UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

| Quarterly Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |||||

For the quarterly period ended March 31, 2023

or

| Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |||||

Commission File Number: 001-09819

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||

| (Registrant’s telephone number, including area code) | ||||||||||||||||||||

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | ☒ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

On April 24, 2023, the registrant had 54,113,514 shares outstanding of common stock, $0.01 par value, which is the registrant’s only class of common stock.

DYNEX CAPITAL, INC.

FORM 10-Q

INDEX

| Page | |||||||||||

PART I. FINANCIAL INFORMATION | |||||||||||

| Item 1. | Financial Statements | ||||||||||

| Consolidated Balance Sheets as of March 31, 2023 (unaudited) and December 31, 2022 | |||||||||||

| Consolidated Statements of Comprehensive Income (Loss) for the three months ended March 31, 2023 (unaudited) and March 31, 2022 (unaudited) | |||||||||||

| Consolidated Statements of Shareholders' Equity for the three months ended March 31, 2023 (unaudited) and March 31, 2022 (unaudited) | |||||||||||

| Consolidated Statements of Cash Flows for the three months ended March 31, 2023 (unaudited) and March 31, 2022 (unaudited) | |||||||||||

| Notes to the Consolidated Financial Statements | |||||||||||

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | ||||||||||

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | ||||||||||

| Item 4. | Controls and Procedures | ||||||||||

| PART II. OTHER INFORMATION | |||||||||||

| Item 1. | Legal Proceedings | ||||||||||

| Item 1A. | Risk Factors | ||||||||||

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | ||||||||||

| Item 3. | Defaults Upon Senior Securities | ||||||||||

| Item 4. | Mine Safety Disclosures | ||||||||||

| Item 5. | Other Information | ||||||||||

| Item 6. | Exhibits | ||||||||||

| SIGNATURES | |||||||||||

i

DYNEX CAPITAL, INC.

CONSOLIDATED BALANCE SHEETS

($s in thousands except per share data)

| March 31, 2023 | December 31, 2022 | ||||||||||

| ASSETS | (unaudited) | ||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Cash collateral posted to counterparties | |||||||||||

Mortgage-backed securities (including pledged of $ | |||||||||||

| Due from counterparties | |||||||||||

| Derivative assets | |||||||||||

| Accrued interest receivable | |||||||||||

| Other assets, net | |||||||||||

| Total assets | $ | $ | |||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |||||||||||

| Liabilities: | |||||||||||

| Repurchase agreements | $ | $ | |||||||||

| Due to counterparties | |||||||||||

| Derivative liabilities | |||||||||||

| Cash collateral posted by counterparties | |||||||||||

| Accrued interest payable | |||||||||||

| Accrued dividends payable | |||||||||||

| Other liabilities | |||||||||||

| Total liabilities | |||||||||||

| Shareholders’ equity: | |||||||||||

Preferred stock, par value $ | |||||||||||

Common stock, par value $ | |||||||||||

| Additional paid-in capital | |||||||||||

| Accumulated other comprehensive loss | ( | ( | |||||||||

| Accumulated deficit | ( | ( | |||||||||

| Total shareholders’ equity | |||||||||||

| Total liabilities and shareholders’ equity | $ | $ | |||||||||

See notes to the consolidated financial statements.

1

DYNEX CAPITAL, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(unaudited)

($s in thousands except per share data)

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| INTEREST INCOME (EXPENSE) | |||||||||||

| Interest income | $ | $ | |||||||||

| Interest expense | ( | ( | |||||||||

| Net interest (expense) income | ( | ||||||||||

| OTHER GAINS (LOSSES) | |||||||||||

| Realized loss on sales of investments, net | ( | ||||||||||

| Unrealized gain (loss) on investments, net | ( | ||||||||||

| (Loss) gain on derivative instruments, net | ( | ||||||||||

| Total other (losses) gains, net | ( | ||||||||||

| EXPENSES | |||||||||||

| Compensation and benefits | ( | ( | |||||||||

| Other general and administrative | ( | ( | |||||||||

| Other operating expenses | ( | ( | |||||||||

| Total operating expenses | ( | ( | |||||||||

| Net (loss) income | ( | ||||||||||

| Preferred stock dividends | ( | ( | |||||||||

| Net (loss) income to common shareholders | $ | ( | $ | ||||||||

| Other comprehensive income: | |||||||||||

| Unrealized gain (loss) on available-for-sale investments, net | $ | $ | ( | ||||||||

| Total other comprehensive gain (loss) | ( | ||||||||||

| Comprehensive (loss) income to common shareholders | $ | ( | $ | ||||||||

| Weighted average common shares-basic | |||||||||||

| Weighted average common shares-diluted | |||||||||||

| Net (loss) income per common share-basic | $ | ( | $ | ||||||||

| Net (loss) income per common share-diluted | $ | ( | $ | ||||||||

| Dividends declared per common share | $ | $ | |||||||||

2

DYNEX CAPITAL, INC.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(unaudited)

($s in thousands)

| Preferred Stock | Common Stock | Additional Paid-in Capital | Accumulated Other Comprehensive Loss | Accumulated Deficit | Total Shareholders’ Equity | ||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | ||||||||||||||||||||||||||||||||||||||

| Balance as of December 31, 2022 | $ | $ | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||||||||||||

| Stock issuance | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| Restricted stock granted, net of amortization | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| Other share-based compensation, net of amortization | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| Adjustments for tax withholding on share-based compensation | — | — | ( | ( | — | — | ( | ||||||||||||||||||||||||||||||||||

| Stock issuance costs | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||

| Net loss | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||

| Dividends on preferred stock | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||

| Dividends on common stock | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||

| Balance as of March 31, 2023 | $ | $ | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||||||||||||

3

| Preferred Stock | Common Stock | Additional Paid-in Capital | Accumulated Other Comprehensive Loss | Accumulated Deficit | Total Shareholders’ Equity | ||||||||||||||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | ||||||||||||||||||||||||||||||||||||||

| Balance as of December 31, 2021 | $ | $ | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||||||||

| Stock issuance | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| Restricted stock granted, net of amortization | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| Other share-based compensation, net of amortization | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| Adjustments for tax withholding on share-based compensation | — | — | ( | ( | — | — | ( | ||||||||||||||||||||||||||||||||||

| Stock issuance costs | — | — | — | — | ( | — | — | ( | |||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||

| Dividends on preferred stock | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||

| Dividends on common stock | — | — | — | — | — | — | ( | ( | |||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | — | ( | — | ( | |||||||||||||||||||||||||||||||||

| Balance as of March 31, 2022 | $ | $ | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||||||||||||

See notes to the consolidated financial statements.

4

DYNEX CAPITAL, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(unaudited)

($s in thousands)

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Operating activities: | |||||||||||

| Net (loss) income | $ | ( | $ | ||||||||

| Adjustments to reconcile net (loss) income to cash provided by operating activities: | |||||||||||

| Realized loss on sale of investments, net | |||||||||||

| Unrealized (gain) loss on investments, net | ( | ||||||||||

| Loss (gain) on derivative instruments, net | ( | ||||||||||

| Amortization of investment premiums, net | |||||||||||

| Other amortization and depreciation, net | |||||||||||

| Share-based compensation expense | |||||||||||

| Increase in accrued interest receivable | ( | ( | |||||||||

| (Decrease) increase in accrued interest payable | ( | ||||||||||

| Change in other assets and liabilities, net | ( | ( | |||||||||

| Net cash provided by operating activities | |||||||||||

| Investing activities: | |||||||||||

| Purchases of investments | ( | ( | |||||||||

| Principal payments received on trading securities | |||||||||||

| Principal payments received on available-for-sale investments | |||||||||||

| Principal payments received on mortgage loans held for investment | |||||||||||

| Net (payments) receipts on derivatives, including terminations | ( | ||||||||||

| Increase in cash collateral posted by counterparties | |||||||||||

| Net cash (used in) provided by investing activities | ( | ||||||||||

| Financing activities: | |||||||||||

| Borrowings under repurchase agreements | |||||||||||

| Repayments of repurchase agreement borrowings | ( | ( | |||||||||

| Proceeds from issuance of common stock | |||||||||||

| Payments related to tax withholding for share-based compensation | ( | ( | |||||||||

| Dividends paid | ( | ( | |||||||||

| Net cash provided by financing activities | |||||||||||

| Net (decrease) increase in cash including cash posted to counterparties | ( | ||||||||||

| Cash including cash posted to counterparties at beginning of period | |||||||||||

| Cash including cash posted to counterparties at end of period | $ | $ | |||||||||

| Supplemental Disclosure of Cash Activity: | |||||||||||

| Cash paid for interest | $ | $ | |||||||||

See notes to the consolidated financial statements.

