Annual Report

and Shareholder Letter

December 31, 2014

Franklin Mutual Beacon Fund

Formerly, Mutual Beacon Fund

Sign up for electronic delivery at franklintempleton.com/edelivery

Franklin Templeton Investments

Gain From Our Perspective®

At Franklin Templeton Investments, we’re dedicated to one goal: delivering exceptional asset management for our clients. By bringing together multiple, world-class investment teams in a single firm, we’re able to offer specialized expertise across styles and asset classes, all supported by the strength and resources of one of the world’s largest asset managers. This has helped us to become a trusted partner to individual and institutional investors across the globe.

Focus on Investment Excellence

At the core of our firm, you’ll find multiple independent investment teams—each with a focused area of expertise—from traditional to alternative strategies and multi-asset solutions. And because our portfolio groups operate autonomously, their strategies can be combined to deliver true style and asset class diversification.

All of our investment teams share a common commitment to excellence grounded in rigorous, fundamental research and robust, disciplined risk management. Decade after decade, our consistent, research-driven processes have helped Franklin Templeton earn an impressive record of strong, long-term results.

Global Perspective Shaped by Local Expertise

In today’s complex and interconnected world, smart investing demands a global perspective. Franklin Templeton pioneered international investing over 60 years ago, and our expertise in emerging markets spans more than a quarter of a century. Today, our investment professionals are on the ground across the globe, spotting investment ideas and potential risks firsthand. These locally based teams bring in-depth understanding of local companies, economies and cultural nuances, and share their best thinking across our global research network.

Strength and Experience

Franklin Templeton is a global leader in asset management serving clients in over 150 countries.1 We run our business with the same prudence we apply to asset management, staying focused on delivering relevant investment solutions, strong long-term results and reliable, personal service. This approach, focused on putting clients first, has helped us to become one of the most trusted names in financial services.

1. As of 12/31/13. Clients are represented by the total number of shareholder accounts.

Not FDIC Insured | May Lose Value | No Bank Guarantee

| Contents | |

| Shareholder Letter | 1 |

| Annual Report | |

| Franklin Mutual Beacon Fund | 4 |

| Performance Summary | 9 |

| Your Fund’s Expenses | 14 |

| Financial Highlights and | |

| Statement of Investments | 16 |

| Financial Statements | 28 |

| Notes to Financial Statements | 32 |

| Report of Independent Registered | |

| Public Accounting Firm | 47 |

| Tax Information | 48 |

| Board Members and Officers | 49 |

| Shareholder Information | 54 |

| 1

Annual Report

Franklin Mutual Beacon Fund

(formerly, Mutual Beacon Fund)

This annual report for Franklin Mutual Beacon Fund covers the fiscal year ended December 31, 2014.

Your Fund’s Goals and Main Investments

The Fund seeks capital appreciation, which may occasionally be short term, with income as a secondary goal, by investing primarily in equity securities of companies the Fund’s managers believe are at prices below their intrinsic value. The Fund may invest up to 35% of its assets in foreign securities.

Performance Overview

The Fund’s Class Z shares delivered a +6.82% cumulative total return for the 12 months ended December 31, 2014. In comparison, the Fund’s benchmark, the Standard & Poor’s 500 Index (S&P 500), which is a broad measure of U.S. stock performance, generated a +13.69% total return.1 You can find more of the Fund’s performance data in the Performance Summary beginning on page 9.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Economic and Market Overview

The global economy grew moderately during 2014 as U.S. economic growth expanded while growth rates in much of the rest of the world declined. U.S. economic activity was supported in some quarters by increased consumer spending, business investment and federal defense spending. The housing market strengthened, and lower gasoline prices and improved job growth contributed to rising retail sales. The U.S. Federal Reserve Board (Fed) began reducing its large-scale bond purchases $10 billion a month in January and ended the buying program in October. But it continued its practice of maintaining holdings of longer term securities at sizable levels. Toward period-end, the Fed stated that it could be patient with regard to raising interest rates and that the interest rate might not rise for

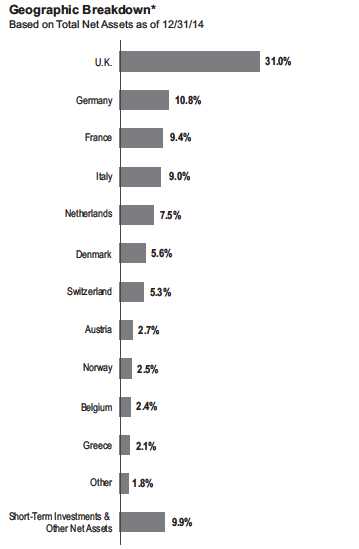

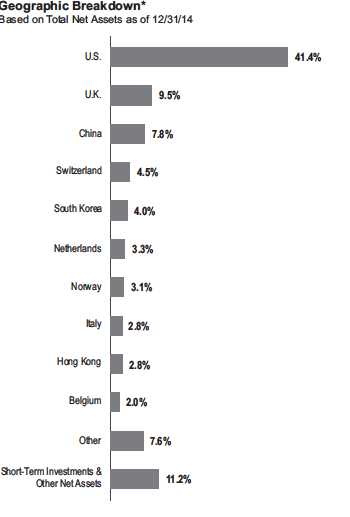

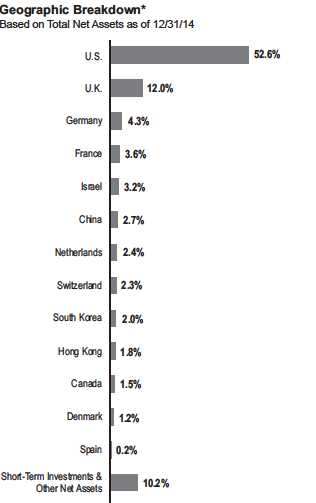

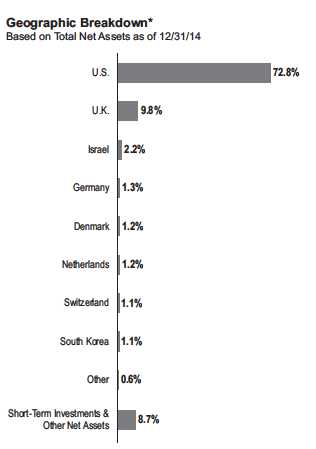

*Weightings may be negative or may not total 100% due to rounding, use of any derivatives, unsettled trades or other factors.

at least a couple of meetings, possibly implying at least the first two meetings of 2015.

Outside the U.S., the U.K. economy grew relatively well, supported by the services and manufacturing sectors. In the eurozone, economic growth remained subdued, as concerns persisted about the potential negative impacts to growth from the crisis in Ukraine and China’s moderating growth rate. In June, the European Central Bank (ECB) reduced its main interest rate and, for the first time, set a negative deposit rate; the ECB reduced both rates again in September. The ECB

1. Source: Morningstar.

The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio. See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 21.

4 | Annual Report

franklintempleton.com

FRANKLIN MUTUAL BEACON FUND

broadened its monetary easing stance by implementing an asset purchase program to prevent deflation and stimulate the economy. Japan’s second- and third-quarter economic contractions indicated the economy was in a recession, although private consumption and exports improved in the third quarter. In October, the Bank of Japan expanded its stimulus measures amid weak domestic demand and as substantially lower crude oil prices exerted further downward pressure on inflation. Near period-end, Japan’s ruling coalition was reelected in early parliamentary elections and subsequently announced a fresh stimulus package aimed at reviving economic growth.

Global developed market stocks, as measured by the MSCI World Index, advanced overall during the 12-month period amid a generally accommodative monetary policy environment and continued strength in corporate earnings. In several emerging markets, economic growth generally moderated. Emerging market stocks overall, as measured by the MSCI Emerging Markets Index, fell for the year, amid headwinds such as soft domestic demand, weak exports, plummeting crude oil prices, regional geopolitical tensions and concerns about possible U.S. interest rate increases. Many emerging market currencies depreciated against the U.S. dollar, leading several central banks to raise interest rates seeking to support their currencies. Several other central banks lowered interest rates to promote economic growth. Gold prices ended the year lower amid benign global inflation and a strong U.S. dollar.

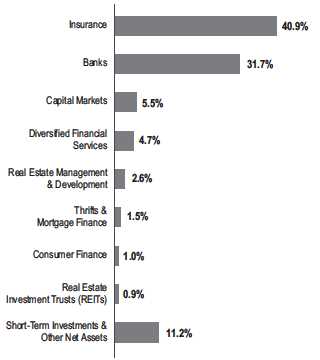

| Top 10 Sectors/Industries | ||

| Based on Equity Securities as of 12/31/14 | ||

| % of Total | ||

| Net Assets | ||

| Media | 14.7 | % |

| Software | 9.3 | % |

| Pharmaceuticals | 9.2 | % |

| Banks | 7.5 | % |

| Tobacco | 5.8 | % |

| Insurance | 5.5 | % |

| Health Care Equipment & Supplies | 4.5 | % |

| Chemicals | 3.3 | % |

| Food & Staples Retailing | 3.3 | % |

| Diversified Telecommunication Services | 2.9 | % |

Investment Strategy

At Mutual Series, we are committed to our distinctive value approach to investing, which we believe can generate above-average risk-adjusted returns over time for our shareholders.

Our major investment strategy is investing in undervalued stocks. When selecting undervalued equities, we are attracted to fundamentally strong companies with healthy balance sheets, high-quality assets, substantial free cash flow and shareholder-oriented management teams and whose stocks are trading at discounts to our assessment of the companies’ intrinsic or business value. We also look for asset rich companies whose shares may be trading at depressed levels due to concerns over short-term earnings disappointments, litigation, management strategy or other perceived negatives. This strict value approach is not only intended to improve the likelihood of upside potential, but it is also intended to reduce the risk of substantial declines. While the vast majority of our undervalued equity investments are made in publicly traded companies globally, we may invest occasionally in privately held companies as well.

We complement this more traditional investment strategy with two others. One is distressed investing, a highly specialized field that has proven quite profitable during certain periods over the years. Distressed investing is complex and can take many forms. The most common distressed investment the Fund undertakes is the purchase of financially troubled or bankrupt companies’ debt at a substantial discount to face value. After the financially distressed company is reorganized, often in bankruptcy court, the old debt is typically replaced with new securities issued by the financially stronger company.

The other piece of our investment strategy is participating in arbitrage situations, another highly specialized field. When companies announce proposed mergers or takeovers, commonly referred to as “deals,” the target company may trade at a discount to the bid it ultimately accepts. One form of arbi-trage involves purchasing the target company’s stock when it is trading below the value we believe it would receive in a deal. In keeping with our commitment to a relatively conservative investment approach, we typically focus our arbitrage efforts on announced deals, and eschew rumored deals or other situations we consider relatively risky.

In addition, it is our practice to hedge the Fund’s currency exposure when we deem it advantageous for our shareholders.

What is meant by “hedge”?

To hedge an investment is to take a position intended to offset potential losses/gains that may be incurred by a companion financial instrument.

Manager’s Discussion

Many Fund holdings increased in value during the 12-month period. Top contributors to performance included software

franklintempleton.com

Annual Report

| 5

FRANKLIN MUTUAL BEACON FUND

company Microsoft, medical device maker Medtronic and Teva Pharmaceutical Industries.

Microsoft shares rose as the company named a new chief executive officer (CEO) in February. We viewed the hiring of Microsoft insider Satya Nadella as positive given his technical background and track record of reaching beyond Microsoft and embracing other technologies. A good example of Nadella’s openness was the March announcement that the company’s Office productivity suite would be made available for the Apple iPad. Nadella also announced a restructuring plan in July. The restructuring was intended to simplify the company’s operations and align the recently acquired Nokia Devices and Services business with the overall strategy.

