UNITED STATES | ||

SECURITIES AND EXCHANGE COMMISSION | ||

WASHINGTON, D.C. 20549 | ||

FORM 10-K | ||

(Mark One) | |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2016. | |

OR | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO | |

COMMISSION FILE NUMBER 1-9750 | |

___________________________________________________________________

(Exact name of registrant as specified in its charter)

__________________________________________________________________

Delaware | 38-2478409 | ||||||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | ||||||

1334 York Avenue | 10021 | ||||||

New York, New York | (Zip Code) | ||||||

(Address of principal executive offices) | |||||||

(212) 606-7000 | |||||||

(Registrant’s telephone number, including area code) | |||||||

Securities registered pursuant to Section 12(b) of the Act: | |||||||

Title of each class | Name of each exchange on which registered | ||||||

Common Stock, | New York Stock Exchange | ||||||

$0.01 Par Value | |||||||

Securities registered pursuant to Section 12(g) of the Act: None | |||||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter periods that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§232.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. Large accelerated filer þ Accelerated filer o Non-accelerated filer o (Do not check if a smaller reporting company) Smaller reporting company o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes o No þ

As of June 30, 2016, the aggregate market value of the 47,997,224 shares of Common Stock held by non-affiliates of the registrant was $1,315,123,938 based upon the closing price ($27.40) on the New York Stock Exchange composite tape on such date for the Common Stock.

As of February 23, 2017, there were outstanding 52,976,046 shares of Common Stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement for the 2017 annual meeting of shareholders are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

Page | |||

2

PART I

ITEM 1: DESCRIPTION OF BUSINESS

Company Overview

Sotheby's is a global art business, offering our clients opportunities to connect with and transact in the world's most extraordinary objects. Auctioneers since 1744, today we offer a variety of innovative art-related services, including the brokerage of private art sales, private jewelry sales through Sotheby's Diamonds, exclusive private selling exhibitions at our S|2 galleries, art-related financing, and art advisory services, as well as retail wine locations in New York and Hong Kong.

As successor to a business that began in 1744, Sotheby's is the oldest company listed on the New York Stock Exchange ("NYSE") (symbol: BID) and is the only publicly traded investment opportunity in the art market. Sotheby's is incorporated in Delaware.

Business Organization

Our operations are organized under two segments: the Agency segment and the Finance segment, which does business as and is referred to in this report as Sotheby’s Financial Services (“SFS”). The Agency segment earns commissions by matching buyers and sellers of authenticated fine art, decorative art, jewelry, wine and collectibles (collectively, "art" or "works of art" or "artwork" or "property") through the auction or private sale process. To a much lesser extent, Agency segment activities also include the sale of artworks that are principally acquired as a consequence of the auction process, as well as the activities of RM Sotheby's, an equity investee that operates as an auction house for investment-quality automobiles (see Note 5 of Notes to Consolidated Financial Statements). SFS earns interest income through art-related financing activities by making loans that are secured by works of art. Art Agency, Partners (“AAP”), through which we offer art advisory services, provides clients strategic guidance on collection identity and development, acquisitions, and short and long-term planning. Our advisory services are classified within All Other for segment reporting purposes, along with our retail wine business and brand licensing activities. See Note 2 of Notes to Consolidated Financial Statements for information regarding our segment reporting.

Agency Segment

Through our Agency segment, we accept property on consignment, stimulate buyer interest through professional marketing techniques, and match sellers (also known as consignors) to buyers through the auction or private sale process. Prior to offering a work of art for sale, we perform due diligence activities to authenticate and determine the ownership history of the property being sold. See “Converting Consignment Opportunities” below for further information regarding the consignment process.

Following an auction or private sale, we invoice the buyer for the purchase price of the property (including any commission owed by the buyer), collect payment from the buyer, and remit to the consignor the net sale proceeds after deducting our commissions, expenses and applicable taxes and royalties. As compensation for our auction services, we earn a commission from both the buyer ("buyer's premium") and, to a lesser extent, the seller ("seller's commission") (collectively, "auction commission revenue"), both of which are calculated as a percentage of the hammer price of the property sold at auction. In 2016, 2015, and 2014, auction commission revenues accounted for approximately 75%, 75%, and 81%, respectively, of our consolidated revenues. Private sale commission revenues are earned through the direct brokering of purchases and sales of art. Private sales are initiated either by a client wishing to sell property with Sotheby's acting as its exclusive agent in the transaction, or by a prospective buyer who is interested in purchasing a certain work of art privately. In 2016, 2015, and 2014, private sale commission revenues accounted for approximately 7%, 6%, and 6%, respectively, of our consolidated revenues.

Under the standard terms and conditions of our auction and private sales, we are not obligated to pay the consignor for property that has not been paid for by the buyer. If a buyer defaults on payment, the sale may be cancelled, and the property will be returned to the consignor. Alternatively, the consignor may reoffer the property at one of our future auctions or negotiate a private sale with us acting as their agent. In certain instances and subject to management approval under our internal corporate governance policy, we may pay the net sale proceeds to the consignor before payment is collected from the buyer and/or we may allow the buyer to take possession of the property before making payment. In situations when the buyer takes possession of the property before making payment, we are liable to the seller for the net sale proceeds whether or not the buyer makes payment.

3

From time-to-time in the ordinary course of our business, we will guarantee to a consignor a minimum sale price in connection with the sale of property at auction (an "auction guarantee"). If the property offered under the auction guarantee sells above the minimum guaranteed price, we are generally entitled to a share of the excess proceeds (the "overage"). In the event that the property sells for less than the minimum guaranteed price, we must perform under the auction guarantee by funding the difference between the sale price at auction and the amount of the auction guarantee (the "shortfall"). If any item of property offered under the auction guarantee does not sell, the amount of the auction guarantee must be paid, but we take ownership of the unsold property and may recover the amount paid through its future sale.

We may reduce our financial exposure under auction guarantees through contractual risk and reward sharing arrangements. Such auction guarantee risk and reward sharing arrangements include irrevocable bids and partner sharing arrangements. In exchange for accepting a share of the financial exposure under the auction guarantee, our counterparties to these arrangements are generally entitled to receive a share of our auction commission if the property sells and/or a share of the overage, if any.

Auction guarantees are an important financial incentive which may significantly influence an art collector's decision on whether and how to sell their property. As such, auction guarantees provide us the opportunity to secure highly sought-after consignments, often well in advance of a specific selling season. When we evaluate the performance of our portfolio of auction guarantees, we take into consideration the overall revenues earned on the transaction, which includes our auction commission revenues, as well as any overage or shortfall.

See "Auction Commission Margin" under Part II, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations," for a complete discussion of the factors impacting auction commission margin, as well as a discussion of the overall financial performance of the Agency segment for the years ended December 31, 2016, 2015 and 2014. See Note 4 of Notes to Consolidated Financial Statements for additional information about auction and private sale receivables. See Note 19 of Notes to Consolidated Financial Statements for additional information about auction guarantees.

Sotheby's Financial Services

SFS is an art financing company that is uniquely positioned as a niche lender with the ability to tailor attractive financing packages for clients who wish to obtain immediate access to liquidity from their art assets. SFS deploys a combination of art expertise, skill in international law and finance, and access to capital to provide art collectors and dealers with financing secured by their works of art, allowing them to unlock the value in their collections. A considerable number of traditional lending sources offer conventional loans at a lower cost to borrowers than the average cost of loans offered by SFS and many traditional lenders offer borrowers a variety of integrated financial services such as wealth management. Few lenders, however, are willing to accept works of art as sole collateral for loans, as they do not have access to market information allowing them to effectively appraise collateral during the life of a loan, nor do they have the wherewithal to efficiently monetize loan collateral. Through a combination of our art expertise and skills in international law and finance, we have the ability to tailor attractive financing packages for clients who wish to obtain immediate access to liquidity from their art assets.

