EXHIBIT 99 (c)(3)

SourcingLink.net, Inc.

Presentation to the Board of Directors

Fairness Opinion Supplement

As of: September 26, 2003

Report Date: September 26, 2003

As Amended: October 20, 2003

This analysis is based upon information supplied by SourcingLink.net, Inc. Friend & Company (“Friend”) has relied upon and assumed, without independent verification, the accuracy and completeness of the financial and other information provided to us. Any recipient of this document hereby agrees that all information contained herein is confidential, and that they will treat it as such, and will not, without prior written consent from Friend, directly or indirectly, disclose, copy or distribute such information. For additional information, please contact Friend at the address or telephone number listed below.

a Division of B. Riley & Co. • Member NASD and SIPC

3333 Michelson Dr. © Suite 650 © Irvine, CA © 92612 ©Telephone: (949) 852-9911 © Fax: (949) 852-0430

Qualification Of Report:

THE FOLLOWING PAGES CONTAIN MATERIAL PROVIDED TO THE BOARD OF DIRECTORS (THE “DIRECTORS”) OF SOURCINGLINK.NET, INC. (“SOURCINGLINK” OR THE “COMPANY”) BY FRIEND & COMPANY (“FRIEND”) FOR THE PURPOSE OF PROVIDING A FAIRNESS OPINION REGARDING THE PROPOSED SPLIT TRANSACTION AND PRIVATE PLACEMENT. THE TERMS AND CONDITIONS OF THE TRANSACTIONS ARE SET OUT MORE FULLY IN THE COMPANY’S DRAFT PROXY STATEMENT TO THE SECURITIES AND EXCHANGE COMMISSION (“SEC”). FRIEND WILL BE RENDERING AN OPINION TO THE DIRECTORS AS TO THE FAIRNESS, FROM A FINANCIAL POINT OF VIEW, TO SOURCINGLINK’S SHAREHOLDERS OF THE CONSIDERATION TO BE PAID IN THE SPLIT TRANSACTION AND THE SALE PRICE PER SHARE OFFERED IN THE PRIVATE PLACEMENT.

THE ACCOMPANYING MATERIAL WAS PREPARED ON A CONFIDENTIAL BASIS SOLELY FOR USE IN CONNECTION WITH AN ORAL PRESENTATION TO THE DIRECTORS AND NOT WITH A VIEW TOWARD COMPLYING WITH DISCLOSURE STANDARDS UNDER STATE AND FEDERAL SECURITIES LAWS. THE INFORMATION CONTAINED IN THIS MATERIAL WAS FURNISHED BY THE COMPANY. FRIEND HAS RELIED ON, BUT DID NOT ASSUME ANY RESPONSIBILITY TO INDEPENDENTLY INVESTIGATE OR VERIFY, THE ACCURACY, COMPLETENESS AND FAIRNESS OF ALL SUCH INFORMATION, AND THE CONCLUSIONS CONTAINED HEREIN ARE CONDITIONED UPON COMPANY INFORMATION BEING ACCURATE, COMPLETE AND FAIR IN ALL RESPECTS.

ALL ESTIMATES, FORECASTS AND PROJECTIONS CONTAINED HEREIN HAVE BEEN PREPARED BY THE COMPANY OR ARE DERIVED FROM ESTIMATES, FORECASTS AND PROJECTIONS PREPARED BY THE COMPANY, WHICH INVOLVE NUMEROUS AND SIGNIFICANT SUBJECTIVE DETERMINATIONS. THE ESTIMATES, FORECASTS AND PROJECTIONS CONTAINED HEREIN MAY OR MAY NOT BE ACHIEVED AND DIFFERENCES BETWEEN PROJECTED RESULTS AND THOSE ACTUALLY ACHIEVED MAY BE MATERIAL. WITH RESPECT TO THE FINANCIAL FORECASTS AND PROJECTIONS EXAMINED BY FRIEND, FRIEND ASSUMED THAT THEY WERE REASONABLY PREPARED ON BASIS REFLECTING THE BEST CURRENTLY AVAILABLE ESTIMATES AND GOOD FAITH JUDGMENTS OF THE COMPANY AS TO FUTURE PERFORMANCE FOR ALL PERIODS SPECIFIED THEREIN. NO REPRESENTATION OR WARRANTY, EXPRESSED OR IMPLIED, IS MADE AS TO THE ACCURACY, COMPLETENESS OR FAIRNESS OF SUCH INFORMATION AND NOTHING CONTAINED HEREIN IS, OR SHALL BE RELIED UPON AS, A PROMISE OR REPRESENTATION, WHETHER AS TO THE PAST OR THE FUTURE. NEITHER FRIEND NOR ANY OF ITS ADVISORS TAKE ANY RESPONSIBILITY FOR THE ACCURACY OR COMPLETENESS OF ANY OF THE ACCOMPANYING MATERIAL. FRIEND HAS NOT BEEN REQUESTED TO, AND DID NOT MAKE AN INDEPENDENT EVALUATION OR APPRAISAL OF THE ASSETS OR LIABILITIES (CONTINGENT OR OTHERWISE KNOWN OR UNKNOWN) OF THE COMPANY, NOR HAVE THEY BEEN FURNISHED WITH ANY SUCH EVALUATIONS OR APPRAISALS.

|

Qualification of Report (Continued):

THE PREPARATION OF A FAIRNESS OPINION INVOLVES VARIOUS DETERMINATIONS AS TO THE MOST APPROPRIATE AND RELEVANT METHODS OF FINANCIAL ANALYSES AND THE APPLICATION OF THOSE METHODS TO PARTICULAR CIRCUMSTANCES AND, THEREFORE, SUCH AN OPINION IS NOT READILY SUSCEPTIBLE TO SUMMARY DESCRIPTION. FURTHERMORE, FRIEND DID NOT ATTRIBUTE ANY PARTICULAR WEIGHT TO ANY ANALYSIS OR FACTOR CONSIDERED BY IT, BUT RATHER MADE QUALITATIVE JUDGMENTS AS TO THE SIGNIFICANCE AND RELEVANCE OF EACH ANALYSIS AND FACTOR. ACCORDINGLY, FRIEND’S ANALYSES MUST BE CONSIDERED AS A WHOLE. CONSIDERING ANY PORTION OF SUCH ANALYSES OR THE FACTORS CONSIDERED, WITHOUT CONSIDERING ALL ANALYSES AND FACTORS, COULD CREATE A MISLEADING OR INCOMPLETE VIEW OF THE PROCESS UNDERLYING THE CONCLUSIONS EXPRESSED HEREIN. IN ITS ANALYSES, FRIEND MADE MANY ASSUMPTIONS WITH RESPECT TO INDUSTRY PERFORMANCE, GENERAL BUSINESS AND ECONOMIC CONDITIONS AND OTHER MATTERS, MANY OF WHICH ARE BEYOND THE CONTROL OF THE COMPANY. ANY ESTIMATES CONTAINED IN THESE ANALYSES ARE NOT NECESSARILY INDICATIVE OF ACTUAL VALUES OR PREDICTIVE OF FUTURE RESULTS OR VALUES, WHICH MAY BE SIGNIFICANTLY MORE OR LESS FAVORABLE THAN AS SET FORTH HEREIN. IN ADDITION, ANALYSES RELATING TO THE VALUE OF BUSINESSES DO NOT PURPORT TO BE APPRAISALS OR TO REFLECT THE PRICES AT WHICH BUSINESSES ACTUALLY MAY BE SOLD.

THESE MATERIALS ARE FOR THE USE OF THE DIRECTORS ONLY AND MAY NOT BE USED FOR ANY OTHER PURPOSE WITHOUT FRIEND’S WRITTEN CONSENT. THE CONCLUSIONS EXPRESSED HEREIN ARE SUBJECT TO THE ASSUMPTIONS AND OTHER MATTERS CONTAINED IN THE WRITTEN FAIRNESS OPINION BEING DELIVERED TO THE DIRECTORS.

3333 Michelson Dr. · Suite 650 · Irvine, CA · 92612 · Telephone: (949) 852-9911 · Fax: (949) 852-0430

|

| Executive Summary | CONFIDENTIAL |

|

Engagement Overview

Table of Contents

| Section | ||

| Executive Summary | I | |

| Considerations and Observations | II | |

| Common Stock Trading Analysis | III | |

| Valuation Analysis | IV | |

| • Methodology Overview • Comparable Company Analysis • Selected Precedent Merger and Acquisition Analysis • Selected Precedent Going Private Transaction Analysis |

||

| Appendix |

V | |

|

| Executive Summary | CONFIDENTIAL |

|

Engagement Overview

| • | The Board of Directors (the “Board”) of SourcingLink.net, Inc., (“SourcingLink” or the “Company”) has engaged Friend & Company (“Friend”) to opine as to the fairness, from a financial point of view, of: |

| • | the $0.15 price per pre-split share for the Split Transaction to the stockholders receiving the cash consideration (the “Split Opinion”); and |

| • | the sale price per share of SourcingLink’s common stock to be issued in connection with the Private Placement to SourcingLink and its stockholders (the “Private Placement Opinion”). |

| • | Friend was asked by the board of directors to consider both the fairness relating to the Split Transaction and the Private Placement separately. As such, Friend has not made any opinions, orally, written or otherwise, as to the comparability of the price per pre-split share for the Split Transaction and the price per share for the common stock to be issued in the Private Placement and no comparison of the two transactions should be implied or inferred. |

| • | In rendering its Opinions, among other things, Friend: |

| • | Considered applicable valuation methodologies utilized for similar transactions; |

| • | Reviewed the draft proxy statement and associated documents related to the proposed Split Transaction; |

| • | Reviewed SourcingLink’s Forms 10-KSB for the years ended March 31, 1998 through 2003, and its Form 10-QSB for the quarter ended June 30, 2003; |

| • | Reviewed certain financial and operating information provided to Friend & Company by management relating to SourcingLink’s business, including its budget for the fiscal year ending March 31, 2004; |

| • | Visited SourcingLink’s headquarters in San Diego, California; |

| • | Interviewed SourcingLink’s management to discuss SourcingLink’s operations, historical financial statements and future prospects; |

|

1 |

| Executive Summary | CONFIDENTIAL |

|

Engagement Overview, cont.

| • | Reviewed certain contracts, including material customer contracts, including, but not limited to, the contract with Carrefour S.A., which expired in the first part of fiscal 2004. Friend & Company noted that the Carrefour S.A. contract has generated the majority of SourcingLink’s revenue and cash flow in fiscal years 2003, 2002 and 2001; |

| • | Reviewed SourcingLink’s historical market prices and trading volume of its publicly traded common stock, along with publicly available financial data on SourcingLink; |

| • | Reviewed publicly available financial data and stock market performance data of public companies that Friend & Company deemed generally comparable to SourcingLink; and |

| • | In arriving at our Private Placement Opinion, Friend also considered, among other things, the following: |

| • | The current market price of SourcingLink’s common stock and the prospects, or lack thereof, of higher prices in the near to intermediate future; |

| • | SourcingLink’s lack of prospects for raising alternative debt or equity financing; |

| • | SourcingLink’s past inability to meet its sales and operating profit budgets, as discussed with SourcingLink’s management; |

| • | The going concern qualifying statement made by SourcingLink’s former auditors, PricewaterhouseCoopers LLP, in their Report of Independent Auditors for the fiscal year ended March 31, 2003; |

|

2 |

| Executive Summary | CONFIDENTIAL |

|

Engagement Overview, cont.

