Class P: GGRPX

Before you invest, you may want to review the Goldman Sachs Commodity Strategy Fund’s (the “Fund”) Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, reports to shareholders and other information about the Fund online at www.gsamfunds.com/summaries. You can also get this information at no cost by calling 800-621-2550, or by sending an e-mail request to gs-funds-document-requests@gs.com. The Fund’s Prospectus and Statement of Additional Information (“SAI”), both dated April 30, 2019, are incorporated by reference into this Summary Prospectus.

It is our intention that beginning on January 1, 2021, paper copies of the Fund’s annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. At any time, you may elect to receive reports and certain communications from the Fund electronically by calling the applicable toll-free number below or by contacting your financial intermediary.

You may elect to receive all future shareholder reports in paper free of charge. If you hold shares of the Fund directly with the Fund’s transfer agent, you can inform the transfer agent that you wish to receive paper copies of reports by calling toll-free 800-621-2550 for Class P shareholders. If you hold shares of the Fund through a financial intermediary, please contact your financial intermediary to make this election. Your election to receive reports in paper will apply to all Goldman Sachs Funds held in your account if you invest through your financial intermediary or all Goldman Sachs Funds held with the Fund’s transfer agent if you invest directly with the transfer agent.

| INVESTMENT OBJECTIVE |

The Fund seeks long-term total return.

| FEES AND EXPENSES OF THE FUND |

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment)

| Class P | ||||

| Management Fees |

0.50 | % | ||

| Other Expenses |

0.15 | % | ||

| Acquired Fund Fees and Expenses |

0.16 | % | ||

| Total Annual Fund Operating Expenses1 |

0.81 | % | ||

| Fee Waiver and Expense Limitation2 |

(0.21 | )% | ||

| Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation |

0.60 | % |

| 1 | The “Total Annual Fund Operating Expenses” do not correlate to the ratios of net and total expenses to average net assets provided in the Financial Highlights, which reflect the operating expenses of the Fund and do not include “Acquired Fund Fees and Expenses.” |

| 2 | The Investment Adviser has agreed to: (i) waive a portion of its management fee payable by the Fund in an amount equal to any management fees it earns as an investment adviser to the affiliated funds in which the Fund invests; (ii) waive a portion of its management fee in an amount equal to the management fee paid to the Investment Adviser by the CSF Subsidiary (as defined below) at an annual rate of 0.42% of the CSF Subsidiary’s average daily net assets; and (iii) reduce or limit “Other Expenses” (excluding acquired fund fees and expenses, transfer agency fees and expenses, taxes, interest, brokerage fees, expenses of shareholder meetings, litigation and indemnification, and extraordinary expenses) to 0.074% of the Fund’s average daily net assets. The management fee waiver arrangement with respect to the CSF Subsidiary may not be discontinued by the Investment Adviser as long as its contract with the CSF Subsidiary is in place. The other management fee waiver and expense limitation arrangements will remain in effect through at least April 30, 2020, and prior to such date the Investment Adviser may not terminate the arrangements without the approval of the Board of Trustees. |

2 SUMMARY PROSPECTUS — GOLDMAN SACHS COMMODITY STRATEGY FUND

| EXPENSE EXAMPLE |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in Class P Shares of the Fund for the time periods indicated and then redeem all of your Class P Shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (except that the Example incorporates the fee waiver and expense limitation arrangements for only the first year). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||

| Class P Shares |

$ 62 | $ 239 | $ 431 | $ 987 |

| PORTFOLIO TURNOVER |

The Fund pays transaction costs when it buys and sells securities or instruments (i.e., “turns over” its portfolio). A high rate of portfolio turnover may result in increased transaction costs, including brokerage commissions, which must be borne by the Fund and its shareholders, and is also likely to result in higher short-term capital gains for taxable shareholders. These costs are not reflected in annual fund operating expenses or in the expense example above, but are reflected in the Fund’s performance. The Fund’s portfolio turnover rate for the fiscal year ended December 31, 2018 was 46% of the average value of its portfolio.

| PRINCIPAL STRATEGY |

The Fund seeks to maintain substantial economic exposure to the performance of the commodities markets. The Fund primarily gains exposure to the commodities markets by investing in a wholly-owned subsidiary of the Fund organized as a company under the laws of the Cayman Islands, Cayman Commodity – CSF, Ltd. (the “CSF Subsidiary”). The CSF Subsidiary is advised by the Investment Adviser, and has the same investment objective as the Fund.