SFS makes term loans secured by artworks that are not presently intended for sale, allowing us to establish or enhance mutually beneficial relationships with art collectors. Term loans may also generate future auction or private sale consignments and/or purchases. In certain situations, term loans are made to refinance receivables generated by the auction and private sale purchases of our clients. Term loans normally have initial maturities of up to two years and typically carry a variable market rate of interest. To a much lesser extent, SFS also makes consignor advances secured by artworks that are contractually committed, in the near term, to be offered for sale through our Agency segment. Consignor advances allow sellers to receive funds upon consignment for an auction or private sale that will occur up to one year in the future and normally have short-term maturities.

Prior to 2014, the lending activities of SFS were funded primarily by the operating cash flows of our Agency segment, with the ability to supplement those cash flows with revolving credit facility borrowings. In January 2014, in order to reduce our cost of capital and enhance returns, we established a separate capital structure for SFS through which client loans are predominantly funded with borrowings drawn from a dedicated revolving credit facility. To a lesser extent, cash balances are also used to fund a portion of the loans made by SFS, as appropriate. The establishment of a dedicated revolving credit facility for SFS has allowed us to finance approximately 84% of the loan portfolio with debt as of December 31, 2016 and has contributed to a 42% increase in the client loan portfolio when compared to December 31, 2013 and a higher level of profitability for the segment.

4

The repayment of secured loans can be adversely impacted by a decline in the art market in general or in the value of the collateral, which is concentrated within certain collecting categories. In addition, in situations when there are competing claims on the collateral and/or when a borrower becomes subject to bankruptcy or insolvency laws, our ability to realize on our collateral may be limited or delayed.

We aim to mitigate the risk associated with potential devaluation in our collateral by targeting a 50% loan-to-value ("LTV") ratio (i.e., the principal loan amount divided by the low auction estimate of the collateral). However, loans may also be made with LTV ratios between 51% and 60%, and in rare circumstances, loans may be made at an initial LTV ratio higher than 60%. The dedicated revolving credit facility for SFS permits borrowings on the portion of any loan that does not exceed a 60% LTV ratio.

The LTV ratio of certain loans may increase above our 50% target due to a decrease in the low auction estimate of the collateral. The revaluation of term loan collateral is performed by our specialists on an annual basis or more frequently if there is a material change in the circumstances related to the loan, the value of the collateral, the disposal plans for the collateral, or if an event of default occurs.

See "Sotheby's Financial Services" under Part II, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations," for information on the financial performance of SFS for the years ended December 31, 2016, 2015 and 2014. See Note 4 of Notes to Consolidated Financial Statements for information about the SFS loan portfolio. See Note 9 of Notes to Consolidated Financial Statements for information about the SFS revolving credit facility.

The Art Market

The global art market is influenced over time by the overall strength and stability of the global economy, the financial markets of various countries, geopolitical conditions, and world events, all of which may impact the willingness of potential buyers and sellers to purchase and sell art. In addition, the amount and quality of art consigned for sale is influenced by other factors not within our control, and many consignments become available only as a result of the death or financial or marital difficulties of the owner (see "Converting Consignment Opportunities" below). These factors cause the supply and demand for works of art to be unpredictable and may lead to significant variability in our revenues from period to period.

Seasonality

The global art auction market has two principal selling seasons, which generally occur in the second and fourth quarters of the year. In the aggregate, second and fourth quarter Net Auction Sales1 represented 82%, 78%, and 79% of our total annual Net Auction Sales in 2016, 2015, and 2014, respectively, with auction commission revenues comprising approximately 75%, 75%, and 81% of our total revenues in each of these years. Accordingly, our financial results are seasonal, with peak revenues and operating income generally occurring in the second and fourth quarters. Consequently, first and third quarter results have historically reflected lower revenues when compared to the second and fourth quarters and, typically, a net loss due to the fixed nature of many of our operating expenses.

In quarterly reporting periods, the comparison of our results between reporting periods can be significantly influenced by a number of factors, such as changes in the timing of when certain auctions occur, the level of non-recurring single-owner auction sale events, the level and timing of individually negotiated private sale transactions, and changes in certain accounting estimates that rely upon forecasted results such as variable incentive and share-based compensation expense and our estimated annual effective income tax rate. Accordingly, when evaluating our performance, we believe that investors should also consider results for six and twelve month periods, which better reflect the business cycle of the global art auction market. See Note 29 of Notes to Consolidated Financial Statements for our quarterly results for the years ended December 31, 2016 and 2015.

__________

1 Represents the total hammer (sale) price of property sold at auction.

5

Competition

Artworks are sold primarily through the major auction houses, numerous art dealers, smaller auction houses, and also directly between private collectors. In recent years, a growing number of art dealers and private collectors now buy and sell artworks at art fairs such as the The European Fine Art Fair ("TEFAF"), Art Basel, and the Frieze art fairs.

Competition in the global art market is intense. A fundamental challenge facing any auctioneer or art dealer is the sourcing of high quality and valuable property for sale either as agent or as principal. Our primary competitor in the global art market is Christie's, a privately owned auction house. To a lesser extent, we also face competition from a variety of art dealers across all collecting categories, as well as smaller auction houses such as Bonhams and Phillips and certain regional auction houses. In the Chinese art market, we compete with Beijing Poly International Auction Co. Ltd., China Guardian Auctions Co. Ltd. and Beijing Hanhai Auction Co. Ltd.

In 2016, 2015, and 2014, Sotheby's and Christie's together totaled approximately $8.7 billion, $12.3 billion, and $12.9 billion, respectively, of Aggregate Auction Sales2, of which we accounted for $4.2 billion (49%), $5.9 billion (48%), and $6.1 billion (47%), respectively.

It is not possible to measure with any particular accuracy the entire global art market or to reach definitive conclusions regarding overall competition because privately owned art dealers and auction houses frequently do not publicly report annual totals for art sales, revenues, or profits, and the amounts reported may not be verifiable. However, the most recent TEFAF Art Market Report estimates that global art sales totaled approximately $64 billion in 2015 with private sales by dealers and other agents accounting for 53% of the market and public auctions accounting for 47%.

Converting Consignment Opportunities

The ability to source high quality and valuable property for consignment is highly dependent on the meaningful institutional and personal relationships we have with our clients, which sometimes span generations. As these relationships develop over time, we provide our clients with strategic guidance on collection identity, development and acquisition, and then help them navigate the financial, logistical and personal considerations involved with deciding to sell their valued artworks. A client's decision to sell their art may be part of their long-term financial planning process or could occur suddenly as a result of a sudden change in circumstances. Over time, the principal reasons that art collectors sell have become known as the "four D's": (i) Death; (ii) Debt; (iii) Divorce; and (iv) Discretion (e.g., change in collecting preferences, redecorating a residence, and market strength). These reasons each represent a potential opportunity for consignment, but the timing of when they may arise is unpredictable and not within our control. As a result, it is difficult to predict with any certainty the supply of high quality and valuable property available for consignment in advance of peak selling seasons.

The more valuable the property, the more likely it is that an owner looking to sell their artwork will consider more than one option and will solicit proposals from more than one potential purchaser or agent. Traditionally, the primary options available to a seller of art have been:

•Sale or consignment to an art dealer;

•Sale or consignment to an auction house;

•Private sale to a collector or museum; or

•Consignment to an internet based service for certain categories of property (in particular, collectibles).

