Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| |

[X] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

or

|

| |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________________________ to _____________________________

Commission file number: 0-18953

AAON, INC.

(Exact name of registrant as specified in its charter)

|

| |

Nevada | 87-0448736 |

(State or other jurisdiction | (IRS Employer |

of incorporation or organization) | Identification No.) |

| |

2425 South Yukon, Tulsa, Oklahoma | 74107 |

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (918) 583-2266

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.004

(Title of Class)

Rights to Purchase Series A Preferred Stock

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

[ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

[X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

[X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934).

|

| |

Large accelerated filer [X] | Accelerated filer [ ] |

Non-accelerated filer [ ] | Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act.)

[ ] Yes [X] No

The aggregate market value of the common equity held by non-affiliates computed by reference to the closing price of registrant’s common stock on the last business day of registrant’s most recently completed second quarter June 30, 2016 was $1,093.9 million.

As of February 16, 2017, registrant had outstanding a total of 52,641,334 shares of its $.004 par value Common Stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of registrant's definitive Proxy Statement to be filed in connection with the Annual Meeting of Stockholders to be held May 16, 2017, are incorporated into Part III.

|

| | | |

TABLE OF CONTENTS |

Item Number and Caption | Page Number |

| | | |

PART I | | | |

| | | |

| 1. | Business. | |

| | | |

| 1A. | Risk Factors. | |

| | | |

| 1B. | Unresolved Staff Comments. | |

| | | |

| 2. | Properties. | |

| | | |

| 3. | Legal Proceedings. | |

| | | |

| 4. | Mine Safety Disclosure. | |

| | | |

PART II | | | |

| | | |

| 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | |

| | | |

| 6. | Selected Financial Data. | |

| | | |

| 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations. | |

| | | |

| 7A. | Quantitative and Qualitative Disclosures About Market Risk. | |

| | | |

| 8. | Financial Statements and Supplementary Data. | |

| | | |

| 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | |

| | | |

| 9A. | Controls and Procedures. | |

| | | |

| 9B. | Other Information. | |

| | | |

PART III | | | |

| | | |

| 10. | Directors, Executive Officers and Corporate Governance. | |

| | | |

| 11. | Executive Compensation. | |

| | | |

| 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | |

| | | |

| 13. | Certain Relationships and Related Transactions, and Director Independence. | |

| | | |

| 14. | Principal Accountant Fees and Services. | |

| | | |

PART IV | | | |

| | | |

| 15. | Exhibits and Financial Statement Schedules. | |

Forward-Looking Statements

This Annual Report includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “expects”, “anticipates”, “intends”, “plans”, “believes”, “seeks”, “estimates”, “should”, “will”, and variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions, which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date on which they are made. We undertake no obligations to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Important factors that could cause results to differ materially from those in the forward-looking statements include (1) the timing and extent of changes in raw material and component prices, (2) the effects of fluctuations in the commercial/industrial new construction market, (3) the timing and extent of changes in interest rates, as well as other competitive factors during the year, and (4) general economic, market or business conditions.

PART I

Item 1. Business.

General Development and Description of Business

AAON, Inc., a Nevada corporation, ("AAON Nevada") was incorporated on August 18, 1987. Our operating subsidiaries include AAON, Inc., an Oklahoma corporation, and AAON Coil Products, Inc., a Texas corporation. Unless the context otherwise requires, references in this Annual Report to “AAON,” the “Company”, “we”, “us”, “our”, or “ours” refer to AAON Nevada and our subsidiaries.

We are engaged in the engineering, manufacturing, marketing and sale of air conditioning and heating equipment consisting of standard, semi-custom and custom rooftop units, chillers, packaged outdoor mechanical rooms, air handling units, makeup air units, energy recovery units, condensing units, geothermal/water-source heat pumps and coils.

Products and Markets

Our products serve the commercial and industrial new construction and replacement markets. To date, our sales have been primarily to the domestic market. Foreign sales accounted for approximately $14.7 million, $14.6 million and $19.9 million of our sales in 2016, 2015 and 2014, respectively.

Our rooftop and condensing unit markets primarily consist of units installed on commercial or industrial structures of generally less than ten stories in height. Our air handling units, self-contained units, geothermal/water-source heat pumps, chillers, packaged outdoor mechanical rooms and coils are applicable to all sizes of commercial and industrial buildings.

The size of these markets is determined primarily by the number of commercial and industrial building completions. The replacement market consists of products installed to replace existing units/components that are worn or damaged. Currently, slightly over half of the industry's market consists of replacement units.

The commercial and industrial new construction market is subject to cyclical fluctuations in that it is generally tied to housing starts, but has a lag factor of six to 18 months. Housing starts, in turn, are affected by such factors as interest rates, the state of the economy, population growth and the relative age of the population. When new construction is down, we emphasize the replacement market.

Based on our 2016 sales of $384.0 million, we estimate that we have approximately a 12-13% share of the greater than five ton rooftop market and a 2-3% share of the less than five ton market. Approximately 55% of our sales were generated from the renovation and replacement markets and 45% from new construction. The percentage of sales for new construction vs. replacement to particular customers is related to the customer’s stage of development.

We purchase certain components, fabricate sheet metal and tubing and then assemble and test the finished products. Our primary finished products consist of a single unit system containing heating and cooling in a self-contained cabinet, referred to in the industry as "unitary products”. Our other finished products are chillers, packaged outdoor mechanical rooms, coils, air handling units, condensing units, makeup air units, energy recovery units, rooftop units and geothermal/ water-source heat pumps.

We offer three groups of rooftop units: the RQ Series, consisting of eight cooling sizes ranging from two to ten tons; the RN Series, offered in 28 cooling sizes ranging from six to 140 tons; and the RL Series, which is offered in 21 cooling sizes ranging from 45 to 240 tons.

We also offer the SA, SB and M2 Series as indoor packaged, water-cooled or geothermal/water-source heat pump self-contained units with cooling capacities of three to 70 tons.

Our small packaged geothermal/water-source heat pump units consist of the WH Series horizontal configuration and WV Series vertical configuration, both from one-half to five tons.

We manufacture a LF Series chiller, air-cooled, a LN Series chiller, air-cooled, and a LZ Series chiller and packaged outdoor mechanical room, which are available in both air-cooled condensing and evaporative-cooled configurations, covering a range of four to 540 tons. BL Series boiler outdoor mechanical rooms are also available with 400-6,000 MBH heating capacity. FZ Series fluid cooler outdoor mechanical rooms are also available with a range of 50 to 450 tons.

We offer four groups of condensing units: the CB Series, two to five tons; the CF Series, two to 70 tons; the CN Series, 55 to 140 tons; and the CL Series, 45 to 230 tons.

Our air handling units consist of the indoor F1, H3 and V3 Series and the modular M2 and M3 Series, as well as air handling unit configurations of the RQ, RN, RL and SA Series units.

Our energy recovery option applicable to our RQ, RN, RL and SB units, as well as our V3, M2 and M3 Series air handling units, respond to the U.S. Clean Air Act mandate to increase fresh air in commercial structures. Our products are designed to compete on the higher quality end of standardized products.

Performance characteristics of our products range in cooling capacity from one-half to 540 tons and in heating capacity from 69,000 to 9,000,000 BTUs. All of our products meet the Department of Energy's (“DOE”) minimum efficiency standards, which define the maximum amount of energy to be used in producing a given amount of cooling. Many of our units far exceed these minimum standards and are among the highest efficiency units currently available.

A typical commercial building installation requires one ton of air conditioning for every 300-400 square feet or, for a 100,000 square foot building, 250 tons of air conditioning, which can involve multiple units.

Major Customers

One customer, Texas AirSystems, accounted for 10% or more of our sales during 2016 and 2015. No customer accounted for 10% or more of our sales during 2014.

