0000823277--08-312024Q3FALSExbrli:sharesiso4217:USDxbrli:pureiso4217:USDxbrli:shareschscp:Bushelschscp:Barrelsutr:Tutr:tchscp:MMBtuutr:bbl00008232772023-09-012024-05-310000823277chscp:A8PreferredStockMember2023-09-012024-05-310000823277chscp:ClassBSeries1PreferredStockMember2023-09-012024-05-310000823277chscp:ClassBSeries2PreferredStockMember2023-09-012024-05-310000823277chscp:ClassBSeries3PreferredStockMember2023-09-012024-05-310000823277chscp:ClassBSeries4PreferredStockMember2023-09-012024-05-3100008232772024-07-1000008232772024-05-3100008232772023-08-3100008232772024-03-012024-05-3100008232772023-03-012023-05-3100008232772022-09-012023-05-3100008232772022-08-3100008232772023-05-310000823277chscp:ASCTopic606Memberchscp:EnergyMember2024-03-012024-05-310000823277chscp:EnergyMemberchscp:ASCTopic815Member2024-03-012024-05-310000823277chscp:OtherGuidanceMemberchscp:EnergyMember2024-03-012024-05-310000823277chscp:EnergyMember2024-03-012024-05-310000823277chscp:ASCTopic606Memberchscp:AgMember2024-03-012024-05-310000823277chscp:AgMemberchscp:ASCTopic815Member2024-03-012024-05-310000823277chscp:OtherGuidanceMemberchscp:AgMember2024-03-012024-05-310000823277chscp:AgMember2024-03-012024-05-310000823277chscp:ASCTopic606Memberus-gaap:CorporateAndOtherMember2024-03-012024-05-310000823277us-gaap:CorporateAndOtherMemberchscp:ASCTopic815Member2024-03-012024-05-310000823277us-gaap:CorporateAndOtherMemberchscp:OtherGuidanceMember2024-03-012024-05-310000823277us-gaap:CorporateAndOtherMember2024-03-012024-05-310000823277chscp:ASCTopic606Member2024-03-012024-05-310000823277chscp:ASCTopic815Member2024-03-012024-05-310000823277chscp:OtherGuidanceMember2024-03-012024-05-310000823277chscp:ASCTopic606Memberchscp:EnergyMember2023-03-012023-05-310000823277chscp:EnergyMemberchscp:ASCTopic815Member2023-03-012023-05-310000823277chscp:OtherGuidanceMemberchscp:EnergyMember2023-03-012023-05-310000823277chscp:EnergyMember2023-03-012023-05-310000823277chscp:ASCTopic606Memberchscp:AgMember2023-03-012023-05-310000823277chscp:AgMemberchscp:ASCTopic815Member2023-03-012023-05-310000823277chscp:OtherGuidanceMemberchscp:AgMember2023-03-012023-05-310000823277chscp:AgMember2023-03-012023-05-310000823277chscp:ASCTopic606Memberus-gaap:CorporateAndOtherMember2023-03-012023-05-310000823277us-gaap:CorporateAndOtherMemberchscp:ASCTopic815Member2023-03-012023-05-310000823277us-gaap:CorporateAndOtherMemberchscp:OtherGuidanceMember2023-03-012023-05-310000823277us-gaap:CorporateAndOtherMember2023-03-012023-05-310000823277chscp:ASCTopic606Member2023-03-012023-05-310000823277chscp:ASCTopic815Member2023-03-012023-05-310000823277chscp:OtherGuidanceMember2023-03-012023-05-310000823277chscp:ASCTopic606Memberchscp:EnergyMember2023-09-012024-05-310000823277chscp:EnergyMemberchscp:ASCTopic815Member2023-09-012024-05-310000823277chscp:OtherGuidanceMemberchscp:EnergyMember2023-09-012024-05-310000823277chscp:EnergyMember2023-09-012024-05-310000823277chscp:ASCTopic606Memberchscp:AgMember2023-09-012024-05-310000823277chscp:AgMemberchscp:ASCTopic815Member2023-09-012024-05-310000823277chscp:OtherGuidanceMemberchscp:AgMember2023-09-012024-05-310000823277chscp:AgMember2023-09-012024-05-310000823277chscp:ASCTopic606Memberus-gaap:CorporateAndOtherMember2023-09-012024-05-310000823277us-gaap:CorporateAndOtherMemberchscp:ASCTopic815Member2023-09-012024-05-310000823277us-gaap:CorporateAndOtherMemberchscp:OtherGuidanceMember2023-09-012024-05-310000823277us-gaap:CorporateAndOtherMember2023-09-012024-05-310000823277chscp:ASCTopic606Member2023-09-012024-05-310000823277chscp:ASCTopic815Member2023-09-012024-05-310000823277chscp:OtherGuidanceMember2023-09-012024-05-310000823277chscp:ASCTopic606Memberchscp:EnergyMember2022-09-012023-05-310000823277chscp:EnergyMemberchscp:ASCTopic815Member2022-09-012023-05-310000823277chscp:OtherGuidanceMemberchscp:EnergyMember2022-09-012023-05-310000823277chscp:EnergyMember2022-09-012023-05-310000823277chscp:ASCTopic606Memberchscp:AgMember2022-09-012023-05-310000823277chscp:AgMemberchscp:ASCTopic815Member2022-09-012023-05-310000823277chscp:OtherGuidanceMemberchscp:AgMember2022-09-012023-05-310000823277chscp:AgMember2022-09-012023-05-310000823277chscp:ASCTopic606Memberus-gaap:CorporateAndOtherMember2022-09-012023-05-310000823277us-gaap:CorporateAndOtherMemberchscp:ASCTopic815Member2022-09-012023-05-310000823277us-gaap:CorporateAndOtherMemberchscp:OtherGuidanceMember2022-09-012023-05-310000823277us-gaap:CorporateAndOtherMember2022-09-012023-05-310000823277chscp:ASCTopic606Member2022-09-012023-05-310000823277chscp:ASCTopic815Member2022-09-012023-05-310000823277chscp:OtherGuidanceMember2022-09-012023-05-310000823277chscp:CHSCapitalNotesReceivableMember2023-09-012024-05-310000823277chscp:CHSCapitalNotesReceivableMember2024-05-310000823277chscp:CHSCapitalNotesReceivableMember2023-08-310000823277chscp:CFNitrogenLLCMember2024-05-310000823277chscp:CFNitrogenLLCMember2023-08-310000823277chscp:VenturaFoodsLlcMember2024-05-310000823277chscp:VenturaFoodsLlcMember2023-08-310000823277chscp:ArdentMillsLLCMember2024-05-310000823277chscp:ArdentMillsLLCMember2023-08-310000823277chscp:OtherEquityMethodInvestmentsMember2024-05-310000823277chscp:OtherEquityMethodInvestmentsMember2023-08-310000823277chscp:CFNitrogenLLCMember2023-09-012024-05-310000823277chscp:CFNitrogenLLCMember2022-09-012023-05-310000823277chscp:NotesPayableMember2024-05-310000823277chscp:NotesPayableMember2023-08-310000823277chscp:ChsCapitalNotesPayableMember2024-05-310000823277chscp:ChsCapitalNotesPayableMember2023-08-310000823277us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberchscp:FiveYearRevolvingFacilitiesMember2024-05-310000823277us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberchscp:FiveYearRevolvingFacilitiesMember2023-08-310000823277chscp:CommittedMember2024-05-310000823277chscp:UncommittedMember2024-05-310000823277chscp:LoanAmountUtilizedMember2024-05-310000823277us-gaap:SubordinatedDebtMemberchscp:RepurchaseFacilityMember2024-05-310000823277us-gaap:SubordinatedDebtMemberchscp:RepurchaseFacilityMember2023-08-310000823277us-gaap:PrivatePlacementMember2024-04-180000823277chscp:InterestRateLowMember2024-04-180000823277chscp:InterestRateHighMember2024-04-180000823277us-gaap:PrivatePlacementMember2024-05-310000823277us-gaap:PrivatePlacementMember2023-08-310000823277us-gaap:UnsecuredDebtMemberchscp:Termloansfromcooperativesandotherbanks430Kpayablein2025Member2024-05-310000823277us-gaap:UnsecuredDebtMemberchscp:Termloansfromcooperativesandotherbanks430Kpayablein2025Member2023-08-310000823277chscp:CapitalEquityCertificatesMember2024-02-290000823277chscp:NonpatronageEquityCertificatesMember2024-02-290000823277chscp:NonqualifiedEquityCertificatesMember2024-02-290000823277us-gaap:PreferredStockMember2024-02-290000823277us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-02-290000823277us-gaap:RetainedEarningsMember2024-02-290000823277us-gaap:NoncontrollingInterestMember2024-02-2900008232772024-02-290000823277chscp:CapitalEquityCertificatesMember2024-03-012024-05-310000823277chscp:NonpatronageEquityCertificatesMember2024-03-012024-05-310000823277chscp:NonqualifiedEquityCertificatesMember2024-03-012024-05-310000823277us-gaap:RetainedEarningsMember2024-03-012024-05-310000823277us-gaap:PreferredStockMember2024-03-012024-05-310000823277us-gaap:NoncontrollingInterestMember2024-03-012024-05-310000823277us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-012024-05-310000823277chscp:CapitalEquityCertificatesMember2024-05-310000823277chscp:NonpatronageEquityCertificatesMember2024-05-310000823277chscp:NonqualifiedEquityCertificatesMember2024-05-310000823277us-gaap:PreferredStockMember2024-05-310000823277us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-05-310000823277us-gaap:RetainedEarningsMember2024-05-310000823277us-gaap:NoncontrollingInterestMember2024-05-310000823277chscp:CapitalEquityCertificatesMember2023-02-280000823277chscp:NonpatronageEquityCertificatesMember2023-02-280000823277chscp:NonqualifiedEquityCertificatesMember2023-02-280000823277us-gaap:PreferredStockMember2023-02-280000823277us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-02-280000823277us-gaap:RetainedEarningsMember2023-02-280000823277us-gaap:NoncontrollingInterestMember2023-02-2800008232772023-02-280000823277chscp:CapitalEquityCertificatesMember2023-03-012023-05-310000823277chscp:NonpatronageEquityCertificatesMember2023-03-012023-05-310000823277chscp:NonqualifiedEquityCertificatesMember2023-03-012023-05-310000823277us-gaap:RetainedEarningsMember2023-03-012023-05-310000823277us-gaap:PreferredStockMember2023-03-012023-05-310000823277us-gaap:NoncontrollingInterestMember2023-03-012023-05-310000823277us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-012023-05-310000823277chscp:CapitalEquityCertificatesMember2023-05-310000823277chscp:NonpatronageEquityCertificatesMember2023-05-310000823277chscp:NonqualifiedEquityCertificatesMember2023-05-310000823277us-gaap:PreferredStockMember2023-05-310000823277us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-05-310000823277us-gaap:RetainedEarningsMember2023-05-310000823277us-gaap:NoncontrollingInterestMember2023-05-310000823277chscp:CapitalEquityCertificatesMember2023-08-310000823277chscp:NonpatronageEquityCertificatesMember2023-08-310000823277chscp:NonqualifiedEquityCertificatesMember2023-08-310000823277us-gaap:PreferredStockMember2023-08-310000823277us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-08-310000823277us-gaap:RetainedEarningsMember2023-08-310000823277us-gaap:NoncontrollingInterestMember2023-08-310000823277chscp:CapitalEquityCertificatesMember2023-09-012024-05-310000823277chscp:NonpatronageEquityCertificatesMember2023-09-012024-05-310000823277chscp:NonqualifiedEquityCertificatesMember2023-09-012024-05-310000823277us-gaap:RetainedEarningsMember2023-09-012024-05-310000823277us-gaap:PreferredStockMember2023-09-012024-05-310000823277us-gaap:NoncontrollingInterestMember2023-09-012024-05-310000823277us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-012024-05-310000823277chscp:CapitalEquityCertificatesMember2022-08-310000823277chscp:NonpatronageEquityCertificatesMember2022-08-310000823277chscp:NonqualifiedEquityCertificatesMember2022-08-310000823277us-gaap:PreferredStockMember2022-08-310000823277us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-08-310000823277us-gaap:RetainedEarningsMember2022-08-310000823277us-gaap:NoncontrollingInterestMember2022-08-310000823277chscp:CapitalEquityCertificatesMember2022-09-012023-05-310000823277chscp:NonpatronageEquityCertificatesMember2022-09-012023-05-310000823277chscp:NonqualifiedEquityCertificatesMember2022-09-012023-05-310000823277us-gaap:RetainedEarningsMember2022-09-012023-05-310000823277us-gaap:PreferredStockMember2022-09-012023-05-310000823277us-gaap:NoncontrollingInterestMember2022-09-012023-05-310000823277us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-012023-05-310000823277chscp:A8CumulativeRedeemableMember2024-03-012024-05-310000823277chscp:A8CumulativeRedeemableMember2023-03-012023-05-310000823277chscp:A8CumulativeRedeemableMember2023-09-012024-05-310000823277chscp:A8CumulativeRedeemableMember2022-09-012023-05-310000823277chscp:ClassBSeries1PreferredStockMember2024-03-012024-05-310000823277chscp:ClassBSeries1PreferredStockMember2023-03-012023-05-310000823277chscp:ClassBSeries1PreferredStockMember2022-09-012023-05-310000823277chscp:ClassBSeries2PreferredStockMember2024-03-012024-05-310000823277chscp:ClassBSeries2PreferredStockMember2023-03-012023-05-310000823277chscp:ClassBSeries2PreferredStockMember2022-09-012023-05-310000823277chscp:ClassBSeries3PreferredStockMember2024-03-012024-05-310000823277chscp:ClassBSeries3PreferredStockMember2023-03-012023-05-310000823277chscp:ClassBSeries3PreferredStockMember2022-09-012023-05-310000823277chscp:ClassBSeries4PreferredStockMember2024-03-012024-05-310000823277chscp:ClassBSeries4PreferredStockMember2023-03-012023-05-310000823277chscp:ClassBSeries4PreferredStockMember2022-09-012023-05-310000823277us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-02-290000823277us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2024-02-290000823277us-gaap:AccumulatedTranslationAdjustmentMember2024-02-290000823277us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-03-012024-05-310000823277us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2024-03-012024-05-310000823277us-gaap:AccumulatedTranslationAdjustmentMember2024-03-012024-05-310000823277us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-05-310000823277us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2024-05-310000823277us-gaap:AccumulatedTranslationAdjustmentMember2024-05-310000823277us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-02-280000823277us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-02-280000823277us-gaap:AccumulatedTranslationAdjustmentMember2023-02-280000823277us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-03-012023-05-310000823277us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-03-012023-05-310000823277us-gaap:AccumulatedTranslationAdjustmentMember2023-03-012023-05-310000823277us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-05-310000823277us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-05-310000823277us-gaap:AccumulatedTranslationAdjustmentMember2023-05-310000823277us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-08-310000823277us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-08-310000823277us-gaap:AccumulatedTranslationAdjustmentMember2023-08-310000823277us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-09-012024-05-310000823277us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-09-012024-05-310000823277us-gaap:AccumulatedTranslationAdjustmentMember2023-09-012024-05-310000823277us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-08-310000823277us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2022-08-310000823277us-gaap:AccumulatedTranslationAdjustmentMember2022-08-310000823277us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-09-012023-05-310000823277us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2022-09-012023-05-310000823277us-gaap:AccumulatedTranslationAdjustmentMember2022-09-012023-05-310000823277us-gaap:PensionPlansDefinedBenefitMember2024-03-012024-05-310000823277us-gaap:PensionPlansDefinedBenefitMember2023-03-012023-05-310000823277us-gaap:OtherPensionPlansDefinedBenefitMember2024-03-012024-05-310000823277us-gaap:OtherPensionPlansDefinedBenefitMember2023-03-012023-05-310000823277us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2024-03-012024-05-310000823277us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2023-03-012023-05-310000823277us-gaap:PensionPlansDefinedBenefitMember2023-09-012024-05-310000823277us-gaap:PensionPlansDefinedBenefitMember2022-09-012023-05-310000823277us-gaap:OtherPensionPlansDefinedBenefitMember2023-09-012024-05-310000823277us-gaap:OtherPensionPlansDefinedBenefitMember2022-09-012023-05-310000823277us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2023-09-012024-05-310000823277us-gaap:OtherPensionPlansPostretirementOrSupplementalPlansDefinedBenefitMember2022-09-012023-05-310000823277chscp:NitrogenProductionMember2024-03-012024-05-310000823277us-gaap:AllOtherSegmentsMember2024-03-012024-05-310000823277chscp:NitrogenProductionMember2023-03-012023-05-310000823277us-gaap:AllOtherSegmentsMember2023-03-012023-05-310000823277chscp:NitrogenProductionMember2023-09-012024-05-310000823277us-gaap:AllOtherSegmentsMember2023-09-012024-05-310000823277chscp:EnergyMember2024-05-310000823277chscp:AgMember2024-05-310000823277chscp:NitrogenProductionMember2024-05-310000823277us-gaap:CorporateAndOtherMember2024-05-310000823277us-gaap:AllOtherSegmentsMember2024-05-310000823277chscp:NitrogenProductionMember2022-09-012023-05-310000823277us-gaap:AllOtherSegmentsMember2022-09-012023-05-310000823277chscp:CommodityAndFreightDerivativesMemberus-gaap:NondesignatedMember2024-05-310000823277us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2024-05-310000823277chscp:CommodityAndFreightDerivativesMemberus-gaap:NondesignatedMember2023-08-310000823277us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2023-08-310000823277us-gaap:CostOfSalesMemberus-gaap:NondesignatedMemberchscp:CommodityAndFreightDerivativesMember2024-03-012024-05-310000823277us-gaap:CostOfSalesMemberus-gaap:NondesignatedMemberchscp:CommodityAndFreightDerivativesMember2023-03-012023-05-310000823277us-gaap:CostOfSalesMemberus-gaap:NondesignatedMemberchscp:CommodityAndFreightDerivativesMember2023-09-012024-05-310000823277us-gaap:CostOfSalesMemberus-gaap:NondesignatedMemberchscp:CommodityAndFreightDerivativesMember2022-09-012023-05-310000823277us-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2024-03-012024-05-310000823277us-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2023-03-012023-05-310000823277us-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2023-09-012024-05-310000823277us-gaap:CostOfSalesMemberus-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2022-09-012023-05-310000823277us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:NondesignatedMember2024-03-012024-05-310000823277us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:NondesignatedMember2023-03-012023-05-310000823277us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:NondesignatedMember2023-09-012024-05-310000823277us-gaap:ForeignExchangeContractMemberus-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:NondesignatedMember2022-09-012023-05-310000823277us-gaap:NondesignatedMember2024-03-012024-05-310000823277us-gaap:NondesignatedMember2023-03-012023-05-310000823277us-gaap:NondesignatedMember2023-09-012024-05-310000823277us-gaap:NondesignatedMember2022-09-012023-05-310000823277us-gaap:LongMemberus-gaap:NondesignatedMemberchscp:GrainandoilseedcontractsMember2024-05-310000823277us-gaap:ShortMemberus-gaap:NondesignatedMemberchscp:GrainandoilseedcontractsMember2024-05-310000823277us-gaap:LongMemberus-gaap:NondesignatedMemberchscp:GrainandoilseedcontractsMember2023-08-310000823277us-gaap:ShortMemberus-gaap:NondesignatedMemberchscp:GrainandoilseedcontractsMember2023-08-310000823277us-gaap:LongMemberchscp:EnergyproductsMemberus-gaap:NondesignatedMember2024-05-310000823277chscp:EnergyproductsMemberus-gaap:ShortMemberus-gaap:NondesignatedMember2024-05-310000823277us-gaap:LongMemberchscp:EnergyproductsMemberus-gaap:NondesignatedMember2023-08-310000823277chscp:EnergyproductsMemberus-gaap:ShortMemberus-gaap:NondesignatedMember2023-08-310000823277chscp:SoyproductcontractsMemberus-gaap:LongMemberus-gaap:NondesignatedMember2024-05-310000823277chscp:SoyproductcontractsMemberus-gaap:ShortMemberus-gaap:NondesignatedMember2024-05-310000823277chscp:SoyproductcontractsMemberus-gaap:LongMemberus-gaap:NondesignatedMember2023-08-310000823277chscp:SoyproductcontractsMemberus-gaap:ShortMemberus-gaap:NondesignatedMember2023-08-310000823277us-gaap:LongMemberus-gaap:NondesignatedMemberchscp:CropnutrientscontractsMember2024-05-310000823277us-gaap:ShortMemberus-gaap:NondesignatedMemberchscp:CropnutrientscontractsMember2024-05-310000823277us-gaap:LongMemberus-gaap:NondesignatedMemberchscp:CropnutrientscontractsMember2023-08-310000823277us-gaap:ShortMemberus-gaap:NondesignatedMemberchscp:CropnutrientscontractsMember2023-08-310000823277us-gaap:LongMemberchscp:OceanFreightContractsMemberus-gaap:NondesignatedMember2024-05-310000823277chscp:OceanFreightContractsMemberus-gaap:ShortMemberus-gaap:NondesignatedMember2024-05-310000823277us-gaap:LongMemberchscp:OceanFreightContractsMemberus-gaap:NondesignatedMember2023-08-310000823277chscp:OceanFreightContractsMemberus-gaap:ShortMemberus-gaap:NondesignatedMember2023-08-310000823277us-gaap:LongMemberchscp:NaturalgascontractsMemberus-gaap:NondesignatedMember2024-05-310000823277chscp:NaturalgascontractsMemberus-gaap:ShortMemberus-gaap:NondesignatedMember2024-05-310000823277us-gaap:LongMemberchscp:NaturalgascontractsMemberus-gaap:NondesignatedMember2023-08-310000823277chscp:NaturalgascontractsMemberus-gaap:ShortMemberus-gaap:NondesignatedMember2023-08-310000823277us-gaap:CashFlowHedgingMember2023-09-012024-05-310000823277us-gaap:CashFlowHedgingMember2022-09-012023-08-310000823277us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2024-05-310000823277us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2023-08-310000823277us-gaap:CommodityMemberus-gaap:CashFlowHedgingMember2024-03-012024-05-310000823277us-gaap:CommodityMemberus-gaap:CashFlowHedgingMember2023-03-012023-05-310000823277us-gaap:CommodityMemberus-gaap:CashFlowHedgingMember2023-09-012024-05-310000823277us-gaap:CommodityMemberus-gaap:CashFlowHedgingMember2022-09-012023-05-310000823277us-gaap:CostOfSalesMemberus-gaap:CommodityMember2024-03-012024-05-310000823277us-gaap:CostOfSalesMemberus-gaap:CommodityMember2023-03-012023-05-310000823277us-gaap:CostOfSalesMemberus-gaap:CommodityMember2023-09-012024-05-310000823277us-gaap:CostOfSalesMemberus-gaap:CommodityMember2022-09-012023-05-310000823277us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberchscp:CommodityAndFreightDerivativesMember2024-05-310000823277us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberchscp:CommodityAndFreightDerivativesMember2024-05-310000823277us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberchscp:CommodityAndFreightDerivativesMember2024-05-310000823277us-gaap:FairValueMeasurementsRecurringMemberchscp:CommodityAndFreightDerivativesMember2024-05-310000823277us-gaap:ForeignExchangeContractMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-05-310000823277us-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-05-310000823277us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMember2024-05-310000823277us-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMember2024-05-310000823277us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-05-310000823277us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-05-310000823277us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-05-310000823277us-gaap:FairValueMeasurementsRecurringMember2024-05-310000823277us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberchscp:CommodityAndFreightDerivativesMember2023-08-310000823277us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberchscp:CommodityAndFreightDerivativesMember2023-08-310000823277us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberchscp:CommodityAndFreightDerivativesMember2023-08-310000823277us-gaap:FairValueMeasurementsRecurringMemberchscp:CommodityAndFreightDerivativesMember2023-08-310000823277us-gaap:ForeignExchangeContractMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-08-310000823277us-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-08-310000823277us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMember2023-08-310000823277us-gaap:ForeignExchangeContractMemberus-gaap:FairValueMeasurementsRecurringMember2023-08-310000823277us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-08-310000823277us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-08-310000823277us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-08-310000823277us-gaap:FairValueMeasurementsRecurringMember2023-08-31

