UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

(Mark One)

For the fiscal year ended

OR

For the transition period from to

Commission file number

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

(Address of principal executive offices, zip code)

Registrant’s telephone number, including

area code:

Name of each exchange on which registered:

Securities registered pursuant to Section 12(b)

of the Act:

Securities registered pursuant to Section 12(g) of the Act: Common Stock

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted

pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit and post such files). Yes ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of the “large accelerated filer,” “accelerated filer,” “non-accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company | |||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

On August 31, 2023, the aggregate market value

of the voting stock held by non-affiliates of the Registrant was $

On June 4, 2024, the Registrant had

Documents incorporated by reference: None.

TABLE OF CONTENTS

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Report contains forward-looking statements within the meaning of the federal securities laws. Statements other than statements of historical fact included in this Report, including the statements under the headings “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Business” and elsewhere in this Report regarding future events or prospects are forward-looking statements. The words “approximates,” “believes,” “forecast,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “would,” “could,” “should,” “seek,” “may,” or other similar expressions in this Report, as well as other statements regarding matters that are not historical fact, constitute forward-looking statements. We caution investors that any forward-looking statements presented in this Report are based on the beliefs of, assumptions made by, and information currently available to, us. Such statements are based on assumptions and the actual outcome will be affected by known and unknown risks, trends, uncertainties and factors that are beyond our control or ability to predict. Although we believe that our assumptions are reasonable, they are not guarantees of future performance and some may inevitably prove to be incorrect. As a result, our actual future results may differ from our expectations, and those differences may be material. Accordingly, investors should use caution in relying on forward-looking statements to anticipate future results or trends.

Some of the risks and uncertainties that may cause our actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include the following:

| ● | Our ability to generate positive cash flow from operations; |

| ● | Our ability to obtain additional financing to fund our operations; |

| ● | The impact of economic, political and market conditions on us and our customers; |

| ● | The impact of unfavorable results of legal proceedings; |

| ● | Our exposure to potential liability arising from possible errors and omissions, breach of fiduciary duty, breach of duty of care, waste of corporate assets and/or similar claims that may be asserted against us; |

| ● | Our ability to compete effectively against competitors offering different technologies; |

| ● | Our business development and operating development; |

| ● | Our expectations of growth in demand for our products; and |

| ● | Other risks described under the heading “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K |

We do not intend to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise except to the extent required by law. You should interpret all subsequent written or oral forward-looking statements attributable to us or persons acting on our behalf as being expressly qualified by the cautionary statements in this Report. As a result, you should not place undue reliance on these forward-looking statements.

References in this Report to “we”, “us”, “the Company,” “Aura” or “Aura Systems” means Aura Systems, Inc. As used herein, reference to “Fiscal 2024” refers to the fiscal year ending February 29, 2024, “Fiscal 2023” refers to the fiscal year ending February 28, 2023, “Fiscal 2022” refers to the fiscal year ending February 28, 2022, “Fiscal 2021” refers to the fiscal year ending February 28, 2021, reference to “Fiscal 2020” refers to the fiscal year ended February 29, 2020, reference to “Fiscal 2019” refers to the fiscal year ended February 28, 2019, reference to “Fiscal 2018” refers to the fiscal year ended February 28, 2018, reference to “Fiscal 2017” refers to the Fiscal year ended February 28, 2017, reference to “Fiscal 2016” refers to the fiscal year ended February 29, 2016, and reference to “Fiscal 2015” refers to the fiscal year ended February 28, 2015.

ii

PART I

ITEM 1. BUSINESS

Introduction

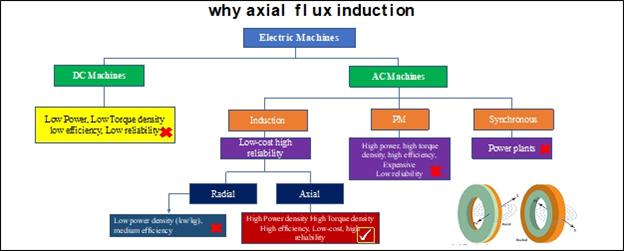

Aura Systems, Inc. (“Aura”), is a Delaware corporation founded in 1987. The Company innovated and commercialized the technology for Axial Flux Induction electric motors and generators. Aura’s axial flux induction motor technology (“AAFIM”) provides an industrial solution that does not use any permanent magnets, no rare earth elements, is smaller and lighter, uses significant less materials (just copper and steel), very high efficiency, significantly less copper, highly reliably, very robust, and no scheduled maintenance.

The industrial electric motor market is expected to grow from an estimated USD 113.3 billion in 2020 to USD 169.1 billion by 2026, at a CAGR of 6.9% during the forecast period1.

Electric motors are employed in infrastructure, major structures, and industries all around the world. Each year, almost 30 million motors are sold for industrial use alone2. Electric motors find application in a variety of equipment throughout industry. Common industrial applications include: (i) compressors, (ii) fans and blowers, (iii) heavy duty equipment, (iv) HVAC systems, (v) pumps and (vi) machine tools (lathes and mills, etc.).

The universal global trend for electrification has created in addition to the industrial demand for motors a very large demand for motors used in electric transportation for vehicles, planes, and boats (“EV”). In such applications, one or more electric motors are used for propulsion. Most electric motors currently used for electric mobility employ high energy permanent magnets3 due to their high efficiency and small size. The magnetic material is usually sintered neodymium–iron–boron (NdFeB) made or processed in China.

It is expected that over 100 million electric motors will be required per year by 2032 to meet the demand for the growing EV market4.

For Electric Vehicle applications, AAFIM provide efficiencies that are equal to or higher than ones provided by the best high energy permanent magnet solution (“PM”). AAFIM are smaller, have higher reliability, are more robust, have larger operating speed range, are not limited to 100 degrees C operating temperature for the equivalent PM machine. In addition, AAFIM costs are significantly lower than the equivalent PM machines.

The history of electric machines reveals that the earliest machines were, in fact, axial flux machines. However, after the first radial flux machines were demonstrated in the beginning of the 20th century, radial flux machines were accepted as the mainstream configuration. The reason for shelving the axial flux machines were multifold and can be summarized as follows: (i) strong axial magnetic attraction force between the stator and the rotor, (ii) fabrication difficulties such as cutting the slots in laminated cores, (iii) high cost involved in manufacturing the laminated stator core, (iv) difficulties in assembling the machine and keeping a uniform air gap and (v) providing a laminated rotor that can withstand the large centripetal forces.

| 1 | Markets & Markets Electric Motor Market Published Date: November 2020 | Report Code: EP 3882 |

| 2 | Precedence Research October 6, 2021 |

| 3 | Will rare earth be eliminated in EV motor-Dr. James Edmondson November 2, 2020 |

| 4 | Emerging Electric Motor Technologies for the EV Market September 28, 2021, Luke Gear |

1

In recent years there has been great interest in axial flux topology for numerous industrial, commercial, and electric mobility motor and power generation applications. However, to date the commercial focus in axial flux motors has been designs using rare earth permanent magnets (“PM”). The use of rare earth permanent magnets in axial flux topology can be attributed to the historical belief that it is “difficult to manufacture a laminated rotor with a cage winding for an axial flux machine. If the cage windings are replaced with nonmagnetic high conductivity (Cu or AL) homogenous disk or steel disk coated with Cu layer, the performance of the machine drastically deteriorates” (Axial Flux Permanent Magnet Brushless Machines by Jacek F Gieras, Rong-Jie Wang and Maarten K Kamper 2008).

