UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| [X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended January 31, 2016. | |

| [ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Commission File No. 1-7062 | |

| InnSuites Hospitality Trust | ||

| (Exact Name of Registrant as Specified in Its Charter) | ||

| Ohio | 34-6647590 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification Number) | |

|

InnSuites Hotels Centre, 1625 E. Northern Avenue, Suite 105, Phoenix, Arizona |

85020 | |

| (Address of Principal Executive Offices) | (ZIP Code) | |

| Registrant’s Telephone Number, including area code: (602) 944-1500 | ||

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Exchange on Which Registered | |

|

Shares of Beneficial Interest, without par value |

NYSE MKT |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

Aggregate market value of Shares of Beneficial Interest held by non-affiliates of the registrant as of July 31, 2015, based upon the closing sales price of the registrant’s Shares of Beneficial Interest on that date, as reported on the NYSE MKT: $5,878,624

Number of Shares of Beneficial Interest outstanding as of April 19, 2016: 8,817,803

Documents incorporated by reference: Portions of the following documents are incorporated by reference: Proxy Statement for 2016 Annual Meeting of Shareholders (portions of which are incorporated by reference into Part III hereof).

PART I

Item 1. BUSINESS

INTRODUCTION TO OUR BUSINESS

InnSuites Hospitality Trust (the “Trust”) is headquartered in Phoenix, Arizona and is an unincorporated Ohio real estate investment trust formed on June 21, 1979; however, the Trust is not a real estate investment trust for federal taxation purposes. The Trust, with its affiliates RRF Limited Partnership, a Delaware limited partnership (the “Partnership”), and InnSuites® Hotels, Inc., a Nevada corporation (“InnSuites Hotels”), owns interests in and operates four hotels, provides management services for a total of six hotels, and provides trademark license services for a total of seven hotels. At January 31, 2016, the Trust owned a 72.11% sole general partner interest in the Partnership, which controlled a 51.01% interest in one InnSuites hotel located in Tucson, Arizona, and controlled a 51.65% interest in one InnSuites hotel located in Ontario, California. We anticipate to sell one or more of our hotels by January 31, 2017.

The Trust also owned a direct 50.93% interest in one InnSuites hotel located in Yuma, Arizona and owned a direct 50.91% interest in one InnSuites® hotel located in Albuquerque, New Mexico (all four InnSuites hotels are hereinafter referred to as the “Hotels”). InnSuites Hotels, a wholly-owned subsidiary of the Trust, provides management services for the Hotels and two hotels owned by affiliates of James F. Wirth, the Trust’s Chairman and Chief Executive Officer. InnSuites Hotels also provides trademark and licensing services to the Hotels, two hotels owned by affiliates of Mr. Wirth and one unrelated hotel property. In addition, we provide additional services in our other business segment as reservations services for 6,300 unrelated hotel properties. The Trust has approximately 300 employees.

The Hotels have an aggregate of 576 hotel suites and operate as moderate and full-service hotels that apply a value studio and two-room suite operating philosophy formulated in 1980 by Mr. Wirth. The Trust owns and operates hotels as studio and two-room suite hotels that offer services such as free hot breakfast buffets and complimentary afternoon social hours plus amenities, such as microwave ovens, refrigerators, free high-speed hard wired and wireless Internet access and coffee makers in each studio or two-room suite.

The Trust believes that a significant opportunity for revenue growth and profitability will arise from the skillful management of the Trust’s Hotels or managed hotel properties for both increased occupancy and rates. The Trust’s primary business objective is to maximize returns to its shareholders through increases in asset value and long-term total returns to shareholders. The Trust seeks to achieve this objective through participation in increased revenues from the Hotels as a result of intensive management and marketing of the InnSuites® hotels and the “InnSuites Boutique Hotel Collection” brands in the southwestern region of the United States. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Future Positioning” for a more detailed discussion of the Trust’s strategic objectives.

The Trust has a single class of Shares of Beneficial Interest, without par value, that are traded on the NYSE MKT under the symbol “IHT.” The Partnership has two outstanding classes of limited partnership interests, Class A and Class B, which are identical in all respects. However, each Class A Partnership unit is convertible, at the option of the Class A holder, into one newly-issued Share of Beneficial Interest of the Trust and each Class B Partnership unit is convertible, upon approval of the Board of Trustees of the Trust, into one newly-issued Share of Beneficial Interest of the Trust. The Partnership Agreement of the Partnership subjects both general and limited partner units to certain restrictions on transfer.

In furtherance of our strategic plan, we have significantly expanded InnDependent Boutique Collection (“IBC Hotels”), a wholly owned subsidiary of InnSuites Hospitality Trust, which has a network of approximately 6,300 members representing 170 countries and over 2,000,000 rooms and suites. During the fiscal year ended January 31, 2014, IBC Hotels formed a marketing alliance with the Independent Lodging Industry Association (“ILIA”). We believe this new hotel network provides independent hotel owners a competitive advantage against traditional franchised brands in their markets. The network provides a booking system and loyalty program. IBC Hotels charges a 10% booking fee, which we believe increases the independent hotel profits. Competitors of IBC Hotels can charge anywhere from a 30% to 50% booking fee. InnDependent InnCentives, IBC’s loyalty program, allows hoteliers to benefit from guests who frequently stay at IBC independent hotels. IBC Hotels is dedicated to providing guests with a unique, non-cookie cutter hotel experience in addition to providing value-added amenities and resort locations to its guests. IBC Hotels has an InnDependent InnCentives travel rewards program that provides a free stay at any worldwide IBC Hotel of the guests’ choice after booking 12 nights on IBC Hotels’ website. In addition, on January 8, 2016, IBC Hotels purchased substantially all of the assets of International Vacation Hotels, a technology company located in Dallas, Texas, which provides reservation services to over 600 independent international hotels. For more information about the acquisition of International Vacation Hotels, see Note 27 of our Consolidated Financial Statements - “Acquisition of International Vacation Hotels”.

| 2 |

MANAGEMENT AND LICENSING CONTRACTS

The Trust directly manages the Hotels through the Trust’s wholly-owned subsidiary, InnSuites Hotels. Under the management agreements, InnSuites Hotels manages the daily operations of the Hotels and the two hotels owned by affiliates of Mr. Wirth. All Trust managed Hotel expenses, revenues and reimbursements among the Trust, InnSuites Hotels and the Partnership have been eliminated in consolidation. The management fees for the Hotels and the two hotels owned by Mr. Wirth are 3% of room revenue and a monthly accounting fee of $2,000 per hotel. These agreements have no expiration date and may be cancelled by either party with 90-days written notice in the event the property changes ownership.

The Trust also provides the use of the “InnSuites” trademark to the Hotels and the two hotels owned by affiliates of Mr. Wirth through the Trust’s wholly-owned subsidiary, InnSuites Hotels, at no additional charge.

MEMBERSHIP AGREEMENTS

InnSuites Hotels has entered into membership agreements with Best Western International, Inc. (“Best Western”) with respect to all of the Hotels. In exchange for use of the Best Western name, trademark and reservation system, the Hotels pay fees to Best Western based on reservations received through the use of the Best Western reservation system and the number of available suites at the Hotels. The agreements with Best Western have no specific expiration terms and may be cancelled by either party. Best Western requires that the Hotels meet certain requirements for room quality, and the Hotels are subject to removal from its reservation system if these requirements are not met. The Hotels with third-party membership agreements received significant reservations through the Best Western reservation system. Under these arrangements, fees paid for membership fees and reservations were approximately $331,000 and $342,000 for fiscal years ended January 31, 2016 and 2015, respectively.

COMPETITION IN THE HOTEL INDUSTRY

The hotel industry is highly competitive. We expect the major challenge for the fiscal year ending January 31, 2017 (“fiscal year 2017”) to be the continuation of strong competition for corporate leisure group and government business in the markets in which we operate, which may affect our ability to increase room rates while maintaining market share. Each of the Hotels experiences competition primarily from other mid-market hotels located in its immediate vicinity, but also competes with hotel properties located in other geographic markets. While none of the Hotels’ competitors dominate any of the Trust’s geographic markets, some of those competitors may have greater marketing and financial resources than the Trust.

Certain additional hotel property developments and/or hotel refurbishments have recently been completed by competitors in a number of the Hotels’ markets, and additional hotel property developments may be built in the future. Such hotel developments have had, and could continue to have, an adverse effect on the revenue of our Hotels in their respective markets.

The Trust has chosen to focus its hotel investments in the southwest region of the United States. The Trust has a concentration of assets in the southern Arizona market. In the markets in which the Trust operates, in particular, the Yuma, Arizona and Ontario, California markets, supply has increased during the past several years. In the Yuma, Arizona market, demand has been steady but a recent increase in supply has added significant pressure to our ability to maintain our rates and occupancy in that market. Either an increase in supply or a decline in demand could result in increased competition, which could have an adverse effect on the revenue of our Hotels in their respective markets.

IBC Hotels provides a variety of brand-like services without the cost or hassle of a brand for a month-to-month agreement to independent hotels, which make up approximately one-half of the worlds hotels (not including B&Bs and rentals). These services include but are not limited to: web/mobile site presence, hotel app, booking engine, loyalty program along with strategic partnerships that provide metasite channels, fast-tracked financing, purchasing, IT services, training and education and integrations to a variety of service providers including rental cars and tours as well as property management and additional distribution.

