UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

Copies to:

| Caroline Kraus, Esq. | Stephen H. Bier, Esq. | |

| Goldman Sachs & Co. LLC | Dechert LLP | |

| 200 West Street | 1095 Avenue of the Americas | |

| New York, New York 10282 | New York, NY 10036 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: October 31

Date of reporting period: October 31, 2022

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| The Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds Annual Report October 31, 2022 Dividend Focus Funds Income Builder Rising Dividend Growth

Dividend Focus Funds

| ∎ | INCOME BUILDER |

| ∎ | RISING DIVIDEND GROWTH |

| 1 | ||||

| 20 | ||||

| 43 | ||||

| 46 | ||||

| 46 | ||||

| 52 | ||||

| 59 | ||||

| 80 | ||||

| 81 | ||||

|

NOT FDIC-INSURED |

May Lose Value | No Bank Guarantee | ||||

FUND RESULTS

Goldman Sachs Income Builder Fund

| Investment Objective |

|

The Fund seeks to provide income and capital appreciation.

|

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Fundamental Equity Team, the Goldman Sachs Fixed Income Investment Management Team, and the Goldman Sachs Multi-Asset Solutions (“MAS”) Group, collectively the Goldman Sachs Income Builder Team (the “Income Builder Team”), discuss the Goldman Sachs Income Builder Fund’s (the “Fund”) performance and positioning for the 12-month period ended October 31, 2022 (the “Reporting Period”).

| Q | How did the Fund perform during the Reporting Period? |

| A | During the Reporting Period, the Fund’s Class A, Class C, Institutional, Investor, Class R6 and Class P Shares generated -10.34%, -10.99%, -10.02%, -10.09%, -10.05% and -10.05%, respectively. These returns compare to the -7.00% and -10.90% average annual total returns of the Russell 1000® Value Index (with dividends reinvested) (the “Russell Value Index”) and the ICE BofAML BB to B US High Yield Constrained Index (the “ICE BofA Index”), respectively, during the same period. |

| The Fund is a dynamically managed multi-asset class portfolio with a baseline allocation of 60% to fixed income securities and 40% to equity securities. In seeking to meet its investment objective, the Fund has the flexibility to opportunistically tilt the allocation to fixed income and equity securities up to 15% above or below that baseline allocation. The Fund seeks to provide a high and stable income stream plus capital appreciation, with lower volatility than the equity market. The percentage of the portfolio invested in equity and fixed income securities will vary from time to time as the Income Builder Team evaluates such securities’ relative attractiveness based on, among other factors, income opportunities, market valuations, economic growth and inflation prospects. |

| Because of these stated goals of the Fund, the Income Builder Team believes the returns of the Russell Value Index and the ICE BofA Index should be considered for reference only. |

| Q | What was the Fund’s 12-month distribution rate and what was its 30-Day SEC yield during the Reporting Period? |

| A | During the Reporting Period, the Fund’s Class A, Class C, Institutional, Investor, Class R6 and Class P Shares provided 12-month distribution rates of 7.95%, 7.28%, 8.09%, 8.03%, 8.10% and 8.10%, respectively. (The 12-month distribution rate is calculated by taking the sum of all cash distributions to shareholders over the past 12 months and dividing this sum by the Fund’s month-end net asset value (“NAV”) for |

| the last month of the period. This rate includes capital gain/loss distributions, if any. This is not an SEC yield.) On October 31, 2022, the Fund’s 30-Day Standardized Subsidized SEC yields for its Class A, Class C, Institutional, Investor, Class R6 and Class P Shares were 4.54%, 4.07%, 5.13%, 5.05%, 5.14% and 5.15%, respectively. (The 30-Day Standardized Subsidized SEC Yield is calculated in accordance with SEC regulations and is determined by dividing the Fund’s net investment income per share earned over the 30-day period by the Fund’s maximum public offering price per share on the last day of such period, which figure is then annualized. The 30-Day Standardized Subsidized SEC Yield may differ from the distribution rate because of the exclusion of distributed capital gains. The 30-Day Standardized Subsidized SEC Yield reflects any fee waivers and/or expense reimbursements in effect during the period, without which the yield would be reduced.) |

| Q | What economic and market factors most influenced the Fund during the Reporting Period? |

| A | During the Reporting Period, the financial markets and the Fund were most influenced by inflationary pressures, changing central bank monetary policy, rising interest rates, macroeconomic data and the Russia/Ukraine war. |

| In the last two months of 2021, when the Reporting Period began, U.S. equities recorded modest gains. Retail earnings upside surprises and hints of easing supply-chain constraints supported the U.S. equity market’s upward trajectory early in November. Congress passed a $1 trillion infrastructure bill, and President Joe Biden signed the bill into law. Fed Chair Jerome Powell was appointed for a second term days before the Thanksgiving holiday, bringing clarity to the central bank’s path forward. However, renewed concerns over COVID-19 developments brought U.S. equities under pressure late in November, as the emergence of the highly contagious Omicron variant triggered a sell-off among global risk assets. Persistently high inflation weighed on market sentiment as well. In December, despite record COVID-19 cases in many areas of the U.S., studies showed the variant was accompanied by milder symptoms than previous variants, which helped to push up U.S. equities. Supply-chain |

1

FUND RESULTS

| issues and high inflation continued to pressure corporate earnings, though investors seemed to believe the impact had reached its peak. Positive seasonality and the so-called “Santa Rally” also lifted U.S. equities toward the end of the month. As for the fixed income market, it was volatile during November and December, as macroeconomic data continued to challenge central bank views about the temporary nature of rising inflation. The U.S. Federal Reserve (the “Fed”) said it could be patient about raising interest rates but indicated it would not hesitate to act if inflation continued to rise. At the same time, policymakers began to scale back the Fed’s $120 billion a month asset purchase program. |

| In the first quarter of 2022, dramatic repricing of the Fed’s interest rate hike path and expectations for a more aggressive balance sheet run-off phase were accelerated due to concerns about elevated and persistent inflation pressures. Tensions arising from geopolitical conflict also raised concern, as commodity prices became volatile, the global supply chain came into question again, and Russia invaded Ukraine. During March, Fed officials raised short-term interest rates by 25 basis points, the first rate hike since the end of 2018. (A basis point is 1/100th of a percentage point.) Policymakers also continued tapering the Fed’s asset purchase program and ended the program entirely during March. Signs that corporate earnings momentum might be weakening further weighed on investor sentiment. Against this backdrop, U.S. equities declined during the first calendar quarter overall. In fixed income, credit spreads (or yield differentials between corporate bonds and U.S. Treasury securities of similar maturity) widened as bond yields rose in response to inflationary pressures and Fed policy action. |

| During the second quarter of 2022, bond yields continued to rise and U.S. equities sold off. Inflation, the Fed’s policy response and recession worries were at the core of the narrative during the quarter. In the U.S., consumer inflation reached its highest level in nearly four decades during May 2022 and then hit a new high in June, as rising energy and food costs pushed up prices. Supply-chain disruptions, high energy prices and uncertainty related to the Russia/Ukraine war appeared to increase the risk of recession. The Fed accelerated its pace of tightening. In May, Fed policymakers raised short-term interest rates by 50 basis points and then hiked rates by another 75 basis points in June. In July, the U.S. Treasury yield curve, or spectrum of maturities, inverted between two-year and 10-year maturities, meaning two-year yields were higher than 10-year yields. (Historically, an inverted U.S. Treasury yield curve often precedes an economic recession.) Rising short-term yields and expectations for continued Fed tightening hurt duration-sensitive securities, while concerns about the U.S. economic outlook led to credit spread widening. (Duration is a measure of a security’s sensitivity to changes in interest rates.) |

| In the third quarter of 2022, U.S. equities and fixed income assets continued to struggle. Noticeable tightening of financial conditions, guided by investor expectations for a more aggressive Fed interest rate hiking cycle, was the major |

| story for the quarter. The Fed’s hawkish policy was supported by higher than consensus expected core Consumer Price Index (“CPI”) data and a still-tight labor market that showed only moderate signs of cooling. (Hawkish tends to suggest higher interest rates; opposite of dovish. Core CPI data excludes food and energy prices.) Indeed, Fed officials raised short-term interest rates by 75 basis points in July and then by another 75 basis points in September. Geopolitical tensions also remained high due to the possible weaponization of energy flows. There also appeared to be significant concern among investors that corporate earnings could suffer given the combination of margin pressures, demand destruction, higher labor costs, slower economic activity, and a stronger U.S. dollar that could erode overseas sales. |

| U.S. equities generated positive absolute returns in October 2022 amidst a shift in the Fed’s narrative, depressed investor sentiment and positioning, and solid third quarter corporate earnings results that exceeded market expectations in the vast majority of cases. Despite September 2022 CPI data coming in higher than consensus expected, Fed officials began to contend that inflation would likely decline in the upcoming months should demand weaken and supply-chain issues soften as policymakers anticipated. However, policymakers also suggested they would end their current tightening cycle with short-term interest rates at a higher level than many market participants had expected. Fixed income assets broadly declined, as investor optimism about a drop in inflationary pressures gave way to worries about the scope of Fed tightening and the potential of a recession. In this environment, the U.S. Treasury yield curve inversion increased, as two-year yields rose in anticipation of additional upcoming Fed action. (On November 2nd, after the end of the Reporting Period, the Fed raised short-term interest rates by another 75 basis points.) |

| For the Reporting Period overall, U.S. large-cap equities, as measured by the S&P 500® Index, recorded double-digit negative absolute returns. U.S. value-oriented stocks, as measured by the Russell Value Index, also posted negative absolute returns but significantly outperformed U.S. growth-oriented stocks, as measured by the Russell 1000® Growth Index. The broad fixed income market, including high yield corporate bonds and bank loans, produced negative absolute returns during the Reporting Period overall. |

| Q | What was the Fund’s asset allocation positioning during the Reporting Period, and what effect did it have on performance? |

| A | At the beginning of the Reporting Period, the Fund was invested 56.5% in fixed income and 41.9% in equities, with the balance in cash and cash equivalents. This breakout is inclusive of equity derivatives exposure but does not necessarily include the cash to support those positions. |

