UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| Caroline Kraus, Esq. | Copies to: | |

| Goldman Sachs & Co. LLC | Geoffrey R.T. Kenyon, Esq. | |

| 200 West Street | Dechert LLP | |

| New York, New York 10282 | 100 Oliver Street | |

| 40th Floor | ||

| Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: March 31

Date of reporting period: September 30, 2021

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| The Semi-Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| Semi-Annual Report | September 30, 2021 | |||

| Multi Sector Fixed Income Funds | ||||

| Bond | ||||

| Core Fixed Income | ||||

| Global Core Fixed Income | ||||

| Income | ||||

| Long Short Credit Strategies | ||||

| Strategic Income | ||||

Goldman Sachs Multi Sector Fixed Income Funds

| ∎ | BOND |

| ∎ | CORE FIXED INCOME |

| ∎ | GLOBAL CORE FIXED INCOME |

| ∎ | INCOME |

| ∎ | LONG SHORT CREDIT STRATEGIES |

| ∎ | STRATEGIC INCOME |

| 2 | ||||

| 15 | ||||

| 128 | ||||

| 135 | ||||

| 135 | ||||

| 143 | ||||

| 151 | ||||

| 158 | ||||

| 165 | ||||

| 172 | ||||

| 179 | ||||

| 212 | ||||

| NOT FDIC-INSURED | May Lose Value | No Bank Guarantee | ||

Goldman Sachs Multi-Sector Fixed Income Funds

The following are highlights both of key factors affecting the fixed income market and of any changes made to the Goldman Sachs Multi-Sector Fixed Income Funds (the “Funds”) during the six months ended September 30, 2021 (the “Reporting Period”). A fuller review of the market and these changes will appear in the Funds’ annual shareholder report covering the 12 months ended March 31, 2022.

Market and Economic Review

| ∎ | The broad U.S. fixed income market, as measured by the Bloomberg U.S. Aggregate Bond Index, posted a return of 1.88% during the Reporting Period, significantly underperforming the broad U.S. equity market. |

| ∎ | Early in the Reporting Period, global central banks generally remained accommodative, with the U.S. Federal Reserve (“Fed”) indicating it needed to see “substantial progress” on its employment and inflation goals before altering U.S. monetary policy. |

| ∎ | Remarkably strong U.S. inflation data, deemed “transitory” by the Fed, a disappointing U.S. jobs report released in April 2021 and the spread of the COVID-19 Delta variant suggested pandemic-related dynamics could continue distorting economic data as the Reporting Period progressed. |

| ∎ | In September 2021, as inflationary trends continued, driven by a sharp rise in energy prices and persistent supply-chain bottlenecks, developed markets central banks delivered or hinted at sooner than previously consensus expected policy normalization, with the Fed stating it might start raising interest rates during 2022 and the tapering of its asset purchases “may soon be warranted.” |

| ∎ | Shorter-term U.S. Treasury yields rose modestly during the Reporting Period overall, while intermediate- and longer-term U.S. Treasury yields fell moderately. |

| ∎ | Corporate bonds, both investment grade and high yield, outperformed U.S. Treasuries during the Reporting Period. So, too, did Treasury inflation protected securities and emerging markets debt. Securitized assets, including mortgage-backed securities and asset-backed securities, underperformed U.S. Treasuries during the Reporting Period. |

Fund Changes and Highlights

Goldman Sachs Bond Fund

| ∎ | Effective October 1, 2021, just after the close of the Reporting Period, Michael Swell no longer served as a portfolio manager for the Fund. Ashish Shah continues to serve as a portfolio manager for the Fund. |

Goldman Sachs Core Fixed Income Fund

| ∎ | Effective October 1, 2021, just after the close of the Reporting Period, Michael Swell no longer served as a portfolio manager for the Fund. Ashish Shah continues to serve as a portfolio manager for the Fund. |

Goldman Sachs Long Short Credit Strategies Fund

| ∎ | Effective July 29, 2021, the Fund’s benchmark index changed from the ICE Bank of America Merrill Lynch U.S. Dollar Three-Month LIBOR Constant Maturity Index to the ICE Bank of America Merrill Lynch Three-Month U.S. Treasury Bill Index. |

Goldman Sachs Strategic Income Fund

| ∎ | Effective July 29, 2021, the Fund’s benchmark index changed from the ICE Bank of America Merrill Lynch U.S. Dollar Three-Month LIBOR Constant Maturity Index to the ICE Bank of America Merrill Lynch Three-Month U.S. Treasury Bill Index. |

| ∎ | Effective October 1, 2021, just after the close of the Reporting Period, Michael Swell no longer served as a portfolio manager for the Fund. Ashish Shah continues to serve as a portfolio manager for the Fund. |

| ∎ | The Strategic Income Fund is a dynamic fund which may have large fluctuations in sector allocations within a time period. |

Goldman Sachs Income Fund

| ∎ | The Fund outperformed its relative benchmark due to the Fund’s overweight allocations to high yield and investment grade corporate bonds. Spread Sectors (High yield and investment grade corporate bond) remain generally resilient against rate market volatility and supply chain pressures. |

1

Bond Fund

as of September 30, 2021

| PERFORMANCE REVIEW |

| |||||||||||||||||

| April 1, 2021–September 30, 2021 | Fund Total Return (based on NAV)1 |

Bloomberg U.S. Aggregate Bond Index2 |

30-Day Standardized Subsidized Yield3 |

30-Day Standardized Unsubsidized Yield3 |

||||||||||||||

| Class A | 2.41 | % | 1.88 | % | 1.22 | % | 1.04 | % | ||||||||||

| Class C | 2.12 | 1.88 | 0.51 | 0.33 | ||||||||||||||

| Institutional | 2.67 | 1.88 | 1.59 | 1.41 | ||||||||||||||

| Service | 2.41 | 1.88 | 1.09 | 0.91 | ||||||||||||||

| Investor | 2.64 | 1.88 | 1.51 | 1.33 | ||||||||||||||

| Class R6 | 2.68 | 1.88 | 1.60 | 1.42 | ||||||||||||||

| Class R | 2.37 | 1.88 | 1.01 | 0.83 | ||||||||||||||

| Class P | 2.68 | 1.88 | 1.60 | 1.42 | ||||||||||||||

| 1 | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The Bloomberg U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds and mortgage-backed and asset-backed securities. The Index figure does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| 3 | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standardized Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect during the period shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

2

FUND BASICS

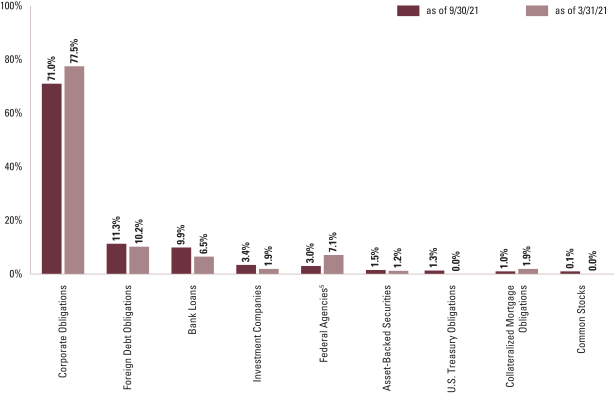

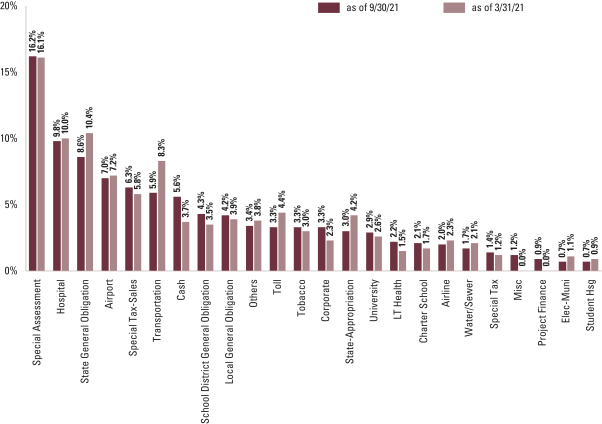

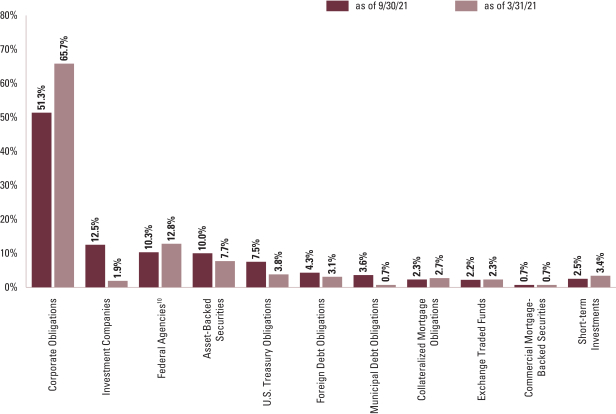

| FUND COMPOSITION4 |

| Percentage of Net Assets |

| 4 | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Short-term investments represent commercial paper. Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| 5 | “Federal Agencies” are mortgage-backed securities guaranteed by the Government National Mortgage Association (“GNMA”), Federal National Mortgage Association (“FNMA”) and Federal Home Loan Mortgage Corp. (“FHLMC”). GNMA instruments are backed by the full faith and credit of the U.S. Government. |

| 6 | “Agency Debentures” include agency securities offered by companies such as FNMA and FHLMC, which operate under a government charter. While they are required to report to a government regulator, their assets are not explicitly guaranteed by the government and they otherwise operate like any other publicly traded company. |

For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance.

