dx-2020123100008266752020FYFALSE——00008266752020-01-012020-12-310000826675us-gaap:CommonStockMember2020-01-012020-12-310000826675us-gaap:SeriesBPreferredStockMember2020-01-012020-12-310000826675us-gaap:SeriesCPreferredStockMember2020-01-012020-12-31iso4217:USD00008266752020-06-30xbrli:shares00008266752021-02-25iso4217:USDxbrli:shares00008266752020-12-3100008266752019-12-3100008266752019-01-012019-12-3100008266752018-01-012018-12-310000826675us-gaap:PreferredStockMember2017-12-310000826675us-gaap:PreferredStockIncludingAdditionalPaidInCapitalMember2017-12-310000826675us-gaap:CommonStockMember2017-12-310000826675us-gaap:AdditionalPaidInCapitalMember2017-12-310000826675us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-310000826675us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2017-12-3100008266752017-12-310000826675us-gaap:PreferredStockMember2018-01-012018-12-310000826675us-gaap:PreferredStockIncludingAdditionalPaidInCapitalMember2018-01-012018-12-310000826675us-gaap:CommonStockMember2018-01-012018-12-310000826675us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310000826675us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2018-01-012018-12-310000826675us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310000826675us-gaap:PreferredStockMember2018-12-310000826675us-gaap:PreferredStockIncludingAdditionalPaidInCapitalMember2018-12-310000826675us-gaap:CommonStockMember2018-12-310000826675us-gaap:AdditionalPaidInCapitalMember2018-12-310000826675us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310000826675us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2018-12-3100008266752018-12-310000826675us-gaap:PreferredStockMember2019-01-012019-12-310000826675us-gaap:PreferredStockIncludingAdditionalPaidInCapitalMember2019-01-012019-12-310000826675us-gaap:CommonStockMember2019-01-012019-12-310000826675us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310000826675us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2019-01-012019-12-310000826675us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310000826675us-gaap:PreferredStockMember2019-12-310000826675us-gaap:PreferredStockIncludingAdditionalPaidInCapitalMember2019-12-310000826675us-gaap:CommonStockMember2019-12-310000826675us-gaap:AdditionalPaidInCapitalMember2019-12-310000826675us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310000826675us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2019-12-310000826675us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2020-01-012020-12-310000826675us-gaap:PreferredStockMember2020-01-012020-12-310000826675us-gaap:PreferredStockIncludingAdditionalPaidInCapitalMember2020-01-012020-12-310000826675us-gaap:CommonStockMember2020-01-012020-12-310000826675us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310000826675us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310000826675us-gaap:PreferredStockMember2020-12-310000826675us-gaap:PreferredStockIncludingAdditionalPaidInCapitalMember2020-12-310000826675us-gaap:CommonStockMember2020-12-310000826675us-gaap:AdditionalPaidInCapitalMember2020-12-310000826675us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000826675us-gaap:AccumulatedDistributionsInExcessOfNetIncomeMember2020-12-31xbrli:pure0000826675dx:AgencyMemberus-gaap:ResidentialMortgageBackedSecuritiesMember2020-12-310000826675dx:AgencyMemberus-gaap:CommercialMortgageBackedSecuritiesMember2020-12-310000826675us-gaap:InterestOnlyStripMember2020-12-310000826675us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMember2020-12-310000826675us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2020-12-310000826675dx:AgencyMemberus-gaap:ResidentialMortgageBackedSecuritiesMember2019-12-310000826675dx:AgencyMemberus-gaap:CommercialMortgageBackedSecuritiesMember2019-12-310000826675us-gaap:InterestOnlyStripMember2019-12-310000826675us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMember2019-12-310000826675us-gaap:MortgageBackedSecuritiesIssuedByUSGovernmentSponsoredEnterprisesMember2019-12-310000826675dx:AgencyMemberus-gaap:ResidentialMortgageBackedSecuritiesMember2020-01-012020-12-310000826675dx:AgencyMemberus-gaap:ResidentialMortgageBackedSecuritiesMember2019-01-012019-12-310000826675dx:AgencyMemberus-gaap:ResidentialMortgageBackedSecuritiesMember2018-01-012018-12-310000826675dx:AgencyMemberus-gaap:CommercialMortgageBackedSecuritiesMember2020-01-012020-12-310000826675dx:AgencyMemberus-gaap:CommercialMortgageBackedSecuritiesMember2019-01-012019-12-310000826675dx:AgencyMemberus-gaap:CommercialMortgageBackedSecuritiesMember2018-01-012018-12-310000826675us-gaap:InterestOnlyStripMemberdx:AgencyMember2019-01-012019-12-310000826675us-gaap:InterestOnlyStripMemberdx:AgencyMember2018-01-012018-12-310000826675us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMember2018-01-012018-12-310000826675us-gaap:USTreasurySecuritiesMember2018-01-012018-12-3100008266752020-01-010000826675us-gaap:InterestOnlyStripMemberdx:AgencyMember2020-12-310000826675us-gaap:InterestOnlyStripMemberdx:AgencyMember2019-12-310000826675us-gaap:InterestOnlyStripMemberdx:NonAgencyMember2020-12-310000826675us-gaap:InterestOnlyStripMemberdx:NonAgencyMember2019-12-310000826675us-gaap:MaturityUpTo30DaysMember2020-12-310000826675us-gaap:MaturityUpTo30DaysMember2019-12-310000826675us-gaap:Maturity30To90DaysMember2020-12-310000826675us-gaap:Maturity30To90DaysMember2019-12-310000826675us-gaap:MaturityOver90DaysMember2020-12-31dx:Agreements0000826675us-gaap:InterestRateSwapMember2020-01-012020-12-310000826675us-gaap:InterestRateSwapMember2019-01-012019-12-310000826675us-gaap:InterestRateSwapMember2018-01-012018-12-310000826675us-gaap:InterestRateSwaptionMember2020-01-012020-12-310000826675us-gaap:InterestRateSwaptionMember2019-01-012019-12-310000826675us-gaap:InterestRateSwaptionMember2018-01-012018-12-310000826675us-gaap:FutureMember2020-01-012020-12-310000826675us-gaap:FutureMember2019-01-012019-12-310000826675us-gaap:FutureMember2018-01-012018-12-310000826675us-gaap:ExchangeTradedOptionsMember2020-01-012020-12-310000826675us-gaap:ExchangeTradedOptionsMember2019-01-012019-12-310000826675us-gaap:ExchangeTradedOptionsMember2018-01-012018-12-310000826675us-gaap:LongMemberus-gaap:ForwardContractsMember2020-01-012020-12-310000826675us-gaap:LongMemberus-gaap:ForwardContractsMember2019-01-012019-12-310000826675us-gaap:LongMemberus-gaap:ForwardContractsMember2018-01-012018-12-310000826675us-gaap:ForwardContractsMemberus-gaap:ShortMember2020-01-012020-12-310000826675us-gaap:ForwardContractsMemberus-gaap:ShortMember2019-01-012019-12-310000826675us-gaap:ForwardContractsMemberus-gaap:ShortMember2018-01-012018-12-310000826675us-gaap:ExchangeTradedOptionsMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMember2020-12-310000826675us-gaap:ExchangeTradedOptionsMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMember2019-12-310000826675us-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:InterestRateSwaptionMember2020-12-310000826675us-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:InterestRateSwaptionMember2019-12-310000826675us-gaap:LongMemberus-gaap:ForwardContractsMemberus-gaap:NotDesignatedAsHedgingInstrumentTradingMember2020-12-310000826675us-gaap:LongMemberus-gaap:ForwardContractsMemberus-gaap:NotDesignatedAsHedgingInstrumentTradingMember2019-12-310000826675dx:A6MonthsOrLessMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:InterestRateSwaptionMember2019-12-310000826675us-gaap:ShortMemberus-gaap:FutureMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMember2020-12-310000826675us-gaap:FutureMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMember2019-12-310000826675us-gaap:ForwardContractsMemberus-gaap:ShortMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMember2020-12-310000826675us-gaap:ForwardContractsMemberus-gaap:ShortMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMember2019-12-310000826675dx:A6MonthsOrLessMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:InterestRateSwaptionMember2020-12-310000826675dx:A6MonthsOrLessMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:InterestRateSwaptionMember2020-01-012020-12-310000826675dx:GreaterThan6MonthsMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:InterestRateSwaptionMember2020-12-310000826675dx:GreaterThan6MonthsMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:InterestRateSwaptionMember2020-01-012020-12-310000826675us-gaap:InterestRateSwaptionMember2020-12-310000826675dx:A6MonthsOrLessMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:InterestRateSwaptionMember2019-01-012019-12-310000826675us-gaap:ExchangeTradedOptionsMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMember2020-01-012020-12-310000826675us-gaap:ExchangeTradedOptionsMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMember2019-12-312019-12-310000826675us-gaap:ShortMemberus-gaap:FutureMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMember2020-01-012020-12-310000826675us-gaap:InterestRateSwapMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMember2019-12-310000826675us-gaap:InterestRateSwapMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMember2020-01-012020-12-310000826675us-gaap:InterestRateSwapMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMember2020-12-310000826675us-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMemberus-gaap:InterestRateSwaptionMember2020-01-012020-12-310000826675us-gaap:ShortMemberus-gaap:FutureMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMember2019