DYNEX CAPITAL, INC. | | 2024 PROXY STATEMENT | | 3 |

proposal by holders entitled to vote exceeds the number of votes cast against the proposal. Abstentions and broker non-votes (if applicable) will not count as votes cast and will have no effect on the outcome of the proposal.

INFORMATION ABOUT VOTING

You will receive multiple Notices of Internet Availability of Proxy Materials or printed copies of the proxy materials if you hold your shares in different ways (e.g., joint tenancy, trusts, custodial accounts, etc.) or in multiple accounts. You should vote the shares represented by each Notice of Internet Availability of Proxy Materials and proxy card you receive to ensure that all of your shares are voted.

Shareholders of record can vote during the Annual Meeting or by proxy. There are three ways for shareholders of record to vote by proxy:

• By Telephone - you can vote by telephone toll-free by following the instructions on the proxy card (you will need the control number on your Notice of Internet Availability of Proxy Materials or proxy card);

• By Internet - you can vote over the Internet by following the instructions on the Notice of Internet Availability of Proxy Materials or proxy card (you will need the control number on your Notice of Internet Availability of Proxy Materials or proxy card); or

• By Mail - if you received these proxy materials by mail, you can vote by mail by signing, dating and mailing the proxy card in the postage-paid envelope provided.

If you hold shares in the Dynex Capital, Inc. 401(k) Plan, your voting instructions for those shares must be received by 5:00 p.m. Eastern Daylight Time on May 15, 2024 to allow sufficient time for voting by the trustee of the plan.

If you hold your shares through an intermediary, such as a bank or broker, you will receive voting instructions from the holder of record and you must register in advance to attend the Annual Meeting.

REVOCABILITY OF PROXY

If you are a shareholder of record, you may change or revoke your proxy at any time before your shares are voted at the Annual Meeting, by any of the following methods:

• By submitting a written notice of revocation to the Secretary of the Company by the close of business on May 15, 2024;

• By submitting by the close of business on May 15, 2024 a completed proxy card bearing a later date than any other proxy submitted by you;

• By toll-free telephone by following the instructions on the proxy card (you will need the control number on your Notice of Internet Availability of Proxy Materials or proxy card);

• By visiting the website listed on the Notice of Internet Availability of Proxy Materials or proxy card and following the instructions (you will need the control number on your Notice of Internet Availability of Proxy Materials or proxy card); or

• By attending the Annual Meeting and voting during the Annual Meeting.

Your latest proxy card, telephone vote, or Internet vote with respect to the same shares is the one that will be counted.

If you hold your shares through an intermediary, such as a bank or broker, you should contact the holder of record to change your vote.

Voting your shares by telephone or over the Internet or sending in a proxy card will not affect your right to attend and vote during the Annual Meeting. However, if you hold your shares through an intermediary, such as a bank or broker and you plan to vote during the Annual Meeting, you must register in advance of the Annual Meeting.

If you vote in time for the Annual Meeting by proxy, the individuals named on the proxy (your “proxies”) will vote your shares of common stock in accordance with the choices you specified. If you properly submit a proxy without indicating your instructions, the shares of common stock represented by such proxy will be voted FOR the election of the nominees named in this Proxy Statement as directors, FOR the approval of the compensation of the Company’s named executive officers, and FOR the ratification of the selection of BDO USA, PC as the Company’s auditors for the 2024 fiscal year.

| | | | | | | | | | | | | | |

4 | | 2024 PROXY STATEMENT | | DYNEX CAPITAL, INC. |

OTHER MATTERS

Management and the Board know of no other matters to come before the Annual Meeting other than those stated in the Notice of Annual Meeting of Shareholders. However, if any other matters are properly presented to the shareholders for action, it is the intention of the individuals named in the proxy to vote in their discretion on all matters on which the shares represented by such proxy are entitled to vote.

ANNUAL REPORT ON FORM 10-K AND MAILING

The Company’s Annual Report on Form 10-K, including financial statements for the year ended December 31, 2023, which is available on the Internet as set forth in the Notice of Internet Availability of Proxy Materials and is being mailed together with this Proxy Statement to shareholders who receive the proxy materials by mail, contains financial and other information about the activities of the Company, but is not incorporated into this Proxy Statement and is not to be considered a part of these proxy soliciting materials.

| | | | | | | | | | | | | | |

| DYNEX CAPITAL, INC. | | 2024 PROXY STATEMENT | | 5 |

| | |

PROPOSAL ONE

ELECTION OF DIRECTORS |

DIRECTOR NOMINEES

Pursuant to Virginia law and our Restated Articles of Incorporation (the “Articles of Incorporation”), directors of the Company are to be elected by the holders of shares of common stock at the Annual Meeting to serve until the next annual meeting and until their successors are elected and duly qualified. Director David H. Stevens passed away in January 2024. During his time with the company, he leveraged his extensive industry experience and deep knowledge of mortgage finance, capital markets, and housing policy to shape and advance the Company’s strategy and ensure that the Company continued to thrive in an increasingly complex market. On September 8, 2023, the Board appointed Smriti L. Popenoe to the Board. On March 6, 2024, the Board appointed Alexander I. Crawford and Andrew I. Gray to the Board. The appointees to the Board were recommended by executive officers of Dynex. On March 11, 2024, Robert A. Salcetti and Michael R. Hughes stepped down as members of the Board. On the recommendation of the Nominating & Corporate Governance Committee (the “Nominating Committee”), the Board nominated Byron L. Boston, Julia L. Coronado, Alexander I. Crawford, Andrew I. Gray, Joy D. Palmer, and Smriti L. Popenoe for election by the holders of shares of common stock to the Board at the Annual Meeting.

Unless otherwise indicated, a proxy will be voted FOR the election of Messrs. Boston, Crawford, and Gray, Dr. Coronado, and Mses. Palmer and Popenoe to the Board. Each director nominee has agreed to serve if elected. Selected biographical information regarding each director nominee is set forth below.

Although it is anticipated that each director nominee will be able to serve, should any nominee become unavailable to serve, the shares represented by each proxy may be voted for another person or persons designated by the Board. In no event will a proxy be voted for more than six directors.

