Total | ||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Goldman Sachs Global Managed Beta Fund | ||||||||||||||||||||||||||||

| Goldman Sachs Global Managed Beta Fund—Summary | ||||||||||||||||||||||||||||

| Investment Objective | ||||||||||||||||||||||||||||

| The Goldman Sachs Global Managed Beta Fund (the “Fund”) seeks to provide long-term capital growth. | ||||||||||||||||||||||||||||

| Fees and Expenses of the Fund | ||||||||||||||||||||||||||||

| This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. The table does not take into account brokerage commissions that you may pay on your purchases and sales of Institutional Shares of the Fund. | ||||||||||||||||||||||||||||

| Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

| Expense Example | ||||||||||||||||||||||||||||

| This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in Institutional Shares of the Fund for the time periods indicated and then redeem all of your Institutional Shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (except that the Example incorporates the fee waiver and expense limitation arrangements for only the first year). The Example does not take into account brokerage commissions that you may pay on your purchases and sales of Institutional Shares of the Fund. Although your actual costs may be higher or lower, based on these assumptions your costs would be: | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

| Portfolio Turnover | ||||||||||||||||||||||||||||

| The Fund pays transaction costs when it buys and sells securities or instruments (i.e., “turns over” its portfolio). A high rate of portfolio turnover may result in increased transaction costs, including brokerage commissions, which must be borne by the Fund and its shareholders, and is also likely to result in higher short-term capital gains for taxable shareholders. These costs are not reflected in annual fund operating expenses or in the expense example above, but are reflected in the Fund’s performance. The Fund’s portfolio turnover rate for the fiscal period ended August 31, 2019 was 56% of the average value of its portfolio. | ||||||||||||||||||||||||||||

| Principal Investment Strategies | ||||||||||||||||||||||||||||

| The Fund primarily seeks to achieve its investment objective by investing in a diversified portfolio of global equity asset classes (the “Underlying Asset Classes”) that provide broad beta exposure to the global equity markets. “Beta” refers to the component of returns that is attributable to broad market risk exposure. The Investment Adviser will determine the capital allocation to the Underlying Asset Classes (and within the Underlying Asset Classes) based on its cycle-aware long term strategic allocation model, which may include factor-based diversification. The Fund currently intends to gain exposure to the Underlying Asset Classes, and in the approximate ranges, listed below:

