UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

Copies to:

| Caroline Kraus, Esq. | Stephen H. Bier, Esq. |

|||||||

| Goldman Sachs & Co. LLC | Dechert LLP |

|||||||

| 200 West Street | 1095 Avenue of the Americas |

|||||||

| New York, New York 10282 | New York, NY 10036 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: August 31

Date of reporting period: August 31, 2022

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| The Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| Annual Report | August 31, 2022 | |||

| Fundamental Equity Growth Funds | ||||

| Concentrated Growth | ||||

| Flexible Cap | ||||

| Large Cap Core* | ||||

| Mid Cap Growth** | ||||

| Small Cap Growth | ||||

| Small/Mid Cap Growth | ||||

| Strategic Growth | ||||

| Technology Opportunities | ||||

| U.S. Equity ESG | ||||

| * | Effective after the close of business on April 13, 2022, the Goldman Sachs Capital Growth Fund was renamed the Goldman Sachs Large Cap Core Fund. |

| ** | Effective after the close of business on April 13, 2022, the Goldman Sachs Growth Opportunities Fund was renamed the Goldman Sachs Mid Cap Growth Fund. |

Goldman Sachs Fundamental Equity Growth Funds

| ∎ | CONCENTRATED GROWTH |

| ∎ | FLEXIBLE CAP |

| ∎ | LARGE CAP CORE |

| ∎ | MID CAP GROWTH |

| ∎ | SMALL CAP GROWTH |

| ∎ | SMALL/MID CAP GROWTH |

| ∎ | STRATEGIC GROWTH |

| ∎ | TECHNOLOGY OPPORTUNITIES |

| ∎ | U.S. EQUITY ESG |

|

| ||||

| 1 | ||||

| 3 | ||||

| 50 | ||||

| 71 | ||||

| 82 | ||||

| 82 | ||||

| 89 | ||||

| 96 | ||||

| 104 | ||||

| 112 | ||||

| 119 | ||||

| 127 | ||||

| 135 | ||||

| 142 | ||||

| 149 | ||||

| 174 | ||||

| 175 | ||||

| NOT FDIC-INSURED | May Lose Value | No Bank Guarantee | ||

MARKET REVIEW

Goldman Sachs Fundamental Equity Growth Funds

Overall, U.S. equities struggled during the 12 months ended August 31, 2022 (the “Reporting Period”). The Standard & Poor’s® 500 Index (the “S&P 500 Index”) ended the Reporting Period with a return of -11.23%. The Russell 3000® Index generated a return of -13.28%. Persistent supply-chain disruptions, shifting U.S. Federal Reserve (“Fed”) policy, heightened inflation levels, COVID-19 pandemic overhangs and ongoing war between Russia and Ukraine were the primary concerns pressuring the U.S. equity markets during the Reporting Period.

As the Reporting Period began in September 2021, the S&P 500 Index saw its first decline since January 2021 and its worst month since September 2020. Focus centered around Fed tapering, complex legislative negotiations, persistent supply-chain disruptions, spread of the COVID-19 Delta variant, global risk events, rising energy costs and the rapid uptick in U.S. Treasury yields.

During the fourth quarter of 2021, the S&P 500 Index increased in October, fell in November and increased in December. The third quarter corporate earnings season propelled a U.S. equity market rally in October, with retail earnings upside surprises and hints of easing supply-chain constraints supporting the market’s upward trajectory into early November. Later in November, a $1 trillion infrastructure bill was signed into law, and Fed Chair Powell was appointed for a second term, bringing clarity to the Fed’s leadership. However, renewed concerns around COVID-19 developments pressured U.S. equities, with the emergence of the more contagious Omicron variant triggering a sell-off. Persistently high inflation also weighed on market sentiment. In December, the S&P 500 Index rebounded despite record COVID-19 case counts in many population centers in the U.S., as studies showed the variant was generally accompanied by milder symptoms than previous variants. Positive seasonality and the so-called “Santa Rally” also lifted the S&P 500 Index towards the end of the month. The Fed walked back its use of “transitory” in describing the inflationary environment and announced it would double its pace of asset purchase tapering and indicated potential interest rate hikes in 2022.

During the first quarter of 2022, the S&P 500 Index fell, marking its first quarterly decline since the first quarter of 2020. Among the major economic and geopolitical developments were the dramatic repricing of the Fed interest rate hike path and accelerated expectations for a more aggressive balance sheet runoff phase due to concerns about elevated and persistent inflation pressures. The hawkish Fed policy shift drove a large increase in bond yields, and U.S. Treasuries suffered one of their worst quarters on record. (Hawkish suggest higher interest rates; opposite of dovish.) COVID-19, and more specifically, the Omicron variant, was still an overhang, with resurgent cases bringing back supply-chain issues and worker shortages. Amid this backdrop, dampened corporate earnings momentum played into the bearish narrative for the U.S. equities markets. (Bearish refers to an expected downward movement in the prices of securities.) Growth equities meaningfully lagged value equities as a potential by-product of anticipated higher interest rates in the near term.

The S&P 500 Index fell more dramatically in the second quarter of 2022, as inflation, the Fed’s policy response and recession worries were at the core of investors’ narratives, resulting in a broad risk-off, or heightened risk aversion, atmosphere. Geopolitical overhang also remained a concern, as it affected energy prices, leading to low consumer sentiment and potentially changing consumer spending trends. On the other hand, equity inflows, buyback strength, insider buying, resilient consumer spending and some hints of cooling in the labor market were seen by the consensus as tailwinds. In late May/early June 2022, it remained unclear whether a rebound seen in the U.S. equity markets from the May 20, 2022 year-to-date low represented the start of a recovery or a bear-market rally. This question was quickly answered later in the month after the release of a higher than consensus expected May Consumer Price Index report, which sent the S&P 500 Index to a new year-to-date low. Moreover, following a 25 basis point hike in March 2022 and a 50 basis point increase in May 2022, the Fed agreed to a 75 basis point interest rate hike during its June 2022 meeting, wherein Fed Chair Powell asserted the Fed’s unconditional commitment to price stability with a policy response evolving based on incoming data. (A basis point is 1/100th of a percentage point.) At the end of the quarter, investors were looking ahead to the second quarter corporate earnings reporting season with some caution, as input price pressures and consumption trends factored into analyst arguments for downward revisions to earnings estimates.

In July 2022, U.S. equities rallied strongly, posting its largest monthly gain since November 2020 even as the Fed delivered another 75 basis point interest rate hike and Fed Chair Powell reiterated the central bank’s commitment to bringing inflation back to its target around 2%. Despite fears about aggressive monetary policy tightening and indications the U.S. economy had contracted for a second consecutive quarter, stocks advanced amid mostly better than consensus expected corporate earnings and a

1

MARKET REVIEW

decline in mid- to longer-term inflation expectations. U.S. equities continued to rally through mid-August 2022 driven by softer U.S. inflation readings and strong labor market data. However, the S&P 500 Index gave up its gains in the second half of the month on the back of hawkish Fed commentary. Business and consumer confidence remained depressed, pointing toward persistent weakness in economic activity. However, the U.S. labor market added 315,000 jobs in August. While the U.S. unemployment rate inched up from 3.5% to 3.7%, it was largely driven by a higher participation rate, i.e. increased labor supply rather than weaker labor demand. Nonetheless, given the moderating but elevated inflation, the Fed continued to signal further monetary tightening, which hurt the U.S. equity market in the latter half of August. In his speech at Jackson Hole, Fed Chair Powell reiterated that restoring price stability would likely require maintaining a restrictive policy stance for some time.

For the Reporting Period overall, only three of the 11 sectors of the S&P 500 Index posted absolute gains, led by the energy sector. Following at some distance were utilities and consumer staples, which also generated positive returns during the Reporting Period. On a relative basis, the weakest performing sectors in the S&P 500 Index were communication services, consumer discretionary and information technology.

Within the U.S. equity market, all capitalization segments generated negative absolute returns during the Reporting Period, but small-cap stocks, as measured by the Russell 2000® Index, were weakest, followed by mid-cap stocks, as measured by the Russell Midcap® Index, and then large-cap stocks, as measured by the Russell 1000® Index. From a style perspective, for the second consecutive 12-month period, value stocks meaningfully outperformed growth stocks on a relative basis across the capitalization spectrum during the Reporting Period. (All as measured by the FTSE Russell indices.)

