UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive,

Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| Copies to: |

||||||

|

|

Robert Griffith, Esq. |

Stephen H. Bier, Esq. | ||||

| Goldman Sachs & Co. LLC |

Dechert LLP | |||||

| 200 West Street |

1095 Avenue of the Americas | |||||

| New York, New York 10282 |

New York, NY 10036 | |||||

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: November 30

Date of reporting period: May 31, 2024

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| The Semi-Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds Semi-Annual Report May 31, 2024 Goldman Sachs MLP Energy Infrastructure Fund

Goldman Sachs MLP Energy Infrastructure Fund

| 1 | ||||

| 2 | ||||

| 4 | ||||

| 5 | ||||

| 8 | ||||

| 15 | ||||

| 28 | ||||

|

Effective January 24, 2023, open-end mutual funds and exchange-traded funds are required to provide shareholders with streamlined annual and semi-annual shareholder reports (“Tailored Shareholder Reports”). Funds will be required to prepare a separate Tailored Shareholder Report for each share class of a fund that highlights key information to investors. Other information, including financial statements, will no longer appear in a fund’s shareholder report, but will be available online, delivered free of charge upon request, and filed with the Securities and Exchange Commission on a semi-annual basis on Form N-CSR. The new requirements have a compliance date of July 24, 2024. |

| NOT FDIC-INSURED | May Lose Value | No Bank Guarantee | ||||

Goldman Sachs MLP Energy Infrastructure Fund

The following are highlights both of key factors affecting energy-related equity markets and of any key changes made to the Goldman Sachs MLP Energy Infrastructure Fund (the “Fund”) during the six months ended May 31, 2024 (the “Reporting Period”). A streamlined annual shareholder report covering the 12 months ended November 30, 2024 will be provided to Fund shareholders, per new Securities and Exchange Commission (“SEC”) requirements with a compliance date of July 24, 2024.

Market and Economic Review

| ∎ | During the Reporting Period, energy infrastructure master limited partnerships (“MLPs”), as measured by the Alerian MLP Index,1 generated a total return of 10.24% during the Reporting Period. The broader midstream2 sector, as measured by the Alerian Midstream Energy Index3 (AMNA) (which includes both energy MLPs and “C” corporations), recorded a total return of 12.23% during the same period. |

| ∎ | When the Reporting Period began in December 2023, energy-related equities were rather resilient despite ongoing macroeconomic uncertainty, which had persisted through much of 2023, and amid a pullback in crude oil prices, driven by heightened geopolitical tensions with the October outbreak of war in the Middle East. |

| ∎ | Energy-related equities subsequently advanced, broadly posting gains through the end of the Reporting Period. Strong midstream equity performance was underpinned by a supportive commodity price backdrop and improvement in how investors viewed the sector’s value proposition. |

| ∎ | Midstream energy fundamentals were some of the most attractive they had historically been, with many midstream energy companies generating record amounts of free cash flow. This, in turn, gave companies the ability to de-lever significantly, creating less volatility in equity prices. |

| ∎ | Management teams have been intently focused on maximizing shareholder value, i.e., they have been more disciplined on capital expenditures, and on returning excess free cash flow to shareholders through dividend growth and share buyback programs. Such management focus helped drive equity price performance. |

| ∎ | During the Reporting Period, there was a divergence in midstream equity performance, with energy infrastructure MLPs outperforming energy infrastructure “C” corporations. As a reminder, the midstream opportunity set includes companies structured as MLPs and “C” corporations, with “C” corporations currently representing the majority of the midstream market capitalization. The Goldman Sachs Liquid Real Assets Team (the “Team”) believes such MLP outperformance can largely be attributed to two factors. |

| ∎ | First, MLP valuation mean reversion for MLP multiples. (Mean reversion is a financial theory positing that asset prices and historical returns eventually revert to their long-term mean or average level. Multiples refers to a class of different indicators that can be used to value a security. A multiple is simply a ratio that is calculated by dividing the market or estimated value of an asset by a specific item on the financial statements.) |

| ∎ | Second, continued consolidation in the MLP market segment, with “C” corporations buying MLPs for a premium, which has benefited MLPs’ performance and created a technical tailwind for many of the smaller MLPs. Notably, MLP-only indices have reallocated consolidation proceeds to a smaller MLP universe. |

| ∎ | At the end of the Reporting Period, the Team considered the midstream sector a compelling investment opportunity due to a strong commodity price backdrop, healthy fundamentals and discounted valuations. |

Fund Changes and Highlights

No material changes were made to the Fund during the Reporting Period.

| 1 | Source: Alerian. The Alerian MLP Index is the leading gauge of energy infrastructure MLPs. The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price-return basis (AMZ) and on a total-return basis (AMZX). It is not possible to invest directly in an unmanaged index. |

| 2 | The midstream component of the energy industry is usually defined as those companies providing products or services that help link the supply side (i.e., energy producers) and the demand side (i.e., energy end-users for any type of energy commodity). Such midstream businesses can include, but are not limited to, those that process, store, market and transport various energy commodities. |

| 3 | Source: Alerian. The Alerian Midstream Energy Index is a broad-based composite of North American energy infrastructure companies. The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price-return (AMNA) and on a total-return (AMNAX) basis. It is not possible to invest directly in an unmanaged index. |

| 1 |

Goldman Sachs MLP Energy Infrastructure Fund

as of May 31, 2024

| PERFORMANCE REVIEW |

| December 1, 2023–May 31, 2024 |

Fund Total Return |

Alerian MLP

Index (Total Return, Unhedged, USD)2 |

||||

| Class A |

9.76% | 10.24% | ||||

| Class C |

9.33 | 10.24 | ||||

| Institutional |

9.98 | 10.24 | ||||

| Investor |

9.90 | 10.24 | ||||

| Class R6 |

9.96 | 10.24 | ||||

| Class R |

9.61 | 10.24 | ||||

| Class P |

9.96 | 10.24 | ||||

| 1 | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The Alerian MLP Index (Total Return, Unhedged, USD) is a composite of the 50 most prominent energy master limited partnerships calculated by S&P Global Ratings using a float-adjusted market capitalization methodology. The Alerian MLP Index is disseminated by the New York Stock Exchange real-time on a price return basis (NYSE: AMZ). The corresponding total return index is calculated and disseminated daily through ticker AMZX. The Alerian MLP Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| TOP TEN HOLDINGS AS OF 5/31/24‡ |

| Holding |

% of Net Assets |

Line of Business | ||

| Energy Transfer LP |

12.5% | Pipeline Transportation | Natural Gas | ||

| MPLX LP |

12.2 | Gathering + Processing | ||

| Sunoco LP |

11.4 | Marketing | Wholesale | ||

| Enterprise Products Partners LP |

10.1 | Pipeline Transportation | Natural Gas | ||

| Plains All American Pipeline LP |

10.1 | Pipeline Transportation | Petroleum | ||

| Western Midstream Partners LP |

8.3 | Gathering + Processing | ||

| Hess Midstream LP |

5.2 | Gathering + Processing | ||

| EnLink Midstream LLC |

4.8 | Gathering + Processing | ||

| Cheniere Energy, Inc. |

3.9 | Other | Liquefaction | ||

| DT Midstream, Inc. |

3.6 | Pipeline Transportation | Natural Gas | ||

| ‡ | The top 10 holdings may not be representative of the Fund’s future investments. |

