UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive,

Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| Copies to: | ||

| Caroline Kraus, Esq |

Stephen H. Bier, Esq. | |

| Goldman Sachs & Co. LLC |

Dechert LLP | |

| 200 West Street |

1095 Avenue of the Americas | |

| New York, New York 10282 |

New York, NY 10036 | |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: November 30

Date of reporting period: November 30, 2022

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| The Annual Report to Shareholders is filed herewith. |

Goldman Sachs MLP Energy Infrastructure Fund

| NOT FDIC-INSURED | May Lose Value | No Bank Guarantee | ||

PORTFOLIO RESULTS

Goldman Sachs MLP Energy Infrastructure Fund

Investment Objective and Principal Investment Strategy

The Fund seeks total return through current income and capital appreciation.

The Fund invests, under normal circumstances, at least 80% of its net assets plus any borrowings for investment purposes (measured at the time of purchase) in U.S. and non-U.S. equity or fixed income securities issued by energy infrastructure companies, including master limited partnerships (“MLPs”) and “C” corporations. The Fund’s investments in MLPs will consist of at least 25% of the Fund’s total assets as measured at the time of purchase. The Fund intends to concentrate its investments in the energy sector.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Energy and Infrastructure Team discusses the Goldman Sachs MLP Energy Infrastructure Fund’s (the “Fund”) performance and positioning for the 12-month period ended November 30, 2022 (the “Reporting Period”).

| Q | How did the Fund perform during the Reporting Period? |

| A | During the Reporting Period, the Fund’s Class A, Class C, Institutional, Investor, Class R6, Class R and Class P Shares generated average annual total returns, without sales charges, of 34.91%, 33.89%, 35.45%, 35.28%, 35.45%, 34.59% and 35.43%, respectively. These returns compare to the 42.25% average annual total return of the Alerian MLP Index. The Alerian MLP Index is a leading measure of energy infrastructure master limited partnerships (“MLPs”).1 |

| Q | How did energy-related securities overall perform during the Reporting Period? |

| A | Energy-related securities generally produced strong gains during the Reporting Period, as crude oil and natural gas prices rose and remained elevated despite bouts of volatility. The price of Brent crude oil increased 23.70% during the Reporting Period, while natural gas prices averaged $6.26 MMBtu, 38% higher than their average at the beginning of the Reporting Period. (MMBtu is million British thermal units, the standard measurement for natural gas.) |

As the Reporting Period started in December 2021, commodities and energy-related securities experienced a brief but sharp sell-off. The sell-off was driven by worries around the spread of the COVID-19 Omicron variant, which had raised concerns about how the variant might impact near-term demand for commodities. However, data

| 1 | Source: Alerian. The Alerian MLP Index is the leading gauge of energy infrastructure Master Limited Partnerships (“MLPs”). The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price-return basis (AMZ) and on a total-return basis (AMZX). It is not possible to invest directly in an unmanaged index. |

suggesting Omicron was less severe symptomatically than previous variants helped to ease market fears and supported a rebound in crude oil prices and energy-related securities through year-end 2021.

During the first quarter of 2022, commodities and energy-related securities advanced overall, as underlying fundamentals strengthened. U.S. oil demand ticked higher, while supply struggled to keep up, as discipline from OPEC+ and from U.S. producers, who have become primarily focused on maximizing free cash flow, reined in production growth. (OPEC+ is the Organization of the Petroleum Exporting Countries (“OPEC”) and Russia.) The result was undersupplied energy markets, which were further pressured by the invasion of Ukraine by Russia, a major global exporter of crude oil and natural gas, on February 24th. After the invasion, crude oil prices rose, with Brent crude oil reaching $128 per barrel, its highest level since 2008, in early March.

After surging to this record level, crude oil prices subsequently experienced volatility during the second calendar quarter, driven by developments surrounding the Russia/Ukraine war, the possibility of a European Union ban on Russian oil, and potential oil demand-side concerns stemming from rising COVID-19 cases and lockdown procedures in China. However, a combination of strong global energy demand, tight inventories, limited spare capacity and announcements of the European Union’s ban on Russian oil imports kept crude oil prices elevated. On the supply side, global supply shortages led to low inventories of crude oil and natural gas, while at the same time, demand continued to recover, supported by an uptick in seasonal travel as well as by high liquified natural gas (“LNG”) prices that pushed certain countries to turn to crude oil and related refined products as replacements.

1

PORTFOLIO RESULTS

During the remainder of the Reporting Period, crude oil prices experienced weakness, with Brent crude oil prices falling 21.65% between July 1, 2022 and November 30, 2022. Much of the weakness was driven by global demand concerns related to two primary issues—growing recession risks and ongoing COVID-19 lockdowns in China—as well as U.S. dollar strength. Prices were briefly supported by the OPEC+ announcement in October that it planned to cut production by two million barrels per day, starting in November, in an effort to stabilize prices. However, investors’ broader macroeconomic concerns ultimately pared back any gains. It is important to note that OPEC+ was already well below its production quota, and therefore, we estimate that the cut in production in November amounted to approximately one million barrels per day compared to production levels beforehand. Overall, the macroeconomic concerns that drove extreme market volatility and weighed on crude oil prices during the last five months of the Reporting Period overshadowed the underlying tight oil market fundamentals. Despite this weakness, Brent crude oil prices remained elevated at the end of the Reporting Period at nearly $85 per barrel—34% higher than the average price of $64 a barrel from 2016 through 2019, prior to COVID-19.

At the end of the Reporting Period, the fundamental backdrop remained supportive of strong crude oil prices, in our view, with global demand (ex-China) having largely normalized to pre-COVID levels. On the supply side, production levels were also back to pre-COVID levels, but years of underinvestment, combined with healthy demand growth, left inventory levels nearly 10% below long-term averages.2

On the natural gas side, years of unsound energy policies, predominantly in Europe, and underinvestment in natural gas infrastructure led to the energy shortages and steep increase in consumer prices seen during the Reporting Period. The ongoing war in Ukraine further intensified the effects of the energy crisis, with the curtailment of Russian gas exports to Europe resulting in historically low inventories and high prices. For example, Nordic power prices were up 535% during the Reporting Period overall.3

Despite the volatility in crude oil and natural gas prices during the Reporting Period, as well as record high inflation levels and a recession narrative, midstream4 energy markets ultimately moved higher. The Alerian MLP Index, which measures energy infrastructure master limited partnerships

| 2 | Joint Organisations Data Initiative (JODI). |

| 3 | European Power Prices: Germany Power Baseload Forward Year 1. |

| 4 | The midstream component of the energy industry is usually defined as those companies providing products or services that help link the supply side (i.e., energy producers) and the demand side (i.e., energy end-users for any type of energy commodity. Such midstream businesses can include, but are not limited to, those that process, store, market and transport various energy commodities. |

(“MLPs”), and the Alerian Midstream Energy Index,5 which measures the broader midstream sector inclusive of both energy MLPs and “C” corporations, generated total returns of 42.25% and 30.78%, respectively, during the Reporting Period. The midstream markets, as represented by the Alerian MLP Index and the Alerian Midstream Energy Index, significantly outperformed the S&P 500® Index6, which returned -9.21% during the Reporting Period.

Higher oil and natural gas prices and growing volumes supported strong earnings growth for midstream companies, and management teams continued to focus on capital discipline, balance sheet strength and, above all, generating free cash flow and returning it back to investors via dividends and buybacks—all of which we believe was generally well received by the market. The strong quarterly earnings announcements during the Reporting Period and upward earnings revisions reaffirmed the fundamental stability and defensive nature of the midstream sector, which helped to support equity price performance in a volatile market environment. In addition, the sector may have benefited from a broad rotation from growth to value stocks as well as from an uptick in MLP merger and acquisition activity during the Reporting Period.

Toward the end of the Reporting Period, the U.S. Inflation Reduction Act of 2022 was passed, which aims to make a historic down payment on deficit reduction to fight inflation, invest in domestic energy production and manufacturing, and reduce carbon emissions by approximately 40% by 2030. The Inflation Reduction Act of 2022 included a new 15% corporate alternative minimum tax based on book income for companies that report more than $1 billion in profits to shareholders. However, midstream companies structured as MLPs were excluded from this new provision, which we believe further supported equity price performance during the Reporting Period.

At the end of the Reporting Period, energy infrastructure remained one of the highest yielding equity market segments, with yields in excess of 6%, which is four times higher than that of the S&P 500® Index and nearly twice the yields of both the utilities and real estate investment trusts sectors.

| 5 | Source: Alerian. The Alerian Midstream Energy Index is a broad-based composite of North American energy infrastructure companies. The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price-return basis (AMNA), total-return basis (AMNAX), net total-return (AMNAN), and adjusted net total return (AMNTR) basis. It is not possible to invest directly in an unmanaged index. |

| 6 | Source: S&P Global. The S&P 500® Index is a U.S. stock market index based on the market capitalizations of 500 large companies having common stock listed on the New York Stock Exchange or NASDAQ. The S&P 500® Index components and their weightings are determined by S&P Dow Jones Indices. It is not possible to invest directly in an unmanaged index. |

2

PORTFOLIO RESULTS

From a valuation perspective at the end of the Reporting Period, the midstream sector screened as inexpensive, trading at a 4.9x discount relative to the broader equity markets, with a more than 10% free cash flow yield. In our view, valuations remained dislocated from the sector’s earnings potential.

| Q | What key factors were responsible for the Fund’s relative performance during the Reporting Period? |

| A | During the Reporting Period, the Fund generated double-digit positive absolute returns but underperformed the Alerian MLP Index on a relative basis. These results were driven by subsector and security selection. |

Regarding its exposures, the Fund was hurt by security selection in the gathering/processing and natural gas pipeline transportation subsectors.7 It was helped by security selection in the hydrocarbon production mining and petroleum pipeline transportation subsectors.

