UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

Copies to:

| Caroline Kraus, Esq. |

Stephen H. Bier, Esq. | |||

| Goldman Sachs & Co. LLC |

Dechert LLP | |||

| 200 West Street |

1095 Avenue of the Americas | |||

| New York, New York 10282 |

New York, NY 10036 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: March 31

Date of reporting period: September 30, 2022

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| The Semi-Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds Semi-Annual Report September 30, 2022 Multi Sector Fixed Income Funds Bond Core Fixed Income Global Core Fixed Income Income Long Short Credit Strategies Strategic Income

Goldman Sachs Multi Sector Fixed Income Funds

| ∎ | BOND |

| ∎ | CORE FIXED INCOME |

| ∎ | GLOBAL CORE FIXED INCOME |

| ∎ | INCOME |

| ∎ | LONG SHORT CREDIT STRATEGIES |

| ∎ | STRATEGIC INCOME |

| 1 | ||||

| 3 | ||||

| 16 | ||||

| 140 | ||||

| 147 | ||||

| 147 | ||||

| 155 | ||||

| 163 | ||||

| 170 | ||||

| 177 | ||||

| 184 | ||||

| 191 | ||||

| 225 | ||||

| NOT FDIC-INSURED | May Lose Value | No Bank Guarantee | ||||

Multi Sector Fixed Income Funds

The following are highlights both of key factors affecting the fixed income market and of any changes made to the Goldman Sachs Multi-Sector Fixed Income Funds (the “Funds”) during the six months ended September 30, 2022 (the “Reporting Period”). Attribution highlights are provided for those Funds that materially outperformed or underperformed their respective benchmark during the Reporting Period. A fuller review of the market and these changes will appear in the Funds’ annual shareholder report covering the 12 months ended March 31, 2023.

| ∎ | During the Reporting Period, the performance of the global fixed income markets was broadly influenced by central bank monetary policy, rising interest rates, inflationary trends, slowing economic growth and geopolitical pressures. |

| ∎ | The broad global investment grade bond market, as represented by the Bloomberg Global Aggregate Index (Gross, USD, hedged),i returned -7.49%. |

| ∎ | The Bloomberg U.S. Aggregate Bond Index,ii representing the broad U.S. fixed income market, returned -9.22%. |

| ∎ | Global economic activity moderated during the Reporting Period, as central banks grew increasingly hawkish and financial conditions tightened. (Hawkish tends to suggest higher interest rates; opposite of dovish.) |

| ∎ | Inflationary pressures were persistent, with food and energy prices reaching a four-decade high during September 2022 amid continued supply and demand imbalances driven by geopolitical turmoil, including the Russia/Ukraine war, and COVID-19 flareups in China. |

| ∎ | Higher inflation led to weaker consumer purchasing power and less favorable consumer sentiment, which, in turn, weighed on consumption. However, job creation remained strong, especially in the U.S. |

| ∎ | Many central banks around the world tightened monetary policy during the Reporting Period in an effort to tame inflation. |

| ∎ | The People’s Bank of China was a notable exception as policymakers engaged in measured and selective easing to address economic growth headwinds from a property market downturn and ongoing COVID-19 restrictions in the country. |

| ∎ | In the U.S., the Federal Reserve (the “Fed”), which had initially raised the targeted federal funds (“fed funds”) rate by 25 basis points in March 2022, continued on its rate hiking path. (A basis point is 1/100th of a percentage point.) |

| ∎ | In May 2022, policymakers lifted the targeted fed funds rate by 50 basis points to a range between 0.75% and 1.00%. |

| ∎ | On June 1st, the Fed began to reduce the size of its balance sheet. |

| ∎ | In mid-June, policymakers raised the targeted fed funds rate by 75 basis points to a range between 1.50% to 1.75%—the largest single rate increase since 1994—and signaled they would continue tightening monetary policy at an aggressive pace. |

| ∎ | During July, the Fed hiked the targeted fed funds rate another 75 basis points, though comments by Fed Chair Jerome Powell suggested a potential deceleration in the pace of future rate hikes. |

| ∎ | At the Fed’s Jackson Hole symposium in August, Powell dispelled near-term prospects of a policy pivot, stressing that Fed officials remained committed to “restoring price stability” and acknowledging this might require “a restrictive policy stance for some time.” |

| ∎ | During September, the Fed raised the targeted fed funds rate an additional 75 basis points—to a range of 3.00% to 3.25%, with many market participants anticipating further rate hikes in the months ahead. |

| ∎ | The Reporting Period closed on a volatile note as markets responded to the hawkish Fed monetary policy outlook, heightened geopolitical uncertainty, energy disruptions in Europe and proposed budget from the U.K. government that sought to support economic growth through personal and corporate tax cuts and supply-side reforms. (Supply-side economics is a theory that maintains that increasing the supply of goods and services is the engine for economic growth.) (After the end of the Reporting Period, the proposed U.K. budget was withdrawn as concerns about U.K. fiscal policy and its inflationary implications drove a sharp rise in U.K. government bond yields and further tightening of global financial conditions.) |

| i | The Bloomberg Global Aggregate Index is a flagship measure of global investment grade debt from 28 local currency markets. This multi-currency benchmark includes treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers. |

| ii | The Bloomberg U.S. Aggregate Bond Index is a broad-based fixed income index that includes bonds of investment grade quality or better, including corporate bonds, U.S. Treasury securities, mortgage-backed securities, asset backed securities and municipal bonds. |

1

| ∎ | For the Reporting Period overall, U.S. Treasury yields rose significantly across the yield curve, or spectrum of maturities, though shorter-term U.S. Treasury yields rose more dramatically than intermediate- and longer-term U.S. Treasury yields. |

| ∎ | During the Reporting Period as a whole, spread, or non-government bond, sectors generated negative absolute returns. External and local emerging markets debt were among the worst performers, followed by U.S. investment grade corporate bonds, Treasury inflation protected securities, U.S. high yield corporate bonds and U.S. mortgage-backed securities—with each sector underperforming U.S. Treasuries during the Reporting Period. High yield loans, asset-backed securities and commercial mortgage-backed securities also recorded negative returns, though to a lesser extent and outperformed U.S. Treasuries during the Reporting Period. |

Fund Changes and Highlights

Goldman Sachs Bond Fund

| ∎ | Effective October 25, 2022, Ron Arons began serving as portfolio manager for the Fund. Ashish Shah continues to serve as a portfolio manager for the Fund. |

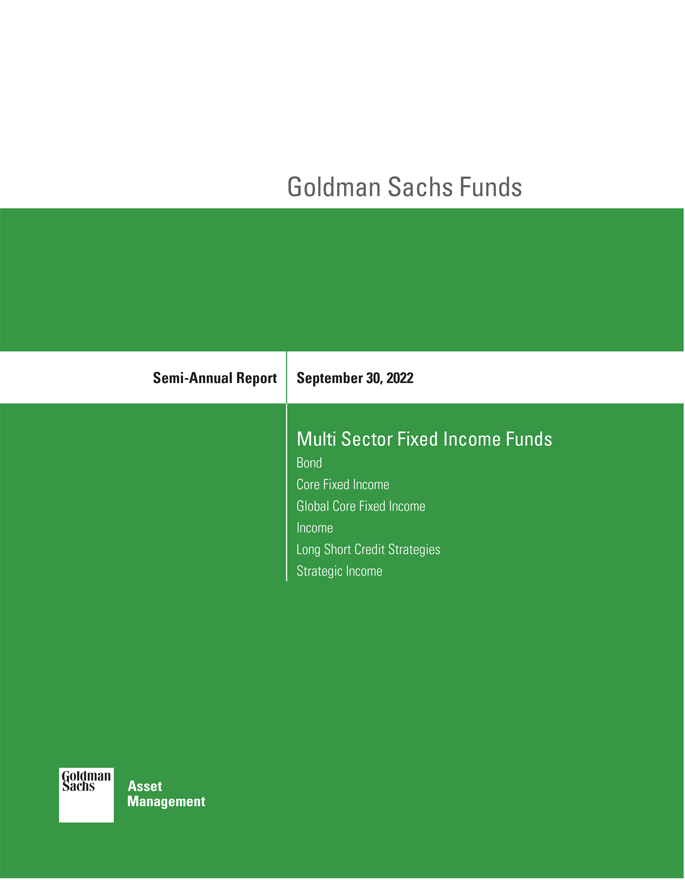

| ∎ | There was a significant increase during the Reporting Period in the Fund’s allocation to Federal agencies generally and to pass-through agency mortgage-backed securities more specifically, as we sought to capitalize on the material widening in mortgage-backed securities’ spreads that occurred. This increased allocation generated additional income for the Fund during the Reporting Period and provided an opportunity to capitalize on spread tightening once market volatility begins to subside. |

| ∎ | We reduced the Fund’s exposure to corporate bonds in an effort to position the portfolio more conservatively given the increased economic uncertainty and greater risk of recession during the Reporting Period. |

Goldman Sachs Core Fixed Income Fund

| ∎ | Effective October 25, 2022, Ron Arons began serving as portfolio manager for the Fund. Ashish Shah continues to serve as a portfolio manager for the Fund. |

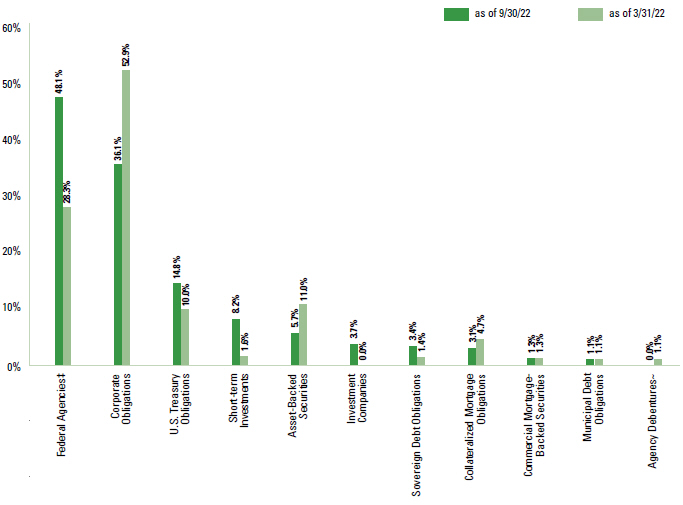

| ∎ | There was a significant increase during the Reporting Period in the Fund’s allocation to Federal agencies generally and to pass-through agency mortgage-backed securities more specifically, as we sought to capitalize on the material widening in mortgage-backed securities’ spreads that occurred. This increased allocation generated additional income for the Fund during the Reporting Period and provided an opportunity to capitalize on spread tightening once market volatility begins to subside. |