5

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

($s in thousands except per share data)

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Organization

Dynex Capital, Inc. was incorporated in the Commonwealth of Virginia on December 18, 1987 and commenced operations in February 1988. The Company is an internally managed mortgage real estate investment trust, or mortgage REIT, which primarily earns income from investing on a leveraged basis in Agency mortgage-backed securities (“Agency MBS”) and in to-be-announced securities (“TBAs” or “TBA securities”). Agency MBS have a guaranty of principal and interest payments by a U.S. government-sponsored entity (“GSE”) such as Fannie Mae and Freddie Mac, which are in conservatorship and are currently supported by a senior preferred stock purchase agreement from the U.S. Treasury. As of March 31, 2023, the majority of the Company’s Agency MBS are secured by residential real property (“Agency RMBS”). The remainder of the Company’s investments are in Agency commercial MBS (“Agency CMBS”) and in both Agency and non-Agency CMBS interest-only (“CMBS IO”). Non-Agency MBS do not have a GSE guaranty of principal or interest payments.

Consolidation and Variable Interest Entities

The consolidated financial statements include the accounts of the Company and the accounts of its majority owned subsidiaries and variable interest entities (“VIE”) for which it is the primary beneficiary. All intercompany accounts and transactions have been eliminated in consolidation.

The Company consolidates a VIE if the Company is determined to be the VIE’s primary beneficiary, which is defined as the party that has both: (i) the power to control the activities that most significantly impact the VIE’s financial performance and (ii) the right to receive benefits or absorb losses that could potentially be significant to the VIE. The Company reconsiders its evaluation of whether to consolidate a VIE on an ongoing basis, based on changes in the facts and circumstances pertaining to the VIE. Though the Company invests in Agency and non-Agency MBS

6

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

($s in thousands except per share data)

Income Taxes

The Company has elected to be taxed as a real estate investment trust (“REIT”) under the Internal Revenue Code of 1986 (the “Tax Code”) and the corresponding provisions of state law. To qualify as a REIT, the Company must meet certain asset, income, ownership, and distribution tests. To meet these requirements, the Company’s main source of income is interest earned from obligations secured by mortgages on real property, and the Company must distribute at least 90% of its annual REIT taxable income to shareholders. The Company’s income will generally not be subject to federal income tax to the extent it is distributed as dividends to shareholders.

The Company assesses its tax positions for all open tax years and determines whether the Company has any material unrecognized liabilities and records these liabilities, if any, to the extent they are deemed more likely than not to have been incurred.

Net Income (Loss) Per Common Share

The Company calculates basic net income (loss) per common share by dividing net income (loss) to common shareholders for the period by weighted-average shares of common stock outstanding for that period. Please see Note 2 for the calculation of the Company’s basic and diluted net income (loss) per common share for the periods indicated.

The Company currently has unvested restricted stock, service-based restricted stock units (“RSUs”) and performance-based stock units (“PSUs”) issued and outstanding. Restricted stock awards are considered participating securities and therefore are included in the computation of basic net income per common share using the two-class method because holders of unvested shares of restricted stock are eligible to receive non-forfeitable dividends. Holders of RSUs and PSUs accrue forfeitable dividend equivalent rights over the period outstanding, receiving dividend payments only upon the settlement date if the requisite service-based and performance-based conditions have been achieved, as applicable. As such, RSUs and PSUs are excluded from the computation of basic net income per common share, but are included in the computation of diluted net income per common share unless the effect is to reduce a net loss or increase the net income per common share (also known as “anti-dilutive”). Upon vesting (or settlement, in the case of units), restrictions on transfer expire on each share of restricted stock, RSU, and PSU, and each such share or unit becomes one unrestricted share of common stock and is included in the computation of basic net income per common share.

Because the Company’s 6.900% Series C Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock (the “Series C Preferred Stock”) is redeemable at the Company’s option for cash only and convertible into shares of common stock only upon a change of control of the Company (and subject to other circumstances) as described in Article IIIC of the Company’s Restated Articles of Incorporation, the effect of those shares and their related dividends were excluded from the calculation of diluted net income per common share for the periods presented.

Cash and Cash Equivalents

Cash includes unrestricted demand deposits at highly rated financial institutions and highly liquid investments with original maturities of three months or less. The Company’s cash balances fluctuate throughout the year and may exceed Federal Deposit Insurance Corporation (“FDIC”) insured limits from time to time. Although the Company bears risk to amounts in excess of those insured by the FDIC, it does not anticipate any losses as a result due to the financial position and creditworthiness of the depository institutions in which those deposits are held.

Cash Collateral Posted To/By Counterparties

Cash collateral posted to/by counterparties represents amounts pledged/received to cover margin requirements related to the Company’s financing and derivative instruments. If the amount pledged to a counterparty exceeds the amount received from a counterparty, the net amount is recorded as an asset within “cash collateral posted to

7

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

($s in thousands except per share data)

counterparties”, and if the amount received from a counterparty exceeds the amount pledged to a counterparty, the net amount is recorded as a liability within “cash collateral posted by counterparties” on the Company’s consolidated balance sheets.

The following table provides a reconciliation of “cash” and “cash posted to counterparties” reported on the Company's consolidated balance sheet as of March 31, 2023, that sum to the total of the same such amounts shown on the Company’s consolidated statement of cash flows for the three months ended March 31, 2023:

| March 31, 2023 | |||||

| Cash and cash equivalents | $ | ||||

| Cash collateral posted to counterparties | |||||

| Total cash including cash posted to counterparties shown on consolidated statement of cash flows | $ | ||||

Mortgage-Backed Securities

The Company’s MBS are recorded at fair value on the Company’s consolidated balance sheet. Changes in fair value of MBS purchased prior to January 1, 2021 are designated as available-for-sale (“AFS”) with changes in fair value reported in other comprehensive income (“OCI”) as an unrealized gain (loss) until the security is sold or matures. Effective January 1, 2021, the Company elected the fair value option (“FVO”) for all MBS purchased on or after that date with changes in fair value reported in net income as “unrealized gain (loss) on investments, net” until the security is sold or matures. Upon the sale of an MBS, any unrealized gain or loss within OCI or net income is reclassified to “realized gain (loss) on sale of investments, net” within net income using the specific identification method.

Interest Income, Premium Amortization, and Discount Accretion. Interest income on MBS is accrued based on the outstanding principal balance (or notional balance in the case of IO securities) and the contractual terms. Premiums or discounts associated with the purchase of Agency MBS as well as any non-Agency MBS are amortized or accreted into interest income over the projected life of such securities using the effective interest method, and adjustments to premium amortization and discount accretion are made for actual cash payments. The Company’s projections of future cash payments are based on input received from external sources and internal models and may include assumptions about the amount and timing of loan prepayment rates, fluctuations in interest rates, credit losses, and other factors. On at least a quarterly basis, the Company reviews and makes any necessary adjustments to its cash flow projections and updates the yield recognized on these assets.

Determination of MBS Fair Value. The Company estimates the fair value of the majority of its MBS based upon prices obtained from pricing services and broker quotes. The remainder of the Company’s MBS are valued by discounting the estimated future cash flows derived from cash flow models that utilize information such as the security’s coupon rate, estimated prepayment speeds, expected weighted average life, collateral composition, estimated future interest rates, expected losses, and credit enhancements as well as certain other relevant information. Please refer to Note 6 for further discussion of MBS fair value measurements.

Allowance for Credit Losses. On at least a quarterly basis, the Company evaluates any MBS designated as AFS with a fair value less than its amortized cost for credit losses. If the difference between the present value of cash flows expected to be collected on the MBS is less than its amortized cost, the difference is recorded as an allowance for credit loss through net income up to and not exceeding the amount that the amortized cost exceeds current fair value. Subsequent changes in credit loss estimates are recognized in earnings in the period in which they occur. Because the majority of the Company’s investments are higher credit quality and most are guaranteed by a GSE, the Company is not likely to have an allowance for credit losses related to its MBS recorded on its consolidated balance sheet.

8

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

($s in thousands except per share data)

Repurchase Agreements

Derivative Instruments

Derivative instruments are accounted for at fair value, and all benefits/costs and changes in fair value, including gains and losses realized upon termination, maturity, or settlement, are recorded in “gain (loss) on derivative instruments, net” on the Company’s consolidated statements of comprehensive income (loss). Cash receipts and payments related to derivative instruments are classified in the investing activities section of the consolidated statements of cash flows in accordance with the underlying nature or purpose of the derivative transactions.