| 2 |

FUND BASICS

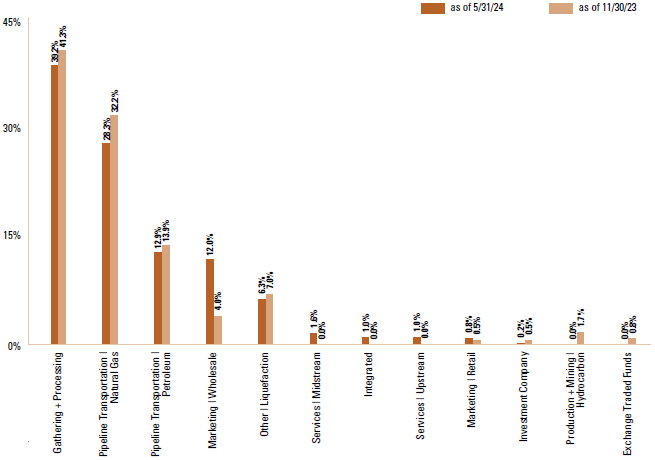

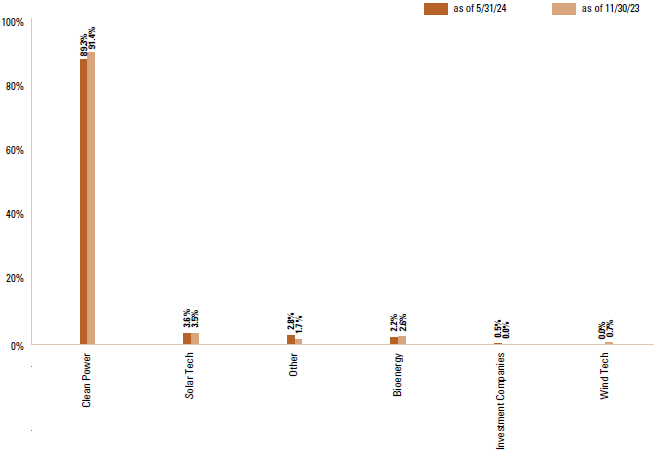

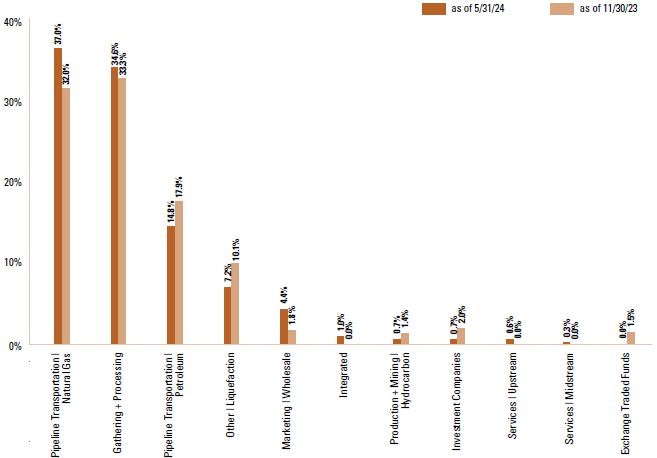

| FUND SECTOR ALLOCATIONS* |

| * | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of total net assets. Underlying sector allocations of exchange-traded funds and other investment companies held by the fund are not reflected in the graph above. Figures in the above table may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance. |