____________

2 Represents the total hammer (sale) price of property sold at auction, plus buyer's premium.

6

A complex array of factors may influence a seller's decision to favor one of these options over the others, and may include any or all of the following considerations:

•The level and breadth of expertise of the art dealer or auction house with respect to the property;

•The extent of the prior relationship, if any, between the art dealer or auction house and its staff and the seller;

• | The reputation and historic level of achievement by the art dealer or auction house in attaining high sale prices in the property's specialized category; |

• | Recommendations by third parties consulted by the seller; |

• | The client's desire for privacy; |

• | The level of pre-sale estimates; |

• | The desirability of a public auction in order to achieve the maximum possible price; |

• | The amount of cash offered by an art dealer, auction house or other purchaser to purchase the property outright, which is greatly influenced by the amount and cost of capital resources available to such parties; |

• | The availability and terms of financial incentives offered by auction houses, including auction guarantees, short-term financing, and auction commission sharing arrangements; |

• | The commission charged by art dealers or auction houses to sell a work on consignment; |

• | The cost, style, and extent of pre-sale marketing and promotion to be undertaken by an art dealer or auction house; and |

• | The availability and extent of related services, such as tax or insurance appraisals. |

Regulation of the Art Market

Regulation of the art market varies from jurisdiction to jurisdiction. In many jurisdictions, we are subject to laws and regulations, including, but not limited to, import and export regulations, cultural property regulations, data protection and privacy laws, anti-money laundering laws, antitrust laws, copyright and resale royalty laws, laws and regulations involving sales, use, value-added and other indirect taxes, and regulations related to the use of real estate. In addition, we are subject to local auction regulations, such as New York City Auction Regulations Subchapter M of Title 6 §§ 2-121-2-125, et. seq. Such regulations currently do not impose a material impediment to our business, but do affect the art market generally. A material adverse change in such regulations, such as the American Royalties Too Act of 2014 introduced in the U.S. Congress, which would impose a 5% resale royalty (with a cap of $35,000) on sales of art through large auction houses, could affect our business. Additionally, export and import laws and cultural property ownership laws could affect the availability of certain kinds of property for sale at our principal auction locations, increase the cost of moving property to such locations, or expose us to legal claims or government inquiries. We have a Compliance Department which, amongst other activities, develops and updates compliance policies, and audits, monitors, and provides training to our employees on compliance with many of these laws and regulations.

Our Strategic Priorities

We are focused on four key strategic priorities: (i) the development and implementation of a compelling growth strategy; (ii) embracing technology more effectively, both internally and through client-facing products; (iii) the efficient allocation of capital; and (iv) the attraction, development, and retention of talent. Throughout 2016, we have made significant progress against each of these priorities.

In January 2016, we acquired AAP, a firm that provides a range of art-related services, in exchange for initial cash consideration of $50 million and earn-out consideration of $35 million. The purpose of this acquisition is to grow auction and private sale revenues by enhancing our relationships with art collectors and by improving our position in the fine art market, particularly in Impressionist, Modern and Contemporary Art. Also, as a result of this acquisition, we have added a new revenue stream by integrating AAP's existing art advisory business, providing a new avenue for growth. See Note 3 of Notes to Consolidated Financial Statements for additional information regarding the acquisition of AAP.

7

In July 2016, we acquired The Mei Moses Art Indices, which is now known as Sotheby's Mei Moses. Widely recognized as the preeminent measure of the state of the art market, the indices use repeat sales (i.e., the sale of the same object at different points in time) to track changes in value. Through this acquisition, we have unique access to an analytic tool and data that provide objective and verifiable information to complement the world-class expertise of our art specialists.

In November 2016, we acquired Orion Analytical, a materials analysis and consulting firm that utilizes state-of-the-art technical and scientific methods in the examination of art, cultural property, wine and other objects. With this acquisition, we have established a scientific research department led by Orion Analytical's founder, Jamie Martin, the leading scientist in the field of materials analysis, enhancing our world-class expertise and provenance research capabilities. Bringing scientific expertise in-house mirrors a trend seen in the world’s great museums and distinguishes us in the marketplace as we help make the art market a safer place to transact.

In addition to these acquisitions, we have also appointed several new executives and client service professionals, enhancing our business development and private sale capabilities, as well as our advisory business.

In the world of technology, in 2016, we launched and refined a new generation of mobile applications across several major platforms including iPhone, iPad, Apple TV, Android, Amazon Fire TV, and Samsung Smart TV. These applications enable our clients to live-stream our auctions, review auction results and experience audio tours of our exhibitions. Additionally, throughout the year, digital participation in our auctions continued to grow. For the year ended December 31, 2016, online sales, which includes sales to on-line bidders during our live auctions, as well as on-line only auctions, totaled $155 million, a 20% increase when compared to the prior year.

Lastly, we have continued to refine our capital allocation framework to facilitate the efficient use of capital for our shareholders. This framework takes a comprehensive look at the totality of our capital needs, including the liquidity required to support our recurring business and working capital needs, capital required for the pursuit of growth opportunities, and an appropriate level of capital reserved to mitigate the risk of a cyclical downturn in the global art market. Importantly, this framework also considers the risks associated with our use of auction guarantees and their potential impact on our liquidity. Additionally, in conjunction with our capital allocation framework, we have stress tested our business model under the different market conditions of the last decade in order to determine cash-basis break-even levels at significantly lower levels of Net Auction Sales.

Guided by this framework, in 2016, we have returned approximately $360 million to shareholders through our common stock repurchase program. To date, over a three-year period, we have repurchased 17.4 million shares of our common stock, returning $510 million to our shareholders and reducing our outstanding share count by 23%. See Note 14 of Notes to Consolidated Financial Statements for additional information on our share repurchase program.

Brand Licensing Activities

Prior to 2004, we were engaged in the marketing and brokerage of luxury residential real estate sales through Sotheby's International Realty ("SIR"). In 2004, we sold SIR to a subsidiary of Realogy Corporation ("Realogy"), formerly Cendant Corporation. In conjunction with the sale, we entered into an agreement with Realogy to license the SIR trademark and certain related trademarks for an initial 50-year term with a 50-year renewal option (the "Realogy License Agreement"). The Realogy License Agreement is applicable worldwide.

The Realogy License Agreement provides for an ongoing license fee during its term based on the volume of commerce transacted under the licensed trademarks. In 2016, 2015, and 2014, we earned $9.1 million, $8.1 million, and $7.2 million, respectively, in license fee revenue related to the Realogy License Agreement.

We also license the Sotheby's name for use in connection with the art auction business in Australia, and art education services in the U.S. and the U.K. We will consider additional opportunities to license the Sotheby's brand in businesses where appropriate.

Financial and Geographical Information about Segments

See Note 2 of Notes to Consolidated Financial Statements for financial and geographical information about Sotheby's segments.

8

Employees

As of December 31, 2016, we have 1,617 employees, with 652 located in the Americas, 524 in the U.K., 231 in Continental Europe, and 210 in Asia. We regard our relations with our employees as good. The table below provides a breakdown of Sotheby's employees by segment as of December 31, 2016 and 2015.

December 31, | 2016 | 2015 | ||||

Agency | 1,373 | 1,368 | ||||

Finance | 11 | 11 | ||||

All Other | 233 | 217 | ||||

Total | 1,617 | 1,596 | ||||

Employees classified within "All Other" principally relate to our central corporate and information technology departments.

