UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For

the fiscal year ended

For the transition period from ___ to ___

OR

Date of event requiring this shell company report: _______

Commission

file number

(Exact name of Registrant as specified in its charter)

(Jurisdiction of Incorporation or organization)

(Address of principal executive offices)

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

| Common Stock, Fully Paid and Non-Assessable Common Shares Without Par Value | ||

| (Title of Class) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

| (Title of Class) |

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report: common shares as of December 31, 2022. No preferred shares issued and outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes

☐

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past ninety days.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Emerging growth company |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:☐

| U.S. GAAP ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

| Item 17 ☐ | Item 18 ☐ |

If this is an Annual Report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act.)

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (s 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

| 1 |

37 CAPITAL INC.

FORM 20-F ANNUAL REPORT 2022

TABLE OF CONTENTS

| ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | 3 |

| ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE | 3 |

| ITEM 3. KEY INFORMATION | 3 |

| ITEM 4. INFORMATION ON THE COMPANY | 7 |

| ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 15 |

| ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 21 |

| ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 24 |

| ITEM 8. FINANCIAL INFORMATION | 28 |

| ITEM 9. THE OFFER & LISTING | 29 |

| ITEM 10. ADDITIONAL INFORMATION | 33 |

| ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 42 |

| ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 43 |

| ITEM 13. DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 43 |

| ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | 43 |

| ITEM 15. CONTROLS AND PROCEDURES | 43 |

| ITEM 16. AUDIT COMMITTEE, CODE OF ETHICS, ACCOUNTANT FEES. | 44 |

| ITEM 17. FINANCIAL STATEMENTS | 45 |

| ITEM 18. FINANCIAL STATEMENTS | 45 |

| ITEM 19. LIST OF EXHIBITS | 46 |

| SIGNATURE PAGE | 82 |

| 2 |

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

| Name of Directors and/or Officers of the Issuer | Position Held as at the date of this Annual Report |

| Jacob H. Kalpakian, Vancouver, British Columbia, Canada | President, CEO and Director |

| Neil Spellman*, Carlsbad, CA, USA | CFO & Director |

Bedo H. Kalpakian*1, Delta, British Columbia, Canada |

Director |

| Gregory T. McFarlane*, Washington, Utah, USA | Director |

| Maria P. Arenas, Surrey, British Columbia, Canada | Corporate Secretary |

*Members of the Audit Committee

1Bedo Kalpakian was appointed to the Board of Directors on May 25, 2021

Fred Tejada stepped down from the Board of Directors on May 1, 2021.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

Item 3.A. Selected Financial Data

The selected financial data in Table I has been derived from the audited financial statements of 37 Capital Inc. (hereinafter referred to as the “Company” or the “Registrant” or “37 Capital”). The financial data under 2022, 2021, 2020, 2019 and 2018 have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”). The information should be read in conjunction with the Registrant's financial statements and notes thereto included in Item 17 of this Annual Report.

All financial figures presented herein and throughout this Annual Report are expressed in Canadian dollars (Cdn$) unless otherwise specified. All common shares and per share amounts included in this Annual Report on Form 20-F (2022) have been restated to give retroactive effect to the 5:1 share consolidation, which took effect on June 20, 2021 as further described in Results of Operations in Item 4.(a) of this document.

TABLE I

The financial data under the tables 2022, 2021, 2020, 2019 and 2018 have been prepared in accordance with IFRS.

Year Ended December 31, 2022 | Year Ended December 31, 2021 | Year Ended December 31, 2020 | Year Ended December 31, 2019 | Year Ended December 31, 2018 | ||||||||||||||||

| Operating Revenue | $ | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| Interest Income | $ | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| Comprehensive loss | $ | (125,036 | ) | (1,044,863 | ) | (133,379 | ) | (147,137 | ) | (160,856 | ) | |||||||||

| Basic and diluted loss per common share before other items | $ | (0.03 | ) | (0.24 | ) | (0.09 | ) | (0.10 | ) | (0.12 | ) | |||||||||

| Total Assets | $ | 55,683 | 2,113 | 40,573 | 33,180 | 2,960 | ||||||||||||||

| Capital Stock | $ | 27,536,269 | 27,511,269 | 25,864,950 | 25,857,450 | 25,849,950 | ||||||||||||||

| Number of common shares at year-end | 5,745,947 | 4,495,947 | 1,458,542 | 1, 438,542 | 1,418,542 | |||||||||||||||

| Long-term obligations | $ | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| Cash dividends | $ | 0 | 0 | 0 | 0 | 0 | ||||||||||||||

| 3 |

Bank of Canada Exchange Rates

| Monthly High ($)(1) | Monthly Low ($)(1) | ||||||||

| July 2022 | 0.7798 | 0.7612 | |||||||

| August 2022 | 0.7841 | 0.7627 | |||||||

| September 2022 | 0.7704 | 0.7285 | |||||||

| October 2022 | 0.7382 | 0.7217 | |||||||

| November 2022 | 0.7526 | 0.7273 | |||||||

| December 2022 | 0.7444 | 0.7306 | |||||||

(1) The high and low exchange rates have been calculated using the rates of the Bank of Canada.

| For Year Ended December 31, 2022 | For Year Ended December 31, 2021 | For Year Ended December 31, 2020 | For Year Ended December 31, 2019 | For Year Ended December 31, 2018 | |||||||||||||||||

| Average rate ($)(2) | 0.7692 | 0.7980 | 0.7461 | 0.7560 | 0.7446 | ||||||||||||||||

| High ($)(3) | 0.8031 | 0.8306 | 0.7863 | 0.7699 | 0.7581 | ||||||||||||||||

| Low ($)(3) | 0.7217 | 0.7727 | 0.6898 | 0.7393 | 0.7330 | ||||||||||||||||

(2)The average exchange rate for the period has been calculated using the yearly rate of the Bank of Canada.

(3)The high and low exchange rates in each period were determined from the yearly rate of the Bank of Canada.

All of the amounts in the Exchange rates tables above are stated in U.S. currency. Accordingly, at the closing on December 31, 2022, the US $1.00 was equal to Cdn $1.3544.

Item 3.D. Risk Factors

The Company and the Securities of the Company, should be considered a highly speculative investment. The following risk factors should be given special consideration when evaluating an investment in any of the Company's Securities:

1) RISKS RELATED TO THE COMPANY’S BUSINESS

- Regulations: Mineral exploration programs are subject to extensive federal, provincial and local laws and regulations governing such exploration, development and operation of mining activities as well as the protection of the environment, including laws and regulations relating to obtaining permits to mine, protection of air and water quality, hazardous waste management, mine reclamation and the protection of endangered or threatened species.

- Exploration and Development: The resource properties in which the Company has an interest are in the exploration stages only and do not have a known body of commercial ore. Exploration and development of natural resource properties involve a high degree of risk and few properties which are explored are ultimately developed into producing properties. Substantial expenditures are required to establish reserves through drilling, to develop processes to extract the resources and, in the case of new properties, to develop the extraction and processing facilities and infrastructure at any site chosen for extraction. Although substantial benefits may be derived from the discovery of a major deposit, no assurance can be given that resources will be discovered in sufficient quantities or grades to justify commercial operations or that the funds required for development can be obtained on a timely basis.

| 4 |

- Operating Hazards and Risks: Exploration for natural resources involves many risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome.

- Fluctuating Metal Prices: The prices of those commodities have fluctuated widely, particularly in recent years, and are affected by numerous factors beyond the Company's control including international, economic and political trends, expectations of inflation or deflation, currency exchange rate fluctuations, interest rates fluctuations, global or regional consumptive patterns, speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors on the prices of metals determines the economic viability of exploration projects, which cannot be accurately predicted.

- Environmental Factors: Should the Company decide to conduct any mineral exploration work then all phases of the Company's mineral exploration work shall be subject to environmental regulations. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees.

- Competition: The resource industry is intensely competitive in all of its respective phases, and the Company competes with many companies possessing much greater financial resources and technical facilities than the Company. As such, competition is adversely affecting the Company's ability to acquire suitable mineral exploration properties at reasonable prices.

- Management: The Company is dependent on a relatively small number of key employees, the loss of any of whom could have an adverse effect on the Company.

- Dilution: There are a number of outstanding securities and agreements pursuant to which common shares of the Company may be issued in the future. This will result in further dilution to the Company's shareholders.