| • | The use of proceeds from the Private Placement, which were disclosed to Friend, are primarily to effect the proposed Split Transaction. Friend & Company noted that the closing prices of SourcingLink’s common stock over the past year are at a significant discount to the consideration in the proposed Private Placement. In addition, SourcingLink has failed to generate positive earning per share throughout its history. We noted that the proposed Private Placement would allow SourcingLink’s stockholders to receive a premium price for their common stock, paid in cash with minimum transaction costs; |

| • | SourcingLink’s primary source of revenue and cash flow for the fiscal years 2003, 2002 and 2001 has come from the contract with Carrefour S.A., which expired in the first part of fiscal 2004; |

| • | SourcingLink continues to lose money on a monthly basis and at June 30, 2003, it had an accumulated deficit of approximately $24.4 million. If SourcingLink is unable to obtain the funds necessary to continue to operate its business, it would be required to reduce operating spending, which could materially and adversely affect its business. |

| • | The analysis does not address the underlying business decision by the Company to proceed with or effect the transactions, or the structure thereof, the relative merits of the transactions compared to any alternative business strategy or transaction in which the Company might engage, or whether any alternative transaction might produce superior benefits. |

| • | Nothing in this analysis should be construed to imply or constitute a recommendation to SourcingLink stockholders as how to vote with respect to the Split Transaction or Private Placement or any action a stockholder should take with respect to the proposed transactions. |

| • | Based on the foregoing analysis, Friend will deliver an opinion to the Board of Directors of SourcingLink stating that (i) the consideration offered to the stockholders receiving the consideration in the Split Transaction is fair, from a financial point of view, to those stockholders receiving the consideration, and (ii) the sale price per pre-split share offered in the Private Placement is fair, from a financial point of view, to SourcingLink and its stockholders. |

|

3 |

| Executive Summary | CONFIDENTIAL |

|

Transaction Overview

The Split Transaction

| • | SourcingLink desires to amend its Certificate of Incorporation to effect a reverse stock split and cash payment of fractional shares followed immediately by a forward stock split. The reverse/forward stock split is proposed to terminate SourcingLink’s reporting obligations under the Securities Exchange Act of 1934. |

| • | Under the structure of the Split Transaction, the Company will effect a reverse split of SourcingLink’s common stock at a ratio of 5,100 to 1 followed immediately by a forward split at a ratio of 1 to 5,100 shares of common stock (the “Split Transaction”). |

| • | Upon completion of the Split Transaction, stockholders holding less than one full share after giving effect to the reverse 5,100 to 1 stock split will receive a payment of $0.15 per share (the “Purchase Price”) for each share of common stock held immediately prior to the effective time of the reverse split (each, a “Pre-Split Share”). |

| • | If the reverse stock split is completed, stockholders with less than 5,100 Pre-Split shares will have no further interest in SourcingLink and will become entitled only to payment for their Pre-Split shares. |

| • | The Split Transaction is expected to result in the cash-out of approximately 1,566,000 shares of common stock at the purchase price of $0.15 per share, for an aggregate purchase price of not more than approximately $235,000. |

| • | The intended effect of the Split Transaction will be to reduce the number of stockholders of record to less than 300, thereby allowing the Company to terminate its reporting obligations under the Securities Exchange Act of 1934. |

| • | In order to be approved, 6,349,398 shares of common stock must be voted in favor of the Split Transaction. |

|

4 |

| Executive Summary | CONFIDENTIAL |

|

Transaction Overview, cont.

The Private Placement

| • | SourcingLink desires to issue and sell 3,333,333 shares of common stock at $0.15 per share and seven-year warrants to purchase up to an additional aggregate of 366,667 shares of common stock at an exercise price of $0.15 per share in a private placement to an institutional investor, St. Cloud Investments Ltd. (“St. Cloud”) pursuant to a non-binding letter of intent between St. Cloud and the Company. |

| • | The warrants contain a call right in favor of SourcingLink for a period ending on June 30, 2004. Such call right, when exercised, requires the warrantholder to exercise the warrants for the number of shares of common stock specified by SourcingLink. |

| • | As of September 26, 2003, there were 12,698,794 shares of SourcingLink common stock outstanding. After completion of the Private Placement, St. Cloud will own approximately 27.3% of SourcingLink’s common stock. |

| • | St. Cloud is an existing investor in the Company and owns approximately 8.6% of the Company’s common stock, as of August 22, 2003. |

| • | SourcingLink’s goal in the additional financing is to raise sufficient capital needed to fund the Split Transaction. |

| • | The Private Placement is subject to the approval by SourcingLink’s stockholders of the Split Transaction. |

|

5 |

| Executive Summary | CONFIDENTIAL |

|

Valuation Methodology Overview

In evaluating the Split Transaction we performed the following valuation analysis:

| • | Comparable Public Company Analysis |

| • | Precedent Transaction Analysis |

| • | Going Private Transaction Analys is |

Additionally, we performed the following analysis:

| • | Premiums paid analysis |

| • | Historical stock trading and volume analysis |

|

6 |

| Executive Summary | CONFIDENTIAL |

|

Valuation Analysis Summary

VALUATION ANALYSIS SUMMARY

| Low |

High |

Median |

Transaction |

|||||||||||||||||

| Comparable Company Analysis |

||||||||||||||||||||

| Implied price per share |

$ | 0.14 | — | $ | 0.50 | $ | 0.27 | $ | 0.15 | |||||||||||

| Precedent Transaction Analysis |

||||||||||||||||||||

| Implied price per share |

$ | 0.09 | — | $ | 0.65 | $ | 0.22 | $ | 0.15 | |||||||||||

| Premiums Paid |

||||||||||||||||||||

| One day prior |

5.7 | % | — | 227.2 | % | 48.1 | % | 200.0 | % | |||||||||||

| One week prior |

-0.8 | % | — | 177.1 | % | 50.6 | % | 177.8 | % | |||||||||||

| Four weeks prior |

-17.5 | % | — | 212.5 | % | 65.2 | % | 182.1 | % | |||||||||||

| Going Private Transactions |

||||||||||||||||||||

| Implied price per share |

$ | 0.08 | — | $ | 0.61 | $ | 0.13 | $ | 0.15 | |||||||||||

| Premiums Paid |

||||||||||||||||||||

| One day prior |

5.7 | % | — | 156.0 | % | 41.6 | % | 200.0 | % | |||||||||||

| One week prior |

4.4 | % | — | 177.8 | % | 45.3 | % | 177.8 | % | |||||||||||

| Four weeks prior |

-33.3 | % | — | 169.5 | % | 45.8 | % | 182.1 | % | |||||||||||

|

7 | |||

| Considerations & Observations | CONFIDENTIAL |

|

Overview: SourcingLink.net

| • | SourcingLink competes in an industry that is extremely competitive and in which many of its competitors possess a significant amount of financial and operation resources. |

| • | The Company’s largest customer to date, Carrefour, S.A. (“Carrefour”), completed its contract with the Company in the beginning of fiscal 2004. Carrefour has generated the majority of SourcingLink’s revenue and cash flow in fiscal years 2003, 2002 and 2001. |

| • | The Company has depended on revenue from its professional services operations for the generation of the majority of its revenues, of which the Carrefour contract provided for the majority of that revenue. In addition, SourcingLink management expects that its professional services revenue in fiscal year 2004 will decline from the level achieved in fiscal 2003. |

| • | SourcingLink faces long sales and implementation cycles, which prohibit management from accurately predicting the source and extent of future cash flows. |

| • | Revenues have declined for the fiscal year ending March 31, 2003 versus the prior year, as well as for the three months ended June 30, 2003 versus the three months ended June 30, 2002. |

| • | The Company continues to lose cash on a monthly basis. In the quarter ended June 30, 2003, SourcingLink’s operating activities used cash of $90,000 per month and had a net loss for the three-month period of $371,000. |

| • | In order to compensate for the drop in revenues due to the completion of the Carrefour contract, the Company has reduced certain operating expenses to lower the rate of consumption of cash. The Company plans to maintain this lower level of investment in sales and marketing, management and product development of its solutions and services until it can secure new customers and/or obtain additional equity financing. |

|

8 | |||

| Considerations & Observations | CONFIDENTIAL |

|

Historical and Projected Financials

Income Statement

SourcingLink.net, Inc.

Consolidated Income Statements

($000s)

| 3 months ended |

Trailing Ended |

|||||||||||||||||||||||||||

| Twelve Months Ended March 31, | 2001 |

2002 |

2003 |

6/30/02 |

6/30/03 |

6/30/03 |

2004 |

|||||||||||||||||||||

| Audited | Audited | Audited | Unaudited | Unaudited | Unaudited | Projected | ||||||||||||||||||||||

| Revenue |

||||||||||||||||||||||||||||

| Professional services |

$ |

3,521 |

|

$ | 3,613 | $ | 3,095 | $ | 861 | $ | 484 | $ | 2,718 | $ | 1,860 | |||||||||||||

| Subscribers |

491 | 59 | 185 | 45 | 43 | 183 | 723 | |||||||||||||||||||||

| Total revenues |

4,012 | 3,672 | 3,280 | 906 | 527 | 2,901 | 2,584 | |||||||||||||||||||||

| Cost of revenues |

||||||||||||||||||||||||||||

| Professional services |

958 | 1,130 | 1,015 | 260 | 195 | 950 | 538 | |||||||||||||||||||||

| Subscribers |

633 | 228 | 197 | 48 | 39 | 188 | 304 | |||||||||||||||||||||

| Total cost of revenues |

1,591 | 1,358 | 1,212 | 308 | 234 | 1,138 | 842 | |||||||||||||||||||||

| Gross profit |

2,421 | 2,314 | 2,068 | 598 | 293 | 1,763 | 1,742 | |||||||||||||||||||||

| Operating expenses |

||||||||||||||||||||||||||||

| Selling, general and administrative |

3,028 | 3,216 | 2,518 | 711 | 540 | 2,347 | 2,962 | |||||||||||||||||||||

| Product development |

954 | 773 | 780 | 157 | 98 | 721 | 718 | |||||||||||||||||||||

| Depreciation and amortization |

254 | 341 | 395 | 103 | 27 | 319 | 217 | |||||||||||||||||||||

| Total operating expenses |

4,236 | 4,330 | 3,693 | 971 | 665 | 3,387 | 3,897 | |||||||||||||||||||||

| Operating income (loss) |

(1,815 | ) | (2,016 | ) | (1,625 | ) | (373 | ) | (372 | ) | (1,624 | ) | (2,155 | ) | ||||||||||||||

| Other expense (income), net |

21 | 21 | (85 | ) | (85 | ) | 1 | 1 | (0 | ) | ||||||||||||||||||

| Interest income (expense) |

243 | 86 | 20 | 9 | 2 | 13 | — | |||||||||||||||||||||

| Net income before taxes |

(1,593 | ) | (1,951 | ) | (1,520 | ) | (279 | ) | (371 | ) | (1,612 | ) | (2,154 | ) | ||||||||||||||

| (Provision) benefit for income taxes |

— | — | — | — | — | — | (10 | ) | ||||||||||||||||||||

| Net income (loss) |

$ | (1,593 | ) | $ | (1,951 | ) | $ | (1,520 | ) | $ | (279 | ) | $ | (371 | ) | $ | (1,612 | ) | $ | (2,164 | ) | |||||||

| Per Share Data |

||||||||||||||||||||||||||||

| Earnings (loss) per share — fully diluted |

$ | (0.20 | ) | $ | (0.24 | ) | $ | (0.16 | ) | $ | (0.03 | ) | $ | (0.04 | ) | $ | (0.17 | ) | $ | (0.17 | ) | |||||||

| EBITDA Calculation |

||||||||||||||||||||||||||||

| Operating Income (EBIT) |

$ | (1,815 | ) | $ | (2,016 | ) | $ | (1,625 | ) | $ | (373 | ) | $ | (372 | ) | $ | (1,624 | ) | $ | (2,155 | ) | |||||||

| Add: Depreciation & Amortization |

254 | 341 | 395 | 103 | 27 | 319 | 217 | |||||||||||||||||||||

| EBITDA |

$ | (1,561 | ) | $ | (1,675 | ) | $ | (1,230 | ) | $ | (270 | ) | $ | (345 | ) | $ | (1,305 | ) | $ | (1,938 | ) | |||||||

|

9 |

| Considerations & Observations | CONFIDENTIAL |

|

Historical and Projected Financials, cont.