Aura Systems with its axial flux induction technology solved the issues related to the rotor back in 2002 and has shipped over 11,000 axial flux induction machines in the 5-15 kW range to numerous military and commercial users. Aura’s proprietary rotor does not require any laminates and provides the structural integrity to withstand very large centripetal forces while, at the same time, providing the proper electric and magnetic properties without the usual issues associated with a solid rotor or a steel disk coated with a copper layer.

ID TechEX research forecasts a huge increase in demand of axial flux motors over the next 10 years, with first applications in high performance vehicles and certain hybrid applications5.

Aura has during the last few years optimized its axial flux induction machine technology (no PM) where the performance (efficiency, torque, energy density) is now equal to or greater than the very best of both axial and radial permanent magnet machines. Of course, this is done using only copper and steel with aluminum for housing at a fraction of the cost of equivalent PM machines.

Aura’s Axial Flux Induction technology is the culmination of decades of cutting-edge electromagnetic research and more than $150 million in development by Aura scientists and engineers. Aura’s axial flux induction technology used for mobile power generation was first used in a combat zone by U.S. forces in the U.N actions in the Balkans and since then, the U.S. military has used it in combat zones in both Iraq and Afghanistan. To date the Company shipped over 11,000 systems for mobile power applications in the 5-15 kW range of which over 3,000 systems were for various military applications.

Aura’s Axial Flux Induction Machine has inherited advantages such as (i) no rare earth or any other kind of permanent magnets, (ii) significantly less copper (60% less) than equivalent traditional induction motors, (iii) significantly higher energy density, (iv) fewer overall materials, and (v) high efficiency. In addition, being an induction machine, Aura’s solution does not have any brushes or commutators and therefore do not have any potential for sparks.

Aura’s Axial Flux induction (“AAFIM”) Competitive Edge

| ○ | Performance- AAFIM provides the highest power density across all other known motor technologies with energy density of more than 50 kW/liter for machines in the 250-kW range. In addition, Aura’s solution provides efficiencies that are higher than any other solutions for commercial and industrial applications. For 250 kW EV applications Aura’s designs show efficiency of more than 96%. AAFIM solution also has significantly lower rotor inertia than other solutions. This increases the machine efficiency even further since it requires less input torque to move the rotor. |

| ○ | Size and weight-Aura’s solution is significantly smaller in volume and has lower weight than any known solution for equivalent power rated machines (even includes PM machines). When compared to traditional radial flux (“RF”) induction machines, AAFIM has less than 40 % of the weight and more than 40% reduction in volume. The AAFIM pancake design creates a solution that can be integrated with vehicles and boats for seamless exportable power. |

| ○ | Cost-AAFIM provides a significant cost advantage over equivalent induction and PM machines. The cost advantage comes from (a) the higher energy density which means less materials and (b) in the case of PM machines significant cost advantage for equivalent machines by just elimination of the permanent magnets. When compared to radial flux induction, Aura’s solution uses approximately 60% less copper. Due to the fractional materials used and the simple manufacturing processes Aura’s high-performance machines are less expensive to manufacture than other equivalent machines. |

| ○ | Other Advantages-Aura’s solution is extremely reliable with the only components to wear out are the bearings. AAFIM do not require any scheduled maintenance and the only materials used are copper and steel for the active components and aluminum for the housing. These materials are readily available everywhere and are not controlled by any country or political group. In addition to the performance, Aura’s rotor lends itself to mass manufacturing. Many of Aura’s axial flux induction machines have been operating for twenty years and have shown remarkable reliability. |

| 5 | Emerging Electric Motor Technologies for the EV Market September 28, 2021 Luke Gear Electric motors |

2

After a lengthy development period, the Company first began commercializing the AuraGen® in late 1999 and early 2000. In 2001, the first commercial AuraGen® product was a 4-pole machine which, when combined with our proprietary and patented Electronic Control Unit (“ECU”), generated 5 kW of exportable 120/240 VAC power. We subsequently added a 6-pole configuration and introduced our patented bi-directional power supply that provided for 8.5 kW watts of exportable power with the capability of providing both alternating (“AC”) and direct (“DC”) power simultaneously. In Fiscal 2008, the Company introduced an AuraGen® system that generated up to 17 kW of continuous power by combining two 8.5 kW systems on a single shaft. Starting in July 2019, we began to redesign and upgrade the ECU and develop new axial flux generator configurations. As a result of such efforts, our redesigned ECU allows us to replace the old 5 kW solution with a 6.5 kW solution using the same 4-pole generator as well as to upgrade the output of the 6-pole machine from 8.5 kW to 12 kW.

Our more recent efforts have resulted in our new 10 kW mobile power generator that which is approximately 20% smaller in diameter and 10% smaller in axial length than the legacy 8.5 kW solution and we have completed the design and are now in the process of fabrication of a 250-kW axial flux motor which has approximately the same dimensions as our legacy 8.5 kW mobile power solution. This new 250 kW motor has a base speed of 5,000 rpm and an operating range of up to 20,000 rpm.

In March 2019, stockholders of the Company represented a majority of the outstanding shares of the Company’s common stock delivered signed written consents to the Company removing Ronald Buschur, William Anderson and Si Ryong Yu as members of the Company’s Board and electing Ms. Cipora Lavut, Mr. David Mann, and Dr. Robert Lempert as directors of the Company in their stead. Because of Aura’s refusal to recognize the legal effectiveness of the consents, in April 2019 the stockholders filed suit in the Court of Chancery of the State of Delaware pursuant to Section 225 of the Delaware General Corporations Law, seeking an order confirming the validity of the consents. On July 8, 2019 the Court of Chancery entered final judgment in favor of the stockholder plaintiffs, confirming that (a) Ronald Buschur, Si Ryong Yu and William Anderson had been validly removed by the holders of a majority of the Company’s outstanding stock acting by written consent (b) Ms. Lavut, Mr. Mann and Dr. Lempert had been validly elected by the holders of a majority of the Company’s outstanding stock acting by written consent, and (c) the Company’s Board of Directors validly consists of Cipora Lavut, David Mann, Robert Lempert, Gary Douglas and Salvador Diaz-Versón, Jr. See Item 3, Legal Proceedings for more information. Following this ruling by the Court of Chancery, the newly confirmed Board of Directors terminated the employment of Melvin Gagerman, who had served as CEO and CFO of the Company since 2006, and installed Ms. Lavut as President, Mr. Mann as Chief Financial Officer and Dr. Lempert as Secretary of the Company.

Impact of the COVID-19 Pandemic

As a result of the COVID-19 pandemic, we have experienced varying degrees of business disruptions and periods of closure of our corporate facilities as have our customers, suppliers, and vendors, resulting in significant adverse impacts to our operating results. Resurgences in certain parts of the world resulted in further business disruptions periodically throughout Fiscal 2023, Fiscal 2022 and Fiscal 2021. Such disruptions have continued into Fiscal 2024, impacting our business.

3

Business Arrangements.