Looking Ahead

At the end of the Reporting Period, we remained optimistic about the overall strength of the U.S. economy yet vigilant as we navigate anticipated U.S. equity market volatility ahead as the Fed’s hawkish stance, elevated inflation, high commodities prices, China’s economic growth slowdown, the U.S.’ resilient labor market and COVID-19 overhangs remain key factors to watch. While fears of a deep recession have waned, there remains the risk the Fed could overtighten monetary policy, and we do expect economic growth to slow in the U.S. through the end of 2022 and into 2023. Further, given higher oil and gas prices, strength in shelter inflation (inclusive of rent and lodging away from home) and potential COVID-19-related supply disruptions from China, we expect inflation to remain elevated in the near term but then to moderate gradually toward the end of the year. We expect the Fed’s monetary policy to continue to tighten to anchor inflation expectations. Finally, geopolitical uncertainties remain elevated. While uncertainty dominates, we believe some of this had already been priced into the U.S. equity market, as valuations, in our view, were more reasonable at the end of the Reporting Period than at the start of 2022. Amid this backdrop, we intend to stay true, as always, to our quality-first investment approach as we continue to seek to invest in businesses with healthy balance sheets, relatively stable cash flow generation and differentiated business models aligned to secular advantages. We continue to test our strategies and re-evaluate our assumptions with increasing information, staying focused on the long-term investment horizon.

Regardless of market direction, our fundamental, bottom-up stock selection continues to drive our process, rather than headlines or sentiment. We maintain high conviction in the companies the Fundamental Equity Growth Funds own and believe they have the potential to outperform relative to the broader market regardless of economic growth conditions. As always, we maintain our focus on seeking companies that we believe will generate long-term growth in today’s ever-changing market conditions.

2

Goldman Sachs Concentrated Growth Fund

Portfolio Composition

The Fund seeks to achieve its investment objective of seeking long-term growth of capital by investing, under normal circumstances, in U.S. equity investments selected for their potential to achieve capital appreciation over the long term. The Fund typically holds 30-40 companies that are considered by the Investment Adviser to be positioned for long-term growth. The Fund may invest in securities of companies of any capitalization. Although the Fund invests primarily in publicly traded U.S. securities, it may invest up to 25% of its total assets in foreign securities, including securities of issuers in countries with emerging markets or economies (“emerging countries”) and securities quoted in foreign currencies. The Fund may also invest up to 10% of its total assets in fixed income securities, such as government, corporate and bank debt obligations.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Fundamental Equity U.S. Equity Team discusses the Goldman Sachs Concentrated Growth Fund’s (the “Fund”) performance and positioning for the 12-month period ended August 31, 2022 (the “Reporting Period”).

| Q | How did the Fund perform during the Reporting Period? |

| A | During the Reporting Period, the Fund’s Class A, Class C, Institutional, Investor, Class R6, Class R and Class P Shares generated average annual total returns, without sales charges, of -26.54%, -27.13%, -26.32%, -26.35%, -26.31%, -26.72% and -26.32%, respectively. These returns compare to the -19.06% average annual total return of the Fund’s benchmark, the Russell 1000® Growth Index (with dividends reinvested) (the “Russell Index”), during the same period. |

| Q | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | The Fund underperformed the Russell Index on a relative basis during the Reporting Period due primarily to stock selection overall. Sector allocation as a whole also detracted, albeit more modestly, from relative performance during the Reporting Period. |

| Q | Which equity market sectors most significantly affected Fund performance? |

| A | The sectors that detracted most from the Fund’s relative performance during the Reporting Period were communication services, consumer discretionary and information technology, wherein stock selection in each proved challenging. Sector allocation positioning in communication services also hurt. Only partially offsetting these detractors was effective stock selection in health care and real estate — the only two sectors to contribute positively to the Fund’s relative results during the Reporting Period. |

| Q | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | Those stocks detracting most from the Fund’s results relative to the Russell Index were Snap, PayPal Holdings and Affirm Holdings. |

| Snap is a social media and camera company that develops and provides applications and products for communication. A broader impact of supply-chain shortages and Apple’s IDFA erosion weighed on advertiser demand, ultimately driving Snap’s quarterly earnings results lower. (The Identifier for Advertisers (“IDFA”) is a random device identifier assigned by Apple to a user’s device. Advertisers use this to track data so they can deliver customized advertising. The IDFA is used for tracking and identifying a user without revealing personal information.) Then, after issuing guidance that contradicted previous revenue and profit targets in May 2022, the company’s stock suffered a substantial pullback, as investors were uneasy about macroeconomic pressures facing the company. The company announced a disappointing quarter, as it saw increased competition for advertising dollars and macroeconomic headwinds. The company illustrated a slowdown in the advertising market and did not provide a guide for the third calendar quarter. However, the company had strong engagement trends and daily active user growth, and the longer-term goal of artificial reality and maps monetization remained intact. At the end of the Reporting Period, we continued to believe user growth and engagement were still positive, and we expected new products to drive higher revenue. Longer term, we believed Snap remained well situated to take incremental share of digital ad dollars, as it |

3

PORTFOLIO RESULTS

| continued to drive user engagement with innovative features and has a strong management team, in our view, committed to execution. Furthermore, its shares depreciated due to no company-specific news but rather due to a broad and abrupt market reversal from high growth names to value due to concerns around rising interest rates, which, in turn, drove losses across the technology industry. |

| Shares of digital payment technology company PayPal Holdings initially declined during the Reporting Period amid rumors the company was looking to acquire Pinterest, though PayPal Holdings ultimately decided the move would be too difficult to accomplish. Further, the company’s earnings report in November 2021 exceeded consensus expectations on earnings per share, but revenue fell below consensus expectations. The lesser volumes were caused by lower than consensus expected back-to-school spending along with a travel slowdown due to the COVID-19 variants. Its shares then depreciated following the company’s fourth quarter 2021 earnings announcement, wherein they issued disappointing forward guidance amid supply-chain issues, inflation, labor shortages and weaker consumer sentiment. The company’s stock depreciated further in the second quarter of 2022, as there were longer-term market share concerns with lowered revenue growth and operating margins adjusted downward, and the concerns of the prior quarter remained overhangs. At the end of the Reporting Period, we maintained our conviction in the company, as, in our view, it has the resources and capability to continue to grow its core customer base as it focuses on user engagement. As a scaled player in the payment industry, we believed PayPal Holdings was well positioned to leverage its existing customer base to implement any new payment technology. Also, we believed its strong balance sheet should allow it to either develop new technology, such as “buy now, pay later,” in house or to acquire an existing player within the industry. |

| Financial technology company Affirm Holdings originally suffered during the Reporting Period from the widespread reversal away from high growth companies as interest rate hikes waned on valuations. Then, its shares declined following its fourth quarter 2021 earnings release in February 2022, which featured better than consensus revenue and gross merchandise value (“GMV”) results, but its forward guidance concerned investors with its management pointing out a potential step down in GMV results and elevated transaction costs. Regarding transaction costs, the company’s long-term target on revenue excluding these costs as a percentage of GMV had not changed, which we viewed as a favorable sign. However, the company struggled amid macroeconomic headwinds, such as record level inflation, rising interest rates and decreased consumer spending, which together raised concerns about subprime credit lending and profitability. We had established a Fund position in Affirm Holdings earlier in the Reporting Period and despite the firm’s strong earnings and exclusive partnership to grow its GMV, we ultimately sold the position in favor a what we saw as a better risk/reward opportunity. |

| Q | What were some of the Fund’s best-performing individual stocks? |

| A | The Fund benefited most relative to the Russell Index from positions in Eli Lilly and Company, McDonald’s and Sarepta Therapeutics. |

| Eli Lilly and Company develops and manufactures pharmaceutical products. Its earnings results in the first quarter of 2022 beat consensus estimates by three cents with adjusted quarterly earnings of $2.49 per share, while its revenue beat consensus forecasts as well. These results were boosted by a jump in sales of the company’s Trulicity diabetes drug and COVID-19 therapies. Eli Lilly and Company was able to achieve 10% growth outside of its COVID-19 work and saw more than 60% of its revenues in the fourth quarter of 2021 coming from its “growth brand” of pharmaceutical products. Also, five new medicines were on deck to launch during the next two years. In August 2022, its earnings report featured a slight miss compared to consensus expectations, but the company maintained its full-year guidance and announced that all of its drug launches remained on track. At the end of the Reporting Period, we continued to view Eli Lilly and Company as one of the fastest growing pharmaceuticals companies with no major patent concerns until 2030 and a robust new product pipeline with multi-billion dollar opportunities ahead. |

| Fast-food restaurant giant McDonald’s successfully navigated a difficult operating environment amidst being forced to close its 850 locations in Russia and being faced with rising costs during the Reporting Period. Its Russian segment was a lower margin business, so this was not viewed by investors as a material negative. Consumers trading down in a higher cost environment also benefitted its sales. At the end of the Reporting Period, we continued to believe McDonald’s was well positioned to gain share and perform well in the near term given what we see as its leadership in value, strong operations and ongoing digital efforts. |