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-Q

| | | | | | | | | | | |

| ☑ | | Quarterly Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

| | For the quarterly period ended | May 31, 2024 |

| or |

| ☐ | | Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 for the transition period from to |

Commission file number: 001-36079

CHS Inc.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Minnesota | | 41-0251095 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification Number) |

5500 Cenex Drive

Inver Grove Heights, Minnesota 55077

(Address of principal executive offices, including zip code)

(651) 355-6000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| 8% Cumulative Redeemable Preferred Stock | CHSCP | The Nasdaq Stock Market LLC |

| Class B Cumulative Redeemable Preferred Stock, Series 1 | CHSCO | The Nasdaq Stock Market LLC |

| Class B Reset Rate Cumulative Redeemable Preferred Stock, Series 2 | CHSCN | The Nasdaq Stock Market LLC |

| Class B Reset Rate Cumulative Redeemable Preferred Stock, Series 3 | CHSCM | The Nasdaq Stock Market LLC |

| Class B Cumulative Redeemable Preferred Stock, Series 4 | CHSCL | The Nasdaq Stock Market LLC |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☑ No ☐

Indicate by check mark whether the Registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit such files).

Yes ☑ No ☐

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☑ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☑

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date:

The issuer has no common stock outstanding.

TABLE OF CONTENTS

Unless the context otherwise requires, for purposes of this Quarterly Report on Form 10-Q, the words "CHS," "we," "us" and "our" refer to CHS Inc., a Minnesota cooperative corporation, and its subsidiaries as of May 31, 2024.

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains, and our other CHS Inc. publicly available documents contain, and our officers, directors and representatives may from time to time make "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as "anticipate," "intend," "plan," "goal," "seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "will" and similar references to future periods. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our businesses, financial condition and results of operations, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not place undue reliance on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements are discussed or identified in our filings made with the U.S. Securities and Exchange Commission, including in the "Risk Factors" discussion in Item 1A of CHS Annual Report on Form 10-K for the fiscal year ended August 31, 2023. These factors may include changes in commodity prices; the impact of government policies, mandates, regulations and trade agreements; global and regional political, economic, legal and other risks of doing business globally; the ongoing war between Russia and Ukraine; the escalation of conflict in the Middle East; the impact of inflation; the impact of epidemics, pandemics, outbreaks of disease and other adverse public health developments, including COVID-19; the impact of market acceptance of alternatives to refined petroleum products; consolidation among our suppliers and customers; nonperformance by contractual counterparties; changes in federal income tax laws or our tax status; the impact of compliance or noncompliance with applicable laws and regulations; the impact of any governmental investigations; the impact of environmental liabilities and litigation; actual or perceived quality, safety or health risks associated with our products; the impact of seasonality; the effectiveness of our risk management strategies; business interruptions, casualty losses and supply chain issues; the impact of workforce factors; our funding needs and financing sources; financial institutions’ and other capital sources’ policies concerning energy-related businesses; technological improvements that decrease the demand for our agronomy and energy products; our ability to complete, integrate and benefit from acquisitions, strategic alliances, joint ventures, divestitures and other nonordinary course-of-business events; security breaches or other disruptions to our information technology systems or assets; the impact of our environmental, social and governance practices, including failures or delays in achieving our strategies or expectations related to climate change or other environmental matters; the impairment of long-lived assets; the impact of bank failures; and other factors affecting our businesses generally. Any forward-looking statements made by us in this document are based only on information currently available to us and speak only as of the date on which the statement is made. We undertake no obligation to update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise except as required by applicable law.

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

CHS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | |

| | May 31,

2024 | | August 31,

2023 |

| | (Dollars in thousands) |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 310,128 | | | $ | 1,765,286 | |

| Receivables | 3,817,151 | | | 3,105,811 | |

| Inventories | 3,305,167 | | | 3,215,179 | |

| Other current assets | 1,027,818 | | | 1,042,373 | |

Total current assets | 8,460,264 | | | 9,128,649 | |

| Investments | 3,893,649 | | | 3,828,872 | |

| Property, plant and equipment | 5,032,713 | | | 4,869,373 | |

| Other assets | 1,071,289 | | | 1,130,524 | |

Total assets | $ | 18,457,915 | | | $ | 18,957,418 | |

| LIABILITIES AND EQUITIES | | | |

| Current liabilities: | | | |

| Notes payable | $ | 337,538 | | | $ | 547,923 | |

| Current portion of long-term debt | 157,181 | | | 7,839 | |

| Accounts payable | 2,696,898 | | | 2,930,607 | |

| Accrued expenses | 864,484 | | | 773,054 | |

| Other current liabilities | 1,153,091 | | | 1,639,771 | |

Total current liabilities | 5,209,192 | | | 5,899,194 | |

| Long-term debt | 1,669,212 | | | 1,819,819 | |

| Other liabilities | 665,194 | | | 786,016 | |

| Commitments and contingencies (Note 13) | | | |

| Equities: | | | |

| Preferred stock | 2,264,038 | | | 2,264,038 | |

| Equity certificates | 5,736,833 | | | 5,911,649 | |

| Accumulated other comprehensive loss | (270,861) | | | (265,395) | |

| Capital reserves | 3,178,615 | | | 2,537,486 | |

Total CHS Inc. equities | 10,908,625 | | | 10,447,778 | |

| Noncontrolling interests | 5,692 | | | 4,611 | |

Total equities | 10,914,317 | | | 10,452,389 | |

Total liabilities and equities | $ | 18,457,915 | | | $ | 18,957,418 | |

The accompanying notes are an integral part of the condensed consolidated financial statements (unaudited).