Balance Sheet

SourcingLink.net, Inc.

Consolidated Balance Sheet

($000s)

| March 31, |

June 30, | March 31, | |||||||||||

| 2002 |

2003 |

2003 |

2004 |

||||||||||

| Assets | Audited | Audited | Unaudited | Projected | |||||||||

| Current Assets |

|||||||||||||

| Cash and cash equivalents |

$ | 2,934 | $ | 1,346 | $ | 1,076 | $ | 1,555 | |||||

| Accounts receivable, net |

61 | 171 | 177 | 417 | |||||||||

| Other current assets |

105 | 59 | 97 | 80 | |||||||||

| Total current assets |

3,100 | 1,576 | 1,350 | 2,052 | |||||||||

| Property and equipment, net |

503 | 129 | 102 | 242 | |||||||||

| Other assets |

8 | 46 | 46 | 46 | |||||||||

| Total assets |

$ | 3,611 | $ | 1,751 | $ | 1,498 | $ | 2,340 | |||||

| Liabilities and Shareholders Equity |

|||||||||||||

| Accounts payable and accrued liabilities |

$ | 909 | $ | 733 | $ | 698 | $ | 925 | |||||

| Deferred revenue |

330 | 146 | 299 | 2,606 | |||||||||

| Total current liabilities |

1,239 | 879 | 997 | 3,532 | |||||||||

| Long term debt |

— | — | — | — | |||||||||

| Total liabilities |

1,239 | 879 | 997 | 3,532 | |||||||||

| Stockholders’ equity |

2,372 | 872 | 501 | (1,192 | ) | ||||||||

| Total liabilities & stockholders’ equity |

$ | 3,611 | $ | 1,751 | $ | 1,498 | $ | 2,340 | |||||

| Total interest bearing debt |

— | — | — | — | |||||||||

| Working capital |

1,861 | 697 | 353 | (1,480 | ) | ||||||||

|

10 |

| Common Stock Trading Analysis | CONFIDENTIAL |

|

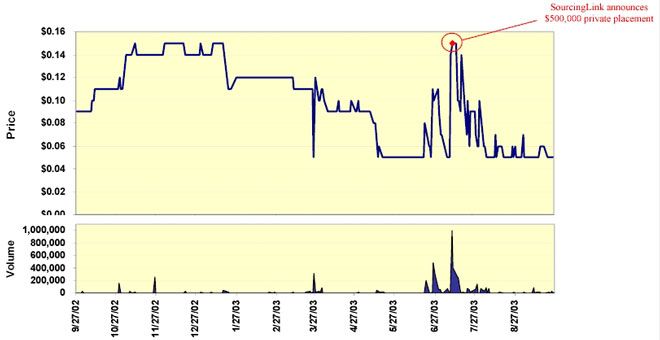

Historical Stock Chart

SNET 1-Year Stock Chart

September 27, 2002 to September 26, 2003

Date

|

11 |

| Common Stock Trading Analysis | CONFIDENTIAL |

|

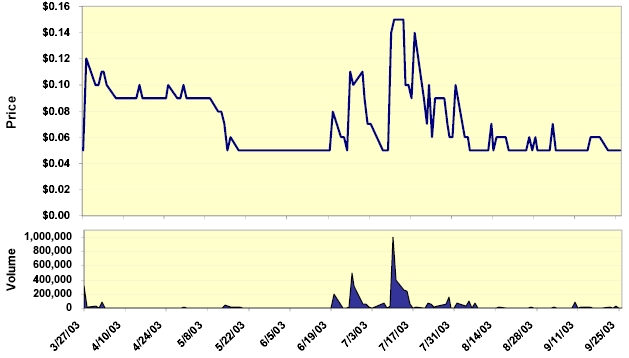

Historical Stock Chart, cont.

SNET 6-Month Stock Chart

March 27, 2002 to September 26, 2003

Date

|

12 |

| Common Stock Trading Analysis | CONFIDENTIAL |

|

Historical Stock Chart, cont.

SNET 3-Month Stock Chart

June 27, 2002 to September 26, 2003

Date

|

13 |

| Common Stock Trading Analysis | CONFIDENTIAL |

|

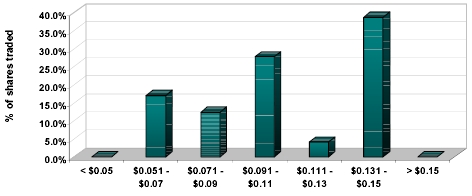

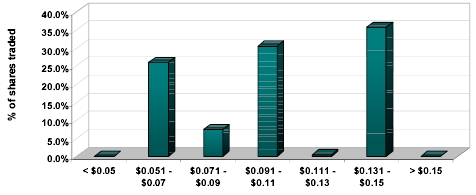

Volume at Price Chart

| • | Because an abnormally large number of shares (996,400) were traded on July 10, 2003, Friend chose to also analyze a volume at price chart that is adjusted to exclude the trading volume of that day in an attempt to look at a more “normalize” volume at price chart. That chart is located on the right and on the following pages. |

SNET 1-Year Volume at Price

September 27, 2002 to September 26, 2003

Price Segment

SNET 1-Year Volume at Price — Adjusted

September 27, 2002 to September 26, 2003

Price Segment

|

14 |

| Common Stock Trading Analysis | CONFIDENTIAL |

|

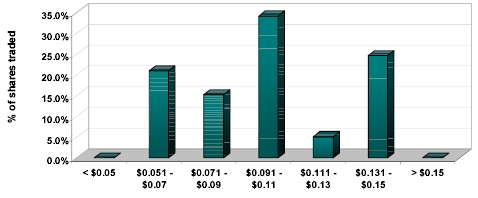

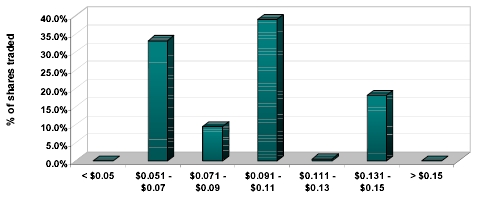

Volume at Price Chart, cont.

SNET 6-Month Volume at Price

March 27, 2002 to September 26, 2003

Price Segment

SNET 6-Month Volume at Price — Adjusted

March 27, 2002 to September 26, 2003

Price Segment

|

15 |

| Common Stock Trading Analysis | CONFIDENTIAL |

|

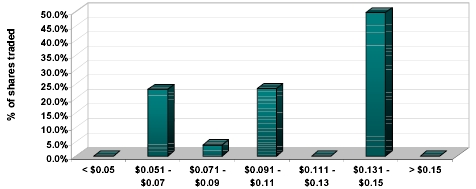

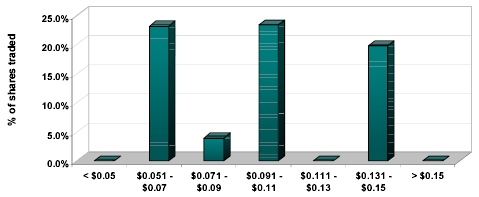

Volume at Price Chart, cont.

SNET 3-Month Volume at Price

June 27, 2002 to September 26, 2003

Price Segment

SNET 3-Month Volume at Price — Adjusted

June 27, 2002 to September 26, 2003

Price Segment

|

16 |

| Valuation Analysis | CONFIDENTIAL |

|

Valuation Methodology Overview

In determining a range of fairness for the price per Pre-Split share for the Split Transaction and the sale price per share offered in the Private Placement, Friend relied on two fundamental valuation approaches and an analysis of the Company’s common stock and trading volume over the past year:

| • | Comparable Public Company Analysis — estimates value based on comparison of the target company’s financial statistics with financial statistics of relevant comparable public companies. |

| • | Precedent Transaction Analysis — estimates value based on comparison of multiples paid for comparable companies in arms-length negotiated mergers or acquisitions. |

| • | Going Private Transaction Analysis — estimates value based on comparison of multiples paid for companies in which the intent of the transaction is to take the company private. This analysis was only used as a test for fairness for the Split Opinion. |

Other Valuation Approaches Considered

Discounted Cash Flow Method

The DCF approach utilizes the concept that the worth of a business is best represented by the present value of the estimated cash flow streams it can generate in the future. The estimated cash flow streams of a business enterprise are then adjusted to reflect the time value of money as well as the associated business and economic risks of that enterprise. While the DCF approach is the most theoretically valid approach, it relies on the ability of the appraiser and Company management to forecast cash flows with reasonable accuracy and assess the risk associated with those cash flows. As with any forecast, there is an element of uncertainty involved.

Because SourcingLink’s management does not generally prepare long-term projections and as recent sales and earnings have not met expectations as established in the Company’s annual budget (as expressed to Friend by Company management), an alternative would be to use the Company’s historical earnings as a proxy for expected earnings. However, since the Company has no history of positive earnings and does not expect to have positive earnings in the projected fiscal year ending March 31, 2004, the DCF approach to valuation was deemed not appropriate by Friend.

|

17 |

| Executive Summary | CONFIDENTIAL |

|

Transaction Overview, cont.

Adjusted Net Book Value Method

Adjusted Net Book Value Method technique values each of the assets and liabilities as its estimated current market value and adjusts the equity figure accordingly. The approach is generally applicable to businesses which are holding companies, liquidation candidates, have substantial capital investment in tangible assets or for which the operating earnings are relatively insignificant as an indicator of investment value. However, the assumption that a business enterprise is worth the value of its underlying book assets is not accurate in most industries. As such, Friend deemed this method to not be appropriate for this Opinion given the particular characteristics of the transaction and that SourcingLink is insolvent from a tangible book value basis.

|

18 |

| Selected Public Company Analysis | CONFIDENTIAL |

|

Valuation Analysis, cont.