Medtronic shares rallied in mid-October as the company reaffirmed its commitment to purchasing Ireland-based Covidien at the terms agreed upon when the acquisition was announced in June. Investors had been cautious about the deal after the U.S. Treasury issued a new set of rules in late September intended to limit cross-border merger and acquisition (M&A) deals that could enable U.S.-based companies to lower tax expenses by re-domiciling in countries with lower corporate tax rates. In November, the U.S. Federal Trade Commission approved the company’s acquisition of Covidien with minimal conditions. Medtronic stated that significant cost saving opportunities would arise from the deal and, in our view, those savings may allow Medtronic to further increase its return of free cash flow to shareholders via dividends and share buybacks. Medtronic also received Food and Drug Administration approval in June for its CoreValve self-expanding catheter and positive trial results in April for its Admiral drug-coated angioplasty balloon, both of which we viewed as having potentially meaningful impacts on revenue if they reach the market.

The performance of Israel-based Teva Pharmaceutical Industries was largely driven by positive events related to the company’s most profitable drug, Copaxone, used to prevent the relapse of multiple sclerosis. In March, the U.S. Supreme Court agreed to hear Teva’s appeal (with oral arguments occurring in October) to maintain a patent, which further delayed the entrance of generic competition. The delay provided Teva the opportunity to convert more U.S. patients to its new formulation and allowed it to potentially retain a higher portion of the franchise once generic alternatives entered the market. In December, Teva received more good news regarding Copaxone with the new formulation gaining European Union approval. Investors also reacted favorably to the January 2014 announcement of a new CEO as the market believed he could successfully carry on Teva’s cost-cutting restructuring program.

| Top 10 Equity Holdings | ||

| 12/31/14 | ||

| Company | % of Total | |

| Sector/Industry, Country | Net Assets | |

| Medtronic Inc. | 3.5 | % |

| Health Care Equipment & Supplies, U.S. | ||

| Twenty-First Century Fox Inc., B | 3.4 | % |

| Media, U.S. | ||

| Microsoft Corp. | 3.0 | % |

| Software, U.S. | ||

| Symantec Corp. | 3.0 | % |

| Software, U.S. | ||

| Lorillard Inc. | 2.9 | % |

| Tobacco, U.S. | ||

| Wells Fargo & Co. | 2.8 | % |

| Banks, U.S. | ||

| Merck & Co. Inc. | 2.7 | % |

| Pharmaceuticals, U.S. | ||

| JPMorgan Chase & Co. | 2.6 | % |

| Banks, U.S. | ||

| Koninklijke KPN NV | 2.5 | % |

| Diversified Telecommunication Services, Netherlands | ||

| British American Tobacco PLC | 2.5 | % |

| Tobacco, U.K. |

During the period under review, some of the Fund’s investments negatively affected performance. These included offshore drilling company Transocean, retailer Tesco and natural resources firm Freeport-McMoRan.

Transocean is a Switzerland-headquartered company providing offshore contract drilling services. The offshore drilling market continued to be mired in a downturn with little clarity regarding the length and depth of the current cycle as oil prices plunged during the second half of 2014. Oil companies pushed back projects, leaving a number of new rigs without contracts and increasing potential downtime between jobs for existing rigs. The growing fleet of uncontracted rigs at period-end portended, in our view, weak second-half results and a challenging start to 2015. On a positive note, the company started a Master Limited Partnership (MLP), Transocean Partners, which went public in September. The MLP may provide Transocean with a way to generate cash by selling (dropping down) assets into Transocean Partners while still controlling the operations of those assets.

Shares of U.K.-based Tesco fell throughout 2014. In March, the stock declined as investors became more concerned about price competition from major discounters and competitor supermarkets. Then in August, Tesco issued an unexpected trading statement ahead of its scheduled first-half results. The company lowered its profit guidance primarily for its flagship U.K. oper-

6 | Annual Report

franklintempleton.com

FRANKLIN MUTUAL BEACON FUND

ations and cut its dividend. The stock price took a further hit in September with the announcement of material accounting irregularities in Tesco’s core U.K. operations and a contemporaneous change of both the company’s CEO and chief financial officer. At the end of the year, the company appeared to be at the beginning of what could be a protracted turnaround.

Shares of Freeport-McMoRan came under pressure during 2014 in large part due to falling crude oil prices during the second half of the year, as well as lower prices for copper and gold. The company’s stock also came under pressure from events related to its operations in Indonesia. In early 2014, Indonesia’s government issued new mining-related tax and regulatory policies with the apparent intent to force miners to build smelters within the country. In September, production at the company’s Grasberg mine in Indonesia declined following a fatal accident. The workers’ union subsequently threatened to strike, a development that ultimately did not occur. We took a favorable view of agreements announced in May for Freeport to sell shale assets in Texas and to purchase deepwater oil and gas projects in the Gulf of Mexico. We believe the deepwater assets are more attractive than the shale assets, and proceeds from the shale asset sale allowed Freeport to pay off some of its debt. In addition, we had a favorable view on copper over the longer term as we believed supply shortages were likely in the next few years.

During the period, the Fund held currency forwards and futures to hedge a portion of the currency risk of the portfolio’s non-U.S. dollar investments. The hedges had a positive impact on the Fund’s performance.

What is a currency forward contract?

A currency forward contract, or currency forward, is an agreement between the Fund and a counterparty to buy or sell a foreign currency at a specific exchange rate on a future date.

What is a futures contract?

A futures contract, or a future, is an agreement between the Fund and a counterparty made through a U.S. or foreign futures exchange to buy or sell an asset at a specific price on a future date.

CFA® is a trademark owned by CFA Institute.

As fellow shareholders, we found recent relative performance disappointing, but it is not uncommon for our strategy to lag amid a strong equity market. We remain committed to our disciplined, value investment approach as we seek to generate attractive, long-term, risk-adjusted returns for shareholders. Thank you for your continued participation in Franklin Mutual Beacon Fund. We look forward to continuing to serve your investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of December 31, 2014, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

franklintempleton.com

Annual Report

| 7

FRANKLIN MUTUAL BEACON FUND

Christian Correa has been portfolio manager for Franklin

Mutual Beacon Fund (formerly, Mutual Beacon Fund)

since 2007 and a co-portfolio manager since December

2010. He joined Franklin Templeton Investments in 2003

and serves as Director of Research for Franklin Mutual

Advisers. Previously, he covered merger arbitrage and

special situations at Lehman Brothers Holdings Inc.

Aman Gupta has been assistant portfolio manager for

Franklin Mutual Beacon Fund (formerly, Mutual Beacon

Fund) since December 2013 and has been an analyst

for Franklin Mutual Advisers since 2010. Previously,

Mr. Gupta was a senior equity analyst and director at

Evergreen Investments, where he covered the health care

industry with additional responsibilities in the consumer

and industrials sectors.

Mandana Hormozi has been a co-portfolio manager for

Franklin Mutual Beacon Fund (formerly, Mutual Beacon

Fund) since 2010 and was assistant portfolio manager for

the Fund since 2009. Before that, she was assistant portfo-

lio manager for Franklin Mutual Global Discovery Fund

(formerly, Mutual Global Discovery Fund) since 2007.

She has been an analyst for Franklin Mutual Advisers since

2003, when she joined Franklin Templeton Investments.

Previously, she was a senior vice president in the equity

research department at Lazard Freres. Also, she was an

economic research analyst at Mitsubishi Bank.

8 | Annual Report

franklintempleton.com

FRANKLIN MUTUAL BEACON FUND

Performance Summary as of December 31, 2014

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| Net Asset Value | ||||||

| Share Class (Symbol) | 12/31/14 | 12/31/13 | Change | |||

| Z (BEGRX) | $ | 16.59 | $ | 16.91 | -$ | 0.32 |

| A (TEBIX) | $ | 16.47 | $ | 16.80 | -$ | 0.33 |

| C (TEMEX) | $ | 16.36 | $ | 16.70 | -$ | 0.34 |

| R (n/a) | $ | 16.33 | $ | 16.68 | -$ | 0.35 |

| R6 (FMBRX) | $ | 16.58 | $ | 16.88 | -$ | 0.30 |

| Distributions (1/1/14 - 12/31/14) | ||||||

| Dividend | Long-Term | |||||

| Share Class | Income | Capital Gain | Total | |||

| Z | $ | 0.6889 | $ | 0.7921 | $ | 1.4810 |

| A | $ | 0.6346 | $ | 0.7921 | $ | 1.4267 |

| C | $ | 0.5105 | $ | 0.7921 | $ | 1.3026 |

| R | $ | 0.6087 | $ | 0.7921 | $ | 1.4008 |

| R6 | $ | 0.7049 | $ | 0.7921 | $ | 1.4970 |

franklintempleton.com

Annual Report

| 9

FRANKLIN MUTUAL BEACON FUND

PERFORMANCE SUMMARY

Performance as of 12/31/14

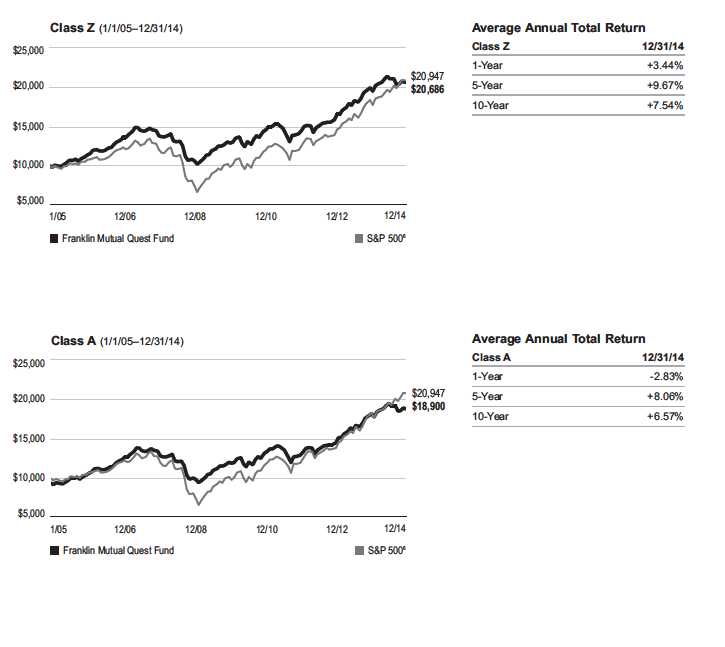

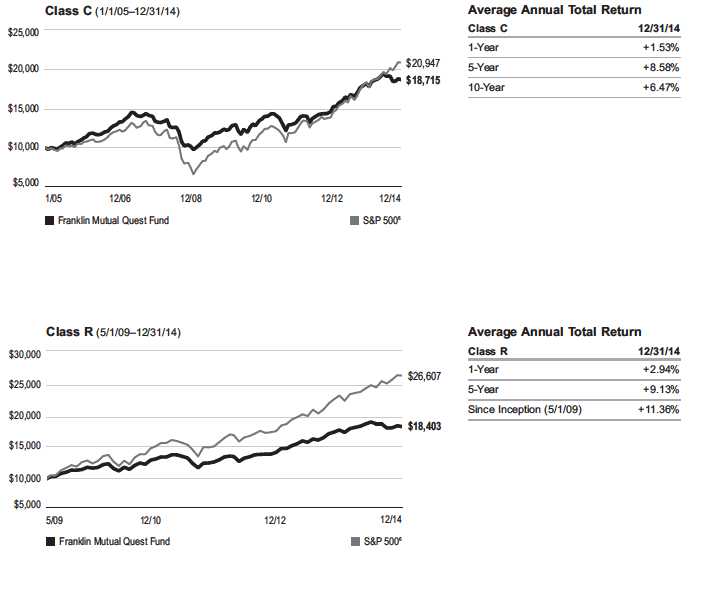

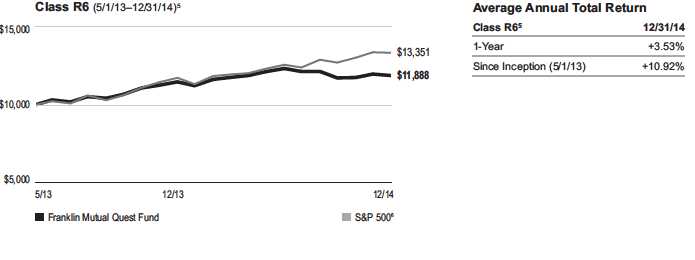

Cumulative total return excludes sales charges. Average annual total return and value of $10,000 investment include maximum sales charges. Class Z/R/R6: no sales charges; Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only.

