Summary

Prospectus

Prospectus

March 30, 2023

Goldman Sachs MLP Energy Infrastructure Fund

Class P:

GMNPX

Before you invest, you may want to review the Goldman Sachs MLP Energy Infrastructure Fund (the “Fund”) Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, reports to shareholders and other information about the Fund online at www.gsam.com/content/gsam/us/en/advisors/fund-center/summary-prospectuses.html. You can also get this information at no cost by calling 800-621-2550 or by sending an e-mail request to gs-funds-document-requests@gs.com. The Fund’s Prospectus and Statement of Additional Information (“SAI”), both dated March 30, 2023, are incorporated by reference into this Summary Prospectus.

| Investment Objective |

The Goldman Sachs MLP Energy Infrastructure Fund (the "Fund") seeks total return through current income

and capital appreciation.

| Fees and Expenses of the Fund |

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund.

You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and Example below.

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| |

Class P |

| Management Fees |

0.97% |

| Distribution and/or Service (12b-1) Fees |

None |

| Other Expenses |

0.10% |

| All Other Expenses |

0.10% |

| Deferred/Current Income Tax Expenses1

|

1.14% |

| Total Annual Fund Operating Expenses |

2.21% |

1

The Fund accrues deferred tax liability/benefit for its future

tax liability associated with the capital appreciation of its investments, distributions it receives on interests of master limited partnerships

considered to be a return of capital, and for any net operating gains. The Fund’s accrued deferred tax liability, if any, is reflected each day in the Fund’s net asset value (“NAV”) per share. The Fund’s deferred tax liability/benefit will depend upon income, gains, losses, and deductions

the Fund is allocated from its master limited partnership investments and on the Fund’s realized and unrealized gains and losses, and may vary

greatly from year to year. Therefore, any estimate of deferred tax liability/benefit cannot be reliably predicted from year to year.

| Expense Example |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing

in other mutual funds.

The Example assumes that you invest $10,000 in Class P Shares of the Fund for the time periods indicated and then redeem all of your Class P Shares at the end of those

periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (except that the Example incorporates any applicable fee waiver and/or

expense limitation arrangements for only the first year). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| |

1 Year |

3 Years |

5 Years |

10 Years |

| Class P Shares |

$224 |

$691 |

$1,185 |

$2,544 |

| Portfolio Turnover |

The Fund pays transaction costs when it buys and sells securities or instruments (i.e., “turns over” its portfolio). A high rate of portfolio turnover may result in increased transaction costs, including brokerage commissions, which must be borne

by the Fund and its shareholders. High portfolio turnover may result in the Fund’s recognition of gains (losses) that will increase (decrease) the Fund’s tax liability and thereby impact the amount of the

Fund’s after-tax distributions. In addition, high portfolio turnover may increase the Fund’s current and accumulated earnings and profits, resulting in a greater portion of the Fund’s distributions being treated as

taxable dividends for federal income tax purposes. These costs are not reflected in the annual fund operating expenses or in the expense example above, but are reflected in the Fund’s performance. The

Fund’s portfolio turnover rate for the fiscal year ended November 30, 2022 was

117% of the average value of its portfolio.

2 Summary Prospectus — Goldman Sachs MLP Energy

Infrastructure Fund

| Principal Strategy |

The Fund invests, under normal circumstances, at least 80% of its net assets plus any borrowings for

investment purposes (measured at the time of purchase) (“Net Assets”) in U.S. and non-U.S. equity or fixed income securities issued by energy infrastructure companies, including master limited partnerships

(“MLPs”) and “C” corporations (“C-Corps”). The

Fund’s investments in MLPs will consist of at least 25% of the Fund’s total assets as measured at the time of purchase. The Fund intends to concentrate its investments in the energy sector.

