UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05387

Franklin Mutual Series Funds

(Exact name of registrant as specified in charter)

101 John F. Kennedy Parkway, Short Hills, NJ 07078-2705

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: (210) 912-2100

Date of fiscal year end: 12/31

Date of reporting period: 12/31/18

| Item 1. | Reports to Stockholders. |

|

Annual Report and Shareholder Letter

December 31, 2018 |

Internet Delivery of Fund Reports Unless You Request Paper Copies: Effective January 1, 2021, as permitted by the SEC, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request them from the Fund or your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. If you have not signed up for electronic delivery, we would encourage you to join fellow shareholders who have. You may elect to receive shareholder reports and other communications electronically from the Fund by calling (800) 632-2301 or by contacting your financial intermediary.

You may elect to continue to receive paper copies of all your future shareholder reports free of charge by contacting your financial intermediary or, if you invest directly with a Fund, calling (800) 632-2301 to let the Fund know of your request. Your election to receive reports in paper will apply to all funds held in your account.

Franklin Templeton

Successful investing begins with ambition. And achievement only comes when you reach for it. That’s why we continually strive to deliver better outcomes for investors. No matter what your goals are, our deep, global investment expertise allows us to offer solutions that can help.

During our more than 70 years of experience, we’ve managed through all kinds of markets—up, down and those in between. We’re always preparing for what may come next. It’s because of this, combined with our strength as one of the world’s largest asset managers that we’ve earned the trust of millions of investors around the world.

Dear Franklin Mutual Beacon Fund Shareholder:

1. Source: Morningstar. Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company.

See www.franklintempletondatasources.com for additional data provider information.

| Not FDIC Insured | | | May Lose Value | | | No Bank Guarantee |

|

franklintempleton.com |

Not part of the annual report |

1 |

|

2 |

Not part of the annual report |

franklintempleton.com |

1. Source: Morningstar.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 19.

|

franklintempleton.com |

Annual Report |

3 |

FRANKLIN MUTUAL BEACON FUND

2. Source: U.S. Bureau of Labor Statistics.

|

4 |

Annual Report |

franklintempleton.com |

FRANKLIN MUTUAL BEACON FUND

|

franklintempleton.com |

Annual Report |

5 |

FRANKLIN MUTUAL BEACON FUND

3. Not a Fund holding.

4. Not held at period-end.

See www.franklintempletondatasources.com for additional data provider information.

|

6 |

Annual Report |

franklintempleton.com |

FRANKLIN MUTUAL BEACON FUND

|

franklintempleton.com |

Annual Report |

7 |

FRANKLIN MUTUAL BEACON FUND

|

8 |

Annual Report |

franklintempleton.com |

FRANKLIN MUTUAL BEACON FUND

|

franklintempleton.com |

Annual Report |

9 |

FRANKLIN MUTUAL BEACON FUND

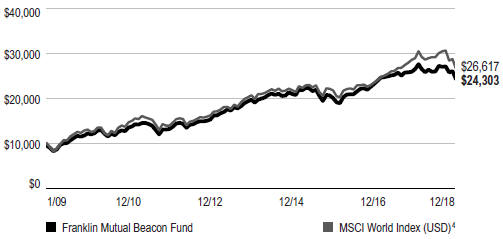

Performance Summary as of December 31, 2018

The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 12/31/18

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum is 5.50% and the minimum is 0%. Class A: 5.50% maximum initial sales charge. For other share classes, visit franklintempleton.com.

| Share Class | |

Cumulative Total Return1 |

|

|

Average Annual Total Return2 |

| ||

| Z |

||||||||

| 1-Year |

-8.24% | -8.24% | ||||||

| 5-Year |

+24.81% | +4.53% | ||||||

| 10-Year |

+164.78% | +10.23% | ||||||

| A3 |

||||||||

| 1-Year |

-8.49% | -13.53% | ||||||

| 5-Year |

+23.16% | +3.08% | ||||||

| 10-Year |

+157.09% | +9.29% | ||||||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

See page 12 for Performance Summary footnotes.

|

10 |

Annual Report |

franklintempleton.com |

FRANKLIN MUTUAL BEACON FUND

PERFORMANCE SUMMARY

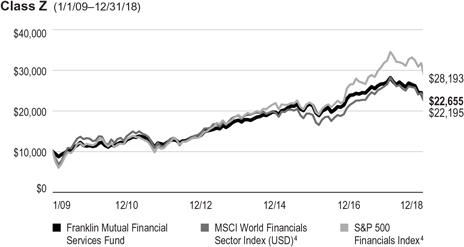

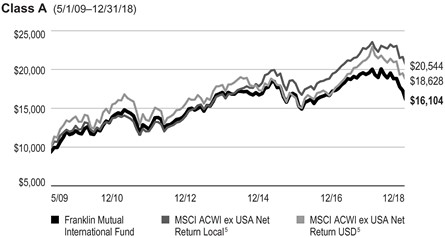

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

Class Z (1/1/09–12/31/18)

Class A (1/1/09–12/31/18)

See page 12 for Performance Summary footnotes.

|

franklintempleton.com |

Annual Report |

11 |

FRANKLIN MUTUAL BEACON FUND

PERFORMANCE SUMMARY

Distributions (1/1/18–12/31/18)

| Share Class | Net

Investment Income |

Long-Term Capital Gain |

Total | |||||||||

| Z |

$0.3098 | $1.1480 | $1.4578 | |||||||||

| A |

$0.2717 | $1.1480 | $1.4197 | |||||||||

| C |

$0.0151 | $1.1480 | $1.1631 | |||||||||

| R |

$0.2313 | $1.1480 | $1.3793 | |||||||||

| R6 |

$0.3208 | $1.1480 | $1.4688 | |||||||||

Total Annual Operating Expenses5

| Share Class | ||||

| Z |

0.78 | % | ||

| A |

1.03 | % | ||

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Value securities may not increase in price as anticipated or may decline further in value. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Because the Fund may invest its assets in companies in a specific region, including Europe, it is subject to greater risks of adverse developments in that region and/or the surrounding regions than a fund that is more broadly diversified geographically. Current political and financial uncertainty surrounding the European Union may increase market volatility and the economic risk of investing in companies in Europe. Smaller-company stocks have exhibited greater price volatility than larger-company stocks, particularly over the short term. The Fund’s investments in companies engaged in mergers, reorganizations or liquidations also involve special risks as pending deals may not be completed on time or on favorable terms. The Fund may invest in lower-rated bonds, which entail higher credit risk. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

3. Prior to 9/10/18, these shares were offered at a higher initial sales charge of 5.75%, thus actual returns would have differed. Total returns with sales charges have been restated to reflect the current maximum initial sales charge of 5.50%.

4. Source: Morningstar. The MSCI World Index (USD) is a free float-adjusted, market capitalization-weighted index designed to measure equity market performance in global developed markets.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

|

12 |

Annual Report |

franklintempleton.com |

FRANKLIN MUTUAL BEACON FUND

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| Actual (actual return after expenses) |

Hypothetical (5% annual return before expenses) |

|||||||||||||||||

| Share Class | Beginning Account Value 7/1/18 |

Ending Account Value 12/31/18 |

Expenses Paid During Period 7/1/18–12/31/181,2 |

Ending Account Value 12/31/18 |

Expenses Paid During Period 7/1/18–12/31/181,2 |

Net Annualized Expense | ||||||||||||

| Z | $1,000 | $935.10 | $3.80 | $1,021.27 | $3.97 | 0.78% | ||||||||||||

| A | $1,000 | $933.80 | $5.02 | $1,020.01 | $5.24 | 1.03% | ||||||||||||

| C | $1,000 | $930.30 | $8.66 | $1,016.23 | $9.05 | 1.78% | ||||||||||||

| R | $1,000 | $932.90 | $6.24 | $1,018.75 | $6.51 | 1.28% | ||||||||||||

| R6 | $1,000 | $935.10 | $3.51 | $1,021.58 | $3.67 | 0.72% | ||||||||||||

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 184/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

|

franklintempleton.com |

Annual Report |

13 |

FRANKLIN MUTUAL BEACON FUND

| Year Ended December 31, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| Class Z |

||||||||||||||||||||

| Per share operating performance | ||||||||||||||||||||

| (for a share outstanding throughout the year) |

||||||||||||||||||||

| Net asset value, beginning of year |

$16.61 | $15.30 | $14.30 | $16.59 | $16.91 | |||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||

| Net investment incomeb |

0.29 | 0.29 | 0.37 | c | 0.29 | 0.54d | ||||||||||||||

| Net realized and unrealized gains (losses) |

(1.68 | ) | 1.90 | 1.93 | (0.99 | ) | 0.62 | |||||||||||||

| Total from investment operations |

(1.39 | ) | 2.19 | 2.30 | (0.70 | ) | 1.16 | |||||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