The Fund may also employ a macro hedging strategy that seeks to diversify the Fund’s overall exposure to the global equity asset classes. This hedging strategy primarily entails the purchase of options on interest rates or fixed income instruments and it has risk/return characteristics with low expected correlation to that of the global equity markets. The Investment Adviser intends to employ this hedging strategy as a diversifying complement to the Underlying Asset Classes. The Fund may invest in exchange-traded funds (“ETFs”), futures and other instruments that provide economic exposures to the Underlying Asset Classes. The Fund may also invest directly in equity securities, including real estate investment trusts (“REITs”). The Fund may invest, without limitation, in securities or obtain exposures to Underlying Asset Classes that are denominated in currencies other than the U.S. dollar. The Fund may use currency management techniques, primarily forward foreign currency contracts, for hedging or non-hedging purposes. The Fund intends to have investments economically tied to at least three countries, including the United States, and may invest in the securities of issuers in emerging market countries. Under normal circumstances, the Fund intends to invest no more than 25% of its total assets in emerging markets equity securities and no more than 30% of its total assets in the securities of small capitalization companies. The Fund may invest without restriction as to issuer capitalization, currency, maturity or credit rating. The Fund may use leverage (e.g., by borrowing or through derivatives). The Fund may invest in derivatives for both hedging and non-hedging purposes. The Fund’s derivative investments may include: (i) futures contracts, including futures based on securities and/or indices; (ii) options, including long and short positions in call options and put options on indices, or currencies, swaptions and options on futures contracts; and (iii) forward contracts, including currency forwards. As a result, the sum of the Fund’s investment exposures may at times exceed the amount of assets invested in the Fund, although these exposures may vary over time. The use of leverage magnifies gains and losses. As a result of the Fund’s use of derivatives, the Fund may also hold significant amounts of U.S. Treasuries or short-term investments, including money market funds and short duration bond funds, cash and time deposits, and enter into repurchase agreements. The Fund expects to engage in put and call option transactions to gain exposure to the global equity markets. A put option gives the purchaser the right to sell the option’s reference security to the Fund at an agreed-upon exercise price prior to the option’s expiration, and a call option gives the purchaser the right to buy the option’s reference security from the Fund at an agreed-upon exercise price prior to the option’s expiration. This options-based strategy seeks to generate returns in moderately rising or moderately declining global equity markets where the Investment Adviser believes realized volatility will be lower than the volatility implied by the option prices. In such markets, the Fund would generally realize gains to the extent the income from collected premiums exceeds the aggregate appreciation or depreciation of the reference security relative to the exercise price. Conversely, in sharply rising or sharply declining global equity markets, the Fund may experience losses to the extent that the aggregate appreciation or depreciation of the reference security relative to the exercise price exceeds the income from collected premiums. Furthermore, the strategy may detract from the Fund’s relative performance in sharply rising global equity markets because it limits the Fund’s opportunity to profit from an increase in the equity prices beyond the exercise price, and may not fully protect the Fund in sharply declining global equity markets because the Fund will continue to bear the risk of a decline in the value of its portfolio securities. In selecting individual securities, the Fund may use a rules-based methodology, in combination with a qualitative overlay, that emphasizes fundamentally-based and market-based stock selection, portfolio construction and efficient implementation. The Fund may seek to gain exposure to Underlying Asset Classes using a factor-based diversification approach, rather than obtaining such exposure through market capitalization weighted indices. Factor-based diversification seeks to capture common sources of active equity returns, including, but not limited to, the following factors: Momentum, Valuation, Volatility and Quality. The Momentum factor seeks to identify companies whose stock prices are expected to increase or decrease (by, among other things, evaluating each company’s recent performance results). The Valuation factor seeks to identify companies whose stock prices are trading at a discount to their fundamental or intrinsic value (by, among other things, comparing each company’s book value to market value). The Volatility factor seeks to identify companies whose stock prices are expected to have a relatively lower degree of fluctuation over time. The Quality factor seeks to identify companies that are expected to generate higher returns on assets (i.e., more profitable). The Investment Adviser seeks to capitalize on the low correlations in returns across these factors by diversifying exposure to securities selected based on such factors. The Fund may make investment decisions that deviate from those generated by the Investment Adviser’s proprietary models, at the discretion of the Investment Adviser. In addition, the Investment Adviser may, in its discretion, make changes to its quantitative techniques, or use other quantitative techniques that are based on its proprietary research. The Fund’s benchmark index is the MSCI All Country World Index Investable Market Index (“MSCI ACWI IMI”) (Net, USD, 50% Non-US Developed Hedged to USD). | ||||||||||||||||||||||||||||