BOARD COMPOSITION

The following information sets forth the names, ages, principal occupations and business experience for the Company’s director nominees as of March 31, 2024. In addition to the information presented below regarding each director nominee’s specific experience, qualifications, attributes and skills that led our Board to the conclusion that he or she should serve as a director, we also believe that all of our director nominees are aligned with our purpose of making lives better through careful stewardship of individuals' savings, providing financing and strengthening the communities we serve. Further, we believe our director nominees live our core values of kindness, stewardship, performance mentality, integrity, trust as well as equality and inclusion. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to the Company and our Board. Finally, we value their significant experience on other boards and board committees. Unless otherwise indicated, the business experience and principal occupations shown for each director has extended five or more years.

| | | | | | | | | | | | | | | | | |

NOMINEE | AGE | GENDER DIVERSE | RACIAL/ETHNIC DIVERSE | INDEPENDENT | TENURE |

Boston | 65 | | ● | | 12 years |

Coronado | 55 | ● | | ● | 3 years |

Crawford | 57 | | | ● | 1 month |

Gray | 58 | | ● | ● | 1 month |

| Palmer | 66 | ● | | ● | 3 years |

| Popenoe | 55 | ● | ● | | 7 months |

| | | | | | | | | | | | | | |

6 | | 2024 PROXY STATEMENT | | DYNEX CAPITAL, INC. |

BOARD COMPOSITION AND ATTRIBUTES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| AGE | | | | | | TENURE | | | | |

50-55 Years Old | ● | ● | | | | Less than 1 Year | ● | ● | ● | |

56-60 Years Old | ● | ● | | | | 1-5 Years | ● | ● | | |

61-65 Years Old | ● | | |

| | 6-10 Years | | | | |

66-70 Years Old | ● | | | | | 11-15 Years | ● | | | |

| | | | | | | | |

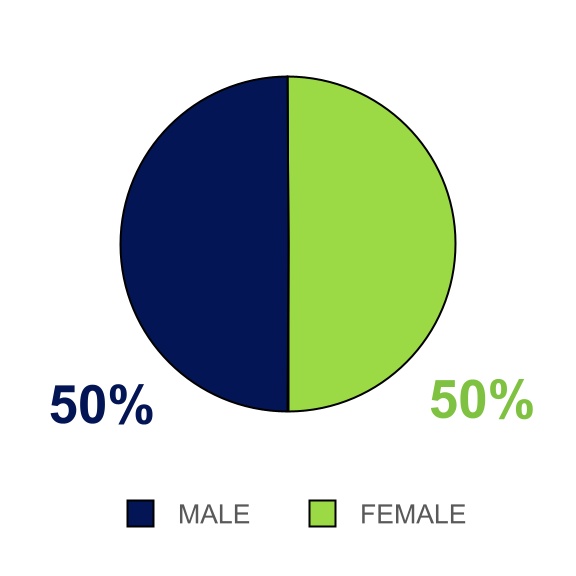

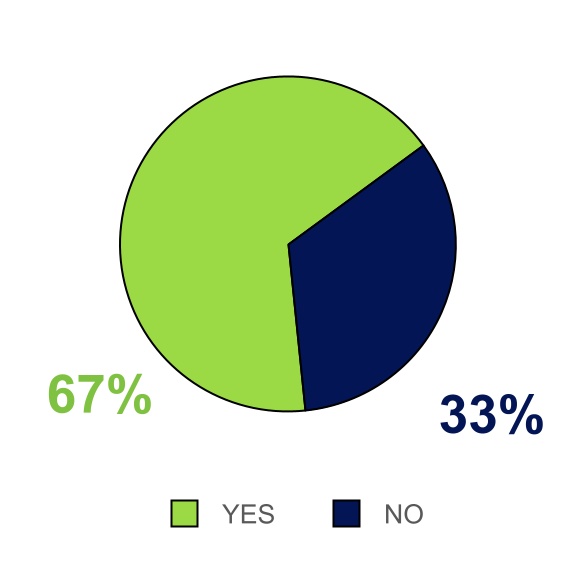

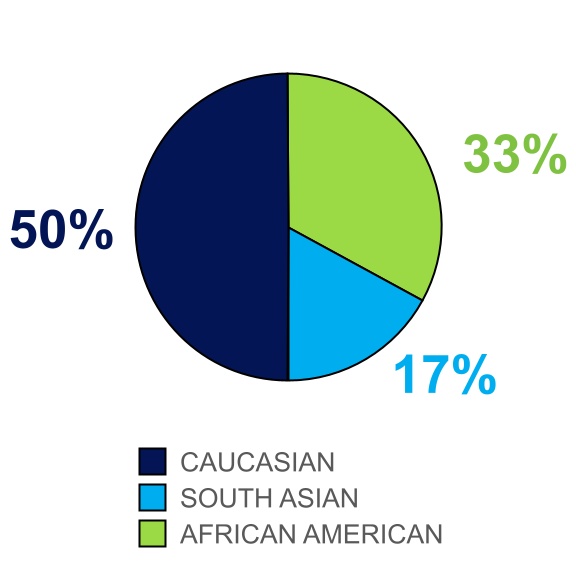

| GENDER DIVERSITY | | INDEPENDENT |

| | | | | | | | |

RACIALLY OR ETHNICALLY DIVERSE | | |

| | | | | | | | | | | | | | |

| DYNEX CAPITAL, INC. | | 2024 PROXY STATEMENT | | 7 |

DIRECTOR SKILLS AND QUALIFICATIONS

The Board believes that its directors collectively have the level and balance of skills, experience, diversity, and character to execute the Board’s responsibilities. The table below reflects some of the key skills that our Board has identified as particularly valuable to the effective oversight of the Company and the execution of our corporate strategy, along with the number of directors that have these skills. This director skills matrix is not intended to be an exhaustive list of each of our

director’s skills or contributions to our Board. All of our directors also exhibit high integrity, an appreciation for diversity of background and thought, innovative thinking, a proven record of success, and deep knowledge of corporate governance requirements and best practices. Additional information on each director, including some of their specific experience, qualifications, attributes and skills, is set forth below under “Proposal One – Election of Directors”.

Indicates a relevant skill, knowledge and/or experience identified by that director.