Sources and Availability of Raw Materials

The most important materials we purchase are steel, copper and aluminum, which are obtained from domestic suppliers. We also purchase from other domestic manufacturers certain components, including compressors, electric motors and electrical controls used in our products. We attempt to obtain the lowest possible cost in our purchases of raw materials and components, consistent with meeting specified quality standards. We are not dependent upon any one source for raw materials or the major components of our manufactured products. By having multiple suppliers, we believe that we will have adequate sources of supplies to meet our manufacturing requirements for the foreseeable future.

Sourcing of raw materials may be impacted in the future by the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act") that contains provisions to improve transparency and accountability concerning the supply of certain minerals, known as "conflict minerals", originating from the Democratic Republic of Congo and adjoining countries. As companies begin implementing the requirements adopted by the Securities and Exchange Commission ("SEC") in response to the provisions in the Dodd-Frank Act, availability of materials that contain conflict minerals may be affected.

We attempt to limit the impact of price fluctuations on these materials by entering into cancellable and non-cancellable fixed price contracts with our major suppliers for periods of six to 18 months. We expect to receive delivery of raw materials from our fixed price contracts for use in our manufacturing operations.

Representatives

We employ a sales staff of 31 individuals and utilize approximately 65 independent manufacturer representatives' organizations (“Representatives”) having 104 offices to market our products in the United States and Canada. We also have one international sales organization, which utilizes 12 distributors in other countries. Sales are made directly to the contractor or end user, with shipments being made from our Tulsa, Oklahoma, and Longview, Texas, plants to the job site.

Our products and sales strategy focuses on niche markets. The targeted markets for our equipment are customers seeking products of better quality than offered, and/or options not offered, by standardized manufacturers.

To support and service our customers and the ultimate consumer, we provide parts availability through our sales offices. We also have factory service organizations at each of our plants. Additionally, a number of the Representatives we utilize have their own service organizations, which, in connection with us, provide the necessary warranty work and/or normal service to customers.

Warranties

Our product warranty policy is: the earlier of one year from the date of first use or 18 months from date of shipment for parts only; an additional four years for compressors (if applicable); 15 years on aluminized steel gas-fired heat exchangers (if applicable); 25 years on stainless steel heat exchangers (if applicable); and ten years on gas-fired heat exchangers in RL products (if applicable). Our warranty policy for the RQ series covers parts for two years from date of unit shipment and labor for one year from date of unit shipment. Our warranty policy for the WH and WV Series geothermal/water-source heat pumps covers parts for five years from the date of manufacture.

The Company also sells extended warranties on parts for various lengths of time ranging from six months to ten years. Revenue for these separately priced warranties is deferred and recognized on a straight-line basis over the separately priced warranty period.

Research and Development

Our products are engineered for performance, flexibility and serviceability. This has become a critical factor in competing in the heating, ventilation and air conditioning (“HVAC”) equipment industry. We must continually develop new and improved products in order to compete effectively and to meet evolving regulatory standards in all of our major product lines.

All of our Research and Development ("R&D") activities are self-sponsored, rather than customer-sponsored. R&D activities have involved the RQ, RN and RL (rooftop units), F1, H3, V3, M2 and M3 (air handling units), LF, LN and LZ (chillers), CB, CF and CN (condensing units), SA and SB (self-contained units), WH and WV (water-source heat pumps), FZ (fluid coolers) and BL (boilers), as well as component evaluation and refinement, development of control systems and new product development. We incurred research and development expenses of approximately $12.0 million, $7.5 million and $6.3 million in 2016, 2015 and 2014, respectively.

Backlog

Our backlog as of February 1, 2017 was approximately $53.5 million compared to approximately $52.3 million as of February 1, 2016. The current backlog consists of orders considered by management to be firm and generally are filled on average within approximately 60 to 90 days after an order is deemed to become firm; however, the orders are subject to cancellation by the customers.

Working Capital Practices

Working capital practices in the industry center on inventories and accounts receivable. Our management regularly reviews our working capital with a view of maintaining the lowest level consistent with requirements of anticipated levels of operation. Our greatest needs arise during the months of July - November, the peak season for inventory (primarily purchased material) and accounts receivable. Our working capital requirements are generally met by cash flow from operations and a bank revolving credit facility, which currently permits borrowings up to $30 million and had a zero balance at December 31, 2016. We believe that we will have sufficient funds available to meet our working capital needs for the foreseeable future.

Seasonality

Sales of our products are moderately seasonal with the peak period being July - November of each year due to timing of construction projects being directly related to warmer weather.

Competition

In the standardized market, we compete primarily with Lennox International, Inc., Trane (Ingersoll Rand Limited), York (Johnson Controls Inc.) and Carrier (United Technologies Corporation). All of these competitors are substantially larger and have greater resources than we do. Our products compete on the basis of total value, quality, function, serviceability, efficiency, availability of product, product line recognition and acceptability of sales outlet. However, in new construction where the contractor is the purchasing decision maker, we are often at a competitive disadvantage because of the emphasis placed on initial cost. In the replacement market and other owner-controlled purchases, we have a better chance of getting the business since quality and long-term cost are generally taken into account.

Employees

As of February 12, 2017, we employed 1,619 permanent employees. Our employees are not represented by unions. Management considers its relations with our employees to be good.

Patents, Trademarks, Licenses and Concessions

We do not consider any patents, trademarks, licenses or concessions to be material to our business operations, other than patents issued regarding our energy recovery wheel option, blower, gas-fired heat exchanger, evaporative-cooled condenser de-superheater and low leakage damper which have terms of 20 years with expiration dates ranging from 2016 to 2033.

Environmental Matters

Laws concerning the environment that affect or could affect our operations include, among others, the Clean Water Act, the Clean Air Act, the Resource Conservation and Recovery Act, the Occupational Safety and Health Act, the National Environmental Policy Act, the Toxic Substances Control Act, regulations promulgated under these Acts, and any other federal, state or local laws or regulations governing environmental matters. We believe that we are in compliance with these laws and that future compliance will not materially affect our earnings or competitive position.

Available Information

Our Internet website address is http://www.aaon.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, will be available free of charge through our Internet website as

soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The information on our website is not a part of, or incorporated by reference into, this annual report on Form 10-K.

Copies of any materials we file with the SEC can also be obtained free of charge through the SEC’s website at http://www.sec.gov, at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549, or by calling the SEC at 1-800-732-0330.

Item 1A. Risk Factors.

The following risks and uncertainties may affect our performance and results of operations. The discussion below contains "forward-looking statements" as outlined in the Forward-Looking Statements section above. Our ability to mitigate risks may cause our future results to materially differ from what we currently anticipate. Additionally, the ability of our competitors to react to material risks will affect our future results.

Our business can be hurt by economic conditions.

Our business is affected by a number of economic factors, including the level of economic activity in the markets in which we operate. Sales in the commercial and industrial new construction markets correlate to the number of new homes and buildings that are built, which in turn is influenced by cyclical factors such as interest rates, inflation, consumer spending habits, employment rates and other macroeconomic factors over which we have no control. In the HVAC business, a decline in economic activity as a result of these cyclical or other factors typically results in a decline in new construction and replacement purchases which could impact our sales volume and profitability.

We may be adversely affected by problems in the availability, or increases in the prices, of raw materials and components.

Problems in the availability, or increases in the prices, of raw materials or components could depress our sales or increase the costs of our products. We are dependent upon components purchased from third parties, as well as raw materials such as steel, copper and aluminum. Occasionally, we enter into cancellable and non-cancellable contracts on terms from six to 18 months for raw materials and components at fixed prices. However, if a key supplier is unable or unwilling to meet our supply requirements, we could experience supply interruptions or cost increases, either of which could have an adverse effect on our gross profit.

We risk having losses resulting from the use of non-cancellable fixed price contracts.

Historically, we have attempted to limit the impact of price fluctuations on commodities by entering into non-cancellable fixed price contracts with our major suppliers for periods of six to 18 months. We expect to receive delivery of raw materials from our fixed price contracts for use in our manufacturing operations. These fixed price contracts are not accounted for using hedge accounting since they meet the normal purchases and sales exemption.

We may not be able to successfully develop and market new products.