During the Reporting Period, we continued to emphasize risk-adjusted returns and focused on high-quality issuers (i.e., those with strong dividend/distribution coverage, cash flow growth potential, capital discipline, etc.). As a result, the Fund was modestly underweight versus the Alerian MLP Index in high-beta stocks,8 which detracted from its relative performance during the Reporting Period as energy-related stocks rallied amid elevated crude oil and natural gas prices.

| Q | What individual holdings detracted from the Fund’s relative performance during the Reporting Period? |

| A | During the Reporting Period, the Fund’s underweight versus the Alerian MLP Index in EnLink Midstream LLC and its overweights in Fast Radius, Inc. and ONEOK, Inc. detracted from relative performance. |

EnLink Midstream LLC (ENLC) is a midstream operator involved in natural gas gathering, treating, processing, transmission, distribution, supply and marketing, and crude oil marketing. The company has assets across U.S. shale basins, including exposure to the Permian Basin and MidCon Basin. The Fund’s underweight position in ENLC detracted from relative performance during the Reporting Period, as an increase in customer activity across the company’s operating segments greatly improved its financial outlook. Additionally, ENLC has entered into multiple joint ventures to utilize its existing asset base for carbon capture, a growth area being pursued by many midstream operators.

| 7 | Sector and subsector allocations are defined by GSAM and may differ from sector allocations used by the Alerian MLP Index. |

| 8 | Beta is a measure of a stock’s volatility relative to an index or the overall market. A beta greater than 1.0 indicates that the stock’s price is theoretically more volatile than the index or overall market. |

An overweight in Fast Radius, Inc. (FSRD), a provider of cloud-based manufacturing platform solutions that deliver data and insights for design, production and supply-chain management, also detracted from the Fund’s relative performance. Its shares fell after FSRD significantly reduced its 2022 revenue expectations, as the global economic slowdown and supply-chain disruptions impaired customer demand for its cloud-based manufacturing process. The decline jeopardized the company’s ability to raise the capital it needed to build out its operations. By the end of the Reporting Period, we had sold the Fund’s position in FSRD common stock.9

ONEOK, Inc. (OKE) is a leading midstream service provider that owns one of the nation’s premier natural gas liquids systems. Severe winter storms in North Dakota resulted in widespread shut-ins during April and May 2022, which, in turn, drove lower earnings for OKE during the second calendar quarter. In early July 2022, OKE’s Medford, Oklahoma fractionator suffered an explosion, rendering the entire facility unusable. Until its third quarter 2022 earnings announcement was made in early November, investors were concerned about OKE’s ability to achieve its financial targets. However, as part of its third quarter 2022 earnings call, OKE not only reiterated its full-year financial guidance but provided a preliminary look at 2023 financial performance, which was substantially better than consensus expectations.

| Q | What individual holdings added to the Fund’s relative performance during the Reporting Period? |

| A | Compared to the Alerian MLP Index, the Fund was helped during the Reporting Period by an overweight in Cheniere Energy, Inc. and underweight positions in Magellan Midstream Partners, L.P. and Genesis Energy L.P. |

Cheniere Energy, Inc. is a pure-play U.S. LNG producer that exports LNG to dozens of countries worldwide. With global LNG supplies more and more constrained by growing demand, curtailed Russian exports and outages at various U.S. LNG facilities, Cheniere Energy, Inc. has become an essential supplier of LNG to world markets. As a result of tightening markets, the spread between global LNG prices and U.S. natural gas prices widened considerably during the Reporting Period, improving the company’s near-term and long-term profit outlook. Additionally, Cheniere Energy, Inc. has leveraged its position to contract incremental capacity expected to come online during the next several years.

| 9 | The Fund maintained a small position in private investments in public equities (“PIPEs”), warrants and founder shares of FSRD at the end of the Reporting Period. |

3

PORTFOLIO RESULTS

Magellan Midstream Partners, L.P. (MMP) is primarily involved in the storage, transportation and distribution of refined petroleum products. We believe shares of MMP declined during the Reporting Period because refined product volumes remained somewhat weak compared to 2019 levels and because the company’s assets are largely not a beneficiary of the continued recovery in oil and gas production volumes.

Genesis Energy, L.P. (GEL) is a midstream MLP that provides energy infrastructure and logistics services, primarily focused on the U.S. Gulf Coast and on the Gulf of Mexico region. GEL’s diversified asset exposure, including sectors not directly related to energy (e.g., soda ash), drove its underperformance relative to stocks with greater beta exposure to energy commodity prices.

| Q | Were there any notable purchases or sales during the Reporting Period? |

| A | During the Reporting Period, the Fund established a position in Kinetik Holdings Inc. (KNTK), a Permian Basin-based midstream company focused on providing natural gas gathering, processing and transportation services for upstream10 companies. We initiated the Fund position because we believe KNTK offers strong exposure to the growth of midstream volumes in the Permian Basin and was trading, at the time of purchase, at a significant discount to similarly positioned companies. Additionally, we believe the company’s fee-based contract structure should provide some insulation to earnings volatility in case commodity prices weaken from current levels. |

Another notable Fund purchase during the Reporting Period was Chesapeake Energy Corporation (CHK), a U.S. exploration and production company. In our view, CHK is well positioned for growing U.S. LNG exports from the U.S. Gulf Coast because of the location of its acreage, particularly in the Haynesville Shale. Additionally, the company successfully emerged from financial restructuring in 2021, and we believe its lower debt levels compared to its peer average also position the company to effectively navigate a variety of potential market environments.

In addition to the sale of FSRD, mentioned earlier, we exited the Fund’s position in Archaea Energy Inc. (LFG) during the Reporting Period. LFG is focused on developing and operating landfill-based renewable natural gas facilities that capture waste emissions and converts them into low carbon fuel. On October 17, 2022, LFG received an all-cash buyout

| 10 | The upstream component of the energy industry is usually defined as those operations stages in the oil and gas industry that involve exploration and production. Upstream operations deal primarily with the exploration stages of the oil and gas industry, with upstream firms taking the first steps to first locate, test and drill for oil and gas. Later, once reserves are proven, upstream firms will extract any oil and gas from the reserve. |

offer from BP p.l.c. for $26 a share, a 54% premium over the share price at the market close on October 14th. Once the stock traded within what we deemed a reasonable spread (i.e., difference in price) to the buyout offer, we sold the Fund’s position.

Also during the Reporting Period, we exited the Fund’s position in Shell Midstream Partners, L.P. (SHLX), which owns, operates, develops and acquires pipelines and other midstream and logistics assets. SHLX was acquired by Shell USA, Inc. on October 19, 2022. We sold the Fund’s position ahead of the acquisition to take advantage of other investment opportunities.

| Q | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | During the Reporting Period, the Fund used equity call options primarily to gain tactical exposure to exploration and production companies, which are closer to the wellhead and therefore, well positioned, in our view, to benefit from the commodity price recovery. In certain situations, for stocks with elevated volatility, we sold covered equity call options to collect premiums. Overall, the use of equity call options had a neutral impact on the Fund’s performance during the Reporting Period. |

| Q | What is the Fund’s tactical view and strategy for the months ahead? |

| A | At the end of the Reporting Period, we had a positive outlook for commodity prices and oil-related securities, though global demand concerns and U.S. dollar strength may continue to drive market volatility in the near term. Our view was supported, we believed, by strong fundamentals, with tight supply/demand dynamics and critically low inventories. |

Additionally, we have seen energy policy shift as the global economy looks to address growing global energy needs, with energy security becoming a priority of many developed nations following the Russian invasion of Ukraine. In our view, North America is uniquely positioned as a potential key source of safe, reliable and relatively clean oil and natural gas for decades to come. Looking at LNG specifically, the U.S. has spent billions of dollars on LNG infrastructure during the last five years or so to supply the world with essential LNG under long-term contracts. Since 2017, the U.S. has grown natural gas production by about 50% and LNG exports by more than 900%, making it the largest global LNG exporter, with expectations for U.S. LNG exports to triple by 2032 relative to 2021 levels.11

We further expected the energy sector to potentially experience additional interest as the world’s perception around energy security and terminal value shifts and as money managers rationalize underweight energy exposure.

| 11 | Bloomberg and Energy Information Agency. |

4

PORTFOLIO RESULTS

Energy equities were expected by many analysts to deliver approximately 10.5% of S&P 500® Index earnings in calendar year 2022, even though the sector represents only 5.3% of the S&P 500® Index. Looking at the relationship of earnings contribution to index weight historically would suggest the energy sector’s weight within the S&P 500® Index could grow to nearly 8%, presenting an opportunity for continued outperformance and sector interest.