During Fiscal 2018 and Fiscal 2019, the Company’s engineering, manufacturing, sales, and marketing activities were reduced while we focused on renegotiating numerous financial obligations. During this time, the Company’s agreements with numerous customers, third party vendors, and organizations and entities material to the operation of the Company business were canceled, delayed or terminated. During Fiscal 2018, the Company successfully restructured in excess of $30 million of debt. Also, during Fiscal 2018, the Company signed a joint venture agreement with a Chinese company to build, service and distribute AuraGen® mobile power products in China. Under the Jiangsu Shengfeng joint venture agreement, the Chinese partner owns 51% of the joint venture and the Company owns 49%. The Chinese partner contributed a total of approximately $9.75 million to the venture principally in the form of facilities, equipment, and approximately $500 of working capital while the Company contributed $250 in cash as well as a limited license. The limited license sold to the joint venture, however, does not permit the venture to manufacture the AuraGen® rotor; rather, the joint venture is required to purchase all rotor subassemblies as well as certain software elements directly from the Company. During Fiscal 2018, Jiangsu Shengfeng placed a $1,000 order with the Company including a $700 advance payment of which the Company has failed to deliver product in accordance with the order received. On November 20, 2019, the Company reached a preliminary agreement with Jiangsu Shengfeng regarding the return of $700 previously advanced to the Company. The preliminary agreement reached consists of a non-interest-bearing promissory note and a payment plan pursuant to which the $700 was to be paid over an 11-month period beginning March 15, 2020, through February 15, 2021. The preliminary agreement was subject to the JV continuous operation. However, starting in January 2020 the JV was shut down by the Chinese authority due to the COVID-19 virus. In 2023, the JV was dissolved and liquidated.

As of February 29, 2024, the unpaid balance of $700 was reported as part of notes payables – related party in the accompanying financial statements. During Fiscal 2020, the Company recorded an impairment expense of $250 to fully write-off the Jiangsu Shengfeng investment due to the uncertainty of the operation. In 2023 the JV was dissolved and liquidated.

In Fiscal 2020 stockholders of the Company successfully removed Ronald Buschur, William Anderson and Si Ryong Yu from the Company’s Board of Directors and elected Ms. Cipora Lavut, Mr. David Mann and Dr. Robert Lempert as directors of the Company in their stead. See Item 3, Legal Proceedings for more information. Also, in Fiscal 2020, Melvin Gagerman, Aura’s CEO and CFO since 2006, was replaced. In July 2019 Ms. Lavut succeeded Mr. Gagerman as President and Mr. Mann succeeded Mr. Gagerman as CFO. Dr. Lempert was appointed as Secretary of the Company by the Board of Directors also in July 2019.

Recent Developments.

As a result of the COVID-19 pandemic, we have experienced varying degrees of business disruptions and periods of closure of our corporate facilities as have our customers, suppliers, and vendors, resulting in significant adverse impacts to our operating results. Resurgences in certain parts of the world resulted in further business disruptions periodically throughout Fiscal 2023, Fiscal 2022 and Fiscal 2021. Such disruptions have continued into Fiscal 2024, impacting our business.

4

The AuraGen®/VIPER Product Overview:

Markets Served by the AuraGen®/VIPER

Induction Motor Applications

Aura’s axial flux induction machine can be used as either an electric motor or generator as described above. Due to the inherit advantages of Aura’s axial flux induction machine, such as (i) no rare earth or any other kind of permanent magnets, (ii) significantly less copper (60% less) than equivalent traditional induction motors (iii) higher energy density and (iv) fewer overall materials, we believe Aura’s axial flux induction motor can be used across a wide range of industries and applications. Because even a small percent increase in motor efficiency translates to a market-wide savings of tens of billions of dollars per year and because Aura’s axial flux motor design is more efficient than equivalent radial flux induction motors, we believe that with the proper financial resources, over time, we can capture a reasonable share of the global electric motor market.

Electric motor are the main users of electricity, accounting for approximately 53% of the global demand for electricity. Over 65% of the energy used to support electric motors is used for industrial motor systems.6 The industrial electric motor market is expected to grow from an estimated USD 113.3 billion in 2020 to USD 169.1 billion by 2026, at a CAGR of 6.9% during the forecast period.72. The increase in global electricity consumption, and the use of electrical equipment and machines in different industries and the renewables sector are major factors driving growth in the electric motor market during the forecast period.

Electric motors are employed in infrastructure, major structures, and industries all around the world. Each year, approximal 30 million motors are sold for industrial use alone.8 Electric motors find application in a variety of equipment throughout industry. Common industrial applications include: (i) compressors, (ii) fans and blowers, (iii) heavy duty equipment, (iv) HVAC systems, (v) pumps and (vi) machine tools (laths and mills etc.) Electric motors and generators are one of the most important tools in modern day life.

Numerous studies show a high potential for energy efficiency improvement in motor systems. Specifically, system optimization approaches which address the entire motor system demonstrate high potential for energy savings. For most countries the saving potentials for energy efficiency improvements in motor systems with best available technology lie between 9 and 13 percent of the national industrial electricity demand.9

Aura’s machines use approximately 60% less copper, are approximately 1/3 the size and weight and are more efficient than the equivalent traditional radial flux (“RF”) induction machine.

When compared to radial and axial flux permanent magnet machines, Aura machines are less expensive to manufacture, do not use any rare earths, do not use any permanent magnets, are not dependent on supply from China, are more robust, have a higher operating speed range, have lower maintenance, have a longer lifetime, and are generally smaller, lighter and higher in efficiency.

EV applications

The universal global trend for electrification has created in addition to the industrial demand for motors also a very large demand for motors used in electric transportation for vehicles, planes, and boats (“EV”). In such applications, one or more electric motors are used for propulsion. The power to drive the electric motors is generally a battery system or fuel cell. Both batteries and fuel cells convert some form of fuel to electricity through some chemical process. EVs include, but are not limited to, road and off-road vehicles, surface and underwater vessels, electric aircraft, and electric spacecraft.

| 6 | Identification of Technoeconomic Opportunities with the Use of Premium Efficiency Motors as Alternative for Developing Countries -Julio R. Gómez etc. Published: October 16, 2020 |

| 7 | Markets & Markets Electric Motor Market Published Date: Nov 2020 | Report Code: EP 3882 |

| 8 | Precedence Research October 6, 2021 |

| 9 | Energy efficiency in electric motor systems- UN industrial Development Organization Venna 2012 |

5

It is rather interesting to note that, while electric motors have been around for more than 200 years, technical information on electric motors in EVs is very scarce and generally only found in niche technology sites. Most EV literature only notes the motor’s relative quietness, its torque response, its simplicity, and long-term low maintenance requirements. Most of the space dedicated to the powertrain (motor, motor- controller and some cases a gear box) is focuses, instead, on the battery—its size and weight, where it sits, the range, how long it takes to fully charge, etc. Yet, the majority function of the battery system is to support the electric motors and its controller.

In addition to the batteries, the electric motor and supporting power electronics are critical components of EV drivetrain. It is expected that over 100 million electric motors will be required per year by 2032 to meet the demand for the growing EV market10 (where would all the rare earths come from to support 100 million motors per year?).

The global Electric Vehicle Market size is projected to grow from 4 million units in 2021 to 34.76 million units by 2030.11 The AC motor (most power by alternating current) is expected to witness the fastest growth in the electric motor market during the forecast period.

The global electric powertrain market (electric motor, plus motor controller plus a gear box) size is projected to surpass around US$ 200 billion by 2027 and growing at a CAGR 13.8%. The motor/generator component expected to show lucrative growth over the analysis period attributed to the escalated penetration of plug-in hybrid battery electric vehicle (“PHEV”) and battery electric vehicle (“BEV”) across the globe.12

There are several key performance metrics for electric motors. Power and torque density enables improved driving dynamics in a smaller and lighter package, with weight and space being at a premium in EVs. Another critical area is efficiency. Improving efficiency means that less energy stored in the battery is wasted when accelerating the vehicle, resulting in improved range from the same battery capacity. Smaller motor system weight will also contribute to increase in range since less weight needs to be moved.