(0.31 | ) | (0.31 | ) | (0.37 | ) | (0.37 | ) | (0.69) | |||||||||||

| Net realized gains |

(1.15 | ) | (0.57 | ) | (0.93 | ) | (1.22 | ) | (0.79) | |||||||||||

| Total distributions |

(1.46 | ) | (0.88 | ) | (1.30 | ) | (1.59 | ) | (1.48) | |||||||||||

| Net asset value, end of year |

$13.76 | $16.61 | $15.30 | $14.30 | $16.59 | |||||||||||||||

| Total return |

(8.24)% | 14.39% | 16.11% | (4.14)% | 6.82% | |||||||||||||||

| Ratios to average net assets |

||||||||||||||||||||

| Expensese,f |

0.80% | g | 0.78% | 0.80% | 0.84% | g | 0.83% | |||||||||||||

| Expenses incurred in connection with securities sold short |

0.01% | —% | 0.01% | 0.04% | 0.04% | |||||||||||||||

| Net investment income |

1.77% | 1.78% | 2.48% | c | 1.73% | 3.14%d | ||||||||||||||

| Supplemental data | ||||||||||||||||||||

| Net assets, end of year (000’s) |

$2,271,217 | $2,700,327 | $2,564,120 | $2,420,165 | $2,774,929 | |||||||||||||||

| Portfolio turnover rate |

47.20% | 24.80% | 30.94% | 35.80% | 40.06% | |||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.10 per share related to income received in the form of special dividends in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 1.81%.

dNet investment income per share includes approximately $0.24 per share related to income received in the form of a special dividend in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 1.74%.

eIncludes dividend and/or interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the periods presented. See Note 1(d).

fBenefit of expense reduction rounds to less than 0.01%.

gBenefit of waiver and payments by affiliates rounds to less than 0.01%.

|

14 |

Annual Report | The accompanying notes are an integral part of these financial statements. |

franklintempleton.com |

FRANKLIN MUTUAL BEACON FUND

FINANCIAL HIGHLIGHTS

| Year Ended December 31, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| Class A |

||||||||||||||||||||

| Per share operating performance | ||||||||||||||||||||

| (for a share outstanding throughout the year) |

||||||||||||||||||||

| Net asset value, beginning of year |

$16.47 | $15.18 | $14.20 | $16.47 | $16.80 | |||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||

| Net investment incomeb |

0.25 | 0.25 | 0.33 | c | 0.24 | 0.49d | ||||||||||||||

| Net realized and unrealized gains (losses) |

(1.67 | ) | 1.87 | 1.91 | (0.97 | ) | 0.60 | |||||||||||||

| Total from investment operations |

(1.42 | ) | 2.12 | 2.24 | (0.73 | ) | 1.09 | |||||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

(0.27 | ) | (0.26 | ) | (0.33 | ) | (0.32 | ) | (0.63) | |||||||||||

| Net realized gains |

(1.15 | ) | (0.57 | ) | (0.93 | ) | (1.22 | ) | (0.79) | |||||||||||

| Total distributions |

(1.42 | ) | (0.83 | ) | (1.26 | ) | (1.54 | ) | (1.42) | |||||||||||

| Net asset value, end of year |

$13.63 | $16.47 | $15.18 | $14.20 | $16.47 | |||||||||||||||

| Total returne |

(8.49)% | 14.09% | 15.80% | (4.33)% | 6.48% | |||||||||||||||

| Ratios to average net assets |

||||||||||||||||||||

| Expensesf,g |

1.05% | h | 1.03% | 1.05% | 1.12% | h | 1.13% | |||||||||||||

| Expenses incurred in connection with securities sold short |

0.01% | —% | 0.01% | 0.04% | 0.04% | |||||||||||||||

| Net investment income |

1.52% | 1.53% | 2.23% | c | 1.45% | 2.84%d | ||||||||||||||

| Supplemental data | ||||||||||||||||||||

| Net assets, end of year (000’s) |

$890,294 | $983,048 | $992,306 | $1,019,568 | $1,101,706 | |||||||||||||||

| Portfolio turnover rate |

47.20% | 24.80% | 30.94% | 35.80% | 40.06% | |||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.10 per share related to income received in the form of special dividends in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 1.56%.

dNet investment income per share includes approximately $0.24 per share related to income received in the form of a special dividend in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 1.44%.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

fIncludes dividend and/or interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the periods presented. See Note 1(d).

gBenefit of expense reduction rounds to less than 0.01%.

hBenefit of waiver and payments by affiliates rounds to less than 0.01%.

|

franklintempleton.com |

The accompanying notes are an integral part of these financial statements. | Annual Report |

15 |

FRANKLIN MUTUAL BEACON FUND

FINANCIAL HIGHLIGHTS

| Year Ended December 31, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| Class C |

||||||||||||||||||||

| Per share operating performance | ||||||||||||||||||||

| (for a share outstanding throughout the year) |

||||||||||||||||||||

| Net asset value, beginning of year |

$16.34 | $15.06 | $14.10 | $16.36 | $16.70 | |||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||

| Net investment incomeb |

0.13 | 0.12 | 0.22 | c | 0.12 | 0.37d | ||||||||||||||

| Net realized and unrealized gains (losses) |

(1.65 | ) | 1.86 | 1.88 | (0.96 | ) | 0.59 | |||||||||||||

| Total from investment operations |

(1.52 | ) | 1.98 | 2.10 | (0.84 | ) | 0.96 | |||||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

(0.02 | ) | (0.13 | ) | (0.21 | ) | (0.20 | ) | (0.51) | |||||||||||

| Net realized gains |

(1.15 | ) | (0.57 | ) | (0.93 | ) | (1.22 | ) | (0.79) | |||||||||||

| Total distributions |

(1.17 | ) | (0.70 | ) | (1.14 | ) | (1.42 | ) | (1.30) | |||||||||||

| Net asset value, end of year |

$13.65 | $16.34 | $15.06 | $14.10 | $16.36 | |||||||||||||||

| Total returne |

(9.19)% | 13.25% | 14.94% | (5.06)% | 5.78% | |||||||||||||||

| Ratios to average net assets |

||||||||||||||||||||

| Expensesf,g |

1.80% | h | 1.78% | 1.80% | 1.84% | h | 1.83% | |||||||||||||

| Expenses incurred in connection with securities sold short |

0.01% | —% | 0.01% | 0.04% | 0.04% | |||||||||||||||

| Net investment income |

0.77% | 0.78% | 1.48% | c | 0.73% | 2.14%d | ||||||||||||||

| Supplemental data | ||||||||||||||||||||

| Net assets, end of year (000’s) |

$59,828 | $260,113 | $275,138 | $285,333 | $320,832 | |||||||||||||||

| Portfolio turnover rate |

47.20% | 24.80% | 30.94% | 35.80% | 40.06% | |||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.10 per share related to income received in the form of special dividends in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 0.81%.

dNet investment income per share includes approximately $0.24 per share related to income received in the form of a special dividend in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 0.74%.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

fIncludes dividend and/or interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the periods presented. See Note 1(d).

gBenefit of expense reduction rounds to less than 0.01%.

hBenefit of waiver and payments by affiliates rounds to less than 0.01%.

|

16 |

Annual Report | The accompanying notes are an integral part of these financial statements. |

franklintempleton.com |

FRANKLIN MUTUAL BEACON FUND

FINANCIAL HIGHLIGHTS

| Year Ended December 31, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| Class R |

||||||||||||||||||||

| Per share operating performance | ||||||||||||||||||||

| (for a share outstanding throughout the year) |

||||||||||||||||||||

| Net asset value, beginning of year |

$16.28 | $15.01 | $14.05 | $16.33 | $16.68 | |||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||

| Net investment incomeb |

0.20 | 0.21 | 0.30 | c | 0.20 | 0.44d | ||||||||||||||

| Net realized and unrealized gains (losses) |

(1.64 | ) | 1.84 | 1.89 | (0.97 | ) | 0.61 | |||||||||||||

| Total from investment operations |

(1.44 | ) | 2.05 | 2.19 | (0.77 | ) | 1.05 | |||||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