Indicates a relevant skill, knowledge and/or experience identified by that director. | | | | | | | | | | | | | | | | | | | | |

| Boston | Coronado | Crawford | Gray | Palmer | Popenoe |

| Senior Leadership | | | | | | |

| Financial Services Industry | | | | | | |

| M&A | | | | | | |

| Capital Markets | | | | | | |

| Business Operations | | | | | | |

Cybersecurity and Technology | | | | | | |

Risk Management | | | | | | |

| Government Policy and Regulatory | | | | | | |

Accounting/Audit | | | | | | |

| Mortgage Industry | | | | | | |

| Investment Management | | | | | | |

| Corporate Governance | | | | | | |

Public Company Experience | | | | | | |

| Business Development and Strategy | | | | | | |

| Social Responsibility/ ESG | | | | | | |

| Artificial Intelligence | | | | | | |

| Finance | | | | | | |

| Independent Audit Committee Financial Expert | | | | | | |

| Managing Climate Change | | | | | | |

| Human Capital Management | | | | | | |

| Executive Compensation | | | | | | |

| | | | | | | | | | | | | | |

8 | | 2024 PROXY STATEMENT | | DYNEX CAPITAL, INC. |

| | | | | | | | |

| DIRECTOR NOMINEE BIOGRAPHIES |

| BYRON L. BOSTON | Chairman of the Board and Chief Executive Officer |

Byron L. Boston joined the Board in 2012 and was appointed to the role of Chairman in December 2023. Byron has served as the Chief Executive Officer since January 2014, and previously served as the President of Dynex from March 2012 to December 2020, and as Chief/Co-Chief Investment Officer from April 2008 until December 2023. Byron leads the strategic operations that have resulted in long term net gains and significant economic return for investors.

Business Leadership: Byron brings more than 20 years of leadership experience and has an extensive background in U.S. real estate finance, asset management/investment banking, and fixed-income capital markets. Byron was successful in building Sunset Financial Resources, a mortgage REIT specializing in high-quality residential and commercial loans and securities, and instrumental in growing Dynex Capital's business after he joined the Company in 2008. Byron leverages this extensive experience and deep understanding of Dynex’s growth and strategy to guide the Company’s business operations and disciplined investment approach. As CEO and Chairman of Dynex’s Board of Directors, he also helps drive continued collaboration between the Company’s executive leadership team and Board.

Mortgage-Backed Security Experience: Over the course of his career, Byron has gained significant experience in the debt and equity capital markets. During his six years at Freddie Mac, he developed and led the initial investment plan to grow the company’s retained portfolio. Previously, Byron spent over a decade at Credit Suisse First Boston as a fixed income bond trader specializing in mortgage backed securities and over two years at Lehman Brothers as a mortgage-backed securities bond trader.

Background: Byron currently serves on multiple boards in advisory and leadership capacities including Mortgage Bankers Association and National Association of Real Estate Investment Trusts (“NAREIT”) Advisory Board of Governors representing the industry on a national level. He also serves on the board of the Salzburg Global Seminar where he has served as the Chair of the Investment Committee and the Chair of the Finance Committee. He received an A.B. in Economics and Government from Dartmouth College and a MBA with emphasis in Accounting and Finance from the University of Chicago Booth School of Business, where he was also a member of the Director’s Consortium.

|

Age: 65 Director Since: 2012 Chairman Since: 2023 Committee: Investment (Chair) Key Skills: •Senior Leadership & Business Operations •Financial Services Industry •Capital Markets •Mortgage Industry •Investment Management •Corporate Governance Other Current Boards: NAREIT Advisory Board of Governors, Salzburg Global Seminar |

| | | | | | | | | | | | | | |

| DYNEX CAPITAL, INC. | | 2024 PROXY STATEMENT | | 9 |

| | | | | | | | |

| JULIA L. CORONADO, Ph.D. | Lead Independent Director of the Board |

Julia L. Coronado, Ph.D. joined the Board in October 2020 and was appointed as Lead Independent Director in December 2023. Financial Experience: Since 2017, Julia has served as the President and Founder of MacroPolicy Perspectives, LLC (MPP) a research advisory firm with deep expertise in macroeconomics, regulatory policy, financial and global markets that helps inform client decisions in financial services and other industries. Since 2018, she has served as Clinical Associate Professor of Finance at the University of Texas at Austin. From 2014 to 2017, Julia was the Chief Economist at Graham Capital Management where she managed a global economic forecast, advised portfolio managers, and participated in risk and investment committees. Additionally, she spent 10 years in the banking industry, first as a Senior US Economist at BNP Paribas and then at Barclays as Senior US Economist. Julia also served as a staff economist for the Federal Reserve Board of Governors in Washington, D.C. and contributed to the Federal Open Market Committee forecasts from 1997 to 2006. Financial Advisory Experience: Julia brings over 30 years of experience in international and domestic market economics, fiscal and monetary policy, and global economic forecasting. She is a regular commentator in financial media, (including CNBC, Bloomberg, Marketplace, and the Wall Street Journal). Julia has also represented the U.S. at the Organization for Economic Cooperation & Development and testified before Congress on Social Security reform and digital currency developments. Her experience across these areas, as well as her service on other public company and advisory boards, allows her to provide significant insight to help guide the Company’s business strategy and enable it to thrive in a complex macroeconomic environment. Background: Julia is an Independent Director on the Board of Robert Half, an international staffing and consulting firm, where she serves on the nominating & governance committee. Julia is a member of the Economic Studies Council at the Brookings Institution and member of the Advisory Boards of the Bureau of Economic Analysis, the Pension Research Council at the Wharton School, and the Cleveland Federal Reserve Center for Inflation Research. She received a B.A. in Economics from the University of Illinois and a Ph.D. in Economics from the University of Texas at Austin.