Most electric motors currently used for electric mobility employ high energy permanent magnets.13 The magnetic material is usually sintered neodymium–iron–boron (NdFeB) made or processed in China. Neodymium is one of the rare earth elements. China has around a third of all rare earth reserves and around 80% of global production.14 In 1987 the Chinese President Deng Xiaoping famously said, “the middle East has Oil; China has rare earths”. An Oxford Analytics Expert briefing on July 30, 2020, states that “(i) Permanent Magnets will account for 3⁄4 of rare earth demand by 2030 up from 1⁄4 in 2020 and (ii)Electric vehicles and offshore wind will drive demand and be most vulnerable to supply shocks”.

Permanent magnet (“PM”) machines can be extremely light in weight and highly efficient. In PM machines the magnetic field B is fixed by the magnets and the only way to change this is with a bucking field. These bucking currents result in increase in temperature that could affect the magnetization of the permanent magnets.

In PM machines the operating temperature must be kept at below 100oC because at that temperature the magnets start to lose some of their magnetization and at 180oC they become completely demagnetized. However, in EV applications at low speed, one needs to use a lot of current (generating high heat) to get the required torque; similarly, at high speeds one needs a lot of current for the bucking fields to reduce the B field. Thus, PM machines for electric mobility require a very complex cooling system. All the components in the machine are designed for maximum specifications but operationally the machine is limited by temperature requirements of the magnets. The cost of such machines is high due to (i) The permanent magnets, (ii) the complex cooling system and (iii) complex controller.

| 10 | Emerging Electric Motor Technologies for the EV Market Sep 28, 2021 Luke Gear |

| 11 | Market & market Electric Vehicle Market May 2021 Report code AT4907 |

| 12 | Precedence research June 9, 2021 |

| 13 | Will rare earth be eliminated in EV motor-Dr. James Edmondson Nov 2-2020 |

| 14 | Vikendi December 29, 2021 |

6

In addition to the cost issues, the permanent magnets are subject to the economic and political control of China. There is always the possible situation that China economically weaponizes rare earth and stops sending the refined product to the U.S so they cannot be used in weapon systems or commercial applications such as electric vehicles.15 In the past during political disputes China threatened to cease export of rare earths.16

As to environmental, rare-earth magnets used in EV applications are responsible for major environmental pollution. The extraction of rare earths “produce mountains of toxic waste, with high risk of environmental and health hazards. For every ton of rare earth produced, the mining process yields 13-kg of dust, 9,600-12,000 cubic meters of waste gas, 75 cubic meters of wastewater, and one ton of radioactive residue. This stems from the fact that rare earth element ores have metals that, when mixed with leaching pond chemicals, contaminate air, water, and soil. Most worrying is that rare earth ores are often laced with radioactive thorium and uranium, which result in especially detrimental health effects. Overall, for every ton of rare earth, 2,000 tons of toxic waste are produced.”17

Unlike the PM machines, Aura’s axial flux induction machines do not use any permanent magnets and therefore the controller can change the B fields since B is proportionate to the voltage divided by the frequency (V/f). Thus, the Aura machine, when operated with a smart inverter, has an advantage over a PM machine. The Aura machine has a smaller volume, equal or better efficiency, more reliable and a large cost advantage. This advantage becomes increasingly important as performance is increased.

Mobile and Remote Power Applications

The global generator sales market was $20.3 billion in 2019 and is estimated to reach $27.16 billion by 2027 (Fortune Business Insight). Most industries dealing with construction and infrastructure rely on mobile generators to support modern computers, digital sensors and instruments as well as electrical driven tools. Current automotive alternators cannot supply the existing demanded power for many such applications and thus the common solution is the use of stand-alone gensets (often referred to a “Auxiliary Power Units” or simply “APUs”). These APUs, however, (i) consume large amounts of fuel, (ii) are heavy and bulky and accordingly must often be towed on trailers, and (iii) require constant maintenance. Additionally, traditional APUs are generally not considered to be environmentally friendly power solutions based on their high fuel consumption, loud operating noise levels, and the emissions they secrete into the air. In comparison, the AuraGen® system is small and light enough to generally be integrated directly into existing vehicles, does not require maintenance, nor do they require any set-up or tear-down time. In addition, there is no heavy lifting required and to contact with hot surfaces. The AuraGen® operation when integrated in a vehicle or a boat is completely seamless and transparent to the user.

Likewise, for law enforcement, emergency responders and militaries alike, mobile power is generally a necessity. Indeed, one of the fastest growing segments for mobile power is the military marketplace for On-Board-Exportable-Power (OBEP), which is electric power on vehicles that can be used to support non-vehicle functions such as weapon systems and C4I functions (command, control, communication, computers and information). Currently, most on-board power is provided by APUs. Given the drawbacks of APUs, however, militaries, law enforcement and first responders all over the world are seeking more efficient integrated power solutions for their vehicles.

In addition, numerous leisure users are increasingly demanding mobile power for use of air-conditioning, appliances and other amenities.

| 15 | China Maintains Dominance in Rare Earth Production-National defense 9/8/21 by Stew Magnuson |

| 16 | Supercomputers Predict rare earth Market Vulnerability-National defense 9/9/21 by Stew Magnuson |

| 17 | Not so “green” technology: the complicated legacy of rare earth mining 12. Aug. 2021 Harvard International Review |

7

Beside stand-alone gensets (often referred to “auxiliary power units” or simply “APU” s), all automotive users rely on integrated alternators in their vehicles for such things as navigation systems, electric seating, electric windows, sound/ phone systems and lights. In 2019 alone, 87.9 million passenger vehicles were sold globally18 (each one used an alternator). The market for automotive alternators is presently dominated mainly by four companies: Denso, Valeo, Mitsubishi Electric, and Hitachi Automotive. These companies jointly control nearly 80% of the global market. The compact size and significant increase in efficiency of the AuraGen® provides an ideal replacement (fit and form) for high output automotive alternators while offering higher efficiency, longer lifetime and the flexibility of multi types of voltage both AC and DC. Recently, the Company completed the design and development for a 10-kW alternator with a diameter of 10 inches and axial length of less than 6 inches. The new 10 kW alternator will provide the full 10 kW power at alternator speeds of 2,500-13,000 rpm with efficiency higher than 90%.

The AuraGen® solution increase in efficiency over traditional generators, when combined with our load following architecture and the ability to provide both AC and VDC simultaneously.

Competition

The Company is involved in the application of its AuraGen® technology to electric motors and mobile power. Therefore, it faces substantial competition from companies offering different technologies.

Electric Motors

There are four (4) basic approaches for electrical machines: (i) the rotor can be electrically excited such that it creates a magnetic field with constant orientation (as in synchronous machines) that usually uses brushes and or commutators; (ii) the shape of the rotor can induce reluctance variations in the stator (as in switched reluctance machines); (iii) the rotor can be permanently magnetized with permanent magnets (“PM “) as in brushless DC machines; and (iv) the rotor field can be induced from the stator due to the rotor’s structure as in induction machines. Our axial flux technology is an induction machine.