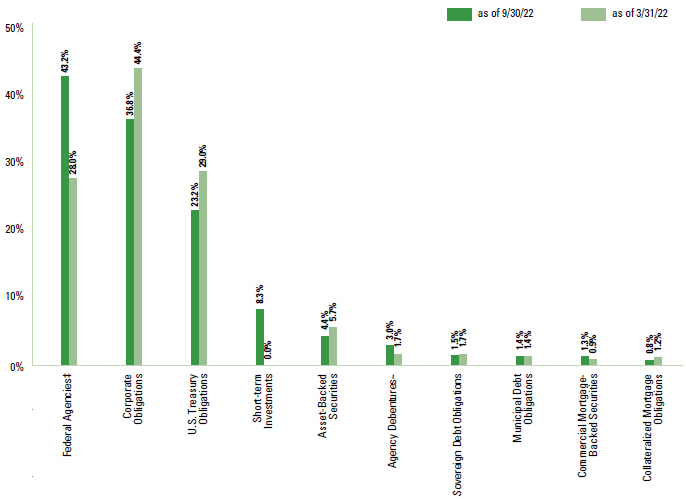

Goldman Sachs Income Fund

| ∎ | There was a significant increase during the Reporting Period in the Fund’s allocation to Federal agencies generally and to pass-through agency mortgage-backed securities more specifically, as we sought to capitalize on the material widening in mortgage-backed securities’ spreads that occurred. This increased allocation generated additional income for the Fund during the Reporting Period and provided an opportunity to capitalize on spread tightening once market volatility begins to subside. |

Goldman Sachs Strategic Income Fund

| ∎ | Effective October 25, 2022, Ron Arons began serving as portfolio manager for the Fund. Ashish Shah continues to serve as a portfolio manager for the Fund. |

| ∎ | There was a significant increase during the Reporting Period in the Fund’s allocation to Federal agencies generally and to pass-through agency mortgage-backed securities more specifically, as we sought to capitalize on the material widening in mortgage-backed securities’ spreads that occurred. This increased allocation generated additional income for the Fund during the Reporting Period and provided an opportunity to capitalize on spread tightening once market volatility begins to subside. |

2

Bond Fund

as of September 30, 2022

| PERFORMANCE REVIEW |

| April 1, 2022–September 30, 2022 | Fund Total Return (based on NAV)1 |

30-Day Standardized Unsubsidized Yield2 |

Bloomberg U.S. Aggregate Bond Index3 |

30-Day Standardized Subsidized Yield2 |

||||||||||||||||

| Class A |

-10.97 | % | 2.95 | % | -9.22 | % | 3.19 | % | ||||||||||||

| Class C |

-11.32 | 2.29 | -9.22 | 2.55 | ||||||||||||||||

| Institutional |

-10.73 | 3.40 | -9.22 | 3.66 | ||||||||||||||||

| Service |

-11.04 | 2.89 | -9.22 | 3.14 | ||||||||||||||||

| Investor |

-10.80 | 3.32 | -9.22 | 3.58 | ||||||||||||||||

| Class R6 |

-10.83 | 3.42 | -9.22 | 3.68 | ||||||||||||||||

| Class R |

-11.09 | 2.81 | -9.22 | 3.06 | ||||||||||||||||

| Class P |

-10.83 | 3.42 | -9.22 | 3.67 | ||||||||||||||||

| 1 | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standardized Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

| 3 | The Bloomberg U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds and mortgage-backed and asset-backed securities. The Index figure does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the period shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

3

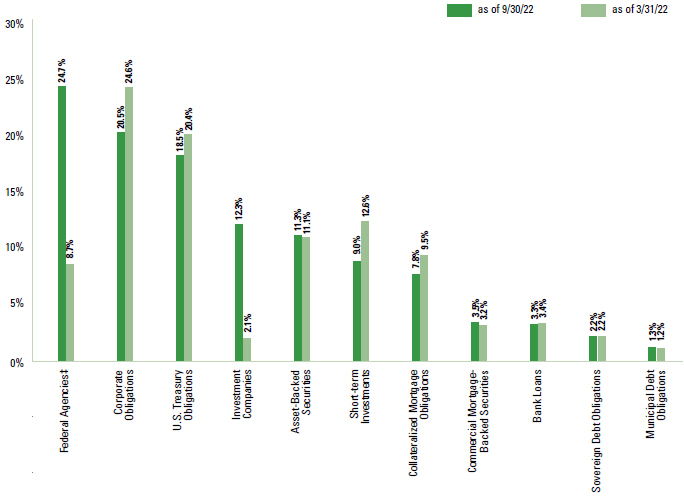

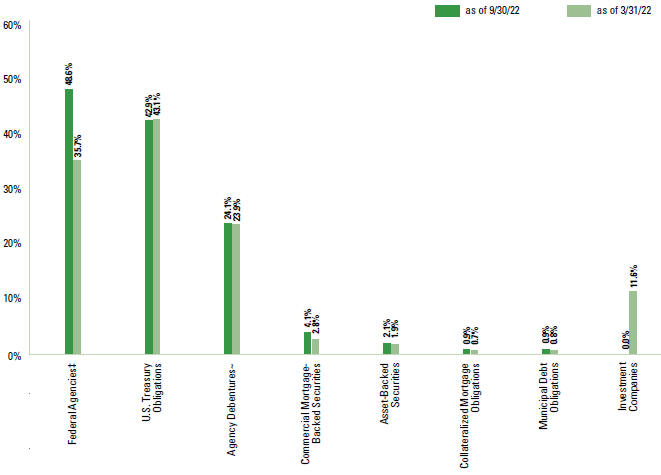

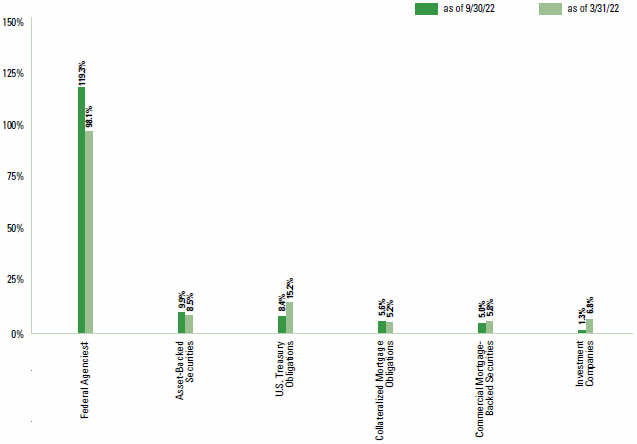

| FUND BASICS |

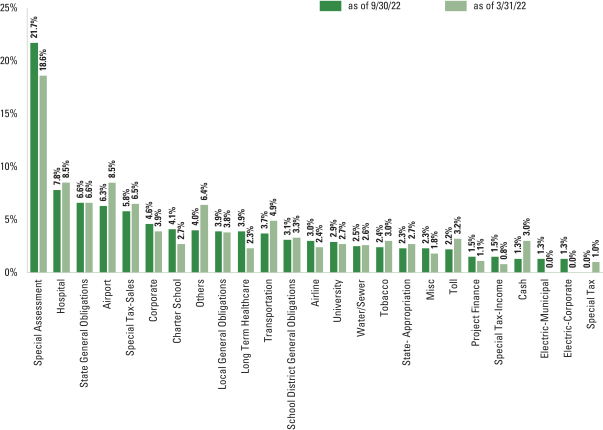

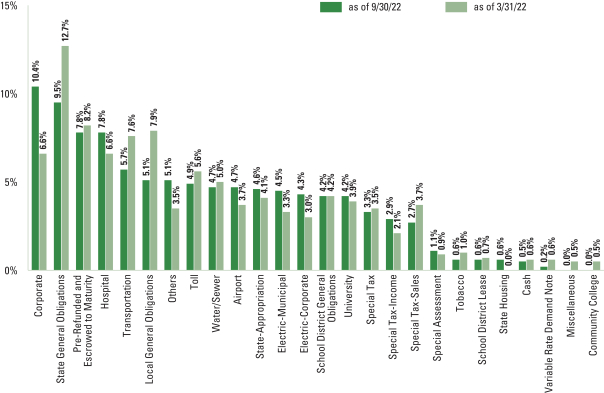

| FUND COMPOSITION * |

Percentage of Net Assets

| * | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Short-term investments represent certificates of deposit and commercial paper. Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| ‡ | “Federal Agencies” are mortgage-backed securities guaranteed by the Government National Mortgage Association (“GNMA”), Federal National Mortgage Association (“FNMA”) and Federal Home Loan Mortgage Corp. (“FHLMC”). GNMA instruments are backed by the full faith and credit of the U.S. Government. |

| ~ | “Agency Debentures” include agency securities offered by companies such as FNMA and FHLMC, which operate under a government charter. While they are required to report to a government regulator, their assets are not explicitly guaranteed by the government and they otherwise operate like any other publicly traded company. |

| For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance. |

4

FUND BASICS

Core Fixed Income Fund

as of September 30, 2022

| PERFORMANCE REVIEW | ||||||||||

| April 1, 2022–September 30, 2022 | Fund Total Return (based on NAV)1 |

30-Day Standardized Unsubsidized Yield2 |

Bloomberg U.S. Aggregate Bond Index3 |

30-Day Standardized Subsidized Yield2 | |||||||||||||||||||||

| Class A |

-10.57 | % | 3.16 | % | -9.22 | % | 3.26 | % | |||||||||||||||||

| Class C |

-10.95 | 2.51 | -9.22 | 2.61 | |||||||||||||||||||||

| Institutional |

-10.48 | 3.63 | -9.22 | 3.73 | |||||||||||||||||||||

| Service |

-10.60 | 3.11 | -9.22 | 3.21 | |||||||||||||||||||||

| Investor |

-10.46 | 3.54 | -9.22 | 3.64 | |||||||||||||||||||||

| Class R6 |

-10.46 | 3.64 | -9.22 | 3.74 | |||||||||||||||||||||

| Class R |

-10.69 | 3.03 | -9.22 | 3.13 | |||||||||||||||||||||

| Class P |

-10.36 | 3.63 | -9.22 | 3.74 | |||||||||||||||||||||

| 1 | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standardized Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

| 3 | The Bloomberg U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds and mortgage-backed and asset-backed securities. The Index figure does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the period shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

5

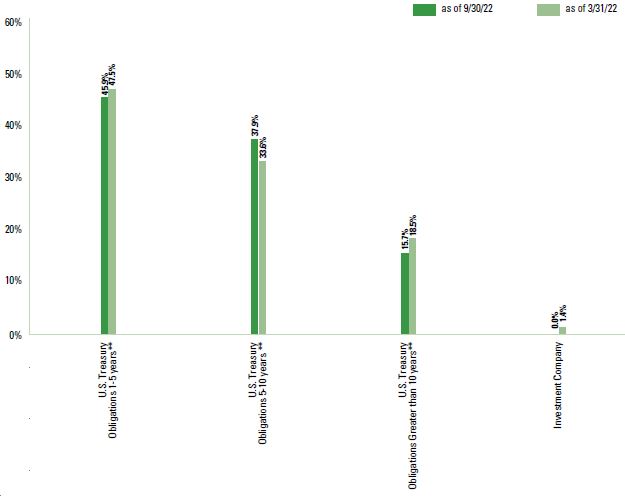

| FUND BASICS |

| FUND COMPOSITION * |

Percentage of Net Assets

| * | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Short-term investments represent certificates of deposit and commercial paper. Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| ‡ | “Federal Agencies” are mortgage-backed securities guaranteed by the Government National Mortgage Association (“GNMA”), Federal National Mortgage Association (“FNMA”) and Federal Home Loan Mortgage Corp. (“FHLMC”). GNMA instruments are backed by the full faith and credit of the U.S. Government. |

| ~ | “Agency Debentures” include agency securities offered by companies such as FNMA and FHLMC, which operate under a government charter. While they are required to report to a government regulator, their assets are not explicitly guaranteed by the government and they otherwise operate like any other publicly traded company. |

| For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance. |

6

FUND BASICS

Global Core Fixed Income Fund

as of September 30, 2022

| PERFORMANCE REVIEW |

| April 1, 2022–September 30, 2022 | Fund Total Return (based on NAV)1 |

30-Day Standardized Unsubsidized Yield2 |

Bloomberg Global Aggregate Bond Index (Gross, USD, Hedged)3 |

30-Day Standardized Subsidized Yield2 | ||||||||||||||||

| Class A |

-9.23% | 1.67% | -7.49% | 1.95% | ||||||||||||||||

| Class C |

-9.50 | 0.97 | -7.49 | 1.26 | ||||||||||||||||

| Institutional |

-9.10 | 2.07 | -7.49 | 2.34 | ||||||||||||||||

| Service |

-9.31 | 1.57 | -7.49 | 1.83 | ||||||||||||||||

| Investor |

-9.07 | 1.99 | -7.49 | 2.28 | ||||||||||||||||

| Class R6 |

-9.02 | 2.08 | -7.49 | 2.35 | ||||||||||||||||

| Class P |

-9.09 | 2.09 | -7.49 | 2.35 | ||||||||||||||||

| 1 | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standardized Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

| 3 | The Bloomberg U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds and mortgage-backed and asset-backed securities. The Index figure does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the period shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