While the travel landscape is competitive in itself, each one of the services has provided by IBC Hotels its own competitive landscape. Online travel agencies (OTAs) continue to fight for the unwashed customer looking for the occasional booking and hotels to push excess inventory. Brands have historically had solid demand due to their loyalty programs and consistent product offerings along with powerful education and training programs. Technology and tourism companies have powerfully operated in their segment without much cross-over. Independent hotels have historically had trouble getting financing and purchasing power without a large brand or management contract.

The Trust may also compete for investment opportunities with other entities that have greater financial resources. These entities also may generally accept more risk than the Trust can prudently manage. Competition may generally reduce the number of suitable future investment opportunities available to the Trust and increase the bargaining power of owners seeking to sell their properties.

| 3 |

REGULATION

The Trust is subject to numerous federal, state and local government laws and regulations affecting the hospitality industry, including usage, building and zoning requirements and the laws and regulations related to the preparation and sale of food and beverage such as health and liquor license laws. A violation of any of those laws and regulations or increased government regulation could require the Trust to make unplanned expenditures which may result in higher operating costs. In addition, the Trust’s success in expanding our hotel operations depends upon its ability to obtain necessary building permits and zoning variances from local authorities. Compliance with these laws is time intensive and costly and may reduce the Trust’s revenues and operating income.

Under the Americans with Disabilities Act of 1990 (the “ADA”), all public accommodations are required to meet certain federal requirements related to access and use by disabled persons. In addition to ADA work completed to date, the Trust may be required to remove additional access barriers or make unplanned, substantial modifications to its Hotels to comply with the ADA or to comply with other changes in governmental rules and regulations, or become subject to claims, fines and damage awards, any of which could reduce the number of total available rooms, increase operating costs and have a negative impact on the Trust’s results of operations.

Our hotel properties are subject to various federal, state and local environmental laws that impose liability for contamination. Under these laws, governmental entities have the authority to require us, as the current or former owner of the property, to perform or pay for the clean-up of contamination (including swimming pool chemicals or hazardous substances or biological waste) at or emanating from the property and to pay for natural resource damage arising from contamination. These laws often impose liability without regard to whether the owner or operator knew of or caused the contamination. Such liability can be joint and several, so that each covered person can be responsible for all of the costs involved, even if more than one person may have been responsible for the contamination. We can also be liable to private parties for costs of remediation, personal injury death and/or property damage resulting from contamination at or emanating from our hotel properties. Moreover, environmental contamination can affect the value of a property and, therefore, an owners’ ability to borrow funds using the property as collateral or to sell the property on favorable terms or at all. Furthermore, persons who sent waste to a waste disposal facility, such as a landfill or an incinerator, may be liable for costs associated with cleanup of that facility.

The Trust is also subject to laws governing our relationship with employees, including minimum or living wage requirements, overtime, working conditions and work permit requirements. There are frequent proposals under consideration, at the federal and state levels, to increase the minimum wage. Additional increases to the state or federal minimum wage rate, and employee benefit costs including health care or other costs associated with employees could increase expenses and result in lower operating margins.

Lastly, the Trust collects and maintains information relating to its guests for various business purposes, including maintaining guest preferences to enhance the Trust’s customer service and for marketing and promotional purposes. The collection and use of personal data are governed by privacy laws and regulations. Compliance with applicable privacy regulations may increase the Trust’s operating costs and/or adversely impact its ability to service its guests and market its products, properties and services to its guests. In addition, non-compliance with applicable privacy regulations by the Trust (or in some circumstances non-compliance by third parties engaged by the Trust) could result in fines or restrictions on its use or transfer of data.

SEASONALITY OF THE HOTEL BUSINESS

The Hotels’ operations historically have been somewhat seasonal. The two southern Arizona hotels experience their highest occupancy in the first fiscal quarter and, to a lesser extent, the fourth fiscal quarter. The second fiscal quarter tends to be the lowest occupancy period at the two southern Arizona hotels. This seasonality pattern can be expected to cause fluctuations in the Trust’s quarterly revenues. The two hotels located in California and New Mexico historically experience their most profitable periods during the second and third fiscal quarters (the summer season), providing some balance to the general seasonality of the Trust’s hotel business.

The seasonal nature of the Trust’s business increases its vulnerability to risks such as labor force shortages and cash flow issues. Further, if an adverse event such as an actual or threatened terrorist attack, international conflict, data breach, regional economic downturn or poor weather conditions should occur during the first or fourth fiscal quarters, the adverse impact to the Trust’s revenues could likely be greater as a result of its southern Arizona seasonal business.

OTHER AVAILABLE INFORMATION

We also make available, free of charge, on our Internet website at www.innsuitestrust.com, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after we file such material with, or furnish it to, the Securities and Exchange Commission (the “SEC”). Information on our Internet website shall not be deemed incorporated into, or be part of, this report.

| 4 |

Item 1A. RISK FACTORS

Not required for smaller reporting companies.

Item 1B. UNRESOLVED STAFF COMMENTS

Not required for smaller reporting companies.

Item 2. PROPERTIES

The Trust maintains its administrative offices at the InnSuites Hotels Centre, at 1625 E. Northern Avenue, Suite 105, Phoenix, Arizona 85020 in a space leased by the Trust from a third party. All of the Hotels are operated as InnSuites® Hotels, while all Hotels are also marketed as Best Western® Hotels. All of the Hotels operate in the following locations:

| PROPERTY | NUMBER OF SUITES | YEAR OF CONSTRUCTION / ADDITION | MOST RECENT RENOVATION (1) | PERCENT OWNERSHIP BY THE TRUST | ||||||||||||

| InnSuites Hotel and Suites Airport Albuquerque Best Western Hotel | 101 | 1975/1985 | 2005 | 50.91 | %(2) | |||||||||||

| InnSuites Hotel and Suites Tucson Oracle Best Western Hotel | 159 | 1981/1983 | 2006 | 36.78 | %(3) | |||||||||||

| InnSuites Hotels and Suites Yuma Best Western Hotel | 166 | 1982/1984 | 2014 | 50.93 | %(4) | |||||||||||

| InnSuites Hotels and Suites Ontario Airport Best Western Hotel | 150 | 1990 | 2015 | 37.24 | %(5) | |||||||||||

| Total Suites | 576 | |||||||||||||||

(1) The Trust defines a renovation as the remodeling of more than 10% of a property’s available suites in a fiscal year.

(2) The Trust owns a direct 50.91% interest in the InnSuites Hotel and Suites Airport Albuquerque Best Western Hotel.

(3) The Partnership owns a 51.01% interest in the InnSuites Hotel and Suites Tucson Oracle Best Western Hotel. The Trust owns a 72.11% general partner interest in the Partnership.

(4) The Trust holds a direct 50.93% ownership interest in the InnSuites Hotels and Suites Yuma Best Western Hotel.

(5) The Partnership owns a 51.65% interest in the InnSuites Hotel and Suites Ontario Airport Best Western Hotel. The Trust owns a 72.11% general partner interest in the Partnership.

See “Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations – General” herein for a discussion of occupancy rates at the Hotels.

See Note 11 to the Trust’s Consolidated Financial Statements – “Mortgage Notes Payable” herein for a discussion of mortgages encumbering the Hotels.

See Note 21 to the Trust’s Consolidated Financial Statements – “Commitments and Contingencies” for a discussion of the lease for our corporate headquarters and the non-cancellable ground lease to which our Albuquerque Hotel is subject.

Item 3. LEGAL PROCEEDINGS

The Trust is not a party to, nor are any of its properties subject to, any material litigation or environmental regulatory proceedings. See Note 21 to Trust’s Consolidated Financial Statements – “Commitments and Contingencies”.

| 5 |

Item 4. MINE SAFETY DISCLOSURES

None.

PART II

Item 5. MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The Trust’s Shares of Beneficial Interest are traded on the NYSE MKT under the symbol “IHT.” On April 19, 2016, the Trust had 8,817,803 shares outstanding. As of April 24, 2016, there were 362 holders of record of our Shares of Beneficial Interest.

The following table sets forth, for the periods indicated, the high and low sales prices of the Trust’s Shares of Beneficial Interest, as reported on the NYSE MKT, as well as dividends declared thereon:

| Fiscal Year 2016 | High | Low | Dividends | |||||||||

| First Quarter | $ | 3.27 | $ | 2.03 | - | |||||||

| Second Quarter | $ | 2.96 | $ | 2.21 | - | |||||||

| Third Quarter | $ | 3.10 | $ | 2.32 | - | |||||||

| Fourth Quarter | $ | 2.65 | $ | 2.08 | $ | 0.01 | ||||||

| Fiscal Year 2015 | High | Low | Dividends | |||||||||

| First Quarter | $ | 2.59 | $ | 1.45 | - | |||||||

| Second Quarter | $ | 2.31 | $ | 1.75 | - | |||||||

| Third Quarter | $ | 3.09 | $ | 1.61 | - | |||||||

| Fourth Quarter | $ | 3.32 | $ | 1.99 | $ | 0.01 | ||||||

The Trust intends to maintain a conservative dividend policy to facilitate the reduction of debt and internal growth. In the fiscal years ended 2016 and 2015, the Trust paid dividends of $0.01 per share in the fourth quarter of each year. The Trust has paid dividends each fiscal year since its inception in 1971 and the Trust expects comparable cash dividends will continue to be paid in the future.