|

Age: 55 Director Since: 2020 Committees: •Compensation (Chair) •Nominating & Corporate Governance •Investment Key Skills: • Senior Leadership & Business Operations • Financial Services Industry • Capital Markets • Government Policy and Regulatory • Academia Other Current Public Boards: Robert Half |

| | | | | | | | | | | | | | |

10 | | 2024 PROXY STATEMENT | | DYNEX CAPITAL, INC. |

| | | | | | | | |

| ALEXANDER I. CRAWFORD | |

Alexander I. Crawford joined the board in March 2024. Business Leadership, Financial Services, and Technology Experience: Alexander brings extensive financial knowledge and expertise across the broad financial ecosystem, including global multi-asset risk management, public and private equity, credit, and tail-risk hedging. He is also recognized as a thought leader in the risk management of artificial intelligence. As the founder, Chairman, and CEO of Artificial Intelligence Risk, Inc., Alexander created a governance, risk, compliance, and cybersecurity platform for corporate artificial intelligence ("AI") and developed incisive data-driven analytics and quantitative tools to analyze and mitigate risks through innovative strategies. Alexander is a thought leader on making AI effective, safe, and ethical and has written extensively on the topic. His background and expertise will help strengthen Dynex’s technology capabilities and position in an evolving financial services industry. Additional Professional Experience: Alexander also brings to our Board extensive experience and expertise in risk management and compliance. He served in a number of senior risk management roles, including most recently as Partner and Chief Investment Risk Officer at Lord, Abbett & Co. LLC from 2012 to 2022, and is now a Limited Partner there. As the Chief Investment Risk Officer, Alexander engaged with global regulators on various topics. He is well-respected by his peers and regulators and sat on numerous industry working groups during his tenure, such as leading the LIBOR transition effort at Lord Abbett. He was responsible for writing detailed regulatory policies and procedures for the U.S. and Europe and continues to engage globally on complying with existing and creating new policies regarding AI with governments, regulators, companies, and NGOs. In addition, Alexander was a charter member of Lord Abbett's ESG committee and has written extensively on the intersection of sustainability, ESG, and AI. He is the lead author of a forthcoming white paper using a data-driven approach that focuses on broadening sustainability to look at important sustainability metrics beyond simply greenhouse gases. Background: Alexander earned a B.S. in Computer Science from Harvard University. He has been a senior executive at major financial institutions, including Goldman Sachs, Morgan Stanley, Deutsche Bank, and RBS, for over 10 years. He has focused extensively on MBS throughout his career, and his MBS research has appeared in numerous publications. His 35-year career will offer significant insights for the Company’s business and make him a valuable member of the Board. |

Age: 57 Director Since: March 2024 Committees: •Audit •Compensation •Investment Key Skills: •Financial Services Industry •Risk Management •Government Policy and Regulatory •Artificial Intelligence and Technology •Investment Management |

| | | | | | | | | | | | | | |

| DYNEX CAPITAL, INC. | | 2024 PROXY STATEMENT | | 11 |

| | | | | | | | |

| ANDREW I. GRAY | |

Andrew I. Gray joined the board in March 2024. Andrew is currently an Executive Advisor at MyNextSeason and serves on the Board of Trustees of the Global Association of Risk Professionals (GARP). Andrew has over 30 years of leadership experience across the financial services industry, including profit and loss management, strategy, finance, risk, and technology. He has a strong track record in guiding leadership teams and advising boards on business growth, operational improvement and risk, and regulatory compliance. Risk Professional Experience: Most recently, Andrew served as the Group Chief Risk Officer ("CRO") and Management Committee member for The Depository Trust and Clearing Corporation (the “DTCC”). Over his tenure he transformed the global risk function and drove significant improvements in market, liquidity, credit, and non-financial risk capabilities, including cybersecurity, business continuity, data management, and operational risk. With his extensive background in the financial services and risk management industries, he will play a crucial role in helping guide Dynex’s operational and growth strategy. Business Leadership Experience: Prior to his CRO role, Andrew led DTCC’s core businesses, including Clearance and Settlement of Equities and Fixed Income products, Asset Services, Wealth Management Services, Insurance & Retirement Services, Institutional Trade Processing and Data Services. He had responsibility for P&L management, strategy development and execution, rollout of new business and industry initiatives, M&A transactions, and implementation of enhanced processes for business risk management. Previously, Andrew spent over a decade at Merrill Lynch in senior leadership roles, including COO of the firm’s Latin America and Canada business, Managing Director of Strategy and Business Development, and the Head of Corporate Planning for the enterprise. In these roles, he gained valuable experience in business restructuring and management, strategy development and execution, new business development, financial reporting, planning and analysis, technology transformation, and crisis management. Technology Experience: Andrew started his career at Booz Allen & Hamilton, where, as a member of the Information Technology Group, he led consultant teams supporting financial services clients around the world. In his industry roles, he has led technology transformation projects and, as CRO for DTCC, drove major investments in resilience and cybersecurity. Background: In addition to his current service as a GARP Board Trustee, Andrew chaired and served on DTCC subsidiary boards and was a Board Member of the International Securities Services Association ("ISSA"). He received a Bachelor of Science in Mechanical Engineering from the Massachusetts Institute of Technology and also has a Master of Government Administration from the University of Pennsylvania. |

Age: 58 Director Since: March 2024 Committees: •Audit •Compensation •Investment Key Skills: •Senior Leadership & Business Operations •Financial Services Industry •Government Policy and Regulatory •Risk Management •Corporate Governance •Capital Markets •Technology |

| | | | | | | | | | | | | | |

12 | | 2024 PROXY STATEMENT | | DYNEX CAPITAL, INC. |

| | | | | | | | |

| JOY D. PALMER | |

Joy D. Palmer joined the Board in October 2020. Finance and Accounting Experience: Over the course of Joy’s 34-year career, she has served in a variety of accounting, finance, and investor relations roles. Joy is an expert in Generally Accepted Accounting Principles (“GAAP”), regulatory policies, the mortgage finance industry, including mortgage investing and origination, as well as how market trends impact financial institutions, including national banks. Banking and Treasury Experience: From 2002 to 2020 she held a variety of roles at the the Comptroller of the Currency ("OCC"), Office of the Chief Accountant, including as the Deputy Chief Accountant, Accounting Policy Advisor to Large Banks and Policy Accountant of Community and Midsize Banks, where she helped oversee the regulation and supervision of national and foreign banks which operate in the U.S. During this time, Joy also contributed to the drafting of advisories, bulletins, risk tips, and other publications to provide examiners with readily accessible resources on evolving issues including mortgage banking guidelines. She also led extensive work on accounting topics such as Current Expected Credit losses ("CECL") and Troubled Debt Restructuring ("TDRs"). Prior to the OCC, Joy worked at Merrill Lynch as a Director of Equity Research focusing on specialty finance companies, banks, and the GSE's. Joy started her career at Beneficial Corporation with responsibilities for Investor Relations and Treasury Management focusing on liquidity and cash management monitoring, derivatives, capital markets activity as well as sell-side analyst communications and presentations to the board of directors. Background: Joy earned a Bachelor’s in Accounting from Montclair State University and a MBA from NYU Stern School of Business with emphasis in finance. Over her career and currently, Joy has been an adjunct professor teaching classes on financial statement reporting and analysis, accounting, asset management and tax topics. |