7

| FUND BASICS |

| CURRENCY ALLOCATION + |

| Percentage of Net Assets | ||||||||||

| as of 9/30/22 | as of 3/31/22 | |||||||||

| U.S. Dollar |

68.6 | % | 54.2 | % | ||||||

| Japanese Yen |

19.0 | 16.1 | ||||||||

| Euro |

14.5 | 14.9 | ||||||||

| Chinese Yuan Renminbi |

5.7 | 6.6 | ||||||||

| British Pound |

2.0 | 3.3 | ||||||||

| Canadian Dollar |

1.5 | 1.2 | ||||||||

| South Korean Won |

0.5 | 0.6 | ||||||||

| Indonesia Rupiah |

0.3 | 0.3 | ||||||||

| Singapore Dollar |

0.3 | 0.3 | ||||||||

| Thailand Baht |

0.2 | 0.4 | ||||||||

| Israeli Shekel |

0.2 | 0.1 | ||||||||

| + | The percentage shown for each currency reflects the value of investments in that category as a percentage of net assets. Figures in the table may not sum to 100% due to the exclusion of other assets and liabilities. The table depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance. |

8

FUND BASICS

Income Fund

as of September 30, 2022

| PERFORMANCE REVIEW |

| April 1, 2022–September 30, 2022 | Fund Total Return (based on NAV)1 |

30-Day Standardized Unsubsidized Yield2 |

Bloomberg U.S. Aggregate Bond Index3 |

30-Day Standardized Subsidized Yield2 | ||||||||||||||||

| Class A |

-10.79% | 6.20% | -9.22% | 6.61% | ||||||||||||||||

| Class C |

-11.24 | 5.66 | -9.22 | 6.09 | ||||||||||||||||

| Institutional |

-10.75 | 6.80 | -9.22 | 7.22 | ||||||||||||||||

| Investor |

-10.79 | 6.72 | -9.22 | 7.14 | ||||||||||||||||

| Class R6 |

-10.74 | 6.81 | -9.22 | 7.24 | ||||||||||||||||

| Class R |

-11.01 | 6.19 | -9.22 | 6.61 | ||||||||||||||||

| Class P |

-10.75 | 6.84 | -9.22 | 7.26 | ||||||||||||||||

| 1 | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standardized Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

| 3 | The Bloomberg U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds and mortgage-backed and asset-backed securities. The Index figure does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the period shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

9

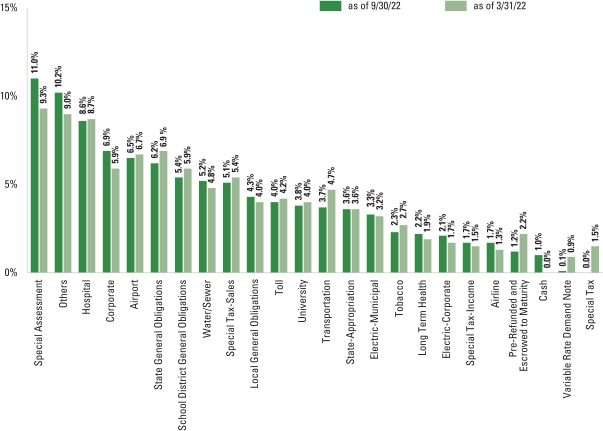

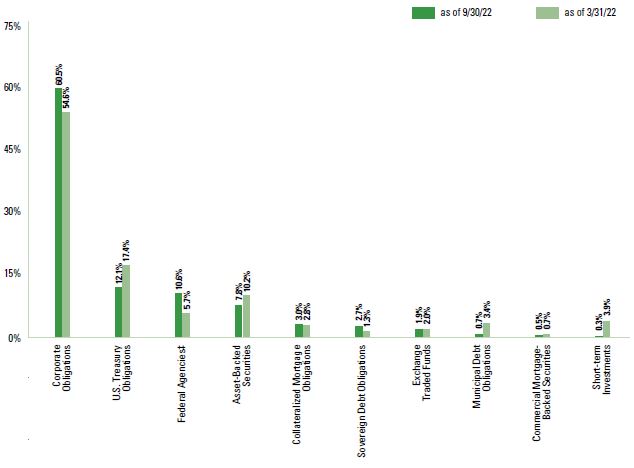

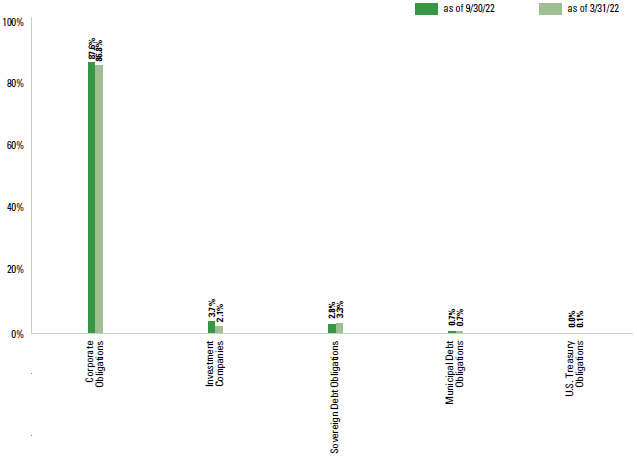

| FUND BASICS |

| FUND COMPOSITION * |

Percentage of Net Assets

| * | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| ‡ | “Federal Agencies” are mortgage-backed securities guaranteed by the Government National Mortgage Association (“GNMA”), Federal National Mortgage Association (“FNMA”) and Federal Home Loan Mortgage Corp. (“FHLMC”). GNMA instruments are backed by the full faith and credit of the U.S. Government. |

| For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance. |

10

FUND BASICS

Long Short Credit Strategies Fund

as of September 30, 2022

| PERFORMANCE REVIEW |

| April 1, 2022–September 30, 2022 | Fund Total Return (based on NAV)1 |

30-Day Standardized Unsubsidized Yield2 |

ICE BofAML Three-Month U.S. Treasury Bill Index3 |

30-Day Standardized Subsidized Yield2 | ||||||||||||||||

| Class A |

-8.80% | 5.64% | 0.57% | 5.97% | ||||||||||||||||

| Class C |

-9.14 | 5.08 | 0.57 | 5.42 | ||||||||||||||||

| Institutional |

-8.54 | 6.20 | 0.57 | 6.54 | ||||||||||||||||

| Investor |

-8.68 | 6.13 | 0.57 | 6.47 | ||||||||||||||||

| Class R6 |

-8.64 | 6.22 | 0.57 | 6.56 | ||||||||||||||||

| Class R |

-8.92 | 5.59 | 0.57 | 5.93 | ||||||||||||||||

| Class P |

-8.54 | 6.13 | 0.57 | 6.43 | ||||||||||||||||

| 1 | The net asset value (“NAV”) represents the net assets of the Fund (ex-dividend) divided by the total number of shares outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standardized Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

| 3 | The ICE BofAML Three-Month U.S. Treasury Bill Index, an unmanaged index, measures total return on cash, including price and interest income, based on short-term government Treasury Bills of about 90-day maturity, as reported by Bank of America Merrill Lynch, and does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. |

| The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the period shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

11

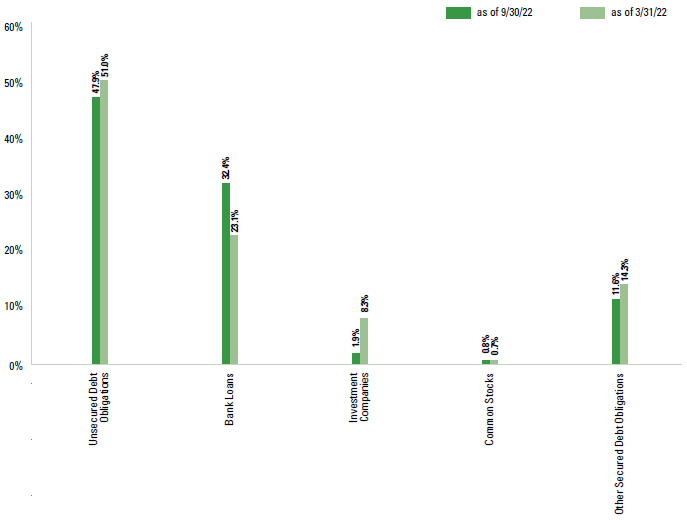

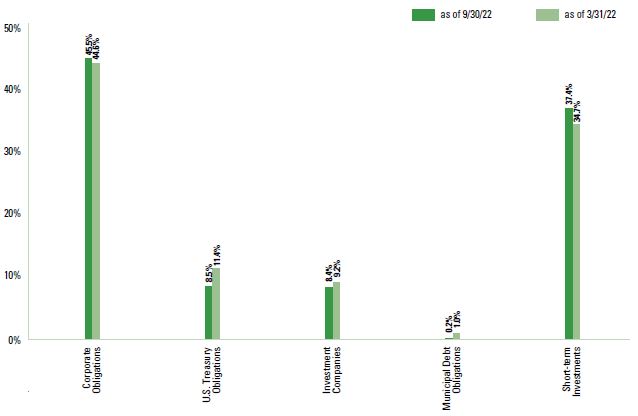

| FUND BASICS |

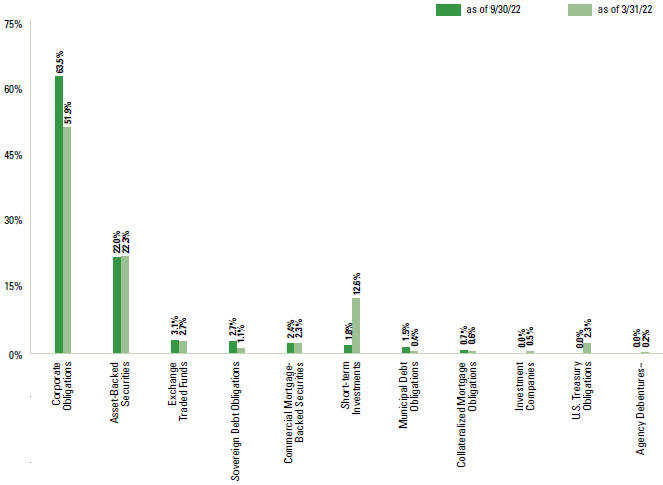

| FUND COMPOSITION * |

Percentage of Net Assets

| * | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Consolidated Schedule of Investments. |