Website Address

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, are available free of charge on the Investor Relations page of our website, www.sothebys.com. These reports are made available on the same day that they are electronically filed with or furnished to the Securities and Exchange Commission (the "SEC"). Information available on the website is not incorporated by reference and is not deemed to be part of this Form 10-K.

ITEM 1A: RISK FACTORS

Before you make an investment decision with respect to our common stock, you should carefully consider all of the information included in this Form 10-K and our subsequent periodic filings with the SEC. In particular, you should carefully consider the risk factors described below and the risks and uncertainties related to "Forward Looking Statements," any of which could have a material adverse effect on our business, results of operations, financial condition and the actual outcome of matters as to which forward looking statements are made in this annual report. The following risk factors, which are not ranked in any particular order, should be read in conjunction with the balance of this annual report, including the Consolidated Financial Statements and related notes.

The global economy, the financial markets and political conditions of various countries may negatively affect our business and clients, as well as the supply of and demand for works of art.

The global art market is influenced over time by the overall strength and stability of the global economy and the financial markets of various countries, although this correlation may not be immediately evident. In addition, global political conditions and world events may affect our business through their effect on the economies of various countries, as well as on the willingness of potential buyers and sellers to purchase and sell art in the wake of economic uncertainty. Our business can be particularly influenced by the economies, financial markets and political conditions of the U.S., the U.K., China, and the other major countries or territories of Europe and Asia (including the Middle East). Accordingly, weakness in those economies and financial markets can adversely affect the supply of and demand for works of art and our business. Furthermore, global political conditions may also influence the enactment of legislation that could adversely impact our business.

Competition in the global art market is intense and may adversely impact our business, results of operations, and financial condition.

We compete with other auctioneers and art dealers to obtain valuable consignments to offer for sale either at auction or through private sale. The level of competition is intense and can adversely impact our ability to obtain valuable consignments for sale, as well as the commission margins achieved on such consignments.

We cannot be assured of the amount and quality of property consigned for sale, which may cause significant variability in our results of operations.

The amount and quality of property consigned for sale is influenced by a number of factors not within our control. Many major consignments, and specifically single-owner sale consignments, become available only as a result of the death or financial or marital difficulties of the owner, all of which are unpredictable and may cause significant variability in our results of operations from period to period.

9

The demand for art is unpredictable, which may cause significant variability in our results of operations.

The demand for art is influenced not only by overall economic conditions, but also by changing trends in the art market as to which collecting categories and artists are most sought after and by the collecting preferences of individual collectors. These conditions and trends are difficult to predict and may adversely impact our ability to obtain and sell consigned property, potentially causing significant variability in our results of operations from period to period.

We rely on a select group of clients who make a significant contribution to our revenues, profitability, and operating cash flows.

Sotheby's is a global art business that caters to a select group of the world's most discerning art collectors. Accordingly, our revenues, profitability, and operating cash flows are highly dependent upon our ability to develop and maintain relationships with these clients, as well as their financial strength.

Tax matters may cause significant variability in our results of operations.

We operate in many tax jurisdictions throughout the world, and the provision for income taxes involves a significant amount of judgment regarding the interpretation of relevant facts and laws in these jurisdictions. Our effective income tax rate and recorded tax balances can significantly change between periods due to a number of complex factors including, but not limited to: (i) our projected levels of taxable income; (ii) changes in the jurisdictional mix of our forecasted and/or actual pre-tax income; (iii) increases or decreases to valuation allowances recorded against deferred tax assets; (iv) tax audits conducted by various tax authorities; (v) adjustments to income taxes upon the finalization of income tax returns; (vi) the ability to claim foreign tax credits; (vii) estimates of cash held in the U.S. and in foreign jurisdictions; (viii) our working capital and investment needs; (ix) the repatriation of foreign earnings for which we have not previously provided income taxes; and (x) tax planning strategies. Additionally, our effective income tax rate could be impacted by future changes in applicable laws, including the European Commission’s investigations on illegal state aid and the Organisation for Economic Co-operation and Development project on Base Erosion and Profit Shifting, which may result in changes to long-standing tax principles, as well as the uncertainty of the timing and nature of any comprehensive tax reform in the U.S., which could involve, among other things, reductions in the corporate income tax rate, the reduction or elimination of the deferral of U.S. income tax on our unrepatriated foreign earnings, and the reduction or elimination of certain tax credits or deductions.

Our clients reside in various tax jurisdictions throughout the world. To the extent that there are changes to tax laws or tax reporting obligations in any of these jurisdictions, such changes could adversely impact the ability and/or willingness of our clients to purchase or sell works of art. Additionally, we are subject to laws and regulations in many countries involving sales, use, value-added and other indirect taxes which are assessed by various governmental authorities and imposed on certain revenue-producing transactions between us and our clients. The application of these laws and regulations to our unique business and global client base, and the estimation of any related liabilities is complex and requires a significant amount of judgment. We are generally not responsible for these indirect tax liabilities unless we fail to collect the correct amount of sales, use, value-added, or other indirect taxes. Failure to collect the correct amount of indirect tax on a transaction may expose us to claims from tax authorities.

The loss of key personnel could adversely impact our ability to compete.

We are largely a service business in which the ability of our employees to develop and maintain relationships with potential sellers and buyers of works of art is essential to our success. Moreover, our business is unique, making it important to retain key specialists and members of management. Accordingly, our business is highly dependent upon our success in attracting and retaining qualified personnel.

Our business plans and strategic initiatives may not succeed.

Our future operating results are dependent, in part, on our ability to successfully implement our business plans and strategic initiatives. The inability to successfully implement our business plans and strategic initiatives could result in, among other things, the loss of clients and the impairment of assets. Also, our short-term operating results and liquidity could be unfavorably impacted by the implementation of our business plans and strategic initiatives. See "Our Strategic Priorities" under Part I, Item 1, "Description of Business."

10

Government laws and regulations may restrict or limit our business or impact the value of our real estate assets.

Many of our activities are subject to laws and regulations including, but not limited to, import and export regulations, cultural property regulations, data protection and privacy laws, anti-money laundering laws, antitrust laws, copyright and resale royalty laws, laws and regulations involving sales, use, value-added and other indirect taxes, and regulations related to the use of real estate. In addition, we are subject to local auction regulations, such as New York City Auction Regulations Subchapter M of Title 6 § 2-121-2-125, et. seq. Such regulations currently do not impose a material impediment to our business, but do affect the art market generally. A material adverse change in such regulations, such as the American Royalties Too Act of 2014 introduced in the U.S. Congress, which would impose a 5% resale royalty (with a cap of $35,000) on sales of art through large auction houses, could affect our business. Additionally, export and import laws and cultural property ownership laws could affect the availability of certain kinds of property for sale at our principal auction locations, increase the cost of moving property to such locations, or expose us to legal claims or government inquiries.

Our ability to collect auction receivables may be adversely impacted by buyers from emerging markets, as well as by the banking and foreign currency laws and regulations and judicial systems of the countries in which we operate and in which our clients reside.

We operate in 40 countries and have a worldwide client base that has grown in recent years due in part to an increase in the activity of buyers from emerging markets, in particular, China. The collection of auction receivables related to buyers from emerging markets may be adversely impacted by the buyer's lack of familiarity with the auction process and the buyer's financial condition. Our ability to collect auction receivables may also be adversely impacted by the banking and foreign currency laws and regulations regarding the movement of funds out of certain countries, as well as by our ability to enforce our rights as a creditor in jurisdictions where the applicable laws and regulations may be less defined, particularly in emerging markets.