CHS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended May 31, | | Nine Months Ended May 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (Dollars in thousands) |

| Revenues | $ | 9,608,983 | | | $ | 12,026,051 | | | $ | 30,087,121 | | | $ | 36,098,738 | |

| Cost of goods sold | 9,141,188 | | | 11,351,711 | | | 28,608,484 | | | 34,160,996 | |

| Gross profit | 467,795 | | | 674,340 | | | 1,478,637 | | | 1,937,742 | |

| Marketing, general and administrative expenses | 316,435 | | | 273,238 | | | 866,721 | | | 749,829 | |

| Operating earnings | 151,360 | | | 401,102 | | | 611,916 | | | 1,187,913 | |

| | | | | | | |

| Interest expense | 23,425 | | | 36,949 | | | 78,513 | | | 106,166 | |

| Other income | (29,934) | | | (31,027) | | | (105,802) | | | (83,629) | |

| Equity income from investments | (151,999) | | | (162,940) | | | (373,167) | | | (523,236) | |

| Income before income taxes | 309,868 | | | 558,120 | | | 1,012,372 | | | 1,688,612 | |

| Income tax expense | 12,613 | | | 10,777 | | | 21,416 | | | 66,305 | |

| Net income | 297,255 | | | 547,343 | | | 990,956 | | | 1,622,307 | |

| Net (loss) income attributable to noncontrolling interests | (19) | | | (156) | | | 452 | | | (111) | |

| Net income attributable to CHS Inc. | $ | 297,274 | | | $ | 547,499 | | | $ | 990,504 | | | $ | 1,622,418 | |

The accompanying notes are an integral part of the condensed consolidated financial statements (unaudited).

CHS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended May 31, | | Nine Months Ended May 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | (Dollars in thousands) |

| Net income | $ | 297,255 | | | $ | 547,343 | | | $ | 990,956 | | | $ | 1,622,307 | |

| Other comprehensive (loss) income, net of tax: | | | | | | | |

| Pension and other postretirement benefits | 49 | | | 130 | | | 117 | | | 4,681 | |

| | | | | | | |

| Cash flow hedges | (681) | | | (2,531) | | | 1,461 | | | (7,595) | |

| Foreign currency translation adjustment | (2,960) | | | (707) | | | (7,044) | | | (2,022) | |

| Other comprehensive loss, net of tax | (3,592) | | | (3,108) | | | (5,466) | | | (4,936) | |

| Comprehensive income | 293,663 | | | 544,235 | | | 985,490 | | | 1,617,371 | |

| Comprehensive (loss) income attributable to noncontrolling interests | (19) | | | (156) | | | 452 | | | (111) | |

| Comprehensive income attributable to CHS Inc. | $ | 293,682 | | | $ | 544,391 | | | $ | 985,038 | | | $ | 1,617,482 | |

The accompanying notes are an integral part of the condensed consolidated financial statements (unaudited).

CHS INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | |

| | Nine Months Ended May 31, |

| | 2024 | | 2023 |

| | (Dollars in thousands) |

| Cash flows from operating activities: | | | |

| Net income | $ | 990,956 | | | $ | 1,622,307 | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | |

| Depreciation and amortization, including amortization of deferred major maintenance | 421,721 | | | 400,474 | |

| Equity income from investments, net of distributions received | (46,576) | | | (167,940) | |

| Provision for current expected credit losses | 8,623 | | | (10,592) | |

| Deferred taxes | (102,718) | | | (65,839) | |

| Other, net | (2,885) | | | (3,853) | |

| Changes in operating assets and liabilities: | | | |

| Receivables | (774,470) | | | (206,328) | |

| Inventories | (89,988) | | | 372,049 | |

| Accounts payable and accrued expenses | (81,183) | | | 214,410 | |

| Other, net | (163,747) | | | (184,963) | |

| Net cash provided by operating activities | 159,733 | | | 1,969,725 | |

| Cash flows from investing activities: | | | |

| Acquisition of property, plant and equipment | (541,411) | | | (374,230) | |

| Proceeds from disposition of property, plant and equipment | 12,669 | | | 22,823 | |

| Expenditures for major maintenance | (14,784) | | | (184,435) | |

| | | |

| Changes in CHS Capital notes receivable, net | 39,383 | | | (120,657) | |

| Financing extended to customers | (111,403) | | | (138,407) | |

| Payments from customer financing | 101,269 | | | 152,323 | |

| | | |

| Other investing activities, net | (5,195) | | | (8,505) | |

| Net cash used in investing activities | (519,472) | | | (651,088) | |

| Cash flows from financing activities: | | | |

| Proceeds from notes payable and long-term debt | 2,575,799 | | | 6,124,177 | |

| Payments on notes payable, long-term debt and finance lease obligations | (2,806,167) | | | (6,104,543) | |

| Preferred stock dividends paid | (126,501) | | | (126,501) | |

| Redemptions of equities | (342,147) | | | (480,435) | |

| Cash patronage dividends paid | (365,952) | | | (502,938) | |

| Other financing activities, net | (30,590) | | | (56,924) | |

| Net cash used in financing activities | (1,095,558) | | | (1,147,164) | |

| Effect of exchange rate changes on cash and cash equivalents | 538 | | | (16) | |

| (Decrease) increase in cash and cash equivalents and restricted cash | (1,454,759) | | | 171,457 | |

| Cash and cash equivalents and restricted cash at beginning of period | 1,844,587 | | | 903,474 | |

| Cash and cash equivalents and restricted cash at end of period | $ | 389,828 | | | $ | 1,074,931 | |

The accompanying notes are an integral part of the condensed consolidated financial statements (unaudited).

CHS INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 1 Basis of Presentation and Significant Accounting Policies

Basis of Presentation

These unaudited condensed consolidated financial statements reflect, in the opinion of management, all normal recurring adjustments necessary for a fair statement of our financial position, results of operations and cash flows for the periods presented. The results of operations and cash flows for interim periods are not necessarily indicative of results for a full fiscal year because of the seasonal nature of our businesses, among other things. Our unaudited condensed consolidated financial statements and notes are presented as permitted by the requirements for Quarterly Reports on Form 10-Q and should be read in conjunction with the consolidated financial statements and notes thereto for the year ended August 31, 2023, included in our Annual Report on Form 10-K filed with the Securities and Exchange Commission ("SEC").

Significant Accounting Policies

No significant accounting policies were updated or changed since our Annual Report on Form 10-K for the year ended August 31, 2023.

Recent Accounting Pronouncements

In November 2023, the Financial Accounting Standards Board (the "FASB") issued Accounting Standards Update ("ASU") 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which enhances the disclosures required for operating segments in our annual and interim consolidated financial statements. This ASU is effective on a retrospective basis for our annual reporting beginning in fiscal 2025 and for interim period reporting beginning in fiscal 2026. We are currently evaluating the impact of adopting this ASU on our consolidated financial statements.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which provides additional transparency for income tax disclosures. This ASU is effective for our annual reporting for fiscal 2026 on a prospective basis. We are currently evaluating the impact of adopting this ASU on our consolidated financial statements.

Note 2 Revenues

The following table presents revenues recognized under Accounting Standards Codification ("ASC") Topic 606, Revenue from Contracts with Customers ("ASC Topic 606"), disaggregated by reportable segment, as well as the amount of revenues recognized under ASC Topic 815, Derivatives and Hedging ("ASC Topic 815"), and other applicable accounting guidance for the three and nine months ended May 31, 2024 and 2023. Other applicable accounting guidance primarily includes revenues recognized under ASC Topic 470, Debt, and ASC Topic 842, Leases, that fall outside the scope of ASC Topic 606.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | ASC Topic 606 | | ASC Topic 815 | | Other Guidance | | Total Revenues |

| Three Months Ended May 31, 2024 | | (Dollars in thousands) |

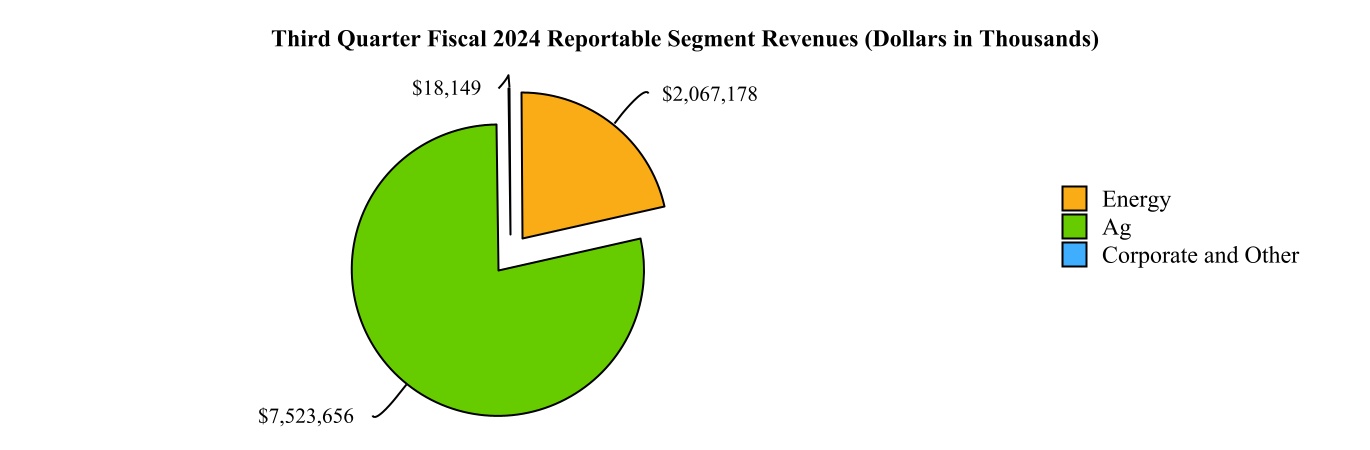

| Energy | | $ | 1,875,368 | | | $ | 191,810 | | | $ | — | | | $ | 2,067,178 | |

| Ag | | 2,680,506 | | | 4,836,245 | | | 6,905 | | | 7,523,656 | |

| Corporate and Other | | 5,647 | | | — | | | 12,502 | | | 18,149 | |

| Total revenues | | $ | 4,561,521 | | | $ | 5,028,055 | | | $ | 19,407 | | | $ | 9,608,983 | |

| | | | | | | | |

| Three Months Ended May 31, 2023 | | | | | | | | |

| Energy | | $ | 1,980,243 | | | $ | 283,844 | | | $ | — | | | $ | 2,264,087 | |

| Ag | | 3,295,312 | | | 6,444,559 | | | 4,105 | | | 9,743,976 | |

| Corporate and Other | | 6,388 | | | — | | | 11,600 | | | 17,988 | |

| Total revenues | | $ | 5,281,943 | | | $ | 6,728,403 | | | $ | 15,705 | | | $ | 12,026,051 | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | ASC Topic 606 | | ASC Topic 815 | | Other Guidance | | Total Revenues |

| Nine Months Ended May 31, 2024 | | (Dollars in thousands) |

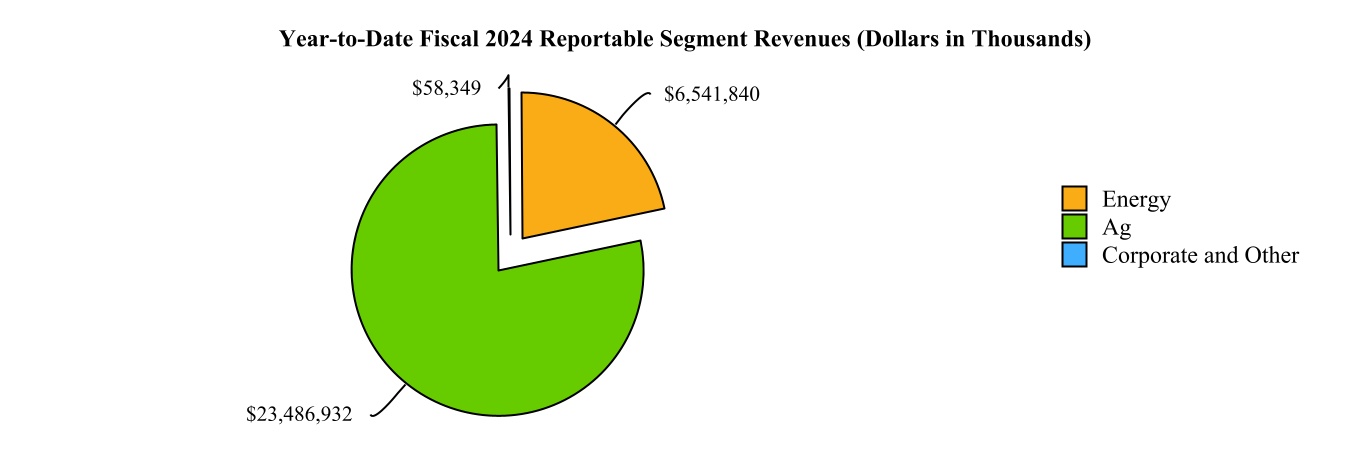

| Energy | | $ | 5,896,394 | | | $ | 645,446 | | | $ | — | | | $ | 6,541,840 | |

| Ag | | 6,385,233 | | | 17,075,587 | | | 26,112 | | | 23,486,932 | |

| Corporate and Other | | 18,810 | | | — | | | 39,539 | | | 58,349 | |

| Total revenues | | $ | 12,300,437 | | | $ | 17,721,033 | | | $ | 65,651 | | | $ | 30,087,121 | |

| | | | | | | | |

| Nine Months Ended May 31, 2023 | | | | | | | | |

| Energy | | $ | 6,775,463 | | | $ | 776,831 | | | $ | — | | | $ | 7,552,294 | |

| Ag | | 7,757,867 | | | 20,724,153 | | | 15,670 | | | 28,497,690 | |

| Corporate and Other | | 18,874 | | | — | | | 29,880 | | | 48,754 | |

| Total revenues | | $ | 14,552,204 | | | $ | 21,500,984 | | | $ | 45,550 | | | $ | 36,098,738 | |

Less than 1% of revenues accounted for under ASC Topic 606 included within the tables above are recorded over time and relate primarily to service contracts.

Contract Assets and Contract Liabilities

Contract assets relate to unbilled amounts arising from goods that have already been transferred to customers where the right to payment is not conditional on the passage of time. This results in recognition of an asset as the amount of revenue recognized at a certain point in time exceeds the amount billed to customers. Contract assets are recorded in receivables within our Condensed Consolidated Balance Sheets and were $10.2 million and $16.2 million as of May 31, 2024, and August 31, 2023, respectively.