Regarding midstream energy companies, we believed at the end of the Reporting Period that fundamentals were some of the most attractive on record, with midstream cash flow inflecting higher alongside strong oil and natural gas prices and management teams demonstrating capital and cost discipline. The sector was generating significant amounts of free cash flow at the end of the Reporting Period, which, in our opinion, not only adequately supported then-current distributions and dividends but also left plenty of excess cash to further reduce debt, buy back stock and/or grow distributions and dividends. In addition, while high inflation and recessionary indicators were not positive headlines, midstream businesses have benefited, in our opinion, from having contracted cash flows with embedded inflationary escalators, which historically have proven to support earnings resiliency during economic downturns. The market dynamics seen at the end of the Reporting Period also appeared to be driving a rotation from growth to value stocks, and midstream equities—along with other value-oriented stocks—may be the beneficiaries of increased fund flows. Overall, we believed at the end of the Reporting Period the midstream sector presented a compelling investment opportunity alongside a strong commodity price backdrop, healthy fundamentals and inexpensive valuations. Additionally, the sector was well positioned, in our view, to benefit from the growing need for North American energy.

While there are certainly still risks, such as a tightening of COVID-19 restrictions and/or growing recession concerns, we believed the risk/reward profile for the midstream sector at the end of the Reporting Period remained meaningfully positive.

In managing the Fund, we intend to remain focused on high quality companies with strong dividend/distribution coverage, cash flow growth potential and what we see as a robust outlook for free cash flow generation and healthy balance sheets. As always, we continue to monitor domestic and global economies, geopolitical factors, interest rates and equity market fundamentals as we actively manage the Fund.

5

FUND BASICS

Goldman Sachs MLP Energy Infrastructure Fund

as of November 30, 2022

| TOP TEN HOLDINGS AS OF 11/30/22‡ |

| Holding | % of Net Assets | Line of Business | ||

| Energy Transfer LP |

9.3% | Pipeline Transportation | Natural Gas | ||

| Western Midstream Partners LP |

8.0 | Gathering + Processing | ||

| MPLX LP |

7.6 | Gathering + Processing | ||

| DCP Midstream LP |

7.4 | Gathering + Processing | ||

| Targa Resources Corp. |

6.8 | Gathering + Processing | ||

| Enterprise Products Partners LP |

6.5 | Pipeline Transportation | Natural Gas | ||

| Magellan Midstream Partners LP |

5.8 | Pipeline Transportation | Petroleum | ||

| Plains All American Pipeline LP |

5.0 | Pipeline Transportation | Petroleum | ||

| Cheniere Energy, Inc. |

4.7 | Other | Liquefaction | ||

| The Williams Cos., Inc. |

4.1 | Gathering + Processing |

| ‡ | The top 10 holdings may not be representative of the Fund’s future investments. |

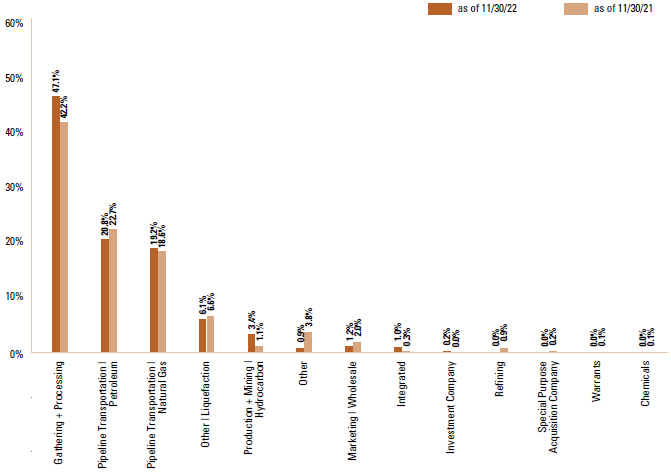

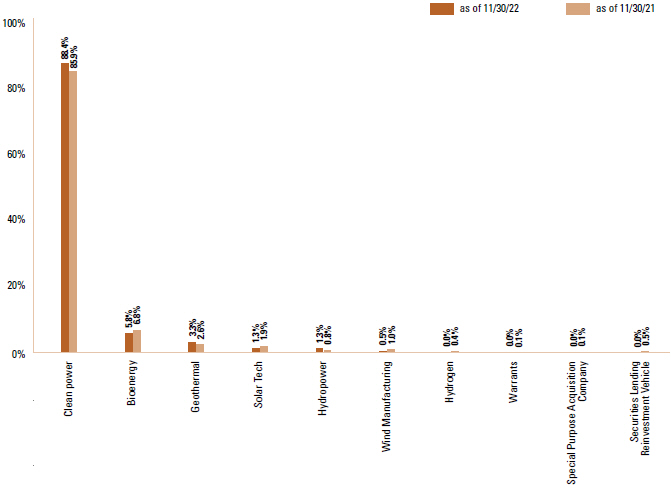

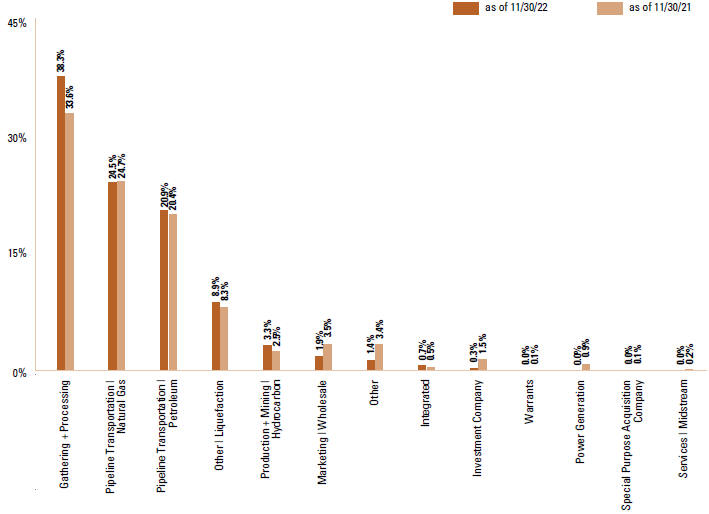

| FUND SECTOR ALLOCATIONS* |

| * | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The percentage shown for each investment category reflects the value of investments in that category as a percentage of total net assets. Figures in the above table may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance. |

6

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

Performance Summary

November 30, 2022

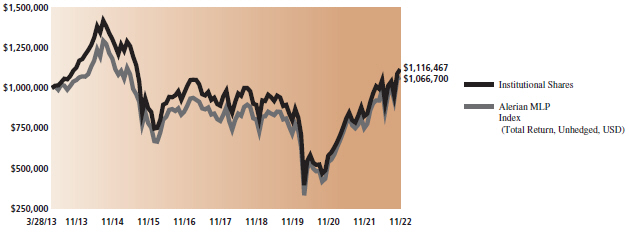

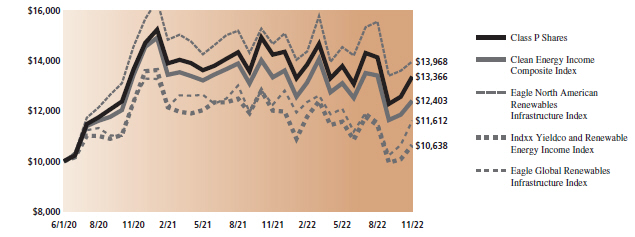

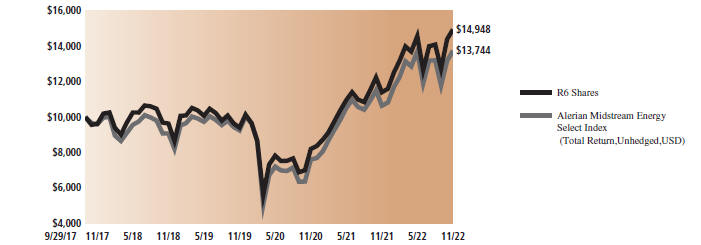

The following graph shows the value, as of November 30, 2022, of a $1,000,000 investment made on March 28, 2013 (commencement of operations) in Institutional Shares at NAV. For comparative purposes, the performance of the Fund’s benchmark, the Alerian MLP Index (Total Return, Unhedged, USD) is shown. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns set forth below represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted below. Please visit our website at www.GSAMFUNDS.com to obtain the most recent month-end returns.