For purposes of the Fund’s 80% policy discussed above, the Fund’s investments in energy infrastructure companies include U.S. and non-U.S. issuers that: (i) are classified

by a third party as operating within the oil and gas storage and transportation sub-industries; (ii) are part of the Fund’s stated benchmark; or (iii) have at least 50% of their assets, income, sales or

profits committed to, or derived from, traditional or alternative midstream (energy infrastructure) businesses, which include businesses that are engaged in the treatment, gathering, compression, processing,

transportation, transmission, fractionation, storage, terminalling, wholesale marketing, liquefaction/regasification of natural gas, natural gas liquids, crude oil, refined products or other energy sources as well as

businesses engaged in owning, storing and transporting alternative energy sources, such as renewables (wind, solar, hydrogen, geothermal, biomass) and alternative fuels (ethanol, hydrogen, biodiesel).

The Fund’s MLP investments may include MLPs structured as limited partnerships (“LPs”) or limited liability companies (“LLCs”); MLPs that are taxed

as C-Corps; institutional units (“I-Units”) issued by MLP affiliates; private investments in public equities (“PIPEs”) issued by MLPs; and other U.S. and non-U.S. equity and fixed income securities and derivative instruments, including

pooled investment vehicles and exchange-traded notes (“ETNs”), that provide exposure to MLPs.

The Fund may also invest up to 20% of its Net Assets in non-energy infrastructure investments, including

equity and fixed income securities of U.S. and non-U.S. companies. Such investments may include issuers in the upstream and downstream sectors of the energy value chain. Upstream energy companies are primarily

engaged in the exploration, recovery, development and production of crude oil, natural gas and

natural gas liquids. Downstream energy companies are primarily engaged in the refining and

retail distribution of natural gas liquids and crude oil.

The Fund’s investments may be of any credit quality, duration or capitalization size. The Fund may

also invest in derivatives, including options, futures, forwards, swaps, options on swaps, structured securities and other derivative instruments. While the Fund may invest in derivatives for hedging

purposes, the Fund generally does not intend to hedge its exposures. The Fund’s investments in derivatives, pooled investment vehicles, and other investments are counted towards the Fund’s 80% policy to the extent

they have economic characteristics similar to the investments included within that policy. The Fund may also invest in privately held companies and companies that only recently began to trade publicly. The Fund

may invest in stock, warrants and other securities of special purpose acquisition companies (“SPACs”).

The Fund is treated as a regular corporation, or “C” corporation, for U.S. federal income tax purposes. Accordingly, unlike traditional

open-end mutual funds, the Fund is subject to U.S. federal income tax on its taxable income at the rates applicable to corporations (at a

rate of 21%) as well as state and local income taxes.

THE FUND IS NON-DIVERSIFIED UNDER THE INVESTMENT COMPANY ACT OF 1940, AS AMENDED (“INVESTMENT COMPANY ACT”), AND MAY INVEST A LARGER PERCENTAGE

OF ITS ASSETS IN FEWER ISSUERS THAN DIVERSIFIED MUTUAL FUNDS.

The Fund’s benchmark index is the Alerian MLP Index (Total Return, Unhedged, USD). The Alerian MLP Index (Total Return, Unhedged, USD) is the leading gauge of energy

infrastructure MLPs and is a capped, float-adjusted, capitalization-weighted index, whose

constituents earn the majority of their cash flow from midstream activities involving energy commodities.

| Principal Risks of the Fund |

Loss of money is a risk of investing in the Fund.

An investment in the Fund is not a bank deposit and is not

insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any government agency. The Fund should not be relied upon as a complete investment program. There can be no assurance that the Fund

will achieve its investment objective. Investments in the Fund involve substantial risks which prospective investors should consider carefully before investing. The Fund's principal risks are presented

below in alphabetical order, and not in the order of importance or potential exposure.

Credit/Default Risk. An issuer or guarantor of fixed income securities or instruments held by the Fund (which may have low

credit ratings) may default on its obligation to pay interest and repay principal or default

on any other obligation. The credit quality of the Fund’s portfolio securities or instruments may meet the Fund’s credit quality requirements at the time of purchase but then deteriorate thereafter, and such a deterioration can occur

rapidly. In certain instances, the downgrading or default of a single holding or guarantor of the Fund’s holding may impair the Fund’s liquidity and have the potential to cause significant deterioration in

net asset value (“NAV”). These risks are heightened in market environments where interest rates are rising as well as in connection with the Fund’s investments in non-investment grade fixed income securities.