Our future success will depend upon our continued investment in research and new product development and our ability to continue to achieve new technological advances in the HVAC industry. Our inability to continue to successfully develop and market new products or our inability to implement technological advances on a pace consistent with that of our competitors could lead to a material adverse effect on our business and results of operations.

We may incur material costs as a result of warranty and product liability claims that would negatively affect our profitability.

The development, manufacture, sale and use of our products involve a risk of warranty and product liability claims. Our product liability insurance policies have limits that, if exceeded, may result in material costs that would have an adverse effect on our future profitability. In addition, warranty claims are not covered by our product liability insurance and there may be types of product liability claims that are also not covered by our product liability insurance.

We may not be able to compete favorably in the highly competitive HVAC business.

Competition in our various markets could cause us to reduce our prices or lose market share, which could have an adverse effect on our future financial results. Substantially all of the markets in which we participate are highly competitive. The most significant competitive factors we face are product reliability, product performance, service and price, with the relative importance of these factors varying among our product line. Other factors that affect competition in the HVAC market include the development and application of new technologies and an increasing emphasis on the development of more efficient HVAC products. Moreover, new product introductions are an important factor in the market categories in which our products compete. Several of our competitors have greater financial and other resources than we have, allowing them to invest in more extensive research and development. We may not be able to compete successfully against current and future competition and current and future competitive pressures faced by us may materially adversely affect our business and results of operations.

The loss of Norman H. Asbjornson could impair the growth of our business.

Norman H. Asbjornson, our founder, has served as our Chief Executive Officer from inception to date and President from inception to November 2016. He has provided the leadership and vision for our strategy and growth. Although important responsibilities and functions have been delegated to other highly experienced and capable management personnel, and our products are technologically advanced and well positioned for sales well into the future, the death, disability or retirement of Mr. Asbjornson could impair the growth of our business. We do not have an employment agreement with Mr. Asbjornson.

The Board of Directors attempts to manage this risk by continually engaging in succession planning concerning Mr. Asbjornson (as well as other key management personnel), as demonstrated by the Board's appointment of Gary D. Fields as President of AAON in November 2016.

Our business is subject to the risks of interruptions by cybersecurity attacks.

We depend upon information technology infrastructure, including network, hardware and software systems to conduct our business. Despite our implementation of network and other cybersecurity measures, our information technology system and networks could be disrupted or experience a security breach from computer viruses, break-ins and similar disruptions from unauthorized tampering with our computer systems. Our security measures may not be adequate to protect against highly targeted sophisticated cyber-attacks, or other improper disclosures of confidential and/or sensitive information. Additionally, we may have access to confidential or other sensitive information of our customers, which, despite our efforts to protect, may be vulnerable to security breaches, theft, or other improper disclosure. Any cyber-related attack or other improper disclosure of confidential information could have a material adverse effect on our business, as well as other negative consequences, including significant damage to our reputation, litigation, regulatory actions and increased cost.

Exposure to environmental liabilities could adversely affect our results of operations.

Our future profitability could be adversely affected by current or future environmental laws. We are subject to extensive and changing federal, state and local laws and regulations designed to protect the environment in the United States and in other parts of the world. These laws and regulations could impose liability for remediation costs and result in civil or criminal penalties in case of non-compliance. Compliance with environmental laws increases our costs of doing business. Because these laws are subject to frequent change, we are unable to predict the future costs resulting from environmental compliance.

We are subject to potentially extreme governmental regulations.

We always face the possibility of new governmental regulations which could have a substantial or even extreme negative effect on our operations and profitability. Negotiations during the summer of 2013 mitigated some of the negative effects of the Department of Energy Final Rule, Regulatory Identification No. 1904-AC23, published on March 7, 2011. However, certain additional testing and listing requirements are still in place and scheduled to be phased in.

Several other intrusive component part governmental regulations are in process. If these proposals become final rules, the effect would be the regulation of compressors and fans in products for which the Department of Energy does not have current authority. This could affect equipment we currently manufacture and could have an impact on our product design, operations and profitability.

The Dodd-Frank Wall Street Reform and Consumer Protection Act contains provisions to improve transparency and accountability concerning the supply of certain minerals, known as "conflict minerals", originating from the Democratic Republic of Congo and adjoining countries. As a result, in August 2012, the SEC adopted annual disclosure and reporting requirements for those companies who use conflict minerals in their products. Accordingly, we began our reasonable country of origin inquiries in fiscal year 2013, with initial disclosure requirements beginning in May 2014. There are costs associated with complying with these disclosure requirements, including for due diligence to determine the sources of conflict minerals used in our products and other potential changes to products, processes or sources of supply as a consequence of such verification activities. The implementation of these rules could adversely affect the sourcing, supply and pricing of materials used in our products. As there may be only a limited number of suppliers offering “conflict free” conflict minerals, we cannot be sure that we will be able to obtain necessary conflict minerals from such suppliers in sufficient quantities or at competitive prices. Also, we may face reputational challenges if we determine that certain of our products contain minerals not determined to be conflict free or if we are unable to sufficiently verify the origins for all conflict minerals used in our products through the procedures we may implement.

We are subject to adverse changes in tax laws.

Our tax expense or benefits could be adversely affected by changes in tax provisions, unfavorable findings in tax examinations or differing interpretations by tax authorities. We are unable to estimate the impact that current and future tax proposals and tax laws could have on our results of operations. We are currently subject to state and local tax examinations for which we do not expect any major assessments.

We are subject to international regulations that could adversely affect our business and results of operations.

Due to our use of representatives in foreign markets, we are subject to many laws governing international relations, including those that prohibit improper payments to government officials and commercial customers, and restrict where we can do business, what information or products we can supply to certain countries and what information we can provide to a non-U.S. government, including but not limited to the Foreign Corrupt Practices Act, U.K. Bribery Act and the U.S. Export Administration Act. Violations of these laws, which are complex, may result in criminal penalties or sanctions that could have a material adverse effect on our business, financial condition and results of operations.

Operations may be affected by natural disasters, especially since most of our operations are performed at a single location.

Natural disasters such as tornadoes and ice storms, as well as accidents, acts of terror, infection and other factors beyond our control could adversely affect our operations. Especially, as our facilities are in areas where tornadoes are likely to occur, and the majority of our operations are at our Tulsa facilities, the effects of natural disasters and other events could damage our facilities and equipment and force a temporary halt to manufacturing and other operations, and such events could consequently cause severe damage to our business. We maintain insurance against these sorts of events; however, this is not guaranteed to cover all the losses and damages incurred.

If we are unable to hire, develop or retain employees, it could have an adverse effect on our business.

We compete to hire new employees and then seek to train them to develop their skills. We may not be able to successfully recruit, develop and retain the personnel we need. Unplanned turnover or failure to hire and retain a diverse, skilled workforce, could increase our operating costs and adversely affect our results of operations.

Variability in self-insurance liability estimates could impact our results of operations.

We self-insure for employee health insurance and workers’ compensation insurance coverage up to a predetermined level, beyond which we maintain stop-loss insurance from a third-party insurer for claims over $200,000 and $750,000 for employee health insurance claims and workers' compensation insurance claims, respectively. Our aggregate exposure varies from year to year based upon the number of participants in our insurance plans. We estimate our self-insurance liabilities using an analysis provided by our claims administrator and our historical claims experience. Our accruals

for insurance reserves reflect these estimates and other management judgments, which are subject to a high degree of variability. If the number or severity of claims for which we self-insure increases, it could cause a material and adverse change to our reserves for self-insurance liabilities, as well as to our earnings.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

As of December 31, 2016, we own all of our facilities, consisting of approximately 1.55 million square feet of space for office, manufacturing, warehouse, assembly operations and parts sales in Tulsa, Oklahoma, and Longview, Texas. We believe that our facilities are well maintained and are in good condition and suitable for the conduct of our business.

