Summary

Prospectus

Prospectus

February 28, 2022

Goldman Sachs International Equity ESG Fund

Class A: GSIFX Class C:

GSICX Institutional: GSIEX Service: GSISX Investor: GIRNX Class R6:GSIWX

Before you invest, you may want to review the Goldman Sachs International Equity ESG Fund (the “Fund”) Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, reports to shareholders and other information about the Fund online at www.gsamfunds.com/mutualfunds. You can also get this information at no cost by calling 800-621-2550 for Institutional, Service and Class R6 shareholders, 800-526-7384 for all other shareholders or by sending an e-mail request to gs-funds-document-requests@gs.com. The Fund’s Prospectus and Statement of Additional Information (“SAI”), both dated February 28, 2022, are incorporated by reference into this Summary Prospectus.

| Investment Objective |

The Goldman Sachs International Equity ESG Fund (the "Fund") seeks long-term capital appreciation.

| Fees and Expenses of the Fund |

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund.

You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table and Example below. You may qualify

for sales charge discounts on purchases of Class A Shares

if you invest at least $50,000 in Goldman Sachs Funds. More information about these and other discounts is available from your financial

professional and in “Shareholder Guide—Common Questions Applicable to the

Purchase of Class A Shares” beginning on page 36 and in Appendix C—Additional Information About Sales Charge Variations, Waivers and Discounts on page 73 of the Prospectus and “Other Information Regarding Maximum Sales Charge, Purchases, Redemptions, Exchanges and Dividends” beginning on page B-145 of the Fund’s Statement of

Additional Information (“SAI”).

Shareholder Fees

(fees paid

directly from your investment)

| |

Class A |

Class C |

Institutional |

Service |

Investor |

Class R6 |

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

5.50% |

None |

None |

None |

None |

None |

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of original purchase price or sale proceeds)1

|

None |

1.00% |

None |

None |

None |

None |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| |

Class A |

Class C |

Institutional |

Service |

Investor |

Class R6 |

| Management Fees |

0.85% |

0.85% |

0.85% |

0.85% |

0.85% |

0.85% |

| Distribution and/or Service (12b-1) Fees |

0.25% |

0.75% |

None |

0.25% |

None |

None |

| Other Expenses |

0.37% |

0.62% |

0.25% |

0.50% |

0.37% |

0.24% |

| Service Fees |

None |

0.25% |

None |

None |

None |

None |

| Shareholder Administration Fees |

None |

None |

None |

0.25% |

None |

None |

| All Other Expenses |

0.37% |

0.37% |

0.25% |

0.25% |

0.37% |

0.24% |

| Total Annual Fund Operating Expenses |

1.47% |

2.22% |

1.10% |

1.60% |

1.22% |

1.09% |

| Fee Waiver and Expense Limitation2

|

(0.29)% |

(0.29)% |

(0.24)% |

(0.24)% |

(0.29)% |

(0.24)% |

| Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation |

1.18% |

1.93% |

0.86% |

1.36% |

0.93% |

0.85% |

1

A contingent deferred sales charge (“CDSC”) of 1% is

imposed on Class C Shares redeemed within 12 months of purchase.

2

The Investment Adviser has agreed to: (i) waive a portion of its

management fee payable by the Fund in order to achieve an effective net management fee rate of 0.82% as an annual percentage of the Fund’s

average daily net assets; and (ii) reduce or limit “Other Expenses” (excluding acquired fund fees and expenses, transfer agency fees and

expenses, service fees, shareholder administration fees, taxes, interest, brokerage fees, expenses of shareholder meetings, litigation and

indemnification, and extraordinary expenses) to 0.004% of the Fund’s average daily net assets. Additionally, Goldman Sachs & Co. LLC

(“Goldman Sachs”), the Fund’s transfer agent, has agreed to waive a portion of its transfer agency fee (a component of “Other

Expenses”) equal to 0.05% as an annual percentage rate of the average daily net assets attributable to Class A, Class C, and Investor Shares of

the Fund. These arrangements will remain in effect through at least February 28, 2023, and prior to such date, the Investment Adviser and Goldman Sachs

may not terminate the arrangements without the approval of the Board of Trustees.

2 Summary Prospectus — Goldman Sachs International Equity ESG Fund

| Expense Example |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing

in other mutual funds.

