At December 31, 2022, officers, employees of Sprott, Fund directors, and other affiliates owned approximately 48% of the Fund.

USE OF ESTIMATES:

The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses for the period. Actual results could differ from these estimates.

VALUATION OF INVESTMENTS:

Securities are valued as of the close of trading on the New York Stock Exchange (NYSE) (generally 4:00 p.m. Eastern time) on the valuation date. All exchange traded securities are valued using the last trade or closing sale price from the primary publicly recognized exchange. If no current closing sale price is available, the mean of the closing bid and ask price is used. If no current day price quotation is available, the previous business day’s closing sale price is used. Investments in open-end mutual funds such as money market funds are valued at the closing NAV. The Fund values its

non-U.S.

dollar denominated securities in U.S. dollars daily at the prevailing foreign currency exchange rates as quoted by a major bank. If events (e.g., market volatility, company announcement or a natural disaster) occur that are expected to materially affect the value of the Fund’s investment, or in the event that it is determined that valuation results in a price for an investment that is deemed not to be representative of the market value of such investment, or if a price is not available, the investment will be valued in accordance with the Adviser’s policies and procedures as reflecting fair value (“Fair Value Policies and Procedures”). U.S. GAAP defines fair value as the price a fund would receive to sell an asset or pay to transfer a liability in an orderly transaction between market participants at the measurement date. The Board of Directors of the Fund (the “Board”) has approved the designation of the Adviser of the Fund as the valuation designee for the Fund. If a security’s market price is not readily available or does not otherwise accurately represent the fair value of the security, the security will be valued in accordance with the Fair Value Policies and Procedures as reflecting fair value. The Adviser has formed a committee (the “Valuation Committee”) to develop pricing policies and procedures and to oversee the pricing function for all financial instruments.

The fair valuation approaches that may be used by the Valuation Committee include market approach, income approach and cost approach. Valuation techniques such as discounted cash flow, use of market comparables and matrix pricing are types of valuation approaches and are typically used in determining fair value. When determining the price for fair valued investments, the Valuation Committee seeks to determine the price that the Fund might reasonably expect to receive or pay from the current sale or purchase of that asset or liability in an arm’s-length transaction. Fair value determinations shall be based upon all available factors that the Valuation Committee deems relevant and consistent with the principles of fair value measurement.

Various inputs are used in determining the value of the Fund’s investments, as noted above. These inputs are summarized in the three broad levels below:

| – |

quoted prices in active markets for identical securities. |

| – |

other significant observable inputs (including quoted prices for similar securities, foreign securities that may be fair valued and repurchase agreements). |

2022 Annual Report to Stockholders

|

15

Sprott Focus Trust

Notes to Financial Statements (continued)

| – |

significant unobservable inputs (including last trade price before trading was suspended, or at a discount thereto for lack of marketability or otherwise, market price information regarding other securities, information received from the company and/or published documents, including SEC filings and financial statements, or other publicly available information). |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the Fund’s investments as of December 31, 2022 based on the inputs used to value them. For a detailed breakout of common stocks by sector classification, please refer to the Schedule of Investments.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

Common Stocks |

|

$ |

246,193,738 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

246,193,738 |

|

Repurchase Agreements |

|

|

— |

|

|

|

7,500,890 |

|

|

|

— |

|

|

|

7,500,890 |

|

Securities Lending Collateral |

|

|

840,210 |

|

|

|

— |

|

|

|

— |

|

|

|

840,210 |

|

Total |

|

$ |

247,033,948 |

|

|

$ |

7,500,890 |

|

|

$ |

— |

|

|

$ |

254,534,838 |

|

There were no transfers between levels for investments held at the end of the period.

COMMON STOCK:

The Fund invests a significant amount of assets in common stock. The value of common stock held by the Fund will fluctuate, sometimes rapidly and unpredictably, due to general market and economic conditions, perceptions regarding the industries in which the issuers of common stock held by the Fund participate or factors relating to specific companies in which the Fund invests.

REPURCHASE AGREEMENTS:

The Fund may enter into repurchase agreements with institutions that the Fund’s investment adviser has determined are creditworthy. The Fund restricts repurchase agreements to maturities of no more than seven days. Securities pledged as collateral for repurchase agreements, which are held until maturity of the repurchase agreements, are

daily and maintained at a value at least equal to the principal amount of the repurchase agreement (including accrued interest). Repurchase agreements could involve certain risks in the event of default or insolvency of the counter-party, including possible delays or restrictions upon the ability of the Fund to dispose of its underlying securities. The maturity associated with these securities is considered continuous.