| Cumulative | Average Annual | Value of $10,000 | Total Annual Operating Expenses4 | |||||||||

| Share Class | Total Return1 | Total Return2 | Investment3 | (with waiver) | (without waiver) | |||||||

| Z | N/A | 0.80 | % | |||||||||

| 1-Year | + | 6.82 | % | + | 6.82 | % | $ | 10,682 | ||||

| 5-Year | + | 74.58 | % | + | 11.79 | % | $ | 17,458 | ||||

| 10-Year | + | 84.03 | % | + | 6.29 | % | $ | 18,403 | ||||

| A | N/A | 1.10 | % | |||||||||

| 1-Year | + | 6.48 | % | + | 0.38 | % | $ | 10,038 | ||||

| 5-Year | + | 71.89 | % | + | 10.12 | % | $ | 16,195 | ||||

| 10-Year | + | 78.44 | % | + | 5.34 | % | $ | 16,816 | ||||

| C | N/A | 1.80 | % | |||||||||

| 1-Year | + | 5.78 | % | + | 4.80 | % | $ | 10,480 | ||||

| 5-Year | + | 65.97 | % | + | 10.66 | % | $ | 16,597 | ||||

| 10-Year | + | 66.54 | % | + | 5.23 | % | $ | 16,654 | ||||

| R | N/A | 1.30 | % | |||||||||

| 1-Year | + | 6.31 | % | + | 6.31 | % | $ | 10,631 | ||||

| 5-Year | + | 70.31 | % | + | 11.24 | % | $ | 17,031 | ||||

| Since Inception (10/30/09) | + | 80.92 | % | + | 12.15 | % | $ | 18,092 | ||||

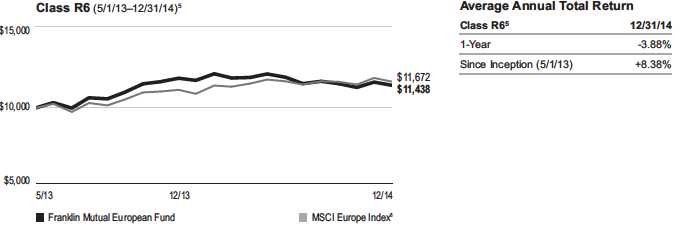

| R65 | 0.71 | % | 2.10 | % | ||||||||

| 1-Year | + | 6.91 | % | + | 6.91 | % | $ | 10,691 | ||||

| Since Inception (5/1/13) | + | 24.91 | % | + | 14.26 | % | $ | 12,491 | ||||

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

10 | Annual Report

franklintempleton.com

FRANKLIN MUTUAL BEACON FUND

PERFORMANCE SUMMARY

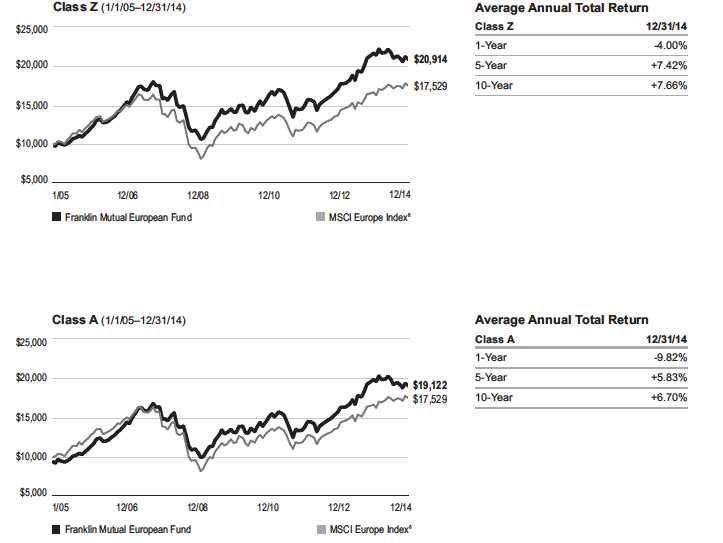

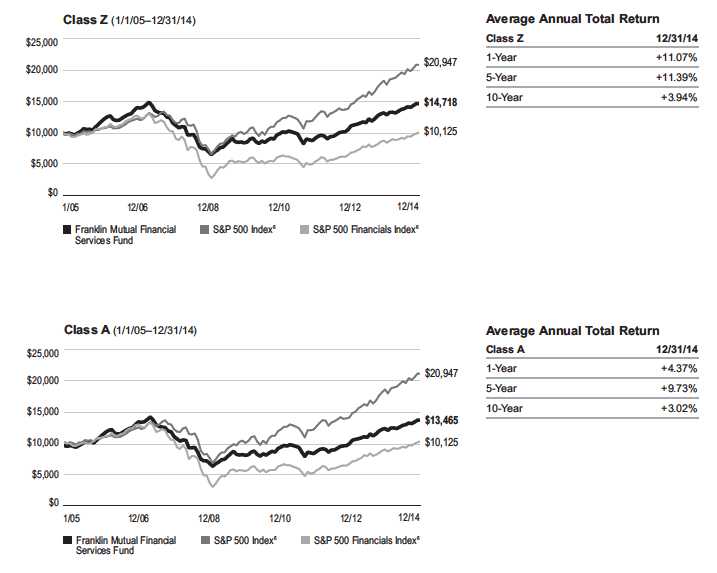

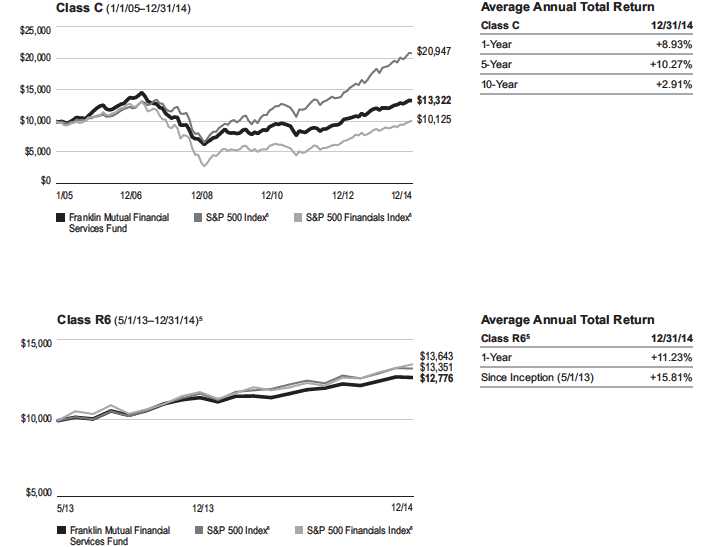

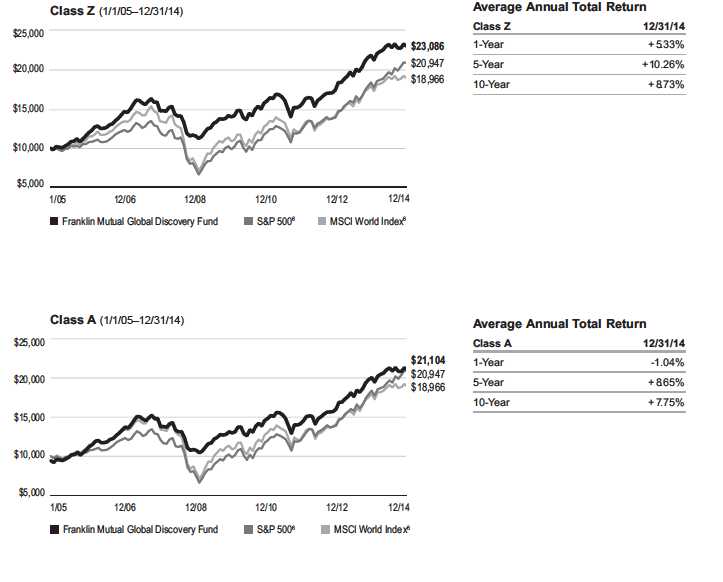

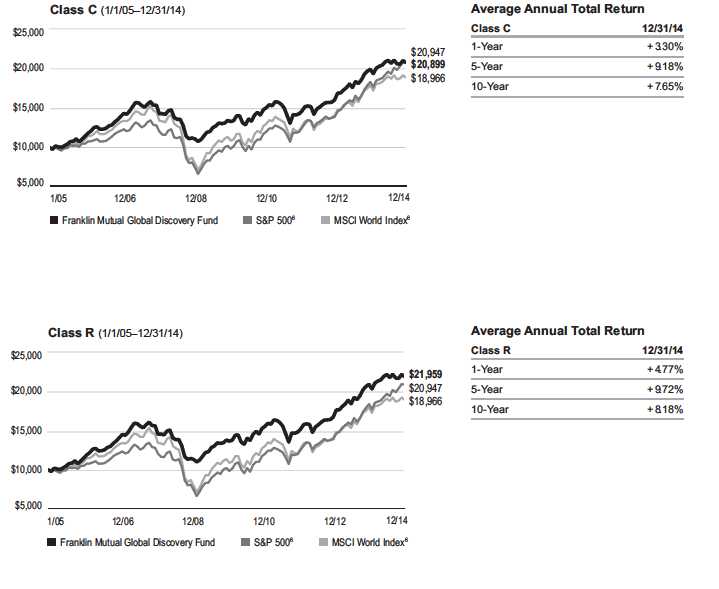

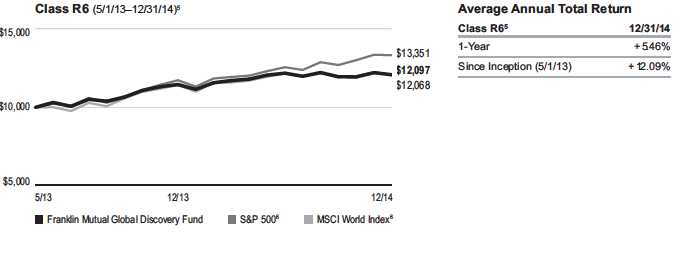

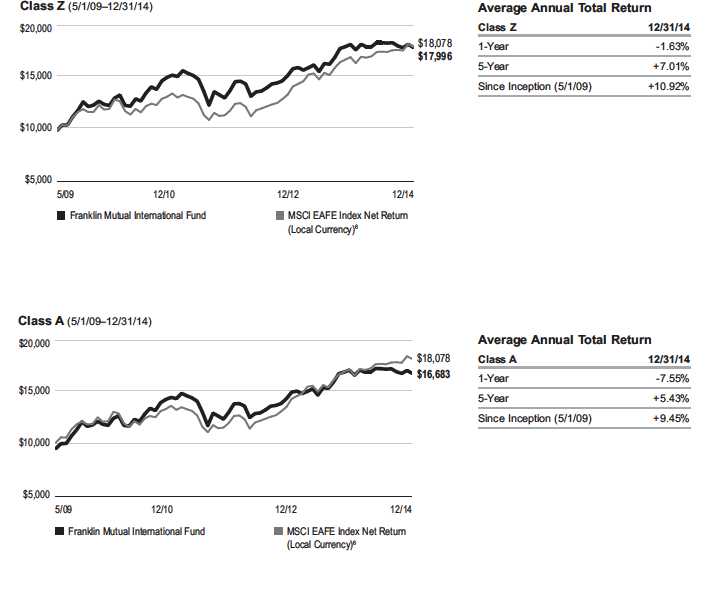

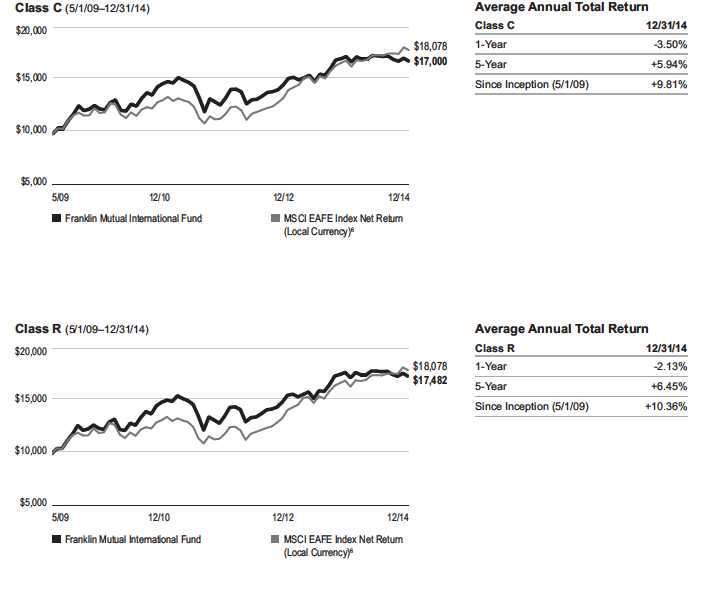

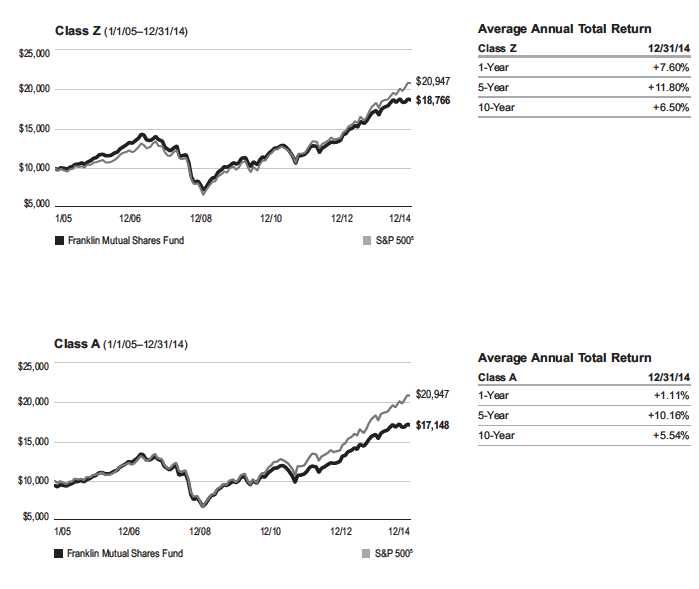

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

franklintempleton.com

Annual Report

| 11

FRANKLIN MUTUAL BEACON FUND

PERFORMANCE SUMMARY

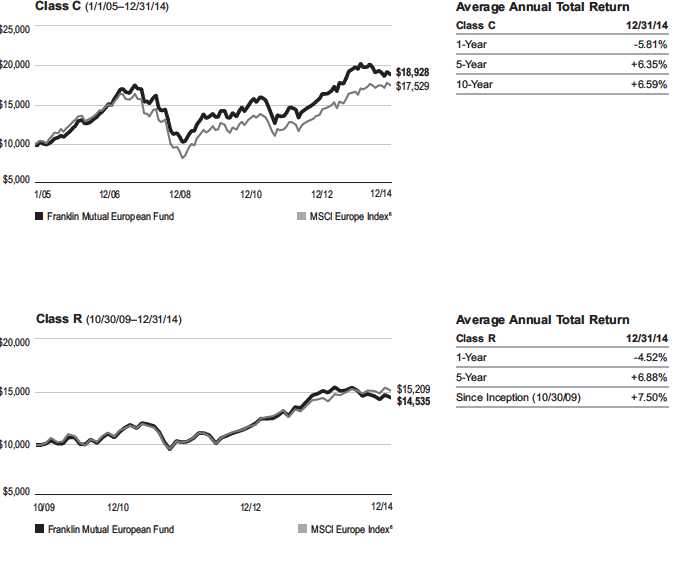

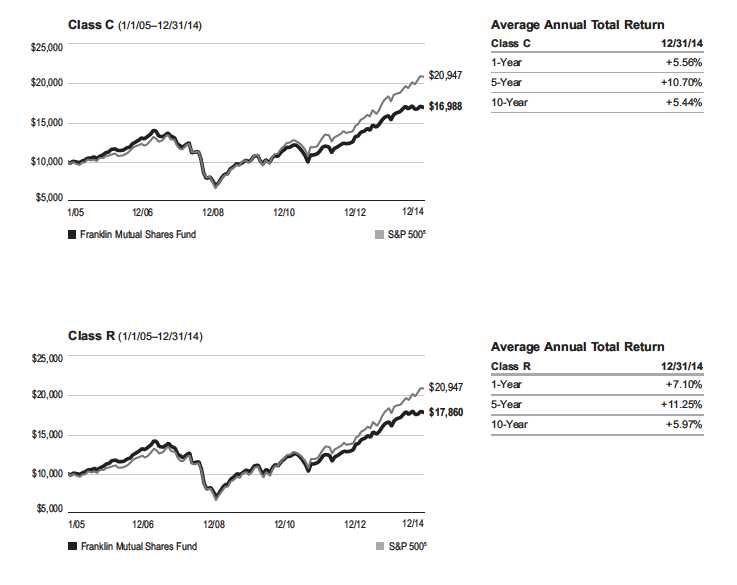

Total Return Index Comparison for a Hypothetical $10,000 Investment (continued)

12 | Annual Report

franklintempleton.com

FRANKLIN MUTUAL BEACON FUND

PERFORMANCE SUMMARY

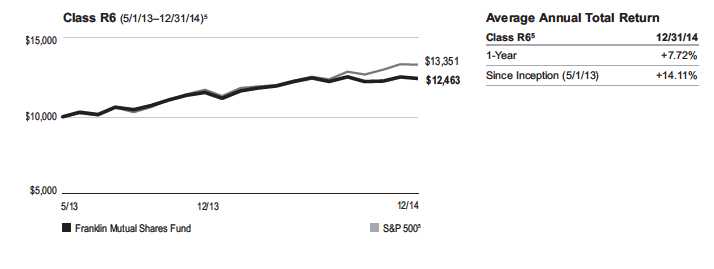

Total Return Index Comparison for a Hypothetical $10,000 Investment (continued)

All investments involve risks, including possible loss of principal. Value securities may not increase in price as anticipated or may decline further in value. The Fund’s investments in smaller company stocks and foreign securities involve special risks. Smaller company stocks have exhibited greater price volatility than larger company stocks, particularly over the short term. Foreign securities risks include currency fluctuations, and economic and political uncertainties. The Fund may also invest in companies engaged in mergers, reorganizations or liquidations, which involve special risks as pending deals may not be completed on time or on favorable terms, as well as lower rated bonds, which entail higher credit risk. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

Class Z: Shares are available to certain eligible investors as described in the prospectus.

Class C: These shares have higher annual fees and expenses than Class A shares.

Class R: Shares are available to certain eligible investors as described in the prospectus. These shares have higher annual fees and expenses than Class A shares.

Class R6: Shares are available to certain eligible investors as described in the prospectus.

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