Our plant and office facilities in Tulsa, Oklahoma, consist of a 342,000 sq. ft. building (327,000 sq. ft. of manufacturing/warehouse space and 15,000 sq. ft. of office space) located on a 12-acre tract of land at 2425 South Yukon Avenue, and a 940,000 sq. ft. manufacturing/warehouse building and a 70,000 sq. ft. office building located on an approximately 78-acre tract of land across the street from the original facility (2440 South Yukon Avenue) (the "Tulsa facilities").

Our manufacturing area is in heavy industrial type buildings, with some coverage by overhead cranes, containing manufacturing equipment designed for sheet metal fabrication and metal stamping. The manufacturing equipment contained in the facilities consists primarily of automated sheet metal fabrication equipment, supplemented by presses. Assembly lines consist of six cart-type conveyor lines and one roller-type conveyor line with variable line speed adjustment, which are motor driven. Subassembly areas and production line manning are based upon line speed.

In February 2016, we broke ground on a new engineering research and development laboratory at the Tulsa manufacturing facility. The three-story 75,000 square foot facility will be both an acoustical and a performance measuring laboratory. The new facility will consist of seven psychrometric chambers allowing AAON to meet and maintain industry certifications.

Our operations in Longview, Texas, are conducted in a plant/office building at 203-207 Gum Springs Road, containing 263,000 sq. ft. on 33.0 acres. The manufacturing area (approximately 256,000 sq. ft.) is located in three 120-foot wide sheet metal buildings connected by an adjoining structure. The remaining 7,000 square feet are utilized as office space. The facility is built for light industrial manufacturing.

Item 3. Legal Proceedings.

We are not a party to any pending legal proceeding which management believes is likely to result in a material liability and no such action has been threatened against us, or, to the best of our knowledge, is contemplated.

Item 4. Mine Safety Disclosure.

Not applicable.

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock is quoted on the NASDAQ Global Select Market under the symbol "AAON". The table below summarizes the intraday high and low reported sale prices for our common stock for the past two fiscal years. As of the close of business on February 16, 2017, there were 1,115 holders of record of our common stock.

|

| | | | |

Quarter Ended | | High | | Low |

| | | | |

March 31, 2015 | | $24.71 | | $20.85 |

June 30, 2015 | | $24.95 | | $22.39 |

September 30, 2015 | | $23.23 | | $19.12 |

December 31, 2015 | | $25.15 | | $19.19 |

| | | | |

March 31, 2016 | | $28.02 | | $19.49 |

June 30, 2016 | | $28.27 | | $25.65 |

September 30, 2016 | | $29.04 | | $25.75 |

December 31, 2016 | | $33.90 | | $27.55 |

Dividends - At the discretion of the Board of Directors, we pay semi-annual cash dividends. Board approval is required to determine the date of declaration and amount for each semi-annual dividend payment.

Our recent dividends are as follows:

|

| | | |

Declaration Date | Record Date | Payment Date | Dividend per Share |

May 2, 2014 | June 12, 2014 | July 1, 2014 | $0.09 |

November 4, 2014 | December 2, 2014 | December 23, 2014 | $0.09 |

May 19, 2015 | June 12, 2015 | July 1, 2015 | $0.11 |

October 29, 2015 | December 2, 2015 | December 23, 2015 | $0.11 |

May 24, 2016 | June 10, 2016 | July 1, 2016 | $0.11 |

November 9, 2016 | December 2, 2016 | December 23, 2016 | $0.13 |

Additionally, on June 5, 2014, we declared a three-for-two stock split of the Company's common stock to be paid in the form of a stock dividend on July 16, 2014. Stockholders of record at the close of business on June 27, 2014 received one additional share for every two shares they held as of that date.

The following is a summary of our share-based compensation plans as of December 31, 2016:

|

| | | | | | | | | | |

EQUITY COMPENSATION PLAN INFORMATION |

Plan category | | (a) Number of securities to be issued upon exercise of outstanding options, warrants and rights | | (b) Weighted-average exercise price of outstanding options, warrants and rights | | (c) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

| | | | | | |

The 2007 Long-Term Incentive Plan | | 410,236 |

| | $ | 10.57 |

| | — |

|

The 2016 Long-Term Incentive Plan | | — |

| | $ | — |

| | 3,393,534 |

|

Repurchases during the fourth quarter of 2016 were as follows:

|

| | | | | | | | | | | | | |

ISSUER PURCHASES OF EQUITY SECURITIES |

| | (a) Total Number of Shares (or Units | | (b) Average Price Paid (Per Share | | (c) Total Number of Shares (or Units) Purchased as part of Publicly Announced | | (d) Maximum Number (or Approximate Dollar Value) of Shares (or Units) that may yet be Purchased under the |

Period | | Purchased) | | or Unit) | | Plans or Programs | | Plans or Programs |

| | | | | | | | |

October 2016 | | 34,455 |

| | $ | 29.61 |

| | 34,455 |

| | — |

|

November 2016 | | 81,225 |

| | 30.80 |

| | 81,225 |

| | — |

|

December 2016 | | 45,234 |

| | 32.87 |

| | 45,234 |

| | — |

|

Total | | 160,914 |

| | $ | 31.13 |

| | 160,914 |

| | — |

|

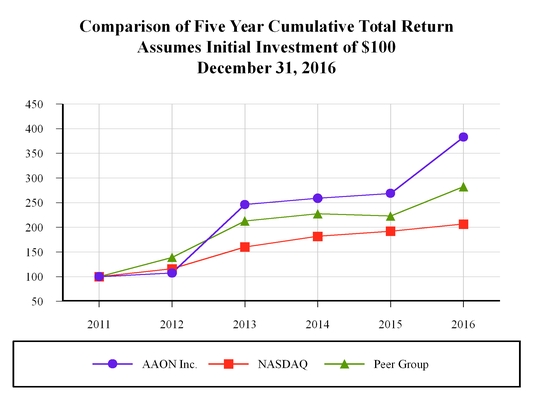

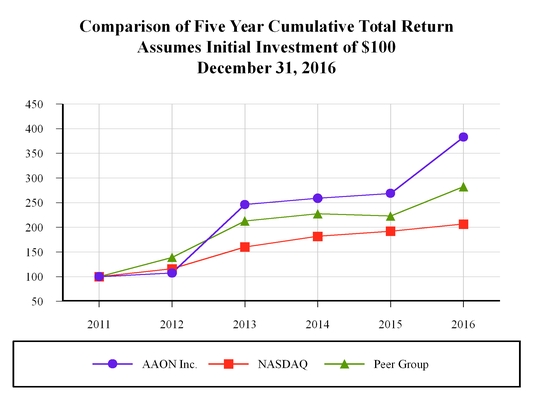

Comparative Stock Performance Graph

The following performance graph compares our cumulative total shareholder return, the NASDAQ Composite and a peer group of U.S. industrial manufacturing companies in the air conditioning, ventilation, and heating exchange equipment markets from December 31, 2011 through December 31, 2016. The graph assumes that $100 was invested at the close of trading December 31, 2011, with reinvestment of dividends. Our peer group includes Lennox International, Inc., Ingersoll Rand Limited, Johnson Controls Inc., and United Technologies Corporation. This table is not intended to forecast future performance of our Common Stock.

This stock performance Graph is not deemed to be “soliciting material” or otherwise be considered to be “filed” with the SEC or subject to Regulation 14A or 14C under the Securities Exchange Act of 1934 (Exchange Act) or to the liabilities of Section 18 of the Exchange Act, and should not be deemed to be incorporated by reference into any filing under the Securities Act of 1933 or the Exchange Act, except to the extent the Company specifically incorporates it by reference into such a filing.

Item 6. Selected Financial Data.