3

FUND BASICS

Core Fixed Income Fund

as of September 30, 2021

| PERFORMANCE REVIEW |

| |||||||||||||||||

| April 1, 2021–September 30, 2021 | Fund Total Return (based on NAV)1 |

Bloomberg U.S. Aggregate Bond Index2 |

30-Day Standardized Subsidized Yield3 |

30-Day Standardized Unsubsidized Yield3 |

||||||||||||||

| Class A | 2.19 | % | 1.88 | % | 0.71 | % | 0.62 | % | ||||||||||

| Class C | 1.89 | 1.88 | -0.01 | -0.10 | ||||||||||||||

| Institutional | 2.35 | 1.88 | 1.07 | 0.98 | ||||||||||||||

| Service | 2.09 | 1.88 | 0.57 | 0.48 | ||||||||||||||

| Investor | 2.31 | 1.88 | 0.99 | 0.90 | ||||||||||||||

| Class R6 | 2.36 | 1.88 | 1.08 | 0.99 | ||||||||||||||

| Class R | 2.06 | 1.88 | 0.49 | 0.40 | ||||||||||||||

| Class P | 2.35 | 1.88 | 1.08 | 0.99 | ||||||||||||||

| 1 | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The Bloomberg U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds, and mortgage-backed and asset-backed securities. The Index figure does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| 3 | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standardized Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect during the period shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

4

FUND BASICS

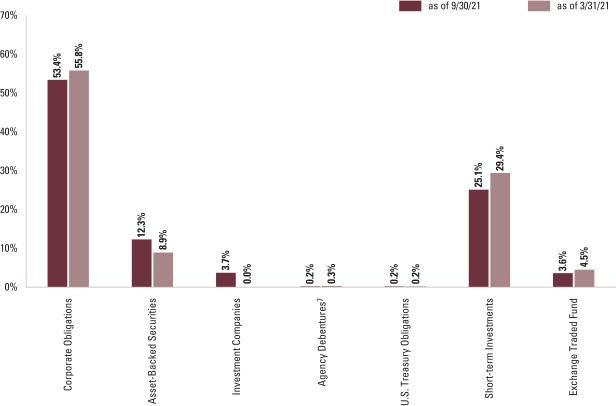

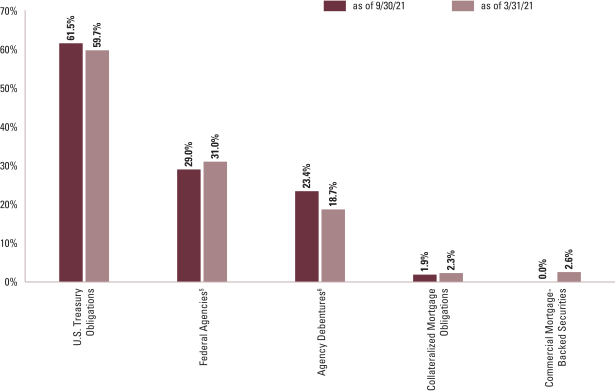

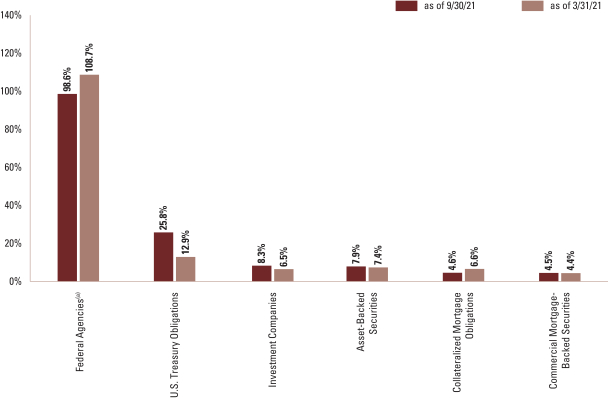

| FUND COMPOSITION4 |

| Percentage of Net Assets |

| 4 | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Short-term investments represent commercial paper. Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| 5 | “Federal Agencies” are mortgage-backed securities guaranteed by the Government National Mortgage Association (“GNMA”), Federal National Mortgage Association (“FNMA”) and Federal Home Loan Mortgage Corp. (“FHLMC”). GNMA instruments are backed by the full faith and credit of the U.S. Government. |

| 6 | “Agency Debentures” include agency securities offered by companies such as FNMA and FHLMC, which operate under a government charter. While they are required to report to a government regulator, their assets are not explicitly guaranteed by the government and they otherwise operate like any other publicly traded company. |

For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance.

5

FUND BASICS

Global Core Fixed Income Fund

as of September 30, 2021

| PERFORMANCE REVIEW |

| |||||||||||||||||

| April 1, 2021–September 30, 2021 | Fund Total Return (based on NAV)1 |

Bloomberg Global Aggregate Bond Index (Gross, USD, Hedged)2 |

30-Day Standardized Subsidized Yield3 |

30-Day Standardized Unsubsidized Yield3 |

||||||||||||||

| Class A | 1.32 | % | 1.06 | % | 0.39 | % | 0.15 | % | ||||||||||

| Class C | 0.95 | 1.06 | -0.34 | -0.59 | ||||||||||||||

| Institutional | 1.48 | 1.06 | 0.72 | 0.49 | ||||||||||||||

| Service | 1.15 | 1.06 | 0.22 | -0.01 | ||||||||||||||

| Investor | 1.45 | 1.06 | 0.66 | 0.41 | ||||||||||||||

| Class R6 | 1.48 | 1.06 | 0.73 | 0.50 | ||||||||||||||

| Class P | 1.48 | 1.06 | 0.73 | 0.50 | ||||||||||||||

| 1 | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The Bloomberg Global Aggregate Bond Index (Gross, USD, Hedged), an unmanaged index, provides a broad based measure of the global investment-grade fixed-rate debt markets and covers the most liquid portion of the global investment grade fixed-rate bond market, including government, credit and collateralized securities. The Index figures do not include any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| 3 | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standardized Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect during the period shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

6

FUND BASICS

| CURRENCY ALLOCATION4 |

| |||||||||

| Percentage of Net Assets | ||||||||||

| as of 9/30/21 | as of 3/31/21 | |||||||||

| U.S. Dollar | 53.6 | % | 62.2 | % | ||||||

| Euro | 20.5 | 17.8 | ||||||||

| Japanese Yen | 12.1 | 17.0 | ||||||||

| Chinese Yuan Renminbi | 6.9 | 5.4 | ||||||||

| British Pound | 3.4 | 2.3 | ||||||||

| Canadian Dollar | 1.2 | 1.2 | ||||||||

| Thai Baht | 0.9 | 1.0 | ||||||||

| South Korean Won | 0.8 | 0.9 | ||||||||

| Indonesian Rupiah | 0.3 | 0.2 | ||||||||

| Singapore Dollar | 0.2 | 0.2 | ||||||||

| Israeli Shekel | 0.1 | 0.1 | ||||||||

| Russian Ruble | 0.1 | 0.1 | ||||||||

| 4 | The percentage shown for each currency reflects the value of investments in that category as a percentage of net assets. Figures in the table may not sum to 100% due to the exclusion of other assets and liabilities. The table depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance.

7

FUND BASICS

Income Fund

as of September 30, 2021

| PERFORMANCE REVIEW |

| |||||||||||||||||

| April 1, 2021–September 30, 2021 | Fund Total Return (based on NAV)1 |

Bloomberg U.S. Aggregate Bond Index2 |

30-Day Standardized Subsidized Yield3 |

30-Day Standardized Unsubsidized Yield3 |

||||||||||||||

| Class A | 3.39 | % | 1.88 | % | 2.98 | % | 2.59 | % | ||||||||||

| Class C | 3.01 | 1.88 | 2.35 | 1.94 | ||||||||||||||

| Institutional | 3.56 | 1.88 | 3.43 | 3.02 | ||||||||||||||

| Investor | 3.52 | 1.88 | 3.35 | 2.95 | ||||||||||||||

| Class R6 | 3.57 | 1.88 | 3.44 | 3.03 | ||||||||||||||

| Class R | 3.27 | 1.88 | 2.85 | 2.45 | ||||||||||||||

| Class P | 3.57 | 1.88 | 3.43 | 3.02 | ||||||||||||||

| 1 | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The Bloomberg U.S. Aggregate Bond Index represents an unmanaged diversified portfolio of fixed income securities, including U.S. Treasuries, investment-grade corporate bonds, and mortgage-backed and asset-backed securities. The Index figure does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| 3 | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standardized Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects fee waivers and/or expense limitations in effect during the period shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

8

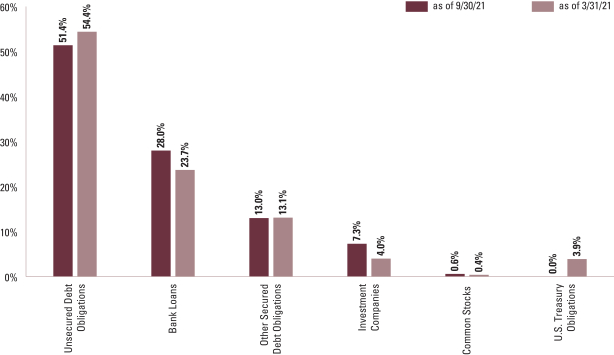

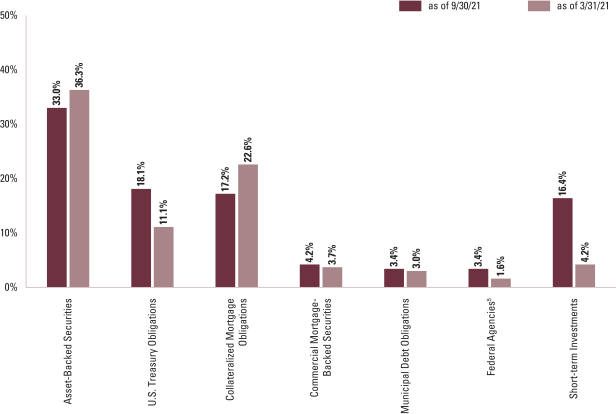

FUND BASICS

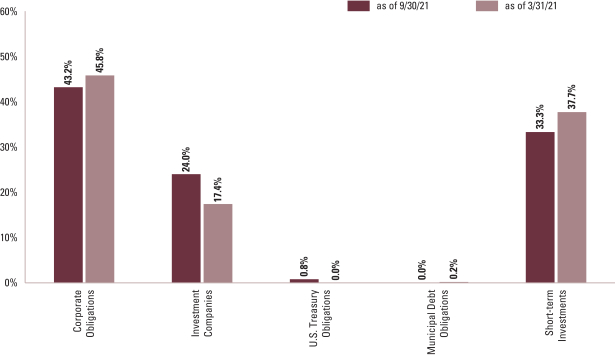

| FUND COMPOSITION4 |

| Percentage of Net Assets |

| 4 | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Short-term investments represent commercial paper. Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| 5 | “Federal Agencies” are mortgage-backed securities guaranteed by the Government National Mortgage Association (“GNMA”), Federal National Mortgage Association (“FNMA”) and Federal Home Loan Mortgage Corp. (“FHLMC”). GNMA instruments are backed by the full faith and credit of the U.S. Government. |

For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance.