Derivatives Risk. The Fund's use of options, futures, swaps, options on swaps and other derivative instruments may result in losses, including due to adverse market

movements. These instruments, which may pose risks in addition to and greater than those associated with investing directly in securities, currencies or other assets and instruments, may increase market exposure

and be illiquid or less liquid, volatile, difficult to price and leveraged so that small changes in the value of the underlying assets or instruments may produce disproportionate losses to the Fund. Certain

derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligations. The use of derivatives is a highly specialized

activity that involves investment techniques and risks different from those associated with investments in more traditional securities and instruments.

Dividend-Paying Investments Risk. The Fund’s investments in dividend-paying securities could cause the Fund to underperform other funds. Securities that pay

dividends, as a group, can fall out of favor with the market, causing such securities to underperform securities that do not pay dividends. Depending upon market conditions and political and legislative responses to such

conditions, dividend-paying securities that meet the Fund’s investment criteria may not be widely available and/or may be highly concentrated in only a few market sectors. In addition, issuers that have paid

regular dividends or distributions to shareholders may not continue to do so at the same level or at all in the future. This may limit the ability of the Fund to produce current income.

3 Summary Prospectus — Goldman Sachs MLP Energy

Infrastructure Fund

Energy Sector Risk. The Fund concentrates its investments in the energy sector, and will therefore be susceptible to adverse

economic, business, social, political, environmental, regulatory or other developments

affecting that sector. The energy sector has historically experienced substantial price volatility. MLPs, energy infrastructure companies and other companies operating in the energy sector are subject to specific risks, including,

among others: fluctuations in commodity prices and/or interest rates; increased governmental or

environmental regulation; reduced availability of natural gas or other commodities for

transporting, processing, storing or delivering; declines in domestic or foreign production; slowdowns in new construction; extreme weather or other natural disasters; and threats of attack by terrorists on energy assets. Energy

companies can be significantly affected by the supply of, and demand for, particular energy products (such as oil and natural gas), which may result in overproduction or underproduction. Additionally,

changes in the regulatory environment for energy companies may adversely impact their profitability. Over time, depletion of natural gas reserves and other energy reserves may also affect the profitability of

energy companies.

During periods of heightened volatility, energy producers that are burdened with debt may seek bankruptcy relief. Bankruptcy laws may permit the revocation or renegotiation

of contracts between energy producers and MLPs/energy infrastructure companies, which could have a dramatic impact on the ability of MLPs/energy infrastructure companies to pay distributions to its

investors, including the Fund, which in turn could impact the ability of the Fund to pay dividends and dramatically impact the value of the Fund’s investments.

Foreign Risk. Foreign securities may be subject to risk of loss because of more or less foreign government regulation; less public information; less stringent investor

protections; less stringent accounting, corporate governance, financial reporting and disclosure standards; and less economic, political and social stability in the countries in which the Fund invests. The imposition of

sanctions, exchange controls, confiscations, trade restrictions (including tariffs) and other government restrictions by the United States and other governments, or from problems in share registration,

settlement or custody, may also result in losses. The type and severity of sanctions and other similar measures, including counter sanctions and other retaliatory actions, that may be imposed could vary broadly in

scope, and their impact is impossible to predict. For example, the imposition of sanctions and other similar measures could, among other things, cause a decline in the value and/or liquidity of securities issued by

the sanctioned country or companies located in or economically tied to the sanctioned country and increase market volatility and disruption in the sanctioned country and throughout the world. Sanctions and other

similar measures could limit or prevent the Fund from buying and selling securities (in the

sanctioned country and other markets), significantly delay or prevent the settlement of

securities transactions, and significantly impact the Fund’s liquidity and performance. Foreign risk also involves the risk of negative foreign currency rate fluctuations, which may cause the value of securities denominated in such

foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time.