2

FUND RESULTS

| Derivatives positions are mostly supported by cash held in the Fund specifically to cover its exposure and any potential margin calls or future losses experienced. |

| The Fund’s duration positioning, which started the Reporting Period between 3.1 and 3.2 years, reached a low of about 2.6 years in August 2022, before increasing to approximately 3.0 years by the end of the Reporting Period. For the Reporting Period overall, the Fund’s duration positioning strategy had a negative impact on its performance. In September 2022, the Income Builder Team slightly increased the Fund’s holdings of interest rate swaps to help manage duration. |

| The Fund’s fixed income allocation remained rather consistent throughout the Reporting Period, with the Income Builder Team actively managing allocations at the security level and in terms of credit quality. During the Reporting Period, the fixed income allocation detracted from the Fund’s returns. |

| The Fund’s equity allocation also remained rather consistent during the Reporting Period, though the Income Builder Team adjusted the Fund’s positioning to reflect its dynamic views as the U.S. economy continued to recover from the COVID-19 shock. When the Reporting Period started, we held a pro-cyclical relative value view, expressing it using a basket of large-cap, high-beta stocks and diversified sector exposure that we believed would provide the Fund with attractive risk/return characteristics. (High beta stocks are those that tend to be more volatile than the broad equity market.) We moderated this dynamic view in February 2022 and eliminated it in early April, reallocating the assets to S&P 500® Index futures. In addition, near the end of March, we increased the Fund’s exposure to energy master limited partnerships (“MLPs”) and energy infrastructure companies by increasing its investment in the Goldman Sachs MLP Energy Infrastructure Fund. In June, we started to moderate this view and reduced the size of the Fund’s position in the Goldman Sachs MLP Energy Infrastructure Fund, using some of the proceeds to increase the Fund’s position in S&P 500® Index futures. In August, we trimmed the Fund’s exposure to European banks stocks by reducing its allocation to EURO STOXX® Banks futures. Overall, during the Reporting Period, the Fund’s investment in a basket of high-beta stocks and its investment in the Goldman Sachs MLP Energy Infrastructure Fund added to performance. These positive results were slightly offset by the Fund’s position in S&P 500® Index futures, which detracted from returns as the broad U.S. equity market retreated. |

| At the end of the Reporting Period, the Fund was invested 51.7% in fixed income and 41.9% in equities, with the balance in cash and cash equivalents. |

| Q | What key factors had the greatest impact on the performance of the Fund’s fixed income allocation during the Reporting Period? |

| A | During the Reporting Period, the Fund’s fixed income allocation recorded negative absolute returns, driven mostly by its longer-duration exposures amid the material rise in interest rates. Also detracting from results was the fixed income allocation’s exposure to emerging markets debt, which suffered due to central bank interest rate hikes, a strengthening U.S. dollar, risks related to China’s “zero-COVID” policy, and the impact, including supply-chain disruptions, of the Russia/Ukraine war. Conversely, the fixed income allocation benefited from its exposure to bank loans. Although bank loans produced negative returns during the Reporting Period, they tend to be less sensitive to interest rate movements than many other fixed income assets. In addition, the fixed income allocation’s exposure to high yield corporate bonds versus its exposure to investment grade corporate bonds bolstered performance, as high yield corporate bonds performed better than investment grade corporate bonds during the Reporting Period. That said, both high yield and investment grade corporate bonds generated negative absolute returns during the Reporting Period. |

| Q | Were any significant purchases or sales made within the fixed income allocation of the Fund during the Reporting Period? |

| A | During the Reporting Period, the Fund established a position in the high yield corporate bonds of Norton Lifelock, a provider of consumer cyber-safety solutions. We are constructive on Norton Lifelock because of its September 2022 acquisition of Avast, a Czech Republic-headquartered cybersecurity software company with cloud-based security infrastructure solutions that offer desktop security and server protection service. The merged business is one of the world’s largest consumer cybersecurity providers, overtaking McAfee. |

| Among other notable purchases were the high yield corporate bonds of PNC Financial Services (“PNC”). Our favorable view of PNC is supported by its status as one of the largest, most stable U.S. regional banks, with assets exceeding $540 billion following its 2021 acquisition of BBVA USA, as well as its strong market positions across the eastern and midwestern U.S. and its recent expansion into Texas. |

| Among positions exited during the Reporting Period was the Fund’s investment in the high yield corporate bonds of Wheel Pros, a leading designer, marketer and distributor of branded aftermarket wheels. We sold the Fund’s position on the back of our fundamental credit concerns. Wheel Pros reported weak second quarter 2022 earnings, with revenue down 14% year over year and adjusted earnings before interest, taxes, depreciation and amortization down 47% year over year amid slowing customer demand and strong cost inflation. |

3

FUND RESULTS

| The Fund also exited its position in the high yield corporate bonds of Norwegian Cruise Line Holdings (“Norwegian”). We are vigilant about the Fund’s exposure to the cruise industry following earnings guidance cuts from several of Norwegian’s peers, including Carnival. |

| Q | What changes were made to the Fund’s fixed income allocation during the Reporting Period? |

| A | As mentioned previously, the Fund’s fixed income allocation remained rather consistent during the Reporting Period, with the Income Builder Team actively managing allocations at the security level and in terms of credit quality. Specifically, we increased the overall credit quality of the fixed income allocation by adding moderately to its exposure to investment grade corporate bonds and by reducing its exposures to high yield corporate bonds, bank loans and emerging markets debt. In addition, in the middle of 2022, we increased the fixed income allocation’s exposure to preferred securities, mainly those issued by large financial companies. |

| In terms of market segments, we increased the Fund’s exposure to banks during the Reporting Period, as we became more cautious on the outlook for the global economy. We have a positive view of banks overall given their strong capital standing, higher net interest income and the improvement in supply and demand conditions after significant new issuance in the first half of 2022. Additionally, we increased the Fund’s exposure to insurance brokers, as we maintained a high conviction for certain types of financial issuers. In our view, insurance brokers, as well as specialty finance companies, tend to post strong growth in inflationary and recessionary environments. On the other hand, we reduced the Fund’s exposure to the consumer cyclicals and telecommunications market segments. Within consumer cyclicals, retail and apparel continued its shift from brick and mortar to e-commerce. Telecommunications faced a secular decline, as these companies have, for all intents and purposes, ceded broadband share to cable companies due to years of underinvestment. |

| Q | What key factors had the greatest impact on the performance of the Fund’s equity allocation during the Reporting Period? |

| A | During the Reporting Period, the Fund’s equity allocation produced negative absolute returns, with stock selection in the utilities, real estate and energy sectors detracting most from performance. Investments in the telecommunications services, health care and information technology sectors added to results. |

| Q | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | The major detractors from Fund performance during the Reporting Period were a relative underweight in ExxonMobil and investments in Enel and Schneider Electric, neither of which are represented in the Russell Value Index. |

| The Fund was hurt by an underweight position versus the Russell Value Index in integrated oil and gas exploration and production company ExxonMobil, a new purchase for the Fund during the Reporting Period. Its shares benefited during the Reporting Period from rising crude oil prices and supply/demand dynamics. In February 2022, the company announced a sweeping restructuring across its global operations, which included cost-cutting efforts and a new headquarters location in Houston. Earnings releases during the summer of 2022 featured significant bets on both net income and earnings per share, along with favorable results from ExxonMobil’s liquefied natural gas segment. At the end of the Reporting Period, we continued to see favorable trends in the operations of the business and planned to see if further capital distributions would be put in place. |

| Enel is an Italian company involved in electricity generation and distribution as well as natural gas distribution. The company’s stock was pressured during the Reporting Period by mixed earnings results. Enel had increased its capital expenditure spending and net debt in a tough operating environment, which appeared to have caused investors some concern. In addition, given that Enel generally trades at a premium to its peers, higher interest rates and elevated inflation weighed on its valuation. In our view, the company’s execution and capital deployment has been best in class, but we decided to exit the Fund’s position during the Reporting Period and reallocate the assets to what we considered to be better risk/reward opportunities. |

| France-based Schneider Electric engages in energy and automation digital solutions for efficiency and sustainability. Its stock declined after the company reported revenue growth that was ahead of consensus estimates but slower than peers because of supply-chain issues. Schneider Electric also faced foreign exchange pressures and inflation headwinds that weighed on its shares, as did weakness in its China operations due to COVID-19-related lockdowns. That said, the company has built a strong software portfolio, in our view, which we believed could help it benefit from secular themes, such as the Internet of Things and digitalization across its end markets. (The Internet of Things refers to interconnection via the Internet of computing devices embedded in everyday objects, enabling them to send and receive data.) In our opinion, Schneider Electric has demonstrated strong cost execution through portfolio rationalization and improved productivity, and we believed the company should continue to deliver margin expansion and reach its intermediate-term margin expansion goal. (Portfolio rationalization is the act of reviewing business operations in order to improve cost efficiency.) Additionally, we continued to have a favorable long-term view of the company at the end of the Reporting Period given its exposure to what we see as its attractive growth opportunities and effective execution capabilities. |