5. Class R6 has a fee waiver contractually guaranteed through at least 4/30/15. Investment results reflect the fee waiver to the extent applicable; without this reduction, the

results would have been lower.

6. Source: Morningstar. The S&P 500 is a market capitalization-weighted index of 500 stocks designed to measure total U.S. equity market performance.

See www.franklintempletondatasources.com for additional data provider information.

franklintempleton.com

Annual Report

| 13

FRANKLIN MUTUAL BEACON FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. | |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

14 | Annual Report

franklintempleton.com

FRANKLIN MUTUAL BEACON FUND

YOUR FUND’S EXPENSES

| Beginning Account | Ending Account | Expenses Paid During | ||||

| Share Class | Value 7/1/14 | Value 12/31/14 | Period* 7/1/14–12/31/14 | |||

| Z | ||||||

| Actual | $ | 1,000 | $ | 996.90 | $ | 4.23 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,020.97 | $ | 4.28 |

| A | ||||||

| Actual | $ | 1,000 | $ | 994.90 | $ | 5.73 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.46 | $ | 5.80 |

| C | ||||||

| Actual | $ | 1,000 | $ | 991.30 | $ | 9.24 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,015.93 | $ | 9.35 |

| R | ||||||

| Actual | $ | 1,000 | $ | 994.00 | $ | 6.73 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,018.45 | $ | 6.82 |

| R6 | ||||||

| Actual | $ | 1,000 | $ | 996.60 | $ | 3.77 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.42 | $ | 3.82 |

*Expenses are calculated using the most recent six-month expense ratio, annualized for each class (Z: 0.84%; A: 1.14%; C: 1.84%; R: 1.34%; and R6: 0.75%), multiplied by the average account value over the period, multiplied by 184/365 to reflect the one-half year period.

franklintempleton.com

Annual Report

| 15

FRANKLIN MUTUAL BEACON FUND

| Financial Highlights | |||||||||||||||

| Year Ended December 31, | |||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||

| Class Z | |||||||||||||||

| Per share operating performance | |||||||||||||||

| (for a share outstanding throughout the year) | |||||||||||||||

| Net asset value, beginning of year | $ | 16.91 | $ | 13.36 | $ | 11.68 | $ | 12.32 | $ | 11.49 | |||||

| Income from investment operationsa: | |||||||||||||||

| Net investment incomeb | 0.54 | c | 0.31 | 0.24 | 0.28 | 0.36 | d | ||||||||

| Net realized and unrealized gains (losses) | 0.62 | 3.56 | 1.68 | (0.57 | ) | 0.91 | |||||||||

| Total from investment operations | 1.16 | 3.87 | 1.92 | (0.29 | ) | 1.27 | |||||||||

| Less distributions from: | |||||||||||||||

| Net investment income | (0.69 | ) | (0.32 | ) | (0.24 | ) | (0.35 | ) | (0.44 | ) | |||||

| Net realized gains | (0.79 | ) | — | — | — | — | |||||||||

| Total distributions | (1.48 | ) | (0.32 | ) | (0.24 | ) | (0.35 | ) | (0.44 | ) | |||||

| Net asset value, end of year | $ | 16.59 | $ | 16.91 | $ | 13.36 | $ | 11.68 | $ | 12.32 | |||||

| Total return | 6.82 | % | 29.11 | % | 16.44 | % | (2.15 | )% | 11.10 | % | |||||

| Ratios to average net assets | |||||||||||||||

| Expensese | 0.83 | %f | 0.80 | %f | 0.84 | % | 0.84 | % | 0.88 | % | |||||

| Expenses incurred in connection with securities sold short | 0.04 | % | —%g | 0.01 | % | —%g | 0.02 | % | |||||||

| Net investment income | 3.14 | %c | 2.02 | % | 1.87 | % | 2.24 | % | 3.06 | %d | |||||

| Supplemental data | |||||||||||||||

| Net assets, end of year (000’s) | $ | 2,774,929 | $ | 2,876,322 | $ | 2,450,546 | $ | 2,423,177 | $ | 2,860,233 | |||||

| Portfolio turnover rate | 40.06 | % | 32.95 | % | 43.23 | % | 51.38 | % | 34.54 | % | |||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.24 per share received in the form of a special dividend paid in connection with certain Fund’s holdings.