Comparable Company Analysis

| • | Compares subject company to publicly traded companies involved in the same or similar line of business. |

| • | Valuation multiples are derived from the operating data calculated as a multiple of Enterprise Value (“EV”). |

| Market Value of Equity | ||

| + |

Total Interest Bearing Debt | |

| - |

Cash | |

| = |

Enterprise Value |

| • | Typical multiples |

— EV/EBITDA

— EV/SALES

| • | Multiples are then evaluated and adjusted to reflect relative strengths and weaknesses between the guideline companies and the subject company. |

| • | Selected multiples are applied to the operating data of the subject company to arrive at a market-based indication of value. |

| • | Accordingly, the analysis is not entirely mathematical; rather it involves complex considerations and judgments concerning differences in financial and operating characteristics and other factors. |

|

19 |

| Selected Public Company Analysis | CONFIDENTIAL |

|

Valuation Analysis, cont.

The relevant companies are as follows:

Verticalnet, Inc. (NasdaqNM:VERT)

Verticalnet is a provider of collaborative supply chain solutions that enable companies to drive costs and inventory out of their supply base through more effective sourcing and supplier collaboration. With a comprehensive set of collaborative supply chain software applications including spend analysis, strategic sourcing, collaborative planning and order management, Verticalnet offers a broad integrated supply chain solution. Its collaborative supply chain solutions enable companies and their entire network of business partners to reap the benefits of working together and sharing information. Verticalnet® Strategic Sourcing, Collaborative Planning, and Order Management enable companies to more effectively manage the Supply Management processes resulting in better visibility, reduced cost, lower inventory and streamlined administrative effort. The Company’s software is sold based on traditional license and maintenance agreements as well as through a newly introduced monthly subscription model. Under a monthly subscription plan, a customer’s software investment is timed more closely with project benefits allowing projects to rapidly become self-funding. Additionally, by instituting monthly subscription pricing, Verticalnet prospects can often afford to pay for the software out of their operating budgets, rather than having to justify a capital expenditure.

QRS Corp, Inc. (NasdaqNM:QRSI)

QRS is a provider of collaborative commerce solutions for the retail industry trading community. Its products and services help thousands of retailers, vendors, manufacturers, suppliers, wholesalers and distributors to connect and communicate electronically, transact business, collaborate on processes and decisions, and differentiate their brands in the global marketplace. Its products and services are typically integrated with our customers’ enterprise information technology systems in order to deliver greater benefits and efficiencies to these customers.

QRS market our products and services in three Solutions Groups: Software Applications, Trading Community Management and Global Services. Software Applications automate and help optimize business processes between companies. Specifically, they support the following business functions: product data synchronization; collaborative product planning, design, production, and shipment; online merchandising, promotions and sales; and supply chain exception management. Software Applications include both enterprise applications installed on customers’ computer systems and hosted applications installed on our computer systems.

Trading Community Management solutions allow retailers, vendors and their trading partners to exchange electronic business documents (such as purchase orders, invoices and advance ship notices) and collaborate on business processes (such as inventory management and financial reconciliation). These electronic transactions are conducted over a value added network (VAN) or over the Internet. QRS’ products and services eliminate paper transactions, mail delays and manual data entry errors as the communication of these electronic business documents is typically integrated with the accounting and inventory systems of our customers and their trading partners.

|

20 |

| Selected Public Company Analysis | CONFIDENTIAL |

|

Valuation Analysis, cont.

Commerce One, Inc. (NasdaqNM:CMRC)

Commerce One provides software and services for setting up and operating online business-to-business (B2B) trading exchanges connecting customers, partners, and suppliers. Its applications help automate sourcing and procurement operations and allow companies to collaborate with their trading partners in order to optimize supply chain operations. It also offers data translation and mediation software that allows companies using different internal information systems to share

product specification data. In addition, the company provides consulting, maintenance, and support services.

Commerce One Conductor provides its customers with a platform to build and manage composite processes as well as a library of “Process Accelerators” to offer a template of best practices and to speed the time to value of key manufacturing processes. Once deployed, these templates are stored in Conductor and are designed for reuse and access by all applications within the systems. The Commerce One Conductor platform and Process Accelerators work together to enable companies and applications to connect, create and maintain shared business processes regardless of their underlying workflow, semantics, user rules and applications.

FreeMarkets, Inc. (NasdaqNM:TRFX)

FreeMarkets, Inc. provides software, services and information to help companies improve their sourcing and supply management processes and enhance the capabilities of their supply management organization. The Company’s customers are buyers of industrial parts, raw materials, commodities and services. The Company’s solutions combine software, services and information to address the global supply management market. FreeMarkets serves its customers from 18 locations in 14 countries on five continents.

Since its inception, FreeMarkets has provided software and services to help companies identify savings, enhance their sourcing efficiency and achieve their strategic sourcing goals by enabling them to source goods and services in our online markets. In providing these services FreeMarkets work with its customers to identify and screen suppliers and to assemble a request for quotation that provides detailed, clear and consistent information for suppliers to use in our online markets. Its web-based technology enables suppliers from around the world to submit bids for our customers’ purchase orders in real-time interactive competition featuring “downward price” dynamic bidding. While we have provided this technology-enhanced service to buyers since 1995, we began to describe it using the “FullSource” name in 2001.

|

21 |

| Selected Public Company Analysis | CONFIDENTIAL |

|

Valuation Analysis, cont.

Cyber Merchants Exchange, Inc. (OTC BB:CMEE)

Cyber Merchants Exchange, Inc. (C-Me) is a business-to-business international trading company that creates efficiencies for retailers to source and finance international purchases. The Company builds private extranets, Internet Sourcing Networks, for its retail partners. The Company also provides vendors with a Virtual Trade Show, a vertical marketplace for vendors to display their product in an open environment accessible to any buyer around the world. In addition, C-Me’s Global Financial Platform allows United States retailers to purchase overseas merchandise without the need of issuing a Letter of Credit. The Company also established the Apparel Sourcing Association Pavilion Trade Show, an international sourcing and manufacturing trade show that brings manufacturers from around the world to one venue to greet, meet and sell to buyers. The Company is developing two additional services, the Wholesale Auction Center and Factory Outlet Mall.

In January 2001, the Company began to focus and continues to focus on sourcing overseas goods for small retailers and off-price retailers such as Value City Department Stores, Ross Stores, Factory 2-U Stores, Ames Department Stores and others who do not have their own import departments. The Company is using email to show the overseas’ stock lots, or close out, merchandise in a standard format, and then C-Me’s sales staff personally presents pre-qualified goods to the retailer who responds to the Company’s email marketing. The Company’s management team believes that having both an efficient and easy-to-use electronic trading system and a national sales force in place will significantly contribute to the Company’s ability to successfully compete in the marketplace.

Global Sources Ltd. (NasdaqNM:GSOL)

Global Sources Ltd. provides services that allow global buyers to identify suppliers and products, and enable suppliers to market their products to a large number of buyers. The Company’s primary online service is creating and hosting marketing Websites that present suppliers’ product and company information Global Sources Online. The Company offers electronic cataloging services for buyers and suppliers. My Catalogs enable buyers to maintain customized information on suppliers. Private Supplier Catalogs are password-protected online environments where suppliers can develop and maintain their own product and company data. Complementing these services are various trade magazines and CD-ROMs. Its businesses are conducted primarily through Trade Media Ltd., its wholly owned subsidiary. Through certain other wholly owned subsidiaries, it also organizes conferences and exhibitions on technology-related issues and licenses Asian Sources/Global Sources Online and catalog services.

|

22 |

| Selected Public Company Analysis | CONFIDENTIAL |

|

Valuation Analysis, cont.

Click Commerce, Inc. (NasdaqNM:CKCM)

Click Commerce, Inc. provides business-to-business partner relationship management software products that connect large, global manufacturing companies with their distribution channel partners. The Click Commerce solution, which consists of the Partner Portal, 14 business applications and the Click Commerce Developer Studio, automates communication and business processes across the distribution channel. The Click Commerce system is personalized to each individual user, accommodating each user’s language, time zone and currency preferences. Companies using its software products can receive and track orders, provide warranty information and provide product and pricing information to their channel partners. The Company’s system is specifically designed to use the Internet, and integrates with existing back-office computer systems without requiring significant additional technology expenditures.

|

23 |

| Selected Public Company Analysis | CONFIDENTIAL |

|

Valuation Analysis, cont.

Public Comparable Company Market Multiples

($ thousands, except per share data)

| Company Name |

Symbol |

Price1 |

Revenue |

EBITDA |

EPS |

Enterprise Value2 |

LTM Multiples | ||||||||||||||||

| EV/ Revenue |

EV/ EBITDA | ||||||||||||||||||||||

| Verticalnet |

VERT | $ | 1.30 | $ | 35,084 | $ | 24,203 | $ | 1.73 | $ | 16,827 | 0.48x | 0.70x | ||||||||||

| QRS Corp. |

QRSI | $ | 9.05 | $ | 126,874 | $ | 14,575 | $ | 0.26 | $ | 110,056 | 0.87x | 7.55x | ||||||||||

| Commerce One |

CMRC | $ | 2.41 | $ | 67,347 | $ | (63,605 | ) | $ | (2.75 | ) | $ | 87,628 | 1.30x | n/m | ||||||||

| Freemarkets |

FMKT | $ | 9.19 | $ | 151,817 | $ | (4,876 | ) | $ | (0.45 | ) | $ | 275,130 | 1.81x | n/m | ||||||||

| Cyber Merchants Exchange |

CMEE | $ | 0.21 | $ | 3,531 | $ | (1,319 | ) | $ | (0.31 | ) | $ | 1,456 | 0.41x | n/m | ||||||||

| Global Sources |

GSOL | $ | 7.96 | $ | 87,526 | $ | 14,787 | $ | 0.20 | $ | 162,103 | 1.85x | 10.96x | ||||||||||

| Click Commerce |

CKCM | $ | 2.02 | $ | 15,520 | $ | (2,637 | ) | $ | (0.31 | ) | $ | 4,566 | 0.29x | n/m | ||||||||

| High |

1.85x | 10.96x | |||||||||||||||||||||

| Low |

0.29x | 0.70x | |||||||||||||||||||||

| Mean |

1.00x | 6.40x | |||||||||||||||||||||

| Median |

0.87x | 7.55x | |||||||||||||||||||||

| Adj. Mean3 |

0.97x | NM | |||||||||||||||||||||

Notes: n/m = Not Meaningful. n/a = Not Available

(1) Price equals 20-day closing average as of September 17, 2003 (2) Enterprise Value (EV) = equity market capitalization plus interest bearing debt less cash. (3) Adjusted Mean excludes high and low observations. | |||||||||||||||||||||||

|

24 |

| Selected Public Company Analysis | CONFIDENTIAL |

|

Valuation Analysis, cont.

Public Comparable Company Market Multiple Analysis

($ thousands, except per share data)

SourcingLink.net, Inc.