4

FUND RESULTS

| Q | Which stocks contributed most to the Fund’s performance during the Reporting Period? |

| A | During the Reporting Period, the Fund benefited from its positions in Devon Energy, Eli Lilly and Company (“Eli Lilly”) and Shell. |

| Devon Energy is an oil and gas exploration and production company. Its fourth quarter 2021 earnings featured strong results with earnings and dividend amounts higher than consensus expectations. Its management’s focus remained on 2022 production and the company’s variable dividend with which Devon Energy continued to lead the industry. |

| Subsequent earnings reports featured results above consensus expectations, largely due to strong production and execution metrics. The company also benefited from rising crude oil prices. At the end of the Reporting Period, our investment thesis for Devon Energy continued to revolve around a better than market expected variable dividend, increased stock buybacks and our continued line of sight to significant capital returns. |

| In the first quarter of 2022, pharmaceutical maker Eli Lilly beat consensus earnings expectations by $0.03, with adjusted quarterly earnings of $2.49 per share, and also exceeded revenue forecasts. Results were boosted by a jump in sales of Eli Lilly’s Trulicity diabetes drug and its COVID-19 therapies, though the stock declined slightly following the announcement. The company was also able to achieve 10% growth in its non-COVID-19-related work and saw more than 60% of its fourth quarter 2021 revenues coming from its “growth brand” of pharmaceutical products. In addition, five new medicines were set to launch in 2022 and 2023. In August 2022, Eli Lilly’s earnings slightly missed consensus expectations, but the company maintained its full year guidance, and all drug launches remained on track. At the end of the Reporting Period, we continued to view Eli Lilly as one of the fastest-growing pharmaceutical firms, with no major patent concerns until 2030 and a robust new product pipeline with multi-billion dollar opportunities ahead. |

| The stock price of Shell, a British oil and gas producer, surged during the Reporting Period due to impressive financial performance amid disrupted oil supply from geopolitical tensions and heightened global demand. Shell ended 2021 with a steep rise in profit, and in response, the company raised its dividend and increased its stock buybacks. Its strong performance continued through the first three quarters of 2022, highlighted by cash flow generation that exceeded consensus expectations each quarter and growing dividends and buybacks within the company’s capital allocation framework. Furthermore, Shell significantly benefited from rising crude oil prices. At the end of the Reporting Period, the company continued to have an attractive free cash flow profile, in our view, and we liked its commitment to return cash to shareholders. |

| Q | Were any significant purchases or sales made within the equity allocation of the Fund during the Reporting Period? |

| A | In addition to ExxonMobil, discussed earlier, the Fund initiated a position in oil and natural gas producer ConocoPhillips during the Reporting Period. In our opinion, it has one of the most disciplined variable capital return policies in the energy sector. ConocoPhillips pays out a percentage of its cash flow from operations, while its peers have adopted a percentage of free cash flow as their model. We believe this helps ensure that ConocoPhillips stays disciplined regarding its capital spending plan. In addition, ConocoPhillips saw an increase in its per-day production of crude oil during the Reporting Period and anticipated another increase in the near term. |

| Among sales completed during the Reporting Period was the Fund’s investment in Enel, mentioned earlier, and its position in Chevron, a global integrated energy, chemical and petroleum company. Chevron has 22% of its energy production located in Kazakhstan, which we considered a high regional risk that was not appropriate for the Fund. |

| Q | What changes were made to the Fund’s equity market sector exposures during the Reporting Period? |

| A | During the Reporting Period, the Income Builder Team increased the Fund’s exposures to the energy and health care sectors. We reduced its exposures to the financials and real estate sectors. |

| In September 2022, as part of the annual strategic asset allocation rebalance, the Income Builder Team increased the Fund’s exposure to global infrastructure securities by slightly decreasing its exposure to U.S. equities. As a result of the greater exposure to global infrastructure securities, the Fund had slightly increased exposure to international equities when the Reporting Period concluded. |

| Q | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | During the Reporting Period, the Income Builder Team wrote equity index options in an effort to generate additional cash flow and potentially reduce volatility (positive impact on performance). In addition, equity index futures were employed to gain passive exposure to European bank stocks and the broad U.S. equity market (in each case, a negative impact). Total return swaps were used within a pro-cyclical tactical view that sought to provide the Fund with attractive risk/return characteristics as the U.S. economy continued to recover from the COVID-19 shock (positive impact). Interest rate swaps and U.S. Treasury futures were utilized as cost-efficient instruments to provide greater precision and versatility in the management of duration (each had a negative impact). Credit default swaps were used to implement specific credit-related investment strategies |

5

FUND RESULTS

| (neutral impact). To hedge against currency risk (that is, the risk that certain currencies might fluctuate in value), the Fund employed currency forwards (neutral impact). |

| Q | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | Effective January 3, 2022, Alexandra Wilson-Elizondo became a portfolio manager for the Fund. As of August 3, 2022, Collin Bell no longer served as a portfolio manager of the Fund and Kevin Martens became a portfolio manager of the Fund. At the end of the Reporting Period, Ashish Shah, Ron Arons, Charles “Brook” Dane, Neill Nuttall, Alexandra Wilson-Elizondo and Kevin Martens served as portfolio managers of the Fund. By design, all investment decisions for the Fund are performed within a team structure, with multiple subject matter experts. This strategic decision making has been a cornerstone of our approach and helps ensure continuity in the Fund. |

| Q | What is the Income Builder Team’s tactical view and strategy for the months ahead? |

| A | At the end of the Reporting Period, the Income Builder Team noted that the U.S. economy had downshifted sharply in 2022 and that higher inflation had had a negative effect on consumer purchasing power and sentiment. Given this economic backdrop, along with higher interest rates and tightening financial conditions, we believed the threat of a recession may have intensified. Taming inflation without a recession would require U.S. economic growth to slow to below its potential in order to rebalance the labor market and reduce wage growth to a pace consistent with the Fed’s 2% inflation target. At the end of the Reporting Period, the negative demand shock from tighter Fed monetary policy had already increased the U.S. unemployment rate and decreased job openings, illustrating how companies had become more cautious about hiring amid higher costs and slowing demand. Overall, we expected U.S. inflation to remain elevated in the near term, though we thought it should moderate in 2023. As for monetary policy, we expected the Fed to tighten further despite higher macroeconomic uncertainty. At the end of the Reporting Period, we believed investor uncertainty about the path of U.S. interest rates would drive volatility in the financial markets. |

| Regarding equities, a majority of U.S. companies had reported better than expected third quarter earnings during October 2022 but many of them had also issued negative guidance, suggesting there might be pain to come. We intended to remain cautious given that earnings per share growth/net margins were contracting globally, and we believed the risk of downward revisions may continue into 2023. At the end of Reporting Period, investor sentiment remained negative overall, but we believed market participants may have already accounted for headline risks, while some technical indicators were suggesting the equity market was oversold. (Oversold refers to a condition where an asset has traded lower in price and has the potential for a |

| price bounce. An oversold condition can last for a long time, and therefore being oversold does not mean a price rally will come soon, or at all.) A possible tailwind is the Fed’s suggestion it may slow its pace of tightening. At the end of the Reporting Period, we planned to stay true to our quality-first investment approach in the months ahead and seek to invest in businesses with healthy balance sheets, relatively stable cash flows and differentiated business models aligned to secular tailwinds. We believed a focus on higher-quality investments can help navigate heightened volatility while also positioning investors to benefit from the next upcycle. We intended to continue re-evaluating our assumptions and to stay focused on the long-term investment horizon. |

| As for fixed income, we noted at the end of the Reporting Period that inflation remained elevated and that the broader economic environment—most notably the labor market—had proved resilient. We thought global central banks, including the Fed, would stay on a hiking path, with the risk that they could go too far too fast given that monetary policy impacts economic conditions with a lag. We believed market stabilization would require evidence of a peak in inflation, a peak in policy hawkishness and a peak in real yields. At the end of the Reporting Period, we thought near-term risks were tilted toward additional tightening in global financial conditions and the path to peak hawkishness would be challenging, particularly as recession risks increase. As a result, we planned to maintain the fixed income allocation’s defensive position, focusing on market segments, such as specialty financials, insurance brokers and gaming companies, that we considered resilient to inflation. Additionally, the Fund had little to no exposure to consumer discretionary, including cruise and theater companies, at the end of the Reporting Period. We were also planning to increase the quality of the Fund’s bank loan exposure. Finally, until credit spreads narrowed, we did not see any value in materially increasing credit risk overall. |

6

FUND BASICS

Income Builder Fund

as of October 31, 2022

| TOP TEN EQUITY HOLDINGS AS OF 10/31/22 ‡ | ||||

| Holding |

% of Net Assets | Line of Business | ||

| JPMorgan Chase & Co. |

1.1% | Banks | ||

| Johnson & Johnson |

1.0 | Pharmaceuticals | ||

| Bristol-Myers Squibb Co. |

1.0 | Pharmaceuticals | ||

| ConocoPhillips |

0.8 | Oil, Gas & Consumable Fuels | ||

| Eli Lilly & Co. |

0.8 | Pharmaceuticals | ||

| Shell PLC ADR |

0.7 | Oil, Gas & Consumable Fuels | ||

| Bank of America Corp. |

0.7 | Banks | ||

| Schneider Electric SE ADR |

0.7 | Electrical Equipment | ||

| NextEra Energy, Inc. |

0.6 | Electric Utilities | ||

| Nordea Bank Abp ADR |

0.6 | Banks | ||

| ‡ | The top 10 holdings may not be representative of the Fund’s future investments. |