On January 2, 2001, the Board of Trustees approved a share repurchase program under Rule 10b-18 of the Securities Exchange Act of 1934, as amended, for the purchase of up to 250,000 Partnership units and/or Shares of Beneficial Interest in open market or privately negotiated transactions. On September 10, 2002, August 18, 2005 and September 10, 2007, the Board of Trustees approved the purchase of up to 350,000 additional Partnership units and/or Shares of Beneficial Interest in open market or privately negotiated transactions. Additionally, on January 5, 2009, September 15, 2009 and January 31, 2010, the Board of Trustees approved the purchase of up to 300,000, 250,000 and 350,000, respectively, additional Partnership units and/or Shares of Beneficial Interest in open market or privately negotiated transactions. Acquired Shares of Beneficial Interest will be held in treasury and will be available for future acquisitions and financings and/or for awards granted under the Trusts’ equity compensation plans/programs. During the fiscal year ended January 31, 2016, the Trust acquired 34,602 Shares of Beneficial Interest in open market transactions at an average price of $2.67 per share. The average price paid includes brokerage commissions. The Trust intends to continue repurchasing Shares of Beneficial Interest in compliance with applicable legal and NYSE MKT requirements. The Trust remains authorized to repurchase an additional 93,317 Partnership units and/or Shares of Beneficial Interest pursuant to the publicly announced share repurchase program, which has no expiration date.

| Issuer Purchases of Equity Securities | ||||||||||||||||

| Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans | Maximum Number of Shares that May Yet Be Purchased Under the Plans | ||||||||||||

| November 1 - November 30, 2015 | 1,696 | $ | 2.53 | 1,696 | 98,256 | |||||||||||

| December 1 - December 31, 2015 | 2,883 | $ | 2.39 | 2,883 | 95,373 | |||||||||||

| January 1 - January 31, 2016 | 2,056 | $ | 2.50 | 2,056 | 93,317 | |||||||||||

| Total | 6,635 | 6,635 | ||||||||||||||

See Part III, Item 12 for information about our equity compensation plans.

| 6 |

See Note 2 to our Consolidated Financial Statements – “Summary of Significant Accounting Policies” for information related to grants of restricted shares made to members of our Board of Trustees during fiscal year 2016. These rants were made in reliance upon the exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 4(a)(2).

For stock option grants during fiscal 2016, see Note 26 to our Consolidated Financial Statements - “Stock Options.”

For the issuance of Shares of Beneficial Interest by the Trust in connection with the acquisition of International Vacation Hotels, see Note 27 to our Consolidated Financial Statements – “Acquisition of International Vacation Hotels.” This issuance was made in reliance upon the exemption from the registration requirements of the Securities Act pursuant to Section 4(a)(2).

For the issuance of Shares of Beneficial Interest by the Trust to Rare Earth Financial, LLC, see Note 18 to our Consolidated Financial Statements – “Other Related Party Transactions.” These issuances were made in reliance upon the exemption from the registration requirements of the Securities Act pursuant to Section 4(a)(2).

Item 6. SELECTED FINANCIAL DATA

Not required for smaller reporting companies.

Item 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

OVERVIEW

We are engaged in the ownership and operation of hotel properties. At January 31, 2016, the Trust had four moderate and full-service hotels with 576 hotel suites. All of our Hotels are branded through membership agreements with Best Western. All Hotels are trademarked as InnSuites Hotels. We are also involved in various operations incidental to the operation of hotels, such as the operation of restaurants, meeting/banquet room rentals and the operation of a reservation system.

Our operations consist of two reportable segments, hotel ownership, which derives its revenue from the operation of the Hotels and reservation services for 6,300 unrelated hotel properties. We provide management services for the Hotels and two hotels owned by affiliates of James F. Wirth, the Trust’s Chairman and Chief Executive Officer. We also provide trademark and licensing services to the Hotels, two hotels owned by affiliates of Mr. Wirth and one unrelated hotel property.

Our results are significantly affected by occupancy and room rates at the Hotels, our ability to manage costs, and changes in the number of available suites caused by acquisition and disposition activities. Results are also significantly impacted by overall economic conditions and conditions in the travel industry. Unfavorable changes in these factors could negatively impact hotel room demand and pricing, which would reduce our profit margins on rented suites. Additionally, our ability to manage costs could be adversely impacted by significant increases in operating expenses, resulting in lower operating margins. Management expects greater demand and steady supply to continue. However, either a further increase in supply or a further decline in demand could result in increased competition, which could have an adverse effect on the revenue of the Hotels in their respective markets.

Although we experienced stronger economic conditions during fiscal year 2016, recent volatility may result in a weakening of the economy during 2017. We expect the major challenge for fiscal year 2017 to be the continuation of strong competition for corporate leisure group and government business in the markets in which we operate, which may affect our ability to increase room rates while maintaining market share. We believe that we have positioned the Hotels to remain competitive through selective refurbishment, by carrying a relatively large number of two-room suites at each location and by maintaining a robust guest Internet access system.

Our strategic plan is to obtain the full benefit of our real estate equity and to migrate our focus from a hotel owner to a hospitality service company by expanding our trademark license, management, reservation, and advertising services, through IBC Hotels. For more information on our strategic plan, including information on our progress in disposing of our hotel properties, see “Future Positioning” in this Management’s Discussion and Analysis of Financial Condition and Results of Operations.

In furtherance of our strategic plan, we have significantly expanded IBC Hotels, a wholly owned subsidiary of InnSuites Hospitality Trust, which provides services to approximately 6,300 properties. We believe this new hotel network provides independent hotel owners a competitive advantage against traditional franchised brands in their markets. The network provides a booking system and loyalty program. IBC Hotels charges a 10% booking fee, which we believe, increases the independent hotel’s profits. Competitors of IBC Hotels can charge anywhere from a 30% to 50% booking fee. InnDependent InnCentives, IBC’s loyalty program, allows hoteliers to benefit from guests who frequently stay at IBC independent hotels. In addition, on January 8, 2016, IBC Hotels and the Trust, purchased substantially all of the assets of International Vacation Hotels, a technology company located in Dallas, Texas which provides reservation services to over 600 independent international hotels. For more information about the acquisition of International Vacation Hotels, see Note 27 of our Consolidated Financial Statements - “Acquisition of International Vacation Hotels”.

| 7 |

We are planning significant expansion of IBC Hotels during the next couple of fiscal years as we concentrate our sales and marketing efforts towards consumers. We anticipate the IBC Hotels sales and marketing efforts to increase our revenues and decrease our consolidated net loss over the next couple of fiscal years. For each reservation, IBC Hotels receives a 10% transactional fee plus reimbursement of our credit card processing fees associated with the reservation. We cannot provide any assurance that our plans will be successful or in line with our expectations.

Throughout Item 7, we refer to continuing and discontinued operations. As discussed, our strategic plan is to no longer be in the business of owning and operating hotels. Accordingly, all hotel properties that are currently held for sale have been included in the discontinued operations throughout the Form 10-K. We have a single hotel property, Yuma that is included in continuing operations until such time as it is in a condition for sale. We expect to have the property for sale by January 31, 2017.

GENERAL

The following discussion should be read in conjunction with our consolidated financial statements and notes thereto appearing elsewhere in this Form 10-K.

At January 31, 2016, we owned through our sole general partner’s interest in the Partnership a direct 50.91% interest in the Albuquerque, New Mexico Hotel, and a 50.93% direct interest in the Yuma, Arizona Hotel. Additionally, at January 31, 2016, we, together with the Partnership, owned a 51.01% interest in a hotel located in Tucson, Arizona and a 51.65% interest in a hotel located in Ontario, California. At January 31, 2015, we owned through our sole general partner’s interest in the Partnership a 72.11% interest in the Tucson, Arizona Hotel, direct 50.82% interest in the Albuquerque, New Mexico Hotel, and a 73.61% direct interest in the Yuma, Arizona Hotel. Additionally, at January 31, 2015, we, together with the Partnership, owned a 51.01% interest in another hotel located in Tucson, Arizona and a 51.71% interest in a hotel located in Ontario, California. We purchased 0 and 9,903 Partnership Class A units of our sole general partner interest during the years ended January 31, 2016 and 2015, respectively. On October 14, 2015, the Trust sold its Tucson St Mary’s hotel to an unrelated third party for approximately $9.7 million. For more information about the disposition of the Tucson St Mary’s hotel, see Note 24 of our Consolidated Financial Statements - “Sale of Tucson Saint Mary’s Suite Hospitality Property”.