-12-310000826675us-gaap:LongMemberus-gaap:ForwardContractsMemberus-gaap:NotDesignatedAsHedgingInstrumentTradingMember2020-01-012020-12-310000826675us-gaap:ForwardContractsMemberus-gaap:ShortMemberus-gaap:NotDesignatedAsHedgingInstrumentEconomicHedgeMember2020-01-012020-12-310000826675us-gaap:ExchangeTradedOptionsMember2020-12-310000826675us-gaap:LongMemberus-gaap:ForwardContractsMember2020-12-310000826675us-gaap:InterestRateSwaptionMember2019-12-310000826675us-gaap:ExchangeTradedOptionsMember2019-12-310000826675us-gaap:LongMemberus-gaap:ForwardContractsMember2019-12-310000826675us-gaap:FutureMember2020-12-310000826675us-gaap:ForwardContractsMemberus-gaap:ShortMember2019-12-310000826675us-gaap:FairValueMeasurementsRecurringMember2020-12-310000826675us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000826675us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-12-310000826675us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000826675us-gaap:FairValueMeasurementsRecurringMember2019-12-310000826675us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310000826675us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2019-12-310000826675us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310000826675us-gaap:ExchangeTradedOptionsMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000826675us-gaap:ExchangeTradedOptionsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310000826675us-gaap:ExchangeTradedOptionsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-12-310000826675us-gaap:ExchangeTradedOptionsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000826675us-gaap:ExchangeTradedOptionsMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310000826675us-gaap:ExchangeTradedOptionsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2019-12-310000826675us-gaap:ExchangeTradedOptionsMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2019-12-310000826675us-gaap:ExchangeTradedOptionsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310000826675us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwaptionMember2020-12-310000826675us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateSwaptionMember2020-12-310000826675us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwaptionMember2020-12-310000826675us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwaptionMember2020-12-310000826675us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwaptionMember2019-12-310000826675us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateSwaptionMember2019-12-310000826675us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwaptionMember2019-12-310000826675us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:InterestRateSwaptionMember2019-12-310000826675us-gaap:LongMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForwardContractsMember2020-12-310000826675us-gaap:LongMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForwardContractsMemberus-gaap:FairValueInputsLevel1Member2020-12-310000826675us-gaap:LongMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForwardContractsMemberus-gaap:FairValueInputsLevel2Member2020-12-310000826675us-gaap:LongMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForwardContractsMember2020-12-310000826675us-gaap:LongMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForwardContractsMember2019-12-310000826675us-gaap:LongMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForwardContractsMemberus-gaap:FairValueInputsLevel1Member2019-12-310000826675us-gaap:LongMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForwardContractsMemberus-gaap:FairValueInputsLevel2Member2019-12-310000826675us-gaap:LongMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForwardContractsMember2019-12-310000826675us-gaap:FutureMemberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000826675us-gaap:FutureMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-12-310000826675us-gaap:FutureMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-12-310000826675us-gaap:FutureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310000826675us-gaap:FutureMemberus-gaap:FairValueMeasurementsRecurringMember2019-12-310000826675us-gaap:FutureMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2019-12-310000826675us-gaap:FutureMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2019-12-310000826675us-gaap:FutureMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2019-12-310000826675us-gaap:ShortMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForwardContractsMember2020-12-310000826675us-gaap:ShortMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForwardContractsMemberus-gaap:FairValueInputsLevel1Member2020-12-310000826675us-gaap:ShortMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForwardContractsMemberus-gaap:FairValueInputsLevel2Member2020-12-310000826675us-gaap:FairValueInputsLevel3Memberus-gaap:ShortMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForwardContractsMember2020-12-310000826675us-gaap:ShortMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForwardContractsMember2019-12-310000826675us-gaap:ShortMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForwardContractsMemberus-gaap:FairValueInputsLevel1Member2019-12-310000826675us-gaap:ShortMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForwardContractsMemberus-gaap:FairValueInputsLevel2Member2019-12-310000826675us-gaap:FairValueInputsLevel3Memberus-gaap:ShortMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:ForwardContractsMember2019-12-31dx:percent0000826675us-gaap:MeasurementInputPrepaymentRateMember2020-12-310000826675us-gaap:MeasurementInputDefaultRateMember2020-12-310000826675us-gaap:MeasurementInputLossSeverityMember2020-12-310000826675us-gaap:MeasurementInputDiscountRateMember2020-12-310000826675us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMember2019-12-310000826675us-gaap:LoansReceivableMember2019-12-310000826675us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMember2020-01-012020-12-310000826675us-gaap:LoansReceivableMember2020-01-012020-12-310000826675us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMemberus-gaap:InterestIncomeMember2020-01-012020-12-310000826675us-gaap:InterestIncomeMemberus-gaap:LoansReceivableMember2020-01-012020-12-310000826675us-gaap:MortgageBackedSecuritiesIssuedByPrivateEnterprisesMember2020-12-310000826675us-gaap:LoansReceivableMember2020-12-310000826675us-gaap:SeriesCPreferredStockMember2020-12-310000826675us-gaap:SeriesCPreferredStockMember2020-10-012020-12-310000826675us-gaap:SeriesAPreferredStockMember2020-03-140000826675us-gaap:SeriesAPreferredStockMember2020-03-142020-03-140000826675us-gaap:SeriesBPreferredStockMember2020-03-1600008266752020-10-012020-12-310000826675us-gaap:SeriesBPreferredStockMember2020-12-310000826675us-gaap:SeriesBPreferredStockMember2020-10-012020-12-3100008266752020-01-132020-01-1300008266752020-01-012020-01-310000826675us-gaap:CommonStockMember2020-01-242020-01-240000826675us-gaap:CommonStockMember2020-02-032020-02-0300008266752020-02-142020-02-1400008266752020-02-012020-02-290000826675us-gaap:CommonStockMember2020-02-242020-02-240000826675us-gaap:CommonStockMember2020-03-022020-03-0200008266752020-03-102020-03-1000008266752020-03-012020-03-310000826675us-gaap:CommonStockMember2020-03-232020-03-230000826675us-gaap:CommonStockMember2020-04-012020-04-0100008266752020-04-082020-04-0800008266752020-04-012020-04-300000826675us-gaap:CommonStockMember2020-04-222020-04-220000826675us-gaap:CommonStockMember2020-05-012020-05-0100008266752020-05-122020-05-1200008266752020-05-012020-05-310000826675us-gaap:CommonStockMember2020-05-222020-05-220000826675us-gaap:CommonStockMember2020-06-012020-06-0100008266752020-06-102020-06-1000008266752020-06-012020-06-300000826675us-gaap:CommonStockMember2020-06-222020-06-220000826675us-gaap:CommonStockMember2020-07-012020-07-0100008266752020-07-132020-07-1300008266752020-07-012020-07-310000826675us-gaap:CommonStockMember2020-07-232020-07-230000826675us-gaap:CommonStockMember2020-08-042020-08-0400008266752020-08-102020-08-1000008266752020-08-012020-08-310000826675us-gaap:CommonStockMember2020-08-212020-08-210000826675us-gaap:CommonStockMember2020-09-012020-09-0100008266752020-09-142020-09-1400008266752020-09-012020-09-300000826675us-gaap:CommonStockMember2020-09-242020-09-240000826675us-gaap:CommonStockMember2020-10-012020-10-0100008266752020-10-132020-10-1300008266752020-10-012020-10-310000826675us-gaap:CommonStockMember2020-10-232020-10-230000826675us-gaap:CommonStockMember2020-11-022020-11-0200008266752020-11-102020-11-1000008266752020-11-012020-11-300000826675us-gaap:CommonStockMember2020-11-202020-11-200000826675us-gaap:CommonStockMember2020-12-012020-12-0100008266752020-12-102020-12-1000008266752020-12-012020-12-310000826675us-gaap:CommonStockMember2020-12-212020-12-210000826675us-gaap:SubsequentEventMemberus-gaap:CommonStockMember2021-01-042021-01-040000826675us-gaap:RestrictedStockMember2019-12-310000826675us-gaap:RestrictedStockMember2018-12-310000826675us-gaap:RestrictedStockMember2017-12-310000826675us-gaap:RestrictedStockMember2020-01-012020-12-310000826675us-gaap:RestrictedStockMember2019-01-012019-12-310000826675us-gaap:RestrictedStockMember2018-01-012018-12-310000826675us-gaap:RestrictedStockMember2020-12-310000826675us-gaap:SubsequentEventMember2021-02-022021-02-020000826675us-gaap:SubsequentEventMember2021-02-152021-02-150000826675us-gaap:SubsequentEventMember2021-02-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

| | | | | |

| ☒ | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2020

or

| | | | | |

| ☐ | Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Commission File Number: 1-9819

DYNEX CAPITAL, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Virginia | | 52-1549373 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| 4991 Lake Brook Drive, Suite 100 | | | |

| Glen Allen, | Virginia | | 23060-9245 |

| (Address of principal executive offices) | | (Zip Code) |

| | | (804) | 217-5800 | |

| (Registrant’s telephone number, including area code) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | DX | | New York Stock Exchange |

| 7.625% Series B Cumulative Redeemable Preferred Stock, par value $0.01 per share | | N/A | | None |

| 6.900% Series C Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock, par value $0.01 per share | | DXPRC | | New York Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

As of June 30, 2020, the aggregate market value of the voting stock held by non-affiliates of the registrant was approximately $315,650,564 based on the closing sales price on the New York Stock Exchange of $14.30.

On February 25, 2021, the registrant had 26,860,470 shares outstanding of common stock, $0.01 par value, which is the registrant’s only class of common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Definitive Proxy Statement for the registrant’s 2021 Annual Meeting of Shareholders, expected to be filed pursuant to Regulation 14A within 120 days from December 31, 2020, are incorporated by reference into Part III.

DYNEX CAPITAL, INC.

FORM 10-K

TABLE OF CONTENTS

| | | | | | | | | | | |

| | | Page |

PART I. | | |

| Item 1. | Business | |

| Item 1A. | Risk Factors | |

| Item 1B. | Unresolved Staff Comments | |

| Item 2. | Properties | |

| Item 3. | Legal Proceedings | |

| Item 4. | Mine Safety Disclosures | |

| | | |

PART II. | | |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities | |

| Item 6. | Selected Financial Data | |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | |

| Item 8. | Financial Statements and Supplementary Data | |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

| Item 9A. | Controls and Procedures | |

| Item 9B. | Other Information | |

| | | |

| PART III. | | |

| Item 10. | Directors, Executive Officers and Corporate Governance | |

| Item 11. | Executive Compensation | |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

| Item 14. | Principal Accountant Fees and Services | |

| | | |

| PART IV. | | |

| Item 15. | Exhibits and Financial Statement Schedules | |

| Item 16. | Form 10-K Summary | |

| | | |

| SIGNATURES | |

CAUTIONARY STATEMENT – This Annual Report on Form 10-K contains “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933, as amended (or “1933 Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (or “Exchange Act”). We caution that any such forward-looking statements made by us are not guarantees of future performance, and actual results may differ materially from those expressed or implied in such forward-looking statements. Some of the factors that could cause actual results to differ materially from estimates expressed or implied in our forward-looking statements are set forth in this Annual Report on Form 10-K for the year ended December 31, 2020. See Item 1A. “Risk Factors” as well as “Forward-Looking Statements” set forth in Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Annual Report on Form 10-K.

In this Annual Report on Form 10-K, we refer to Dynex Capital, Inc. and its subsidiaries as the "Company,” “we,” “us,” or “our,” unless we specifically state otherwise or the context indicates otherwise.

PART I.

ITEM 1. BUSINESS

COMPANY OVERVIEW

Dynex Capital, Inc. commenced operations in 1988 and is an internally managed mortgage real estate investment trust (“REIT”), which primarily invests in residential and commercial mortgage-backed securities (“MBS”). We finance our investments principally with borrowings under repurchase agreements. Our objective is to provide attractive risk-adjusted returns to our shareholders over the long term that are reflective of a leveraged, high quality fixed income portfolio with a focus on capital preservation. We seek to provide returns to our shareholders primarily through the payment of regular dividends and through capital appreciation of our investments.

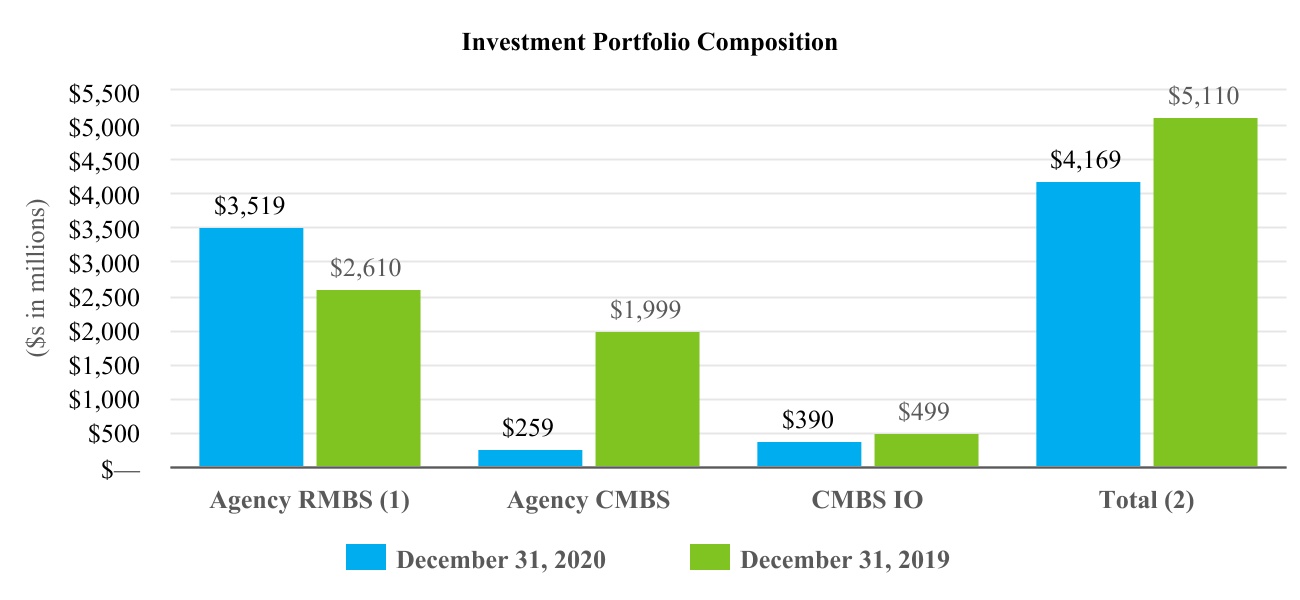

We are primarily invested in Agency MBS including residential MBS (“RMBS”), commercial MBS (“CMBS”) and CMBS interest-only (“IO”) securities. Agency MBS have an implicit guaranty of principal payment by an agency of the U.S. government or a U.S. government-sponsored entity (“GSE”) such as Fannie Mae and Freddie Mac. We also have investments in non-Agency MBS, which consist mainly of CMBS IO. Non-Agency MBS are issued by non-governmental enterprises and do not have a guaranty of principal payment.

INVESTMENT STRATEGY

Our investment strategy and the allocation of our capital to a particular sector or investment is driven by a “top-down” framework that focuses on the risk management, scenario analysis, and expected risk-adjusted returns of any investment. Key points of this framework include the following:

•understanding macroeconomic factors, including monetary and fiscal policies, and possible evolving outcomes, including but not limited to, the current state of the U.S. and global economies;

•understanding the regulatory environment, competition for assets, and the terms and availability of financing;

•sector analysis including understanding absolute returns, relative and risk-adjusted returns, and supply/demand metrics within each sector;

•security and financing analysis including sensitivity analysis on credit, interest rate volatility, liquidity, and market value risk; and

•managing performance and inherent portfolio risks, including but not limited to interest rate, credit, prepayment, and liquidity risks.

In allocating our capital and executing our strategy, we seek to balance the risks of owning specific types of investments with the earnings opportunity on the investment. At various times during the last decade, we have allocated capital to a variety of investments including adjustable-rate and fixed-rate Agency RMBS, Agency CMBS, investment grade and unrated non-Agency RMBS and CMBS, Agency and non-Agency CMBS IO, and residual interests in securitized mortgage loans. Our investments in non-Agency MBS are generally higher quality senior or mezzanine classes (typically rated 'A' or better by one or more of the nationally recognized statistical rating organizations) because they are typically more liquid (i.e., they are more easily converted into cash either through sales or pledges as collateral for repurchase agreement

borrowings) and have less exposure to credit losses than lower-rated non-Agency MBS. We regularly review our existing operations to determine whether our investment strategy or business model should change, including through capital reallocation, changing our targeted investments, and shifting our risk position.

The performance of our investment portfolio will depend on many factors including but not limited to interest rates, trends of interest rates, the steepness of interest rate curves, prepayment rates on our investments, demand for our investments, general market liquidity, and economic conditions and their impact on the credit performance of our investments. In addition, our business model may be impacted by other factors such as the state of the overall credit markets, which could impact the availability and costs of financing. See “Factors that Affect Our Results of Operations and Financial Condition” below, Item 1A of Part I, “Risk Factors”, and Item 7A of Part II, “Quantitative and Qualitative Disclosures About Market Risk” of this Annual Report on Form 10-K for further discussion.

RMBS. As of December 31, 2020, the majority of our investments in RMBS were Agency-issued pass-through securities collateralized primarily by pools of fixed-rate single-family mortgage loans. Monthly payments of principal and interest made by the individual borrowers on the mortgage loans underlying the pools are "passed through" to the security holders, after deducting GSE or U.S. Government agency guarantee and servicer fees. Mortgage pass-through certificates generally distribute cash flows from the underlying collateral on a pro-rata basis among the security holders. Security holders also receive guarantor advances of principal and interest for delinquent loans in the mortgage pools.

We also purchase to-be-announced securities (“TBAs” or “TBA securities”) as a means of investing in non-specified fixed-rate Agency RMBS, and from time to time, we may also sell TBA securities as a means of economically hedging our book value exposure to Agency RMBS. A TBA security is a forward contract (“TBA contract”) for the purchase (“long position”) or sale (“short position”) of a fixed-rate Agency MBS at a predetermined price with certain principal and interest terms and certain types of collateral. The actual Agency securities to be delivered are not identified until approximately 2 days before the settlement date. We hold long and short positions in TBA securities by executing a series of transactions, commonly referred to as “dollar roll” transactions, which effectively delay the settlement of a forward purchase (or sale) of a non-specified Agency RMBS by entering into an offsetting TBA position, net settling the paired-off positions in cash, and simultaneously entering into an identical TBA long (or short) position with a later settlement date. TBAs purchased or sold for a forward settlement date are generally priced at a discount relative to TBAs settling in the current month. This price difference, often referred to as “drop income”, represents the economic equivalent of net interest income (interest income less implied financing cost) on the underlying Agency security from trade date to settlement date. When the financing costs imputed in TBA dollar roll transactions fall lower than the average repurchase agreement financing rate, this is commonly referred to in the industry as TBA dollar rolls “trading special” or “dollar roll specialness”. Dollar roll specialness happens primarily as a result of supply/demand imbalances or volatility in market prepayment expectations. We account for all TBAs (whether net long or net short positions, or collectively “TBA dollar roll positions”) as derivative instruments because we cannot assert that it is probable at inception and throughout the term of an individual TBA transaction that its settlement will result in physical delivery of the underlying Agency RMBS, or that the individual TBA transaction will not settle in the shortest period possible.

CMBS. Substantially all of our CMBS investments as of December 31, 2020 were fixed-rate Agency-issued securities backed by multifamily housing loans. The loans underlying CMBS are generally fixed-rate with scheduled principal payments generally assuming a 30-year amortization period, but typically requiring balloon payments on average approximately 10 years from origination. These loans typically have some form of prepayment protection provisions (such as prepayment lock-out) or prepayment compensation provisions (such as yield maintenance or prepayment penalty), which provide us compensation if underlying loans prepay prior to us earning our expected return on our investment. Yield maintenance and prepayment penalty requirements are intended to create an economic disincentive for the loans to prepay, which we believe makes the fair value of CMBS less costly to hedge relative to RMBS.

CMBS IO. CMBS IO are interest-only securities issued as part of a CMBS securitization and represent the right to receive a portion of the monthly interest payments (but not principal cash flows) on the unpaid principal balance of the underlying pool of commercial mortgage loans. We invest in both Agency-issued and non-Agency issued CMBS IO. The loans collateralizing Agency-issued CMBS IO pools are similar in composition to the pools of loans that collateralize CMBS as discussed above. Non-Agency issued CMBS IO are backed by loans secured by a number of different property types including office buildings, hospitality, and retail, among others. Since CMBS IO securities have no principal associated with

them, the interest payments received are based on the unpaid principal balance of the underlying pool of mortgage loans, which is often referred to as the notional amount. Yields on CMBS IO securities are dependent upon the performance of the underlying loans. Similar to CMBS described above, the Company receives prepayment compensation as most loans in these securities have some form of prepayment protection from early repayment; however, there are no prepayment protections if the loan defaults and is partially or wholly repaid earlier because of loss mitigation actions taken by the underlying loan servicer. Because Agency CMBS IO generally contain higher credit quality loans, they have a lower risk of default than non-Agency CMBS IO. The majority of our CMBS IO investments are investment grade-rated with the majority rated ‘AAA’ by at least one of the nationally recognized statistical rating organizations.

FINANCING STRATEGY

We use leverage to enhance the returns on our invested capital by pledging our investments as collateral for borrowings primarily through the use of uncommitted repurchase agreements. The amount of leverage we utilize depends upon a variety of factors, including but not limited to general economic, political and financial market conditions; the actual and anticipated liquidity and price volatility of our assets; the gap between the duration of assets and liabilities, including hedges; the availability and cost of financing the assets; our opinion of the credit worthiness of financing counterparties; the health of the U.S. residential mortgage and housing markets; our outlook for the level, slope and volatility of interest rates; the credit quality of the loans underlying our investments; the rating assigned to securities; and our outlook for asset spreads. Repurchase agreements generally have original terms to maturity of overnight to six months, though in some instances we may enter into longer-dated maturities depending on market conditions. We pay interest on our repurchase agreement borrowings at a rate usually based on a spread to short-term interest rates and fixed for the term of the borrowing. Borrowings under uncommitted repurchase agreements are renewable at the discretion of our lenders and do not contain guaranteed roll-over terms.

Repurchase agreement financing is provided principally by major financial institutions and broker-dealers acting as financial intermediaries for short-term cash investors including money market funds and securities lenders. Repurchase agreement financing exposes us to counterparty risk to such financial intermediaries, principally related to the excess of our collateral pledged over the amount borrowed. We seek to mitigate this risk by diversifying our repurchase agreement lenders and limiting borrowings from lesser capitalized or lightly regulated counterparties. In limited instances, a money market fund or securities lender has directly provided funds to us without the involvement of a financial intermediary typically at a lower cost than we would incur borrowing from the financial intermediary. Borrowing directly from these sources also reduces our risk to the financial intermediaries. Please refer to "Risk Factors-Risks Related to Our Financing and Hedging Activities" in Item 1A of Part I of this Annual Report on Form 10-K for additional information regarding significant risks related to repurchase agreement financing.

From time to time, we will analyze and evaluate potential business opportunities that we identify or are presented to us, including possible partnerships, mergers, acquisitions, or divestiture transactions that might be a strategic fit for our investment strategy or asset allocation or otherwise maximize value for our shareholders. Pursuing such an opportunity or transaction could require us to issue additional equity or debt securities.

HEDGING STRATEGY

We use derivative instruments to economically hedge our exposure to adverse changes in interest rates resulting from our ownership of primarily fixed-rate investments financed with short-term repurchase agreements. Changes in interest rates can impact net interest income, the market value of our investments, and therefore, our book value per common share. In a period of rising interest rates, our earnings and cash flow may be negatively impacted by borrowing costs increasing faster than interest income from our assets, and our book value may decline as a result of declining market values of our MBS. We frequently adjust our hedging portfolio based on our expectation of future interest rates, including the absolute level of rates and the slope of the yield curve versus market expectations.

Currently, we are primarily using U.S. Treasury futures, options on U.S. Treasury futures, and options on interest rate swaps (“interest rate swaptions”) to mitigate adverse impacts of interest rate changes on the market value of our investment portfolio. Prior to the first quarter of 2020, we primarily utilized interest rate swaps to mitigate such adverse impacts on the market value of our investment portfolio as well as our net interest earnings. However, during the first quarter

of 2020, the novel coronavirus (“COVID-19”) was declared a pandemic in the U.S., resulting in significant market disruptions that resulted in interest rates declining significantly and our counterparties increasing margin requirements on our interest rate swap agreements. As a result, during 2020 we either terminated our interest rate swap agreements or allowed outstanding agreements to mature without replacement. Given Federal Open Market Committee (“FOMC”) monetary policy statements made during 2020, management expects funding costs to remain low in the near-term, and so the Company is not currently hedging interest rate risk to its net interest earnings.

In conducting our hedging activities, we intend to comply with REIT and tax limitations on our hedging instruments which could limit our activities and the instruments that we may use. We also intend to enter into derivative contracts only with the counterparties that we believe have a strong credit rating to help mitigate the risk of counterparty default or insolvency.

OPERATING POLICIES AND RISK MANAGEMENT

We invest and manage our capital pursuant to Operating Policies approved by our Board of Directors. Our Operating Policies set forth investment and risk limitations as they relate to the Company's investment activities and set parameters for the Company's investment and capital allocation decisions. They also require that we manage our operations and investments to comply with various REIT limitations (as discussed further below in “Federal Income Tax Considerations”) and to avoid qualifying as an investment company as such term is defined in the Investment Company Act of 1940 (the "1940 Act") or as a commodity pool operator under the Commodity Exchange Act.

Our Operating Policies place limits on certain risks to which we are exposed, such as interest rate risk, prepayment risk, earnings at risk, and shareholders’ equity at risk from changes in fair value of our investment securities. As part of our risk management process, our Operating Policies require us to perform a variety of stress tests to model the effect of adverse market conditions on our investment portfolio value and our liquidity.

Our Operating Policies limit our investment in non-Agency MBS that are rated BBB+ or lower at the time of purchase by any of the nationally recognized statistical ratings organizations to $250 million in market value and limit our shareholders’ equity at risk with respect to such investments to a maximum of $50 million. We also conduct our own independent evaluation of the credit risk on any non-Agency MBS, such that we do not rely solely on the security’s credit rating. Our Operating Policies also set forth limits for the Company’s overall leverage.

Within the overall limits established by our Operating Policies, our investment and capital allocation decisions depend on prevailing market conditions and other factors and may change over time in response to opportunities available in different economic and capital market environments. The Board may adjust the Operating Policies of the Company from time to time based on macroeconomic expectations, market conditions, and risk tolerances among other factors.

Factors that Affect Our Results of Operations and Financial Condition

Our financial performance is largely driven by the performance of our investment portfolio and related financing and hedging activity and may be impacted by a number of factors including, but not limited to, the absolute level of interest rates, the relative slope of interest rate curves, changes in interest rates and market expectations of future interest rates, actual and estimated future prepayment rates on our investments, supply of and competition for investments, the influence of economic conditions on the credit performance of our investments, and market required yields as reflected by market spreads. All of the above factors are influenced by market forces beyond our control such as macroeconomic and geopolitical conditions, market volatility, U.S. Federal Reserve (“Federal Reserve”) policy, U.S. fiscal and regulatory policy, and foreign central bank and government policy. In addition, our business may be impacted by changes in regulatory requirements, including requirements to qualify for registration under the 1940 Act, and REIT requirements.

Our business model is also impacted by the availability and cost of financing and the state of the overall credit markets. Reductions or limitations in the availability of financing for our investments could significantly impact our business or force us to sell assets, potentially at losses. Disruptions in the repurchase agreement market outside of our control may also directly impact our availability and cost of financing. Repurchase agreement lending by larger U.S. domiciled banks has declined in recent years due to increased regulation and changes to regulatory capital requirements. Their repurchase market

participation has been replaced by smaller independent broker dealers that are generally less regulated and by U.S. domiciled broker dealer subsidiaries of foreign financial institutions.

Regulatory authorities including the Securities and Exchange Commission (“SEC”) and the Federal Reserve are evaluating whether and how much the short-term funding markets, including the repurchase agreement market, may have exacerbated the market volatility experienced in the first and second quarters of 2020. Financial regulators, including the Federal Reserve, continue to closely monitor the short-term funding markets, particularly during times of market stress. In evaluating the short-term funding markets, regulatory authorities are reviewing participants in these markets, including mortgage REITs. The outcome of these evaluations is unknown, but it is possible that the SEC, the Federal Reserve or another regulatory body could impose restrictions on mortgage REITs or structurally change short-term funding markets, which could materially impact our borrowing costs in the repurchase agreement market or the availability of repurchase agreement financing.

The ICE Benchmark Administration Limited, the administrator of the London Interbank Offered Rate (“LIBOR”), has announced that it will cease the publication of one-week and two-month USD LIBOR immediately after December 31, 2021 and will cease the publications of the remaining tenors of USD LIBOR (one, three, six, and 12-month) immediately after June 30, 2023. In the U.S., the Alternative Reference Rates Committee, which was formed by the Federal Reserve Board and the Federal Reserve Bank of New York (“FRBNY”), has promoted the use of the Secured Overnight Financing Rate (“SOFR”), an index calculated by reference to short-term repurchase agreements backed by U.S. Treasury securities, as a preferred alternative rate for USD LIBOR. To the extent we enter into contracts in the future, such as interest rate swaps, we expect such contracts to be based on SOFR. Nonetheless, given the historical importance of LIBOR as a short-term interest rate benchmark, we continue to monitor and evaluate for potential impacts of LIBOR cessation on our business and the markets as a whole.

Please refer to Item 1A, "Risk Factors" as well as Part II, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations" and Item 7A, "Quantitative and Qualitative Disclosures about Market Risk" of this Annual Report on Form 10-K for additional discussions of factors that have the potential to impact our results of operations and financial condition.

COMPETITION

The business models of mortgage REITs range from investing only in Agency MBS to investing substantially in non-investment grade MBS and originating and securitizing mortgage loans and investing in mortgage servicing rights. Some mortgage REITs will invest in RMBS and related investments only, some in CMBS and related investments only, and some in a mix. Each mortgage REIT will assume various types and degrees of risk in its investment strategy. In purchasing investments and obtaining financing, we compete with other mortgage REITs, broker-dealers and investment banking firms, GSEs, mutual funds, banks, hedge funds, mortgage bankers, insurance companies, governmental bodies, including the Federal Reserve, and other entities, many of which have greater financial resources and a lower cost of capital. Increased competition in the market may reduce the available supply of investments and may drive prices of investments to levels which would negatively impact our ability to earn an acceptable amount of income from these investments. Competition can also reduce the availability of borrowing capacity at our repurchase agreement counterparties as such capacity is not unlimited, and many of our repurchase agreement counterparties limit the amount of financing they offer to the mortgage REIT industry.

FEDERAL INCOME TAX CONSIDERATIONS

As a REIT, we are required to abide by certain requirements for qualification as a REIT under the Internal Revenue Code of 1986, as amended (the “Code”). To retain our REIT status, the REIT rules generally require that we invest primarily in real estate-related assets, that our activities be passive rather than active, and that we distribute annually to our shareholders amounts equal to at least 90% of our REIT taxable income, after certain deductions. Dividend distributions to our shareholders in excess of REIT taxable income are considered to be a return of capital to the shareholder.

We use the calendar year for financial reporting in accordance with GAAP as well as for tax purposes. Income determined under GAAP differs from income determined under U.S. federal income tax rules primarily because of

temporary differences in income and expense recognition. The primary differences between our GAAP net income and our taxable income are (i) unrealized gains and losses on derivative instruments, which are recognized in net income for GAAP purposes but are excluded from taxable income until realized; and (ii) realized losses on derivatives that are designated as tax hedges which are recognized in net income for GAAP purposes upon termination or expiration of the instrument but are deferred and amortized for tax purposes.

One of the timing differences between our GAAP net income and taxable income is the losses we realize from terminating derivatives prior to their maturity, which occurs as part of our portfolio and hedge management activities. Deferred tax hedge losses on terminated derivative instruments are recognized over the original periods designated by those terminated derivatives. Recognition of certain deferred tax hedge losses may be also be accelerated if the underlying instrument originally hedged is terminated or paid off. The following table provides the tax hedge losses as of December 31, 2020 that have already been recognized in our GAAP earnings but which will reduce taxable income over the periods indicated:

| | | | | | | | |

| Tax Year of Recognition for Remaining Hedge Losses | | December 31, 2020 |

| ($ in thousands) | | |

| 2021 | | $ | 23,548 | |

| 2022 - 2024 | | 49,255 | |

| 2025 and thereafter | | 68,636 | |

| | $ | 141,439 | |

We also have tax net operating loss (“NOL”) carryforwards which were all generated prior to January 1, 2018. We have $17.4 million of NOL carryforward remaining as of December 31, 2020, which will expire over the next 5 years if not used.

The following table summarizes our dividends declared per share and their related tax characterization for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | |

| Tax Characterization | | Total Dividends Declared Per Share |

| Ordinary | | Capital Gain | | Return of Capital | |

| Common dividends declared: | | | | | | | |

| Year ended December 31, 2020 | $ | — | | | $ | 1.66000 | | | $ | — | | | $ | 1.66000 | |

| Year ended December 31, 2019 | $ | 0.36723 | | | $ | — | | | $ | 1.64277 | | | $ | 2.01000 | |

| | | | | | | |

| Preferred Series A dividends declared: | | | | | | | |

| Year ended December 31, 2020 | $ | — | | | $ | 0.87951 | | | $ | — | | | $ | 0.87951 | |

| Year ended December 31, 2019 | $ | 2.12500 | | | $ | — | | | $ | — | | | $ | 2.12500 | |

| | | | | | | |

| Preferred Series B dividends declared: | | | | | | | |

| Year ended December 31, 2020 | $ | — | | | $ | 1.90625 | | | $ | — | | | $ | 1.90625 | |

| Year ended December 31, 2019 | $ | 1.90625 | | | $ | — | | | $ | — | | | $ | 1.90625 | |

| | | | | | | |

| Preferred Series C dividends declared: | | | | | | | |

| Year ended December 31, 2020 | $ | — | | | $ | 1.12150 | | | $ | — | | | $ | 1.12150 | |

| Year ended December 31, 2019 | $ | — | | | $ | — | | | $ | — | | | $ | — | |

Qualification as a REIT

Qualification as a REIT requires that we satisfy a variety of tests relating to our income, assets, distributions and ownership. The significant tests are summarized below.

Sources of Income. To continue qualifying as a REIT, we must satisfy two distinct tests with respect to the sources of our income: the “75% income test” and the “95% income test.” The 75% income test requires that we derive at least 75% of our gross income (excluding gross income from prohibited transactions) from certain real estate-related sources. In order to satisfy the 95% income test, 95% of our gross income for the taxable year must consist of either income that qualifies under the 75% income test or certain other types of passive income.

If we fail to meet either the 75% income test or the 95% income test, or both, in a taxable year, we might nonetheless continue to qualify as a REIT, if our failure was due to reasonable cause and not willful neglect and the nature and amounts of our items of gross income were properly disclosed to the Internal Revenue Service (the “IRS”). However, in such a case we would be required to pay a tax equal to 100% of any excess non-qualifying income.

Nature and Diversification of Assets. At the end of each calendar quarter, we must meet multiple asset tests. Under the “75% asset test,” at least 75% of the value of our total assets must represent cash or cash items (including receivables), government securities or real estate assets. Under the “10% asset test,” we may not own more than 10% of the outstanding voting power or value of securities of any single non-governmental issuer, provided such securities do not qualify under the 75% asset test or relate to taxable REIT subsidiaries. Under the “5% asset test,” ownership of any stocks or securities that do not qualify under the 75% asset test must be limited, in respect of any single non-governmental issuer, to an amount not greater than 5% of the value of our total assets (excluding ownership of any taxable REIT subsidiaries).

If we inadvertently fail to satisfy one or more of the asset tests at the end of a calendar quarter, such failure would not cause us to lose our REIT status, provided that (i) we satisfied all of the asset tests at the close of the preceding calendar quarter and (ii) the discrepancy between the values of our assets and the standards imposed by the asset tests either did not exist immediately after the acquisition of any particular asset or was not wholly or partially caused by such an acquisition. If the condition described in clause (ii) of the preceding sentence was not satisfied, we still could avoid disqualification by eliminating any discrepancy within 30 days after the close of the calendar quarter in which it arose.

Ownership. In order to maintain our REIT status, we must not be deemed to be closely held and must have more than 100 shareholders. The closely held prohibition requires that not more than 50% of the value of our outstanding shares be owned by five or fewer persons at any time during the last half of our taxable year. The "more than 100 shareholders" rule requires that we have at least 100 shareholders for 335 days of a twelve-month taxable year. If we failed to satisfy the ownership requirements, we would be subject to fines and be required to take curative action to meet the ownership requirements in order to maintain our REIT status.

Under current U.S. federal income tax laws, the highest marginal individual income tax rate is 37% and individuals, estates and trusts may deduct up to 20% of certain pass-through income, including ordinary REIT dividends that are not “capital gain dividends” or “qualified dividend income,” subject to certain limitations. For taxpayers qualifying for the full deduction, the effective maximum tax rate on ordinary REIT dividends is 29.6% (plus a 3.8% surtax on net investment income, if applicable). The maximum rate of withholding with respect to our distributions to certain foreign owners that are treated as attributable to gains from the sale or exchange of U.S. real property interests is 21%.

HUMAN CAPITAL STRATEGY

The Company views its employees as its most important asset and as the key to managing a successful business for the benefit of all of our stakeholders. Our human capital strategy is designed to create a supportive environment where our employees can grow professionally and contribute to the success of the Company. We believe a collaborative, engaging and

equitable culture is key to attracting and retaining skilled, experienced and talented employees as well as fostering the development of the Company’s next generation of leaders.

We are committed to promoting diversity within our workforce and believe diversity extends beyond gender, race, ethnicity, age and sexual orientation to include different perspectives, skills, and experiences and socioeconomic backgrounds. We hire based on qualifications and evaluate, recognize, reward and promote employees based on performance without regard to race, religion, color, national origin, disability, gender, gender identity, sexual orientation, stereotypes or assumptions based thereon. In addition, equity is fundamental to our philosophy of fair and equitable treatment. We regularly review and analyze our compensation practices and engage in ongoing efforts to ensure pay equity within all levels of employment.

As of December 31, 2020, we had 19 full and part-time employees, of which 53% are women or self-identified minorities. Our voluntary turnover rate was 0% for the three years ended December 31, 2020 and the average tenure of our employees is 13.5 years as of December 31, 2020. None of our employees are covered by any collective bargaining agreements, and we are not aware of any union organizing activity relating to our employees.

The Company strives to offer its employees a healthy work-life balance and an open environment in which they are encouraged to offer thoughts and opinions. Employees have a wide selection of resources available to help protect their health, well-being, and financial security, including an on-site gym (currently with limited access as a precaution during the COVID-19 pandemic) coverage of a substantial portion of their health insurance, and a competitive 401(k) company match. In addition, we have historically offered flexible working arrangements to accommodate the individual needs of our employees who request it. Due to the COVID-19 pandemic, all employees are currently encouraged to work from home, and substantially all do, at least on a part-time basis. Like many companies, COVID-19 has increased our focus on health and safety efforts to protect our employees and their families from potential virus exposure, while ensuring that our critical operations remain fully supported. Since the beginning of the COVID-19 pandemic, we have taken precautionary measures and implemented procedures aligned with the Centers for Disease Control and Prevention to protect, manage, and communicate with our workforce to contain the impacts of the virus.

Recognizing the vital role that human capital management serves in the long-term success of the Company, we have initiated a Human Capital Strategy Planning process, which is overseen by the Board, to formalize the process for management and development of employees. In addition to talent management and development initiatives, the Human Capital Strategy Planning process included the following in 2020:

•development of organizational core values and a plan to integrate these values into a variety of human

capital processes and practices;

•offering of a personal development program in which all employees were encouraged to participate;

•initiation of a formalized process for determining current and future human capital requirements;

•implementation of improved performance measures designed to better determine individual and team developmental needs.

ENVIRONMENTAL, SOCIAL, AND GOVERNANCE INITIATIVES

We believe that environmental, social, and corporate governance ("ESG") practices and initiatives are important in sustaining and growing the Company. We believe ESG initiatives create value by improving the environment and lives of our employees, investors, business partners, and the community. The following are notable ESG policies we had in place as of December 31, 2020 as well as targets we have established for 2021:

•The Company's Board of Directors follows our Corporate Governance Guidelines, adopted in accordance with the requirements of the New York Stock Exchange (“NYSE”), which provide a framework to assist directors in fully understanding and effectively implementing their functions while assuring the Company’s ongoing commitment to high standards of corporate conduct and compliance. These Corporate Governance Guidelines cover specific issues including, among other things, the Board's key responsibilities, criteria for membership and selection, committees of the Board, meetings with management, director continuing education, director performance evaluations and compensation, and management succession planning.

•Our Code of Business Conduct and Ethics ("Code of Conduct") applies to all of our employees, officers and directors and covers a wide range of business practices and procedures designed to foster the highest ethical standards in all business relationships. This policy covers, among other things, compliance with applicable laws, conflicts of interest, confidentiality, fair dealing, discrimination and harassment, health and safety, reporting of suspected violations, and enforcement of our Code of Conduct.

•Our Whistleblower Policy provides a structured and formal process to facilitate confidential, anonymous submissions by employees of the Company and others with concerns or complaints regarding the Company's accounting, internal accounting controls, auditing matters or violations of the Company’s Code of Conduct.

•Our Nominating and Corporate Governance Committee is responsible for overseeing our ESG strategies, policies, activities, and communications, including for purposes of risk management.

•In September 2020, our Board of Directors adopted a Board Refreshment and Diversity Policy to ensure a relevant, inclusive and diverse membership on the Board; to provide the Board with the best combination of knowledge, skills, experience and perspectives among its members (including with respect to gender, age, race, culture and experience); and to oversee and support our strategy for the future.

•We adopted the Sustainability Accounting Standards Board (“SASB”) Conceptual Framework in 2020 and are committed to reporting within such framework in 2021.

•We established a Steering Committee in 2020, which is actively developing ESG guidelines and has begun prioritizing measurable ESG goals for the Company for 2021 in response to surveys of our employees. The Steering Committee also intends to survey our Board of Directors, investors and community members to assess the materiality and importance of various ESG matters to these stakeholders.

Community Commitment

We believe that supporting the communities where we work and live is a meaningful commitment to both our employees and our neighbors. With the help of our employees, we strive to create a positive impact in our communities through charitable contributions and financial support that encourages the future development and well-being of our local communities. Employees are encouraged and given opportunities to donate time and funds to community organizations of their choice, and the Company offers a matching gift program for employee charitable contributions. In addition, the Company has historically supported the following areas to which it feels strongly connected:

•affordable housing

•financial literacy

•children’s health and social services; and

•career counseling in underprivileged communities.

Additional details regarding our ESG initiatives, including our community commitments, will be available in our 2021 Proxy Statement.

AVAILABLE INFORMATION

We are subject to the reporting requirements of the Exchange Act and its rules and regulations. The Exchange Act requires us to file reports, proxy statements, and other information with the SEC. These materials may be obtained electronically by accessing the SEC’s home page at www.sec.gov.

Our website can be found at www.dynexcapital.com. Our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, and amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, are made available free of charge through our website as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC.

Our Code of Conduct is available on our website, along with our Audit Committee Charter, our Whistleblower Policy, our Nominating and Corporate Governance Committee Charter, and our Compensation Committee Charter. We will post on our website amendments to the Code of Conduct or waivers from its provisions, if any, which are applicable to any of our directors or executive officers in accordance with the requirements of the SEC or the NYSE.

ITEM 1A. RISK FACTORS

The following is a summary of the risk factors that we believe are most relevant to our business. These are factors which, individually or in the aggregate, we think could cause our actual results to differ significantly from anticipated or historical results. In addition to understanding the key risks described below, investors should understand that it is not possible to predict or identify all risk factors, and consequently, the following is not a complete discussion of all potential risks or uncertainties.

RISKS RELATED TO OUR INVESTMENT ACTIVITIES

Fluctuations in the market value of our investments could negatively impact our net income, comprehensive income, shareholders’ equity, book value per common share, dividends, and liquidity.

Our investments fluctuate in value due to a number of factors including, among others, market volatility (including, as an example, market volatility in the first half of 2020 due to the COVID-19 outbreak), changes in credit spreads, spot and forward interest rates, and actual and anticipated prepayments. Our investments may also fluctuate in value due to increased or reduced demand for the types of investments we own. The level of demand may be impacted by, among other things, interest rates, capital flows, economic conditions, and government policies and actions, such as purchases and sales by the FRBNY.

Changes in credit spreads represent the market’s valuation of the perceived riskiness of assets relative to risk-free rates, and widening credit spreads reduce the market value of our investments because market participants typically require additional yield to hold riskier assets. Credit spreads could change based on macroeconomic or systemic factors specific to a particular security such as prepayment performance or credit performance. Other factors that could impact credit spreads include technical issues such as supply and demand for a particular type of security, market psychology, and FOMC monetary policies. In addition, most of our investments are fixed rate or reset in rate over a period of time, and as interest rates rise, the market value of these investments will typically decrease. If market values decrease significantly, we may experience a material reduction in our liquidity if we are forced to sell assets at losses in order to meet margin calls from our lenders to repay or renew repurchase agreements at maturity, or otherwise to maintain our liquidity. A material reduction in our liquidity could lead to a reduction of the dividend or potentially the payment of the dividend in Company stock subject to the Code.

Fluctuations in interest rates could negatively impact our net interest income, comprehensive income, book value per common share, dividends, and liquidity.

Fluctuations in interest rates impact us in multiple ways. For example, in a period of rising rates, particularly increases in the targeted U.S. Federal Funds Rate (“Federal Funds Rate”), we may experience a decline in our profitability from borrowing rates increasing faster than interest coupons on our investments reset or our investments mature. We may also experience a decline in profitability from our investments adjusting less frequently or relative to a different index from our borrowings (repurchase agreements are typically based on shorter-term rates). Once the Federal Reserve announces a higher targeted range or if markets anticipate that the Federal Reserve is likely to announce a higher targeted range for the Federal Funds Rate, our borrowing costs are likely to immediately increase, thereby negatively impacting our results of operations, financial condition, dividend and book value per common share.

Fluctuations in interest rates may also negatively affect the market value of our securities, resulting in declines in comprehensive income, book value per common share, and liquidity. Since our investment portfolio consists substantially of fixed rate instruments, rising interest rates will reduce the market value of our MBS as a result of higher yield requirements by the market for these types of securities, and reductions in the market value of our MBS could result in margin calls from our lenders. Conversely, while declining interest rates are typically more favorable for us, we may experience increasing prepayments, which would increase amortization expense of any premiums we pay to acquire our investments and thereby result in a decline in net interest income. Declining interest rates may also result in declining market value on RMBS as market participants factor in potentially faster prepayment rates in the future.

We invest in to-be-announced, or TBA, securities and execute TBA dollar roll transactions. It could be uneconomical to roll our TBA contracts or we may be unable to meet margin calls on our TBA contracts, which could negatively affect our financial condition and results of operations.

We execute TBA dollar roll transactions which effectively delay the settlement of a forward purchase (or sale) of a TBA by entering into an offsetting TBA position, net settling the paired-off positions in cash, and simultaneously entering an

identical TBA long (or short) position with a later settlement date. Under certain market conditions, TBA dollar roll transactions may result in negative net interest income whereby the Agency RMBS purchased (or sold) for forward settlement under a TBA contract are priced at a premium to Agency RMBS for settlement in the current month. Market conditions could also adversely impact the TBA dollar roll market and, in particular, shifts in prepay expectations on Agency RMBS or changes in the reinvestment policy on Agency RMBS by the Federal Reserve. Under such conditions, it may be uneconomical to roll our TBA positions prior to the settlement date, and we could have to take physical delivery of the underlying securities and settle our obligations for cash, or in the case of a short position, we could be forced to deliver one of our Agency RMBS, which would mean using cash to payoff any repurchase agreement amounts collateralized by that security. We may not have sufficient funds or alternative financing sources available to settle such obligations. In addition, pursuant to the margin provisions established by the Mortgage-Backed Securities Division (“MBSD”) of the Fixed Income Clearing Corporation, we are subject to margin calls on our TBA contracts and our trading counterparties may require us to post additional margin above the levels established by the MBSD. Negative income on TBA dollar roll transactions or failure to procure adequate financing to settle our obligations or meet margin calls under our TBA contracts could result in defaults or force us to sell assets under adverse market conditions or through foreclosure and adversely affect our financial condition and results of operations.

As a result of monetary easing policies, the Federal Reserve has lowered the Federal Funds Rate and now owns substantial amounts of longer-term Treasury securities and fixed-rate Agency MBS in order to put downward pressure on interest rates. If the Federal Reserve begins tightening monetary policy or if the FRBNY were to sell these securities or even announce that it intends to sell these securities, longer-term interest rates are likely to increase dramatically which could negatively impact the market value of our investments. In addition, an announcement by the Federal Reserve of its intention to increase the targeted Federal Funds rate, or the market’s anticipation of such an announcement, is likely to increase our borrowing costs.

In response to the COVID-19 pandemic, and in order to mitigate its implications for the U.S. economy and financial system, the Federal Reserve aggressively eased monetary policy in 2020 by reducing the Federal Funds Rate to a range of between 0% and 0.25%. The Federal Reserve is also seeking to provide monetary policy stimulus by expanding the holdings of longer-term securities in its portfolio, including large-scale purchases of Treasury securities and fixed-rate Agency RMBS. The purchases were intended to lower longer-term interest rates in general and mortgage rates in particular and ensure the continued smooth functioning of markets. The Federal Reserve is one of the largest holders of Agency RMBS and, as of February 2021, is committed to purchasing at least $40 billion per month in newly issued Agency RMBS until substantial progress has been made toward the Federal Reserve's maximum employment and price stability goals. The purchase activity in Agency RMBS has materially improved market prices in these securities over the balance of 2020. Markets anticipate continued purchases by the Federal Reserve for the foreseeable future given continued economic hardship attributable to the negative impacts of the COVD-19 pandemic. If the Federal Reserve tapers or announces an intention to taper its purchases or it undertakes outright sales of its securities portfolio, the price of Agency RMBS could materially decline, negatively impacting the market value of our investments and thereby, our comprehensive income, book value per common share, and our liquidity.

In addition, by keeping the Federal Funds Rate at the range of between 0% and 0.25%, the Federal Reserve has kept short-term interest rates low which has benefited our borrowing costs. Once the Federal Reserve announces a higher targeted range or if markets determine that the Federal Reserve is likely to announce a higher target range, our borrowing costs are likely to increase which will negatively impact our results of operations and could impact our financial condition and book value.

We invest in assets that are traded in over-the-counter (“OTC”) markets which are less liquid and have less price transparency than securities exchanges. Owning securities that are traded in OTC markets may increase our liquidity risk, particularly in a volatile market environment, because our assets may be more difficult to borrow against or sell in a prompt manner and on terms acceptable to us, and we may not realize the full value at which we previously recorded the investments and/or may incur losses upon sale of these assets.

Though Agency MBS are generally deemed to be very liquid securities, turbulent market conditions, such as market conditions following the COVID-19 outbreak, may significantly and negatively impact the liquidity and market value of these assets. Non-Agency MBS are typically more difficult to value, less liquid, and experience greater price volatility than Agency MBS. In addition, market values for non-Agency MBS are typically more subjective than Agency MBS. Given the trading of our investments in OTC markets, in times of severe market stress, a market may not exist for certain of our assets at any price. If the MBS market were to experience a severe or extended period of illiquidity, lenders may refuse to accept

our assets as collateral for repurchase agreement financing, which could have a material adverse effect on our results of operations, financial condition and business. A sudden reduction in the liquidity of our investments could limit our ability to finance or could make it difficult to sell investments if the need arises. If we are required to liquidate all or a portion of our portfolio quickly, we may realize significantly less than the fair value at which we have previously recorded our investments which would result in lower than anticipated gains or higher losses.

Prepayment rates on the mortgage loans underlying our investments may adversely affect our profitability, the market value of our investments, and our liquidity. Changes in prepayment rates may also subject us to reinvestment risk.