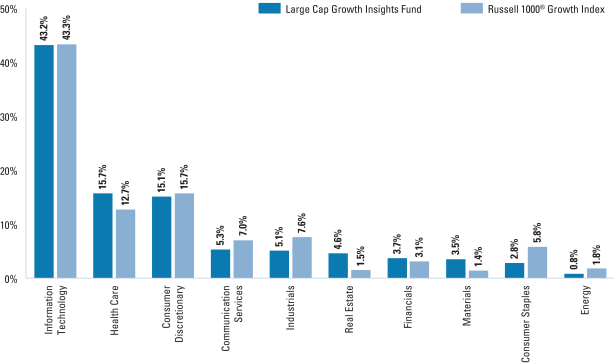

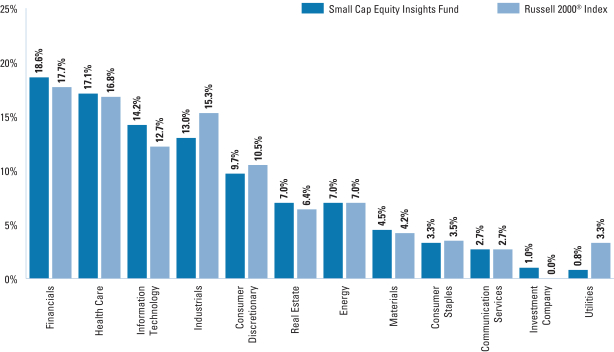

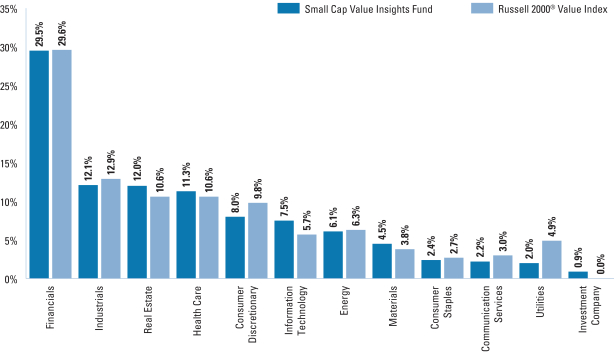

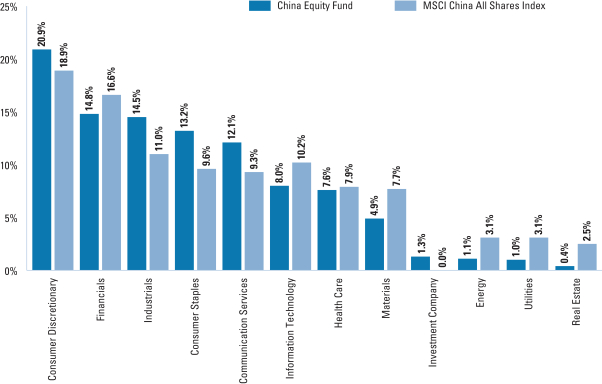

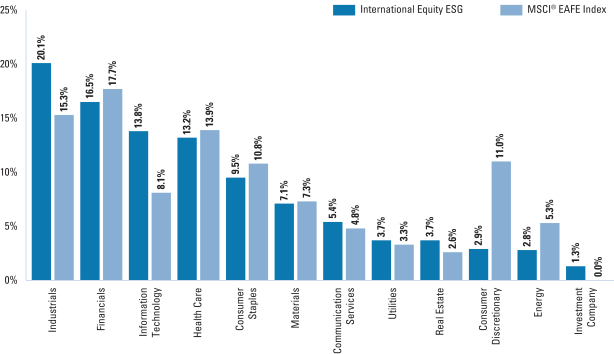

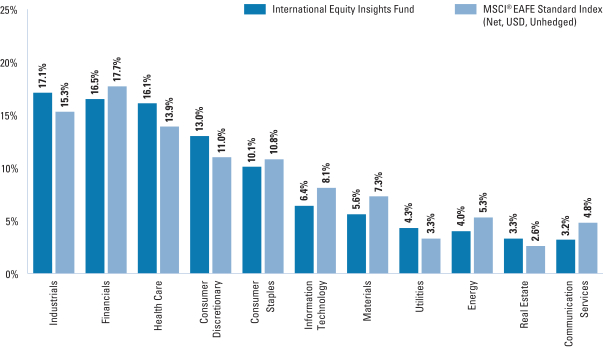

| FUND’S EQUITY SECTOR ALLOCATIONS VS. BENCHMARK† |

| † | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of the total value of the Fund’s equity investments. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

7

FUND BASICS

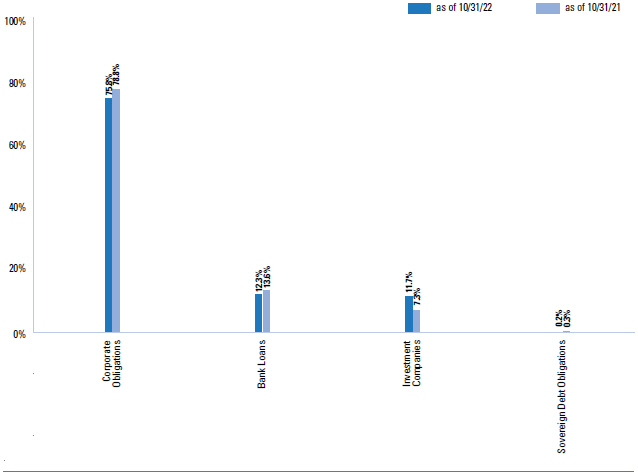

| FUND’S FIXED INCOME COMPOSITION * |

| * | The percentage shown for each investment category reflects the value of investments in that category as a percentage of the Fund’s Fixed Income investments. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| For information on the mutual funds, please call our toll free Shareholder Services Line at 1-800-526-7384 or visit us on the web at www.GSAMFUNDS.com |

8

GOLDMAN SACHS INCOME BUILDER FUND

Performance Summary

October 31, 2022

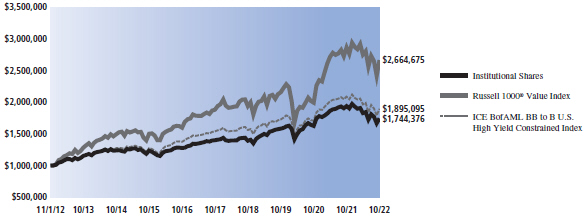

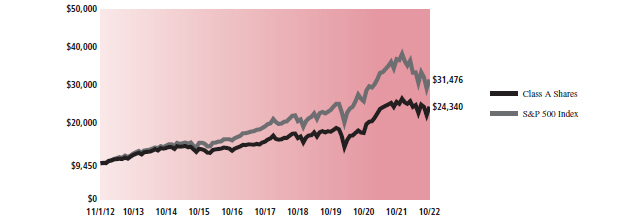

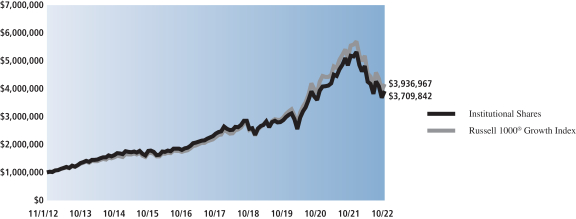

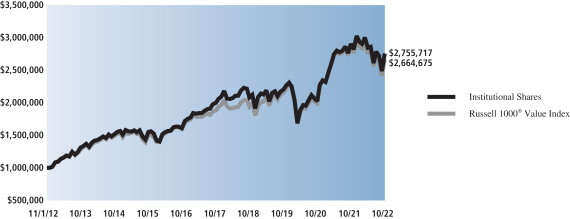

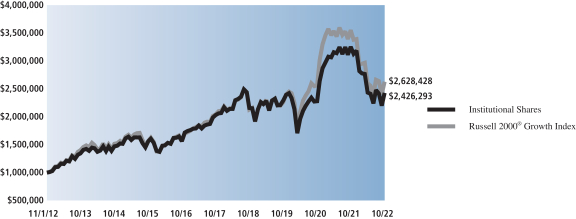

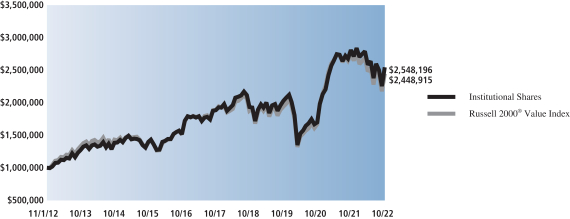

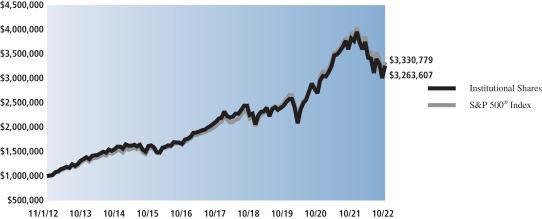

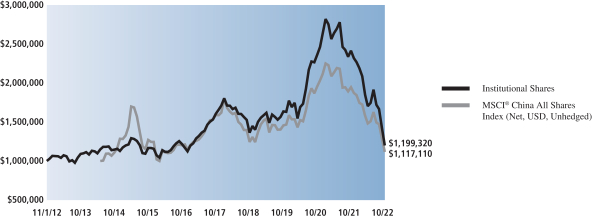

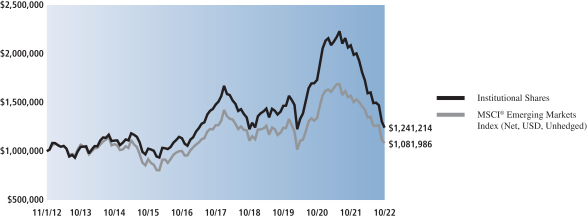

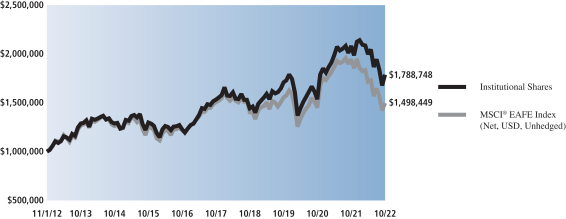

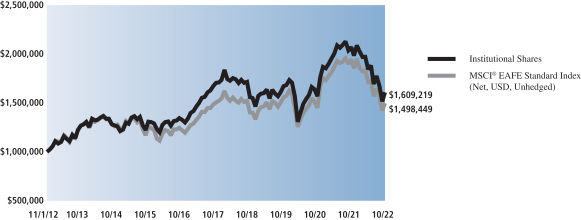

The following graph shows the value, as of October 31, 2022, of a $1,000,000 investment made on November 1, 2012 in Institutional Shares. For comparative purposes, the performance of the Fund’s current benchmarks, the Russell 1000® Value Index and the ICE BofAML BB to B U.S. High Yield Constrained Index, are shown. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns set forth below represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted below. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns.

