UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05349

Goldman Sachs Trust

(Exact name of registrant as specified in charter)

71 South Wacker Drive, Chicago, Illinois 60606

(Address of principal executive offices) (Zip code)

| Caroline Kraus, Esq. | Copies to: | |

| Goldman Sachs & Co. LLC | Geoffrey R.T. Kenyon, Esq. | |

| 200 West Street | Dechert LLP | |

| New York, New York 10282 | 100 Oliver Street | |

| 40th Floor | ||

| Boston, MA 02110-2605 |

(Name and address of agents for service)

Registrant’s telephone number, including area code: (312) 655-4400

Date of fiscal year end: October 31

Date of reporting period: April 30, 2021

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

| The Semi-Annual Report to Shareholders is filed herewith. |

Goldman Sachs Funds

| Semi-Annual Report | April 30, 2021 | |||

| Dividend Focus Funds | ||||

| Income Builder | ||||

| Rising Dividend Growth | ||||

Goldman Sachs Dividend Focus Funds

| ∎ | INCOME BUILDER |

| ∎ | RISING DIVIDEND GROWTH |

| 1 | ||||

| 2 | ||||

| 7 | ||||

| 27 | ||||

| 30 | ||||

| 30 | ||||

| 36 | ||||

| 43 | ||||

| 64 | ||||

| NOT FDIC-INSURED | May Lose Value | No Bank Guarantee | ||

GOLDMAN SACHS DIVIDEND FOCUS FUNDS

Portfolio Management Team Changes for the

Goldman Sachs Dividend Focus Funds

Effective May 24, 2021, after the close of the Reporting Period, Christopher Lvoff no longer served as a portfolio manager of the Goldman Sachs Income Builder Fund and Goldman Sachs Rising Dividend Growth Fund (the “Funds”). Effective the same date, Neill Nuttall, Managing Director and Chief Investment Officer in the Multi-Asset Solutions (“MAS”) Group in Goldman Sachs Asset Management, began serving as a portfolio manager for the Goldman Sachs Income Builder Fund, and Siwen Wu, Vice President in the MAS Group, began serving as a portfolio manager for the Goldman Sachs Rising Dividend Growth Fund. Ashish Shah, Ron Arons, Collin Bell and Charles “Brook” Dane continue to serve as portfolio managers for the Goldman Sachs Income Builder Fund. Monali Vora, Aron Kershner and Kyri Loupis continue to serve as portfolio managers for the Goldman Sachs Rising Dividend Growth Fund. By design, all investment decisions for the Funds are performed within a co-lead or team structure, with multiple subject matter experts. This strategic decision making has been the cornerstone of our approach and helps to ensure continuity in the Funds.

1

Income Builder Fund

as of April 30, 2021

| PERFORMANCE REVIEW |

|

|||||||||||||

| November 1, 2020–April 30, 2021 | Fund Total Return (based on NAV)1 |

Russell 1000® Value Index2 |

ICE BofAML BB to B U.S. High Yield Constrained Index3 |

|||||||||||

| Class A | 14.48 | % | 36.30 | % | 6.63 | % | ||||||||

| Class C | 14.01 | 36.30 | 6.63 | |||||||||||

| Institutional | 14.66 | 36.30 | 6.63 | |||||||||||

| Investor | 14.62 | 36.30 | 6.63 | |||||||||||

| Class R6 | 14.66 | 36.30 | 6.63 | |||||||||||

| Class P | 14.66 | 36.30 | 6.63 | |||||||||||

| 1 | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance assumes the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The Russell 1000® Value Index measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000® Index companies with lower price-to-book ratios and lower expected growth values. This index is constructed to provide a comprehensive and unbiased barometer for the large-cap value segment. The Index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect value characteristics. It is not possible to invest directly in an unmanaged index. |

| 3 | The BofAML BB to B U.S. High Yield Constrained Index contains all securities in the ICE BofAML U.S. High Yield Index rated BB1 through B3, based on an average of Moody’s, S&P and Fitch, but caps issuer exposure at 2%. Index constituents are capitalization-weighted, based on their current amount outstanding, provided the total allocation to an individual issuer does not exceed 2%. Issuers that exceed the limit are reduced to 2% and the face value of each of their bonds is adjusted on a pro-rata basis. Similarly, the face values of bonds of all other issuers that fall below the 2% cap are increased on a pro-rata basis. It is not possible to invest directly in an unmanaged index. |

The returns set forth in the table above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

2

FUND BASICS

| TOP TEN EQUITY HOLDINGS AS OF 4/30/214 | ||||||||

| Holding | % of Net Assets | Line of Business | ||||||

| Johnson & Johnson | 1.0 | % | Pharmaceuticals | |||||

| Comcast Corp. Class A | 0.9 | Media | ||||||

| Linde PLC | 0.9 | Chemicals | ||||||

| Cisco Systems, Inc. | 0.9 | Communications Equipment | ||||||

| Schneider Electric SE ADR | 0.9 | Electrical Equipment | ||||||

| Deere & Co. | 0.9 | Machinery | ||||||

| Medtronic PLC | 0.8 | Health Care Equipment & Supplies | ||||||

| Honeywell International, Inc. | 0.8 | Industrial Conglomerates | ||||||

| JPMorgan Chase & Co. | 0.8 | Banks | ||||||

| Bristol-Myers Squibb Co. | 0.8 | Pharmaceuticals | ||||||

| 4 | The top 10 holdings may not be representative of the Fund’s future investments. The top 10 holdings exclude investments in money market funds. |

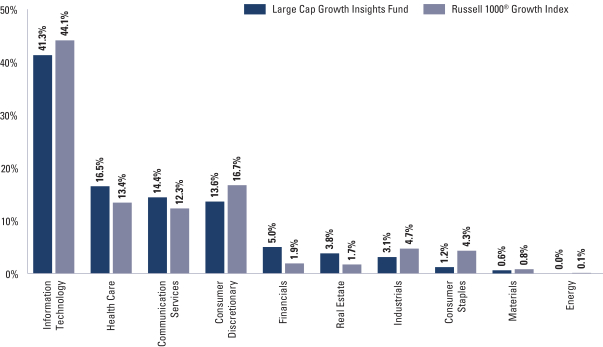

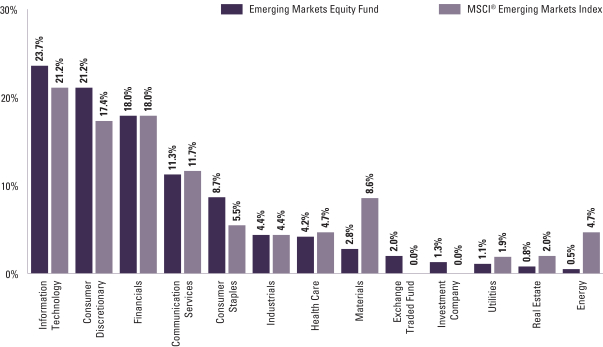

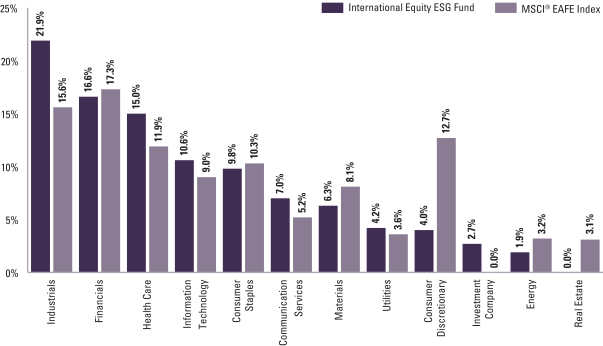

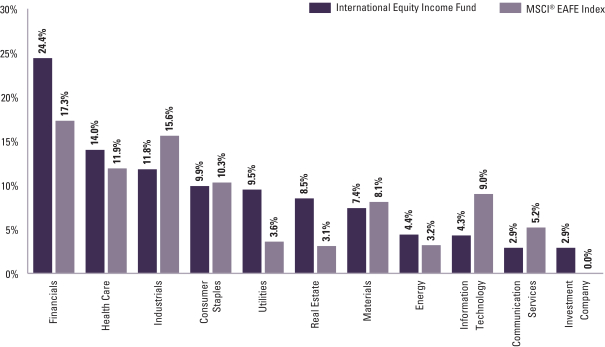

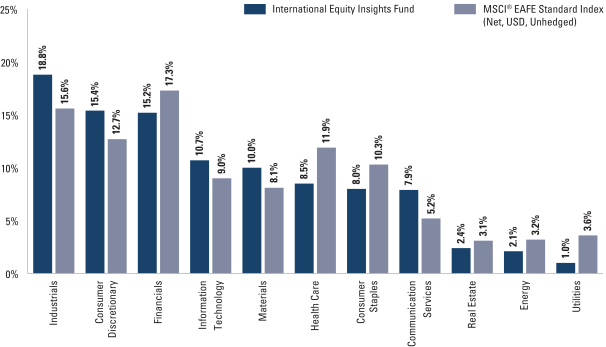

| FUND’S EQUITY SECTOR ALLOCATIONS VS. BENCHMARK5 | ||||||

| As of April 30, 2021 | ||||||

| 5 | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”); however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of the total value of the Fund’s Equity investments market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

3

FUND BASICS

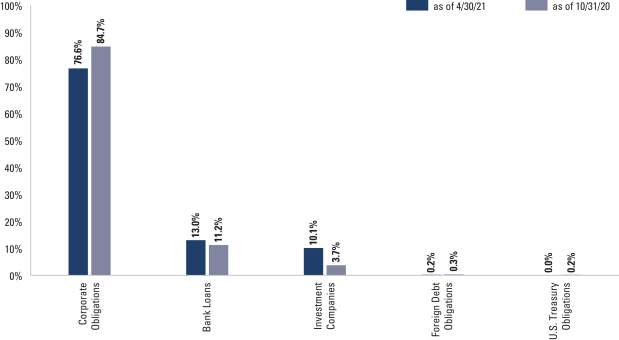

| FUND’S FIXED INCOME COMPOSITION6 |

| 6 | The percentage shown for each investment category reflects the value of investments in that category as a percentage of the Fund’s Fixed Income investments. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about your Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about your Fund’s investment strategies, holdings, and performance.

4

FUND BASICS

Rising Dividend Growth Fund

as of April 30, 2021

| PERFORMANCE REVIEW |

| |||||||||

| November 1, 2020–April 30, 2021 | Fund Total Return (based on NAV)1 |

S&P 500 Index2 | ||||||||

| Class A | 36.14 | % | 28.85 | % | ||||||

| Class C | 35.58 | 28.85 | ||||||||

| Institutional | 36.23 | 28.85 | ||||||||

| Investor | 36.26 | 28.85 | ||||||||

| Class R6 | 36.37 | 28.85 | ||||||||

| Class R | 35.91 | 28.85 | ||||||||

| Class P | 36.23 | 28.85 | ||||||||

| 1 | The net asset value (“NAV”) represents the net assets of the class of the Fund (ex-dividend) divided by the total number of shares of the class outstanding. The Fund’s performance reflects the reinvestment of dividends and other distributions. The Fund’s performance does not reflect the deduction of any applicable sales charges. |

| 2 | The S&P 500 Index is the Standard & Poor’s 500 Composite Index of 500 stocks, an unmanaged index of common stock prices. The Index figures do not reflect any deduction for fees, expenses or taxes. It is not possible to invest directly in an index. |

The returns set forth in the tables above represent past performance. Past performance does not guarantee future results. The Fund’s investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted above. Please visit our web site at www.GSAMFUNDS.com to obtain the most recent month-end returns. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. In their absence, performance would be reduced. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

5

FUND BASICS

| TOP TEN HOLDINGS AS OF 4/30/213 | ||||||||

| Holding | % of Net Assets | Line of Business | ||||||

| Comcast Corp. Class A | 2.5 | % | Media | |||||

| Activision Blizzard, Inc. | 1.9 | Entertainment | ||||||

| MPLX LP | 1.9 | Oil, Gas & Consumable Fuels | ||||||

| Enterprise Products Partners LP | 1.7 | Oil, Gas & Consumable Fuels | ||||||

| Energy Transfer LP | 1.7 | Oil, Gas & Consumable Fuels | ||||||

| ViacomCBS, Inc. Class B | 1.6 | Media | ||||||

| Danaher Corp. | 1.5 | Health Care Equipment & Supplies | ||||||

| Omnicom Group, Inc. | 1.5 | Media | ||||||

| UnitedHealth Group, Inc. | 1.5 | Health Care Providers & Services | ||||||

| The Interpublic Group of Cos., Inc. | 1.3 | Media | ||||||

| 3 | The top 10 holdings may not be representative of the Fund’s future investments. The top 10 holdings exclude investments in money market funds. |

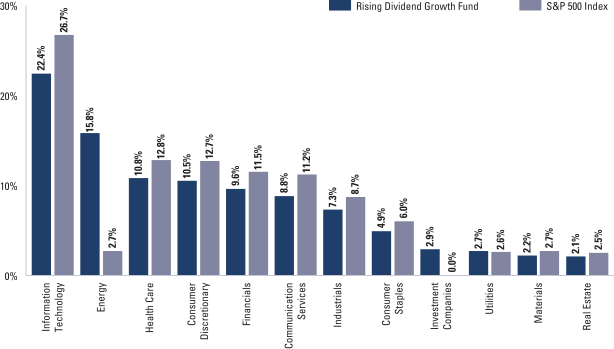

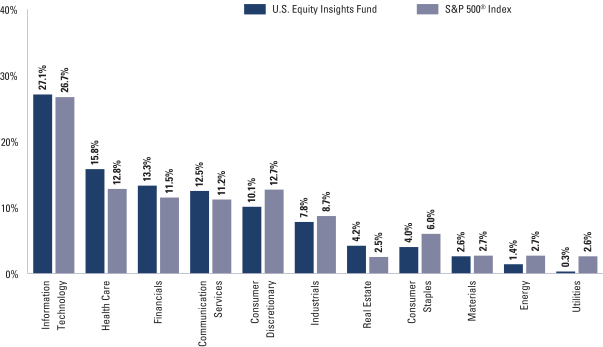

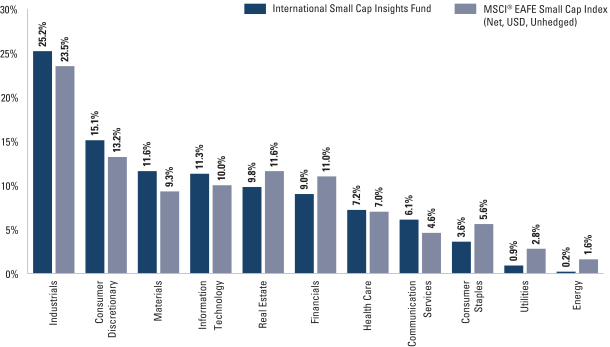

| FUND VS. BENCHMARK SECTOR ALLOCATION4 |

| As of April 30, 2021 |

| 4 | The Fund is actively managed and, as such, its composition may differ over time. Consequently, the Fund’s overall sector allocations may differ from the percentages contained in the graph above. The graph categorizes investments using the Global Industry Classification Standard (“GICS”), however, the sector classifications used by the portfolio management team may differ from GICS. The percentage shown for each investment category reflects the value of investments in that category as a percentage of market value. The graph depicts the Fund’s investments but may not represent the Fund’s market exposure due to the exclusion of certain derivatives, if any, as listed in the Additional Investment Information section of the Schedule of Investments. |

For more information about the Fund, please refer to www.GSAMFUNDS.com. There, you can learn more about the Fund’s investment strategies, holdings, and performance.

6

GOLDMAN SACHS INCOME BUILDER FUND

April 30, 2021 (Unaudited)

| Shares | Description |

Value | ||||||

| Common Stocks – 38.0% | ||||||||

| Aerospace & Defense – 0.6% | ||||||||

| 33,940 | Northrop Grumman Corp. | $ | 12,029,694 | |||||

|

|

|

|||||||

| Banks – 2.8% | ||||||||

| 401,014 | BNP Paribas SA ADR(a) | 12,860,519 | ||||||

| 110,410 | JPMorgan Chase & Co. | 16,982,162 | ||||||

| 89,304 | M&T Bank Corp. | 14,082,348 | ||||||

| 246,698 | Truist Financial Corp. | 14,631,658 | ||||||

|

|

|

|||||||

| 58,556,687 | ||||||||

|

|

|

|||||||

| Beverages – 0.7% | ||||||||

| 278,431 | The Coca-Cola Co. | 15,029,705 | ||||||

|

|

|

|||||||

| Biotechnology – 0.4% | ||||||||

| 31,136 | Amgen, Inc. | 7,461,431 | ||||||

|

|

|

|||||||

| Capital Markets – 1.5% | ||||||||

| 12,057 | BlackRock, Inc. | 9,878,300 | ||||||

| 37,255 | CME Group, Inc. | 7,525,138 | ||||||

| 100,104 | Morgan Stanley | 8,263,585 | ||||||

| 54,793 | Singapore Exchange Ltd. ADR | 6,449,136 | ||||||

|

|

|

|||||||

| 32,116,159 | ||||||||

|

|

|

|||||||

| Chemicals – 1.2% | ||||||||

| 22,290 | Ecolab, Inc. | 4,995,635 | ||||||

| 67,449 | Linde PLC | 19,279,622 | ||||||

|

|

|

|||||||

| 24,275,257 | ||||||||

|

|

|

|||||||

| Commercial Services & Supplies – 0.5% | ||||||||

| 94,610 | Republic Services, Inc. | 10,057,043 | ||||||

|

|

|

|||||||

| Communications Equipment – 1.1% | ||||||||

| 368,793 | Cisco Systems, Inc. | 18,775,252 | ||||||

| 143,937 | Juniper Networks, Inc. | 3,654,560 | ||||||

|

|

|

|||||||

| 22,429,812 | ||||||||

|

|

|

|||||||

| Construction & Engineering – 0.3% | ||||||||

| 262,424 | Vinci SA ADR | 7,179,921 | ||||||

|

|

|

|||||||

| Consumer Finance – 0.4% | ||||||||

| 49,840 | American Express Co. | 7,642,964 | ||||||

|

|

|

|||||||

| Containers & Packaging – 0.7% | ||||||||

| 262,027 | International Paper Co. | 15,197,566 | ||||||

|

|

|

|||||||

| Diversified Telecommunication Services – 0.7% | ||||||||

| 262,770 | Verizon Communications, Inc. | 15,185,478 | ||||||

|

|

|

|||||||

| Electric Utilities – 1.1% | ||||||||

| 923,410 | Enel SpA ADR | 9,132,525 | ||||||

| 128,296 | NextEra Energy, Inc. | 9,944,223 | ||||||

| 68,465 | Xcel Energy, Inc. | 4,881,554 | ||||||

|

|

|

|||||||

| 23,958,302 | ||||||||

|

|

|

|||||||

| Electrical Equipment – 1.6% | ||||||||

| 110,479 | Eaton Corp. PLC | 15,790,763 | ||||||

| 581,783 | Schneider Electric SE ADR | 18,532,698 | ||||||

|

|

|

|||||||

| 34,323,461 | ||||||||

|

|

|

|||||||

| Electronic Equipment, Instruments & Components – 0.4% | ||||||||

| 59,657 | TE Connectivity Ltd. | 8,022,077 | ||||||

|

|

|

|||||||

| Common Stocks – (continued) | ||||||||

| Entertainment(a) – 0.3% | ||||||||

| 29,565 | The Walt Disney Co. | 5,499,681 | ||||||

|

|

|

|||||||

| Equity Real Estate Investment Trusts (REITs) – 2.7% | ||||||||

| 45,375 | Alexandria Real Estate Equities, Inc. | 8,217,412 | ||||||

| 34,381 | American Tower Corp. | 8,759,247 | ||||||

| 43,129 | AvalonBay Communities, Inc. | 8,280,768 | ||||||

| 36,026 | Boston Properties, Inc. | 3,939,443 | ||||||

| 53,000 | Camden Property Trust | 6,385,440 | ||||||

| 167,134 | Hudson Pacific Properties, Inc. | 4,698,137 | ||||||

| 60,024 | Prologis, Inc. | 6,994,597 | ||||||

| 160,584 | Ventas, Inc. | 8,905,989 | ||||||

|

|

|

|||||||

| 56,181,033 | ||||||||

|

|

|

|||||||

| Food Products – 1.0% | ||||||||

| 70,561 | Archer-Daniels-Midland Co. | 4,454,516 | ||||||

| 94,234 | Mondelez International, Inc. Class A | 5,730,370 | ||||||

| 98,097 | Nestle SA ADR | 11,725,534 | ||||||

|

|

|

|||||||

| 21,910,420 | ||||||||

|

|

|

|||||||

| Health Care Equipment & Supplies – 1.3% | ||||||||

| 131,272 | Medtronic PLC | 17,186,130 | ||||||

| 59,020 | Zimmer Biomet Holdings, Inc. | 10,455,983 | ||||||

|

|

|

|||||||

| 27,642,113 | ||||||||

|

|

|

|||||||

| Health Care Providers & Services – 0.8% | ||||||||

| 80,301 | CVS Health Corp. | 6,134,996 | ||||||

| 27,311 | UnitedHealth Group, Inc. | 10,891,627 | ||||||

|

|

|

|||||||

| 17,026,623 | ||||||||

|

|

|

|||||||

| Hotels, Restaurants & Leisure – 1.4% | ||||||||

| 255,076 | Aramark | 9,914,804 | ||||||

| 59,731 | McDonald’s Corp. | 14,101,295 | ||||||

| 46,655 | Starbucks Corp. | 5,341,531 | ||||||

|

|

|

|||||||

| 29,357,630 | ||||||||

|

|

|

|||||||

| Household Products – 0.7% | ||||||||

| 47,498 | Kimberly-Clark Corp. | 6,332,434 | ||||||

| 68,877 | The Procter & Gamble Co. | 9,189,569 | ||||||

|

|

|

|||||||

| 15,522,003 | ||||||||

|

|

|

|||||||

| Industrial Conglomerates – 0.8% | ||||||||

| 76,228 | Honeywell International, Inc. | 17,001,893 | ||||||

|

|

|

|||||||

| Insurance – 1.2% | ||||||||

| 69,298 | Chubb Ltd. | 11,890,844 | ||||||

| 35,068 | The Travelers Cos., Inc. | 5,423,617 | ||||||

| 177,145 | Zurich Insurance Group AG ADR | 7,282,431 | ||||||

|

|

|

|||||||

| 24,596,892 | ||||||||

|

|

|

|||||||

| IT Services – 1.4% | ||||||||

| 21,587 | Accenture PLC Class A | 6,259,582 | ||||||

| 96,554 | Cognizant Technology Solutions Corp. Class A | 7,762,942 | ||||||

| 54,430 | Fidelity National Information Services, Inc. | 8,322,347 | ||||||

|

|

|

|||||||

| The accompanying notes are an integral part of these financial statements. | 7 |

GOLDMAN SACHS INCOME BUILDER FUND

Schedule of Investments (continued)

April 30, 2021 (Unaudited)

| Shares | Description |

Value | ||||||

| Common Stocks – (continued) | ||||||||

| IT Services – (continued) | ||||||||

| 52,010 | International Business Machines Corp. | $ | 7,379,179 | |||||

|

|

|

|||||||

| 29,724,050 | ||||||||

|

|

|

|||||||

| Machinery – 1.5% | ||||||||

| 49,521 | Deere & Co. | 18,364,863 | ||||||

| 56,859 | Illinois Tool Works, Inc. | 13,103,725 | ||||||

|

|

|

|||||||

| 31,468,588 | ||||||||

|

|

|

|||||||

| Media – 0.9% | ||||||||

| 194,739 | Bright Pattern Holding Co.(b) | 486,846 | ||||||

| 346,719 | Comcast Corp. Class A | 19,468,272 | ||||||

|

|

|

|||||||

| 19,955,118 | ||||||||

|

|

|

|||||||

| Metals & Mining – 0.7% | ||||||||

| 166,549 | Rio Tinto PLC ADR | 14,166,658 | ||||||

|

|

|

|||||||

| Multi-Utilities – 1.3% | ||||||||

| 93,765 | Ameren Corp. | 7,955,022 | ||||||

| 63,892 | CMS Energy Corp. | 4,114,006 | ||||||

| 111,510 | National Grid PLC ADR | 7,022,900 | ||||||

| 67,842 | Public Service Enterprise Group, Inc. | 4,284,901 | ||||||

| 29,137 | Sempra Energy | 4,008,377 | ||||||

|

|

|

|||||||

| 27,385,206 | ||||||||

|

|

|

|||||||

| Oil, Gas & Consumable Fuels – 1.1% | ||||||||

| 782 | Chesapeake Energy Corp.(a) | 35,636 | ||||||

| 141,487 | Chevron Corp. | 14,583,065 | ||||||

| 100,649 | Noble Corp. (Oil, Gas & Consumable Fuels) | 1,892,201 | ||||||

| 4,759 | Noble Corp.(b) (Oil, Gas & Consumable Fuels) | 89,469 | ||||||

| 183,398 | Royal Dutch Shell PLC ADR Class A | 6,969,124 | ||||||

| 17,730 | Summit Midstream Partners LP(a) | 418,606 | ||||||

|

|

|

|||||||

| 23,988,101 | ||||||||

|

|

|

|||||||

| Pharmaceuticals – 3.2% | ||||||||

| 100,887 | AstraZeneca PLC ADR(c) | 5,354,073 | ||||||

| 258,320 | Bristol-Myers Squibb Co. | 16,124,334 | ||||||

| 87,212 | Eli Lilly & Co. | 15,939,737 | ||||||

| 125,517 | Johnson & Johnson | 20,425,382 | ||||||

| 120,117 | Novartis AG ADR | 10,238,773 | ||||||

|

|

|

|||||||

| 68,082,299 | ||||||||

|

|

|

|||||||

| Road & Rail – 0.9% | ||||||||

| 35,120 | Norfolk Southern Corp. | 9,806,909 | ||||||

| 37,757 | Union Pacific Corp. | 8,385,452 | ||||||

|

|

|

|||||||

| 18,192,361 | ||||||||

|

|

|

|||||||

| Semiconductors & Semiconductor Equipment – 1.3% | ||||||||

| 23,687 | KLA Corp. | 7,469,695 | ||||||

| 47,244 | QUALCOMM, Inc. | 6,557,467 | ||||||

| 77,921 | Texas Instruments, Inc. | 14,065,520 | ||||||

|

|

|

|||||||

| 28,092,682 | ||||||||

|

|

|

|||||||

| Common Stocks – (continued) | ||||||||

| Software – 0.2% | ||||||||

| 17,095 | Microsoft Corp. | 4,311,017 | ||||||

|

|

|

|||||||

| Specialty Retail – 0.7% | ||||||||

| 45,640 | The Home Depot, Inc. | 14,772,299 | ||||||

|

|

|

|||||||

| Water Utilities – 0.6% | ||||||||

| 82,964 | American Water Works Co., Inc. | 12,941,554 | ||||||

|

|

|

|||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $579,258,184) | $ | 801,283,778 | ||||||

|

|

|

|||||||

| Shares | Dividend Rate |

Value | ||||

| Preferred Stocks(d) – 0.5% | ||||||

| Capital Markets(a)(e) – 0.2% | ||||||

| Morgan Stanley, Inc. (3M USD LIBOR + 3.708%) |

| |||||

| 183,597 | 6.375% | $ | 5,204,975 | |||

|

|

||||||

| Diversified Telecommunication Services – 0.1% | ||||||

| Qwest Corp. |

| |||||

| 43,276 | 6.500 | 1,104,404 | ||||

|

|

||||||

| Insurance(a)(e) – 0.2% | ||||||

| Delphi Financial Group, Inc. (3M USD LIBOR + 3.190%) |

| |||||

| 143,849 | 3.388 | 3,200,640 | ||||

|

|

||||||

| TOTAL PREFERRED STOCKS |

| |||||

| (Cost $8,780,987) | $ | 9,510,019 | ||||

|

|

||||||

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||

| Corporate Obligations – 45.9% | ||||||||||||||

| Advertising(d)(f) – 0.2% | ||||||||||||||

| Terrier Media Buyer, Inc. |

||||||||||||||

| $ | 2,850,000 | 8.875% | 12/15/27 | $ | 3,088,688 | |||||||||

|

|

|

|||||||||||||

| Aerospace & Defense(d) – 0.6% | ||||||||||||||

| The Boeing Co. |

||||||||||||||

| 3,432,000 | 5.150 | 05/01/30 | 3,994,505 | |||||||||||

| 1,652,000 | 5.805 | 05/01/50 | 2,119,879 | |||||||||||

| TransDigm, Inc. |

||||||||||||||

| 365,000 | 6.500 | 05/15/25 | 371,460 | |||||||||||

| 3,300,000 | 5.500 | 11/15/27 | 3,432,000 | |||||||||||

| 315,000 | 4.625(f) | 01/15/29 | 309,488 | |||||||||||

| 266,000 | 4.875 | (f) | 05/01/29 | 262,010 | ||||||||||

| Triumph Group, Inc. |

||||||||||||||

| 2,885,000 | 7.750 | 08/15/25 | 2,856,150 | |||||||||||

|

|

|

|||||||||||||

| 13,345,492 | ||||||||||||||

|

|

|

|||||||||||||

| Agriculture – 0.5% | ||||||||||||||

| BAT Capital Corp.(d) |

||||||||||||||

| 10,000,000 | 4.390 | 08/15/37 | 10,302,700 | |||||||||||

| MHP SE |

||||||||||||||

| 670,000 | 7.750 | 05/10/24 | 705,091 | |||||||||||

|

|

|

|||||||||||||

| 11,007,791 | ||||||||||||||

|

|

|

|||||||||||||

| 8 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS INCOME BUILDER FUND

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Airlines(f) – 0.5% | ||||||||||||||

| Air Canada Pass Through Trust Series 2013-1, Class B |

||||||||||||||

| $ | 1,386,667 | 5.375 % | 05/15/21 | $ | 1,387,249 | |||||||||

| American Airlines, Inc./AAdvantage Loyalty IP Ltd. |

||||||||||||||

| 522,000 | 5.500 | 04/20/26 | 548,100 | |||||||||||

| 1,717,000 | 5.750 | 04/20/29 | 1,839,336 | |||||||||||

| |

Hawaiian Brand Intellectual Property Ltd./HawaiianMiles Loyalty |

| ||||||||||||

| 2,155,000 | 5.750 | 01/20/26 | 2,270,831 | |||||||||||

| United Airlines, Inc.(d) |

||||||||||||||

| 1,625,000 | 4.375 | 04/15/26 | 1,685,938 | |||||||||||

| 2,080,000 | 4.625 | 04/15/29 | 2,160,600 | |||||||||||

|

|

|

|||||||||||||

| 9,892,054 | ||||||||||||||

|

|

|

|||||||||||||

| Automotive – 1.4% | ||||||||||||||

| American Axle & Manufacturing, Inc.(d) |

||||||||||||||

| 1,000 | 6.250 | 04/01/25 | 1,034 | |||||||||||

| BorgWarner, Inc.(f) |

||||||||||||||

| 4,100,000 | 5.000 | 10/01/25 | 4,731,072 | |||||||||||

| Clarios Global LP/Clarios US Finance Co.(d)(f) |

||||||||||||||

| 1,850,000 | 8.500 | 05/15/27 | 1,995,687 | |||||||||||

| Dana, Inc.(d) |

||||||||||||||

| 2,075,000 | 4.250 | 09/01/30 | 2,103,531 | |||||||||||

| Dealer Tire LLC/DT Issuer LLC(d)(f) |

||||||||||||||

| 4,342,000 | 8.000 | 02/01/28 | 4,591,665 | |||||||||||

| Ford Motor Co. |

||||||||||||||

| 1,464,000 | 8.500 | 04/21/23 | 1,639,676 | |||||||||||

| Ford Motor Credit Co. LLC(d) |

||||||||||||||

| 1,600,000 | 4.140 | 02/15/23 | 1,657,830 | |||||||||||

| 400,000 | 4.687 | 06/09/25 | 428,505 | |||||||||||

| 1,543,000 | 5.125 | 06/16/25 | 1,684,302 | |||||||||||

| 4,260,000 | 3.375 | 11/13/25 | 4,356,370 | |||||||||||

| General Motors Co.(d) |

||||||||||||||

| 3,000,000 | 6.600 | 04/01/36 | 3,993,390 | |||||||||||

| Meritor, Inc.(d)(f) |

||||||||||||||

| 450,000 | 6.250 | 06/01/25 | 479,250 | |||||||||||

| Real Hero Merger Sub 2, Inc.(d)(f) |

||||||||||||||

| 360,000 | 6.250 | 02/01/29 | 373,050 | |||||||||||

| Tupy Overseas SA(d)(f) |

||||||||||||||

| 200,000 | 4.500 | 02/16/31 | 197,500 | |||||||||||

| Wheel Pros, Inc.(d)(f) |

||||||||||||||

| 1,420,000 | 6.500 | 05/15/29 | 1,420,000 | |||||||||||

|

|

|

|||||||||||||

| 29,652,862 | ||||||||||||||

|

|

|

|||||||||||||

| Banks – 3.7% | ||||||||||||||

| Akbank T.A.S.(d)(e) (5 Year USD Swap + 5.026%) |

||||||||||||||

| 320,000 | 7.200 | 03/16/27 | 321,260 | |||||||||||

| |

Alfa Bank AO Via Alfa Bond Issuance PLC(d)(e) (5 year CMT + |

| ||||||||||||

| 360,000 | 5.950 | 04/15/30 | 369,967 | |||||||||||

| Banco Davivienda SA(d)(e)(f) (10 year CMT + 5.097%) |

||||||||||||||

| 220,000 | 6.650 | 04/22/49 | 223,641 | |||||||||||

| Banco de Bogota SA |

||||||||||||||

| 330,000 | 6.250 | 05/12/26 | 369,435 | |||||||||||

| Banco do Brasil SA(d)(e) (10 Year CMT + 4.398%) |

||||||||||||||

| 200,000 | 6.250 | 04/15/49 | 197,750 | |||||||||||

| Banco Industrial SA/Guatemala(d)(e)(f) (5 Year CMT + 4.442%) |

||||||||||||||

| 460,000 | 4.875 | 01/29/31 | 473,455 | |||||||||||

|

|

|

|||||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Banks – (continued) | ||||||||||||||

| Banco Mercantil del Norte SA(d)(e) (5 year CMT + 4.967%) |

||||||||||||||

| 690,000 | 6.750 | 09/27/49 | 721,826 | |||||||||||

| Banco Santander SA |

||||||||||||||

| 2,000,000 | 3.490 | 05/28/30 | 2,115,160 | |||||||||||

| Bank of America Corp.(d)(e) (3M USD LIBOR + 3.898%) |

||||||||||||||

| 4,000,000 | 6.100 | 03/17/49 | 4,511,160 | |||||||||||

| BBVA Bancomer SA(d)(e) (5 Year CMT + 2.650%) |

||||||||||||||

| 530,000 | 5.125 | 01/18/33 | 549,312 | |||||||||||

| BNP Paribas SA(f) |

||||||||||||||

| 2,700,000 | 4.375 | 05/12/26 | 3,006,396 | |||||||||||

| CIT Group, Inc.(d) |

||||||||||||||

| 4,025,000 | 5.250 | 03/07/25 | 4,543,219 | |||||||||||

| Citigroup, Inc.(d)(e) |

||||||||||||||

| (3M USD LIBOR + 4.517%) |

||||||||||||||

| 1,890,000 | 6.250 | 08/15/49 | 2,204,212 | |||||||||||

| (SOFR + 3.914%) |

||||||||||||||

| 900,000 | 4.412 | 03/31/31 | 1,030,374 | |||||||||||

| Credit Bank of Moscow Via CBOM Finance PLC |

||||||||||||||

| 260,000 | 4.700 | (f) | 01/29/25 | 263,055 | ||||||||||

| (5 Year USD Swap + 5.416%) |

||||||||||||||

| 280,000 | 7.500 | (d)(e) | 10/05/27 | 281,313 | ||||||||||

| Credit Suisse Group AG(d)(e)(f) (5 Year USD Swap + 4.598%) |

||||||||||||||

| 1,702,000 | 7.500 | 12/11/49 | 1,876,455 | |||||||||||

| Deutsche Bank AG(d)(e) |

||||||||||||||

| (5 Year CMT + 4.524%) |

||||||||||||||

| 800,000 | 6.000 | 10/30/49 | 835,000 | |||||||||||

| (5 Year USD Swap + 2.248%) |

||||||||||||||

| 2,000,000 | 4.296 | 05/24/28 | 2,074,000 | |||||||||||

| First Bank of Nigeria, Ltd. Via FBN Finance Co. BV(f) |

||||||||||||||

| 200,000 | 8.625 | 10/27/25 | 209,310 | |||||||||||

| FirstRand Bank Ltd.(d)(e) (5 Year USD Swap + 3.561%) |

||||||||||||||

| 320,000 | 6.250 | 04/23/28 | 338,660 | |||||||||||

| Freedom Mortgage Corp.(d)(f) |

||||||||||||||

| 3,225,000 | 7.625 | 05/01/26 | 3,362,062 | |||||||||||

| Grupo Aval Ltd.(d) |

||||||||||||||

| 340,000 | 4.375 | (f) | 02/04/30 | 340,382 | ||||||||||

| 200,000 | 4.375 | 02/04/30 | 200,225 | |||||||||||

| ING Groep NV(d)(e) (5 Year USD Swap + 4.446%) |

||||||||||||||

| 5,000,000 | 6.500 | 04/16/49 | 5,562,500 | |||||||||||

| Intesa Sanpaolo SpA(f) |

||||||||||||||

| 8,000,000 | 5.017 | 06/26/24 | 8,670,000 | |||||||||||

| Itau Unibanco Holding SA(d)(e) (5 Year CMT + 3.981%) |

||||||||||||||

| 500,000 | 6.125 | 12/12/49 | 505,875 | |||||||||||

| JPMorgan Chase & Co.(d)(e) |

||||||||||||||

| (3M USD LIBOR + 3.330%) |

||||||||||||||

| 4,000,000 | 6.125 | 04/30/49 | 4,341,600 | |||||||||||

| (3M USD LIBOR + 3.800%) |

||||||||||||||

| 2,700,000 | 3.976 | 08/01/49 | 2,710,665 | |||||||||||

| (SOFR + 2.515%) |

||||||||||||||

| 441,000 | 2.956 | 05/13/31 | 453,895 | |||||||||||

| Morgan Stanley, Inc.(d)(e) (3M USD LIBOR + 3.610%) |

||||||||||||||

| 2,731,000 | 3.794 | 07/15/49 | 2,737,827 | |||||||||||

| Natwest Group PLC |

||||||||||||||

| 2,675,000 | 3.875 | 09/12/23 | 2,871,131 | |||||||||||

| 2,975,000 | 6.000 | 12/19/23 | 3,355,910 | |||||||||||

|

|

|

|||||||||||||

| The accompanying notes are an integral part of these financial statements. | 9 |

GOLDMAN SACHS INCOME BUILDER FUND

Schedule of Investments (continued)

April 30, 2021 (Unaudited)

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Banks – (continued) | ||||||||||||||

| OTP Bank Nyrt(d)(e) (-1x 5M EURIBOR ICE Swap + 3.200%) |

||||||||||||||

| EUR | 390,000 | 2.875 % | 07/15/29 | $ | 479,281 | |||||||||

| Standard Bank Group, Ltd.(d)(e) (5 year USD ICE Swap + 3.754%) |

||||||||||||||

| $ | 200,000 | 5.950 | 05/31/29 | 212,225 | ||||||||||

| Standard Chartered PLC(d)(e)(f) (5 Year CMT + 3.805%) |

||||||||||||||

| 4,255,000 | 4.750 | 01/14/49 | 4,313,506 | |||||||||||

| |

Tinkoff Bank JSC Via TCS Finance, Ltd.(d)(e) (5 year CMT + |

| ||||||||||||

| 550,000 | 9.250 | 09/15/49 | 575,197 | |||||||||||

| Truist Financial Corp.(d)(e) (10 Year CMT + 4.349%) |

||||||||||||||

| 2,237,000 | 5.100 | 03/01/49 | 2,495,284 | |||||||||||

| Turkiye Vakiflar Bankasi TAO |

||||||||||||||

| 200,000 | 6.000 | 11/01/22 | 200,663 | |||||||||||

| 220,000 | 6.500(f) | 01/08/26 | 219,381 | |||||||||||

| UBS Group AG(d)(e) (5 Year USD Swap + 4.590%) |

||||||||||||||

| 4,000,000 | 6.875 | 08/07/49 | 4,545,000 | |||||||||||

| UniCredit SpA(d)(e)(f) (5 Year CMT + 4.750%) |

||||||||||||||

| 1,525,000 | 5.459 | 06/30/35 | 1,624,958 | |||||||||||

| United Bank for Africa PLC |

||||||||||||||

| 670,000 | 7.750 | 06/08/22 | 691,641 | |||||||||||

| Uzbek Industrial and Construction Bank ATB |

||||||||||||||

| 370,000 | 5.750 | 12/02/24 | 382,557 | |||||||||||

| Yapi ve Kredi Bankasi A/S(d)(e) |

||||||||||||||

| (5 year CMT + 7.415%) |

||||||||||||||

| 340,000 | 7.875 | (f) | 01/22/31 | 340,744 | ||||||||||

| (5 Year USD Swap + 11.245%) |

||||||||||||||

| 260,000 | 13.875 | 01/15/49 | 291,769 | |||||||||||

|

|

|

|||||||||||||

| 77,999,238 | ||||||||||||||

|

|

|

|||||||||||||

| Beverages – 0.7% | ||||||||||||||

| Anadolu Efes Biracilik Ve Malt Sanayii A/S |

||||||||||||||

| 350,000 | 3.375 | 11/01/22 | 353,238 | |||||||||||

| |

Anheuser-Busch Cos. LLC/Anheuser-Busch InBev Worldwide, |

| ||||||||||||

| 8,050,000 | 4.700 | 02/01/36 | 9,521,621 | |||||||||||

| Central American Bottling Corp.(d) |

||||||||||||||

| 480,000 | 5.750 | 01/31/27 | 505,200 | |||||||||||

| Constellation Brands, Inc.(d) |

||||||||||||||

| 2,275,000 | 2.875 | 05/01/30 | 2,346,685 | |||||||||||

| Keurig Dr Pepper, Inc.(d) |

||||||||||||||

| 1,055,000 | 3.200 | 05/01/30 | 1,124,788 | |||||||||||

| 308,000 | 3.800 | 05/01/50 | 328,186 | |||||||||||

|

|

|

|||||||||||||

| 14,179,718 | ||||||||||||||

|

|

|

|||||||||||||

| Building Materials(d) – 0.4% | ||||||||||||||

| Builders FirstSource, Inc.(f) |

||||||||||||||

| 1,347,000 | 6.750 | 06/01/27 | 1,444,657 | |||||||||||

| 940,000 | 5.000 | 03/01/30 | 997,575 | |||||||||||

| Cemex SAB de CV |

||||||||||||||

| 670,000 | 7.375 | 06/05/27 | 757,268 | |||||||||||

| CP Atlas Buyer, Inc.(f) |

||||||||||||||

| 2,160,000 | 7.000 | 12/01/28 | 2,235,600 | |||||||||||

| Masonite International Corp.(f) |

||||||||||||||

| 2,075,000 | 5.375 | 02/01/28 | 2,202,094 | |||||||||||

|

|

|

|||||||||||||

| 7,637,194 | ||||||||||||||

|

|

|

|||||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Chemicals(d) – 0.9% | ||||||||||||||

| Air Products & Chemicals, Inc. |

||||||||||||||

| 200,000 | 2.800 | 05/15/50 | 189,676 | |||||||||||

| Axalta Coating Systems LLC(f) |

||||||||||||||

| 3,100,000 | 3.375 | 02/15/29 | 3,007,000 | |||||||||||

| HB Fuller Co. |

||||||||||||||

| 1,060,000 | 4.250 | 10/15/28 | 1,075,900 | |||||||||||

| Herens Holdco S.a.r.l.(f)(g) |

||||||||||||||

| 1,795,000 | 4.750 | 05/15/28 | 1,795,000 | |||||||||||

| INEOS Quattro Finance 2 PLC(f) |

||||||||||||||

| 780,000 | 3.375 | 01/15/26 | 778,050 | |||||||||||

| Ingevity Corp.(f) |

||||||||||||||

| 2,775,000 | 4.500 | 02/01/26 | 2,833,969 | |||||||||||

| 1,305,000 | 3.875 | 11/01/28 | 1,303,369 | |||||||||||

| Minerals Technologies, Inc.(f) |

||||||||||||||

| 1,695,000 | 5.000 | 07/01/28 | 1,767,037 | |||||||||||

| OCI NV(f) |

||||||||||||||

| 1,125,000 | 5.250 | 11/01/24 | 1,164,375 | |||||||||||

| Rayonier AM Products, Inc.(f) |

||||||||||||||

| 296,000 | 7.625 | 01/15/26 | 314,130 | |||||||||||

| Sasol Financing USA LLC |

||||||||||||||

| 280,000 | 4.375 | 09/18/26 | 284,200 | |||||||||||

| Valvoline, Inc.(f) |

||||||||||||||

| 885,000 | 3.625 | 06/15/31 | 862,875 | |||||||||||

| WR Grace & Co-Conn(f) |

||||||||||||||

| 2,938,000 | 4.875 | 06/15/27 | 3,055,520 | |||||||||||

|

|

|

|||||||||||||

| 18,431,101 | ||||||||||||||

|

|

|

|||||||||||||

| Commercial Services – 1.1% | ||||||||||||||

| Allied Universal Holdco LLC/Allied Universal Finance Corp.(d)(f) |

||||||||||||||

| 2,557,000 | 6.625 | 07/15/26 | 2,704,027 | |||||||||||

| Avis Budget Car Rental LLC/Avis Budget Finance, Inc.(d)(f) |

||||||||||||||

| 1,605,000 | 5.375 | 03/01/29 | 1,673,213 | |||||||||||

| Bright Scholar Education Holdings, Ltd. |

||||||||||||||

| 360,000 | 7.450 | 07/31/22 | 373,500 | |||||||||||

| IHS Markit Ltd.(d)(f) |

||||||||||||||

| 5,675,000 | 4.750 | 02/15/25 | 6,378,303 | |||||||||||

| Metis Merger Sub LLC(d)(f) |

||||||||||||||

| 1,209,000 | 6.500 | 05/15/29 | 1,209,000 | |||||||||||

| MPH Acquisition Holdings LLC(d)(f) |

||||||||||||||

| 1,915,000 | 5.750 | 11/01/28 | 1,879,094 | |||||||||||

| NESCO Holdings II, Inc.(d)(f) |

||||||||||||||

| 664,000 | 5.500 | 04/15/29 | 683,090 | |||||||||||

|

Rent-A-Center, Inc.(d)(f) |

||||||||||||||

| 850,000 | 6.375 | 02/15/29 | 918,000 | |||||||||||

| Sabre GLBL, Inc.(d)(f) |

||||||||||||||

| 2,405,000 | 9.250 | 04/15/25 | 2,876,981 | |||||||||||

| Techem Verwaltungsgesellschaft 674 MBH(d) |

||||||||||||||

| EUR | 760,000 | 6.000 | 07/30/26 | 945,708 | ||||||||||

| Verisure Holding AB(d)(f) |

||||||||||||||

| 725,000 | 3.250 | 02/15/27 | 877,253 | |||||||||||

| Verisure Midholding AB(d) |

||||||||||||||

| 600,000 | 5.250 | 02/15/29 | 744,332 | |||||||||||

| 800,000 | 5.250(f) | 02/15/29 | 993,010 | |||||||||||

|

|

|

|||||||||||||

| 22,255,511 | ||||||||||||||

|

|

|

|||||||||||||

| 10 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS INCOME BUILDER FUND

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Computers(d) – 1.3% | ||||||||||||||

| Austin BidCo, Inc.(f) |

||||||||||||||

| $ | 2,371,000 | 7.125 % | 12/15/28 | $ | 2,412,493 | |||||||||

| Banff Merger Sub, Inc.(f) |

||||||||||||||

| 1,000,000 | 9.750 | 09/01/26 | 1,063,750 | |||||||||||

| Booz Allen Hamilton, Inc.(f) |

||||||||||||||

| 2,513,000 | 3.875 | 09/01/28 | 2,519,282 | |||||||||||

| Dell International LLC/EMC Corp.(f) |

||||||||||||||

| 5,000,000 | 8.100 | 07/15/36 | 7,397,150 | |||||||||||

| Hewlett Packard Enterprise Co. |

||||||||||||||

| 3,000,000 | 6.200 | 10/15/35 | 3,985,410 | |||||||||||

| Presidio Holdings, Inc.(f) |

||||||||||||||

| 2,095,000 | 8.250 | 02/01/28 | 2,288,788 | |||||||||||

| Seagate HDD Cayman(f) |

||||||||||||||

| 3,979,000 | 3.125 | 07/15/29 | 3,829,787 | |||||||||||

| Unisys Corp.(f) |

||||||||||||||

| 1,060,000 | 6.875 | 11/01/27 | 1,166,000 | |||||||||||

| Western Digital Corp. |

||||||||||||||

| 3,000,000 | 4.750 | 02/15/26 | 3,322,500 | |||||||||||

|

|

|

|||||||||||||

| 27,985,160 | ||||||||||||||

|

|

|

|||||||||||||

| Cosmetics/Personal Care(d) – 0.2% | ||||||||||||||

| Coty, Inc. |

||||||||||||||

| EUR | 3,650,000 | 4.000 | 04/15/23 | 4,342,354 | ||||||||||

|

|

|

|||||||||||||

| Distribution & Wholesale(d)(f) – 0.9% | ||||||||||||||

| American Builders & Contractors Supply Co, Inc. |

||||||||||||||

| $ | 2,760,000 | 3.875 | 11/15/29 | 2,756,550 | ||||||||||

| BCPE Empire Holdings, Inc. |

||||||||||||||

| 2,446,000 | 7.625 | 05/01/27 | 2,433,770 | |||||||||||

| Core & Main Holdings LP(h) (PIK 9.375%, Cash 8.625%) |

||||||||||||||

| 3,000,000 | 8.625 | 09/15/24 | 3,067,500 | |||||||||||

| IAA, Inc. |

||||||||||||||

| 750,000 | 5.500 | 06/15/27 | 787,500 | |||||||||||

| Performance Food Group, Inc. |

||||||||||||||

| 2,150,000 | 5.500 | 06/01/24 | 2,152,687 | |||||||||||

| 1,150,000 | 5.500 | 10/15/27 | 1,213,250 | |||||||||||

| Univar Solutions USA, Inc. |

||||||||||||||

| 3,200,000 | 5.125 | 12/01/27 | 3,344,000 | |||||||||||

| Wolverine Escrow LLC |

||||||||||||||

| 3,118,000 | 8.500 | 11/15/24 | 3,040,050 | |||||||||||

| 250,000 | 9.000 | 11/15/26 | 243,750 | |||||||||||

|

|

|

|||||||||||||

| 19,039,057 | ||||||||||||||

|

|

|

|||||||||||||

| Diversified Financial Services – 2.6% | ||||||||||||||

| AerCap Holdings NV(d)(e) (5 Year CMT + 4.535%) |

||||||||||||||

| 1,825,000 | 5.875 | 10/10/79 | 1,888,875 | |||||||||||

| Air Lease Corp.(d) |

||||||||||||||

| 2,750,000 | 3.750 | 06/01/26 | 2,970,220 | |||||||||||

| (5 year CMT + 4.076%) |

||||||||||||||

| 1,315,000 | 4.650 | (e) | 06/15/49 | 1,341,300 | ||||||||||

| Ally Financial, Inc. |

||||||||||||||

| 4,000,000 | 8.000 | 11/01/31 | 5,622,120 | |||||||||||

| Aviation Capital Group LLC(d)(f) |

||||||||||||||

| 800,000 | 1.950 | 01/30/26 | 785,680 | |||||||||||

| Avolon Holdings Funding Ltd.(d)(f) |

||||||||||||||

| 3,450,000 | 5.250 | 05/15/24 | 3,767,055 | |||||||||||

|

|

|

|||||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Diversified Financial Services – (continued) | ||||||||||||||

| Compass Group Diversified Holdings LLC(d)(f) |

||||||||||||||

| 1,418,000 | 5.250 | 04/15/29 | 1,495,990 | |||||||||||

| Curo Group Holdings Corp.(d)(f) |

||||||||||||||

| 2,125,000 | 8.250 | 09/01/25 | 2,164,844 | |||||||||||

| GE Capital Funding LLC(d)(f) |

||||||||||||||

| 2,350,000 | 3.450 | 05/15/25 | 2,549,303 | |||||||||||

| |

Global Aircraft Leasing Co.

Ltd.(d)(f)(h) (PIK 7.250%, Cash |

| ||||||||||||

| 1,879,174 | 6.500 | 09/15/24 | 1,874,476 | |||||||||||

| Huarong Finance 2017 Co., Ltd.(d)(e) (-1X 5 year CMT + 7.773%) |

||||||||||||||

| 230,000 | 4.500 | 01/24/49 | 147,488 | |||||||||||

| LD Holdings Group LLC(d)(f) |

||||||||||||||

| 1,910,000 | 6.500 | 11/01/25 | 2,012,662 | |||||||||||

| 1,765,000 | 6.125 | 04/01/28 | 1,771,619 | |||||||||||

| Midcap Financial Issuer Trust(d)(f) |

||||||||||||||

| 1,617,000 | 6.500 | 05/01/28 | 1,671,574 | |||||||||||

| Nationstar Mortgage Holdings, Inc.(d)(f) |

||||||||||||||

| 2,651,000 | 5.500 | 08/15/28 | 2,678,963 | |||||||||||

| Navient Corp. |

||||||||||||||

| 3,000,000 | 5.500 | 01/25/23 | 3,138,750 | |||||||||||

| NFP Corp.(d)(f) |

||||||||||||||

| 1,505,000 | 6.875 | 08/15/28 | 1,578,369 | |||||||||||

| Oilflow SPV 1 DAC |

||||||||||||||

| 338,803 | 12.000 | 01/13/22 | 342,191 | |||||||||||

| OneMain Finance Corp. |

||||||||||||||

| 1,602,000 | 7.125 | 03/15/26 | 1,866,330 | |||||||||||

| OneMain Finance Corp.(d) |

||||||||||||||

| 1,643,000 | 4.000 | 09/15/30 | 1,585,495 | |||||||||||

| Park Aerospace Holdings Ltd.(d)(f) |

||||||||||||||

| 2,235,000 | 5.250 | 08/15/22 | 2,335,575 | |||||||||||

| Raymond James Financial, Inc.(d) |

||||||||||||||

| 900,000 | 4.650 | 04/01/30 | 1,065,726 | |||||||||||

| The Charles Schwab Corp.(d)(e) |

||||||||||||||

| (3M USD LIBOR + 3.315%) |

||||||||||||||

| 2,195,000 | 4.625 | 03/01/49 | 2,243,553 | |||||||||||

| (5 year CMT + 3.168%) |

||||||||||||||

| 2,875,000 | 4.000 | 06/01/49 | 2,965,361 | |||||||||||

| (5 Year CMT + 4.971%) |

||||||||||||||

| 1,250,000 | 5.375 | 06/01/49 | 1,397,437 | |||||||||||

| Unifin Financiera SAB de CV(d) |

||||||||||||||

| 400,000 | 7.000 | 01/15/25 | 380,325 | |||||||||||

| United Wholesale Mortgage LLC(d)(f) |

||||||||||||||

| 3,195,000 | 5.500 | 04/15/29 | 3,135,094 | |||||||||||

| Visa, Inc.(d) |

||||||||||||||

| 450,000 | 2.700 | 04/15/40 | 447,030 | |||||||||||

|

|

|

|||||||||||||

| 55,223,405 | ||||||||||||||

|

|

|

|||||||||||||

| Electrical – 0.8% | ||||||||||||||

| Calpine Corp.(d)(f) |

||||||||||||||

| 4,215,000 | 3.750 | 03/01/31 | 4,014,787 | |||||||||||

| Cikarang Listrindo PT(d) |

||||||||||||||

| 520,000 | 4.950 | 09/14/26 | 534,235 | |||||||||||

| Eskom Holdings SOC Ltd.(i) |

||||||||||||||

| 630,000 | 6.350 | 08/10/28 | 684,928 | |||||||||||

| LLPL Capital Pte Ltd. |

||||||||||||||

| 419,520 | 6.875 | 02/04/39 | 489,606 | |||||||||||

|

|

|

|||||||||||||

| The accompanying notes are an integral part of these financial statements. | 11 |

GOLDMAN SACHS INCOME BUILDER FUND

Schedule of Investments (continued)

April 30, 2021 (Unaudited)

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Electrical – (continued) | ||||||||||||||

| Minejesa Capital B.V. |

||||||||||||||

| $ | 260,000 | 4.625 % | 08/10/30 | $ | 273,299 | |||||||||

| Mong Duong Finance Holdings B.V. |

||||||||||||||

| 530,000 | 5.125 | 05/07/29 | 533,909 | |||||||||||

| NRG Energy, Inc.(d) |

||||||||||||||

| 2,800,000 | 3.750(f) | 06/15/24 | 2,993,592 | |||||||||||

| 115,000 | 5.750 | 01/15/28 | 122,188 | |||||||||||

| 448,000 | 3.375(f) | 02/15/29 | 439,040 | |||||||||||

| 1,198,000 | 3.625(f) | 02/15/31 | 1,169,548 | |||||||||||

| Pacific Gas & Electric Co.(d) |

||||||||||||||

| 1,470,000 | 3.500 | 08/01/50 | 1,270,947 | |||||||||||

| Sempra Energy(d)(e) (5 Year CMT + 4.550%) |

||||||||||||||

| 3,335,000 | 4.875 | 10/15/49 | 3,631,548 | |||||||||||

|

|

|

|||||||||||||

| 16,157,627 | ||||||||||||||

|

|

|

|||||||||||||

| Electrical Components & Equipment(d)(f) – 0.1% | ||||||||||||||

| Wesco Distribution, Inc. |

||||||||||||||

| 1,473,000 | 7.250 | 06/15/28 | 1,631,348 | |||||||||||

|

|

|

|||||||||||||

| Electronics(d)(f) – 0.1% | ||||||||||||||

| Imola Merger Corp. |

||||||||||||||

| 1,803,000 | 4.750 | 05/15/29 | 1,872,867 | |||||||||||

| TTM Technologies, Inc. |

||||||||||||||

| 799,000 | 4.000 | 03/01/29 | 798,001 | |||||||||||

|

|

|

|||||||||||||

| 2,670,868 | ||||||||||||||

|

|

|

|||||||||||||

| Engineering & Construction(d) – 0.3% | ||||||||||||||

| Aeropuertos Dominicanos Siglo XXI SA |

||||||||||||||

| 630,000 | 6.750 | 03/30/29 | 663,469 | |||||||||||

| Arcosa, Inc.(f) |

||||||||||||||

| 1,221,000 | 4.375 | 04/15/29 | 1,245,420 | |||||||||||

| |

ATP Tower Holdings LLC/Andean Tower Partners Colombia |

| ||||||||||||

| 290,000 | 4.050 | 04/27/26 | 284,925 | |||||||||||

| Dycom Industries, Inc.(f) |

||||||||||||||

| 2,764,000 | 4.500 | 04/15/29 | 2,798,550 | |||||||||||

| IHS Netherlands Holdco B.V.(f) |

||||||||||||||

| 200,000 | 7.125 | 03/18/25 | 208,075 | |||||||||||

| International Airport Finance SA |

||||||||||||||

| 199,537 | 12.000 | 03/15/33 | 201,657 | |||||||||||

| KBR, Inc.(f) |

||||||||||||||

| 1,161,000 | 4.750 | 09/30/28 | 1,166,805 | |||||||||||

| Mexico City Airport Trust |

||||||||||||||

| 520,000 | 5.500 | 10/31/46 | 525,135 | |||||||||||

|

|

|

|||||||||||||

| 7,094,036 | ||||||||||||||

|

|

|

|||||||||||||

| Entertainment(d) – 0.6% | ||||||||||||||

| Banijay Entertainment SASU(f) |

||||||||||||||

| 1,800,000 | 5.375 | 03/01/25 | 1,854,000 | |||||||||||

| Boyne USA, Inc.(f) |

||||||||||||||

| 1,275,000 | 4.750 | 05/15/29 | 1,310,062 | |||||||||||

| Live Nation Entertainment, Inc.(f) |

||||||||||||||

| 970,000 | 3.750 | 01/15/28 | 965,150 | |||||||||||

| Motion Bondco DAC(f) |

||||||||||||||

| 3,250,000 | 6.625 | 11/15/27 | 3,306,875 | |||||||||||

| Scientific Games International, Inc.(f) |

||||||||||||||

| 500,000 | 7.000 | 05/15/28 | 537,500 | |||||||||||

|

|

|

|||||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Entertainment(d) – (continued) | ||||||||||||||

| Seaworld Parks & Entertainment, Inc. |

||||||||||||||

| 3,084,000 | 9.500 | 08/01/25 | 3,346,140 | |||||||||||

| Six Flags Entertainment Corp.(f) |

||||||||||||||

| 1,854,000 | 5.500 | 04/15/27 | 1,914,255 | |||||||||||

|

|

|

|||||||||||||

| 13,233,982 | ||||||||||||||

|

|

|

|||||||||||||

| Environmental(d) – 0.3% | ||||||||||||||

| Covanta Holding Corp. |

||||||||||||||

| 670,000 | 5.000 | 09/01/30 | 688,425 | |||||||||||

| GFL Environmental, Inc.(f) |

||||||||||||||

| 730,000 | 5.125 | 12/15/26 | 766,500 | |||||||||||

| 858,000 | 8.500 | 05/01/27 | 940,583 | |||||||||||

| 2,624,000 | 4.000 | 08/01/28 | 2,502,640 | |||||||||||

| Stericycle, Inc.(f) |

||||||||||||||

| 1,950,000 | 5.375 | 07/15/24 | 2,010,937 | |||||||||||

|

|

|

|||||||||||||

| 6,909,085 | ||||||||||||||

|

|

|

|||||||||||||

| Food & Drug Retailing(d) – 1.4% | ||||||||||||||

| |

Albertsons Cos., Inc./Safeway, Inc./New Albertsons |

| ||||||||||||

| 2,595,000 | 4.625 | 01/15/27 | 2,692,312 | |||||||||||

| 1,995,000 | 5.875 | 02/15/28 | 2,127,169 | |||||||||||

| 502,000 | 4.875 | 02/15/30 | 521,453 | |||||||||||

| Arcor SAIC |

||||||||||||||

| 110,000 | 6.000 | 07/06/23 | 105,036 | |||||||||||

| B&G Foods, Inc. |

||||||||||||||

| 4,020,000 | 5.250 | 04/01/25 | 4,130,550 | |||||||||||

| Bellis Acquisition Co. PLC(f) |

||||||||||||||

| GBP | 475,000 | 3.250 | 02/16/26 | 657,540 | ||||||||||

| BRF SA |

||||||||||||||

| $ | 360,000 | 5.750 | 09/21/50 | 351,621 | ||||||||||

| H-Food Holdings LLC/Hearthside Finance Co., Inc.(f) |

||||||||||||||

| 2,820,000 | 8.500 | 06/01/26 | 2,901,075 | |||||||||||

| Kraft Heinz Foods Co. |

||||||||||||||

| 3,198,000 | 5.000 | 07/15/35 | 3,718,612 | |||||||||||

| 2,592,000 | 4.375 | 06/01/46 | 2,768,183 | |||||||||||

| Post Holdings, Inc.(f) |

||||||||||||||

| 5,984,000 | 4.625 | 04/15/30 | 6,028,880 | |||||||||||

| United Natural Foods, Inc.(f) |

||||||||||||||

| 1,455,000 | 6.750 | 10/15/28 | 1,567,763 | |||||||||||

| US Foods, Inc.(f) |

||||||||||||||

| 2,690,000 | 4.750 | 02/15/29 | 2,716,900 | |||||||||||

|

|

|

|||||||||||||

| 30,287,094 | ||||||||||||||

|

|

|

|||||||||||||

| Gaming(d) – 0.4% | ||||||||||||||

| Boyd Gaming Corp. |

||||||||||||||

| 2,950,000 | 4.750 | 12/01/27 | 3,012,688 | |||||||||||

| Genting New York LLC/GENNY Capital, Inc.(f) |

||||||||||||||

| 915,000 | 3.300 | 02/15/26 | 917,205 | |||||||||||

| Melco Resorts Finance Ltd.(f) |

||||||||||||||

| 280,000 | 5.375 | 12/04/29 | 296,660 | |||||||||||

| MGM China Holdings Ltd.(f) |

||||||||||||||

| 915,000 | 4.750 | 02/01/27 | 941,306 | |||||||||||

| MGM Resorts International |

||||||||||||||

| 1,832,000 | 4.750 | 10/15/28 | 1,928,180 | |||||||||||

|

|

|

|||||||||||||

| 12 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS INCOME BUILDER FUND

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Gaming(d) – (continued) | ||||||||||||||

| Wynn Macau Ltd.(f) |

||||||||||||||

| $ | 330,000 | 5.625 % | 08/26/28 | $ | 346,088 | |||||||||

| 550,000 | 5.125 | 12/15/29 | 563,578 | |||||||||||

|

|

|

|||||||||||||

| 8,005,705 | ||||||||||||||

|

|

|

|||||||||||||

| Gas(d) – 0.2% | ||||||||||||||

| AmeriGas Partners LP/AmeriGas Finance Corp. |

||||||||||||||

| 4,125,000 | 5.875 | 08/20/26 | 4,614,844 | |||||||||||

| China Oil & Gas Group, Ltd. |

||||||||||||||

| 360,000 | 5.500 | 01/25/23 | 370,530 | |||||||||||

|

|

|

|||||||||||||

| 4,985,374 | ||||||||||||||

|

|

|

|||||||||||||

| Healthcare Providers & Services – 1.5% | ||||||||||||||

| CAB SELAS(d)(f) |

||||||||||||||

| EUR | 1,175,000 | 3.375 | 02/01/28 | 1,404,620 | ||||||||||

| Catalent Pharma Solutions, Inc.(d)(f) |

||||||||||||||

| $ | 1,005,000 | 3.125 | 02/15/29 | 972,337 | ||||||||||

| CHS/Community Health Systems, Inc.(d)(f) |

||||||||||||||

| 2,170,000 | 4.750 | 02/15/31 | 2,153,725 | |||||||||||

| DaVita, Inc.(d)(f) |

||||||||||||||

| 3,800,000 | 3.750 | 02/15/31 | 3,610,000 | |||||||||||

| Encompass Health Corp.(d) |

||||||||||||||

| 1,200,000 | 4.500 | 02/01/28 | 1,242,000 | |||||||||||

| HCA, Inc. |

||||||||||||||

| 8,870,000 | 5.000 | 03/15/24 | 9,883,664 | |||||||||||

| 250,000 | 5.875(d) | 02/15/26 | 287,188 | |||||||||||

| Laboratoire Eimer Selas(d)(f) |

||||||||||||||

| EUR | 500,000 | 5.000 | 02/01/29 | 609,913 | ||||||||||

| Lifepoint Health, Inc.(d)(f) |

||||||||||||||

| $ | 2,635,000 | 5.375 | 01/15/29 | 2,631,706 | ||||||||||

| ModivCare, Inc.(d)(f) |

||||||||||||||

| 751,000 | 5.875 | 11/15/25 | 796,999 | |||||||||||

| Rede D’or Finance S.a.r.l.(d) |

||||||||||||||

| 200,000 | 4.500 | 01/22/30 | 197,000 | |||||||||||

| Select Medical Corp.(d)(f) |

||||||||||||||

| 1,700,000 | 6.250 | 08/15/26 | 1,806,250 | |||||||||||

| Tenet Healthcare Corp.(d)(f) |

||||||||||||||

| 2,000,000 | 6.250 | 02/01/27 | 2,095,000 | |||||||||||

| Universal Health Services, Inc.(d)(f) |

||||||||||||||

| 2,650,000 | 5.000 | 06/01/26 | 2,721,523 | |||||||||||

|

|

|

|||||||||||||

| 30,411,925 | ||||||||||||||

|

|

|

|||||||||||||

| Holding Companies-Diversified(d) – 0.0% | ||||||||||||||

| KOC Holding A/S |

||||||||||||||

| 700,000 | 6.500 | 03/11/25 | 748,913 | |||||||||||

|

|

|

|||||||||||||

| Home Builders – 0.7% | ||||||||||||||

| |

Brookfield Residential Properties, Inc./Brookfield Residential US |

| ||||||||||||

| 1,642,000 | 4.875 | 02/15/30 | 1,639,947 | |||||||||||

| Forestar Group, Inc.(d)(f) |

||||||||||||||

| 1,505,000 | 3.850 | 05/15/26 | 1,520,050 | |||||||||||

| Installed Building Products, Inc.(d)(f) |

||||||||||||||

| 800,000 | 5.750 | 02/01/28 | 842,000 | |||||||||||

| Lennar Corp.(d) |

||||||||||||||

| 1,825,000 | 4.125 | 01/15/22 | 1,853,143 | |||||||||||

| PulteGroup, Inc. |

||||||||||||||

| 3,000,000 | 7.875 | 06/15/32 | 4,248,750 | |||||||||||

|

|

|

|||||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Home Builders – (continued) | ||||||||||||||

| Taylor Morrison Communities, Inc.(d)(f) |

||||||||||||||

| 1,301,000 | 5.125 | 08/01/30 | 1,427,848 | |||||||||||

| Tri Pointe Homes, Inc.(d) |

||||||||||||||

| 1,850,000 | 5.250 | 06/01/27 | 1,988,750 | |||||||||||

| 413,000 | 5.700 | 06/15/28 | 458,934 | |||||||||||

|

|

|

|||||||||||||

| 13,979,422 | ||||||||||||||

|

|

|

|||||||||||||

| Household Products(d) – 0.2% | ||||||||||||||

| Central Garden & Pet Co. |

||||||||||||||

| 1,380,000 | 4.125 | 10/15/30 | 1,416,225 | |||||||||||

| Kronos Acquisition Holdings, Inc./KIK Custom Products, Inc.(f) |

||||||||||||||

| 1,988,000 | 7.000 | 12/31/27 | 1,923,390 | |||||||||||

| Spectrum Brands, Inc. |

||||||||||||||

| 108,000 | 5.750 | 07/15/25 | 111,105 | |||||||||||

|

|

|

|||||||||||||

| 3,450,720 | ||||||||||||||

|

|

|

|||||||||||||

| Housewares(d) – 0.1% | ||||||||||||||

| CD&R Smokey Buyer, Inc.(f) |

||||||||||||||

| 1,094,000 | 6.750 | 07/15/25 | 1,167,845 | |||||||||||

| Turkiye Sise ve Cam Fabrikalari A/S |

||||||||||||||

| 530,000 | 6.950 | 03/14/26 | 584,424 | |||||||||||

|

|

|

|||||||||||||

| 1,752,269 | ||||||||||||||

|

|

|

|||||||||||||

| Insurance – 0.9% | ||||||||||||||

| Acrisure LLC/Acrisure Finance, Inc.(d)(f) |

||||||||||||||

| 2,230,000 | 4.250 | 02/15/29 | 2,177,037 | |||||||||||

| Acrisure LLC/Acrisure Finance, Inc.(d)(f) |

||||||||||||||

| 1,550,000 | 10.125 | 08/01/26 | 1,768,938 | |||||||||||

| |

Alliant Holdings Intermediate LLC/Alliant Holdings Co- |

|||||||||||||

| 1,666,000 | 6.750 | 10/15/27 | 1,757,630 | |||||||||||

| American International Group, Inc.(d) |

||||||||||||||

| 2,250,000 | 3.400 | 06/30/30 | 2,405,610 | |||||||||||

| BroadStreet Partners, Inc.(d)(f) |

||||||||||||||

| 2,940,000 | 5.875 | 04/15/29 | 2,962,050 | |||||||||||

| Fidelity & Guaranty Life Holdings, Inc.(d)(f) |

||||||||||||||

| 2,850,000 | 5.500 | 05/01/25 | 3,273,624 | |||||||||||

| HUB International Ltd.(d)(f) |

||||||||||||||

| 1,760,000 | 7.000 | 05/01/26 | 1,823,800 | |||||||||||

| Transatlantic Holdings, Inc. |

||||||||||||||

| 75,000 | 8.000 | 11/30/39 | 113,569 | |||||||||||

| USI, Inc.(d)(f) |

||||||||||||||

| 1,850,000 | 6.875 | 05/01/25 | 1,884,687 | |||||||||||

|

|

|

|||||||||||||

| 18,166,945 | ||||||||||||||

|

|

|

|||||||||||||

| Internet – 1.6% | ||||||||||||||

| 21Vianet Group, Inc. |

||||||||||||||

| 400,000 | 7.875 | 10/15/21 | 403,450 | |||||||||||

| Booking Holdings, Inc.(d) |

||||||||||||||

| 2,850,000 | 4.625 | 04/13/30 | 3,339,316 | |||||||||||

| Endure Digital, Inc.(d)(f) |

||||||||||||||

| 6,473,000 | 6.000 | 02/15/29 | 6,197,897 | |||||||||||

| Expedia Group, Inc.(d)(f) |

||||||||||||||

| 1,160,000 | 6.250 | 05/01/25 | 1,349,846 | |||||||||||

| 1,382,000 | 4.625 | 08/01/27 | 1,554,847 | |||||||||||

| Getty Images, Inc.(d)(f) |

||||||||||||||

| 2,260,000 | 9.750 | 03/01/27 | 2,406,900 | |||||||||||

|

|

|

|||||||||||||

| The accompanying notes are an integral part of these financial statements. | 13 |

GOLDMAN SACHS INCOME BUILDER FUND

Schedule of Investments (continued)

April 30, 2021 (Unaudited)

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Internet – (continued) | ||||||||||||||

| Go Daddy Operating Co. LLC/GD Finance Co., Inc.(d)(f) |

||||||||||||||

| $ | 1,305,000 | 5.250 % | 12/01/27 | $ | 1,366,988 | |||||||||

| GrubHub Holdings, Inc.(d)(f) |

||||||||||||||

| 3,400,000 | 5.500 | 07/01/27 | 3,565,750 | |||||||||||

| NortonLifeLock, Inc.(d)(f) |

||||||||||||||

| 4,000,000 | 5.000 | 04/15/25 | 4,045,000 | |||||||||||

| Uber Technologies, Inc.(d)(f) |

||||||||||||||

| 3,200,000 | 7.500 | 05/15/25 | 3,448,000 | |||||||||||

| 1,800,000 | 6.250 | 01/15/28 | 1,953,000 | |||||||||||

| VeriSign, Inc.(d) |

||||||||||||||

| 4,000,000 | 5.250 | 04/01/25 | 4,524,080 | |||||||||||

|

|

|

|||||||||||||

| 34,155,074 | ||||||||||||||

|

|

|

|||||||||||||

| Iron/Steel – 0.3% | ||||||||||||||

| ABJA Investment Co. Pte Ltd. |

||||||||||||||

| 650,000 | 5.950 | 07/31/24 | 704,153 | |||||||||||

| CAP SA(d)(f) |

||||||||||||||

| 200,000 | 3.900 | 04/27/31 | 195,500 | |||||||||||

| Cleveland-Cliffs, Inc.(d) |

||||||||||||||

| 1,038,000 | 5.750 | 03/01/25 | 1,066,545 | |||||||||||

| 2,250,000 | 5.875 | 06/01/27 | 2,356,875 | |||||||||||

| 1,620,000 | 4.875(f) | 03/01/31 | 1,648,350 | |||||||||||

| Metinvest B.V.(d) |

||||||||||||||

| 200,000 | 7.750 | 04/23/23 | 209,850 | |||||||||||

| 200,000 | 8.500 | 04/23/26 | 219,600 | |||||||||||

| Samarco Mineracao SA |

||||||||||||||

| 200,000 | 4.125 | 11/01/22 | 155,500 | |||||||||||

|

|

|

|||||||||||||

| 6,556,373 | ||||||||||||||

|

|

|

|||||||||||||

| Leisure Time – 0.3% | ||||||||||||||

| NCL Corp., Ltd.(d)(f) |

||||||||||||||

| 3,550,000 | 3.625 | 12/15/24 | 3,385,813 | |||||||||||

| 282,000 | 5.875 | 03/15/26 | 294,690 | |||||||||||

| Royal Caribbean Cruises Ltd. |

||||||||||||||

| 955,000 | 5.250 | 11/15/22 | 982,456 | |||||||||||

| 1,815,000 | 5.500(d)(f) | 04/01/28 | 1,903,481 | |||||||||||

|

|

|

|||||||||||||

| 6,566,440 | ||||||||||||||

|

|

|

|||||||||||||

| Lodging(d) – 0.2% | ||||||||||||||

| Hilton Domestic Operating Co., Inc.(f) |

||||||||||||||

| 1,014,000 | 4.000 | 05/01/31 | 1,024,140 | |||||||||||

| Marriott International, Inc. |

||||||||||||||

| 1,664,000 | 4.625 | 06/15/30 | 1,867,707 | |||||||||||

| Travel + Leisure Co.(f) |

||||||||||||||

| 598,000 | 6.625 | 07/31/26 | 685,457 | |||||||||||

|

|

|

|||||||||||||

| 3,577,304 | ||||||||||||||

|

|

|

|||||||||||||

| Machinery – Construction & Mining(d)(f) – 0.1% | ||||||||||||||

| BWX Technologies, Inc. |

||||||||||||||

| 1,023,000 | 4.125 | 06/30/28 | 1,040,903 | |||||||||||

|

|

|

|||||||||||||

| Machinery-Diversified(d)(f) – 0.0% | ||||||||||||||

| Titan Acquisition Ltd./Titan Co-Borrower LLC |

||||||||||||||

| 588,000 | 7.750 | 04/15/26 | 610,050 | |||||||||||

|

|

|

|||||||||||||

| Media(d) – 3.3% | ||||||||||||||

| Altice Financing SA |

||||||||||||||

| 200,000 | 7.500 | 05/15/26 | 207,000 | |||||||||||

|

|

|

|||||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Media(d) – (continued) | ||||||||||||||

| AMC Networks, Inc. |

||||||||||||||

| 1,800,000 | 4.750 | 08/01/25 | 1,854,000 | |||||||||||

| CCO Holdings LLC/CCO Holdings Capital Corp.(f) |

||||||||||||||

| 3,000,000 | 5.875 | 05/01/27 | 3,093,750 | |||||||||||

| 4,980,000 | 4.750 | 03/01/30 | 5,179,200 | |||||||||||

| |

Charter Communications Operating LLC/Charter |

| ||||||||||||

| 12,000,000 | 6.384 | 10/23/35 | 15,632,400 | |||||||||||

| Comcast Corp. |

||||||||||||||

| 2,827,000 | 2.800 | 01/15/51 | 2,622,127 | |||||||||||

| CSC Holdings LLC(f) |

||||||||||||||

| 2,298,000 | 4.625 | 12/01/30 | 2,246,295 | |||||||||||

| 5,372,000 | 5.000 | 11/15/31 | 5,372,000 | |||||||||||

| Cumulus Media New Holdings, Inc.(f) |

||||||||||||||

| 2,421,000 | 6.750 | 07/01/26 | 2,490,604 | |||||||||||

| Diamond Sports Group LLC/Diamond Sports Finance Co.(f) |

||||||||||||||

| 1,590,000 | 5.375 | 08/15/26 | 1,156,725 | |||||||||||

| 3,345,000 | 6.625 | 08/15/27 | 1,806,300 | |||||||||||

| DISH DBS Corp. |

||||||||||||||

| 1,700,000 | 7.375 | 07/01/28 | 1,829,625 | |||||||||||

| Gray Television, Inc.(f) |

||||||||||||||

| 2,125,000 | 7.000 | 05/15/27 | 2,313,594 | |||||||||||

| iHeartCommunications, Inc.(f) |

||||||||||||||

| 550,000 | 4.750 | 01/15/28 | 559,625 | |||||||||||

| News Corp.(f) |

||||||||||||||

| 2,470,000 | 3.875 | 05/15/29 | 2,516,312 | |||||||||||

| Nexstar Broadcasting, Inc.(f) |

||||||||||||||

| 1,500,000 | 5.625 | 07/15/27 | 1,584,375 | |||||||||||

| Radiate Holdco LLC/Radiate Finance, Inc.(f) |

||||||||||||||

| 1,211,000 | 6.500 | 09/15/28 | 1,262,468 | |||||||||||

| Scripps Escrow II, Inc.(f) |

||||||||||||||

| 1,305,000 | 5.375 | 01/15/31 | 1,321,312 | |||||||||||

| Scripps Escrow, Inc.(f) |

||||||||||||||

| 1,050,000 | 5.875 | 07/15/27 | 1,101,188 | |||||||||||

| Sinclair Television Group, Inc.(f) |

||||||||||||||

| 2,100,000 | 5.875 | 03/15/26 | 2,160,375 | |||||||||||

| Sirius XM Radio, Inc.(f) |

||||||||||||||

| 1,085,000 | 4.625 | 07/15/24 | 1,113,481 | |||||||||||

| TEGNA, Inc. |

||||||||||||||

| 2,300,000 | 4.625 | 03/15/28 | 2,346,000 | |||||||||||

| The E.W. Scripps Co.(f) |

||||||||||||||

| 1,875,000 | 5.125 | 05/15/25 | 1,923,937 | |||||||||||

| Townsquare Media, Inc.(f) |

||||||||||||||

| 2,038,000 | 6.875 | 02/01/26 | 2,139,900 | |||||||||||

| Urban One, Inc.(f) |

||||||||||||||

| 1,690,000 | 7.375 | 02/01/28 | 1,749,150 | |||||||||||

| Ziggo B.V.(f) |

||||||||||||||

| 1,628,000 | 4.875 | 01/15/30 | 1,672,770 | |||||||||||

| Ziggo Bond Co. B.V.(f) |

||||||||||||||

| EUR | 675,000 | 3.375 | 02/28/30 | 801,951 | ||||||||||

| $ | 500,000 | 5.125 | 02/28/30 | 511,875 | ||||||||||

|

|

|

|||||||||||||

| 68,568,339 | ||||||||||||||

|

|

|

|||||||||||||

| Mining – 0.8% | ||||||||||||||

| Constellium SE(d)(f) |

||||||||||||||

| 2,585,000 | 3.750 | 04/15/29 | 2,530,069 | |||||||||||

|

|

|

|||||||||||||

| 14 | The accompanying notes are an integral part of these financial statements. |

GOLDMAN SACHS INCOME BUILDER FUND

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Mining – (continued) | ||||||||||||||

| First Quantum Minerals Ltd.(d)(f) |

||||||||||||||

| $ | 4,000,000 | 7.250 % | 04/01/23 | $ | 4,065,000 | |||||||||

| Freeport-McMoRan, Inc.(d) |

||||||||||||||

| 2,000,000 | 5.400 | 11/14/34 | 2,405,000 | |||||||||||

| Glencore Finance Canada Ltd.(f) |

||||||||||||||

| 3,000,000 | 5.550 | 10/25/42 | 3,690,060 | |||||||||||

| Novelis Corp.(d)(f) |

||||||||||||||

| 2,100,000 | 5.875 | 09/30/26 | 2,189,250 | |||||||||||

| 2,400,000 | 4.750 | 01/30/30 | 2,499,000 | |||||||||||

| Vedanta Resources Finance II PLC(d)(f) |

||||||||||||||

| 200,000 | 9.250 | 04/23/26 | 179,225 | |||||||||||

|

|

|

|||||||||||||

| 17,557,604 | ||||||||||||||

|

|

|

|||||||||||||

| Miscellaneous Manufacturing(d) – 0.4% | ||||||||||||||

| Bombardier, Inc.(f) |

||||||||||||||

| 1,125,000 | 7.500 | 12/01/24 | 1,139,063 | |||||||||||

| 1,152,000 | 7.500 | 03/15/25 | 1,149,120 | |||||||||||

| General Electric Co.(e) (3M USD LIBOR + 3.330%) |

||||||||||||||

| 4,477,000 | 3.514 | 06/15/49 | 4,249,345 | |||||||||||

| Hillenbrand, Inc. |

||||||||||||||

| 1,349,000 | 3.750 | 03/01/31 | 1,332,137 | |||||||||||

|

|

|

|||||||||||||

| 7,869,665 | ||||||||||||||

|

|

|

|||||||||||||

| Multi-National – 0.0% | ||||||||||||||

| The Eastern & Southern African Trade & Development Bank |

||||||||||||||

| 370,000 | 5.375 | 03/14/22 | 378,628 | |||||||||||

|

|

|

|||||||||||||

| Office & Business Equipment(d) – 0.1% | ||||||||||||||

| CDW LLC/CDW Finance Corp. |

||||||||||||||

| 1,440,000 | 4.125 | 05/01/25 | 1,503,000 | |||||||||||

| Xerox Holdings Corp.(f) |

||||||||||||||

| 1,055,000 | 5.000 | 08/15/25 | 1,107,750 | |||||||||||

|

|

|

|||||||||||||

| 2,610,750 | ||||||||||||||

|

|

|

|||||||||||||

| Oil Field Services – 2.2% | ||||||||||||||

| California Resources Corp.(d)(f) |

||||||||||||||

| 2,135,000 | 7.125 | 02/01/26 | 2,183,037 | |||||||||||

| Cenovus Energy, Inc.(d) |

||||||||||||||

| 153,000 | 3.000 | 08/15/22 | 156,525 | |||||||||||

| 1,412,000 | 3.800 | 09/15/23 | 1,491,270 | |||||||||||

| 1,780,000 | 5.375 | 07/15/25 | 2,022,650 | |||||||||||

| Chesapeake Energy Corp.(g) |

||||||||||||||

| 2,000,000 | 5.500 | 09/15/26 | 47,500 | |||||||||||

| Cia General de Combustibles SA(f) |

||||||||||||||

| 560,000 | 9.500 | 03/08/25 | 435,050 | |||||||||||

| Continental Resources, Inc.(d)(f) |

||||||||||||||

| 1,306,000 | 5.750 | 01/15/31 | 1,514,960 | |||||||||||

| DNO ASA(d)(f) |

||||||||||||||

| 420,000 | 8.375 | 05/29/24 | 430,500 | |||||||||||

| Genel Energy Finance 4 PLC(d)(f) |

||||||||||||||

| 200,000 | 9.250 | 10/14/25 | 208,000 | |||||||||||

| Geopark Ltd.(d)(f) |

||||||||||||||

| 200,000 | 5.500 | 01/17/27 | 204,825 | |||||||||||

| Guara Norte S.a.r.l.(f) |

||||||||||||||

| 340,000 | 5.198 | 06/15/34 | 341,275 | |||||||||||

| Indigo Natural Resources LLC(d)(f) |

||||||||||||||

| 2,695,000 | 5.375 | 02/01/29 | 2,674,787 | |||||||||||

|

|

|

|||||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Oil Field Services – (continued) | ||||||||||||||

| Kosmos Energy Ltd.(d) |

||||||||||||||

| 500,000 | 7.125 | 04/04/26 | 485,156 | |||||||||||

| Leviathan Bond Ltd.(d)(f) |

||||||||||||||

| 470,000 | 5.750 | 06/30/23 | 491,679 | |||||||||||

| Lukoil Securities B.V.(f) |

||||||||||||||

| 500,000 | 3.875 | 05/06/30 | 525,100 | |||||||||||

| MEG Energy Corp.(d)(f) |

||||||||||||||

| 2,480,000 | 7.125 | 02/01/27 | 2,635,000 | |||||||||||

| 1,250,000 | 5.875 | 02/01/29 | 1,281,250 | |||||||||||

| Nabors Industries Ltd.(d)(f) |

||||||||||||||

| 840,000 | 7.250 | 01/15/26 | 743,400 | |||||||||||

| Nabors Industries, Inc.(d)(f) |

||||||||||||||

| 2,645,000 | 9.000 | 02/01/25 | 2,737,575 | |||||||||||

| Noble Finance Co.(d)(h) |

||||||||||||||

| (PIK 15.000%, Cash 11.000%) |

||||||||||||||

| 63,401 | 11.000 | (f) | 02/15/28 | 68,156 | ||||||||||

| (PIK 15.000%, Cash 11.000%) |

||||||||||||||

| 566,469 | 11.000 | 02/15/28 | 608,954 | |||||||||||

| Occidental Petroleum Corp.(d) |

||||||||||||||

| 2,180,000 | 8.000 | 07/15/25 | 2,539,700 | |||||||||||

| 2,550,000 | 6.625 | 09/01/30 | 2,907,000 | |||||||||||

| Petrobras Global Finance B.V.(j) |

||||||||||||||

| 270,000 | 6.850 | 06/05/15 | 284,405 | |||||||||||

| Petroleos Mexicanos |

||||||||||||||

| EUR | 220,000 | 2.500 | 08/21/21 | 265,040 | ||||||||||

| $ | 200,000 | 6.375 | 01/23/45 | 171,625 | ||||||||||

| Range Resources Corp.(d) |

||||||||||||||

| 1,470,000 | 5.000 | 03/15/23 | 1,503,075 | |||||||||||

| SEPLAT Petroleum Development Co. PLC(d)(f) |

||||||||||||||

| 630,000 | 7.750 | 04/01/26 | 642,789 | |||||||||||

| Sunoco LP/Sunoco Finance Corp.(d) |

||||||||||||||

| 545,000 | 5.500 | 02/15/26 | 559,988 | |||||||||||

| 1,720,000 | 4.500(f) | 05/15/29 | 1,732,900 | |||||||||||

| TechnipFMC PLC(d)(f) |

||||||||||||||

| 2,905,000 | 6.500 | 02/01/26 | 3,093,825 | |||||||||||

| Tecpetrol SA(d) |

||||||||||||||

| 390,000 | 4.875 | 12/12/22 | 382,029 | |||||||||||

| Tiger Holdco Pte Ltd.(d)(f)(h) |

||||||||||||||

| 200,000 | 13.000 | 06/10/23 | 201,102 | |||||||||||

| Transocean Poseidon Ltd.(d)(f) |

||||||||||||||

| 1,041,000 | 6.875 | 02/01/27 | 983,745 | |||||||||||

| Transocean, Inc.(d)(f) |

||||||||||||||

| 8,190,000 | 11.500 | 01/30/27 | 7,882,875 | |||||||||||

| |

USA Compression Partners LP/USA Compression Finance |

| ||||||||||||

| 1,300,000 | 6.875 | 04/01/26 | 1,358,500 | |||||||||||

|

|

|

|||||||||||||

| 45,795,247 | ||||||||||||||

|

|

|

|||||||||||||

| Packaging – 1.2% | ||||||||||||||

| ARD Finance SA(d)(h) (PIK 5.750%, Cash 5.000%) |

||||||||||||||

| EUR | 1,850,000 | 5.000 | 06/30/27 | 2,274,628 | ||||||||||

| |

Ardagh Metal Packaging Finance USA LLC/Ardagh Metal |

| ||||||||||||

| $ | 3,088,000 | 4.000 | 09/01/29 | 3,068,700 | ||||||||||

| Berry Global, Inc.(d)(f) |

||||||||||||||

| 2,200,000 | 4.500 | 02/15/26 | 2,252,250 | |||||||||||

| 2,000,000 | 5.625 | 07/15/27 | 2,127,500 | |||||||||||

|

|

|

|||||||||||||

| The accompanying notes are an integral part of these financial statements. | 15 |

GOLDMAN SACHS INCOME BUILDER FUND

Schedule of Investments (continued)

April 30, 2021 (Unaudited)

| Principal Amount |

Interest Rate |

Maturity Date |

Value | |||||||||||

| Corporate Obligations – (continued) | ||||||||||||||

| Packaging – (continued) | ||||||||||||||

| Graphic Packaging International LLC(f) |

||||||||||||||

| $ | 646,000 | 3.500 % | 03/15/28 | $ | 642,770 | |||||||||

| Kleopatra Finco S.a.r.l.(d)(f) |

||||||||||||||

| EUR | 950,000 | 4.250 | 03/01/26 | 1,120,711 | ||||||||||

| Kleopatra Holdings 2 SCA(d)(f) |

||||||||||||||

| 950,000 | 6.500 | 09/01/26 | 1,063,341 | |||||||||||

| LABL Escrow Issuer LLC(d)(f) |

||||||||||||||

| $ | 1,750,000 | 6.750 | 07/15/26 | 1,876,875 | ||||||||||

| Owens-Brockway Glass Container, Inc.(f) |

||||||||||||||

| 1,750,000 | 5.875 | 08/15/23 | 1,896,562 | |||||||||||

| Pactiv LLC |

||||||||||||||

| 2,845,000 | 8.375 | 04/15/27 | 3,243,300 | |||||||||||

| |

Reynolds Group Issuer, Inc./Reynolds Group Issuer |

| ||||||||||||

| 1,410,000 | 4.000 | 10/15/27 | 1,394,138 | |||||||||||

| Sealed Air Corp.(f) |

||||||||||||||

| 1,843,000 | 6.875 | 07/15/33 | 2,306,054 | |||||||||||

| Trivium Packaging Finance B.V.(d)(f) |

||||||||||||||

| 1,075,000 | 5.500 | 08/15/26 | 1,122,031 | |||||||||||

| 1,300,000 | 8.500 | 08/15/27 | 1,400,750 | |||||||||||

|

|

|

|||||||||||||

| 25,789,610 | ||||||||||||||

|

|

|

|||||||||||||

| Pharmaceuticals(d) – 1.9% | ||||||||||||||

| AbbVie, Inc. |

||||||||||||||

| 6,650,000 | 3.200 | 11/21/29 | 7,104,594 | |||||||||||

| AdaptHealth LLC(f) |

||||||||||||||

| 1,445,000 | 6.125 | 08/01/28 | 1,524,475 | |||||||||||

| 670,000 | 4.625 | 08/01/29 | 668,325 | |||||||||||

| Bausch Health Cos., Inc.(f) |

||||||||||||||

| 1,350,000 | 5.000 | 01/30/28 | 1,370,250 | |||||||||||

| 1,350,000 | 5.250 | 01/30/30 | 1,356,750 | |||||||||||

| Becton Dickinson & Co. |

||||||||||||||

| 3,200,000 | 2.823 | 05/20/30 | 3,303,552 | |||||||||||

| Cheplapharm Arzneimittel GmbH(f) |

||||||||||||||

| 1,268,000 | 5.500 | 01/15/28 | 1,320,305 | |||||||||||