($000s)

| LTM Revenues1 | |||||||||

| Low |

Median |

High | |||||||

| Selected Public Company Enterprise Value Multiple Range |

0.29x | 0.87x | 1.85x | ||||||

| Operating Data |

$ | 2,901 | $ | 2,901 | $ | 2,901 | |||

| Implied Enterprise Value Range |

$ | 854 | $ | 2,516 | $ | 5,373 | |||

| Add: cash2 |

$ | 925 | $ | 925 | $ | 925 | |||

| Less: debt |

— | — | — | ||||||

| Implied Equity Value Range |

$ | 1,779 | $ | 3,441 | $ | 6,298 | |||

| Implied Equity Value Range Per Share |

$ | 0.14 | $ | 0.27 | $ | 0.50 | |||

| (1) | As of June 30, 2003 |

| (2) | As of August 31, 2003 |

|

25 |

| Selected Precedent Transaction Analysis | CONFIDENTIAL |

|

Valuation Analysis, cont.

Precedent Transaction Analysis

| • | Similar to Public Company approach – estimates value based on comparison of multiples paid for comparable companies in arms’-length negotiated mergers or acquisitions. |

| • | Analysis may be impacted by several factors that may introduce “noise” into the analysis, including: |

| • | Premiums (bidding war) |

| • | Discounts |

| • | Market environment not identical for transactions occurring at different times |

| • | Circumstances pertaining to specific companies (i.e. distress) |

| • | Data on transactions may be incomplete or unavailable. |

| • | Critical components: |

| • | “Fit” of comparables |

| • | Valuation metrics |

| • | Market conditions |

|

26 |

| Selected Precedent Transaction Analysis | CONFIDENTIAL |

|

Valuation Analysis, cont.

Precedent Transaction Analysis

Transactions with SIC Code: 7372 — Prepackaged Software

January 1, 2001 to August 26, 2003; Transaction values less than $50 million

($ Millions)

| Target Company LTM Data |

Multiple | |||||||||||||||||

| Date Effective |

Target Name |

Acquiror Name |

% of Shares Acq. |

Transaction Value1 |

Sales |

EBITDA |

EV/Sales | |||||||||||

| 08/08/2003 |

Made2Manage Systems Inc |

Battery Ventures VI LP | 100.00 | $ | 30.51 | $ | 30.10 | $ | 0.49 | 1.01x | ||||||||

| 07/22/2003 |

Elevon Inc |

SSA Global Technologies Inc | 100.00 | $ | 20.25 | $ | 32.90 | $ | 2.43 | 0.62x | ||||||||

| 03/17/2003 |

Viador Inc |

MASB Inc | 100.00 | $ | 3.88 | $ | 5.30 | $ | (3.46 | ) | 0.73x | |||||||

| 03/14/2003 |

TCSI Corp |

Rocket Software Inc | 100.00 | $ | 10.69 | $ | 7.70 | $ | (8.68 | ) | 1.39x | |||||||

| 03/06/2003 |

Extensity Inc |

Geac Computer Corp Ltd | 100.00 | $ | 46.06 | $ | 25.70 | $ | (13.46 | ) | 1.79x | |||||||

| 02/14/2003 |

Clarent Corp |

Verso Technologies Inc | 100.00 | $ | 9.80 | $ | 110.50 | $ | (159.08 | ) | 0.09x | |||||||

| 12/19/2002 |

Excelon Corp |

Progress Software Corp | 100.00 | $ | 24.49 | $ | 41.80 | $ | (74.61 | ) | 0.59x | |||||||

| 12/09/2002 |

InforMax Inc |

Invitrogen Corp | 100.00 | $ | 42.75 | $ | 16.90 | $ | (20.41 | ) | 2.53x | |||||||

| 12/03/2002 |

ClickAction Inc |

infoUSA Inc | 100.00 | $ | 4.10 | $ | 10.10 | $ | (1.63 | ) | 0.41x | |||||||

| 12/02/2002 |

INSpire Insurance Solutions |

CGI Group Inc | 100.00 | $ | 5.40 | $ | 55.20 | $ | (9.06 | ) | 0.10x | |||||||

| 10/15/2002 |

Interlinq Software Corp |

Harland Finl Solutions Inc | 100.00 | $ | 33.55 | $ | 8.70 | $ | 3.30 | 1.79x | ||||||||

| 03/22/2002 |

QueryObject Systems Corp |

CrossZ Solutions SpA | 100.00 | $ | 0.90 | $ | 1.90 | $ | (9.60 | ) | 0.47x | |||||||

| 02/16/2002 |

ALPNET Inc |

SDL PLC | 100.00 | $ | 7.28 | $ | 48.90 | $ | (2.30 | ) | 0.15x | |||||||

| 12/27/2001 |

Liquent Inc |

Information Holdings Inc | 100.00 | $ | 42.58 | $ | 22.10 | $ | (10.90 | ) | 1.93x | |||||||

| 12/21/2001 |

net.Genesis Corp |

SPSS Inc | 100.00 | $ | 43.03 | $ | 19.50 | $ | (39.50 | ) | 2.21x | |||||||

| 12/06/2001 |

Telescan Inc |

Ziasun Technologies Inc | 100.00 | $ | 5.91 | $ | 32.00 | $ | (16.60 | ) | 0.18x | |||||||

| 12/05/2001 |

Eprise Corp |

Divine Inc | 100.00 | $ | 44.84 | $ | 20.10 | $ | (26.00 | ) | 2.23x | |||||||

| 11/16/2001 |

Telemate Net Software Inc |

Verso Technologies Inc | 100.00 | $ | 16.07 | $ | 9.70 | $ | (15.44 | ) | 1.66x | |||||||

| 09/26/2001 |

Learn2.com Inc |

E-Stamp Corp | 100.00 | $ | 6.46 | $ | 22.10 | $ | (13.30 | ) | 0.29x | |||||||

| 09/11/2001 |

Mbrane |

Birdstep Technology ASA | 100.00 | $ | 1.80 | $ | 32.50 | $ | (24.90 | ) | 0.06x | |||||||

| 08/27/2001 |

Microware Systems Corp |

RadiSys Corp | 100.00 | $ | 15.24 | $ | 14.00 | $ | (3.19 | ) | 1.09x | |||||||

| 06/19/2001 |

CUseeMe Networks Inc |

First Virtual Communications | 100.00 | $ | 20.32 | $ | 12.10 | $ | (9.70 | ) | 1.68x | |||||||

| 05/03/2001 |

Alysis Technologies Inc |

Pitney Bowes Inc | 100.00 | $ | 22.16 | $ | 8.70 | $ | (11.35 | ) | 2.55x | |||||||

| 04/30/2001 |

Fourth Shift Corp |

AremisSoft Corp | 100.00 | $ | 40.03 | $ | 64.20 | $ | 0.45 | 0.62x | ||||||||

| 03/28/2001 |

Prime Response Inc |

Chordiant Software Inc | 100.00 | $ | 33.00 | $ | 20.50 | $ | (15.35 | ) | 1.61x | |||||||

| 02/11/2002 |

Leapnet Inc |

Investor Group | 85.00 | $ | 10.01 | $ | 35.60 | $ | (24.70 | ) | 0.28x | |||||||

| 12/21/2001 |

Eagle Point Software Corp |

JB Acquisitions LLC | 73.20 | $ | 23.84 | $ | 18.00 | $ | (0.10 | ) | 1.32x | |||||||

| 05/31/2002 |

Ecometry Corp |

SG Merger Corp | 65.14 | $ | 21.94 | $ | 28.90 | $ | (8.50 | ) | 0.76x | |||||||

| 03/27/2001 |

Document Sciences Corp |

Document Sciences Corp | 54.93 | $ | 12.00 | $ | 22.60 | $ | 0.31 | 0.53x | ||||||||

| 11/30/2001 |

Scientific Learning Corp |

Warburg Pincus | 35.02 | $ | 5.00 | $ | 16.30 | $ | (18.23 | ) | 0.31x | |||||||

| 05/30/2003 |

Sandata Technologies Inc |

Sandata Acquisition Corp | 30.00 | $ | 1.57 | $ | 17.20 | $ | 2.33 | 0.09x | ||||||||

| 01/31/2003 |

Printcafe Software Inc |

Creo Inc | 24.17 | $ | 3.34 | $ | 46.50 | $ | (43 | ) | 0.07x | |||||||

| 01/14/2002 |

Organic Inc |

Seneca Investments LLC | 19.30 | $ | 5.75 | $ | 90.40 | $ | (60.30 | ) | 0.06x | |||||||

| High | 2.55x | |||||||||||||||||

| Low |

0.06x | |||||||||||||||||

| Mean |

0.95x | |||||||||||||||||

| Median |

0.62x | |||||||||||||||||

| Adjusted Mean2 |

0.92x | |||||||||||||||||

| Notes: |

Source: Thompson Financial Securities Data

| n/m | = Not Meaningful. |

| n/a | = Not Available |

| (1) | Transaction Value = Total dollar value of consideration paid, including all payment types. All terms are approximate. |

| (2) | Adjusted Mean excludes high and low observations. |

|

27 |

| Selected Precedent Transaction Analysis | CONFIDENTIAL |

|

Valuation Analysis, cont.

Precedent Transaction Analysis

($ thousands, except per share data)

SourcingLink.net, Inc.

($000’s)

| LTM Revenues1 | |||||||||

| Low |

Median |

High | |||||||

| Selected Public Company |

|||||||||

| Enterprise Value Multiple Ranges |

0.06x | 0.62x | 2.55x | ||||||

| Pro Forma LTM Historical Operating Data |

$ | 2,901 | $ | 2,901 | $ | 2,901 | |||

| Implied Enterprise Value Range |

$ | 161 | $ | 1,809 | $ | 7,388 | |||

| Add: cash2 |

$ | 925 | $ | 925 | $ | 925 | |||

| Less: debt |

— | — | — | ||||||

| Implied Equity Value Range |

$ | 1,086 | $ | 2,734 | $ | 8,313 | |||

| Implied Equity Value Range Per Share |

$ | 0.09 | $ | 0.22 | $ | 0.65 | |||

| (1) | As of June 30, 2003 |

| (2) | As of August 31, 2003 |

|

28 |

| Selected Precedent Transaction Analysis | CONFIDENTIAL |

|

Valuation Analysis, cont.