The Company’s short positions in U.S. Treasury futures contracts are valued based on exchange pricing with daily margin settlements. The margin requirement varies based on the market value of the open positions and the equity retained in the account. Any margin excess or deficit outstanding is recorded as a receivable or payable as of the date of the Company’s consolidated balance sheets. The Company realizes gains or losses on these contracts upon expiration at an amount equal to the difference between the current fair value of the underlying asset and the contractual price of the futures contract.

The Company’s options on U.S. Treasury futures provide the Company the right, but not an obligation, to buy U.S. Treasury futures at a predetermined notional amount and stated term in the future and are valued based on exchange pricing. The Company records the premium paid for the option contract as a derivative asset on its consolidated balance sheet and adjusts the balance for changes in fair value through “gain (loss) on derivative instruments” until the option is exercised or the contract expires. If the option contract expires unexercised, the realized loss is limited to the premium paid. If exercised, the realized gain or loss on the options is equal to the difference between the fair value of the underlying U.S. Treasury future and the premium paid for the option contract.

The Company may also purchase swaptions, which provide the Company the right, but not an obligation, to enter into an interest rate swap at a predetermined notional amount with a stated term and pay and receive rates in the future. The accounting for swaptions is similar to options on U.S. Treasury futures.

A TBA security is a forward contract (“TBA contract”) for the purchase (“long position”) or sale (“short position”) of a non-specified Agency MBS at a predetermined price with certain principal and interest terms and certain types of collateral, but the particular Agency securities to be delivered are not identified until shortly before the settlement date. The Company accounts for long and short positions in TBAs as derivative instruments because the Company cannot assert that it is probable at inception and throughout the term of an individual TBA transaction that its settlement will result in physical delivery of the underlying Agency RMBS or that the individual TBA transaction will settle in the shortest time period possible.

9

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

($s in thousands except per share data)

Share-Based Compensation

The Company’s 2020 Stock and Incentive Plan (the “2020 Plan”) reserves for issuance up to 2,300,000 common shares for eligible employees, non-employee directors, consultants, and advisors to the Company to be granted in the form of stock options, restricted stock, restricted stock units (“RSUs”), stock appreciation rights, performance-based stock units (“PSUs”), and performance-based cash awards (collectively, “awards”). As of March 31, 2023, 1,143,538 common shares are available for issuance under the 2020 Plan.

Currently, the Company has shares of restricted stock and RSUs issued and outstanding which are treated as equity awards and recorded at their fair value using the closing stock price on the grant date. The compensation cost is recognized over the vesting period with a corresponding credit to shareholders’ equity using the straight-line method.

The Company also has PSUs issued and outstanding which contain Company performance-based and market performance-based conditions. PSUs subject to Company performance-based conditions are initially recognized as equity at their fair value which is measured using the closing stock price on the grant date multiplied by the number of units expected to vest based on an assessment of the probability of achievement of the Company performance-based conditions as of the grant date. The grant date fair value is recognized as expense on the Company’s consolidated statements of comprehensive income within “Compensation and benefits” on a straight-line basis over the vesting period and adjusted if necessary based on any change in probability of achievement which is re-assessed as of each reporting date and on at least a quarterly basis.

PSUs subject to market performance-based conditions are recognized as equity at their grant date fair value determined through a Monte-Carlo simulation of the Company’s common stock total shareholder return (“TSR”) relative to the common stock TSR of the group of peer companies specified in the award agreement. Awards subject to market performance-based conditions are not assessed for probability of achievement and are not remeasured subsequent to issuance. The grant date fair value is recognized as expense on the Company’s consolidated statements of comprehensive income within “Compensation and benefits” on a straight-line basis over the vesting period even if the market performance-based conditions are not achieved.

The Company does not estimate forfeitures for any of its share-based compensation awards, but adjusts for actual forfeitures in the periods in which they occur. Because RSUs and PSUs have forfeitable dividend equivalent rights that are paid only upon settlement, any accrued dividend equivalent rights (“DERs”) on forfeited units are reversed with a corresponding credit to “Compensation and benefits.”

Contingencies

The Company did not have any pending lawsuits, claims, or other contingencies as of March 31, 2023 or December 31, 2022.

Recently Issued Accounting Pronouncements

The Company evaluates Accounting Standards Updates issued by the Financial Accounting Standards Board on at least a quarterly basis to evaluate applicability and significance of any impact on its financial condition and results of operations. There were no accounting pronouncements issued during the three months ended March 31, 2023, that are expected to have a material impact on the Company’s financial condition or results of operations.

NOTE 2 – NET INCOME (LOSS) PER COMMON SHARE

10

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

($s in thousands except per share data)

regarding the Company’s stock award activity for the periods presented. The following table presents the computations of basic and diluted net income or loss per common share for the periods indicated:

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Weighted average number of common shares outstanding - basic | |||||||||||

| Incremental common shares-unvested RSUs | |||||||||||

| Incremental common shares-unvested PSUs | |||||||||||

| Weighted average number of common shares outstanding - diluted | |||||||||||

| Net (loss) income to common shareholders | $ | ( | $ | ||||||||

| Net (loss) income per common share-basic | $ | ( | $ | ||||||||

| Net (loss) income per common share-diluted | $ | ( | $ | ||||||||

For the three months ended March 31, 2023, 270,106 of potentially dilutive RSUs and PSUs were excluded from the computation of diluted net loss per common share because including them would have been anti-dilutive for the period.

NOTE 3 – MORTGAGE-BACKED SECURITIES

The following tables provide details on the Company’s MBS by investment type as of the dates indicated:

| March 31, 2023 | December 31, 2022 | ||||||||||||||||||||||||||||||||||

| Par Value | Amortized Cost | Fair Value | Par Value | Amortized Cost | Fair Value | ||||||||||||||||||||||||||||||

| Agency RMBS | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| Agency CMBS | |||||||||||||||||||||||||||||||||||

CMBS IO (1) | n/a | n/a | |||||||||||||||||||||||||||||||||

| Non-Agency other | |||||||||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| March 31, 2023 | |||||||||||||||||||||||

| Amortized Cost | Gross Unrealized Gain | Gross Unrealized Loss | Fair Value | ||||||||||||||||||||

| MBS measured at fair value through OCI: | |||||||||||||||||||||||

| Agency RMBS | $ | $ | $ | ( | $ | ||||||||||||||||||

| Agency CMBS | ( | ||||||||||||||||||||||

| CMBS IO | ( | ||||||||||||||||||||||

| Non-Agency other | ( | ||||||||||||||||||||||

| Total | $ | $ | $ | ( | $ | ||||||||||||||||||

11

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

($s in thousands except per share data)

| MBS measured at fair value through net income: | |||||||||||||||||||||||

| Agency RMBS | $ | $ | $ | ( | $ | ||||||||||||||||||

| Agency CMBS | ( | ||||||||||||||||||||||

| CMBS IO | ( | ||||||||||||||||||||||

| Total | $ | $ | $ | ( | $ | ||||||||||||||||||

| December 31, 2022 | |||||||||||||||||||||||

| Amortized Cost | Gross Unrealized Gain | Gross Unrealized Loss | Fair Value | ||||||||||||||||||||

| MBS measured at fair value through OCI: | |||||||||||||||||||||||

| Agency RMBS | $ | $ | $ | ( | $ | ||||||||||||||||||

| Agency CMBS | ( | ||||||||||||||||||||||

| CMBS IO | ( | ||||||||||||||||||||||

| Non-Agency other | ( | ||||||||||||||||||||||

| Total | $ | $ | $ | ( | $ | ||||||||||||||||||

| MBS measured at fair value through net income: | |||||||||||||||||||||||

| Agency RMBS | $ | $ | $ | ( | $ | ||||||||||||||||||

| Agency CMBS | ( | ||||||||||||||||||||||

| CMBS IO | ( | ||||||||||||||||||||||

| Total | $ | $ | $ | ( | $ | ||||||||||||||||||

The majority of the Company’s MBS are pledged as collateral for the Company’s repurchase agreements, which are disclosed in Note 4. Actual maturities of MBS are affected by the contractual lives of the underlying mortgage collateral, periodic payments of principal, prepayments of principal, and the payment priority structure of the security; therefore, actual maturities are generally shorter than the securities' stated contractual maturities.