The Fund seeks to provide exposure to the commodities markets and returns that correspond to the performance of the S&P GSCI Total Return Index (Gross, USD, Unhedged) (“S&P GSCI”), or other similar indices by investing, through the CSF Subsidiary, in commodity-linked investments. The Fund will also seek to add incremental returns through the use of “roll-timing” or similar strategies as described further below. The S&P GSCI is a composite index of commodity sector returns, representing an unleveraged, long-only investment in commodity futures that is diversified across the spectrum of commodities. Individual components qualify for inclusion in the S&P GSCI on the basis of liquidity and are weighted by their respective world production quantities. In pursuing its objective, the Fund attempts to provide exposure to the returns of real assets that trade in the commodity markets without direct investment in physical commodities. The Fund uses the S&P GSCI as its performance benchmark, but the Fund will not attempt to replicate the index.

Investment in the Subsidiary. The Fund may invest up to 25% of its total assets in the CSF Subsidiary. The CSF Subsidiary primarily obtains its commodity exposure by investing in commodity-linked derivative instruments (which may include total return swaps). Commodity-linked swaps are derivative instruments whereby the cash flows agreed upon between counterparties are dependent upon the price of the underlying commodity or commodity index over the life of the swap. The value of the swap will rise and fall in response to changes in the underlying commodity or commodity index. Commodity-linked swaps expose the CSF Subsidiary and the Fund economically to movements in commodity prices. Such instruments may be leveraged so that small changes in the underlying commodity prices would result in disproportionate changes in the value of the instrument. Neither the Fund nor the CSF Subsidiary invests directly in physical commodities. The CSF Subsidiary will also invest in other instruments, including fixed income securities, either as investments or to serve as margin or collateral for its swap positions, and foreign currency transactions (including forward contracts).

The Fund employs commodity roll-timing strategies. “Rolling” futures exposure is the process by which the holder of a particular futures contract or other instrument providing futures exposure (e.g. swaps) will sell such contract or instrument on or before the expiration date and simultaneously purchase a new contract or instrument with identical terms except for a later expiration date. This process allows a holder of the instrument to extend its current position through the original instrument’s expiration without delivering the underlying asset. The Fund’s rolling may differ from that of the S&P GSCI to the extent necessary to enable the Fund to seek excess returns over the S&P GSCI. The Fund’s “roll-timing” strategies may include, for example, rolling the Fund’s commodity exposure earlier or later versus the S&P GSCI, or holding and rolling positions with longer or different expiration dates than the S&P GSCI.

Fixed Income Investments. As a result of the Fund’s use of derivatives, the Fund may hold as collateral significant amounts of U.S. Treasury or short-term investments, including money market funds. In managing the collateral portion of the Fund’s investment strategy, the Investment Adviser generally seeks capital preservation. The Fund also attempts to enhance returns by investing in investment grade fixed income securities, and may invest up to 10% of its assets in non-investment grade fixed income securities (commonly known as “junk bonds”). The Fund may invest in corporate securities, U.S. Government securities (including agency debentures), mortgage-backed securities, asset-backed securities, and municipal securities. The average duration will vary. The Investment Adviser uses derivatives, including futures and swaps, to manage the duration of the Fund’s investment portfolio.

Other. The Fund may also invest in forwards, futures, and swaps, which are used for both hedging and non-hedging purposes. The Fund may invest up to 35% of its net assets in foreign securities. The Fund’s benchmark index is the S&P GSCI.

| PRINCIPAL RISKS OF THE FUND |

Loss of money is a risk of investing in the Fund. The investment program of the Fund is speculative, entails substantial risks and includes asset classes and investment techniques not

3 SUMMARY PROSPECTUS — GOLDMAN SACHS COMMODITY STRATEGY FUND

employed by more traditional mutual funds. The Fund should not be relied upon as a complete investment program. There can be no assurance that the investment objective of the Fund will be achieved. Moreover, there is no assurance that the investment processes of the Fund will be successful, that the techniques utilized therein will be implemented successfully or that they are adequate for their intended uses, or that the discretionary element of the investment processes of the Fund will be exercised in a manner that is successful or that is not adverse to the Fund. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any government agency. Investors should carefully consider these risks before investing.