(0.23 | ) | (0.21 | ) | (0.30 | ) | (0.29 | ) | (0.61) | |||||||||||

| Net realized gains |

(1.15 | ) | (0.57 | ) | (0.93 | ) | (1.22 | ) | (0.79) | |||||||||||

| Total distributions |

(1.38 | ) | (0.78 | ) | (1.23 | ) | (1.51 | ) | (1.40) | |||||||||||

| Net asset value, end of year |

$13.46 | $16.28 | $15.01 | $14.05 | $16.33 | |||||||||||||||

| Total return |

(8.65)% | 13.76% | 15.58% | (4.61)% | 6.31% | |||||||||||||||

| Ratios to average net assets |

||||||||||||||||||||

| Expensese,f |

1.30% | g | 1.28% | 1.30% | 1.34% | g | 1.33% | |||||||||||||

| Expenses incurred in connection with securities sold short |

0.01% | —% | 0.01% | 0.04% | 0.04% | |||||||||||||||

| Net investment income |

1.27% | 1.28% | 1.98% | c | 1.23% | 2.64%d | ||||||||||||||

| Supplemental data | ||||||||||||||||||||

| Net assets, end of year (000’s) |

$1,662 | $1,601 | $2,035 | $2,343 | $2,246 | |||||||||||||||

| Portfolio turnover rate |

47.20% | 24.80% | 30.94% | 35.80% | 40.06% | |||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.10 per share related to income received in the form of special dividends in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 1.31%.

dNet investment income per share includes approximately $0.24 per share related to income received in the form of a special dividend in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 1.24%.

eIncludes dividend and/or interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the periods presented. See Note 1(d).

fBenefit of expense reduction rounds to less than 0.01%.

gBenefit of waiver and payments by affiliates rounds to less than 0.01%.

|

franklintempleton.com |

The accompanying notes are an integral part of these financial statements. | Annual Report |

17 |

FRANKLIN MUTUAL BEACON FUND

FINANCIAL HIGHLIGHTS

| Year Ended December 31, | ||||||||||||||||||||

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

| Class R6 |

||||||||||||||||||||

| Per share operating performance | ||||||||||||||||||||

| (for a share outstanding throughout the year) |

||||||||||||||||||||

| Net asset value, beginning of year |

$16.60 | $15.30 | $14.30 | $16.58 | $16.88 | |||||||||||||||

| Income from investment operationsa: |

||||||||||||||||||||

| Net investment incomeb |

0.30 | 0.37 | 0.38 | c | 0.30 | 0.56d | ||||||||||||||

| Net realized and unrealized gains (losses) |

(1.68 | ) | 1.82 | 1.93 | (0.98 | ) | 0.63 | |||||||||||||

| Total from investment operations |

(1.38 | ) | 2.19 | 2.31 | (0.68 | ) | 1.19 | |||||||||||||

| Less distributions from: |

||||||||||||||||||||

| Net investment income |

(0.32 | ) | (0.32 | ) | (0.38 | ) | (0.38 | ) | (0.70) | |||||||||||

| Net realized gains |

(1.15 | ) | (0.57 | ) | (0.93 | ) | (1.22 | ) | (0.79) | |||||||||||

| Total distributions |

(1.47 | ) | (0.89 | ) | (1.31 | ) | (1.60 | ) | (1.49) | |||||||||||

| Net asset value, end of year |

$13.75 | $16.60 | $15.30 | $14.30 | $16.58 | |||||||||||||||

| Total return |

(8.18)% | 14.42% | 16.20% | (3.98)% | 6.91% | |||||||||||||||

| Ratios to average net assets |

||||||||||||||||||||

| Expenses before waiver and payments by affiliatese |

0.75% | 0.72% | 0.71% | 0.74% | 0.74% | |||||||||||||||

| Expenses net of waiver and payments by affiliatese,f |

0.73% | 0.71% | 0.71% | 0.74% | g | 0.74% | ||||||||||||||

| Expenses incurred in connection with securities sold short |

0.01% | —% | 0.01% | 0.04% | 0.04% | |||||||||||||||

| Net investment income |

1.84% | 1.85% | 2.57% | c | 1.83% | 3.23%d | ||||||||||||||

| Supplemental data | ||||||||||||||||||||

| Net assets, end of year (000’s) |

$79,358 | $106,845 | $604 | $48,844 | $50,868 | |||||||||||||||

| Portfolio turnover rate |

47.20% | 24.80% | 30.94% | 35.80% | 40.06% | |||||||||||||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.10 per share related to income received in the form of special dividends in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 1.90%.

dNet investment income per share includes approximately $0.24 per share related to income received in the form of a special dividend in connection with certain Fund holdings. Excluding this amount, the ratio of net investment income to average net assets would have been 1.83%.

eIncludes dividend and/or interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the periods presented. See Note 1(d).

fBenefit of expense reduction rounds to less than 0.01%.

gBenefit of waiver and payments by affiliates rounds to less than 0.01%.

|

18 |

Annual Report | The accompanying notes are an integral part of these financial statements. |