| Income Builder Fund’s 10 Year Performance |

Performance of a $1,000,000 investment, with distributions reinvested, from November 1, 2012 through October 31, 2022

|

Average Annual Total Return through October 31, 2022* |

One Year |

Five Years |

Ten Years |

Since Inception | ||||

| Class A |

||||||||

| Excluding sales charges |

-10.34% | 4.11% | 5.31% | — | ||||

| Including sales charges |

-15.28% | 2.94% | 4.72% | — | ||||

| Class C |

||||||||

| Excluding contingent deferred sales charges |

-10.99% | 3.34% | 4.53% | — | ||||

| Including contingent deferred sales charges |

-11.88% | 3.34% | 4.53% | — | ||||

| Institutional |

-10.02% | 4.50% | 5.72% | — | ||||

| Investor |

-10.09% | 4.38% | 5.58% | — | ||||

| Class R6 (Commenced July 31, 2015) |

-10.05% | 4.50% | N/A | 4.64% | ||||

| Class P (Commenced April 16, 2018) |

-10.05% | N/A | N/A | 4.83% | ||||

| * | These returns assume reinvestment of all distributions at NAV and reflect a maximum initial sales charge of 5.50% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Investor, Class R6 and Class P Shares do not involve a sales charge, such a charge is not applied to their Average Annual Total Return. |

9

FUND RESULTS

Goldman Sachs Rising Dividend Growth Fund

| Investment Objective |

|

The Fund seeks long-term growth of capital and current income.

|

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Quantitative Equity Solutions (“QES”) portfolio management team, the Goldman Sachs Global Portfolio Solutions Group and the Goldman Sachs Energy & Infrastructure Team (“E&I Team”) discuss the Goldman Sachs Rising Dividend Growth Fund’s (the “Fund”) performance and positioning for the 12-month period ended October 31, 2022 (the “Reporting Period”).

| Q | How did the Fund perform during the Reporting Period? |

| A | During the Reporting Period, the Fund’s Class A, Class C, Institutional, Investor, Class R6, Class R and Class P Shares generated average annual total returns, without sales charges, of -4.99%, -5.65%, -4.62%, -4.70%, -4.62%, -5.10% and -4.62%, respectively. These returns compare to the -14.61% average annual total return of the Fund’s benchmark, the Standard & Poor’s® 500 Index (with dividends reinvested) (the “S&P 500 Index”), during the same time period. |

| Q | What economic and market factors most influenced the U.S. equity markets as a whole during the Reporting Period? |

| A | The S&P 500 Index returned -0.69% in November 2021. Retail earnings upside surprises and hints of easing supply-chain constraints supported the U.S. equity markets upward trajectory early in the month. Congress passed a $1 trillion infrastructure bill, and President Biden signed the bill into law. U.S. Federal Reserve (“Fed”) Chair Powell was appointed for a second term days before the Thanksgiving holiday, bringing clarity to the central bank’s path forward. However, renewed concerns over COVID-19 developments brought U.S. equities under pressure late in the month, as the emergence of the highly contagious Omicron variant triggered a sell-off among global risk assets, as investors fled to relative safety. Persistently high inflation weighed on market sentiment as well. |

| The S&P 500 Index gained 4.48% in December 2021. Despite record COVID-19 cases in many areas of the U.S., studies showed the variant was accompanied by milder symptoms than previous variants, propelling U.S. equities higher. Supply-chain issues and high inflation continued to put pressure on corporate earnings, though investors seemed to believe the impact had reached its peak. Positively seasonality and the so-called “Santa Rally” also lifted the S&P 500 Index toward the end of the month. |

| In the first quarter of 2022, the S&P 500 Index returned -4.95%, marking the Index’s first quarterly decline since the first quarter of 2020. The dramatic repricing of the Fed |

| interest rate hike path and expectations for a more aggressive balance sheet run-off phase were accelerated due to concerns about elevated and persistent inflation pressures. Tensions arising from geopolitical conflict also brought about concern, as commodity prices became volatile, the global supply chain came into question again, and Russia invaded Ukraine. Dampened corporate earnings momentum also played into the U.S. equity market’s decline in the first quarter. |

| The S&P 500 Index returned -16.10% in the second quarter of 2022. Inflation, the Fed’s policy response and recession worries remained at the core of the narrative during the quarter, resulting in a broad risk-off, or heightened investor risk aversion, atmosphere. At the end of the quarter, investors were looking ahead to the second quarter corporate earnings season with some caution, as input price pressures and consumption trends factored into analysts’ arguments for downward revisions to earnings estimates. |

| In the third quarter of 2022, the S&P 500 returned -4.88%, marking its third consecutive quarterly decline and its longest losing streak since 2008. Year-to-date through September 30, 2022, the S&P 500 Index had its third-worst performance since the 1950s. The noticeable tightening of financial conditions, guided by expectations for a more aggressive interest rate hike cycle, was the major story for the quarter. The Fed’s hawkish policy was supported by higher than consensus expected core Consumer Price Index data and a still-tight labor market that showed only moderate signs of cooling. (Hawkish tends to suggest higher interest rates; opposite of dovish. Core Consumer Price Index (“CPI”) data excludes food and energy prices.) Geopolitical tensions also remained high due to the possible weaponization of energy flows. There also appeared to be significant concern among investors that corporate earnings could suffer given the combination of margin pressures, demand destruction, higher labor costs, slower economic activity and a stronger U.S. dollar eroding overseas sales. |

| The S&P 500 Index increased 8.10% in October 2022, posting the second-best monthly performance year to date. The U.S. equity market recovery can predominantly be credited to a shift in the Fed narrative, depressed investor |

10

FUND RESULTS

| sentiment and positioning, and solid third quarter earnings. Despite the September CPI data coming in higher than consensus expected, Fed officials began to contend that inflation would likely decline in the upcoming months should demand weaken and supply-chain issues soften as policymakers anticipated. Also, with more than half of S&P 500 Index companies having reported third quarter earnings results through the end of the month, those results exceeded market expectations in the vast majority of cases. |

| For the Reporting Period overall, energy was by far the best performing sector in the S&P 500 Index, followed at some distance by consumer staples, utilities and health care, the only sectors to post positive absolute returns. The weakest performing sectors in the S&P 500 Index during the Reporting Period were communication services, consumer discretionary, real estate and information technology. |

| Within the U.S. equity market, all capitalization segments posted double-digit negative absolute returns for the Reporting Period overall. Large-cap stocks, as measured by the Russell 1000® Index, were least weak, followed closely behind by mid-cap stocks, as measured by the Russell Midcap® Index, and then small-cap stocks, as measured by the Russell 2000® Index. From a style perspective, value-oriented stocks notably outpaced growth-oriented stocks across the capitalization spectrum. (All as measured by the FTSE Russell indices.) |

| Q | What economic and market factors most influenced energy MLPs as a whole during the Reporting Period? |

| A | Energy-related equities generally posted strong performance during the Reporting Period, as crude oil and natural gas prices remained elevated despite bouts of volatility. The price of Brent crude oil rose 13.27% during the Reporting Period, while natural gas prices averaged more than $6.23 per MMBtu, which was 15% higher than prices at the beginning of the Reporting Period. (MMBtu is million British thermal units, the standard measurement for natural gas.) |

| As the Reporting Period began in the last two months of 2021, commodities and energy-related equities experienced a brief but sharp sell-off. The sell-off was driven by worries around the spread of the COVID-19 Omicron variant, which had raised concerns about how the variant might impact near-term demand for commodities. However, data suggesting Omicron was less severe symptomatically than previous variants helped to ease market fears and supported a rebound in crude oil prices and energy-related equities through year-end 2021. |

| During the first quarter of 2022, commodities and energy-related equities advanced overall, as underlying fundamentals strengthened. U.S. oil demand ticked higher, while supply struggled to keep pace with production discipline from both OPEC+ and U.S. producers, which were largely focused on maximizing free cash flow. (OPEC+ is The Organization of the Petroleum Exporting Countries |

| (“OPEC”) and Russia.) The result was undersupplied energy markets, which were further pressured by the Russian invasion of Ukraine on February 24th, given that Russia was a major global exporter of crude oil and natural gas. After the invasion, crude oil prices rose, with West Texas Intermediate (“WTI”) crude oil prices reaching $128 per barrel, its highest level since 2008, in early March. |

| After surging to this record level, crude oil prices subsequently experienced volatility during the second calendar quarter, driven by developments surrounding the Russia/Ukraine war, the possibility of a European Union ban on Russian oil, and potential oil demand-side concerns stemming from rising COVID-19 cases and lockdown procedures in China. However, a combination of strong global energy demand, tight inventories, limited space capacity and announcements of the European Union’s ban on Russian oil imports kept crude oil prices elevated. On the supply side, global supply shortages led to low inventories of crude oil and natural gas, while at the same time, demand continued to recover, supported by an uptick in seasonal travel as well as by high liquified natural gas (“LNG”) prices that pushed certain countries to turn to crude and related refined products as replacements. |

| The third quarter of 2022 marked a decline in crude oil prices, with Brent crude oil prices falling 19.32% in these three months. Much of the weakness was driven by global demand concerns related to two primary issues—growing recession risks and ongoing lockdowns in China—as well as U.S. dollar strength. Despite this weakness, Brent crude oil prices ended the Reporting Period at nearly $95 per barrel. |

| Notably, at the end of the Reporting Period, the fundamental backdrop remained supportive of strong crude oil prices, in our view, with global demand (ex-China) having largely normalized to pre-COVID levels. On the supply side, production levels were also back to pre-COVID levels, but years of underinvestment, combined with healthy demand growth, left inventory levels nearly 10% below long-term averages.1 In addition, on October 5, 2022, in response to heighted macro concerns, OPEC+ announced a production cut of two million barrels per day in an effort to stabilize prices and incentivize appropriate investments. It is important to note that OPEC+ was already well below its production quota. Therefore, the production cut beginning in November 2022 was expected to be closer to approximately 800,000 to 1.1 million barrels per day in comparison to then-current production levels. Overall, we believed that macroeconomic concerns that drove extreme market volatility and weighed on crude oil prices during the Reporting Period overshadowed underlying tight oil market fundamentals. |

| On the natural gas side, years of unsound energy policies, predominantly in Europe, and underinvestment in natural gas infrastructure led to the energy shortages and steep increase in consumer prices seen during the Reporting Period. The |