Absence of Regulation. The Fund engages in over-the-counter (“OTC”) transactions, which trade in a dealer network, rather than on an exchange. In general, there is less governmental regulation and supervision of transactions in the OTC markets than of transactions entered into on organized exchanges.

Commodity Sector Risk. Exposure to the commodities markets may subject the Fund to greater volatility than investments in more traditional securities. The value of commodity-linked investments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or factors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs and international economic, business, political and regulatory developments. The prices of energy, industrial metals, precious metals, agriculture and livestock sector commodities may fluctuate widely due to factors such as changes in value, supply and demand and governmental regulatory policies. The commodity-linked investments in which the CSF Subsidiary enters into may involve counterparties in the financial services sector, and events affecting the financial services sector may cause the CSF Subsidiary’s, and therefore the Fund’s, share value to fluctuate.

Credit/Default Risk. An issuer or guarantor of fixed income securities or instruments held by the Fund (which may have low credit ratings) may default on its obligation to pay interest and repay principal or default on any other obligation. Additionally, the credit quality of securities may deteriorate rapidly, which may impair the Fund’s liquidity and cause significant deterioration in net asset value (“NAV”). These risks are more pronounced in connection with the Fund’s investments in non-investment grade fixed income securities.

Derivatives Risk. The Fund’s use of forwards, futures, swaps and other derivative instruments may result in losses. These instruments, which may pose risks in addition to and greater than those associated with investing directly in securities, currencies or other instruments, may be illiquid or less liquid, volatile, difficult to price and leveraged so that small changes in the value of the underlying instruments may produce disproportionate losses to the Fund. Certain derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligation. The use of derivatives is a highly specialized activity that involves investment techniques and risks different from those associated with investments in more traditional securities and instruments.

Expenses Risk. By investing in pooled investment vehicles (including investment companies and exchange-traded funds (“ETFs”)), partnerships and real estate investment trusts (“REITs”) indirectly through the Fund, the investor will incur a proportionate share of the expenses of those other pooled investment vehicles, partnerships and REITs held by the Fund (including operating costs and investment management fees), in addition to the expenses of the Fund.

Foreign and Emerging Countries Risk. Foreign securities may be subject to risk of loss because of more or less foreign government regulation, less public information and less economic, political and social stability in the countries in which the Fund invests. The imposition of exchange controls, sanctions, confiscations, trade restrictions (including tariffs) and other government restrictions by the United States and other governments, or from problems in share registration, settlement or custody, may also result in losses. Foreign risk also involves the risk of negative foreign currency rate fluctuations, which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. These risks may be more pronounced in connection with the Fund’s investments in securities of issuers located in emerging countries.

Large Shareholder Transactions Risk. The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Such large shareholder redemptions, which may occur rapidly or unexpectedly, may cause the Fund to sell portfolio securities at times when it would not otherwise do so, which may negatively impact the Fund’s NAV and liquidity. Similarly, large Fund share purchases may adversely affect the Fund’s performance to the extent that the Fund is delayed in investing new cash or otherwise maintains a larger cash position than it ordinarily would. These transactions may also accelerate the realization of taxable income to shareholders if such sales of investments resulted in gains, and may also increase transaction costs. In addition, a large redemption could result in the Fund’s current expenses being allocated over a smaller asset base, leading to an increase in the Fund’s expense ratio.

Leverage Risk. Borrowing and the use of derivatives may result in leverage and may make the Fund more volatile. The use of leverage may cause the Fund to liquidate portfolio positions to satisfy its obligations or to meet asset segregation requirements when it may not be advantageous to do so. The use of leverage by the Fund can substantially increase the adverse impact to which the Fund’s investment portfolio may be subject.