| 3 |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

|

Shares |

Description | Value | ||||||

| Common Stocks – 103.1% |

| |||||||

| Gathering + Processing – 39.2% |

| |||||||

| 5,964,769 | EnLink Midstream LLC* | $ | 75,692,919 | |||||

| 2,318,764 | Hess Midstream LP Class A | 80,577,049 | ||||||

| 314,179 | Kinetik Holdings, Inc. | 12,878,197 | ||||||

| 4,666,864 | MPLX LP | 189,848,028 | ||||||

| 306,476 | ONEOK, Inc. | 24,824,556 | ||||||

| 445,227 | Targa Resources Corp. | 52,639,188 | ||||||

| 3,485,212 | Western Midstream Partners LP | 130,068,112 | ||||||

| 1,101,718 | Williams Cos., Inc. | 45,732,314 | ||||||

|

|

|

|||||||

| 612,260,363 | ||||||||

|

|

||||||||

| Integrated – 1.0% |

| |||||||

| 134,843 | Exxon Mobil Corp. | 15,811,690 | ||||||

|

|

||||||||

| Marketing | Retail – 0.8% |

| |||||||

| 618,805 | Suburban Propane Partners LP | 12,580,306 | ||||||

|

|

||||||||

| Marketing | Wholesale – 12.0% |

| |||||||

| 187,810 | Global Partners LP Class E | 9,076,857 | ||||||

| 3,480,778 | Sunoco LP | 177,519,678 | ||||||

|

|

|

|||||||

| 186,596,535 | ||||||||

|

|

||||||||

| Other | Liquefaction – 6.3% |

| |||||||

| 750,301 | Cheniere Energy Partners LP | 36,141,999 | ||||||

| 379,054 | Cheniere Energy, Inc. | 59,810,931 | ||||||

| 243,832 | NextDecade Corp.* | 1,745,837 | ||||||

|

|

|

|||||||

| 97,698,767 | ||||||||

|

|

||||||||

| Pipeline Transportation | Natural Gas – 28.3% |

| |||||||

| 515,756 | Atlas Energy Solutions, Inc. | 12,491,610 | ||||||

| 825,140 | DT Midstream, Inc. | 55,350,391 | ||||||

| 12,437,609 | Energy Transfer LP | 194,897,333 | ||||||

| 5,539,431 | Enterprise Products Partners LP | 157,873,784 | ||||||

| 460,474 | Kodiak Gas Services, Inc. | 12,686,059 | ||||||

| 226,518 | Pembina Pipeline Corp. | 8,410,613 | ||||||

|

|

|

|||||||

| 441,709,790 | ||||||||

|

|

||||||||

| Pipeline Transportation | Petroleum – 12.9% |

| |||||||

| 211,461 | Delek Logistics Partners LP | 8,378,085 | ||||||

|

|

||||||||

|

Shares |

Description | Value | ||||||

| Common Stocks – (continued) |

| |||||||

| Pipeline Transportation | Petroleum - (continued) |

| |||||||

| 220,378 | Enbridge, Inc. | $ | 8,061,427 | |||||

| 1,837,276 | Genesis Energy LP | 23,002,696 | ||||||

| 724,768 | NGL Energy Partners LP* | 4,116,682 | ||||||

| 9,239,973 | Plains All American Pipeline LP | 157,171,941 | ||||||

|

|

|

|||||||

| 200,730,831 | ||||||||

|

|

||||||||

| Services | Midstream – 1.6% |

| |||||||

| 991,443 | USA Compression Partners LP | 24,290,354 | ||||||

|

|

||||||||

| Services | Upstream – 1.0% |

| |||||||

| 792,214 | Archrock, Inc. | 16,034,411 | ||||||

|

|

||||||||

| TOTAL COMMON STOCKS (Cost $1,388,050,557) |

$ | 1,607,713,047 | ||||||

|

|

||||||||

| Shares | Dividend Rate |

Value | ||||||

| Investment Company(a) – 0.2% |

| |||||||

| Goldman Sachs Financial Square Government Fund — Institutional Shares |

| |||||||

| 3,041,670 | 5.227% | $ | 3,041,670 | |||||

| (Cost $3,041,670) | ||||||||

|

|

||||||||

| TOTAL INVESTMENTS – 103.3% (Cost $1,391,092,227) |

$ | 1,610,754,717 | ||||||

|

|

||||||||

| LIABILITIES IN EXCESS OF |

(50,736,299 | ) | ||||||

|

|

||||||||

| NET ASSETS – 100.0% | $ | 1,560,018,418 | ||||||

|

|

||||||||

| The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. | ||

| * | Non-income producing security. | |

| (a) | Represents an affiliated fund. | |

| ADDITIONAL INVESTMENT INFORMATION |

|

| ||

| Investment Abbreviations: | ||

| LLC | —Limited Liability Company | |

| LP | —Limited Partnership | |

|

| ||

| 4 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

| Assets: | ||||||||

| Investments in unaffiliated issuers, at value (cost $1,388,050,557) |

$ | 1,607,713,047 | ||||||

| Investments in affiliated issuers, at value (cost $3,041,670) |

3,041,670 | |||||||

| Receivables: |

||||||||

| Investments sold |

8,965,618 | |||||||

| Dividends |

259,233 | |||||||

| Fund shares sold |

73,903 | |||||||

| Collateral on certain derivative contracts(a) |

1,176 | |||||||

| Prepaid state and local franchise taxes |

266,801 | |||||||

| Other assets |

93,924 | |||||||

|

| ||||||||

| Total assets |

1,620,415,372 | |||||||

|

| ||||||||

| Liabilities: | ||||||||

| Due to custodian (overdraft) |

1,398,155 | |||||||

| Foreign currency overdraft, at value (identified cost $1,988) |

1,994 | |||||||

| Payables: |

||||||||

| Investments purchased |

6,320,715 | |||||||

| Current taxes, net |

5,290,690 | |||||||

| Management fees |

1,295,144 | |||||||

| Fund shares redeemed |

163,554 | |||||||

| Distribution and Service fees and Transfer Agency fees |

81,981 | |||||||

| Deferred taxes, net |

45,394,271 | |||||||

| Accrued expenses |

450,450 | |||||||

|

| ||||||||

| Total liabilities |

60,396,954 | |||||||

|

| ||||||||

| Net Assets: | ||||||||

| Paid-in capital |

2,226,817,042 | |||||||

| Total distributable loss |

(666,798,624 | ) | ||||||

|

| ||||||||

| NET ASSETS |

$ | 1,560,018,418 | ||||||

| Net Assets: |

||||||||

| Class A |

$ | 64,272,168 | ||||||

| Class C |

13,547,342 | |||||||

| Institutional |

200,594,882 | |||||||

| Investor |

55,076,034 | |||||||

| Class R6 |

78,519,189 | |||||||

| Class R |

912,373 | |||||||

| Class P |

1,147,096,430 | |||||||

| Total Net Assets |

$ | 1,560,018,418 | ||||||

| Shares Outstanding $0.001 par value (unlimited number of shares authorized): |

||||||||

| Class A |

1,960,369 | |||||||

| Class C |

470,180 | |||||||

| Institutional |

5,735,262 | |||||||

| Investor |

1,609,162 | |||||||

| Class R6 |

2,241,167 | |||||||

| Class R |

29,028 | |||||||

| Class P |

32,633,147 | |||||||

| Net asset value, offering and redemption price per share:(b) |

||||||||

| Class A |

$32.79 | |||||||

| Class C |

28.81 | |||||||

| Institutional |

34.98 | |||||||

| Investor |

34.23 | |||||||

| Class R6 |

35.03 | |||||||

| Class R |

31.43 | |||||||

| Class P |

35.15 | |||||||

| (a) | Includes segregated cash of $1,176 relating to initial margin requirements and/or collateral on options transaction. |

| (b) | Maximum public offering price per share for Class A Shares is $34.70. At redemption, Class C Shares may be subject to a contingent deferred sales charge, assessed on the amount equal to the lesser of the current net asset value or the original purchase price of the shares. |

| The accompanying notes are an integral part of these financial statements. | 5 |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

| Statement of Operations

For the Six Months Ended May 31, 2024 (Unaudited)

|

| Investment Income: | ||||||||

| Dividends — unaffiliated issuers (net of tax withholding of $ 183,285) |

$ | 55,376,417 | ||||||

| Dividends — affiliated issuers |

3,279 | |||||||

| Interest |

44 | |||||||

| Less: Return of Capital on Dividends |

(44,728,256 | ) | ||||||

|

| ||||||||

| Total investment income |

10,651,484 | |||||||

|

| ||||||||

| Expenses: | ||||||||

| Management fees |

7,704,527 | |||||||

| Transfer Agency fees(a) |

327,857 | |||||||

| Professional fees |

183,034 | |||||||

| Distribution and Service (12b-1) fees(a) |

133,795 | |||||||

| Custody, accounting and administrative services |

84,520 | |||||||

| Printing and mailing costs |

70,328 | |||||||

| Registration fees |

59,481 | |||||||

| Service fees — Class C |

17,929 | |||||||

| Trustee fees |

11,701 | |||||||

| Other |

31,458 | |||||||

|

| ||||||||

| Total operating expenses, before taxes |

8,624,630 | |||||||

|

| ||||||||

| Less — expense reductions |

(791 | ) | ||||||

|

| ||||||||

| Net operating expenses, before taxes |

8,623,839 | |||||||

|

| ||||||||

| NET INVESTMENT INCOME, BEFORE TAXES |

2,027,645 | |||||||

|

| ||||||||

| Current and deferred tax expense |

(275,792 | ) | ||||||

|

| ||||||||

| NET INVESTMENT INCOME, NET OF TAXES |

1,751,853 | |||||||

|

| ||||||||

| Realized and unrealized gain (loss): | ||||||||

| Net realized gain (loss) from: |

||||||||

| Investments — unaffiliated issuers |

129,542,469 | |||||||

| Written options |

(202 | ) | ||||||

| Foreign currency transactions |

1,219 | |||||||

| Current and deferred tax expense |

(17,619,971 | ) | ||||||

| Net change in unrealized gain (loss) on: |

||||||||

| Investments — unaffiliated issuers |

43,696,730 | |||||||

| Foreign currency translation |

196 | |||||||

| Current and deferred tax expense |

(5,943,475 | ) | ||||||

|

| ||||||||

| Net realized and unrealized gain, net of taxes |

149,676,966 | |||||||

|

| ||||||||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 151,428,819 | ||||||

|

| ||||||||

| (a) | Class specific Distribution and/or Service (12b-1) and Transfer Agency fees were as follows: |

| Distribution and/or Service (12b-1) Fees | Transfer Agency Fees | |||||||||||||||||

| Class A |

Class C |

Class R |

Class A |

Class C |

Institutional |

Investor |

Class R6 |

Class R |

Class P | |||||||||

| $77,803 | $53,786 | $2,206 | $46,682 | $10,757 | $39,198 | $39,282 | $15,526 | $662 | $175,750 | |||||||||

| 6 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

| Statements of Changes in Net Assets

|

| For the Six Months Ended May 31, 2024 (Unaudited) |

For the Fiscal Year Ended November 30, 2023 |

|||||||||||

| From operations: | ||||||||||||

| Net investment income (loss), net of taxes |

$ 1,751,853 | $ (2,130,111 | ) | |||||||||

| Net realized gain, net of taxes |

111,923,515 | 153,172,242 | ||||||||||

| Net change in unrealized gain, net of taxes |

37,753,451 | 83,302,568 | ||||||||||

|

| ||||||||||||

| Net increase in net assets resulting from operations |

151,428,819 | 234,344,699 | ||||||||||

|

| ||||||||||||

| Distributions to shareholders: | ||||||||||||

| From distributable earnings: |

||||||||||||

| Class A Shares |

(2,419,264 | ) | (3,996,809 | ) | ||||||||

| Class C Shares |

(613,891 | ) | (1,369,179 | ) | ||||||||

| Institutional Shares |

(7,161,826 | ) | (13,267,091 | ) | ||||||||

| Investor Shares |

(1,949,536 | ) | (3,469,337 | ) | ||||||||

| Class R6 Shares |

(3,499,140 | ) | (7,592,272 | ) | ||||||||

| Class R Shares |

(34,845 | ) | (69,455 | ) | ||||||||

| Class P Shares |

(41,328,303 | ) | (75,698,498 | ) | ||||||||

|

| ||||||||||||

| Total distributions to shareholders |

(57,006,805 | ) | (105,462,641 | ) | ||||||||

|

| ||||||||||||

| From share transactions: | ||||||||||||

| Proceeds from sales of shares |

43,001,354 | 173,448,573 | ||||||||||

| Reinvestment of distributions |

56,178,376 | 103,420,259 | ||||||||||

| Cost of shares redeemed |

(281,818,093 | ) | (270,875,593 | ) | ||||||||

|

| ||||||||||||

| Net increase (decrease) in net assets resulting from share transactions |

(182,638,363 | ) | 5,993,239 | |||||||||

|

| ||||||||||||

| TOTAL INCREASE (DECREASE) |

(88,216,349 | ) | 134,875,297 | |||||||||

|

| ||||||||||||

| Net assets: | ||||||||||||

| Beginning of period |

1,648,234,767 | 1,513,359,470 | ||||||||||

|

| ||||||||||||

| End of period |

$1,560,018,418 | $1,648,234,767 | ||||||||||

|

| ||||||||||||

| The accompanying notes are an integral part of these financial statements. | 7 |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

| MLP Energy Infrastructure Fund | |||||||||||||||||||||||||||||||||||

| Class A Shares | |||||||||||||||||||||||||||||||||||

| Six Months Ended | |||||||||||||||||||||||||||||||||||

| May 31, 2024 | Year Ended November 30,

|

||||||||||||||||||||||||||||||||||

| (Unaudited) | 2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||||||||||||||||||

| Per Share Data* | |||||||||||||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 31.06 | $ | 28.86 | $ | 22.75 | $ | 17.15 | $ | 26.10 | $ | 31.90 | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Net investment loss(a) |

(0.04 | ) | (0.13 | ) | (0.07 | ) | (0.13 | )(b) | (0.15 | ) | (0.30 | ) | |||||||||||||||||||||||

| Net realized and unrealized gain (loss) |

3.03 | 4.45 | 7.88 | 7.23 | (7.86 | ) | (3.00 | ) | |||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Total from investment operations |