The following table presents information regarding unrealized gains and losses on investments reported within net income (loss) on the Company’s consolidated statements of comprehensive income (loss) for the periods indicated:

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Agency RMBS | $ | $ | ( | ||||||||

| Agency CMBS | |||||||||||

| CMBS IO | ( | ||||||||||

| Other assets | |||||||||||

| Total unrealized gain (loss) on investments, net | $ | $ | ( | ||||||||

12

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

($s in thousands except per share data)

| Three Months Ended | |||||||||||

| March 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Realized gains on sales of MBS - FVO | $ | $ | |||||||||

| Realized losses on sales of MBS - FVO | ( | ||||||||||

| Total realized loss on sales of investments, net | $ | ( | $ | ||||||||

The following table presents certain information for MBS designated as AFS that were in an unrealized loss position as of the dates indicated:

| March 31, 2023 | December 31, 2022 | ||||||||||||||||||||||||||||||||||

| Fair Value | Gross Unrealized Losses | # of Securities | Fair Value | Gross Unrealized Losses | # of Securities | ||||||||||||||||||||||||||||||

| Continuous unrealized loss position for less than 12 months: | |||||||||||||||||||||||||||||||||||

| Agency MBS | $ | $ | $ | $ | |||||||||||||||||||||||||||||||

| Non-Agency MBS | |||||||||||||||||||||||||||||||||||

| Continuous unrealized loss position for 12 months or longer: | |||||||||||||||||||||||||||||||||||

| Agency MBS | $ | $ | $ | $ | |||||||||||||||||||||||||||||||

| Non-Agency MBS | |||||||||||||||||||||||||||||||||||

The unrealized losses on the Company’s MBS designated as AFS were the result of rising interests rates and declines in market prices and were not credit related; therefore, the Company did not have any allowance for credit losses as of March 31, 2023 or December 31, 2022. Although the unrealized losses are not credit related, the Company assesses its ability and intent to hold any MBS with an unrealized loss until the recovery in its value. This assessment is based on the amount of the unrealized loss and significance of the related investment as well as the Company’s leverage and liquidity position. In addition, for its non-Agency MBS, the Company reviews the credit ratings, the credit characteristics of the mortgage loans collateralizing these securities, and the estimated future cash flows including projected collateral losses.

NOTE 4 – REPURCHASE AGREEMENTS

The Company’s repurchase agreements outstanding as of March 31, 2023 and December 31, 2022 are summarized in the following tables:

| March 31, 2023 | December 31, 2022 | |||||||||||||||||||||||||||||||||||||

| Collateral Type | Balance | Weighted Average Rate | Fair Value of Collateral Pledged | Balance | Weighted Average Rate | Fair Value of Collateral Pledged | ||||||||||||||||||||||||||||||||

| Agency RMBS | $ | % | $ | $ | % | $ | ||||||||||||||||||||||||||||||||

| Agency CMBS | % | % | ||||||||||||||||||||||||||||||||||||

| Agency CMBS IO | % | % | ||||||||||||||||||||||||||||||||||||

| Non-Agency CMBS IO | % | % | ||||||||||||||||||||||||||||||||||||

| Total repurchase agreements | $ | % | $ | $ | % | $ | ||||||||||||||||||||||||||||||||

13

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

($s in thousands except per share data)

The Company had borrowings outstanding under 25 different repurchase agreements as of March 31, 2023, and its equity at risk did not exceed 5% with any counterparty as of that date. The Company also had $24,918 and $4,159 payable to counterparties for transactions pending settlement as of March 31, 2023 and December 31, 2022, respectively.

The following table provides information on the remaining term to maturity and original term to maturity for the Company’s repurchase agreements as of the dates indicated:

| March 31, 2023 | December 31, 2022 | |||||||||||||||||||||||||||||||||||||

| Remaining Term to Maturity | Balance | Weighted Average Rate | WAVG Original Term to Maturity | Balance | Weighted Average Rate | WAVG Original Term to Maturity | ||||||||||||||||||||||||||||||||

| Less than 30 days | $ | % | $ | % | ||||||||||||||||||||||||||||||||||

| 30 to 90 days | % | % | ||||||||||||||||||||||||||||||||||||

| 91 to 180 days | % | % | ||||||||||||||||||||||||||||||||||||

| Total | $ | % | $ | % | ||||||||||||||||||||||||||||||||||

The increase in the Company’s weighted average rate for its borrowings as of March 31, 2023 compared to December 31, 2022 resulted from the increase in the U.S. Federal Funds Target rate (“Fed Funds rate”) set by the Federal Reserve. The Company’s accrued interest payable related to its repurchase agreement borrowings was $12,806 as of March 31, 2023 compared to $16,450 as of December 31, 2022.

The Company has an agreement with Wells Fargo Bank, N.A. for a committed repurchase facility, which has an aggregate maximum borrowing capacity of $250,000 and a maturity date of June 8, 2023. As of March 31, 2023, the Company had $41,220 outstanding with this facility at a weighted average borrowing rate of 5.25 %. The remaining repurchase facilities available to the Company are uncommitted with no guarantee of renewal or terms of renewal.

The Company’s counterparties, as set forth in the master repurchase agreement with the counterparty, require the Company to comply with various customary operating and financial covenants, including, but not limited to, minimum net worth, maximum declines in net worth in a given period, and maximum leverage requirements as well as maintaining the Company’s REIT status. In addition, some of the agreements contain cross default features, whereby default under an agreement with one lender simultaneously causes default under agreements with other lenders. To the extent that the Company fails to comply with the covenants contained in these financing agreements or is otherwise found to be in default under the terms of such agreements, the counterparty has the right to accelerate amounts due under the master repurchase agreement. The Company believes it was in full compliance with all covenants in master repurchase agreements under which there were amounts outstanding as of March 31, 2023.

The Company's repurchase agreements are subject to underlying agreements with master netting or similar arrangements, which provide for the right of offset in the event of default or in the event of bankruptcy of either party to the transactions. The Company reports its repurchase agreements to these arrangements on a gross basis. The following table presents information regarding the Company's repurchase agreements as if the Company had presented them on a net basis as of March 31, 2023 and December 31, 2022:

14

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

($s in thousands except per share data)

| Gross Amount of Recognized Liabilities | Gross Amount Offset in the Balance Sheet | Net Amount of Liabilities Presented in the Balance Sheet | Gross Amount Not Offset in the Balance Sheet (1) | Net Amount | |||||||||||||||||||||||||||||||

| Financial Instruments Posted as Collateral | Cash Posted as Collateral | ||||||||||||||||||||||||||||||||||

| March 31, 2023: | |||||||||||||||||||||||||||||||||||

| Repurchase agreements | $ | $ | $ | $ | ( | $ | $ | ||||||||||||||||||||||||||||

| December 31, 2022: | |||||||||||||||||||||||||||||||||||

| Repurchase agreements | $ | $ | $ | $ | ( | $ | $ | ||||||||||||||||||||||||||||

(1) Amounts disclosed for collateral received by or posted to the same counterparty include cash and the fair value of MBS up to and not exceeding the net amount of the repurchase agreement liability presented in the balance sheet. The fair value of the total collateral received by or posted to the same counterparty may exceed the amounts presented.

NOTE 5 – DERIVATIVES

Types and Uses of Derivatives Instruments

Interest Rate Derivatives. During the periods presented herein, the Company used short positions in U.S. Treasury futures, interest rate swaptions, and call options on U.S. Treasury futures to mitigate the impact of changing interest rates on its repurchase agreement financing costs and the fair value of its investments.

TBA Transactions. The Company purchases TBA securities as a means of investing in non-specified fixed-rate Agency RMBS and may also periodically sell TBA securities as a means of economically hedging its exposure to Agency RMBS. The Company holds long and short positions in TBA securities by executing a series of transactions, commonly referred to as “dollar roll” transactions, which effectively delay the settlement of a forward purchase (or sale) of a non-specified Agency RMBS by entering into an offsetting TBA position, net settling the paired-off positions in cash, and simultaneously entering into an identical TBA long (or short) position with a later settlement date. TBA securities purchased (or sold) for a forward settlement date are generally priced at a discount relative to TBA securities settling in the current month. This discount, often referred to as “drop income” represents the economic equivalent of net interest income (interest income less implied financing cost) on the underlying Agency security from trade date to settlement date. The Company accounts for all TBAs (whether net long or net short positions, or collectively “TBA dollar roll positions”) as derivative instruments because it cannot assert that it is probable at inception and throughout the term of an individual TBA transaction that its settlement will result in physical delivery of the underlying Agency RMBS, or that the individual TBA transaction will settle in the shortest period possible.