Contract liabilities relate to advance payments received from customers for goods and services that we have yet to provide. Contract liabilities of $281.8 million and $240.0 million as of May 31, 2024, and August 31, 2023, respectively, are recorded within other current liabilities on our Condensed Consolidated Balance Sheets. For the three months ended May 31, 2024 and 2023, we recognized revenues of $54.0 million and $93.1 million related to contract liabilities, respectively. For the nine months ended May 31, 2024 and 2023, we recognized revenues of $222.8 million and $285.3 million related to contract liabilities, respectively. These amounts were included in the other current liabilities balance at the beginning of the respective period.

Note 3 Receivables

| | | | | | | | | | | |

| May 31,

2024 | | August 31,

2023 |

| (Dollars in thousands) |

| Trade accounts receivable | $ | 2,696,868 | | | $ | 2,010,162 | |

| CHS Capital short-term notes receivable | 775,210 | | | 845,192 | |

| Other | 427,941 | | | 327,084 | |

| Gross receivables | 3,900,019 | | | 3,182,438 | |

| Less: allowances and reserves | 82,868 | | | 76,627 | |

| Total receivables | $ | 3,817,151 | | | $ | 3,105,811 | |

Receivables are composed of trade accounts receivable, short-term notes receivable in our wholly-owned subsidiary, CHS Capital, LLC ("CHS Capital"), and other receivables, less an allowance for expected credit losses. The allowance for expected credit losses is based on our best estimate of expected credit losses in existing receivable balances and is determined using historical write-off experience, adjusted for various industry and regional data and current expectations of future credit losses.

Notes receivable from commercial borrowers are collateralized by various combinations of mortgages, personal property, accounts and notes receivable, inventories and assignments of certain regional cooperatives' capital stock. These loans are primarily originated in the states of Illinois, Minnesota and North Dakota. CHS Capital also has loans receivable from producer borrowers that are collateralized by various combinations of growing crops, livestock, inventories, accounts receivable, personal property and supplemental mortgages and are primarily originated in the same states as the commercial notes, as well as in South Dakota.

In addition to the short-term balances included in the table above, CHS Capital had long-term notes receivable, with durations of generally not more than 10 years, totaling $101.1 million and $61.1 million as of May 31, 2024, and August 31, 2023, respectively. The long-term notes receivable are included in other assets on our Condensed Consolidated Balance Sheets. As of May 31, 2024, and August 31, 2023, commercial notes represented 27% and 15%, respectively, and producer notes represented 73% and 85%, respectively, of total CHS Capital notes receivable.

CHS Capital has commitments to extend credit to customers if there are no violations of contractually established conditions. As of May 31, 2024, CHS Capital customers had additional available credit of $1.3 billion. No significant troubled debt restructuring activity occurred, and no third-party customer or borrower accounted for more than 10% of the total receivables balance as of May 31, 2024, or August 31, 2023.

Note 4 Inventories

| | | | | | | | | | | |

| May 31,

2024 | | August 31,

2023 |

| (Dollars in thousands) |

| Grain and oilseed | $ | 1,089,436 | | | $ | 1,099,956 | |

| Energy | 849,708 | | | 645,333 | |

| Agronomy | 1,028,520 | | | 1,111,477 | |

| Processed grain and oilseed | 128,717 | | | 141,360 | |

| Other | 208,786 | | | 217,053 | |

| Total inventories | $ | 3,305,167 | | | $ | 3,215,179 | |

As of May 31, 2024, and August 31, 2023, we valued approximately 22% and 16%, respectively, of inventories, primarily crude oil and refined fuels within our Energy segment, using the lower of cost, determined on the last in, first out ("LIFO") method, or net realizable value. If the first in, first out ("FIFO") method of accounting had been used, inventories would have been higher than the reported amount by $463.7 million and $589.0 million as of May 31, 2024, and August 31, 2023, respectively. Actual valuation of inventory under the LIFO method can be made only at the end of each year based on inventory levels and costs at that time. Interim LIFO calculations are based on management's estimates of expected year-end inventory levels and values and are subject to final year-end LIFO inventory valuation.

Note 5 Investments

| | | | | | | | | | | |

| May 31,

2024 | | August 31,

2023 |

| | (Dollars in thousands) |

| Equity method investments: | | | |

| CF Industries Nitrogen, LLC | $ | 2,652,631 | | | $ | 2,577,391 | |

| Ventura Foods, LLC | 504,454 | | | 519,169 | |

| Ardent Mills, LLC | 236,350 | | | 265,146 | |

| | | |

| Other equity method investments | 360,107 | | | 337,281 | |

| Other investments | 140,107 | | | 129,885 | |

| Total investments | $ | 3,893,649 | | | $ | 3,828,872 | |

Joint ventures and other investments in which we have significant ownership and influence, but not control, are accounted for in our condensed consolidated financial statements using the equity method of accounting. Our only significant equity method investment during the nine months ended May 31, 2024 and 2023, was CF Industries Nitrogen, LLC ("CF Nitrogen"), which is summarized below. In addition to the recognition of our share of income from equity method investments, our equity method investments are evaluated for indicators of other-than-temporary impairment on an ongoing basis in accordance with accounting principles generally accepted in the United States ("U.S. GAAP"). Other investments consist primarily of investments in cooperatives without readily determinable fair values and are generally recorded at cost, unless an impairment or other observable market price change occurs that requires an adjustment. We had approximately $723.3 million in cumulative undistributed earnings from our equity method investees included in the investments balance as of May 31, 2024.

CF Nitrogen

We have a $2.7 billion investment in CF Nitrogen, a strategic venture with CF Industries Holdings, Inc. ("CF Industries"). The investment consists of an approximate 9% membership interest (based on product tons) in CF Nitrogen. We account for this investment using the hypothetical liquidation at book value method, recognizing our share of the earnings and

losses of CF Nitrogen as equity income from investments in our Nitrogen Production segment based on our contractual claims on the entity's net assets pursuant to the liquidation provisions of CF Nitrogen's Limited Liability Company Agreement, adjusted for semiannual cash distributions.

The following table provides summarized unaudited financial information for our equity method investment in CF Nitrogen for the nine months ended May 31, 2024 and 2023:

| | | | | | | | | | | |

| Nine Months Ended May 31, |

| 2024 | | 2023 |

| (Dollars in thousands) |

| Net sales | $ | 2,739,479 | | | $ | 4,200,120 | |

| Gross profit | 956,835 | | | 1,898,265 | |

| Net earnings | 922,400 | | | 1,884,666 | |

| Earnings attributable to CHS Inc. | 218,905 | | | 330,855 | |

Our investments in other equity method investees are not significant in relation to our condensed consolidated financial statements, either individually or in aggregate.

Note 6 Notes Payable and Long-Term Debt

Our notes payable and long-term debt are subject to various restrictive requirements for maintenance of minimum consolidated net worth and other financial ratios. We were in compliance with all debt covenants as of May 31, 2024. Notes payable as of May 31, 2024, and August 31, 2023, consisted of the following:

| | | | | | | | | | | |

| May 31,

2024 | | August 31,

2023 |

| (Dollars in thousands) |

| Notes payable | $ | 218,204 | | | $ | 375,932 | |

| CHS Capital notes payable | 119,334 | | | 171,991 | |

| Total notes payable | $ | 337,538 | | | $ | 547,923 | |

Our primary line of credit is a five-year unsecured revolving credit facility with a syndicate of domestic and international banks. The credit facility provides a committed amount of $2.8 billion that expires on April 21, 2028. There were no borrowings outstanding on this facility as of May 31, 2024, or August 31, 2023. We also maintain certain uncommitted bilateral facilities to support our working capital needs.

We have a receivables and loans securitization facility ("Securitization Facility") with certain unaffiliated financial institutions ("Purchasers"). Under the Securitization Facility, we and certain of our subsidiaries ("Originators") sell trade accounts and notes receivable ("Receivables") to Cofina Funding, LLC ("Cofina"), a wholly-owned, bankruptcy-remote, indirect subsidiary of CHS. Cofina in turn transfers the Receivables to the Purchasers, and this arrangement is accounted for as secured financing. We use the proceeds from the sale of Receivables under the Securitization Facility for general corporate purposes, and settlements are made on a monthly basis. The amount available under the Securitization Facility fluctuates over time based on the total amount of eligible Receivables generated during the normal course of business. The Securitization Facility consists of a committed portion with a maximum availability of $850.0 million and an uncommitted portion with a maximum availability of $250.0 million. As of May 31, 2024, total availability under the Securitization Facility was $1.0 billion, of which no amount was utilized.

We also have a repurchase facility ("Repurchase Facility"). Under the Repurchase Facility, we can obtain repurchase agreement financing up to $200.0 million for certain eligible receivables and notes receivables of the Originators. No balance was outstanding under the Repurchase Facility as of May 31, 2024, or August 31, 2023. On July 8, 2024, the Repurchase Facility was amended to extend the facility expiration date to August 28, 2024.

On April 18, 2024, we entered into a Note Purchase Agreement to borrow $700.0 million of debt in the form of notes. The notes under this Note Purchase Agreement are structured in four series with maturities ranging from eight to 15 years and interest accruing at rates ranging from 5.84% to 6.13%. The funding of these notes will take place on July 16, 2024. The funding will be used for general corporate purposes, including funding capital expenditures and investments.

The following table presents summarized long-term debt (including the current portion) as of May 31, 2024, and August 31, 2023:

| | | | | | | | | | | |

| May 31,

2024 | | August 31,

2023 |

| | (Dollars in thousands) |

| Private placement debt | $ | 1,413,000 | | | $ | 1,413,000 | |

| Term loan | 366,000 | | | 366,000 | |

| Finance lease liabilities | 49,125 | | | 49,235 | |

| Deferred financing costs | (2,795) | | | (3,127) | |

| Other | 1,063 | | | 2,550 | |

| Total long-term debt | 1,826,393 | | | 1,827,658 | |

| Less current portion | 157,181 | | | 7,839 | |

| Long-term portion | $ | 1,669,212 | | | $ | 1,819,819 | |

Interest expense for the three months ended May 31, 2024 and 2023, was $23.4 million and $36.9 million, respectively, net of capitalized interest of $6.8 million and $4.1 million, respectively. Interest expense for the nine months ended May 31, 2024 and 2023, was $78.5 million and $106.2 million, respectively, net of capitalized interest of $18.3 million and $9.8 million, respectively.

Note 7 Income Taxes

Our effective tax rate for the three months ended May 31, 2024, was 4.1%, compared to 1.9% for the three months ended May 31, 2023. Our effective tax rate for the nine months ended May 31, 2024, was 2.1%, compared to 3.9% for the nine months ended May 31, 2023. Our income tax expense reflects the mix of full-year earnings projected across business units and current equity management assumptions. Income taxes and effective tax rates vary each year based on profitability, income tax credits, nonpatronage business activity and current equity management assumptions.

Our uncertain tax positions are affected by the tax years that are under audit or remain subject to examination by the relevant taxing authorities. Reserves are recorded against unrecognized tax benefits when we believe certain fully supportable tax return positions are likely to be challenged, and we may not prevail. If we were to prevail on all positions taken in relation to uncertain tax positions, $50.1 million and $116.0 million of the unrecognized tax benefits would ultimately benefit our effective tax rate as of May 31, 2024, and August 31, 2023, respectively. It is reasonably possible that the total amount of unrecognized tax benefits could change significantly in the next 12 months.

Note 8 Equities

Changes in Equities

Changes in equities for the three months ended May 31, 2024 and 2023, are as follows: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Equity Certificates | | | | Accumulated

Other

Comprehensive

Loss | | | | | | |

| Capital

Equity

Certificates | | Nonpatronage

Equity

Certificates | | Nonqualified Equity Certificates | | Preferred

Stock | | | Capital

Reserves | | Noncontrolling

Interests | | Total

Equities |

| | (Dollars in thousands) |

| Balances, February 29, 2024 | $ | 3,832,347 | | | $ | 27,460 | | | $ | 1,928,396 | | | $ | 2,264,038 | | | $ | (267,269) | | | $ | 2,976,811 | | | $ | 5,780 | | | $ | 10,767,563 | |

| Reversal of prior year patronage and redemption estimates | 325,690 | | | — | | | — | | | — | | | — | | | 64,917 | | | — | | | 390,607 | |

| Distribution of 2023 patronage refunds | 614 | | | — | | | 156 | | | — | | | — | | | (65,972) | | | — | | | (65,202) | |

Redemptions of equities | (319,738) | | | (124) | | | (5,827) | | | — | | | — | | | — | | | — | | | (325,689) | |

Preferred stock dividends | — | | | — | | | — | | | — | | | — | | | (42,167) | | | — | | | (42,167) | |

Other, net | 225 | | | — | | | (9) | | | — | | | — | | | 109 | | | (69) | | | 256 | |

| Net income (loss) | — | | | — | | | — | | | — | | | — | | | 297,274 | | | (19) | | | 297,255 | |

| Other comprehensive loss, net of tax | — | | | — | | | — | | | — | | | (3,592) | | | — | | | — | | | (3,592) | |

| Estimated 2024 cash patronage refunds | — | | | — | | | — | | | — | | | — | | | (52,357) | | | — | | | (52,357) | |

| Estimated 2024 equity redemptions | (52,357) | | | — | | | — | | | — | | | — | | | — | | | — | | | (52,357) | |

| Balances, May 31, 2024 | $ | 3,786,781 | | | $ | 27,336 | | | $ | 1,922,716 | | | $ | 2,264,038 | | | $ | (270,861) | | | $ | 3,178,615 | | | $ | 5,692 | | | $ | 10,914,317 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Equity Certificates | | | | Accumulated

Other

Comprehensive

Loss | | | | | | |

| Capital

Equity

Certificates | | Nonpatronage

Equity

Certificates | | Nonqualified Equity Certificates | | Preferred

Stock | | | Capital

Reserves | | Noncontrolling

Interests | | Total

Equities |

| | (Dollars in thousands) |

| Balances, February 28, 2023 | $ | 3,307,140 | | | $ | 27,861 | | | $ | 1,771,844 | | | $ | 2,264,038 | | | $ | (257,163) | | | $ | 2,710,507 | | | $ | 5,092 | | | $ | 9,829,319 | |

| Reversal of prior year patronage and redemption estimates | 462,690 | | | — | | | — | | | — | | | — | | | 119,360 | | | — | | | 582,050 | |

| Distribution of 2022 patronage refunds | 2,615 | | | — | | | 1,226 | | | — | | | — | | | (124,889) | | | — | | | (121,048) | |