2.99 | 4.32 | 7.81 | 7.10 | (8.01 | ) | (3.30 | ) | |||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Distributions to shareholders from net investment income |

(1.26 | ) | (2.12 | ) | (1.70 | ) | (1.50 | ) | — | (0.15 | ) | ||||||||||||||||||||||||

| Distributions to shareholders from return of capital |

— | — | — | — | (0.94 | ) | (2.35 | ) | |||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Total distributions |

(1.26 | ) | (2.12 | ) | (1.70 | ) | (1.50 | ) | (0.94 | ) | (2.50 | ) | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Net asset value, end of period |

$ | 32.79 | $ | 31.06 | $ | 28.86 | $ | 22.75 | $ | 17.15 | $ | 26.10 | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Total return(c) |

9.76 | % | 15.84 | % | 34.91 | % | 41.88 | % | (27.83 | )% | (11.06 | )% | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Net assets, end of period (in 000s) |

$ | 64,272 | $ | 59,874 | $ | 53,751 | $ | 39,835 | $ | 34,024 | $ | 60,112 | |||||||||||||||||||||||

| Ratio of net expenses to average net assets after tax expense(d) |

2.97 | %(e) | 2.42 | % | 2.59 | % | 0.42 | % | 2.61 | % | 1.67 | % | |||||||||||||||||||||||

| Ratio of total expenses to average net assets after tax expense(d) |

2.97 | %(e) | 2.42 | % | 2.59 | % | 0.43 | % | 2.64 | % | 1.67 | % | |||||||||||||||||||||||

| Ratio of net expenses to average net assets before tax expense |

1.42 | %(e) | 1.43 | % | 1.45 | % | 1.45 | % | 1.49 | % | 1.44 | % | |||||||||||||||||||||||

| Ratio of net investment loss to average net assets(f) |

(0.24 | )%(e) | (0.47 | )% | (0.26 | )% | (0.60 | )% | (0.81 | )% | (1.02 | )% | |||||||||||||||||||||||

| Portfolio turnover rate(g) |

32 | % | 102 | % | 117 | % | 166 | % | 139 | % | 51 | % | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| * | On June 5, 2020, the MLP Energy Infrastructure Fund effected a 5-for-1 reverse share split. All per share data prior to June 5, 2020 has been adjusted to reflect the reverse share split. |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Reflects income recognized from special dividends which amounted to $0.04 per share and 0.16% of average net assets. |

| (c) | Assumes investment at the NAV at the beginning of the period, reinvestment of all dividends and distributions, a complete redemption of the investment at the NAV at the end of the period and no sales or redemption charges (if any). Total returns would be reduced if a sales or redemption charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the redemption of Fund shares. Total returns for periods less than one full year are not annualized. |

| (d) | Current and deferred tax expense/benefit for the ratio calculation is derived from the net investment income (loss), and realized and unrealized gains (losses). |

| (e) | Annualized with the exception of tax expenses. |

| (f) | Current and deferred tax benefit for the ratio calculation is derived from net investment income (loss) only. |

| (g) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| 8 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

| Financial Highlights (continued)

Selected Share Data for a Share Outstanding Throughout Each Period |

| MLP Energy Infrastructure Fund | |||||||||||||||||||||||||||||||||||

| Class C Shares | |||||||||||||||||||||||||||||||||||

| Six Months Ended | |||||||||||||||||||||||||||||||||||

| May 31, 2024 | Year Ended November 30,

|

||||||||||||||||||||||||||||||||||

| (Unaudited) | 2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||||||||||||||||||

| Per Share Data* | |||||||||||||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 27.54 | $ | 26.01 | $ | 20.79 | $ | 15.88 | $ | 24.55 | $ | 30.35 | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Net investment loss(a) |

(0.11 | ) | (0.31 | ) | (0.24 | ) | (0.27 | )(b) | (0.29 | ) | (0.50 | ) | |||||||||||||||||||||||

| Net realized and unrealized gain (loss) |

2.64 | 3.96 | 7.16 | 6.68 | (7.44 | ) | (2.80 | ) | |||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Total from investment operations |

2.53 | 3.65 | 6.92 | 6.41 | (7.73 | ) | (3.30 | ) | |||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Distributions to shareholders from net investment income |

(1.26 | ) | (2.12 | ) | (1.70 | ) | (1.50 | ) | — | (0.15 | ) | ||||||||||||||||||||||||

| Distributions to shareholders from return of capital |

— | — | — | — | (0.94 | ) | (2.35 | ) | |||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Total distributions |

(1.26 | ) | (2.12 | ) | (1.70 | ) | (1.50 | ) | (0.94 | ) | (2.50 | ) | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Net asset value, end of period |

$ | 28.81 | $ | 27.54 | $ | 26.01 | $ | 20.79 | $ | 15.88 | $ | 24.55 | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Total return(c) |

9.33 | % | 14.97 | % | 33.89 | % | 40.85 | % | (28.47 | )% | (11.64 | )% | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Net assets, end of period (in 000s) |

$ | 13,547 | $ | 16,025 | $ | 22,030 | $ | 25,647 | $ | 24,897 | $ | 58,044 | |||||||||||||||||||||||

| Ratio of net expenses to average net assets after tax expense(d) |

3.63 | %(e) | 3.20 | % | 3.34 | % | 1.16 | % | 3.37 | % | 2.42 | % | |||||||||||||||||||||||

| Ratio of total expenses to average net assets after tax expense(d) |

3.63 | %(e) | 3.20 | % | 3.34 | % | 1.18 | % | 3.39 | % | 2.42 | % | |||||||||||||||||||||||

| Ratio of net expenses to average net assets before tax expense |

2.17 | %(e) | 2.18 | % | 2.20 | % | 2.20 | % | 2.24 | % | 2.19 | % | |||||||||||||||||||||||

| Ratio of net investment loss to average net assets(f) |

(0.81 | )%(e) | (1.23 | )% | (1.00 | )% | (1.35 | )% | (1.63 | )% | (1.77 | )% | |||||||||||||||||||||||

| Portfolio turnover rate(g) |

32 | % | 102 | % | 117 | % | 166 | % | 139 | % | 51 | % | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| * | On June 5, 2020, the MLP Energy Infrastructure Fund effected a 5-for-1 reverse share split. All per share data prior to June 5, 2020 has been adjusted to reflect the reverse share split. |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Reflects income recognized from special dividends which amounted to $0.04 per share and 0.16% of average net assets. |

| (c) | Assumes investment at the NAV at the beginning of the period, reinvestment of all dividends and distributions, a complete redemption of the investment at the NAV at the end of the period and no sales or redemption charges (if any). Total returns would be reduced if a sales or redemption charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the redemption of Fund shares. Total returns for periods less than one full year are not annualized. |

| (d) | Current and deferred tax expense/benefit for the ratio calculation is derived from the net investment income (loss), and realized and unrealized gains (losses). |

| (e) | Annualized with the exception of tax expenses. |

| (f) | Current and deferred tax benefit for the ratio calculation is derived from net investment income (loss) only. |

| (g) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| The accompanying notes are an integral part of these financial statements. | 9 |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

| Financial Highlights (continued)

Selected Share Data for a Share Outstanding Throughout Each Period |

| MLP Energy Infrastructure Fund | |||||||||||||||||||||||||||||||||||

| Institutional Shares | |||||||||||||||||||||||||||||||||||

| Six Months Ended | |||||||||||||||||||||||||||||||||||

| May 31, 2024 | Year Ended November 30,

|

||||||||||||||||||||||||||||||||||

| (Unaudited) | 2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||||||||||||||||||

| Per Share Data* | |||||||||||||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 32.99 | $ | 30.43 | $ | 23.82 | $ | 17.84 | $ | 26.95 | $ | 32.75 | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Net investment income (loss)(a) |

0.02 | (0.04 | ) | 0.03 | (0.05 | )(b) | (0.11 | ) | (0.20 | ) | |||||||||||||||||||||||||

| Net realized and unrealized gain (loss) |

3.23 | 4.72 | 8.28 | 7.53 | (8.06 | ) | (3.10 | ) | |||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Total from investment operations |

3.25 | 4.68 | 8.31 | 7.48 | (8.17 | ) | (3.30 | ) | |||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Distributions to shareholders from net investment income |