| MLP Energy Infrastructure Fund’s Lifetime Performance | ||

| Performance of a $1,000,000 investment, with distributions reinvested, from March 28, 2013 through November 30, 2022. | ||

| Average Annual Total Return through November 30, 2022* | One Year | Five Years | Since Inception | |||||||||||||||||||||

| Class A (Commenced March 28, 2013) | ||||||||||||||||||||||||

| Excluding sales charges | 34.91% | 4.23% | 0.75% | |||||||||||||||||||||

| Including sales charges | 27.51% | 3.05% | 0.16% | |||||||||||||||||||||

|

|

||||||||||||||||||||||||

| Class C (Commenced March 28, 2013) | ||||||||||||||||||||||||

| Excluding contingent deferred sales charges | 33.89% | 3.52% | 0.03% | |||||||||||||||||||||

| Including contingent deferred sales charges | 32.82% | 3.52% | 0.03% | |||||||||||||||||||||

|

|

||||||||||||||||||||||||

| Institutional (Commenced March 28, 2013) | 35.45% | 4.65% | 1.14% | |||||||||||||||||||||

|

|

||||||||||||||||||||||||

| Investor (Commenced March 28, 2013) | 35.28% | 4.52% | 1.01% | |||||||||||||||||||||

|

|

||||||||||||||||||||||||

| Class R6 (Commenced April 2, 2018) | 35.45% | N/A | 6.41% | |||||||||||||||||||||

|

|

||||||||||||||||||||||||

| Class R (Commenced March 28, 2013) | 34.59% | 4.01% | 0.50% | |||||||||||||||||||||

|

|

||||||||||||||||||||||||

| Class P (Commenced April 16, 2018) | 35.43% | N/A | 4.70% | |||||||||||||||||||||

|

|

||||||||||||||||||||||||

| * | These returns assume reinvestment of all distributions at NAV and reflect a maximum initial sales charge of 5.50% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Investor, Class R6, Class R and Class P Shares do not involve a sales charge, such a charge is not applied to their Average Annual Total Return. |

7

FUND BASICS

Index Definitions

The Alerian MLP Index is a composite of the 50 most prominent energy master limited partnerships calculated by Standard & Poor’s using a float-adjusted market capitalization methodology. The Alerian MLP Index is disseminated by the New York Stock Exchange real-time on a price return basis (NYSE: AMZ). The corresponding total return index is calculated and disseminated daily through ticker AMZX. The Alerian MLP Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index.

8

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

|

November 30, 2022 |

| Shares | Description | Value | ||||||

| Common Stocks – 99.7% |

| |||||||

| Gathering + Processing – 47.1% | ||||||||

| 2,025,000 |

Crestwood Equity Partners LP | $ | 59,980,500 | |||||

| 2,837,500 |

DCP Midstream LP | 111,627,250 | ||||||

| 4,700,000 |

EnLink Midstream LLC | 60,442,000 | ||||||

| 637,500 |

Hess Midstream LP Class A | 19,909,125 | ||||||

| 3,387,500 |

MPLX LP | 115,141,125 | ||||||

| 875,000 |

ONEOK, Inc. | 58,555,000 | ||||||

| 1,387,500 |

Targa Resources Corp. | 103,216,125 | ||||||

| 1,787,500 |

The Williams Cos., Inc. | 62,026,250 | ||||||

| 4,337,500 |

Western Midstream Partners LP | 121,363,250 | ||||||

|

|

|

|||||||

| 712,260,625 | ||||||||

|

|

||||||||

| Integrated – 1.0% | ||||||||

| 33,500 |

Chevron Corp. | 6,140,885 | ||||||

| 81,750 |

Exxon Mobil Corp. | 9,102,045 | ||||||

|

|

|

|||||||

| 15,242,930 | ||||||||

|

|

||||||||

| Marketing | Wholesale – 1.2% | ||||||||

| 437,200 |

Sunoco LP | 18,773,368 | ||||||

|

|

||||||||

| Other – 0.9% | ||||||||

| 101,750 |

Canadian Natural Resources Ltd. | 6,076,510 | ||||||

| 424,700 |

Clean Energy Fuels Corp.* | 2,870,972 | ||||||

| 537,100 |

Tidewater Renewables Ltd.* | 4,703,593 | ||||||

|

|

|

|||||||

| 13,651,075 | ||||||||

|

|

||||||||

| Other | Liquefaction – 6.1% | ||||||||

| 275,000 |

Cheniere Energy Partners LP | 17,072,000 | ||||||

| 400,000 |

Cheniere Energy, Inc. | 70,144,000 | ||||||

| 499,600 |

NextDecade Corp.* | 2,712,828 | ||||||

| 699,500 |

Tellurian, Inc.* | 1,881,655 | ||||||

|

|

|

|||||||

| 91,810,483 | ||||||||

|

|

||||||||

| Pipeline Transportation | Natural Gas – 19.2% | ||||||||

| 512,500 |

DTE Midstream, Inc. | 30,919,125 | ||||||

| 11,250,000 |

Energy Transfer LP | 141,075,000 | ||||||

| 3,937,500 |

Enterprise Products Partners LP | 97,689,375 | ||||||

| 462,500 |

TC Energy Corp. | 20,572,000 | ||||||

|

|

|

|||||||

| 290,255,500 | ||||||||

|

|

||||||||

| Pipeline Transportation | Petroleum – 20.8% | ||||||||

| 987,500 |

Enbridge, Inc. | 40,773,875 | ||||||

| 737,500 |

Genesis Energy LP | 7,795,375 | ||||||

| 1,662,500 |

Magellan Midstream Partners LP | 87,613,750 | ||||||

| 937,500 |

NuStar Energy LP | 15,309,375 | ||||||

| 700,000 |

PBF Logistics LP | 13,930,000 | ||||||

| 1,162,500 |

Pembina Pipeline Corp. | 42,408,000 | ||||||

| 6,125,000 |

Plains All American Pipeline LP | 76,072,500 | ||||||

| 2,375,000 |

Plains GP Holdings LP Class A* | 31,421,250 | ||||||

|

|

|

|||||||

| 315,324,125 | ||||||||

|

|

||||||||

| Shares | Description | Value | ||||||||

| Common Stocks – (continued) |

| |||||||||

| Production + Mining | Hydrocarbon – 3.4% |

| |||||||||

| 37,000 |

Chesapeake Energy Corp. | $ | 3,829,500 | |||||||

| 70,000 |

ConocoPhillips | 8,645,700 | ||||||||

| 56,750 |

Diamondback Energy, Inc. | 8,400,135 | ||||||||

| 63,750 |

EOG Resources, Inc. | 9,048,037 | ||||||||

| 377,500 |

Marathon Oil Corp. | 11,562,825 | ||||||||

| 66,750 |

Ovintiv, Inc. | 3,721,980 | ||||||||

| 24,000 |

Pioneer Natural Resources Co. | 5,663,760 | ||||||||

|

|

|

|||||||||

| 50,871,937 | ||||||||||

|

|

||||||||||

| TOTAL COMMON STOCKS (Cost $1,420,413,884) |

$ | 1,508,190,043 | ||||||||

|

|

||||||||||

| Expiration | Strike | |||||||||

| Units | Date | Price | Value | |||||||

| Warrants* – 0.0% | ||||||||||

| Special Purpose Acquisition Company – 0.0% |

| |||||||||

| Fast Radius, Inc. Private |

||||||||||

|

|

333,300 |

02/11/28 | $11.500 | $ | 3,233 | |||||

| (Cost $499,950) |

||||||||||

|

|

||||||||||

| Dividend | ||||||||||

| Shares | Rate | Value | ||||||||

| Investment Company(a) – 0.2% |

| |||||||||

|

|

Goldman Sachs Financial Square Government Fund - Institutional Shares |

| ||||||||

| 3,558,907 |

3.727% | $ | 3,558,907 | |||||||

| (Cost $3,558,907) |

||||||||||

|

|

||||||||||

| TOTAL INVESTMENTS – 99.9% |

||||||||||

| (Cost $1,424,472,741) |

$ | 1,511,752,183 | ||||||||

|

|

||||||||||

| OTHER ASSETS IN EXCESSS OF |

1,607,287 | |||||||||

|

|

||||||||||

| NET ASSETS – 100.0% |

$ | 1,513,359,470 | ||||||||

|

|

||||||||||

|

The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets.

* Non-income producing security.

(a) Represents affiliated funds. |

| |||||||||

| The accompanying notes are an integral part of these financial statements. | 9 |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

| Schedule of Investments (continued)

November 30, 2022 |

| ADDITIONAL INVESTMENT INFORMATION | ||||||||

|

Investment Abbreviations: GP —General Partnership LLC —Limited Liability Company LP —Limited Partnership |

||||||||

|

|

||||||||

| 10 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

Statement of Assets and Liabilities

November 30, 2022

|

Assets:

|

||||||

| Investments in unaffiliated issuers, at value (cost $1,420,913,834) |

$ | 1,508,193,276 | ||||

| Investments in affiliated issuers, at value (cost $3,558,907) |

3,558,907 | |||||

| Cash |

18,812,293 | |||||

| Receivables: |

||||||

| Dividends |

1,139,587 | |||||

| Fund shares sold |

407,407 | |||||

| Reimbursement from investment adviser |

412 | |||||

| Prepaid federal and state income taxes |

6,175,152 | |||||

| Prepaid state and local franchise taxes |

54,355 | |||||

| Other assets |

37,536 | |||||

| Total assets |

1,538,378,925 | |||||

|

Liabilities: |

||||||

| Payables: |

||||||

| Management fees |

1,181,039 | |||||

| Fund shares redeemed |

609,433 | |||||

| Distribution and Service fees and Transfer Agency fees |

81,673 | |||||

| Investments purchased |

25,966 | |||||

| Deferred taxes, net |

22,133,220 | |||||

| Accrued expenses and other liabilities |

988,124 | |||||

| Total liabilities |

25,019,455 | |||||

| Net Assets: |

||||||

| Paid-in capital |

2,403,462,166 | |||||

| Total distributable earnings (loss) |

(890,102,696) | |||||

| NET ASSETS |

$ | 1,513,359,470 | ||||

| Net Assets: |

||||||

| Class A |

$ | 53,750,881 | ||||

| Class C |

22,030,477 | |||||

| Institutional |

198,806,579 | |||||

| Investor |

59,724,966 | |||||

| Class R6 |

126,620,727 | |||||

| Class R |

842,862 | |||||

| Class P |

1,051,582,978 | |||||

| Total Net Assets |

$ | 1,513,359,470 | ||||

| Shares Outstanding $0.001 par value (unlimited number of shares authorized): |

||||||

| Class A |

1,862,233 | |||||

| Class C |

846,845 | |||||

| Institutional |

6,533,820 | |||||

| Investor |

1,998,161 | |||||

| Class R6 |

4,155,430 | |||||

| Class R |

30,213 | |||||

| Class P |

34,410,034 | |||||

| Net asset value, offering and redemption price per share:(a) |

||||||

| Class A |

$ | 28.86 | ||||

| Class C |

26.01 | |||||

| Institutional |

30.43 | |||||

| Investor |

29.89 | |||||

| Class R6 |

30.47 | |||||

| Class R |

27.90 | |||||

| Class P |

30.56 | |||||

| (a) | Maximum public offering price per share for Class A Shares is $30.54. At redemption, Class C Shares may be subject to a contingent deferred sales charge, assessed on the amount equal to the lesser of the current net asset value (“NAV”) or the original purchase price of the shares. |

| The accompanying notes are an integral part of these financial statements. | 11 |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

Statement of Operations

For the Fiscal Year Ended November 30, 2022

| Investment Income: |

||||||

| Dividends — unaffiliated issuers (net of tax withholding of $965,737) |

$ | 79,652,573 | ||||

| Dividends — affiliated issuers |

33,960 | |||||

| Interest |

1,107 | |||||

| Less: Return of Capital on Dividends |

(63,327,378) | |||||

|

|

||||||

| Total investment income |

16,360,262 | |||||

|

|

||||||

|

Expenses: |

||||||

| Management fees |

13,295,280 | |||||

| Transfer Agency fees(a) |

582,459 | |||||

| Professional fees |

417,390 | |||||

| Distribution and Service (12b-1) fees(a) |

305,397 | |||||

| Custody, accounting and administrative services |

182,983 | |||||

| Printing and mailing costs |

131,051 | |||||

| Registration fees |

116,357 | |||||

| Service fees — Class C |

61,093 | |||||

| Franchise tax expense |

47,329 | |||||

| Trustee fees |

29,310 | |||||

| Other

|

|

55,439

|

| |||

|

|

||||||

| Total operating expenses, before taxes |

15,224,088 | |||||

|

|

||||||

| Less — expense reductions |

(61,318) | |||||

|

|

||||||

| Net operating expenses, before taxes |

15,162,770 | |||||

|

|

||||||

| NET INVESTMENT INCOME, BEFORE TAXES |

1,197,492 | |||||

|

|

||||||

| Current and deferred tax expense |

(43,291) | |||||

|

|

||||||

| NET INVESTMENT INCOME, NET OF TAXES |

1,154,201 | |||||

|

|

||||||

| Realized and unrealized gain (loss): |

||||||

| Net realized gain (loss) from: |

||||||

| Investments — unaffiliated issuers |

150,101,992 | |||||

| Purchased options |

529,334 | |||||

| Written options |

490,347 | |||||

| Foreign currency transactions |

(32,852) | |||||

| Current and deferred tax expense |

(5,536,954) | |||||

| Net change in unrealized gain (loss) on: |

||||||

| Investments — unaffiliated issuers |

272,131,474 | |||||

| Unfunded PIPE commitment |

501,263 | |||||

| Purchased options |

797,385 | |||||

| Written options |

(818,802) | |||||

| Foreign currency translation |

1,682 | |||||

| Current and deferred tax expense

|

|

(10,005,415)

|

| |||

|

|

||||||

| Net realized and unrealized gain, net of taxes |

408,159,454 | |||||

|

|

||||||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS |

$ | 409,313,655 | ||||

|

|

||||||

| (a) | Class specific Distribution and/or Service (12b-1) and Transfer Agency fees were as follows: |

|

Distribution and/or Service (12b-1) Fees |

Transfer Agency Fees | |||||||||||||||||||

| Class A |

Class C |

Class R |

Class A |

Class C |

Institutional |

Investor |

Class R6 |

Class R |

Class P |

|||||||||||

| $118,133 | $183,280 | $3,984 | $75,606 | $39,100 | $73,403 | $73,885 | $44,258 | $1,275 | $274,932 | |||||||||||

| 12 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

Statements of Changes in Net Assets

| For the Fiscal | For the Fiscal | |||||||||

| Year Ended | Year Ended | |||||||||

| November 30, 2022

|

November 30, 2021

|

|||||||||

| From operations: |

||||||||||

| Net investment income (loss), net of taxes | $ | 1,154,201 | $ | (3,105,754) | ||||||

| Net realized gain, net of taxes | 145,551,867 | 256,112,634 | ||||||||

| Net change in unrealized gain, net of taxes | 262,607,587 | 145,328,242 | ||||||||

|

|

||||||||||

| Net increase in net assets resulting from operations | 409,313,655 | 398,335,122 | ||||||||

|

|

||||||||||

| Distributions to shareholders: |

||||||||||

| From distributable earnings: | ||||||||||

| Class A Shares |

(3,048,201 | ) | (2,670,879) | |||||||

| Class C Shares |

(1,670,031 | ) | (1,985,880) | |||||||

| Institutional Shares |

(11,206,812 | ) | (11,471,227) | |||||||

| Investor Shares |

(2,978,411 | ) | (2,547,163) | |||||||

| Class R6 Shares |

(8,446,190 | ) | (10,514,769) | |||||||

| Class R Shares |

(51,446 | ) | (44,881) | |||||||

| Class P Shares |

(56,334,989 | ) | (46,497,058) | |||||||

|

|

||||||||||

| Total distributions to shareholders | (83,736,080 | ) | (75,731,857) | |||||||

|

|

||||||||||

| From share transactions: |

||||||||||

| Proceeds from sales of shares | 300,530,192 | 226,775,467 | ||||||||

| Reinvestment of distributions | 81,724,586 | 72,644,488 | ||||||||

| Cost of shares redeemed | (372,596,029 | ) | (427,116,910) | |||||||

|

|

||||||||||

| Net increase (decrease) in net assets resulting from share transactions | 9,658,749 | (127,696,955) | ||||||||

|

|

||||||||||

| TOTAL INCREASE | 335,236,324 | 194,906,310 | ||||||||

|

|

||||||||||

| Net assets: |

||||||||||

| Beginning of year | 1,178,123,146 | 983,216,836 | ||||||||

|

|

||||||||||

| End of year | $ | 1,513,359,470 | $ | 1,178,123,146 | ||||||

|

|

||||||||||

| The accompanying notes are an integral part of these financial statements. | 13 |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

Selected Share Data for a Share Outstanding Throughout Each Year

| Goldman Sachs MLP Energy Infrastructure Fund

|

||||||||||||||||||||||

| Class A Shares

|

||||||||||||||||||||||

| Year Ended November 30,

|

||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2019 | 2018 | ||||||||||||||||||

| Per Share Data* |

||||||||||||||||||||||

| Net asset value, beginning of year |

$ | 22.75 | $ | 17.15 | $ | 26.10 | $ | 31.90 | $ | 34.00 | ||||||||||||

| Net investment loss(a) |

(0.07 | ) | (0.13 | )(b) | (0.15 | ) | (0.30 | ) | (0.10 | ) | ||||||||||||

| Net realized and unrealized gain (loss) |

7.88 | 7.23 | (7.86 | ) | (3.00 | ) | 0.35 | |||||||||||||||

| Total from investment operations |

7.81 | 7.10 | (8.01 | ) | (3.30 | ) | 0.25 | |||||||||||||||

| Distributions to shareholders from net investment income |

(1.70 | ) | (1.50 | ) | — | (0.15 | ) | (0.80 | ) | |||||||||||||

| Distributions to shareholders from return of capital |

— | — | (0.94 | ) | (2.35 | ) | (1.55 | ) | ||||||||||||||

| Total distributions |

(1.70 | ) | (1.50 | ) | (0.94 | ) | (2.50 | ) | (2.35 | ) | ||||||||||||

| Net asset value, end of year |

$ | 28.86 | $ | 22.75 | $ | 17.15 | $ | 26.10 | $ | 31.90 | ||||||||||||

| Total return(c) |

34.91 | % | 41.88 | % | (27.83 | )% | (11.06 | )% | 0.23 | % | ||||||||||||

| Net assets, end of year (in 000s) |

$ | 53,751 | $ | 39,835 | $ | 34,024 | $ | 60,112 | $ | 95,120 | ||||||||||||

| Ratio of total expenses to average net assets after tax expense(d) |

2.59 | % | 0.43 | % | 2.64 | % | 1.67 | % | 1.67 | % | ||||||||||||

| Ratio of net expenses to average net assets after tax expense(d) |

2.59 | % | 0.42 | % | 2.61 | % | 1.67 | % | 1.67 | % | ||||||||||||

| Ratio of net expenses to average net assets before tax expense |

1.45 | % | 1.45 | % | 1.49 | % | 1.44 | % | 1.40 | % | ||||||||||||

| Ratio of net investment loss to average net assets(e) |

(0.26 | )% | (0.60 | )% | (0.81 | )% | (1.02 | )% | (0.34 | )% | ||||||||||||

| Portfolio turnover rate(f) |

117 | % | 166 | % | 139 | % | 51 | % | 68 | % | ||||||||||||

| * | On June 5, 2020, the MLP Energy Infrastructure Fund effected a 5-for-1 reverse share split. All per share data prior to June 5, 2020 has been adjusted to reflect the reverse share split. |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Reflects income recognized from special dividends which amounted to $0.04 per share and 0.16% of average net assets. |