Age: 66 Director Since: 2020 Committees: •Audit (Chair) •Nominating and Corporate Governance (Chair) •Investment Key Skills: •Financial Services Industry •Government Policy and Regulatory •Mortgage Industry •Investment Management

|

| | | | | | | | | | | | | | |

| DYNEX CAPITAL, INC. | | 2024 PROXY STATEMENT | | 13 |

| | | | | | | | |

| SMRITI L. POPENOE | |

Smriti L. Popenoe joined the Board in September 2023. Smriti first joined Dynex as Chief Investment Officer in 2014 and also took on the role of President in 2020. As President of Dynex, Smriti is accountable for the raising, deployment, and management of the company’s capital. As Chief Investment Officer, she leads the team that oversees the Company’s investment portfolio, associated hedges, and financing arrangements.

Leadership Experience: Smriti brings over 13 years of C-Suite experience and expertise in risk management, investment leadership, and best practices in portfolio optimization. In addition to her 10 years serving on Dynex’s leadership team, she previously served as Chief Risk Officer at PHH Corporation, a leading provider of mortgage banking and fleet management outsourcing services. Financial Services and Portfolio Management Experience: Smriti has almost three decades of experience in the financial services and risk management industries. From 2006 to 2009, Smriti was Senior Vice President at Wells Fargo (then known as Wachovia Bank), where she managed its more than $100 billion investment portfolio and led the team through the financial crisis of 2009. From 2003 to 2006, she served as Senior Vice President, Investments with Sunset Financial Resources, a startup REIT. She managed an investment portfolio of $400B fixed-rate MBS and whole loans while with Freddie Mac at the beginning of her career.

Background: Smriti received the Chartered Financial Analyst (CFA) designation in 1997 and holds three degrees: a B.S. in Chemistry and Environmental Science from St. Joseph’s College in Bangalore, India, a MBA from the University of Rochester and a Master’s-level French diploma from the Alliance Française. She is a Founding Member of the Washington D.C. chapter of Chief, the only organization designed for senior women leaders to strengthen their leadership journey, cross-pollinate ideas across industries, and effect change from the top down. She is passionate about the environment, mentoring women, personal growth, and lifelong learning. She is also a Board member of Industrial Indicators.

|

Age: 55 Director Since: 2023 Committee: Investment Key Skills: •Senior Leadership & Business Operations •Financial Services Industry •Investment Management •Mortgage Industry Other Current Boards: Industrial Indicators |

We are not aware of any family relationship among any director or executive officer; nor are we aware of any involvement of any director or executive officer, currently or in the past ten years, in any legal proceedings that would be material to an evaluation of the ability or integrity of any director or executive officer.

THE BOARD RECOMMENDS THAT THE SHAREHOLDERS VOTE FOR THE DIRECTOR NOMINEES LISTED ABOVE.

| | | | | | | | | | | | | | |

14 | | 2024 PROXY STATEMENT | | DYNEX CAPITAL, INC. |

OUR CORPORATE GOVERNANCE FRAMEWORK

The business and affairs of the Company are managed under the direction of the Board in accordance with the Virginia Stock Corporation Act and the Company’s Articles of Incorporation and Amended and Restated Bylaws ("Bylaws"). Members of the Board are kept informed of the Company’s business through discussions with the Chief Executive Officer and other officers, by reviewing materials provided to them, and by participating in meetings of the Board and its committees. The corporate governance practices followed by the Company, including with respect to environmental and social considerations, are summarized below.

OUR ENVIRONMENTAL, SOCIAL AND GOVERNANCE (“ESG”) INITIATIVES

We believe that ESG practices and initiatives are important in sustaining and growing the Company. Our ESG practices seek to create value by improving the environment and the lives of our employees, shareholders, business partners, and the community and we recognize that understanding our efforts on ESG practices is increasingly important to those key relationships.

Our Board has formal oversight of our ESG strategies, policies, activities, and communications, including overseeing risk management related to the foregoing. The Board formally amended the Nominating Committee Charter in 2020 to memorialize the committee’s primary oversight of our efforts in ESG strategies, policies, activities, and communications. Together, the Board and Nominating Committee monitor and assess our practices to work toward further ESG improvements.

A management committee oversees the ESG guidelines and the Company’s measurable ESG goals as well as the implementation of the Sustainability Accounting Standards Board (“SASB”) Conceptual Framework, which we adopted in 2020. The Company published its SASB disclosure in accordance with the Financials Sector standards of SASB on its website at www.dynexcapital.com.

The Company has historically operated in a partially-virtual environment, which helps limit its carbon footprint. In 2024, the Company is continuing to evaluate its governance practices to monitor its environmental impact.

We continue to search for opportunities in pursuit of the long-term success of our business and to enhance the communities where we operate through corporate giving, employee volunteering, human capital development, and environmental sustainability programs. Additional information regarding our efforts to implement environmental and social factors in the operation of our business is available in the Corporate Responsibility section of our website at www.dynexcapital.com. Nothing on our website and the information contained on, or that can be accessed through, our website referenced throughout this Proxy Statement, including, without limitation, our SASB disclosure in accordance with the Financials Sector standards of SASB, shall be deemed to be incorporated by reference herein unless indicated otherwise, and is not considered part of, this Proxy Statement.

| | | | | | | | | | | | | | |

| DYNEX CAPITAL, INC. | | 2024 PROXY STATEMENT | | 15 |

| | |

CORPORATE GOVERNANCE (CONTINUED) |

The following are notable ESG policies we had in place as of December 31, 2023:

| | | | | |

OUR ENVIRONMENTAL COMMITMENT | As an asset management and investment firm with approximately 22 employees, our business operations have a relatively modest environmental impact. However, energy conservation and environmental sustainability efforts are important to the Company.