Premiums Paid Analysis

Premiums Paid Analysis — Precedent Transactions

Transactions with SIC Code: 7372 — Prepackaged Software

January 1, 2001 to August 26, 2003; Transaction values less than $50 million

($ Millions)

| Date Effective |

Target Name |

Acquiror Name |

% of Shares Acq. |

Transaction Value1 |

Premium 1 day prior to announce- ment date |

Premium 1 week prior to announce- ment date |

Premium 4 weeks prior to ann. date |

|||||||||||

| 08/08/2003 | Made2Manage Systems Inc | Battery Ventures VI LP | 100.00 | $ | 30.51 | 35.7 | % | 42.5 | % | 37.4 | % | |||||||

| 03/14/2003 |

TCSI Corp | Rocket Software Inc | 100.00 | $ | 10.69 | 48.6 | % | 62.5 | % | 48.6 | % | |||||||

| 03/06/2003 | Extensity Inc | Geac Computer Corp Ltd | 100.00 | $ | 46.06 | 128.1 | % | 143.7 | % | 89.3 | % | |||||||

| 12/09/2002 | InforMax Inc | Invitrogen Corp | 100.00 | $ | 42.75 | 142.9 | % | 151.9 | % | 115.9 | % | |||||||

| 10/15/2002 | Interlinq Software Corp | Harland Finl Solutions Inc | 100.00 | $ | 33.55 | 227.2 | % | 161.5 | % | 212.5 | % | |||||||

| 12/27/2001 | Liquent Inc | Information Holdings Inc | 100.00 | $ | 42.58 | 139.0 | % | 146.7 | % | 152.2 | % | |||||||

| 12/21/2001 | net.Genesis Corp | SPSS Inc | 100.00 | $ | 43.03 | 50.0 | % | 40.8 | % | 140.8 | % | |||||||

| 12/05/2001 | Eprise Corp | Divine Inc | 100.00 | $ | 44.84 | 173.2 | % | 177.1 | % | 148.7 | % | |||||||

| 11/16/2001 | Telemate Net Software Inc | Verso Technologies Inc | 100.00 | $ | 16.07 | 48.1 | % | 54.8 | % | 89.2 | % | |||||||

| 08/27/2001 | Microware Systems Corp | RadiSys Corp | 100.00 | $ | 15.24 | 41.7 | % | 70.0 | % | 23.6 | % | |||||||

| 06/19/2001 | CUseeMe Networks Inc | First Virtual Communications | 100.00 | $ | 20.32 | 51.2 | % | 28.5 | % | -15.8 | % | |||||||

| 04/30/2001 | Fourth Shift Corp | AremisSoft Corp | 100.00 | $ | 40.03 | 64.4 | % | 46.2 | % | 111.4 | % | |||||||

| 03/28/2001 | Prime Response Inc | Chordiant Software Inc | 100.00 | $ | 33.00 | 17.2 | % | 84.2 | % | 3.2 | % | |||||||

| 02/11/2002 | Leapnet Inc | Investor Group | 85.00 | $ | 10.01 | 5.7 | % | 5.7 | % | 33.1 | % | |||||||

| 12/21/2001 | Eagle Point Software Corp | JB Acquisitions LLC | 73.20 | $ | 23.84 | 42.2 | % | 50.6 | % | 65.2 | % | |||||||

| 05/31/2002 | Ecometry Corp | SG Merger Corp | 65.14 | $ | 21.94 | 74.2 | % | 68.8 | % | 80.0 | % | |||||||

| 03/27/2001 | Document Sciences Corp | Document Sciences Corp | 54.93 | $ | 12.00 | 18.5 | % | 36.2 | % | 68.4 | % | |||||||

| 11/30/2001 | Scientific Learning Corp | Warburg Pincus | 35.02 | $ | 5.00 | |||||||||||||

| 05/30/2003 | Sandata Technologies Inc | Sandata Acquisition Corp | 30.00 | $ | 1.57 | |||||||||||||

| 01/31/2003 | Printcafe Software Inc | Creo Inc | 24.17 | $ | 3.34 | |||||||||||||

| 01/14/2002 | Organic Inc | Seneca Investments LLC | 19.30 | $ | 5.75 | |||||||||||||

| High |

227.2 | % | 177.1 | % | 212.5 | % | ||||||||||||

| Low |

5.7 | % | 5.7 | % | -15.8 | % | ||||||||||||

| Mean |

76.9 | % | 80.7 | % | 82.6 | % | ||||||||||||

| Median |

50.0 | % | 62.5 | % | 80.0 | % | ||||||||||||

| Adjusted Mean2 |

71.7 | % | 79.3 | % | 80.5 | % | ||||||||||||

Notes:

Source: Thompson Financial Securities Data n/m = Not Meaningful. n/a = Not Available

(1) Transaction Value = Total dollar value of consideration paid, including all payment types. All terms are approximate. (2) Adjusted Mean excludes high and low observations. | ||||||||||||||||||

|

29 |

| Going Private Transaction Analysis | CONFIDENTIAL |

|

Valuation Analysis, cont.

Going Private Transaction Analysis

| • | Similar to Precedent Transaction approach — estimates value based on comparison of multiples paid for comparable companies in arms’-length negotiated mergers or acquisitions in which the intention of the transaction is to take the target company private. |

| • | Analysis regards transactions from a wide variety of industry sectors. Friend chose to use all industries except financial services and natural resources. |

| • | Analysis may be impacted by several factors that may introduce “noise” into the analysis, including: |

| • | Premiums (bidding war) |

| • | Discounts |

| • | Particular reasons for taking company private |

| • | Market environment not identical for transactions occurring at different times |

| • | Circumstances pertaining to specific companies (i.e. distress) |

| • | Data on transactions may be incomplete or unavailable. |

| • | Critical components: |

| • | Valuation metrics |

| • | Market conditions |

|

30 |

| Going Private Transaction Analysis | CONFIDENTIAL |

|

Valuation Analysis, cont.

Going Private Transaction Analysis

All industries except financial services and natural resources

January 1, 2002 to August 26, 2003; Transaction values less than $50 million

($ Millions)

| Multiple | ||||||||||||||||

| Date Effective |

Target Name |

Target Short Business Description |

Acquiror Name |

% of Shares |

Transaction Value1 |

Target Company LTM |

EV/Sales | |||||||||

| 01/09/2002 |

Iwerks Entertainment Inc | Mnfr theatre systems | SimEx Inc | 100.00 | $ | 15.0 | $ | 23.2 | 0.65x | |||||||

| 02/22/2002 |

Colonial Holdings Inc | Own, op racetrack facilities | Gameco Inc | 100.00 | $ | 36.1 | $ | 30.9 | 1.17x | |||||||

| 01/03/2002 |

Children’s Comprehensive Svcs | Pvd education,treatment svcs | Ameris Acquisition Inc | 100.00 | $ | 44.1 | $ | 131.7 | 0.33x | |||||||

| 01/24/2002 |

Blimpie International Inc | Own, op restaurants | Investor Group | 100.00 | $ | 25.8 | $ | 30.1 | 0.86x | |||||||

| 05/24/2002 |

Interfoods of America Inc | Own, op franchised restaurants | Interfoods Acquisition Corp | 100.00 | $ | 7.3 | $ | 152.1 | 0.05x | |||||||

| 03/27/2002 |

RockShox Inc | Mnfr bicycle suspension sys | SRAM Corp | 100.00 | $ | 5.6 | $ | 60.3 | 0.09x | |||||||

| 04/15/2002 |

Viasource Communications Inc | Pvd broadband install svcs | 180 Connect Inc | 100.00 | $ | 44.0 | $ | 215.1 | 0.20x | |||||||

| 06/20/2002 |

MedGrup Corp | Pvd med coding,consulting svc | Provider HealthNet Svcs Inc | 100.00 | $ | 12.7 | $ | 5.4 | 2.35x | |||||||

| 07/23/2002 |

Technisource Inc | Pvd technical support svcs | Intellimark Holdings Inc | 100.00 | $ | 42.8 | $ | 134.8 | 0.32x | |||||||

| 12/17/2002 |

Flight International Group Inc | Provide airplane charter svcs | Raytheon Aerospace Co | 100.00 | $ | 19.6 | $ | 44.8 | 0.44x | |||||||

| 09/06/2002 |

Lante Corp | Pvd Internet solutions svcs | SBI & Co | 100.00 | $ | 42.4 | $ | 33.9 | 1.25x | |||||||

| 10/22/2002 |

Tab Products Co | Mnfr document mgmt solutions | HS Morgan | 100.00 | $ | 31.8 | $ | 103.9 | 0.31x | |||||||

| 01/02/2003 |

Disc Graphics Inc | Pvd packaging services | Investor Group | 100.00 | $ | 10.1 | $ | 49.5 | 0.20x | |||||||

| 12/03/2002 |

US Diagnostic Inc | Own, op imaging facilities | Presgar Medical Imaging Inc | 100.00 | $ | 14.1 | $ | 46.0 | 0.31x | |||||||

| 03/17/2003 |

Viador Inc | Dvlp Internet software | MASB Inc | 100.00 | $ | 3.9 | $ | 5.3 | 0.73x | |||||||

| 12/30/2002 |

DSET Corp | Pvd ecommerce svcs | NE Technologies Inc | 100.00 | $ | 1.5 | $ | 6.0 | 0.26x | |||||||

| 06/27/2003 |

NetLojix Communications Inc | Internet Service Provider{ISP} | Investor Group | 100.00 | $ | 0.3 | $ | 15.6 | 0.02x | |||||||

| 03/17/2003 |

STM Wireless Inc | Mnfr satellite commun equip | Sloan Capital Partners LLC | 100.00 | $ | 4.0 | $ | 20.9 | 0.19x | |||||||

| 05/01/2003 |

ImageX Inc | Pvd ecommerce information svcs | Kinkos Inc | 100.00 | $ | 16.1 | $ | 34.9 | 0.46x | |||||||

| 08/12/2003 |

DSI Toys Inc | Mnfr, whl toys | DSI Acquisition Inc | 100.00 | $ | 5.1 | $ | 49.8 | 0.10x | |||||||

| 08/08/2003 |

Made2Manage Systems Inc | Dvlp software | Battery Ventures VI LP | 100.00 | $ | 30.5 | $ | 30.1 | 1.01x | |||||||

| 05/05/2003 |

Acorn Products Inc | Mnfr, whl hand,edge tools | Oaktree Capital Management LLC |

92.50 | $ | 20.7 | $ | 91.2 | 0.23x | |||||||

| 02/11/2002 |

Leapnet Inc | Dvlp Internet software | Investor Group | 85.00 | $ | 10.0 | $ | 35.6 | 0.28x | |||||||

| 02/22/2002 |

Black Hawk Gaming & Dvlp Co | Own, op casinos and hotels | Gameco Inc | 66.00 | $ | 36.3 | $ | 95.0 | 0.38x | |||||||

| 05/31/2002 |

Ecometry Corp | Pvd software solutions | SG Merger Corp | 65.14 | $ | 21.9 | $ | 28.9 | 0.76x | |||||||

| 04/23/2003 |

ARV Assisted Living Inc | Provide nursing care services | Prometheus Assisted Living LLC |