Our capital allocation and financial policies may impact our liquidity, financial condition, market capitalization and business, and our ongoing ability to return capital to shareholders (and the size and timing of such return) is subject to ongoing business variables.

The actions taken in reference to our capital allocation and financial policies may impact our current and future liquidity, financial condition, market capitalization, and business. In addition, the amount and timing of any potential return of capital to shareholders depends on various factors, including the amount of excess cash generated by our business in the future, the ability to continue to finance the SFS loan portfolio with debt, the business initiatives contemplated and implemented by management, and the amount of capital that may be required to support our future liquidity needs, among other factors.

Foreign currency exchange rate movements can significantly impact our results of operations and financial condition.

We have operations throughout the world. Approximately 55% of our total revenues were earned outside of the U.S. in 2016, including 24% of our total revenues earned in the U.K. Additionally, we have significant assets and liabilities denominated in the Pound Sterling, the Euro, and the Swiss Franc. Revenues, expenses, gains, and losses recorded in foreign currencies are translated using the monthly average exchange rates prevailing during the period in which they are recognized. Assets and liabilities recorded in foreign currencies are translated at the exchange rate on the balance sheet date. Accordingly, fluctuations in foreign currency exchange rates, particularly for the Pound Sterling, the Euro, and the Swiss Franc, can significantly impact our results of operations and financial condition.

11

Subject to management approval under our internal corporate governance policy, we may pay the net sale proceeds to the consignor before payment is collected from the buyer and/or we may allow the buyer to take possession of purchased property before making payment. In these situations, we are exposed to losses in the event the buyer does not make payment.

Under the standard terms and conditions of our auction and private sales, we are not obligated to pay the consignor for property that has not been paid for by the buyer. However, in certain instances and subject to management approval under our internal corporate governance policy, we may pay the net sale proceeds to the consignor before payment is collected from the buyer while we retain possession of the property. In these situations, if the buyer does not make payment, we take title to the property, but could be exposed to losses if the value of the property subsequently declines. In certain other situations and subject to management approval under our internal corporate governance policy, we may allow the buyer to take possession of the purchased property before making payment. In these situations, we are liable to the seller for the net sale proceeds whether or not the buyer makes payment and would incur a loss in the event of buyer default. See Note 4 of Notes to Consolidated Financial Statements for information about auction and private sale receivables.

We could be exposed to losses in the event of title or authenticity claims.

The assessment of property offered for auction or private sale can involve potential claims regarding title and authenticity. The items we sell may be subject to statutory warranties as to title and to a limited guarantee as to authenticity under the Conditions of Sale and Terms of Guarantee that are published in our auction sale catalogues and the terms stated in, and the laws applicable to, agreements governing private sale transactions. Our authentication of the items we offer is based on scholarship and research, but necessarily requires a degree of judgment from our specialists. In the event of a title or authenticity claim against us, we may have recourse against the seller of the property and may have the benefit of insurance, but a claim could nevertheless expose us to losses and to reputational risk.

Auction guarantees create the risk of loss resulting from the potential inaccurate valuation of art.

The market for fine art, decorative art, and jewelry is not a highly liquid trading market and, as a result, the valuation of these items is inherently subjective. Accordingly, we are at risk with respect to our ability to estimate the likely selling prices of property offered with auction guarantees. If our judgments about the likely selling prices of property offered with auction guarantees prove to be inaccurate, there could be a significant adverse impact on our results, financial condition, and liquidity. See Note 19 of Notes to Consolidated Financial Statements for information related to auction guarantees.

We could be exposed to losses in the event of nonperformance by our counterparties in auction guarantee risk and reward sharing arrangements.

In certain situations, we reduce our financial exposure under auction guarantees through risk and reward sharing arrangements. Our counterparties to these risk and reward sharing arrangements are typically major international art dealers or major art collectors. We could be exposed to losses in the event any of these counterparties do not perform according to the terms of these contractual arrangements. See Note 19 of Notes to Consolidated Financial Statements for information related to auction guarantees.

Demand for art-related financing is unpredictable, which may cause variability in the operating results of SFS.

Our business is, in part, dependent on the demand for art-related financing, which can be significantly influenced by overall economic conditions and by the often unpredictable financial requirements of owners of major art collections. Accordingly, the operating results of SFS are subject to variability from period to period.

Our ability to realize proceeds from the sale of collateral for SFS loans may be delayed or limited.

In situations when there are competing claims on the collateral for SFS loans and/or when a borrower becomes subject to bankruptcy or insolvency laws, our ability to realize proceeds from the sale of its collateral may be limited or delayed.

12

The value of art held in inventory and art pledged as collateral for SFS loans is subjective and often fluctuates, exposing us to losses and significant variability in our results of operations.

The art market is not a highly liquid trading market. As a result, the valuation of art is inherently subjective and its realizable value often fluctuates over time. Accordingly, we are at risk both as to the realizable value of the property held in inventory and as to the realizable value of the property pledged as collateral for SFS loans. If there is evidence that the estimated realizable value of a specific item held in inventory is less than its carrying value, a loss is recorded to reflect our revised estimate of realizable value. In addition, if the estimated realizable value of the property pledged as collateral for an SFS loan is less than the corresponding loan balance, we assess whether it is necessary to record a loss to reduce the carrying value of the loan, after taking into account the ability of the borrower to repay any shortfall between the value of the collateral and the amount of the loan. In estimating the realizable value of art held in inventory and art pledged as collateral for SFS loans, we consider the following complex array of factors: (i) whether the property is expected to be offered at auction or sold privately, and the timing of any such sale; (ii) the supply and demand for the property, taking into account current art market conditions, as well as changing trends as to which collecting categories and artists are most sought after; (iii) recent sale prices achieved for comparable items within a particular collecting category and/or by a particular artist, (iv) the state of the global economy and financial markets; and (v) our intent and ability to hold the property in order to maximize its realizable value. Due to the inherent subjectivity involved in estimating the realizable value of art held in inventory and art pledged as collateral for SFS loans, our estimates of realizable value may prove, with the benefit of hindsight, to be different than the amount ultimately realized upon sale. Accordingly, changes in the valuation of art held in inventory and art pledged as collateral for SFS loans expose us to significant variability in our results of operations from period to period.

The low rate of historic losses on the SFS loan portfolio may not be indicative of future loan loss experience.

We have historically incurred minimal losses on the SFS loan portfolio. However, despite our stringent loan underwriting standards, our previous loan loss experience may not be indicative of the future performance of the loan portfolio.

The collateral supporting the SFS loan portfolio is concentrated within certain collecting categories. A material decline in these markets could impair our ability to collect the principal and interest owed on certain loans and could require repayments of borrowings on such affected loans under our revolving credit facility.

The collateral supporting the SFS loan portfolio is concentrated within certain collecting categories. Although we believe the SFS loan portfolio is sufficiently collateralized due to its current aggregate loan-to-value ratio of 48%, a material decline in these markets could impair our ability to collect the principal and interest owed on certain loans. Additionally, the eligibility of individual SFS loans included in the borrowing base of our revolving credit facility requires a minimum loan-to-value ratio of 60%. A material decline in the value of SFS loan collateral could result in an increase in the loan-to-value ratio above 60% for individual loans and could require repayment of a portion of the borrowings associated with such loans.

We could be exposed to losses and/or reputational harm as a result of various claims and lawsuits incidental to the ordinary course of our business.

We become involved in various legal proceedings, lawsuits, and other claims incidental to the ordinary course of our business. We are required to assess the likelihood of any adverse judgments or outcomes in these matters, as well as potential ranges of probable or reasonably possible losses. A determination of the amount of losses, if any, to be recorded or disclosed as a result of these contingencies is based on a careful analysis of each individual exposure with, in some cases, the assistance of outside legal counsel. The amount of losses recorded or disclosed for such contingencies may change in the future due to new developments in each matter or a change in settlement strategy.