Our expenses consist primarily of property taxes, insurance, corporate overhead, interest on mortgage debt, professional fees, depreciation of the Hotels and hotel operating expenses. Hotel operating expenses consist primarily of payroll, guest and maintenance supplies, marketing and utilities expenses. Under the terms of its Partnership Agreement, the Partnership is required to reimburse us for all such expenses. Accordingly, management believes that a review of the historical performance of the operations of the Hotels, particularly with respect to occupancy, which is calculated as rooms sold divided by total rooms available, average daily rate (“ADR”), calculated as total room revenue divided by number of rooms sold, and revenue per available room (“REVPAR”), calculated as total room revenue divided by number of rooms available, is appropriate for understanding revenue from the Hotels. In fiscal year 2016, occupancy increased 10.2% to 73.36% from 63.16% in the prior fiscal year. ADR increased by $2.74 or 4.04% to $70.59 in fiscal year 2016 from $67.85 in fiscal year 2015. The increased occupancy and ADR resulted in a increase in REVPAR of $8.93 or 20.84% to $51.79 in fiscal year 2016 from $42.86 in fiscal year 2015. The increased occupancy and increased rates reflect a continued stronger economy which has allowed us to increase our rates while increasing our occupancy. We anticipate in the next few fiscal years that steady demand will exist with a significant increase in hotel room supply resulting in additional pressure on the hotel industry to lower rates to maintain current occupancy levels.

The following table shows certain historical financial and other information for the periods indicated:

| For the Twelve Months Ended | ||||||||

| January 31, | ||||||||

| 2016 | 2015 | |||||||

| Occupancy | 73.36 | % | 63.16 | % | ||||

| Average Daily Rate (ADR) | $ | 70.59 | $ | 67.85 | ||||

| Revenue Per Available Room (REVPAR) | $ | 51.79 | $ | 42.86 | ||||

No assurance can be given that occupancy, ADR and REVPAR will not increase or decrease as a result of changes in national or local economic or hospitality industry conditions.

| 8 |

We enter into transactions with certain related parties from time to time. For information relating to such related party transactions see the following:

| ● | For a discussion of management and licensing agreements with certain related parties, see “Item 1 – Business – Management and Licensing Contracts.” | |

| ● | For a discussion of guarantees of our mortgage notes payable by certain related parties, see Note 11 to our Consolidated Financial Statements – “Mortgage Notes Payable.” | |

| ● | For a discussion of our equity sales and restructuring agreements involving certain related parties, see Notes 3, 4, 5, 6 and 7 to our Consolidated Financial Statements – “Sale of Ownership Interests in Albuquerque Subsidiary,” “Sale of Ownership Interests in Tucson Hospitality Properties Subsidiary,” “Sale of Ownership Interests in Ontario Hospitality Properties Subsidiary,” “Sale of Ownership Interests in Yuma Hospitality Properties Subsidiary,” and “Sale of Ownership Interests in Tucson Saint Mary’s Suite Hospitality”, respectively. | |

| ● | For a discussion of other related party transactions, see Note 18 to our Consolidated Financial Statements – “Other Related Party Transactions.” |

Results of operations of the Trust for the fiscal year ended January 31, 2016 compared to the fiscal year ended January 31, 2015.

Overview

A summary of total Trust operating results for the fiscal years ended January 31, 2016 and 2015 is as follows:

| 2016 | 2015 | Change | % Change | |||||||||||||

| Total Revenues from Continuing Operations | $ | 3,623,640 | $ | 2,845,122 | $ | 778,518 | 27.4 | % | ||||||||

| Operating Expenses from Continuing Operations | (5,003,640 | ) | (4,751,528 | ) | (252,112 | ) | (5.3 | %) | ||||||||

| Operating Loss from Continuing Operations | (1,380,000 | ) | (1,906,406 | ) | 526,406 | 27.6 | % | |||||||||

| Interest Income from Continuing Operations | 14,416 | 6,656 | 7,760 | 116.6 | % | |||||||||||

| Interest Expense from Continuing Operations | (334,812 | ) | (344,176 | ) | 9,364 | 2.7 | % | |||||||||

| Income Tax Provision from Continuing Operations | (96,963 | ) | (198,647 | ) | 101,684 | 51.2 | % | |||||||||

| Consolidated Net Loss from Continuing Operations | $ | (1,797,359 | ) | $ | (2,442,573 | ) | $ | 645,214 | 26.4 | % | ||||||

| Consolidated Net Income from Discontinued Operations and Assets Held for Sale | $ | 2,136,799 | $ | 201,649 | $ | 1,935,150 | 959.7 | % | ||||||||

A summary of operating results by segment for the fiscal years ended January 31, 2016 and 2015 is as follows:

| 2016 | 2015 | |||||||||||||||

| Hotel Operations & Corporate Overhead | Hotel Operations & Corporate Overhead | Change | % Change | |||||||||||||

| Total Revenue from Continuing Operations | $ | 3,422,468 | $ | 2,824,856 | $ | 597,612 | 21.2 | % | ||||||||

| Operating Expenses from Continuing Operations | (4,505,934 | ) | (4,405,224 | ) | (100,710 | ) | (2.3 | %) | ||||||||

| Operating Loss from Continuing Operations | (1,083,466 | ) | (1,580,368 | ) | 496,902 | 31.4 | % | |||||||||

| Interest Income from Continuing Operations | 14,416 | 6,656 | 7,760 | 116.6 | % | |||||||||||

| Interest Expense from Continuing Operations | (333,006 | ) | (344,176 | ) | 11,170 | 3.2 | % | |||||||||

| Income Tax Provision from Continuing Operations | (96,963 | ) | (198,647 | ) | 101,684 | 51.2 | % | |||||||||

| Net Loss from Continuing Operations | $ | (1,499,019 | ) | $ | (2,116,535 | ) | $ | 617,516 | (29.2 | %) | ||||||

| 2016 | 2015 | |||||||||||||||

| IBC Developments | IBC Developments | Change | % Change | |||||||||||||

| Total Revenue | $ | 201,172 | $ | 20,266 | $ | 180,906 | 892.7 | % | ||||||||

| Operating Expenses | (497,706 | ) | (346,304 | ) | (151,402 | ) | (43.7 | %) | ||||||||

| Operating Loss | (296,534 | ) | (326,038 | ) | 29,504 | 9.0 | % | |||||||||

| Interest Income | - | - | - | 0.0 | % | |||||||||||

| Interest Expense | (1,806 | ) | - | (1,806 | ) | (100.0 | %) | |||||||||

| Income Tax Provision | - | - | - | 0.0 | % | |||||||||||

| Net Loss | $ | (298,340 | ) | $ | (326,038 | ) | $ | 27,698 | 8.5 | % | ||||||

Our overall results in fiscal year 2016 were positively affected by an increase in revenues which were reduced by an increase in operating expenses which included our growing IBC Hotels division and our inability to control our income tax expenses.

| 9 |

REVENUE – CONTINUING OPERATIONS:

Hotel Operations & Corporate Overhead Segment – Continuing Operations

Continuing operations consist primarily of our hotel operations at our Yuma, Arizona property. For the twelve months ended January 31, 2016, we had total revenue of approximately $3,422,000 compared to approximately $2,825,000 for the twelve months ended January 31, 2015, an increase of approximately $597,000. After completing our remodel of our Yuma, Arizona property in 2015, we realized a 28% increase in room revenues during fiscal year 2016 as room revenues were approximately $3,115,000 for fiscal year 2016 as compared to approximately $2,428,000 during fiscal year 2015. Food and beverage revenue was approximately $29,000 for fiscal year 2016 as compared to approximately $39,000 during fiscal year 2015, a decrease of approximately $10,000. Our Yuma, Arizona hotel property is a mid-size property with limited food and beverage operations. During fiscal year 2017, we expect occupancy to be steady with additional pressures on our rates and steady food and beverage revenues. We also realized approximately an 20% decrease in management and trademark fee revenues during fiscal year 2016 as management and trademark revenues were approximately $222,000 during fiscal year 2016 as compared to approximately $278,000 during fiscal year 2015. Management and trademark fee revenues decreased during fiscal year 2016 as one of the hotels owned by Mr. Wirth was sold to an unrelated third party. During fiscal year 2017, we expect management and trademark fee revenues to be remain consistent.

IBC Development Segment – Continuing Operations

For the fiscal year ended January 31, 2016, we had total revenue of approximately $227,000 compared to approximately $20,000 for the fiscal year ended January 31, 2015, an increase of approximately $207,000. We anticipate strong growth in this segment over the next several fiscal years but can provide no assurance regarding such growth.

EXPENSES – CONTINUING OPERATIONS:

Hotel Operations & Corporate Overhead Segment– Continuing Operations

Total expenses, including net interest expense and taxes, of approximately $4,936,000 for the fiscal year ended January 31, 2016 reflects an decrease of approximately $12,000 compared to total expenses of approximately $4,948,000 for the fiscal year ended January 31, 2015. The increase was due to an increase in operating expenses at our Yuma, Arizona property which was anticipated based on the significant increase in occupancy at the property during fiscal year 2016.

Room expenses consisting of salaries and related employment taxes for property management, front office, housekeeping personnel, reservation fees and room supplies were approximately $883,000 for the fiscal year ended January 31, 2016 compared to approximately $819,000 in the prior year period for approximately $64,000, or 7.8%, increase in costs. Occupancy at the Yuma, Arizona property increased during fiscal year 2016, which resulted in an increase in room expenses.

Food and beverage expenses included food and beverage costs, personnel and miscellaneous costs to provide guests evening additional alcoholic beverages, dinners, snacks and small banquet events at our Yuma, Arizona property. For the fiscal year ended January 31, 2016, food and beverage expenses were approximately $63,000 as compared to approximately $82,000 for the fiscal year ended January 31, 2015, a decrease of approximately $19,000, or 23%. The decrease in food and beverage expenses corresponded to the decrease in food and beverage revenues.