- Revenues and Dividends: The Company does not anticipate to generate any revenue in the future and has not recognized any revenue in fiscal 2018, 2019, 2020, 2021 and 2022. In the event that the Company generates any revenues in the future, then the Company intends to retain its earnings in order to finance growth. Furthermore, apart from the Arrangement Agreement, the Company has not paid any dividends in the past and does not expect to pay any dividends in the future.

- Requirement of New Capital: As a company without any revenues, the Company typically needs more capital than it has available to it or can expect to generate through the sale of its assets. In the past, the Company has had to raise, by way of debt and equity financings, considerable funds to meet its capital needs. There is no assurance that the Company will be able to continue to raise funds needed for its business. Failure to raise the necessary funds in a timely fashion will limit the Company's growth or may jeopardize the Company’s ability to continue as a going concern. The Company has outstanding debts, has working capital deficiency, has no revenues, has incurred operating losses, and has no assurances that sufficient funding will be available to the Company to continue its operations for an extended period of time.

- U.S. Federal Income Tax Considerations: The Company is classified as a Passive Foreign Investment Company ("PFIC") for U.S. Federal Income Tax purposes. Classification as a PFIC will create U.S. Tax consequences to a U.S. shareholder of the Company that are unique to the PFIC provisions and that are not encountered in other investments. Prospective investors are advised to consult their own tax advisors with respect to the tax consequences of an investment in the common shares of the Company.

| 5 |

- Penny Stock: The Company's securities are deemed to be Penny Stocks and are therefore subject to Penny Stock rules as defined in Rule 3a(51)(1) of the 1934 Exchange Act. The Penny Stock disclosure requirements may have the effect of reducing the level of trading activity of the Company's securities in the secondary market. Penny Stocks are low-priced shares of small companies not traded on a U.S. national exchange or quoted on Nasdaq. The Company's securities were quoted for trading on the OTCQB tier of the OTC Markets Group (“OTCQB”) until June 1, 2020. Presently, the Company’s securities are quoted on the PINK Sheets on the OTC market. Penny Stocks, such as the Company's securities, can be very risky. Prices of Penny Stocks are often not available. Investors in Penny Stocks are often unable to sell stock back to the dealer that sold them the stock. Investors may lose all their investment in Penny Stocks. There is no guaranteed rate of return on Penny Stocks. Before an investor purchases any Penny Stock, U.S. Federal law requires a salesperson to tell the investor the "offer" and the "bid" on the Penny Stock, and the "compensation" the salesperson and the firm receive for the trade. The firm also must mail a confirmation of these prices to the investor after the trade. The Investor's Broker-dealer is required to obtain the investor's signature to show that the investor has received the statement titled "Important Information on Penny Stocks" before the investor first trades in a Penny Stock. This Statement is required by the U.S. Securities and Exchange Commission ("SEC") and contains important information on Penny Stocks. Furthermore, under penalty of Federal Law the Investor's brokerage firm must tell the investor at two different times - before the investor agrees to buy or sell a Penny Stock, and after the trade, by written confirmation the following: 1) the bid and offer price quotes for the Penny Stock, and the number of shares to which the quoted prices apply, 2) the brokerage firm's compensation for the trade, 3) the compensation received by the brokerage firm's salesperson for the trade. In addition, to these items listed above the investor's brokerage firm must send the investor monthly account statements and a written statement of the investor's financial situation and investment goals as required by the Securities Enforcement and Penny Stock Reform Act of 1990.

- Disruption in Trading: Trading in the common shares of the Company may be halted or suspended or may be subject to cease trade order at any time for certain reasons, including, but not limited to, the failure by the Company to submit documents to the Regulatory Authorities within the required time periods.

- Market Price Volatility: The market price of the Company’s common shares has experienced considerable volatility and may continue to fluctuate in the future. Furthermore, there is a limited trading market for the Company’s common shares and as such, the ability of investors to sell their shares cannot be assured.

- Covid-19 Pandemic - In March 2020, the World Health Organization declared a global pandemic related to the coronavirus known as COVID-19. To date there have been significant wide-spread adverse financial impact globally. The novel strains of coronavirus have caused and are continuing to cause disruptions globally. As the Company has no material operating income or cash flows, it is reliant on additional financing to fund its ongoing operations. An extended disruption that may be caused by the novel strains of coronavirus can affect the Company’s ability to obtain additional financing. As such, the Company may not be able to raise the required funds and may not be able to conduct exploration works on its Extra High mineral property in a timely manner. The impact on the Company is not yet determinable; however, the Company’s financial position, results of operations and cash flows in future periods can be materially affected. In particular, there may be heightened risk of asset impairment and liquidity thus creating further going concern uncertainty.

- Tax Considerations – Persons considering the purchase of the Company’s common shares should consult their tax advisors with regard to the application of Canadian, U.S. and other tax laws to their particular situation.

- Investment in Mexican Gaming Company: The Company has determined that it will not recover its investment in the Mexican gaming company, as a result the Company has written-off its investment in the Mexican gaming company.

- The Company’s investment in its mineral exploration property: Changing conditions in the financial markets, and Canadian Income Tax legislation may have a direct adverse impact on the Company’s ability to raise funds for its Extra High mineral exploration property. A drop in the availability of equity financings will likely impede spending on mineral properties. As a result of all these significant risks, it is quite possible that the Company shall lose its investment in the Company’s Extra High mineral exploration property.

| 6 |

ITEM 4. INFORMATION ON THE COMPANY

Item 4.A. History and Development of the Company

The Company was incorporated by memorandum under the Company Act of the Province of British Columbia, Canada on August 24, 1984 (Exhibit 3.1 – Incorporated by reference) and was registered extra-provincially in the Province of Ontario, Canada on October 19, 1984. On May 31, 1988, the Company adopted the French form of its name to "Ressources Armeno Inc.". On May 25, 1992, the name of the Company was changed to “Ag Armeno Mines and Minerals Inc”. in the English form, and "Les Mines et Mineraux Ag Armeno Inc." in the French form. On April 25, 2000, the name of the Company was changed from “Ag Armeno Mines and Minerals Inc”. in the English form, and "Les Mines et Mineraux Ag Armeno Inc.", in the French form, to “Golden Nugget Exploration Inc”. On May 2, 2002, the name of the Company was changed from “Golden Nugget Exploration Inc.” to “Lucky 1 Enterprises Inc.” On January 17, 2005, the name of the Company was changed to “Bronx Ventures Inc”. and the Company adopted new Articles (Exhibit 3.2 - Incorporated by reference). On March 19, 2007, the Company changed its name to “Zab Resources Inc”. On April 16, 2009, the Company changed its name to “Kokomo Enterprises Inc”. On August 31, 2012, the Company changed its name to “High 5 Ventures Inc.” (Exhibit 3.5 – Incorporated by reference). On July 7, 2014, the Company changed its name to 37 Capital Inc. (see Exhibit 3.6 – Incorporated by reference).

On April 4, 1985, the Company's common shares were listed and posted for trading on the Vancouver Stock Exchange, on the Montreal Exchange on January 15, 1988 and, on the Nasdaq SmallCap Market on May 11, 1988. On July 12, 1991, the Company voluntarily de-listed its common shares from the Montreal Exchange, and, on October 3, 1994, the Company's shares were delisted from the Nasdaq SmallCap Market. Effective October 4, 1994, the Company's shares have been listed for trading on the OTC Bulletin Board and were listed for trading on the OTCQB tier of the OTC Markets Group Inc. (“OTCQB) until June 1, 2020. Presently, the Company’s shares are listed for trading on the PINK Sheets on the OTC Markets. Effective November 29, 1999 the Vancouver Stock Exchange became known as the Canadian Venture Exchange (hereinafter referred to as the “CDNX”) as a result of the merger between the Vancouver Stock Exchange and the Alberta Stock Exchange. On July 5, 2001, the Company made a formal application to the CDNX requesting the voluntary delisting of the Company’s common shares from trading on the CDNX, as a result of which, the common shares of the Company were delisted from trading on the CDNX effective at the close of trading on July 31, 2001.

On July 30, 1986, the Company's share capital split on the basis of one-old-for-two-new common shares. On May 25, 1992, the Company's share capital was consolidated on the basis of ten-old-for-one-new common share. On April 25, 2000, the Company’s share capital was consolidated on the basis of fifteen-old-for-one-new common share. On May 2, 2002, the Company’s share capital was consolidated on the basis of five-old-for-one-new common share and its authorized share capital was subsequently increased to 200,000,000 common shares without par value. On January 17, 2005, the Company’s share capital was consolidated on the basis of thirty-five-old-for-one-new common share and its authorized share capital was increased to an unlimited number of common and preferred shares without par value. On March 19, 2007, the Company subdivided its capital stock on a 1 (old) share for 50 (new) shares basis. As a result, the shares of Bronx Ventures Inc. were de-listed from trading and the shares of Zab Resources Inc. (“Zab”) commenced trading on March 22, 2007 on the OTC Bulletin Board in the USA under the symbol “ZABRF”.