The following selected financial data should be read in conjunction with our Consolidated Financial Statements and Notes thereto included under Item 8 of this report and "Management's Discussion and Analysis of Financial Condition and Results of Operations" contained in Item 7.

|

| | | | | | | | | | | | | | | | | | | | |

| Years Ended December 31, | |

Results of Operations: | 2016 | | 2015 | | 2014 | | 2013 | | 2012 | |

| (in thousands, except per share data) | |

Net sales | $ | 383,977 |

| | $ | 358,632 |

| | $ | 356,322 |

| | $ | 321,140 |

| | $ | 303,114 |

| |

Net income | $ | 53,376 |

| | $ | 45,728 |

| | $ | 44,158 |

| | $ | 37,547 |

| | $ | 27,449 |

| |

Earnings per share: | |

| | |

| | |

| | |

| | |

| |

Basic | $ | 1.01 |

| | $ | 0.85 |

| | $ | 0.81 |

| | $ | 0.68 |

| | $ | 0.50 |

| |

Diluted | $ | 1.00 |

| | $ | 0.84 |

| | $ | 0.80 |

| | $ | 0.68 |

| | $ | 0.49 |

| |

Cash dividends declared per common share: | $ | 0.24 |

| | $ | 0.22 |

| | $ | 0.18 |

| | $ | 0.13 |

| | $ | 0.16 |

| (1) |

(1) Includes special dividend of $0.05 per common share paid on December 24, 2012.

|

| | | | | | | | | | | | | | | | | | | |

| December 31, |

Financial Position at End of Fiscal Year: | 2016 | | 2015 | | 2014 | | 2013 | | 2012 |

| (in thousands) |

Working capital | $ | 101,939 |

| | $ | 80,800 |

| | $ | 82,227 |

| | $ | 72,515 |

| | $ | 47,428 |

|

Total assets | 256,530 |

| | 232,854 |

| | 226,974 |

| | 210,665 |

| | 189,000 |

|

Long-term and current debt | — |

| | — |

| | — |

| | — |

| | — |

|

Total stockholders’ equity | 205,898 |

| | 178,918 |

| | 174,059 |

| | 164,106 |

| | 138,136 |

|

Use of Non-GAAP Financial Measure

To supplement the Company’s consolidated financial statements presented in accordance with generally accepted accounting principles (“GAAP”), an additional non-GAAP financial measure is provided and reconciled in the following table. The Company believes that this non-GAAP financial measure, when considered together with the GAAP financial measures, provides information that is useful to investors in understanding period-over-period operating results. The Company believes that this non-GAAP financial measure enhances the ability of investors to analyze the Company’s business trends and operating performance.

EBITDAX

EBITDAX (as defined below) is presented herein and reconciled from the GAAP measure of net income because of its wide acceptance by the investment community as a financial indicator of a company's ability to internally fund operations.

The Company defines EBITDAX as net income, plus (1) depreciation, (2) amortization of bond premiums, (3) share-based compensation, (4) interest (income) expense and (5) income tax expense. EBITDAX is not a measure of net income or cash flows as determined by GAAP.

The Company’s EBITDAX measure provides additional information which may be used to better understand the Company’s operations. EBITDAX is one of several metrics that the Company uses as a supplemental financial measurement in the evaluation of its business and should not be considered as an alternative to, or more meaningful than, net income, as an indicator of operating performance. Certain items excluded from EBITDAX are significant components in understanding and assessing a company's financial performance. EBITDAX, as used by the Company, may not be comparable to similarly titled measures reported by other companies. The Company believes that EBITDAX is a widely followed measure of operating performance and is one of many metrics used by the Company’s management team, and by other users of the Company’s consolidated financial statements.

The following table provides a reconciliation of net income (GAAP) to EBITDAX (non-GAAP) for the periods indicated:

|

| | | | | | | | | | | | | | | | | | | |

| December 31, |

| 2016 | | 2015 | | 2014 | | 2013 | | 2012 |

| (in thousands) |

Net Income, a GAAP measure | $ | 53,376 |

| | $ | 45,728 |

| | $ | 44,158 |

| | $ | 37,547 |

| | $ | 27,449 |

|

Depreciation | 13,035 |

| | 11,741 |

| | 11,553 |

| | 12,312 |

| | 13,407 |

|

Amortization of bond premiums | 249 |

| | 266 |

| | 688 |

| | 790 |

| | 155 |

|

Share-based compensation | 4,357 |

| | 2,891 |

| | 2,178 |

| | 1,763 |

| | 1,294 |

|

Interest income | (541 | ) | | (427 | ) | | (964 | ) | | (1,011 | ) | | (197 | ) |

Income tax expense | 26,615 |

| | 25,611 |

| | 24,088 |

| | 18,747 |

| | 16,868 |

|

EBITDAX, a non-GAAP measure | $ | 97,091 |

| | $ | 85,810 |

| | $ | 81,701 |

| | $ | 70,148 |

| | $ | 58,976 |

|

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Overview

We engineer, manufacture, market and sell air conditioning and heating equipment consisting of standard, semi-custom and custom rooftop units, chillers, packaged outdoor mechanical rooms, air handling units, makeup air units, energy recovery units, condensing units, geothermal/water-source heat pumps and coils. These products are marketed and sold to retail, manufacturing, educational, lodging, supermarket, medical and other commercial industries. We market our products to all 50 states in the United States and certain provinces in Canada.

Our business can be affected by a number of economic factors, including the level of economic activity in the markets in which we operate. The recent uncertainty of the economy has negatively impacted the commercial and industrial new construction markets. A further decline in economic activity could result in a decrease in our sales volume and profitability. Sales in the commercial and industrial new construction markets correlate closely to the number of new homes and buildings that are built, which in turn is influenced by cyclical factors such as interest rates, inflation, consumer spending habits, employment rates and other macroeconomic factors over which we have no control.

We sell our products to property owners and contractors through a network of manufacturers’ representatives and our internal sales force. The demand for our products is influenced by national and regional economic and demographic factors. The commercial and industrial new construction market is subject to cyclical fluctuations in that it is generally tied to housing starts, but has a lag factor of six to 18 months. Housing starts, in turn, are affected by such factors as interest rates, the state of the economy, population growth and the relative age of the population. When new construction is down, we emphasize the replacement market. The new construction market in 2016 continued to be unpredictable and uneven. Thus, throughout the year, we emphasized promotion of the benefits of AAON equipment to property owners in the replacement market.

The principal components of cost of goods sold are labor, raw materials, component costs, factory overhead, freight out and engineering expense. The principal high volume raw materials used in our manufacturing processes are steel, copper and aluminum and are obtained from domestic suppliers. We also purchase from domestic manufacturers certain components, including compressors, motors and electrical controls.

The price levels of our raw materials fluctuate given that the market continues to be volatile and unpredictable as a result of the uncertainty related to the U.S. economy and global economy. For the year ended December 31, 2016, the prices for copper, galvanized steel and stainless steel decreased approximately 4.8%, 9.5% and 12.3%, respectively, from a year ago, while the price for aluminum remained relatively unchanged from a year ago. For the year ended December 31, 2015, the prices for copper, galvanized steel and stainless steel decreased approximately 13.0%, 10.6%, and 13.9%, respectively, from 2014, while the price for aluminum increased 1.8% from 2014.

In 2011, we began using an all aluminum microchannel condenser coil on our small rooftop unit product line, and in 2013, we began using this condenser coil in our new large rooftop product line as well. The condenser coil is the outdoor coil of a conventional air conditioning system. We expect to be using this type of condenser coil throughout the complete

rooftop unit product line. This will reduce our copper tube usage in this component of the product, however, copper will remain a high volume raw material because of its use throughout the equipment.

We attempt to limit the impact of price fluctuations on these materials by entering into cancellable and non-cancellable fixed price contracts with our major suppliers for periods of six to 18 months. We expect to receive delivery of raw materials from our fixed price contracts for use in our manufacturing operations.