| Principal Risks of the Fund | ||||||||||||||||||||||||||||

| Loss of money is a risk of investing in the Fund. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any government agency. The Fund should not be relied upon as a complete investment program. There can be no assurance that the Fund will achieve its investment objective. Investments in the Fund involve substantial risks which prospective investors should consider carefully before investing. Asset Allocation Risk. The Fund’s allocations to the various Underlying Asset Classes may cause the Fund to underperform other funds with a similar investment objective. Derivatives Risk. The Fund’s use of options, futures, forwards and other derivative instruments may result in losses. These instruments, which may pose risks in addition to and greater than those associated with investing directly in securities, currencies or other instruments, may be illiquid or less liquid, volatile, difficult to price and leveraged so that small changes in the value of underlying instruments may produce disproportionate losses to the Fund. Certain derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligations. The use of derivatives is a highly specialized activity that involves investment techniques and risks different from those associated with investments in more traditional securities and instruments. Expenses. By investing in pooled investment vehicles (including investment companies and ETFs) indirectly through the Fund, the investor will incur not only a proportionate share of the expenses of the other pooled investment vehicles held by the Fund (including operating costs and investment management fees), but also expenses of the Fund. Foreign and Emerging Countries Risk. Foreign securities may be subject to risk of loss because of more or less foreign government regulation, less public information and less economic, political and social stability in the countries in which the Fund invests. The imposition of exchange controls, sanctions, confiscations, trade restrictions (including tariffs) and other government restrictions by the United States and other governments, or from problems in share registration, settlement or custody may also result in losses. Foreign risk also involves the risk of negative foreign currency rate fluctuations, which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. These risks may be more pronounced in connection with the Fund’s investments in securities of issuers located in emerging markets. Geographic Risk. If the Fund focuses its investments in issuers located in a particular country or region, the Fund may be subjected, to a greater extent than if investments were less focused, to the risks of volatile economic cycles and/or conditions and developments that may be particular to that country or region, such as: adverse securities markets; adverse exchange rates; adverse social, political, regulatory, economic, business, environmental or other developments; or natural disasters. GPS Transactions Risk. The Global Portfolio Solutions Group (“GPS” or the “GPS Group”), a business unit within GSAM, currently provides investment advisory services to certain client accounts in respect of which it has discretionary authority to effect investment decisions, as well as client accounts in respect of which it provides investment advice but does not have the discretion to effect investment decisions without the specific instruction of the clients. It is currently expected that certain GPS client accounts will invest in the Fund. Investments by GPS client accounts in the Fund may be made at any time and from time to time, could be substantial and could represent a substantial proportion of the Fund’s capital. As a result of GSAM’s position as Investment Adviser to the Fund and the investment advisory services provided to client accounts through GPS, GSAM may possess information relating to the Fund and GPS client accounts that it would not otherwise possess. Discretionary client accounts advised by GPS may, to the extent permitted by applicable law, purchase and redeem shares from the Fund on the basis of such knowledge, and other shareholders of the Fund, including non-discretionary client accounts advised by GPS, will not be informed of such purchases or redemptions. Redemptions by discretionary client accounts advised by GPS could have an adverse effect on the Fund and its other shareholders, including non-discretionary client accounts advised by GPS. In addition, GPS may effect subscriptions to and full or partial redemptions from the Fund for discretionary client accounts in advance of receiving directions from non-discretionary client accounts regarding such clients’ investments in the Fund, and non-discretionary client accounts may be adversely affected. See also “Large Shareholder Transactions Risk”. Index/Tracking Error Risk. While the Investment Adviser will utilize certain indices as references for making investments for the Fund, the Fund will not attempt to fully replicate the investments, or match the performance, of each such index. Accordingly, the Fund’s allocations to any asset class, and thus the Fund’s overall portfolio composition and performance may not match, and may vary substantially from, that of any index that it may use to measure its investment performance (whether overall or with respect to any asset class) for any period of time. Unlike the Fund, the returns of an index are not reduced by investment and other operating expenses. At times, the Fund’s assets may not be fully invested in securities and instruments attempting to approximate the returns of an index. Due to regulatory or market constraints, the Fund may be unable to obtain sufficient exposure to a particular asset class (e.g., commodities). Interest Rate Risk. The Fund will implement macro hedges by using an interest rate options strategy with risk/return characteristics that has low expected correlation to that of the global equity markets. A declining interest rate environment could cause the exposure value of the Fund’s macro-hedging strategy to decrease, which could impair the Fund’s ability to achieve its investment objective. Generally, the