Infrastructure Company Risk. Infrastructure companies are susceptible to various factors that may negatively impact their businesses

or operations, including costs associated with compliance with and changes in environmental,

governmental and other regulations, rising interest costs in connection with capital construction and improvement programs, government budgetary constraints that impact publicly funded projects, the effects of general

economic conditions throughout the world, surplus capacity and depletion concerns, increased

competition from other providers of

services, uncertainties regarding the availability of fuel and other natural resources at reasonable prices, the effects of energy conservation policies, unfavorable tax laws or accounting policies and high leverage.

Infrastructure companies will also be affected by innovations in technology that could render the way in which a company delivers a product or service obsolete and natural or man-made disasters.

Interest Rate Risk. When interest rates increase, fixed income

securities or instruments held by the Fund will generally decline in value. Long-term fixed

income securities or instruments will normally have more price volatility because of this risk than short-term fixed income securities or instruments. A wide variety of market factors can cause interest rates to rise,

including central bank monetary policy, rising inflation and changes in general economic conditions. Changing interest rates may have unpredictable effects on the markets, may result in heightened market volatility and may

detract from Fund performance. In addition, changes in monetary policy may exacerbate the risks

associated with changing interest rates. Funds with longer average portfolio durations will

generally be more sensitive to changes in interest rates than funds with a shorter average portfolio duration. Fluctuations in interest rates may also affect the liquidity of fixed income securities and instruments

held by the Fund.

Investment Style Risk. Different investment styles (e.g., “growth”, “value” or “quantitative”) tend to shift in and out of

favor depending upon market and economic conditions and investor sentiment. The Fund may

outperform or underperform other funds that invest in similar asset classes but employ different investment styles. The Fund intends to employ a blend of growth and value investment styles depending on market conditions, either of which may

fall out of favor from time to time. Growth stocks may be more volatile than other stocks because they are more sensitive to investor perceptions of the issuing company’s growth of earnings

potential. Growth companies are often expected by investors to increase their earnings at a certain rate. When these expectations are not met, investors can punish the stocks inordinately even if earnings showed an absolute

increase. Also, since growth companies usually invest a high portion of earnings in their business, growth stocks may lack the dividends of some value stocks that can cushion stock prices in a falling

market. Growth oriented funds will typically underperform when value investing is in favor. Value stocks are those that are undervalued in comparison to their peers due to adverse business developments or

other factors.

Large Shareholder Transactions Risk. The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Such large shareholder redemptions, which may occur rapidly or

unexpectedly, may cause the Fund to sell portfolio securities at times when it would not otherwise do so, which may negatively impact the Fund's NAV and liquidity. Similarly, large Fund

share purchases may adversely affect the Fund's performance to the extent that the Fund is delayed in investing new cash or otherwise maintains a larger cash position than it ordinarily would. These transactions may also

accelerate the realization of taxable income to the Fund and shareholders if such sales of investments resulted in gains, and may also increase transaction costs. In addition, a large redemption could result in the

Fund's current expenses being allocated over a smaller asset base, leading to an increase in the Fund's expense ratio.

Liquidity Risk. The Fund may make investments that are illiquid or that may become less liquid in response to market

developments or adverse investor perceptions. Illiquid investments may be more difficult to

value. Liquidity risk may also refer to the risk that the Fund will not be able to pay

redemption proceeds within the allowable time period because of unusual market conditions, declining prices of the securities

4 Summary Prospectus — Goldman Sachs MLP Energy

Infrastructure Fund

sold, an unusually high volume of redemption requests, or other reasons. To meet redemption requests, the

Fund may be forced to sell securities at an unfavorable time and/or under unfavorable conditions. Redemptions by large shareholders may have a negative impact on a Fund’s liquidity.

Market Risk. The value of the securities in which the Fund invests may

go up or down in response to the prospects of individual companies, particular sectors or

governments and/or general economic conditions throughout the world due to increasingly interconnected global economies and financial markets. Events such as war, military conflict, acts of terrorism, social unrest,

natural disasters, recessions, inflation, rapid interest rate changes, supply chain disruptions, sanctions, the spread of infectious illness or other public health threats could also significantly impact the Fund and

its investments.

Master Limited Partnership Risk. Investments in securities of an MLP involve risks that differ from investments in common stock, including

risks related to limited control and limited rights to vote on matters affecting the MLP.