12

FUND BASICS

| TOP TEN INDUSTRY ALLOCATIONS + |

| As of September 30, 2022 | Percentage of Net Assets | ||||

| Media |

8.0 | % | |||

| Chemicals |

5.0 | ||||

| Commercial Services |

4.9 | ||||

| Retailing |

4.7 | ||||

| Oil Field Services |

4.5 | ||||

| Diversified Financial Services |

4.2 | ||||

| Pipelines |

3.2 | ||||

| Internet |

3.1 | ||||

| Technology - Software |

3.0 | ||||

| Packaging |

3.0 | ||||

| + | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. The above table depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance. |

13

| FUND BASICS |

Strategic Income Fund

as of September 30, 2022

| PERFORMANCE REVIEW |

| April 1, 2022–September 30, 2022

|

Fund Total Return

|

30-Day Standardized Unsubsidized Yield2

|

ICE BofAML

|

30-Day Standardized

| ||||||||||||||||

| Class A |

-4.07 | % | 1.34 | % | 0.57 | % | 1.44 | % | ||||||||||||

| Class C |

-4.48 | 0.58 | 0.57 | 0.68 | ||||||||||||||||

| Institutional |

-3.91 | 1.72 | 0.57 | 1.83 | ||||||||||||||||

| Investor |

-3.95 | 1.64 | 0.57 | 1.75 | ||||||||||||||||

| Class R6 |

-4.02 | 1.74 | 0.57 | 1.84 | ||||||||||||||||

| Class R |

-4.31 | 1.14 | 0.57 | 1.24 | ||||||||||||||||

| Class P |

-4.02 | 1.74 | 0.57 | 1.84 | ||||||||||||||||

| 1 | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standardized Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

| 3 | The ICE BofAML Three-Month U.S. Treasury Bill Index, an unmanaged index, measures total return on cash, including price and interest income, based on short-term government Treasury Bills of about 90-day maturity, as reported by Bank of America Merrill Lynch, and does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. |

| The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the period shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

14

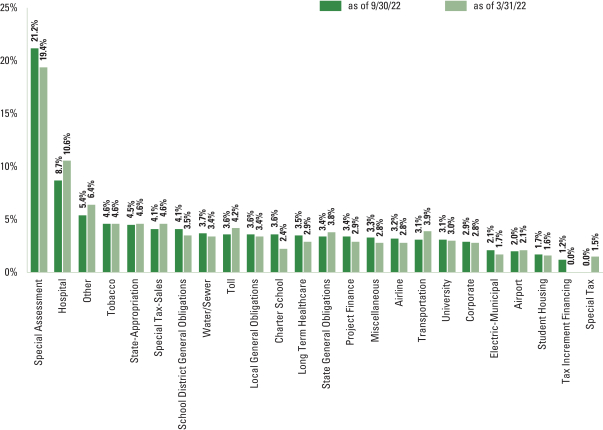

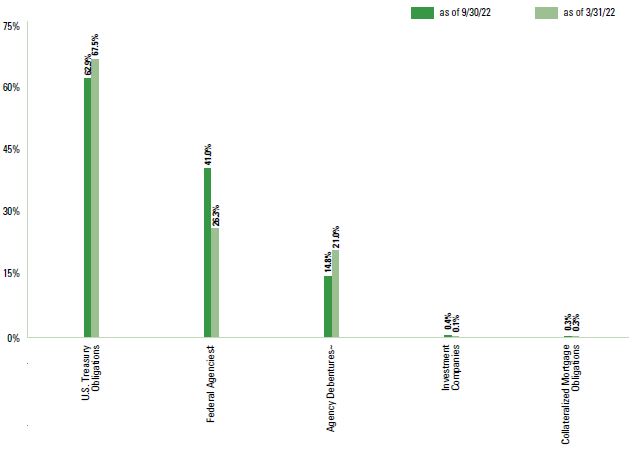

FUND BASICS

| FUND COMPOSITION * |

Percentage of Net Assets

| * | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Short-term investments represent certificates of deposit and commercial paper. Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| ‡ | “Federal Agencies” are mortgage-backed securities guaranteed by the Government National Mortgage Association (“GNMA”), Federal National Mortgage Association (“FNMA”) and Federal Home Loan Mortgage Corp. (“FHLMC”). GNMA instruments are backed by the full faith and credit of the U.S. Government. |

| For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance. |

15

| GOLDMAN SACHS BOND FUND |

September 30, 2022 (Unaudited)