FOREIGN CURRENCY:

Net realized foreign exchange gains or losses arise from sales and maturities of short-term securities, sales of foreign currencies, expiration of currency forward contracts, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities, including investments in securities at the end of the reporting period, as a result of changes in foreign currency exchange rates.

TAXES:

As a qualified regulated investment company under Subchapter M of the Internal Revenue Code, the Fund is not subject to income taxes to the extent that it distributes substantially all of its taxable income for its fiscal year.

The cost of total investments for Federal income tax purposes was $195,555,001. At December 31, 2022, net unrealized appreciation for all securities was $58,979,837, consisting of aggregate gross unrealized appreciation of $71,905,055 and aggregate gross unrealized depreciation of $(12,925,218).

16

|

2022 Annual Report to Stockholders

Sprott Focus Trust

Notes to Financial Statements (continued)

DISTRIBUTIONS:

The Fund pays quarterly distributions on the Fund’s Common Stock at the annual rate of 6% of the rolling average of the prior four calendar

quarter-end

NAVs of the Fund’s Common Stock, with the fourth quarter distribution being the greater of 1.5% of the rolling average or the distribution required by IRS regulations. Distributions are recorded on

ex-dividend

date and to the extent that distributions are not paid from long-term capital gains, net investment income or net short-term capital gains, they will represent a return of capital. Distributions are determined in accordance with income tax regulations that may differ from accounting principles generally accepted in the United States of America. Permanent book and tax differences relating to stockholder distributions will result in reclassifications within the capital accounts. Undistributed net investment income may include temporary book and tax basis differences, which will reverse in a subsequent period. Any taxable income or gain remaining undistributed at fiscal

year-end

is distributed in the following year.

INVESTMENT TRANSACTIONS AND RELATED INVESTMENT INCOME:

Investment transactions are accounted for on the trade date. Dividend income is recorded on the

ex-dividend

date.

Non-cash

dividend income is recorded at the fair market value of the securities received. Interest income is recorded on an accrual basis. Premium and discounts on debt securities are amortized using the effective

method. Realized gains and losses from investment transactions are determined on the basis of identified cost for book and tax purposes.

EXPENSES:

The Fund incurs direct and indirect expenses. Expenses directly attributable to the Fund are charged to the Fund’s operations, while expenses applicable to more than one fund managed by Sprott are allocated equitably.

COMPENSATING BALANCE CREDITS:

The Fund has an arrangement with its custodian bank, whereby a portion of the custodian’s fee is paid indirectly by credits earned on the Fund’s cash on deposit with the bank. This deposit arrangement is an alternative to purchasing overnight investments. Conversely, the Fund pays interest to the custodian on any cash overdrafts, to the extent they are not offset by credits earned (interest accrued) on positive cash balances. The amount of credits earned on the Fund’s cash on deposit amounted to $355 for the year ended December 31, 2022.

CAPITAL STOCK:

The Fund issued 889,667 and 1,636,302 shares of Common Stock as reinvestments of distributions for the years ended December 31, 2022 and December 31, 2021, respectively.

On November 20, 2020, as part of its evaluation of options to enhance shareholder value, the Board of Trustees (the “Board”) authorized Sprott to repurchase up to $50 million in aggregate purchase price of the currently outstanding shares of the Fund’s common stock through 2021. Under this share repurchase program, the Fund could purchase up to 5% of its outstanding common shares as of November 20, 2020, in the open market, until December 31, 2021. On June 4, 2021, the Board approved the purchase of an additional 5% of the Fund’s outstanding common shares, in the open market, until December 31, 2022. Board of Trustees reauthorized an additional 5% repurchase of shares for Sprott Focus Trust on June 3rd, 2022 until December 31, 2023. Any such repurchase would take place at the prevailing prices in the open market or in other transactions.

The following table summarizes the Fund’s share repurchases under its share repurchase program for the period ended December 31, 2022 and December 31, 2021:

|

|

|

|

|

|

|

|

|

| |

|

For year ended December 31,

2022 |

|

|

For year ended December 31,

2021 |

|

Dollar amount repurchased |

|

$ |

4,934,619 |

|

|

$ |

17,282,698 |

|

Shares repurchased |

|

|

563,212 |

|

|

|

2,099,831 |

|

Average price per share (including commission) |

|

$ |

8.68 |

|

|

$ |

8.29 |

|

Weighted average discount to NAV |

|

|

5.09 |

% |

|

|

9.89 |

% |

2022 Annual Report to Stockholders

|

17

Sprott Focus Trust

Notes to Financial Statements (continued)

INVESTMENT ADVISORY AGREEMENT:

The Investment Advisory Agreement between Sprott and the Fund provides for fees to be paid at an annual rate of 1.0% of the Fund’s average daily net assets. The Fund accrued and paid investment advisory fees totaling $2,566,845 to Sprott for the period ended December 31, 2022.