Liquidity Risk. The Fund may make investments that are illiquid or that may become less liquid in response to market developments or adverse investor perceptions. Illiquid investments may be more difficult to value. Liquidity risk may also refer to the risk that the Fund will not be able to pay redemption proceeds within the allowable time period because of unusual market conditions, an unusually high volume of redemption requests, or other reasons. To meet redemption requests, the Fund may be forced to sell securities at an unfavorable time and/or under unfavorable conditions. Liquidity risk may be the result of, among other things,

4 SUMMARY PROSPECTUS — GOLDMAN SACHS COMMODITY STRATEGY FUND

the reduced number and capacity of traditional market participants to make a market in fixed income securities or the lack of an active market. The potential for liquidity risk may be magnified by a rising interest rate environment or other circumstances where investor redemptions from fixed income mutual funds may be higher than normal, potentially causing increased supply in the market due to selling activity. These risks may be more pronounced in connection with the Fund’s investments in securities of issuers located in emerging market countries. Redemptions by large shareholders may have a negative impact on the Fund’s liquidity.

Mortgage-Backed and Other Asset-Backed Securities Risk. Mortgage-related and other asset-backed securities are subject to certain additional risks, including “extension risk” (i.e., in periods of rising interest rates, issuers may pay principal later than expected) and “prepayment risk” (i.e., in periods of declining interest rates, issuers may pay principal more quickly than expected, causing the Fund to reinvest proceeds at lower prevailing interest rates). Mortgage-backed securities offered by non-governmental issuers are subject to other risks as well, including failures of private insurers to meet their obligations and unexpectedly high rates of default on the mortgages backing the securities. Other asset-backed securities are subject to risks similar to those associated with mortgage-backed securities, as well as risks associated with the nature and servicing of the assets backing the securities. Asset-backed securities may not have the benefit of a security interest in collateral comparable to that of mortgage assets, resulting in additional credit risk.

Other Investment Companies Risk. By investing in other investment companies (including ETFs) indirectly through the Fund, investors will incur a proportionate share of the expenses of the other investment companies held by the Fund (including operating costs and investment management fees) in addition to the fees regularly borne by the Fund. In addition, the Fund will be affected by the investment policies, practices and performance of such investment companies in direct proportion to the amount of assets the Fund invests therein.

Subsidiary Risk. The CSF Subsidiary is not registered under the Investment Company Act and is not subject to all the investor protections of the Investment Company Act. Changes in the laws of the United States and/or the Cayman Islands could result in the inability of the Fund and/or the CSF Subsidiary to operate as described in the Prospectus and the SAI and could adversely affect the Fund.

Swaps Risk. In a standard “swap” transaction, two parties agree to exchange the returns, differentials in rates of return or some other amount earned or realized on the “notional amount” of predetermined investments or instruments, which may be adjusted for an interest factor. Swaps can involve greater risks than direct investment in securities, because swaps may be leveraged and subject to counterparty risk (e.g., the risk of a counterparty’s defaulting on the obligation or bankruptcy), credit risk and pricing risk (i.e., swaps may be difficult to value). Swaps may also be considered illiquid. It may not be possible for the CSF Subsidiary to liquidate a swap position at an advantageous time or price, which may result in significant losses.

Tax Risk. Based on a private letter ruling from the Internal Revenue Service (“IRS”), the Fund seeks to gain exposure to the commodity markets primarily through investments in the CSF Subsidiary.

The tax treatment of the Fund’s investments in the CSF Subsidiary could affect whether income derived from such investments is “qualifying income” under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”), or otherwise affect the character, timing and/or amount of the Fund’s taxable income or any gains and distributions made by the Fund. If the IRS were to successfully assert that a Fund’s income from such investments was not “qualifying income,” the Fund may fail to qualify as a regulated investment company (“RIC”) under Subchapter M of the Code if over 10% of its gross income was derived from these investments. If the Fund failed to qualify as a RIC, it would be subject to federal and state income tax on all of its taxable income at regular corporate tax rates with no deduction for any distributions paid to shareholders, which would significantly adversely affect the returns to, and could cause substantial losses for, Fund shareholders.