4

PORTFOLIO RESULTS

| Shares of commercial stage biopharmaceutical company Sarepta Therapeutics depreciated in January 2022 after trading was halted before the announcement of preliminary earnings results that were not well received. Poor results also came from drug trials, though we did not view the announcements to be as material as the market did. However, good news came in July 2022 as accelerated approval was filed for its Duchenne muscular dystrophy gene therapy drug, SRP-9001, and the company’s stock ended up generating robust double-digit gains for the Reporting Period overall. At the end of the Reporting Period, gene therapy remained the main driver of our investment thesis for Sarepta Therapeutics, and our conviction in the company’s operating capabilities as well as in the prospects of its drug pipeline coming to market remained intact. |

| Q | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | During the Reporting Period, we did not use derivatives as part of an active management strategy. |

| Q | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | We initiated a Fund position in multinational information technology services and consulting company Accenture during the Reporting Period. We believe Accenture is a market leader and a well-managed company that should benefit in a robust demand environment. Further, we believe its stock was trading, at the time of purchase, at an attractive valuation given that the company had lagged comparable peers in the months prior and believe the market was underappreciating Accenture’s growth prospects. |

| We established a Fund position in paint and coatings manufacturer Sherwin-Williams in July 2022. Despite supply-chain headwinds from China, the company has taken on a series of price initiatives. Its management also stated it feels good about its margin expansion story for early 2023 should cost pressures ease as it anticipates given that it does not anticipate rolling back its prices, so profitability should resume in the near term. |

| Conversely, we exited the Fund’s position in media content provider Netflix during the Reporting Period. While we continued to like the company, we saw some near-term headwinds facing the business, such as increased competition and macroeconomic pressures. We sold the position in favor what we considered to be better risk/reward profiles elsewhere, but we intend to keep monitoring the company for a longer-term opportunity. |

| We sold the Fund’s position in financial technology services provider Fidelity National Information Services in November 2021. We believed its near-term growth could be inhibited by implied risks in its merchant solution business. We eliminated the position for this reason and due to concerns about its long-term growth based on what we saw as the disruptive competitive landscape for the firm. |

| Q | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | There were no changes to the Fund’s portfolio management team during the Reporting Period. |

| Q | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | In constructing the Fund’s portfolio, we focus on picking stocks rather than on making industry or sector bets. We seek to outpace the benchmark index by overweighting stocks that we expect to outperform and underweighting those that we think may lag. Consequently, changes in its sector weights are generally the direct result of individual stock selection or of stock appreciation or depreciation. That said, during the Reporting Period, the Fund’s exposure to consumer discretionary and information technology increased and its allocations to communication services and consumer staples decreased relative to the Russell Index. |

| Q | How was the Fund positioned relative to its benchmark index at the end of August 2022? |

| A | At the end of August 2022, the Fund had overweighted positions relative to the Russell Index in the health care and materials sectors. On the same date, the Fund had underweighted positions compared to the Russell Index in industrials and consumer staples. The Fund was rather neutrally weighted relative to the Russell Index in communication services, consumer discretionary, information technology and real estate and had no positions at all in the utilities, energy and financials sectors at the end of the Reporting Period. |

5

FUND BASICS

Concentrated Growth Fund

as of August 31, 2022

| TOP TEN HOLDINGS AS OF 8/31/221 | ||||||||

| Holding | % of Net Assets | Line of Business | ||||||

| Apple, Inc. | 11.1 | % | Technology Hardware, Storage & Peripherals | |||||

| Microsoft Corp. | 10.6 | Software | ||||||

| Amazon.com, Inc. | 4.6 | Internet & Direct Marketing Retail | ||||||

| Eli Lilly & Co. | 3.2 | Pharmaceuticals | ||||||

| Mastercard, Inc., Class A | 3.2 | IT Services | ||||||

| Alphabet, Inc., Class A | 3.1 | Interactive Media & Services | ||||||

| Alphabet, Inc., Class C | 2.7 | Interactive Media & Services | ||||||

| American Tower Corp. REIT | 2.6 | Equity Real Estate Investment Trusts (REITs) | ||||||

| Boston Scientific Corp. | 2.6 | Health Care Equipment & Supplies | ||||||

| McDonald’s Corp. | 2.6 | Hotels, Restaurants & Leisure | ||||||

| 1 | The top 10 holdings may not be representative of the Fund’s future investments. |

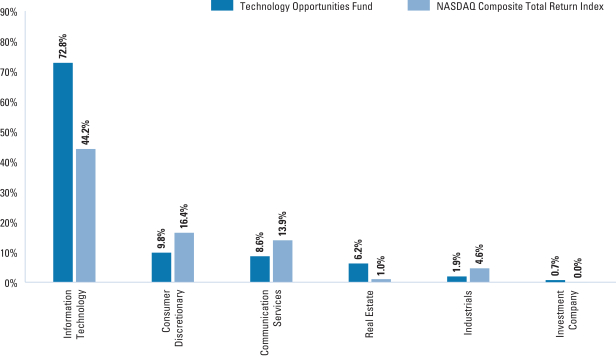

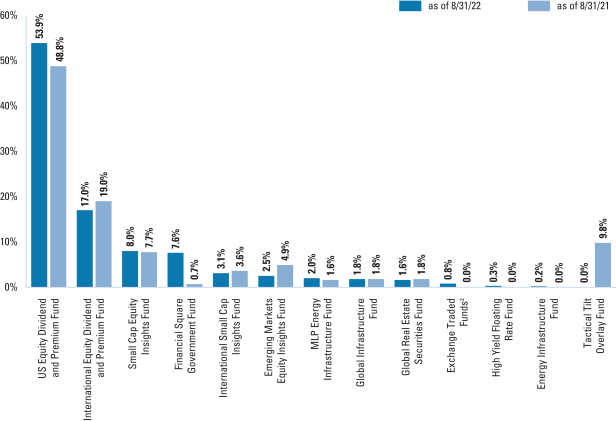

| FUND VS. BENCHMARK SECTOR ALLOCATION2 |

| As of August 31, 2022 |

| 2 | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. Figures in the above graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

6

GOLDMAN SACHS CONCENTRATED GROWTH FUND

Performance Summary

August 31, 2022

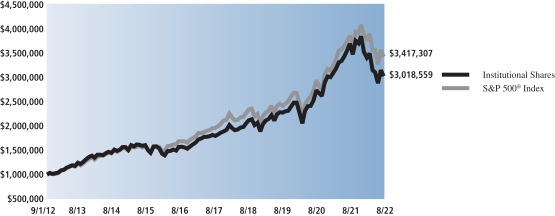

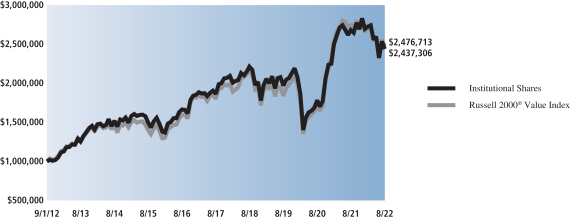

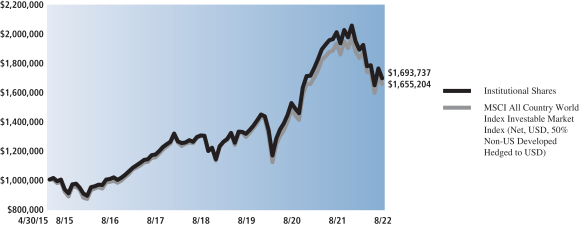

The following graph shows the value, as of August 31, 2022, of a $1,000,000 investment made on September 1, 2012 in Institutional Shares at NAV. For comparative purposes, the performance of the Fund’s benchmark, the Russell 1000® Growth Index (with dividends reinvested), is shown. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns set forth below represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted below. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns.