Redemptions of equities | (457,679) | | | (112) | | | (4,898) | | | — | | | — | | | — | | | — | | | (462,689) | |

| | | | | | | | | | | | | | | |

Other, net | (678) | | | (44) | | | (115) | | | — | | | — | | | 574 | | | (16) | | | (279) | |

| Net income (loss) | — | | | — | | | — | | | — | | | — | | | 547,499 | | | (156) | | | 547,343 | |

| Other comprehensive loss, net of tax | — | | | — | | | — | | | — | | | (3,108) | | | — | | | — | | | (3,108) | |

| Estimated 2023 cash patronage refunds | — | | | — | | | — | | | — | | | — | | | (144,105) | | | — | | | (144,105) | |

| Estimated 2023 equity redemptions | (144,105) | | | — | | | — | | | — | | | — | | | — | | | — | | | (144,105) | |

| Balances, May 31, 2023 | $ | 3,169,983 | | | $ | 27,705 | | | $ | 1,768,057 | | | $ | 2,264,038 | | | $ | (260,271) | | | $ | 3,108,946 | | | $ | 4,920 | | | $ | 10,083,378 | |

Change in equities for the nine months ended May 31, 2024 and 2023, are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Equity Certificates | | | | Accumulated

Other

Comprehensive

Loss | | | | | | |

| Capital

Equity

Certificates | | Nonpatronage

Equity

Certificates | | Nonqualified Equity Certificates | | Preferred

Stock | | | Capital

Reserves | | Noncontrolling

Interests | | Total

Equities |

| | (Dollars in thousands) |

| Balances, August 31, 2023 | $ | 3,951,385 | | | $ | 27,558 | | | $ | 1,932,706 | | | $ | 2,264,038 | | | $ | (265,395) | | | $ | 2,537,486 | | | $ | 4,611 | | | $ | 10,452,389 | |

| Reversal of prior year patronage and redemption estimates | (363,978) | | | — | | | (169,159) | | | — | | | — | | | 1,240,284 | | | — | | | 707,147 | |

| Distribution of 2023 patronage refunds | 708,008 | | | — | | | 169,207 | | | — | | | — | | | (1,243,167) | | | — | | | (365,952) | |

Redemptions of equities | (331,883) | | | (219) | | | (10,045) | | | — | | | — | | | — | | | — | | | (342,147) | |

Preferred stock dividends | — | | | — | | | — | | | — | | | — | | | (168,668) | | | — | | | (168,668) | |

Other, net | 203 | | | (3) | | | 7 | | | — | | | — | | | (870) | | | 629 | | | (34) | |

| Net income | — | | | — | | | — | | | — | | | — | | | 990,504 | | | 452 | | | 990,956 | |

| Other comprehensive loss, net of tax | — | | | — | | | — | | | — | | | (5,466) | | | — | | | — | | | (5,466) | |

| Estimated 2024 cash patronage refunds | — | | | — | | | — | | | — | | | — | | | (176,954) | | | — | | | (176,954) | |

| Estimated 2024 equity redemptions | (176,954) | | | — | | | — | | | — | | | — | | | — | | | — | | | (176,954) | |

| Balances, May 31, 2024 | $ | 3,786,781 | | | $ | 27,336 | | | $ | 1,922,716 | | | $ | 2,264,038 | | | $ | (270,861) | | | $ | 3,178,615 | | | $ | 5,692 | | | $ | 10,914,317 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Equity Certificates | | | | Accumulated

Other

Comprehensive

Loss | | | | | | |

| Capital

Equity

Certificates | | Nonpatronage

Equity

Certificates | | Nonqualified Equity Certificates | | Preferred

Stock | | | Capital

Reserves | | Noncontrolling

Interests | | Total

Equities |

| | (Dollars in thousands) |

| Balances, August 31, 2022 | $ | 3,587,131 | | | $ | 27,933 | | | $ | 1,776,172 | | | $ | 2,264,038 | | | $ | (255,335) | | | $ | 2,055,682 | | | $ | 5,645 | | | $ | 9,461,266 | |

| Reversal of prior year patronage and redemption estimates | (28,368) | | | — | | | (153,858) | | | — | | | — | | | 1,162,661 | | | — | | | 980,435 | |

| Distribution of 2022 patronage refunds | 516,246 | | | — | | | 154,484 | | | — | | | — | | | (1,173,668) | | | — | | | (502,938) | |

Redemptions of equities | (471,589) | | | (184) | | | (8,662) | | | — | | | — | | | — | | | — | | | (480,435) | |

Preferred stock dividends | — | | | — | | | — | | | — | | | — | | | (126,501) | | | — | | | (126,501) | |

Other, net | (390) | | | (44) | | | (79) | | | — | | | — | | | 1,401 | | | (614) | | | 274 | |

| Net income (loss) | — | | | — | | | — | | | — | | | — | | | 1,622,418 | | | (111) | | | 1,622,307 | |

| Other comprehensive loss, net of tax | — | | | — | | | — | | | — | | | (4,936) | | | — | | | — | | | (4,936) | |

| Estimated 2023 cash patronage refunds | — | | | — | | | — | | | — | | | — | | | (433,047) | | | — | | | (433,047) | |

| Estimated 2023 equity redemptions | (433,047) | | | — | | | — | | | — | | | — | | | — | | | — | | | (433,047) | |

| Balances, May 31, 2023 | $ | 3,169,983 | | | $ | 27,705 | | | $ | 1,768,057 | | | $ | 2,264,038 | | | $ | (260,271) | | | $ | 3,108,946 | | | $ | 4,920 | | | $ | 10,083,378 | |

Preferred Stock Dividends

The following table presents a summary of dividends declared per share by series of preferred stock for the three and nine months ended May 31, 2024 and 2023. The timing of dividend declarations throughout the fiscal year changed during fiscal 2024 such that dividends historically declared during the fourth quarter were declared during the third quarter of fiscal 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended May 31, | | Nine Months Ended May 31, |

| Nasdaq symbol | | 2024 | | 2023 | | 2024 | | 2023 |

| Series of preferred stock: | | | (Dollars per share) |

| 8% Cumulative Redeemable | CHSCP | | $ | 0.50 | | | $ | — | | | $ | 2.00 | | | $ | 1.50 | |

| Class B Cumulative Redeemable, Series 1 | CHSCO | | $ | 0.49 | | | $ | — | | | $ | 1.97 | | | $ | 1.48 | |

| Class B Reset Rate Cumulative Redeemable, Series 2 | CHSCN | | $ | 0.44 | | | $ | — | | | $ | 1.78 | | | $ | 1.33 | |

| Class B Reset Rate Cumulative Redeemable, Series 3 | CHSCM | | $ | 0.42 | | | $ | — | | | $ | 1.69 | | | $ | 1.27 | |

| Class B Cumulative Redeemable, Series 4 | CHSCL | | $ | 0.47 | | | $ | — | | | $ | 1.88 | | | $ | 1.41 | |

Accumulated Other Comprehensive Income (Loss)

Changes in accumulated other comprehensive income (loss) by component for the three months ended May 31, 2024 and 2023, are as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Pension and Other Postretirement Benefits | | Cash Flow Hedges | | Foreign Currency Translation Adjustment | | Total |

| (Dollars in thousands) |

| Balance as of February 29, 2024, net of tax | $ | (173,857) | | | $ | 4,174 | | | $ | (97,586) | | | $ | (267,269) | |

| Other comprehensive income (loss), before tax: | | | | | | | |

| Amounts before reclassifications | 20 | | | 2,209 | | | (3,104) | | | (875) | |

| Amounts reclassified | 45 | | | (3,111) | | | — | | | (3,066) | |

| Total other comprehensive income (loss), before tax | 65 | | | (902) | | | (3,104) | | | (3,941) | |

| Tax effect | (16) | | | 221 | | | 144 | | | 349 | |

| Other comprehensive income (loss), net of tax | 49 | | | (681) | | | (2,960) | | | (3,592) | |

| Balance as of May 31, 2024, net of tax | $ | (173,808) | | | $ | 3,493 | | | $ | (100,546) | | | $ | (270,861) | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Pension and Other Postretirement Benefits | | Cash Flow Hedges | | Foreign Currency Translation Adjustment | | Total |

| (Dollars in thousands) |

| Balance as of February 28, 2023, net of tax | $ | (164,089) | | | $ | 3,779 | | | $ | (96,853) | | | $ | (257,163) | |

| Other comprehensive income (loss), before tax: | | | | | | | |

| Amounts before reclassifications | 148 | | | (1,051) | | | (800) | | | (1,703) | |

| Amounts reclassified | 23 | | | (2,289) | | | — | | | (2,266) | |

| Total other comprehensive income (loss), before tax | 171 | | | (3,340) | | | (800) | | | (3,969) | |

| Tax effect | (41) | | | 809 | | | 93 | | | 861 | |

| Other comprehensive income (loss), net of tax | 130 | | | (2,531) | | | (707) | | | (3,108) | |

| Balance as of May 31, 2023, net of tax | $ | (163,959) | | | $ | 1,248 | | | $ | (97,560) | | | $ | (260,271) | |

Changes in accumulated other comprehensive income (loss) by component for the nine months ended May 31, 2024 and 2023, are as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Pension and Other Postretirement Benefits | | Cash Flow Hedges | | Foreign Currency Translation Adjustment | | Total |

| (Dollars in thousands) |

| Balance as of August 31, 2023, net of tax | $ | (173,925) | | | $ | 2,032 | | | $ | (93,502) | | | $ | (265,395) | |

| Other comprehensive income (loss), before tax: | | | | | | | |

| Amounts before reclassifications | 20 | | | 15,130 | | | (7,206) | | | 7,944 | |

| Amounts reclassified | 135 | | | (13,195) | | | — | | | (13,060) | |

| Total other comprehensive income (loss), before tax | 155 | | | 1,935 | | | (7,206) | | | (5,116) | |

| Tax effect | (38) | | | (474) | | | 162 | | | (350) | |

| Other comprehensive income (loss), net of tax | 117 | | | 1,461 | | | (7,044) | | | (5,466) | |

| Balance as of May 31, 2024, net of tax | $ | (173,808) | | | $ | 3,493 | | | $ | (100,546) | | | $ | (270,861) | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Pension and Other Postretirement Benefits | | Cash Flow Hedges | | Foreign Currency Translation Adjustment | | Total |

| (Dollars in thousands) |

| Balance as of August 31, 2022, net of tax | $ | (168,640) | | | $ | 8,843 | | | $ | (95,538) | | | $ | (255,335) | |

| Other comprehensive income (loss), before tax: | | | | | | | |

| Amounts before reclassifications | 351 | | | (24,392) | | | (2,288) | | | (26,329) | |

| Amounts reclassified | 70 | | | 14,368 | | | — | | | 14,438 | |

| Total other comprehensive income (loss), before tax | 421 | | | (10,024) | | | (2,288) | | | (11,891) | |

| Tax effect | 4,260 | | | 2,429 | | | 266 | | | 6,955 | |

| Other comprehensive income (loss), net of tax | 4,681 | | | (7,595) | | | (2,022) | | | (4,936) | |

| Balance as of May 31, 2023, net of tax | $ | (163,959) | | | $ | 1,248 | | | $ | (97,560) | | | $ | (260,271) | |

Amounts reclassified from accumulated other comprehensive income (loss) were related to pension and other postretirement benefits, cash flow hedges and foreign currency translation adjustments. Pension and other postretirement reclassifications include amortization of net actuarial loss, prior service credit and transition amounts and are recorded as cost of goods sold and marketing, general and administrative expenses (see Note 9, Benefit Plans, for further information). As described in Note 11, Derivative Financial Instruments and Hedging Activities, amounts reclassified from accumulated other comprehensive loss for cash flow hedges are recorded in cost of goods sold. Gains or losses on foreign currency translation reclassifications are recorded in other income.

Note 9 Benefit Plans

We have various pension and other defined benefit and defined contribution plans, in which substantially all employees may participate. We also have nonqualified supplemental executive and Board of Directors retirement plans.

Components of net periodic benefit costs for the three and nine months ended May 31, 2024 and 2023, are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended May 31, |

| Qualified

Pension Benefits | | Nonqualified

Pension Benefits | | Other Benefits |

| | 2024 | | 2023 | | 2024 | | 2023 | | 2024 | | 2023 |

| Components of net periodic benefit costs: | (Dollars in thousands) |

| Service cost | $ | 9,348 | | | $ | 9,645 | | | $ | 492 | | | $ | 460 | | | $ | 163 | | | $ | 168 | |

| Interest cost | 8,982 | | | 7,647 | | | 261 | | | 185 | | | 286 | | | 259 | |

| Expected return on assets | (11,965) | | | (10,782) | | | — | | | — | | | — | | | — | |

| Prior service cost (credit) amortization | 45 | | | 37 | | | (29) | | | (29) | | | (111) | | | (111) | |

| Actuarial loss (gain) amortization | 449 | | | 468 | | | 95 | | | 61 | | | (404) | | | (404) | |

| | | | | | | | | | | |

| Net periodic benefit cost (benefit) | $ | 6,859 | | | $ | 7,015 | | | $ | 819 | | | $ | 677 | | | $ | (66) | | | $ | (88) | |

| | | | | | | | | | | |

| Nine Months Ended May 31, |

| Qualified

Pension Benefits | | Nonqualified

Pension Benefits | | Other Benefits |

| | 2024 | | 2023 | | 2024 | | 2023 | | 2024 | | 2023 |

| Components of net periodic benefit costs: | (Dollars in thousands) |

| Service cost | $ | 28,044 | | | $ | 28,934 | | | $ | 1,476 | | | $ | 1,380 | | | $ | 488 | | | $ | 503 | |

| Interest cost | 26,946 | | | 22,941 | | | 783 | | | 556 | | | 858 | | | 776 | |

| Expected return on assets | (35,895) | | | (32,347) | | | — | | | — | | | — | | | — | |

| Prior service cost (credit) amortization | 134 | | | 112 | | | (86) | | | (86) | | | (334) | | | (334) | |

| Actuarial loss (gain) amortization | 1,347 | | | 1,404 | | | 285 | | | 184 | | | (1,212) | | | (1,211) | |

| | | | | | | | | | | |

| Net periodic benefit cost (benefit) | $ | 20,576 | | | $ | 21,044 | | | $ | 2,458 | | | $ | 2,034 | | | $ | (200) | | | $ | (266) | |

Employer Contributions

Contributions depend primarily on market returns on the pension plan assets and minimum funding level requirements. No contributions were made to the pension plans during the nine months ended May 31, 2024, and we do not anticipate being required to make contributions to our pension plans in fiscal 2024, although we may voluntarily elect to do so.