As of November 28, 2007, the common shares of the Company have been listed for trading on the Canadian Securities Exchange (“CSE”) (formerly known as the Canadian National Stock Exchange (CNSX)) under the trading symbol “ZABK”. On October 17, 2008, the Company’s trading symbol on the CSE was changed to “ZAB” pursuant to the CSE adopting a three character symbol format.

On April 16, 2009, the Company’s share capital was consolidated on the basis of 25 (old) shares for 1 (new) share and the Company changed its name to Kokomo Enterprises Inc. (“Kokomo”). As a result, the shares of Zab were de-listed from trading and the shares of Kokomo commenced trading in Canada on the CSE under the symbol “KKO”, and in the U.S.A. the shares of Kokomo commenced trading on the OTC Bulletin Board under the symbol “KKOEF”.

On August 31, 2012, the Company’s share capital was consolidated on the basis of 15 (old) common shares for 1 (new) common share and the Company changed its name to High 5 Ventures Inc. (“High 5”). As a result, the shares of Kokomo were de-listed from trading and the shares of High 5 commenced trading in Canada on the CSE under the symbol “HHH”, and in the U.S.A. the shares of High 5 traded on the OTCQB under the symbol “HHHEF”. The Cusip number of the Company’s common shares is 42966V105.

| 7 |

On April 8, 2013, the Company entered into a purchase and sale agreement with a Mexican gaming company, whereby the Company agreed to purchase a royalty revenue stream of an amount the greater of 10% of the net profits or 5% of the gross revenues of the Mexican land-based casino for a purchase price of $800,000. As of December 31, 2013, the Company invested $800,000 and advanced $49,200 for working capital purposes. The Mexican gaming company repaid the $49,200 advanced and the Company recognized $4,157 in royalty revenue during the year ended December 31, 2014. As at December 31, 2014, the Company assessed the fair value of the investment and recorded impairment of $799,999 on the investment due to nominal royalty payments received. On December 31, 2021, the Company received confirmation that the purchase and sale agreement with the Mexican gaming company has been terminated and is of no further effect. Accordingly, the Company recorded an impairment loss of $1 as at December 31, 2021.

On July 7, 2014, the Company’s share capital was consolidated on the basis of 6 (old) common shares for 1 (new) common share and the Company changed its name to 37 Capital Inc. (“37 Capital”). As a result, the shares of High 5 were de-listed from trading and the shares of 37 Capital commenced trading in Canada on the CSE under the symbol “JJJ”, and in the U.S.A. the shares of 37 Capital started trading on the OTCQB under the symbol “HHHEF”. The Cusip number of the Company’s common shares was 88429G102.

On June 21, 2019 the CSE deemed that the Company is inactive pursuant to the policies of the CSE, as a result the CSE changed the Company’s trading symbol to “JJJ.X”. The Company's common shares traded on the OTCQB tier of the OTC markets under the trading symbol “HHHEF” until June 1, 2020. Presently, the Company’s common shares are listed for trading on the PINK Sheets on the OTC market under the same trading symbol “HHHEF”.

On June 15, 2021, the Company’s share capital was consolidated on the basis of 5 (old) common shares for 1 (new) common share. As a result of the consolidation, the shares of the Company commenced trading on a consolidated basis in Canada on the CSE under the symbol “JJJ.X”, and in the U.S.A. the shares of 37 Capital are listed for trading on the PINK Sheets on the OTC market under the trading symbol “HHHEF. The Cusip number of the Company’s common shares is 88429G201.

Since its incorporation, the Company has been engaged primarily in the identification, acquisition, exploration and, if warranted, the development of natural resource properties and, for a brief period of time from 1991 to 1994, the Company, through its formerly owned Ecuadorean subsidiary, Armenonic del Ecuador S.A. (“Armenonic”) operated the San Bartolome lead/zinc/silver mine in Ecuador.

37 Capital is a junior mineral exploration company. The Company has a 100% undivided interest in the Extra High Claims located in the Province of British Columbia, and the Company has a one-half percent (1/2%) gross receipts royalty interest in certain lithium mineral exploration properties located in the Province of Ontario. Furthermore, the Company had entered into a Property Option Agreement and an Amendment Agreement to the Property Option Agreement in respect to the Acacia Property in British Columbia, Canada whereby the Company had the right and option to acquire a 60% interest in the subject property on certain terms and conditions (see Item 4.D II). The Property Option Agreement and the Amendment Agreement to the Property Option Agreement in respect to the Acacia Property were mutually terminated as of November 1, 2021. The principal business of 37 Capital is in mineral exploration. The Compan’'s ability to pursue its stated primary business and to meet its obligations as they come due is dependent upon the ability of management to obtain the necessary financings either through private placements or by means of public offerings of the Compan’'s securities or through the exercise of incentive stock options or warrants or through debt financings or through the sale of its assets or through the issusance of the Company’s securities.

Arrangement Agreement

On February 26, 2015, the Company incorporated two wholly-owned subsidiaries, 27 Red Capital Inc. (“27 Red”) and 4 Touchdowns Capital Inc. (“4 Touchdowns”). On April 30, 2015, the Company entered into an arrangement agreement (the “Arrangement Agreement”) (see Exhibit 12 – Incorporated by reference) with 27 Red (“Spinco1”) and 4 Touchdowns (“Spinco2”).

| 8 |

The Company completed the Plan of Arrangement with 27 Red (Spinco 1) and 4 Touchdowns (Spinco 2). The effective date of the Arrangement was on February 12, 2016 (the “Effective Date”). Shareholders of record on the Effective Date received one new common share, one Class 1 Reorganization Share and one Class 2 Reorganization Share of the Company. On the Effective Date, and pursuant to the Arrangement, all of the Class 1 Reorganization Shares were automatically transferred by Shareholders to Spinco1 in exchange for 2,067,724 common shares of Spinco1 and issued to Shareholders on a pro rata basis (resulting in one common share of Spinco1 being issued for every one Class 1 Reorganization Share). Immediately following this, the Company redeemed all of the Class 1 Reorganization Shares by the transfer to Spinco1 of $20,677 and a promissory note in the principal amount of $20,677. The promissory note was non-interest bearing, unsecured and due on demand. The redemption of shares was distributed to the shareholders’ of 27 Red as a capital distribution and recorded as a dividend.

Furthermore on the Effective Date, all of the Class 2 Reorganization Shares were automatically transferred by Shareholders to Spinco2 in exchange for 2,067,724 common shares of Spinco2 and issued to Shareholders on a pro rata basis (resulting in one common share of Spinco2 being issued for every one Class 2 Reorganization Share). Immediately following this, the Company redeemed all of the Class 2 Reorganization Shares by the transfer to Spinco2 of $20,677 and a promissory note in the principal amount of $20,677. The promissory note was non-interest bearing, unsecured and due on demand. The redemption of shares was distributed to the shareholders’ of 4 Touchdowns as a capital distribution and recorded as a dividend.

A copy of the Arrangement Agreement is available on www.SEDAR.com.

As a result of the completion of the Arrangement on February 12, 2016, 27 Red and 4 Touchdowns are independent entities and are no longer subsidiaries of the Company.

Company Information

On August 23, 2016, Mr. Neil Spellman of Carlsbad, California, joined the Board of Directors of the Company. Mr. Spellman was appointed as the CFO of the Company effective as of April 1, 2017.

Effective as of August 1, 2021, the Company’s office is located at Suite 303, 570 Granville Street, Vancouver, British Columbia, Canada, V6C 3P1. The telephone number is (604) 681-0204 (ext. 6105) and the telefax number is (604) 681-9428. The contact person is Jake H. Kalpakian.

The Company’s registered and records office is located at Suite 3200-650 West Georgia Street, Vancouver BC V6B 4P7. The telefax number is (604) 669-9385.

The Registrar and Transfer Agent of the Company is Computershare Investor Services Inc., at 510 Burrard Street, Vancouver, BC, Canada V6C 3B9. The telefax number is (604) 661-9407.