| (c) | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete redemption of the investment at the NAV at the end of the year and no sales or redemption charges (if any). Total returns would be reduced if a sales or redemption charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the redemption of Fund shares. |

| (d) | Current and deferred tax expense/benefit for the ratio calculation is derived from the net investment income (loss), and realized and unrealized gains (losses). |

| (e) | Current and deferred tax benefit for the ratio calculation is derived from net investment income (loss) only. |

| (f) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| 14 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

Financial Highlights (continued)

Selected Share Data for a Share Outstanding Throughout Each Year

| Goldman Sachs MLP Energy Infrastructure Fund

|

||||||||||||||||||||||

| Class C Shares

|

||||||||||||||||||||||

| Year Ended November 30,

|

||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2019 | 2018 | ||||||||||||||||||

| Per Share Data* |

||||||||||||||||||||||

| Net asset value, beginning of year |

$ | 20.79 | $ | 15.88 | $ | 24.55 | $ | 30.35 | $ | 32.70 | ||||||||||||

| Net investment loss(a) |

(0.24 | ) | (0.27 | )(b) | (0.29 | ) | (0.50 | ) | (0.35 | ) | ||||||||||||

| Net realized and unrealized gain (loss) |

7.16 | 6.68 | (7.44 | ) | (2.80 | ) | 0.35 | |||||||||||||||

| Total from investment operations |

6.92 | 6.41 | (7.73 | ) | (3.30 | ) | — | |||||||||||||||

| Distributions to shareholders from net investment income |

(1.70 | ) | (1.50 | ) | — | (0.15 | ) | (0.80 | ) | |||||||||||||

| Distributions to shareholders from return of capital |

— | — | (0.94 | ) | (2.35 | ) | (1.55 | ) | ||||||||||||||

| Total distributions |

(1.70 | ) | (1.50 | ) | (0.94 | ) | (2.50 | ) | (2.35 | ) | ||||||||||||

| Net asset value, end of year |

$ | 26.01 | $ | 20.79 | $ | 15.88 | $ | 24.55 | $ | 30.35 | ||||||||||||

| Total return(c) |

33.89 | % | 40.85 | % | (28.47 | )% | (11.64 | )% | (0.38 | )% | ||||||||||||

| Net assets, end of year (in 000s) |

$ | 22,030 | $ | 25,647 | $ | 24,897 | $ | 58,044 | $ | 92,201 | ||||||||||||

| Ratio of total expenses to average net assets after tax expense(d) |

3.34 | % | 1.18 | % | 3.39 | % | 2.42 | % | 2.44 | % | ||||||||||||

| Ratio of net expenses to average net assets after tax expense(d) |

3.34 | % | 1.16 | % | 3.37 | % | 2.42 | % | 2.44 | % | ||||||||||||

| Ratio of net expenses to average net assets before tax expense |

2.20 | % | 2.20 | % | 2.24 | % | 2.19 | % | 2.15 | % | ||||||||||||

| Ratio of net investment loss to average net assets(e) |

(1.00 | )% | (1.35 | )% | (1.63 | )% | (1.77 | )% | (1.06 | )% | ||||||||||||

| Portfolio turnover rate(f) |

117 | % | 166 | % | 139 | % | 51 | % | 68 | % | ||||||||||||

| * | On June 5, 2020, the MLP Energy Infrastructure Fund effected a 5-for-1 reverse share split. All per share data prior to June 5, 2020 has been adjusted to reflect the reverse share split. |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Reflects income recognized from special dividends which amounted to $0.04 per share and 0.16% of average net assets. |

| (c) | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete redemption of the investment at the NAV at the end of the year and no sales or redemption charges (if any). Total returns would be reduced if a sales or redemption charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the redemption of Fund shares. |

| (d) | Current and deferred tax expense/benefit for the ratio calculation is derived from the net investment income (loss), and realized and unrealized gains (losses). |

| (e) | Current and deferred tax benefit for the ratio calculation is derived from net investment income (loss) only. |

| (f) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| The accompanying notes are an integral part of these financial statements. | 15 |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

Financial Highlights (continued)

Selected Share Data for a Share Outstanding Throughout Each Year

| Goldman Sachs MLP Energy Infrastructure Fund

|

||||||||||||||||||||||

| Institutional Shares

|

||||||||||||||||||||||

| Year Ended November 30,

|

||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2019 | 2018 | ||||||||||||||||||

| Per Share Data* |

||||||||||||||||||||||

| Net asset value, beginning of year |

$ | 23.82 | $ | 17.84 | $ | 26.95 | $ | 32.75 | $ | 34.75 | ||||||||||||

| Net investment income (loss)(a) |

0.03 | (0.05 | )(b) | (0.11 | ) | (0.20 | ) | 0.10 | ||||||||||||||

| Net realized and unrealized gain (loss) |

8.28 | 7.53 | (8.06 | ) | (3.10 | ) | 0.25 | |||||||||||||||

| Total from investment operations |

8.31 | 7.48 | (8.17 | ) | (3.30 | ) | 0.35 | |||||||||||||||

| Distributions to shareholders from net investment income |

(1.70 | ) | (1.50 | ) | — | (0.15 | ) | (0.80 | ) | |||||||||||||

| Distributions to shareholders from return of capital |

— | — | (0.94 | ) | (2.35 | ) | (1.55 | ) | ||||||||||||||

| Total distributions |

(1.70 | ) | (1.50 | ) | (0.94 | ) | (2.50 | ) | (2.35 | ) | ||||||||||||

| Net asset value, end of year |

$ | 30.43 | $ | 23.82 | $ | 17.84 | $ | 26.95 | $ | 32.75 | ||||||||||||

| Total return(c) |

35.45 | % | 42.40 | % | (27.54 | )% | (10.77 | )% | 0.67 | % | ||||||||||||

| Net assets, end of year (in 000s) |

$ | 198,807 | $ | 160,785 | $ | 182,236 | $ | 502,633 | $ | 651,132 | ||||||||||||

| Ratio of total expenses to average net assets after tax expense(d) |

2.22 | % | 0.06 | % | 2.25 | % | 1.28 | % | 1.43 | % | ||||||||||||

| Ratio of net expenses to average net assets after tax expense(d) |

2.22 | % | 0.05 | % | 2.22 | % | 1.28 | % | 1.43 | % | ||||||||||||

| Ratio of net expenses to average net assets before tax expense |

1.08 | % | 1.09 | % | 1.10 | % | 1.05 | % | 1.01 | % | ||||||||||||

| Ratio of net investment income (loss) to average net assets(e) |

0.12 | % | (0.21 | )% | (0.56 | )% | (0.61 | )% | 0.34 | % | ||||||||||||

| Portfolio turnover rate(f) |

117 | % | 166 | % | 139 | % | 51 | % | 68 | % | ||||||||||||

| * | On June 5, 2020, the MLP Energy Infrastructure Fund effected a 5-for-1 reverse share split. All per share data prior to June 5, 2020 has been adjusted to reflect the reverse share split. |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Reflects income recognized from special dividends which amounted to $0.04 per share and 0.16% of average net assets. |

| (c) | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete redemption of the investment at the NAV at the end of the year and no sales or redemption charges (if any). Total returns would be reduced if a sales or redemption charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the redemption of Fund shares. |

| (d) | Current and deferred tax expense/benefit for the ratio calculation is derived from the net investment income (loss), and realized and unrealized gains (losses). |

| (e) | Current and deferred tax benefit for the ratio calculation is derived from net investment income (loss) only. |

| (f) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| 16 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

Financial Highlights (continued)

