Total | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Class A, C, Inst, Inv, R6 Shares | Goldman Sachs Income Builder Fund | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Goldman Sachs Income Builder Fund—Summary | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Investment Objective | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Goldman Sachs Income Builder Fund (the “Fund”) seeks to provide income and capital appreciation. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fees and Expenses of the Fund | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. The table does not take into account brokerage commissions that you may pay on your purchases and sales of Institutional Shares of the Fund. You may qualify for sales charge discounts on purchases of Class A Shares if you invest at least $50,000, in Goldman Sachs Funds. More information about these and other discounts is available from your financial professional and in “Shareholder Guide—Common Questions Applicable to the Purchase of Class A Shares” beginning on page 44 and in Appendix C—Additional Information About Sales Charge Variations, Waivers and Discounts on page 87 of the Prospectus and “Other Information Regarding Maximum Sales Charge, Purchases, Redemptions, Exchanges and Dividends” beginning on page B-122 of the Fund’s Statement of Additional Information (“SAI”). | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholder Fees (fees paid directly from your investment) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Expense Example | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. This Example assumes that you invest $10,000 in Class A, Class C, Institutional, Investor and/or Class R6 Shares of the Fund for the time periods indicated and then redeem all of your Class A, Class C, Institutional, Investor and/or Class R6 Shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (except that the Example incorporates the expense limitation arrangement for only the first year). The Example does not take into account brokerage commissions that you may pay on your purchases and sales of Institutional Shares of the Fund. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assuming complete redemption at end of period | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assuming no redemption | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Portfolio Turnover | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund pays transaction costs when it buys and sells securities or instruments (i.e., “turns over” its portfolio). A high rate of portfolio turnover may result in increased transaction costs, including brokerage commissions, which must be borne by the Fund and its shareholders, and is also likely to result in higher short-term capital gains for taxable shareholders. These costs are not reflected in the annual fund operating expenses or in the expense example above, but are reflected in the Fund’s performance. The Fund’s portfolio turnover rate for the fiscal year ended October 31, 2019 was 47% of the average value of its portfolio. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Strategy | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The Fund seeks to provide income through investments in fixed income securities (bonds) and high dividend paying equities, preferred equities and other similar securities (stocks). The Fund also seeks to provide income by writing call options. The Fund seeks to achieve capital appreciation primarily through equity securities. The percentage of the portfolio invested in equity and fixed income securities will vary from time to time as the Investment Adviser evaluates such securities’ relative attractiveness based on, among other factors, income opportunities, market valuations, economic growth and inflation prospects. The Fund has a baseline allocation to fixed income securities of 60% and to equity securities of 40%. In seeking to meet its investment objective, the Fund has the flexibility to opportunistically tilt the allocation to fixed income and equity securities up to 15% above or below the baseline allocation, measured at the time of investment. Equity Investments. The Fund may invest up to 55% of its total assets (not including securities lending collateral and any investment of that collateral) (“Total Assets”) measured at the time of purchase in equity investments, which include, among others, U.S. common stocks, preferred stocks and American Depositary Receipts (“ADRs”) of U.S. and foreign issuers (including issuers in countries with emerging markets or economies (“emerging countries”)), as well as master limited partnerships (“MLPs”), real estate investment trusts (“REITs”) and affiliated and unaffiliated investment companies, including exchange-traded funds (“ETFs”). With respect to the equity portion of the Fund’s portfolio, the Investment Adviser employs a value investment philosophy and seeks to identify quality businesses selling at compelling valuations. The Investment Adviser expects that equity investments will be weighted in favor of companies which pay dividends or other current income. While the Fund may invest in companies of any market capitalization, the Investment Adviser will typically favor equity securities of large-cap companies within the range of the market capitalization of the Russell 1000® Value Index at the time of investment. Fixed Income Investments. The Fund may invest up to 75% of its Total Assets measured at the time of purchase in fixed income investments. The Fund’s fixed income investments may include, among others:

The Fund’s investments in foreign fixed income securities may include securities of foreign issuers (including issuers in emerging countries) and securities denominated in a currency other than the U.S. dollar. The Fund may invest in both non-investment grade and investment grade fixed income securities. Non-investment grade fixed income securities (commonly known as “junk bonds”), which are rated BB+ or lower by Standard & Poor’s Ratings Services (“Standard & Poor’s”), or Moody’s Investors Service, Inc. (“Moody’s”), or have a comparable rating by another nationally recognized statistical rating organization (“NRSRO”) (or, if unrated, determined by the Investment Adviser to be of comparable credit quality), at the time of investment. Non-investment grade securities may include, among others, non-investment grade bonds, non-investment grade floating rate loans and other floating or variable rate obligations. With respect to the fixed income portion of its portfolio, the Fund does not maintain a fixed target duration. Other Investments. The Fund may invest without limit in non-U.S. equity and non-U.S. fixed income securities. In addition to direct investments in equity and fixed income securities, the Fund may invest in derivatives, including credit default swaps (including credit default index swaps or “CDX”), total return swaps and futures, which can be used for both hedging purposes and to seek to increase total return. The Fund may also utilize various interest rate-related derivatives, including futures and swaps, to manage the duration of its fixed income positions. Additionally, the Fund may hedge its nondollar investments back to the U.S. dollar through the use of foreign currency derivatives, including currency futures and forward foreign currency contracts, or invest in such instruments for speculative purposes. The Fund seeks to generate additional cash flow and may reduce volatility by the sale of call options on the S&P 500® Index or other regional stock market indices (or related ETFs). The Fund expects that, under normal circumstances, it will sell put and call options in an amount up to 12% of the value of the Fund’s portfolio. The Fund expects to sell put and call options that are “out of the money.” As the seller of these options, the Fund will receive cash (the “premium”) from the purchaser. If the purchaser exercises the option, the Fund pays the purchaser the difference between the price of the index and the exercise price of the option. The premium, the exercise price and the market price of the index determine the gain or loss realized by the Fund as the seller of the call option. A put option gives the purchaser the right to sell the option’s underlier (e.g., a security or an index-linked instrument) at an agreed-upon exercise price prior to the option’s expiration, and a put option is “out of the money” when this exercise price is below the current market price of the underlier. Conversely, a call option gives the purchaser the right to buy the option’s underlier at an agreed-upon exercise price prior to the option’s expiration, and a call option is “out of the money” when this exercise price is above the current market price of the underlier. The Fund expects to sell out-of-the-money put and call options with the same underliers and expiration dates in what is referred to as a “strangle” strategy. Generally, a sold “strangle” position would realize gains from collected premiums when its underlier has a market price that is between the exercise prices of the associated put and call options. Losses may be experienced to the extent that the underlier has a market price that is either below the exercise price of the put option (subtracting any premiums from the exercise price) or above the exercise price of the call option (adding any premiums to the exercise price), i.e., if the strangle position expires “in the money.” The Fund expects to use total return swaps to gain exposure to the above-described option strategy. Income realized with respect to this strategy is generally expected to be characterized as ordinary income, which the Fund may periodically distribute to shareholders. The Fund’s transactions in swaps will be subject to special tax rules, which could affect the amount, timing and character of distributions to you. As a result of these rules, the Fund’s investment in total return swaps is expected to result in the Fund realizing more ordinary income subject to tax at ordinary income tax rates than if the Fund did not invest in such swaps. During periods in which the U.S. equity markets are generally unchanged or falling, or in a modestly rising market where the income from premiums exceeds the aggregate appreciation of the underlying index over its exercise price, a diversified portfolio receiving premiums from its call option writing strategy may outperform the same portfolio without such an options strategy. However, in rising markets where the aggregate appreciation of the underlying index over its exercise price exceeds the income from premiums, a portfolio with a call writing strategy could significantly underperform the same portfolio without the options. The Investment Adviser may decide to sell a position for various reasons, including valuation and price considerations, readjustment of the Investment Adviser’s outlook based on subsequent events, the Investment Adviser’s ongoing assessment of the quality and effectiveness of management, if new investment ideas offer the potential for better risk/reward profiles than existing holdings, or for risk management purposes. The Fund’s benchmarks are the Russell 1000® Value Index and the ICE BofAML BB to B U.S. High Yield Constrained Index. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Principal Risks of the Fund | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Loss of money is a risk of investing in the Fund. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any government agency. The Fund should not be relied upon as a complete investment program. There can be no assurance that the Fund will achieve its investment objective. Investments in the Fund involve substantial risks which prospective investors should consider carefully before investing. The Fund’s principal risks are presented below in alphabetical order, and not in the order of importance or potential exposure. Credit/Default Risk. An issuer or guarantor of fixed income securities held by the Fund (which may have low credit ratings) may default on its obligation to pay interest and repay principal or default on any other obligation. Additionally, the credit quality of securities may deteriorate rapidly, which may impair the Fund’s liquidity and cause significant deterioration in net asset value (“NAV”). These risks are more pronounced in connection with the Fund’s investments in non-investment grade fixed income securities. Derivatives Risk. The Fund’s use of futures, swaps, options on swaps and other derivative instruments may result in losses. These instruments, which may pose risks in addition to and greater than those associated with investing directly in securities, currencies or other instruments, may be illiquid