The Example assumes that you invest $10,000 in Class A, Class C, Institutional, Service, Investor and/or Class R6 Shares of the Fund for the time periods indicated and

then redeem all of your Class A, Class C, Institutional, Service, Investor and/or Class R6 Shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the

Fund’s operating expenses remain the same (except that the Example incorporates any applicable fee waiver and/or expense limitation arrangements for only the first year). Although your actual costs may be higher or

lower, based on these assumptions your costs would be:

| |

1 Year |

3 Years |

5 Years |

10 Years |

| Class A Shares |

$664 |

$963 |

$1,284 |

$2,190 |

| Class C Shares |

$296 |

$667 |

$1,165 |

$2,534 |

| Institutional Shares |

$88 |

$327 |

$584 |

$1,322 |

| Service Shares |

$139 |

$482 |

$850 |

$1,883 |

| Investor Shares |

$95 |

$359 |

$644 |

$1,454 |

| Class R6 Shares |

$87 |

$324 |

$579 |

$1,310 |

| Class C Shares – Assuming no

redemption |

$196 |

$667 |

$1,165 |

$2,534 |

| Portfolio Turnover |

The Fund pays transaction costs when it buys and sells securities or instruments (i.e., “turns over” its portfolio). A high rate of portfolio turnover may result in increased transaction costs, including brokerage commissions, which must be borne

by the Fund and its shareholders, and is also likely to result in higher short-term capital gains for taxable shareholders. These costs are not reflected in the annual fund operating expenses or in the expense

example above, but are reflected in the Fund’s performance. The Fund’s portfolio turnover rate for the fiscal year ended October 31, 2021 was 39% of the average value of its portfolio.

| Principal Strategy |

The Fund invests, under normal circumstances, at least 80% of its net assets plus any borrowings for

investment purposes (measured at the time of purchase) (“Net Assets”) in a diversified portfolio of equity investments in non-U.S. issuers that the Investment Adviser believes adhere to the Fund’s

environmental, social and governance (“ESG”) criteria. Such equity investments may include exchange-traded funds (“ETFs”), futures and other instruments with similar economic exposures. The Fund intends to

have investments economically tied to at least three countries, not including the United States, and may invest in the securities of issuers in emerging market countries.

The Fund seeks to achieve its investment objective by investing, under normal circumstances, in approximately 30-50 companies that are considered by the Investment Adviser to be

positioned for long-term capital appreciation.

The Fund’s ESG criteria are generally designed to exclude companies that are directly engaged in,

and/or derive significant revenue from, certain industries or product lines, including, but not

limited to:

◼

alcohol;

◼

tobacco;

◼

gambling;

◼

adult entertainment;

◼

for-profit

prisons;

◼

weapons;

◼

oil and gas exploration and production;

◼

thermal coal mining; and

◼

thermal coal power generation.

In determining whether a company is directly engaged in, and/or derives significant revenue from, the

industries or product lines listed above, the Fund will use revenue thresholds for certain industries or product lines (e.g., companies that derive more than 5% of revenue from tobacco) and categorical exclusions for other

industries or product lines (e.g., companies that derive any revenue from controversial weapons) and apply such thresholds and exclusions to data provided by one or more third-party vendor(s). Generally, the

highest revenue threshold used will be 5%. The Investment Adviser, in its sole discretion, retains the right not to use data provided by third-party vendors where it deems the data to be not representative of a

company’s current business operations. In such cases, or where data on specific companies may not be available from third-party vendors, the Investment Adviser may make reasonable estimates or otherwise exercise its

discretion. The Fund’s ESG criteria may be updated periodically to, among other things, add or remove certain industries or product lines from the screening process, revise the revenue thresholds and

categorical exclusions applicable to such activities, or change particular industries or product lines from a categorical exclusion to a revenue threshold, or vice versa.

Once the Investment Adviser determines that an issuer meets the Fund’s ESG criteria, the Investment Adviser conducts a supplemental analysis of individual companies’

corporate governance factors and a range of environmental and social factors that may vary by sector. This supplemental analysis will be conducted alongside traditional fundamental, bottom-up financial analysis of

individual companies, using traditional fundamental metrics.