Excluding this amount, the ratio of net investment income to average net assets would have been 1.74%.

dNet investment income per share includes approximately $0.18 per share received in the form of a special dividend paid in connection with a corporate real estate

investment trust (REIT) conversion. Excluding this non-recurring amount, the ratio of net investment income to average net assets would have been 1.53%.

eIncludes dividend and interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(e).

fBenefit of expense reduction rounds to less than 0.01%.

gRounds to less than 0.01%.

16 | Annual Report | The accompanying notes are an integral part of these financial statements.

franklintempleton.com

| FRANKLIN MUTUAL BEACON FUND | |||||||||||||||

| FINANCIAL HIGHLIGHTS | |||||||||||||||

| Year Ended December 31, | |||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||

| Class A | |||||||||||||||

| Per share operating performance | |||||||||||||||

| (for a share outstanding throughout the year) | |||||||||||||||

| Net asset value, beginning of year | $ | 16.80 | $ | 13.28 | $ | 11.61 | $ | 12.24 | $ | 11.40 | |||||

| Income from investment operationsa: | |||||||||||||||

| Net investment incomeb | 0.49 | c | 0.26 | 0.20 | 0.24 | 0.32 | d | ||||||||

| Net realized and unrealized gains (losses) | 0.60 | 3.54 | 1.67 | (0.56 | ) | 0.90 | |||||||||

| Total from investment operations | 1.09 | 3.80 | 1.87 | (0.32 | ) | 1.22 | |||||||||

| Less distributions from: | |||||||||||||||

| Net investment income | (0.63 | ) | (0.28 | ) | (0.20 | ) | (0.31 | ) | (0.38 | ) | |||||

| Net realized gains | (0.79 | ) | — | — | — | — | |||||||||

| Total distributions | (1.42 | ) | (0.28 | ) | (0.20 | ) | (0.31 | ) | (0.38 | ) | |||||

| Net asset value, end of year | $ | 16.47 | $ | 16.80 | $ | 13.28 | $ | 11.61 | $ | 12.24 | |||||

| Total returne | 6.48 | % | 28.70 | % | 16.10 | % | (2.50 | )% | 10.82 | % | |||||

| Ratios to average net assets | |||||||||||||||

| Expensesf | 1.13 | %g | 1.10 | %g | 1.14 | % | 1.14 | % | 1.18 | % | |||||

| Expenses incurred in connection with securities sold short | 0.04 | % | —%h | 0.01 | % | —%h | 0.02 | % | |||||||

| Net investment income | 2.84 | %c | 1.72 | % | 1.57 | % | 1.94 | % | 2.76 | %d | |||||

| Supplemental data | |||||||||||||||

| Net assets, end of year (000’s) | $ | 1,101,706 | $ | 1,148,409 | $ | 983,981 | $ | 1,062,477 | $ | 1,327,189 | |||||

| Portfolio turnover rate | 40.06 | % | 32.95 | % | 43.23 | % | 51.38 | % | 34.54 | % | |||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.24 per share received in the form of a special dividend paid in connection with certain Fund’s holdings.

Excluding this amount, the ratio of net investment income to average net assets would have been 1.44%.

dNet investment income per share includes approximately $0.18 per share received in the form of a special dividend paid in connection with a corporate REIT conversion.

Excluding this non-recurring amount, the ratio of net investment income to average net assets would have been 1.23%.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

fIncludes dividend and interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(e).

gBenefit of expense reduction rounds to less than 0.01%.

hRounds to less than 0.01%.

franklintempleton.com

The accompanying notes are an integral part of these financial statements. | Annual Report | 17

FRANKLIN MUTUAL BEACON FUND

FINANCIAL HIGHLIGHTS

| Year Ended December 31, | |||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||

| Class C | |||||||||||||||

| Per share operating performance | |||||||||||||||

| (for a share outstanding throughout the year) | |||||||||||||||

| Net asset value, beginning of year | $ | 16.70 | $ | 13.21 | $ | 11.54 | $ | 12.16 | $ | 11.29 | |||||

| Income from investment operationsa: | |||||||||||||||

| Net investment income b | 0.37 | c | 0.15 | 0.11 | 0.15 | 0.24 | d | ||||||||

| Net realized and unrealized gains (losses) | 0.59 | 3.51 | 1.66 | (0.55 | ) | 0.88 | |||||||||

| Total from investment operations | 0.96 | 3.66 | 1.77 | (0.40 | ) | 1.12 | |||||||||

| Less distributions from: | |||||||||||||||

| Net investment income | (0.51 | ) | (0.17 | ) | (0.10 | ) | (0.22 | ) | (0.25 | ) | |||||

| Net realized gains | (0.79 | ) | — | — | — | — | |||||||||

| Total distributions | (1.30 | ) | (0.17 | ) | (0.10 | ) | (0.22 | ) | (0.25 | ) | |||||

| Net asset value, end of year | $ | 16.36 | $ | 16.70 | $ | 13.21 | $ | 11.54 | $ | 12.16 | |||||

| Total returne | 5.78 | % | 27.79 | % | 15.29 | % | (3.15 | )% | 9.96 | % | |||||

| Ratios to average net assets | |||||||||||||||

| Expensesf | 1.83 | %g | 1.80 | %g | 1.84 | % | 1.84 | % | 1.88 | % | |||||

| Expenses incurred in connection with securities sold short | 0.04 | % | —%h | 0.01 | % | —%h | 0.02 | % | |||||||

| Net investment income | 2.14 | %c | 1.02 | % | 0.87 | % | 1.24 | % | 2.06 | %d | |||||

| Supplemental data | |||||||||||||||

| Net assets, end of year (000’s) | $ | 320,832 | $ | 336,222 | $ | 295,958 | $ | 315,390 | $ | 400,949 | |||||

| Portfolio turnover rate | 40.06 | % | 32.95 | % | 43.23 | % | 51.38 | % | 34.54 | % | |||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.24 per share received in the form of a special dividend paid in connection with certain Fund’s holdings.

Excluding this amount, the ratio of net investment income to average net assets would have been 0.74%.

dNet investment income per share includes approximately $0.18 per share received in the form of a special dividend paid in connection with a corporate REIT conversion.

Excluding this non-recurring amount, the ratio of net investment income to average net assets would have been 0.53%.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

fIncludes dividend and interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(e).

gBenefit of expense reduction rounds to less than 0.01%.

hRounds to less than 0.01%.

18 | Annual Report | The accompanying notes are an integral part of these financial statements.

franklintempleton.com

| FRANKLIN MUTUAL BEACON FUND | |||||||||||||||

| FINANCIAL HIGHLIGHTS | |||||||||||||||

| Year Ended December 31, | |||||||||||||||

| 2014 | 2013 | 2012 | 2011 | 2010 | |||||||||||

| Class R | |||||||||||||||

| Per share operating performance | |||||||||||||||

| (for a share outstanding throughout the year) | |||||||||||||||

| Net asset value, beginning of year | $ | 16.68 | $ | 13.19 | $ | 11.52 | $ | 12.16 | $ | 11.38 | |||||

| Income from investment operationsa: | |||||||||||||||

| Net investment incomeb | 0.44 | c | 0.23 | 0.18 | 0.21 | 0.26 | d | ||||||||

| Net realized and unrealized gains (losses) | 0.61 | 3.50 | 1.66 | (0.55 | ) | 0.93 | |||||||||

| Total from investment operations | 1.05 | 3.73 | 1.84 | (0.34 | ) | 1.19 | |||||||||

| Less distributions from: | |||||||||||||||

| Net investment income | (0.61 | ) | (0.24 | ) | (0.17 | ) | (0.30 | ) | (0.41 | ) | |||||

| Net realized gains | (0.79 | ) | — | — | — | — | |||||||||

| Total distributions | (1.40 | ) | (0.24 | ) | (0.17 | ) | (0.30 | ) | (0.41 | ) | |||||

| Net asset value, end of year | $ | 16.33 | $ | 16.68 | $ | 13.19 | $ | 11.52 | $ | 12.16 | |||||

| Total return | 6.31 | % | 28.34 | % | 15.95 | % | (2.69 | )% | 10.63 | % | |||||

| Ratios to average net assets | |||||||||||||||

| Expensese | 1.33 | %f | 1.30 | %f | 1.34 | % | 1.34 | % | 1.38 | % | |||||

| Expenses incurred in connection with securities sold short | 0.04 | % | —%g | 0.01 | % | —%g | 0.02 | % | |||||||

| Net investment income | 2.64 | %c | 1.52 | % | 1.37 | % | 1.74 | % | 2.56 | %d | |||||

| Supplemental data | |||||||||||||||

| Net assets, end of year (000’s) | $ | 2,246 | $ | 1,956 | $ | 1,905 | $ | 2,039 | $ | 976 | |||||

| Portfolio turnover rate | 40.06 | % | 32.95 | % | 43.23 | % | 51.38 | % | 34.54 | % | |||||

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.24 per share received in the form of a special dividend paid in connection with certain Fund’s holdings.

Excluding this amount, the ratio of net investment income to average net assets would have been 1.24%.

dNet investment income per share includes approximately $0.18 per share received in the form of a special dividend paid in connection with a corporate REIT conversion.

Excluding this non-recurring amount, the ratio of net investment income to average net assets would have been 1.03%.

eIncludes dividend and interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(e).

fBenefit of expense reduction rounds to less than 0.01%.

gRounds to less than 0.01%.

franklintempleton.com

The accompanying notes are an integral part of these financial statements. | Annual Report | 19

FRANKLIN MUTUAL BEACON FUND

FINANCIAL HIGHLIGHTS

| Year Ended December 31, | ||||||

| 2014 | 2013 | a | ||||

| Class R6 | ||||||

| Per share operating performance | ||||||

| (for a share outstanding throughout the year) | ||||||

| Net asset value, beginning of year | $ | 16.88 | $ | 14.77 | ||

| Income from investment operationsb: | ||||||

| Net investment incomec | 0.56 | d | 0.24 | |||

| Net realized and unrealized gains (losses) | 0.63 | 2.21 | ||||

| Total from investment operations | 1.19 | 2.45 | ||||

| Less distributions from: | ||||||

| Net investment income | (0.70 | ) | (0.34 | ) | ||

| Net realized gains | (0.79 | ) | — | |||

| Total distributions | (1.49 | ) | (0.34 | ) | ||

| Net asset value, end of year | $ | 16.58 | $ | 16.88 | ||

| Total returne | 6.91 | % | 16.83 | % | ||

| Ratios to average net assetsf | ||||||

| Expenses before waiver, payments by affiliates and expense reductiong | 0.74 | % | 2.10 | % | ||

| Expenses net of waiver, payments by affiliates and expense reductiong,h | 0.74 | % | 0.71 | % | ||

| Expenses incurred in connection with securities sold short | 0.04 | % | —%i | |||

| Net investment income | 3.23 | %d | 2.11 | % | ||

| Supplemental data | ||||||

| Net assets, end of year (000’s) | $ | 50,868 | $ | 6 | ||

| Portfolio turnover rate | 40.06 | % | 32.95 | % | ||

aFor the period May 1, 2013 (effective date) to December 31, 2013.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dNet investment income per share includes approximately $0.24 per share received in the form of a special dividend paid in connection with certain Fund’s holdings.

Excluding this amount, the ratio of net investment income to average net assets would have been 1.83%.

eTotal return is not annualized for periods less than one year.

fRatios are annualized for periods less than one year.

gIncludes dividend and interest expense on securities sold short and security borrowing fees, if any. See below for the ratios of such expenses to average net assets for the

periods presented. See Note 1(e).

hBenefit of expense reduction rounds to less than 0.01%.

iRounds to less than 0.01%.