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||||

| Mortgage-Backed Obligations – 52.6% |

| |||||||||||||||

| Collateralized Mortgage Obligations – 3.1% |

| |||||||||||||||

| Interest Only(a) – 0.7% |

| |||||||||||||||

| FHLMC REMIC Series 4314, Class SE (-1X 1M USD LIBOR + 6.050%) |

| |||||||||||||||

| $ | 295,588 | 3.232 | %(b) | 03/15/44 | $ | 29,389 | ||||||||||

| FHLMC REMIC Series 4583, Class ST (-1X 1M USD LIBOR + 6.000%) |

| |||||||||||||||

| 578,480 | 3.182 | (b) | 05/15/46 | 63,664 | ||||||||||||

| FHLMC REMIC Series 4989, Class EI |

| |||||||||||||||

| 290,055 | 4.000 | 07/25/50 | 56,175 | |||||||||||||

| FHLMC REMIC Series 4998, Class GI |

||||||||||||||||

| 1,387,156 | 4.000 | 08/25/50 | 267,983 | |||||||||||||

| FHLMC REMIC Series 5020, Class IH |

||||||||||||||||

| 922,674 | 3.000 | 08/25/50 | 145,991 | |||||||||||||

| FNMA REMIC Series 2011-124, Class SC (-1X 1M USD LIBOR + 6.550%) |

| |||||||||||||||

| 126,974 | 3.466 | (b) | 12/25/41 | 14,139 | ||||||||||||

| FNMA REMIC Series 2012-5, Class SA (-1X 1M USD LIBOR + 5.950%) |

| |||||||||||||||

| 185,274 | 2.866 | (b) | 02/25/42 | 18,679 | ||||||||||||

| FNMA REMIC Series 2012-88, Class SB (-1X 1M USD LIBOR + 6.670%) |

| |||||||||||||||

| 119,552 | 3.586 | (b) | 07/25/42 | 12,191 | ||||||||||||

| FNMA REMIC Series 2014-6, Class SA (-1X 1M USD LIBOR + 6.600%) |

| |||||||||||||||

| 164,525 | 3.516 | (b) | 02/25/44 | 18,989 | ||||||||||||

| FNMA REMIC Series 2017-31, Class SG (-1X 1M USD LIBOR + 6.100%) |

| |||||||||||||||

| 438,009 | 3.016 | (b) | 05/25/47 | 50,241 | ||||||||||||

| FNMA REMIC Series 2018-17, Class CS (-1X 1M USD LIBOR + 3.450%) |

| |||||||||||||||

| 551,076 | 0.366 | (b) | 03/25/48 | 9,227 | ||||||||||||

| FNMA REMIC Series 2020-49, Class KS (-1X 1M USD LIBOR + 6.100%) |

| |||||||||||||||

| 392,864 | 3.016 | (b) | 07/25/50 | 45,386 | ||||||||||||

| FNMA REMIC Series 2020-62, Class GI | ||||||||||||||||

| 605,535 | 4.000 | 06/25/48 | 117,486 | |||||||||||||

| GNMA REMIC Series 2020-61, Class SW (-1X 1M USD LIBOR + 6.050%) |

| |||||||||||||||

| 420,162 | 3.036 | (b) | 08/20/49 | 40,187 | ||||||||||||

| GNMA REMIC Series 2010-20, Class SE (-1X 1M USD LIBOR + 6.250%) |

| |||||||||||||||

| 436,176 | 3.236 | (b) | 02/20/40 | 46,407 | ||||||||||||

| GNMA REMIC Series 2013-181, Class SA (-1X 1M USD LIBOR + 6.100%) |

| |||||||||||||||

| 217,906 | 3.086 | (b) | 11/20/43 | 22,352 | ||||||||||||

| GNMA REMIC Series 2014-132, Class SL (-1X 1M USD LIBOR + 6.100%) |

| |||||||||||||||

| 169,332 | 3.086 | (b) | 10/20/43 | 9,627 | ||||||||||||

| GNMA REMIC Series 2014-133, Class BS (-1X 1M USD LIBOR + 5.600%) |

| |||||||||||||||

| 124,152 | 2.586 | (b) | 09/20/44 | 10,157 | ||||||||||||

| GNMA REMIC Series 2014-162, Class SA (-1X 1M USD LIBOR + 5.600%) |

| |||||||||||||||

| 102,343 | 2.586 | (b) | 11/20/44 | 8,943 | ||||||||||||

|

|

||||||||||||||||

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||||

| Mortgage-Backed Obligations – (continued) | ||||||||||||||||

| Interest Only(a) – (continued) |

| |||||||||||||||

| GNMA REMIC Series 2015-111, Class IM |

| |||||||||||||||

| $ | 275,346 | 4.000 | % | 08/20/45 | $ | 42,929 | ||||||||||

| GNMA REMIC Series 2015-119, Class SN (-1X 1M USD LIBOR + 6.250%) |

| |||||||||||||||

| 132,058 | 3.236 | (b) | 08/20/45 | 14,572 | ||||||||||||

| GNMA REMIC Series 2015-123, Class SP (-1X 1M USD LIBOR + 6.250%) |

| |||||||||||||||

| 167,230 | 3.236 | (b) | 09/20/45 | 19,066 | ||||||||||||

| GNMA REMIC Series 2015-167, Class AS (-1X 1M USD LIBOR + 6.250%) |

| |||||||||||||||

| 99,827 | 3.236 | (b) | 11/20/45 | 10,392 | ||||||||||||

| GNMA REMIC Series 2015-168, Class SD (-1X 1M USD LIBOR + 6.200%) |

| |||||||||||||||

| 80,260 | 3.186 | (b) | 11/20/45 | 8,876 | ||||||||||||

| GNMA REMIC Series 2016-109, Class IH |

| |||||||||||||||

| 393,251 | 4.000 | 10/20/45 | 59,927 | |||||||||||||

| GNMA REMIC Series 2016-27, Class IA |

| |||||||||||||||

| 152,130 | 4.000 | 06/20/45 | 19,444 | |||||||||||||

| GNMA REMIC Series 2018-122, Class HS (-1X 1M USD LIBOR + 6.200%) |

| |||||||||||||||

| 410,820 | 3.186 | (b) | 09/20/48 | 44,433 | ||||||||||||

| GNMA REMIC Series 2018-122, Class SE (-1X 1M USD LIBOR + 6.200%) |

| |||||||||||||||

| 270,311 | 3.186 | (b) | 09/20/48 | 27,895 | ||||||||||||

| GNMA REMIC Series 2018-124, Class SN (-1X 1M USD LIBOR + 6.200%) |

| |||||||||||||||

| 389,005 | 3.186 | (b) | 09/20/48 | 41,749 | ||||||||||||

| GNMA REMIC Series 2018-137, Class SN (-1X 1M USD LIBOR + 6.150%) |

| |||||||||||||||

| 297,270 | 3.136 | (b) | 10/20/48 | 30,106 | ||||||||||||

| GNMA REMIC Series 2018-139, Class SQ (-1X 1M USD LIBOR + 6.150%) |

| |||||||||||||||

| 202,426 | 3.136 | (b) | 10/20/48 | 20,146 | ||||||||||||

| GNMA REMIC Series 2019-1, Class SN (-1X 1M USD LIBOR + 6.050%) |

| |||||||||||||||

| 83,287 | 3.036 | (b) | 01/20/49 | 8,095 | ||||||||||||

| GNMA REMIC Series 2019-110, Class PS (-1X 1M USD LIBOR + 6.050%) |

| |||||||||||||||

| 195,846 | 3.036 | (b) | 09/20/49 | 21,599 | ||||||||||||

| GNMA REMIC Series 2019-151, Class IA |

| |||||||||||||||

| 950,345 | 3.500 | 12/20/49 | 161,366 | |||||||||||||

| GNMA REMIC Series 2019-151, Class NI |

| |||||||||||||||

| 563,739 | 3.500 | 10/20/49 | 87,895 | |||||||||||||

| GNMA REMIC Series 2019-153, Class EI |

| |||||||||||||||

| 1,221,545 | 4.000 | 12/20/49 | 221,149 | |||||||||||||

| GNMA REMIC Series 2019-20, Class SF (-1X 1M USD LIBOR + 3.790%) |

| |||||||||||||||

| 159,974 | 0.776 | (b) | 02/20/49 | 4,104 | ||||||||||||

| GNMA REMIC Series 2019-6, Class SA (-1X 1M USD LIBOR + 6.050%) |

| |||||||||||||||

| 90,702 | 3.036 | (b) | 01/20/49 | 9,106 | ||||||||||||

| GNMA REMIC Series 2020-146, Class KI |

| |||||||||||||||

| 1,462,167 | 2.500 | 10/20/50 | 193,145 | |||||||||||||

| GNMA REMIC Series 2020-151, Class MI |

||||||||||||||||

| 786,200 | 2.500 | 10/20/50 | 102,712 | |||||||||||||

|

|

||||||||||||||||

16 The accompanying notes are an integral part of these financial statements.

GOLDMAN SACHS BOND FUND

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||||

| Mortgage-Backed Obligations – (continued) | ||||||||||||||||

| Interest Only(a) – (continued) |

| |||||||||||||||

| GNMA REMIC Series 2020-21, Class SA (-1X 1M USD LIBOR + 6.050%) |

| |||||||||||||||

| $ | 636,127 | 3.036 | %(b) | 02/20/50 | $ | 70,449 | ||||||||||

| GNMA REMIC Series 2020-55, Class AS (-1X 1M USD LIBOR + 6.050%) |

| |||||||||||||||

| 572,671 | 3.036 | (b) | 04/20/50 | 63,744 | ||||||||||||

| GNMA REMIC Series 2020-61, Class GI |

| |||||||||||||||

| 498,433 | 5.000 | 05/20/50 | 91,478 | |||||||||||||

| GNMA REMIC Series 2020-61, Class SF (-1X 1M USD LIBOR + 6.440%) |

| |||||||||||||||

| 233,584 | 3.426 | (b) | 07/20/43 | 25,815 | ||||||||||||

| GNMA REMIC Series 2020-78, Class DI |

| |||||||||||||||

| 736,503 | 4.000 | 06/20/50 | 132,203 | |||||||||||||

|

|

|

|||||||||||||||

| 2,519,608 | ||||||||||||||||

|

|

||||||||||||||||

| Sequential Fixed Rate – 0.1% |

| |||||||||||||||

| FNMA REMIC Series 2005-70, Class PA |

| |||||||||||||||

| 25,560 | 5.500 | 08/25/35 | 25,940 | |||||||||||||

| FNMA REMIC Series 2011-52, Class GB |

| |||||||||||||||

| 189,267 | 5.000 | 06/25/41 | 188,956 | |||||||||||||

| FNMA REMIC Series 2012-111, Class B |

| |||||||||||||||

| 16,893 | 7.000 | 10/25/42 | 17,787 | |||||||||||||

| FNMA REMIC Series 2012-153, Class B |

| |||||||||||||||

| 46,043 | 7.000 | 07/25/42 | 48,401 | |||||||||||||

|

|

|

|||||||||||||||

| 281,084 | ||||||||||||||||

|

|

||||||||||||||||

| Sequential Floating Rate(b) – 2.3% |

| |||||||||||||||

| Bellemeade Re Ltd. Series 2021-2A, Class M1B (1M SOFR + 1.500%) |

| |||||||||||||||

| 275,000 | 3.781 | (c) | 06/25/31 | 262,875 | ||||||||||||

| CIM Trust Series 2019-INV3, Class A15 |

| |||||||||||||||

| 63,717 | 3.500 | (c) | 08/25/49 | 56,856 | ||||||||||||

| Connecticut Avenue Securities Trust Series 2018-R07, Class 1M2 (1M USD LIBOR + 2.400%) |

| |||||||||||||||

| 51,134 | 5.484 | (c) | 04/25/31 | 51,165 | ||||||||||||

| Connecticut Avenue Securities Trust Series 2019-R02, Class 1M2 (1M USD LIBOR + 2.300%) |

| |||||||||||||||

| 61,057 | 5.384 | (c) | 08/25/31 | 60,906 | ||||||||||||

| Connecticut Avenue Securities Trust Series 2019-R03, Class 1M2 (1M USD LIBOR + 2.150%) |

| |||||||||||||||

| 28,323 | 5.234 | (c) | 09/25/31 | 28,159 | ||||||||||||

| Connecticut Avenue Securities Trust Series 2019-R06, Class 1M2 (1M USD LIBOR + 2.100%) |

| |||||||||||||||

| 39,841 | 5.184 | (c) | 09/25/39 | 39,783 | ||||||||||||

| Connecticut Avenue Securities Trust Series 2019-R07, Class 1M2 (1M USD LIBOR + 2.100%) |

| |||||||||||||||

| 36,811 | 5.184 | (c) | 10/25/39 | 36,541 | ||||||||||||

| Connecticut Avenue Securities Trust Series 2020-R01, Class 1M2 (1M USD LIBOR + 2.050%) |

| |||||||||||||||

| 15,744 | 5.134 | (c) | 01/25/40 | 15,519 | ||||||||||||

| Countrywide Alternative Loan Trust Series 2006-OC8, Class 2A3 (1M USD LIBOR + 0.500%) |

| |||||||||||||||

| 1,329,777 | 3.584 | 11/25/36 | 1,128,080 | |||||||||||||

|

|

||||||||||||||||

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||||

| Mortgage-Backed Obligations – (continued) |

| |||||||||||||||

| Sequential Floating Rate(b) – (continued) |

| |||||||||||||||

| Countrywide Alternative Loan Trust Series 2007-OA6, Class A1A (1M USD LIBOR + 0.280%) |

| |||||||||||||||

| $ | 255,513 | 3.364 | % | 06/25/37 | $ | 223,450 | ||||||||||

| Deutsche Alt-A Securities Mortgage Loan Trust Series 2007-OA5, Class A1A (1M USD LIBOR + 0.200%) |

| |||||||||||||||

| 505,872 | 3.284 | 08/25/47 | 442,142 | |||||||||||||

| FHLMC STACR Debt Notes Series 2020-HQA5, Class M2 (1M SOFR + 2.600%) |

| |||||||||||||||

| 140,448 | 4.881 | (c) | 11/25/50 | 141,221 | ||||||||||||

| FHLMC STACR REMIC Trust Series 2020-DNA2, Class M2 (1M USD LIBOR + 1.850%) |

| |||||||||||||||

| 57,496 | 4.934 | (c) | 02/25/50 | 56,621 | ||||||||||||

| FHLMC STACR REMIC Trust Series 2020-DNA4, Class B1 (1M USD LIBOR + 6.000%) |

| |||||||||||||||

| 740,000 | 9.084 | (c) | 08/25/50 | 767,995 | ||||||||||||

| FHLMC STACR REMIC Trust Series 2020-DNA4, Class M2 (1M USD LIBOR + 3.750%) |

| |||||||||||||||

| 3,774 | 6.834 | (c) | 08/25/50 | 3,776 | ||||||||||||

| FHLMC STACR REMIC Trust Series 2020-DNA5, Class B1 (1M SOFR + 4.800%) |

| |||||||||||||||

| 754,000 | 7.081 | (c) | 10/25/50 | 748,568 | ||||||||||||

| FHLMC STACR REMIC Trust Series 2020-HQA3, Class B1 (1M USD LIBOR + 5.750%) |

| |||||||||||||||

| 725,000 | 8.834 | (c) | 07/25/50 | 733,273 | ||||||||||||

| FHLMC STACR REMIC Trust Series 2020-HQA4, Class B1 (1M USD LIBOR + 5.250%) |

| |||||||||||||||

| 485,000 | 8.334 | (c) | 09/25/50 | 483,094 | ||||||||||||

| FHLMC STACR REMIC Trust Series 2020-HQA4, Class M2 (1M USD LIBOR + 3.150%) |

| |||||||||||||||

| 28,899 | 6.234 | (c) | 09/25/50 | 28,932 | ||||||||||||

| FHLMC STACR REMIC Trust Series 2021-HQA1, Class B1 (1M SOFR + 3.000%) |

| |||||||||||||||

| 291,000 | 5.281 | (c) | 08/25/33 | 226,482 | ||||||||||||

| JPMorgan Alternative Loan Trust Series 2006-A7, Class 1A1 (1M USD LIBOR + 0.320%) |

| |||||||||||||||

| 138,587 | 3.404 | 12/25/36 | 122,894 | |||||||||||||

| JPMorgan Mortgage Trust Series 2021-LTV2, Class A1 |

| |||||||||||||||

| 896,906 | 2.520 | (c) | 05/25/52 | 748,712 | ||||||||||||

| Mill City Mortgage Loan Trust Series 2017-2, Class A3 |

| |||||||||||||||

| 150,175 | 3.107 | (c) | 07/25/59 | 144,533 | ||||||||||||

| Mill City Mortgage Loan Trust Series 2019-GS2, Class M1 |

| |||||||||||||||

| 720,000 | 3.000 | (c) | 08/25/59 | 641,900 | ||||||||||||

| Mill City Mortgage Loan Trust Series 2021-NMR1, Class M2 |

| |||||||||||||||

| 760,000 | 2.500 | (c) | 11/25/60 | 627,936 | ||||||||||||

| Towd Point Mortgage Trust Series 2017-3, Class B2 |

| |||||||||||||||

| 100,000 | 3.828 | (c) | 07/25/57 | 86,662 | ||||||||||||

| Verus Securitization Trust Series 2022-INV1, Class A1 |

| |||||||||||||||

| 98,675 | 5.041 | (c)(d) | 08/25/67 | 96,112 | ||||||||||||

| Wells Fargo Mortgage Backed Securities Trust Series 2019-3, Class A1 |

| |||||||||||||||

| 30,367 | 3.500 | (c) | 07/25/49 | 28,633 | ||||||||||||

|

|

|

|||||||||||||||

| 8,032,820 | ||||||||||||||||

|

|

||||||||||||||||

| TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS | 10,833,512 | |||||||||||||||

|

|

||||||||||||||||

The accompanying notes are an integral part of these financial statements. 17

| GOLDMAN SACHS BOND FUND |

Schedule of Investments (continued)