| Concentrated Growth Fund’s 10 Year Performance |

Performance of a $1,000,000 Investment, including any applicable sales charges, with distributions reinvested, from September 1, 2012 through August 31, 2022.

| Average Annual Total Return through August 31, 2022* | One Year | Five Years | Ten Years | Since Inception | ||||||||

| Class A |

||||||||||||

| Excluding sales charges |

-26.54% | 11.30% | 11.78% | — | ||||||||

| Including sales charges |

-30.57% | 10.05% | 11.15% | — | ||||||||

|

| ||||||||||||

| Class C |

||||||||||||

| Excluding contingent deferred sales charges |

-27.13% | 10.46% | 10.95% | — | ||||||||

| Including contingent deferred sales charges |

-27.85% | 10.46% | 10.95% | — | ||||||||

|

| ||||||||||||

| Institutional |

-26.32% | 11.68% | 12.19% | — | ||||||||

|

| ||||||||||||

| Investor |

-26.35% | 11.57% | 12.06% | — | ||||||||

|

| ||||||||||||

| Class R6 (Commenced July 31, 2015) |

-26.31% | 11.69% | N/A | 10.49% | ||||||||

|

| ||||||||||||

| Class R |

-26.72% | 11.02% | 11.51% | — | ||||||||

|

| ||||||||||||

| Class P (Commenced April 17, 2018) |

-26.32% | N/A | N/A | 10.63% | ||||||||

|

| ||||||||||||

| * | These returns assume reinvestment of all distributions at NAV and reflect a maximum initial sales charge of 5.50% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Investor, Class P, Class R and Class R6 Shares do not involve a sales charge, such a charge is not applied to their Average Annual Total Return. |

7

PORTFOLIO RESULTS

Goldman Sachs Flexible Cap Fund

Portfolio Composition

The Fund invests, under normal circumstances, at least 80% of its net assets plus any borrowings for investment purposes (measured at time of purchase) (“Net Assets”) in equity investments in small-, mid- and large-cap issuers. The Fund seeks to achieve its investment objective by investing, under normal circumstances, in companies that are considered by the Investment Adviser to be positioned for long-term growth of capital. This strategy is combined with a quantitative risk allocation process that is used to assist portfolio construction and trading decisions.

Portfolio Management Discussion and Analysis

Below, the Goldman Sachs Fundamental Equity U.S. Equity Team discusses the Goldman Sachs Flexible Cap Fund’s (the “Fund”) performance and positioning for the 12-month period ended August 31, 2022 (the “Reporting Period”).

| Q | How did the Fund perform during the Reporting Period? |

| A | During the Reporting Period, the Fund’s Class A, Class C, Institutional, Investor, Class R6, Class R and Class P Shares generated average annual total returns, without sales charges, of -11.46%, -12.07%, -11.10%, -11.21%, -11.12%, -11.68% and -11.07%, respectively. These returns compare to the -11.23% average annual total return of the Fund’s benchmark, the S&P 500 Index (with dividends reinvested), during the same period. |

| Q | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | While absolute returns disappointed, several share classes of the Fund outperformed the S&P 500 Index on a relative basis during the Reporting Period due both to stock selection and sector allocation overall. |

| Q | Which equity market sectors most significantly affected Fund performance? |

| A | The sectors that contributed most positively to the Fund’s relative performance during the Reporting Period were health care, financials and energy. Effective stock selection drove results in each of these sectors. The sectors that detracted most from the Fund’s relative results during the Reporting Period were information technology, consumer staples and materials, wherein stock selection proved challenging. |

| Q | What were some of the Fund’s best-performing individual stocks? |

| A | Those stocks the Fund benefited most from relative to the S&P 500 Index were positions in Devon Energy, Meta Platforms and Pioneer Natural Resources. |

| Devon Energy, an exploration and production oil and gas company, posted fourth quarter 2021 earnings that featured strong results, with both earnings and dividend amounts higher than market expectations. Investor focus remained on 2022 production and a variable dividend wherein Devon Energy leads the industry. Each subsequent earnings report during the Reporting Period similarly featured results above market expectations, largely due to strong production and execution metrics. At the end of the Reporting Period, our investment thesis continued to revolve around a better than consensus expected variable dividend, increased buybacks and what we saw as a line of sight to significant capital returns. |

| Meta Platforms engages in the development of social media applications. The company, formerly known as Facebook, was a top contributor to relative results because the Fund held an underweighted position in this weakly-performing stock during the Reporting Period. In February 2022, the company announced materially lowered forward guidance. Issues of concerns included social media competition/engagement, introduction of Reels to compete with TikTok with limited traction, and IDFA concerns as it related to pending regulations being imposed. (The Identifier for Advertisers (“IDFA”) is a random device identifier assigned by Apple to a user’s device. Advertisers use this to track data so they can deliver customized advertising. The IDFA is used for tracking and identifying a user without revealing personal information.) At the end of the Reporting Period, the Fund maintained a position in Meta Platforms because we believed the company has an attractive valuation and is focusing its efforts on different new devices to diversify and enter new markets. We were also optimistic the company will continue what we view as its attractive operating margins and that the |

8

PORTFOLIO RESULTS

| broader industry has positive tailwinds. However, a fair amount of uncertainty remained around the future prospects of Meta Platforms. |

| The strong performance of oil and gas exploration and production company Pioneer Natural Resources was supported by subdued oil production, high and improving demand, and new geopolitical tensions fueled by the war in Ukraine. Another point of optimism supporting its stock was that the company is committed to return 75% of its free cash flow in the form of distributions. We believed the company’s healthy balance sheet and efficient production would likely continue to drive performance and keep its earnings in line with market expectations. In our view, the company’s cash yield of approximately 15% also remained attractive. However, given a more scrutinized operating environment for exploration and production companies along with potential political intervention, in the context of the entirety of the Fund’s portfolio, we opted to sell the position, taking profits. |

| Q | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | Detracting most from the Fund’s results relative to the S&P 500 Index were positions in Exxon Mobil, EPAM Systems and Adobe. |

| Oil and gas integrated energy company Exxon Mobil, a new purchase for the Fund during the Reporting Period, was a top detractor from relative results because the Fund held an underweight position in its strongly performing stock. Its shares benefited primarily from an increase in crude oil prices and favorable supply/demand dynamics. Also, in February 2022, it was announced that sweeping restructuring would be taking place across its global operations. Examples of changes included cost cutting and a new headquarters location in Houston. Further, earnings releases in the summer of 2022 featured significant outperformance of market expectations on both net income and earnings per share. Results from its liquid natural gas segment also proved favorable. At the end of the Reporting Period, we continued to see what we viewed as attractive trends in the operations of its business, and we looked to see further capital distributions put in place. |

| We initiated a Fund position in software product development and digital platform services company EPAM Systems in September 2021 but ultimately exited the position in March 2022. It performed poorly, as the company had significant business operations in Ukraine, and its management cited concerns around revenue and costs being adversely affected by the ongoing war there. We had viewed the company as one of our favorites within the mid-cap information technology services industry, but the geopolitical conflict concerns invalidated our investment thesis, and we sold the position. |

| Shares of digital marketing and media solutions company Adobe fell in December 2021 after poor earnings and forward guidance was given by its management. Then, in March 2022, price hikes were announced for enterprise-level customers. Fortunately, the products offered by Adobe are highly integrated into most clients’ business operations, so we believe most will accept the higher prices. At the end of the Reporting Period, we continued to believe Adobe had industry-leading operating margins, and if the macroenvironment weakens, that its management would be able to adjust expenses accordingly. |

| Q | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | During the Reporting Period, we did not use derivatives as part of an active management strategy. |

| Q | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | In addition to the purchase of Exxon Mobil, already mentioned, we initiated a Fund position in multinational information technology services and consulting company Accenture during the Reporting Period. We believe Accenture is a market leader and a well-managed company that should benefit in a robust demand environment. Further, we believe its stock was trading, at the time of purchase, at an attractive valuation given that the company had lagged comparable peers in the months prior and believe the market was underappreciating Accenture’s growth prospects. |

| Conversely, in addition to those sales mentioned earlier, we exited the Fund’s position in Intuit, which offers financial management and compliance products and services, in September 2021. Despite what we see as the strength of the business and clear levers of growth, on a relative basis, Intuit looked less attractive to us than other large-cap technology companies. We ultimately decided to sell the position in favor of what we considered to be more attractive investment opportunities elsewhere. |

| We eliminated the Fund’s position in semiconductor company Texas Instruments during the Reporting Period. Concerns were observed regarding peak gross margins and compressing cash flows as a result of capital expenditure investments planned by the company for the next few years. |