PURCHASES AND SALES OF INVESTMENT SECURITIES:

For the year ended December 31, 2022, the costs of purchases and proceeds from sales of investment securities, other than short-term securities, amounted to $49,332,788 and $65,000,565, respectively.

DISTRIBUTIONS TO STOCKHOLDERS:

The tax character of distributions paid to common stockholders during 2022 and 2021 were as follows:

|

|

|

|

|

|

|

|

|

DISTRIBUTIONS PAID FROM INCOME: |

|

2022 |

|

|

2021 |

|

Ordinary Income |

|

$ |

5,414,264 |

|

|

$ |

15,255,974 |

|

Long-term capital gain |

|

|

10,428,686 |

|

|

|

6,772,477 |

|

|

|

$ |

15,842,950 |

|

|

$ |

22,028,451 |

|

As of December 31, 2022, the tax basis components of distributable earnings included in stockholder’s equity were as follows:

|

|

|

|

|

Net unrealized appreciation (depreciation) |

|

$ |

58,989,398 |

|

Undistributed long-term capital gain |

|

|

839,510 |

|

|

|

$ |

59,828,908 |

|

As of December 31, 2022, the Fund did not have any post October capital or currency losses.

The difference between book and tax basis unrealized appreciation (depreciation) is attributable primarily to deferral of losses on wash sales, the realization for tax purposes of unrealized gains on investments in passive foreign investment companies, and

non-REIT

return of capital basis adjustments. For financial reporting purposes, capital accounts and distributions to stockholders are adjusted to reflect the tax character of permanent book and tax differences. Any permanent differences resulting from different book and tax treatment are reclassified at

year-end

and have no impact on net income, NAV or NAV per share to the fund. For the year ended December 31, 2022 there were no permanent differences requiring a reclassification between total distributable earnings (losses) and

paid-in

capital.

Management has analyzed the Fund’s tax positions taken on federal income tax returns for all open tax years

(2019-2022)

and has concluded that as of December 31, 2022, no provision for income tax is required in the Fund’s financial statements.

Lending of Portfolio Securities:

The Fund, using State Street Bank and Trust Company (“State Street”) as its lending agent, may loan securities to qualified brokers and dealers in exchange for negotiated lenders’ fees. The Fund receives cash collateral, which may be invested by the lending agent in short-term instruments. Collateral for securities on loan is at least equal to 102% (for loans of U.S. securities) or 105% (for loans of non-U.S. securities) of the market value of the loaned securities at the inception of each loan. The market value of the loaned securities is determined at the close of business of the Fund and any additional required collateral is delivered to the Fund on the next business day. As December 31, 2022, the cash collateral received by the Fund was invested in the State Street Navigator Securities Lending Government Money Market Portfolio, which is a 1940 Act registered money market fund. To the extent that advisory or other fees paid by the State Street Navigator Securities Lending Government Money Market Portfolio are for the same or similar services as fees paid by the Fund, there will be a layering of fees, which would increase expenses and decrease returns. Information regarding the value of the securities loaned and the value of the collateral at period end is included in the Schedule of Investments. The Fund could experience a delay in recovering its securities, a possible loss of income or value and record realized gain or loss on securities deemed sold due to a borrower’s inability to return securities on loan. These loans involve the risk of delay in receiving additional collateral in the event that the collateral decreases below the value of the securities loaned and the risks of the loss of rights in the collateral should the borrower of the securities experience financial difficulties.

18

|

2022 Annual Report to Stockholders

Sprott Focus Trust

Notes to Financial Statements (continued)

As of December 31, 2022, the Fund had outstanding loans of securities to certain approved brokers for which the Fund received collateral:

|

|

|

|

|

|

|

|

|

|

|

|

|

Market Value of Loaned

Securities |

|

Market Value of Cash

Collateral |

|

|

Market Value of Non Cash

Collateral |

|

|

Total Collateral |

|

| $22,277,825 |

|

$ |

840,210 |

|

|

$ |

22,067,000 |

|

|

$ |

22,907,210 |

|

The following table presents financial instruments, net of the related collateral received by the Portfolio as of December 31, 2022.

