Summary

Prospectus

Prospectus

March 30, 2023

Financial Square Treasury Instruments Fund

Resource

Shares: GIRXX

Before you invest, you may want to review the Financial Square Treasury Instruments Fund (the “Fund”) Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, reports to shareholders and other information about the Fund online at www.gsamfunds.com/moneymarketfunds. You can also get this information at no cost by calling 800-621-2550 or by sending an e-mail request to gs-funds-document-requests@gs.com. The Fund’s Prospectus and Statement of Additional Information (“SAI”), both dated March 30, 2023, are incorporated by reference into this Summary Prospectus.

| Investment Objective |

The Goldman Sachs Financial Square Treasury Instruments Fund (the “Fund”) seeks to

maximize current income to the extent consistent with the preservation of capital and the maintenance of liquidity by investing exclusively in high quality money market instruments.

| Fees and Expenses of the Fund |

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund.

You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and Example below.

Shareholder

Fees

(fees paid directly from your investment)

| |

Treasury

Instruments

Fund |

| Maximum Sales Charge (Load) Imposed on Purchases |

None |

| Maximum Deferred Sales Charge (Load) |

None |

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends |

None |

| Redemption Fees |

None |

| Exchange Fees |

None |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your

investment)

| Management Fees |

0.18% |

| Distribution (12b-1) Fees |

0.15% |

| Other Expenses |

0.52% |

| Service and Administration Fees |

0.50% |

| All Other Expenses |

0.02% |

| Total Annual Fund Operating Expenses |

0.85% |

| Expense Example |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing

in other mutual funds.

The Example assumes that you invest $10,000 in Resource Shares of the Fund for the time periods indicated and then redeem all of your Resource Shares at the end of those

periods. The Example also assumes

that your investment has a 5% return each year and that the Fund’s operating expenses remain the

same (except that the Example incorporates any applicable fee waiver and/or expense limitation arrangements for only the first year). Although your actual costs may be higher or lower, based on these

assumptions your costs would be:

| |

1 Year |

3 Years |

5 Years |

10 Years |

| Resource Shares |

$87 |

$271 |

$471 |

$1,049 |

| Principal Strategy |

The Fund pursues its investment objective by investing only in U.S. Treasury Obligations, which include

securities issued or guaranteed by the U.S. Treasury where the payment of principal and interest is backed by the full faith and credit of the U.S. government (“U.S. Treasury Obligations”), the

interest from which is generally exempt from state income taxation.

The Fund intends to be a “government money market fund,” as such term is defined in or

interpreted under Rule 2a-7 under the Investment Company Act of 1940, as amended (“Investment Company Act”). “Government money market funds” are money market funds that invest at least 99.5% of their

total assets in cash and securities issued or guaranteed by the United States or certain U.S. government agencies or instrumentalities (“U.S. Government Securities”). Although “government money market

funds” may also invest in repurchase agreements that are collateralized fully by cash or U.S. Government Securities, the Fund may not invest in repurchase agreements. “Government money market funds”

are exempt from requirements that permit money market funds to impose a “liquidity fee” and/or “redemption gate” that temporarily restricts redemptions. As a “government money market

fund,” the Fund values its securities using the amortized cost method. The Fund seeks to maintain a stable net asset value (“NAV”) of $1.00 per share.

Under Rule 2a-7, the Fund may invest only in U.S. dollar-denominated securities that meet certain risk-limiting conditions relating to portfolio quality, maturity and liquidity.

| Principal Risks of the Fund |

You could lose money by investing in the Fund. Although the Fund seeks to preserve the value of your investment at

$1.00 per share, it cannot guarantee it will do so. An investment in the Fund is not a

2 Summary Prospectus — Financial

Square Treasury Instruments Fund

bank deposit and is not insured or guaranteed by the Federal Deposit

Insurance Corporation or any other government agency. The Fund’s sponsor has no legal obligation to provide financial

support to the Fund, and you should not expect that the sponsor will provide financial support to the Fund at any time. The Fund should not be relied upon as a complete investment program. There can be

no assurance that the Fund will achieve its investment objective. The Fund's principal risks are presented below in alphabetical order, and not in the order of importance or potential

exposure.

Credit/Default Risk. An issuer or guarantor of a security held by the Fund may default on its obligation to pay interest and repay principal or default on any other obligation.

Additionally, the credit quality of securities may deteriorate rapidly, which may impair the Fund’s liquidity and cause significant deterioration in NAV.

Interest Rate Risk. When interest rates increase, the Fund’s yield will tend to be lower than prevailing market rates, and the market value of its investments will generally

decline. The Fund may face a heightened level of interest rate risk in connection with the type and extent of certain monetary policy changes made by the Federal Reserve, such as target interest rate changes.

Changing interest rates may have unpredictable effects on the markets, may result in heightened market volatility and may detract from Fund performance. A low interest rate environment poses additional risks

to the Fund, because low yields on the Fund’s portfolio holdings may have an adverse impact on the Fund’s ability to provide a positive yield to its shareholders, pay expenses out of current income, or, at times,

maintain a stable $1.00 share price and/or achieve its investment objective. Fluctuations in interest rates may also affect the liquidity of the Fund’s investments. A sudden or unpredictable increase in interest

rates may cause volatility in the market and may decrease the liquidity of the Fund's investments, which would make it harder for the Fund to sell its investments at an advantageous time.