Selected Share Data for a Share Outstanding Throughout Each Year

| Goldman Sachs MLP Energy Infrastructure Fund

|

||||||||||||||||||||||

| Investor Shares

|

||||||||||||||||||||||

| Year Ended November 30,

|

||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2019 | 2018 | ||||||||||||||||||

| Per Share Data* |

||||||||||||||||||||||

| Net asset value, beginning of year |

$ | 23.45 | $ | 17.60 | $ | 26.65 | $ | 32.50 | $ | 34.50 | ||||||||||||

| Net investment loss(a) |

(0.00 | ) | (0.08 | )(b) | (0.15 | ) | (0.25 | ) | (0.05 | ) | ||||||||||||

| Net realized and unrealized gain (loss) |

8.14 | 7.43 | (7.96 | ) | (3.10 | ) | 0.40 | |||||||||||||||

| Total from investment operations |

8.14 | 7.35 | (8.11 | ) | (3.35 | ) | 0.35 | |||||||||||||||

| Distributions to shareholders from net investment income |

(1.70 | ) | (1.50 | ) | — | (0.15 | ) | (0.80 | ) | |||||||||||||

| Distributions to shareholders from return of capital |

— | — | (0.94 | ) | (2.35 | ) | (1.55 | ) | ||||||||||||||

| Total distributions |

(1.70 | ) | (1.50 | ) | (0.94 | ) | (2.50 | ) | (2.35 | ) | ||||||||||||

| Net asset value, end of year |

$ | 29.89 | $ | 23.45 | $ | 17.60 | $ | 26.65 | $ | 32.50 | ||||||||||||

| Total return(c) |

35.28 | % | 42.23 | % | (27.63 | )% | (11.01 | )% | 0.68 | % | ||||||||||||

| Net assets, end of year (in 000s) |

$ | 59,725 | $ | 40,346 | $ | 32,396 | $ | 98,506 | $ | 142,664 | ||||||||||||

| Ratio of total expenses to average net assets after tax expense(d) |

2.34 | % | 0.18 | % | 2.38 | % | 1.42 | % | 1.43 | % | ||||||||||||

| Ratio of net expenses to average net assets after tax expense(d) |

2.34 | % | 0.17 | % | 2.36 | % | 1.42 | % | 1.43 | % | ||||||||||||

| Ratio of net expenses to average net assets before tax expense |

1.20 | % | 1.20 | % | 1.23 | % | 1.19 | % | 1.15 | % | ||||||||||||

| Ratio of net investment loss to average net assets(e) |

(0.01 | )% | (0.36 | )% | (0.73 | )% | (0.77 | )% | (0.07 | )% | ||||||||||||

| Portfolio turnover rate(f) |

117 | % | 166 | % | 139 | % | 51 | % | 68 | % | ||||||||||||

| * | On June 5, 2020, the MLP Energy Infrastructure Fund effected a 5-for-1 reverse share split. All per share data prior to June 5, 2020 has been adjusted to reflect the reverse share split. |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Reflects income recognized from special dividends which amounted to $0.04 per share and 0.16% of average net assets. |

| (c) | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete redemption of the investment at the NAV at the end of the year and no sales or redemption charges (if any). Total returns would be reduced if a sales or redemption charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the redemption of Fund shares. |

| (d) | Current and deferred tax expense/benefit for the ratio calculation is derived from the net investment income (loss), and realized and unrealized gains (losses). |

| (e) | Current and deferred tax benefit for the ratio calculation is derived from net investment income (loss) only. |

| (f) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| The accompanying notes are an integral part of these financial statements. | 17 |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

Financial Highlights (continued)

Selected Share Data for a Share Outstanding Throughout Each Period

| Goldman Sachs MLP Energy Infrastructure Fund

| |||||||||||||||||||||||||||

| Class R6 Shares

| |||||||||||||||||||||||||||

| Year Ended November 30,

|

Period Ended | ||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2019 | ||||||||||||||||||||||||

| Per Share Data* |

|||||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 23.85 | $ | 17.86 | $ | 27.00 | $ | 32.75 | $ | 32.15 | |||||||||||||||||

| Net investment income (loss)(b) |

0.04 | (0.04 | )(c) | (0.05 | ) | (0.20 | ) | (0.10 | ) | ||||||||||||||||||

| Net realized and unrealized gain (loss) |

8.28 | 7.53 | (8.15 | ) | (3.05 | ) | 2.50 | ||||||||||||||||||||

| Total from investment operations |

8.32 | 7.49 | (8.20 | ) | (3.25 | ) | 2.40 | ||||||||||||||||||||

| Distributions to shareholders from net investment income |

(1.70 | ) | (1.50 | ) | — | (0.15 | ) | (0.65 | ) | ||||||||||||||||||

| Distributions to shareholders from return of capital |

— | — | (0.94 | ) | (2.35 | ) | (1.15 | ) | |||||||||||||||||||

| Total distributions |

(1.70 | ) | (1.50 | ) | (0.94 | ) | (2.50 | ) | (1.80 | ) | |||||||||||||||||

| Net asset value, end of period |

$ | 30.47 | $ | 23.85 | $ | 17.86 | $ | 27.00 | $ | 32.75 | |||||||||||||||||

| Total return(d) |

35.45 | % | 42.41 | % | (27.60 | )% | (10.60 | )% | 7.15 | % | |||||||||||||||||

| Net assets, end of period (in 000s) |

$ | 126,621 | $ | 138,288 | $ | 181,968 | $ | 165,252 | $ | 205,470 | |||||||||||||||||

| Ratio of total expenses to average net assets after tax expense(e) |

2.21 | % | 0.05 | % | 2.26 | % | 1.26 | % | 1.11 | %(f) | |||||||||||||||||

| Ratio of net expenses to average net assets after tax expense(e) |

2.21 | % | 0.04 | % | 2.23 | % | 1.26 | % | 1.11 | %(f) | |||||||||||||||||

| Ratio of net expenses to average net assets before tax expense |

1.07 | % | 1.08 | % | 1.11 | % | 1.04 | % | 1.00 | % | |||||||||||||||||

| Ratio of net investment income (loss) to average net assets(g) |

0.13 | % | (0.17 | )% | (0.29 | )% | (0.66 | )% | (0.46 | )%(f) | |||||||||||||||||

| Portfolio turnover rate(h) |

117 | % | 166 | % | 139 | % | 51 | % | 68 | % | |||||||||||||||||

| * | On June 5, 2020, the MLP Energy Infrastructure Fund effected a 5-for-1 reverse share split. All per share data prior to June 5, 2020 has been adjusted to reflect the reverse share split. |

| (a) | Commenced operations on April 02, 2018. |

| (b) | Calculated based on the average shares outstanding methodology. |

| (c) | Reflects income recognized from special dividends which amounted to $0.04 per share and 0.16% of average net assets. |

| (d) | Assumes investment at the NAV at the beginning of the period, reinvestment of all dividends and distributions, a complete redemption of the investment at the NAV at the end of the period and no sales or redemption charges (if any). Total returns would be reduced if a sales or redemption charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the redemption of Fund shares. Total returns for periods less than one full year are not annualized. |

| (e) | Current and deferred tax expense/benefit for the ratio calculation is derived from the net investment income (loss), and realized and unrealized gains (losses). |

| (f) | Annualized with the exception of tax expenses. |

| (g) | Current and deferred tax benefit for the ratio calculation is derived from net investment income (loss) only. |

| (h) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| 18 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

Financial Highlights (continued)

Selected Share Data for a Share Outstanding Throughout Each Year

| Goldman Sachs MLP Energy Infrastructure Fund

|

||||||||||||||||||||||

| Class R Shares

|

||||||||||||||||||||||

| Year Ended November 30,

|

||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2019 | 2018 | ||||||||||||||||||

| Per Share Data* |

||||||||||||||||||||||

| Net asset value, beginning of year |

$ | 22.09 | $ | 16.72 | $ | 25.60 | $ | 31.40 | $ | 33.55 | ||||||||||||

| Net investment loss(a) |

(0.13 | ) | (0.18 | )(b) | (0.17 | ) | (0.40 | ) | (0.20 | ) | ||||||||||||

| Net realized and unrealized gain (loss) |

7.64 | 7.05 | (7.77 | ) | (2.90 | ) | 0.40 | |||||||||||||||

| Total from investment operations |

7.51 | 6.87 | (7.94 | ) | (3.30 | ) | 0.20 | |||||||||||||||

| Distributions to shareholders from net investment income |

(1.70 | ) | (1.50 | ) | — | (0.15 | ) | (0.80 | ) | |||||||||||||

| Distributions to shareholders from return of capital |

— | — | (0.94 | ) | (2.35 | ) | (1.55 | ) | ||||||||||||||

| Total distributions |

(1.70 | ) | (1.50 | ) | (0.94 | ) | (2.50 | ) | (2.35 | ) | ||||||||||||

| Net asset value, end of year |

$ | 27.90 | $ | 22.09 | $ | 16.72 | $ | 25.60 | $ | 31.40 | ||||||||||||

| Total return(c) |

34.59 | % | 41.57 | % | (28.11 | )% | (11.24 | )% | 0.24 | % | ||||||||||||

| Net assets, end of year (in 000s) |

$ | 843 | $ | 731 | $ | 796 | $ | 1,012 | $ | 2,254 | ||||||||||||

| Ratio of total expenses to average net assets after tax expense(d) |

2.85 | % | 0.67 | % | 2.90 | % | 1.92 | % | 1.93 | % | ||||||||||||

| Ratio of net expenses to average net assets after tax expense(d) |

2.84 | % | 0.66 | % | 2.87 | % | 1.92 | % | 1.93 | % | ||||||||||||

| Ratio of net expenses to average net assets before tax expense |

1.70 | % | 1.70 | % | 1.74 | % | 1.69 | % | 1.65 | % | ||||||||||||

| Ratio of net investment loss to average net assets(e) |

(0.50 | )% | (0.85 | )% | (0.94 | )% | (1.31 | )% | (0.59 | )% | ||||||||||||

| Portfolio turnover rate(f) |

117 | % | 166 | % | 139 | % | 51 | % | 68 | % | ||||||||||||

| * | On June 5, 2020, the MLP Energy Infrastructure Fund effected a 5-for-1 reverse share split. All per share data prior to June 5, 2020 has been adjusted to reflect the reverse share split. |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Reflects income recognized from special dividends which amounted to $0.04 per share and 0.16% of average net assets. |

| (c) | Assumes investment at the NAV at the beginning of the year, reinvestment of all dividends and distributions, a complete redemption of the investment at the NAV at the end of the year and no sales or redemption charges (if any). Total returns would be reduced if a sales or redemption charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the redemption of Fund shares. |

| (d) | Current and deferred tax expense/benefit for the ratio calculation is derived from the net investment income (loss), and realized and unrealized gains (losses). |

| (e) | Current and deferred tax benefit for the ratio calculation is derived from net investment income (loss) only. |

| (f) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| The accompanying notes are an integral part of these financial statements. | 19 |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