Brushed machines are machines in which the rotor coil is supplied with current through brushes. Unlike commutators, brushes only transfer electric current to a moving rotor; commutators also provide switching of the current direction. Large, brushed machines which are run with DC to the stator windings at synchronous speed are the most common generator in power plants because they also supply reactive power to the grid. They can be started by the turbine and can generate power at constant speed without a controller. This type of machine is often referred to in the literature as a “synchronous machine”.

Reluctance machines have no windings in the rotor, only a ferromagnetic material shaped so that “electromagnets” in the stator can “grab” the teeth in the rotor resulting in a slight movement. The electromagnets are then turned off, while another set of electromagnets is turned on to move the stator further. Reluctance machines are also sometimes referred to as “step motors” as a result of the step-like movement. These machines are suited for low speed and accurate position control. Reluctance machines can be supplied with PMs in the stator to improve performance. The “electromagnet” is then “turned off” by sending a negative current to the coil. When the current is positive the magnet and the current cooperate to create a stronger magnetic field, which will improve the reluctance machine’s maximum torque without increasing the current’s maximum absolute value.

PM machines have permanent magnets in the rotor which set up a magnetic field. The magnetic field is created by modern PMs (Neodymium Iron Boron magnets “NeFeB”), which means that PM machines have a higher torque/volume and torque/weight ratio than machines with rotor coils under continuous operation.

In general, it is usually possible to overload electric machines for a short time until the current in the coils heats parts of the machine to a temperature which causes damage. However, PM machines are very sensitive to such overloads because too high of a current in the coils can create a magnetic field strong enough to demagnetize the magnets. The majority (80%) of NeFeB magnets are produced in China. Magnax and many other are examples of Companies using such an approach.

| 18 | Motor Intelligence. Automotive alternator market growth trends forecast 2021-2026 |

8

AC induction machine (no PM) is the most common electrical machine in use today. A changing magnetic field in the stator induces a current in the rotor. The current in the rotor produces its own magnetic field, which then interacts with the magnetic field of the stator, causing the rotor to turn. The name induction comes from the fact that current is induced in the rotor by the changing magnetic field of the stator. Radial flux induction machines have been the workhorse of industry due to their robustness, attractive cost, and ease of control; however, they are relatively, heavy and bulky. On the other hand, Aura’s axial flux (“AF”) induction machines, have all of the advantages of the radial flux machines but with the advantage of higher energy density and higher efficiency resulting in a smaller and lighter machine with equivalent or better performance. Unlike the PM machines, induction machines do not use any permanent magnets and therefore the controller can change the B fields since B is proportionate to the voltage divided by the frequency (V/f).

Although our axial flux induction technology provides significant advantages in both cost (significant less copper, steel and aluminum), size/weight and performance, most of our competitors have far greater financial, technical, and marketing resources than we have. They have larger budgets for research, new product development and marketing, and have long-standing customer relationships.

Key players in the market are (i) Nidec Motor Corporation, (ii) ABB Ltd., (iii) Siemens AG, (iv) WEG Electric Corp, (v) Regal Beloit Corporation, (vi) Wolong, and (vii) Teco Westinghouse.

Generators

There are five basic approaches used in mobile generators.

Gensets AKA APU. Portable generators meet the large market need for auxiliary power. Millions of units per year are sold in North America alone, and millions more are sold across the world to meet market demands for 1 to 20 Kilowatts of portable power. The market for these power levels addresses the commercial, leisure and residential markets, and is essentially divided into: (a) higher power, higher quality and higher price commercial level units; and (b) lower power, lower quality and lower price level units. Gensets provide the strongest competition across the widest marketplace for auxiliary power. Onan, Honda, Generac and Kohler, among others, are well established and respected brand names in the genset market for higher reliability auxiliary power generation. There are over 40 registered genset-manufacturing companies in the United States.

Some of the key suppliers are Caterpillar (US), Cummins (US), Rolls-Royce Holdings (UK), Atlas Copco (Sweden), Mitsubishi Heavy Industries, Ltd. (Japan), Yanmar (Japan), Generac (US), ABB (Switzerland), Siemens Energy (Germany), Weichai Group (China), Kohler Co. (US), Kirloskar Oil Engines Ltd. (India), Denyo (Japan), and Sterling & Wilson (India),

High Output Alternators. There are many High Output Alternator manufacturers. Some of the better-known ones are Delco-Remy, Bosh, Nippon Densu, Hitachi, Mitsubishi and Prestolite. All alternators provide their rated power at very high RPM and significantly less power at lower RPM. In addition, alternators are generally only 30% efficient at the low RPM range and increase to 50% efficiency at the high RPM range.

Inverters. There are many inverter manufacturers across the globe; the best known one is Xentrex. The pricing of industrial grade sine wave inverters is approximately $400 per kilowatt plus the cost of a high output alternator (estimated at $1,000) and a good throttle controller (estimated in the range of $250-500).

Permanent-Magnet Alternators. A number of companies have introduced alternators using exotic rare earth Neodymium (NdFeB) magnets. These alternators tend to have higher power generation capabilities than regular alternators at lower RPM. Unfortunately, PM machines with NdFeB magnets are very sensitive to temperature and, unlike the AuraGen®, cannot survive the typical under-the-hood environment (200oF+). In order to apply such devices for automotive applications one must add an active cooling system to keep the magnets from demagnetizing at approximately 200oF. In addition, most of the rare earth magnets (NeFeB) are manufactured in China and are subject to potential political and economic pressure.

9

In addition to the temperature challenges of such machines, there are other issues involving active control of the magnetic field. The main disadvantage of PM generators is the difficulty of output voltage regulation to compensate for speed and load variation due to the lack of a simple means of field control.

Fuel Cells. Fuel cells are solid-state devices that produce electricity by combining a fuel containing hydrogen with oxygen. They have a wide range of applications and can be used in place of the internal combustion engine and traditional lead-acid and lithium-ion batteries. These systems are generally more expensive. The most widely deployed fuel cells are estimated to cost significantly more per kilowatt than alternative solutions.

Others

Evans Electric in Australia has introduced an axial flux machine with a complete conductive rotor. Such a machine was first introduced by Brinner more than 20 years ago and was abandoned because the rotor lacked the required rigidity to withstand the magnetic and centrifugal forces. The Brinner machine is cited in Aura’s issued patents.

Numerous companies are introducing axial flux machines; however, they generally use rare earth NeFeB magnets (made in China) and are thus not induction machines but rather permanent magnet machines. Some of the better-known companies are YASA, EVO, Magnax and Phi Power.

Most of our competitors have far greater financial, technical, and marketing resources than we have. They have larger budgets for research, new product development and marketing, and have long-standing customer relationships. We also compete with many larger and more established companies in the hiring and retention of qualified personnel. Our financial condition has limited our ability to market the AuraGen®.

The AuraGen® uses a different technology and because our product is radically different from traditionally available mobile power solutions, users may require lengthy evaluation periods to gain confidence in the product. OEMs and large fleet users also typically require considerable time to make changes to their planning and production.

Competitive Advantages of the AuraGen® Axial Flux Induction technology

As a motor-Aura’s Axial Flux (“AF”) induction motor/generator is increasingly attracting attention from high impact potential users seeking advantages over conventional motors, particularly for Electric Vehicle applications. These advantages include (i) compact construction, (ii) better power to weight ratio, (iii) shorter axial length, (iv) better efficiency, (v) better torque to volume and weight ratio, (vi) very high utilization of active materials (less than 60% of the copper) and (vii) excellent ventilation and cooling. Induction machines (i) do not use any rare earth elements and have no permanent magnets. Due to their flat shape, lower weight and compact construction, Aura’s axial flux motors are ideal for pumps, fans, food processors, HVHC, etc. An axial flux machine is also preferred in applications where the rotor can be integrated with the rotating part of mechanical loads.