9

FUND BASICS

Long Short Credit Strategies Fund

as of September 30, 2021

| PERFORMANCE REVIEW |

| |||||||||||||||||||||

| April 1, 2021–September 30, 2021 | Fund Total Return (based on NAV)1 |

ICE BofAML Three-Month U.S. Treasury Bill Index2 |

ICE BofAML U.S. Dollar Three-Month LIBOR Constant Maturity Index3 |

30-Day Standardized Subsidized Yield4 |

30-Day Standardized Unsubsidized Yield4 |

|||||||||||||||||

| Class A | 2.11 | % | 0.01 | % | 0.08 | % | 2.40 | % | 2.15 | % | ||||||||||||

| Class C | 1.73 | 0.01 | 0.08 | 1.74 | 1.49 | |||||||||||||||||

| Institutional | 2.28 | 0.01 | 0.08 | 2.82 | 2.56 | |||||||||||||||||

| Investor | 2.24 | 0.01 | 0.08 | 2.74 | 2.48 | |||||||||||||||||

| Class R6 | 2.28 | 0.01 | 0.08 | 2.83 | 2.57 | |||||||||||||||||

| Class R | 1.98 | 0.01 | 0.08 | 2.25 | 1.99 | |||||||||||||||||

| Class P | 2.28 | 0.01 | 0.08 | 2.83 | 2.57 | |||||||||||||||||

| 1 | The net asset value (“NAV”) represents the net assets of the Fund (ex-dividend) divided by the total number of shares outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The ICE BofAML Three-Month U.S. Treasury Bill Index, an unmanaged index, measures total return on cash, including price and interest income, based on short-term government Treasury Bills of about 90-day maturity, as reported by Bank of America Merrill Lynch, and does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

| 3 | The ICE BofAML U.S. Dollar Three-Month LIBOR Constant Maturity Index (the “BofA/Merrill Lynch Index”) tracks the performance of a synthetic asset paying LIBOR to a stated maturity. The BofA/Merrill Lynch Index is based on the assumed purchase at par of a synthetic instrument having exactly its stated maturity and with a coupon equal to that day’s fixing rate. That issue is assumed to be sold the following business day (priced at a yield equal to the current day fixing rate) and rolled into a new instrument. It is not possible to invest directly in an index. |

| 4 | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standardized Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

10

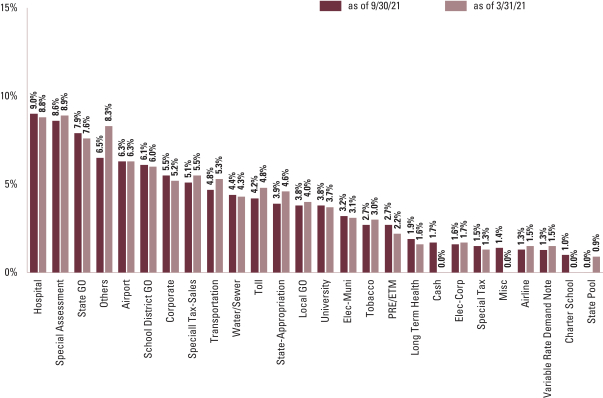

FUND BASICS

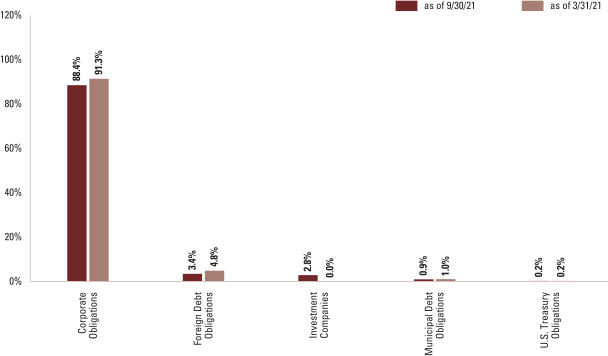

| FUND COMPOSITION4 |

| Percentage of Net Assets |

| 4 | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

11

FUND BASICS

| TOP TEN INDUSTRY ALLOCATIONS5 | ||||||

| As of September 30, 2021 | Percentage of Net Assets | |||||

| Media |

8.2 | % | ||||

| Oil Field Services |

5.8 | |||||

| Technology - Software |

4.6 | |||||

| Internet |

4.6 | |||||

| Retailing |

4.5 | |||||

| Commercial Services |

4.4 | |||||

| Pipelines |

4.3 | |||||

| Chemicals |

4.1 | |||||

| Diversified Financial Services |

4.0 | |||||

| Packaging |

3.5 | |||||

| 5 | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. The above table depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance.

12

FUND BASICS

Strategic Income Fund

as of September 30, 2021

| PERFORMANCE REVIEW |

| |||||||||||||||||||||

| April 1, 2021–September 30, 2021 | Fund Total Return (based on NAV)1 |

ICE BofAML Three-Month U.S. Treasury Bill Index2 |

ICE BofAML U.S. |

30-Day Standardized Subsidized Yield4 |

30-Day Standardized Unsubsidized Yield4 |

|||||||||||||||||

| Class A | 2.30 | % | 0.01 | % | 0.08 | % | 1.95 | % | 1.90 | % | ||||||||||||

| Class C | 1.90 | 0.01 | 0.08 | 1.30 | 1.26 | |||||||||||||||||

| Institutional | 2.44 | 0.01 | 0.08 | 2.35 | 2.31 | |||||||||||||||||

| Investor | 2.30 | 0.01 | 0.08 | 2.28 | 2.24 | |||||||||||||||||

| Class R6 | 2.45 | 0.01 | 0.08 | 2.37 | 2.32 | |||||||||||||||||

| Class R | 2.09 | 0.01 | 0.08 | 1.78 | 1.73 | |||||||||||||||||

| Class P | 2.45 | 0.01 | 0.08 | 2.37 | 2.32 | |||||||||||||||||

| 1 | The net asset value (NAV) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The ICE BofAML Three-Month U.S. Treasury Bill Index, an unmanaged index, measures total return on cash, including price and interest income, based on short-term government Treasury Bills of about 90-day maturity, as reported by Bank of America Merrill Lynch, and does not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an unmanaged index. |

| 3 | The ICE BofAML U.S. Dollar Three-Month LIBOR Constant Maturity Index (the “BofA/Merrill Lynch Index”) tracks the performance of a synthetic asset paying LIBOR to a stated maturity. The BofA/Merrill Lynch Index is based on the assumed purchase at par of a synthetic instrument having exactly its stated maturity and with a coupon equal to that day’s fixing rate. That issue is assumed to be sold the following business day (priced at a yield equal to the current day fixing rate) and rolled into a new instrument. It is not possible to invest directly in an index. |

| 4 | The method of calculation of the 30-Day Standardized Subsidized Yield is mandated by the Securities and Exchange Commission and is determined by dividing the net investment income per share earned during the last 30 days of the period by the maximum public offering price (“POP”) per share on the last day of the period. This number is then annualized. The 30-Day Standardized Subsidized Yield reflects fee waivers and/or expense reimbursements recorded by the Fund during the period. Without waivers and/or reimbursements, yields would be reduced. This yield does not necessarily reflect income actually earned and distributed by the Fund and, therefore, may not be correlated with the dividends or other distributions paid to shareholders. The 30-Day Standardized Unsubsidized Yield does not adjust for any fee waivers and/or expense reimbursements in effect. If the Fund does not incur any fee waivers and/or expense reimbursements during the period, the 30-Day Standardized Subsidized Yield and 30-Day Standardized Unsubsidized Yield will be identical. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the period shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

13

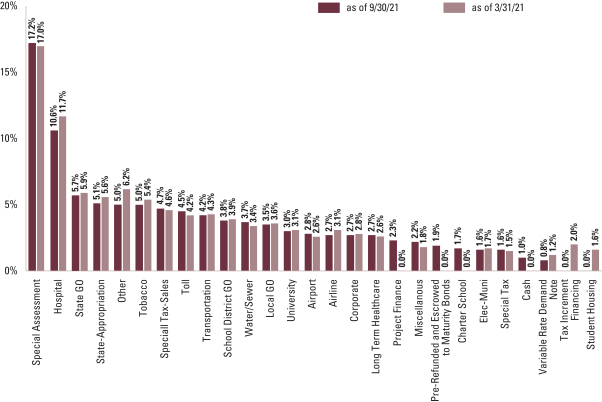

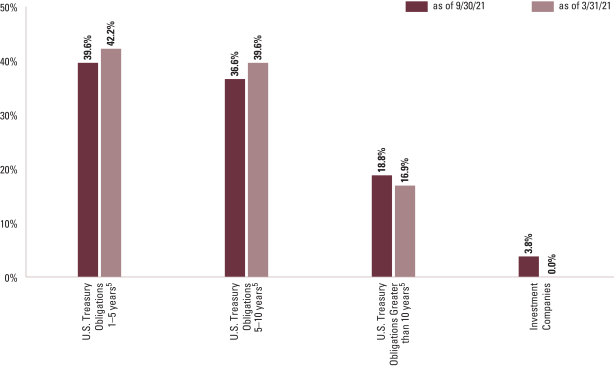

FUND BASICS

| FUND COMPOSITION4 |

| Percentage of Net Assets |

| 4 | The percentage shown for each investment category reflects the value of investments in that category as a percentage of net assets. Short-term investments represent commercial paper. Figures in the graph may not sum to 100% due to the exclusion of other assets and liabilities. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

| 5 | “Federal Agencies” are mortgage-backed securities guaranteed by the Government National Mortgage Association (“GNMA”), Federal National Mortgage Association (“FNMA”) and Federal Home Loan Mortgage Corp. (“FHLMC”). GNMA instruments are backed by the full faith and credit of the U.S. Government. |

For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance.