(1.26 | ) | (2.12 | ) | (1.70 | ) | (1.50 | ) | — | (0.15 | ) | ||||||||||||||||||||||||

| Distributions to shareholders from return of capital |

— | — | — | — | (0.94 | ) | (2.35 | ) | |||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Total distributions |

(1.26 | ) | (2.12 | ) | (1.70 | ) | (1.50 | ) | (0.94 | ) | (2.50 | ) | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Net asset value, end of period |

$ | 34.98 | $ | 32.99 | $ | 30.43 | $ | 23.82 | $ | 17.84 | $ | 26.95 | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Total return(c) |

9.98 | % | 16.22 | % | 35.45 | % | 42.40 | % | (27.54 | )% | (10.77 | )% | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Net assets, end of period (in 000s) |

$ | 200,595 | $ | 192,787 | $ | 198,807 | $ | 160,785 | $ | 182,236 | $ | 502,633 | |||||||||||||||||||||||

| Ratio of net expenses to average net assets after tax expense(d) |

2.60 | %(e) | 2.08 | % | 2.22 | % | 0.05 | % | 2.22 | % | 1.28 | % | |||||||||||||||||||||||

| Ratio of total expenses to average net assets after tax expense(d) |

2.60 | %(e) | 2.08 | % | 2.22 | % | 0.06 | % | 2.25 | % | 1.28 | % | |||||||||||||||||||||||

| Ratio of net expenses to average net assets before tax expense |

1.06 | %(e) | 1.07 | % | 1.08 | % | 1.09 | % | 1.10 | % | 1.05 | % | |||||||||||||||||||||||

| Ratio of net investment income (loss) to average net assets(f) |

0.14 | %(e) | (0.12 | )% | 0.12 | % | (0.21 | )% | (0.56 | )% | (0.61 | )% | |||||||||||||||||||||||

| Portfolio turnover rate(g) |

32 | % | 102 | % | 117 | % | 166 | % | 139 | % | 51 | % | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| * | On June 5, 2020, the MLP Energy Infrastructure Fund effected a 5-for-1 reverse share split. All per share data prior to June 5, 2020 has been adjusted to reflect the reverse share split. |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Reflects income recognized from special dividends which amounted to $0.04 per share and 0.16% of average net assets. |

| (c) | Assumes investment at the NAV at the beginning of the period, reinvestment of all dividends and distributions, a complete redemption of the investment at the NAV at the end of the period and no sales or redemption charges (if any). Total returns would be reduced if a sales or redemption charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the redemption of Fund shares. Total returns for periods less than one full year are not annualized. |

| (d) | Current and deferred tax expense/benefit for the ratio calculation is derived from the net investment income (loss), and realized and unrealized gains (losses). |

| (e) | Annualized with the exception of tax expenses. |

| (f) | Current and deferred tax benefit for the ratio calculation is derived from net investment income (loss) only. |

| (g) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| 10 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

| Financial Highlights (continued)

Selected Share Data for a Share Outstanding Throughout Each Period |

| MLP Energy Infrastructure Fund | |||||||||||||||||||||||||||||||||||

| Investor Shares | |||||||||||||||||||||||||||||||||||

| Six Months Ended | |||||||||||||||||||||||||||||||||||

| May 31, 2024 | Year Ended November 30,

|

||||||||||||||||||||||||||||||||||

| (Unaudited) | 2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||||||||||||||||||

| Per Share Data* | |||||||||||||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 32.33 | $ | 29.89 | $ | 23.45 | $ | 17.60 | $ | 26.65 | $ | 32.50 | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Net investment loss(a) |

— | (b) | (0.06 | ) | — | (b) | (0.08 | )(c) | (0.15 | ) | (0.25 | ) | |||||||||||||||||||||||

| Net realized and unrealized gain (loss) |

3.16 | 4.62 | 8.14 | 7.43 | (7.96 | ) | (3.10 | ) | |||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Total from investment operations |

3.16 | 4.56 | 8.14 | 7.35 | (8.11 | ) | (3.35 | ) | |||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Distributions to shareholders from net investment income |

(1.26 | ) | (2.12 | ) | (1.70 | ) | (1.50 | ) | — | (0.15 | ) | ||||||||||||||||||||||||

| Distributions to shareholders from return of capital |

— | — | — | — | (0.94 | ) | (2.35 | ) | |||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Total distributions |

(1.26 | ) | (2.12 | ) | (1.70 | ) | (1.50 | ) | (0.94 | ) | (2.50 | ) | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Net asset value, end of period |

$ | 34.23 | $ | 32.33 | $ | 29.89 | $ | 23.45 | $ | 17.60 | $ | 26.65 | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Total return(d) |

9.90 | % | 16.11 | % | 35.28 | % | 42.23 | % | (27.63 | )% | (11.01 | )% | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Net assets, end of period (in 000s) |

$ | 55,076 | $ | 53,118 | $ | 59,725 | $ | 40,346 | $ | 32,396 | $ | 98,506 | |||||||||||||||||||||||

| Ratio of net expenses to average net assets after tax expense(e) |

2.71 | %(f) | 2.16 | % | 2.34 | % | 0.17 | % | 2.36 | % | 1.42 | % | |||||||||||||||||||||||

| Ratio of total expenses to average net assets after tax expense(e) |

2.71 | %(f) | 2.16 | % | 2.34 | % | 0.18 | % | 2.38 | % | 1.42 | % | |||||||||||||||||||||||

| Ratio of net expenses to average net assets before tax expense |

1.17 | %(f) | 1.18 | % | 1.20 | % | 1.20 | % | 1.23 | % | 1.19 | % | |||||||||||||||||||||||

| Ratio of net investment income (loss) to average net assets(g) |

0.01 | %(f) | (0.20 | )% | (0.01 | )% | (0.36 | )% | (0.73 | )% | (0.77 | )% | |||||||||||||||||||||||

| Portfolio turnover rate(h) |

32 | % | 102 | % | 117 | % | 166 | % | 139 | % | 51 | % | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| * | On June 5, 2020, the MLP Energy Infrastructure Fund effected a 5-for-1 reverse share split. All per share data prior to June 5, 2020 has been adjusted to reflect the reverse share split. |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Less than $0.005 per share. |

| (c) | Reflects income recognized from special dividends which amounted to $0.04 per share and 0.16% of average net assets. |

| (d) | Assumes investment at the NAV at the beginning of the period, reinvestment of all dividends and distributions, a complete redemption of the investment at the NAV at the end of the period and no sales or redemption charges (if any). Total returns would be reduced if a sales or redemption charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the redemption of Fund shares. Total returns for periods less than one full year are not annualized. |

| (e) | Current and deferred tax expense/benefit for the ratio calculation is derived from the net investment income (loss), and realized and unrealized gains (losses). |

| (f) | Annualized with the exception of tax expenses. |

| (g) | Current and deferred tax benefit for the ratio calculation is derived from net investment income (loss) only. |

| (h) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| The accompanying notes are an integral part of these financial statements. | 11 |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

| Financial Highlights (continued)

Selected Share Data for a Share Outstanding Throughout Each Period |

| MLP Energy Infrastructure Fund | |||||||||||||||||||||||||||||||||||

| Class R6 Shares | |||||||||||||||||||||||||||||||||||

| Six Months Ended | |||||||||||||||||||||||||||||||||||

| May 31, 2024 | Year Ended November 30,

|

||||||||||||||||||||||||||||||||||

| (Unaudited) | 2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||||||||||||||||||

| Per Share Data* | |||||||||||||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 33.05 | $ | 30.47 | $ | 23.85 | $ | 17.86 | $ | 27.00 | $ | 32.75 | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Net investment income (loss)(a) |

0.07 | (0.03 | ) | 0.04 | (0.04 | )(b) | (0.05 | ) | (0.20 | ) | |||||||||||||||||||||||||

| Net realized and unrealized gain (loss) |

3.17 | 4.73 | 8.28 | 7.53 | (8.15 | ) | (3.05 | ) | |||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Total from investment operations |

3.24 | 4.70 | 8.32 | 7.49 | (8.20 | ) | (3.25 | ) | |||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Distributions to shareholders from net investment income |

(1.26 | ) | (2.12 | ) | (1.70 | ) | (1.50 | ) | — | (0.15 | ) | ||||||||||||||||||||||||

| Distributions to shareholders from return of capital |

— | — | — | — | (0.94 | ) | (2.35 | ) | |||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Total distributions |