1 Joint Organisations Data Initiative (JODI).

11

FUND RESULTS

| ongoing war in Ukraine further intensified the effects of the energy crisis, with the curtailment of Russian gas exports to Europe resulting in historically low inventories and high prices, with European power prices up 93% year to date through October 31, 2022.2 |

| Despite the volatility in crude oil and natural gas prices during the Reporting Period, as well as record high inflation levels and a recession narrative, midstream3 energy markets ultimately moved higher. The Alerian MLP Index4, which measures energy infrastructure master limited partnerships (“MLPs”), and the Alerian Midstream Energy Index5, which measures the broader midstream sector inclusive of both energy MLPs and “C” corporations, generated total returns of 30.19% and 16.94%, respectively, during the Reporting Period. The midstream markets, as represented by the Alerian MLP Index and the Alerian Midstream Energy Index, outperformed the S&P 500 Index significantly. |

| Higher oil and natural gas prices and growing volumes supported strong earnings growth for midstream companies, and management teams continued to focus on capital discipline, balance sheet strength and, above all, generating free cash flow and returning it back to investors via dividends and buybacks—all of which we believe was generally well received by the market. The strong quarterly earnings announcements during the Reporting Period and upward earnings revisions reaffirmed the fundamental stability and defensive nature of the sector, which helped to support equity price performance during a volatile market environment. In addition, the sector may have benefited from the broad rotation from growth to value as well as from an uptick in MLP merger and acquisition activity. |

| Toward the end of the Reporting Period, the U.S. Inflation Reduction Act (“IRA”) of 2022 was passed, which aims to make a historic down payment on deficit reduction to fight inflation, invest in domestic energy production and manufacturing, and reduce carbon emissions by |

| 2 | European Power Prices: Germany Power Baseload Forward Year 1. |

| 3 | The midstream component of the energy industry is usually defined as those companies providing products or services that help link the supply side (i.e., energy producers) and the demand side (i.e., energy end-users for any type of energy commodity. Such midstream businesses can include, but are not limited to, those that process, store, market and transport various energy commodities. |

| 4 | Source: Alerian. The Alerian MLP Index is the leading gauge of energy infrastructure MLPs. The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price-return basis (AMZ) and on a total-return basis (AMZX). It is not possible to invest directly in an unmanaged index. |

| 5 | Source: Alerian. The Alerian Midstream Energy Index is a broad-based composite of North American energy infrastructure companies. The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities involving energy commodities, is disseminated real-time on a price-return basis (AMNA), total-return basis (AMNAX), net total-return (AMNAN), and adjusted net total return (AMNTR) basis. It is not possible to invest directly in an unmanaged index. |

| approximately 40% by 2030. The IRA included a new 15% corporate alternative minimum tax based on book income for companies that report more than $1 billion in profits to shareholders. However, midstream companies structured as MLPs were excluded from this new provision, which we believe further supported equity price performance during the Reporting Period. |

| At the end of the Reporting Period, energy infrastructure remained one of the highest yielding equity market segments, with yields in excess of 7%, which is four times higher than that of the S&P 500 Index and twice the yields of both the utilities and real estate investment trusts sectors. From a valuation perspective at the end of the Reporting Period, the midstream sector screened as inexpensive, trading at a 4.4x discount relative to its long-term average and at an approximately 12% free cash flow yield. In our view, valuations remained dislocated from the sector’s earnings potential. |

| Q | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | While absolute returns disappointed, the Fund significantly outperformed the S&P 500 Index on a relative basis for the Reporting Period. |

| During the Reporting Period, the Fund’s dividend-paying investments outperformed the S&P 500 ex-Energy Index, the benchmark used for the dividend-paying growers portion of the Fund. Stock selection contributed most positively to relative results within this portion of the Fund. Sector allocation also added value. |

| The Fund’s MLP & Energy Infrastructure Sleeve posted robust double-digit absolute gains that outperformed the Alerian MLP Index, the benchmark used for the MLP & Energy Infrastructure Sleeve of the Fund, on a relative basis. In managing the MLP & Energy Infrastructure Sleeve, the E&I Team remained focused on high quality midstream companies with strong dividend and distribution coverage, cash flow growth potential and what it considered to be a robust outlook for free cash flow generation and healthy balance sheets. The E&I Team believes this quality bias ultimately led to relative outperformance during a Reporting Period of market exuberance. |

| In addition, the MLP & Energy Infrastructure Sleeve’s tactical allocation to upstream6 companies contributed positively to its relative performance given that these companies generally have more commodity price sensitivity and, therefore, on a relative basis, benefited to a greater degree than other market segments from the strong |

| 6 | The upstream component of the energy industry is usually defined as those operations stages in the oil and gas industry that involve exploration and production. Upstream operations deal primarily with the exploration stages of the oil and gas industry, with upstream firms taking the first steps to first locate, test and drill for oil and gas. Later, once reserves are proven, upstream firms will extract any oil and gas from the reserve. |

12

FUND RESULTS

| commodity price environment. These companies also experienced steep inflections in free cash flow during the Reporting Period, which led to distribution growth. |

| Also, the MLP & Energy Infrastructure Sleeve’s higher exposure to midstream companies with an LNG focus, compared to the Alerian MLP Index, contributed positively to its relative performance. The global natural gas supply/demand imbalance that has existed for some time was exacerbated by the Russian invasion of Ukraine in February 2022, as it led to a surge in key commodity prices, including LNG. Also, during June 2022, Russia’s Gazprom announced a reduction in the amount of gas it can pump through the Nord Stream 1 pipeline to Germany, further exacerbating supply tightness. As a result of tightening market dynamics, the spread, or differential, between global LNG prices and U.S. natural gas prices significantly widened during the Reporting Period, benefiting the profit outlook for North American midstream companies with significant LNG exposure. |

| Q | Which equity market sectors most significantly affected Fund performance during the Reporting Period? |

| A | The dividend-paying growers portion of the Fund does not take explicit sector bets relative to the S&P 500 ex-Energy Index but rather allocations are the result of stock selection. |

| That said, the sectors that contributed most positively on a relative basis to the S&P 500 ex-Energy Index during the Reporting Period were information technology, communication services and health care. Only partially offsetting these positive contributors were consumer staples, utilities and financials, which detracted from this portion of the Fund’s relative results. |

| Q | What were some of the Fund’s best-performing individual stocks during the Reporting Period? |

| A | The top individual contributors to the Fund’s relative performance during the Reporting Period were each underweight positions—most notably in Facebook parent company Meta Platforms, e-commerce retailing leader Amazon.com, Google parent company Alphabet, software behemoth Microsoft and electric vehicle maker Tesla. Each of these companies underperformed the S&P 500 ex-Energy Index during the Reporting Period. |

| Q | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | Detracting most from the Fund’s results relative to the S&P 500 ex-Energy Index during the Reporting Period were underweight positions in information technology giant Apple and pharmaceuticals company Eli Lilly & Co. and overweight positions in communication services company Comcast, apparel and footwear company VF Corp. and investment management firm T. Rowe Price Group. Apple |

| and Eli Lilly & Co. outperformed the S&P 500 ex-Energy Index, and Comcast, VF Corp. and T. Rowe Price Group underperformed the S&P 500 ex-Energy Index during the Reporting Period. |

| Q | Which sub-industries within the Alerian MLP Index most significantly affected Fund performance during the Reporting Period? |

| A | As measured by the Alerian MLP Index, relative overweights to the production & mining/hydrocarbon and to the other/liquefication sub-industries contributed most positively to the MLP & Energy Infrastructure Sleeve’s performance during the Reporting Period due to these sub-industries’ exposure to the strong commodity price environment. In addition, a relative underweight position and effective security selection in the pipeline transportation/petroleum sub-industry boosted performance. |

| A relative overweight to the power generation sub-industry, most notably exposure to renewable power generation, detracted most form the MLP & Energy Infrastructure Sleeve’s performance during the Reporting Period. The renewable power generation segment experienced weakness alongside the broader clean energy industry given rising interest rate concerns and growing recession risks, which weighed on equity markets as a whole during the Reporting Period. Weak security selection within the gathering & processing and pipeline transportation/natural gas sub-industries also detracted from relative performance. |

| Q | What were some of the Fund’s best-performing MLPs and energy infrastructure companies during the Reporting Period? |

| A | Relative to the Alerian MLP Index, among those MLPs and energy infrastructure companies that contributed most to the Fund’s performance during the Reporting Period were Cheniere Energy Inc., Hess Midstream LP and NGL Energy Partners LP. |

| Cheniere Energy Inc., a pure-play U.S. LNG export operator, is not a constituent of the Alerian MLP Index and outperformed the Alerian MLP Index during the Reporting Period. Cheniere Energy Inc. is a leading producer of LNG in the U.S., exporting LNG to dozens of countries worldwide. As the global market has become more and more short of LNG, both as a result of growing demand and curtailed Russian supplies, Cheniere Energy Inc. has become an essential supplier to world markets. As a result of tightening markets, the spread between global LNG prices and U.S. natural gas prices widened considerably during the Reporting Period, improving the company’s near-term and long-term profit outlook. Additionally, Cheniere Energy Inc. has leveraged its position to contract incremental capacity that is expected to come online during the next several years. |

| An underweight position in Hess Midstream LP (HESM), a U.S. company focused on gathering, storing and transporting natural gas liquids (“NGLs”), crude oil and propane, |