14

GOLDMAN SACHS BOND FUND

September 30, 2021 (Unaudited)

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||

| Corporate Obligations – 48.6% | ||||||||||||||

| Aerospace & Defense – 0.8% | ||||||||||||||

| General Dynamics Corp.(a) |

||||||||||||||

| $ | 65,000 | 3.250 | % | 04/01/25 | $ | 69,805 | ||||||||

| Howmet Aerospace, Inc.(a) |

||||||||||||||

| 1,160,000 | 3.000 | 01/15/29 | 1,167,250 | |||||||||||

| Northrop Grumman Corp.(a) |

||||||||||||||

| 815,000 | 2.930 | 01/15/25 | 863,183 | |||||||||||

| 25,000 | 4.030 | 10/15/47 | 29,424 | |||||||||||

| Raytheon Technologies Corp. |

||||||||||||||

| 475,000 | 3.950 | (a) | 08/16/25 | 523,227 | ||||||||||

| 10,000 | 5.700 | 04/15/40 | 13,713 | |||||||||||

| 100,000 | 4.050 | (a) | 05/04/47 | 116,078 | ||||||||||

| Spirit AeroSystems, Inc.(a)(b) |

||||||||||||||

| 495,000 | 7.500 | 04/15/25 | 524,081 | |||||||||||

| The Boeing Co.(a) |

||||||||||||||

| 50,000 | 3.250 | 02/01/35 | 50,145 | |||||||||||

| 25,000 | 3.375 | 06/15/46 | 24,073 | |||||||||||

| 25,000 | 3.850 | 11/01/48 | 25,533 | |||||||||||

| TransDigm, Inc.(a) |

||||||||||||||

| 166,000 | 6.250 | (b) | 03/15/26 | 173,055 | ||||||||||

| 575,000 | 6.375 | 06/15/26 | 594,406 | |||||||||||

|

|

|

|||||||||||||

| 4,173,973 | ||||||||||||||

|

|

|

|||||||||||||

| Agriculture – 0.3% | ||||||||||||||

| BAT Capital Corp.(a) |

||||||||||||||

| 840,000 | 3.222 | 08/15/24 | 890,879 | |||||||||||

| 25,000 | 4.758 | 09/06/49 | 26,882 | |||||||||||

| Reynolds American, Inc. |

||||||||||||||

| 700,000 | 4.850 | 09/15/23 | 757,876 | |||||||||||

|

|

|

|||||||||||||

| 1,675,637 | ||||||||||||||

|

|

|

|||||||||||||

| Airlines(a) – 0.0% | ||||||||||||||

| Southwest Airlines Co. |

||||||||||||||

| 60,000 | 5.250 | 05/04/25 | 67,905 | |||||||||||

|

|

|

|||||||||||||

| Apparel(a) – 0.0% | ||||||||||||||

| NIKE, Inc. |

||||||||||||||

| 65,000 | 2.400 | 03/27/25 | 68,273 | |||||||||||

|

|

|

|||||||||||||

| Automotive – 1.1% | ||||||||||||||

| American Honda Finance Corp. |

||||||||||||||

| 15,000 | 1.200 | 07/08/25 | 15,081 | |||||||||||

| BMW US Capital LLC(a)(b) |

||||||||||||||

| 30,000 | 3.625 | 04/18/29 | 33,431 | |||||||||||

| Ford Motor Co.(a) |

||||||||||||||

| 27,000 | 9.000 | 04/22/25 | 32,469 | |||||||||||

| Ford Motor Credit Co. LLC(a) |

||||||||||||||

| 476,000 | 2.700 | 08/10/26 | 477,262 | |||||||||||

| 330,000 | 2.979 | 08/03/22 | 333,698 | |||||||||||

| 650,000 | 4.140 | 02/15/23 | 666,267 | |||||||||||

| 839,000 | 3.625 | 06/17/31 | 847,447 | |||||||||||

| General Motors Co. |

||||||||||||||

| 425,000 | 5.400 | 10/02/23 | 463,611 | |||||||||||

| 225,000 | 4.000 | 04/01/25 | 244,786 | |||||||||||

| 35,000 | 6.600 | (a) | 04/01/36 | 47,035 | ||||||||||

| 35,000 | 5.150 | (a) | 04/01/38 | 41,700 | ||||||||||

| 50,000 | 5.950 | (a) | 04/01/49 | 66,099 | ||||||||||

| General Motors Financial Co., Inc.(a) |

||||||||||||||

| 300,000 | 4.300 | 07/13/25 | 328,716 | |||||||||||

|

|

|

|||||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Automotive – (continued) | ||||||||||||||

| General Motors Financial Co., Inc.(a) – (continued) |

||||||||||||||

| 125,000 | 5.650 | 01/17/29 | 150,303 | |||||||||||

| 500,000 | 2.350 | 01/08/31 | 490,035 | |||||||||||

| Hyundai Capital America |

||||||||||||||

| 70,000 | 2.750 | 09/27/26 | 72,562 | |||||||||||

| IHO Verwaltungs GmbH(a)(b)(c) (PIK 7.125%, Cash 6.375%) |

||||||||||||||

| 823,000 | 6.375 | 05/15/29 | 886,782 | |||||||||||

| Lear Corp.(a) |

||||||||||||||

| 30,000 | 5.250 | 05/15/49 | 37,160 | |||||||||||

| Toyota Motor Credit Corp. |

||||||||||||||

| 65,000 | 3.000 | 04/01/25 | 69,287 | |||||||||||

|

|

|

|||||||||||||

| 5,303,731 | ||||||||||||||

|

|

|

|||||||||||||

| Banks – 12.0% | ||||||||||||||

| ABN AMRO Bank NV(a)(d) (-1x 5 Year EUR Swap + 4.674%) |

||||||||||||||

| EUR | 400,000 | 4.375 | 12/31/99 | 497,511 | ||||||||||

| AIB Group PLC(b) |

||||||||||||||

| $ | 1,300,000 | 4.750 | 10/12/23 | 1,398,293 | ||||||||||

| Banco do Brasil SA(a)(d) (10 Year CMT + 4.398%) |

||||||||||||||

| 200,000 | 6.250 | 12/31/99 | 199,000 | |||||||||||

| Banco Santander SA |

||||||||||||||

| 800,000 | 2.746 | 05/28/25 | 838,808 | |||||||||||

| 600,000 | 4.250 | 04/11/27 | 673,908 | |||||||||||

| 200,000 | 2.749 | 12/03/30 | 198,656 | |||||||||||

| Bank of America Corp. |

||||||||||||||

| 425,000 | 4.200 | 08/26/24 | 464,848 | |||||||||||

| 1,300,000 | 3.248 | (a) | 10/21/27 | 1,403,220 | ||||||||||

| 925,000 | 4.183 | (a) | 11/25/27 | 1,030,579 | ||||||||||

| 100,000 | 6.110 | 01/29/37 | 134,841 | |||||||||||

| (3M USD LIBOR + 0.640%) |

||||||||||||||

| 40,000 | 2.015 | (a)(d) | 02/13/26 | 41,043 | ||||||||||

| (3M USD LIBOR + 0.810%) |

||||||||||||||

| 60,000 | 3.366 | (a)(d) | 01/23/26 | 64,111 | ||||||||||

| (3M USD LIBOR + 0.970%) |

||||||||||||||

| 65,000 | 3.458 | (a)(d) | 03/15/25 | 69,150 | ||||||||||

| (3M USD LIBOR + 0.990%) |

||||||||||||||

| 75,000 | 2.496 | (a)(d) | 02/13/31 | 75,897 | ||||||||||

| (3M USD LIBOR + 1.190%) |

||||||||||||||

| 525,000 | 2.884 | (a)(d) | 10/22/30 | 548,063 | ||||||||||

| (3M USD LIBOR + 1.310%) |

||||||||||||||

| 750,000 | 4.271 | (a)(d) | 07/23/29 | 850,432 | ||||||||||

| (3M USD LIBOR + 1.575%) |

||||||||||||||

| 525,000 | 3.824 | (a)(d) | 01/20/28 | 579,731 | ||||||||||

| (3M USD LIBOR + 1.814%) |

||||||||||||||

| 30,000 | 4.244 | (a)(d) | 04/24/38 | 35,055 | ||||||||||

| (5 year CMT + 1.200%) |

||||||||||||||

| 475,000 | 2.482 | (a)(d) | 09/21/36 | 465,225 | ||||||||||

| (SOFR + 1.220%) |

||||||||||||||

| 640,000 | 2.299 | (a)(d) | 07/21/32 | 630,925 | ||||||||||

| (SOFR + 1.530%) |

||||||||||||||

| 600,000 | 1.898 | (a)(d) | 07/23/31 | 577,488 | ||||||||||

| Barclays PLC(a)(d) |

||||||||||||||

| (3M USD LIBOR + 1.400%) |

||||||||||||||

| 1,275,000 | 4.610 | 02/15/23 | 1,294,495 | |||||||||||

| (SOFR + 2.714%) |

||||||||||||||

| 825,000 | 2.852 | 05/07/26 | 865,813 | |||||||||||

|

|

|

|||||||||||||

| The accompanying notes are an integral part of these financial statements. | 15 |

GOLDMAN SACHS BOND FUND

Schedule of Investments (continued)

September 30, 2021 (Unaudited)

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Banks – (continued) | ||||||||||||||