The following are highlights of our results of operations, cash flows, and financial condition:

| |

• | We spent $26.6 million in capital expenditures in 2016, an increase of $5.6 million from the $21.0 million spent in 2015, primarily due to construction projects related to our new research and development lab, water-source heat pump production line, as well as other internal development projects. |

| |

• | We paid cash dividends of $12.7 million in 2016 compared to $11.9 million in 2015. |

| |

• | Our volumes continue to increase, with an approximate 12.5% increase in units sold for 2016 versus 2015. |

Results of Operations

Units sold for years ended December 31:

|

| | | | | | | | | |

| | 2016 | | 2015 | | 2014 |

| | | | | | |

Rooftop Units | | 16,764 |

| | 14,891 |

| | 14,336 |

|

Split Systems | | 3,753 |

| | 3,385 |

| | 2,622 |

|

Outdoor Mechanical Rooms | | 65 |

| | 57 |

| | 114 |

|

Water Source Heat Pumps | | 316 |

| | 243 |

| | 251 |

|

Total Units | | 20,898 |

| | 18,576 |

| | 17,323 |

|

Year Ended December 31, 2016 vs. Year Ended December 31, 2015

Net Sales

|

| | | | | | | | | | | | | | |

| | Years Ending December 31, |

| | 2016 | | 2015 | | $ Change | % Change |

| | (in thousands, except unit data) |

Net sales | | $ | 383,977 |

| | $ | 358,632 |

| | $ | 25,345 |

| 7.1 | % |

Total units | | 20,898 |

| | 18,576 |

| | 2,322 |

| 12.5 | % |

Net sales increased due to an increase in our total units sold, offset by a decline in the average price per unit for both of our locations.

Cost of Sales

|

| | | | | | | | | | | | | | |

| | Years Ending December 31, | | Percent of Sales |

| | 2016 | | 2015 | | 2016 | | 2015 |

| | (in thousands) | | | | |

Cost of sales | | $ | 265,897 |

| | $ | 249,951 |

| | 69.2 | % | | 69.7 | % |

Gross Profit | | 118,080 |

| | 108,681 |

| | 30.8 | % | | 30.3 | % |

The principal components of cost of sales are labor, raw materials, component costs, factory overhead, freight out and engineering expense. The principal high volume raw materials used in our manufacturing processes are steel, copper and aluminum, which are obtained from domestic suppliers.

Twelve month average raw material cost per pound as of December 31:

|

| | | | | | | | | | | |

| | Years Ending December 31, | | |

| | 2016 | | 2015 | | % Change |

| | | | | | |

Copper | | $ | 3.37 |

| | $ | 3.54 |

| | (4.8 | )% |

Galvanized Steel | | $ | 0.38 |

| | $ | 0.42 |

| | (9.5 | )% |

Stainless Steel | | $ | 1.14 |

| | $ | 1.30 |

| | (12.3 | )% |

Aluminum | | $ | 1.67 |

| | $ | 1.67 |

| | — | % |

Selling, General and Administrative Expenses

|

| | | | | | | | | | | | | | |

| | Years Ending December 31, | | Percent of Sales |

| | 2016 | | 2015 | | 2016 | | 2015 |

| | (in thousands) | | | | |

Warranty | | $ | 3,601 |

| | $ | 4,317 |

| | 0.9 | % | | 1.2 | % |

Profit Sharing | | 8,991 |

| | 8,037 |

| | 2.3 | % | | 2.2 | % |

Salaries & Benefits | | 11,363 |

| | 11,078 |

| | 3.0 | % | | 3.1 | % |

Stock Compensation | | 2,914 |

| | 2,082 |

| | 0.8 | % | | 0.6 | % |

Advertising | | 1,395 |

| | 1,191 |

| | 0.4 | % | | 0.3 | % |

Depreciation | | 796 |

| | 930 |

| | 0.2 | % | | 0.3 | % |

Insurance | | 1,072 |

| | 1,153 |

| | 0.3 | % | | 0.3 | % |

Professional Fees | | 2,032 |

| | 1,794 |

| | 0.5 | % | | 0.5 | % |

Donations | | 370 |

| | 452 |

| | 0.1 | % | | 0.1 | % |

Bad Debt Expense | | (45 | ) | | (48 | ) | | — | % | | — | % |

Other | | 6,017 |

| | 6,452 |

| | 1.6 | % | | 1.8 | % |

Total SG&A | | $ | 38,506 |

| | $ | 37,438 |

| | 10.0 | % | | 10.4 | % |

The increase in SG&A is primarily due to increased compensation costs due to better operating results, offset by a decrease in warranty expense as a result of continued improvements in quality control and a decrease in other expense.

Income Taxes

|

| | | | | | | | | | | | | | |

| | Years Ending December 31, | | Effective Tax Rate |

| | 2016 | | 2015 | | 2016 | | 2015 |

| | (in thousands) | | | | |

Income tax provision | | $ | 26,615 |

| | $ | 25,611 |

| | 33.3 | % | | 35.9 | % |

The Company early adopted ASU 2016-09, Improvements to Employee Share-Based Payment Accounting, applying the changes for excess tax benefits and tax deficiencies prospectively. As a result, excess tax benefits and deficiencies are reported as an income tax benefit or expense on the statement of income rather than as a component of additional paid-in capital on the statement of equity. Excess tax benefits and deficiencies are treated as discrete items to the income tax provision in the reporting period in which they occur. For the twelve months ended December 31, 2016, the Company recorded $2.1 million in excess tax benefits as an income tax benefit.

Year Ended December 31, 2015 vs. Year Ended December 31, 2014

Net Sales

|

| | | | | | | | | | | | | | |

| | Years Ending December 31, |

| | 2015 | | 2014 | | $ Change | % Change |

| | (in thousands, except unit data) |

Net sales | | $ | 358,632 |

| | $ | 356,322 |

| | $ | 2,310 |

| 0.6 | % |

Total units | | 18,576 |

| | 17,323 |

| | 1,253 |

| 7.2 | % |

Net sales remained relatively stable while we saw an increase in our total units sold. Most of the increase in our units sold came from our Longview facility which have a lower average price per unit.

Cost of Sales

|

| | | | | | | | | | | | | | |

| | Years Ending December 31, | | Percent of Sales |

| | 2015 | | 2014 | | 2015 | | 2014 |

| | (in thousands) | | | | |

Cost of sales | | $ | 249,951 |

| | $ | 248,059 |

| | 69.7 | % | | 69.6 | % |

Gross Profit | | 108,681 |

| | 108,263 |

| | 30.3 | % | | 30.4 | % |

The principal components of cost of sales are labor, raw materials, component costs, factory overhead, freight out and engineering expense. The principal high volume raw materials used in our manufacturing processes are steel, copper and aluminum, which are obtained from domestic suppliers.

Twelve month average raw material cost per pound as of December 31:

|

| | | | | | | | | | | |

| | Years Ending December 31, | | |

| | 2015 | | 2014 | | % Change |

| | | | | | |

Copper | | $ | 3.54 |

| | $ | 4.07 |

| | (13.0 | )% |

Galvanized Steel | | $ | 0.42 |

| | $ | 0.47 |

| | (10.6 | )% |

Stainless Steel | | $ | 1.30 |

| | $ | 1.51 |

| | (13.9 | )% |

Aluminum | | $ | 1.67 |

| | $ | 1.64 |

| | 1.8 | % |

Selling, General and Administrative Expenses

|

| | | | | | | | | | | | | | |

| | Years Ending December 31, | | Percent of Sales |

| | 2015 | | 2014 | | 2015 | | 2014 |

| | (in thousands) | | | | |

Warranty | | $ | 4,317 |

| | $ | 4,874 |

| | 1.2 | % | | 1.4 | % |

Profit Sharing | | 8,037 |

| | 7,781 |

| | 2.2 | % | | 2.2 | % |

Salaries & Benefits | | 11,078 |

| | 11,638 |

| | 3.1 | % | | 3.3 | % |

Stock Compensation | | 2,082 |

| | 1,520 |

| | 0.6 | % | | 0.4 | % |

Advertising | | 1,191 |

| | 1,015 |

| | 0.3 | % | | 0.3 | % |

Depreciation | | 930 |

| | 878 |

| | 0.3 | % | | 0.2 | % |

Insurance | | 1,153 |

| | 1,160 |

| | 0.3 | % | | 0.3 | % |

Professional Fees | | 1,794 |

| | 1,986 |

| | 0.5 | % | | 0.6 | % |

Donations | | 452 |

| | 4,202 |

| | 0.1 | % | | 1.2 | % |

Bad Debt Expense | | (48 | ) | | (1 | ) | | — | % | | — | % |

Other | | 6,452 |

| | 5,509 |

| | 1.8 | % | | 1.5 | % |

Total SG&A | | $ | 37,438 |

| | $ | 40,562 |

| | 10.4 | % | | 11.4 | % |

The decrease in SG&A is primarily due to the non-recurring donations in 2014, along with a decrease in warranty expense as a result of continued improvements in quality control, offset by an increase in other expense. In 2015, other expense increased due to sales taxes to certain states.