The Investment Adviser may engage in active dialogues with company management teams to further inform investment decision-making and to foster best corporate governance

practices using its fundamental and ESG analysis. The Fund may invest in a company prior to completion of the supplemental analysis or without engaging with company management. Instances in which the supplemental

analysis may not be completed prior to investment include but are not limited to initial

public offerings (“IPOs”), in-kind transfers, corporate actions, and/or certain

short-term holdings.

The Investment Adviser may sell holdings for several reasons, including, among others, changes in a company’s fundamentals or earnings, a company no longer

meeting the Fund’s ESG criteria, or a company otherwise failing to conform to the Investment Adviser’s investment philosophy.

The Fund

expects to invest a substantial portion of its assets in the securities of issuers located in the developed countries of Western Europe and in Japan, but may also invest in securities of issuers located in emerging market countries.

The Fund’s investments in a particular developed country may exceed 25% of its

investment portfolio.

The Fund may also invest up to 20% of its Net Assets in equity investments that may not adhere to the Fund’s ESG criteria and in fixed income securities, such as

government, corporate and bank debt obligations.

The Fund’s performance benchmark index is the Morgan Stanley Capital International (MSCI) Europe,

Australasia, Far East (EAFE) Index (Net, USD, Unhedged).

3 Summary Prospectus — Goldman Sachs International Equity ESG Fund

| Principal Risks of the Fund |

Loss of money is a risk of investing in the Fund.

An investment in the Fund is not a bank deposit and is not

insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any government agency. The Fund should not be relied upon as a complete investment program. There can be no assurance that the Fund

will achieve its investment objective. Investments in the Fund involve substantial risks which prospective investors should consider carefully before investing. The Fund's principal risks are presented

below in alphabetical order, and not in the order of importance or potential exposure.

ESG Standards Risk. The Fund’s adherence to its ESG criteria and the application of the Investment Adviser’s

supplemental ESG analysis when selecting investments generally will affect the Fund’s exposure to certain companies, sectors, regions, and countries and may affect the Fund’s performance depending

on whether such investments are in or out of favor. For example, the Fund generally will not seek to invest in companies that the Investment Adviser believes have adverse social or environmental impacts (e.g.,

alcohol, tobacco, gambling, adult entertainment, oil and gas, coal or weapons companies). Adhering to the ESG criteria and applying the Investment Adviser’s supplemental ESG analysis may also affect the

Fund’s performance relative to similar funds that do not adhere to such criteria or apply such analysis. Additionally, the Fund’s adherence to the ESG criteria and the application of the supplemental ESG analysis in

connection with identifying and selecting equity investments in non-U.S. issuers often require more subjective analysis and may be relatively more difficult than applying the ESG criteria or the supplemental ESG

analysis to equity investments of all issuers because data availability may be more limited with respect to non-U.S. issuers. When assessing whether an issuer meets the Fund’s ESG criteria and conducting an

ESG analysis of an issuer, the Investment Adviser generally will rely on third-party data that it believes to be reliable, but it does not guarantee the accuracy of such third-party data. ESG information

from third-party data providers may be incomplete, inaccurate or unavailable and may vary significantly from one third-party data provider to another, which may adversely impact the investment process. Certain

investments may be dependent on U.S. and foreign government policies, including tax incentives and subsidies, which may change without notice. The Fund’s ESG criteria and the application of the

supplemental ESG analysis may be changed without shareholder approval.

Foreign and Emerging Countries Risk. Foreign securities may be subject to risk of loss because of more or less foreign government regulation; less public information;

less stringent investor protections; less stringent accounting, corporate governance, financial reporting and disclosure standards; and less economic, political and social stability in the countries in which the Fund

invests. The imposition of exchange controls (including repatriation restrictions), sanctions, confiscations, trade restrictions (including tariffs) and other government restrictions by the United States and other

governments, or from problems in share registration, settlement or custody, may also result in losses. Foreign risk also involves the risk of negative foreign currency exchange rate fluctuations, which may cause the value

of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly

over short periods of time. These risks may be more pronounced in connection with the Fund’s investments in securities of issuers located in, or otherwise economically tied to, emerging countries.