9

PORTFOLIO RESULTS

| Our preference at the end of the Reporting Period was for other names in the industry, so we decided to sell in favor of other positions. |

| Q | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | There were no changes to the Fund’s portfolio management team during the Reporting Period. |

| Q | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | In constructing the Fund’s portfolio, we focus on picking stocks rather than on making industry or sector bets. We seek to outpace the benchmark index by overweighting stocks that we expect to outperform and underweighting those that we think may lag. Consequently, changes in its sector weights are generally the direct result of individual stock selection or of stock appreciation or depreciation. That said, during the Reporting Period, the Fund’s exposure to industrials increased and its allocation to health care decreased relative to the S&P 500 Index. |

| Q | How was the Fund positioned relative to its benchmark index at the end of August 2022? |

| A | At the end of August 2022, the Fund had underweighted positions compared to the S&P 500 Index in consumer staples, and health care and an overweighted position relative to the S&P 500 Index in industrials. The Fund was rather neutrally weighted relative to the Russell Index in the remaining eight sectors of the S&P 500 Index at the end of the Reporting Period. |

10

FUND BASICS

Flexible Cap Fund

as of August 31, 2022

| TOP TEN HOLDINGS AS OF 8/31/221 | ||||||||

| Holding | % of Net Assets | Line of Business | ||||||

| Apple, Inc. | 6.8 | % | Technology Hardware, Storage & Peripherals | |||||

| Microsoft Corp. | 5.9 | Software | ||||||

| Amazon.com, Inc. | 2.8 | Internet & Direct Marketing Retail | ||||||

| Alphabet, Inc., Class C | 1.8 | Interactive Media & Services | ||||||

| Exxon Mobil Corp. | 1.7 | Oil, Gas & Consumable Fuels | ||||||

| Meta Platforms, Inc., Class A | 1.6 | Interactive Media & Services | ||||||

| JPMorgan Chase & Co. | 1.5 | Banks | ||||||

| Alphabet, Inc., Class A | 1.4 | Interactive Media & Services | ||||||

| Tesla, Inc. | 1.4 | Automobiles | ||||||

| Bank of America Corp. | 1.2 | Banks | ||||||

| 1 | The top 10 holdings may not be representative of the Fund’s future investments. |

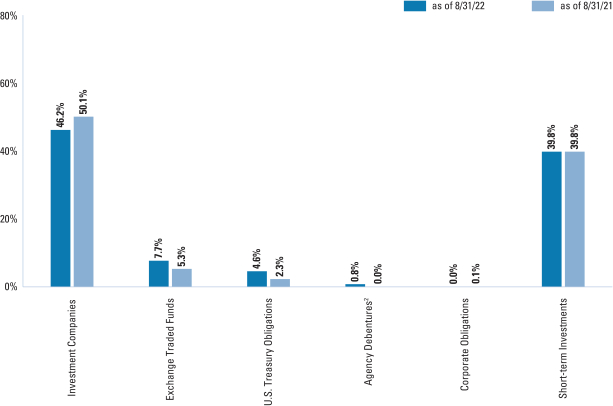

| FUND VS. BENCHMARK SECTOR ALLOCATION2 |

| As of August 31, 2022 |

| 2 | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. Figures in the above graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

11

GOLDMAN SACHS FLEXIBLE CAP FUND

Performance Summary

August 31, 2022

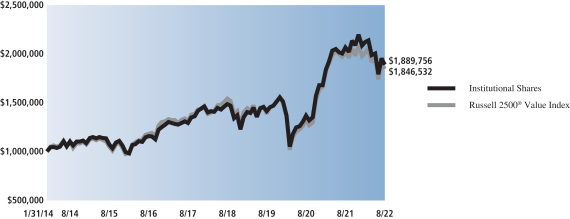

The following graph shows the value, as of August 31, 2022, of a $10,000 investment made on September 1, 2012 in Class A Shares at NAV (with the maximum sales charge of 5.50%). For comparative purposes, the performance of the Fund’s benchmark, the S&P 500® Index (with dividends reinvested), is shown. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns set forth below represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted below. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns.

| Flexible Cap Fund’s 10 Year Performance |

Performance of a $10,000 Investment, including any applicable sales charges, with distributions reinvested, from September 1, 2012 through August 31, 2022.

| Average Annual Total Return through August 31, 2022* | One Year | Five Years | Ten Years | Since Inception | ||||||||

| Class A |

||||||||||||

| Excluding sales charges |

-11.46% | 11.51% | 12.89% | — | ||||||||

| Including sales charges |

-16.35% | 10.26% | 12.25% | — | ||||||||

|

| ||||||||||||

| Class C |

||||||||||||

| Excluding contingent deferred sales charges |

-12.07% | 10.69% | 12.05% | — | ||||||||

| Including contingent deferred sales charges |

-12.95% | 10.69% | 12.05% | — | ||||||||

|

| ||||||||||||

| Institutional |

-11.10% | 11.93% | 13.32% | — | ||||||||

|

| ||||||||||||

| Investor |

-11.21% | 11.79% | 13.18% | — | ||||||||

|

| ||||||||||||

| Class R6 (Commenced July 31, 2015) |

-11.12% | 11.93% | N/A | 10.84% | ||||||||

|

| ||||||||||||

| Class R |

-11.68% | 11.23% | 12.61% | — | ||||||||

|

| ||||||||||||

| Class P (Commenced April 17, 2018) |

-11.07% | N/A | N/A | 10.92% | ||||||||

|

| ||||||||||||

| * | These returns assume reinvestment of all distributions at NAV and reflect a maximum initial sales charge of 5.50% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Investor, Class P, Class R and Class R6 Shares do not involve a sales charge, such a charge is not applied to their Average Annual Total Return. |

12

PORTFOLIO RESULTS

Goldman Sachs Large Cap Core Fund

Portfolio Composition

At the start of the Reporting Period, the Fund sought to achieve its investment objective of seeking long-term growth of capital by investing, under normal circumstances, in companies that were considered by the Investment Advisor to be positioned for long-term growth.

Effective after the close of business on April 13, 2022, the Fund seeks to achieve its investment objective of long-term growth of capital by investing, under normal circumstances, at least 80% of its net assets plus any borrowings for investment purposes (measured at the time of purchase) (“Net Assets”) in a diversified portfolio of equity investments in large-cap issuers. Large-cap issuers are issuers with public stock market capitalizations (based upon shares available for trading on an unrestricted basis) within the range of the market capitalizations of companies constituting the Russell 1000® Index at the time of investment. The Fund seeks to achieve its investment objective by investing, under normal circumstances, in companies that are considered by the Investment Adviser to be positioned for long-term growth. Although the Fund invests primarily in publicly traded U.S. securities, it may invest up to 25% of its total assets in foreign securities, including securities of issuers in countries with emerging markets or economies (“emerging countries”) and securities quoted in foreign currencies.

Portfolio Management Discussion and Analysis

Effective after the close of business on April 13, 2022, Goldman Sachs Capital Growth Fund was re-named Goldman Sachs Large Cap Core Fund and changes were made to its principal investment strategy. Below, the Goldman Sachs Fundamental Equity U.S. Equity Team discusses the Goldman Sachs Large Cap Core Fund’s (the “Fund”) performance and positioning for the 12-month period ended August 31, 2022 (the “Reporting Period”).