56.50 | $ | 39.2 | $ | 158.4 | 0.25x | |||||||

| 08/19/2002 |

Balanced Care Corp | Pvd residential care svcs | IPC Advisors SARL | 46.71 | $ | 4.0 | $ | 56.3 | 0.07x | |||||||

| 03/04/2002 |

Ugly Duckling Corp | Own, op used car dealerships | Ernest C Garcia II | 39.20 | $ | 17.0 | $ | 448.6 | 0.04x | |||||||

| 07/26/2002 |

Pierre Foods Inc | Produce prepared sandwiches | Investor Group | 37.00 | $ | 5.3 | $ | 232.1 | 0.02x | |||||||

| 01/18/2002 |

National Home Centers Inc | Op home products supply stores | Dwain Neumann | 36.50 | $ | 3.7 | $ | 100.6 | 0.04x | |||||||

| 05/30/2003 |

Sandata Technologies Inc | Dvlp software | Sandata Acquisition Corp | 30.00 | $ | 1.6 | $ | 17.2 | 0.09x | |||||||

| 01/03/2003 |

R-B Rubber Products Inc | Mnfr, whl rubber products | Dash Multi-Corp Inc | 29.90 | $ | 3.0 | $ | 12.4 | 0.24x | |||||||

| 02/28/2003 |

Landair Corp | Trucking company | Investor Group | 29.00 | $ | 19.7 | $ | 102.5 | 0.19x | |||||||

| 02/04/2003 |

Royal Precision Inc | Mnfr steel golf club shafts | Royal Associates Inc | 23.00 | $ | 0.3 | $ | 23.6 | 0.01x | |||||||

| 05/12/2003 |

Pak Mail Centers of America | Pvd mailing, packaging svcs | Pak Mail Acquisition Corp | 20.60 | $ | 0.0 | $ | 4.3 | 0.01x | |||||||

| 01/14/2002 |

Organic Inc | Dvlp Internet mktng software | Seneca Investments LLC | 19.30 | $ | 5.8 | $ | 90.4 | 0.06x | |||||||

| 04/11/2003 |

WorldPort Communications Inc | Pvd telecom svcs | WorldPort Communications Inc | 15.70 | $ | 3.1 | $ | 7.3 | 0.42x | |||||||

| 05/07/2002 |

Century Builders Group Inc | Residential construction co | New Century Homebuilders Inc | 9.50 | $ | 3.5 | $ | 79.3 | 0.04x | |||||||

| High | 2.35x | |||||||||||||||

|

|

Low |

0.01x | ||||||||||||||

|

|

Mean |

0.38x | ||||||||||||||

|

|

Median |

0.24x | ||||||||||||||

|

|

Adjusted Mean2 |

0.34x | ||||||||||||||

| Notes: |

| Source: | Thompson Financial Securities Data |

| n/m | = Not Meaningful. |

| n/a | = Not Available |

| (1) | Transaction Value = Total dollar value of consideration paid, including all payment types. All terms are approximate. |

| (2) | Adjusted Mean excludes high and low observations. |

|

31 | |||||

| Going Private Transaction Analysis | CONFIDENTIAL |

|

Valuation Analysis, cont.

Going Private Transaction Analysis

($ thousands, except per share data)

SourcingLink.net, Inc.

($000’s)

| LTM Revenues1 | |||||||||

| Low |

Median |

High | |||||||

| Selected Public Company |

|||||||||

| Enterprise Value Multiple Ranges |

0.01x | 0.24x | 2.35x | ||||||

| Pro Forma LTM Historical Operating Data |

$ | 2,901 | $ | 2,901 | $ | 2,901 | |||

| Implied Enterprise Value Range |

$ | 28 | $ | 706 | 6,828 | ||||

| Add: cash2 |

$ | 925 | $ | 925 | $ | 925 | |||

| Less: debt |

— | — | — | ||||||

| Implied Equity Value Range |

$ | 953 | $ | 1,631 | $ | 7,753 | |||

| Implied Equity Value Range Per Share |

$ | 0.08 | $ | 0.13 | $ | 0.61 | |||

| (1) | As of June 30, 2003 |

| (2) | As of August 31, 2003 |

|

32 |

| Selected Public Company Analysis | CONFIDENTIAL |

|

Valuation Analysis, cont.

Premiums Paid Analysis

Premiums Paid Analysis — Going Private Transactions

All industries except financial services and natural resources

January 1, 2002 to August 26, 2003; Transaction values less than $50 million

($ Millions)

| Date Effective |

Target Name |

Target Short Business Description |

Acquiror Name |

% of Shares Acq. |

Transaction Value1 |

Premium 1 day prior to announce- ment date |

Premium 1 week prior to announce- ment date |

Premium 4 weeks prior to ann. date |

||||||||||||

| 02/22/2002 |

Children’s Comprehensive Svcs | Pvd education,treatment svcs | Ameris Acquisition Inc | 100.00 | $ | 44 | 39.9 | % | 31.9 | % | 36.4 | % | ||||||||

| 07/26/2002 |

Blimpie International Inc | Own,op restaurants | Investor Group | 100.00 | $ | 26 | 86.7 | % | 90.5 | % | 62.8 | % | ||||||||

| 01/18/2002 |

Technisource Inc | Pvd technical support svcs | Intellimark Holdings Inc | 100.00 | $ | 43 | 43.4 | % | 48.2 | % | 73.9 | % | ||||||||

| 01/03/2002 |

Lante Corp | Pvd Internet solutions svcs | SBI & Co | 100.00 | $ | 42 | 100.0 | % | 77.4 | % | 57.1 | % | ||||||||

| 01/14/2002 |

Tab Products Co | Mnfr document mgmt solutions | HS Morgan | 100.00 | $ | 32 | 26.6 | % | 20.1 | % | 13.6 | % | ||||||||

| 01/24/2002 |

Disc Graphics Inc | Pvd packaging services | Investor Group | 100.00 | $ | 10 | 73.3 | % | 65.5 | % | 51.7 | % | ||||||||

| 05/31/2002 |

DSET Corp | Pvd ecommerce svcs | NE Technologies Inc | 100.00 | $ | 2 | 87.5 | % | 76.5 | % | 71.4 | % | ||||||||

| 02/11/2002 |

NetLojix Communications Inc | Internet Service Provider{ISP} | Investor Group | 100.00 | $ | 0 | 100.0 | % | 100.0 | % | -33.3 | % | ||||||||

| 08/19/2002 |

ImageX Inc | Pvd ecommerce information svcs | Kinkos Inc | 100.00 | $ | 16 | 156.0 | % | 169.5 | % | 169.5 | % | ||||||||

| 07/23/2002 |

DSI Toys Inc | Mnfr,whl toys | DSI Acquisition Inc | 100.00 | $ | 5 | 11.9 | % | 4.4 | % | 9.3 | % | ||||||||

| 09/06/2002 |

Made2Manage Systems Inc | Dvlp software | Battery Ventures VI LP | 100.00 | $ | 31 | 35.7 | % | 42.5 | % | 37.4 | % | ||||||||

| 10/22/2002 |

Acorn Products Inc | Mnfr,whl hand,edge tools | Oaktree Capital Management LLC | 92.50 | $ | 21 | 39.4 | % | 22.8 | % | 40.0 | % | ||||||||

| 01/03/2003 |

Leapnet Inc | Dvlp Internet software | Investor Group | 85.00 | $ | 10 | 5.7 | % | 5.7 | % | 33.1 | % | ||||||||

| 05/30/2003 |

Black Hawk Gaming & Dvlp Co | Own,op casinos and hotels | Gameco Inc | 66.00 | $ | 36 | 16.7 | % | 22.1 | % | 34.3 | % | ||||||||

| 01/02/2003 |

Ecometry Corp | Pvd software solutions | SG Merger Corp | 65.14 | $ | 22 | 74.2 | % | 68.8 | % | 80.0 | % | ||||||||

| 04/23/2003 |

ARV Assisted Living Inc | Provide nursing care services | Prometheus Assisted Living LLC | 56.50 | $ | 39 | 52.9 | % | 56.0 | % | 58.5 | % | ||||||||

| 02/28/2003 |

Balanced Care Corp | Pvd residential care svcs | IPC Advisors SARL | 46.71 | $ | 4 | 150.0 | % | 177.8 | % | 150.0 | % | ||||||||

| 12/30/2002 |

Pierre Foods Inc | Produce prepared sandwiches | Investor Group | 37.00 | $ | 5 | 53.9 | % | 158.1 | % | 150.0 | % | ||||||||

| 06/27/2003 |

National Home Centers Inc | Op home products supply stores | Dwain Neumann | 36.50 | $ | 4 | 26.1 | % | 20.7 | % | 33.3 | % | ||||||||

| 05/05/2003 |

Sandata Technologies Inc | Dvlp software | Sandata Acquisition Corp | 30.00 | $ | 2 | 32.6 | % | 32.6 | % | 51.6 | % | ||||||||

| 04/11/2003 |

R-B Rubber Products Inc | Mnfr,whl rubber products | Dash Multi-Corp Inc | 29.90 | $ | 3 | 83.0 | % | 69.7 | % | 75.0 | % | ||||||||

| 05/01/2003 |

Landair Corp | Trucking company | Investor Group | 29.00 | $ | 20 | 25.0 | % | 31.1 | % | 24.9 | % | ||||||||

| 08/12/2003 |

Organic Inc | Dvlp Internet mktng software | Seneca Investments LLC | 19.30 | $ | 6 | 13.8 | % | 17.9 | % | -17.5 | % | ||||||||

| 08/08/2003 |

WorldPort Communications Inc | Pvd telecom svcs | WorldPort Communications Inc | 15.70 | $ | 3 | 22.0 | % | 19.1 | % | -2.0 | % | ||||||||

| High |

156.0 | % | 177.8 | % | 169.5 | % | ||||||||||||||

| Low |

5.7 | % | 4.4 | % | -33.3 | % | ||||||||||||||

| Mean |

56.5 | % | 59.5 | % | 52.5 | % | ||||||||||||||

| Median |

41.6 | % | 45.3 | % | 45.8 | % | ||||||||||||||

| Adjusted Mean2 |

54.3 | % | 56.7 | % | 51.1 | % | ||||||||||||||

| Notes: |

Source: Thompson Financial Securities Data

n/m = Not Meaningful.

n/a = Not Available

| (1) | Transaction Value = Total dollar value of consideration paid, including all payment types. All terms are approximate. |

| (2) | Adjusted Mean excludes high and low observations. |

|

33 |

| CONFIDENTIAL |

|

Changes to Fairness Opinion Supplement

| • | Friend’s Fairness Opinion to the SourcingLink board of directors was orally delivered on September 26, 2003. Accordingly, the text of this supplement on the prior pages contains information regarding the Split Transaction and the Private Placement based on information known as of that date. Since then, one of the fact sets describing the Private Placement has changed. |

| • | On October 17, 2003, St. Cloud purchased from four prior investors in SourcingLink all of their respective equity holdings in SourcingLink. As a result of this transaction and St. Cloud’s previous investments in the Company, St. Cloud currently beneficially owns approximately 47.8% of SourcingLink’s outstanding stock. |

| • | In the event that the Private Placement is completed, St. Cloud’s beneficial ownership of SourcingLink’s outstanding stock will increase from approximately 47.8% to approximately 63.7%. |

| • | Friend and Company has reviewed this change in ownership and its relevance to our prior analysis and conclusions and confirmed that our opinion that the sale price per share of SourcingLink’s Common Stock to be issued in connection with the Private Placement is fair to SourcingLink and its stockholders, in light of this change, from a financial point of view. The letter to SourcingLink’s board of directors on the following page confirms this understanding. |

|

34 |

| Bring Down Letter | CONFIDENTIAL |

|

Changes to Fairness Opinion Supplement, cont.

October 20, 2003

Board of Directors

SOURCINGLINK.NET, INC.