Certain MLP securities may trade in lower volumes due to their smaller capitalizations, and may be subject to more abrupt or erratic price movements and lower market liquidity. MLPs are generally considered interest-rate

sensitive investments that generally rely on capital markets to finance capital expenditures and growth opportunities. During periods of interest rate volatility, limited capital markets access and/or low

commodities pricing, these investments may not provide attractive returns.

Mid-Cap and Small-Cap Risk. Investments in mid-capitalization and small-capitalization companies involve greater risks than those associated with larger, more established

companies. These securities may be subject to more abrupt or erratic price movements and may lack sufficient market liquidity, and these issuers often face greater business risks.

Non-Diversification Risk. The Fund is non-diversified, meaning that it is permitted to invest a larger percentage of its assets in

one or more issuers or in fewer issuers than diversified mutual funds. Thus, the Fund

may be more susceptible to adverse developments affecting any single issuer held in its portfolio, and may be more susceptible to greater losses because of these developments.

Portfolio Turnover Rate Risk. A high rate of portfolio turnover involves correspondingly greater expenses which must be borne by the

Fund and its shareholders.

Private Investment in Public Equities Risk. The Fund may make PIPE transactions. PIPE transactions typically involve the purchase of securities directly from a publicly traded company or its affiliates in a private placement transaction,

typically at a discount to the market price of the company’s common stock. In a PIPE transaction, the Fund may bear the price risk from the time of pricing until the time of closing. Equity issued in this manner is

often subject to transfer restrictions and is therefore less liquid than equity issued through a registered public offering. For example, the Fund may be subject to lock-up agreements that prohibit transfers for a fixed

period of time. In addition, because the sale of the securities in a PIPE transaction is not registered under the Securities Act, the securities are “restricted” and cannot be immediately resold into the

public markets. The Fund may enter into a registration rights agreement with the issuer pursuant to which the issuer commits to file a resale registration statement allowing the Fund to publicly resell its securities. However, the

ability of the Fund to freely transfer the shares is conditioned upon, among other things, the SEC’s preparedness to declare the resale registration statement effective and the issuer’s right to suspend the

Fund’s use of the resale registration statement if the

issuer is pursuing a transaction or some other material non-public event is occurring. Accordingly, PIPE

securities may be subject to risks associated with illiquid investments.

Special Purpose Acquisition Companies Risk. The Fund may invest in stock, warrants and other securities of SPACs. SPACs are in essence blank check companies without

operating history or ongoing business other than seeking acquisitions. The value of a SPAC’s securities is particularly dependent on the ability of its management to identify and complete a profitable acquisition.

There is no guarantee that the SPACs in which the Fund invests will complete an acquisition or that any acquisitions completed by the SPACs in which the Fund invests will be profitable. The values of

investments in SPACs may be highly volatile and these investments may also have little or no

liquidity.

Stock Risk. Stock prices have historically risen and fallen in periodic cycles. U.S. and foreign stock markets have experienced periods of substantial price volatility in

the past and may do so again in the future.

Strategy Risk. The Fund’s strategy of investing primarily in

MLPs, resulting in its being taxed as a corporation, or a “C” corporation, rather

than as a regulated investment company for U.S. federal income tax purposes, is a relatively

new investment strategy for funds. This strategy involves complicated accounting, tax and valuation issues. Volatility in the NAV may be experienced because of the use of estimates at various times during a given year that may

result in unexpected and potentially significant consequences for the Fund and its

shareholders.

Tax Risk. Tax risks associated with investments in the Fund include but are not limited to the following:

MLP

Tax Risk. MLPs are generally treated as partnerships for U.S. federal income tax purposes.

Partnerships do not pay U.S. federal income tax at the partnership level. Rather, each partner is allocated a share of the partnership’s income, gains, losses, deductions and expenses. A change in current tax

law or a change in the underlying business mix of a given MLP could result in an MLP being treated as a corporation for U.S. federal income tax purposes, which would result in the MLP being required to pay U.S.

federal income tax (as well as state and local income taxes) on its taxable income. This would have the effect of reducing the amount of cash available for distribution by the MLP and could result in a

reduction in the value of the Fund’s investment in the MLP and lower income to the

Fund.