We could be exposed to reputational harm as a result of wrongful actions by certain third parties.

We are involved in various business arrangements and ventures with unaffiliated third parties. Wrongful actions by such parties could harm our brand and reputation.

13

A breach of the security measures protecting our global network of information systems and those of certain third-party service providers utilized by Sotheby's could adversely impact our operations, reputation and brand.

The protection of client, employee and company data is extremely important to us. The regulatory environment surrounding information security and privacy is becoming increasingly demanding and frequently changing in the jurisdictions in which we do business. Clients and employees have expectations that we will protect their information from cyber-attacks and other security breaches. We have implemented systems and processes that are designed to protect personal and company information and to prevent data losses, however, these measures cannot provide absolute security, and our systems may be vulnerable to cyber-security breaches such as viruses, hacking, and similar disruptions from unauthorized intrusions. In addition, we are dependent on a global network of information systems to conduct our business and are committed to maintaining a strong infrastructure to secure these systems. As part of our information systems infrastructure, we rely increasingly upon third-party service providers to perform services related to our live auction bidding platform, retail wine and other e-commerce, video broadcasting, website content distribution, marketing, and to store, process and transmit information including client, employee and company information. Any failure on our part or by these third-party service providers to maintain the security of our confidential data and our client and employee personal information could result in business disruption, damage to reputation, financial obligations, lawsuits, sizable fines and costs, and loss of employee and client confidence in Sotheby's, and thus could have a material adverse impact on our business and financial condition, and adversely affect our results of operations. A significant security breach could require future expenditures to implement additional security measures to protect against new privacy threats or to comply with state, federal and international laws aimed at addressing those threats.

Due to the nature of our business, valuable works of art are exhibited and stored at our facilities around the world. Such works of art could be subject to damage or theft, which could have a material adverse effect on our operations, reputation and brand.

Valuable works of art are exhibited and stored at our facilities around the world. Although we maintain state of the art security measures at our premises, valuable artworks may be subject to damage or theft. The damage or theft of valuable property despite these security measures could have a material adverse impact on our business and reputation.

Insurance coverage for artwork may become more difficult to obtain or the terms of such coverage may become less favorable, exposing us to losses resulting from the damage or loss of artwork in our possession.

We maintain insurance coverage for the works of art we own, works of art consigned by clients, and all other property that may be in our custody, which are exhibited and stored at our facilities around the world. An inability to adequately insure such works of art due to limited capacity of the global art insurance market, or the inability to secure coverage on acceptable terms, could, in the future, have a material adverse impact on our business, results of operations, and financial condition.

Our business continuity plans may not be effective in addressing the impact of unexpected events that could impact our business.

Our inability to successfully implement our business continuity plans in the wake of an unexpected event, such as an act of God or a terrorist attack occurring in or near one of our major selling and/or sourcing offices and/or any other unexpected event, could disrupt our ability to operate and adversely impact our operations.

Future costs and obligations related to our U.K. Pension Plan are dependent on unpredictable factors, which may cause significant variability in our employee benefit costs.

Future costs and obligations related to our defined benefit pension plan in the U.K. are heavily influenced by changes in interest rates, investment performance in the debt and equity markets, changes in statutory requirements in the U.K., and actuarial assumptions, each of which is unpredictable and may cause significant variability in our employee benefit costs. See Note 8 of Notes to Consolidated Financial Statements for information related to our defined benefit pension plan in the U.K.

ITEM 1B: UNRESOLVED STAFF COMMENTS

None.

14

ITEM 2: PROPERTIES

We are headquartered at 1334 York Avenue in New York (the "York Property"). The York Property includes land and approximately 489,000 square feet of building area. The York Property is home to our sole North American auction salesroom and principal North American exhibition space, including S|2, our private sale exhibition gallery. The York Property is also home to the U.S. operations of SFS, as well as our corporate offices. The York Property is subject to a seven-year, $325 million mortgage that matures on July 1, 2022 (the "York Property Mortgage"). See Note 9 of Notes to Consolidated Financial Statements for additional information on the York Property Mortgage.

Our U.K. operations are based in London on New Bond Street, where the main salesrooms, exhibition spaces, and administrative offices are located. As part of a multi-year refurbishment initiative, we have invested approximately $14 million in New Bond Street over the past 5 years to enhance exhibition space, construct an S|2 private sales gallery, and establish a Sotheby's Diamonds salon. Almost the entire New Bond Street complex is either owned or held under various long-term lease, freehold, and virtual freehold arrangements. (Freeholds are occupancy arrangements in which we own the property outright. Virtual freeholds are occupancy arrangements in which there is a 2,000-year lease with nominal yearly rent payments that cannot be escalated during the term of the lease.) We also lease 52,000 square feet for a warehouse facility in Greenford, West London under a lease that expires in 2030.

We also lease space primarily for Agency segment operations in various locations throughout North America, South America, Continental Europe and Asia, including sales centers in Geneva and Zurich, Switzerland; Milan, Italy; Paris, France; and Hong Kong, China.

We believe our worldwide premises are adequate for the current conduct of our business. We have recently completed a review of our New York real estate holdings and concluded that we will continue to occupy the York Property for the foreseeable future. We are also continuing to evaluate our real estate holdings in London, taking into account the strategic and operating requirements for this location. See statement on Forward Looking Statements.

ITEM 3: LEGAL PROCEEDINGS

See Note 18 of Notes to Consolidated Financial Statements for information related to legal proceedings.

ITEM 4: MINE SAFETY DISCLOSURES

Not applicable.

15

PART II

ITEM 5: MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES

Market and Stockholders

Our common stock is traded on the NYSE under the symbol BID. As of February 13, 2017, there were 838 registered holders of record of our common stock. The quarterly price ranges for our common stock for the years ended December 31, 2016 and 2015 were as follows:

2016 | 2015 | |||||||||||||||

High | Low | High | Low | |||||||||||||

Quarter Ended | ||||||||||||||||

March 31 | $ | 27.49 | $ | 18.86 | $ | 45.41 | $ | 39.70 | ||||||||

June 30 | $ | 32.25 | $ | 24.96 | $ | 47.28 | $ | 40.47 | ||||||||

September 30 | $ | 41.23 | $ | 26.20 | $ | 45.74 | $ | 31.46 | ||||||||

December 31 | $ | 42.66 | $ | 33.85 | $ | 35.40 | $ | 25.49 | ||||||||

Dividends and Common Stock Repurchases

See Note 14 of Notes to Consolidated Financial Statements for detailed information regarding dividends and common stock repurchases. The following table provides information regarding our monthly common stock repurchases during the quarter ended December 31, 2016:

Period | Total number of shares purchased | Average price paid per share | Total number of shares purchased as part of publicly announced plans or programs | Approximate dollar value of shares that may yet be purchased under publicly announced plans or programs (a) | |||||||||||

October 2016 | 2,050,000 | $ | 36.00 | 2,050,000 | $ | 40,226,234 | |||||||||

November 2016 | — | $ | — | — | $ | 40,226,234 | |||||||||

December 2016 | — | $ | — | — | $ | 40,226,234 | |||||||||

Total | 2,050,000 | $ | 36.00 | 2,050,000 | |||||||||||

(a) Represents the dollar value of shares that were available to be repurchased under our publicly announced share repurchase program at the end of each respective monthly period.