Shareholders should review “Other Information” under “Taxation” on page 62 of the Prospectus for more information.

U.S. Government Securities Risk. The U.S. government may not provide financial support to U.S. government agencies, instrumentalities or sponsored enterprises if it is not obligated to do so by law. U.S. Government Securities issued by the Federal National Mortgage Association (“Fannie Mae”), Federal Home Loan Mortgage Corporation (“Freddie Mac”) and the Federal Home Loan Banks are neither issued nor guaranteed by the U.S. Treasury and, therefore, are not backed by the full faith and credit of the United States. The maximum potential liability of the issuers of some U.S. Government Securities held by the Fund may greatly exceed their current resources, including their legal right to support from the U.S. Treasury. It is possible that issuers of U.S. Government Securities will not have the funds to meet their payment obligations in the future.

5 SUMMARY PROSPECTUS — GOLDMAN SACHS COMMODITY STRATEGY FUND

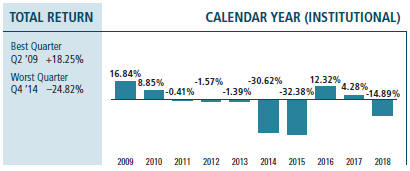

| PERFORMANCE |

The bar chart and table below provide an indication of the risks of investing in the Fund by showing: (a) changes in the performance of the Fund’s Institutional Shares from year to year; and (b) how the average annual total returns of the Fund’s Institutional Shares compare to those of a broad-based securities market index. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available at no cost at www.gsamfunds.com/performance or by calling the appropriate phone number on the back cover of the Prospectus.

Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown.

AVERAGE ANNUAL TOTAL RETURN

| For the period ended December 31, 2018 |

1 Year | 5 Years | 10 Years | Since Inception |

||||||||||||

| Institutional Shares (Inception 3/30/07)* |

||||||||||||||||

| Returns Before Taxes |

-14.89% | -14.09% | -5.38% | -8.19% | ||||||||||||

| Returns After Taxes on Distributions |

-15.35% | -14.64% | -6.22% | -9.29% | ||||||||||||

| Returns After Taxes on Distributions and Sale of Fund Shares |

-8.79% | -10.05% | -3.85% | -5.42% | ||||||||||||

| S&P GSCI (Gross, USD, Unhedged; reflects no deduction for fees or expenses) |

-13.82% | 0.50% | -5.77% | -8.06% | ||||||||||||

| * | Returns are for a share class that is not presented that would have substantially similar annual returns because the shares are invested in the same portfolio of securities and the annual returns would differ only to the extent that the share classes do not have the same expenses. |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

6 SUMMARY PROSPECTUS — GOLDMAN SACHS COMMODITY STRATEGY FUND

| PORTFOLIO MANAGEMENT |

Goldman Sachs Asset Management, L.P. is the investment adviser for the Fund (the “Investment Adviser” or “GSAM”).

Portfolio Managers: Samuel Finkelstein, Managing Director, Global Head of Macro Strategies, has managed the Fund since 2010; and Mark Van Wyk, Managing Director, has managed the Fund since 2019.

| BUYING AND SELLING FUND SHARES |

The Fund does not impose minimum purchase requirements for initial or subsequent investments in Class P Shares.

You may purchase and redeem (sell) Class P Shares of the Fund on any business day through the Goldman Sachs Private Wealth Management business unit, The Goldman Sachs Trust Company, N.A., The Goldman Sachs Trust Company of Delaware, The Ayco Company, L.P. or with certain intermediaries that are authorized to offer Class P Shares.

| TAX INFORMATION |

The Fund’s distributions are taxable, and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Investments through tax-deferred arrangements may become taxable upon withdrawal from such arrangements.

| PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES |

If you purchase the Fund through an intermediary that is authorized to offer Class P Shares, the Fund and/or its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your intermediary’s website for more information.

7 SUMMARY PROSPECTUS — GOLDMAN SACHS COMMODITY STRATEGY FUND

[THIS PAGE LEFT INTENTIONALLY BLANK]

8 SUMMARY PROSPECTUS — GOLDMAN SACHS COMMODITY STRATEGY FUND

SELSATSUM2-19P