To the extent a distribution received by the Fund from an MLP is treated as a return of capital, the Fund’s adjusted tax basis in the interests of the MLP may be reduced,

which will result in an increase in an amount of income or gain (or decrease in the amount of loss) that will be recognized by the Fund for tax purposes upon the sale of any such interests or upon subsequent

distributions in respect of such interests. Furthermore, any return of capital distribution received from the MLP may require the Fund to restate the character of its distributions and amend any shareholder tax reporting

previously issued. Moreover, a change in current tax law, or a change in the underlying business mix of a given MLP, could result in an MLP investment being treated as a corporation for U.S. federal income tax

purposes, which could result in a reduction of the value of the Fund’s investment in the MLP and lower income to the Fund. Distributions from an MLP in excess of the Fund’s basis in the MLP will

generally be treated as capital gain. However, a portion of the gain may instead be treated as ordinary income to the extent attributable to certain assets held by the MLP the sale of which would produce ordinary income.

Investment in MLP C Corporations. As discussed above, the Fund may invest in MLPs taxed as C corporations. Such MLPs are obligated to

pay federal income tax on their taxable income at the corporate tax rate and the amount of

cash available for distribution by such MLPs would

5 Summary

Prospectus — Goldman Sachs MLP Energy Infrastructure Fund

generally be reduced by any such tax. Additionally, distributions received by the Fund would be taxed under federal income tax laws applicable to corporate dividends (as

dividend income, potentially subject to the corporate dividends received deduction, return of capital, or capital gain). Thus, investment in MLPs taxed as C corporations could result in a reduction of the

value of your investment in the Fund and lower income, as compared to investments in MLPs that are classified as partnerships for tax purposes.

Fund Structure Risk.

Unlike traditional mutual funds that are structured as regulated investment companies for

U.S. federal income tax purposes, the Fund will be taxable as a regular corporation, or “C” corporation, for U.S. federal income tax purposes. This means the Fund generally will be subject to U.S.

federal income tax on its taxable income at the rates applicable to corporations (at a rate of 21%), and will also be subject to state and local income taxes.

Tax Estimation/NAV Risk. In calculating the Fund’s daily NAV, the Fund will, among other things, account for its current

taxes and deferred tax liability and/or asset balances. The Fund will accrue a deferred income

tax liability balance, at the then effective statutory U.S. federal income tax rate (at a

rate of 21%) plus an estimated state and local income tax rate, for its future tax liability associated with the capital appreciation of its investments and the distributions received by the Fund on interests of MLPs considered to be return of

capital and for any net operating gains. Any deferred tax liability balance will reduce the Fund’s NAV. The Fund may also accrue a deferred tax asset balance, which reflects an estimate of the Fund’s future tax

benefit associated with net operating losses and unrealized losses. Any deferred tax asset balance will increase the Fund’s NAV. To the extent the Fund has a deferred tax asset balance, consideration is given as to

whether or not a valuation allowance, which would offset the value of some or all of the deferred tax asset balance, is required. The Fund will rely to some extent on information provided by MLPs, which may not be provided to

the Fund on a timely basis, to estimate current taxes and deferred tax liability and/or asset balances for purposes of financial statement reporting and determining its NAV. The daily estimate of the Fund’s

current taxes and deferred tax liability and/or asset balances used to calculate the Fund’s NAV could vary significantly from the Fund’s actual tax liability or benefit, and, as a result, the determination

of the Fund’s actual tax liability or benefit may have a material impact on the Fund’s NAV. From time to time, the Fund may modify its estimates or assumptions regarding its current taxes and deferred tax liability and/or

asset balances as new information becomes available, which modifications in estimates or assumptions may have a material impact on the Fund’s NAV. Shareholders who redeem their

shares at a NAV that is based on estimates of the Fund’s current taxes and deferred tax liability and/or asset balances may benefit at the expense of remaining shareholders (or

remaining shareholders may benefit at the expense of redeeming shareholders) if the estimates are later revised or ultimately differ from the Fund’s actual tax liability and/or

asset balances.