16

Equity Compensation Plans

The following table provides information as of December 31, 2016 related to shares of common stock that may be issued under our existing equity compensation plans, including the Stock Option Plan, Restricted Stock Unit Plan, and Directors Stock Plan, each of which are described in Note 21 of Notes to Consolidated Financial Statements (in thousands, except per share data):

(A) | (B) | (C) | ||||||||

Plan Category | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (1) | Weighted Average Exercise Price of Outstanding Options, Warrants and Rights (2) | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (3) | |||||||

Equity compensation plans approved by shareholders | 2,158 | $ | 22.11 | 2,877 | ||||||

Equity compensation plans not approved by shareholders | 127 | $ | — | — | ||||||

Total | 2,285 | $ | 22.11 | 2,877 | ||||||

_____________________________________________________________

(1) | The number of securities that may be issued under equity compensation plans approved by shareholders includes 2,108,208 shares awarded under our Restricted Stock Unit Plan for which vesting is contingent upon future employee service and/or the achievement of certain profitability targets, as well as 50,000 vested and outstanding stock options. The number of securities that may be issued under equity compensation plans not approved by shareholders consists solely of inducement awards granted to Thomas S. Smith, Jr., our President and Chief Executive Officer ("CEO"), upon the commencement of his employment on March 31, 2015. As of December 31, 2016, these awards consist of 79,804 unvested shares of restricted stock and 47,070 fully-vested restricted stock units. The inducement awards granted to Mr. Smith were not issued pursuant to our Restricted Stock Unit Plan and have not been registered with the SEC. See Note 21 of Notes to Consolidated Financial Statements for a description of these inducement awards. |

(2) | The weighted-average exercise price includes the exercise price of outstanding stock options, but does not take into account 2,108,208 shares awarded under our Restricted Stock Unit Plan or the 79,804 unvested restricted stock shares and 47,070 fully-vested restricted stock units granted to Mr. Smith upon the commencement of his employment as our President and CEO on March 31, 2015. |

(3) | Includes 2,635,874 shares available for future issuance under our Restricted Stock Unit Plan, 104,100 shares available for issuance under our Stock Option Plan, and 136,645 shares available for issuance under our Directors Stock Plan. |

17

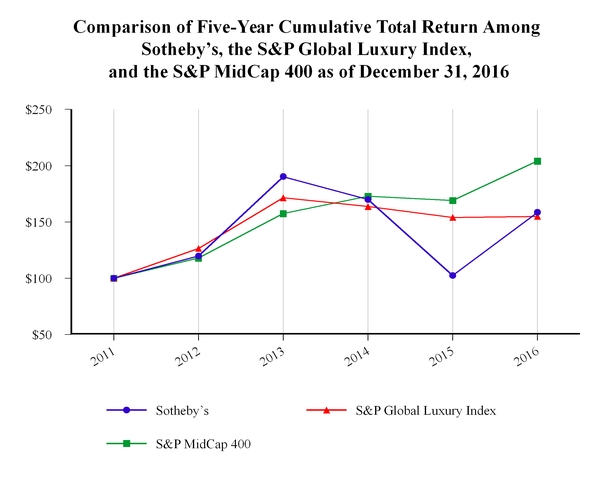

Performance Graph

The following graph compares the cumulative total shareholder return on our common stock for the five-year period from December 31, 2011 to December 31, 2016 with the cumulative return of the Standard & Poor's Global Luxury Index (the "S&P Global Luxury Index"), which is a line-of-business index largely composed of companies whose products and services appeal to a segment of the population consistent with our clients, and the Standard & Poor's MidCap 400 Stock Index (the"S&P MidCap 400").

The graph reflects an investment of $100 in our common stock, the S&P Global Luxury Index, and the S&P MidCap 400 on December 31, 2011, and a reinvestment of dividends at the average of the closing stock prices at the beginning and end of each quarter.

12/31/11 | 12/31/12 | 12/31/13 | 12/31/14 | 12/31/15 | 12/31/16 | |||||||||||||||||||

Sotheby's | $ | 100.00 | $ | 119.69 | $ | 190.20 | $ | 169.81 | $ | 102.39 | $ | 158.43 | ||||||||||||

S&P Global Luxury Index | $ | 100.00 | $ | 126.42 | $ | 171.42 | $ | 163.60 | $ | 153.91 | $ | 154.89 | ||||||||||||

S&P MidCap 400 | $ | 100.00 | $ | 117.87 | $ | 157.38 | $ | 172.74 | $ | 169.01 | $ | 204.02 | ||||||||||||

18

ITEM 6: SELECTED FINANCIAL DATA

Year ended December 31, | 2016 | 2015 | 2014 | 2013 | 2012 | |||||||||||||||

(Thousands of dollars, except per share data) | ||||||||||||||||||||

Income Statement Data: | ||||||||||||||||||||

Revenues: | ||||||||||||||||||||

Agency commissions and fees | $ | 671,833 | $ | 791,920 | $ | 825,126 | $ | 793,639 | $ | 717,231 | ||||||||||

Inventory sales | 62,863 | 108,699 | 69,958 | 30,638 | 26,180 | |||||||||||||||

Finance | 52,716 | 50,489 | 33,013 | 21,277 | 17,707 | |||||||||||||||

Other | 17,965 | 10,386 | 9,956 | 8,124 | 7,374 | |||||||||||||||

Total revenues | $ | 805,377 | $ | 961,494 | $ | 938,053 | $ | 853,678 | $ | 768,492 | ||||||||||

Net interest expense (a) | $ | (29,016 | ) | $ | (30,969 | ) | $ | (33,306 | ) | $ | (39,911 | ) | $ | (42,879 | ) | |||||

Net income attributable to Sotheby's | $ | 74,112 | $ | 43,727 | $ | 117,795 | $ | 130,006 | $ | 108,292 | ||||||||||

Basic earnings per share | $ | 1.28 | $ | 0.64 | $ | 1.69 | $ | 1.90 | $ | 1.59 | ||||||||||

Diluted earnings per share | $ | 1.27 | $ | 0.63 | $ | 1.68 | $ | 1.88 | $ | 1.57 | ||||||||||

Cash dividends declared per common share | $ | — | $ | 0.40 | $ | 4.74 | $ | 0.20 | $ | 0.52 | ||||||||||

Statistical Metrics: | ||||||||||||||||||||

Net Auction Sales (b) | $ | 3,556,090 | $ | 5,016,738 | $ | 5,151,419 | $ | 4,338,948 | $ | 3,809,656 | ||||||||||

Auction Commission Margin (c) | 17.1 | % | 14.3 | % | 14.7 | % | 15.9 | % | 16.3 | % | ||||||||||

Private Sales (d) | $ | 583,410 | $ | 673,119 | $ | 624,511 | $ | 1,179,038 | $ | 906,510 | ||||||||||

Non-GAAP Financial Measures: | ||||||||||||||||||||

Adjusted Net Income (e) | $ | 99,616 | $ | 143,131 | $ | 142,398 | $ | 139,461 | $ | 116,553 | ||||||||||

Adjusted Diluted Earnings Per Share (e) | $ | 1.71 | $ | 2.07 | $ | 2.03 | $ | 2.02 | $ | 1.69 | ||||||||||

EBITDA (e) | $ | 168,640 | $ | 241,102 | $ | 256,776 | $ | 245,066 | $ | 220,640 | ||||||||||

Adjusted EBITDA (e) | $ | 210,384 | $ | 294,551 | $ | 298,613 | $ | 246,438 | $ | 235,658 | ||||||||||