| BNP Paribas SA(b) |

||||||||||||||

| $ | 1,750,000 | 3.500 | % | 03/01/23 | $ | 1,824,060 | ||||||||

| 550,000 | 3.375 | 01/09/25 | 586,476 | |||||||||||

| (5 Year USD Swap + 4.149%) |

||||||||||||||

| 200,000 | 6.625 | (a)(d) | 12/31/99 | 217,306 | ||||||||||

| (SOFR + 1.004%) |

||||||||||||||

| 725,000 | 1.323 | (a)(d) | 01/13/27 | 713,480 | ||||||||||

| (SOFR + 2.074%) |

||||||||||||||

| 350,000 | 2.219 | (a)(d) | 06/09/26 | 359,251 | ||||||||||

| BPCE SA(b) |

||||||||||||||

| 1,025,000 | 4.000 | 09/12/23 | 1,090,303 | |||||||||||

| 525,000 | 4.625 | 09/12/28 | 605,509 | |||||||||||

| (SOFR + 1.312%) |

||||||||||||||

| 475,000 | 2.277 | (a)(d) | 01/20/32 | 461,306 | ||||||||||

| CaixaBank SA(a)(d) (-1X 5 Year EUR Swap + 6.346%) |

||||||||||||||

| EUR | 400,000 | 5.875 | 12/31/99 | 532,841 | ||||||||||

| CIT Bank NA(a)(d) (SOFR + 1.715%) |

||||||||||||||

| $ | 600,000 | 2.969 | 09/27/25 | 631,116 | ||||||||||

| Citigroup, Inc. |

||||||||||||||

| 780,000 | 3.500 | 05/15/23 | 817,011 | |||||||||||

| 1,050,000 | 3.400 | 05/01/26 | 1,143,009 | |||||||||||

| 125,000 | 4.300 | 11/20/26 | 140,540 | |||||||||||

| 1,125,000 | 4.450 | 09/29/27 | 1,279,474 | |||||||||||

| 475,000 | 4.125 | 07/25/28 | 530,504 | |||||||||||

| (3M USD LIBOR + 0.897%) |

||||||||||||||

| 65,000 | 3.352 | (a)(d) | 04/24/25 | 69,043 | ||||||||||

| (3M USD LIBOR + 1.023%) |

||||||||||||||

| 510,000 | 4.044 | (a)(d) | 06/01/24 | 539,452 | ||||||||||

| (SOFR + 0.669%) |

||||||||||||||

| 70,000 | 0.981 | (a)(d) | 05/01/25 | 70,267 | ||||||||||

| (SOFR + 1.422%) |

||||||||||||||

| 550,000 | 2.976 | (a)(d) | 11/05/30 | 578,495 | ||||||||||

| Citizens Financial Group, Inc.(a) |

||||||||||||||

| 65,000 | 2.850 | 07/27/26 | 69,064 | |||||||||||

| Commerzbank AG(a)(d) (-1x 5 Year EUR Swap + 6.363%) |

||||||||||||||

| EUR | 400,000 | 6.125 | 03/31/99 | 507,936 | ||||||||||

| Credit Agricole SA(a)(b)(d) |

||||||||||||||

| (5 Year USD Swap + 4.319%) |

||||||||||||||

| 250,000 | 6.875 | 12/31/99 | 278,088 | |||||||||||

| (SOFR + 1.676%) |

||||||||||||||

| $ | 375,000 | 1.907 | 06/16/26 | 381,701 | ||||||||||

| Credit Suisse AG |

||||||||||||||

| 300,000 | 2.950 | 04/09/25 | 318,048 | |||||||||||

| Credit Suisse Group AG |

||||||||||||||

| 307,000 | 4.550 | 04/17/26 | 344,979 | |||||||||||

| 875,000 | 4.282 | (a)(b) | 01/09/28 | 971,635 | ||||||||||

| (SOFR + 1.730%) |

||||||||||||||

| 385,000 | 3.091 | (a)(b)(d) | 05/14/32 | 394,656 | ||||||||||

| Deutsche Bank AG |

||||||||||||||

| 65,000 | 4.100 | 01/13/26 | 71,020 | |||||||||||

| (SOFR + 1.718%) |

||||||||||||||

| 525,000 | 3.035 | (a)(d) | 05/28/32 | 535,710 | ||||||||||

| (SOFR + 1.870%) |

||||||||||||||

| 450,000 | 2.129 | (a)(d) | 11/24/26 | 457,268 | ||||||||||

| (SOFR + 2.159%) |

||||||||||||||

| 300,000 | 2.222 | (a)(d) | 09/18/24 | 307,437 | ||||||||||

|

|

|

|||||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Banks – (continued) | ||||||||||||||

| Erste Group Bank AG(a)(d) (5 Year EUR Swap + 6.204%) |

||||||||||||||

| EUR | 400,000 | 6.500 | 12/31/99 | 513,728 | ||||||||||

| Fifth Third Bancorp(a) |

||||||||||||||

| $ | 375,000 | 2.375 | 01/28/25 | 389,685 | ||||||||||

| First Horizon Corp.(a) |

||||||||||||||

| 700,000 | 3.550 | 05/26/23 | 730,772 | |||||||||||

| 700,000 | 4.000 | 05/26/25 | 763,644 | |||||||||||

| Freedom Mortgage Corp.(a)(b) |

||||||||||||||

| 508,000 | 7.625 | 05/01/26 | 518,160 | |||||||||||

| HSBC Holdings PLC |

||||||||||||||

| 200,000 | 4.950 | 03/31/30 | 237,890 | |||||||||||

| (3M USD LIBOR + 1.000%) |

||||||||||||||

| 450,000 | 1.125 | (a)(d) | 05/18/24 | 455,009 | ||||||||||

| (3M USD LIBOR + 1.211%) |

||||||||||||||

| 600,000 | 3.803 | (a)(d) | 03/11/25 | 639,900 | ||||||||||

| (SOFR + 1.538%) |

||||||||||||||

| 1,050,000 | 1.645 | (a)(d) | 04/18/26 | 1,056,195 | ||||||||||

| Huntington Bancshares, Inc.(a) |

||||||||||||||

| 825,000 | 4.000 | 05/15/25 | 904,563 | |||||||||||

| ING Groep NV(a)(b)(d) (1 Year CMT + 1.100%) |

||||||||||||||

| 950,000 | 1.400 | 07/01/26 | 951,928 | |||||||||||

| Intesa Sanpaolo SpA(a)(d) (5 Year EUR Swap + 7.192%) |

||||||||||||||

| EUR | 350,000 | 7.750 | 12/31/99 | 494,615 | ||||||||||

| JPMorgan Chase & Co. |

||||||||||||||

| $ | 425,000 | 3.625 | (a) | 12/01/27 | 464,143 | |||||||||

| 45,000 | 6.400 | 05/15/38 | 65,580 | |||||||||||

| (3M USD LIBOR + 0.730%) |

||||||||||||||

| 195,000 | 3.559 | (a)(d) | 04/23/24 | 204,099 | ||||||||||

| (3M USD LIBOR + 0.890%) |

||||||||||||||

| 175,000 | 3.797 | (a)(d) | 07/23/24 | 185,000 | ||||||||||

| (3M USD LIBOR + 1.000%) |

||||||||||||||

| 60,000 | 4.023 | (a)(d) | 12/05/24 | 64,298 | ||||||||||

| (3M USD LIBOR + 1.155%) |

||||||||||||||

| 65,000 | 3.220 | (a)(d) | 03/01/25 | 68,673 | ||||||||||

| (3M USD LIBOR + 1.245%) |

||||||||||||||

| 1,000,000 | 3.960 | (a)(d) | 01/29/27 | 1,103,920 | ||||||||||

| (3M USD LIBOR + 3.800%) |

||||||||||||||

| 1,710,000 | 3.926 | (a)(d) | 12/31/99 | 1,713,916 | ||||||||||

| (SOFR + 1.160%) |

||||||||||||||

| 570,000 | 2.301 | (a)(d) | 10/15/25 | 591,033 | ||||||||||

| (SOFR + 2.040%) |

||||||||||||||

| 25,000 | 2.522 | (a)(d) | 04/22/31 | 25,487 | ||||||||||

| (SOFR + 2.515%) |

||||||||||||||

| 275,000 | 2.956 | (a)(d) | 05/13/31 | 286,363 | ||||||||||

| (SOFR + 3.125%) |

||||||||||||||

| 800,000 | 4.600 | (a)(d) | 12/31/99 | 818,376 | ||||||||||

| (SOFR + 3.790%) |

||||||||||||||

| 75,000 | 4.493 | (a)(d) | 03/24/31 | 87,545 | ||||||||||

| Macquarie Group Ltd.(a)(b)(d) (SOFR + 1.069%) |

||||||||||||||

| 450,000 | 1.340 | 01/12/27 | 446,211 | |||||||||||

| Mitsubishi UFJ Financial Group, Inc. |

||||||||||||||

| 60,000 | 3.741 | 03/07/29 | 66,769 | |||||||||||

| 30,000 | 4.286 | 07/26/38 | 35,901 | |||||||||||

| Morgan Stanley(a)(d) (SOFR + 0.879%) |

||||||||||||||

| 35,000 | 1.593 | 05/04/27 | 35,101 | |||||||||||

| Morgan Stanley, Inc.(a)(d) (SOFR + 1.360%) |

||||||||||||||

| 750,000 | 2.484 | 09/16/36 | 733,597 | |||||||||||

|

|

|

|||||||||||||

| 16 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS BOND FUND

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Banks – (continued) | ||||||||||||||

| Morgan Stanley, Inc. |

||||||||||||||

| $ | 1,050,000 | 3.700 | % | 10/23/24 | $ | 1,138,998 | ||||||||

| 50,000 | 4.000 | 07/23/25 | 55,104 | |||||||||||

| 425,000 | 3.950 | 04/23/27 | 472,676 | |||||||||||

| (3M USD LIBOR + 0.847%) |

||||||||||||||

| 350,000 | 3.737 | (a)(d) | 04/24/24 | 367,290 | ||||||||||

| (3M USD LIBOR + 1.400%) |

||||||||||||||

| 1,550,000 | 1.525 | (a)(d) | 10/24/23 | 1,569,731 | ||||||||||

| (3M USD LIBOR + 1.431%) |

||||||||||||||

| 35,000 | 4.457 | (a)(d) | 04/22/39 | 42,364 | ||||||||||

| (3M USD LIBOR + 1.628%) |

||||||||||||||

| 200,000 | 4.431 | (a)(d) | 01/23/30 | 230,760 | ||||||||||

| (SOFR + 0.525%) |

||||||||||||||

| 35,000 | 0.790 | (a)(d) | 05/30/25 | 34,900 | ||||||||||

| (SOFR + 1.034%) |

||||||||||||||

| 750,000 | 1.794 | (a)(d) | 02/13/32 | 713,977 | ||||||||||

| (SOFR + 1.143%) |

||||||||||||||

| 725,000 | 2.699 | (a)(d) | 01/22/31 | 749,548 | ||||||||||

| (SOFR + 1.152%) |

||||||||||||||

| 855,000 | 2.720 | (a)(d) | 07/22/25 | 895,561 | ||||||||||

| (SOFR + 3.120%) |

||||||||||||||

| 400,000 | 3.622 | (a)(d) | 04/01/31 | 440,912 | ||||||||||

| Natwest Group PLC |

||||||||||||||

| 826,000 | 3.875 | 09/12/23 | 876,097 | |||||||||||

| (3M USD LIBOR + 1.550%) |

||||||||||||||

| 850,000 | 4.519 | (a)(d) | 06/25/24 | 904,748 | ||||||||||

| (3M USD LIBOR + 1.762%) |

||||||||||||||

| 225,000 | 4.269 | (a)(d) | 03/22/25 | 242,804 | ||||||||||

| (5 Year CMT + 2.100%) |

||||||||||||||

| 200,000 | 3.754 | (a)(d) | 11/01/29 | 213,250 | ||||||||||

| Royal Bank of Canada |

||||||||||||||

| 35,000 | 1.150 | 06/10/25 | 35,070 | |||||||||||

| Standard Chartered PLC(a)(b)(d) (3M USD LIBOR + 1.150%) |

||||||||||||||

| 1,325,000 | 4.247 | 01/20/23 | 1,339,575 | |||||||||||

| State Street Corp.(a)(d) |

||||||||||||||

| (3M USD LIBOR + 1.030%) |

||||||||||||||

| 60,000 | 4.141 | 12/03/29 | 70,060 | |||||||||||

| (SOFR + 2.650%) |

||||||||||||||

| 25,000 | 3.152 | 03/30/31 | 27,309 | |||||||||||

| The Bank of Nova Scotia |

||||||||||||||

| 70,000 | 2.200 | 02/03/25 | 72,640 | |||||||||||

| Truist Bank(a) |

||||||||||||||

| 350,000 | 2.250 | 03/11/30 | 352,454 | |||||||||||

| Truist Financial Corp.(a)(d) (SOFR + 0.609%) |

||||||||||||||

| 40,000 | 1.267 | 03/02/27 | 39,820 | |||||||||||

| Turkiye Vakiflar Bankasi TAO |

||||||||||||||

| 200,000 | 8.125 | 03/28/24 | 214,788 | |||||||||||

| 200,000 | 6.500 | (b) | 01/08/26 | 204,000 | ||||||||||

| Wells Fargo & Co. |

||||||||||||||

| 1,975,000 | 3.000 | 10/23/26 | 2,115,620 | |||||||||||

| 600,000 | 4.300 | 07/22/27 | 680,940 | |||||||||||

| 75,000 | 4.150 | (a) | 01/24/29 | 85,143 | ||||||||||

| (SOFR + 1.087%) |

||||||||||||||

| 65,000 | 2.406 | (a)(d) | 10/30/25 | 67,706 | ||||||||||

| (SOFR + 2.000%) |

||||||||||||||

| 50,000 | 2.188 | (a)(d) | 04/30/26 | 51,627 | ||||||||||

|

|

|

|||||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Banks – (continued) | ||||||||||||||