franklintempleton.com |

FRANKLIN MUTUAL BEACON FUND

Statement of Investments, December 31, 2018

| Country | Shares/ Warrants |

Value | ||||||||||

|

|

||||||||||||

| Common Stocks and Other Equity Interests 87.3% |

||||||||||||

| Aerospace & Defense 2.1% |

||||||||||||

| BAE Systems PLC |

United Kingdom | 11,814,998 | $ | 69,188,011 | ||||||||

|

|

|

|||||||||||

| Auto Components 0.1% |

||||||||||||

| a,b,c International Automotive Components Group Brazil LLC |

Brazil | 2,846,329 | 120,619 | |||||||||

| a,b,c International Automotive Components Group North America LLC |

United States | 22,836,904 | 2,722,159 | |||||||||

|

|

|

|||||||||||

| 2,842,778 | ||||||||||||

|

|

|

|||||||||||

| Banks 8.8% |

||||||||||||

| JPMorgan Chase & Co. |

United States | 890,830 | 86,962,826 | |||||||||

| Standard Chartered PLC |

United Kingdom | 13,443,194 | 104,454,934 | |||||||||

| Wells Fargo & Co. |

United States | 2,124,250 | 97,885,440 | |||||||||

|

|

|

|||||||||||

| 289,303,200 | ||||||||||||

|

|

|

|||||||||||

| Biotechnology 1.1% |

||||||||||||

| Shire PLC |

United Kingdom | 644,845 | 37,580,872 | |||||||||

|

|

|

|||||||||||

| Chemicals 2.0% |

||||||||||||

| BASF SE |

Germany | 956,972 | 66,659,457 | |||||||||

| a,b,d Dow Corning Corp., Contingent Distribution |

United States | 12,598,548 | — | |||||||||

|

|

|

|||||||||||

| 66,659,457 | ||||||||||||

|

|

|

|||||||||||

| Communications Equipment 1.9% |

||||||||||||

| Cisco Systems Inc. |

United States | 1,458,142 | 63,181,293 | |||||||||

|

|

|

|||||||||||

| Consumer Finance 2.5% |

||||||||||||

| Capital One Financial Corp. |

United States | 1,102,998 | 83,375,619 | |||||||||

|

|

|

|||||||||||

| Diversified Telecommunication Services 2.2% |

||||||||||||

| Koninklijke KPN NV |

Netherlands | 24,353,643 | 71,435,271 | |||||||||

|

|

|

|||||||||||

| Electrical Equipment 3.3% |

||||||||||||

| a Sensata Technologies Holding PLC |

United States | 2,429,802 | 108,952,322 | |||||||||

|

|

|

|||||||||||

| Entertainment 3.3% |

||||||||||||

| The Walt Disney Co. |

United States | 994,700 | 109,068,855 | |||||||||

|

|

|

|||||||||||

| Food & Staples Retailing 0.2% |

||||||||||||

| a Rite Aid Corp. |

United States | 8,457,611 | 5,990,526 | |||||||||

|

|

|

|||||||||||

| Health Care Equipment & Supplies 4.3% |

||||||||||||

| Medtronic PLC |

United States | 1,576,090 | 143,361,146 | |||||||||

|

|

|

|||||||||||

| Hotels, Restaurants & Leisure 3.9% |

||||||||||||

| Accor SA |

France | 1,604,708 | 68,233,205 | |||||||||

| Sands China Ltd. |

Macau | 13,934,400 | 61,036,961 | |||||||||

|

|

|

|||||||||||

| 129,270,166 | ||||||||||||

|

|

|

|||||||||||

| Industrial Conglomerates 1.0% |

||||||||||||

| General Electric Co. |

United States | 4,584,600 | 34,705,422 | |||||||||

|

|

|

|||||||||||

| Insurance 4.5% |

||||||||||||

| American International Group Inc. |

United States | 1,514,000 | 59,666,740 | |||||||||

| The Hartford Financial Services Group Inc. |

United States | 2,006,000 | 89,166,700 | |||||||||

|

|

|

|||||||||||

| 148,833,440 | ||||||||||||

|

|

|

|||||||||||

| Interactive Media & Services 2.5% |

||||||||||||

| a Baidu Inc., ADR |

China | 516,947 | 81,987,794 | |||||||||

|

|

|

|||||||||||

| IT Services 3.1% |

||||||||||||

| Cognizant Technology Solutions Corp., A |

United States | 1,629,630 | 103,448,912 | |||||||||

|

|

|

|||||||||||

|

franklintempleton.com |

Annual Report |

19 |

FRANKLIN MUTUAL BEACON FUND

STATEMENT OF INVESTMENTS

| Country | Shares/ Warrants |

Value | ||||||||||

|

|

||||||||||||

| Common Stocks and Other Equity Interests (continued) |

||||||||||||

| Media 6.1% |

||||||||||||

| a Charter Communications Inc., A |

United States | 312,587 | $ | 89,077,917 | ||||||||

| a Cumulus Media Inc., A |

United States | 30,173 | 325,869 | |||||||||

| a Cumulus Media Inc., B |

United States | 57,236 | 543,742 | |||||||||

| a Cumulus Media Inc., wts., 6/04/38 |

United States | 13,170 | 125,115 | |||||||||

| a Discovery Inc., C |

United States | 2,709,700 | 62,539,876 | |||||||||

| a Liberty Global PLC, C |

United Kingdom | 2,435,700 | 50,272,848 | |||||||||

|

|

|

|||||||||||

| 202,885,367 | ||||||||||||

|

|

|

|||||||||||

| Metals & Mining 0.2% |

||||||||||||

| Warrior Met Coal Inc. |

United States | 207,416 | 5,000,800 | |||||||||

|

|

|

|||||||||||

| Oil, Gas & Consumable Fuels 5.7% |

||||||||||||

| Kinder Morgan Inc. |

United States | 4,414,700 | 67,898,086 | |||||||||

| Royal Dutch Shell PLC, A |

United Kingdom | 2,206,089 | 64,849,084 | |||||||||

| The Williams Cos. Inc. |

United States | 2,581,832 | 56,929,396 | |||||||||

|

|

|

|||||||||||

| 189,676,566 | ||||||||||||

|

|

|

|||||||||||

| Pharmaceuticals 13.3% |

||||||||||||

| Eli Lilly & Co. |

United States | 767,312 | 88,793,345 | |||||||||

| GlaxoSmithKline PLC |

United Kingdom | 5,783,258 | 109,977,483 | |||||||||

| Merck & Co. Inc. |

United States | 1,163,977 | 88,939,482 | |||||||||

| Novartis AG, ADR |

Switzerland | 1,774,190 | 152,243,244 | |||||||||

|

|

|

|||||||||||

| 439,953,554 | ||||||||||||

|

|

|

|||||||||||

| Software 5.1% |

||||||||||||

| a Check Point Software Technologies Ltd. |

Israel | 734,812 | 75,428,452 | |||||||||

| a Red Hat Inc. |

United States | 207,100 | 36,375,044 | |||||||||

| Symantec Corp. |

United States | 2,955,337 | 55,841,092 | |||||||||

|

|

|

|||||||||||

| 167,644,588 | ||||||||||||

|

|

|

|||||||||||

| Specialty Retail 2.0% |

||||||||||||

| Dufry AG |

Switzerland | 708,780 | 67,547,069 | |||||||||

|

|

|

|||||||||||

| Technology Hardware, Storage & Peripherals 1.9% |

||||||||||||

| Western Digital Corp. |

United States | 1,676,500 | 61,980,205 | |||||||||

|

|

|

|||||||||||

| Thrifts & Mortgage Finance 1.4% |

||||||||||||

| Indiabulls Housing Finance Ltd. |

India | 3,646,376 | 44,752,884 | |||||||||

|

|

|

|||||||||||

| Tobacco 2.8% |

||||||||||||

| British American Tobacco PLC |

United Kingdom | 2,851,046 | 90,894,907 | |||||||||

|

|

|

|||||||||||

| Wireless Telecommunication Services 2.0% |

||||||||||||

| a T-Mobile U.S. Inc. |

United States | 1,020,000 | 64,882,200 | |||||||||

|

|

|

|||||||||||

| Total Common Stocks and Other Equity Interests (Cost $2,711,462,123) |

2,884,403,224 | |||||||||||

|

|

|

|||||||||||

| Management Investment Companies (Cost $27,875,091) 0.8% |

||||||||||||

| Diversified Financial Services 0.8% |

||||||||||||

| a Altaba Inc. |

United States | 430,920 | 24,967,505 | |||||||||

|

|

|

|||||||||||

| Preferred Stocks 5.4% |

||||||||||||

| Automobiles 2.2% |

||||||||||||

| e Porsche Automobil Holding SE, 3.429%, pfd. |

Germany | 1,225,551 | 72,080,616 | |||||||||

|

|

|

|||||||||||

| Technology Hardware, Storage & Peripherals 3.2% |

||||||||||||

| e Samsung Electronics Co. Ltd., 4.46%, pfd. |

South Korea | 3,738,607 | 106,581,401 | |||||||||

|

|

|

|||||||||||

| Total Preferred Stocks (Cost $131,568,444) |

178,662,017 | |||||||||||

|

|

|

|||||||||||

|

20 |

Annual Report |

franklintempleton.com |

FRANKLIN MUTUAL BEACON FUND

STATEMENT OF INVESTMENTS

| Country | Principal Amount |

Value | ||||||||||

|

|

||||||||||||

| Corporate Notes and Senior Floating Rate Interests 2.1% |

||||||||||||

| f,g Cumulus Media New Holdings Inc., Term Loan, 7.03%, (1-month USD LIBOR + 4.50%), 5/13/22 |

United States | $ | 10,762,620 | $ | 10,213,274 | |||||||

| Frontier Communications Corp., |

||||||||||||

| senior note, 10.50%, 9/15/22 |

United States | 16,691,000 | 11,683,700 | |||||||||

| senior note, 11.00%, 9/15/25 |

United States | 23,907,000 | 15,000,447 | |||||||||

| f,g Veritas US Inc., |

||||||||||||

| Term Loan B1, 7.022%, (1-month USD LIBOR + 4.50%), 1/27/23 |

United States | 13,060,226 | 11,237,241 | |||||||||

| Term Loan B1, 7.303%, (3-month USD LIBOR + 4.50%), 1/27/23 |

United States | 4,281,659 | 3,684,012 | |||||||||

| h Veritas US Inc./Veritas Bermuda Ltd., |

||||||||||||

| senior note, 144A, 7.50%, 2/01/23 |

United States | 2,766,000 | 2,268,120 | |||||||||

| senior note, 144A, 10.50%, 2/01/24 |

United States | 22,708,000 | 15,044,050 | |||||||||

|

|

|

|||||||||||

| Total Corporate Notes and Senior Floating Rate Interests (Cost $86,351,756) |

69,130,844 | |||||||||||

|

|

|

|||||||||||

| Corporate Notes and Senior Floating Rate Interests in Reorganization 0.8% |

||||||||||||

| b,c,i Broadband Ventures III LLC, secured promissory note, 5.00%, 2/01/12 |

United States | 10,848 | — | |||||||||

| i iHeartCommunications Inc., |

||||||||||||

| senior secured note, first lien, 9.00%, 12/15/19 |

United States | 18,873,000 | 12,739,275 | |||||||||

| f,g Tranche D Term Loan, 8.443%, (3-month USD LIBOR + 6.75%), 1/30/19 |

United States | 15,813,483 | 10,696,081 | |||||||||

| f,g Tranche E Term Loan, 9.193%, (3-month USD LIBOR + 7.50%), 7/30/19 |

United States | 5,080,935 | 3,435,068 | |||||||||

|

|

|

|||||||||||

| Total Corporate Notes and Senior Floating Rate Interests in Reorganization (Cost $38,808,737) |