Note 10 Segment Reporting

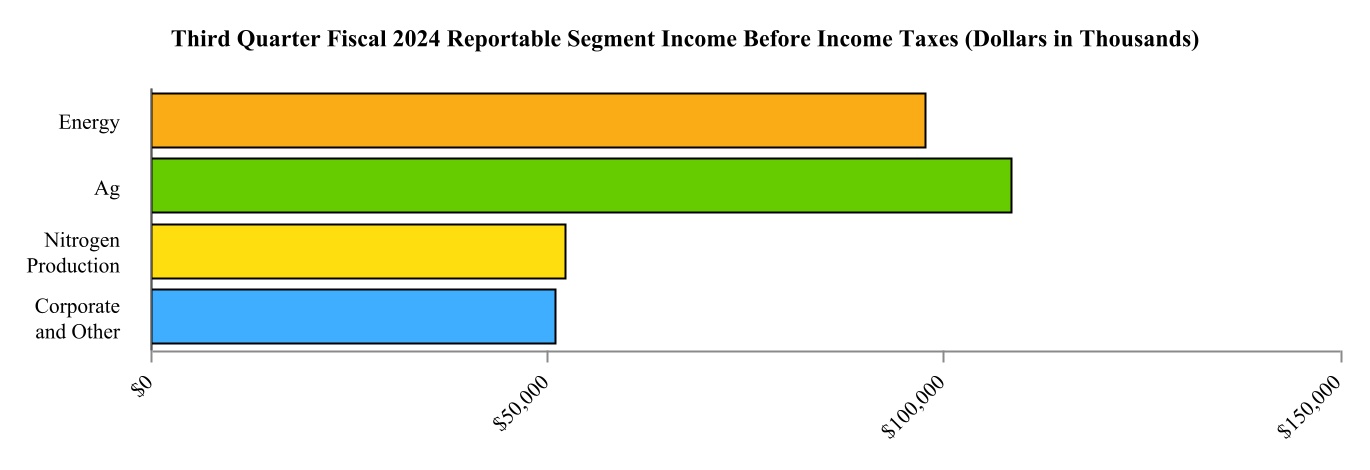

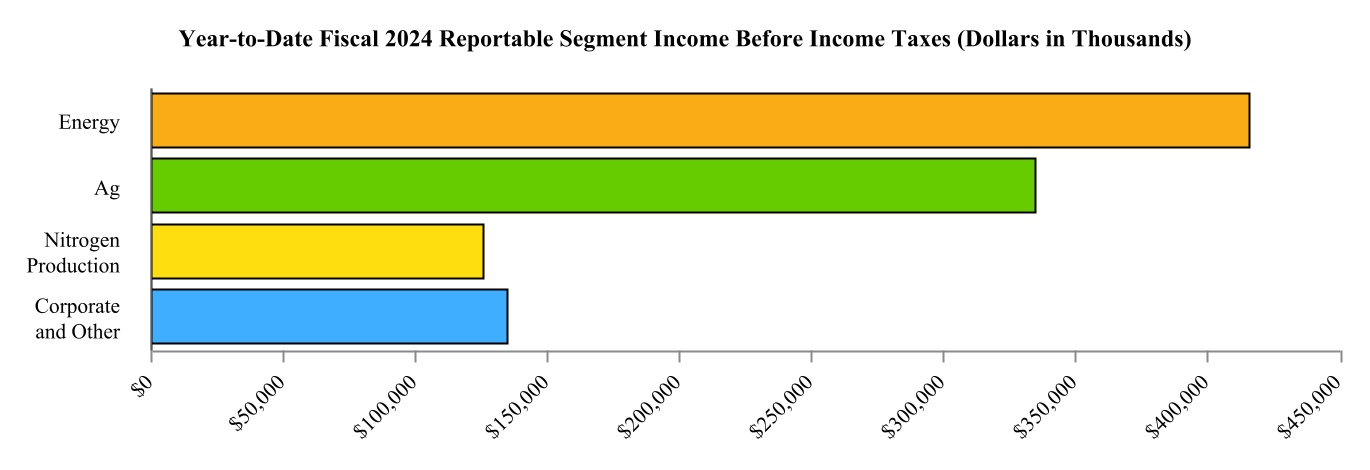

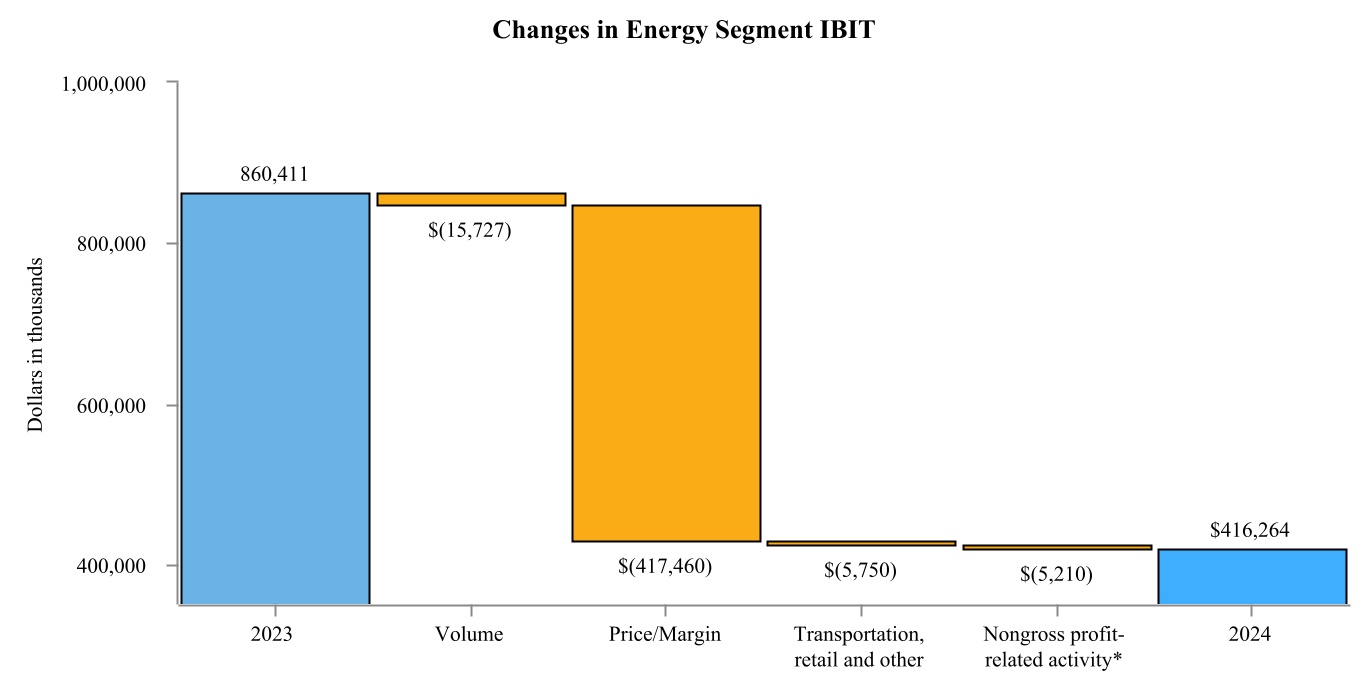

We are an integrated agricultural cooperative, providing grain, food, agronomy and energy resources to businesses and consumers on a global basis. We provide a wide variety of products and services, from initial agricultural inputs such as fuels, farm supplies, crop nutrients and crop protection products, to agricultural outputs that include grain and oilseed, processed grain and oilseed, renewable fuels and food products. We define our operating segments in accordance with ASC Topic 280, Segment Reporting, to reflect the manner in which our chief operating decision maker, our Chief Executive Officer, evaluates performance and allocates resources in managing the business. We have aggregated those operating segments into three reportable segments: Energy, Ag and Nitrogen Production.

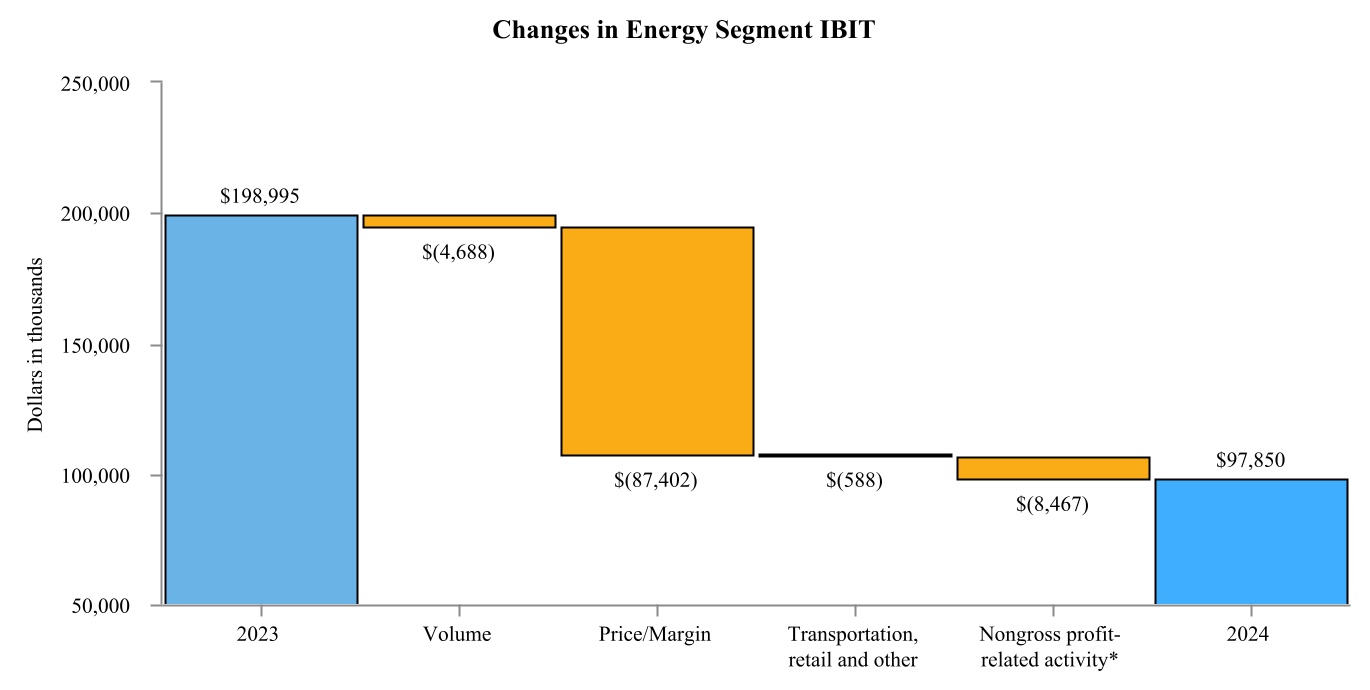

Our Energy segment produces and provides primarily for wholesale distribution of petroleum products and transportation of those products. Our Ag segment purchases and further processes or resells grain and oilseed originated by our country operations business, by our member cooperatives and by third parties; serves as a wholesaler and retailer of crop inputs; and produces and markets ethanol. Our Nitrogen Production segment consists of our equity method investment in CF Nitrogen that records earnings and allocated expenses but not revenues. Our supply agreement with CF Nitrogen entitles us to purchase up to a specified quantity of granular urea and urea ammonium nitrate ("UAN") annually from CF Nitrogen. Corporate and Other represents our financing and hedging businesses, which primarily consist of a U.S. Commodity Futures Trading Commission-regulated futures commission merchant ("FCM") for commodities hedging and financial services related to crop production. Our nonconsolidated investments in Ventura Foods, LLC ("Ventura Foods"), and Ardent Mills, LLC ("Ardent Mills"), are also included in our Corporate and Other category.

Corporate administrative expenses and interest are allocated to each reportable segment and Corporate and Other, based on direct use of services, such as information technology and legal, and other factors or considerations relevant to the costs incurred.