(1.26 | ) | (2.12 | ) | (1.70 | ) | (1.50 | ) | (0.94 | ) | (2.50 | ) | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Net asset value, end of period |

$ | 35.03 | $ | 33.05 | $ | 30.47 | $ | 23.85 | $ | 17.86 | $ | 27.00 | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Total return(c) |

9.96 | % | 16.26 | % | 35.45 | % | 42.41 | % | (27.60 | )% | (10.60 | )% | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Net assets, end of period (in 000s) |

$ | 78,519 | $ | 115,489 | $ | 126,621 | $ | 138,288 | $ | 181,968 | $ | 165,252 | |||||||||||||||||||||||

| Ratio of net expenses to average net assets after tax expense(d) |

2.46 | %(e) | 2.06 | % | 2.21 | % | 0.04 | % | 2.23 | % | 1.26 | % | |||||||||||||||||||||||

| Ratio of total expenses to average net assets after tax expense(d) |

2.46 | %(e) | 2.06 | % | 2.21 | % | 0.05 | % | 2.26 | % | 1.26 | % | |||||||||||||||||||||||

| Ratio of net expenses to average net assets before tax expense |

1.05 | %(e) | 1.06 | % | 1.07 | % | 1.08 | % | 1.11 | % | 1.04 | % | |||||||||||||||||||||||

| Ratio of net investment income (loss) to average net assets(f) |

0.40 | %(e) | (0.10 | )% | 0.13 | % | (0.17 | )% | (0.29 | )% | (0.66 | )% | |||||||||||||||||||||||

| Portfolio turnover rate(g) |

32 | % | 102 | % | 117 | % | 166 | % | 139 | % | 51 | % | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| * | On June 5, 2020, the MLP Energy Infrastructure Fund effected a 5-for-1 reverse share split. All per share data prior to June 5, 2020 has been adjusted to reflect the reverse share split. |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Reflects income recognized from special dividends which amounted to $0.04 per share and 0.16% of average net assets. |

| (c) | Assumes investment at the NAV at the beginning of the period, reinvestment of all dividends and distributions, a complete redemption of the investment at the NAV at the end of the period and no sales or redemption charges (if any). Total returns would be reduced if a sales or redemption charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the redemption of Fund shares. Total returns for periods less than one full year are not annualized. |

| (d) | Current and deferred tax expense/benefit for the ratio calculation is derived from the net investment income (loss), and realized and unrealized gains (losses). |

| (e) | Annualized with the exception of tax expenses. |

| (f) | Current and deferred tax benefit for the ratio calculation is derived from net investment income (loss) only. |

| (g) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| 12 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

| Financial Highlights (continued)

Selected Share Data for a Share Outstanding Throughout Each Period |

| MLP Energy Infrastructure Fund | |||||||||||||||||||||||||||||||||||

| Class R Shares | |||||||||||||||||||||||||||||||||||

| Six Months Ended | |||||||||||||||||||||||||||||||||||

| May 31, 2024 | Year Ended November 30,

|

||||||||||||||||||||||||||||||||||

| (Unaudited) | 2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||||||||||||||||||

| Per Share Data* | |||||||||||||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 29.86 | $ | 27.90 | $ | 22.09 | $ | 16.72 | $ | 25.60 | $ | 31.40 | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Net investment loss(a) |

(0.08 | ) | (0.21 | ) | (0.13 | ) | (0.18 | )(b) | (0.17 | ) | (0.40 | ) | |||||||||||||||||||||||

| Net realized and unrealized gain (loss) |

2.91 | 4.29 | 7.64 | 7.05 | (7.77 | ) | (2.90 | ) | |||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Total from investment operations |

2.83 | 4.08 | 7.51 | 6.87 | (7.94 | ) | (3.30 | ) | |||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Distributions to shareholders from net investment income |

(1.26 | ) | (2.12 | ) | (1.70 | ) | (1.50 | ) | — | (0.15 | ) | ||||||||||||||||||||||||

| Distributions to shareholders from return of capital |

— | — | — | — | (0.94 | ) | (2.35 | ) | |||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Total distributions |

(1.26 | ) | (2.12 | ) | (1.70 | ) | (1.50 | ) | (0.94 | ) | (2.50 | ) | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Net asset value, end of period |

$ | 31.43 | $ | 29.86 | $ | 27.90 | $ | 22.09 | $ | 16.72 | $ | 25.60 | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Total return(c) |

9.61 | % | 15.52 | % | 34.59 | % | 41.57 | % | (28.11 | )% | (11.24 | )% | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Net assets, end of period (in 000s) |

$ | 912 | $ | 1,000 | $ | 843 | $ | 731 | $ | 796 | $ | 1,012 | |||||||||||||||||||||||

| Ratio of net expenses to average net assets after tax expense(d) |

3.22 | %(e) | 2.72 | % | 2.84 | % | 0.66 | % | 2.87 | % | 1.92 | % | |||||||||||||||||||||||

| Ratio of total expenses to average net assets after tax expense(d) |

3.22 | %(e) | 2.72 | % | 2.85 | % | 0.67 | % | 2.90 | % | 1.92 | % | |||||||||||||||||||||||

| Ratio of net expenses to average net assets before tax expense |

1.67 | %(e) | 1.68 | % | 1.70 | % | 1.70 | % | 1.74 | % | 1.69 | % | |||||||||||||||||||||||

| Ratio of net investment loss to average net assets(f) |

(0.50 | )%(e) | (0.76 | )% | (0.50 | )% | (0.85 | )% | (0.94 | )% | (1.31 | )% | |||||||||||||||||||||||

| Portfolio turnover rate(g) |

32 | % | 102 | % | 117 | % | 166 | % | 139 | % | 51 | % | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| * | On June 5, 2020, the MLP Energy Infrastructure Fund effected a 5-for-1 reverse share split. All per share data prior to June 5, 2020 has been adjusted to reflect the reverse share split. |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Reflects income recognized from special dividends which amounted to $0.04 per share and 0.16% of average net assets. |

| (c) | Assumes investment at the NAV at the beginning of the period, reinvestment of all dividends and distributions, a complete redemption of the investment at the NAV at the end of the period and no sales or redemption charges (if any). Total returns would be reduced if a sales or redemption charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the redemption of Fund shares. Total returns for periods less than one full year are not annualized. |

| (d) | Current and deferred tax expense/benefit for the ratio calculation is derived from the net investment income (loss), and realized and unrealized gains (losses). |

| (e) | Annualized with the exception of tax expenses. |

| (f) | Current and deferred tax benefit for the ratio calculation is derived from net investment income (loss) only. |

| (g) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| The accompanying notes are an integral part of these financial statements. | 13 |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

| Financial Highlights (continued)

Selected Share Data for a Share Outstanding Throughout Each Period |

| MLP Energy Infrastructure Fund | |||||||||||||||||||||||||||||||||||

| Class P Shares | |||||||||||||||||||||||||||||||||||

| Six Months Ended | |||||||||||||||||||||||||||||||||||

| May 31, 2024 | Year Ended November 30,

|

||||||||||||||||||||||||||||||||||

| (Unaudited) | 2023 | 2022 | 2021 | 2020 | 2019 | ||||||||||||||||||||||||||||||

| Per Share Data* | |||||||||||||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 33.15 | $ | 30.56 | $ | 23.92 | $ | 17.91 | $ | 27.05 | $ | 32.85 | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Net investment income (loss)(a) |

0.04 | (0.03 | ) | 0.03 | (0.05 | )(b) | (0.08 | ) | (0.20 | ) | |||||||||||||||||||||||||

| Net realized and unrealized gain (loss) |

3.22 | 4.74 | 8.31 | 7.56 | (8.12 | ) | (3.10 | ) | |||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Total from investment operations |

3.26 | 4.71 | 8.34 | 7.51 | (8.20 | ) | (3.30 | ) | |||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Distributions to shareholders from net investment income |

(1.26 | ) | (2.12 | ) | (1.70 | ) | (1.50 | ) | — | (0.15 | ) | ||||||||||||||||||||||||

| Distributions to shareholders from return of capital |

— | — | — | — | (0.94 | ) | (2.35 | ) | |||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Total distributions |

(1.26 | ) | (2.12 | ) | (1.70 | ) | (1.50 | ) | (0.94 | ) | (2.50 | ) | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Net asset value, end of period |