26,870,424 | |||||||||||

|

|

|

|||||||||||

| Shares | ||||||||||||

|

|

|

|||||||||||

| Companies in Liquidation 0.0%† |

||||||||||||

| a,b,d Tribune Media, Litigation Trust, Contingent Distribution |

United States | 502,429 | — | |||||||||

| a,d Vistra Energy Corp., Litigation Trust, Contingent Distribution |

United States | 46,282,735 | 41,654 | |||||||||

|

|

|

|||||||||||

| Total Companies in Liquidation (Cost $1,582,525) |

41,654 | |||||||||||

|

|

|

|||||||||||

| Total Investments before Short Term Investments (Cost $2,997,648,676) |

3,184,075,668 | |||||||||||

|

|

|

|||||||||||

| Principal Amount |

||||||||||||

|

|

|

|||||||||||

| Short Term Investments 2.9% |

||||||||||||

| U.S. Government and Agency Securities 2.9% |

||||||||||||

| j FHLB, 1/02/19 |

United States | $ | 9,300,000 | 9,300,000 | ||||||||

| j U.S. Treasury Bill, |

||||||||||||

| 1/02/19 - 4/25/19 |

United States | 58,700,000 | 58,462,883 | |||||||||

| k 1/10/19 - 6/06/19 |

United States | 27,800,000 | 27,587,969 | |||||||||

|

|

|

|||||||||||

| Total U.S. Government and Agency Securities |

||||||||||||

| (Cost $95,347,792) |

95,350,852 | |||||||||||

|

|

|

|||||||||||

| Total Investments (Cost $3,092,996,468) 99.3% |

3,279,426,520 | |||||||||||

| Securities Sold Short (1.2)% |

(39,553,897 | ) | ||||||||||

| Other Assets, less Liabilities 1.9% |

62,485,882 | |||||||||||

|

|

|

|||||||||||

| Net Assets 100.0% |

$ | 3,302,358,505 | ||||||||||

|

|

|

|||||||||||

|

franklintempleton.com |

Annual Report |

21 |

FRANKLIN MUTUAL BEACON FUND

STATEMENT OF INVESTMENTS

| Country | Shares | Value | ||||||||||

|

|

||||||||||||

| l Securities Sold Short (1.2)% |

||||||||||||

| Common Stocks (1.2)% |

||||||||||||

| Internet & Direct Marketing Retail (0.6)% |

||||||||||||

| Alibaba Group Holding Ltd., ADR |

China | 155,131 | $ | (21,263,806 | ) | |||||||

|

|

|

|||||||||||

| Pharmaceuticals (0.6)% |

||||||||||||

| Takeda Pharmaceutical Co. Ltd. |

Japan | 541,051 | (18,290,091 | ) | ||||||||

|

|

|

|||||||||||

| Total Securities Sold Short (Proceeds $ 49,678,223) |

$ | (39,553,897 | ) | |||||||||

|

|

|

|||||||||||

†Rounds to less than 0.1% of net assets.

aNon-income producing.

bFair valued using significant unobservable inputs. See Note 14 regarding fair value measurements.

cSee Note 10 regarding restricted securities.

dContingent distributions represent the right to receive additional distributions, if any, during the reorganization of the underlying company. Shares represent total underlying principal of debt securities.

eVariable rate security. The rate shown represents the yield at period end.

fThe coupon rate shown represents the rate at period end.

gSee Note 1(f) regarding senior floating rate interests.

hSecurity was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be sold in transactions exempt from registration only to qualified institutional buyers or in a public offering registered under the Securities Act of 1933. These securities have been deemed liquid under guidelines approved by the Trust’s Board of Trustees. At December 31, 2018, the aggregate value of these securities was $17,312,170, representing 0.5% of net assets.

iSee Note 8 regarding credit risk and defaulted securities.

jThe security was issued on a discount basis with no stated coupon rate.

kA portion or all of the security has been segregated as collateral for securities sold short. At December 31, 2018, the aggregate value of these securities pledged amounted to $15,493,632, representing 0.5% of net assets.

lSee Note 1(d) regarding securities sold short.

At December 31, 2018, the Fund had the following futures contracts outstanding. See Note 1(c).

Futures Contracts

| Description | Type | Number of Contracts |

Notional Amount* |

Expiration Date |

Value/ Unrealized Appreciation (Depreciation) |

|||||||||||||||

|

|

||||||||||||||||||||

| Currency Contracts | ||||||||||||||||||||

| EUR/USD |

Short | 952 | $137,117,750 | 3/18/19 | $ 20,449 | |||||||||||||||

| GBP/USD |

Short | 1,150 | 91,928,125 | 3/18/19 | 190,027 | |||||||||||||||

|

|

|

|||||||||||||||||||

| Total Futures Contracts |

$210,476 | |||||||||||||||||||

|

|

|

|||||||||||||||||||

*As of period end.

|

22 |

Annual Report |

franklintempleton.com |

FRANKLIN MUTUAL BEACON FUND

STATEMENT OF INVESTMENTS

At December 31, 2018, the Fund had the following forward exchange contracts outstanding. See Note 1(c).

Forward Exchange Contracts

| Currency | Counterpartya | Type | Quantity | Contract Amount |

Settlement Date |

Unrealized Appreciation |

Unrealized Depreciation |

|||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

| OTC Forward Exchange Contracts | ||||||||||||||||||||||||||||

| Euro |

BOFA | Buy | 514,089 | $ | 587,389 | 1/14/19 | $ | 2,386 | $ | — | ||||||||||||||||||

| Euro |

HSBK | Buy | 277,777 | 316,930 | 1/14/19 | 1,743 | — | |||||||||||||||||||||

| Euro |

HSBK | Sell | 793,770 | 937,700 | 1/14/19 | 27,069 | — | |||||||||||||||||||||

| Euro |

UBSW | Buy | 1,904 | 2,176 | 1/14/19 | 8 | — | |||||||||||||||||||||

| British Pound |

BOFA | Buy | 207,683 | 263,151 | 1/16/19 | 1,919 | — | |||||||||||||||||||||

| British Pound |

HSBK | Buy | 1,659,952 | 2,103,056 | 1/16/19 | 15,580 | — | |||||||||||||||||||||

| British Pound |

SSBT | Sell | 22,932,950 | 30,563,775 | 1/16/19 | 1,293,904 | — | |||||||||||||||||||||

| British Pound |

UBSW | Buy | 496,188 | 627,061 | 1/16/19 | 6,236 | — | |||||||||||||||||||||

| British Pound |

BOFA | Sell | 2,400,269 | 3,159,408 | 2/14/19 | 91,565 | — | |||||||||||||||||||||

| British Pound |

BONY | Sell | 3,000,000 | 3,958,700 | 2/14/19 | 124,327 | — | |||||||||||||||||||||

| British Pound |

HSBK | Sell | 3,962,799 | 5,217,835 | 2/14/19 | 152,886 | — | |||||||||||||||||||||

| British Pound |

UBSW | Sell | 11,000,000 | 14,463,243 | 2/14/19 | 403,875 | — | |||||||||||||||||||||

| South Korean Won |

BONY | Sell | 3,620,832,500 | 3,272,330 | 2/15/19 | 16,280 | — | |||||||||||||||||||||

| South Korean Won |

HSBK | Buy | 10,853,517,380 | 9,629,812 | 2/15/19 | 130,263 | — | |||||||||||||||||||||

| South Korean Won |

HSBK | Sell | 47,975,040,092 | 43,220,481 | 2/15/19 | 78,714 | — | |||||||||||||||||||||

| South Korean Won |

UBSW | Buy | 4,409,345,698 | 3,928,540 | 2/15/19 | 36,584 | — | |||||||||||||||||||||

| South Korean Won |

UBSW | Sell | 18,391,848,448 | 16,565,502 | 2/15/19 | 26,551 | — | |||||||||||||||||||||

| South Korean Won |

UBSW | Sell | 19,077,483,100 | 16,907,841 | 2/15/19 | — | (247,670 | ) | ||||||||||||||||||||

| Euro |

BOFA | Buy | 2,600,955 | 2,982,914 | 2/20/19 | 10,109 | — | |||||||||||||||||||||

| Euro |

BOFA | Sell | 593,336 | 705,526 | 2/20/19 | 22,750 | — | |||||||||||||||||||||

| Euro |

BONY | Buy | 4,765,990 | 5,458,238 | 2/20/19 | 26,178 | — | |||||||||||||||||||||

| Euro |

BONY | Sell | 4,607,719 | 5,347,138 | 2/20/19 | 44,850 | — | |||||||||||||||||||||

| Euro |

HSBK | Buy | 978,837 | 1,121,202 | 2/20/19 | 5,185 | — | |||||||||||||||||||||

| Euro |

HSBK | Sell | 595,411 | 708,200 | 2/20/19 | 23,036 | — | |||||||||||||||||||||

| Euro |

SSBT | Buy | 704,673 | 806,889 | 2/20/19 | 4,007 | — | |||||||||||||||||||||

| Euro |

SSBT | Sell | 4,010,232 | 4,636,971 | 2/20/19 | 22,236 | — | |||||||||||||||||||||