20 | Annual Report | The accompanying notes are an integral part of these financial statements.

franklintempleton.com

FRANKLIN MUTUAL BEACON FUND

| Statement of Investments, December 31, 2014 | ||||

| Country | Shares | Value | ||

| Common Stocks and Other Equity Interests 86.5% | ||||

| Auto Components 0.4% | ||||

| a,bInternational Automotive Components Group Brazil LLC | Brazil | 2,846,329 | $ | 269,206 |

| a,b,cInternational Automotive Components Group North America LLC | United States | 22,836,904 | 17,291,647 | |

| 17,560,853 | ||||

| Banks 7.5% | ||||

| Barclays PLC | United Kingdom | 23,519,630 | 89,267,212 | |

| JPMorgan Chase & Co. | United States | 1,762,110 | 110,272,844 | |

| Wells Fargo & Co. | United States | 2,188,070 | 119,949,996 | |

| 319,490,052 | ||||

| Beverages 1.1% | ||||

| PepsiCo Inc. | United States | 510,803 | 48,301,532 | |

| Chemicals 3.3% | ||||

| Arkema | France | 1,295,470 | 86,323,253 | |

| a,d,eDow Corning Corp., Contingent Distribution | United States | 12,598,548 | — | |

| Tronox Ltd., A | United States | 2,187,603 | 52,239,959 | |

| 138,563,212 | ||||

| Communications Equipment 1.4% | ||||

| Cisco Systems Inc. | United States | 2,094,362 | 58,254,679 | |

| Construction & Engineering 0.9% | ||||

| Sinopec Engineering Group Co. Ltd. | China | 58,345,700 | 39,504,372 | |

| Diversified Telecommunication Services 3.6% | ||||

| a,d,eGlobal Crossing Holdings Ltd., Contingent Distribution | United States | 60,632,757 | — | |

| Koninklijke KPN NV | Netherlands | 33,100,190 | 105,254,630 | |

| TDC AS | Denmark | 6,263,530 | 48,063,579 | |

| 153,318,209 | ||||

| Energy Equipment & Services 2.8% | ||||

| Baker Hughes Inc. | United States | 1,359,380 | 76,220,437 | |

| fTransocean Ltd. | United States | 2,409,819 | 44,171,982 | |

| 120,392,419 | ||||

| Food & Staples Retailing 3.3% | ||||

| Tesco PLC | United Kingdom | 16,371,974 | 48,230,900 | |

| Walgreens Boots Alliance Inc. | United States | 1,177,451 | 89,721,766 | |

| 137,952,666 | ||||

| Health Care Equipment & Supplies 4.5% | ||||

| Medtronic Inc. | United States | 2,043,235 | 147,521,567 | |

| Stryker Corp. | United States | 478,132 | 45,102,192 | |

| 192,623,759 | ||||

| Health Care Providers & Services 1.0% | ||||

| Cigna Corp. | United States | 406,872 | 41,871,198 | |

| Hotels, Restaurants & Leisure 0.6% | ||||

| aPinnacle Entertainment Inc. | United States | 1,138,380 | 25,328,955 | |

| Insurance 5.5% | ||||

| The Allstate Corp. | United States | 793,406 | 55,736,771 | |

| a,bOlympus Re Holdings Ltd. | United States | 106,700 | — | |

| aRSA Insurance Group PLC | United Kingdom | 12,512,342 | 84,837,992 | |

| White Mountains Insurance Group Ltd. | United States | 146,141 | 92,084,906 | |

| 232,659,669 | ||||

| franklintempleton.com | Annual Report | 21 | |||

FRANKLIN MUTUAL BEACON FUND

STATEMENT OF INVESTMENTS

| Country | Shares | Value | ||

| Common Stocks and Other Equity Interests (continued) | ||||

| IT Services 2.4% | ||||

| gPolaris Consulting and Services Ltd./India | India | 6,669,381 | $ | 18,150,747 |

| Xerox Corp. | United States | 6,013,798 | 83,351,240 | |

| 101,501,987 | ||||

| Media 14.7% | ||||

| CBS Corp., B | United States | 1,178,271 | 65,205,517 | |

| Comcast Corp., Special A | United States | 731,577 | 42,113,230 | |

| aDIRECTV | United States | 743,000 | 64,418,100 | |

| aLiberty Global PLC, C | United Kingdom | 1,241,640 | 59,983,628 | |

| Reed Elsevier PLC | United Kingdom | 2,648,846 | 45,416,317 | |

| RTL Group SA | Germany | 528,912 | 50,635,495 | |

| Time Warner Cable Inc. | United States | 424,034 | 64,478,610 | |

| Time Warner Inc. | United States | 569,092 | 48,611,839 | |

| aTribune Media Co., A | United States | 322,993 | 19,305,292 | |

| aTribune Media Co., B | United States | 234,472 | 14,014,391 | |

| Tribune Publishing Co. | United States | 154,221 | 3,531,661 | |

| Twenty-First Century Fox Inc., B | United States | 3,954,737 | 145,890,248 | |

| 623,604,328 | ||||

| Metals & Mining 1.6% | ||||

| Freeport-McMoRan Inc., B | United States | 2,965,589 | 69,276,159 | |

| a,b,gPMG LLC | United States | 5,455 | 294,219 | |

| 69,570,378 | ||||

| Oil, Gas & Consumable Fuels 1.3% | ||||

| Apache Corp. | United States | 896,560 | 56,187,415 | |

| Personal Products 0.9% | ||||

| Avon Products Inc. | United States | 3,821,101 | 35,880,138 | |

| Pharmaceuticals 9.2% | ||||

| Eli Lilly & Co. | United States | 695,870 | 48,008,071 | |

| aHospira Inc. | United States | 1,397,795 | 85,614,944 | |

| Merck & Co. Inc. | United States | 2,005,510 | 113,892,913 | |

| Novartis AG, ADR | Switzerland | 527,301 | 48,859,711 | |

| Teva Pharmaceutical Industries Ltd., ADR | Israel | 1,620,652 | 93,203,696 | |

| 389,579,335 | ||||

| Real Estate Management & Development 2.0% | ||||

| eCanary Wharf Group PLC | United Kingdom | 10,069,634 | 84,897,949 | |

| Semiconductors & Semiconductor Equipment 0.3% | ||||

| Tokyo Electron Ltd., ADR | Japan | 720,000 | 13,737,600 | |

| Software 9.3% | ||||

| CA Inc. | United States | 1,276,425 | 38,867,141 | |

| aCheck Point Software Technologies Ltd. | Israel | 681,851 | 53,573,033 | |

| Microsoft Corp. | United States | 2,761,833 | 128,287,143 | |

| Open Text Corp. | Canada | 839,150 | 48,888,879 | |

| Symantec Corp. | United States | 4,968,542 | 127,467,945 | |

| 397,084,141 | ||||

| Technology Hardware, Storage & Peripherals 0.7% | ||||

| Samsung Electronics Co. Ltd. | South Korea | 24,201 | 29,361,768 |

22 | Annual Report

franklintempleton.com

FRANKLIN MUTUAL BEACON FUND

STATEMENT OF INVESTMENTS

| Country | Shares | Value | ||

| Common Stocks and Other Equity Interests (continued) | ||||

| Tobacco 5.8% | ||||

| Altria Group Inc. | United States | 417,710 | $ | 20,580,572 |

| British American Tobacco PLC | United Kingdom | 1,926,205 | 105,083,146 | |

| Lorillard Inc. | United States | 1,940,551 | 122,138,280 | |

| 247,801,998 | ||||

| Wireless Telecommunication Services 2.4% | ||||

| Vodafone Group PLC | United Kingdom | 29,547,319 | 102,542,358 | |

| Total Common Stocks and Other Equity Interests | ||||

| (Cost $2,798,341,580) | 3,677,570,970 | |||

| Preferred Stocks 3.0% | ||||

| Automobiles 1.3% | ||||

| Porsche Automobil Holding SE, pfd. | Germany | 672,530 | 54,652,207 | |

| Technology Hardware, Storage & Peripherals 1.7% | ||||

| Samsung Electronics Co. Ltd., pfd. | South Korea | 75,123 | 71,361,905 | |

| Total Preferred Stocks (Cost $114,540,328) | 126,014,112 | |||

| Principal | ||||

| Amount* | ||||

| Corporate Bonds, Notes and Senior Floating Rate | ||||

| Interests 3.9% | ||||

| h,iBluestem Brands Inc., First Lien Term Loan, 8.50%, 11/07/20 | United States | 6,420,000 | 6,227,400 | |

| h,iCaesars Entertainment Operating Co. Inc., Senior Tranche, first lien, | ||||

| 3/01/17, | ||||

| B5B, 5.949% | United States | 7,949,777 | 6,979,244 | |

| B6B, 6.949% | United States | 33,533,690 | 29,635,399 | |

| B7, 9.75% | United States | 10,720,130 | 9,508,755 | |

| h,iCengage Learning Acquisitions Inc., First Lien Exit Term Loan, 7.00%, | ||||

| 3/31/20 | United States | 1,447,065 | 1,434,403 | |

| First Data Corp., senior note, 11.75%, 8/15/21 | United States | 7,703,000 | 8,877,708 | |

| iHeartCommunications Communications Inc., | ||||

| senior secured note, first lien, 9.00%, 12/15/19 | United States | 18,873,000 | 18,660,679 | |

| h,iTranche B Term Loan, 3.819%, 1/29/16 | United States | 109,609 | 108,479 | |

| h,iTranche C Term Loan, 3.819%, 1/29/16 | United States | 20,291 | 20,062 | |

| h,iTranche D Term Loan, 6.919%, 1/30/19 | United States | 15,813,482 | 14,938,807 | |

| h,iTranche E Term Loan, 7.669%, 7/30/19 | United States | 5,080,935 | 4,884,049 | |

| h,iJC Penney Corp. Inc., Term Loan, 6.00%, 5/22/18 | United States | 21,428,341 | 21,120,309 | |

| h,iKIK Custom Products Inc., Second Lien Term Loan, 9.50%, 11/17/19 | United States | 22,739,000 | 22,710,576 | |

| NGPL PipeCo LLC, | ||||

| jsecured note, 144A, 7.119%, 12/15/17 | United States | 8,028,000 | 7,927,650 | |

| h,iTerm Loan B, 6.75%, 9/15/17 | United States | 652,112 | 630,919 | |

| Walter Energy Inc., | ||||

| h, iB, Term Loan, 7.25%, 4/01/18 | United States | 9,375,505 | 7,295,315 | |

| jfirst lien, 144A, 9.50%, 10/15/19 | United States | 5,229,000 | 4,000,185 | |

| f,j,ksecond lien, 144A, PIK, 11.50%, 4/01/20 | United States | 4,425,000 | 1,460,467 | |

| Total Corporate Bonds, Notes and Senior Floating | ||||

| Rate Interests (Cost $168,690,230) | 166,420,406 | |||

| Corporate Notes and Senior Floating Rate Interests | ||||

| in Reorganization 1.2% | ||||

| b,lBroadband Ventures III LLC, secured promissory note, 5.00%, 2/01/12 | United States | 10,848 | — | |

| h,i,lTexas Competitive Electric Holdings Co. LLC, Extended Term Loan, | ||||

| 4.648%, 10/10/17 | United States | 46,282,735 | 29,968,071 | |

| j,lTexas Competitive Electric Holdings Co. LLC/Texas Competitive Electric | ||||

| Holdings Finance Inc., senior secured note, 144A, 11.50%, 10/01/20 | United States | 28,306,000 | 20,168,025 | |