$ | 35.15 | $ | 33.15 | $ | 30.56 | $ | 23.92 | $ | 17.91 | $ | 27.05 | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Total return(c) |

9.96 | % | 16.25 | % | 35.43 | % | 42.40 | % | (27.55 | )% | (10.73 | )% | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| Net assets, end of period (in 000s) |

$ | 1,147,096 | $ | 1,209,941 | $ | 1,051,583 | $ | 772,491 | $ | 526,900 | $ | 843,448 | |||||||||||||||||||||||

| Ratio of net expenses to average net assets after tax expense(d) |

2.53 | %(e) | 2.07 | % | 2.21 | % | 0.04 | % | 2.23 | % | 1.27 | % | |||||||||||||||||||||||

| Ratio of total expenses to average net assets after tax expense(d) |

2.53 | %(e) | 2.07 | % | 2.21 | % | 0.05 | % | 2.26 | % | 1.27 | % | |||||||||||||||||||||||

| Ratio of net expenses to average net assets before tax expense |

1.05 | %(e) | 1.06 | % | 1.07 | % | 1.08 | % | 1.10 | % | 1.04 | % | |||||||||||||||||||||||

| Ratio of net investment income (loss) to average net assets(f) |

0.26 | %(e) | (0.11 | )% | 0.12 | % | (0.23 | )% | (0.38 | )% | (0.61 | )% | |||||||||||||||||||||||

| Portfolio turnover rate(g) |

32 | % | 102 | % | 117 | % | 166 | % | 139 | % | 51 | % | |||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||

| * | On June 5, 2020, the MLP Energy Infrastructure Fund effected a 5-for-1 reverse share split. All per share data prior to June 5, 2020 has been adjusted to reflect the reverse share split. |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Reflects income recognized from special dividends which amounted to $0.04 per share and 0.16% of average net assets. |

| (c) | Assumes investment at the NAV at the beginning of the period, reinvestment of all dividends and distributions, a complete redemption of the investment at the NAV at the end of the period and no sales or redemption charges (if any). Total returns would be reduced if a sales or redemption charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the redemption of Fund shares. Total returns for periods less than one full year are not annualized. |

| (d) | Current and deferred tax expense/benefit for the ratio calculation is derived from the net investment income (loss), and realized and unrealized gains (losses). |

| (e) | Annualized with the exception of tax expenses. |

| (f) | Current and deferred tax benefit for the ratio calculation is derived from net investment income (loss) only. |

| (g) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| 14 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

| 1. ORGANIZATION |

Goldman Sachs Trust (the “Trust”) is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. The Trust includes the Goldman Sachs MLP Energy Infrastructure Fund (the “Fund”). The Fund is a non-diversified portfolio under the Act offering seven classes of shares — Class A, Class C, Institutional, Investor, Class R6, Class R and Class P Shares.

Class A Shares are sold with a front-end sales charge of up to 5.50%. Class C Shares are sold with a contingent deferred sales charge (“CDSC”) of 1.00%, which is imposed on redemptions made within 12 months of purchase. Institutional, Investor, Class R6, Class R and Class P Shares are not subject to a sales charge.

Goldman Sachs Asset Management, L.P. (“GSAM”), an affiliate of Goldman Sachs & Co. LLC (“Goldman Sachs”), serves as investment adviser to the Fund pursuant to a management agreement (the “Agreement”) with the Trust.

| 2. SIGNIFICANT ACCOUNTING POLICIES |

The financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and require management to make estimates and assumptions that may affect the reported amounts and disclosures. Actual results may differ from those estimates and assumptions. The Fund is an investment company under GAAP and follows the accounting and reporting guidance applicable to investment companies.

A. Investment Valuation — The Fund’s valuation policy is to value investments at fair value.

B. Investment Income and Investments — Investment income includes interest income, dividend income, net of any foreign withholding taxes, and less any amounts reclaimable. Interest income is accrued daily and adjusted for amortization of premiums and accretion of discounts. Dividend income is recognized on ex-dividend date or, for certain foreign securities, as soon as such information is obtained subsequent to the ex-dividend date. Non-cash dividends, if any, are recorded at the fair market value of the securities received. Investment transactions are reflected on trade date. Realized gains and losses are calculated using identified cost. Investment transactions are recorded on the following business day for daily net asset value (“NAV”) calculations.

Distributions from master limited partnerships (“MLPs”) are generally recorded based on the characterization reported on the Fund’s schedule K-1 received from the MLPs. The Fund records its pro-rata share of the income/loss and capital gains/losses, allocated from the underlying partnerships and adjusts the cost basis of the underlying partnerships accordingly.

C. Class Allocations and Expenses — Investment income, realized and unrealized gain (loss), if any, and non-class specific expenses of the Fund are allocated daily based upon the proportion of net assets of each class. Non-class specific expenses directly incurred by the Fund are charged to the Fund, while such expenses incurred by the Trust are allocated across the applicable Funds on a straight-line and/or pro-rata basis depending upon the nature of the expenses. Class specific expenses, where applicable, are borne by the respective share classes and include Distribution and Service, Transfer Agency and Service and Shareholder Administration fees.

D. Distributions to Shareholders — Over the long term, the Fund makes distributions to its shareholders each fiscal quarter at a rate that is approximately equal to the distributions the Fund receives from the MLPs and other securities in which it invests. To permit the Fund to maintain more stable quarterly distributions, the distribution for any particular quarterly period may be more or less than the amount of total distributable earnings actually earned by the Fund. The Fund estimates that only a portion of the distributions paid to shareholders will be treated as income. The remaining portion of the Fund’s distribution, which may be significant, is expected to be a return of capital. These estimates are based on the Fund’s operating results during the period, and their final federal income tax characterization may differ.

The characterization of distributions to shareholders for financial reporting purposes is determined in accordance with federal income tax rules, which may differ from GAAP. Certain components of the Fund’s net assets on the Statement of Assets and Liabilities reflect permanent GAAP/Tax differences based on the appropriate tax character.

| 15 |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

| Notes to Financial Statements (continued)

May 31, 2024 (Unaudited) |

| 2. SIGNIFICANT ACCOUNTING POLICIES (continued) |

E. Income Taxes — The Fund does not intend to qualify as a regulated investment company pursuant to Subchapter M of the Internal Revenue Code of 1986, as amended, but will rather be taxed as a corporation. As a result, the Fund is obligated to pay federal, state and local income tax on its taxable income. The Fund invests primarily in MLPs, which generally are treated as partnerships for federal income tax purposes. As a limited partner in the MLPs, the Fund must report its allocable share of the MLPs’ taxable income or loss in computing its own taxable income or loss, regardless of whether the MLPs make distributions to the Fund.

The Fund’s tax expense or benefit is included in the Statement of Operations based on the component of income or gains/ losses to which such expense or benefit relates. Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes. Such temporary differences are principally: (i) taxes on unrealized gains/losses, which are attributable to the temporary difference between fair market value and tax basis, (ii) the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting and income tax purposes, and (iii) the net tax benefit of accumulated net operating losses and capital loss carryforwards. The Fund will accrue a deferred income tax liability balance, at the currently effective statutory United States (“U.S.”) federal income tax rate plus an estimated state and local income tax rate, for its future tax liability associated with the capital appreciation of its investments and the distributions received by the Fund on interests of MLPs considered to be return of capital and for any net operating gains. The Fund may also record a deferred tax asset balance, which reflects an estimate of the Fund’s future tax benefit associated with net operating losses, capital loss carryforwards, and/or unrealized losses.

To the extent the Fund has a deferred tax asset, consideration is given to whether or not a valuation allowance, which would offset the value of some or all of the deferred tax asset balance, is required. A valuation allowance is required if based on the evaluation criterion provided by Accounting Standards Codification (“ASC”) 740, Income Taxes (ASC 740) it is more likely than not that some portion, or all, of the deferred tax asset will not be realized. The factors considered in assessing the Fund’s valuation allowance include: the nature, frequency, and severity of current and cumulative losses, the duration of the statutory carryforward periods and the associated risks that operating and capital loss carryforwards may expire unutilized. From time to time, as new information becomes available, the Fund will modify its estimates or assumptions regarding the deferred tax liability or asset. Unexpected significant decreases in cash distributions from the Fund’s MLP investments or significant declines in the fair value of its investments may change the Fund’s assessment regarding the recoverability of their deferred tax assets and may result in a valuation allowance. If a valuation allowance is required to reduce any deferred tax asset in the future, it could have a material impact on the Fund’s NAV and results of operations in the period it is recorded. The Fund will rely to some extent on information provided by MLPs, which may not be provided to the Fund on a timely basis, to estimate operating income/loss and gains/losses and current taxes and deferred tax liabilities and/or asset balances for purposes of daily reporting of NAVs and financial statement reporting. In addition, sales of MLP investments will result in allocations to the Fund of taxable ordinary income or loss and capital gain or loss, each in amounts that will not be reported to the Fund until the following year, in magnitudes often not readily estimable before such reporting is made. The portion of gain on a disposition of an MLP equity security that is taxed as ordinary income under the Code will be recognized even if there is a net taxable loss on the disposition.