Foreign Custody Risk. The Fund may hold foreign securities and cash with foreign banks, agents, and securities depositories

appointed by the Fund’s custodian (each a “Foreign Custodian”). Some Foreign

Custodians may be recently organized or new to the foreign custody business. In some

countries, Foreign Custodians may be subject to little or no regulatory oversight over or independent evaluation of their operations. Further, the laws of certain countries may place limitations on the Fund’s ability to

recover its assets if a Foreign Custodian enters bankruptcy. Investments in emerging markets may be subject to even greater custody risks than investments in more developed markets. Custody services in emerging market

countries are very often underdeveloped and may be considerably less well regulated than in

more developed countries, and thus may not afford the same level of investor protection as

would apply in developed countries.

Issuer Concentration Risk. The Fund intends to invest in up to approximately 50 companies. This relatively small number of issuers

may subject the Fund to greater risks, because a decline in the value of any single

investment held by the Fund may adversely affect the Fund’s overall value more than it would affect that of a fund holding a greater number of investments.

Large Shareholder Transactions Risk. The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund.

Such large shareholder redemptions, which may occur rapidly or unexpectedly, may cause the

Fund to sell portfolio securities at times when it would not otherwise do so, which may

negatively impact the Fund's net asset value ("NAV") and liquidity. Similarly, large Fund share purchases may adversely affect the Fund's performance to the extent that the Fund is delayed in investing new cash or

otherwise maintains a larger cash position than it ordinarily would. These transactions may also accelerate the realization of taxable income to shareholders if such sales of investments resulted in gains, and may also increase

transaction costs. In addition, a large redemption could result in the Fund's current expenses being allocated over a smaller asset base, leading to an increase in the Fund's expense ratio.

Market Risk. The value of the securities in which the Fund invests may go up or down in response to the prospects of individual companies, particular sectors or governments

and/or general economic conditions throughout the world due to increasingly interconnected global economies and financial markets. Events such as war, acts of terrorism, social unrest, natural disasters,

the spread of infectious illness or other public health threats could also significantly impact the Fund and its investments.

Sector Risk. To the extent the Fund focuses its investments in securities of issuers in one or more sectors (such as

the financial services or telecommunications sectors), the Fund will be subject, to a greater

extent than if its investments were diversified across different sectors, to the risks of

volatile economic cycles and/or conditions and developments that may be particular to that sector, such as: adverse economic, business, political, environmental or other developments.

Stock Risk. Stock prices have historically risen and fallen in periodic cycles. U.S. and foreign stock markets have experienced periods of substantial price volatility in

the past and may do so again in the future.

| Performance |

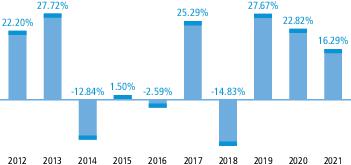

The bar chart and table below provide an indication of the risks of investing in the Fund by showing: (a)

changes in the performance of the Fund’s Class A Shares from year to year; and (b) how the average annual total returns of the Fund’s Class A, Class C, Institutional, Service, Investor and Class R6

Shares compare to those of a

4 Summary Prospectus — Goldman Sachs International Equity ESG Fund

broad-based securities market index. Through February 27, 2018, the Fund had been known as the Goldman Sachs Focused International Equity Fund, and certain of its strategies differed. Performance information set forth below reflects the

Fund’s former strategies prior to that date. The Fund’s past performance, before

and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available at no cost at www.gsamfunds.com/performance or by calling the appropriate phone number on the back cover of the Prospectus.

The bar chart (including “Best Quarter” and “Worst Quarter” information) does not reflect the sales loads applicable to Class A Shares. If the sales loads were

reflected, returns would be less. Performance reflects applicable fee

waivers and/or expense limitations in effect during the periods shown.

CALENDAR YEAR (CLASS A)