| Total Corporate Notes and Senior Floating Rate Interests | ||||

| in Reorganization (Cost $66,784,584) | 50,136,096 | |||

| franklintempleton.com | Annual Report | 23 | |||

FRANKLIN MUTUAL BEACON FUND

STATEMENT OF INVESTMENTS

| Country | Shares | Value | |||

| Companies in Liquidation 1.0% | |||||

| aAdelphia Recovery Trust | United States | 48,268,724 | $ | 115,845 | |

| a,dAdelphia Recovery Trust, Arahova Contingent Value Vehicle, | |||||

| Contingent Distribution | United States | 6,161,087 | 61,611 | ||

| a,b,c,gCB FIM Coinvestors LLC | United States | 15,831,950 | — | ||

| a,d,eCentury Communications Corp., Contingent Distribution | United States | 16,986,000 | — | ||

| a,bFIM Coinvestor Holdings I, LLC | United States | 19,805,560 | — | ||

| a,mLehman Brothers Holdings Inc., Bankruptcy Claim | United States | 163,140,446 | 40,785,111 | ||

| a,d,eTribune Media Litigation Trust, Contingent Distribution | United States | 496,804 | — | ||

| Total Companies in Liquidation (Cost $49,903,037) | 40,962,567 | ||||

| Principal | |||||

| Amount* | |||||

| Municipal Bonds (Cost $11,956,511) 0.2% | |||||

| Puerto Rico Commonwealth GO, Refunding, Series A, 8.00%, 7/01/35 | United States | 12,808,000 | 11,190,990 | ||

| Total Investments before Short Term Investments | |||||

| (Cost $3,210,216,270) | 4,072,295,141 | ||||

| Short Term Investments 3.0% | |||||

| U.S. Government and Agency Securities 2.5% | |||||

| nFHLB, 1/02/15 | United States | 2,500,000 | 2,500,000 | ||

| n,oU.S. Treasury Bills, 1/02/15 - 5/28/15 | United States | 102,800,000 | 102,792,502 | ||

| Total U.S. Government and Agency Securities | |||||

| (Cost $105,286,191) | 105,292,502 | ||||

| Total Investments before Money Market Funds | |||||

| (Cost $3,315,502,461) | 4,177,587,643 | ||||

| Shares | |||||

| pInvestments from Cash Collateral Received for Loaned | |||||

| Securities (Cost $21,910,834) 0.5% | |||||

| Money Market Funds 0.5% | |||||

| qBNY Mellon Overnight Government Fund, 0.072% | United States | 21,910,834 | 21,910,834 | ||

| Total Investments (Cost $3,337,413,295) 98.8% | 4,199,498,477 | ||||

| Options Written (0.0)%† | (30,000 | ) | |||

| Securities Sold Short (1.0)% | (44,527,044 | ) | |||

| Other Assets, less Liabilities 2.2% | 95,638,656 | ||||

| Net Assets 100.0% | $ | 4,250,580,089 | |||

| Number of | |||||

| Contracts | |||||

| rOptions Written (Premiums Received $225,175) (0.0)%† | |||||

| Puts – Exchange-Traded | |||||

| Tobacco (0.0)%† | |||||

| Lorillard Inc., January Strike Price $55, Expires 1/17/15 | United States | 2,000 | $ | (30,000 | ) |

| Shares | |||||

| sSecurities Sold Short (1.0)% | |||||

| Common Stocks (1.0)% | |||||

| Diversified Telecommunication Services (0.7)% | |||||

| AT&T Inc. | United States | 891,600 | $ | (29,948,844 | ) |

| Semiconductors & Semiconductor Equipment (0.3)% | |||||

| Applied Materials Inc. | United States | 585,000 | (14,578,200 | ) | |

| Total Securities Sold Short (Proceeds $42,748,380) | $ | (44,527,044 | ) | ||

| 24 | Annual Report | franklintempleton.com | ||||

FRANKLIN MUTUAL BEACON FUND

STATEMENT OF INVESTMENTS

*The principal amount is stated in U.S. dollars unless otherwise indicated.

†Rounds to less than 0.1% of net assets.

aNon-income producing.

bSee Note 9 regarding restricted securities.

cAt December 31, 2014, pursuant to the Fund’s policies and the requirements of applicable securities law, the Fund may be restricted from trading these securities for a limited

or extended period of time.

dContingent distributions represent the right to receive additional distributions, if any, during the reorganization of the underlying company. Shares represent total underlying

principal of debt securities.

eSecurity has been deemed illiquid because it may not be able to be sold within seven days. At December 31, 2014, the aggregate value of these securities was $84,897,949,

representing 2.00% of net assets.

fA portion or all of the security is on loan at December 31, 2014. See Note 1(f).

gSee Note 11 regarding holdings of 5% voting securities.

hSee Note 1(g) regarding senior floating rate interests.

iThe coupon rate shown represents the rate at period end.

jSecurity was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be sold in transactions exempt from registration only to qualified institutional buyers

or in a public offering registered under the Securities Act of 1933. These securities have been deemed liquid under guidelines approved by the Trust’s Board of Trustees. At

December 31, 2014, the aggregate value of these securities was $33,556,327, representing 0.79% of net assets.

kIncome may be received in additional securities and/or cash.

lSee Note 8 regarding credit risk and defaulted securities.

mBankruptcy claims represent the right to receive distributions, if any, during the liquidation of the underlying pool of assets. Shares represent amount of allowed unsecured

claims.

nThe security is traded on a discount basis with no stated coupon rate.

oSecurity or a portion of the security has been pledged as collateral for securities sold short, open futures, forward and written option contracts. At December 31, 2014, the

aggregate value of these securities and/or cash pledged as collateral was $73,750,025, representing 1.74% of net assets.

pSee Note 1(f) regarding securities on loan.

qThe rate shown is the annualized seven-day yield at period end.

rSee Note 1(c) regarding written options.

sSee Note 1(e) regarding securities sold short.

| At December 31, 2014, the Fund had the following futures contracts outstanding. See Note 1(c). | ||||||||||||

| Futures Contracts | ||||||||||||

| Number of | Notional Expiration | Unrealized | Unrealized | |||||||||

| Description | Type | Contracts | Value | Date | Appreciation | Depreciation | ||||||

| Currency Contracts | ||||||||||||

| EUR/USD | Short | 566 | $ | 85,657,025 | 3/16/15 | $ | 2,063,594 | $ | — | |||

| GBP/USD | Short | 1,341 | 130,496,063 | 3/16/15 | 757,207 | — | ||||||

| Unrealized appreciation (depreciation) | 2,820,801 | — | ||||||||||

| Net unrealized appreciation (depreciation) | $ | 2,820,801 | ||||||||||

| At December 31, 2014, the Fund had the following forward exchange contracts outstanding. See Note 1(c). | ||||||||||||

| Forward Exchange Contracts | ||||||||||||

| Contract | Settlement | Unrealized | Unrealized | |||||||||

| Currency | Counterpartya Type | Quantity | Amount | Date Appreciation Depreciation | ||||||||

| Euro | BANT | Buy | 625,376 | $ | 781,455 | 1/20/15 | $ | — | $ | (24,583 | ) | |

| Euro | BANT | Sell | 26,749,217 | 35,965,198 | 1/20/15 | 3,591,478 | — | |||||

| Euro | BONY | Buy | 845,319 | 1,052,504 | 1/20/15 | — | (29,441 | ) | ||||

| Euro | DBFX | Buy | 2,028,933 | 2,529,213 | 1/20/15 | — | (73,661 | ) | ||||

| Euro | DBFX | Sell | 587,064 | 781,899 | 1/20/15 | 71,394 | — | |||||

| Euro | FBCO | Buy | 947,297 | 1,178,065 | 1/20/15 | — | (31,581 | ) | ||||

| Euro | FBCO | Sell | 18,350,185 | 24,538,865 | 1/20/15 | 2,330,224 | — | |||||

| Euro | HSBC | Buy | 2,061,513 | 2,566,277 | 1/20/15 | — | (71,294 | ) | ||||

| Euro | HSBC | Sell | 2,672,949 | 3,567,101 | 1/20/15 | 332,117 | — | |||||

| Euro | SCBT | Sell | 11,365,852 | 15,196,171 | 1/20/15 | 1,440,444 | — | |||||

| franklintempleton.com | Annual Report | 25 | |||||||||||

| FRANKLIN MUTUAL BEACON FUND | |||||||||||

| STATEMENT OF INVESTMENTS | |||||||||||

| Forward Exchange Contracts (continued) | |||||||||||

| Contract | Settlement | Unrealized | Unrealized | ||||||||

| Currency | Counterpartya Type | Quantity | Amount | Date Appreciation Depreciation | |||||||

| Euro | SSBT | Buy | 2,069,734 | $ | 2,579,650 | 1/20/15 | $ | — | $ | (74,718 | ) |

| Euro | SSBT | Sell | 5,743,930 | 7,682,077 | 1/20/15 | 730,383 | — | ||||

| British Pound | BANT | Buy | 5,047,087 | 8,455,355 | 1/21/15 | — | (589,788 | ) | |||

| British Pound | BBU | Buy | 6,166,629 | 9,966,144 | 1/21/15 | — | (355,841 | ) | |||

| British Pound | DBFX | Sell | 23,789,768 | 40,602,711 | 1/21/15 | 3,527,855 | — | ||||

| British Pound | HSBC | Buy | 948,877 | 1,594,351 | 1/21/15 | — | (115,586 | ) | |||

| British Pound | HSBC | Sell | 16,992,691 | 28,989,531 | 1/21/15 | 2,507,491 | — | ||||

| British Pound | SSBT | Buy | 2,568,499 | 4,307,057 | 1/21/15 | — | (304,213 | ) | |||

| British Pound | SSBT | Sell | 26,862,993 | 45,645,788 | 1/21/15 | 3,781,504 | — | ||||

| South Korean Won | BANT | Buy | 2,654,988,142 | 2,465,857 | 2/12/15 | — | (43,695 | ) | |||

| South Korean Won | BANT | Sell | 33,654,647,558 | 31,907,186 | 2/12/15 | 1,295,744 | (91,898 | ) | |||

| South Korean Won | BONY | Sell | 2,307,897,756 | 2,236,261 | 2/12/15 | 130,752 | — | ||||

| South Korean Won | FBCO | Sell | 41,494,946,675 | 39,921,538 | 2/12/15 | 2,077,482 | (12,037 | ) | |||

| South Korean Won | HSBC | Buy | 20,682,265,363 | 19,219,178 | 2/12/15 | 37,200 | (387,821 | ) | |||

| South Korean Won | HSBC | Sell | 55,183,499,676 | 52,584,488 | 2/12/15 | 2,349,985 | (109,740 | ) | |||

| Swiss Franc | BANT | Sell | 34,566,502 | 38,286,127 | 2/12/15 | 3,491,945 | — | ||||

| Swiss Franc | BBU | Buy | 4,276,906 | 4,723,467 | 2/12/15 | — | (418,391 | ) | |||

| Swiss Franc | DBFX | Buy | 18,978,182 | 20,960,080 | 2/12/15 | — | (1,856,894 | ) | |||

| Swiss Franc | FBCO | Buy | 6,154,000 | 6,799,925 | 2/12/15 | — | (605,390 | ) | |||

| Swiss Franc | HSBC | Buy | 5,157,414 | 5,720,259 | 2/12/15 | — | (528,874 | ) | |||

| Danish Krone | BANT | Buy | 20,362,265 | 3,459,627 | 2/17/15 | — | (149,809 | ) | |||

| Danish Krone | BANT | Sell | 23,242,154 | 3,931,329 | 2/17/15 | 153,395 | — | ||||

| Danish Krone | BBU | Buy | 3,040,574 | 506,519 | 2/17/15 | — | (12,284 | ) | |||

| Danish Krone | BONY | Buy | 5,285,234 | 916,264 | 2/17/15 | — | (57,167 | ) | |||

| Danish Krone | BONY | Sell | 3,201,901 | 544,036 | 2/17/15 | 23,578 | — | ||||

| Danish Krone | DBFX | Buy | 6,424,105 | 1,115,696 | 2/17/15 | — | (71,479 | ) | |||