Gross Amounts Not Offset in the Statement of Assets and Liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross Asset Amounts Presented in Statement of Assets and Liabilities (a) |

|

Financial

Instrument |

|

|

|

|

|

Net Amount

(not less than $0) |

|

| $22,277,825 |

|

$ |

— |

|

|

$ |

(22,277,825 |

) |

|

$ |

— |

|

(a) |

Represents market value of loaned securities at year end. |

(b) |

The actual collateral received is greater than the amount shown here due to collateral requirements of the security lending agreement. |

All securities on loan are classified as Common Stock in the Fund’s Schedule of Investments as of December 31, 2022, with a contractual maturity of overnight and continuous.

Other information regarding the Fund is available in the Fund’s most recent Report to Stockholders. This information is available through Sprott Asset Management’s website (www.sprottfocustrust.com) and on the Securities and Exchange Commission’s website (www.sec.gov).

2022 Annual Report to Stockholders

|

19

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Directors of Sprott Focus Trust, Inc.

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of Sprott Focus Trust Inc., (the “Fund”), including the schedule of investments, as of December 31, 2022, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and financial highlights for each of the five years in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of December 31, 2022, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB. We have served as the Fund’s auditor since 1998.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of December 31, 2022 by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

February 27, 2023

20

|

2022 Annual Report to Stockholders

Fund’s Portfolio Management, Investment Objectives and Policies and Principal Risks (unaudited)

The following information in this annual report is a summary of certain changes since April 27, 2005. This information may not reflect all of the changes that have occurred since you purchased shares of the Fund.

W. Whitney George is the portfolio manager of the Fund. He has served as the portfolio manager of the Fund since 2000.

Royce & Associates, LLC served as investment adviser of the Fund from November 1, 1996 to March 6, 2015. After the close of business on March 6, 2015, Sprott Asset Management LP and Sprott Asset Management USA Inc. (the “Sub-Adviser”) became the investment adviser and investment sub-adviser, respectively, of the Fund.

Investment Objectives and Policies

The Fund’s primary investment goal is long-term capital growth.

The Fund normally invests at least 65% of its assets in equity securities. The Sub-Adviser uses a value approach to invest the Fund’s assets in a limited number of domestic and foreign companies. While the Fund is not restricted as to stock market capitalization, the Sub-Adviser focuses the Fund’s investments primarily in small-cap companies (companies with stock market capitalizations between $500 million and $2.5 billion) and micro-cap companies (companies with stock market capitalizations below $500 million) with significant business activities in the United States. Stock market capitalization is calculated by multiplying the total number of common shares issued and outstanding by the per share market price of the common stock.

The Fund may invest up to 35% of its assets in direct obligations of the U.S. Government or its agencies and in the non-convertible preferred stocks and debt securities of domestic and foreign companies.

The Sub-Adviser invests the Fund’s assets primarily in a limited number of companies selected using a value approach. While it does not limit the stock market capitalizations of the companies in which the Fund may invest, the Sub-Adviser has historically focused on small-cap and micro-cap equity securities.

The Sub-Adviser uses a value method in managing the Fund’s assets. In selecting equity securities for the Fund, the Sub-Adviser evaluates the quality of a company’s balance sheet, the level of its cash flows and various measures of a company’s profitability. The Sub-Adviser then uses these factors to assess the company’s current worth, basing this assessment on either what it believes a knowledgeable buyer might pay to acquire the entire company or what it thinks the value of the company should be in the stock market. This analysis takes a number of factors into consideration, including the company’s future growth prospects and current financial condition.

The Sub-Adviser invests in the equity securities of companies that are trading significantly below its estimate of the company’s “current worth” in an attempt to reduce the risk of overpaying for such companies. The Sub-Adviser’s value approach strives to reduce some of the other risks of investing in small-cap companies (for the Fund’s portfolio taken as a whole) by evaluating various other risk factors. The Sub-Adviser attempts to lessen financial risk by buying companies with strong balance sheets. While no assurance can be given that this risk-averse value approach will be successful, the Sub-Adviser believes that it can reduce some of the risks of investing in the securities of small-cap companies, which are inherently fragile in nature and whose securities have substantially greater market price volatility. Although the Sub-Adviser’s approach to security selection seeks to reduce downside risk to the Fund’s portfolio, especially during periods of broad small-cap market declines, it may also potentially have the effect of limiting gains in strong small-cap up markets.

Equity Securities Risk.

The price of equity securities may rise or fall because of changes in the broad market or changes in a company’s financial condition, sometimes rapidly or unpredictably. A stock or stocks selected for the Fund’s portfolio may fail to perform as expected. A value stock may decrease in price or may not increase in price as anticipated by the portfolio managers if other investors fail to recognize the company’s value or the factors that the portfolio managers believe will cause the stock price to increase do not occur.