Telecommunications expense, consisting of telephone and Internet costs, were relatively flat for the fiscal year ended January 31, 2016 at approximately $20,000 as compared to the prior fiscal year ended January 31, 2015 at approximately $21,000. Management anticipates this will be consistent for fiscal year 2017.

General and administrative expenses include overhead charges for management, accounting, shareholder and legal services. General and administrative expenses of approximately $2,013,000 for the fiscal year ended January 31, 2016 increased approximately $37,000 from approximately $2,050,000 for the fiscal year ended January 31, 2015 primarily due to increased bad debt expenses, credit card expenses, professional fees and management fees at our Ontario, California property and our Tucson, Arizona property.

Sales and marketing expense increased approximately $76,000, or 36%, from approximately $211,000 for the fiscal year ended January 31, 2015 to approximately $286,000 for the fiscal year ended January 31, 2016. We added additional sales and marketing personnel to increase sales for the property and we incurred additional sales and marketing fees from Best Western as the property provided guests additional Best Western points to increase guest satisfaction.

Repairs and maintenance expense slightly increased by approximately $22,000 from approximately $285,000 reported for the fiscal year ended January 31, 2015 compared with approximately $307,000 for the fiscal year ended January 31, 2016. The increase was primarily due to additional repairs and maintenance initiatives completed by us in an effort to ensure that our hotel product exceeds our guests’ satisfaction.

| 10 |

Hospitality expense increased by approximately $9,000, or 6.5%, from $139,000 for the fiscal year ended January 31, 2015 to approximately $148,000 for the fiscal year ended January 31, 2016. The increase was primarily due to additional product mix provided during the Hotels’ complimentary happy hour, increased occupancy and continued compliance with food and beverage requirements provided by Best Western.

Utility expenses increased approximately $6,000 from approximately $185,000 reported for the fiscal year ended January 31, 2015 compared with approximately $191,000 for the fiscal year ended January 31, 2016. Increased utility costs occurred in our Yuma, Arizona property due to additional occupancy levels.

Hotel property depreciation expense remained relatively flat at approximately $468,000 for the fiscal year ended January 31, 2016 as compared to approximately $495,000 for the fiscal year ended January 31, 2015.

Real estate and personal property taxes, insurance and ground rent expense remained relatively flat at approximately $110,000 for the fiscal year ended January 31, 2016 as compared to approximately $113,000 for the fiscal year ended January 31, 2015.

Interest expense less interest income is net interest expense. Net interest expense was approximately $320,000 for the fiscal year ended January 31, 2016, a decrease of approximately $16,000 from the prior fiscal year total of approximately $336,000. We continue to work with our lenders to refinance the property loans. With the sale of one of our Tucson, Arizona properties, the trust had additional cash flow available for working capital during the fiscal year ended January 31, 2016 and as a result, interest income increased and interest expenses decreased during fiscal year 2016 resulting in a net interest expense decrease during fiscal year 2016. During fiscal year 2017, we anticipate a decrease in net interest expenses but can provide no assurance that such expenses will not increase.

Income tax provision was approximately $97,000 for the fiscal year ended January 31, 2016, a decrease of approximately $102,000 from the prior fiscal year total of approximately $199,000. Decrease in the income tax provision is primarily due to the decreased sales of ownership interests in our properties during our fiscal year ended January 31, 2016 as compared to the prior fiscal year period. Sales of ownership interests in our properties for tax purposes are considered income but under generally accepted accounting principles (“GAAP”), they are considered an increase in the Trusts’ equity.

IBC Development Segment

Total expenses, which were comprised primarily of general and administrative and sales and marketing expenses of approximately $498,000 for the fiscal year ended January 31, 2016 reflects an increase of approximately $151,000 compared to total expenses of approximately $346,000 for the fiscal year ended January 31, 2015. General and administrative expense increased approximately $249,000, from approximately $31,000 for the fiscal year ended January 31, 2015 to approximately $280,000 for the fiscal year ended January 31, 2016. During the fiscal year ended January 31, 2016, we expanded our general and administrative efforts by adding more reservation agents and focused our resources on the development of technology to meet the independent guest and hotelier needs. Sales and Marketing expense decreased approximately $122,000, from approximately $314,000 for the fiscal year ended January 31, 2015 to approximately $192,000 for the fiscal year ended January 31, 2016. During the fiscal year ended January 31, 2016, we decreased our sales and marketing expenses by decreasing our traditional less effective marketing campaigns and moved to deliver electronic focused marketing campaigns as well as consolidating marketing and sales resources. Specifically, we expanded our hotel booking engine capabilities, website and hotel guest rewards program.

Net Income (Loss):

We had consolidated net income of $339,000 for the fiscal year ended January 31, 2016, compared to consolidated net loss of approximately $2,241,000 in the prior fiscal year. Basic and diluted net loss per share was $(0.22) and $(0.29) for the fiscal year ended January 31, 2016 and 2015, respectively.

REVENUE – DISCONTINUED OPERATIONS:

Hotel Operations & Corporate Overhead Segment – Discontinued Operations

Discontinued operations consists of our hotel operations at our Hotel Tucson City Center InnSuites property in Tucson, Arizona (“Tucson St. Mary’s”), which we sold on October 14, 2015, our remaining Tucson, Arizona property, our Albuquerque, New Mexico property and our Ontario, California property.

For the twelve months ended January 31, 2016, we had total revenue of approximately $10,848,000 compared to approximately $11,828,000 for the twelve months ended January 31, 2015, a decrease of approximately $980,000 due in part to the sale of our Tucson St. Mary’s property.

| 11 |

We realized a 7.6% decrease in room revenues during fiscal year 2016 as room revenues were approximately $9,945,000 for fiscal year 2016 as compared to approximately $10,759,000 during fiscal year 2015. Food and beverage revenue was approximately $811,000 for fiscal year 2016 as compared to approximately $916,000 during fiscal year 2015, a decrease of approximately $105,000. Food and beverage revenues decreased due in part to the sale of one of our Tucson, Arizona properties and continued market oriented pressures in our Ontario, California property. During fiscal year 2017, we expect occupancy to be steady with additional pressures on our rates and steady food and beverage revenues but can provide no assurance that occupancy will not decrease. Other revenue was approximately $92,000 for fiscal year 2016 as compared to approximately $154,000 during fiscal year 2015, a decrease of approximately $62,000. Other revenues decreased due in part to the sale of our Tucson St. Mary’s property.

We anticipate that at least one additional hotel will be sold during fiscal year 2017 but we can provide no assurance that such sale will occur on terms favorable to us or in our expected time frame, or at all. We anticipate steady revenues at each of our remaining hotel properties included in discontinued operations during fiscal year 2017.

EXPENSES – DISCONTINUED OPERATIONS:

Hotel Operations & Corporate Overhead Segment – Discontinued Operations

Overall, we anticipate that at least one additional hotel will be sold during fiscal year 2017. We anticipate expenses to remain steady at each of our remaining hotel properties including discontinued operations during fiscal year 2017 but cannot provide assurance that such expenses will not increase. Total expenses decreased during fiscal year 2016 as compared to fiscal year 2015 as a result of the sale of one of our Tucson, Arizona properties.

Total expenses including net interest expense, of approximately $11,063,000 for the fiscal year ended January 31, 2016 reflects a decrease of approximately $563,000 compared to total expenses of approximately $11,626,000 for the fiscal year ended January 31, 2015. The decrease was due in part to the sale of our Tucson St. Mary’s property.

Room expenses consisting of salaries and related employment taxes for property management, front office, housekeeping personnel, reservation fees and room supplies were approximately $3,451,000 for the fiscal year ended January 31, 2016 compared to approximately $3,138,000 in the prior year period for approximately a $313,000, or 10%, increase in costs. Our occupancy at our Ontario, California property increased during fiscal year 2016 which resulted in an increase in room expenses, offset by the sale of our one of our Tucson, Arizona properties.

Food and beverage expenses included food and beverage costs, personnel and miscellaneous costs to provide guests additional evening alcoholic beverages, dinners, snacks very large banquet events at the hotel property sold in Tucson, Arizona. For the fiscal year ended January 31, 2016, food and beverage expenses were approximately $793,000 as compared to approximately $822,000 for the fiscal year ended January 31, 2015, an decrease of approximately $29,000, or 3.5%. These costs decreased as a direct result of the sale of the Tucson St. Mary’s property.

Telecommunications expense, consisting of telephone and Internet costs, for the fiscal year ended January 31, 2016 were approximately $6,000 as compared to the prior fiscal year ended January 31, 2015 at approximately $10,000, a decrease of approximately $4,000. We anticipates these expenses will continue to decrease as we sell additional hotel properties during the fiscal year ending January 31, 2017.

General and administrative expenses include overhead charges for management and administration of the hotel properties. General and administrative expenses of approximately $1,289,000 for the fiscal year ended January 31, 2016 decreased approximately $81,000 from approximately $1,370,000 for the fiscal year ended January 31, 2015 primarily due to increased bad debt expenses, credit card expenses, professional fees and management fees at our Ontario, California property and our Tucson, Arizona property.

Sales and marketing expense slightly decreased from approximately $791,000 for the fiscal year ended January 31, 2015 to approximately by $788,000 for the fiscal year ended January 31, 2016. Due to additional economic pressures at our remaining Tucson, Arizona property, we added additional sales and marketing resources which increased our sales and marketing expenses. The increase was offset by the sale of our Tucson St. Mary’s property.