15

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

($s in thousands except per share data)

derivative instrument for the periods indicated:

| Three Months Ended | ||||||||||||||

| March 31, | ||||||||||||||

| Type of Derivative Instrument | 2023 | 2022 | ||||||||||||

| U.S. Treasury futures | $ | ( | $ | |||||||||||

| Interest rate swaptions | ||||||||||||||

| Options on U.S. Treasury futures | ( | |||||||||||||

| TBA securities-long positions | ( | |||||||||||||

| (Loss) gain on derivative instruments, net | $ | ( | $ | |||||||||||

The table below provides the carrying amount by type of derivative instrument comprising the Company’s derivative assets and liabilities on its consolidated balance sheets as of the dates indicated:

| Type of Derivative Instrument | Balance Sheet Location | Purpose | March 31, 2023 | December 31, 2022 | ||||||||||||||||||||||

| Options on U.S. Treasury futures | Derivative assets | Economic hedging | $ | $ | ||||||||||||||||||||||

| TBA securities | Derivative assets | Investing | ||||||||||||||||||||||||

| Total derivatives assets | $ | $ | ||||||||||||||||||||||||

| TBA securities | Derivative liabilities | Investing | $ | $ | ||||||||||||||||||||||

| Total derivatives liabilities | $ | $ | ||||||||||||||||||||||||

The Company’s short positions in U.S. Treasury futures are considered legally settled on a daily basis, therefore the carrying value on the Company’s consolidated balance sheet nets to $0. As of March 31, 2023, the amount of cash posted by the Company to cover required initial margin for its U.S. Treasury futures was $114,590 , which is recorded within “cash collateral posted to counterparties.” The Company also had variation margin amount due of $17,337 as of March 31, 2023, which is recorded within “due to counterparties.”

The Company’s options on U.S. Treasury futures are recorded at fair value on its consolidated balance sheet as of March 31, 2023. The Company’s cost basis as of March 31, 2023 was $4,034 , which represents the premium paid.

The following table summarizes information about the Company's long positions in TBA securities as of the dates indicated:

| March 31, 2023 | December 31, 2022 | |||||||||||||

Implied market value (1) | $ | $ | ||||||||||||

Implied cost basis (2) | ||||||||||||||

Net carrying value (3) | $ | $ | ( | |||||||||||

(1) Implied market value represents the estimated fair value of the underlying Agency MBS as of the dates indicated .

(2) Implied cost basis represents the forward price to be paid for the underlying Agency MBS as of the dates indicated.

(3) Net carrying value is the amount included on the consolidated balance sheets within “derivative assets” and “derivative liabilities” and represents the difference between the implied market value and the implied cost basis of the TBA securities as of the dates indicated.

16

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

($s in thousands except per share data)

Volume of Activity

The table below summarizes changes in the Company’s derivative instruments for the three months ended March 31, 2023:

| Type of Derivative Instrument | Beginning Notional Amount-Long (Short) | Additions | Settlements, Terminations, or Pair-Offs | Ending Notional Amount-Long (Short) | ||||||||||||||||||||||

| U.S. Treasury futures | $ | ( | $ | ( | $ | $ | ( | |||||||||||||||||||

| Options on U.S. Treasury futures | ( | |||||||||||||||||||||||||

| TBA securities | ( | |||||||||||||||||||||||||

Offsetting

The Company's derivatives are subject to underlying agreements with master netting or similar arrangements, which provide for the right of offset in the event of default or in the event of bankruptcy of either party to the transactions. The Company reports its derivative assets and liabilities subject to these arrangements on a gross basis. Please see Note 4 for information related to the Company’s repurchase agreements, which are also subject to underlying agreements with master netting or similar arrangements. The following tables present information regarding those derivative assets and liabilities subject to such arrangements as if the Company had presented them on a net basis as of March 31, 2023 and December 31, 2022:

| Offsetting of Assets | |||||||||||||||||||||||||||||||||||

| Gross Amount of Recognized Assets | Gross Amount Offset in the Balance Sheet | Net Amount of Assets Presented in the Balance Sheet | Gross Amount Not Offset in the Balance Sheet (1) | Net Amount | |||||||||||||||||||||||||||||||

| Financial Instruments Received as Collateral | Cash Received as Collateral | ||||||||||||||||||||||||||||||||||

| March 31, 2023 | |||||||||||||||||||||||||||||||||||

| Options on U.S. Treasury futures | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| TBA securities | ( | ||||||||||||||||||||||||||||||||||

| Derivative assets | $ | $ | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||

| December 31, 2022 | |||||||||||||||||||||||||||||||||||

| Options on U.S. Treasury futures | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| TBA securities | ( | ||||||||||||||||||||||||||||||||||

| Derivative assets | $ | $ | $ | $ | ( | $ | $ | ||||||||||||||||||||||||||||

17

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

($s in thousands except per share data)

| Offsetting of Liabilities | |||||||||||||||||||||||||||||||||||

| Gross Amount of Recognized Liabilities | Gross Amount Offset in the Balance Sheet | Net Amount of Liabilities Presented in the Balance Sheet | Gross Amount Not Offset in the Balance Sheet (1) | Net Amount | |||||||||||||||||||||||||||||||

| Financial Instruments Posted as Collateral | Cash Posted as Collateral | ||||||||||||||||||||||||||||||||||

| March 31, 2023 | |||||||||||||||||||||||||||||||||||

| TBA securities | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| Derivative liabilities | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| December 31, 2022 | |||||||||||||||||||||||||||||||||||

| TBA securities | $ | $ | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||||||

| Derivative liabilities | $ | $ | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||||||

NOTE 6 – FAIR VALUE OF FINANCIAL INSTRUMENTS

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Fair value is based on the assumptions market participants would use when pricing an asset or liability and also considers all aspects of nonperformance risk, including the entity’s own credit standing, when measuring fair value of a liability. ASC Topic 820 established a valuation hierarchy of three levels as follows:

•Level 1 – Inputs are unadjusted, quoted prices in active markets for identical assets or liabilities as of the measurement date.

•Level 2 – Inputs include quoted prices in active markets for similar assets or liabilities; quoted prices in inactive markets for identical or similar assets or liabilities; or inputs either directly observable or indirectly observable through correlation with market data at the measurement date and for the duration of the instrument’s anticipated life.

•Level 3 – Unobservable inputs are supported by little or no market activity. The unobservable inputs represent management’s best estimate of how market participants would price the asset or liability at the measurement date. Consideration is given to the risk inherent in the valuation technique and the risk inherent in the inputs to the model.

18

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

($s in thousands except per share data)

| March 31, 2023 | December 31, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||

| Fair Value | Level 1 | Level 2 | Level 3 | Fair Value | Level 1 | Level 2 | Level 3 | ||||||||||||||||||||||||||||||||||||||||

| Assets carried at fair value: | |||||||||||||||||||||||||||||||||||||||||||||||

| MBS | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||

| Derivative assets: | |||||||||||||||||||||||||||||||||||||||||||||||

| Options on U.S. Treasury futures | |||||||||||||||||||||||||||||||||||||||||||||||

| TBA securities-long position | |||||||||||||||||||||||||||||||||||||||||||||||

| Total assets carried at fair value | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||

| Liabilities carried at fair value: | |||||||||||||||||||||||||||||||||||||||||||||||

| TBA securities-long position | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||

| Total liabilities carried at fair value | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||

The fair value measurements for most of the Company's MBS are considered Level 2 because there are substantially similar securities actively trading or for which there has been recent trading activity in their respective markets and are based on prices received from pricing services and quotes from brokers. In valuing a security, the pricing service uses either a market approach, which uses observable prices and other relevant information that is generated by market transactions of identical or similar securities, or an income approach, which uses valuation techniques such as discounted cash flow modeling. The Company reviews the prices it receives from its pricing sources as well as the assumptions and inputs utilized by its pricing sources for reasonableness. Examples of the observable inputs and assumptions include market interest rates, credit spreads, and projected prepayment speeds, among other things.

Options on U.S. Treasury futures are valued based on closing exchange prices on these contracts and are classified accordingly as Level 1 measurements. The fair value of TBA securities is estimated using methods similar to those used to fair value the Company’s Level 2 MBS.