September 30, 2022 (Unaudited)

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||||

| Mortgage-Backed Obligations – (continued) |

| |||||||||||||||

| Commercial Mortgage-Backed Securities – 1.4% |

| |||||||||||||||

| Sequential Fixed Rate – 0.8% |

| |||||||||||||||

| Banc of America Commercial Mortgage Trust Series 2016-UBS10, Class D |

| |||||||||||||||

|

|

$ | 500,000 | 3.000 | %(c) | 07/15/49 | $ | 398,074 | |||||||||

| COMM Mortgage Trust Series 2017-COR2, Class D |

| |||||||||||||||

| 350,000 | 3.000 | (c) | 09/10/50 | 259,935 | ||||||||||||

| DOLP Trust Series 2021-NYC, Class A |

| |||||||||||||||

| 1,100,000 | 2.956 | (c) | 05/10/41 | 877,538 | ||||||||||||

| Wells Fargo Commercial Mortgage Trust Series 2017-RC1, Class D |

| |||||||||||||||

| 150,000 | 3.250 | (c) | 01/15/60 | 114,128 | ||||||||||||

| Wells Fargo Commercial Mortgage Trust Series 2022-C62, Class A4 |

| |||||||||||||||

| 800,000 | 4.000 | (b) | 04/15/55 | 718,583 | ||||||||||||

| Wells Fargo Commercial Mortgage Trust Series 2022-C62, Class D |

| |||||||||||||||

| 550,000 | 2.500 | (c) | 04/15/55 | 341,908 | ||||||||||||

|

|

|

|||||||||||||||

| 2,710,166 | ||||||||||||||||

|

|

||||||||||||||||

| Sequential Floating Rate(b)(c) – 0.6% |

| |||||||||||||||

| BX Trust Series 2021-ARIA, Class F (1M USD LIBOR + 2.594%) |

| |||||||||||||||

| 1,450,000 | 5.412 | 10/15/36 | 1,309,898 | |||||||||||||

| BX Trust Series 2022-PSB, Class A (1M TSFR LIBOR + 2.451%) |

| |||||||||||||||

| 650,000 | 5.296 | 08/15/39 | 649,588 | |||||||||||||

|

|

|

|||||||||||||||

| 1,959,486 | ||||||||||||||||

|

|

||||||||||||||||

| TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES | $ | 4,669,652 | ||||||||||||||