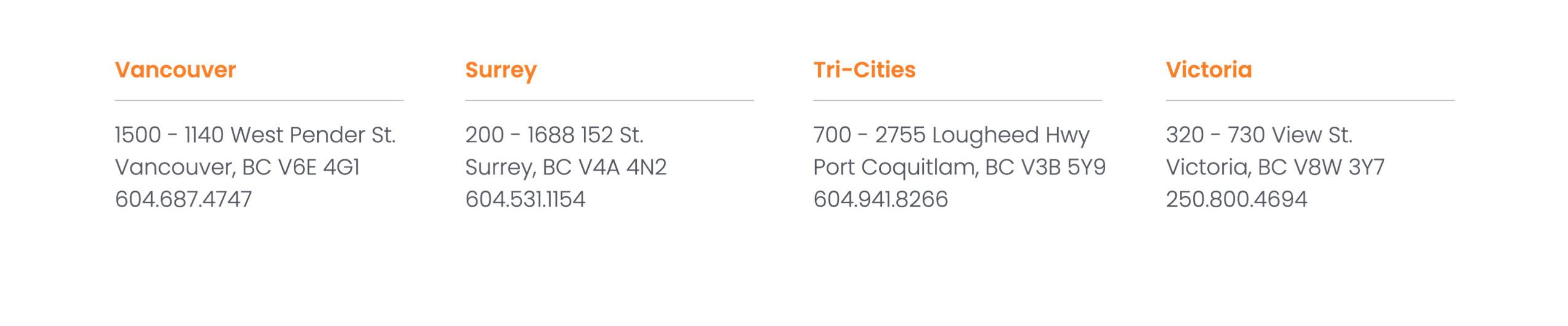

As of March 28, 2017, the Company’s auditors are Dale Matheson Carr-Hilton Labonte LLP, Chartered Professional Accountants, at 1500-1140 W. Pender Street, Vancouver, BC V6E 4G1 (the “Auditors”). The telefax number is (604) 689-2778.

Item 4.B. Business Overview

Summary

37 Capital is a junior mineral exploration company. The Company has a 100% undivided interest in the Extra High Claims located in the Province of British Columbia, and the Company is entitled to receive a one-half percent (1/2%) gross receipts royalty interest after six months from the date of commencement of commercial production from certain lithium mineral properties located in the Province of Ontario. Furthermore, the Company had entered into a Property Option Agreement and an Amendment Agreement to the Property Option Agreement in respect to the Acacia Property in British Columbia, Canada whereby the Company had the right and option to acquire a 60% interest in the subject property on certain terms and conditions (see Item 4.D II). By mutual consent, the Property Option Agreement and the Amendment Agreement to the Property Option Agreement were terminated effective November 1, 2021. The principal business of 37 Capital is in mineral exploration. However, the Company had a minority investment in a non-mining related project located in Mexico. The Company has determined that it will not recover its investment in the non-mining related project located in Mexico, and has written-off its investment.

| 9 |

37 Capital is a reporting issuer in the Provinces of British Columbia, Alberta, Quebec and Ontario and files all public documents on www.Sedar.com. The Company is a foreign private issuer in the United States of America and in this respect files, on EDGAR, its Annual Report on Form 20-F and other reports on Form 6K at the following link:

http://www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0000825171&owner=exclude&count=40 will give you direct access to the Company’s filings.

Presently, 37 Capital is seeking opportunities of merit to get involved with. It should be noted that there are no assurances whatsoever that 37 Capital shall be successful in its attempts of seeking opportunities of merit.

Item 4. C. Organizational Structure

Arrangement Agreement

On February 26, 2015, the Company incorporated two wholly-owned subsidiaries, 27 Red Capital Inc. (“27 Red”) and 4 Touchdowns Capital Inc. (“4 Touchdowns”). On April 30, 2015, the Company entered into an arrangement agreement (the “Arrangement Agreement”) (see Exhibit 12 – Incorporated by reference) with 27 Red (“Spinco1”) and 4 Touchdowns (“Spinco2”).

At the Company’s annual and special meeting which was held on June 4, 2015 (see Exhibit 12 – Incorporated by reference), the Company’s shareholders passed all the resolutions presented including the re-election of the board of directors, re-appointment of the Company’s auditor, approval of the Company’s stock option plan, and the proposed Plan of Arrangement with 27 Red and 4 Touchdowns.

In respect to the plan of arrangement, the Company applied for an Interim Order which was granted on May 6, 2015 by the Supreme Court of British Columbia, and on June 12, 2015 the Company received the final court approval for the Plan of Arrangement.

The Company completed the Plan of Arrangement with 27 Red (Spinco 1) and 4 Touchdowns (Spinco 2). The effective date of the Arrangement was on February 12, 2016 (the “Effective Date”). Shareholders of record on the Effective Date received one new common share, one Class 1 Reorganization Share and one Class 2 Reorganization Share of the Company. On the Effective Date, and pursuant to the Arrangement, all of the Class 1 Reorganization Shares were automatically transferred by Shareholders to Spinco1 in exchange for 2,067,724 common shares of Spinco1 and issued to Shareholders on a pro rata basis (resulting in one common share of Spinco1 being issued for every one Class 1 Reorganization Share). Immediately following this, the Company redeemed all of the Class 1 Reorganization Shares by the transfer to Spinco1 of $20,677 and a promissory note in the principal amount of $20,677. The promissory note was non-interest bearing, unsecured and due on demand. The redemption of shares was distributed to the shareholders’ of 27 Red as a capital distribution and recorded as a dividend.

Furthermore on the Effective Date, all of the Class 2 Reorganization Shares were automatically transferred by Shareholders to Spinco2 in exchange for 2,067,724 common shares of Spinco2 and issued to Shareholders on a pro rata basis (resulting in one common share of Spinco2 being issued for every one Class 2 Reorganization Share). Immediately following this, the Company redeemed all of the Class 2 Reorganization Shares by the transfer to Spinco2 of $20,677 and a promissory note in the principal amount of $20,677. The promissory note was non-interest bearing, unsecured and due on demand. The redemption of shares was distributed to the shareholders’ of 4 Touchdowns as a capital distribution and recorded as a dividend.

A copy of the Arrangement Agreement is available on www.SEDAR.com.

As a result of the completion of the Arrangement on February 12, 2016, 27 Red and 4 Touchdowns are independent entities and are no longer subsidiaries of the Company.

As a result of the completion of the Consulting Agreements on February 16, 2016, 27 Red and 4 Touchdowns are are no longer related to the Company.

| 10 |

Item 4.D. Property, Plants and Equipment

I. Extra High Claims, Kamloops Mining Division, British Columbia, Canada

On March 26, 2004, the Company entered into an Option Agreement (Exhibit 10.5 – Incorporated by reference) with an arm’s length party (the “Arm’s Length Party”) in respect to certain mineral claims, which are situated in the Kamloops Mining Division in British Columbia (the “Extra High Claims”). Pursuant to the terms of the Option Agreement as amended on March 8, 2005, the Company obtained the right to acquire a 100% undivided interest in the Extra High Claims, subject to a 1.5% net smelter returns royalty (the “Arm’s Length Royalty”), by making staged cash payments totalling $150,000 and incurring exploration expenditures on the Extra High Claims totalling $500,000 over a period of three years. Upon the Company earning a 100% undivided interest in the Extra High Claims, the Company obtained the right to purchase at any time 50% of the Arm’s Length Royalty by paying to the Arm’s Length Party the sum of $500,000 leaving the Arm’s Length Party with a 0.75% NSR royalty.

In the spring of 2004, the Company commissioned an independent review of the Extra High Mineral Property by Erik Ostensoe, P. Geo., who prepared a report, dated the 22nd day of April, 2004 titled “National Policy 43-101 Report, Extra High Mineral Property, Kamloops Mining Division, British Columbia”. The report recommended exploration work programs be carried out on the Extra High Mineral Property in order to evaluate the mineral potential of the Extra High Mineral Property. This report has been filed on www.Sedar.com by the Company.

From May, 2005 up to December, 2005, the Company conducted its exploration program on the Extra High Claims. The exploration program consisted of soil sampling, geological mapping, trenching and diamond drilling. A total of 1,874.3 metres of NQ diamond drilling and 455 lineal metres of trenching were completed while 194 soil samples were collected over 4 areas on the Extra High Mineral Property. The exploration work program was conducted by, and was under the direct supervision of, J.W. Murton, P. Eng, a qualified person as defined by National Instrument 43-101. At the time, Mr. J.W. Murton was a director of the Company. Mr. J. W. Murton recommended a two phase exploration program on the Extra High Mineral Property due to the positive results obtained from the 2005 exploration program. Mr. J. W. Murton prepared for the Company a Technical Report (NI 43-101) on the Extra High Claims (2005 Exploration Program) dated February 28, 2006 which has been filed by the Company on www.Sedar.com, and on the Company’s corporate website, www.37capitalinc.com. For further particulars about the Extra High Mineral Property and the 2005 Exploration Program, please visit either www.sedar.com or www.37capitalinc.com. Mr. J.W. Murton is no longer a director of the Company.