NOTE 7 – SHAREHOLDERS’ EQUITY AND SHARE-BASED COMPENSATION

Preferred Stock. The Company’s Board of Directors has designated 6,600,000 shares of the Company’s preferred stock for issuance as Series C Preferred Stock, of which the Company has 4,460,000 of such shares outstanding as of March 31, 2023. The Series C Preferred Stock has no stated maturity, is not subject to any sinking fund or mandatory redemption, and will remain outstanding indefinitely unless redeemed, repurchased or converted into common stock pursuant to the terms of the Series C Preferred Stock. Except under certain limited circumstances described in Article IIIC of the Company’s Restated Articles of Incorporation, the Company may not redeem the Series C Preferred Stock prior to April 15, 2025. On or after that date, the Series C Preferred Stock may be redeemed at any time and from time to time at the Company's option at a cash redemption price of $25.00 per share plus any accumulated and unpaid dividends. Because the Series C Preferred Stock is redeemable only at the option of the issuer, it is classified as equity on the Company’s consolidated balance sheet.

The Series C Preferred Stock pays a cumulative cash dividend equivalent to 6.900 % of the $25.00 liquidation preference per share each year until April 15, 2025. The terms of the Series C Preferred Stock state that upon April 15, 2025 and thereafter, the Company will pay cumulative cash dividends at a percentage of the $25.00 liquidation value per share equal to an annual floating rate of 3-month LIBOR plus a spread of 5.461 %. When 3-month LIBOR ceases

19

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

($s in thousands except per share data)

to be a published, the fallback provision provided in the terms of the Series C Preferred Stock will allow for the Company to appoint a third-party independent financial institution of national standing to select an industry accepted alternative base rate. The Company paid its regular quarterly dividend of $0.43125 per share of Series C Preferred Stock on April 17, 2023 to shareholders of record as of April 1, 2023.

Common Stock. During the three months ended March 31, 2023, the Company issued 199,274 shares of its common stock through its at-the-market (“ATM”) program at an aggregate value of $2,771 , net of broker commissions and fees. The Company currently pays a monthly dividend on its common stock. The Company’s timing, frequency, and amount of dividends declared on its common stock are determined by its Board of Directors. When declaring dividends, the Board of Directors considers the Company’s taxable income, the REIT distribution requirements of the Tax Code, and maintaining compliance with dividend requirements of the Series C Preferred Stock, along with other factors that the Board of Directors may deem relevant from time to time.

Share-Based Compensation. Total share-based compensation expense recognized by the Company was $1,010 for the three months ended March 31, 2023 compared to $846 for the three months ended March 31, 2022.

The following tables present a rollforward of share-based awards for the periods indicated:

| Three Months Ended | ||||||||||||||||||||||||||

| March 31, | ||||||||||||||||||||||||||

| 2023 | 2022 | |||||||||||||||||||||||||

| Type of Award | Shares | Weighted Average Grant Date Fair Value Per Share | Shares | Weighted Average Grant Date Fair Value Per Share | ||||||||||||||||||||||

| Restricted stock: | ||||||||||||||||||||||||||

| Awards outstanding, beginning of period | $ | $ | ||||||||||||||||||||||||

| Granted | ||||||||||||||||||||||||||

| Vested | ( | ( | ||||||||||||||||||||||||

| Awards outstanding, end of period | $ | $ | ||||||||||||||||||||||||

| RSUs: | ||||||||||||||||||||||||||

| Awards outstanding, beginning of period | $ | $ | ||||||||||||||||||||||||

| Granted | ||||||||||||||||||||||||||

| Vested | ( | |||||||||||||||||||||||||

| Awards outstanding, end of period | $ | $ | ||||||||||||||||||||||||

| PSUs: | ||||||||||||||||||||||||||

| Awards outstanding, beginning of period | $ | $ | ||||||||||||||||||||||||

| Granted | ||||||||||||||||||||||||||

| Vested | ||||||||||||||||||||||||||

| Awards outstanding, end of period | $ | $ | ||||||||||||||||||||||||

The number of RSUs that will potentially settle may range from 0% if the recipient’s service-based vesting condition is not met to 100% if the service-based vesting condition is met. The number of PSUs that will potentially settle may range from 0% to 200% based on the achievement of the performance goals defined in the grant award. As of March 31, 2023, the Company expects 100% of the PSUs outstanding will be settled on their vesting dates. The Company has DERs accrued for RSUs and PSUs of $89 and $446 , respectively, as of March 31, 2023 compared to

20

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

DYNEX CAPITAL, INC.

($s in thousands except per share data)

$152 and $354 , respectively, as of December 31, 2022, which is included on the Company’s consolidated balance sheet within “accrued dividends payable.”

The following table discloses the grant date fair value of the Company’s remaining unvested awards as of March 31, 2023, which will be amortized into compensation expense over the period disclosed:

| March 31, 2023 | |||||||||||

| Remaining Compensation Cost | WAVG Period of Recognition | ||||||||||

| Restricted stock | $ | ||||||||||

| RSUs | |||||||||||

| PSUs | |||||||||||

| Total | $ | ||||||||||

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our unaudited consolidated financial statements and the accompanying notes included in Part I, Item 1. “Financial Statements” in this Quarterly Report on Form 10-Q and our audited consolidated financial statements and the accompanying notes included in Part II, Item 8 in our 2022 Form 10-K. References herein to “Dynex,” the “Company,” “we,” “us,” and “our” include Dynex Capital, Inc. and its consolidated subsidiaries, unless the context otherwise requires. In addition to current and historical information, the following discussion and analysis contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to our future business, financial condition or results of operations. For a description of certain factors that may have a significant impact on our future business, financial condition or results of operations, see “Forward-Looking Statements” at the end of this discussion and analysis.

For more information about our business including our operating policies, investment philosophy and strategy, financing and hedging strategies, and other important information, please refer to Part I, Item 1 of our 2022 Form 10-K.

EXECUTIVE OVERVIEW

Interest rate volatility experienced during 2022 continued in the first quarter of 2023. The last month of the quarter included a steep drop in medium and longer term interest rates as two banks collapsed, and financial system duress became the focus of regulators and market participants. The Federal Reserve’s dual mandate of maximum employment and price stability while taming inflation is a difficult task. As the front end of the yield curve moves up with the continuation of Fed Funds rate increases, the back end has fallen while spreads have widened as smaller banks could be net sellers of MBS. Our hedging activities help insulate the Company’s book value against rising interest rates, but do not protect the Company from widening spreads.

The charts below show the range of U.S. Treasury rates and information regarding market spreads as of and for the periods indicated:

21

Market Spreads as of: | Change in Spreads | |||||||||||||||||||

| Investment Type: | March 31, 2023 | December 31, 2022 | ||||||||||||||||||

Agency RMBS: (1) | ||||||||||||||||||||

| 2.0% coupon | 39 | 27 | (12) | |||||||||||||||||

| 2.5% coupon | 39 | 35 | (4) | |||||||||||||||||

| 3.0% coupon | 39 | 33 | (6) | |||||||||||||||||

| 3.5% coupon | 39 | 36 | (3) | |||||||||||||||||

| 4.0% coupon | 42 | 33 | (9) | |||||||||||||||||

| 4.5% coupon | 51 | 34 | (17) | |||||||||||||||||

| 5.0% coupon | 50 | 28 | (22) | |||||||||||||||||

| 5.5% coupon | 55 | 33 | (22) | |||||||||||||||||

Agency DUS (Agency CMBS)(2) | 78 | 74 | (4) | |||||||||||||||||

Freddie K AAA IO (Agency CMBS IO)(2) | 210 | 235 | 25 | |||||||||||||||||

AAA CMBS IO (Non-Agency CMBS IO)(2) | 350 | 315 | (35) | |||||||||||||||||

(1)Option adjusted spreads (“OAS”) are based on Company estimates using third-party models and market data. OAS shown for prior periods may differ from previous disclosures because.the Company regularly updates the third-party model used.

(2)Data represents the spread to swap rate on newly issued securities and is sourced from J.P. Morgan.

Summary of First Quarter 2023 Performance

Our total economic return for the first quarter of 2023 was a loss of $(0.54) per common share, comprised of a $(0.93) decline in book value offset by dividends declared of $0.39 per common share. The loss in book value was driven primarily by spread widening on MBS as a result of turmoil in the banking sector during the first quarter of 2023. The impact of spread widening on our MBS muted the benefit gained from the decline in the 10-year U.S. Treasury rate during March 2023. The decline in the 10-year U.S. Treasury rate also resulted in losses in the fair value of our interest rate hedges, which exceeded net unrealized gains on our investment portfolio by $(18.7) million, and comprised the majority of comprehensive loss to common shareholders of $(28.9) million, or $(0.54) per common share, for the first quarter of 2023. In addition to spread widening, our earnings continue to be impacted by increasing borrowing costs as the Federal Reserve continues raising the Fed Funds rate in its efforts to tame inflation. Our interest

22

expense exceeded our interest income by $(0.5) million for the first quarter of 2023.