| Q | How did the Fund perform during the Reporting Period? |

| A | During the Reporting Period, the Fund’s Class A, Class C, Institutional, Service, Investor, Class R6, Class R and Class P Shares generated average annual total returns, without sales charges, of -15.37%, -16.04%, -15.08%, -15.50%, -15.16%, -15.07%, -15.58% and -15.08%, respectively. These returns compare to the -12.96% average annual total return of the Fund’s benchmark, the Russell 1000® Index (with dividends reinvested) (the “Russell Index”), during the same period. |

| Q | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | The Fund underperformed the Russell Index on a relative basis during the Reporting Period due primarily to stock selection overall. Sector allocation as a whole had a rather neutral effect on relative performance during the Reporting Period. |

| Q | Which equity market sectors most significantly affected Fund performance? |

| A | The sectors that detracted most from the Fund’s relative performance during the Reporting Period were communication services, industrials and health care, wherein stock selection in each dampened results. The sectors that contributed most positively to the Fund’s relative performance during the Reporting Period were energy, financials and real estate, wherein stock selection in each proved effective. Having a modest overweight to energy, which was the strongest sector in the Russell Index during the Reporting Period, also boosted relative results. |

| Q | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | Those stocks detracting most from the Fund’s results relative to the Russell Index were positions in Snap, Exxon Mobil and PayPal Holdings. |

| Snap is a social media and camera company that develops and provides applications and products for communication. A broader impact of supply-chain shortages and Apple’s IDFA erosion weighed on advertiser demand, ultimately driving Snap’s quarterly earnings results lower. (The Identifier for Advertisers (“IDFA”) is a random device identifier assigned by Apple to a user’s device. Advertisers use this to track data so they can deliver customized advertising. The IDFA is used for tracking and identifying a user without revealing personal information.) Then, after |

13

PORTFOLIO RESULTS

| issuing guidance that contradicted previous revenue and profit targets in May 2022, the company’s stock suffered a substantial pullback, as investors were uneasy about macroeconomic pressures facing the company. The company announced a disappointing quarter, as it saw increased competition for advertising dollars and macroeconomic headwinds. The company illustrated a slowdown in the advertising market and did not provide a guide for the third calendar quarter. However, the company had strong engagement trends and daily active user growth, and the longer-term goal of artificial reality and maps monetization remained intact. At the end of the Reporting Period, we continued to believe user growth and engagement were still positive, and we expected new products to drive higher revenue. Longer term, we believed Snap remained well situated to take incremental share of digital ad dollars, as it continued to drive user engagement with innovative features and had a strong management team, in our view, committed to execution. Furthermore, its shares depreciated due to no company-specific news but rather due to a broad and abrupt market reversal from high growth names to value due to concerns around rising interest rates, which, in turn, drove losses across the technology industry. |

| Oil and gas integrated energy company Exxon Mobil, a new purchase for the Fund during the Reporting Period, was a top detractor from relative results because the Fund held an underweight position in its strongly performing stock. Its shares benefited primarily from an increase in crude oil prices and favorable supply/demand dynamics. Also, in February 2022, it was announced that sweeping restructuring would be taking place across its global operations. Examples of changes included cost cutting and a new headquarters location in Houston. Further, earnings releases in the summer of 2022 featured significant outperformance of market expectations on both net income and earnings per share. Results from its liquid natural gas segment also proved favorable. At the end of the Reporting Period, we continued to see what we viewed as attractive trends in the operations of its business, and we looked to see further capital distributions put in place. |

| Shares of digital payment technology company PayPal Holdings initially declined during the Reporting Period amid rumors the company was looking to acquire Pinterest, though PayPal Holdings ultimately decided the move would be too difficult to accomplish. Further, the company’s earnings report in November 2021 exceeded consensus expectations on earnings per share, but revenue fell below consensus expectations. The lesser volumes were caused by lower than consensus expected back-to-school spending along with a travel slowdown due to the COVID-19 variants. Its shares then depreciated following the company’s fourth quarter 2021 earnings announcement, wherein the company issued disappointing forward guidance amid supply-chain issues, inflation, labor shortages and weaker consumer sentiment. The company’s stock depreciated further in the second quarter of 2022, as there were longer-term market share concerns with lowered revenue growth and operating margins adjusted downward, and the concerns of the prior quarter remained overhangs. At the end of the Reporting Period, we maintained our conviction in the company, as, in our view, it has the resources and capability to continue to grow its core customer base as it focuses on user engagement. As a scaled player in the payment industry, we believed PayPal Holdings was well positioned to leverage its existing customer base to implement any new payment technology. Also, we believed its strong balance sheet should allow it to either develop new technology, such as “buy now, pay later,” in house or to acquire an existing player within the industry. |

| Q | What were some of the Fund’s best-performing individual stocks? |

| A | Those stocks the Fund benefited most from relative to the Russell Index were positions in Chevron, Pioneer Natural Resources and CVS Health. |

| Chevron is a global integrated energy, chemical and petroleum company. Its stock price, similar to the energy sector more broadly, benefited from an increase in crude oil prices in the first quarter of 2022, driven by slow oil supply growth as the Organization of the Petroleum Exporting Countries (“OPEC”) struggled to produce oil in line with its production goals, while demand proved to be resilient and on track to reach pre-pandemic levels. Furthermore, fuel prices appreciated as tensions between Ukraine and Russia heightened, causing countries to threaten sanctions on Russia, which supplies more than a third of the European Union’s natural gas. At the end of the Reporting Period, we continued to believe Chevron’s management had solid capital allocation discipline with a shareholder friendly team. We were optimistic at the end of the Reporting Period given our view that the company has a strong balance sheet, a Permian Basin portfolio that enables balanced growth and free cash flow, and an ability to generate free cash flow from its core asset base. |

| Similarly, the strong performance of oil and gas exploration and production company Pioneer Natural Resources was |

14

PORTFOLIO RESULTS

| supported by subdued oil production, high and improving demand, and new geopolitical tensions fueled by the war in Ukraine. Another point of optimism supporting its stock was that the company is committed to return 75% of its free cash flow in the form of distributions. We believed the company’s healthy balance sheet and efficient production would likely continue to drive performance and keep its earnings in line with market expectations. In our view, the company’s cash yield of approximately 15% also remained attractive. However, given a more scrutinized operating environment for exploration and production companies along with potential political intervention, in the context of the entirety of the Fund’s portfolio, we opted to sell the position, taking profits. |

| Healthcare services provider CVS Health provided updated earnings guidance in January 2022 that was meaningfully higher than its prior guidance and consensus expectations. The raised guidance came before its fourth quarter 2021 earnings announcement and followed the strong momentum of its third quarter 2021 results. Its earnings in the spring of 2022 reflected strength in the health care insurance business, though cost pressures and operating margins became a potential concern. It reaffirmed our investment thesis on the company, wherein we believe CVS Health will likely benefit from its transition to a healthcare enterprise, potentially driving faster growth. Despite the challenging operating environment and the roll-off of some COVID-19-driven business, success, in our view, can been seen in the company’s foundational business, accelerated by the strategy of its management. |

| Q | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | During the Reporting Period, we did not use derivatives as part of an active management strategy. |

| Q | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | In addition to the purchase of Exxon Mobil, mentioned earlier, we initiated a Fund position in multinational information technology services and consulting company Accenture during the Reporting Period. We believe Accenture is a market leader and a well-managed company that should benefit in a robust demand environment. Further, we believe its stock was trading, at the time of purchase, at an attractive valuation given that the company had lagged comparable peers in the months prior and believe the market was underappreciating Accenture’s growth prospects. |

| Conversely, we trimmed the Fund’s position in media content provider Netflix during the Reporting Period. While we continued to like this company, we saw some near-term headwinds facing the business, such as increased competition and macroeconomic pressures. We also trimmed the Fund’s position in e-commerce behemoth Amazon.com during the Reporting Period. We remained constructive on its long-term growth prospects and its top-line revenue growth, but we also saw valuation concerns. In our view, there may be a trough in Amazon.com’s profitability in the remaining months of 2022, including the holiday season. |

| Q | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | There were no changes to the Fund’s portfolio management team during the Reporting Period. |

| Q | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

| A | In constructing the Fund’s portfolio, we focus on picking stocks rather than on making industry or sector bets. We seek to outpace the benchmark index by overweighting stocks that we expect to outperform and underweighting those that we think may lag. Consequently, changes in its sector weights are generally the direct result of individual stock selection or of stock appreciation or depreciation. That said, during the Reporting Period, relative to the Russell Index, the Fund’s allocation to financials increased, and its allocation to information technology decreased. |

| Q | How was the Fund positioned relative to its benchmark index at the end of August 2022? |

| A | At the end of August 2022, the Fund was overweight relative to the Russell Index in materials, was underweight relative to the Russell Index in consumer staples and financials, and was rather neutrally weighted to the remaining eight sectors in the Russell Index. |