On September 8, 2006, the Company entered into an Option Agreement (Exhibit 10.11 – Incorporated by reference) with Colt Resources Inc. (“Colt”), a company formerly related by certain directors and officers, whereby Colt obtained the right to acquire a 50% undivided interest, subject to the Arm’s Length Royalty, in the Extra High Claims by incurring exploration expenditures of $240,000 on the Extra High Claims by no later than February 28, 2007 and by making cash payments to the Company totalling $133,770 by no later than March 26, 2007.

On September 12, 2006, the Company and the Arm’s Length Party amended the Option Agreement (Exhibit 10.5.1 – Incorporated by reference) by entering into an Amending Agreement whereby the Company was granted an extension period until June 26, 2007 to make the balance of cash payments to the Arm’s Length Party and incur the remaining exploration expenditures on the Extra High Claims.

On October 31, 2006, the Company and Colt entered into an Amending Agreement (Exhibit 10.11.2 – Incorporated by reference) whereby Colt was granted an extension period until June 26, 2007 to incur exploration expenditures on the Extra High Claims and to make the cash payments to the Company.

On April 16, 2007, the Company and the Arm’s Length Party amended the Option Agreement (Exhibit 10.5.2 – Incorporated by reference) by entering into an Amending Agreement whereby the Company was released of the requirement to incur the remaining exploration expenditures but instead was required to make a cash payment of $60,000 (paid) to the Arm’s Length Party.

| 11 |

On June 14, 2007, the Company amended its Option Agreement with Colt whereby Colt had the right to acquire a 34% interest in the Extra High Claims by making cash payments to the Company totalling $193,770 by no later than June 26, 2007. The Amending Agreement released Colt of the requirement to incur $240,000 in exploration expenditures on the Extra High Claims.

On June 26, 2007, the Company made its final payment to the Arm’s Length Party thereby earning a 100% undivided interest in the Extra High Claims subject only to the Arm’s Length Royalty. Colt made its final payment to the Company and earned its 34% interest in the Extra High Claims, thus reducing the Company’s interest to 66%.

During 2007, the Company and its joint venture partner Colt conducted a diamond drilling program on the Extra High Claims. A total of 1,293.59 metres were drilled in 8 NQ diamond drill holes. The diamond drilling program was targeted at expanding the previously indicated mineralization in the K7 lens and was successful in revealing the potential for larger zones of lower grade mineralization lying adjacent to the massive sulphide mineralization indicated in earlier work. The diamond drilling program was conducted by and was under the direct supervision of J. W. Murton, P. Eng., a qualified person as defined by National Instrument 43-101. At the time, Mr. J. W. Murton was a director of the Company. For further particulars about the diamond drilling program please see the report on the 2007 Diamond Drilling Program dated February 28, 2008 that was prepared for the Company and Colt by J. W. Murton, P. Eng. which has been filed by the Company on its corporate website www.37capitalinc.com. As of December 10, 2009, J.W. Murton resigned as a director of the Company.

At December 31, 2007, the Company held a 66% interest in the Extra High Claims.

On January 21, 2008, the Company entered into an Option Agreement (the “2008 Option Agreement”) (Exhibit 10.11.3 - Incorporated by reference) with Colt whereby Colt was granted the right and option to acquire, in two separate equal tranches, the Company’s 66% undivided interest in the Extra High Claims. Pursuant to the 2008 Option Agreement, Colt exercised the first tranche of the option by making a cash payment of $250,000 to the Company thus acquiring from the Company a 33% undivided interest in the Extra High Claims. As a result of Colt exercising the first tranche of the option, Colt increased its undivided interest in the Extra High Claims to 67% and Colt became the operator of the Extra High Claims.

In order to exercise the second tranche of the option, Colt was required to make a cash payment of $250,000 to the Company on or before December 31, 2008. Colt did not exercise the second tranche of the option. Consequently, Colt held a 67% undivided interest in the Extra High Claims and the Company held a 33% undivided interest in the Extra High Claims. Pursuant to the Joint Venture which the Company and Colt had formed, each party were required to contribute its proportionate share of property related expenditures. If any party would have failed to contribute its share of future property related expenditures, then its interest would be diluted on a straight-line basis. If any party’s interest would have been diluted to less than 10%, then that party’s interest in the Extra High Claims would have been converted into a 0.5% net smelter returns royalty.

Neither the Company nor the operator of the Extra High Claims had incurred any meaningful exploration or evaluation expenditures in recent years with respect to the Extra High Claims. Accordingly, during the fiscal year-ended 2011 the Company recognized an impairment provision of $151,339 to reduce the carrying amount to $1. If there is an indication in the future that the impairment loss recognized no longer exists or has decreased, the recoverable amount will be estimated and the carrying value of the property will be increased to its recoverable amount. The Company did not incur any expenditures on the Extra High Claims during the years 2019, 2020, 2021 and 2022 however during 2016 the Company transferred from its PAC account with the Mineral Titles Office of the Province of British Columbia credits totalling $4,096 to Colt’s PAC account to enable Colt to use the credits towards assessment filing on the Extra High Claims.

Pursuant to the March 30, 2016 Amending Agreement (Exhibit 10.11.4 – Incorporated by reference), Colt and the Company agreed to reduce the size of the Extra High Claims from 1,077 hectares to 650 hectares by abandoning certain claims.

On March 31, 2016, the Company together with Colt extended to December 25, 2019 the expiry date of certain mineral claims totalling 650 hectares which comprise the Extra High Claims. During 2016, the Company together with Colt abandoned a total of 427 hectares of mineral claims which were previously part of the Extra High Claims. A 2016 Assessment Report on Preliminary Metallurgical Testing on the Extra High Claims was prepared by J.W. Murton on May 20, 2016 on behalf of Colt.

| 12 |

As at December 31, 2018, the Company held a 33% undivided interest in the Extra High Claims.

On October 31, 2019, as amended on November 4, 2019, the Company entered into a Property Purchase Agreement with Colt whereby the Company purchased Colt’s 67% right, interest and title in and to the Extra High Property for a cash consideration of $100,000 of which $25,000 was paid on the closing date of the Property Purchase Agreement and the balance i.e. $75,000 was payable after eighteen months (unpaid) from the closing date. Additionally, the Company was obligated to pay Colt a 0.5% NSR from commercial production which would have been purchased by the Company at any time by making a payment of $500,000 (see Exhibit 10.11.5 – Incorporated by reference). As at December 31, 2019, the Company owns a 100% undivided right, interest and title in and to the Extra High Property which covers an area of 650 hectares.

The Company withdrew from its PAC account with the Mineral Titles Office of the Province of British Columbia credits totalling $51,920.64 to extend the expiry date of the Extra High Property until December 25, 2021. On December 1, 2021, the Deputy Chief Gold Commissioner of the Government of British Columbia granted the request by the Company to extend the expiry date of the Extra High mineral claims until July 31, 2022. The expiry date of the mineral claims were further extended up to December 25, 2022.

During the year ended December 31, 2021, the Company recorded an impairment loss of $25,001 as the Company decided not to conduct any exploration work on the Extra High Property.

Pursuant to the Company’s offer letter to Colt dated July 6, 2022 (see Exhibit 10.11.6* - Attached), the Company has made a cash payment of $15,000 and has issued 50,000 common shares in the capital of the Company to Colt as consideration for the full and final settlement of all matters between the Company and Colt in respect to the Extra High Property located in the Province of British Columbia. The 50,000 common shares in the capital of the Company were subject to a hold period from trading which expired on December 10, 2022.

During the year ended December 31, 2022, the Company incurred $38,001 to extend the expiry date of the Extra High Property to June 30, 2023.

In addition to the 0.5% NSR Royalty payable to Colt, the Extra High Property is subject to a 1.5% Net Smelter Returns Royalty (“NSR”) payable to a third party, 50% of which, or 0.75%, can be purchased by the Company at any time by paying $500,000.

As of the date of this Annual Report, the Company holds a 100% undivided interest in the Extra High Claims.

The Extra High Claims are located on Samatosum Mountain, immediately south of the formerly producing Samatosum Mine, 60 km northeast of Kamloops, British Columbia.