|

|

||||||||||||||||

| Federal Agencies – 48.1% |

||||||||||||||||

| Adjustable Rate FHLMC(b) – 0.0% |

||||||||||||||||

| (12M USD LIBOR + 1.761%) |

||||||||||||||||

| $ | 21,052 | 2.677 | % | 09/01/35 | $ | 21,434 | ||||||||||

|

|

||||||||||||||||

| FHLMC – 0.6% |

||||||||||||||||

| 53,753 | 6.000 | 08/01/27 | 54,694 | |||||||||||||

| 6,855 | 5.000 | 08/01/33 | 6,873 | |||||||||||||

| 1,116 | 5.000 | 09/01/33 | 1,119 | |||||||||||||

| 1,672 | 5.000 | 10/01/33 | 1,676 | |||||||||||||

| 1,649 | 5.000 | 11/01/34 | 1,654 | |||||||||||||

| 64,477 | 5.000 | 12/01/34 | 64,642 | |||||||||||||

| 2,292 | 5.000 | 07/01/35 | 2,298 | |||||||||||||

| 115 | 5.000 | 11/01/35 | 115 | |||||||||||||

| 25,239 | 5.000 | 03/01/39 | 25,396 | |||||||||||||

| 2,381 | 5.000 | 05/01/39 | 2,396 | |||||||||||||

| 5,268 | 5.000 | 04/01/40 | 5,303 | |||||||||||||

| 1,338 | 5.000 | 08/01/40 | 1,346 | |||||||||||||

| 17,254 | 4.000 | 02/01/41 | 16,449 | |||||||||||||

| 716 | 5.000 | 04/01/41 | 720 | |||||||||||||

| 1,366 | 5.000 | 06/01/41 | 1,375 | |||||||||||||

| 400,891 | 4.000 | 03/01/48 | 378,060 | |||||||||||||

| 409,437 | 4.000 | 04/01/48 | 386,004 | |||||||||||||

| 1,161,260 | 4.500 | 08/01/48 | 1,127,498 | |||||||||||||

|

|

|

|||||||||||||||

| 2,077,618 | ||||||||||||||||

|

|

||||||||||||||||

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||||

| Mortgage-Backed Obligations – (continued) |

| |||||||||||||||

| GNMA – 20.6% |

| |||||||||||||||

| $ | 15,507 | 5.500 | % | 11/15/32 | $ | 15,902 | ||||||||||

|

|

10,236 | 5.500 | 01/15/33 | 10,516 | ||||||||||||

| 17,893 | 5.500 | 02/15/33 | 18,466 | |||||||||||||

| 20,461 | 5.500 | 03/15/33 | 21,072 | |||||||||||||

| 25,986 | 5.500 | 07/15/33 | 26,648 | |||||||||||||

| 8,220 | 5.500 | 08/15/33 | 8,439 | |||||||||||||

| 4,287 | 5.500 | 09/15/33 | 4,396 | |||||||||||||

| 9,863 | 5.500 | 04/15/34 | 10,121 | |||||||||||||

| 7,031 | 5.500 | 05/15/34 | 7,196 | |||||||||||||

| 92,340 | 5.500 | 09/15/34 | 95,748 | |||||||||||||

| 105,938 | 5.500 | 12/15/34 | 109,981 | |||||||||||||

| 73,204 | 5.500 | 01/15/35 | 76,063 | |||||||||||||

| 183 | 5.500 | 05/15/36 | 187 | |||||||||||||

| 2,962 | 4.000 | 02/20/41 | 2,853 | |||||||||||||

| 4,695 | 4.000 | 11/20/41 | 4,520 | |||||||||||||

| 779 | 4.000 | 01/20/42 | 750 | |||||||||||||

| 2,491 | 4.000 | 04/20/42 | 2,398 | |||||||||||||

| 1,549 | 4.000 | 10/20/42 | 1,491 | |||||||||||||

| 400,464 | 4.000 | 08/20/43 | 380,325 | |||||||||||||

| 2,232 | 4.000 | 03/20/44 | 2,119 | |||||||||||||

| 2,751 | 4.000 | 05/20/44 | 2,611 | |||||||||||||

| 191,071 | 4.000 | 11/20/44 | 181,223 | |||||||||||||

| 45,662 | 4.000 | 12/20/44 | 43,308 | |||||||||||||

| 12,540 | 4.000 | 05/20/45 | 11,894 | |||||||||||||

| 45,383 | 4.000 | 07/20/45 | 43,015 | |||||||||||||

| 246,230 | 4.000 | 01/20/46 | 233,231 | |||||||||||||

| 972,918 | 3.000 | 11/20/46 | 873,832 | |||||||||||||

| 1,367,107 | 3.500 | 04/20/47 | 1,257,342 | |||||||||||||

| 1,278,278 | 3.500 | 12/20/47 | 1,175,645 | |||||||||||||

| 813,599 | 4.500 | 05/20/48 | 788,354 | |||||||||||||

| 1,219,816 | 4.500 | 08/20/48 | 1,181,205 | |||||||||||||

| 144,250 | 5.000 | 08/20/48 | 143,361 | |||||||||||||

| 858,161 | 4.500 | 09/20/48 | 830,998 | |||||||||||||

| 1,018,535 | 5.000 | 10/20/48 | 1,012,099 | |||||||||||||

| 585,540 | 5.000 | 11/20/48 | 581,840 | |||||||||||||

| 584,703 | 5.000 | 12/20/48 | 580,825 | |||||||||||||

| 1,306,344 | 4.500 | 01/20/49 | 1,264,280 | |||||||||||||

| 1,080,920 | 5.000 | 01/20/49 | 1,073,752 | |||||||||||||

| 529,016 | 4.000 | 02/20/49 | 496,709 | |||||||||||||

| 1,085,805 | 4.500 | 02/20/49 | 1,050,503 | |||||||||||||

| 28,131 | 4.500 | 03/20/49 | 27,208 | |||||||||||||

| 338,241 | 4.000 | 03/20/49 | 317,479 | |||||||||||||

| 94,013 | 5.000 | 03/20/49 | 93,360 | |||||||||||||

| 582,483 | 4.000 | 04/20/49 | 546,546 | |||||||||||||

| 738,584 | 3.000 | 08/20/49 | 661,275 | |||||||||||||

| 334,619 | 4.500 | 10/20/49 | 322,484 | |||||||||||||

| 340,208 | 4.500 | 12/20/49 | 327,552 | |||||||||||||

| 305,022 | 4.000 | 01/20/51 | 285,536 | |||||||||||||

| 1,478,400 | 3.500 | 02/20/51 | 1,359,289 | |||||||||||||

| 81,177 | 3.500 | 03/20/51 | 74,648 | |||||||||||||

| 1,842,674 | 3.000 | 11/20/51 | 1,635,588 | |||||||||||||

| 1,869,510 | 3.000 | 12/20/51 | 1,657,655 | |||||||||||||

| 4,000,000 | 2.500 | TBA-30yr(e) | 3,434,888 | |||||||||||||

| 1,000,000 | 2.000 | TBA-30yr(e) | 832,470 | |||||||||||||

| 1,000,000 | 3.000 | TBA-30yr(e) | 882,725 | |||||||||||||

|

|

||||||||||||||||

18 The accompanying notes are an integral part of these financial statements.

GOLDMAN SACHS BOND FUND

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||||

| Mortgage-Backed Obligations – (continued) |

| |||||||||||||||

| GNMA – (continued) |

| |||||||||||||||

| $ | 4,000,000 | 4.000 | % | TBA-30yr(e) | $ | 3,731,530 | ||||||||||

| 27,000,000 | 4.500 | TBA-30yr(e) | 25,810,475 | |||||||||||||

| 16,000,000 | 5.000 | TBA-30yr(e) | 15,634,144 | |||||||||||||

|

|

|

|||||||||||||||

| 71,260,070 | ||||||||||||||||

|

|

||||||||||||||||

| UMBS – 13.0% |

| |||||||||||||||

| 124 | 5.500 | 09/01/23 | 124 | |||||||||||||

| 99 | 5.500 | 10/01/23 | 99 | |||||||||||||

| 5,457 | 4.500 | 02/01/39 | 5,351 | |||||||||||||

| 2,551 | 4.500 | 04/01/39 | 2,514 | |||||||||||||

| 4,394 | 4.500 | 08/01/39 | 4,328 | |||||||||||||

| 60,449 | 4.500 | 12/01/39 | 59,544 | |||||||||||||

| 47,147 | 4.500 | 06/01/40 | 46,170 | |||||||||||||

| 21,068 | 4.500 | 08/01/41 | 20,640 | |||||||||||||

| 40,524 | 3.000 | 12/01/42 | 36,267 | |||||||||||||

| 94,129 | 3.000 | 01/01/43 | 84,240 | |||||||||||||

| 24,672 | 3.000 | 02/01/43 | 22,080 | |||||||||||||

| 9,374 | 3.000 | 03/01/43 | 8,389 | |||||||||||||

| 149,288 | 3.000 | 04/01/43 | 133,606 | |||||||||||||

| 24,365 | 3.000 | 05/01/43 | 21,805 | |||||||||||||

| 32,407 | 3.000 | 06/01/43 | 29,003 | |||||||||||||

| 10,478 | 3.000 | 07/01/43 | 9,377 | |||||||||||||

| 21,028 | 5.000 | 06/01/44 | 20,710 | |||||||||||||

| 308,034 | 4.000 | 12/01/44 | 291,839 | |||||||||||||

| 12,662 | 3.500 | 03/01/45 | 11,588 | |||||||||||||

| 1,060,555 | 4.500 | 04/01/45 | 1,035,701 | |||||||||||||

| 330,685 | 3.000 | 04/01/45 | 294,087 | |||||||||||||

| 130,028 | 4.500 | 05/01/45 | 126,981 | |||||||||||||

| 460,872 | 4.500 | 06/01/45 | 449,982 | |||||||||||||

| 3,766,628 | 3.500 | 07/01/45 | 3,447,048 | |||||||||||||

| 616,836 | 4.000 | 08/01/45 | 584,984 | |||||||||||||

| 212,217 | 4.000 | 11/01/45 | 201,292 | |||||||||||||

| 2,327,843 | 4.000 | 01/01/46 | 2,208,000 | |||||||||||||

| 63,296 | 4.000 | 03/01/46 | 59,838 | |||||||||||||

| 37,859 | 4.000 | 06/01/46 | 35,682 | |||||||||||||

| 10,510 | 4.000 | 08/01/46 | 9,906 | |||||||||||||

| 94,822 | 4.000 | 10/01/46 | 89,370 | |||||||||||||

| 68,470 | 4.000 | 06/01/47 | 64,720 | |||||||||||||

| 358,355 | 4.500 | 07/01/47 | 347,493 | |||||||||||||

| 172,330 | 4.500 | 11/01/47 | 167,322 | |||||||||||||

| 220,821 | 4.000 | 12/01/47 | 208,729 | |||||||||||||

| 618,117 | 4.000 | 01/01/48 | 583,881 | |||||||||||||

| 1,301,561 | 4.000 | 02/01/48 | 1,228,898 | |||||||||||||

| 956,017 | 4.000 | 03/01/48 | 902,435 | |||||||||||||

| 563,814 | 4.500 | 05/01/48 | 545,668 | |||||||||||||

| 637,320 | 4.000 | 06/01/48 | 601,622 | |||||||||||||

| 384,324 | 4.000 | 08/01/48 | 362,557 | |||||||||||||

| 311,099 | 4.500 | 09/01/48 | 301,767 | |||||||||||||

| 1,363,419 | 5.000 | 11/01/48 | 1,355,253 | |||||||||||||

| 204,326 | 4.500 | 06/01/49 | 197,231 | |||||||||||||

| 572,402 | 3.500 | 07/01/49 | 522,813 | |||||||||||||

| 372,576 | 3.500 | 08/01/49 | 340,299 | |||||||||||||

| 1,917,092 | 3.000 | 09/01/49 | 1,692,490 | |||||||||||||

| 40,876 | 4.500 | 10/01/49 | 39,280 | |||||||||||||

| 854,719 | 4.500 | 01/01/50 | 825,055 | |||||||||||||

|

|

||||||||||||||||

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||||

| Mortgage-Backed Obligations – (continued) |

| |||||||||||||||

| UMBS – (continued) |

| |||||||||||||||

| $ | 2,340,687 | 4.000 | % | 03/01/50 | $ | 2,196,413 | ||||||||||

| 5,732,614 | 4.500 | 03/01/50 | 5,540,203 | |||||||||||||

| 979,721 | 2.500 | 09/01/50 | 832,720 | |||||||||||||

| 2,757,733 | 3.000 | 12/01/50 | 2,430,334 | |||||||||||||

| 4,892,522 | 2.500 | 05/01/51 | 4,133,825 | |||||||||||||

| 6,419,907 | 2.500 | 09/01/51 | 5,424,905 | |||||||||||||

| 43,522 | 5.000 | 05/01/52 | 42,867 | |||||||||||||

| 1,427,071 | 5.000 | 06/01/52 | 1,406,569 | |||||||||||||

| 3,443,065 | 5.000 | 07/01/52 | 3,389,400 | |||||||||||||

| 30,791 | 5.000 | 08/01/52 | 30,293 | |||||||||||||

|

|

|

|||||||||||||||

| 45,065,587 | ||||||||||||||||

|

|

||||||||||||||||

| UMBS, 30 Year, Single Family(e) – 13.9% |

| |||||||||||||||

| 1,000,000 | 4.500 | TBA-30yr | 951,406 | |||||||||||||

| 4,000,000 | 3.000 | TBA-30yr | 3,477,500 | |||||||||||||

| 26,000,000 | 2.500 | TBA-30yr | 21,817,656 | |||||||||||||

| 27,000,000 | 2.000 | TBA-30yr | 21,847,220 | |||||||||||||

|

|

|

|||||||||||||||

| 48,093,782 | ||||||||||||||||

|

|

||||||||||||||||

| TOTAL FEDERAL AGENCIES |

$ | 166,518,491 | ||||||||||||||

|

|

||||||||||||||||

| TOTAL MORTGAGE-BACKED OBLIGATIONS (Cost $192,895,147) |

$ | 182,021,655 | ||||||||||||||

|

|

||||||||||||||||

|

|

||||||||||||||||

| Corporate Obligations – 36.1% |

| |||||||||||||||

| Advertising(c)(f) – 0.1% |

| |||||||||||||||

| Outfront Media Capital LLC/Outfront Media Capital Corp. |

| |||||||||||||||

| $ | 460,000 | 4.625 | % | 03/15/30 | $ | 358,818 | ||||||||||

|

|

||||||||||||||||

| Aerospace & Defense(f) – 0.5% |

| |||||||||||||||

| General Dynamics Corp. |

| |||||||||||||||

| 60,000 | 3.750 | 05/15/28 | 56,377 | |||||||||||||

| Northrop Grumman Corp. |

| |||||||||||||||

| 750,000 | 2.930 | 01/15/25 | 716,100 | |||||||||||||

| 25,000 | 4.030 | 10/15/47 | 19,836 | |||||||||||||

| Raytheon Technologies Corp. |

| |||||||||||||||

| 100,000 | 4.050 | 05/04/47 | 79,802 | |||||||||||||

| The Boeing Co. |

| |||||||||||||||

| 65,000 | 2.196 | 02/04/26 | 57,705 | |||||||||||||

| 105,000 | 3.250 | 02/01/35 | 74,208 | |||||||||||||

| 15,000 | 3.375 | 06/15/46 | 9,063 | |||||||||||||

| 25,000 | 3.850 | 11/01/48 | 16,183 | |||||||||||||

| TransDigm, Inc. |

| |||||||||||||||

| 166,000 | 6.250 | (c) | 03/15/26 | 160,992 | ||||||||||||

| 575,000 | 6.375 | 06/15/26 | 543,507 | |||||||||||||

|

|

|

|||||||||||||||

| 1,733,773 | ||||||||||||||||

|

|

||||||||||||||||

| Agriculture – 0.3% |

| |||||||||||||||

| Altria Group, Inc. |

| |||||||||||||||

| 55,000 | 4.250 | 08/09/42 | 37,597 | |||||||||||||

| BAT Capital Corp.(f) |

| |||||||||||||||

| 60,000 | 3.557 | 08/15/27 | 52,685 | |||||||||||||

| 25,000 | 4.758 | 09/06/49 | 17,148 | |||||||||||||

|

|

||||||||||||||||

The accompanying notes are an integral part of these financial statements. 19

| GOLDMAN SACHS BOND FUND |

Schedule of Investments (continued)

September 30, 2022 (Unaudited)