2022 Annual Report to Stockholders

|

21

Fixed Income Securities.

Up to 35% of the Fund’s assets may be invested in direct obligations of the U.S. Government or its agencies and in non-convertible preferred stocks and debt securities of various domestic and foreign issuers, including up to 5% of its assets in below investment-grade debt securities, also known as high-yield/high-risk securities. There are no limits on the maturity or duration of the fixed income securities in which the Fund may invest.

Two of the main risks of investing in fixed income securities are credit risk and interest rate risk. Below investment-grade debt securities are primarily speculative and may entail substantial risk of loss of principal and non-payment of interest, but may also produce above-average returns for the Fund. Debt securities rated C or D may be in default as to the payment of interest or repayment of principal. As of the date of the financial statements, interest rates are near historical lows, which makes it more likely that they will increase in the future, which could, in turn, result in a decline in the market value of the fixed income securities held by the Fund.

Foreign Investments.

The Fund invests a portion of its assets in securities of foreign issuers. In most instances, investments will be made in companies principally based, or whose securities are traded in, the United States or the other developed countries of North America, Europe, Asia, Australia and New Zealand and not in emerging markets countries.

Foreign investments involve certain risks which typically are not present in securities of domestic issuers. There may be less information available about a foreign company than a domestic company; foreign companies may not be subject to accounting, auditing and reporting standards and requirements comparable to those applicable to domestic companies; and foreign markets, brokers and issuers are generally subject to less extensive government regulation than their domestic counterparts. Foreign securities may be less liquid and may be subject to greater price volatility than domestic securities. Foreign investments also may be subject to local economic and political risks which might adversely affect the Fund’s ability to realize on its investment in such securities. No assurance can be given that the Sub-Adviser will be able to anticipate these potential events or counter their effects.

The Fund does not expect to purchase or sell foreign currencies to hedge against declines in the U.S. dollar or to lock in the value of the foreign securities it purchases, and its foreign investments may be adversely affected by changes in foreign currency rates. Consequently, the risks associated with such investments may be greater than if the Fund did engage in foreign currency transactions for hedging purposes.

Income earned or

received

by the Fund from sources within foreign countries may be subject to withholding and other taxes imposed by such countries.

Limited Number of Portfolio Holdings.

The Fund generally invests a significant portion of its assets in a limited number of stocks, which may involve considerably more risk than a broadly diversified portfolio because a decline in the value of any one of these stocks would cause the Fund’s overall value to decline to a greater degree.

Sector Risk.

To the extent the Fund focuses its investments in securities of issuers in one or more sectors (such as the financial services or materials sectors), the Fund will be subject, to a greater extent than if its investments were diversified across different sectors, to the risks of volatile economic cycles and/or conditions and developments that may be particular to that sector, such as: adverse economic, business, political, environmental or other developments.

Securities Lending.

The Fund may lend up to 25% of its assets to brokers, dealers and other financial institutions. Securities lending allows the Fund to retain ownership of the securities loaned and, at the same time, to earn additional income. Since there may be delays in the recovery of loaned securities or even a loss of rights in collateral supplied should the borrower fail financially, loans will be made only to parties that participate in a global securities lending program organized and monitored by the Fund’s custodian and who are deemed by it to be of good standing. Furthermore, such loans will be made only if, in the Sub-Adviser’s judgment, the consideration to be earned from such loans would justify the risk.

Share Price Discount.

The Fund is a closed-end registered investment company whose shares of common stock may trade at a discount to their net asset value. Shares of the Fund’s common stock are also subject to the market risks of investing in the underlying portfolio securities held by the Fund.

Small/Mid-Cap Companies.

The Fund normally invests primarily in small/mid cap companies, which may involve considerably more risk than investing in larger-cap companies. Investments in securities of micro-cap, small-cap a

nd

/or mid-cap companies may involve considerably more risk than investments in s

ecuritie

s of larger-cap companies.

22

|

2022 Annual Report to Stockholders

Warrants, Rights or Options.

The Fund may invest up to 5% of its assets in warrants, rights or options. A warrant, right or call option entitles the holder to purchase a given security within a specified period for a specified price and does not represent an ownership interest in the underlying security. A put option gives the holder the right to sell a particular security at a specified price during the term of the option. These securities have no voting rights, pay no dividends and have no liquidation rights. In addition, market prices of warrants, rights or call options do not necessarily move parallel to the market prices of the underlying securities; market prices of put options tend to move inversely to the market prices of the underlying securities.