Prior to the decline in the 10-year U.S. Treasury rate in March 2023, we realized gains of $89.0 million when we rolled our interest rate hedges in February 2023. While included in our comprehensive loss for the first quarter of 2023, these realized gains will not be recognized in taxable income and therefore not distributable to our shareholders during the same period. Because these derivative instruments are designated for tax purposes as interest rate hedges, realized gains and losses are instead amortized into our taxable income over the original periods hedged by those derivatives. Our estimated REIT taxable income for the first quarter of 2023 includes an estimated benefit of approximately $18.2 million, or $0.34 per average common share outstanding during the period, from the amortization of accumulated deferred tax hedge gains, which were estimated to be $766.0 million as of March 31, 2023 compared to $695.2 million as of December 31, 2022. This benefit will be distributable to common shareholders as part of our taxable ordinary income in future periods. Additional information regarding the estimated impact of deferred tax hedge amortization on our estimated REIT taxable income is discussed in “Liquidity and Capital Resources” within this Item 2.

The following table provides details about the changes in our financial position during the first quarter of 2023:

| Net Change in Fair Value | Components of Comprehensive Loss | Common Book Value Rollforward | Per Common Share | ||||||||||||||||||||

Balance as of December 31, 2022 (1) | $ | 789,828 | $ | 14.73 | |||||||||||||||||||

| Net interest income | $ | (462) | |||||||||||||||||||||

| TBA drop income | 1,457 | ||||||||||||||||||||||

| G & A and other operating expenses | (7,798) | ||||||||||||||||||||||

| Preferred stock dividends | (1,923) | ||||||||||||||||||||||

| Changes in fair value: | |||||||||||||||||||||||

| MBS and loans | $ | 48,599 | |||||||||||||||||||||

| TBAs | 41,906 | ||||||||||||||||||||||

| U.S. Treasury futures | (106,373) | ||||||||||||||||||||||

| Options on U.S. Treasury futures | (4,258) | ||||||||||||||||||||||

| Total net change in fair value | (20,126) | ||||||||||||||||||||||

| Comprehensive loss to common shareholders | (28,852) | (0.54) | |||||||||||||||||||||

| Capital transactions: | |||||||||||||||||||||||

Net proceeds from stock issuance (2) | 3,489 | — | |||||||||||||||||||||

| Common dividends declared | (21,137) | (0.39) | |||||||||||||||||||||

Balance as of March 31, 2023 (1) | $ | 743,328 | $ | 13.80 | |||||||||||||||||||

(1)Amounts represent total shareholders' equity less the aggregate liquidation preference of the Company's preferred stock, in thousands and on a per common share basis.

(2)Net proceeds from stock issuance include $2.8 million from common stock ATM program and $0.8 million from share-based compensation grants, net of amortization. The amount shown for “per common share” includes the impact of the increase in the number of common shares outstanding.

23

Current Outlook

We believe market conditions will remain volatile as participants anticipate the Federal Reserve ending quantitative tightening and as the potential for quantitative easing begins. We believe liquidity and flexibility are necessary for navigating through this macroeconomic environment. The recent turmoil in the banking sector has caused spread widening on Agency RMBS, which is providing us additional opportunities to invest in new assets with yields at an attractive spread over U.S. Treasury securities. We believe there are compelling opportunities for investment as technical factors of supply and demand attempt to find equilibrium. In the medium and long term, we expect Agency RMBS are likely to remain attractive as an asset class that provides liquidity and flexibility with minimal credit risk due to the implicit guarantee by GSEs. There are several paths to recovery of recent drops in market value of MBS. In the event of a recession, demand for risk-free assets like Agency RMBS will increase. Any certainty about Federal Reserve policy will likely reduce interest rate volatility, which should help MBS spreads to tighten. Longer-term, if and when the Federal Reserve decides to reverse its policy and begins reducing the Fed Funds rate, the yield curve is likely to steepen, establishing a high-return environment for a levered Agency RMBS investor.

FINANCIAL CONDITION

Investment Portfolio

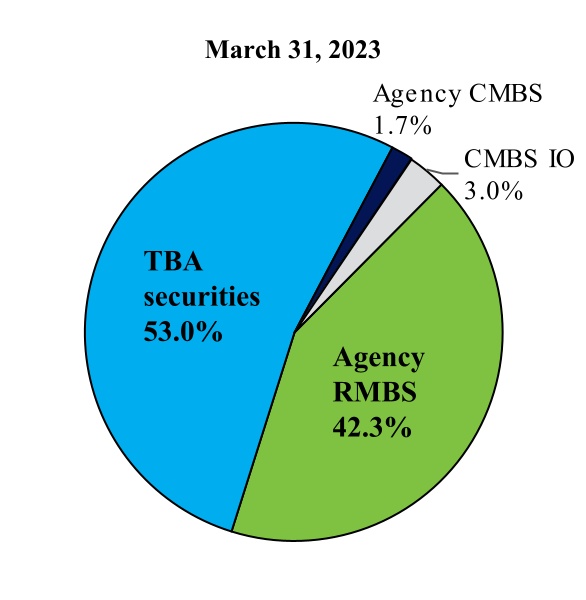

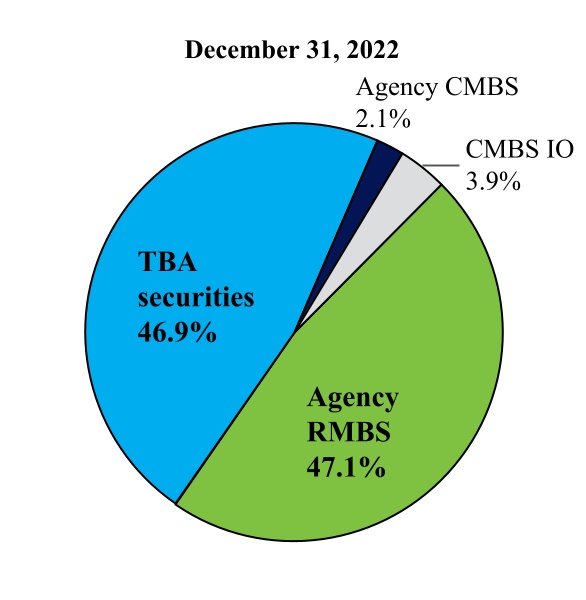

The following charts compare the composition of our MBS portfolio including TBA securities as of the dates indicated:

To minimize losses due to spread volatility, we frequently change the coupon distribution in our Agency RMBS and TBA portfolios. During the first quarter, we shifted the majority of our 4.0% TBA securities into TBA securities with higher coupons and sold a portion of our specified pools of Agency RMBS with coupons of 2.0% to purchase higher coupon Agency RMBS when spreads widened. The majority of those purchases were at a discount to par. We expect spreads will remain volatile and range-bound in the intermediate term while the Federal Reserve continues reducing MBS from its balance sheet. Longer term, as investors return to the MBS market and demand improves, we expect the fair value of our investment portfolio to increase and our book value to trend higher.