| Danish Krone | DBFX | Sell | 13,595,745 | 2,295,571 | 2/17/15 | 85,628 | — | ||||

| Danish Krone | FBCO | Buy | 2,800,000 | 464,955 | 2/17/15 | — | (9,825 | ) | |||

| Danish Krone | SSBT | Buy | 11,127,690 | 1,919,151 | 2/17/15 | — | (110,382 | ) | |||

| Danish Krone | SSBT | Sell | 269,344,282 | 48,319,809 | 2/17/15 | 4,538,801 | — | ||||

| British Pound | BANT | Buy | 10,543,288 | 16,938,086 | 2/19/15 | — | (510,718 | ) | |||

| British Pound | BANT | Sell | 40,503,576 | 66,892,815 | 2/19/15 | 3,792,936 | (8,248 | ) | |||

| British Pound | BBU | Buy | 340,072 | 540,149 | 2/19/15 | — | (10,287 | ) | |||

| British Pound | DBFX | Buy | 3,529,648 | 5,695,897 | 2/19/15 | — | (196,395 | ) | |||

| British Pound | DBFX | Sell | 2,014,199 | 3,139,580 | 2/19/15 | 5,763 | (4,482 | ) | |||

| British Pound | FBCO | Buy | 4,279,429 | 6,851,939 | 2/19/15 | — | (184,213 | ) | |||

| British Pound | FBCO | Sell | 34,296,631 | 56,633,490 | 2/19/15 | 3,196,329 | — | ||||

| British Pound | HSBC | Buy | 15,419,657 | 24,753,679 | 2/19/15 | — | (728,500 | ) | |||

| British Pound | HSBC | Sell | 3,626,415 | 5,841,034 | 2/19/15 | 190,762 | — | ||||

| British Pound | SSBT | Buy | 5,324,036 | 8,553,937 | 2/19/15 | — | (258,622 | ) | |||

| British Pound | SSBT | Sell | 34,904,556 | 57,480,356 | 2/19/15 | 3,111,619 | (15,625 | ) | |||

| Euro | BANT | Sell | 90,389 | 119,197 | 2/27/15 | 9,767 | — | ||||

| Euro | DBFX | Sell | 475,484 | 627,410 | 2/27/15 | 51,767 | — | ||||

| Euro | SCBT | Sell | 1,981,071 | 2,604,158 | 2/27/15 | 205,779 | — | ||||

| Euro | BANT | Sell | 4,806,505 | 6,125,544 | 4/16/15 | 303,903 | — | ||||

| Euro | BBU | Sell | 300,101 | 376,612 | 4/16/15 | 13,129 | — | ||||

| Euro | BONY | Sell | 578,791 | 725,602 | 4/16/15 | 24,571 | — | ||||

| Euro | DBFX | Sell | 2,930,119 | 3,701,974 | 4/16/15 | 153,013 | — | ||||

| Euro | FBCO | Sell | 9,726,475 | 12,193,867 | 4/16/15 | 413,157 | — | ||||

| Euro | HSBC | Sell | 6,441,447 | 7,988,347 | 4/16/15 | 186,464 | — | ||||

| Euro | SCBT | Sell | 289,395 | 362,713 | 4/16/15 | 12,198 | — | ||||

| Euro | SSBT | Sell | 7,671,536 | 9,667,125 | 4/16/15 | 375,358 | — | ||||

| British Pound | BONY | Buy | 3,420,181 | 5,492,137 | 4/22/15 | — | (166,039 | ) | |||

| British Pound | HSBC | Sell | 32,724,985 | 52,687,226 | 4/22/15 | 1,726,037 | — | ||||

| 26 | Annual Report | franklintempleton.com | ||||||||||

FRANKLIN MUTUAL BEACON FUND

STATEMENT OF INVESTMENTS

| Forward Exchange Contracts (continued) | |||||||||||

| Contract | Settlement | Unrealized | Unrealized | ||||||||

| Currency | Counterpartya Type | Quantity | Amount | Date Appreciation Depreciation | |||||||

| British Pound | SCBT | Sell | 36,469,647 | $ | 58,752,601 | 4/22/15 | $ | 1,960,014 | $ | — | |

| Euro | BANT | Sell | 18,533,325 | 23,142,563 | 5/18/15 | 687,266 | — | ||||

| Euro | BONY | Sell | 208,936 | 254,693 | 5/18/15 | 1,543 | — | ||||

| Euro | DBFX | Sell | 38,278,515 | 47,501,685 | 5/18/15 | 1,122,774 | — | ||||

| Euro | FBCO | Sell | 19,611,334 | 24,474,067 | 5/18/15 | 712,636 | — | ||||

| Euro | HSBC | Sell | 642,361 | 782,868 | 5/18/15 | 4,572 | — | ||||

| Euro | SSBT | Sell | 583,902 | 723,968 | 5/18/15 | 16,502 | — | ||||

| British Pound | BANT | Buy | 1,473,331 | 2,298,757 | 5/21/15 | — | (4,936 | ) | |||

| British Pound | BANT | Sell | 24,066,417 | 37,663,943 | 5/21/15 | 195,059 | — | ||||

| British Pound | FBCO | Buy | 612,224 | 953,059 | 5/21/15 | 110 | — | ||||

| British Pound | FBCO | Sell | 17,336,132 | 27,110,243 | 5/21/15 | 119,706 | — | ||||

| British Pound | HSBC | Buy | 2,517,986 | 3,937,063 | 5/21/15 | — | (16,822 | ) | |||

| British Pound | SSBT | Sell | 31,767,671 | 49,684,637 | 5/21/15 | 225,710 | — | ||||

| Norwegian Krone | BANT | Buy | 53,337,096 | 7,356,380 | 5/21/15 | — | (242,195 | ) | |||

| Norwegian Krone | BONY | Buy | 904,657 | 125,451 | 5/21/15 | — | (4,786 | ) | |||

| Norwegian Krone | DBFX | Buy | 72,990,445 | 9,901,309 | 5/21/15 | 9,608 | (175,338 | ) | |||

| Norwegian Krone | DBFX | Sell | 128,042,438 | 18,728,417 | 5/21/15 | 1,649,919 | — | ||||

| Norwegian Krone | FBCO | Buy | 810,240 | 108,155 | 5/21/15 | — | (84 | ) | |||

| Unrealized appreciation (depreciation) | 52,975,371 | (8,663,682 | ) | ||||||||

| Net unrealized appreciation (depreciation) | $ | 44,311,689 | |||||||||

| aMay be comprised of multiple contracts with the same counterparty, currency and settlement date. | |||||||||||

| See Abbreviations on page 46. | |||||||||||

franklintempleton.com

The accompanying notes are an integral part of these financial statements. | Annual Report | 27

FRANKLIN MUTUAL BEACON FUND

Financial Statements

Statement of Assets and Liabilities

December 31, 2014

| Assets: | ||

| Investments in securities: | ||

| Cost - Unaffiliated issuers | $ | 3,320,261,706 |

| Cost - Controlled affiliated issuers (Note 11) | 381,819 | |

| Cost - Non-controlled affiliated issuers (Note 11) | 16,769,770 | |

| Total cost of investments | $ | 3,337,413,295 |

| Value - Unaffiliated issuers | $ | 4,181,053,511 |

| Value - Controlled affiliated issuers (Note 11) | 294,219 | |

| Value - Non-controlled affiliated issuers (Note 11) | 18,150,747 | |

| Total value of investments (includes securities loaned in the amount of $20,915,345) | 4,199,498,477 | |

| Restricted Cash (Note 1d) | 7,950,000 | |

| Foreign currency, at value (cost $28,821,524) | 28,886,158 | |

| Receivables: | ||

| Investment securities sold | 70,075 | |

| Capital shares sold | 2,045,413 | |

| Dividends and interest | 8,052,541 | |

| Due from brokers | 46,145,574 | |

| Variation margin | 204,730 | |

| Unrealized appreciation on forward exchange contracts | 52,975,371 | |

| Other assets | 744,103 | |

| Total assets | 4,346,572,442 | |

| Liabilities: | ||

| Payables: | ||

| Investment securities purchased | 2,276,150 | |

| Capital shares redeemed | 5,696,567 | |

| Management fees | 2,447,823 | |

| Distribution fees | 1,101,066 | |

| Transfer agent fees | 705,822 | |

| Trustees’ fees and expenses | 214,666 | |

| Funds advanced by custodian | 225,267 | |

| Options written, at value (premiums received $225,175) | 30,000 | |

| Securities sold short, at value (proceeds $42,748,380) | 44,527,044 | |

| Payable upon return of securities loaned | 21,910,834 | |

| Due to brokers | 7,950,000 | |

| Unrealized depreciation on forward exchange contracts | 8,663,682 | |

| Accrued expenses and other liabilities | 243,432 | |

| Total liabilities | 95,992,353 | |

| Net assets, at value | $ | 4,250,580,089 |

| Net assets consist of: | ||

| Paid-in capital | $ | 3,301,327,863 |

| Undistributed net investment income | 8,140,663 | |

| Net unrealized appreciation (depreciation) | 907,603,760 | |

| Accumulated net realized gain (loss) | 33,507,803 | |

| Net assets, at value | $ | 4,250,580,089 |

28 | Annual Report | The accompanying notes are an integral part of these financial statements.

franklintempleton.com

| FRANKLIN MUTUAL BEACON FUND | ||

| FINANCIAL STATEMENTS | ||

| Statement of Assets and Liabilities (continued) | ||

| December 31, 2014 | ||

| Class Z: | ||

| Net assets, at value | $ | 2,774,928,528 |

| Shares outstanding | 167,309,838 | |

| Net asset value and maximum offering price per share | $ | 16.59 |

| Class A: | ||

| Net assets, at value | $ | 1,101,705,607 |

| Shares outstanding | 66,881,841 | |

| Net asset value per sharea | $ | 16.47 |

| Maximum offering price per share (net asset value per share ÷ 94.25%) | $ | 17.47 |

| Class C: | ||

| Net assets, at value | $ | 320,831,776 |

| Shares outstanding | 19,608,140 | |

| Net asset value and maximum offering price per sharea | $ | 16.36 |

| Class R: | ||

| Net assets, at value | $ | 2,246,403 |

| Shares outstanding | 137,556 | |

| Net asset value and maximum offering price per share | $ | 16.33 |

| Class R6: | ||

| Net assets, at value | $ | 50,867,775 |

| Shares outstanding | 3,067,249 | |

| Net asset value and maximum offering price per share | $ | 16.58 |

| aRedemption price is equal to net asset value less contingent deferred sales charges, if applicable. | |||

| franklintempleton.com | The accompanying notes are an integral part of these financial statements. | Annual Report | | | 29 |

FRANKLIN MUTUAL BEACON FUND

FINANCIAL STATEMENTS

Statement of Operations

for the year ended December 31, 2014

| Investment income: | |||

| Dividends: | |||

| Unaffiliated issuers | $ | 148,287,249 | |

| Non-controlled affiliated issuers (Note 11) | 743,381 | ||

| Interest | 22,034,131 | ||

| Income from securities loaned | 349,766 | ||

| Total investment income | 171,414,527 | ||

| Expenses: | |||

| Management fees (Note 3a) | 27,591,295 | ||

| Administrative fees (Note 3b) | 1,632,294 | ||

| Distribution fees: (Note 3c) | |||

| Class A | 3,391,489 | ||

| Class C | 3,296,825 | ||

| Class R | 10,428 | ||

| Transfer agent fees: (Note 3e) | |||

| Class Z | 2,613,611 | ||

| Class A | 1,049,661 | ||

| Class C | 306,112 | ||

| Class R | 1,929 | ||

| Class R6 | 82 | ||

| Custodian fees (Note 4) | 222,316 | ||

| Reports to shareholders | 242,591 | ||

| Registration and filing fees | 143,017 | ||