2022 Annual Report to Stockholders

|

23

Directors and Officers

(Unaudited)

All Directors and Officers may be reached c/o Sprott Asset Management LP, 200 Bay Street, Suite 2600, Toronto, Ontario, Canada M5J 2J1.

W. Whitney George, Director

1

, Senior Portfolio Manager

Year of Birth: 1958 | Number of Funds Overseen: 1 | Tenure: Director since 2013; Term expires 2024 | Other Directorships: None

Principal Occupation(s) During Past Five Years:

Chief Executive Officer of Sprott Inc. since June 2022; President of Sprott Inc. from January 2019 to June 2022; Executive Vice President of Sprott Inc. from January 2016 to January 2019; Chief Investment Officer of Sprott Asset Management, LP, a registered investment adviser, since April 2018; Senior Portfolio Manager since March 2015 and Chairman since January 2017, Sprott Asset Management USA Inc.

Michael W. Clark, Director

Year of Birth: 1959 | Number of Funds Overseen: 5 | Tenure: Director since 2015; Term expires 2022 | Other Directorships: None

Principal Occupation(s) During Past Five Years:

President, Chief Operating Officer, Chief Risk Officer, Head of Executive Committee, and member of Board of Directors of Chilton Investment Company since 2005.

Peyton T. Muldoon, Director

Year of Birth: 1969 | Number of Funds Overseen: 5 | Tenure: Director since 2017; Term expires 2023 | Other Directorships: None

Principal Occupation(s) During Past 5 Years:

Licensed salesperson, Sotheby’s International Realty, a global real estate brokerage firm since 2011.

Leslie Barrett, Director

Year of Birth: 1965 | Number of Funds Overseen:

5 | Tenure: Director since 2022; Term expires 2022 | Other Directorships: None

Principal Occupations During past 5 years:

Senior Software Engineer at Bloomberg LP specializing in Natural Language Processing and Machine Learning since 2012.

James R. Pierce, Jr., Director

Year of Birth: 1956 | Number of Funds Overseen: 5 | Tenure: Director since 2015; Term expires 2024 | Other Directorships: None

Principal Occupation(s) During Past Five Years:

Chairman of JLT Specialty Insurance Services, Inc. since September, 2014.

Thomas W. Ulrich, President, Secretary, Chief Compliance Officer

Year of Birth: 1963 | Tenure: Since 2015

Principal Occupation(s) During Past Five Years:

Managing Director, Sprott Inc. group of companies (since January 2018); General Counsel and Chief Compliance Officer of Sprott Asset Management USA Inc. (since October, 2012); In-House Counsel and Chief Compliance Officer of Sprott Global Resource Investments Ltd. (since October, 2012).

Varinder Bhathal, Treasurer

Year of Birth: 1971 | Tenure: since 2017

Principal Occupation(s) During Past 5 Years:

Chief Financial Officer of Sprott Asset Management LP since Dec 2018;

Managing Director, Corporate Finance and Investment Operations of Sprott Inc. since Oct 2017; Chief Financial Officer of Sprott Capital Partners since Oct 2016; Vice President, Finance of Sprott Inc. Dec 2015 to Oct 2017.

1 |

Mr. George is an “interested person”, as defined in Section 2(a)(19) of the 1940 Act, of the Fund due to several relationships including his position as President of Sprott, Inc., the parent company of Sprott Asset Management USA Inc., the Fund’s sub-adviser. |

The Statement of Additional Information has additional information about the Fund’s Directors and is available without charge, upon request, by calling (203) 656-2340.

24

|

2022 Annual Report to Stockholders

Board Approvals of Investment Advisory and Subadvisory Agreements

(Unaudited)

Board Approval of Investment Advisory and Sub-Advisory

Agreements for Sprott Focus Trust, Inc.

The Board of Directors (the “Board”) of Sprott Focus Trust, Inc. (the “Fund”) met in person at a regularly scheduled meeting on June 3, 2022, in Watch Hill, Rhode Island, for purposes of, among other things, considering whether it would be in the best interests of the Fund and its stockholders for the Board to approve the existing Investment Advisory Agreement by and between the Fund and Sprott Asset Management L.P. (the “Adviser”) and the existing Investment

Sub-Advisory Agreement

by and among the Fund, the Adviser, and Sprott Asset Management USA Inc. (the

“Sub-Adviser”)

(the

“Sub-Advisory

Agreement” and, together with the Investment Advisory Agreement, the “Agreements”).