or less liquid, volatile, difficult to price and leveraged so that small changes in the value of the underlying instruments may produce disproportionate losses to the Fund. Certain derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligation. The use of derivatives is a highly specialized activity that involves investment techniques and risks different from those associated with investments in more traditional securities and instruments. Foreign and Emerging Countries Risk. Foreign securities may be subject to risk of loss because of more or less foreign government regulation, less public information and less economic, political and social stability in the countries in which the Fund invests. The imposition of exchange controls, sanctions, confiscations, trade restrictions (including tariffs) and other government restrictions by the United States and other governments, or from problems in share registration, settlement or custody, may also result in losses. Foreign risk also involves the risk of negative foreign currency rate fluctuations, which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. These risks may be more pronounced in connection with the Fund’s investments in securities of issuers located in emerging countries. Interest Rate Risk. When interest rates increase, fixed income securities or instruments held by the Fund will generally decline in value. Long-term fixed income securities or instruments will normally have more price volatility because of this risk than short-term fixed income securities or instruments. The risks associated with changing interest rates may have unpredictable effects on the markets and the Fund’s investments. Fluctuations in interest rates may also affect the liquidity of fixed income securities and instruments held by the Fund. Investment Style Risk. Different investment styles (e.g., “growth”, “value” or “quantitative”) tend to shift in and out of favor depending upon market and economic conditions and investor sentiment. The Fund may outperform or underperform other funds that invest in similar asset classes but employ a different investment style. Value investing is an example of an investment style. Value Stocks are those believed to be undervalued in comparison to their peers, due to market, company-specific, or other factors. Large Shareholder Transactions Risk. The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Such large shareholder redemptions, which may occur rapidly or unexpectedly, may cause the Fund to sell portfolio securities at times when it would not otherwise do so, which may negatively impact the Fund’s NAV and liquidity. Similarly, large Fund share purchases may adversely affect the Fund’s performance to the extent that the Fund is delayed in investing new cash or otherwise maintains a larger cash position than it ordinarily would. These transactions may also accelerate the realization of taxable income to shareholders if such sales of investments resulted in gains, and may also increase transaction costs. In addition, a large redemption could result in the Fund’s current expenses being allocated over a smaller asset base, leading to an increase in the Fund’s expense ratio. Loan-Related Investments Risk. In addition to risks generally associated with debt investments (e.g., interest rate risk and default risk), loan-related investments such as loan participations and assignments are subject to other risks. Although a loan obligation may be fully collateralized at the time of acquisition, the collateral may decline in value, be or become illiquid or less liquid, or lose all or substantially all of its value subsequent to investment. Many loan investments are subject to legal or contractual restrictions on resale and certain loan investments may be or become illiquid or less liquid and more difficult to value, particularly in the event of a downgrade of the loan or the borrower. There is less readily available, reliable information about most loan investments than is the case for many other types of investments. Substantial increases in interest rates may cause an increase in loan obligation defaults. With respect to loan participations, the Fund may not always have direct recourse against a borrower if the borrower fails to pay scheduled principal and/or interest; may be subject to greater delays, expenses and risks than if the Fund had purchased a direct obligation of the borrower; and may be regarded as the creditor of the agent lender (rather than the borrower), subjecting the Fund to the creditworthiness of that lender as well. Investors in loans, such as the Fund, may not be entitled to rely on the anti-fraud protections of the federal securities laws, although they may be entitled to certain contractual remedies. The market for loan obligations may be subject to irregular trading activity, wide bid/ask spreads and extended trade settlement periods. Because transactions in many loans are subject to extended trade settlement periods, the Fund may not receive the proceeds from the sale of a loan for a period after the sale. As a result, sale proceeds related to the sale of loans may not be available to make additional investments or to meet the Fund’s redemption obligations for a period after the sale of the loans, and, as a result, the Fund may have to sell other investments or engage in borrowing transactions, such as borrowing from its credit facility, if necessary to raise cash to meet its obligations. During periods of heightened redemption activity or distressed market conditions, the Fund may seek to obtain expedited trade settlement, which will generally incur additional costs (although expedited trade settlement will not always be available). Senior loans hold the most senior position in the capital structure of a business entity, and are typically secured with specific collateral, but are nevertheless usually rated below investment grade. Because second lien loans are subordinated or unsecured and thus lower in priority of payment to senior loans, they are subject to the additional risk that the cash flow of the borrower and property securing the loan or debt, if any, may be insufficient to meet scheduled payments after giving effect to the senior secured obligations of the borrower. Second lien loans generally have greater price volatility than senior loans and may be less liquid. Generally, loans have the benefit of restrictive covenants that limit the ability of the borrower to further encumber its assets or impose other obligations. To the extent a loan does not have certain covenants (or has less restrictive covenants), an investment in the loan will be particularly sensitive to the risks associated with loan investments. Management Risk. A strategy used by the Investment Adviser may fail to produce the intended results. Market Risk. The market value of the securities in which the Fund invests may go up or down in response to the prospects of individual companies, particular sectors or governments and/or general economic conditions throughout the world due to increasingly interconnected global economies and financial markets. Master Limited Partnership Risk. Investments in securities of an MLP involve risks that differ from investments in common stock, including risks related to limited control and limited rights to vote on matters affecting the MLP. Certain MLP securities may trade in lower volumes due to their smaller capitalizations, and may be subject to more abrupt or erratic price movements and lower market liquidity. MLPs are generally considered interest-rate sensitive investments. During periods of interest rate volatility, these investments may not provide attractive returns. Investments in securities of an MLP also include tax-related risks. For example, to the extent a distribution received by the Fund from an MLP is treated as a return of capital, the Fund’s adjusted tax basis in the interests of the MLP may be reduced, which will result in an increase in an amount of income or gain (or decrease in the amount of loss) that will be recognized by the Fund for tax purposes upon the sale of any such interests or upon subsequent distributions in respect of such interests. Non-Investment Grade Fixed Income Securities Risk. Non-investment grade fixed income securities and unrated securities of comparable credit quality (commonly known as “junk bonds”) are considered speculative and are subject to increased risk of an issuer’s inability to meet principal and interest payment obligations. These securities may be subject to greater price volatility due to such factors as specific issuer developments, interest rate sensitivity, negative perceptions of the junk bond markets generally and less liquidity. Option Writing Risk. Writing (selling) call options limits the opportunity to profit from an increase in the market value of stocks in exchange for up-front cash (the premium) at the time of selling the call option. In a rising market, the Fund could significantly under-perform the market. Furthermore, the Fund’s call option writing strategies may not fully protect it against market declines because the Fund will continue to bear the risk of a decline in the value of its portfolio securities. In a sharply-falling equity market, the Fund will likely also experience sharp declines in its NAV. Other Investments Risk. By investing in pooled investment vehicles (including investment companies and ETFs), partnerships and REITs indirectly through the Fund, investors will incur a proportionate share of the expenses of the other pooled investment vehicles, partnerships and REITs held by the Fund (including operating costs and investment management fees) in addition to the fees and expenses regularly borne the Fund. In addition, the Fund will be affected by the investment policies, practices and performance of such investments in direct proportion to the amount of assets the Fund invests therein. REIT Risk. REITs whose underlying properties are concentrated in a particular industry or geographic region are subject to risks affecting such industries and regions. The securities of REITs involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements because of interest rate changes, economic conditions and other factors. Securities of such issuers may lack sufficient market liquidity to enable the Fund to effect sales at an advantageous time or without a substantial drop in price. Stock Risk. Stock prices have historically risen and fallen in periodic cycles. U.S. and foreign stock markets have experienced periods of substantial price volatility in the past and may do so again in the future. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Performance | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

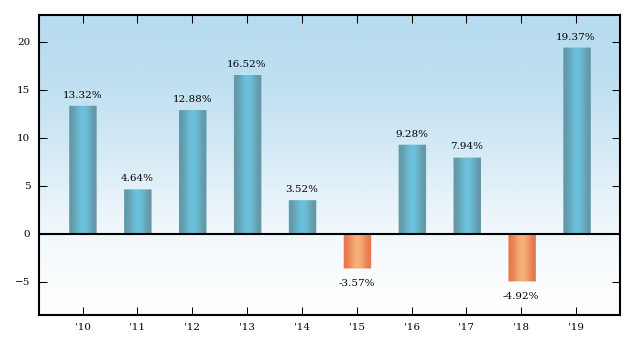

| The bar chart and table below provide an indication of the risks of investing in the Fund by showing: (a) changes in the performance of the Fund’s Class A Shares from year to year; and (b) how the average annual total returns of the Fund’s Class A, Class C, Institutional, Investor and/or Class R6 Shares compare to those of broad-based securities market indices. Through June 29, 2012, the Fund had been known as the Goldman Sachs Balanced Fund, and its investment objective and certain of its strategies differed. Performance information set forth below reflects the Fund’s former investment objective and strategies prior to that date. Because the Fund invests in both equity and fixed income securities, the Fund shows its performance against both the Russell 1000® Value Index (which shows how the Fund’s performance compares to an index of large cap value equities) and the ICE BofAML BB to B U.S. High Yield Constrained Index (which shows how the Fund’s performance compares to an index of high yield fixed income securities). The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available at no cost at www.gsamfunds.com/performance or by calling the appropriate phone number on the back cover of the Prospectus. The bar chart (including “Best Quarter” and “Worst Quarter” information) does not reflect the sales loads applicable to Class A Shares. If the sales loads were reflected, returns would be less. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| TOTAL RETURN CALENDAR YEAR (CLASS A) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Best Quarter Q1 ‘19 +19.16% Worst Quarter Q3 ‘11 –6.91% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| AVERAGE ANNUAL TOTAL RETURN For the period ended December 31, 2019 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The after-tax returns are for Class A Shares only. The after-tax returns for Class C, Institutional, Investor and Class R6 Shares, will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||