| Euro |

UBSW | Buy | 756,243 | 866,106 | 2/20/19 | 4,134 | — | |||||||||||||||||||||

| Euro |

BOFA | Buy | 2,591,262 | 2,991,019 | 4/18/19 | 5,690 | — | |||||||||||||||||||||

| Euro |

BOFA | Sell | 173,877 | 202,016 | 4/18/19 | 932 | — | |||||||||||||||||||||

| Euro |

BOFA | Sell | 1,921,837 | 2,222,086 | 4/18/19 | — | (457 | ) | ||||||||||||||||||||

| Euro |

BONY | Sell | 175,899 | 204,370 | 4/18/19 | 949 | — | |||||||||||||||||||||

| Euro |

BONY | Sell | 2,025,583 | 2,341,270 | 4/18/19 | — | (1,251 | ) | ||||||||||||||||||||

| Euro |

HSBK | Buy | 823,233 | 950,173 | 4/18/19 | 1,869 | — | |||||||||||||||||||||

| Euro |

HSBK | Sell | 500,000 | 577,100 | 4/18/19 | — | (1,134 | ) | ||||||||||||||||||||

| Euro |

SSBT | Sell | 539,982 | 621,946 | 4/18/19 | — | (2,525 | ) | ||||||||||||||||||||

| Euro |

UBSW | Buy | 600,954 | 693,822 | 4/18/19 | 1,162 | — | |||||||||||||||||||||

| Euro |

UBSW | Sell | 317,370 | 367,790 | 4/18/19 | 761 | — | |||||||||||||||||||||

| Euro |

UBSW | Sell | 1,920,017 | 2,206,718 | 4/18/19 | — | (13,720 | ) | ||||||||||||||||||||

| British Pound |

BONY | Sell | 3,132,966 | 4,074,773 | 4/24/19 | 57,270 | — | |||||||||||||||||||||

| British Pound |

UBSW | Sell | 3,995,039 | 5,240,400 | 4/24/19 | 117,433 | — | |||||||||||||||||||||

| Euro |

BOFA | Sell | 9,189,964 | 10,649,835 | 5/07/19 | 4,378 | — | |||||||||||||||||||||

| Euro |

BONY | Sell | 5,200,000 | 5,977,390 | 5/07/19 | — | (46,179 | ) | ||||||||||||||||||||

| Euro |

HSBK | Sell | 3,316,744 | 3,830,296 | 5/07/19 | — | (11,748 | ) | ||||||||||||||||||||

| Euro |

HSBK | Sell | 27,571,569 | 32,057,463 | 5/07/19 | 119,147 | — | |||||||||||||||||||||

| Euro |

SSBT | Sell | 94,796 | 110,672 | 5/07/19 | 863 | — | |||||||||||||||||||||

| Euro |

UBSW | Sell | 6,554,346 | 7,526,900 | 5/07/19 | — | (65,514 | ) | ||||||||||||||||||||

| Euro |

UBSW | Sell | 9,892,595 | 11,466,388 | 5/07/19 | 7,017 | — | |||||||||||||||||||||

| South Korean Won |

BONY | Sell | 4,439,872,340 | 4,004,575 | 5/17/19 | — | (3,143 | ) | ||||||||||||||||||||

| South Korean Won |

HSBK | Sell | 5,943,138,476 | 5,353,214 | 5/17/19 | — | (11,450 | ) | ||||||||||||||||||||

|

franklintempleton.com |

Annual Report |

23 |

FRANKLIN MUTUAL BEACON FUND

STATEMENT OF INVESTMENTS

Forward Exchange Contracts (continued)

| Currency | Counterpartya | Type | Quantity | Contract Amount |

Settlement Date |

Unrealized Appreciation |

Unrealized Depreciation |

|||||||||||||||||||||

|

|

||||||||||||||||||||||||||||

| OTC Forward Exchange Contracts (continued) |

|

|||||||||||||||||||||||||||

| South Korean Won |

UBSW | Sell | 33,206,907,922 | $ | 29,698,043 | 5/17/19 | $ | — | $ | (276,674 | ) | |||||||||||||||||

| Euro |

HSBK | Sell | 557,670 | 642,759 | 5/21/19 | — | (4,021 | ) | ||||||||||||||||||||

| Euro |

SSBT | Sell | 2,500,000 | 2,887,650 | 5/21/19 | — | (11,827 | ) | ||||||||||||||||||||

| Euro |

SSBT | Sell | 54,672,573 | 63,663,478 | 5/21/19 | 254,730 | — | |||||||||||||||||||||

| British Pound |

BOFA | Sell | 36,906,347 | 47,733,779 | 5/28/19 | 331,731 | — | |||||||||||||||||||||

| British Pound |

UBSW | Sell | 4,176,956 | 5,319,984 | 5/28/19 | — | (44,846 | ) | ||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||

| Total Forward Exchange Contracts |

$ | 3,476,307 | $ | (742,159 | ) | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||

| Net unrealized appreciation (depreciation) |

|

$ | 2,734,148 | |||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||

aMay be comprised of multiple contracts with the same counterparty, currency and settlement date.

See Note 11 regarding other derivative information.

See Abbreviations on page 42.

|

24 |

Annual Report | The accompanying notes are an integral part of these financial statements. |

franklintempleton.com |

FRANKLIN MUTUAL BEACON FUND

Statement of Assets and Liabilities

December 31, 2018

| Assets: |

||||

| Investments in securities: |

||||

| Cost - Unaffiliated issuers |

$ | 3,092,996,468 | ||

|

|

|

|||

| Value - Unaffiliated issuers |

$ | 3,279,426,520 | ||

| Cash |

317,423 | |||

| Receivables: |

||||

| Investment securities sold |

2,299,112 | |||

| Capital shares sold |

10,438,943 | |||

| Dividends and interest |

10,500,510 | |||

| European Union tax reclaims |

3,590,373 | |||

| Deposits with brokers for: |

||||

| Securities sold short |

44,159,501 | |||

| Futures contracts |

5,172,350 | |||

| Unrealized appreciation on OTC forward exchange contracts |

3,476,307 | |||

| Other assets |

470 | |||

|

|

|

|||

| Total assets |

3,359,381,509 | |||

|

|

|

|||

| Liabilities: |

||||

| Payables: |

||||

| Capital shares redeemed |

11,505,343 | |||

| Management fees |

1,929,241 | |||

| Distribution fees |

505,575 | |||

| Transfer agent fees |

620,201 | |||

| Trustees’ fees and expenses |

277,183 | |||

| Variation margin on futures contracts |

442,675 | |||

| Securities sold short, at value (proceeds $49,678,223) |

39,553,897 | |||

| Unrealized depreciation on OTC forward exchange contracts |

742,159 | |||

| Deferred tax |

1,170,447 | |||

| Accrued expenses and other liabilities |

276,283 | |||

|

|

|

|||

| Total liabilities |

57,023,004 | |||

|

|

|

|||

| Net assets, at value |

$ | 3,302,358,505 | ||

|

|

|

|||

| Net assets consist of: |

||||

| Paid-in capital |

$ | 3,025,246,633 | ||

| Total distributable earnings (loss) |

277,111,872 | |||

|

|

|

|||

| Net assets, at value |

$ | 3,302,358,505 | ||

|

|

|

|

franklintempleton.com |

The accompanying notes are an integral part of these financial statements. | Annual Report |

25 |

FRANKLIN MUTUAL BEACON FUND

FINANCIAL STATEMENTS

Statement of Assets and Liabilities (continued)

December 31, 2018

| Class Z: | ||||

| Net assets, at value |

$ | 2,271,216,822 | ||

|

|

|

|||

| Shares outstanding |

165,101,679 | |||

|

|

|

|||

| Net asset value and maximum offering price per share |

$13.76 | |||

|

|

|

|||

| Class A: | ||||

| Net assets, at value |

$ | 890,293,923 | ||

|

|

|

|||

| Shares outstanding |

65,328,586 | |||

|

|

|

|||

| Net asset value per sharea |

$13.63 | |||

|

|

|

|||

| Maximum offering price per share (net asset value per share ÷ 94.50%) |

$14.42 | |||

|

|

|

|||

| Class C: | ||||

| Net assets, at value |

$ | 59,828,464 | ||

|

|

|

|||

| Shares outstanding |

4,381,711 | |||

|

|

|

|||

| Net asset value and maximum offering price per sharea |

$13.65 | |||

|

|

|

|||

| Class R: | ||||

| Net assets, at value |

$ | 1,661,537 | ||

|

|

|

|||

| Shares outstanding |

123,410 | |||

|

|

|

|||

| Net asset value and maximum offering price per share |

$13.46 | |||

|

|

|

|||

| Class R6: | ||||

| Net assets, at value |

$ | 79,357,759 | ||

|

|

|

|||

| Shares outstanding |

5,770,966 | |||

|

|

|

|||

| Net asset value and maximum offering price per share |

$13.75 | |||

|

|

|

aRedemption price is equal to net asset value less contingent deferred sales charges, if applicable.