Legal Description

The Extra High Mineral Claims tenures are as follows:

| TENURE NUMBER | NAME OF CLAIM | Property Size (in hectares) | CONVERSION DATE OR DATE STAKED | BC MAP # | EXPIRY DATE | |||||||||||||

| 509949 | Extra High | 60.829 | 2005/MAR/31 | 082M | 2023/JUN/30 | |||||||||||||

| 509961 | Extra High | 121.664 | 2005/MAR/31 | 082M | 2023/JUN/30 | |||||||||||||

| 509969 | Extra High | 344.834 | 2005/MAR/31 | 082M | 2023/JUN/30 | |||||||||||||

| 510214 | Extra High | 40.557 | 2005/APR/05 | 082M | 2023/JUN/30 | |||||||||||||

| 510215 | Extra High | 81.124 | 2005/APR/05 | 082M | 2023/JUN/30 | |||||||||||||

| Total: | 650 | |||||||||||||||||

| 13 |

During 2016, the Company together with Colt abandoned the following mineral claims totaling 427 hectares which were previously part of the Extra High Claims:

| TENURE NUMBER | NAME OF CLAIM | Property Size (in hectares) | CONVERSION DATE OR DATE STAKED | BC MAP # | EXPIRY DATE | |||||||||||||||

| 509956 | Extra High | 182.52 | 2005 | /MAR/31 | 082 | M | 2016/APR/02 | |||||||||||||

| 509963 | Extra High | 40.569 | 2005 | /MAR/31 | 082 | M | 2016/APR/02 | |||||||||||||

| 510213 | Extra High | 20.289 | 2005 | /APR/05 | 082 | M | 2016/APR/02 | |||||||||||||

| 510306 | Extra High | 60.857 | 2005 | /APR/05 | 082 | M | 2016/APR/02 | |||||||||||||

| 509952 | Super High#1 | 60.824 | 2005 | /MAR/31 | 082 | M | 2016/MAR/31 | |||||||||||||

| 520184 | Super High#2 | 20.275 | 2005 | /SEP/20 | 082 | M | 2016/SEP/20 | |||||||||||||

| 520186 | Super High#3 | 40.544 | 2005 | /SEP/20 | 082 | M | 2016/SEP/20 | |||||||||||||

II. Acacia Property, Adams Plateau, British Columbia

On September 30, 2019, the Company entered into a property option agreement (the “Option Agreement”) with Eagle Plains Resources ltd. (“Eagle Plains”) to acquire a 60% interest in the Acacia Property (“Acacia Property”) in Adams Plateau Area of the Province of British Columbia. The following was required to exercise the option:

| • | Issuance of 20,000 common shares (issued) to Eagle Plains upon receipt of the current Acacia PropertyNI 43-101 Technical Report; |

| • | Incur of a total of $100,000 in property related expenditures on or before the first anniversary of the Option Agreement; |

| • | Issuance of 10,000 common shares to Eagle Plains and incur a total of $100,000 in property related expenditures on or before the second anniversary of the Option Agreement; |

| • | Issuance of 10,000 common shares to Eagle Plains and incur a total of $300,000 in property related expenditures on or before the third anniversary of the Option Agreement; |

| • | Issuance of 10,000 common shares to Eagle Plains and incur a total of $750,000 in property related expenditures on or before the fourth anniversary of the Option Agreement; and |

| • | Issuance of 10,000 common shares to Eagle Plains and incur a total of $1,250,000 in property related expenditures on or before the fifth anniversary of the Option Agreement. |

Within a period of 30 days after each annual anniversary of the Option Agreement, the Company was required to decide whether or not it wishes to continue with the Option Agreement.

On October 15, 2020, the Company entered into an amendment agreement to the Option Agreement with Eagle Plains as the Company was not able to incur the required amount of $100,000 in property related expenditure during the 1st Anniversary. The following were the amendments which were required to exercise the option:

| • | Issuance of 20,000 common shares (issued) to Eagle Plans. |

| • | Commitment to incur $200,000 in property related expenditures during the 2nd period of the agreement which was not incurred by the Company. |

| 14 |

During November 2021, by mutual consent, the Company and Eagle Plains terminated the Option Agreement dated September 30, 2019 and the Amendment Agreement to the Option Agreement dated October 15, 2020. Accordingly, the Company recorded an impairment loss of $15,000 during the year ended December 31, 2021.

III. Ontario, Canada Lithium Properties (Mineral Leases)

These Mineral Leases were previously written off at the end of fiscal 2000. During the year ended December 31, 2008, the Company sold all of its Mineral Leases for gross proceeds of $54,500. However, in the event that at a future date the Mineral Leases are placed into commercial production, then the Company is entitled to receive a 0.50% gross receipts royalty after six months from the date of commencement of commercial production.

IV. Investment in Mexican Gaming Company

In April 2013, the Company entered into a purchase and sale agreement with a Mexican gaming company, whereby the Company agreed to purchase a royalty revenue stream of an amount the greater of 10% of the net profits or 5% of the gross revenues of the Mexican land-based casino for a purchase price of $800,000. As of December 31, 2013, the Company invested $800,000 and advanced $49,200 for working capital purposes. The Mexican gaming company repaid the $49,200 advanced and the Company recognized $4,157 in royalty revenue during the year ended December 31, 2014. As at December 31, 2014, the Company assessed the fair value of its investment in Mexico and recorded impairment of $799,999 on the investment due to nominal royalty payments received (see Exhibit 10.13 – Incorporated by reference). On December 31, 2021, the Company received confirmation that the purchase and sale agreement with the Mexican gaming company has been terminated and is of no further effect. Accordingly, the Company recorded an impairment loss of $1 during the year ended December 31, 2021.

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

Item. 5.A. Results of Operations

The following table contains selected annual information for the three years ended December 31, 2022, 2021 and 2020 which are in accordance with IFRS:

| Year Ended December 31, 2022 | Year Ended December 31, 2021 | Year Ended December 31, 2020 | ||||||||||

| Revenue | $ | 0 | 0 | 0 | ||||||||

| Interest income | 0 | 0 | 0 | |||||||||

| Expenses | (125,036 | ) | (1,044,863 | ) | (133,379 | ) | ||||||

| Basic and diluted loss per common share before other items | (0.03 | ) | (0.24 | ) | (0.09 | ) | ||||||

| Comprehensive loss | (125,036 | ) | (1,044,863 | ) | (133,379 | ) | ||||||

| Total assets | 55,683 | 2,113 | 40,573 | |||||||||

| Long-term financial obligations | 0 | 0 | 0 | |||||||||

| Cash dividends | 0 | 0 | 0 | |||||||||

All financial figures presented herein are expressed in Canadian Dollars (CDN$) unless otherwise specified.

In Canada, the common shares of the Company trade on the Canadian Securities Exchange (CSE) under the symbol “JJJ.X”, and in the USA, the Company's common shares traded on the OTCQB tier of the OTC markets under the trading symbol “HHHEF” until June 1, 2020. Presently, the Company’s common shares are listed for trading in the USA on the PINK Sheets on the OTC market. The Cusip number of the Company’s common shares is 88429G201. The Company’s office is located at 303 – 570 Granville Street, Vancouver, British Columbia, Canada, V6C 3P1 and its registered office is located at Suite 3200-650 West Georgia Street, Vancouver BC V6B 4P7. The Company’s registrar and transfer agent is Computershare Investor Services Inc. located at 510 Burrard Street, Vancouver, British Columbia, Canada, V6C 3B9.

| 15 |

For the year ended December 31, 2022:

| • | The Company’s operating expenses were $125,036 as compared to $1,044,863 for the corresponding period in 2021 and as compared to $133,379 for the corresponding period in 2020. |

| • | The Company recorded a comprehensive loss of $125,036 as compared to a comprehensive loss of $1,044,863 for the corresponding period in 2021 and as compared to a comprehensive loss of $133,379 during the corresponding period in 2020. |

| • | The Company’s basic and diluted loss per common share was $0.03 as compared to a basic and diluted loss of $0.24 during the corresponding period in 2021 and as compared to a basic and diluted loss of $0.09 during the corresponding period in 2020. |

| • | The Company’s total assets were $55,683 as compared to $2,113 during the corresponding period in 2021 and as compared to $40,573 during the corresponding period in 2020. |

| • | The Company’s total liabilities were $826,925 as compared to $697,319 during the corresponding period in 2021 and as compared $1,337,235 during the corresponding period in 2020. |

| • | The Company had a working capital deficiency of $825,243 as compared to a working capital deficiency of $695,206 during the corresponding period of 2021 and as compared to a working capital deficiency of $1,336,664 during the corresponding period in 2020. |

The Company is presently not a party to any legal proceedings whatsoever.