Our corporate efforts to reduce our environmental impact include: •Using specific green products for office cleaning and pest control; •Recycling of paper and aluminum cans; •Recycling of electronic equipment and ink cartridges; •Use of energy certified laptops; and •Eliminating single use plastics such as coffee pods, straws, utensils, and water bottles. |

OUR SOCIAL

COMMITMENT | Our primary social considerations and impacts relate to our investment activity, serving our community, and human capital management, all of which are critical to our success as an organization. INVESTMENT ACTIVITY We have been a leader for over 35 years in providing private capital to the U.S. housing finance system and in support of affordable housing in communities across the United States. Our business helps to enhance liquidity in residential and commercial real estate mortgage markets and, in turn, facilitate home ownership and affordable housing in the United States. HUMAN CAPITAL MANAGEMENT We strive to have highly engaged employees committed to looking out for each other and our shareholders. The Company views its employees as its most important asset and as the key to fulfilling our goals of making people’s lives better, strengthening the communities we serve, and managing a successful business for the benefit of our stakeholders. Our human capital strategy is designed to create an environment where our employees can grow professionally and contribute to the success of the Company. We believe a supportive, collaborative, engaging, and equitable culture is key to attracting and retaining skilled, experienced, and talented employees as well as fostering the development of the Company’s next generation of leaders. |

| DIVERSITY AND INCLUSION

We promote diversity within our workforce and believe diversity extends beyond gender, race, ethnicity, age or sexual orientation to include different perspectives, skills, and experiences and socioeconomic backgrounds. We hire based on qualifications and evaluate, recognize, reward and promote employees based on performance without regard to race, religion, color, national origin, disability, gender, gender identity, sexual orientation, stereotypes or assumptions based thereon. In addition, equity is fundamental to our philosophy of fair and equitable treatment. We regularly review and analyze our compensation practices and engage in ongoing efforts to ensure pay equity within all levels of employment.

We strive to maintain a corporate culture that is welcoming, inclusive and respectful to all. As of December 31, 2023, 50% of our employees were women or self-identified minorities. |

| | | | | | | | | | | | | | |

16 | | 2024 PROXY STATEMENT | | DYNEX CAPITAL, INC. |

| | |

CORPORATE GOVERNANCE (CONTINUED) |

| | | | | |

| HEALTH, SAFETY, AND WELLNESS We strive to offer our employees a healthy work-life balance and an open environment in which they are encouraged to offer thoughts and opinions. Employees have a wide selection of resources available to protect their health, well-being, financial security, safety, and work-life balance, including an onsite gym, coverage of a substantial portion of their health insurance, and a competitive 401(k) Company match. We provide our employees with access to flexible, comprehensive and convenient medical coverage intended to meet their needs and the needs of their families. In addition to standard medical coverage, we offer employees dental and vision coverage, health savings and flexible spending accounts, paid time off, employee assistance programs, voluntary short-term and long-term disability insurance, term life insurance, and other benefits. We also offer flexible working arrangements to accommodate the individual needs of our employees. EMPLOYEE DEVELOPMENT Recognizing the vital role that human capital management serves in the long-term success of the Company, we have initiated a Human Capital Strategy Planning process, overseen by our Board, to formalize the process for management and development of employees. In addition to talent management and development initiatives, the Human Capital Strategy Planning process has included the following: •development of organizational core values and a plan to integrate these values into a variety of human capital processes and practices; •offering of a personal development program for employees; •formalized process for determining current and future human capital requirements; and •implementation of improved performance measures designed to better determine individual and team developmental needs. |

OUR GOVERNANCE COMMITMENT | We believe good corporate governance is critical to achieving long-term shareholder value. We are committed to governance practices and policies that serve the long-term interests of the Company and its shareholders. Highlights of our governance practices include: •Our Board represents a well-rounded and diverse combination of skills, knowledge, experience and perspectives. •The Board regularly meets in executive sessions with its independent directors. •All of the members of our key committees are independent. •All three members of our Audit Committee qualify as “audit committee financial experts.” •One-half of our directors are female. •The Board currently has a Lead Independent Director. •Incumbent directors up for re-election to our Board who fail to receive a majority of the votes cast in an uncontested election must tender their resignation for consideration. |

| | | | | | | | | | | | | | |

| DYNEX CAPITAL, INC. | | 2024 PROXY STATEMENT | | 17 |

| | |

CORPORATE GOVERNANCE (CONTINUED) |

| | | | | |

|

•Our Board is fully declassified, and directors are elected annually. •Our directors are required to annually disclose commitments to other boards and must obtain prior approval before joining the board of another public company to prevent "overboarding". •Each share of our common stock has equal voting rights with one vote per share. •Our Board has adopted a Board Refreshment and Diversity Policy to (i) ensure a relevant, inclusive and diverse membership on the Board, (ii) provide the Board with the best combination of knowledge, skills, experience, and perspectives among its members (including with respect to gender, age, race, culture, and experience), and (iii) oversee and support our strategy for the future. •The Company has not established term limits for directors. Pursuant to its Board Refreshment and Diversity Policy, the Nominating Committee evaluates the qualifications and contributions of each incumbent director before recommending the nomination of such director for re-election. •We have succession plans for the CEO, completed our CFO transition in 2022, and are in the process of designing such plans for other senior management positions. •We are dedicated to thoughtful director succession planning. •The Company has not adopted a “poison pill” or other similar shareholder rights provisions in its governance documents. •Key risks are overseen by Board committees, including enterprise-wide risk management (Audit Committee), investment related risks (Investment Committee), executive compensation risks (Compensation Committee) and our ESG risks, strategies, policies, activities, and communications (Nominating Committee). •During 2023, our directors continued to be engaged, with 100% director attendance for Board and committee meetings. •The Company has a Code of Business Conduct and Ethics (“Code of Conduct”) that applies to all of our employees, officers and directors and covers a wide range of business practices and procedures designed to foster the highest ethical standards in all business relationships. This policy covers, among other things, compliance with applicable laws, conflicts of interest, confidentiality, fair dealing, discrimination and harassment, health and safety, reporting of suspected violations, and enforcement of our Code of Conduct. •Our Whistleblower Policy provides a structured and formal process to facilitate confidential, anonymous submissions by employees of the Company and others with concerns or complaints regarding the Company’s accounting, internal accounting controls, auditing matters or violations of the Company’s Code of Conduct. •The Company has a robust compensation recoupment, or "clawback" policy. •Our Board and each of our key committees annually conduct a substantive self-evaluation. •We require that executives and directors own a meaningful amount of Company stock. •We prohibit our executive officers and directors from hedging and pledging Company stock. |

| | | | | | | | | | | | | | |

18 | | 2024 PROXY STATEMENT | | DYNEX CAPITAL, INC. |

| | |

CORPORATE GOVERNANCE (CONTINUED) |

DIRECTOR INDEPENDENCE

The Board has adopted Corporate Governance Guidelines that set forth the practices of the Board with respect to its size, criteria for membership and selection to the Board, committees of the Board, meetings and access to management, director compensation, director orientation and continuing education, annual performance evaluation of the Board, director responsibilities, annual review of performance of the Chief Executive Officer, management succession and ethics and conduct. The Guidelines are available on the Company’s website at www.dynexcapital.com under “Investor Center - Corporate Information - Corporate Governance.” A printed copy is available to any shareholder upon written request to the Secretary of the Company, 4991 Lake Brook Drive, Suite 100, Glen Allen, Virginia 23060.