It is the Fund’s policy to classify interest and penalties associated with underpayment of federal and state income taxes, if any, as income tax expense on its Statement of Operations. The Fund anticipates filing income tax returns in the U.S. federal jurisdiction and various states, and such returns are subject to examination by the tax jurisdictions. The Fund has reviewed all major jurisdictions and concluded that there is no significant impact on its net assets and no tax liability resulting from unrecognized tax benefits or expenses relating to uncertain tax positions expected to be taken on its tax returns.

Return of Capital Estimates — Distributions received from the Fund’s investments in MLPs generally are comprised of income and return of capital. The Fund records investment income and return of capital based on estimates made at the time such distributions are received. Such estimates are based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on information received from MLPs after their tax reporting periods are concluded.

F. Foreign Currency Translation — The accounting records and reporting currency of the Fund are maintained in U.S. dollars. Assets and liabilities denominated in foreign currencies are translated into U.S. dollars using the current exchange rates at the close of each business day. The effect of changes in foreign currency exchange rates on investments is included within net realized and

| 16 |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

|

|

| 2. SIGNIFICANT ACCOUNTING POLICIES (continued) |

unrealized gain (loss) on investments. Changes in the value of other assets and liabilities as a result of fluctuations in foreign exchange rates are included in the Statement of Operations within net change in unrealized gain (loss) on foreign currency translations. Transactions denominated in foreign currencies are translated into U.S. dollars on the date the transaction occurred, the effects of which are included within net realized gain (loss) on foreign currency transactions.

| 3. INVESTMENTS AND FAIR VALUE MEASUREMENTS |

U.S. GAAP defines the fair value of a financial instrument as the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price); the Fund’s policy is to use the market approach. GAAP establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The level in the fair value hierarchy within which the fair value measurement in its entirety falls shall be determined based on the lowest level input that is significant to the fair value measurement in its entirety. The levels used for classifying investments are not necessarily an indication of the risk associated with investing in these investments. The three levels of the fair value hierarchy are described below:

Level 1 — Unadjusted quoted prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2 — Quoted prices in markets that are not active or financial instruments for which significant inputs are observable (including, but not limited to, quoted prices for similar investments, interest rates, foreign exchange rates, volatility and credit spreads), either directly or indirectly;

Level 3 — Prices or valuations that require significant unobservable inputs (including GSAM’s assumptions in determining fair value measurement).

The Board of Trustees (“Trustees”) has approved Valuation Procedures that govern the valuation of the portfolio investments held by the Fund, including investments for which market quotations are not readily available. With respect to the Fund’s investments that do not have readily available market quotations, the Trustees have designated GSAM as the valuation designee to perform fair valuations pursuant to Rule 2a-5 under the Investment Company Act of 1940 (the “Valuation Designee”). GSAM has day-to-day responsibility for implementing and maintaining internal controls and procedures related to the valuation of the Fund’s portfolio investments. To assess the continuing appropriateness of pricing sources and methodologies, GSAM regularly performs price verification procedures and issues challenges as necessary to third party pricing vendors or brokers, and any differences are reviewed in accordance with the Valuation Procedures.

A. Level 1 and Level 2 Fair Value Investments — The valuation techniques and significant inputs used in determining the fair values for investments classified as Level 1 and Level 2 are as follows:

Equity Securities — Equity securities traded on a United States (“U.S.”) securities exchange or the NASDAQ system, or those located on certain foreign exchanges, including but not limited to the Americas, are valued daily at their last sale price or official closing price on the principal exchange or system on which they are traded. If there is no sale or official closing price or such price is believed by GSAM to not represent fair value, equity securities will be valued at the valid closing bid price for long positions and at the valid closing ask price for short positions (i.e. where there is sufficient volume, during normal exchange trading hours). If no valid bid/ask price is available, the equity security will be valued pursuant to the Valuation Procedures and consistent with applicable regulatory guidance. To the extent these investments are actively traded, they are classified as Level 1 of the fair value hierarchy, otherwise they are generally classified as Level 2. Certain equity securities containing unique attributes may be classified as Level 2.

Unlisted equity securities for which market quotations are available are valued at the last sale price on the valuation date, or if no sale occurs, at the last bid price, and are generally classified as Level 2. Securities traded on certain foreign securities exchanges are valued daily at fair value determined by an independent fair value service (if available) under Valuation Procedures approved

| 17 |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

| Notes to Financial Statements (continued)

May 31, 2024 (Unaudited) |

| 3. INVESTMENTS AND FAIR VALUE MEASUREMENTS (continued) |

by the Trustees and consistent with applicable regulatory guidance. The independent fair value service takes into account multiple factors including, but not limited to, movements in the securities markets, certain depositary receipts, futures contracts and foreign currency exchange rates that have occurred subsequent to the close of the foreign securities exchange. These investments are generally classified as Level 2 of the fair value hierarchy.

Underlying Funds (including Money Market Funds) — Underlying funds (“Underlying Funds”) include exchange-traded funds (“ETFs”) and other investment companies. Investments in the Underlying Funds (except ETFs) are valued at the NAV per share on the day of valuation. ETFs are valued daily at the last sale price or official closing price on the principal exchange or system on which the investment is traded. Because the Fund invests in Underlying Funds that fluctuate in value, the Fund’s shares will correspondingly fluctuate in value. Underlying Funds are generally classified as Level 1 of the fair value hierarchy. To the extent that underlying ETFs are actively traded, they are classified as Level 1 of the fair value hierarchy, otherwise they are generally classified as Level 2. For information regarding an Underlying Fund’s accounting policies and investment holdings, please see the Underlying Fund’s shareholder report.

Derivative Contracts — A derivative is an instrument whose value is derived from underlying assets, indices, reference rates or a combination of these factors. The Fund enters into derivative transactions to hedge against changes in interest rates, securities prices, and/or currency exchange rates, to increase total return, or to gain access to certain markets or attain exposure to other underliers. For financial reporting purposes, cash collateral that has been pledged to cover obligations of the Fund and cash collateral received, if any, is reported separately on the Statement of Assets and Liabilities as either due to broker/receivable for collateral on certain derivative contracts. Non-cash collateral pledged by the Fund, if any, is noted in the Schedule of Investments.

Exchange-traded derivatives, including futures and options contracts, are generally valued at the last sale or settlement price on the exchange where they are principally traded. Exchange-traded options without settlement prices are generally valued at the midpoint of the bid and ask prices on the exchange where they are principally traded (or, in the absence of two-way trading, at the last bid price for long positions and the last ask price for short positions). Exchange-traded derivatives, including future contracts, typically fall within Level 1 of the fair value hierarchy. Over-the-counter (“OTC”) and centrally cleared derivatives are valued using market transactions and other market evidence, including market-based inputs to models, calibration to market-clearing transactions, broker or dealer quotations, or other alternative pricing sources. Where models are used, the selection of a particular model to value OTC and centrally cleared derivatives depends upon the contractual terms of, and specific risks inherent in, the instrument, as well as the availability of pricing information in the market. Valuation models require a variety of inputs, including contractual terms, market prices, yield curves, credit curves, measures of volatility, voluntary and involuntary prepayment rates, loss severity rates and correlations of such inputs. For OTC and centrally cleared derivatives that trade in liquid markets, model inputs can generally be verified and model selection does not involve significant management judgment. OTC and centrally cleared derivatives are classified within Level 2 of the fair value hierarchy when significant inputs are corroborated by market evidence.

i. Options Contracts — When the Fund writes call or put options contracts, an amount equal to the premium received is recorded as a liability and is subsequently marked-to-market to reflect the current value of the option written. Swaptions are options on swap contracts.