| Westpac Banking Corp. |

||||||||||||||

| 65,000 | 2.350 | 02/19/25 | 67,978 | |||||||||||

| (5 Year CMT + 2.000%) |

||||||||||||||

| 300,000 | 4.110 | (a)(d) | 07/24/34 | 325,875 | ||||||||||

|

|

|

|||||||||||||

| 59,115,503 | ||||||||||||||

|

|

|

|||||||||||||

| Beverages – 1.3% | ||||||||||||||

| |

Anheuser-Busch Cos. LLC/Anheuser-Busch InBev Worldwide, |

| ||||||||||||

| 325,000 | 4.700 | 02/01/36 | 392,876 | |||||||||||

| 1,625,000 | 4.900 | 02/01/46 | 2,018,039 | |||||||||||

| Anheuser-Busch InBev Worldwide, Inc.(a) |

||||||||||||||

| 55,000 | 5.450 | 01/23/39 | 71,288 | |||||||||||

| 650,000 | 4.600 | 04/15/48 | 778,122 | |||||||||||

| Constellation Brands, Inc.(a) |

||||||||||||||

| 625,000 | 4.400 | 11/15/25 | 699,625 | |||||||||||

| 225,000 | 3.700 | 12/06/26 | 248,555 | |||||||||||

| 500,000 | 3.600 | 02/15/28 | 550,180 | |||||||||||

| 625,000 | 3.150 | 08/01/29 | 668,963 | |||||||||||

| JDE Peet’s NV(a)(b) |

||||||||||||||

| 375,000 | 1.375 | 01/15/27 | 370,395 | |||||||||||

| Keurig Dr Pepper, Inc.(a) |

||||||||||||||

| 377,000 | 4.057 | 05/25/23 | 398,515 | |||||||||||

| 30,000 | 4.417 | 05/25/25 | 33,334 | |||||||||||

| Molson Coors Beverage Co. |

||||||||||||||

| 20,000 | 5.000 | 05/01/42 | 24,246 | |||||||||||

|

|

|

|||||||||||||

| 6,254,138 | ||||||||||||||

|

|

|

|||||||||||||

| Biotechnology(a) – 0.1% | ||||||||||||||

| Royalty Pharma PLC |

||||||||||||||

| 425,000 | 1.200 | 09/02/25 | 422,050 | |||||||||||

|

|

|

|||||||||||||

| Building Materials(a) – 0.5% | ||||||||||||||

| Carrier Global Corp. |

||||||||||||||

| 1,125,000 | 2.493 | 02/15/27 | 1,174,489 | |||||||||||

| Cemex SAB de CV(b) |

||||||||||||||

| 200,000 | 5.200 | 09/17/30 | 214,810 | |||||||||||

| Martin Marietta Materials, Inc. |

||||||||||||||

| 750,000 | 3.200 | 07/15/51 | 745,747 | |||||||||||

| Masco Corp. |

||||||||||||||

| 325,000 | 1.500 | 02/15/28 | 316,085 | |||||||||||

|

|

|

|||||||||||||

| 2,451,131 | ||||||||||||||

|

|

|

|||||||||||||

| Chemicals – 1.3% | ||||||||||||||

| Ashland LLC(a)(b) |

||||||||||||||

| 345,000 | 3.375 | 09/01/31 | 348,450 | |||||||||||

| Ashland Services B.V.(a) |

||||||||||||||

| EUR | 650,000 | 2.000 | 01/30/28 | 777,006 | ||||||||||

| DuPont de Nemours, Inc.(a) |

||||||||||||||

| $ | 425,000 | 4.205 | 11/15/23 | 456,357 | ||||||||||

| 55,000 | 5.319 | 11/15/38 | 71,124 | |||||||||||

| Huntsman International LLC(a) |

||||||||||||||

| 350,000 | 4.500 | 05/01/29 | 396,781 | |||||||||||

| 250,000 | 2.950 | 06/15/31 | 255,112 | |||||||||||

| International Flavors & Fragrances, Inc.(a)(b) |

||||||||||||||

| 650,000 | 1.832 | 10/15/27 | 649,207 | |||||||||||

| LYB International Finance B.V. |

||||||||||||||

| 25,000 | 5.250 | 07/15/43 | 32,125 | |||||||||||

|

|

|

|||||||||||||

| The accompanying notes are an integral part of these financial statements. | 17 |

GOLDMAN SACHS BOND FUND

Schedule of Investments (continued)

September 30, 2021 (Unaudited)

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Chemicals – (continued) | ||||||||||||||

| OCP SA(a)(b) |

||||||||||||||

| $ | 200,000 | 5.125 | % | 06/23/51 | $ | 197,663 | ||||||||

| Sasol Financing USA LLC(a) |

||||||||||||||

| 310,000 | 5.875 | 03/27/24 | 325,364 | |||||||||||

| SPCM SA(a)(b) |

||||||||||||||

| 590,000 | 3.375 | 03/15/30 | 587,050 | |||||||||||

| The Dow Chemical Co.(a) |

||||||||||||||

| 30,000 | 3.600 | 11/15/50 | 31,893 | |||||||||||

| The Sherwin-Williams Co.(a) |

||||||||||||||

| 500,000 | 3.450 | 06/01/27 | 548,425 | |||||||||||

| 475,000 | 2.950 | 08/15/29 | 503,049 | |||||||||||

| Tronox, Inc.(a)(b) |

||||||||||||||

| 990,000 | 4.625 | 03/15/29 | 982,575 | |||||||||||

| Valvoline, Inc.(a)(b) |

||||||||||||||

| 315,000 | 3.625 | 06/15/31 | 311,850 | |||||||||||

|

|

|

|||||||||||||

| 6,474,031 | ||||||||||||||

|

|

|

|||||||||||||

| Commercial Services(a) – 0.9% | ||||||||||||||

| Ashtead Capital, Inc.(b) |

||||||||||||||

| 300,000 | 2.450 | 08/12/31 | 294,717 | |||||||||||

| CoStar Group, Inc.(b) |

||||||||||||||

| 625,000 | 2.800 | 07/15/30 | 635,024 | |||||||||||

| Global Payments, Inc. |

||||||||||||||

| 375,000 | 2.650 | 02/15/25 | 391,792 | |||||||||||

| 225,000 | 3.200 | 08/15/29 | 237,866 | |||||||||||

| 35,000 | 4.150 | 08/15/49 | 39,338 | |||||||||||

| MPH Acquisition Holdings LLC(b) |

||||||||||||||

| 542,000 | 5.750 | 11/01/28 | 509,480 | |||||||||||

| PayPal Holdings, Inc. |

||||||||||||||

| 1,150,000 | 1.650 | 06/01/25 | 1,179,072 | |||||||||||

| 1,175,000 | 2.650 | 10/01/26 | 1,255,452 | |||||||||||

|

|

|

|||||||||||||

| 4,542,741 | ||||||||||||||

|

|

|

|||||||||||||

| Computers – 1.6% | ||||||||||||||

| Amdocs Ltd.(a) |

||||||||||||||

| 350,000 | 2.538 | 06/15/30 | 348,481 | |||||||||||

| Apple, Inc. |

||||||||||||||

| 35,000 | 2.500 | 02/09/25 | 36,839 | |||||||||||

| 65,000 | 3.200 | 05/13/25 | 70,151 | |||||||||||

| 1,875,000 | 2.450 | (a) | 08/04/26 | 1,984,894 | ||||||||||

| 40,000 | 4.500 | (a) | 02/23/36 | 50,074 | ||||||||||

| Booz Allen Hamilton, Inc.(a)(b) |

||||||||||||||

| 253,000 | 4.000 | 07/01/29 | 259,641 | |||||||||||

| Dell International LLC/EMC Corp.(a) |

||||||||||||||

| 600,000 | 5.450 | 06/15/23 | 643,974 | |||||||||||

| 275,000 | 5.850 | 07/15/25 | 319,861 | |||||||||||

| 325,000 | 6.020 | 06/15/26 | 387,614 | |||||||||||

| 50,000 | 5.300 | 10/01/29 | 60,463 | |||||||||||

| 50,000 | 6.200 | 07/15/30 | 63,987 | |||||||||||

| 100,000 | 8.350 | 07/15/46 | 163,298 | |||||||||||

| Hewlett Packard Enterprise Co.(a) |

||||||||||||||

| 1,300,000 | 4.450 | 10/02/23 | 1,392,690 | |||||||||||

| 550,000 | 4.650 | 10/01/24 | 607,431 | |||||||||||

| 969,000 | 4.900 | 10/15/25 | 1,096,317 | |||||||||||

| 155,000 | 6.350 | 10/15/45 | 208,776 | |||||||||||

| HP, Inc.(a) |

||||||||||||||

| 30,000 | 3.400 | 06/17/30 | 31,891 | |||||||||||

|

|

|

|||||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Computers – (continued) | ||||||||||||||