Repairs and maintenance expense slightly increased by approximately $20,000 from approximately $958,000 reported for the fiscal year ended January 31, 2015 compared with approximately $978,000 for the fiscal year ended January 31, 2016. The increase was primarily due to additional repairs and maintenance initiatives completed by us in an effort to ensure that our hotel product exceeds our guests’ satisfaction.

| 12 |

Hospitality expense increased by approximately $29,000, or 4%, from $731,000 for the fiscal year ended January 31, 2015 to approximately $760,000 for the fiscal year ended January 31, 2016. The increase was primarily due to additional product mix provided during the Hotels’ complimentary happy hour, increased occupancy and continued compliance with food and beverage requirements provided by Best Western.

Utility expenses decreased approximately $100,000 from approximately $1,129,000 reported for the fiscal year ended January 31, 2015 compared with approximately $1,029,000 for the fiscal year ended January 31, 2016. We incurred decreased utility costs as a result of the sale of our Tucson St. Mary’s property.

Depreciation expense decreased approximately $612,000 from approximately $1,285,000 reported for the fiscal year ended January 31, 2015 compared with approximately $673,000 for the fiscal year ended January 31, 2016. We incurred decreased deprecation expenses as a result of the sale of our Tucson St. Mary’s property and due to the accounting treatment of ceasing depreciation on our remaining discontinued operations hotel properties, which directly attributed to a year over year decrease of approximately $612,000.

Real estate and personal property taxes, insurance and ground rent expense decreased approximately $161,000 from approximately $831,000 reported for the fiscal year ended January 31, 2015 compared with approximately $670,000 for the fiscal year ended January 31, 2016. These expenses decreased as a result of our sale of our Tucson St. Mary’s property.

Interest expenses were approximately $598,000 for the fiscal year ended January 31, 2016, an increase of approximately $62,000 from the prior fiscal year total of approximately $536,000. We continue to work with our lenders to refinance the property loans. During fiscal year 2017, we anticipate interest expenses will decrease with the anticipated sale of additional hotel properties.

LIQUIDITY AND CAPITAL RESOURCES

Overview – Hotel Operations & Corporate Overhead and IBC Development Segments

Our principal source of cash to meet our cash requirements, including distributions to our shareholders, is our share of the Partnership’s cash flow, quarterly distributions from the Albuquerque, New Mexico and Yuma, Arizona properties and more recently, sales of non-controlling interests in certain of our Hotels. The Partnership’s principal source of revenue is hotel operations for the one hotel property it owns (until its planned sale – as discussed previously) and quarterly distributions from the Tucson, Arizona and Ontario, California properties. Our liquidity, including our ability to make distributions to our shareholders, will depend upon our ability, and the Partnership’s ability, to generate sufficient cash flow from hotel operations and to service our debt.

Hotel operations are significantly affected by occupancy and room rates at the Hotels. We anticipate occupancy and ADR will be steady during this coming year; capital improvements are expected to be similar from the prior year. As of January 31, 2016, the Trust did not have an open bank line of credit.

With approximately $2.0 million of cash which includes approximately $200,000 from discontinued operations as of January 31, 2016 and the availability of a $1,000,000 related party Demand/Revolving Line of Credit/Promissory Note, we believe that we will have enough cash on hand to meet all of our financial obligations as they become due for at least the next year. In addition, our management is analyzing other strategic options available to us, including the refinancing of another property or raising additional funds through additional non-controlling interest sales; however, such transactions may not be available on terms that are favorable to us, or at all.

There can be no assurance that we will be successful in refinancing debt or raising additional or replacement funds, or that these funds may be available on terms that are favorable to us. If we are unable to raise additional or replacement funds, we may be required to sell certain of our assets to meet our liquidity needs, which may not be on terms that are favorable.

We anticipate additional new-build hotel supply during fiscal year 2017 up until the hotel supply inventory has been stabilized during fiscal year 2018. In fiscal year 2017, we anticipate additional pressure on revenues and operating margins. We expect the major challenge for fiscal year 2017 to be the continuation of strong competition for corporate leisure group and government business in the markets in which we operate, which may affect our ability to increase room rates while maintaining market share.

Net cash used by operating activities totaled approximately $604,000 during fiscal year 2016 as compared to net cash provided by operating activities of approximately $600,000 during the prior fiscal year. The decrease in net cash provided by operating activities was due to adjustments to reconcile net income to net cash used by operating activities.

| 13 |

Consolidated net income was approximately $339,000 for the year ended January 31, 2016 as compared to consolidated net loss for the year ended January 31, 2015 of approximately $2,241,000. Explanation of the differences between these fiscal years are explained above in the results of operations of the Trust.

Changes in the adjustments to reconcile net income and net loss for the years ended January 31, 2016 and 2015, respectively, consist primarily of hotel property depreciation, gain on disposal of assets, and changes in assets and liabilities. Hotel property depreciation was approximately $1,782,000 during fiscal year 2015 compared to approximately $1,178,000 during fiscal year 2016, a decrease of $604,000. During fiscal year 2016, the Trust had a gain on disposal of assets of approximately $2,352,000 which increased the net cash used in operating activities.

Changes in assets and liabilities for accounts receivable, prepaid expenses and other assets and accounts payable and accrued expenses totaled approximately $99,000 and $835,000 for the fiscal years ended January 31, 2016 and 2015, respectively. This significant decrease in changes in assets and liabilities for the fiscal year ended January 31, 2016 compared to the fiscal year ended January 31, 2015 was primarily due to our desire to decrease our accounts payable and accrued expenses after the sale of our Tucson St. Mary’s property.

Net cash provided by investing activities totaled approximately $653,000 for the year ended January 31, 2016 compared to net cash used in investing activities totaled of $1,302,000 for the year ended January 31, 2015. The increase in net cash provided by investing activities during fiscal year 2016 was due to the cash received from the sale of our Tucson St. Mary’s hotel property offset by a significant increase in expenditures related to improvements and additions to hotel properties and our purchase of intangibles assets associated with our purchase of International Vacation Hotels in January 2016. Net lending on advances to affiliates – related parties coupled with collections on advances to affiliates – related parties was approximately $971,000 during fiscal year 2016 as compared to approximately $1,000 during fiscal year 2015, which decreased our net cash used in investing activities by approximately $1,956,000 during fiscal year 2016.

Net cash provided by financing activities totaled approximately $1,400,000 and $814,000 for the years ended January 31, 2016 and 2015, respectively. The increase of approximately $1,450,000 was primarily due to the sale of stock, net decrease of payments and borrowings on mortgage notes payable, notes payable to banks and line of credit – related party, note receivable – related party was offset by the decreased proceeds from the sale of non-controlling ownership interest in subsidiary.

Principal payments on mortgage notes payables was approximately $625,000 and approximately $2,153,000 during the fiscal year ended January 31, 2016 and 2015, respectively. During the fiscal year ended January 31, 2015, we paid off our $1.0 million mortgage on our Albuquerque property which increased the amount of principal payments on mortgage notes payables paid. During fiscal year 2017, we anticipate a reduction of principal payments on mortgage notes payables as our mortgages will be paid off with hotel sale proceeds.

Payments on notes payable to banks netted against borrowings on notes payable to banks were approximately $358,000 during the fiscal year ended January 31, 2016 as compared to approximately ($152,000) during the fiscal year ended January 31, 2015. We do not anticipate refinancing any of our hotel properties in fiscal year 2017.

For the fiscal year ended January 31, 2016, payments on line of credit – related party netted against borrowings on line of credit – related party was approximately ($248,000) of net cash used in financing activities as compared to approximately $210,000 of net cash provided by financing activities for the fiscal year ended January 31, 2015. For the fiscal year ended January 31, 2016, lendings on note receivable – related party netted against collections on note receivable – related party was approximately $299,000 of net cash used in financing activities.

For the fiscal year ended January 31, 2016, payments and borrowings on other notes payable was approximately ($471,000) of net cash used in financing activities and approximately $338,000 of net cash provided by financing activities during the fiscal year ended January 31, 2015. During the fiscal year ended January 31, 2016, we continued to pay off American Express merchant processing loans.

Proceeds from sales of non-controlling ownership interests in subsidiaries decreased by approximately $1,540,000 as sales of non-controlling ownership interest was approximately $3,339,000 for the year ended January 31, 2015 and approximately $1,826,000 for the year ended January 31, 2016. During the fiscal year ended January 31, 2016, we primarily sold additional non-controlling interests in our Yuma Hospitality and Tucson Saint Mary’s Suite Hospitality subsidiaries.

With an increase in the Sales of Non-Controlling Ownership Interest in Subsidiaries, an increase in Distributions to Non-Controlling Interest Holders is expected. Distributions to Non-Controlling Interest Holders for the fiscal year ending January 31, 2016 were approximately $1,244,000 as compared to approximately $769,000 for the fiscal year ended January 31, 2015. These Distributions are an offset to the Net Cash Provided by Financing Activities.

| 14 |

The Trust repurchased additional Treasury Stock of approximately $92,000 during the fiscal year ended January 31, 2016 compared with $220,000 for the prior fiscal year ended January 31, 2015. Additional purchases of Treasury Stock is an offset to the Net Cash Provided by Financing Activities.