Income Taxes

|

| | | | | | | | | | | | | | |

| | Years Ending December 31, | | Effective Tax Rate |

| | 2015 | | 2014 | | 2015 | | 2014 |

| | (in thousands) | | | | |

Income tax provision | | $ | 25,611 |

| | $ | 24,088 |

| | 35.9 | % | | 35.3 | % |

Liquidity and Capital Resources

Our working capital and capital expenditure requirements are generally met through net cash provided by operations and the occasional use of the revolving bank line of credit based on our current liquidity at the time.

Our cash and cash equivalents increased $16.2 million from December 31, 2015 to December 31, 2016. As of December 31, 2016, we had $24.2 million in cash and cash equivalents.

As of December 31, 2016, we had certificates of deposit of $5.5 million and investments held to maturity at amortized cost of $14.1 million. These certificates of deposit had maturity dates of less than two months to approximately 7 months. The investments held to maturity at amortized cost had maturity dates of less than one month to approximately 6 months.

On July 25, 2016 we renewed our line of credit with BOKF, NA dba Bank of Oklahoma, formerly known as Bank of Oklahoma, N.A. ("Bank of Oklahoma"). The revolving line of credit matures on July 27, 2018. We expect to renew our line of credit in July 2018 with favorable terms. Under the line of credit, there was one standby letter of credit of $0.8 million as of December 31, 2016. At December 31, 2016 we have $29.2 million of borrowings available under the revolving credit facility. No fees are associated with the unused portion of the committed amount.

As of December 31, 2016 and 2015, there were no outstanding balances under the revolving credit facility. Interest on borrowings is payable monthly at LIBOR plus 2.5%. The weighted average interest rate was 3.0% and 2.6% for the years ended December 31, 2016 and 2015, respectively.

At December 31, 2016, we were in compliance with all of the covenants under the revolving credit facility. We are obligated to comply with certain financial covenants under the revolving credit facility. These covenants require that we meet certain parameters related to our tangible net worth and total liabilities to tangible net worth ratio. At December 31, 2016, our tangible net worth was $205.9 million, which meets the requirement of being at or above $125.0 million. Our total liabilities to tangible net worth ratio was 0.2 to 1.0 which meets the requirement of not being above 2 to 1.

The Board has authorized three stock repurchase programs for the Company. The Company may purchase shares on the open market from time to time, up to a total of 5.7 million shares. The Board must authorize the timing and amount of these purchases. Effective May 24, 2016, the Board authorized up to $25.0 million in open market repurchases and on June 2, 2016, the Company executed a repurchase agreement in accordance with the rules and regulations of the SEC allowing the Company to repurchase an aggregate amount of $25.0 million or a total of approximately 2.0 million shares from the open market. The repurchase agreement will terminate upon the aforementioned thresholds having been met, on April 15, 2017, or upon other provisions contained in the repurchase agreement by either the Company or its agent. The Company also has a stock repurchase arrangement by which employee-participants in our 401(k) savings and investment plan are entitled to have shares in AAON, Inc. stock in their accounts sold to the Company. The maximum number of shares to be repurchased is contingent upon the number of shares sold by employee-participants. Lastly, the Company repurchases shares of AAON, Inc. stock from certain of its directors and employees for payment of statutory tax withholdings on stock transactions. Any other repurchases from directors or employees is contingent upon Board approval. All repurchases are done at current market prices.

Our repurchase activity is as follows:

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| 2016 | 2015 | 2014 |

Program | Shares | Total $ | $ per share | Shares | Total $ | $ per share | Shares | Total $ | $ per share |

Open market | 165,598 |

| $ | 4,440,658 |

| $ | 26.82 |

| 1,037,590 |

| $ | 24,999,963 |

| $ | 24.09 |

| 1,016,717 |

| $ | 19,998,406 |

| $ | 19.67 |

|

401(k) | 540,501 |

| 14,875,850 |

| 27.52 |

| 512,754 |

| 11,557,598 |

| 22.54 |

| 417,172 |

| 8,246,172 |

| 19.77 |

|

Directors and employees | 30,072 |

| 823,446 |

| 27.38 |

| 25,746 |

| 585,413 |

| 22.74 |

| 54,341 |

| 1,038,459 |

| 19.11 |

|

Total | 736,171 |

| $ | 20,139,954 |

| $ | 27.36 |

| 1,576,090 |

| $ | 37,142,974 |

| $ | 23.57 |

| 1,488,230 |

| $ | 29,283,037 |

| $ | 19.68 |

|

|

| | | | | | | | |

| Inception to Date |

Program | Shares | Total $ | $ per share |

Open market | 3,834,819 |

| $ | 60,948,460 |

| $ | 15.89 |

|

401(k) | 6,082,443 |

| 65,732,720 |

| 10.81 |

|

Directors and employees | 1,873,632 |

| 15,663,608 |

| 8.36 |

|

Total | 11,790,894 |

| $ | 142,344,788 |

| $ | 12.07 |

|

Dividends - At the discretion of the Board of Directors, we pay semi-annual cash dividends. Board approval is required to determine the date of declaration and amount for each semi-annual dividend payment.

Our recent dividends are as follows:

|

| | | | | |

Declaration Date | Record Date | Payment Date | Dividend per Share |

May 2, 2014 | June 12, 2014 | July 1, 2014 | $ | 0.09 |

|

November 4, 2014 | December 2, 2014 | December 23, 2014 | $ | 0.09 |

|

May 19, 2015 | June 12, 2015 | July 1, 2015 | $ | 0.11 |

|

October 29, 2015 | December 2, 2015 | December 23, 2015 | $ | 0.11 |

|

May 24, 2016 | June 10, 2016 | July 1, 2016 | $ | 0.11 |

|

November 9, 2016 | December 2, 2016 | December 23, 2016 | $ | 0.13 |

|

Additionally, on June 5, 2014, we declared a three-for-two stock split of the Company's common stock to be paid in the form of a stock dividend on July 16, 2014. Stockholders of record at the close of business on June 27, 2014 received one additional share for every two shares they held as of that date.

Based on historical performance and current expectations, we believe our cash and cash equivalents balance, the projected cash flows generated from our operations, our existing committed revolving credit facility (or comparable financing) and our expected ability to access capital markets will satisfy our working capital needs, capital expenditures and other liquidity requirements associated with our operations in 2017 and the foreseeable future.