Financial Highlights (continued)

Selected Share Data for a Share Outstanding Throughout Each Period

| Goldman Sachs MLP Energy Infrastructure Fund

| |||||||||||||||||||||||||||

| Class P Shares

| |||||||||||||||||||||||||||

| Year Ended November 30,

|

Period

Ended

| ||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2019 | ||||||||||||||||||||||||

| Per Share Data* |

|||||||||||||||||||||||||||

| Net asset value, beginning of period |

$ | 23.92 | $ | 17.91 | $ | 27.05 | $ | 32.85 | $ | 34.80 | |||||||||||||||||

| Net investment income (loss)(b) |

0.03 | (0.05 | )(c) | (0.08 | ) | (0.20 | ) | (0.15 | ) | ||||||||||||||||||

| Net realized and unrealized gain (loss) |

8.31 | 7.56 | (8.12 | ) | (3.10 | ) | — | (d) | |||||||||||||||||||

| Total from investment operations |

8.34 | 7.51 | (8.20 | ) | (3.30 | ) | (0.15 | ) | |||||||||||||||||||

| Distributions to shareholders from net investment income |

(1.70 | ) | (1.50 | ) | — | (0.15 | ) | (0.65 | ) | ||||||||||||||||||

| Distributions to shareholders from return of capital |

— | — | (0.94 | ) | (2.35 | ) | (1.15 | ) | |||||||||||||||||||

| Total distributions |

(1.70 | ) | (1.50 | ) | (0.94 | ) | (2.50 | ) | (1.80 | ) | |||||||||||||||||

| Net asset value, end of period |

$ | 30.56 | $ | 23.92 | $ | 17.91 | $ | 27.05 | $ | 32.85 | |||||||||||||||||

| Total return(e) |

35.43 | % | 42.40 | % | (27.55 | )% | (10.73 | )% | (0.72 | )% | |||||||||||||||||

| Net assets, end of period (in 000s) |

$ | 1,051,583 | $ | 772,491 | $ | 526,900 | $ | 843,448 | $ | 1,073,157 | |||||||||||||||||

| Ratio of total expenses to average net assets after tax expense(f) |

2.21 | % | 0.05 | % | 2.26 | % | 1.27 | % | 1.05 | %(g) | |||||||||||||||||

| Ratio of net expenses to average net assets after tax expense(f) |

2.21 | % | 0.04 | % | 2.23 | % | 1.27 | % | 1.05 | %(g) | |||||||||||||||||

| Ratio of net expenses to average net assets before tax expense |

1.07 | % | 1.08 | % | 1.10 | % | 1.04 | % | 1.00 | % | |||||||||||||||||

| Ratio of net investment income to average net assets(h) |

0.12 | % | (0.23 | )% | (0.38 | )% | (0.61 | )% | (0.68 | )%(g) | |||||||||||||||||

| Portfolio turnover rate(i) |

117 | % | 166 | % | 139 | % | 51 | % | 68 | %(g) | |||||||||||||||||

| * | On June 5, 2020, the MLP Energy Infrastructure Fund effected a 5-for-1 reverse share split. All per share data prior to June 5, 2020 has been adjusted to reflect the reverse share split. |

| (a) | Commenced operations on April 16, 2018. |

| (b) | Calculated based on the average shares outstanding methodology. |

| (c) | Reflects income recognized from special dividends which amounted to $0.04 per share and 0.16% of average net assets. |

| (d) | Less than $0.005 per share. |

| (e) | Assumes investment at the NAV at the beginning of the period, reinvestment of all dividends and distributions, a complete redemption of the investment at the NAV at the end of the period and no sales or redemption charges (if any). Total returns would be reduced if a sales or redemption charge was taken into account. Returns do not reflect the impact of taxes to shareholders relating to Fund distributions or the redemption of Fund shares. Total returns for periods less than one full year are not annualized. |

| (f) | Current and deferred tax expense/benefit for the ratio calculation is derived from the net investment income (loss), and realized and unrealized gains (losses). |

| (g) | Annualized with the exception of tax expenses. |

| (h) | Current and deferred tax benefit for the ratio calculation is derived from net investment income (loss) only. |

| (i) | The Fund’s portfolio turnover rate is calculated in accordance with regulatory requirements, without regard to transactions involving short term investments and certain derivatives. If such transactions were included, the Fund’s portfolio turnover rate may be higher. |

| 20 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND

November 30, 2022

| 1. ORGANIZATION |

Goldman Sachs Trust (the “Trust”) is a Delaware statutory trust registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company. The Trust includes the Goldman Sachs MLP Energy Infrastructure Fund (the “Fund”). The Fund is a non-diversified portfolio under the Act offering seven classes of shares — Class A, Class C, Institutional, Investor, Class R6, Class R and Class P Shares.

Class A Shares are sold with a front-end sales charge of up to 5.50%. Class C Shares are sold with a contingent deferred sales charge (“CDSC”) of 1.00%, which is imposed on redemptions made within 12 months of purchase. Institutional, Investor, Class R6, Class R and Class P shares are not subject to a sales charge.

Goldman Sachs Asset Management, L.P. (“GSAM”), an affiliate of Goldman Sachs & Co. LLC (“Goldman Sachs”), serves as investment adviser to the Fund pursuant to a management agreement (the “Agreement”) with the Trust.

| 2. SIGNIFICANT ACCOUNTING POLICIES |

The financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and require management to make estimates and assumptions that may affect the reported amounts and disclosures. Actual results may differ from those estimates and assumptions. The Fund is an investment company under GAAP and follows the accounting and reporting guidance applicable to investment companies.

A. Investment Valuation — The Fund’s valuation policy is to value investments at fair value.

B. Investment Income and Investments — Investment income includes interest income, dividend income, net of any foreign withholding taxes, and less any amounts reclaimable. Interest income is accrued daily and adjusted for amortization of premiums and accretion of discounts. Dividend income is recognized on ex-dividend date or, for certain foreign securities, as soon as such information is obtained subsequent to the ex-dividend date. Non-cash dividends, if any, are recorded at the fair market value of the securities received. Investment transactions are reflected on trade date. Realized gains and losses are calculated using identified cost. Investment transactions are recorded on the following business day for daily net asset value (“NAV”) calculations.

Distributions from master limited partnerships (“MLPs”) are generally recorded based on the characterization reported on the Fund’s schedule K-1 received from the MLPs. The Fund records its pro-rata share of the income/loss and capital gains/losses, allocated from the underlying partnerships and adjusts the cost basis of the underlying partnerships accordingly.

C. Class Allocations and Expenses — Investment income, realized and unrealized gain (loss), if any, and non-class specific expenses of the Fund are allocated daily based upon the proportion of net assets of each class. Non-class specific expenses directly incurred by the Fund are charged to the Fund, while such expenses incurred by the Trust are allocated across the applicable Funds on a straight-line and/or pro-rata basis depending upon the nature of the expenses. Class specific expenses, where applicable, are borne by the respective share classes and include Distribution and Service, Transfer Agency and Service and Shareholder Administration fees.

D. Distributions to Shareholders — Over the long term, the Fund makes distributions to its shareholders each fiscal quarter at a rate that is approximately equal to the distributions the Fund receives from the MLPs and other securities in which it invests. To permit the Fund to maintain more stable quarterly distributions, the distribution for any particular quarterly period may be more or less than the amount of total distributable earnings actually earned by the Fund. The Fund estimates that only a portion of the distributions paid to shareholders will be treated as income. The remaining portion of the Fund’s distribution, which may be significant, is expected to be a return of capital. These estimates are based on the Fund’s operating results during the period, and their final federal income tax characterization may differ.

The characterization of distributions to shareholders for financial reporting purposes is determined in accordance with federal income tax rules, which may differ from GAAP. Certain components of the Fund’s net assets on the Statement of Assets and Liabilities reflect permanent GAAP/Tax differences based on the appropriate tax character.

| 21 |

GOLDMAN SACHS MLP ENERGY INFRASTRUCTURE FUND