We continue to contribute to a Capital Expenditures Fund (the “Fund”) an amount equal to 4% of the InnSuites Hotels’ revenues from operation of the Hotels. The Fund is restricted by the mortgage lender for one of our properties. As of January 31, 2016 and 2015, there were no monies held in these accounts reported on our Consolidated Balance Sheet as “Restricted Cash.” The Fund is intended to be used for capital improvements to the Hotels and refurbishment and replacement of furniture, fixtures and equipment. During the fiscal year ended January 31, 2016 and 2015, the Hotels spent approximately $2,126,000 and $1,415,000, respectively, for capital expenditures. We consider the majority of these improvements to be revenue producing. Therefore, these amounts are capitalized and depreciated over their estimated useful lives. For fiscal year 2017 capital expenditures, we plan on spending less on capital improvements as we have sold our oldest and largest hotel which required significant amounts of capital improvements. Repairs and maintenance were charged to expense as incurred and approximated $307,000 and $285,000 for fiscal years 2016 and 2015, respectively.

We have minimum debt payments of approximately $1,467, 000 and approximately $524,000 due during fiscal years 2017 and 2018, respectively. Minimum debt payments due during fiscal year 2017 include approximately $494,000 of mortgage notes payable, approximately $932,000 notes payable to bank and approximately $40,000 of secured promissory notes outstanding to unrelated third parties arising from the Shares of Beneficial Interest and Partnership unit repurchases.

In addition to our mortgage notes payable of approximately $13.9 million outstanding with respect to the Hotels, we also have approximately $932,000 of our non-revolving note payable, approximately $13,000 of an unsecured business loan and approximately $55,000 of secured promissory notes outstanding to unrelated third parties arising from the Shares of Beneficial Interest and Partnership unit repurchases.

We may seek to negotiate additional credit facilities or issue debt instruments. Any debt incurred or issued by us may be secured or unsecured, long-term, medium-term or short-term, bear interest at a fixed or variable rate and be subject to such other terms as we consider prudent.