fund will implement the strategy by purchasing interest rate options that may profit if rates fall, remain constant or rise less than what is expected for the interest rate yield curve. The strategy may be less likely to generate positive returns during a period of rising rates. Large Shareholder Transactions Risk. The Fund may experience adverse effects when certain large shareholders, such as institutional investors and Goldman Sachs affiliates, purchase or redeem large amounts of shares of the Fund. Such large shareholder redemptions, which may occur rapidly or unexpectedly, may cause the Fund to sell portfolio securities at time when it would not otherwise do so, which may negatively impact the Fund’s NAV and liquidity. Similarly, large Fund share purchases may adversely affect the Fund’s performance to the extent that the Fund is delayed in investing new cash or otherwise maintains a larger cash position than it ordinarily would. These transactions may also accelerate the realization of taxable income to shareholders if such sales of investments resulted in gains, and may also increase transaction costs. In addition, a large redemption could result in the Fund’s current expenses being allocated over a smaller asset base, leading to an increase in the Fund’s expense ratio. Leverage Risk. Borrowings and the use of derivatives may result in leverage and may make the Fund more volatile. When the Fund uses leverage the sum of the Fund’s investment exposures may significantly exceed the amount of assets invested in the Fund, although these exposures may vary over time. The use of leverage may cause the Fund to liquidate portfolio positions to satisfy its obligations or to meet asset segregation requirements when it may not be advantageous to do so. The use of leverage by the Fund can substantially increase the adverse impact to which the Fund’s investment portfolio may be subject. Liquidity Risk. The Fund may make investments that are illiquid or that may become less liquid in response to market developments or adverse investor perceptions. Illiquid investments may be more difficult to value. Liquidity risk may also refer to the risk that the Fund will not be able to pay redemption proceeds within the allowable time period because of unusual market conditions, an unusually high volume of redemption requests or other reasons. To meet redemption requests, the Fund may be forced to sell securities, at an unfavorable time and/or under unfavorable conditions. These risks may be more pronounced in connection with the Fund’s investments in securities of issuers located in emerging market countries. Redemptions by large shareholders may have a negative impact on the Fund’s liquidity. Market Risk. The value of the securities in which the Fund invests may go up or down in response to the prospects of individual companies, particular sectors or governments and/or general economic conditions throughout the world due to increasingly interconnected global economies and financial markets. Mid-Cap and Small-Cap Risk. Investments in mid-capitalization and small-capitalization companies involve greater risks than those associated with larger, more established companies. These securities may be subject to more abrupt or erratic price movements and may lack sufficient market liquidity, and these issuers often face greater business risks. Option Writing Risk. Writing (selling) options may limit the opportunity to profit from an increase or decrease in the market value of a reference security in exchange for up-front cash (the premium) at the time of selling the option. In a sharp rising or falling market, the Fund could significantly underperform the market or other portfolios without an option writing strategy. The Fund could also experience a sudden, significant permanent loss due to dramatic movements in the market value of reference security, which may far exceed the premiums received for writing the option. Such significant losses could cause significant deteriorations in the Fund’s NAV. Furthermore, the premium received from the Fund’s option writing strategies may not fully protect it against market movements because the Fund will continue to bear the risk of movements in the value of its portfolio investments. REIT Risk. REITs whose underlying properties are concentrated in a particular industry or geographic region are subject to risks affecting such industries and regions. The securities of REITs involve greater risks than those associated with larger, more established companies and may be subject to more abrupt or erratic price movements because of interest rate changes, economic conditions and other factors. Securities of such issuers may lack sufficient market liquidity to enable the Fund to effect sales at an advantageous time or without a substantial drop in price. Stock Risk. Stock prices have historically risen and fallen in periodic cycles. U.S. and foreign stock markets have experienced periods of substantial price volatility in the past and may do so again in the future. | ||||||||||||||||||||||||||||

| Performance | ||||||||||||||||||||||||||||

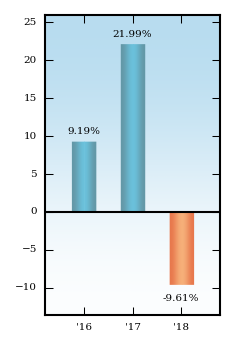

| The bar chart and table below provide an indication of the risks of investing in the Fund by showing (a) changes in the performance of the Fund’s Institutional Shares from year to year; and (b) how the average annual total returns of the Fund’s Institutional Shares compare to those of a broad-based securities market index. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available at no cost at www.gsamfunds.com/performance or by calling the phone number on the back cover of the Prospectus. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown. | ||||||||||||||||||||||||||||

| TOTAL RETURN CALENDAR YEAR (INSTITUTIONAL) | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||

| The total returns for Institutional Shares for the 9-month period ended September 30, 2019 was 17.61% Best Quarter Q1 ‘17 +6.31% Worst Quarter Q4 ‘18 –12.43% | ||||||||||||||||||||||||||||

| AVERAGE ANNUAL TOTAL RETURN For the period ended December 31, 2018 | ||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||