The Board in its business judgment has determined that Messrs. Crawford and Gray, Dr. Coronado, and Ms. Palmer are independent, and that Messrs. Hughes, Salcetti and Stevens were independent as defined by the New York Stock Exchange ("NYSE") listing standards. In reaching these conclusions, the Board considered whether the Company and its subsidiaries conduct business and have other relationships with organizations of which certain members of the Board or members of their immediate families are or were directors or officers. In addition, the Board considered all relevant facts and circumstances, including relationships that a director may have due to his or her status as an investor in an entity that may have a relationship with the Company.

As permitted by the NYSE, the Company’s Corporate Governance Guidelines establish categorical standards under which, except with respect to members of the Audit Committee and the Compensation Committee, the following relationships between a non-employee director and the Company will not be considered material:

• if during any twelve-month period within the last three years, the director or any immediate family member of the director received $120,000 or less in direct compensation from the Company, excluding director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service);

• if during each of the current fiscal year and three most recent fiscal years, the director is, or was, an executive officer or an employee (or has, or had, an immediate family member who is, or was, an executive officer) of another

company that made payments to, or received payments from, the Company for property or services in an amount which, in each of the last three fiscal years, did not exceed the greater of $1 million or 2% of such other company’s consolidated gross revenues; or

• if the director serves as an executive officer of a charitable organization to which the Company made charitable contributions that did not exceed the greater of $1 million, or 2% of such charitable organization’s consolidated gross revenues in each of the last three fiscal years.

None of the Company’s directors, their immediate family members, or organizations in which they are a partner, shareholder or officer, are engaged in any material relationships with the Company, except Mr. Boston, who serves as Chief Executive Officer and Chairman of the Board and Ms. Popenoe who serves as President and Chief Investment Officer of the Company.

CODE OF BUSINESS CONDUCT AND ETHICS

The Board has approved our Code of Conduct for directors, officers and employees of the Company and each of its subsidiaries including the Company’s Chief Executive Officer and Chief Financial Officer. The Code of Conduct addresses such topics as compliance with applicable laws, conflicts of interest, use and protection of Company assets, confidentiality, dealings with the press and communications with the public, accounting and financial reporting matters, fair dealing, discrimination and harassment and health and safety. It is available on the Company’s website at www.dynexcapital.com under “Investor Center - Corporate Information - Corporate Governance.” A printed copy of the Code of Conduct is available to any shareholder upon written request to the Secretary of the Company at the address set forth in the beginning of this Proxy Statement.

We intend to provide any required disclosure of an amendment to or waiver from the Code of Conduct that applies to our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, on the Company’s website at www.dynexcapital.com under “Investor Center - Corporate Information - Corporate Governance” promptly following the amendment or waiver. We may elect to disclose any such amendment or waiver in a report on Form 8-K filed with the SEC either in addition to or in lieu of the website disclosure.

| | | | | | | | | | | | | | |

| DYNEX CAPITAL, INC. | | 2024 PROXY STATEMENT | | 19 |

| | |

CORPORATE GOVERNANCE (CONTINUED) |

BOARD AND COMMITTEE MEETINGS

The Board holds meetings throughout the year on various topics with some spanning over two days. In 2023, there were six meetings of the Board and eighteen committee meetings. Each incumbent director attended 75% or more of the total number meetings of the Board and of the committees on which he or she served during 2023, with 100% attendance.

Executive sessions where independent or non-management directors meet on an informal basis are held regularly without management participation. At least once a year, the Board schedules an executive session including only independent directors. Such sessions were generally chaired by the Chairperson of the Board, and following Mr. Boston's appointment to Chairman of the Board, are generally chaired by the Lead Independent Director, Dr. Coronado.

The Company encourages members of the Board to attend the annual meeting of shareholders. All of the then-serving directors attended the 2023 Annual Meeting of Shareholders, and we expect that all of the nominee directors will attend the 2024 Annual Meeting.

OUR BOARD LEADERSHIP STRUCTURE

Under the Company’s Corporate Governance Guidelines, the Board has the responsibility to determine the most appropriate leadership structure for the Company, including whether it is best for the Company at a given point in time for the roles of Chairperson of the Board and Chief Executive Officer to be separate or combined.

At the present, the Board has determined that combining the roles of Chairperson of the Board and Chief Executive Officer is the most appropriate leadership structure. Mr. Boston is currently serving as Chief Executive Officer and Chairman of the Board. We believe that Mr. Boston's combined roles provide an effective bridge between the Board and senior management, creating strong, unified leadership. As Chairman, Mr. Boston's primary responsibilities include setting the agenda for Board meetings, chairing Board meetings, and participating in strategic planning efforts at the Company. Together with Ms. Popenoe, Director and Chief Investment Officer, he also provides updates to the remaining directors on important Company issues including business strategy, investment strategy, capital management, risk management and stakeholder management efforts.

Mr. Boston has in-depth knowledge of the Company and extensive industry experience from

his tenure as a director and from his working in the housing finance sector for most of his 40+ year career. This allows him to guide the Board’s agenda in setting priorities for the Company and addressing the risks and challenges the Company faces, but with management insight into the execution of the Company’s strategy. Dr. Coronado serves as the Lead Independent Director. Dr. Coronado assists with setting agendas, calling meetings of the independent directors and/or non-management directors as needed, and serving as the liaison between the independent directors and the Chairman. Mr. Boston and Dr. Coronado collaborate together, drawing upon their deep knowledge of the operations of the business and industry, to best serve the interests of the Company and ensure appropriate oversight. The Board periodically reviews the Company’s corporate governance structure to ensure that it remains the most appropriate structure for the Company and its shareholders. As a result, although the Board has determined that the current structure works best for the Company at this time, the Board may implement another structure if deemed to be appropriate in the future.