The AuraGen® motor’s operational range is between -40 and 340-degrees F; therefore, it is suitable to operate in a harsh environment.

As an alternator. Aura’s induction machine provides significant advantages in power generation, particularly in mobile applications. Its smaller volume and higher efficiency, when combined with the geometric shape means it can be integrated with existing vehicles and boats. Such integrated solutions do not require set up time. There are no heavy weights to lift (gensets), usable cargo space is optimized and there is no need for separate fuel/containers. Remarkably, there is no scheduled maintenance required.

The AuraGen® alternator’s operational range is between -40- and 340-degrees F; therefore, it is suitable for operating under the hood of a vehicle where the ambient temperature can easily be above 200 degrees F.

10

Earth-Forward, Green Technology. The AuraGen® system is significantly more environmentally friendly than traditional motors and generators. Because of its extreme efficiency and smaller size, the AuraGen® system utilizes fewer resources and materials to manufacture (in particular less than 60% of the copper). When used in power generation, the AuraGen® uses a vehicle’s primary automotive engine, which is already highly regulated for environmental protection. Traditional mobile power solutions, in comparison, use small, less efficient, auxiliary engines that produce significantly higher levels of emissions per unit of power output than the automobile engine.

Durability; No Scheduled Maintenance. The AuraGen® motor/generator solution does not require any scheduled maintenance. The historical failure rate for Aura’s machines over a 20-year period is less than 0.5%. The bearings are rated for 28,000 hours.

Aura’s axial flux induction (no PM) can be summarized as:

| ● | Disruptive since it addresses the entire field of electrical motors and generators by providing a solution that is smaller, lighter, more efficient, cost less to manufacture and does not use any permanent magnets. |

| ● | Aura has demonstrated mass production of this technology with more than 11,000 machines. |

| ● | The economic value proposition is well defined in terms of cost, performance and size. |

| ● | The Aura solution provides significant global reduction in the use of raw materials such as copper, steel, and aluminum. |

| ● | The higher efficiency of Aura’s motor, when used in a manufacturing environment, can lead to a noticeable reduction in the global consumption of energy. |

| ● | When used for mobile power generation, Aura’s technology leads to a significant reduction in global pollution by being able to reduce and, in many situations, eliminate completely small diesel and gasoline engines used in power generation. |

| ● | When used for electric vehicles, the smaller size, weight, and increased efficiency could lead to an increase in range and/or reduced battery weight. |

| ● | When used in remote stand-alone diesel power generation such as cell towers, Aura’s increased efficiency, lower rotor inertia, voltages flexibility and load-following architecture results in a significant reduction in fuel usage (and, of course, reduced pollution). |

| ● | Aura’s significantly (65% less) lower rotor inertia and variable speed capabilities make Aura’s solution ideal for small hydro applications that are currently being ignored because of construction cost, low head, and slow flow situations. |

Targeted Market

The Company is re-examining and identifying new key markets to focus on as the Company expands operations.

11

The global drive for electrification is in search of better, more effective electric motors. The recent realization by many potential users of such motors that permanent magnet motors are depending on NeFeB rare earth magnets from China has created a need for alternative to the PM motors. Our axial flux induction machine is a solution that does not use any magnets and has the required performance characteristic as well as fit and form for numerous applications.

Electric motors

Electric motors for industrial applications. We have completed the design of 4 kW and 10 kW machines. The designs show significantly increased efficiency as compared to equivalent other designs, and in addition they are a fraction of the size and weight, use approximately 50-60% less copper and cost less to manufacture.

Electric motors for high end electric cars. We are exploring the use of our axial flux induction machine to be integrated into high end electric cars. This application would require approximately 250-300-kW machine that will use 800VDC buss system and will operate at up to 20,000 RPM. We now have a completed design for an axial flux induction (no PM) design with energy density of more than 50 kW per liter (the best other known design is approximately 40 kW/liter using rare earth permanent magnets) and efficiency of more than 95%. Our design has an active diameter of approximately 9.45 inches and active axial length of approximately 4.92 inches.

Mobile power generation

Military market. One focused market for the Company’s VIPER solution is military applications. The global military land vehicles market is expected to grow by 29% through 2022, increasing to $30.33 billion by 2022.19 While traditional markets for military vehicles such as the U.S. are choosing to upgrade and maintain existing fleets rather than replace aging vehicles, other regions are looking to purchase new units, which also provides maintenance and upgrade opportunities. The active number of military vehicles was estimated at over 408,000 in 2012 and is expected to increase to slightly over 418,000 by 2021. New vehicle procurement is expected to decline in western defense and increase in emerging markets of APAC and the Middle East.

Automotive alternators. In 2019, 87.9 million units of passenger cars were sold globally,20 each one used an alternator. The market for automotive alternators is dominated mainly by four companies: Denso, Valeo, Mitsubishi Electric, and Hitachi Automotive. These companies jointly control nearly 80% of the global market. The compact size and significant increase in efficiency of the AuraGen® provides an ideal replacement (fit and form) for high output automotive alternators.

Diesel based cell towers. According to Statista (Technology and telecommunication Thomas Alsop sept 22, 2020), in 2019, there were 395,562 mobile wireless cell sites in the United States, with a large amount of investment going toward 5G-ready cell sites and antennas as per the source. Phil Marshall, chief research officer at Tolaga Research, estimates the global number of base stations at 6.5 million sites, while Chinese equipment vendor Huawei puts the number at 7 million. Many of the cell sites are powered by diesel generators. The AuraGen® solution increase in efficiency over traditional generators, when combined with our load following architecture and the ability to provide both AC and -48VDC simultaneously makes our solution very attractive to cell towers operators that depend on diesel power. Our solution has the potential for significant diesel fuel savings in such an application.

Transport Refrigeration (“TRU”). The main competitors for the all-electric TRU are traditional diesel-based solutions provided by Thermo-king and Carrier. The diesel based comparable systems provided by Thermo-king and Carrier are somewhat less expensive than our AuraGen® all-electric solution, however the diesel solutions require frequent maintenance and the utilization of a separate diesel engine that consumes additional fuel every operating hour. In addition, the diesel solution emits harmful emissions that have been recognized by the U.S. Environmental Protection Agency, California’s Air Resource Board and others as dangerous pollutants and are increasingly subject to federal and state regulations. A CARB 2015 report “Technology Assessment Transport refrigeration” cites and provides an analysis of our solution that can be applied for significant pollution reduction and fuel savings for truck-based transport refrigeration.

| 19 | John Keller July 10, 2014, Military and Aerospace Electronics |

| 20 | Motor Intelligence. Automotive alternator market growth trends forecast 2021-2026 |

12

Facilities, Manufacturing Process and Suppliers

During Fiscal 2024 and Fiscal 2023, the Company occupied approximately 18,000 square feet of space in Lake Forest, California. In early Fiscal 2022 the Company consolidated all its administrative offices and operations into this new modern stand-alone facility. The Lake Forest facility is subject to a lease agreement with a 66-month lease period effective from February 2021, through August 31, 2026. The monthly base lease rate for the Lake Forest Facility is currently $24,239 per month with a 3% annual escalation. We expect to expand operations next year that will require additional space.

As the Company continues to expand operations, we will need to renew relationships and contracts with our suppliers or locate suitable new suppliers for subassemblies and other components.