Large Shareholder Transactions Risk. The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund.

Such large shareholder redemptions, which may occur rapidly or unexpectedly, may cause the

Fund to sell portfolio securities at times when it would not otherwise do so, which may

negatively impact the Fund's NAV and liquidity. Similarly, large Fund share purchases may adversely affect the Fund's performance to the extent that the Fund is delayed in investing new cash or otherwise maintains a larger

cash position than it ordinarily would. These transactions may also accelerate the realization of taxable income to shareholders if such sales of investments resulted in gains, and may also increase transaction costs.

In addition, a large redemption could result in the Fund's current expenses being allocated over a smaller asset base, leading to an increase in the Fund's expense ratio.

Liquidity Risk. The Fund may make investments that are illiquid or that may become less liquid in response to market developments or adverse investor perceptions. Illiquid

investments may be more difficult to value. The liquidity of portfolio securities can deteriorate rapidly due to credit events affecting issuers or guarantors, such as a credit rating downgrade, or due to general market

conditions or a lack of willing buyers. An inability to sell one or more portfolio positions, or selling such positions at an unfavorable time and/or under unfavorable conditions, can adversely affect the

Fund’s ability to maintain a stable $1.00 share price. Liquidity risk may also refer to the risk that the Fund will not be able to pay redemption proceeds within the allowable time period because of unusual market

conditions, declining prices of the securities sold, an unusually high volume of redemption requests, or other reasons. Liquidity risk may be the result of, among other things, the reduced number and capacity of

traditional market participants to

make a market in fixed income securities or the lack of an active market. The potential for liquidity risk

may be magnified by a rising interest rate environment or other circumstances where investor

redemptions from money market and other fixed income mutual funds may be higher than normal,

potentially causing increased supply in the market due to selling activity.

Market Risk. The value of the securities in which the Fund invests may go up or down in response to the prospects of

governments and/or general economic conditions throughout the world due to increasingly

interconnected global economies and financial markets. Events such as war, military conflict,

acts of terrorism, social unrest, natural disasters, recessions, inflation, rapid interest rate changes, supply chain disruptions, sanctions, the spread of infectious illness or other public health threats could also

significantly impact the Fund and its investments.

Stable NAV Risk. The Fund may not be able to maintain a stable $1.00 share price at all times. If any money market fund

that intends to maintain a stable NAV fails to do so (or if there is a perceived threat of

such a failure), other such money market funds, including the Fund, could be subject to

increased redemption activity, which could adversely affect the Fund’s NAV. Shareholders of the Fund should not rely on or expect the Investment Adviser or an affiliate to purchase distressed assets from the Fund, make capital

infusions into the Fund, enter into capital support agreements with the Fund or take other actions to help the Fund maintain a stable $1.00 share price.

3 Summary Prospectus — Financial

Square Treasury Instruments Fund

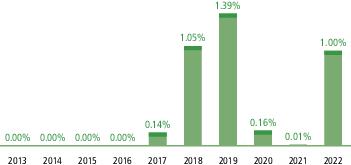

| Performance |

The bar chart and table below provide an indication of the risks of investing in the Fund by showing: (a) changes in the performance of the Fund’s Resource Shares from year to year; and (b) the average annual total returns of the Fund’s Resource Shares. The Fund’s past performance is not necessarily an indication of how the Fund will perform in the future. Performance reflects fee waivers

and/or expense limitations in effect during the periods shown. Updated performance information is available at no cost at www.gsamfunds.com/performance or by calling 1-800-621-2550.

CALENDAR YEAR

| During the periods shown in the chart above:

|

Returns |

Quarter ended |

| Best Quarter Return |

0.69% |

December 31, 2022 |

| Worst Quarter Return |

0.00% |

March 31, 2022 |

| AVERAGE ANNUAL TOTAL RETURN For the period ended

December 31, 2022 |

|

|

|

|

| 1 Year |

5 Years |

10 Years |

Inception

Date | |

| Resource Shares |

1.00% |

0.72% |

0.37% |

5/14/2010 |

| Portfolio Management |

Goldman Sachs Asset Management, L.P. is the investment adviser for the Fund (the “Investment

Adviser” or “GSAM”).

| Buying and Selling Fund Shares |

Generally, Resource Shares may be purchased only through certain intermediaries that have a relationship

with Goldman Sachs & Co. LLC (“Goldman Sachs”), including banks, trust companies, brokers, registered investment advisers and other financial institutions (“Intermediaries”) that

have agreed to provide certain administration and personal and account maintenance services to their customers who are the beneficial owners of Resource Shares. The minimum initial investment requirement imposed upon

Intermediaries for the purchase of Resource Shares is generally $10 million, and there is no minimum imposed upon additional investments. Intermediaries may, however, impose a minimum amount for initial and

additional investments in Resource Shares, and may establish other requirements such as a

minimum account balance.

You may purchase and

redeem (sell) shares of the Fund on any business day through an Intermediary.

| Tax Information |

The Fund’s distributions are taxable, and will be taxed as ordinary income or capital gains, unless

you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Investments made through tax-deferred arrangements may become taxable upon withdrawal from such arrangements.

| Payments to Broker-Dealers and Other Financial Intermediaries |

If you purchase the Fund through an Intermediary, the Fund and/or its related companies may pay the

Intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the Intermediary and your salesperson to recommend the Fund over another investment. Ask your

salesperson or visit your Intermediary’s website for more information.