In connection with the Board’s review of the Agreements, the directors who were not “interested persons” of the Fund within the meaning of the Investment Company Act of 1940, as amended (the “1940 Act”) (collectively, the “Independent Directors”) requested, and the Adviser and

Sub-Adviser

(together, the “Advisers”) provided the Board with, information about a variety of matters, including, without limitation, the following information:

| |

• |

|

nature, extent and quality of services to be provided by the Advisers, including background information on the qualifications and experience of key professional of the Advisers personnel that provide services to the Fund; |

| |

• |

|

investment performance of the Fund, including comparative performance information for registered investment companies similar to the Fund; |

| |

• |

|

fees charged to and expenses of the Fund, including comparative fee and expense information for registered investment companies similar to the Fund; |

| |

• |

|

costs of the services provided, and profits realized by the Advisers; |

| |

• |

|

and economies of scale. |

In connection with the Board’s review of the Agreements, the Independent Directors considered the matters set forth above along with the following information:

| |

• |

|

Whitney George’s long portfolio management tenure with the Fund and its historical investment performance; |

| |

• |

|

Mr. George’s significant ownership and, thus, stake in the Fund; and |

| |

• |

|

the Advisers’ experience in managing pooled investment vehicles and accounts. |

At the June 3, 2022 meeting, the Board and the Independent Directors determined that the continuation of the Agreements was in the best interests of the Fund in light of the services, personnel, expenses and such other matters as the Board considered to be relevant in the exercise of its reasonable business judgment and approved them.

To reach this determination, the Board considered its duties under the 1940 Act as well as under the general principles of state law in reviewing and approving advisory contracts; the fiduciary duty of investment advisers with respect to advisory agreements and the receipt of investment advisory compensation; the standards used by courts in determining whether investment company boards have fulfilled their duties; and the factors to be considered by the Board in voting on such agreements. To assist the Board in its evaluation of each of the Agreements, the Independent Directors received materials in advance of the Board meeting from the Advisers. The Independent Directors also met with Mr. George. The Board applied its business judgment to determine whether the arrangements by and among the Fund, SAM and SAM USA are reasonable business arrangements from the Fund’s perspective as well as from the perspective of its stockholders.

Nature, Extent and Quality of Services Provided by SAM and SAM USA

The Board considered the following factors to be of fundamental importance to its consideration of the nature, extent and quality of services provided by the Advisers: (i) Mr. George’s long tenure as the portfolio manager of the Fund; (ii) Mr. George’s value investing experience and related track record; (iii) background information on the qualifications and experience of the Advisers’ senior management and the key professional personnel that provide services to the Fund; (iv) the Advisers’ experience in managing pooled investment vehicles and accounts and its related organizational capabilities; and (v) the financial soundness of Sprott Inc., each Adviser’s ultimate parent company. The Board noted and took into account how well both the Adviser

and Sub-Adviser continued

to operate, with no diminishment of services, during the ongoing

COVID-19 crisis.

The Board noted that the Adviser, together with the

Sub-Adviser,

provided compliance services, research, trade execution, operations, risk monitoring, settlement, and service provider monitoring for the Fund. The Board discussed the allocation of responsibilities between the Adviser

and Sub-Adviser, noting

that portfolio management was delegated to

the Sub-Adviser and

the Adviser retained oversight responsibilities. The Board concluded that each Adviser had sufficient quality and depth of personnel, resources, investment methods and compliance policies and procedures essential to continue performing its duties under the Agreements and that the nature, overall quality and extent of the management services provided by the Advisers to the Fund were satisfactory.

Investment Performance

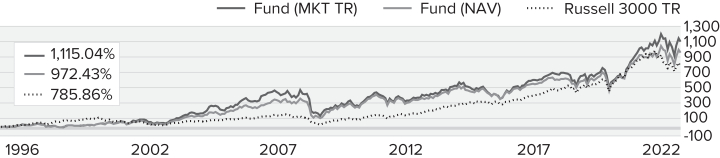

The Board considered that for

the one-year period

ended December 31, 2021, the Fund returned 22.93%, slightly

2022 Annual Report to Stockholders

|

25

Board Approvals of Investment Advisory and Subadvisory Agreements

(Unaudited) (continued)

underperforming the Russell 3000 Index (its benchmark index) and peer group, and the Fund’s Morningstar/Lipper/Strategic Insight category. The Board noted that since-inception (on November 1, 1996), the Fund had very slightly underperformed its benchmark index and outperformed the Morningstar/Lipper/Strategic Insight category and peer group, and returned 9.88%. For the five and

ten-year

periods, the Fund underperformed its benchmark index, peer group and Morningstar/Lipper/Strategic Insight category. The Board discussed the differences between the holdings in the Fund’s portfolio and the components of the Russell 3000 Index.