On April 1, 2017, Mr. Bedo H. Kalpakian stepped down as the Company’s President, CEO & CFO. In replacement to Mr. Bedo H. Kalpakian, effective as of April 1, 2017 Mr. Jacob H. Kalpakian has become the President & CEO of the Company, and Mr. Neil Spellman has become the CFO of the Company.

The Company’s Board of Directors decided to change the Company’s auditors. Effective as of March 28, 2017, the Company’s Auditors are Dale Matheson Carr-Hilton Labonte LLP, Chartered Professional Accountants, 1500-1140 W. Pender St., Vancouver, BC V6E 4G1. The telefax number is (604) 689-2778.

Pursuant to debt settlement agreements dated December 11, 2020 totaling the sum of $739,351.50 between the Company and certain creditors, including Jackpot Digital Inc. (“Jackpot’) and the Company’s President and CEO, on January 25, 2021 the Company issued a total of 2,957,406 common shares of the Company at a deemed price of $0.25 per common share (the “Debt Settlement Shares of the Company”), of which Jackpot acquired 597,380 Debt Settlement Shares of the Company and the Company’s President and CEO acquired 615,395 Debt Settlement Shares of the Company. As of the date of this Annual Report, Jackpot owns 607,377 common shares of the Company representing approximately 10.5% of the issued and outstanding common shares of the Company. The Debt Settlement Shares of the Company were subject to a hold period which expired on May 26, 2021.

| 16 |

At the Company’s Annual General Meeting which was held on November 15, 2017 Mr. Bedo Kalpakian did not stand for re-election. At the Company’s Annual General Meetings which were held on November 16, 2018, November 18, 2019 and November 20, 2020, the Company’s shareholders passed all the resolutions presented including the re-election of Jacob H. Kalpakian, Gregory T. McFarlane, Fred A.C. Tejada and Neil Spellman as Directors of the Company; re-appointed the Company’s Auditor, Dale Matheson Carr-Hilton Labonte LLP, Chartered Professional Accountants for the ensuing year and authorized the Directors to fix the remuneration to be paid to the Auditor; and re-approved the Company’s Stock Option Plan.

Effective as of May 1, 2021, Fred A.C. Tejada resigned from the Board of Directors of the Company, and effective as of May 25, 2021, Bedo H. Kalpakian was appointed as a director of the Company.

At the Company’s Annual General Meeting, which was held on December 3, 2021, the Company’s shareholders passed all the resolutions presented including the re-election of Jake H. Kalpakian, Gregory T. McFarlane, Neil Spellman and Bedo H. Kalpakian as Directors of the Company; re-appointed the Company’s Auditor, Dale Matheson Carr-Hilton Labonte LLP, Chartered Professional Accountants for the ensuing year and authorized the Directors to fix the remuneration to be paid to the Auditor; and re-approved the Company’s Stock Option Plan.

At the Company’s Annual General Meeting, which was held on November 14, 2022, the Company’s shareholders passed all the resolutions presented including the re-election of Jake H. Kalpakian, Gregory T. McFarlane, Neil Spellman and Bedo H. Kalpakian as Directors of the Company; re-appointed the Company’s Auditor, Dale Matheson Carr-Hilton Labonte LLP, Chartered Professional Accountants for the ensuing year and authorized the Directors to fix the remuneration to be paid to the Auditor; and re-approved the Company’s Stock Option Plan.

During December 2019, the Company had intended to issue up to 800,000 flow-through units of the Company at a price of $0.25 per unit for gross proceeds to the Company of $200,000 in order to use the proceeds of this financing towards mineral exploration work expenditures located in the Province of British Columbia. However, due to the Covid-19 pandemic the Company was only able to raise the amount of $20,000 which the Company intended to incur towards mineral exploration work expenditures during the Company’s 2021 fiscal year. As such, the Company issued 80,000 flow-through units. Each flow-through unit consisted of one flow-through common share of the Company and one non-flow-through share purchase warrant to acquire one non-flow-through common share of the Company at a price of $0.50 for a period of two years. All securities issued in connection with this financing were subject to a hold period which expired on May 16, 2021. As the Company was not able to utilize the $20,000 towards mineral exploration expenditures, during the year-ended December 31, 2022, the Company made a formal application to Canada Revenue Agency (the “CRA”) and cancelled the Company’s flow-through share application which was submitted to the CRA during the year ended December 31, 2020 (see Exhibit 10.21* - Attached). Subsequent to the year-ended December 31, 2022, the non-flow share purchase warrants expired unexercised.

The Company is presently not a party to any legal proceedings whatsoever.

Summary of Quarterly Results

| For the Quarterly Periods ended: | December 31, 2022 | September 30, 2022 | June 30, 2022 | March 31, 2022 | ||||||||||||

| Total Revenues | 0 | 0 | 0 | 0 | ||||||||||||

| Net loss and comprehensive loss | (57,456 | ) | (20,694 | ) | (24,768 | ) | (22,118 | ) | ||||||||

| Loss per share | (0.01 | ) | (0.00 | ) | (0.01 | ) | (0.01 | ) | ||||||||

| For the Quarterly Periods ended: | December 31, 2021 | September 30, 2021 | June 30, 2021 | March 31, 2021 | ||||||||||||

| Total Revenues | 0 | 0 | 0 | 0 | ||||||||||||

| Net loss and comprehensive loss | (969,942 | ) | (24,056 | ) | (30,952 | ) | (19,913 | ) | ||||||||

| Loss per share | (0.22 | ) | (0.01 | ) | (0.01 | ) | (0.01 | ) | ||||||||

The Company’s business is not of a seasonal nature.

Item 5.B. Liquidity and Capital Resources

Liquidity and Capital Resources

The Company has incurred significant operating losses over the past three fiscal years, has limited resources, and no sources of operating cash flow.

During 2023, the Company shall require at least $400,000 so as to conduct its operations uninterruptedly. In order to meet this requirement, the Company intends to seek equity and/or debt financings through private placements and/or public offerings and/or loans. In the past, the Company has been successful in securing equity and debt financings in order to conduct its operations uninterruptedly. While the Company does not give any assurances whatsoever that in the future it will continue being successful in securing equity and/or debt financings in order to conduct its operations uninterruptedly, it is the Company’s intention to pursue these methods for future funding of the Company.

| 17 |

As at December 31, 2022:

| • | the Company’s total assets were $55,683 as compared to $2,113 for the year ended December 31, 2021 and as compared to $40,573 for the year ended December 31, 2020. |

| • | the Company’s total liabilities were $826,925 as compared to $697,319 for the period ended December 31, 2021 and as compared to $1,337,235 for the period ended December 31, 2020. |

| • | the Company had $122 in cash as compared to $1,611 in cash for the year ended December 31, 2021 and as compared to $9 in cash for the year ended December 31, 2020. |

| • | the Company had GST receivable in the amount of $1,560 as compared to $502 for the year ended December 31, 2021 and as compared to $562 for the year ended December 31, 2020. |

Shares for Debt Financing

Pursuant to debt settlement agreements dated December 11, 2020 totaling the amount of $739,351.50 between the Company and certain creditors, on January 25, 2021 (see Exhibit 10.20 – Incorporated by reference), the Company issued 2,957,406 common shares of the Company (the “Debt Settlement Shares of the Company”) at a price of $0.25 per common share in settlement of debts totaling the amount of $739,351.50 to certain creditors, including to a related party and a director and officer of the Company. The Debt Settlement Shares of the Company were subject to a hold period which expired on May 26, 2021. The fair value of the 2,957,406 common shares was $1,626,573. As a result, the Company recorded a loss on debt settlement of $887,222.

Private Placement Financing

i) During August and October 2022, the Company issued in aggregate 1,200,000 non flow-through units of the Company. Each non flow-through unit consists of one common share and one share purchase warrant to acquire one common share of the Company at a price of $0.05 for a period of five years. All securities issued in connection with this financing were subject to four months and one day hold period.

ii) During the year ended December 31, 2020, the Company received $20,000 of subscription funds for 80,000 flow- through units of the Company at $0.25 per unit, each unit consisted of one common share and one share purchase warrant exercisable at $0.50 per share for two years. On January 15, 2021, the Company issued 80,000 flow-through units of the Company at $0.25 per unit. The securities issued were subject to a hold period which expired on May 16, 2021.