Balance Sheet Data: | ||||||||||||||||||||

Working capital (f) | $ | 525,878 | $ | 913,166 | $ | 610,315 | $ | 829,784 | $ | 706,244 | ||||||||||

Total assets (f) | $ | 2,504,426 | $ | 3,263,313 | $ | 3,129,796 | $ | 2,887,480 | $ | 2,567,360 | ||||||||||

Average Loan Portfolio (g) | $ | 646,135 | $ | 732,814 | $ | 583,304 | $ | 433,619 | $ | 335,898 | ||||||||||

Average Credit Facility Borrowings (h) | $ | 534,433 | $ | 541,004 | $ | 306,448 | $ | — | $ | — | ||||||||||

Long-term debt, net (f) | $ | 598,941 | $ | 604,961 | $ | 295,163 | $ | 509,480 | $ | 508,337 | ||||||||||

Total equity | $ | 505,602 | $ | 806,704 | $ | 878,238 | $ | 1,139,665 | $ | 992,826 | ||||||||||

Legend: | |

(a) | Represents interest expense less interest income. |

(b) | Represents the total hammer (sale) price of property sold at auction. |

(c) | Represents total auction commission revenues as a percentage of Net Auction Sales. |

(d) | Represents the total purchase price of property sold in private sales that we have brokered, including our commissions. |

(e) | See "Non-GAAP Financial Measures" under Part II, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations," for a description of this non-GAAP financial measure and a reconciliation to the most comparable GAAP amount. |

(f) | See Note 1 of Notes to Consolidated Financial Statements for information regarding the retrospective adoption of an accounting standard in 2016 that requires unamortized debt issuance costs to be included as a direct deduction from the related debt liability on the balance sheet. Prior period balances in this table have been adjusted to conform to this new presentation. |

(g) | Represents the average SFS loan portfolio outstanding during the period. |

(h) | Represents average borrowings outstanding during the period under the revolving credit facility for SFS. |

19

ITEM 7: | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF |

OPERATIONS

Management's Discussion and Analysis of Financial Condition and Results of Operations (or, "MD&A") should be read in conjunction with Note 2 ("Segment Reporting") of Notes to Consolidated Financial Statements.

Critical Accounting Estimates

The preparation of financial statements and related disclosures in accordance with GAAP requires management to make judgments, assumptions, and estimates that affect the amounts reported in our Consolidated Financial Statements and accompanying notes. Actual results may ultimately differ from our original estimates, as future events and circumstances sometimes do not develop as expected. Note 1 of Notes to Consolidated Financial Statements describes the significant accounting policies and methods used in the preparation of our Consolidated Financial Statements. In addition, we believe that the following are our most critical accounting estimates, which are not ranked in any particular order, that may affect our reported financial condition and/or results of operations.

(1) | Valuation of Inventory and Loan Collateral—The art market is not a highly liquid trading market. As a result, the valuation of art is inherently subjective and the realizable value of art often fluctuates over time. If there is evidence that the estimated realizable value of a specific item held in inventory is less than its carrying value, we record a loss to reflect our revised estimate of realizable value. If the estimated realizable value of the property pledged as collateral for an SFS loan is less than the corresponding loan balance, we assess whether it is necessary to record a loss to reduce the carrying value of the loan, after taking into account the ability of the borrower to repay any shortfall between the value of the collateral and the amount of the loan. |

In estimating the realizable value of art held in inventory and art pledged as collateral for SFS loans, we consider the following complex array of factors: (i) whether the property is expected to be offered at auction or sold privately, and the timing of any such sale; (ii) the supply and demand for the property, taking into account current art market conditions, as well as changing trends as to which collecting categories and artists are most sought after; (iii) recent sale prices achieved for comparable items within a particular collecting category and/or by a particular artist; (iv) the state of the global economy and financial markets; and (v) our intent and ability to hold the property in order to maximize its realizable value.

Due to the inherent subjectivity involved in estimating the realizable value of art held in inventory and art pledged as collateral for SFS loans, our estimates of realizable value may prove, with the benefit of hindsight, to be different than the amount ultimately realized upon sale.

See Note 1 of Notes to Consolidated Financial Statements for information related to inventory. See Note 4 of Notes to Consolidated Financial Statements for information related to SFS loans.

(2) Accounts Receivable—Accounts receivable principally includes amounts due from buyers as a result of auction and private sale transactions. The recorded amount reflects the purchase price of the property, including our commission. Under the standard terms and conditions of our auction and private sales, we are not obligated to pay the consignor for property that has not been paid for by the buyer. If a buyer defaults on payment, the sale may be cancelled and the property will be returned to the consignor. We continually evaluate the collectability of amounts due from individual buyers and, if we determine that it is probable that a buyer will default, a cancelled sale is recorded in the period in which that determination is made and the associated accounts receivable balance, including our auction commission, is reversed. Historically, cancelled sales have not been material in relation to the aggregate hammer price of property sold at auction.

In certain instances and subject to management approval under our internal corporate governance policy, we may pay the consignor the net sale proceeds before payment is collected from the buyer while we retain possession of the property. In these situations, if the buyer does not make payment, Sotheby's takes title to the property, but could be exposed to losses if the value of the property subsequently declines. In certain other situations and subject to management approval under our internal corporate governance policy, we allow the buyer to take possession of purchased property before making payment. In these situations, we are liable to the seller for the net sale proceeds whether or not the buyer makes payment and would incur a loss in the event of buyer default.

Our judgments regarding the collectability of accounts receivable are based on an assessment of the buyer's payment history, discussions with the buyer, and the value of any property held as security against the buyer's payment obligation. Our judgments with respect to the collectability of amounts due from buyers for auction and private sale purchases may prove, with the benefit of hindsight, to be incorrect. See Note 4 of Notes to Consolidated Financial Statements for information related to accounts receivable.

20

(3) Pension Obligations—The benefit obligation related to our defined benefit pension plan in the U.K. (the "U.K. Pension Plan") is based on an actuarial valuation. Inherent in this valuation are key assumptions and estimates, including those related to the discount rate, the expected long-term rate of return on plan assets, future inflation, and mortality, which are reviewed and updated, as appropriate, on at least an annual basis. In developing these assumptions and estimates, we consider current market conditions, market indices, and other relevant data.

The discount rate represents the approximate weighted average rate at which the obligations of the U.K. Pension Plan could be effectively settled and is based on a yield curve for a selection of high-quality corporate bonds with maturity dates approximating the length of time remaining until individual benefit payment dates. The discount rates as of December 31, 2015 used to calculate the service and interest cost elements included in the calculation of the $6.9 million net pension credit recorded in 2016 were 3.8% and 3.4%, respectively. A hypothetical increase or decrease of 0.1% in this assumption would result in a decrease or increase in net annual pension cost of approximately $0.4 million. As of December 31, 2016, the discount rate used to calculate the $327.6 million benefit obligation was 2.7%. A hypothetical increase or decrease of 0.1% in this assumption would result in a decrease or increase in the benefit obligation of approximately $6.5 million.

The expected long-term rate of return is weighted according to the composition of invested assets and is based on expected future appreciation, as well as dividend and interest yields currently available in the equity and bond markets. In particular, the expected rate of return for growth assets represents our best estimate of annualized long-term returns by asset class. The expected rate of return on debt securities is based on interest yields currently available on long-dated U.K. government bonds and highly-rated corporate bonds. The expected long-term rate of return on plan assets used to calculate the $6.9 million net pension cost recorded in 2016 was 5.2%. A hypothetical increase or decrease of 0.25% in this assumption would result in a decrease or increase in net annual pension cost of approximately $0.9 million.