13

FUND RESULTS

| contributed positively given its underperformance of the Alerian MLP Index during the Reporting Period. While HESM is a high quality midstream company with strong contractual support, it underperformed relative to its peers during the Reporting Period as it has less commodity price exposure. In addition, HESM has light liquidity. |

| The MLP & Energy Infrastructure Sleeve of the Fund did not hold a position in NGL Energy Partners (NGL) during the Reporting Period, which contributed positively to its relative results given NGL’s weak performance. NGL, a diversified midstream MLP with operations focused on crude oil logistics, water treatment services, NGL logistics and retail propane, is a small company with what the E&I Team sees as low quality assets and a significant amount of leverage. In addition, the company’s execution has been poor, in the E&I Team’s view, with NGL missing consensus earnings expectations seven of the last eight quarters. |

| Q | Which MLPs and energy infrastructure companies detracted significantly from the Fund’s performance during the Reporting Period? |

| A | Among those MLPs and energy infrastructure companies detracting most from the Fund’s results relative to the Alerian MLP Index were EnLink Midstream LLC, TC Energy Corp. and ONEOK, Inc. |

| EnLink Midstream LLC (ENLC) is a U.S. midstream energy company that transports, stores and sells natural gas, NGLs, crude oil and condensates to industrial end-users, utilities, marketers and other pipelines. A relative underweight position in ENLC detracted from the MLP & Energy Infrastructure Sleeve’s performance, as ENLC outperformed the Alerian MLP Index during the Reporting Period. As crude oil and natural gas prices rose, the production outlook for ENLC’s assets improved materially during the Reporting Period, bettering its short- and long-term profit outlooks. Additionally, ENLC has leveraged its preeminent Louisiana gas pipeline asset base to be a first mover in the burgeoning carbon capture and storage business. |

| A relative overweight position in TC Energy Corp. (TRP), a major North American energy company with extensive natural gas and liquids pipelines throughout the region, detracted from the MLP & Energy Infrastructure Sleeve’s results given its weak performance during the Reporting Period. The E&I Team considers TRP to be a low beta, or low volatility, stock in a rising market. However, during the Reporting Period, an equity issuance was a headwind to TRP’s equity price performance. During the summer of 2022, TRP announced a reinstatement of its dividend reinvestment plan and then a $1.8 billion bought deal offering of common shares. (A bought deal is a securities offering in which an investment bank commits to buy the entire offering from the client company. A bought deal eliminates the issuing company’s financing risk, ensuring that it will raise the intended amount.) Further, cost overruns at the Coastal Gaslink Pipeline, in which TRP has an |

| ownership stake, and announcements of major new capital expenditure projects, including the Southeast Gateway Pipeline, a $4.5 billion offshore natural gas pipeline project in Mexico in which TRP has an even larger ownership stake, occurred at a time when competitors were trying to reduce capital expenditures and increase free cash flow. |

| The MLP & Energy Infrastructure Sleeve held an overweight position in ONEOK, Inc. (OKE), a leading midstream service provider that owns one of the nation’s premier NGL systems. Severe winter storms in North Dakota resulted in widespread shut-ins during April and May 2022, which, in turn, drove lower earnings for OKE during the second calendar quarter. In early July 2022, OKE’s Medford, Oklahoma fractionator suffered an explosion, rendering the entire facility unusable. Until its third quarter 2022 earnings announcement was made in early November (just after the close of the Reporting Period), investors were concerned about OKE’s ability to achieve its financial targets. (Notably, as part of its third quarter 2022 earnings call, OKE not only reiterated its full-year financial guidance but also provided a preliminary look at 2023 financial performance, which was substantially better than consensus expectations.) |

| Q | How did the Fund use derivatives during the Reporting Period? |

| A | The MLP & Energy Infrastructure Sleeve of the Fund did not use derivatives during the Reporting Period. The dividend-paying equity investments portion of the Fund used equity index futures on an opportunistic basis during the Reporting Period to equitize its modest cash position. In other words, we put the Fund’s excess cash holdings to work by using them as collateral for the purchase of equity index futures. The use of these derivatives did not have a material impact on Fund results during the Reporting Period. |

| Q | Did the Fund make any significant equity purchases or sales during the Reporting Period? |

| A | The dividend-paying growers portion of the Fund uses a systematic, rules-based approach and thus equity purchases and sales are based solely on that quantitative process. |

| Q | Did the Fund make any significant purchases or sales of MLPs and energy infrastructure companies during the Reporting Period? |

| A | We initiated a position in EOG Resources, Inc. during the Reporting Period. EOG Resources, Inc. explores, develops, produces and markets natural gas and crude oil, primarily in the U.S. In our view, the company was well positioned to benefit from healthy oil and gas prices given its scale, and we anticipated that EOG Resources, Inc. would pay out above-market yields while maintaining a strong balance sheet. |

| We established a position in Marathon Oil Corp., which engages in the exploration and production of petroleum and natural gas. With the commodity price environment observed |

14

FUND RESULTS

| during the Reporting Period, the valuation of the company, in our opinion, was disconnected from its fundamentals and we believed offered compelling upside potential. |

| Conversely, we sold the Fund’s position in NextEra Energy Partners LP during the Reporting Period. NextEra Energy Partners LP owns, operates and acquires contracted clean energy projects, including wind and solar. We exited the position because we believed the company’s valuation was looking expensive relative to traditional energy companies and because rising interest rates had the potential, in our view, to negatively affect the company’s ability to finance new projects and earn what we considered to be an appropriate rate of return. |

| We eliminated the Fund’s position in Enviva Inc, which manufactures processed biomass fuel and offers wood chips and wood pellets to power generation and industrial customers in the U.S. and Europe. We sold the position due to what we considered to be better opportunities elsewhere with more potential upside exposure to the strong commodity environment. Additionally, there was some debate around the sustainability of the company’s wood sourcing, which drew some negative attention from the market. |

| Q | Were there any notable changes in the Fund’s equity sector weightings during the Reporting Period? |

| A | As mentioned earlier, under the QES team’s investment approach, the dividend-paying growers portion of the Fund does not take sector bets by design. Therefore, the dividend-paying investments portion of the Fund, using a quantitative process, strove to be similar to the S&P 500 ex-Energy Index in terms of sector allocation. We seek to provide exposure to high quality, dividend-paying growers within each sector. |

| Q | Were there any notable changes in the Fund’s MLP and energy infrastructure company weightings during the Reporting Period? |

| A | There were no notable changes in the Fund’s MLP and energy infrastructure company weightings during the Reporting Period. At the end of the Reporting Period, the MLP & Energy Infrastructure Sleeve had its largest allocations in the gathering & processing, natural gas pipeline transportation, petroleum pipeline transportation, and liquefication segments of the Alerian MLP Index. |

| Q | How was the dividend-paying investments portion of the Fund positioned relative to the S&P 500 ex-Energy Index at the end of the Reporting Period? |

| A | As mentioned earlier, it is not part of the dividend-paying investments portion of the Fund’s approach to take sector bets. Thus, at the end of October 2022, the dividend-paying investments portion of the Fund had rather neutral positions |

| in each sector of the S&P 500 ex-Energy Index, with the exception of communication services, wherein an underweighted position was held. |

| Q | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | There were no changes to the Fund’s portfolio management team in either the dividend-paying investments portion of the Fund or the MLP & Energy Infrastructure Sleeve of the Fund during the Reporting Period. |

| Q | What is the Fund’s tactical view and strategy for the months ahead? |

| A | The Fund seeks long-term growth of capital and current income. Within the dividend-paying growers sleeve, we maintained confidence at the end of the Reporting Period in high quality business models that have demonstrated commitment to grow their dividend in a rather stable manner. |

| On the energy side, while global demand concerns and U.S. dollar strength may continue to drive market volatility in the near term, we had a positive outlook for commodity prices and oil-related equities at the end of the Reporting Period. Our view was supported, we believed, by strong fundamentals, with tight supply/demand dynamics and critically low inventories. Additionally, we have seen energy policy shift as the global economy looks to address growing global energy needs, with energy security becoming a priority of many developed nations following the Russian invasion of Ukraine. We believed North America was uniquely positioned as a potential key source of safe, reliable and relatively clean oil and natural gas for decades to come. Looking at LNG specifically, the U.S. has spent billions of dollars on LNG infrastructure during the last five years or so to supply the world with essential LNG under long-term contracts. Since 2017, the U.S. has grown natural gas production by about 50% and LNG exports by more than 900%, making it the largest global LNG exporter, with expectations for U.S. LNG exports to triple by 2032 relative to 2021 levels.7 |