Warrants

As at December 31, 2022, a total of 1,280,000 warrants with exercise prices ranging from $0.05 to $0.60 per warrant share were outstanding. Subsequent to the year ended December 31, 2022, 80,000 share purchase warrants exercisable at $0.50 per share expired unexercised. As of the date of this Annual Report, there are a total of 1,200,000 warrants outstanding.

While there are no assurances whatsoever that warrants may be exercised, however if any warrants are exercised in the future, then any funds received by the Company from the exercising of warrants shall be used for general working capital purposes.

Loan Payable

The Company had borrowed the sum of $103,924 from an arm’s length party to pay certain amounts that were owed by the Company to some of its creditors. The borrowed amount of $103,924 was non-interest bearing, unsecured and was payable on demand. Pursuant to a debt settlement agreement dated December 11, 2020 with the Company and the arm’s length party, on January 25, 2021 the Company issued a total of 415,697 common shares of the Company with a fair value of $0.55 per shares in full settlement of the debt (the “Debt Settlement Shares of the Company”). The Company recognized a loss of $124,709. The Debt Settlement Shares of the Company were subject to a hold period which expired on May 26, 2021.

| 18 |

During May 2021, an arm’s length party lent the Issuer the amount of $50,000. As of December 31, 2022, the loan is outstanding and has accrued interest in the amount of $7,973.

During July 2022, an arm’s length party has lent the Company the amount of $15,000. As of December 31, 2022, the loan has been repaid together with the accrued interest in the amount of $274.

Refundable Subscription

During the twelve months ended December 31, 2016, the Company cancelled subscription agreements of a non-brokered private placement financing totaling $45,000 and the Company refunded $35,000. As of December 31, 2020, the remaining $10,000 was still owing and was due on demand. Pursuant to a debt settlement agreement dated December 11, 2020 with the Company and the arm’s length party, on January 25, 2021 the Company issued a total of 40,000 common shares of the Company with a fair value of $0.55 per share in full settlement of the $10,000 refundable subscription (the “Debt Settlement Shares of the Company”). A loss of $12,000 was recognized by the Company during the year ended December 31, 2021.

Convertible Debentures Financing 2015

On January 6, 2015, the Company closed a convertible debenture financing with two directors of the Company for the amount of $250,000. The convertible debentures matured on January 6, 2016, and bear interest at the rate of 12% per annum payable on a quarterly basis. The convertible debentures are convertible into common shares of the Company at a conversion price of $1.50 per share. The liability component of the convertible debentures was recognized initially at the fair value of a similar liability with no equity conversion option, which was calculated based on the application of a market interest rate of 25%. On the initial recognition of the convertible debentures, the amount of $222,006 was recorded under convertible debentures and the amount of $27,994 has been recorded under the equity portion of convertible debenture reserve.

On October 29, 2021 the Company entered into an Addendum (see Exhibit 10.15.1 - Incorporated by reference) to the convertible debentures whereby the maturity date of the principal amount totaling $250,000 of the convertible debentures together with the accrued interest has been extended indefinitely, until mutual consent of the Company and Lender has been reached.

As of the date of this Annual Report, the convertible debentures plus the accrued interest are outstanding.

Convertible Debentures Financing 2013

During the year ended December 31, 2013, the Company issued several convertible debentures for a total amount of $975,000. The convertible debentures had a maturity date of 18 months from the date of closing, and bore interest at the rate of 15% per annum payable on a quarterly basis. The liability component of the convertible debenture was recognized initially at the fair value of a similar liability with no equity conversion option, which was calculated based on the application of a market interest rate of 20%. The difference between the $975,000 face value of the debentures and the fair value of the liability component was recognized in equity. On the initial recognition of the convertible debentures, the amount of $913,072 has been recorded under convertible debentures and the amount of

$61,928 has been recorded under the equity portion of convertible debentures.

During the year ended December 31, 2022 the Company recorded interest expense of $nil (2021 - $nil). Pursuant to debt settlement agreements dated December 11, 2020 in respect to the convertible debentures 2013, on January 25, 2021 the Company issued an aggregate of 833,409 common shares of the Company with a fair value of $0.55 per share in settlement of the outstanding convertible debentures 2013 totaling $100,000 plus accrued interest. The Company recognized a loss of $250,023 during the year ended December 31, 2021. The common shares issued were subject to a hold period which expired on May 26, 2021.

| 19 |

Stock Options

As at December 31,2022, there were no outstanding stock options (December 31, 2021 – Nil).

Item 5.C. Research and development, patents and licences

The Company does not have a research and development department nor does it have any patents or licenses.

Item 5.D. Trend Information

During the last several years commodity prices have fluctuated significantly, and should this trend continue or should commodity prices remain at current levels, then companies such as 37 Capital will have difficulty in raising funds and/or acquiring mineral properties of merit at reasonable prices.

Item 5.E. Off balance sheets arrangements.

The Company has no off balance sheets arrangements and the Company’s financial information including its balance sheets and statements of comprehensive loss have been fairly represented in accordance with IFRS.

Item 5.F. Tabular disclosure of contractual obligations

The Company has two convertible debentures totalling $250,000 plus accrued interest, which have been extended indefinitely (see Exhibit 10.15. 1 - Incorporated by reference). The Company has no Capital Lease Obligations or Purchase Lease Obligations reflected on the Company’s Balance Sheets, however the Company has Obligations pursuant to the 2015 Convertible Debentures Financing (see Exhibit 10.15 – Incorporated by reference). During the year ended December 31, 2021, the Company entered into Debt Settlements Agreements to settle certain outstanding debts and loans (see Exhibit 10.20 – Incorporated by reference).

Furthermore, pursuant to the Property Purchase Agreement with Colt, the Company was obligated to pay $75,000 to Colt within eighteen months from the closing date of the Property Option Agreement (see Exhibit 10.11.5 – Incorporated by reference). Pursuant to the Company’s offer letter to Colt dated July 6, 2022 which was accepted by Colt (see Exhibit 10.11.6* - Attached), the Company has made a cash payment of $15,000 and, has issued 50,000 common shares in the capital of the Company to Colt as consideration for the full and final settlement of all matters between the Company and Colt in respect to the Extra High Property located in the Province of British Columbia. The 50,000 common shares in the capital of the Company were subject to a hold period from trading which expired on December 10, 2022.

In respect to information covered by Items 5.E. and 5.F., all financial information and statements have been fairly represented in accordance with IFRS.

Item 5.G. Safe Harbour

Special Note regarding Forward-Looking Statements

We make certain forward looking-statements in this Form 20-F within the meaning of Section 27A of the Securities Act 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, relating to our financial condition, profitability, liquidity, resources, business outlook, proposed acquisitions, market forces, corporate strategies, contractual commitments, capital requirements and other matters. The Private Securities Litigation Reform Act of 1995 provides a safe harbour for forward-looking statements. To comply with the terms of the safe harbour, we note that a variety of factors could cause our actual results and experience to differ substantially from the anticipated results or other expectations expressed in our forward-looking statements. When words and expressions such as: “believes,” “expects,” “anticipates,” “estimates,” “plans,” “intends,” “objectives,” “goals,” “aims,” “projects,” “forecasts,” “possible,” “seeks,” “may,” “could,” “should,” “might,” “likely,” “enable” or similar words or expressions are used in this Form 20-F, as well as statements containing phrases such as “in our view,” “there can be no assurances,” “although no assurances can be given,” or “there is no way to anticipate with certainty,” forward-looking statements are being made. These forward-looking statements speak as of the date of this Form 20-F.

| 20 |

The forward-looking statements are not guarantees of future performance and involve risk and uncertainties. These risks and uncertainties may affect the operation, performance, development and results of our business and could cause future outcomes to differ materially from those set forth in our forward-looking statements. These statements are based on our current beliefs as to the outcome projected or implied in the forward-looking statements. Furthermore, some forward-looking statements are based upon assumptions of future events which may not prove to be accurate. The forward-looking statements involve risks and uncertainties including, but not limited to, the risks and uncertainties referred to in “Item 3.D. RISK FACTORS,” and elsewhere within the document and in other of our filings with the Securities and Exchange Commission.

New risk factors emerge from time to time and it is not possible for us to predict all such risk factors which can cause actual results to differ significantly from those forecast in any forward-looking statements. Given these risks and uncertainties, investors should not overly rely or attach undue weight to forward-looking statements as an indication of our actual future results.

ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES

As of December 31, 2022, the name, municipality of residence and the principal occupation of the directors and officers of the Company are the following: