Securities Act File No. [ ]

As filed with the Securities and Exchange Commission on October 22, 2021

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| Pre-Effective Amendment No. _____ | ☐ | |||

| Post-Effective Amendment No. _____ | ☐ |

(Check appropriate box or boxes.)

GOLDMAN SACHS TRUST

(Exact Name of Registrant as Specified in Charter)

71 South Wacker Drive

Chicago, Illinois 60606

(Address of Principal Executive Offices)

Registrant’s Telephone Number, including Area Code: (312) 655-4400

CAROLINE L. KRAUS, ESQ.

Goldman Sachs & Co. LLC

200 West Street

New York, New York 10282

(Name and Address of Agent for Service)

Copies to:

| STEPHEN H. BIER, ESQ. | BRENDEN P. CARROLL, ESQ. | |

| Dechert LLP | Dechert LLP | |

| 1095 Avenue of the Americas | 1900 K Street, NW | |

| New York, NY 10036 | Washington, DC 20006 |

Approximate Date of Proposed Public Offering: As soon as practicable after the effective date of this Registration Statement.

Title of Securities Being Registered:

Class A, Institutional, Investor, Service, Class R6 and Class P Shares of Goldman Sachs Enhanced Income Fund, a series of the Registrant. The Registrant has registered an indefinite amount of securities pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended; accordingly, no fee is payable herewith in reliance upon Section 24(f).

It is proposed that this filing will become effective on November 22, 2021 pursuant to Rule 488 under the Securities Act of 1933.

GOLDMAN SACHS HIGH QUALITY FLOATING RATE FUND

71 South Wacker Drive

Chicago, Illinois 60606

November [●], 2021

Dear Shareholder:

We are writing to inform you of an important matter concerning your investment in the Goldman Sachs High Quality Floating Rate Fund (the “Acquired Fund”). At a meeting held on October 12-13, 2021, the Board of Trustees of the Acquired Fund (the “Board”) approved a reorganization pursuant to which the Acquired Fund will be reorganized with and into another series of the Goldman Sachs Trust—the Goldman Sachs Enhanced Income Fund (the “Surviving Fund,” and together with the Acquired Fund, the “Funds”). Shareholders were first notified of the reorganization on October 15, 2021 in a supplement to the Acquired Fund’s then effective Prospectuses and Summary Prospectuses.

After careful consideration, the Board, including a majority of the Trustees who are not “interested persons” of the Funds, as that term is defined in the Investment Company Act of 1940, as amended (the “Independent Trustees”), approved the reorganization. After considering the recommendation of Goldman Sachs Asset Management, L.P. (“GSAM”), the investment adviser to the Acquired Fund and the Surviving Fund, the Board, including a majority of the Independent Trustees, concluded that: (i) the reorganization is in the best interests of each Fund; and (ii) the interests of the shareholders of each Fund will not be diluted as a result of the reorganization.

Effective on or about January 28, 2022 (the “Closing Date”), you will own shares in the Surviving Fund equal in dollar value to your interest in the Acquired Fund on the Closing Date. No sales charge, redemption fees or other transaction fees will be imposed in the reorganization. The reorganization is intended to be a tax-free reorganization for Federal income tax purposes.

NO ACTION ON YOUR PART IS REQUIRED REGARDING THE REORGANIZATION. YOU WILL AUTOMATICALLY RECEIVE SHARES OF THE SURVIVING FUND IN EXCHANGE FOR YOUR SHARES OF THE ACQUIRED FUND AS OF THE CLOSING DATE. THE BOARD IS NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY.

If you have any questions regarding the attached Information Statement/Prospectus or other materials, please contact the Acquired Fund at 1-800-526-7384.

| By Order of the Board of Trustees of the Goldman Sachs Trust, | ||

| James A. McNamara | ||

| President | ||

COMBINED INFORMATION STATEMENT

FOR

GOLDMAN SACHS HIGH QUALITY FLOATING RATE FUND

(a series of the GOLDMAN SACHS TRUST)

AND

PROSPECTUS FOR

GOLDMAN SACHS ENHANCED INCOME FUND

(a series of the GOLDMAN SACHS TRUST)

The address, telephone number and website of the Goldman Sachs High Quality Floating Rate Fund

and the Goldman Sachs Enhanced Income Fund is:

71 South Wacker Drive

Chicago, Illinois 60606

1-800-526-7384

www.gsamfunds.com

Shares of the Goldman Sachs Enhanced Income Fund have not been approved or disapproved by the U.S. Securities and Exchange Commission (the “SEC”). The SEC has not passed upon the adequacy of this Information Statement/Prospectus. Any representation to the contrary is a criminal offense.

An investment in either the Goldman Sachs High Quality Floating Rate Fund (the “Acquired Fund”) or the Goldman Sachs Enhanced Income Fund (the “Surviving Fund,” and together with the Acquired Fund, the “Funds”) is not a bank deposit and is not insured or guaranteed by the U.S. Federal Deposit Insurance Corporation or any other government agency.

This Information Statement/Prospectus sets forth information about the Surviving Fund that an investor needs to know before investing. Please read this Information Statement/Prospectus carefully before investing and keep it for future reference.

The date of this Information Statement/Prospectus is November [●], 2021.

For more complete information about each Fund, please read the Fund’s Prospectus and Statement of Additional Information, as they may be amended and/or supplemented. Each Fund’s Prospectus and Statement of Additional Information, and other additional information about each Fund, have been filed with the SEC (www.sec.gov) and are available upon written or oral request and without charge by writing to the address above or calling the following toll-free number: 1-800-526-7384.

INTRODUCTION

This combined information statement/prospectus, dated November [●], 2021 (the “Information Statement/Prospectus”), is being furnished to shareholders of the Acquired Fund in connection with an Agreement and Plan of Reorganization between the Acquired Fund and the Surviving Fund (the “Plan”), pursuant to which the Acquired Fund will (i) transfer all of its assets attributable to each class of its shares to the Surviving Fund in exchange for shares of the Surviving Fund and the assumption by the Surviving Fund of all of the liabilities of the Acquired Fund; and (ii) distribute to its shareholders a portion of the Surviving Fund shares to which each shareholder is entitled (as discussed below) in complete liquidation of the Acquired Fund (the “Reorganization”). At a meeting held on October 12-13, 2021, the Board of Trustees of the Funds (the “Board” or “Trustees”) approved the Plan. A copy of the Plan is attached to this Information Statement/Prospectus as Exhibit A. Shareholders should read this entire Information Statement/Prospectus, including the exhibits, carefully.

After considering the recommendation of Goldman Sachs Asset Management, L.P. (“GSAM” or the “Investment Adviser”), investment adviser to the Acquired Fund and the Surviving Fund, the Board concluded that: (i) the Reorganization is in the best interests of each Fund; and (ii) the interests of the shareholders of each Fund will not be diluted as a result of the Reorganization.

NO ACTION IS REQUIRED REGARDING THE REORGANIZATION. AS DISCUSSED MORE FULLY BELOW, THE FUNDS ARE RELYING ON RULE 17a-8 UNDER THE INVESTMENT COMPANY ACT OF 1940, AS AMENDED. SHAREHOLDERS OF THE ACQUIRED FUND ARE NOT BEING ASKED TO VOTE ON OR APPROVE THE PLAN. THE BOARD IS NOT ASKING YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND A PROXY.

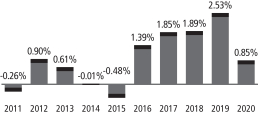

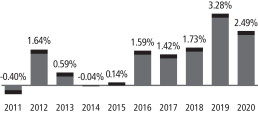

Background to the Reorganization

GSAM, an SEC-registered investment adviser, serves as investment adviser to the Acquired Fund, an investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). GSAM also serves as investment adviser to the Surviving Fund, also an investment company registered under the 1940 Act. GSAM serves as investment adviser to the Funds under the Management Agreements, each dated April 30, 1997. The Investment Adviser recommended to the Board that it approve the reorganization of the Acquired Fund with and into the Surviving Fund, each an existing series of Goldman Sachs Trust (the “Trust”), because it believes that the Reorganization: (i) would rationalize Funds that have similar investment objectives and similar investment strategies (albeit with some notable differences); (ii) may provide enhanced opportunities to realize greater efficiencies in the form of lower total operating expenses over time; and (iii) would enable the combined Fund to be better positioned for asset growth. The Investment Adviser also believes that the Reorganization is preferable to liquidating the Acquired Fund, as it will provide you and other shareholders with the opportunity to invest in a fund that: (i) has a similar investment objective and similar investment strategies (albeit with some notable differences); and (ii) is part of the Goldman Sachs Funds — a large, diverse fund family. Moreover, the Surviving Fund had higher total returns than the Acquired Fund over the one-, five- and ten-year periods ended December 31, 2020, and generally equivalent total returns year-to-date (as of September 30, 2021).1

On October 12-13, 2021, the Board, including a majority of the Trustees who are not “interested persons” of the Funds, as that term is defined in the 1940 Act (the “Independent Trustees”), voted to approve the Reorganization. In approving the Reorganization, the Board, including a majority of the Independent Trustees, concluded that: (i) the Reorganization is in the best interests of each Fund; and (ii) the interests of the shareholders of each Fund will not be diluted as a result of the Reorganization. The Board also considered and approved the terms and conditions of the Plan.

| 1 | On October 20, 2021, the Surviving Fund implemented certain changes to its principal investment strategy. Performance reflects the Surviving Fund’s investment strategies prior to that date. |

ii

At its meeting, the Board received and evaluated materials provided by the Investment Adviser regarding the Reorganization and its effect on the existing shareholders of the Funds. The Board also evaluated and discussed: (i) any material differences between each Fund’s investment objective, strategies, policies and risks; (ii) the specific terms of the Reorganization; and (iii) other information, such as the relative sizes of the Funds, the performance records of the Funds and the expenses of the Funds and the anticipated asset growth of the Funds in the foreseeable future. In addition, the Board considered additional factors, which are discussed in more detail below under “Why did the Board approve the Reorganization?”

The Independent Trustees were assisted in their consideration of the Reorganization by independent counsel.

Questions and Answers

How will the Reorganization affect me?

Under the terms of the Plan, the Acquired Fund will transfer all of its assets to the Surviving Fund and the Surviving Fund will assume all of the liabilities of the Acquired Fund. Subsequently, the Acquired Fund will be liquidated and you will become a shareholder of the Surviving Fund. You will receive shares of the Surviving Fund that are equal in aggregate net asset value to the shares of the Acquired Fund that you held on the Closing Date (as defined below). Shareholders of each class of shares of the Acquired Fund will receive the corresponding class of the Surviving Fund, as follows:

| Acquired Fund |

Surviving Fund | |||

| Class A | g | Class A | ||

| Institutional | g | Institutional | ||

| Service | g | Service | ||

| Investor | g | Investor | ||

| Class R6 | g | Class R6 | ||

| Class P | g | Class P | ||

No sales charge, contingent deferred sales charge (“CDSC”), commission, redemption fee or other transactional fee will be charged as a result of the Reorganization.

It is currently expected that a portion of the Acquired Fund’s portfolio assets (approximately 25%) will be sold prior to the consummation of the Reorganization, which may result in the Acquired Fund realizing capital gains. The repositioning will generally involve eliminating or reducing certain existing positions in the Acquired Fund’s portfolio. Taking into account net capital losses and capital loss carryforwards expected to be available to offset realized gains, it is currently estimated that the Acquired Fund will not distribute capital gains to its shareholders as a result of the repositioning (based on assets as of September 30, 2021), although the actual amount of such distribution may change depending on market conditions and on transactions entered into by the Acquired Fund prior to the Closing Date. Shareholders of the Acquired Fund will generally be taxed on any resulting capital gain distributions if the Acquired Fund actually distributes such capital gains. It is also estimated that such portfolio repositioning will result in the Acquired Fund bearing average spread costs associated with the sale of its portfolio assets (due to transaction costs, including any trading taxes) of approximately 3-5 basis points.

When will the Reorganization occur?

The Reorganization is scheduled to occur on or about January 28, 2022, but may occur on such earlier or later date as the parties agree (the “Closing Date”).

iii

How will the Reorganization affect the fees to be paid by the Surviving Fund, and how do they compare with the fees paid by the Acquired Fund?

Following the Reorganization, the Acquired Fund shareholders are expected to experience a decrease in net fees and expenses with respect to their investment in the Surviving Fund through at least July 29, 2023. The Surviving Fund’s management fee schedule is lower than that of the Acquired Fund across all breakpoints. In addition, with respect to each share class of the Surviving Fund, GSAM has agreed to reduce or limit “Other Expenses” (excluding acquired fund fees and expenses, transfer agency fees and expenses, service fees, taxes, interest, brokerage fees, expenses of shareholder meetings, litigation and indemnification, and extraordinary expenses) to 0.064% of the Surviving Fund’s average daily net assets attributed to such class through at least July 29, 2023. Prior to such date, GSAM may not terminate the arrangement without the approval of the Board of Trustees of the Surviving Fund. Following the expiration of the expense reimbursement agreement, it is possible that the total annual fund operating expenses of certain share classes of the Surviving Fund may be higher than the total annual fund operating expenses of the corresponding share class of the Acquired Fund, based in part on the asset size of the Surviving Fund at that time.

Additional information, including pro forma expense information, is included in this Information Statement/Prospectus under “Summary — The Funds’ Fees and Expenses.”

Why did the Board approve the Reorganization?

In approving the Reorganization, the Board, including a majority of the Independent Trustees, concluded that: (i) the Reorganization is in the best interests of each Fund; and (ii) the interests of the shareholders of each Fund will not be diluted as a result of the Reorganization. The Trustees also believe that the Reorganization offers a number of potential benefits. These potential benefits and considerations include the following:

| • | The Reorganization would rationalize Funds that have similar investment objectives and investment strategies (albeit with some notable differences). |

| • | The Reorganization may provide enhanced opportunities to realize greater efficiencies in the form of lower total operating expenses over time and also would enable the combined Fund to be better positioned for asset growth. |

| • | The Reorganization is preferable to liquidating the Acquired Fund as it will provide you and other shareholders with the opportunity to invest in a fund that has a similar investment objective and investment strategy (albeit with some notable differences) and a significantly larger asset base to better pursue its investment objective and strategy. The Funds have a similar universe of permissible investments; however, the Surviving Fund is permitted to invest in additional types of fixed income securities (including emerging country securities, municipal securities and non-investment grade fixed income securities) and, unlike the Acquired Fund, the Surviving Fund is not limited to investing only in U.S. dollar-denominated securities or to investing, under normal circumstances, at least 80% of its net assets plus any borrowings for investment purposes (measured at the time of purchase) (“Net Assets”) in high quality floating rate or variable rate obligations. These differences, as well as other differences, are discussed in more detail below under “Summary — Comparison of the Acquired Fund with the Surviving Fund and Comparison of Principal Investments Risks of Investing in the Funds.” |

| • | The Surviving Fund had higher total returns than the Acquired Fund over the one-, five- and ten-year periods ended December 31, 2020, and generally equivalent total returns year-to-date (as of September 30, 2021).2 |

| • | The Reorganization is expected to qualify as a “reorganization” within the meaning of Section 368 of the Internal Revenue Code of 1986, as amended (the “Code”), and, therefore, you will not recognize |

| 2 | On October 20, 2021, the Surviving Fund implemented certain changes to its principal investment strategy. Performance reflects the Surviving Fund’s investment strategies prior to that date. |

iv

| gain or loss for federal income tax purposes on the exchange of your shares of the Acquired Fund for the shares of the Surviving Fund. |

| • | The Surviving Fund’s management fee schedule is lower than the Acquired Fund across all breakpoints. For the fiscal year ended March 31, 2021, the Acquired Fund’s effective management fee (after breakpoints) was 0.31% and the Surviving Fund’s effective management fee (after breakpoints) was 0.25%. Accordingly, shareholders of the Acquired Fund are expected to experience a lower management fee rate upon consummation of the Reorganization. |

| • | GSAM will bear the external costs of the Reorganization (as described below). |

| • | Current shareholders of the Acquired Fund may redeem their shares at any time before the Reorganization takes place, as set forth in the Acquired Fund’s prospectuses. |

Additional considerations are discussed in more detail below under “Summary — Reasons for the Reorganization and Board Considerations.”

Who bears the expenses associated with the Reorganization?

GSAM has agreed to pay the external costs (e.g., legal, auditor/accounting, printing and mailing costs) associated with each Fund’s participation in the Reorganization. GSAM estimates that these costs will be approximately $275,000.

Additionally, as discussed in more detail above under “How will the Reorganization affect me?”, it is currently expected that a portion of the Acquired Fund’s portfolio assets (approximately 25%) will be sold prior to the consummation of the Reorganization. It is estimated that such portfolio repositioning will result in the Acquired Fund bearing average spread costs associated with the sale of its portfolio assets (due to transaction costs, including any trading taxes) of approximately 3-5 basis points.

Will the Investment Adviser benefit from the Reorganization?

Although reorganizing the Acquired Fund with and into the Surviving Fund (instead of liquidating the Acquired Fund) will benefit GSAM by managing a larger pool of assets, which will produce increased management fees that will accrue to GSAM, the Investment Adviser believes that the combined Fund would be better positioned for asset growth than the Acquired Fund on its own.

What are the Federal income and other tax consequences of the Reorganization?

As a condition to the closing of the Reorganization, the Funds must receive an opinion of Dechert LLP to the effect that the Reorganization will constitute a “reorganization” within the meaning of Section 368 of the Code. Accordingly, subject to the limited exceptions described below under the heading “Tax Status of the Reorganization,” it is expected that neither you nor a Fund will recognize gain or loss as a direct result of the Reorganization, and that the aggregate tax basis of the Surviving Fund shares that you receive in the Reorganization will be the same as the aggregate tax basis of the shares that you surrendered in the Reorganization.

In addition, in connection with the Reorganization, it is currently expected that a portion of the Acquired Fund’s portfolio assets (approximately 25%) will be sold prior to the consummation of the Reorganization, which may result in the Acquired Fund realizing capital gains. The repositioning will generally involve eliminating or reducing certain existing positions in the Acquired Fund’s portfolio. Taking into account net capital losses and capital loss carryforwards expected to be available to offset realized gains, it is currently estimated that the Acquired Fund will not distribute capital gains to its shareholders as a result of the repositioning (based on assets as September 30, 2021), although the actual amount of such distribution may change depending on market conditions and on transactions entered into by the Acquired Fund prior to the Closing Date. Shareholders of the Acquired Fund will generally be taxed on any resulting capital gain distributions if the Acquired Fund actually

v

distributes such capital gains. It is also estimated that such portfolio repositioning will result in the Acquired Fund bearing average spread costs associated with the sale of its portfolio assets (due to transaction costs, including any trading taxes) of approximately 3-5 basis points.

Why are shareholders not being asked to vote on the Reorganization?

The Trust’s Declaration of Trust and applicable state law do not require shareholder approval of the Reorganization. Moreover, Rule 17a-8 under the 1940 Act does not require shareholder approval of the Reorganization, provided certain conditions are met. Because applicable legal requirements do not require shareholder approval under these circumstances and the Board has determined that the Reorganization is in the best interests of each Fund, shareholders are not being asked to vote on the Reorganization.

Where can I get more information?

| Each Fund’s current prospectuses and any applicable supplements. | On file with the SEC (http://www.sec.gov) (file nos. 811-05349; 33-17619) and available at no charge by calling: 1-800-526-7384 or on the Funds’ website (www.gsamfunds.com).

| |

| Each Fund’s current statement of additional information and any applicable supplements. | On file with the SEC (http://www.sec.gov) (file nos. 811-05349; 33-17619) and available at no charge by calling: 1-800-526-7384 or on the Funds’ website (www.gsamfunds.com).

| |

| Each Fund’s most recent annual and semi-annual reports to shareholders. | On file with the SEC (http://www.sec.gov) (file nos. 811¬-5349; 33-17619) and available at no charge by calling: 1-800-526-7384 or on the Funds’ website (www.gsamfunds.com).

| |

| A statement of additional information for this Information Statement/Prospectus, dated November [●], 2021 (the “SAI”). The SAI contains additional information about the Surviving Fund. | On file with the SEC (http://www.sec.gov) (file nos. 811-05349; 33-17619) and available at no charge by calling: 1-800-526-7384. The SAI is incorporated by reference into this Information Statement/Prospectus

| |

| To ask questions about this Information Statement/Prospectus. | Call the toll-free telephone number: 1-800-526-7384. |

Each Fund’s: (i) prospectuses, dated July 29, 2021, as supplemented October 22, 2021 (with respect to the Acquired Fund), and dated October 22, 2021 (with respect to the Surviving Fund), (ii) statement of additional information, dated July 29, 2021, as supplemented October 22, 2021 (with respect to the Acquired Fund), and dated October 22, 2021 (with respect to the Surviving Fund), and (iii) March 31, 2021 Annual Report, are incorporated by reference into this Information Statement/Prospectus, which means they are considered legally a part of this Information Statement/Prospectus. The materials have been filed with the SEC (www.sec.gov) and are available upon written or oral request and without charge by writing to the address above or calling the following toll-free number: 1-800-526-7384.

vi

| 1 | ||||

| 1 | ||||

| 5 | ||||

| 14 | ||||

| 18 | ||||

| 21 | ||||

| 23 | ||||

| Payments to Broker-Dealers and Other Financial Intermediaries |

23 | |||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 29 | ||||

| 35 | ||||

| 37 | ||||

| 43 | ||||

| 43 | ||||

| A-1 | ||||

| B-1 | ||||

| C-1 | ||||

| D-1 |

-i-

GOLDMAN SACHS HIGH QUALITY FLOATING RATE FUND

AND

GOLDMAN SACHS ENHANCED INCOME FUND

The following is a summary of more complete information appearing later in this Information Statement/Prospectus or incorporated by reference herein. You should read carefully the entire Information Statement/Prospectus, including the form of Agreement and Plan of Reorganization attached as Exhibit A, because it contains details that are not in the summary.

Comparison of the Acquired Fund with the Surviving Fund

Although each Fund seeks to achieve its investment objective by investing in a diversified portfolio of fixed income securities, there are some important differences between the principal investment strategies of the Surviving Fund and those of the Acquired Fund. These differences are discussed in more detail in the side-by-side chart below to facilitate comparison.

| The Acquired Fund | The Surviving Fund | |||

| Diversification Status | The Funds are currently diversified under the 1940 Act. | |||

| Investment Objective | The Fund seeks to provide a high level of current income, consistent with low volatility of principal. | The Fund seeks to generate return in excess of traditional money market products while maintaining an emphasis on preservation of capital and liquidity. | ||

| Principal Investment Strategy | The Fund invests, under normal circumstances, at least 80% of Net Assets in high quality floating rate or variable rate obligations. Floating rate and variable rate obligations are debt instruments issued by companies or other entities with interest rates that reset periodically (typically, daily, monthly, quarterly, or semi-annually) in response to changes in the market rate of interest on which the interest rate is based. The Fund considers “high quality” obligations to be (i) those rated AAA or Aaa by a nationally recognized statistical rating organization (“NRSRO”) at the time of purchase (or the equivalent short term rating for short term obligations such as commercial paper), or, if unrated, determined by the Investment Adviser to be of comparable credit quality, including repurchase agreements with counter-parties rated AAA or Aaa by an NRSRO at the time of purchase, or, if unrated, determined by the Investment Adviser to be of comparable credit quality, and (ii) securities issued or guaranteed by the U.S. Government, its agencies, | The Fund invests, under normal circumstances, primarily in a portfolio of U.S. or foreign fixed income securities, including securities issued or guaranteed by the U.S. government, its agencies, instrumentalities or sponsored enterprises (“U.S. Government Securities”), including agency issued adjustable rate and fixed rate mortgage-backed securities or other mortgage-related securities (“Agency Mortgage-Backed Securities”), corporate notes, privately issued adjustable rate and fixed rate mortgage-backed securities or other mortgage-related securities (“Private Mortgage-Backed Securities” and, together with Agency Mortgage-Backed Securities, “Mortgage-Backed Securities”), commercial paper, fixed and floating rate asset-backed securities (including collateralized loan obligations), high yield non-investment grade fixed income securities (i.e., securities rated BB+, Ba1 or below by a nationally recognized statistical rating organization (“NRSRO”) or, if unrated, determined by the Investment Adviser to be of comparable | ||

1

| The Acquired Fund | The Surviving Fund | |||

| instrumentalities or sponsored enterprises (“U.S. Government Securities”), including securities representing an interest in or collateralized by agency issued adjustable rate and fixed rate mortgage loans or other mortgage-related securities (“Agency Mortgage-Backed Securities”), and in repurchase agreements collateralized by U.S. Government Securities, with counterparties approved by the Investment Adviser pursuant to procedures approved by the Board of Trustees. The remainder of the Fund’s Net Assets (up to 20%) may be invested in fixed rate obligations (subject to the credit quality requirements specified above) and investment grade floating rate or variable rate obligations. The Fund also intends to invest in derivatives, including (but not limited to) futures, swaps, options on swaps and other derivative instruments, which are used primarily to manage the Fund’s duration. The Fund may also invest in privately issued adjustable rate and fixed rate mortgage-backed securities or other mortgage-related securities (“Private Mortgage-Backed Securities” and, together with Agency Mortgage-Backed Securities, “Mortgage-Backed Securities”). The Fund may invest in obligations of foreign issuers (including sovereign and agency obligations), although 100% of the Fund’s portfolio will be invested in U.S. dollar-denominated securities.

The Fund’s investments in floating and variable rate obligations may include, without limitation: agency floating rate bonds and agency Mortgage-Backed Securities, including adjustable rate mortgages and collateralized mortgage obligation floaters; asset-backed floating rate bonds including, but not limited to, those backed by Federal Family Education Loan Program (“FFELP”) student loans and credit card receivables; other floating rate Mortgage-Backed Securities; asset-backed securities (including collateralized loan obligations); corporate obligations; and overnight repurchase agreements.

The Fund may gain exposure to Agency Mortgage-Backed Securities through several methods, including by utilizing to-be-announced (“TBA”) agreements in Agency Mortgage-Backed Securities or |

credit quality), sovereign and corporate debt securities, and other U.S. dollar denominated debt instruments of emerging market countries. The Fund may also invest in fixed income securities issued by or on behalf of states, territories, and possessions of the United States (including the District of Columbia) (“Municipal Securities”). The Fund may also seek to obtain exposure to fixed income investments through investments in affiliated or unaffiliated investment companies, including exchange-traded funds (“ETFs”).

Except for asset-backed securities, Mortgage-Backed Securities and U.S. Treasury securities deliverable in futures transactions, the Fund will not invest in securities with remaining maturities of more than 5 years as determined in accordance with the SAI. With respect to asset-backed securities and Mortgage-Backed Securities, the Fund will not invest in asset-backed securities with a weighted average life of more than 5 years. In pursuing the Fund’s investment objective, the Investment Adviser will seek to enhance the Fund’s return by identifying those fixed income securities that are within the maturity limitations discussed above and that the Investment Adviser believes offer advantageous yields relative to other similar securities.

The Fund may not invest, in the aggregate, more than 10% of its total assets measured at the time of purchase (“Total Assets”) in (i) U.S. dollar denominated emerging market countries debt and (ii) non-investment grade fixed income securities.

The Fund may engage in forward foreign currency transactions in G4 currencies (U.S. Dollar, Euro, GBP and JPY) for both hedging and non-hedging purposes. The Fund may invest in obligations of domestic and foreign issuers that are denominated in currencies other than the U.S. dollar (and may also be denominated in a currency other than that associated with the issuer’s domicile).

The Fund also intends to invest in other derivative instruments, including (but not limited to) interest rate futures contracts, |

2

| The Acquired Fund | The Surviving Fund | |||

| through the use of reverse repurchase agreements. TBA agreements for Agency Mortgage-Backed Securities are standardized contracts for future delivery of fixed-rate mortgage pass-through securities in which the exact mortgage pools to be delivered are not specified until shortly before settlement. Reverse repurchase agreements involve the sale of securities held by the Fund subject to an agreement to repurchase them at a mutually agreed upon date and price (including interest). These transactions enable the Fund to gain exposure to specified pools of Agency Mortgage-Backed Securities by purchasing them on a forward settling basis and using the proceeds of the reverse repurchase agreement to settle the trade. The Fund may enter into reverse repurchase agreements when the Investment Adviser expects that the return to be earned from the investment of the transaction proceeds to be greater than the interest expense of the transaction. Reverse repurchase agreements may also be entered into as a temporary measure for emergency purposes or to meet redemption requests.

The Fund may also seek to obtain exposure to fixed income investments through investments in affiliated or unaffiliated investment companies, including exchange-traded funds (“ETFs”).

The Fund’s target duration range under normal interest rate conditions is expected to approximate that of the ICE BofAML Three-Month U.S. Treasury Bill Index, plus or minus 3 months, and over the last five years ended June 30, 2021, the duration of the Index has ranged between 0.16 and 0.25 years. |

options (including options on futures contracts, swaps, bonds and indexes), swaps (including credit default, index, basis, total return, volatility and currency swaps) and other forward contracts. The Fund may use derivatives, instead of buying and selling debt directly, to manage duration, to gain exposure to certain securities or indexes, or to take short positions with respect to individual securities or indexes. The Fund may invest in derivatives that are not denominated in U.S. dollars.

The Fund may gain exposure to Agency Mortgage-Backed Securities through several methods, including by utilizing to-be-announced (“TBA”) agreements in Agency Mortgage-Backed Securities or through the use of reverse repurchase agreements. TBA agreements for Agency Mortgage- Backed Securities are standardized contracts for future delivery of fixed-rate mortgage pass-through securities in which the exact mortgage pools to be delivered are not specified until shortly before settlement. A reverse repurchase agreement enables the Fund to gain exposure to specified pools of Agency Mortgage-Backed Securities by purchasing them on a forward settling basis and using the proceeds of the reverse repurchase agreement to settle the trade.

The Fund’s target duration range under normal interest rate conditions is expected to be approximately 1 year plus or minus 1 year, and over the past five years ended June 30, 2021, the duration of the ICE BofAML One-Year U.S. Treasury Note Index has ranged between 0.90 to 0.99 years. | |||

| What is each Fund’s limit with respect to an investment in a single industry or group of industries? | Each Fund may not invest more than 25% of its total assets in the securities of one or more issuers conducting their principal business activities in the same industry (excluding the U.S. Government or its agencies or instrumentalities). | |||

3

| The Acquired Fund | The Surviving Fund | |||

| Benchmarks | The Fund’s benchmark index is the ICE BofAML Three-Month U.S. Treasury Bill Index. | The Fund’s benchmark index is the ICE BofAML One-Year U.S. Treasury Note Index. | ||

| Fund turnover | Each Fund pays transaction costs when it buys and sells securities or instruments (i.e., “turns over” its portfolio). A high rate of portfolio turnover may result in increased transaction costs, including brokerage commissions, which must be borne by the Fund and its shareholders, and is also likely to result in higher short-term capital gains for taxable shareholders. These costs are not reflected in annual fund operating expenses or in the expense example, but are reflected in the Fund’s performance. | |||

| The Acquired Fund’s and Surviving Fund’s portfolio turnover rate for the fiscal year ended March 31, 2021 was 24% and 58%, respectively, of the average value of the portfolio. | ||||

| Investment Adviser | GSAM serves as the investment adviser of each Fund. | |||

| Fund management team | Each Fund has the same portfolio management team, which consists of Dave Fishman and John Olivo.

Dave Fishman, Managing Director, has managed the Surviving Fund and the Acquired Fund since 2008. Mr. Fishman is the head of GSAM’s Global Liquidity Management team. Mr. Fishman joined the Investment Adviser in 1997.

John Olivo, Managing Director, has managed the Surviving Fund and the Acquired Fund since 2016. Mr. Olivo is the global head of GSAM’s short duration fixed income strategies. Mr. Olivo is a member of the Investment Strategy Committee. Mr. Olivo joined the Investment Adviser in 1995.

Dave Fishman and John Olivo are expected to continue to manage the Surviving Fund upon the consummation of the Reorganization.

The SAI provides additional information about the portfolio managers’ compensation and other accounts managed by the portfolio managers. | |||

| Fiscal year end | March 31 | |||

As the above table indicates, the Funds have similar investment objectives and investment strategies (albeit with some notable differences). The Funds have a similar universe of permissible investments; however, the Surviving Fund is permitted to invest in additional types of fixed income securities (including emerging country securities, Municipal Securities and non-investment grade fixed income securities) and, unlike the Acquired Fund, the Surviving Fund is not limited to investing only in U.S. dollar-denominated securities or to investing, under normal circumstances, at least 80% of its Net Assets in high quality floating rate or variable rate obligations. Additionally, the Surviving Fund has a longer target duration than the Acquired Fund.

The Surviving Fund’s principal investment strategies may impact performance and the risk/return profile of your investment. The investment philosophy of the Funds, as well as additional information on portfolio risks, securities and techniques, is described in more detail in Exhibit B.

4

Risks of Investing in the Funds

The Chart below compares the principal and additional risks of investing in each Fund. Principal risks of each Fund are discussed in the Summary section of the Prospectus. The following section provides additional information on the risks that apply to the Funds, which may result in a loss of your investment. The risks applicable to each Fund are presented below in alphabetical order, and not in the order of importance or potential exposure. None of the Funds should be relied upon as a complete investment program. There can be no assurance that a Fund will achieve its investment objective. Investments in a Fund involve substantial risks which prospective investors should consider carefully before investing.

| ✓ Principal Risk ● Additional Risk |

Acquired Fund |

Surviving Fund |

||||||

| Call/Prepayment |

✓ | ✓ | ||||||

| Collateralized Loan Obligations and Other Collateralized Debt Obligations |

✓ | ✓ | ||||||

| Counterparty |

● | ✓ | ||||||

| Credit/Default |

● | ✓ | ||||||

| Derivatives |

✓ | ✓ | ||||||

| Emerging Countries |

✓ | |||||||

| ESG Integration |

● | ● | ||||||

| Extension |

● | ✓ | ||||||

| Floating and Variable Rate Obligations |

✓ | ✓ | ||||||

| Foreign |

✓ | ✓ | ||||||

| Inflation Protected Securities |

● | ● | ||||||

| Interest Rate |

✓ | ✓ | ||||||

| Large Shareholder Transactions |

✓ | ✓ | ||||||

| Leverage |

● | ● | ||||||

| Liquidity |

● | ● | ||||||

| Management |

● | ● | ||||||

| Market |

✓ | ✓ | ||||||

| Mortgage-Backed and/or Other Asset-Backed Securities |

✓ | ✓ | ||||||

| Municipal Securities |

✓ | |||||||

| NAV |

● | ● | ||||||

| Non-Hedging Foreign Currency Trading |

● | |||||||

| Non-Investment Grade Fixed Income Securities |

✓ | |||||||

| Other Investment Companies |

✓ | ✓ | ||||||

| Reverse Repurchase Agreements |

● | ✓ | ||||||

| Sovereign Default |

||||||||

| Political |

● | ● | ||||||

| Economic |

● | ● | ||||||

| Repayment |

● | ● | ||||||

| U.S. Government Securities |

✓ | ✓ | ||||||

Call/Prepayment Risk—An issuer could exercise its right to pay principal on an obligation held by the Fund (such as a mortgage- backed security) earlier than expected. This may happen when there is a decline in interest rates, when credit spreads change, or when an issuer’s credit quality improves. Under these circumstances, the Fund may be unable to recoup all of its initial investment and will also suffer from having to reinvest in lower-yielding securities.

5

Collateralized Loan Obligations and Other Collateralized Debt Obligations Risk—The Fund may invest in collateralized loan obligations (“CLOs”) and other similarly structured investments. A CLO is an asset-backed security whose underlying collateral is a pool of loans, which may include, among others, domestic and foreign floating rate and fixed rate senior secured loans, senior unsecured loans, and subordinate corporate loans, including loans that may be rated below investment grade or equivalent unrated loans. In addition to the normal risks associated with loan- and credit-related securities discussed elsewhere in the Prospectus (e.g., interest rate risk and default risk), investments in CLOs carry additional risks including, but not limited to, the risk that: (i) distributions from the collateral may not be adequate to make interest or other payments; (ii) the quality of the collateral may decline in value or default; (iii) the Fund may invest in tranches of CLOs that are subordinate to other tranches; (iv) the structure and complexity of the transaction and the legal documents could lead to disputes among investors regarding the characterization of proceeds; and (v) the CLO’s manager may perform poorly. CLOs may charge management and other administrative fees, which are in addition to those of the Fund.

CLOs issue classes or “tranches” that offer various maturity, risk and yield characteristics. Losses caused by defaults on underlying assets are borne first by the holders of subordinate tranches. Tranches are categorized as senior, mezzanine and subordinated/ equity, according to their degree of risk. If there are defaults or the CLO’s collateral otherwise underperforms, scheduled payments to senior tranches take precedence over those of mezzanine tranches, and scheduled payments to mezzanine tranches take precedence over those of subordinated/equity tranches. The riskiest portion is the “equity” tranche which bears the bulk of defaults from the collateral and serves to protect the other, more senior tranches from default in all but the most severe circumstances. Because it is partially protected from defaults, a senior tranche from a CLO trust typically has higher ratings and lower yields than its underlying collateral and may be rated investment grade. Despite the protection from the equity and mezzanine tranches, more senior tranches of CLOs can experience losses due to actual defaults, increased sensitivity to defaults due to collateral default and disappearance of more subordinate tranches, market anticipation of defaults, as well as aversion to CLO securities as a class. The Fund’s investments in CLOs primarily consist of investment grade tranches.

Typically, CLOs are privately offered and sold, and thus, are not registered under the securities laws. As a result, investments in CLOs may be characterized by the Fund as illiquid investments and may have limited independent pricing transparency. However, an active dealer market may exist for CLOs that qualify under the Rule 144A “safe harbor” from the registration requirements of the Securities Act for resales of certain securities to qualified institutional buyers, and such CLOs may be characterized by the Fund as liquid investments.

The Fund may also invest in collateralized debt obligations (“CDOs”), which are structured similarly to CLOs, but are backed by pools of assets that are debt securities (rather than being limited only to loans), typically including bonds, other structured finance securities (including other asset-backed securities and other CDOs) and/or synthetic instruments. Like CLOs, the risks of an investment in a CDO depend largely on the type and quality of the collateral securities and the tranche of the CDO in which the Fund invests. CDOs collateralized by pools of asset-backed securities carry the same risks as investments in asset-backed securities directly, including losses with respect to the collateral underlying those asset-backed securities. In addition, certain CDOs may not hold their underlying collateral directly, but rather, use derivatives such as swaps to create “synthetic” exposure to the collateral pool. Such CDOs entail the risks associated with derivative instruments.

Counterparty Risk—Many of the protections afforded to cleared transactions, such as the security afforded by transacting through a clearing house, might not be available in connection with certain OTC transactions. Therefore, in those instances in which the Fund enters into certain OTC transactions, the Fund will be subject to the risk that its direct counterparty will not perform its obligations under the transactions and that the Fund will sustain losses. However, recent regulatory developments require margin on certain uncleared OTC transactions which may reduce, but not eliminate, this risk.

Credit/Default Risk—An issuer or guarantor of fixed income securities or instruments held by a Fund (which, for certain Funds, may have low credit ratings) may default on its obligation to pay interest and repay principal or

6

default on any other obligation. The credit quality of a Fund’s portfolio securities or instruments may meet the Fund’s credit quality requirements at the time of purchase but then deteriorate thereafter, and such a deterioration can occur rapidly. In certain instances, the downgrading or default of a single holding or guarantor of the Fund’s holding may impair the Fund’s liquidity and have the potential to cause significant deterioration in NAV. These risks are more pronounced in connection with a Fund’s investments in non-investment grade fixed income securities.

Derivatives Risk—The Fund’s use of options, futures, forwards, swaps, options on swaps, structured securities and other derivative instruments may result in losses. These instruments, which may pose risks in addition to and greater than those associated with investing directly in securities, currencies or other instruments, may be illiquid or less liquid, volatile, difficult to price and leveraged so that small changes in the value of the underlying instruments may produce disproportionate losses to the Fund. Certain derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligations, liquidity risk and risks arising from margin requirements, which include the risk that the Fund will be required to pay additional margin or set aside additional collateral to maintain open derivative positions. Derivatives may be used for both hedging and non-hedging purposes.

The use of derivatives is a highly specialized activity that involves investment techniques and risks different from those associated with investments in more traditional securities and instruments, and there is no guarantee that the use of derivatives will achieve their intended result. If the Investment Adviser is incorrect in its expectation of the timing or level of fluctuation in securities prices, interest rates, currency prices or other variables, the use of derivatives could result in losses, which in some cases may be significant. A lack of correlation between changes in the value of derivatives and the value of the portfolio assets (if any) being hedged could also result in losses. In addition, there is a risk that the performance of the derivatives or other instruments used by the Investment Adviser to replicate the performance of a particular asset class may not accurately track the performance of that asset class.

As an investment company registered with the SEC, the Fund must identify on its books (often referred to as “asset segregation”) liquid assets, or engage in other SEC- or SEC staff-approved or other appropriate measures, to “cover” open positions with respect to certain kinds of derivative instruments. For more information about these practices, see Appendix A. As discussed in more detail in Appendix A and the SAI, the SEC adopted a final rule related to the use of derivatives, short sales, reverse repurchase agreements and certain other transactions by registered investment companies. In connection with the final rule, the SEC and its staff will rescind and withdraw applicable guidance and relief regarding asset segregation and coverage transactions reflected in the Fund’s asset segregation and cover practices discussed therein.

Emerging Countries Risk (Surviving Fund)—The Fund may invest in securities of issuers located in emerging countries. Investments in securities of issuers located in, or otherwise economically tied to, emerging countries are subject to the risks associated with investments in foreign securities. The securities markets of most emerging countries are less liquid, developed and efficient, are subject to greater price volatility, and have smaller market capitalizations. In addition, emerging markets and frontier countries may have more or less government regulation and generally do not impose as extensive and frequent accounting, auditing, financial and other reporting requirements as the securities markets of more developed countries. As a result, there could be less information available about issuers in emerging and frontier market countries, which could negatively affect the Investment Adviser’s ability to evaluate local companies or their potential impact on the Fund’s performance. Further, investments in securities of issuers located in certain emerging countries involve the risk of loss resulting from problems in share registration, settlement or custody, substantial economic, political and social disruptions and the imposition of exchange controls (including repatriation restrictions). The legal remedies for investors in emerging and frontier markets may be more limited than the remedies available in the U.S., and the ability of U.S. authorities (e.g., SEC and the U.S. Department of Justice) to bring actions against bad actors may be limited. These risks are not normally associated with investments in more developed countries. For more information about these risks, see Appendix A in the Fund’s prospectus.

7

ESG Integration Risk—The Investment Adviser employs a fundamental investment process that may integrate ESG factors with traditional fundamental factors. The relevance and weightings of specific ESG factors to or within the fundamental investment process varies across asset classes, sectors and strategies and no one factor or consideration is determinative. When integrating ESG factors into the investment process, the Investment Adviser may rely on third-party data that it believes to be reliable, but it does not guarantee the accuracy of such third-party data. ESG information from third-party data providers may be incomplete, inaccurate or unavailable, which may adversely impact the investment process. Moreover, ESG information, whether from an external and/or internal source, is, by nature and in many instances, based on a qualitative and judgmental assessment. An element of subjectivity and discretion is therefore inherent to the interpretation and use of ESG data. While the Investment Adviser believes that the integration of material ESG factors into the Fund’s investment process has the potential to identify financial risks and contribute to the Fund’s long-term performance, ESG factors may not be considered for each and every investment decision, and there is no guarantee that the integration of ESG factors will result in better performance. Investors can differ in their views of what constitutes positive or negative ESG characteristics. Moreover, the current lack of common standards may result in different approaches to integrating ESG factors. As a result, the Fund may invest in companies that do not reflect the beliefs and values of any particular investor. The Investment Adviser’s approach to ESG integration may evolve and develop over time, both due to a refinement of investment decision-making processes to address ESG factors and risks, and because of legal and regulatory developments.

Extension Risk—An issuer could exercise its right to pay principal on an obligation held by the Fund (such as a mortgage-backed security) later than expected. This may happen when there is a rise in interest rates. Under these circumstances, the value of the obligation will decrease, and the Fund will also suffer from the inability to reinvest in higher yielding securities.

Floating and Variable Rate Obligations Risk—Floating rate and variable rate obligations are debt instruments issued by companies or other entities with interest rates that reset periodically (typically, daily, monthly, quarterly, or semi-annually) in response to changes in the market rate of interest on which the interest rate is based. For floating and variable rate obligations, there may be a lag between an actual change in the underlying interest rate benchmark and the reset time for an interest payment of such an obligation, which could harm or benefit the Fund, depending on the interest rate environment or other circumstances. In a rising interest rate environment, for example, a floating or variable rate obligation that does not reset immediately would prevent the Fund from taking full advantage of rising interest rates in a timely manner. However, in a declining interest rate environment, the Fund may benefit from a lag due to an obligation’s interest rate payment not being immediately impacted by a decline in interest rates.

Certain floating and variable rate obligations have an interest rate floor feature, which prevents the interest rate payable by the security from dropping below a specified level as compared to a reference interest rate (the “reference rate”), such as LIBOR. Such a floor protects the Fund from losses resulting from a decrease in the reference rate below the specified level. However, if the reference rate is below the floor, there will be a lag between a rise in the reference rate and a rise in the interest rate payable by the obligation, and the Fund may not benefit from increasing interest rates for a significant amount of time.

On March 5, 2021, the United Kingdom’s Financial Conduct Authority (“FCA”) and ICE Benchmark Authority formally announced that certain LIBORs will cease publication after December 31, 2021 while others will cease publication after June 30, 2023. The unavailability or replacement of LIBOR may affect the value, liquidity or return on certain Fund investments and may result in costs incurred in connection with closing out positions and entering into new trades. Any pricing adjustments to the Fund’s investments resulting from a substitute reference rate may adversely affect the Fund’s performance and/or NAV.

Foreign Risk —When the Fund invests in foreign securities, it may be subject to risks of loss not typically associated with U.S. issuers. Loss may result because of more or less foreign government regulation; less public information; less stringent investor protections; less stringent accounting, corporate governance, financial

8

reporting and disclosure standards; less liquid, developed or efficient trading markets, greater volatility and less economic, political and social stability in the countries in which the Fund invests. Loss may also result from, among other things, deteriorating economic and business conditions in other countries, including the United States, regional and global conflicts, the imposition of exchange controls (including repatriation restrictions), sanctions, foreign taxes, confiscation of assets and property, trade restrictions (including tariffs), expropriation and other government restrictions by the United States and other governments, higher transaction costs, difficulty enforcing contractual obligations or from problems in share registration, settlement or custody. The Fund or the Investment Adviser may determine not to invest in, or may limit its overall investment in, a particular issuer, country or geographic region due to, among other things, heightened risks regarding repatriation restrictions, confiscation of assets and property, expropriation or nationalization. The Fund will also be subject to the risk of negative foreign currency rate fluctuations which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. Foreign risks will normally be greatest when the Fund invests in securities of issuers located in emerging countries. For more information about these risks, see Appendix A.

Inflation Protected Securities Risk—The value of IPS generally fluctuates in response to changes in real interest rates, which are in turn tied to the relationship between nominal interest rates and the rate of inflation. Therefore, if inflation were to rise at a faster rate than nominal interest rates, real interest rates might decline, leading to an increase in the value of IPS. In contrast, if nominal interest rates increased at a faster rate than inflation, real interest rates might rise, leading to a decrease in the value of IPS. Although the principal value of IPS declines in periods of deflation, holders at maturity receive no less than the par value of the bond. However, if a Fund purchases IPS in the secondary market whose principal values have been adjusted upward due to inflation since issuance, the Fund may experience a loss if there is a subsequent period of deflation. If inflation is lower than expected during the period the Fund holds an IPS, the Fund may earn less on the security than on a conventional bond.

Interest Rate Risk—When interest rates increase, fixed income securities or instruments held by the Fund (which may include inflation protected securities) will generally decline in value. Long-term fixed income securities or instruments will normally have more price volatility because of this risk than short-term fixed income securities or instruments. A wide variety of market factors can cause interest rates to rise, including central bank monetary policy, rising inflation and changes in general economic conditions. The risks associated with changing interest rates may have unpredictable effects on the markets and the Fund’s investments. Fluctuations in interest rates may also affect the liquidity of fixed income securities and instruments held by the Fund.

Interest rates in the United States are currently at historically low levels. Certain countries have experienced negative interest rates on certain fixed-income instruments. Changing interest rates, including rates that fall below zero, may have unpredictable effects on markets, may result in heightened market volatility and may detract from Fund performance to the extent the Fund is exposed to such interest rates and/or volatility.

Large Shareholder Transactions Risk—The Fund may experience adverse effects when certain large shareholders, such as other funds, institutional investors (including those trading by use of non-discretionary mathematical formulas), financial intermediaries (who may make investment decisions on behalf of underlying clients and/or include the Fund in their investment model), individuals, accounts and Goldman Sachs & Co. LLC (“Goldman Sachs”) affiliates, purchase or redeem large amounts of shares of the Fund. Such large shareholder redemptions, which may occur rapidly or unexpectedly, may cause the Fund to sell portfolio securities at times when it would not otherwise do so, which may negatively impact the Fund’s NAV and liquidity. Similarly, large Fund share purchases may adversely affect the Fund’s performance to the extent that the Fund is delayed in investing new cash or otherwise maintains a larger cash position than it ordinarily would. These transactions may also accelerate the realization of taxable income to shareholders if such sales of investments resulted in gains, and may also increase transaction costs. In addition, a large redemption could result in the Fund’s current expenses being allocated over a smaller asset base, leading to an increase in the Fund’s expense ratio.

9

Leverage Risk—Leverage creates exposure to potential gains and losses in excess of the initial amount invested. Borrowing and the use of derivatives may result in leverage and may make the Fund more volatile. When the Fund uses leverage, the sum of the Fund’s investment exposures may significantly exceed the amount of assets invested in the Fund, although these exposures may vary over time. Relatively small market movements may result in large changes in the value of a leveraged investment. A Fund will identify liquid assets on its books or otherwise cover transactions that may give rise to such risk, to the extent required by applicable law. The use of leverage may cause the Fund to liquidate portfolio positions to satisfy its obligations or to meet segregation requirements when it may not be advantageous to do so. The use of leverage by the Fund can substantially increase the adverse impact to which the Fund’s investment portfolio may be subject.

Liquidity Risk—The Fund may invest to a greater degree in securities or instruments that trade in lower volumes and may make investments that are less liquid than other investments. Also, the Fund may make investments that may become less liquid in response to market developments or adverse investor perceptions. Investments that are illiquid or that trade in lower volumes may be more difficult to value. When there is no willing buyer and investments cannot be readily sold at the desired time or price, the Fund may have to accept a lower price or may not be able to sell the security or instrument at all. An inability to sell one or more portfolio positions can adversely affect the Fund’s value or prevent the Fund from being able to take advantage of other investment opportunities.

To the extent that the traditional dealer counterparties that engage in fixed income trading do not maintain inventories of bonds (which provide an important indication of their ability to “make markets”) that keep pace with the growth of the bond markets over time, relatively low levels of dealer inventories could lead to decreased liquidity and increased volatility in the fixed income markets. Additionally, market participants other than a Fund may attempt to sell fixed income holdings at the same time as the Fund, which could cause downward pricing pressure and contribute to decreased liquidity.

Because the Fund may invest in non-investment grade fixed income securities and emerging country issuers, the Fund may be especially subject to the risk that during certain periods, the liquidity of particular issuers or industries, or all securities within a particular investment category, may shrink or disappear suddenly and without warning as a result of adverse economic, market or political events, or adverse investor perceptions, whether or not accurate.

Liquidity risk may also refer to the risk that the Fund will not be able to pay redemption proceeds within the allowable time period stated in the Prospectus or without significant dilution to remaining investors’ interests because of unusual market conditions, an unusually high volume of redemption requests or other reasons. While the Fund reserves the right to meet redemption requests through in-kind distributions, the Fund may instead choose to raise cash to meet redemption requests through sales of portfolio securities or permissible borrowings. If the Fund is forced to sell investments at an unfavorable time and/or under unfavorable conditions, such sales may adversely affect the Fund’s NAV and dilute remaining investors’ interests.

Certain shareholders, including clients or affiliates of the Investment Adviser and/or other funds managed by the Investment Adviser, may from time to time own or control a significant percentage of the Fund’s shares. Redemptions by these shareholders of their shares of the Fund may further increase the Fund’s liquidity risk and may impact the Fund’s NAV. These shareholders may include, for example, institutional investors, funds of funds, discretionary advisory clients and other shareholders, whose buy-sell decisions are controlled by a single decision-maker.

Management Risk—A strategy used by the Investment Adviser may fail to produce the intended results.

Market Risk—The value of the securities in which the Fund invests may go up or down in response to the prospects of individual companies, particular sectors or governments and/or general economic conditions throughout the world. Price changes may be temporary or last for extended periods. The Fund’s investments may

10

be overweighted from time to time in one or more sectors or countries, which will increase the Fund’s exposure to risk of loss from adverse developments affecting those sectors or countries.