15

FUND BASICS

Large Cap Core Fund

as of August 31, 2022

| TOP TEN HOLDINGS AS OF 8/31/221 | ||||||||

| Holding | % of Net Assets | Line of Business | ||||||

| Apple, Inc. | 6.2 | % | Technology Hardware, Storage & Peripherals | |||||

| Microsoft Corp. | 5.6 | Software | ||||||

| Amazon.com, Inc. | 2.8 | Internet & Direct Marketing Retail | ||||||

| Alphabet, Inc., Class A | 1.7 | Interactive Media & Services | ||||||

| Alphabet, Inc., Class C | 1.6 | Interactive Media & Services | ||||||

| UnitedHealth Group, Inc. | 1.5 | Health Care Providers & Services | ||||||

| JPMorgan Chase & Co. | 1.5 | Banks | ||||||

| CVS Health Corp. | 1.5 | Health Care Providers & Services | ||||||

| Bank of America Corp. | 1.4 | Banks | ||||||

| Exxon Mobil Corp. | 1.4 | Oil, Gas & Consumable Fuels | ||||||

| 1 | The top 10 holdings may not be representative of the Fund’s future investments. |

| FUND VS. BENCHMARK SECTOR ALLOCATION2 |

| As of August 31, 2022 |

| 2 | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. Figures in the above graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

16

LARGE CAP CORE FUND

Performance Summary

August 31, 2022

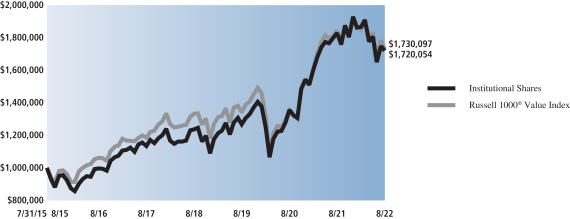

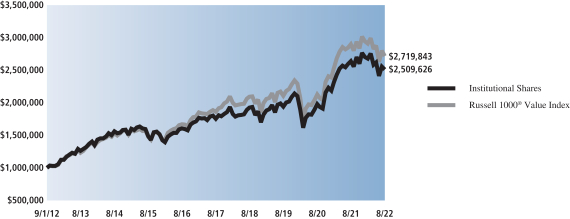

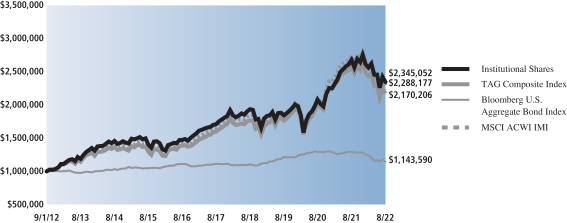

The following graph shows the value, as of August 31, 2022, of a $10,000 investment made on September 1, 2012 in Class A Shares at NAV (with the maximum sales charge of 5.50%). For comparative purposes, the performance of the Fund’s benchmark, the Russell 1000 Index (with dividends reinvested), is shown. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown and in their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns set forth below represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted below. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns.

| Large Cap Core Fund’s 10 Year Performance |

Performance of a $10,000 Investment, including any applicable sales charges, with distributions reinvested, from September 1, 2012 through August 31, 2022.

| Average Annual Total Return through August 31, 2022* | One Year | Five Years | Ten Years | Since Inception | ||||||||

| Class A |

||||||||||||

| Excluding sales charges |

-15.37% | 11.63% | 12.80% | — | ||||||||

| Including sales charges |

-20.03% | 10.38% | 12.16% | — | ||||||||

|

| ||||||||||||

| Class C |

||||||||||||

| Excluding contingent deferred sales charges |

-16.04% | 10.81% | 11.96% | — | ||||||||

| Including contingent deferred sales charges |

-16.88% | 10.81% | 11.96% | — | ||||||||

|

| ||||||||||||

| Institutional |

-15.08% | 12.05% | 13.24% | — | ||||||||

|

| ||||||||||||

| Service |

-15.50% | 11.50% | 12.67% | — | ||||||||

|

| ||||||||||||

| Investor |

-15.16% | 11.91% | 13.08% | — | ||||||||

|

| ||||||||||||

| Class R6 (Commenced July 31, 2015) |

-15.07% | 12.07% | N/A | 11.24% | ||||||||

|

| ||||||||||||

| Class R |

-15.58% | 11.36% | 12.52% | — | ||||||||

|

| ||||||||||||

| Class P (Commenced April 17, 2018) |

-15.08% | N/A | N/A | 10.44% | ||||||||

|

| ||||||||||||

| * | These returns assume reinvestment of all distributions at NAV and reflect a maximum initial sales charge of 5.50% for Class A Shares and the assumed contingent deferred sales charge for Class C Shares (1% if redeemed within 12 months of purchase). Because Institutional, Service, Investor, Class P, Class R and Class R6 Shares do not involve a sales charge, such a charge is not applied to their Average Annual Total Return. |

17

PORTFOLIO RESULTS

Goldman Sachs Mid Cap Growth Fund

Portfolio Composition

At the start of the Reporting Period, the Fund sought to achieve its investment objective of seeking long-term growth of capital by investing, under normal circumstances, in companies that were considered by the Investment Advisor to be positioned for long-term growth, investing primarily in medium-sized growth companies. Effective after the close of business on April 13, 2022, the Fund seeks to achieve its investment objective of seeking long-term growth of capital by investing, under normal circumstances, at least 80% of its net assets plus any borrowings for investment purposes (measured at the time of purchase) (“Net Assets”) in a diversified portfolio of equity investments in mid-cap issuers. Mid-cap issuers are issuers with public stock market capitalizations (based upon shares available for trading on an unrestricted basis) within the range of the market capitalizations of companies constituting the Russell Midcap® Growth Index at the time of investment. Although the Fund invests primarily in publicly traded U.S. securities, it may invest up to 25% of its total assets in foreign securities, including securities of issuers in countries with emerging markets or economies (“emerging countries”) and securities quoted in foreign currencies. The Fund may also invest in privately held companies and companies that only recently began to trade publicly.

Portfolio Management Discussion and Analysis

Effective after the close of business on April 13, 2022, Goldman Sachs Growth Opportunities Fund was re-named Goldman Sachs Mid Cap Growth Fund and changes were made to its principal investment strategy. Below, the Goldman Sachs Fundamental Equity U.S. Equity Team discusses the Goldman Sachs Mid Cap Growth Fund’s (the “Fund”) performance and positioning for the 12-month period ended August 31, 2022 (the “Reporting Period”).

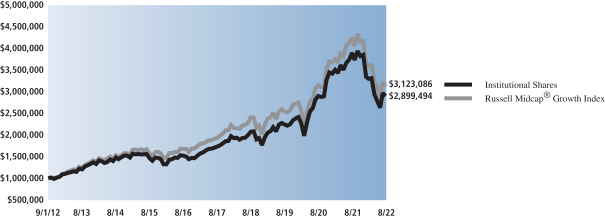

| Q | How did the Fund perform during the Reporting Period? |

| A | During the Reporting Period, the Fund’s Class A, Class C, Institutional, Service, Investor, Class R6, Class R and Class P Shares generated average annual total returns, without sales charges, of -25.93%, -26.40%, -25.69%, -26.06%, -25.79%, -25.69%, -26.10% and -25.68%, respectively. These returns compare to the -26.69% average annual total return of the Fund’s benchmark, the Russell Midcap® Growth Index (with dividends reinvested) (the “Russell Index”), during the same period. |

| Q | What key factors were responsible for the Fund’s performance during the Reporting Period? |

| A | While absolute returns disappointed, the Fund outperformed the Russell Index on a relative basis during the Reporting Period due primarily to stock selection overall. Sector allocation as a whole detracted modestly from relative performance. |

| Q | Which equity market sectors most significantly affected Fund performance? |

| A | The sectors that contributed most positively to the Fund’s relative performance during the Reporting Period were consumer staples, consumer discretionary and health care, wherein effective stock selection drove results. Having an overweight to consumer staples, which outperformed the Russell Index during the Reporting Period, and having an underweight to consumer discretionary, which underperformed the Russell Index during the Reporting Period, also boosted the Fund’s relative results. The sectors that detracted most from the Fund’s relative performance during the Reporting Period were materials, energy and financials. Stock selection proved especially challenging in the materials sector. Sector allocation positioning in energy and financials hurt most. |

| Q | What were some of the Fund’s best-performing individual stocks? |

| A | The Fund benefited most relative to the Russell Index from positions in ON Semiconductor, Palo Alto Networks and Pioneer Natural Resources. |

| ON Semiconductor engages in the design, manufacture and marketing of a portfolio of semiconductor components. The year 2021 was an impressive one for many semiconductor firms, and ON Semiconductor was a beneficiary. Its performance in the fourth quarter of 2021 was driven by a strong beat of consensus expectations and raised guidance on |