The following tables compare our fixed-rate Agency RMBS investments, including TBA dollar roll positions, as of the dates indicated:

24

| March 31, 2023 | ||||||||||||||||||||||||||||||||||||||||||||

| Par/Notional | Amortized Cost/ Implied Cost Basis (1)(3) | Fair Value (2)(3) | Weighted Average | |||||||||||||||||||||||||||||||||||||||||

| Coupon | Loan Age (in months)(4) | 3 Month CPR (4)(5) | Estimated Duration (6) | Market Yield (4)(7) | ||||||||||||||||||||||||||||||||||||||||

| 30-year fixed-rate: | ($s in thousands) | |||||||||||||||||||||||||||||||||||||||||||

| 2.0% | $ | 1,051,974 | $ | 1,066,795 | $ | 875,432 | 26 | 3.3 | % | 7.00 | 4.46 | % | ||||||||||||||||||||||||||||||||

| 2.5% | 649,246 | 675,274 | 564,171 | 31 | 3.7 | % | 6.73 | 4.45 | % | |||||||||||||||||||||||||||||||||||

| 4.0% | 319,350 | 323,220 | 308,733 | 28 | 5.8 | % | 5.53 | 4.51 | % | |||||||||||||||||||||||||||||||||||

| 4.5% | 909,477 | 901,346 | 896,708 | 7 | 3.6 | % | 4.87 | 4.71 | % | |||||||||||||||||||||||||||||||||||

| 5.0% | 321,515 | 321,233 | 321,846 | 4 | 3.2 | % | 3.93 | 4.98 | % | |||||||||||||||||||||||||||||||||||

| TBA 4.0% | 547,000 | 515,130 | 522,915 | n/a | n/a | 5.56 | n/a | |||||||||||||||||||||||||||||||||||||

| TBA 4.5% | 460,000 | 446,074 | 450,441 | n/a | n/a | 4.67 | n/a | |||||||||||||||||||||||||||||||||||||

| TBA 5.0% | 2,345,000 | 2,319,212 | 2,337,560 | n/a | n/a | 3.21 | n/a | |||||||||||||||||||||||||||||||||||||

| TBA 5.5% | 400,000 | 399,000 | 404,000 | n/a | n/a | 2.41 | n/a | |||||||||||||||||||||||||||||||||||||

| Total | $ | 7,003,562 | $ | 6,967,284 | $ | 6,681,806 | 19 | 3.7 | % | 4.60 | 4.60 | % | ||||||||||||||||||||||||||||||||

| December 31, 2022 | ||||||||||||||||||||||||||||||||||||||||||||

| Par/Notional | Amortized Cost/ Implied Cost Basis (1)(3) | Fair Value (2)(3) | Weighted Average | |||||||||||||||||||||||||||||||||||||||||

| Coupon | Loan Age (in months)(4) | 3 Month CPR (4)(5) | Estimated Duration (6) | Market Yield (4)(7) | ||||||||||||||||||||||||||||||||||||||||

| 30-year fixed-rate: | ($s in thousands) | |||||||||||||||||||||||||||||||||||||||||||

| 2.0% | $ | 1,193,344 | $ | 1,210,065 | $ | 982,387 | 23 | 5.2 | % | 7.14 | 4.53 | % | ||||||||||||||||||||||||||||||||

| 2.5% | 659,181 | 685,838 | 566,525 | 28 | 5.9 | % | 6.67 | 4.59 | % | |||||||||||||||||||||||||||||||||||

| 4.0% | 325,726 | 329,725 | 309,940 | 25 | 7.2 | % | 5.56 | 4.75 | % | |||||||||||||||||||||||||||||||||||

| 4.5% | 803,043 | 799,786 | 782,319 | 4 | 4.4 | % | 5.02 | 4.89 | % | |||||||||||||||||||||||||||||||||||

| 5.0% | 123,204 | 125,460 | 121,707 | 4 | 7.2 | % | 3.99 | 5.19 | % | |||||||||||||||||||||||||||||||||||

| TBA 4.0% | 1,539,000 | 1,454,263 | 1,447,286 | n/a | n/a | 5.47 | n/a | |||||||||||||||||||||||||||||||||||||

| TBA 4.5% | 380,000 | 371,173 | 366,759 | n/a | n/a | 4.79 | n/a | |||||||||||||||||||||||||||||||||||||

| TBA 5.0% | 950,000 | 947,484 | 937,523 | n/a | n/a | 4.24 | n/a | |||||||||||||||||||||||||||||||||||||

| Total | $ | 5,973,498 | $ | 5,923,794 | $ | 5,514,446 | 18 | 5.4 | % | 5.54 | 4.70 | % | ||||||||||||||||||||||||||||||||

(1)Implied cost basis of TBAs represents the forward price to be paid for the underlying Agency MBS.

(2)Fair value of TBAs is the implied market value of the underlying Agency security as of the end of the period.

(3)TBAs are included on the consolidated balance sheet within “derivative assets/liabilities” at their net carrying value which is the difference between their implied market value and implied cost basis. Please refer to Note 5 of the Notes to the Consolidated Financial Statements for additional information.

(4)TBAs are excluded from this calculation as they do not have a defined weighted-average loan balance or age until mortgages have been assigned to the pool.

(5)Constant prepayment rate (“CPR”) represents the 3-month CPR of Agency RMBS held as of date indicated.

(6)Duration measures the sensitivity of a security's price to the change in interest rates and represents the percent change in price of a security for a 100-basis point increase in interest rates. We calculate duration using third-party financial models and empirical data. Different models and methodologies can produce different estimates of duration for the same securities.

(7)Represents the weighted average market yield projected using cash flows generated off the forward curve based on market prices as of the date indicated and assuming zero volatility.

25

Approximately 5% of our MBS portfolio is comprised of Agency CMBS, Agency CMBS IO, and non-Agency CMBS IO. Our Agency CMBS and Agency CMBS IO are backed by loans collateralized by multifamily properties, which have performed well for the last decade versus other sectors of the commercial real estate market. Our Agency CMBS IO are Class X1 from Freddie Mac Series K deals from which interest continues to be advanced even in the event of an underlying default up until liquidation. According to Freddie Mac, 99.9% of the loans in K-deals are current as of February 2023. Our non-Agency CMBS IO were all originated prior to 2018 with a weighted average remaining life of less than 2 years. The underlying loans for the non-Agency CMBS IO securities are collateralized by a number of different property types including: 29% retail, 24% office, 14% multifamily, 13% hotel and 21% all other real estate categories. In the current macroeconomic environment, we are not actively purchasing CMBS or CMBS IO as current risk versus reward remains unattractive relative to Agency RMBS.

The following table provides certain information regarding our CMBS and CMBS IO as of the dates indicated:

| March 31, 2023 | |||||||||||||||||||||||||||||

| Amortized Cost | Fair Value | WAVG Life Remaining (1) | WAVG Coupon (2) | WAVG Market Yield (3) | |||||||||||||||||||||||||

| Agency CMBS | $ | 125,833 | $ | 119,474 | 4.7 | 3.20 | % | 4.43 | % | ||||||||||||||||||||

| Agency CMBS IO | 170,010 | 161,446 | 6.2 | 0.43 | % | 4.73 | % | ||||||||||||||||||||||

| Non-Agency CMBS IO | 50,530 | 48,838 | 1.9 | 0.82 | % | 11.70 | % | ||||||||||||||||||||||

| Total | $ | 346,373 | $ | 329,758 | |||||||||||||||||||||||||

| December 31, 2022 | |||||||||||||||||||||||||||||

| Amortized Cost | Fair Value | WAVG Life Remaining (1) | WAVG Coupon (2) | WAVG Market Yield (3) | |||||||||||||||||||||||||

| Agency CMBS | $ | 132,333 | $ | 124,690 | 4.8 | 3.22 | % | 4.50 | % | ||||||||||||||||||||

| Agency CMBS IO | 179,734 | 168,147 | 6.3 | 0.41 | % | 5.32 | % | ||||||||||||||||||||||

| Non-Agency CMBS IO | 59,107 | 56,839 | 2.1 | 0.83 | % | 8.54 | % | ||||||||||||||||||||||

| Total | $ | 371,174 | $ | 349,676 | |||||||||||||||||||||||||

| (1) Represents the weighted average life remaining in years based on contractual cash flows as of the dates indicated. | |||||||||||||||||||||||||||||

| (2) Represents the weighted average coupon based on par/notional as of the dates indicated. | |||||||||||||||||||||||||||||

(3) Represents the weighted average market yield projected using cash flows generated off the forward curve based on market prices as of the dates indicated and assuming zero volatility. | |||||||||||||||||||||||||||||

Repurchase Agreements

We have not experienced any difficulty in securing financing with any of our counterparties, and our repurchase agreement counterparties have not indicated any concerns regarding leverage or credit. Please refer to Note 4 of the Notes to the Consolidated Financial Statements contained within this Quarterly Report on Form 10-Q as well as “Results of Operations” and “Liquidity and Capital Resources” contained within this Item 7 for additional information relating to our repurchase agreement borrowings.

Derivative Assets and Liabilities

We rolled our interest rate hedges during February 2023, realizing gains of $89.0 million. As interest rates declined during March 2023, the fair value of our interest rate hedges declined $(199.7) million. As of March 31, 2023, the Company held short positions of $4.4 billion in 10-year U.S. Treasury futures and $900.0 million in 5-year U.S. Treasury futures and held put options on 10-year U.S. Treasury futures of $250.0 million.

26