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||||

| Corporate Obligations – (continued) |

| |||||||||||||||

| Agriculture – (continued) |

||||||||||||||||

| Cargill, Inc.(c)(f) |

||||||||||||||||

| $ | 70,000 | 2.125 | % | 04/23/30 | $ | 56,724 | ||||||||||

| 10,000 | 2.125 | 11/10/31 | 7,790 | |||||||||||||

| Philip Morris International, Inc. |

| |||||||||||||||

| 30,000 | 3.375 | (f) | 08/15/29 | 25,649 | ||||||||||||

| Reynolds American, Inc. |

| |||||||||||||||

| 700,000 | 4.850 | 09/15/23 | 697,522 | |||||||||||||

|

|

|

|||||||||||||||

| 895,115 | ||||||||||||||||

|

|

||||||||||||||||

| Apparel(f) – 0.0% |

| |||||||||||||||

| NIKE, Inc. |

| |||||||||||||||

| 60,000 | 2.850 | 03/27/30 | 52,216 | |||||||||||||

|

|

||||||||||||||||

| Automotive – 0.5% |

| |||||||||||||||

| American Honda Finance Corp. |

| |||||||||||||||

| 70,000 | 2.250 | 01/12/29 | 58,843 | |||||||||||||

| BMW US Capital LLC |

| |||||||||||||||

| 30,000 | 3.625 | (c)(f) | 04/18/29 | 27,197 | ||||||||||||

| BorgWarner, Inc. |

| |||||||||||||||

| 60,000 | 5.000 | (c) | 10/01/25 | 58,851 | ||||||||||||

| Cummins, Inc. |

| |||||||||||||||

| 45,000 | 2.600 | (f) | 09/01/50 | 28,069 | ||||||||||||

| General Motors Co. |

| |||||||||||||||

| 425,000 | 5.400 | 10/02/23 | 424,970 | |||||||||||||

| 225,000 | 4.000 | 04/01/25 | 216,727 | |||||||||||||

| 36,000 | 5.950 | (f) | 04/01/49 | 30,047 | ||||||||||||

| General Motors Financial Co., Inc.(f) |

| |||||||||||||||

| 300,000 | 4.300 | 07/13/25 | 286,860 | |||||||||||||

| 125,000 | 5.650 | 01/17/29 | 118,313 | |||||||||||||

| 500,000 | 2.350 | 01/08/31 | 363,705 | |||||||||||||

| Hyundai Capital America |

| |||||||||||||||

| 70,000 | 2.750 | 09/27/26 | 61,667 | |||||||||||||

| Lear Corp. |

| |||||||||||||||

| 30,000 | 5.250 | (f) | 05/15/49 | 23,708 | ||||||||||||

| Nissan Motor Acceptance Co. LLC(c)(f) |

| |||||||||||||||

| 35,000 | 2.000 | 03/09/26 | 29,623 | |||||||||||||

| 45,000 | 1.850 | 09/16/26 | 36,547 | |||||||||||||

| Toyota Motor Credit Corp. |

| |||||||||||||||

| 25,000 | 3.050 | 03/22/27 | 23,034 | |||||||||||||

| 60,000 | 4.450 | 06/29/29 | 57,883 | |||||||||||||

|

|

|

|||||||||||||||

| 1,846,044 | ||||||||||||||||

|

|

||||||||||||||||

| Banks – 10.0% |

| |||||||||||||||

| ABN AMRO Bank NV (-1X 5 year EUR Swap + 4.674%) |

| |||||||||||||||

| EUR | 400,000 | 4.375 | (b)(f) | 12/31/99 | 333,217 | |||||||||||

| Banco do Brasil SA (10 year CMT + 4.398%) |

| |||||||||||||||

| $ | 200,000 | 6.250 | (b)(f) | 10/29/49 | 171,125 | |||||||||||

| Banco Mercantil del Norte SA (5 year CMT + 4.643%) |

| |||||||||||||||

| 260,000 | 5.875 | (b)(c)(f) | 12/31/99 | 211,624 | ||||||||||||

| Banco Santander SA |

| |||||||||||||||

| 800,000 | 2.746 | 05/28/25 | 731,640 | |||||||||||||

| 600,000 | 4.250 | 04/11/27 | 552,882 | |||||||||||||

| 200,000 | 2.749 | 12/03/30 | 141,860 | |||||||||||||

| Bank of America Corp. |

| |||||||||||||||

| 425,000 | 4.200 | 08/26/24 | 418,332 | |||||||||||||

|

|

||||||||||||||||

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||||

| Corporate Obligations – (continued) |

| |||||||||||||||

| Banks – (continued) |

| |||||||||||||||

|

|

$ | 50,000 | 3.248 | %(f) | 10/21/27 | $ | 44,859 | |||||||||

| 925,000 | 4.183 | (f) | 11/25/27 | 857,059 | ||||||||||||

| 100,000 | 6.110 | 01/29/37 | 96,716 | |||||||||||||

| (3M USD LIBOR + 0.990%) |

| |||||||||||||||

| 75,000 | 2.496 | (b)(f) | 02/13/31 | 59,204 | ||||||||||||

| (3M USD LIBOR + 1.190%) |

| |||||||||||||||

| 525,000 | 2.884 | (b)(f) | 10/22/30 | 430,925 | ||||||||||||

| (3M USD LIBOR + 1.310%) |

| |||||||||||||||

| 750,000 | 4.271 | (b)(f) | 07/23/29 | 684,232 | ||||||||||||

| (3M USD LIBOR + 1.575%) |

| |||||||||||||||

| 590,000 | 3.824 | (b)(f) | 01/20/28 | 543,372 | ||||||||||||

| (5 year CMT + 1.200%) |

| |||||||||||||||

| 475,000 | 2.482 | (b)(f) | 09/21/36 | 343,663 | ||||||||||||

| (SOFR + 1.330%) |

| |||||||||||||||

| 325,000 | 2.972 | (b)(f) | 02/04/33 | 254,605 | ||||||||||||

| (SOFR + 1.530%) |

| |||||||||||||||

| 600,000 | 1.898 | (b)(f) | 07/23/31 | 446,940 | ||||||||||||

| (SOFR + 1.830%) |

| |||||||||||||||

| 275,000 | 4.571 | (b)(f) | 04/27/33 | 246,780 | ||||||||||||

| (SOFR + 1.880%) |

| |||||||||||||||

| 90,000 | 2.831 | (b)(f) | 10/24/51 | 53,379 | ||||||||||||

| Barclays PLC (SOFR + 2.714%) |

| |||||||||||||||

| 825,000 | 2.852 | (b)(f) | 05/07/26 | 749,603 | ||||||||||||

| BNP Paribas SA(c) |

| |||||||||||||||

| 550,000 | 3.375 | 01/09/25 | 522,665 | |||||||||||||

| (5 year USD Swap + 4.149%) |

| |||||||||||||||

| 200,000 | 6.625 | (b)(f) | 12/31/99 | 184,600 | ||||||||||||

| (SOFR + 1.004%) |

| |||||||||||||||

| 725,000 | 1.323 | (b)(f) | 01/13/27 | 615,735 | ||||||||||||

| (SOFR + 2.074%) |

| |||||||||||||||

| 350,000 | 2.219 | (b)(f) | 06/09/26 | 314,759 | ||||||||||||

| BPCE SA(c) |

| |||||||||||||||

| 525,000 | 4.625 | 09/12/28 | 478,926 | |||||||||||||

| (SOFR + 1.730%) |

| |||||||||||||||

| 750,000 | 3.116 | (b)(f) | 10/19/32 | 532,695 | ||||||||||||

| CaixaBank SA (-1X 5 year EUR Swap + 6.346%) |

| |||||||||||||||

| EUR | 400,000 | 5.875 | (b)(f) | 12/31/99 | 328,748 | |||||||||||

| Citigroup, Inc. |

| |||||||||||||||

| $ | 780,000 | 3.500 | 05/15/23 | 774,290 | ||||||||||||

| 125,000 | 4.300 | 11/20/26 | 118,240 | |||||||||||||

| 475,000 | 4.125 | 07/25/28 | 429,177 | |||||||||||||

| (3M USD LIBOR + 1.023%) |

| |||||||||||||||

| 510,000 | 4.044 | (b)(f) | 06/01/24 | 506,037 | ||||||||||||

| (SOFR + 1.422%) |

| |||||||||||||||

| 550,000 | 2.976 | (b)(f) | 11/05/30 | 451,913 | ||||||||||||

| Citizens Financial Group, Inc. |

| |||||||||||||||

| 65,000 | 2.850 | (f) | 07/27/26 | 59,478 | ||||||||||||

| Commerzbank AG (-1X 5 year EUR Swap + 6.363%) |

| |||||||||||||||

| EUR | 400,000 | 6.125 | (b)(f) | 03/31/99 | 330,171 | |||||||||||

| Credit Agricole SA(b)(c)(f) |

| |||||||||||||||

| (5 year USD Swap + 4.319%) |

| |||||||||||||||

| $ | 250,000 | 6.875 | 12/31/99 | 230,208 | ||||||||||||

| (SOFR + 1.676%) |

| |||||||||||||||

| 375,000 | 1.907 | 06/16/26 | 335,528 | |||||||||||||

|

|

||||||||||||||||

20 The accompanying notes are an integral part of these financial statements.

GOLDMAN SACHS BOND FUND

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||||

| Corporate Obligations – (continued) |

| |||||||||||||||

| Banks – (continued) |

| |||||||||||||||

| Credit Suisse AG |

| |||||||||||||||

| $ | 300,000 | 2.950 | % | 04/09/25 | $ | 275,637 | ||||||||||

| Credit Suisse Group AG |

| |||||||||||||||

| 307,000 | 4.550 | 04/17/26 | 282,738 | |||||||||||||

| 875,000 | 4.282 | (c)(f) | 01/09/28 | 746,349 | ||||||||||||

| Deutsche Bank AG |

| |||||||||||||||

| 65,000 | 4.100 | 01/13/26 | 62,079 | |||||||||||||

| (SOFR + 1.870%) |

| |||||||||||||||

| 450,000 | 2.129 | (b)(f) | 11/24/26 | 382,577 | ||||||||||||

| (SOFR + 2.159%) |

| |||||||||||||||

| 300,000 | 2.222 | (b)(f) | 09/18/24 | 285,942 | ||||||||||||

| Fifth Third Bancorp |

| |||||||||||||||

| 375,000 | 2.375 | (f) | 01/28/25 | 350,588 | ||||||||||||

| First Horizon Corp.(f) |

| |||||||||||||||

| 700,000 | 3.550 | 05/26/23 | 692,909 | |||||||||||||

| 700,000 | 4.000 | 05/26/25 | 673,281 | |||||||||||||

| First-Citizens Bank & Trust Co. (3M TSFR + 1.715%) |

| |||||||||||||||

| 600,000 | 2.969 | (b)(f) | 09/27/25 | 563,964 | ||||||||||||

| HSBC Holdings PLC |

| |||||||||||||||

| 200,000 | 4.950 | 03/31/30 | 184,030 | |||||||||||||

| (3M USD LIBOR + 1.000%) |

| |||||||||||||||

| 450,000 | 3.961 | (b)(f) | 05/18/24 | 445,495 | ||||||||||||

| (3M USD LIBOR + 1.211%) |

| |||||||||||||||

| 600,000 | 3.803 | (b)(f) | 03/11/25 | 580,188 | ||||||||||||

| (SOFR + 1.538%) |

| |||||||||||||||

| 1,050,000 | 1.645 | (b)(f) | 04/18/26 | 934,720 | ||||||||||||

| Huntington Bancshares, Inc. |

| |||||||||||||||

| 825,000 | 4.000 | (f) | 05/15/25 | 798,847 | ||||||||||||

| ING Groep NV (1 Year CMT + 1.100%) |

| |||||||||||||||

| 950,000 | 1.400 | (b)(c)(f) | 07/01/26 | 835,534 | ||||||||||||

| JPMorgan Chase & Co.(f) |

| |||||||||||||||

| 425,000 | 3.625 | 12/01/27 | 386,180 | |||||||||||||

| (3M USD LIBOR + 0.730%) |

| |||||||||||||||

| 195,000 | 3.559 | (b) | 04/23/24 | 193,013 | ||||||||||||

| (3M USD LIBOR + 0.890%) |

| |||||||||||||||

| 175,000 | 3.797 | (b) | 07/23/24 | 172,781 | ||||||||||||

| (3M USD LIBOR + 1.245%) |

| |||||||||||||||

| 500,000 | 3.960 | (b) | 01/29/27 | 471,775 | ||||||||||||

| (SOFR + 1.160%) |

| |||||||||||||||

| 550,000 | 2.301 | (b) | 10/15/25 | 515,823 | ||||||||||||

| (SOFR + 1.800%) |

| |||||||||||||||

| 326,000 | 4.586 | (b) | 04/26/33 | 293,560 | ||||||||||||

| (SOFR + 2.040%) |

| |||||||||||||||

| 25,000 | 2.522 | (b) | 04/22/31 | 19,758 | ||||||||||||

| (SOFR + 2.515%) |

| |||||||||||||||

| 200,000 | 2.956 | (b) | 05/13/31 | 158,960 | ||||||||||||

| (SOFR + 3.125%) |

| |||||||||||||||

| 585,000 | 4.600 | (b) | 12/31/99 | 508,886 | ||||||||||||

| KeyCorp. (SOFR + 2.060%) |

| |||||||||||||||

| 895,000 | 4.789 | (b)(f) | 06/01/33 | 823,704 | ||||||||||||

| Macquarie Group Ltd. (SOFR + 1.069%) |

| |||||||||||||||

| 450,000 | 1.340 | (b)(c)(f) | 01/12/27 | 385,313 | ||||||||||||

| Mitsubishi UFJ Financial Group, Inc. |

| |||||||||||||||

| 30,000 | 4.286 | 07/26/38 | 25,534 | |||||||||||||

|

|

||||||||||||||||

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||||

| Corporate Obligations – (continued) |

| |||||||||||||||

| Banks – (continued) |

| |||||||||||||||

| Morgan Stanley |

| |||||||||||||||

| $ | 50,000 | 4.000 | % | 07/23/25 | $ | 48,532 | ||||||||||

| 174,000 | 3.950 | 04/23/27 | 161,780 | |||||||||||||

| (3M USD LIBOR + 0.847%) |

| |||||||||||||||

| 350,000 | 3.737 | (b)(f) | 04/24/24 | 346,318 | ||||||||||||

| (3M USD LIBOR + 1.628%) |

| |||||||||||||||