|

26 |

Annual Report | The accompanying notes are an integral part of these financial statements. |

franklintempleton.com |

FRANKLIN MUTUAL BEACON FUND

FINANCIAL STATEMENTS

Statement of Operations

for the year ended December 31, 2018

| Investment income: |

||||

| Dividends: (net of foreign taxes)* |

||||

| Unaffiliated issuers |

$ 86,138,340 | |||

| Interest: |

||||

| Unaffiliated issuers |

10,609,792 | |||

| Income from securities loaned: |

||||

| Unaffiliated issuers (net of fees and rebates) |

33,178 | |||

| Non-controlled affiliates (Note 3f) |

20,195 | |||

| Other income (Note 1g) |

1,042,396 | |||

|

|

|

|||

| Total investment income |

97,843,901 | |||

|

|

|

|||

| Expenses: |

||||

| Management fees (Note 3a) |

25,808,103 | |||

| Distribution fees: (Note 3c) |

||||

| Class A |

2,330,762 | |||

| Class C |

2,038,800 | |||

| Class R |

9,055 | |||

| Transfer agent fees: |

||||

| Class Z |

2,268,365 | |||

| Class A |

817,109 | |||

| Class C |

178,772 | |||

| Class R |

1,587 | |||

| Class R6 |

38,336 | |||

| Custodian fees (Note 4) |

202,127 | |||

| Reports to shareholders |

190,182 | |||

| Registration and filing fees |

107,687 | |||

| Professional fees |

112,321 | |||

| Trustees’ fees and expenses |

233,836 | |||

| Dividends on securities sold short |

245,449 | |||

| Other |

80,976 | |||

|

|

|

|||

| Total expenses |

34,663,467 | |||

| Expense reductions (Note 4) |

(29,916 | ) | ||

| Expenses waived/paid by affiliates (Note 3f and 3g) |

(22,860 | ) | ||

|

|

|

|||

| Net expenses |

34,610,691 | |||

|

|

|

|||

| Net investment income |

63,233,210 | |||

|

|

|

|||

| Realized and unrealized gains (losses): |

||||

| Net realized gain (loss) from: |

||||

| Investments:# |

||||

| Unaffiliated issuers |

297,508,315 | |||

| Non-controlled affiliates (Note 3f and 12) |

10,196 | |||

| Foreign currency transactions |

(993,030 | ) | ||

| Forward exchange contracts |

12,657,327 | |||

| Futures contracts |

17,946,424 | |||

| Securities sold short |

(1,132,196 | ) | ||

|

|

|

|||

| Net realized gain (loss) |

325,997,036 | |||

|

|

|

|||

| Net change in unrealized appreciation (depreciation) on: |

||||

| Investments: |

||||

| Unaffiliated issuers |

(729,501,793 | ) | ||

| Translation of other assets and liabilities denominated in foreign currencies |

(311,658 | ) | ||

| Forward exchange contracts |

21,388,656 | |||

| Futures contracts |

4,450,073 | |||

| Securities sold short |

9,551,893 | |||

| Change in deferred taxes on unrealized appreciation |

(498,289 | ) | ||

|

|

|

|||

| Net change in unrealized appreciation (depreciation) |

(694,921,118 | ) | ||

|

|

|

|||

| Net realized and unrealized gain (loss) |

(368,924,082 | ) | ||

|

|

|

|

franklintempleton.com |

The accompanying notes are an integral part of these financial statements. | Annual Report |

27 |

FRANKLIN MUTUAL BEACON FUND

FINANCIAL STATEMENTS

Statement of Operations (continued)

for the year ended December 31, 2018

| Net increase (decrease) in net assets resulting from operations |

$(305,690,872 | ) | ||

|

|

|

|||

| *Foreign taxes withheld on dividends |

$ | 3,722,763 | ||

| #Net of foreign taxes |

$ | 155,569 | ||

|

28 |

Annual Report | The accompanying notes are an integral part of these financial statements. |

franklintempleton.com |

FRANKLIN MUTUAL BEACON FUND

FINANCIAL STATEMENTS

Statements of Changes in Net Assets

| Year Ended December 31, | ||||||||

|

|

|

|||||||

| 2018 | 2017 | |||||||

|

|

||||||||

| Increase (decrease) in net assets: |

||||||||

| Operations: |

||||||||

| Net investment income |

$ | 63,233,210 | $ | 65,956,895 | ||||

| Net realized gain (loss) |

325,997,036 | 183,147,634 | ||||||

| Net change in unrealized appreciation (depreciation) |

(694,921,118 | ) | 281,136,333 | |||||

|

|

|

|||||||

| Net increase (decrease) in net assets resulting from operations |

(305,690,872 | ) | 530,240,862 | |||||

|

|

|

|||||||

| Distributions to shareholders: (Note 1h) |

||||||||

| Class Z |

(221,433,179 | ) | (139,862,559 | ) | ||||

| Class A |

(83,941,345 | ) | (48,591,653 | ) | ||||

| Class C |

(5,683,570 | ) | (11,029,993 | ) | ||||

| Class R |

(157,769 | ) | (88,349 | ) | ||||

| Class R6 |

(7,782,384 | ) | (4,128,902 | ) | ||||

|

|

|

|||||||

| Total distributions to shareholders |

(318,998,247 | ) | (203,701,456 | ) | ||||

|

|

|

|||||||

| Capital share transactions: (Note 2) |

||||||||

| Class Z |

540,717 | (86,429,444 | ) | |||||

| Class A |

72,748,807 | (92,158,566 | ) | |||||

| Class C |

(185,991,052 | ) | (38,165,096 | ) | ||||

| Class R |

390,017 | (607,336 | ) | |||||

| Class R6 |

(12,575,413 | ) | 108,551,501 | |||||

|

|

|

|||||||

| Total capital share transactions |

(124,886,924 | ) | (108,808,941 | ) | ||||

|

|

|

|||||||

| Net increase (decrease) in net assets |

(749,576,043 | ) | 217,730,465 | |||||

| Net assets: |

||||||||

| Beginning of year |

4,051,934,548 | 3,834,204,083 | ||||||

|

|

|

|||||||

| End of year (Note 1h) |

$ | 3,302,358,505 | $ | 4,051,934,548 | ||||

|

|

|

|||||||

|

franklintempleton.com |

The accompanying notes are an integral part of these financial statements. | Annual Report |

29 |

FRANKLIN MUTUAL BEACON FUND

|

30 |

Annual Report |

franklintempleton.com |

FRANKLIN MUTUAL BEACON FUND

NOTES TO FINANCIAL STATEMENTS

|

franklintempleton.com |

Annual Report |

31 |

FRANKLIN MUTUAL BEACON FUND

NOTES TO FINANCIAL STATEMENTS

|

32 |

Annual Report |

franklintempleton.com |

FRANKLIN MUTUAL BEACON FUND

NOTES TO FINANCIAL STATEMENTS

|

franklintempleton.com |

Annual Report |

33 |

FRANKLIN MUTUAL BEACON FUND

NOTES TO FINANCIAL STATEMENTS

*Effective during the current reporting period, it is no longer required to present certain line items in the Statements of Changes in Net Assets. The below prior period amounts affected by this change are shown as they were in the prior year Statements of Changes in Net Assets.