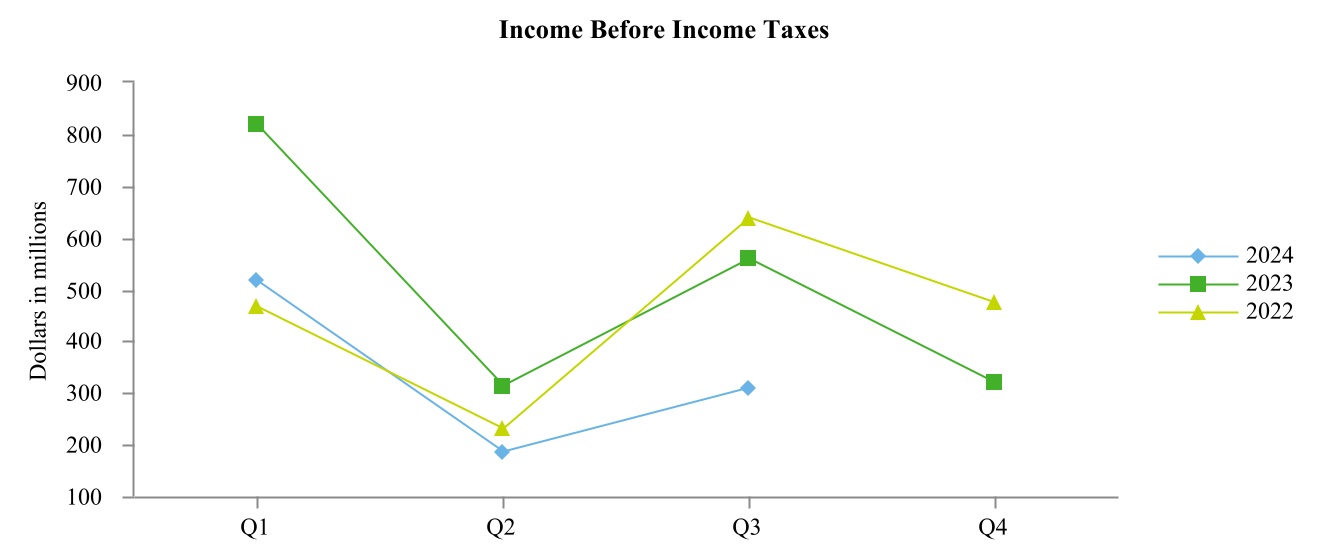

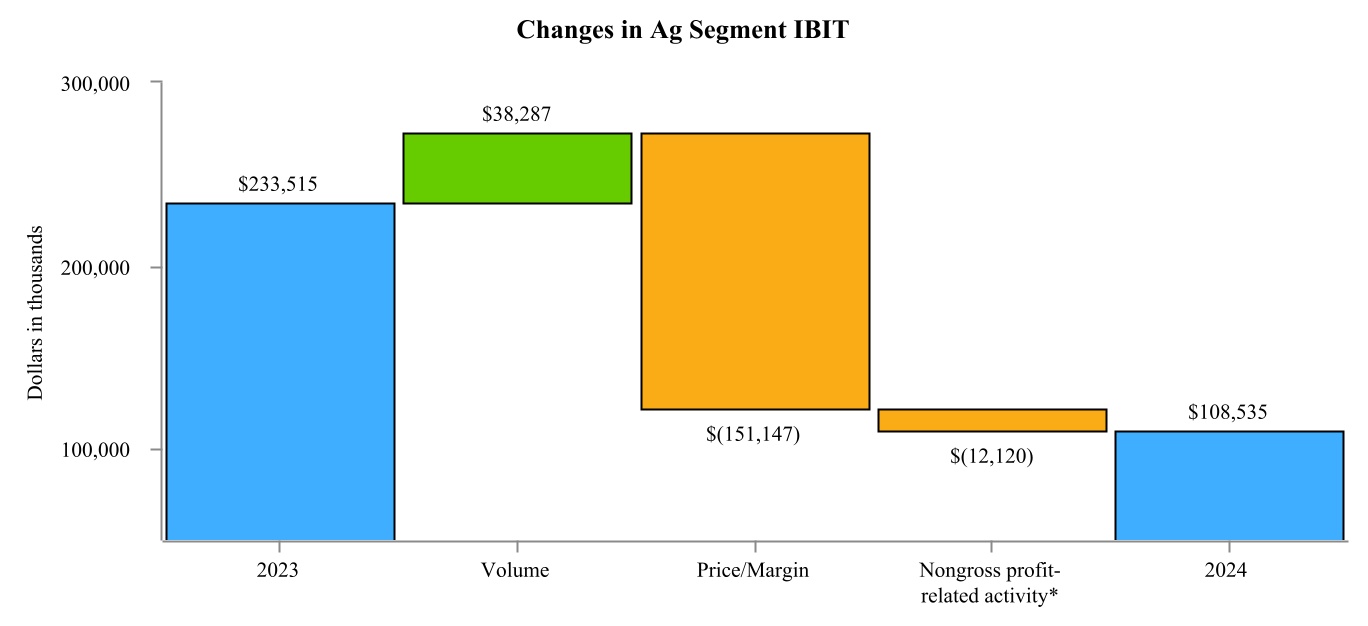

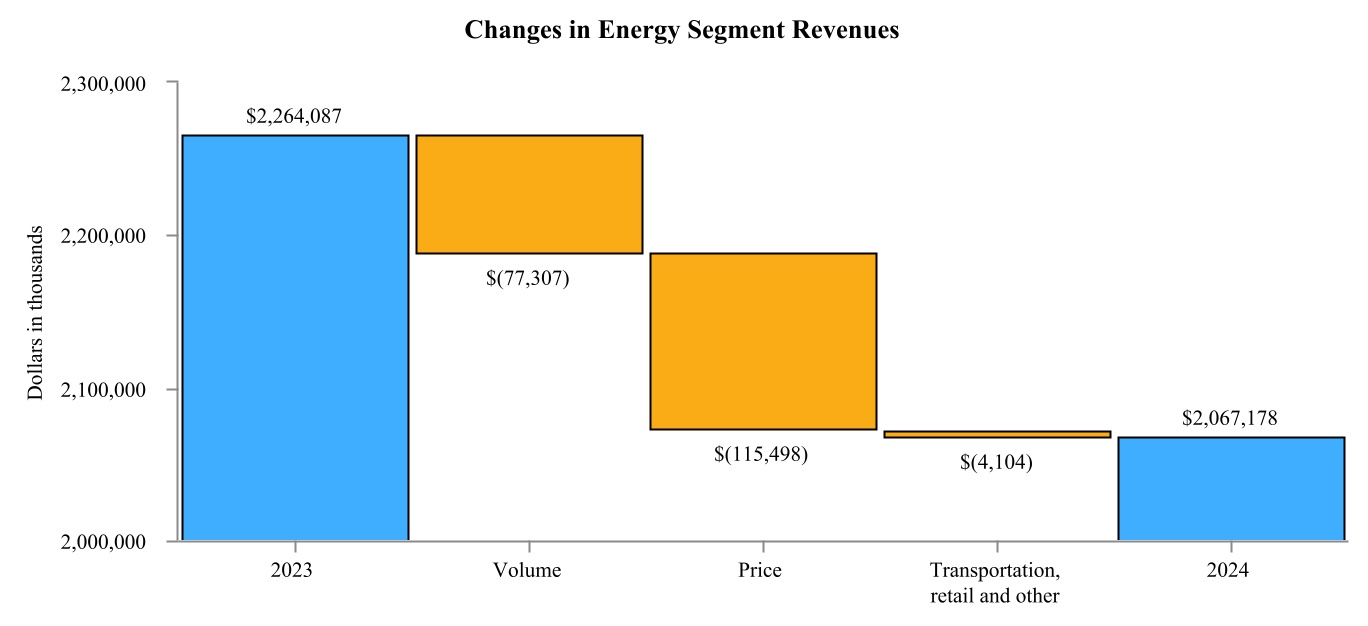

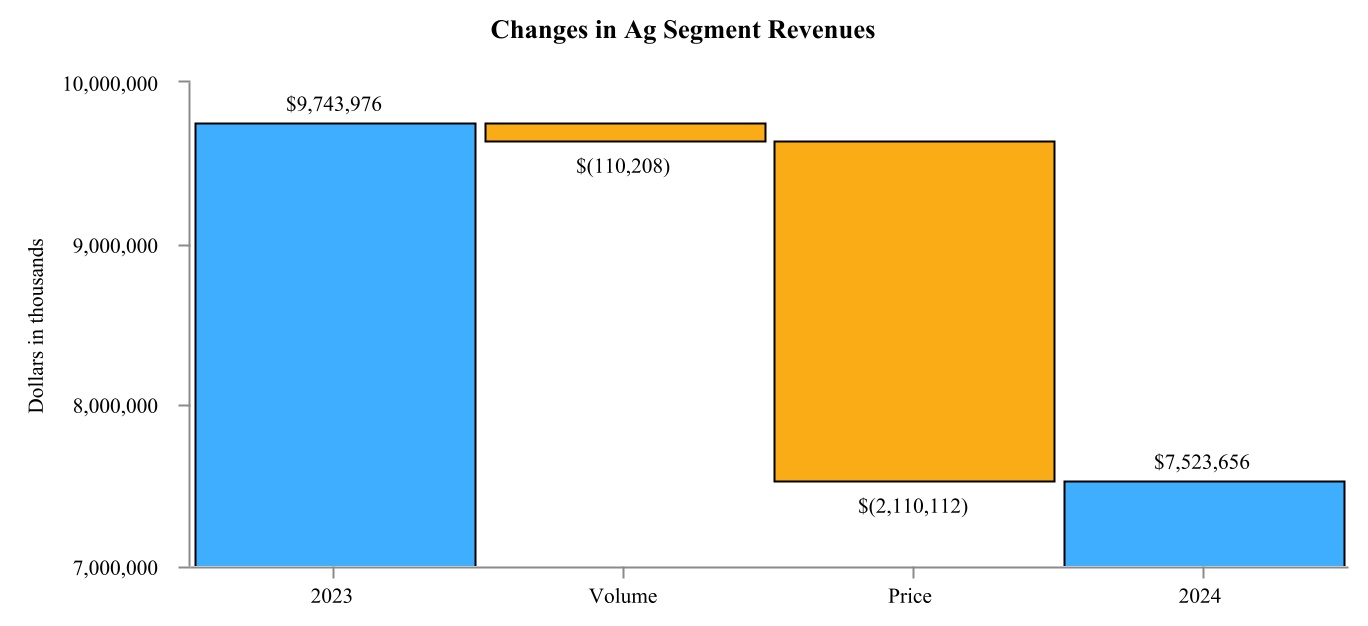

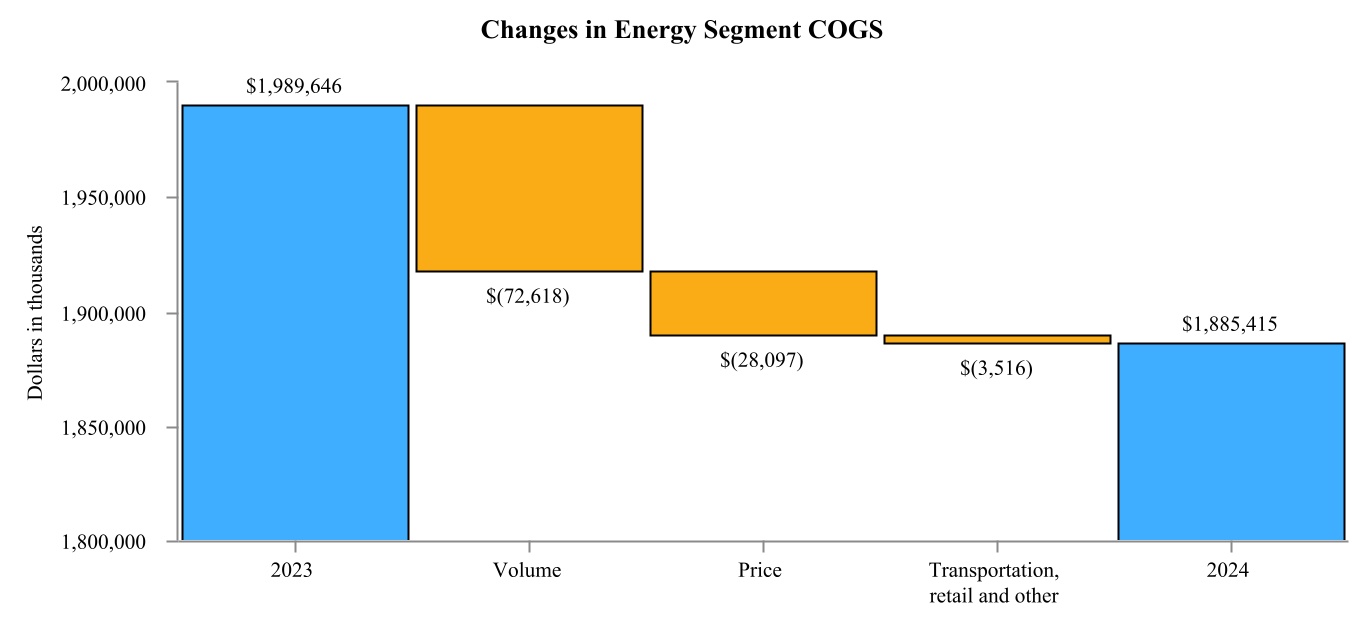

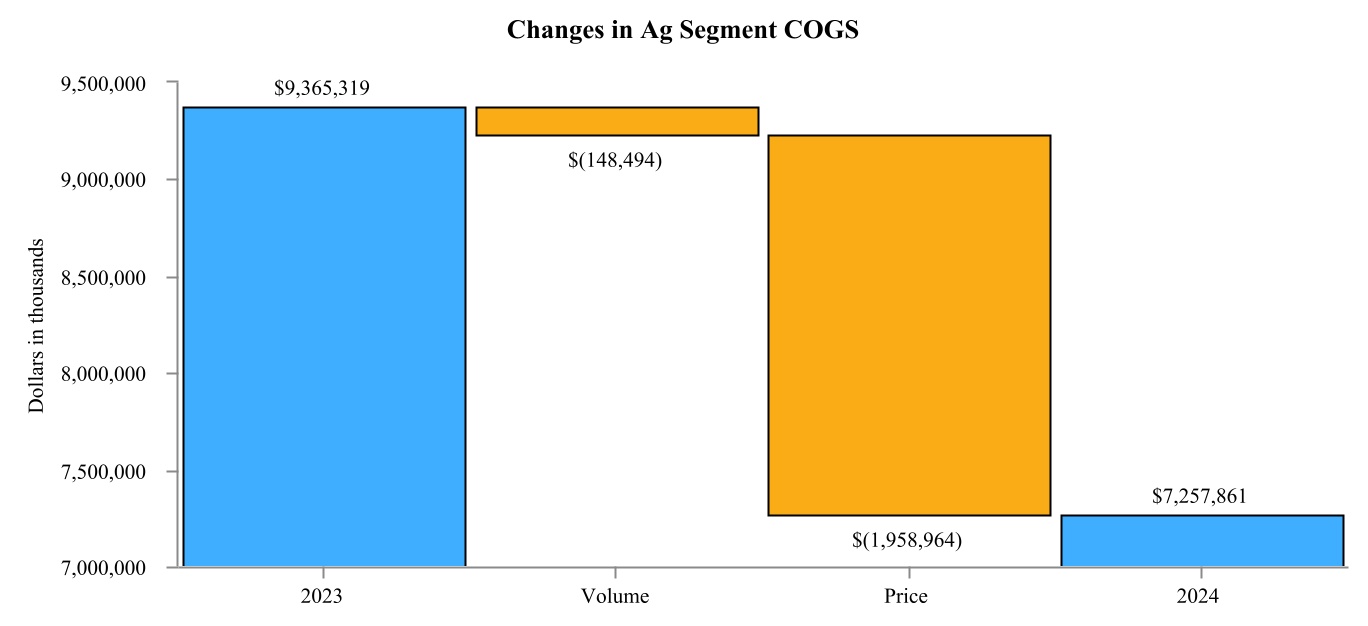

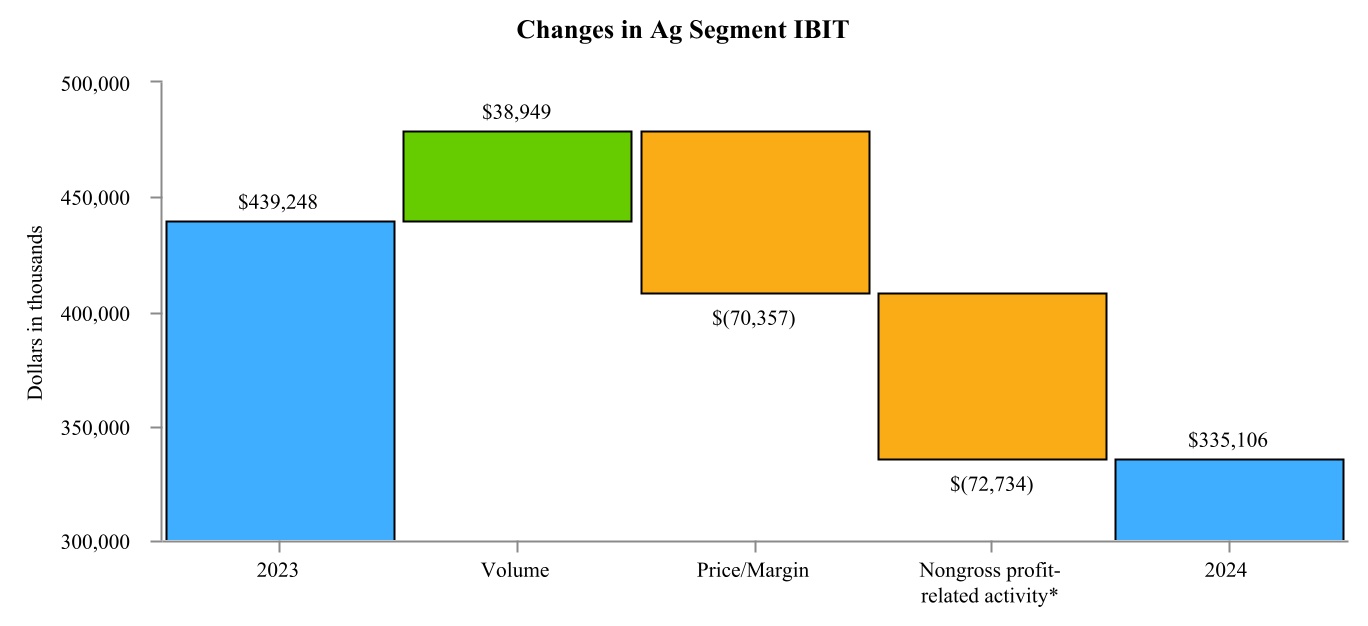

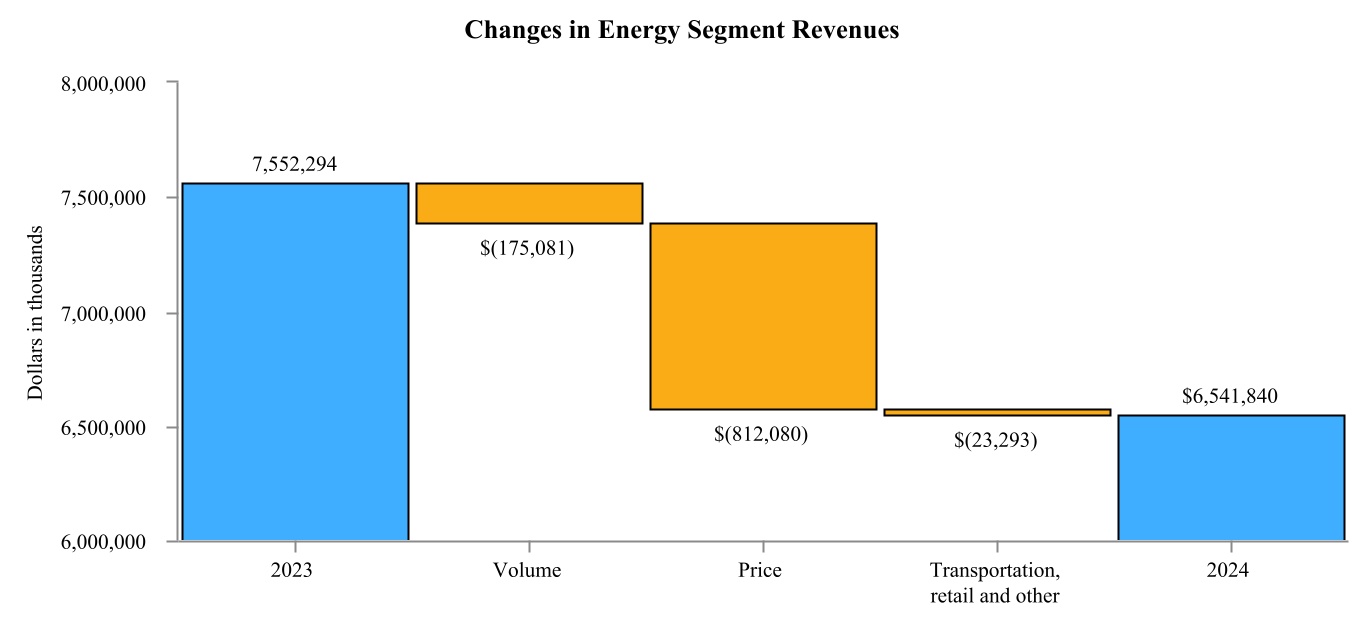

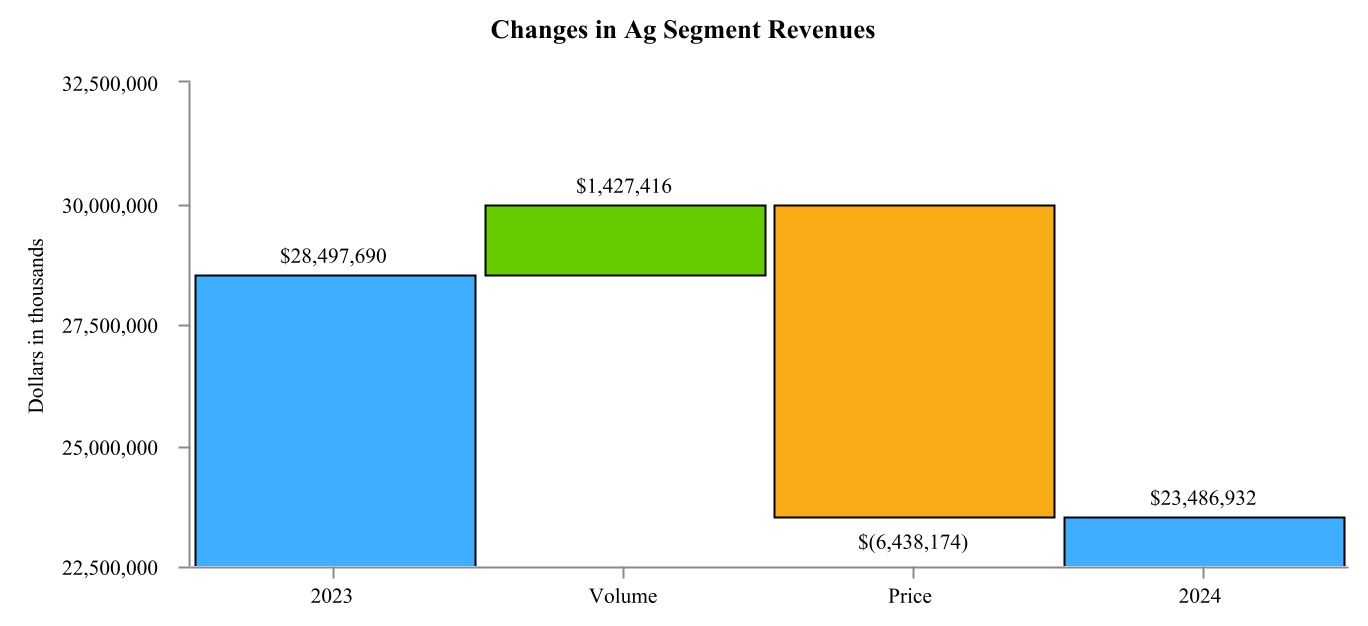

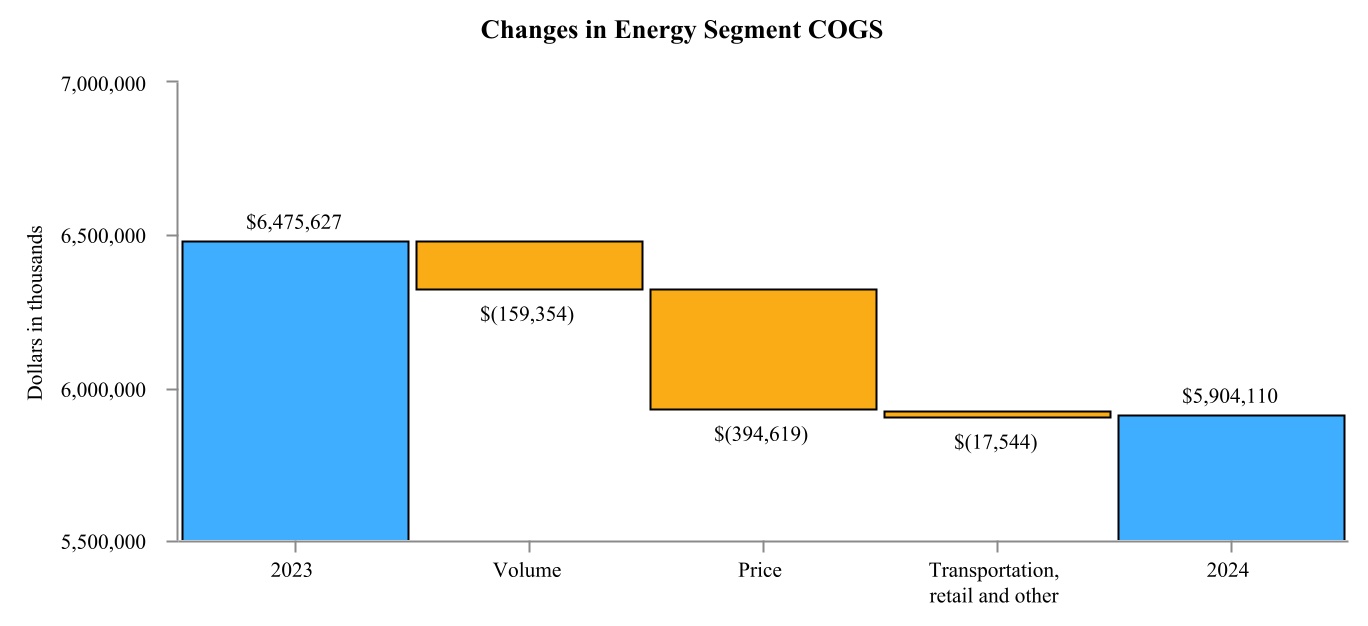

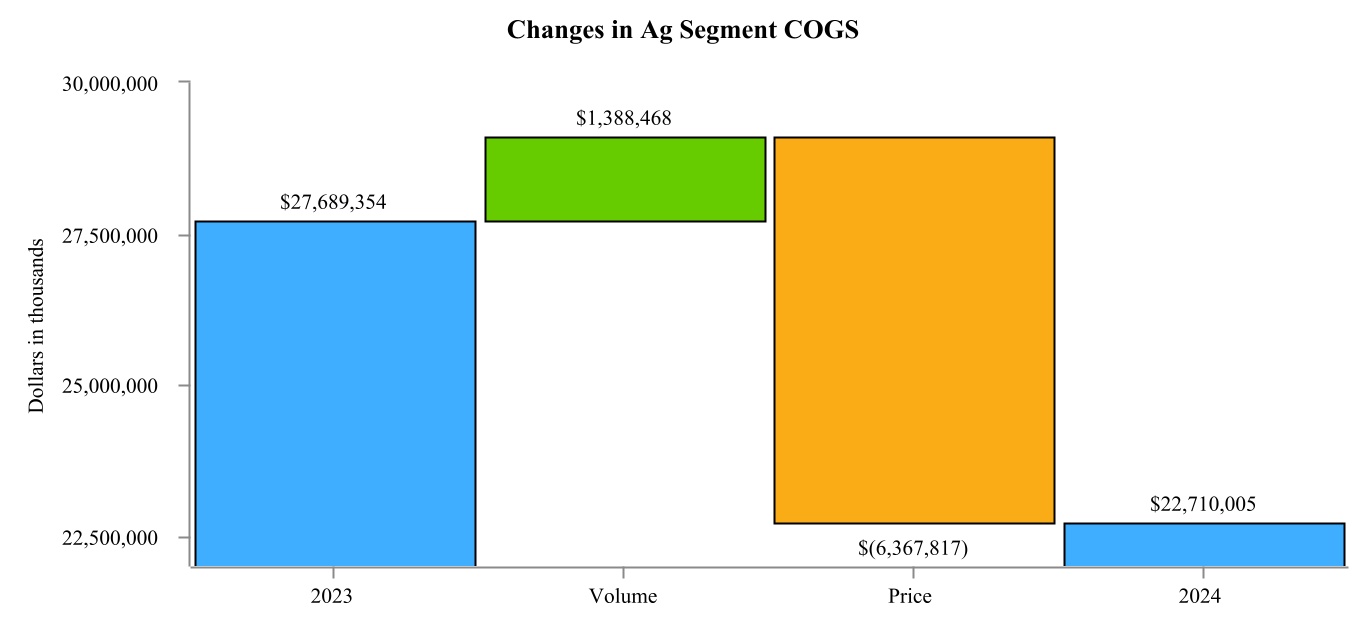

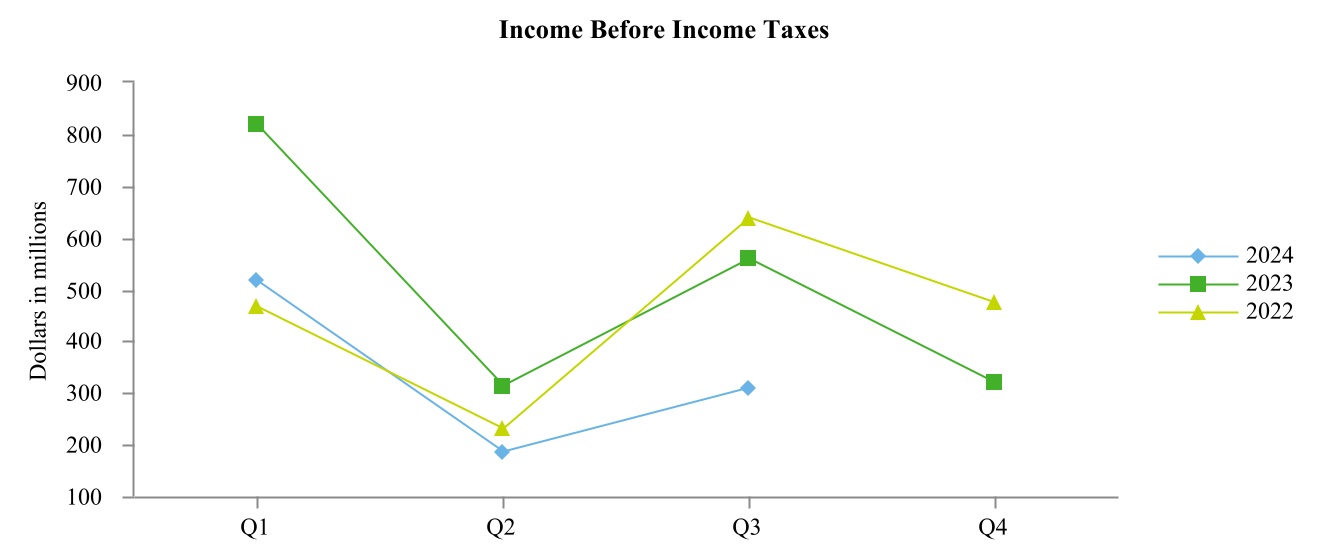

Many of our business activities are highly seasonal and our operating results vary throughout the year. Our revenues and income before income taxes ("IBIT") generally trend lower during the second fiscal quarter and increase in the third fiscal quarter. For example, in our Ag segment, our country operations business generally experiences higher volumes and revenues during the fall harvest and spring planting seasons, which generally correspond to our first and third fiscal quarters, respectively. Additionally, our agronomy business generally experiences higher volumes and revenues during the spring planting season. Our global grain and processing operations are subject to fluctuations in volume and revenues based on producer harvests, world grain prices, demand and international trade relationships. Our Energy segment generally experiences higher volumes and revenues in certain operating areas, such as refined products, in the spring, summer and early fall when gasoline and diesel fuel use by agricultural producers is highest and is subject to global supply and demand forces. Other energy products, such as propane, generally experience higher volumes and revenues during the winter heating and fall crop-drying seasons.