Although the Board recognized that past performance was not necessarily an indicator of future results, it found that Mr. George, SAM, and SAM USA had the necessary qualifications, experience and track record to manage the Fund. In light of the foregoing, the Independent Directors determined that SAM continued to be the appropriate investment adviser for the Fund and that SAM USA continue to be the appropriate

investment sub-adviser for

the Fund.

Fees and Expenses

The Board considered that the advisory fee payable to the Adviser was 1.00%, and the net expense ratio for the Fund was 1.12%. The Board noted that both the advisory fee was above the peer group averages and the expense ratio was below the peer group averages. The Board noted that

the Sub-Adviser did

not receive any separate advisory fee from the Fund or the Adviser. After further discussion, the Board concluded that the fees collected by the Adviser for managing the Fund and overseeing

the Sub-Adviser were

not unreasonable.

Profitability

The Board reviewed the profitability analysis provided by the Adviser with respect to its management of the Fund. The Board considered that no fees or expenses were allocated to

the Sub-Adviser,

an entity affiliated and under the common control with the Adviser, and as such, the Board did not separately analyze the

Sub-Adviser’s

profitability. The Board noted that the Adviser earned a profit from managing the Fund over the past year. The Board discussed that the profit was not unreasonable when considering the resources devoted to implementing the Fund’s investment strategy, and the quality of the Fund’s personnel.

Economies of Scale

The Board considered the existence of any economies of scale in the provision of services by the Advisers and whether those economies were shared with the Fund through breakpoints in its management fees or other means, such as expense caps or fee waivers. The Board

noted that the assets of the Fund were too small to meaningfully consider economies of scale and the necessity of breakpoints. The Board concluded that the current fee structure for the Fund was reasonable and that no changes were currently necessary.

Conclusion

It was noted that no single factor was cited as determinative to the decision of the Directors. Rather, after weighing all of the considerations and conclusions discussed above, the entire Board, including all of the Independent Directors, approved the Investment Advisory Agreement and

the Sub-Advisory Agreement,

concluding that having the Fund continue to receive services from the Advisers under the Agreements was in the best interest of the stockholders of the Fund and that the investment advisory fee rate was reasonable in relation to the services provided.

26

|

2022 Annual Report to Stockholders

Notes to Performance and Other Important Information

(Unaudited)

The thoughts expressed in this report concerning recent market movement and future outlook are solely the opinion of Sprott at December 31, 2022 and, of course, historical market trends are not necessarily indicative of future market movements. Statements regarding the future prospects for particular securities held in the Fund’s portfolio and Sprott’s investment intentions with respect to those securities reflect Sprott’s opinions as of December 31, 2022 and are subject to change at any time without notice. There can be no assurance that securities mentioned in this report will be included in the Fund in the future. Investments in securities of micro-cap, small-cap and/or mid-cap companies may involve considerably more risk than investments in securities of larger-cap companies. All publicly released material information is always disclosed by the Fund on the website at www.sprottfocustrust.com.

Sector weightings are determined using the Global Industry Classification Standard (“GICS”). GICS was developed by, and is the exclusive property of, Standard & Poor’s Financial Services LLC (“S&P”) and MSCI Inc. (“MSCI”). GICS is the trademark of S&P and MSCI. “Global Industry Classification Standard (GICS)” and “GICS Direct” are service marks of S&P and MSCI.

All indexes referred to are unmanaged and capitalization weighted. Each index’s returns include net reinvested dividends and/or interest income. Russell Investment Group is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell

®

is a trademark of Russell Investment Group. The Russell 3000 Index measures the performance of the largest 3,000 U.S. companies representing approximately 98% of the investable U.S. equity market. The Russell 3000 Index is constructed to provide a comprehensive, unbiased and stable barometer of the broad market and is completely reconstituted annually to ensure new and growing equities are reflected. The performance of an index does not represent exactly any particular investment, as you cannot invest directly in an index. Returns for the market indexes used in this report were based on information supplied to Sprott by Russell Investments.

The Price-Earnings, or P/E, Ratio is calculated by dividing a fund’s share price by its trailing 12-month earnings-per share (EPS). The Price-to- Book, or P/B, Ratio is calculated by dividing a fund’s share price by its book value per share. The Sharpe Ratio is calculated for a specified period by dividing a fund’s annualized excess returns by its annualized standard deviation. The higher the Sharpe Ratio, the better the fund’s historical risk-adjusted performance. Standard deviation is a statistical measure within which a fund’s total returns have varied over time. The greater the standard deviation, the greater a fund’s volatility.

Sprott Focus Trust

Sprott Focus Trust