16855 West Bernardo Drive

San Diego, CA 92127

Members of the Board:

Pursuant to our fairness opinion dated September 26, 2003 relating to the non-binding letter of intent between SourcinkgLink.net, Inc. (“SourcingLink” or the “Company”) and St. Cloud Investments Ltd. (“St. Cloud”), which provides for the issuance and sale in a private placement of 3,333,333 shares of SourcingLink’s common stock (the “Common Stock”) at $0.15 per share and a warrant to purchase up to an additional 366,667 shares of Common Stock at an exercise price of $0.15 per share (the “Private Placement”) to St. Cloud, a principal stockholder, we have reexamined our analyses, incorporating recent information concerning St. Cloud’s beneficial ownership of SourcingLink’s Common Stock prior to and after the proposed Private Placement. Based on the foregoing, the impact of these recent developments produced results that are, taken as a whole, immaterial to our prior analyses and conclusions.

Therefore, as of the date hereof, subject to all of the terms and conditions and assumptions of the fairness opinion dated September 26, 2003 (the “Private Placement Opinion”), we hereby confirm our opinion that the sale price per share of SourcingLink’s Common Stock to be issued in connection with the Private Placement is fair to SourcingLink and its stockholders from a financial point of view.

Very truly yours,

/s/ Friend + Company

FRIEND & COMPANY

|

35 |

| Appendix | CONFIDENTIAL |

|

Comparable Company Statistics

Comparable Company Market Statistics

(000’s)

(except per share data)

| Verticalnet VERT NASDAQ 30-Jun-03 |

QRS Corp QRSI NASDAQ 30-Jun-03 |

Commerce One NASDAQ 30-Jun-03 |

Freemarkets NASDAQ 30-Jun-03 |

Click Commerce NASDAQ 30-Jun-03 |

||||||||||||||||||||||||

| Company Ticker Symbol Exchange Operating Data: LTM as of |

Cyber Merchants NASDAQ 31-Mar-03 |

Global NASDAQ 30-Jun-03 |

||||||||||||||||||||||||||

| Revenue |

$ | 35,084 | $ | 126,874 | $ | 67,347 | $ | 151,817 | $ | 3,531 | $ | 87,526 | $ | 15,520 | ||||||||||||||

| Costs of Sales |

4,557 | 64,732 | 41,831 | 74,095 | 2,285 | 10,950 | 8,488 | |||||||||||||||||||||

| Gross Profit |

30,527 | 62,142 | 25,516 | 77,722 | 1,246 | 76,576 | 7,032 | |||||||||||||||||||||

| Research & Development |

4,640 | 12,707 | 50,582 | 27,662.00 | 0 | 5,324.00 | 2,685.00 | |||||||||||||||||||||

| S, G & A |

6,577 | 45,599 | 66,807 | 71,673 | 2,593 | 65,442 | 7,761 | |||||||||||||||||||||

| EBIT1 |

19,310 | 3,836 | (91,873 | ) | (21,613 | ) | (1,347 | ) | 5,810 | (3,414 | ) | |||||||||||||||||

| Interest Expense (Income), Net |

7,767 | (376 | ) | (3,209 | ) | (3,521 | ) | 201 | (784 | ) | (574 | ) | ||||||||||||||||

| Other Income (Loss) |

— | — | — | — | — | (246 | ) | 354 | ||||||||||||||||||||

| Earnings (Loss) Before Income Taxes |

11,543 | 4,212 | (88,664 | ) | (18,092 | ) | (1,548 | ) | 6,348 | (2,486 | ) | |||||||||||||||||

| Net Income |

$ | 28,486 | $ | 4,164 | ($ | 87,184 | ) | ($ | 18,965 | ) | ($ | 2,348 | ) | $ | 5,391 | ($ | 2,486 | ) | ||||||||||

| EPS |

$ | 1.73 | $ | 0.26 | ($ | 2.75 | ) | ($ | 0.45 | ) | ($ | 0.31 | ) | $ | 0.2 | ($ | 0.3 | ) | ||||||||||

| EBITDA |

24,203 | 14,575 | (63,605 | ) | (4,876 | ) | (1,319 | ) | 14,787 | (2,637 | ) | |||||||||||||||||

| EBITDA (%) |

69.0 | % | 11.5 | % | n/m | n/m | n/m | 16.9 | % | n/m | ||||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||||||||||

| Cash & Equivalents |

$ | 5,278 | $ | 34,183 | $ | 13,981 | $ | 119,490 | $ | 134 | $ | 47,343 | $ | 12,225 | ||||||||||||||

| Accounts Receivable, net |

1,510 | 15,541 | 5,138 | 22,660 | 483 | 3,865 | 4,656 | |||||||||||||||||||||

| Prepaids & Other |

2,702 | 2,925 | 7,134 | 7,638 | 982 | 4,963 | 1,043 | |||||||||||||||||||||

| Total Current Assets |

9,490 | 52,649 | 26,253 | 149,788 | 1,599 | 56,171 | 17,924 | |||||||||||||||||||||

| Fixed Assets, net |

353 | 8,441 | 5,307 | 14,656 | 12 | 11,038 | 1,112 | |||||||||||||||||||||

| Goodwill & Intangible, net |

1,350 | 9,282 | 17,381 | 4,465 | 689 | 0 | 466 | |||||||||||||||||||||

| Other Assets, net |

698 | 8,457 | 36,524 | 10,045 | 15 | 2,328 | 470 | |||||||||||||||||||||

| Total Assets |

11,891 | 78,829 | 85,465 | 178,954 | 2,315 | 69,537 | 19,972 | |||||||||||||||||||||

| Accounts Payable |

3,817 | 6,661 | 3,051 | 3,998 | 518 | 4,703 | 737 | |||||||||||||||||||||

| Accruals |

— | 9,670 | 2,924 | 4,752 | — | 5,885 | 3,222 | |||||||||||||||||||||

| Notes Payable, current |

115 | 832 | — | 1,428 | 40 | — | — | |||||||||||||||||||||

| Capital leases, current |

— | — | — | — | — | — | 327 | |||||||||||||||||||||

| Deferred Revenue |

352 | 2,338 | 17,205 | — | — | 20,224 | 4,958 | |||||||||||||||||||||

| Other |

1,266 | 6,331 | 13,816 | 18,642 | — | 546 | 1,473 | |||||||||||||||||||||

| Total Current Liabilities |

5,550 | 25,832 | 36,996 | 28,820 | 558 | 31,358 | 10,717 | |||||||||||||||||||||

| Capital leases, long term |

— | — | — | 0 | — | — | — | |||||||||||||||||||||

| L-T Debt |

728 | — | 25,000 | 438 | — | — | — | |||||||||||||||||||||

| Other |

— | 5,986 | 3,128 | 2,462 | — | 15,767 | 1,042 | |||||||||||||||||||||

| Total Liabilities |

6,278 | 31,818 | 65,124 | 31,720 | 558 | 47,125 | 11,759 | |||||||||||||||||||||

| Shareholders Equity |

5,613 | 47,011 | 20,341 | 147,234 | 1,756 | 22,412 | 8,213 | |||||||||||||||||||||

| Total Liabilities & Shareholders Equity |

$ | 11,891 | $ | 78,829 | $ | 85,465 | $ | 178,954 | $ | 2,315 | $ | 69,537 | $ | 19,972 | ||||||||||||||

| Investment in Working Capital 1 |

($ | 1,338 | ) | ($ | 7,366 | ) | ($ | 24,724 | ) | $ | 1,478 | $ | 906 | ($ | 22,530 | ) | ($ | 5,018 | ) | |||||||||

| Working Capital as a % of Sales |

-3.8 | % | -5.8 | % | -36.7 | % | 1.0 | % | 25.7 | % | -25.7 | % | -32.3 | % | ||||||||||||||

| Total Interest Bearing Debt 2 |

843 | 832 | 25,000 | 8,166 | 40 | — | 327 | |||||||||||||||||||||

| (1) | Excludes cash and short-term investments; represents those assets and liabilities spontaneously generated by the Company’s principal operations. |

| (2) | Total Interest Bearing Debt = Long-term debt plus current maturities plus liquidation preference of preferred stock. |

|

36 |

| Appendix | CONFIDENTIAL |

|

Comparable Company Statistics, cont.

Comparable Company Market Statistics, Cont.

(000’s)

(except per share data)

| Company Ticker Symbol Exchange Latest Twelve Months as of: |

Verticalnet VERT NASDAQ 30-Jun-03 |

QRS Corp QRSI NASDAQ 30-Jun-03 |

Commerce One CMRC NASDAQ 30-Jun-03 |

Freemarkets FMKT NASDAQ 30-Jun-03 |

Cyber Merchants CMEE NASDAQ 30-Jun-03 |

Global GSOL NASDAQ 30-Jun-03 |

Click CKCM NASDAQ 30-Jun-03 |

|||||||||||||||||||||

| Per Share Data: |

||||||||||||||||||||||||||||

| LTM Shares Outstanding (000’s) |

16,419 | 15,844 | 31,742 | 42,031 | 7,473 | 26,314 | 8,137 | |||||||||||||||||||||

| Earnings Per Share |

$ | 1.73 | $ | 0.26 | ($ | 2.75 | ) | ($ | 0.45 | ) | ($ | 0.31 | ) | $ | 0.20 | ($ | 0.31 | ) | ||||||||||

| Market Values & Share Price |

||||||||||||||||||||||||||||

| Market Value of Equity |

21,262 | 143,407 | 76,609 | 386,454 | 1,551 | 209,446 | 16,464 | |||||||||||||||||||||

| Closing prices as of Valuation |

$ | 1.28 | $ | 8.78 | $ | 2.42 | $ | 8.05 | $ | 0.23 | $ | 8.06 | $ | 2.08 | ||||||||||||||

| 20-Day Average Stock Price |

1.30 | 9.05 | 2.41 | 9.19 | 0.21 | 7.96 | 2.02 | |||||||||||||||||||||

| 52 Week Price Range |

||||||||||||||||||||||||||||

| High |

$ | 2.40 | $ | 9.79 | $ | 6.06 | $ | 9.86 | $ | 0.50 | $ | 11.10 | $ | 4.37 | ||||||||||||||

| Low |

$ | 0.60 | $ | 3.27 | $ | 1.37 | $ | 3.50 | $ | 0.20 | $ | 3.36 | $ | 0.98 | ||||||||||||||

| Daily Volume (12-week average) |

287,189 | 126,960 | 308,471 | 438,635 | 425 | 7,229 | 68,237 | |||||||||||||||||||||

| Daily Volume (10-day average) |

293,030 | 85,220 | 304,420 | 396,240 | 500 | 2,950 | 105,040 | |||||||||||||||||||||

| Enterprise Value |

||||||||||||||||||||||||||||

| Market Value of Equity |

$ | 21,262 | $ | 143,407 | $ | 76,609 | $ | 386,454 | $ | 1,551 | $ | 209,446 | $ | 16,464 | ||||||||||||||

| Total Interest bearing Debt |

843 | 832 | 25,000 | 8,166 | 40 | — | 327 | |||||||||||||||||||||

| Liquidation Preference of Preferred Stock |