SALE OF OWNERSHIP INTERESTS IN ALBUQUERQUE SUBSIDIARY

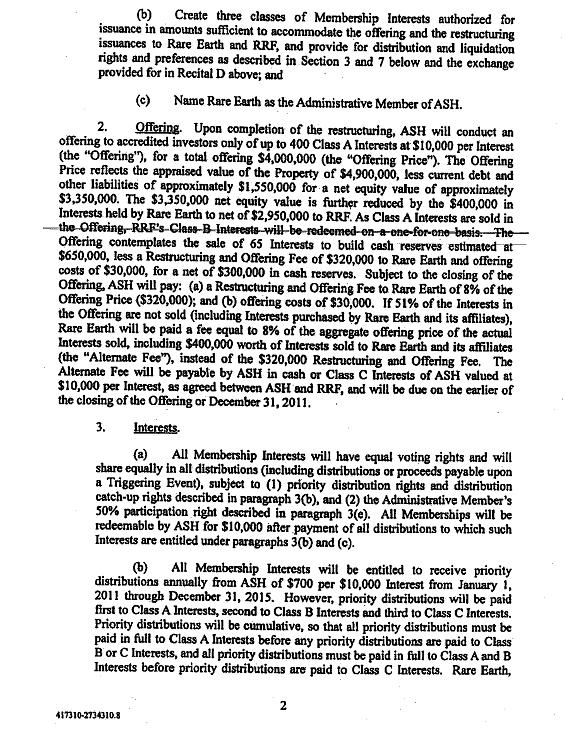

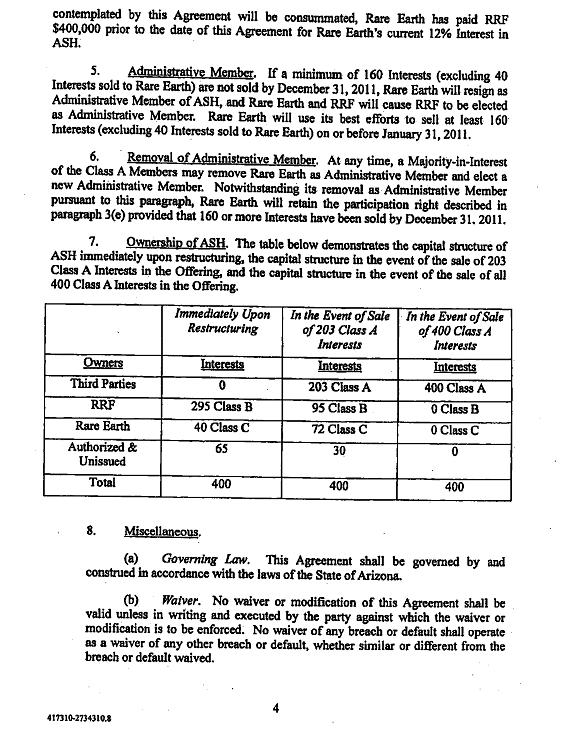

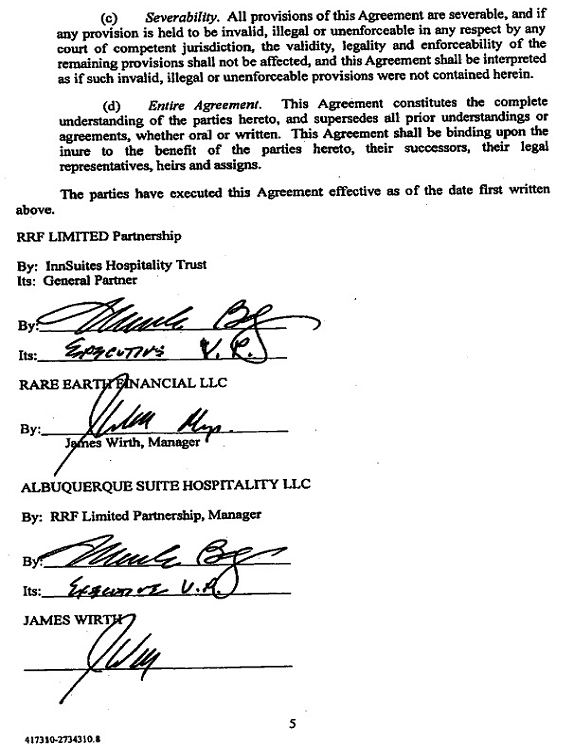

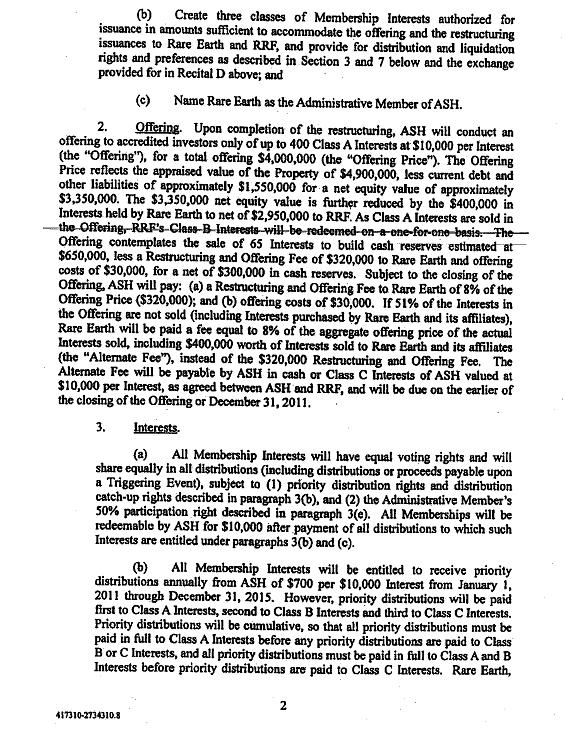

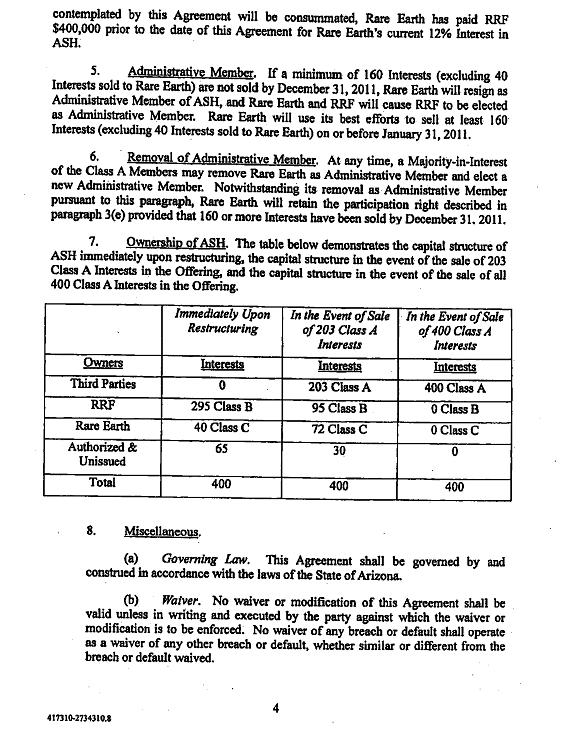

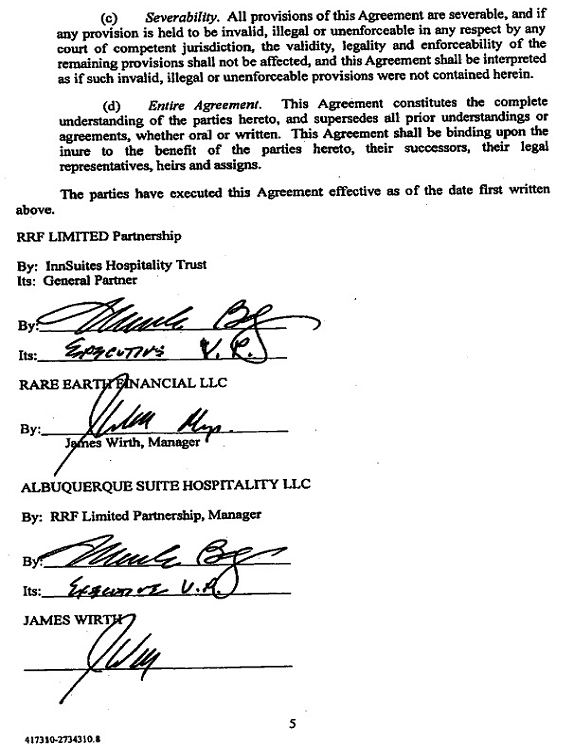

On July 22, 2010, the Board of Trustees unanimously approved, with Mr. Wirth abstaining, for the Partnership to enter into an agreement with Rare Earth Financial, LLC (“Rare Earth”), an affiliate of Mr. Wirth, to sell units in Albuquerque Suite Hospitality, LLC (the “Albuquerque entity”), which owns and operates the Albuquerque, New Mexico hotel property. Under the agreement, Rare Earth agreed to either purchase or bring in other investors to purchase at least 49% of the membership interests in the Albuquerque entity and the parties agreed to restructure the operating agreement of the Albuquerque entity. A total of 400 units were available for sale for $10,000 per unit, with a two-unit minimum subscription. On September 24, 2010, the parties revised the Amended and Restated Operating Agreement to name Rare Earth as the administrative member of the Albuquerque entity in charge of the day-to-day management.

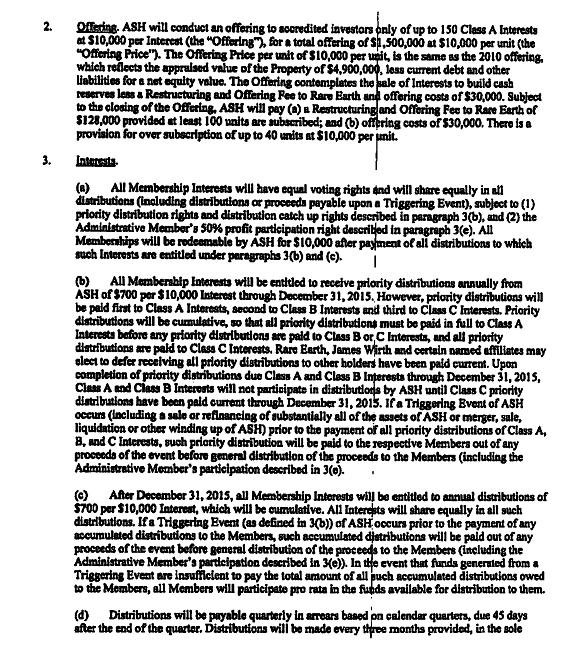

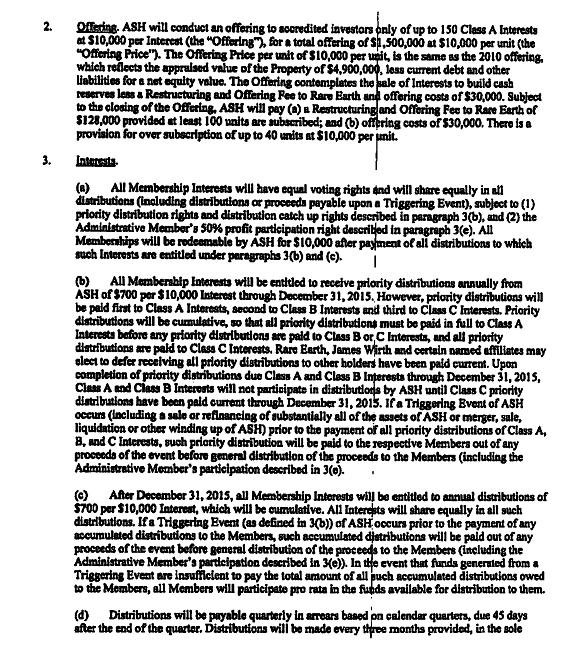

On December 9, 2013, the Trust entered into an updated restructuring agreement with Rare Earth to allow for the sale of additional interest units in the Albuquerque entity for $10,000 per unit. Under the updated restructuring agreement, Rare Earth agreed to either purchase or bring in other investors to purchase up to 150 (and potentially up to 190 if the overallotment is exercised) units. Under the terms of the updated restructuring agreement, the Trust agreed to hold at least 50.1% of the outstanding units in the Albuquerque entity, on a post-transaction basis and intends to maintain this minimum ownership percentage through the purchase of units under this offering. The Board of Trustees approved this restructuring on December 9, 2013. The units in the Albuquerque entity are allocated to three classes with differing cumulative discretionary priority distribution rights through December 31, 2015. Class A units are owned by unrelated third parties and have first priority for distributions. Class B units are owned by the Trust and have second priority for distributions. Class C units are owned by Rare Earth or other affiliates of Mr. Wirth and have the lowest priority for distributions from the Albuquerque entity. Priority distributions of $700 per unit per year are cumulative until December 31, 2015; however, after December 31, 2015 Class A unit holders continue to hold a preference on distributions over Class B and Class C unit holders.

If certain triggering events related to the Albuquerque entity occur prior to the payment of all accumulated distributions to its members, such accumulated distributions will be paid out of any proceeds of the event before general distribution of the proceeds to the members. In the event that funds generated from a triggering event are insufficient to pay the total amount of all such accumulated distributions owed to the members, all Class A members will participate pro rata in the funds available for distribution to them until paid in full, then Class B, and then Class C. After all investors have received their initial capital plus a 7% per annum simple return, any additional profits will be allocated 50% to Rare Earth, with the remaining 50% allocated proportionately to all unit classes. Rare Earth received a restructuring fee of $128,000, conditioned upon and arising from the sale of the first 100 units in the Albuquerque entity following the December 31, 2013 restructuring. The Albuquerque entity plans to use its best efforts to pay the discretionary priority distributions. The Trust does not guarantee and is not otherwise obligated to pay the cumulative discretionary priority distributions. InnSuites Hotels will continue to provide management, licensing and reservation services to the Albuquerque, New Mexico property.

| 15 |

During the fiscal year ended January 31, 2016, there were 2 Class A units of the Albuquerque entity sold, of which all were entirely purchased from Rare Earth at $10,000 per unit. As of January 31, 2016, the Trust held a 50.91% ownership interest, or 279 Class B units, in the Albuquerque entity, Mr. Wirth and his affiliates held a 0.18% interest, or 1 Class C unit, and other parties held a 48.91% interest, or 268 Class A units. As of January 31, 2016, the Albuquerque entity has discretionary Priority Return payments to unrelated unit holders of approximately $188,000, to the Trust of approximately $195,000, and to Mr. Wirth and his affiliates of approximately $1,000 per year payable quarterly for calendar year 2016.

SALE OF OWNERSHIP INTERESTS IN TUCSON HOSPITALITY PROPERTIES SUBSIDIARY

On February 17, 2011, the Partnership entered into a restructuring agreement with Rare Earth to allow for the sale of non-controlling interest units in Tucson Hospitality Properties, LP (the “Tucson entity”), which operates the Tucson Oracle hotel property, then wholly-owned by the Partnership. Under the agreement, Rare Earth agreed to either purchase or bring in other investors to purchase up to 250 units, which represents approximately 41% of the outstanding limited partnership units in the Tucson entity, on a post-transaction basis, and the parties agreed to restructure the limited partnership agreement of the Tucson entity. The Board of Trustees approved this restructuring on January 31, 2011.

On October 1, 2013, the Partnership entered into an updated restructured limited partnership agreement with Rare Earth to allow for the sale of additional interest units in the Tucson entity for $10,000 per unit. Under the agreement, Rare Earth agreed to either purchase or bring in other investors to purchase up to 160 (and potentially up to 200 if the overallotment is exercised) units. Under the terms of the updated restructuring agreement, the Partnership agreed to hold at least 50.1% of the outstanding limited partnership units in the Tucson entity, on a post-transaction basis, and intends to maintain this minimum ownership percentage through the purchase of units under this offering. The Board of Trustees approved this restructuring on September 14, 2013. The limited partnership interests in the Tucson entity are allocated to three classes with differing cumulative discretionary priority distribution rights through June 30, 2016. Class A units are owned by unrelated third parties and have first priority for distributions. Class B units are owned by the Partnership and have second priority for distributions. Class C units are owned by Rare Earth or other affiliates of Mr. Wirth and have the lowest priority for distributions from the Tucson entity. Priority distributions of $700 per unit per year are cumulative until June 30, 2016; however, after June 30, 2016 Class A unit holders continue to hold a preference on distributions over Class B and Class C unit holders.