18

PORTFOLIO RESULTS

| earnings as well as by margins and top-line revenue growing organically amid ongoing supply-chain constraints. In June 2022, it was announced the company would be joining the S&P 500 Index, which drove its returns higher still. Strength in its results was also supported by strong performance in the auto and industrial end-markets. At the end of the Reporting Period, we continued to view the company as one of our favorite semiconductor names in the mid-cap universe. |

| A largely positive earnings report drove the stock of network security solutions provider Palo Alto Networks higher in late August 2021, just before the start of the Reporting Period. Accelerated billings growth and total revenue both saw better than consensus expected results unfold. Then, another largely positive earnings report drove the stock higher in late February 2022. Billing growth continued to accelerate on the back of its next generation security business, while its other business segments and customer expansion surprised on the upside as well. Further, in August 2022, the company posted its fiscal fourth quarter 2022 earnings, reporting billings growth ahead of guidance and consensus estimates. The strong results were driven by continued strength of its next generation security business. It had become evident to us that companies are increasing their demand for firewalls, as they scramble to protect their businesses and data from digital threats. At the end of the Reporting Period, we continued to believe Palo Alto Network’s strong pipeline will feed the business, and its recent management changes reflected the company’s focus on securing larger customers going forward while adding accretive incremental operating margin. |

| The strong performance of oil and gas exploration and production company Pioneer Natural Resources was supported by subdued oil production, high and improving demand, and new geopolitical tensions fueled by the war in Ukraine. Another point of optimism supporting its stock was that the company is committed to return 75% of its free cash flow in the form of distributions. We believed the company’s healthy balance sheet and efficient production would likely continue to drive performance and keep its earnings in line with market expectations. In our view, the company’s cash yield of approximately 15% also remained attractive. However, given a more scrutinized operating environment for exploration and production companies along with potential political intervention, in the context of the entirety of the Fund’s portfolio, we opted to sell the position, taking profits. |

| Q | Which stocks detracted significantly from the Fund’s performance during the Reporting Period? |

| A | Detracting most from the Fund’s results relative to the Russell Index were positions in DocuSign, Affirm Holdings and Guardant Health. |

| Cloud-based electronic signature solutions provider DocuSign reported strong third quarter 2021 earnings in November 2021, yet they were not as exceptional as investors had expected. Even though its billings had increased 28% year over year, the company missed its own estimates while also issuing fourth quarter 2021 guidance that was lower than consensus estimates. Further, the company reported earnings in line with estimates for the fourth quarter of 2021 but provided guidance that missed consensus estimates. It seemed DocuSign’s exceptional COVID-19 pandemic-fueled earnings may be slowing, so, ultimately, we exited the Fund’s position for what we saw as better risk/reward opportunities. |

| Financial technology company Affirm Holdings, a new purchase for the Fund during the Reporting Period, originally suffered during the Reporting Period from the widespread reversal away from high growth companies as interest rate hikes waned on valuations. Then, its shares declined following its fourth quarter 2021 earnings release in February 2022, which featured better than consensus revenue and gross merchandise value (“GMV”) results, but its forward guidance concerned investors with its management pointing out a potential step down in GMV results and elevated transaction costs. Regarding transaction costs, the company’s long-term target on revenue excluding these costs as a percentage of GMV had not changed, which we viewed as a favorable sign. However, the company struggled amid macroeconomic headwinds, such as record level inflation, rising interest rates and decreased consumer spending, which together raised concerns about subprime credit lending and profitability. We had established a Fund position in Affirm Holdings earlier in the Reporting Period and despite the firm’s strong earnings and exclusive partnership to grow its GMV, we ultimately sold the position in favor a what we saw as a better risk/reward opportunity. |

| Shares of Guardant Health, a precision oncology treatment company, depreciated during the fourth quarter of 2021 due to no particular fundamental driver. We continued to like the company, as it reported a solid quarterly result and provided positive updates on its research and development progress. However, in May 2022, a poor earnings report caused the stock to face significant pressures. Our investment thesis |

19

PORTFOLIO RESULTS

| became invalidated, and we ultimately decided to sell the name at that time to pursue what we viewed as more attractive investment opportunities. |

| Q | How did the Fund use derivatives and similar instruments during the Reporting Period? |

| A | During the Reporting Period, we did not use derivatives as part of an active management strategy. |

| Q | Did the Fund make any significant purchases or sales during the Reporting Period? |

| A | We initiated a Fund position in medical device manufacturing company DexCom during the Reporting Period. The company’s glucose monitoring systems are potentially considered best-in-class among comparable products, and its newest product, G7, was recently approved for use in Europe, with U.S. approval likely to come within the next year or so. |

| We re-established a Fund position in analytical laboratory instrument manufacturing company Mettler-Toledo International during the Reporting Period. The company had targeted toward increasing its growth in China for 2022, as it had a very limited COVID-19 revenue benefit, leading to no overhang of a revenue cliff. (A revenue, or patent, cliff is a colloquialism to denote the potential sharp decline in revenues upon patent expiration of one or more leading products of a firm. A patent cliff is when a firm’s revenues could “fall off a cliff” when one or more established products go off-patent, since these products can be replicated and sold at much cheaper prices by competitors.) We re-initiated the Fund’s position in the company on the pullback and intend to continue to look for opportunities to further rebuild the position. |

| Conversely, in addition to those sales mentioned earlier, we exited the Fund’s position in software solutions provider Splunk during the Reporting Period. While we still liked the company, we decided to allocate resources to what we considered to be more attractive risk/reward opportunities elsewhere. |

| Q | Were there any changes to the Fund’s portfolio management team during the Reporting Period? |

| A | There were no changes to the Fund’s portfolio management team during the Reporting Period. |

| Q | Were there any notable changes in the Fund’s weightings during the Reporting Period? |

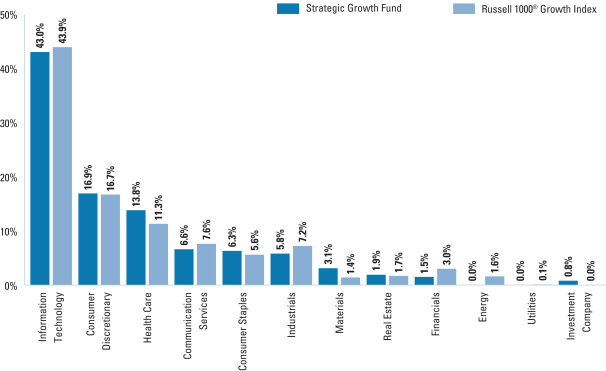

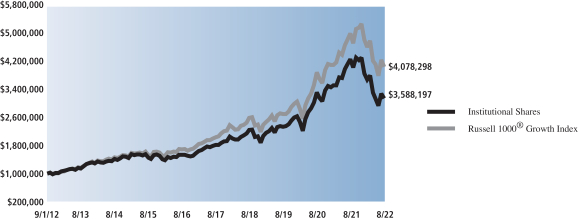

| A | In constructing the Fund’s portfolio, we focus on picking stocks rather than on making industry or sector bets. We seek to outpace the benchmark index by overweighting stocks that we expect to outperform and underweighting those that we think may lag. Consequently, changes in its sector weights are generally the direct result of individual stock selection or of stock appreciation or depreciation. That said, during the Reporting Period, the Fund’s exposure to consumer discretionary, health care, industrials and real estate increased and its allocations to communication services, consumer staples, information technology and materials decreased relative to the Russell Index. |

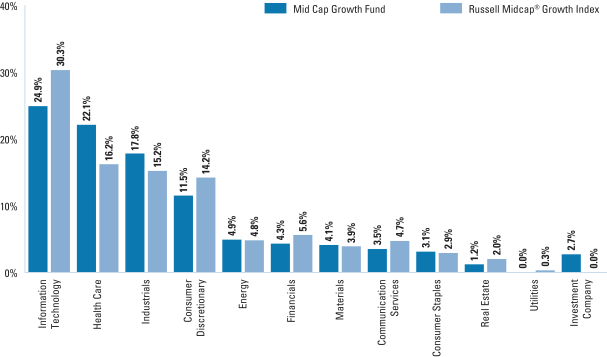

| Q | How was the Fund positioned relative to its benchmark index at the end of August 2022? |