Global economies and financial markets are becoming increasingly interconnected, and conditions and events in one country, region or financial market may adversely impact issuers in a different country, region or financial market. Furthermore, local, regional and global events such as war, acts of terrorism, social unrest, natural disasters, the spread of infectious illness or other public health threats could also adversely impact issuers, markets and economies, including in ways that cannot necessarily be foreseen. The Fund could be negatively impacted if the value of a portfolio holding were harmed by such political or economic conditions or events. In addition, governmental and quasi-governmental organizations have taken a number of unprecedented actions designed to support the markets. Such conditions, events and actions may result in greater market risk.

Mortgage-Backed and Other Asset-Backed Securities Risk—Mortgage-related and other asset-backed securities are subject to certain additional risks. Generally, rising interest rates tend to extend the duration of fixed rate Mortgage-Backed Securities, making them more sensitive to changes in interest rates. As a result, in a period of rising interest rates, if the Fund holds Mortgage-Backed Securities, it may exhibit additional volatility. This is known as extension risk. In addition, adjustable and fixed rate Mortgage-Backed Securities are subject to prepayment risk. When interest rates decline, borrowers may pay off their mortgages sooner than expected. This can reduce the returns of the Fund because the Fund may have to reinvest that money at the lower prevailing interest rates.

The Fund’s investments in other asset-backed securities are subject to risks similar to those associated with Mortgage-Backed Securities, as well as additional risks associated with the nature of the assets and the servicing of those assets. Asset-backed securities may not have the benefit of a security interest in collateral comparable to that of mortgage assets, resulting in additional credit risk.

The Fund may invest in Mortgage-Backed Securities issued by the U.S. Government (see “U.S. Government Securities Risk”). To the extent that the Fund invests in Mortgage-Backed Securities offered by non-governmental issuers, such as commercial banks, savings and loan institutions, private mortgage insurance companies, mortgage bankers and other secondary market issuers, the Fund may be subject to additional risks. Timely payment of interest and principal of non-governmental issuers are supported by various forms of private insurance or guarantees, including individual loan, title, pool and hazard insurance purchased by the issuer. There can be no assurance that the private insurers can meet their obligations under the policies. An unexpectedly high rate of defaults on the mortgages held by a mortgage pool may adversely affect the value of a mortgage-backed security and could result in losses to the Fund. The risk of such defaults is generally higher in the case of mortgage pools that include subprime mortgages. Subprime mortgages refer to loans made to borrowers with weakened credit histories or with a lower capacity to make timely payments on their mortgages.

The Fund may gain exposure to Agency Mortgage-Backed Securities by utilizing TBA agreements. TBA agreements involve the risk that the other party to the transaction will not meet its obligation. If this occurs, the Fund could lose the opportunity to obtain a price or yield that it considers advantageous. In such circumstances, the Fund may not be able to secure an alternative investment with comparable terms. TBA agreements may give rise to a form of leverage. The Fund’s use of TBA agreements may also result in a higher portfolio turnover rate and/or increased capital gains for the Fund.

Municipal Securities Risk (Surviving Fund)—Municipal securities are subject to call/prepayment risk, credit/default risk, extension risk, interest rate risk and certain additional risks. The Fund may be more sensitive to adverse economic, business or political developments if it invests a substantial portion of its assets in the debt securities of similar projects (such as those relating to education, health care, housing, transportation, and utilities), industrial development bonds, or in particular types of municipal securities (such as general obligation bonds, private activity bonds and moral obligation bonds). While interest earned on municipal securities is generally not subject to federal tax, any interest earned on taxable municipal securities is fully taxable at the

11

federal level and may be subject to tax at the state level. Specific risks are associated with different types of municipal securities. With respect to general obligation bonds, the full faith, credit and taxing power of the municipality that issues a general obligation bond secures payment of interest and repayment of principal. Certain of the municipalities in which the Funds invest may experience significant financial difficulties, which may lead to bankruptcy or default. Timely payments depend on the issuer’s credit quality, ability to raise tax revenues and ability to maintain an adequate tax base.

With respect to revenue bonds, payments of interest and principal are made only from the revenues generated by a particular facility, class of facilities or the proceeds of a special tax, or other revenue source, and depends on the money earned by that source. Private activity bonds are issued by municipalities and other public authorities to finance development of industrial facilities for use by a private enterprise. The private enterprise pays the principal and interest on the bond, and the issuer does not pledge its full faith, credit and taxing power for repayment. If the private enterprise defaults on its payments, the Fund may not receive any income or get its money back from the investment. Moral obligation bonds are generally issued by special purpose public authorities of a state or municipality. If the issuer is unable to meet its obligations, repayment of these bonds becomes a moral commitment, but not a legal obligation, of the state or municipality. Municipal notes are shorter term municipal debt obligations. They may provide interim financing in anticipation of, and are secured by, tax collection, bond sales or revenue receipts. If there is a shortfall in the anticipated proceeds, the notes may not be fully repaid and the Fund may lose money. In a municipal lease obligation, the issuer agrees to make payments when due on the lease obligation. The issuer will generally appropriate municipal funds for that purpose, but is not obligated to do so. Although the issuer does not pledge its unlimited taxing power for payment of the lease obligation, the lease obligation is secured by the leased property. However, if the issuer does not fulfill its payment obligation it may be difficult to sell the property and the proceeds of a sale may not cover the Fund’s loss.

NAV Risk—The net asset value of the Fund and the value of your investment will fluctuate.

Non-Hedging Foreign Currency Trading Risk (Surviving Fund)—The Fund may engage in forward foreign currency transactions for investment purposes. The Investment Adviser may purchase or sell foreign currencies through the use of forward contracts based on the Investment Adviser’s judgment regarding the direction of the market for a particular foreign currency or currencies. In pursuing this strategy, the Investment Adviser seeks to profit from anticipated movements in currency rates by establishing “long” and/or “short” positions in forward contracts on various foreign currencies. Foreign exchange rates can be extremely volatile and a variance in the degree of volatility of the market or in the direction of the market from the Investment Adviser’s expectations may produce significant losses to the Fund. Some of the transactions may also be subject to interest rate risk.

Non-Investment Grade Fixed Income Securities Risk (Surviving Fund)—Non-investment grade fixed income securities and unrated securities of comparable credit quality (commonly known as “junk bonds”) are considered speculative and are subject to the increased risk of an issuer’s inability to meet principal and interest payment obligations. These securities may be subject to greater price volatility due to such factors as specific issuer developments, interest rate sensitivity, negative perceptions of the junk bond markets generally and less liquidity.

Other Investment Companies Risk—By investing in other investment companies (including ETFs), indirectly through the Fund, investors will incur a proportionate share of the expenses of the other investment companies held by the Fund (including operating costs and investment management fees) in addition to the fees and expenses regularly borne by the Fund. In addition, the Fund will be affected by the investment policies, practices and performance of such investment companies in direct proportion to the amount of assets the Fund invests therein.

Reverse Repurchase Agreements Risk—Reverse repurchase agreements involve the sale of securities held by the Fund subject to an agreement to repurchase them at a mutually agreed upon date and price (including interest). The Fund may enter these transactions when the Investment Adviser expects that the return to be earned from the

12

investment of the transaction proceeds to be greater than the interest expense of the transaction. Reverse repurchase agreements may also be entered into as a temporary measure for emergency purposes or to meet redemption requests.

Reverse repurchase agreements are a form of secured borrowing and subject the Fund to the risks associated with leverage, including exposure to potential gains and losses in excess of the amount invested. If the securities held by the Fund decline in value while these transactions are outstanding, the NAV of the Fund’s outstanding shares will decline in value by proportionately more than the decline in value of the securities. In addition, reverse repurchase agreements involve the risk that the investment return earned by the Fund (from the investment of the proceeds) will be less than the interest expense of the transaction, that the market value of the securities sold by the Fund will decline below the price the Fund is obligated to pay to repurchase the securities, and that the other party may fail to return the securities in a timely manner or at all.