For the year ended December 31, 2017, distributions to shareholders were as follows:

| Distributions from net investment income : |

||||

| Class Z |

$ | (48,496,718 | ) | |

| Class A |

(15,320,414 | ) | ||

| Class C |

(2,055,677 | ) | ||

| Class R |

(23,201 | ) | ||

| Class R6 |

(1,872,829 | ) | ||

| Distributions from net realized gains: |

||||

| Class Z |

(91,365,841 | ) | ||

| Class A |

(33,271,239 | ) | ||

| Class C |

(8,974,316 | ) | ||

| Class R |

(65,148 | ) | ||

| Class R6 |

(2,256,073 | ) |

For the year ended December 31, 2017, undistributed net investment income included in net assets was $1,171,624.

|

34 |

Annual Report |

franklintempleton.com |

FRANKLIN MUTUAL BEACON FUND

NOTES TO FINANCIAL STATEMENTS

2. Shares of Beneficial Interest

At December 31, 2018, there were an unlimited number of shares authorized (without par value). Transactions in the Fund’s shares were as follows:

| Year Ended December 31, | ||||||||||||||||

| 2018 | 2017 | |||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||

| Class Z Shares: | ||||||||||||||||

| Shares sold |

8,257,116 | $ | 133,575,147 | 12,158,938 | $ | 199,279,041 | ||||||||||

| Shares issued in reinvestment of distributions |

15,183,241 | 206,770,472 | 7,927,106 | 130,651,385 | ||||||||||||

| Shares redeemed |

(20,924,183 | ) | (339,804,902 | ) | (25,064,661 | ) | (416,359,870 | ) | ||||||||

| Net increase (decrease) |

2,516,174 | $ | 540,717 | (4,978,617 | ) | $ | (86,429,444 | ) | ||||||||

| Class A Shares: | ||||||||||||||||

| Shares solda |

13,762,741 | $ | 220,038,461 | 5,808,494 | $ | 94,712,185 | ||||||||||

| Shares issued in reinvestment of distributions |

6,066,419 | 81,741,950 | 2,889,127 | 47,191,652 | ||||||||||||

| Shares redeemed |

(14,199,056 | ) | (229,031,604 | ) | (14,375,309 | ) | (234,062,403 | ) | ||||||||

| Net increase (decrease) |

5,630,104 | $ | 72,748,807 | (5,677,688 | ) | $ | (92,158,566 | ) | ||||||||

| Class C Shares: | ||||||||||||||||

| Shares sold |

777,745 | $ | 12,227,859 | 1,150,062 | $ | 18,503,214 | ||||||||||

| Shares issued in reinvestment of distributions |

398,415 | 5,563,069 | 672,846 | 10,882,501 | ||||||||||||

| Shares redeemeda |

(12,713,218 | ) | (203,781,980 | ) | (4,170,647 | ) | (67,550,811 | ) | ||||||||

| Net increase (decrease) |

(11,537,058 | ) | $ | (185,991,052 | ) | (2,347,739 | ) | $ | (38,165,096 | ) | ||||||

| Class R Shares: | ||||||||||||||||

| Shares sold |

27,604 | $ | 454,716 | 32,014 | $ | 516,552 | ||||||||||

| Shares issued in reinvestment of distributions |

11,829 | 157,768 | 5,476 | 88,349 | ||||||||||||

| Shares redeemed |

(14,360 | ) | (222,467 | ) | (74,775 | ) | (1,212,237 | ) | ||||||||

| Net increase (decrease) |

25,073 | $ | 390,017 | (37,285 | ) | $ | (607,336 | ) | ||||||||

| Class R6 Shares: | ||||||||||||||||

| Shares sold |

1,125,287 | $ | 18,530,681 | 6,649,392 | $ | 112,866,490 | ||||||||||

| Shares issued in reinvestment of distributions |

570,780 | 7,773,465 | 249,808 | 4,128,902 | ||||||||||||

| Shares redeemed |

(2,360,255 | ) | (38,879,559 | ) | (503,515 | ) | (8,443,891 | ) | ||||||||

| Net increase (decrease) |

(664,188 | ) | $ | (12,575,413 | ) | 6,395,685 | $ | 108,551,501 | ||||||||

aMay include a portion of Class C shares that were automatically converted to Class A.

3. Transactions with Affiliates

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton. Certain officers and trustees of the Fund are also officers and/or directors of the following subsidiaries:

| Subsidiary | Affiliation | |

| Franklin Mutual Advisers, LLC (Franklin Mutual) |

Investment manager | |

| Franklin Templeton Services, LLC (FT Services) |

Administrative manager | |

| Franklin Templeton Distributors, Inc. (Distributors) |

Principal underwriter | |

| Franklin Templeton Investor Services, LLC (Investor Services) |

Transfer agent |

|

franklintempleton.com |

Annual Report |

35 |

FRANKLIN MUTUAL BEACON FUND

NOTES TO FINANCIAL STATEMENTS

3. Transactions with Affiliates (continued)

a. Management Fees

The Fund pays an investment management fee to Franklin Mutual based on the average daily net assets of the Fund as follows:

| Annualized Fee Rate | Net Assets | |||

| 0.675% |

Up to and including $5 billion | |||

| 0.645% |

Over $5 billion, up to and including $7 billion | |||

| 0.625% |

Over $7 billion, up to and including $10 billion | |||

| 0.615% |

In excess of $10 billion | |||

For the year ended December 31, 2018, the gross effective investment management fee rate was 0.675% of the Fund’s average daily net assets.

b. Administrative Fees

Under an agreement with Franklin Mutual, FT Services provides administrative services to the Fund. The fee is paid by Franklin Mutual based on the Fund’s average daily net assets, and is not an additional expense of the Fund.

c. Distribution Fees

The Board has adopted distribution plans for each share class, with the exception of Class Z and Class R6 shares, pursuant to Rule 12b-1 under the 1940 Act. Under the Fund’s Class A reimbursement distribution plan, the Fund reimburses Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. Under the Class A reimbursement distribution plan, costs exceeding the maximum for the current plan year cannot be reimbursed in subsequent periods. In addition, under the Fund’s Class C and R compensation distribution plans, the Fund pays Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate for each class. The plan year, for purposes of monitoring compliance with the maximum annual plan rates, is February 1 through January 31.

The maximum annual plan rates, based on the average daily net assets, for each class, are as follows:

| Class A |

0.35 | % | ||

| Class C |

1.00 | % | ||

| Class R |

0.50 | % |

The Board has set the current rate at 0.25% per year for Class A shares until further notice and approval by the Board.

d. Sales Charges/Underwriting Agreements

Front-end sales charges and contingent deferred sales charges (CDSC) do not represent expenses of the Fund. These charges are deducted from the proceeds of sales of Fund shares prior to investment or from redemption proceeds prior to remittance, as applicable. Distributors has advised the Fund of the following commission transactions related to the sales and redemptions of the Fund’s shares for the year:

| Sales charges retained net of commissions paid to unaffiliated brokers/dealers |

$ | 70,223 | ||

| CDSC retained |

$ | 9,451 |

Effective September 10, 2018, the Board approved changes to certain front-end sales charges and dealer commissions on Class A shares. Further details are disclosed in the Fund’s Prospectus.

|

36 |

Annual Report |

franklintempleton.com |

FRANKLIN MUTUAL BEACON FUND

NOTES TO FINANCIAL STATEMENTS

e. Transfer Agent Fees

Each class of shares pays transfer agent fees to Investor Services for its performance of shareholder servicing obligations. The fees are based on an annualized asset based fee of 0.02% plus a transaction based fee. In addition, each class reimburses Investor Services for out of pocket expenses incurred and, except for Class R6, reimburses shareholder servicing fees paid to third parties. These fees are allocated daily based upon their relative proportion of such classes’ aggregate net assets. Class R6 pays Investor Services transfer agent fees specific to that class.

For the year ended December 31, 2018, the Fund paid transfer agent fees of $3,304,169, of which $1,629,059 was retained by Investor Services.

f. Investments in Affiliated Management Investment Companies

The Fund invests in one or more affiliated management investment companies for purposes other than exercising a controlling influence over the management or policies. Management fees paid by the Fund are waived on assets invested in the affiliated management investment companies, as noted in the Statement of Operations, in an amount not to exceed the management and administrative fees paid directly or indirectly by each affiliate. During the year ended December 31, 2018, the Fund held investments in affiliated management investment companies as follows:

| Number of Shares Held at Beginning of Year |

Gross Additions |

Gross Reductions |

Number of Shares Held at End of Year |

Value at End of Year |

Income from securities loaned |

Realized Gain (Loss) |

Net Change in Unrealized Appreciation (Depreciation) |

|||||||||||||||||||||||||

| Non-Controlled Affiliates | ||||||||||||||||||||||||||||||||

| Institutional Fiduciary Trust Money Market Portfolio, 1.99% |

— | 16,525,000 | (16,525,000 | ) | — | $ — | $20,195 | $ — | $ — | |||||||||||||||||||||||

g. Waiver and Expense Reimbursements

Investor Services has voluntarily agreed in advance to waive or limit its fees so that the Class R6 transfer agent fees do not exceed 0.02% based on the average net assets of the class. Investor Services may discontinue this waiver in the future.

4. Expense Offset Arrangement

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During the year ended December 31, 2018, the custodian fees were reduced as noted in the Statement of Operations.

5. Independent Trustees’ Retirement Plan