Research and Development

We believe that ongoing research and development is important to the success of our product in order to utilize the most recent technology, develop additional products and additional uses for existing products, stay current with changes in vehicle manufacture and design and to maintain an advantage over potential competition. Our engineering, research and development costs for Fiscal 2024 was approximately $0.8 million compared to approximately $0.9 million in Fiscal 2023. In Fiscal 2024 we have completed the design for (i) 4 kW motor for water pump applications, (ii) a new optimized 10 kW mobile power solution smaller and higher efficiency of the older design, and (iii) a 250-kW motor solution for EV applications. In addition, during fiscal 2024 we made significant engineering progress in the design of novel innovative active cooling solutions for very high energy density motors and generators. We expect to finalize this innovation during the second quarter of 2024.

Patents and Intellectual Property

Our intellectual property portfolio consists of trademarks, proprietary know-how, trade secrets, and patents. Historically the Company obtained over 70 patents in electromagnetic and electrooptical technologies.

The basic philosophy followed by Aura is to build layers of defense to protect the Company’s IP. This is achieved through the development of fundamental patents and surrounds them with application patents. The detailed fabrication of the rotor is kept as a trade secret since this is a critical component in Aura’s proprietary intellectual assets.

The challenges of implementing a patent philosophy are based on cost. Patent maintenance costs are expensive, particularly international patents. In order to maximize a limited budget, our approach is to first file a number of new US patents. This will provide a year before international patents need to be filed.

Current active patents are (i) Patent 8720618 Issued date 5/3/2014, (ii) Patent 6700214 Issued date 3/2/2004, and (iii) Patent 6700802 Issued date 3/2/2004.

We expect over the next 12 months to file new technology patent applications covering:

| 1. | Topology (several patents) |

Using different number of stators (one or more) and rotors (one or more) to reach wide range of speed and torque. Also, utilization of optimal topology makes capability to achieve high power/torque density which is a key component for the electric vehicle (EV) and electric airplane (EA) industries.

13

| 2. | Stacking |

Using new laminations, the hysteresis and eddy current losses decrease. So, a capability is made to increase the efficiency of these machines as the most important parameter for electric machines evaluation. Moreover, these laminations deliver higher saturation profile to reach high torque density which is very important for the EV and EA industries.

| 3. | Winding (several patents) |

New winding patterns can be made to increase current density for increasing the torque density and the power density.

| 4. | Cooling system (several patents) |

Development of novel cooling systems which make better heat dissipation is used to reach highest torque and power density.

| 5. | Vibration and noise (several patents) |

Implementation of new methods for vibration and noise reduction is the key component for electric machines which are used in home appliances, EV and EA.

| 6. | Materials |

Using newly developed alloys help to decrease losses, increase efficiency, magnify torque, and power density. The alloy steel used in the stator cores, alloy casting used for rotor and alloy aluminum used for enclosure have essential influences on the machine performance.

| 7. | Advanced Automotive alternator |

Current air-cooled automotive alternators are power limited to around 1.5 kW. A new design using Aura’s axial flux induction will increase the power to 3.5-5 kW at the same size as current automotive alternators at a lower reduced cost.

| 8. | Integration of inverter components with motor (2 in 1 integration) |

Higher integration will lead to better overall efficiency and smaller packaging.

In addition, we also plan to file specific motor application patents for (i) Drone usage, (ii) Pump usage, (iii) Compressors, (iv) Fans and Blower usage, (v) Machine tools usage, (vi) Specific 2-and 4-wheel EV usage and (vii) Airplane/air taxi applications.

For mobile power applications we plan to file a number of patent applications for (i) military usage, (ii) Hybrid APU, (iii) diesel power Cell tower usage, (iv)water treatment plants and (v) marine usage.

Government Regulation

We are subject to laws and regulations that affect the Company’s activities, which include, but are not limited to, the areas of labor, intellectual property and ownership and infringement, tax, import and export requirements, environmental, and health and safety. As we recommence operations, our operations will again be subject to federal, state and local laws and regulations governing the occupational health and safety of our employees and wage regulations. For example, we are subject to the requirements of the federal Occupational Safety and Health Act, as amended, or OSHA, and comparable state laws that protect and regulate employee health and safety. We expect to expend resources to maintain compliance with OSHA requirements and industry best practices.

Employees

As of the date of this filing, the Company has a total of eleven (11) full-time employees in research and development, sales, operations and administration. Additionally, the Company engages independent contractors, on an as-needed basis, to support various areas of the business. During Fiscal 2024 and Fiscal 2023 we engaged two independent contractors to support engineering developments.

14

Significant Customers

In Fiscal 2024, one significant customer, CBOL, accounted for 55% of revenues. In Fiscal 2023, one significant customer, CBOL, accounted for 55% of revenues, however no customer is considered significant.

Raw Materials

The most important raw materials we use in manufacturing our products are steel, copper, and aluminum. Raw materials are purchased both domestically and outside the United States. We have no significant long-term supply contracts. When possible, we maintain a number of sources for our raw materials, which we believe contribute to our ability to obtain competitive pricing. The cost of some of our raw materials and shipping costs are dependent on petroleum cost. Higher material prices, cost of petroleum, and costs of sourced products could have an adverse effect on margins.

We enter into standard purchase agreements with certain foreign and domestic suppliers to source selected products. The terms of these arrangements are customary for the industry and do not contain any long-term contractual obligations on our behalf.

Available Information

We file annual, quarterly and current reports and other information with the Securities and Exchange Commission (the “SEC” or the “Commission”). These materials can be inspected and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Copies of these materials may also be obtained by mail at prescribed rates from the SEC’s Public Reference Room at the above address. Information about the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website at www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

On our website, www.aurasystems.com, we provide free of charge our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments thereto, as soon as reasonably practicable after they have been electronically filed or furnished to the SEC. Information contained on our website is not part of this Annual Report on Form 10-K or our other filings with the SEC.

ITEM 1A. Risk Factors

We have been a party to litigation, a consent solicitation and a proxy contest with shareholders controlling a majority of the Company’s stock, which is costly and time-consuming and has had a material adverse effect on our business, results of operations and financial condition and could adversely affect our stock price.

In March 2019, stockholders of the Company representing a majority of the outstanding shares of the Company’s common stock delivered signed written consents to the Company removing Ronald Buschur, William Anderson and Si Ryong Yu as members of the Company’s Board and electing Ms. Cipora Lavut, Mr. David Mann and Dr. Robert Lempert as directors of the Company. Because of Aura’s refusal to recognize the legal effectiveness of the consents, on April 8, 2019, the stockholders filed suit in the Court of Chancery of the State of Delaware pursuant to Section 225 of the Delaware General Corporations Law, seeking an order confirming the validity of the consents. On July 8, 2019 the Court of Chancery entered final judgment in favor of the stockholder plaintiffs, confirming that (a) Ronald Buschur, Si Ryong Yu and William Anderson had been validly removed by the holders of a majority of the Company’s outstanding stock acting by written consent (b) Ms. Lavut, Mr. Mann and Dr. Lempert had been validly elected by the holders of a majority of the Company’s outstanding stock acting by written consent, and (c) the Company’s Board of Directors validly consists of Cipora Lavut, David Mann, Robert Lempert, Gary Douglas and Salvador Diaz-Versón, Jr. Aura’s refusal to recognize the legal effectiveness of the consents and the decision by the Company’s former leadership team to utilize corporate resources to vigorously contest the shareholder action has consumed significant financial resources, temporarily stagnated operations, and resulted in substantial costs, all of which had a material adverse effect on our business, operating results and financial condition.

Going Concern

The Company’s financial statements have been prepared under the assumption that the Company will continue as a going concern. As discussed in Note 1 to the financial statements, during the year ended February 29, 2024, the Company incurred a net loss of $4.2 million, used cash in operations of $3 million, and at February 29, 2024, had a stockholders’ deficit of $21.5 million. In addition, at February 29, 2024, notes payable and related accrued interest with an aggregate balance of $6.7 million have reached maturity and are past due. These factors raise substantial doubt about the Company’s ability to continue as a going concern within one year of the date that the financial statements are issued. In addition, the Company’s independent registered public accounting firm, in their report on the Company’s February 29, 2024, audited financial statements, raised substantial doubt about the Company’s ability to continue as a going concern.

Our ability to continue as a going concern is dependent upon our ability to increase revenues, obtain additional financing, drive further operating efficiencies, reduce expenditures, and ultimately, create profitable operations. In the event that the Company does not generate sufficient cash flows from operations and is unable to obtain funding, the Company will be forced to delay, reduce, or eliminate some or all of its discretionary spending, which could adversely affect the Company’s business prospects, ability to meet long-term liquidity needs or ability to continue operations. The Company does not have any sufficient committed sources of capital and does not know whether additional financing will be available when needed on terms that are acceptable, if at all. This going concern statement from our independent public accounting firm may discourage some investors from purchasing our stock or providing alternative capital financing. The failure to satisfy our capital requirements will adversely affect our business, financial condition, results of operations and prospects.

15

The effects of a pandemic or widespread outbreak of an illness, such as the COVID-19 pandemic, has had and could continue to have a material adverse impact on our business, results of operations and financial condition.

While the impact of the COVID-19 pandemic on our business has largely abated, uncertainties continue from the ongoing effects of the pandemic and an economic slowdown. The effects of government agency actions and the Company’s policies and those of third parties to combat future pandemics may negatively impact productivity and the Company’s ability to market and sell its products, cause disruptions to its supply chain anon d impair its ability to execute its business development strategy. These and other disruptions in the Company’s operations and the global economy could negatively impact the Company’s business, operating results and financial condition.

Additional discussion related to the various risks and uncertainties described above is included elsewhere within this “Risk Factors” section of our Form 10-K.

We derive a substantial portion of our revenues from customers in industries susceptible to trends and factors affecting those industries, including the COVID-19 pandemic.

Our axial flux induction technology is geared toward industrial, commercial and EV motor users, and in addition, our mobile power solution is geared to end-markets such as commercial vehicles, communications, transportation industries, and consumer and industrial equipment markets. Factors negatively affecting these industries also negatively affect our business, financial condition and results of operations. Any adverse occurrence, including industry slowdown, recession, costly or constraining regulations, excessive inflation, prolonged disruptions in one or more of our customers’ production schedules or labor disturbances, that results in significant decline in the volume of sales in these industries, or in an overall downturn in the business and operations of our customers in these industries, could materially adversely affect our business, financial condition and results of operations.

As a result of the COVID-19 pandemic, global vehicle production has decreased, and some manufacturers have completely shut down manufacturing operations in some countries and regions, including the United States and Europe. As a result, we have experienced, and are likely to continue to experience, delays in the production and distribution of our products and the loss of sales. If the global economic effects caused by the COVID-19 pandemic continue or increase, overall customer demand may continue to decrease which could have a further adverse effect on our business, results of operations and financial condition.

We will need additional capital in the future to meet our obligations and financing may not be available. During Fiscal 2024 and Fiscal 2023, the Company increased its engineering and manufacturing activities, but it still struggled with meeting its financial requirements. If we cannot obtain additional capital, we will not be able to continue our operations.

As a result of our operating losses, we have largely financed our operations through sales of our equity securities. Beginning with Fiscal 2017, the Company significantly reduced its engineering, manufacturing, sales, and marketing activities to focus on renegotiating numerous financial obligations and conserving cash. For Fiscal 2024 and Fiscal 2023, we had approximately $3 million negative and $3.1 million negative cash flows from operations, respectively, due primarily to the impact of the COVID-19 pandemic. The Company’s engineering and manufacturing activities remained limited due to our inability to increase sales and raise significant amounts of new financing. Our ability to continue as a going concern is directly dependent upon our ability to obtain additional operating capital and generating sufficient operating cash flow. The impacts of the COVID-19 pandemic, increased interest rates and inflation have caused significant uncertainty and volatility in the credit markets and there can be no assurance that lenders or investors will make additional commitments to provide financing to us under current circumstances. As a result of the impacts of the COVID-19 pandemic, we may be required to raise additional capital and our access to and cost of financing will depend on, among other things, global economic conditions, conditions in the global financing markets, the availability of sufficient amounts of financing, and our prospects. If we are unable to obtain additional funding as and when we need it, we will not be able to recommence operations or undertake our planned expansion.

16

If we do not receive additional financing when and as needed, we may not be able to continue the research, development and commercialization of our technology and products. In that case, our business and results of operations would be materially and adversely affected.

Our capital requirements have been and will continue to be significant. We will require substantial additional funds in excess of our current financial resources for research, development and commercialization of products, to obtain and maintain patents and other intellectual property rights in these technologies and products, and for working capital and other purposes, the timing and amount of which are difficult to ascertain. When and as we need additional funds, such funds may not be available on commercially reasonable terms or at all. If we cannot obtain additional funding when and as needed, our business and results of operation would be materially and adversely affected.

Our intellectual property rights are valuable, and any inability or failure to protect them could reduce the value of our products, services and brand, which would have a material adverse effect on our business.

Our patents, trademarks, and all of our other intellectual property rights are important assets for us. There are events that are outside of our control that pose a threat to our intellectual property rights. For example, effective intellectual property protection may not be available in every country in which our products and services are distributed or made available. Also, the efforts we have taken to protect our proprietary rights may not be sufficient or effective. Due to our lack of financial resources, we may not be able to adequately protect our technology portfolio or apply for new patents to extend our intellectual property portfolio. The expiration of patents in our patent portfolio may also have an adverse effect on our business. Any significant impairment of our intellectual property rights could harm our business and or our ability to compete. Protecting our intellectual property rights is costly and time consuming and we may need to resort to litigation to enforce our patent rights or to determine the scope and validity of third-party intellectual property rights and we may not have the financial resources to pay for such litigation. Some of our competitors may be able to sustain the costs of complex patent litigation more effectively than we can because they have substantially greater resources.

We seek to obtain patent protection for our innovations. It is possible, however, that some of these innovations may not be protectable. In addition, given the costs of obtaining patent protection, we may choose not to protect certain innovations that later turn out to be important. Furthermore, there is always the possibility, despite our efforts, that the scope of the protection gained will be insufficient or that an issued patent may be deemed invalid or unenforceable. Our inability or failure to protect our intellectual property rights could have a material adverse effect on our business by reducing the value of our products, services and brand.

We occasionally become subject to commercial disputes that could harm our business by distracting our management from the operation of our business, by increasing our expenses and, if we do not prevail, by subjecting us to potential monetary damages and other remedies.

From time to time, we are engaged in disputes regarding our commercial transactions. These disputes could result in monetary damages or other remedies that could adversely impact our financial position or operations. Even if we prevail in these disputes, they may distract our management from operating our business and the cost of defending these disputes would reduce our operating results.