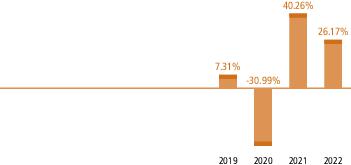

| Performance |

The bar chart and table below provide an indication of the risks of investing in the Fund by showing: (a)

changes in the performance of the Fund’s Class P Shares from year to year; and (b) how the average annual total returns of the Fund’s Class P Shares compare to those of a broad-based securities market

index. Through June 26, 2020, certain of the Fund’s strategies differed. Performance

information set forth below reflects the Fund’s former strategies prior to that date.

The Fund’s past performance, before and after taxes, is not necessarily an indication

of how the Fund will perform in the future. Updated performance information is available at no cost at

https://www.gsam.com/content/dam/gsam/pdfs/us/en/fund-resources/monthly-highlights/retail-fund-facts.pdf?sa=n&rd=n or by calling the phone number on

the back cover of the Prospectus.

Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown.

CALENDAR YEAR (CLASS P)

| During the periods shown in the chart above:

|

Returns |

Quarter ended |

| Best Quarter Return |

35.25% |

June 30, 2020 |

| Worst Quarter Return |

-54.44% |

March 31, 2020 |

| AVERAGE ANNUAL TOTAL RETURN For the period ended

December 31, 2022 |

|

|

|

| 1 Year |

Since

Inception |

Inception

Date | |

| Class P Shares |

|

|

4/16/2018 |

| Returns Before Taxes |

26.17% |

3.48% |

|

| Returns After Taxes on Distributions |

23.22% |

2.50% |

|

| Returns After Taxes on Distributions and Sale of Fund Shares |

15.45% |

2.36% |

|

| Alerian MLP Index (Total Return, Unhedged, USD) (reflects no deduction for fees or expenses) |

30.92% |

5.34% |

|

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund Shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

| Portfolio Management |

Goldman Sachs Asset Management, L.P. is the investment adviser for the Fund (the “Investment

Adviser” or “GSAM”).

Portfolio Managers: Kyri Loupis, Managing Director, has managed the Fund since 2013; Matthew Cooper, Vice President, has

managed the Fund since 2014; and Christopher A. Schiesser, Vice President, has managed the

Fund since 2023.

6 Summary

Prospectus — Goldman Sachs MLP Energy Infrastructure Fund

| Buying and Selling Fund Shares |

The Fund does not impose minimum purchase requirements for initial or subsequent investments in Class

P Shares.

You may

purchase and redeem (sell) Class P Shares of the Fund on any business day through the Goldman Sachs Private Wealth Management business unit, The Goldman Sachs Trust Company, N.A., The Goldman Sachs Trust Company of Delaware, The

Ayco Company, L.P. or with certain intermediaries that are authorized to offer Class P

Shares.

| Tax Information |

The Fund is treated as a regular corporation, or “C” corporation, for U.S. federal, state and

local income tax purposes. The Fund will make distributions that will be treated for U.S. federal income tax purposes as (i) first, taxable dividends to the extent of your allocable share of the Fund’s earnings and

profits, (ii) second, non-taxable returns of capital to the extent of your tax basis in your shares of the Fund (for the portion of those distributions that exceed the Fund’s earnings and profits) and (iii) third, taxable gains (for

the balance of those distributions).

Dividend income will be treated as “qualified dividends” for federal income tax purposes,

subject to favorable capital gain tax rates, provided that certain requirements are met. Unlike a regulated investment company, the Fund will not be able to pass-through the character of its recognized net capital

gain by paying “capital gain dividends.” Although the Fund expects that a significant portion of its distributions will be treated as nontaxable return of capital and gains, combined, no assurance can be

given in this regard. Additionally, a sale of Fund shares is a taxable event for shares held in a taxable account.

| Payments to Broker-Dealers and Other Financial Intermediaries |

If you purchase the Fund through an intermediary that is authorized to offer Class P Shares, the Fund

and/or its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the intermediary and your salesperson to

recommend the Fund over another investment. Ask your salesperson or visit your intermediary’s website for more information.