| During the periods shown in the chart above: |

Returns |

Quarter ended |

| Best Quarter Return |

21.69% |

December 31, 2020 |

| Worst Quarter Return |

-22.65% |

March 31, 2020 |

| AVERAGE ANNUAL TOTAL RETURN For the period ended December 31, 2021

|

|

|

|

|

| 1 Year |

5 Years |

10 Years |

Inception Date | |

| Class A Shares |

|

|

|

12/1/1992 |

| Returns Before Taxes |

9.89% |

12.97% |

9.48% |

|

| Returns After Taxes on Distributions |

7.90% |

12.44% |

9.09% |

|

| Returns After Taxes on Distributions and Sale of Fund Shares |

6.57% |

10.35% |

7.81% |

|

| Class C Shares |

|

|

|

8/15/1997 |

| Returns Before Taxes |

14.28% |

13.41% |

9.29%*

|

|

| Institutional Shares |

|

|

|

2/7/1996 |

| Returns Before Taxes |

16.67% |

14.65% |

10.52% |

|

| Service Shares |

|

|

|

3/6/1996 |

| Returns Before Taxes |

16.12% |

14.12% |

9.99% |

|

| Investor Shares |

|

|

|

8/31/2010 |

| Returns Before Taxes |

16.60% |

14.54% |

10.39% |

|

| Class R6 Shares |

|

|

|

2/26/2016 |

| Returns Before Taxes |

16.70%** |

14.68%** |

10.53%** |

|

| MSCI EAFE Index (Net, USD, Unhedged; reflects no deduction for fees or expenses) |

11.26% |

9.54% |

8.02% |

|

*

Class C Shares automatically convert into Class A Shares eight

years after the purchase date. The 10-Year performance for Class C Shares does not reflect the conversion to Class A Shares after the first eight years

of performance.

**

Class R6 Shares commenced operations on February 26, 2016. Prior

to that date, the performance of Class R6 Shares shown in the table above is that of Institutional Shares. Performance has not been adjusted to reflect

the lower expenses of Class R6 Shares. Class R6 Shares would have had higher returns because: (i) Institutional Shares and Class R6 Shares represent

interests in the same portfolio of securities; and (ii) Class R6 Shares have lower expenses.

The after-tax returns are for Class A Shares only. The

after-tax returns for Class C, Institutional, Service, Investor and Class R6 Shares will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are

5 Summary Prospectus — Goldman Sachs International Equity ESG Fund

not relevant to investors who hold Fund Shares through

tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

| Portfolio Management |

Goldman Sachs Asset Management, L.P. is the investment adviser for the Fund (the “Investment

Adviser” or “GSAM”).

Portfolio Managers: Alexis Deladerrière, CFA, Managing Director, has managed the Fund since 2012; and Abhishek Periwal, CFA, Vice President, has managed the Fund since

2018.

| Buying and Selling Fund Shares |

The minimum initial investment for Class A and Class C Shares is, generally, $1,000. The minimum initial

investment for Institutional Shares is, generally, $1,000,000 for individual or certain institutional investors, alone or in combination with other assets under the management of the Investment Adviser and

its affiliates. There is no minimum for initial purchases of Investor and Class R6 Shares, except for certain institutional investors who purchase Class R6 Shares directly with the Fund’s transfer

agent for which the minimum initial investment is $5,000,000. Those share classes with a minimum initial investment requirement do not impose it on certain employee benefit plans, and Institutional Shares do not impose it

on certain investment advisers investing on behalf of other accounts.

The minimum subsequent investment for Class A and Class C shareholders is $50, except for certain employee benefit plans, for which there is no minimum. There is no

minimum subsequent investment for Institutional, Investor or Class R6 shareholders.

The Fund does not impose minimum purchase requirements

for initial or subsequent investments in Service Shares, although an Intermediary (as defined

below) may impose such minimums and/or establish other requirements such as a minimum account

balance.

You may purchase and redeem (sell) shares of the Fund on any business day through certain intermediaries that have a relationship with Goldman Sachs, including banks, trust

companies, brokers, registered investment advisers and other financial institutions (“Intermediaries”).

| Tax Information |

The Fund’s distributions are taxable, and will be taxed as ordinary income or capital gains, unless

you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Investments through tax-deferred arrangements may become taxable upon withdrawal from such arrangements.

| Payments to Broker-Dealers and Other Financial Intermediaries |

If you purchase the Fund through an Intermediary, the Fund and/or its related companies may pay the

Intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the Intermediary and your salesperson to recommend the Fund over another investment. Ask your

salesperson or visit your Intermediary’s website for more information.

6 Summary Prospectus — Goldman Sachs International Equity ESG Fund

[This page

intentionally left blank]

7 Summary Prospectus — Goldman Sachs International Equity ESG Fund

[This page

intentionally left blank]

8 Summary Prospectus — Goldman Sachs International Equity ESG Fund

EQINTSUM1-22