Statement of Cash Flows

The table below reflects a summary of our net cash flows provided by operating activities, net cash flows used in investing activities, and net cash flows used in financing activities for the years indicated.

|

| | | | | | | | | | | |

| 2016 | | 2015 | | 2014 |

| (in thousands) |

Operating Activities | | | | | |

Net Income | $ | 53,376 |

| | $ | 45,728 |

| | $ | 44,158 |

|

Income statement adjustments, net | 18,996 |

| | 16,250 |

| | 12,154 |

|

Changes in assets and liabilities: | | | | | |

Accounts receivable | 7,048 |

| | (5,884 | ) | | (5,007 | ) |

Income tax receivable | (1,537 | ) | | 312 |

| | (257 | ) |

Inventories | (9,478 | ) | | (1,059 | ) | | (5,613 | ) |

Prepaid expenses and other | (83 | ) | | 76 |

| | (305 | ) |

Accounts payable | 654 |

| | (5,109 | ) | | 3,512 |

|

Deferred revenue | 417 |

| | 189 |

| | 782 |

|

Accrued liabilities | (5,470 | ) | | 4,852 |

| | 4,094 |

|

Net cash provided by operating activities | 63,923 |

| | 55,355 |

| | 53,518 |

|

Investing Activities | | | | | |

Capital expenditures | (26,604 | ) | | (20,967 | ) | | (16,127 | ) |

Purchases of investments | (14,496 | ) | | (20,863 | ) | | (16,820 | ) |

Maturities of investments and proceeds from called investments | 24,095 |

| | 18,519 |

| | 26,536 |

|

Other | 80 |

| | 117 |

| | 382 |

|

Net cash used in investing activities | (16,925 | ) | | (23,194 | ) | | (6,029 | ) |

Financing Activities | | | | | |

(Payments) borrowings under revolving credit facility, net | — |

| | — |

| | — |

|

Stock options exercised | 2,063 |

| | 2,795 |

| | 1,318 |

|

Repurchase of stock | (19,317 | ) | | (36,558 | ) | | (29,066 | ) |

Employee taxes paid by withholding shares

| (823 | ) | | (585 | ) | | (218 | ) |

Cash dividends paid to stockholders | (12,676 | ) | | (11,857 | ) | | (9,656 | ) |

Net cash used in financing activities | $ | (30,753 | ) | | $ | (46,205 | ) | | $ | (37,622 | ) |

Cash Flows from Operating Activities

Cash flows from operating activities increased primarily due to increased levels of operations generating excess cash flows.

Cash Flows from Investing Activities

The capital expenditure program for 2017 is estimated to be approximately $41.8 million. The increase in capital expenditures is primarily due to construction projects related to our new research and development lab, water-source heat pump production line, as well as other internal development projects. Many of these projects are subject to review and cancellation at the discretion of our CEO and Board of Directors without incurring substantial charges. The increase in capital expenditures was offset by decreased investment purchases, primarily driven by the use of maturing investment funds in our capital expenditure program.

Cash Flows from Financing Activities

Our buyback activity in 2016 decreased compared to prior years, due to less open market repurchases of our stock pursuant to the terms of our repurchase agreement.

Off-Balance Sheet Arrangements

We are not party to any off-balance sheet arrangements that have or are reasonably likely to have a material current or future effect on our financial condition, changes in financial condition, revenues, expenses, results of operations, liquidity, capital expenditures or capital resources.

Commitments and Contractual Agreements

We had no material contractual purchase agreements as of December 31, 2016.

Contingencies

We are subject to various claims and legal actions that arise in the ordinary course of business. We closely monitor these claims and legal actions and frequently consult with our legal counsel to determine whether they may, when resolved, have a material adverse effect on our financial position, results of operations or cash flows and we accrue and/or disclose loss contingencies as appropriate. We have concluded that the likelihood is remote that the ultimate resolution of any pending litigation or claims will be material or have a material adverse effect on the Company's business, financial position, results of operations or cash flows.

Critical Accounting Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“US GAAP”) requires management to make estimates and assumptions about future events, and apply judgments that affect the reported amounts of assets, liabilities, revenue and expenses in our consolidated financial statements and related notes. We base our estimates, assumptions and judgments on historical experience, current trends and other factors believed to be relevant at the time our consolidated financial statements are prepared. However, because future events and their effects cannot be determined with certainty, actual results could differ from our estimates and assumptions, and such differences could be material. We believe the following critical accounting policies affect our more significant estimates, assumptions and judgments used in the preparation of our consolidated financial statements.

Inventory Reserves – We establish a reserve for inventories based on the change in inventory requirements due to product line changes, the feasibility of using obsolete parts for upgraded part substitutions, the required parts needed for part supply sales, replacement parts and for estimated shrinkage.

Warranty – A provision is made for estimated warranty costs at the time the product is shipped and revenue is recognized. The warranty period is: the earlier of one year from the date of first use or 18 months from date of shipment for parts only; an additional four years on compressors (if applicable); 15 years on aluminized steel gas-fired heat exchangers (if applicable); 25 years on stainless steel heat exchangers (if applicable); and 10 years on gas-fired heat exchangers in RL products (if applicable). With the introduction of the RQ product line in 2010, our warranty policy for the RQ series was implemented to cover parts for two years from date of unit shipment and labor for one year from date of unit shipment. Our warranty policy for the WH and WV Series geothermal/water-source heat pumps covers parts for five years from the date of manufacture. Warranty expense is estimated based on the warranty period, historical warranty trends and associated costs, and any known identifiable warranty issue.

Due to the absence of warranty history on new products, an additional provision may be made for such products. Our estimated future warranty cost is subject to adjustment from time to time depending on changes in actual warranty trends and cost experience. Should actual claim rates differ from our estimates, revisions to the estimated product warranty liability would be required.

Stock Compensation – We measure and recognize compensation expense for all share-based payment awards made to our employees and directors, including stock options and restricted stock awards, based on their fair values at the time of grant. Compensation expense is recognized on a straight-line basis during the service period of the related share-based compensation award. Forfeitures are accounted for as they occur. The fair value of each option award and restricted stock award is estimated on the date of grant using the Black-Scholes-Merton option pricing model. The use of the Black-Scholes-Merton option valuation model requires the input of subjective assumptions such as: the expected volatility, the expected term of the options granted, expected dividend yield, and the risk-free rate.

New Accounting Pronouncements

Changes to U.S. GAAP are established by the Financial Accounting Standards Board ("FASB") in the form of accounting standards updates ("ASUs") to the FASB's Accounting Standards Codification.

We consider the applicability and impact of all ASUs. ASUs not listed below were assessed and determined to be either not applicable or are expected to have minimal impact on our consolidated financial statements and notes thereto.

In May 2014, the FASB issued ASU 2014-09, Revenue from Contracts with Customers, which requires an entity to recognize the amount of revenue to which it expects to be entitled for the transfer of promised goods or services to customers. The ASU will replace most existing revenue recognition guidance in U.S. GAAP when it becomes effective. In August 2015, with the issuance of ASU 2015-14, the FASB amended the effective date for us to January 1, 2018.

The following ASUs have been issued in 2016 along with ASU 2014-09 with the same effective dates and transition requirements:

| |

• | ASU 2016-08, Principal versus Agent Considerations (Reporting Revenue Gross versus Net), which provides implementation guidance for Topic 606 on principal versus agent considerations. |

| |

• | ASU 2016-10, Identifying Performance Obligations and Licensing, which provides clarification for two aspects of Topic 606: identifying performance obligations and the licensing implementation guidance. |

| |

• | ASU 2016-12, Revenue from Contracts with Customers, which further amends Topic 606. |

| |

• | ASU 2016-20, Technical Corrections and Improvements to Topic 606, Revenue from Contracts with Customers, which further amends Topic 606. |

The Company plans to adopt using the retrospective transition method. The Company has begun assessing the impact of ASU 2015-09 and believes the impact will not be material to the consolidated financial statements. We do not expect to complete our evaluation until after our first quarter of 2017. Once we adopt ASU 2014-09, we do not anticipate that our internal control framework will materially change, but rather that existing internal controls will be modified and augmented, as necessary, to consider our new revenue recognition policy effective January 1, 2018.

In January 2016, the FASB issued ASU 2016-01, Recognition and Measurement of Financial Assets and Financial Liabilities, which will address certain aspects of recognition, measurement, presentation and disclosure of financial instruments. The ASU becomes effective in the annual reporting period beginning after December 31, 2017, including interim reporting periods. We do not expect ASU 2016-01 will have a material effect on our consolidated financial statements and notes thereto.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

Commodity Price Risk

We are exposed to volatility in the prices of commodities used in some of our products and, occasionally, we use fixed price cancellable and non-cancellable contracts with our major suppliers for periods of six to 18 months to manage this exposure.

Item 8. Financial Statements and Supplementary Data.

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

|

| |

| Page |

| |

Report of Independent Registered Public Accounting Firm | |

| |

Consolidated Balance Sheets | |

| |

Consolidated Statements of Income | |

| |

Consolidated Statements of Stockholders’ Equity | |

| |

Consolidated Statements of Cash Flows | |

| |