| NetApp, Inc.(a) |

||||||||||||||

| 35,000 | 2.375 | 06/22/27 | 36,510 | |||||||||||

|

|

|

|||||||||||||

| 7,762,892 | ||||||||||||||

|

|

|

|||||||||||||

| Cosmetics/Personal Care – 0.0% | ||||||||||||||

| The Procter & Gamble Co. |

||||||||||||||

| 45,000 | 2.800 | 03/25/27 | 48,443 | |||||||||||

|

|

|

|||||||||||||

| Diversified Financial Services – 2.5% | ||||||||||||||

| AerCap Ireland Capital DAC/AerCap Global Aviation Trust |

||||||||||||||

| 1,150,000 | 4.625 | 07/01/22 | 1,184,730 | |||||||||||

| 450,000 | 3.300 | (a) | 01/23/23 | 463,855 | ||||||||||

| 400,000 | 4.875 | (a) | 01/16/24 | 432,112 | ||||||||||

| 295,000 | 6.500 | (a) | 07/15/25 | 342,356 | ||||||||||

| Air Lease Corp. |

||||||||||||||

| 550,000 | 2.250 | 01/15/23 | 561,973 | |||||||||||

| 425,000 | 3.375 | (a) | 07/01/25 | 451,316 | ||||||||||

| 1,325,000 | 2.875 | (a) | 01/15/26 | 1,382,399 | ||||||||||

| 875,000 | 3.750 | (a) | 06/01/26 | 947,319 | ||||||||||

| 50,000 | 3.250 | (a) | 10/01/29 | 52,105 | ||||||||||

| Ally Financial, Inc.(a) |

||||||||||||||

| 275,000 | 1.450 | 10/02/23 | 279,208 | |||||||||||

| 55,000 | 5.800 | 05/01/25 | 63,321 | |||||||||||

| American Express Co.(a) |

||||||||||||||

| 165,000 | 2.500 | 07/30/24 | 173,410 | |||||||||||

| Aviation Capital Group LLC(a)(b) |

||||||||||||||

| 375,000 | 1.950 | 01/30/26 | 373,830 | |||||||||||

| Avolon Holdings Funding Ltd.(a)(b) |

||||||||||||||

| 425,000 | 3.950 | 07/01/24 | 451,031 | |||||||||||

| 675,000 | 2.875 | 02/15/25 | 694,372 | |||||||||||

| 175,000 | 4.250 | 04/15/26 | 188,482 | |||||||||||

| Capital One Financial Corp.(a) |

||||||||||||||

| 320,000 | 3.300 | 10/30/24 | 343,238 | |||||||||||

| GE Capital International Funding Co. |

||||||||||||||

| 1,600,000 | 3.373 | 11/15/25 | 1,734,112 | |||||||||||

| 250,000 | 4.418 | 11/15/35 | 300,530 | |||||||||||

| Huarong Finance 2019 Co. Ltd. |

||||||||||||||

| 280,000 | 3.750 | 05/29/24 | 265,300 | |||||||||||

| JAB Holdings B.V.(a)(b) |

||||||||||||||

| 250,000 | 2.200 | 11/23/30 | 244,990 | |||||||||||

| Mastercard, Inc.(a) |

||||||||||||||

| 250,000 | 3.300 | 03/26/27 | 274,845 | |||||||||||

| Navient Corp.(a) |

||||||||||||||

| 508,000 | 5.000 | 03/15/27 | 521,970 | |||||||||||

| 15,000 | 4.875 | 03/15/28 | 15,188 | |||||||||||

| Nomura Holdings, Inc. |

||||||||||||||

| 230,000 | 2.608 | 07/14/31 | 228,949 | |||||||||||

| Raymond James Financial, Inc.(a) |

||||||||||||||

| 75,000 | 4.650 | 04/01/30 | 88,931 | |||||||||||

| The Charles Schwab Corp.(a) |

||||||||||||||

| 60,000 | 4.200 | 03/24/25 | 66,288 | |||||||||||

| 55,000 | 3.300 | 04/01/27 | 60,024 | |||||||||||

|

|

|

|||||||||||||

| 12,186,184 | ||||||||||||||

|

|

|

|||||||||||||

| Electrical – 1.6% | ||||||||||||||

| Alliant Energy Finance LLC(a)(b) |

||||||||||||||

| 375,000 | 3.750 | 06/15/23 | 393,240 | |||||||||||

|

|

|

|||||||||||||

| 18 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS BOND FUND

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Electrical – (continued) | ||||||||||||||

| Ameren Corp.(a) |

||||||||||||||

| $ | 125,000 | 3.500 | % | 01/15/31 | $ | 136,091 | ||||||||

| Appalachian Power Co.(a) |

||||||||||||||

| 30,000 | 3.700 | 05/01/50 | 32,651 | |||||||||||

| Berkshire Hathaway Energy Co.(a) |

||||||||||||||

| 225,000 | 3.250 | 04/15/28 | 245,275 | |||||||||||

| 400,000 | 3.700 | 07/15/30 | 450,292 | |||||||||||

| 20,000 | 4.450 | 01/15/49 | 24,752 | |||||||||||

| Dominion Energy, Inc.(e) |

||||||||||||||

| 675,000 | 3.071 | 08/15/24 | 713,893 | |||||||||||

| Enel Finance International NV(a)(b) |

||||||||||||||

| 975,000 | 1.875 | 07/12/28 | 968,838 | |||||||||||

| Exelon Corp.(a) |

||||||||||||||

| 325,000 | 4.050 | 04/15/30 | 367,897 | |||||||||||

| 50,000 | 4.700 | 04/15/50 | 63,118 | |||||||||||

| Exelon Generation Co. LLC(a) |

||||||||||||||

| 35,000 | 3.250 | 06/01/25 | 37,315 | |||||||||||

| Florida Power & Light Co.(a) |

||||||||||||||

| 65,000 | 2.850 | 04/01/25 | 68,988 | |||||||||||

| NextEra Energy Capital Holdings, Inc.(a) |

||||||||||||||

| 525,000 | 1.900 | 06/15/28 | 526,470 | |||||||||||

| NRG Energy, Inc.(a)(b) |

||||||||||||||

| 675,000 | 3.750 | 06/15/24 | 718,544 | |||||||||||

| Pacific Gas & Electric Co.(a) |

||||||||||||||

| 250,000 | 2.100 | 08/01/27 | 243,943 | |||||||||||

| 125,000 | 3.300 | 08/01/40 | 115,355 | |||||||||||

| 275,000 | 3.500 | 08/01/50 | 249,917 | |||||||||||

| Southern California Edison Co.(a) |

||||||||||||||

| 725,000 | 3.700 | 08/01/25 | 788,191 | |||||||||||

| 450,000 | 4.200 | 03/01/29 | 505,967 | |||||||||||

| 25,000 | 4.875 | 03/01/49 | 29,886 | |||||||||||

| 50,000 | 3.650 | 02/01/50 | 51,217 | |||||||||||

| Southern Power Co.(a) |

||||||||||||||

| 60,000 | 4.950 | 12/15/46 | 72,429 | |||||||||||

| Southwestern Electric Power Co.(a) |

||||||||||||||

| 35,000 | 2.750 | 10/01/26 | 36,841 | |||||||||||

| Vistra Operations Co. LLC(a)(b) |

||||||||||||||

| 1,175,000 | 3.550 | 07/15/24 | 1,236,335 | |||||||||||

|

|

|

|||||||||||||

| 8,077,445 | ||||||||||||||

|

|

|

|||||||||||||

| Electronics(a) – 0.3% | ||||||||||||||

| Honeywell International, Inc. |

||||||||||||||

| 35,000 | 1.350 | 06/01/25 | 35,520 | |||||||||||

| 40,000 | 2.500 | 11/01/26 | 42,440 | |||||||||||

| Sensata Technologies, Inc.(b) |

||||||||||||||

| 276,000 | 3.750 | 02/15/31 | 277,035 | |||||||||||

| SYNNEX Corp.(b) |

||||||||||||||

| 500,000 | 2.375 | 08/09/28 | 495,100 | |||||||||||

| 500,000 | 2.650 | 08/09/31 | 488,720 | |||||||||||

|

|

|

|||||||||||||

| 1,338,815 | ||||||||||||||

|

|

|

|||||||||||||

| Engineering & Construction(a) – 0.3% | ||||||||||||||

| MasTec, Inc.(b) |

||||||||||||||

| 610,000 | 4.500 | 08/15/28 | 636,687 | |||||||||||

| Mexico City Airport Trust |

||||||||||||||

| 400,000 | 4.250 | 10/31/26 | 425,050 | |||||||||||

| 250,000 | 3.875 | (b) | 04/30/28 | 258,094 | ||||||||||

|

|

|

|||||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Engineering & Construction(a) – (continued) | ||||||||||||||