BOARD OVERSIGHT OF RISK MANAGEMENT

The Company’s executive officers are responsible for the day-to-day management of risks the Company faces, while the Board, as a whole and through its committees, has responsibility for the oversight of risk management. Directors are expected to devote sufficient time and apply themselves to understanding the Company’s business and its significant risks. The Board has an Investment Committee that oversees the investment activities of the Company and the risks related to these activities. The Investment Committee regularly receives presentations from senior management regarding the Company’s investment portfolio, its risk profile and its investment and risk management strategies. As part of that process, the Investment Committee oversees the Company’s compliance with the Company’s investment policy and investment risk policy, including notifying the Board if the risk limits are approached or exceeded. In addition, the Audit Committee oversees the Company’s enterprise risk management program, which includes, among other items, non-investment related risks such as strategic risk, operational risk, reputational risk, and cybersecurity risk. In conducting this oversight, the Audit Committee reviews and discusses with management and the Company’s risk and control personnel the Company’s policies and practices with respect to risk assessment and risk management for all non-investment risks identified by management. The Audit Committee annually assesses cybersecurity

| | | | | | | | | | | | | | |

20 | | 2024 PROXY STATEMENT | | DYNEX CAPITAL, INC. |

| | |

CORPORATE GOVERNANCE (CONTINUED) |

risk, which encompasses reviewing and discussing the risks identified by management and the Company’s policies and practices in place to mitigate cybersecurity-related risks, and also receives periodic updates as necessary from management to keep the Board abreast of changes in any matter related to cybersecurity, including, but not limited to, results of control testing, employee training, cybersecurity insurance and new or emerging threats or risks. The Audit Committee also specifically reviews and discusses with management, the independent auditor, and risk and control personnel the risks related to financial reporting and controls on at least a quarterly basis. Additionally, the Compensation Committee reviews and discusses with management the extent to which the Company’s compensation policies and practices create or mitigate risks for the Company. In addition, the Nominating Committee reviews and discusses with management the extent to which the Company’s ESG policies and practices create or mitigate risks for the Company. The Company believes that its leadership structure promotes effective Board oversight of risk management as the Audit Committee, Compensation Committee, and Nominating Committee are each comprised solely of independent directors, and the Investment Committee is primarily comprised of independent directors and management of the Company. Each of the committees actively monitors the Company’s policies and practices with respect to risk assessment and risk management, and the directors are provided with the information necessary to evaluate the Company’s significant risks and strategies for addressing them. Although each committee is responsible for evaluating certain risks and overseeing the management of such risks, the entire Board is regularly informed through committee reports about such risks as well as through regular reports directly from the executive officers responsible for management of particular risks to the Company.

COMMUNICATIONS WITH THE BOARD

Any director, including the Chairperson of the Board, may be contacted by writing to such director c/o the Secretary of the Company at the address set forth in the beginning of this Proxy Statement. Communications to the non-management directors as a group may be sent to the Lead Independent Director of the Board c/o the Secretary of the Company at the same address. The Company promptly forwards, without screening, any correspondence addressed to a specified director to such director, and any correspondence addressed to the non-management directors as a group to the Lead Independent Director of the Board.

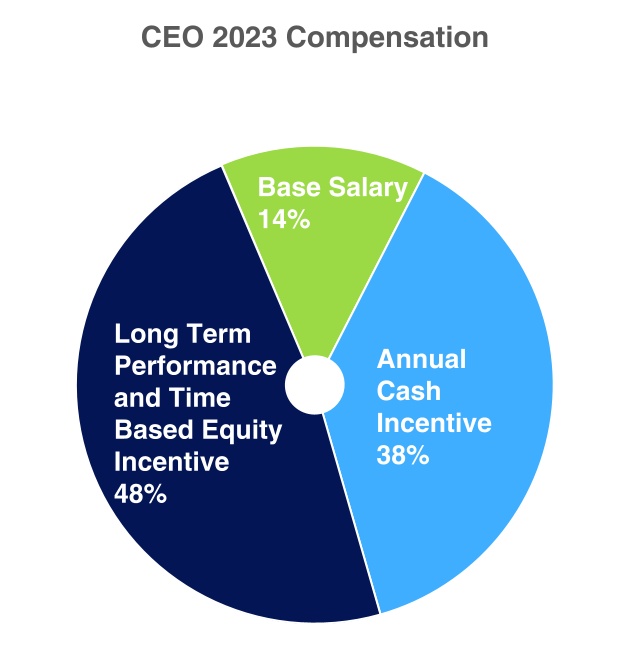

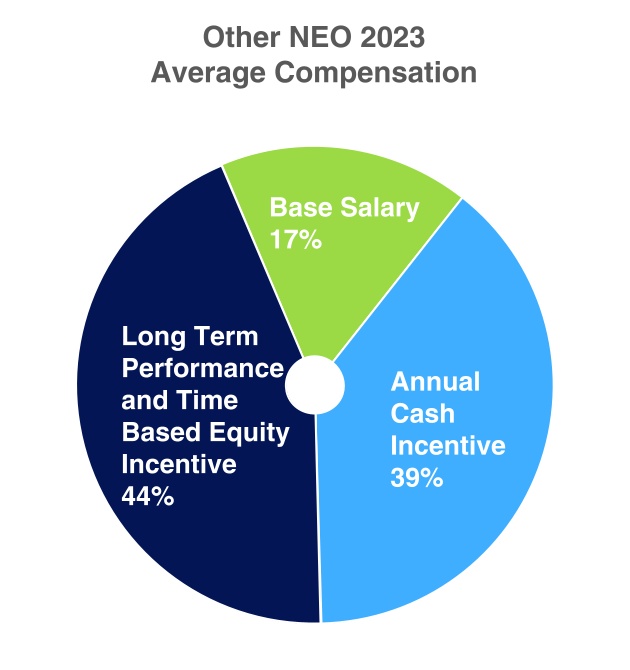

BOARD COMMITTEES