| We further expected the energy sector to potentially experience additional interest as the world’s perception around energy security and terminal value shifts and as money managers rationalize underweight energy exposure. Energy equities were expected by many analysts to deliver approximately 10.5% of S&P 500 Index earnings in calendar year 2022, even though the sector represents only 5.3% of the S&P 500 Index. Looking at the relationship of earnings contribution to index weight historically would suggest the energy sector’s weight within the S&P 500 Index could grow to nearly 8%, presenting an opportunity for continued outperformance and sector interest. |

| 7 | Bloomberg and Energy Information Agency. |

15

FUND RESULTS

| Regarding midstream energy companies, we believed at the end of the Reporting Period that fundamentals were some of the most attractive on record, with midstream cash flow inflecting higher alongside strong oil and natural gas prices and management teams demonstrating capital and cost discipline. The sector was generating significant amounts of free cash flow at the end of the Reporting Period, which, in our opinion, not only adequately supported then-current distributions and dividends but also left plenty of excess cash to further de-lever, buy back stock and/or grow distributions and dividends. In addition, while high inflation and recessionary indicators were not positive headlines, midstream businesses have benefited from having contracted cash flows with embedded inflationary escalators, which historically have proven to support earnings resiliency during economic downturns. The market dynamics seen at the end of the Reporting Period also appeared to be driving a rotation from growth to value stocks, and midstream equities—along with other value-oriented stocks—may be the beneficiaries of increased fund flows. Overall, we believed at the end of the Reporting Period the midstream sector presented a compelling investment opportunity alongside a strong commodity price backdrop, healthy fundamentals and inexpensive valuations. Additionally, the sector was well positioned, in our view, to benefit from the growing need for North American energy. |

| While there are certainly still risks, such as continued COVID-19 lockdowns in China and growing recession concerns, we believed the risk/reward profile for the midstream sector at the end of the Reporting Period remained meaningfully positive. |

| In managing the MLP & Energy Infrastructure Sleeve, we intend to remain focused on high quality companies with strong dividend/distribution coverage, cash flow growth potential and what we see as a robust outlook for free cash flow generation and healthy balance sheets. As always, we continue to monitor domestic and global economies, geopolitical factors, interest rates and equity market fundamentals as we actively manage the Fund. |

16

FUND BASICS

Rising Dividend Growth Fund

as of October 31, 2022

| TOP TEN HOLDINGS AS OF 10/31/22 ± | ||||

| Holding |

% of Net Assets | Line of Business | ||

| Comcast Corp. Class A |

2.4% | Media | ||

| Activision Blizzard, Inc. |

1.9 | Entertainment | ||

| Energy Transfer LP |

1.8 | Oil, Gas & Consumable Fuels | ||

| NextEra Energy, Inc. |

1.5 | Electric Utilities | ||

| Western Midstream Partners LP |

1.4 | Oil, Gas & Consumable Fuels | ||

| Oracle Corp. |

1.4 | Software | ||

| UnitedHealth Group, Inc. |

1.4 | Health Care Providers & Services | ||

| The Interpublic Group of Cos., Inc. |

1.3 | Media | ||

| MPLX LP |

1.3 | Oil, Gas & Consumable Fuels | ||

| Visa, Inc. Class A |

1.3 | IT Services | ||

| ± | The top 10 holdings may not be representative of the Portfolio’s future investments. The top 10 holdings exclude investments in money market funds. |

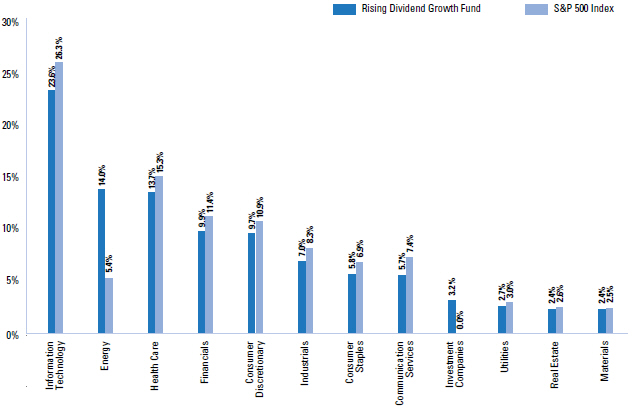

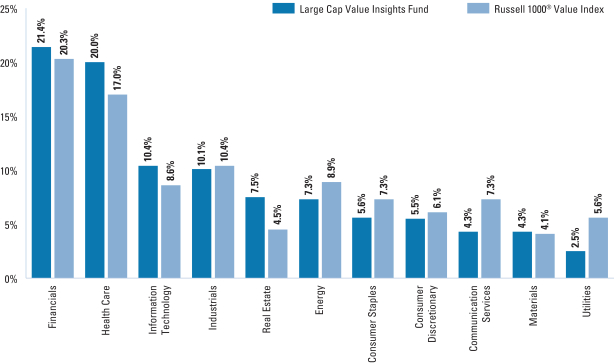

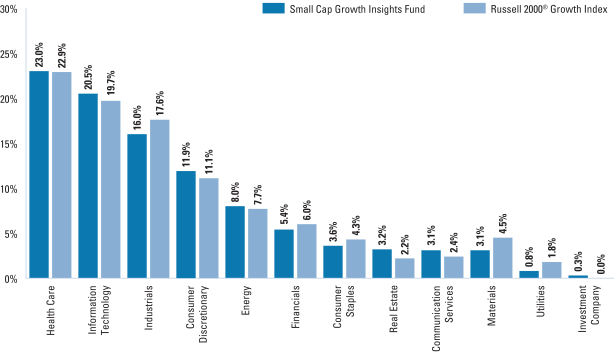

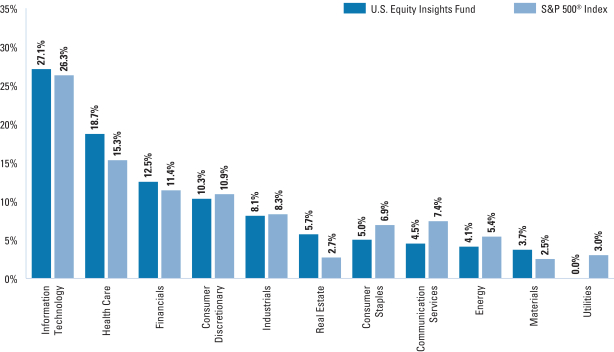

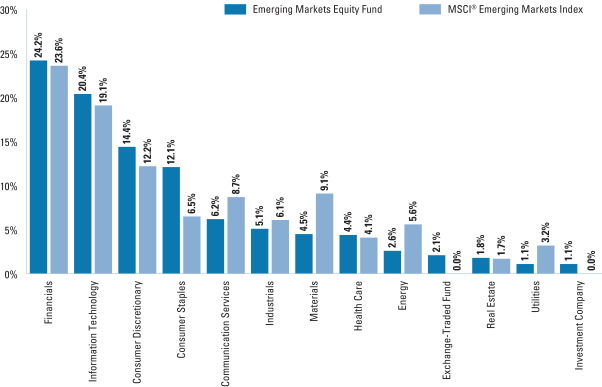

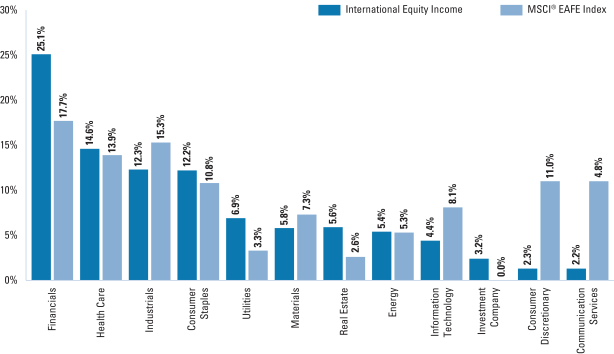

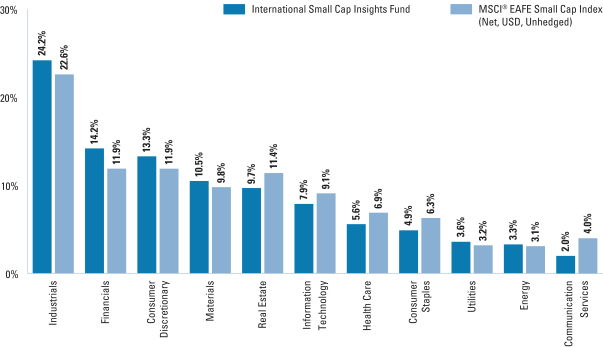

| FUND VS. BENCHMARK SECTOR ALLOCATION † |

| † | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. Figures in the graph may not sum to 100% due to rounding and/or the exclusion of other assets and liabilities. The graph categorizes investments using the Global Industry Classification Standard (“GICS”); however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value (excluding investments in the securities lending reinvestment vehicle, if any). The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance. |

17

GOLDMAN SACHS RISING DIVIDEND GROWTH FUND

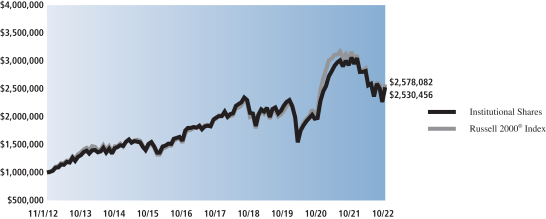

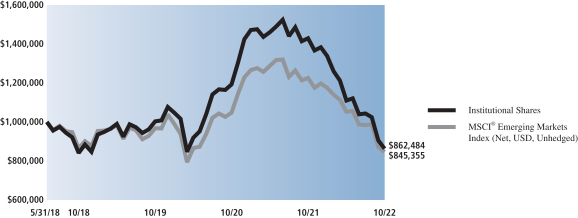

Performance Summary