| Mexico City Airport Trust – (continued) |

||||||||||||||

| 310,000 | 5.500 | (b) | 07/31/47 | 315,038 | ||||||||||

|

|

|

|||||||||||||

| 1,634,869 | ||||||||||||||

|

|

|

|||||||||||||

| Entertainment(a)(b) – 0.1% | ||||||||||||||

| Caesars Entertainment, Inc. |

||||||||||||||

| 498,000 | 6.250 | 07/01/25 | 524,145 | |||||||||||

|

|

|

|||||||||||||

| Environmental(a) – 0.1% | ||||||||||||||

| GFL Environmental, Inc.(b) |

||||||||||||||

| 150,000 | 3.750 | 08/01/25 | 154,312 | |||||||||||

| Waste Management, Inc. |

||||||||||||||

| 250,000 | 1.150 | 03/15/28 | 240,870 | |||||||||||

|

|

|

|||||||||||||

| 395,182 | ||||||||||||||

|

|

|

|||||||||||||

| Food & Drug Retailing(a) – 0.4% | ||||||||||||||

| Conagra Brands, Inc. |

||||||||||||||

| 15,000 | 4.600 | 11/01/25 | 16,857 | |||||||||||

| Kraft Heinz Foods Co. |

||||||||||||||

| 1,122,000 | 4.250 | 03/01/31 | 1,261,456 | |||||||||||

| Mondelez International, Inc. |

||||||||||||||

| 65,000 | 2.750 | 04/13/30 | 68,010 | |||||||||||

| Post Holdings, Inc.(b) |

||||||||||||||

| 498,000 | 5.625 | 01/15/28 | 522,900 | |||||||||||

| Sysco Corp. |

||||||||||||||

| 75,000 | 6.600 | 04/01/40 | 110,037 | |||||||||||

|

|

|

|||||||||||||

| 1,979,260 | ||||||||||||||

|

|

|

|||||||||||||

| Gas(a) – 0.1% | ||||||||||||||

| NiSource, Inc. |

||||||||||||||

| 100,000 | 3.600 | 05/01/30 | 109,746 | |||||||||||

| The East Ohio Gas Co.(b) |

||||||||||||||

| 150,000 | 1.300 | 06/15/25 | 150,497 | |||||||||||

|

|

|

|||||||||||||

| 260,243 | ||||||||||||||

|

|

|

|||||||||||||

| Healthcare Providers & Services(a) – 1.0% | ||||||||||||||

| Anthem, Inc. |

||||||||||||||

| 65,000 | 2.375 | 01/15/25 | 67,737 | |||||||||||

| Centene Corp. |

||||||||||||||

| 1,270,000 | 3.000 | 10/15/30 | 1,301,750 | |||||||||||

| CommonSpirit Health |

||||||||||||||

| 635,000 | 3.910 | 10/01/50 | 693,708 | |||||||||||

| DENTSPLY SIRONA, Inc. |

||||||||||||||

| 350,000 | 3.250 | 06/01/30 | 372,733 | |||||||||||

| DH Europe Finance II S.a.r.l. |

||||||||||||||

| 700,000 | 2.200 | 11/15/24 | 728,672 | |||||||||||

| 275,000 | 2.600 | 11/15/29 | 286,745 | |||||||||||

| HCA, Inc. |

||||||||||||||

| 40,000 | 5.500 | 06/15/47 | 51,651 | |||||||||||

| Laboratory Corp. of America Holdings |

||||||||||||||

| 65,000 | 3.600 | 02/01/25 | 69,863 | |||||||||||

| STERIS Irish FinCo UnLtd Co. |

||||||||||||||

| 525,000 | 2.700 | 03/15/31 | 536,519 | |||||||||||

| Thermo Fisher Scientific, Inc. |

||||||||||||||

| 45,000 | 4.133 | 03/25/25 | 49,534 | |||||||||||

| 100,000 | 1.750 | 10/15/28 | 99,762 | |||||||||||

| Zimmer Biomet Holdings, Inc. |

||||||||||||||

| 800,000 | 3.550 | 03/20/30 | 874,672 | |||||||||||

|

|

|

|||||||||||||

| 5,133,346 | ||||||||||||||

|

|

|

|||||||||||||

| The accompanying notes are an integral part of these financial statements. | 19 |

GOLDMAN SACHS BOND FUND

Schedule of Investments (continued)

September 30, 2021 (Unaudited)

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Household Products(a) – 0.0% | ||||||||||||||

| Kimberly-Clark Corp. |

||||||||||||||

| $ | 10,000 | 2.875 | % | 02/07/50 | $ | 10,152 | ||||||||

|

|

|

|||||||||||||

| Housewares(a)(b) – 0.1% | ||||||||||||||

| The Scotts Miracle-Gro Co. |

||||||||||||||

| 524,000 | 4.000 | 04/01/31 | 522,690 | |||||||||||

|

|

|

|||||||||||||

| Insurance – 1.2% | ||||||||||||||

| Acrisure LLC/Acrisure Finance, Inc.(a)(b) |

||||||||||||||

| 536,000 | 4.250 | 02/15/29 | 529,970 | |||||||||||

| American International Group, Inc. |

||||||||||||||

| 100,000 | 4.125 | 02/15/24 | 107,966 | |||||||||||

| 1,075,000 | 3.900 | (a) | 04/01/26 | 1,191,078 | ||||||||||

| 375,000 | 4.200 | (a) | 04/01/28 | 427,301 | ||||||||||

| 250,000 | 3.400 | (a) | 06/30/30 | 273,053 | ||||||||||

| Arch Capital Finance LLC(a) |

||||||||||||||

| 1,000,000 | 4.011 | 12/15/26 | 1,124,760 | |||||||||||

| Arch Capital Group US, Inc. |

||||||||||||||

| 250,000 | 5.144 | 11/01/43 | 329,375 | |||||||||||

| Great-West Lifeco Finance 2018 LP(a)(b) |

||||||||||||||

| 225,000 | 4.047 | 05/17/28 | 254,426 | |||||||||||

| Marsh & McLennan Cos., Inc.(a) |

||||||||||||||

| 575,000 | 4.375 | 03/15/29 | 667,730 | |||||||||||

| Reinsurance Group of America, Inc.(a) |

||||||||||||||

| 65,000 | 3.900 | 05/15/29 | 72,467 | |||||||||||

| Willis North America, Inc.(a) |

||||||||||||||

| 205,000 | 2.950 | 09/15/29 | 214,217 | |||||||||||

| XLIT Ltd. |

||||||||||||||

| 775,000 | 4.450 | 03/31/25 | 859,808 | |||||||||||

|

|

|

|||||||||||||

| 6,052,151 | ||||||||||||||

|

|

|

|||||||||||||

| Internet(a) – 0.6% | ||||||||||||||

| Amazon.com, Inc. |

||||||||||||||

| 30,000 | 3.800 | 12/05/24 | 32,741 | |||||||||||

| 45,000 | 5.200 | 12/03/25 | 52,281 | |||||||||||

| 400,000 | 3.875 | 08/22/37 | 470,824 | |||||||||||

| Expedia Group, Inc. |

||||||||||||||

| 300,000 | 3.600 | 12/15/23 | 317,514 | |||||||||||

| 60,000 | 6.250 | (b) | 05/01/25 | 69,160 | ||||||||||

| 125,000 | 4.625 | 08/01/27 | 141,746 | |||||||||||

| 300,000 | 2.950 | 03/15/31 | 303,888 | |||||||||||

| Match Group Holdings II LLC(b) |

||||||||||||||

| 290,000 | 3.625 | 10/01/31 | 287,100 | |||||||||||

| Prosus NV(b) |

||||||||||||||

| 200,000 | 4.027 | 08/03/50 | 186,500 | |||||||||||

| 200,000 | 3.832 | 02/08/51 | 180,815 | |||||||||||

| Uber Technologies, Inc.(b) |

||||||||||||||

| 650,000 | 7.500 | 05/15/25 | 693,062 | |||||||||||

|

|

|

|||||||||||||

| 2,735,631 | ||||||||||||||

|

|

|

|||||||||||||

| Iron/Steel – 0.4% | ||||||||||||||

| ArcelorMittal SA |

||||||||||||||

| 1,265,000 | 4.250 | 07/16/29 | 1,390,640 | |||||||||||

| Steel Dynamics, Inc.(a) |

||||||||||||||

| 150,000 | 2.400 | 06/15/25 | 156,125 | |||||||||||

| 275,000 | 1.650 | 10/15/27 | 272,090 | |||||||||||

| Vale Overseas Ltd. |

||||||||||||||

| 134,000 | 6.250 | 08/10/26 | 158,696 | |||||||||||

|

|

|

|||||||||||||

| 1,977,551 | ||||||||||||||

|

|

|

|||||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Lodging(a) – 0.7% | ||||||||||||||

| Hilton Domestic Operating Co., Inc. |

||||||||||||||

| 969,000 | 4.875 | 01/15/30 | 1,039,252 | |||||||||||

| 3,000 | 4.000 | (b) | 05/01/31 | 3,053 | ||||||||||

| |

Hilton Grand Vacations Borrower Escrow LLC/Hilton Grand |

| ||||||||||||

| 522,000 | 5.000 | 06/01/29 | 531,787 | |||||||||||

| Hyatt Hotels Corp. |

||||||||||||||

| 475,000 | 1.800 | 10/01/24 | 476,088 | |||||||||||

| Marriott Ownership Resorts, Inc.(b) |

||||||||||||||

| 630,000 | 4.500 | 06/15/29 | 639,450 | |||||||||||

| MGM Resorts International |

||||||||||||||

| 310,000 | 6.750 | 05/01/25 | 327,825 | |||||||||||

| 438,000 | 4.750 | 10/15/28 | 461,543 | |||||||||||

|

|

|

|||||||||||||

| 3,478,998 | ||||||||||||||

|

|

|

|||||||||||||

| Machinery – Construction & Mining – 0.0% | ||||||||||||||

| Caterpillar Financial Services Corp. |

||||||||||||||

| 15,000 | 2.150 | 11/08/24 | 15,669 | |||||||||||

|

|

|

|||||||||||||

| Machinery-Diversified(a) – 0.3% | ||||||||||||||

| Otis Worldwide Corp. |

||||||||||||||

| 175,000 | 2.293 | 04/05/27 | 181,800 | |||||||||||

| 1,275,000 | 2.565 | 02/15/30 | 1,308,724 | |||||||||||

| Westinghouse Air Brake Technologies Corp. |

||||||||||||||

| 30,000 | 4.950 | 09/15/28 | 34,526 | |||||||||||

|

|

|

|||||||||||||

| 1,525,050 | ||||||||||||||

|

|

|

|||||||||||||

| Media – 1.2% | ||||||||||||||

| |

Charter Communications Operating LLC/Charter |

| ||||||||||||

| 1,012,000 | 4.500 | 02/01/24 | 1,094,650 | |||||||||||

| 425,000 | 4.908 | 07/23/25 | 477,742 | |||||||||||

| 30,000 | 6.384 | 10/23/35 | 39,404 | |||||||||||

| Comcast Corp. |

||||||||||||||

| 225,000 | 3.100 | (a) | 04/01/25 | 240,709 | ||||||||||

| 256,000 | 3.300 | (a) | 02/01/27 | 279,468 | ||||||||||

| 350,000 | 3.150 | (a) | 02/15/28 | 380,205 | ||||||||||

| 6,000 | 6.500 | 11/15/35 | 8,615 | |||||||||||

| 75,000 | 3.750 | (a) | 04/01/40 | 84,416 | ||||||||||

| 55,000 | 3.999 | (a) | 11/01/49 | 63,665 | ||||||||||

| Cox Communications, Inc.(a)(b) |

||||||||||||||

| 50,000 | 3.350 | 09/15/26 | 54,052 | |||||||||||

| CSC Holdings LLC(a)(b) |

||||||||||||||

| 243,000 | 3.375 | 02/15/31 | 225,079 | |||||||||||

| Discovery Communications LLC(a) |

||||||||||||||

| 25,000 | 5.200 | 09/20/47 | 30,830 | |||||||||||

| DISH DBS Corp. |

||||||||||||||

| 465,000 | 7.750 | 07/01/26 | 525,450 | |||||||||||

| Fox Corp.(a) |

||||||||||||||

| 300,000 | 4.030 | 01/25/24 | 321,780 | |||||||||||

| NBCUniversal Media LLC |

||||||||||||||

| 458,000 | 4.450 | 01/15/43 | 553,727 | |||||||||||

| Sirius XM Radio, Inc.(a)(b) |

||||||||||||||

| 230,000 | 3.125 | 09/01/26 | 232,587 | |||||||||||

| 201,000 | 3.875 | 09/01/31 | 196,226 | |||||||||||

| The Walt Disney Co. |

||||||||||||||

| 1,125,000 | 4.000 | 10/01/23 | 1,203,941 | |||||||||||

|

|

|

|||||||||||||

| 20 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS BOND FUND

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Media – (continued) | ||||||||||||||