| Label |

Element |

Value |

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Registrant Name |

dei_EntityRegistrantName |

GOLDMAN SACHS TRUST

|

|

| Prospectus Date |

rr_ProspectusDate |

Jul. 28, 2017

|

|

| Goldman Sachs High Yield Fund |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Risk/Return [Heading] |

rr_RiskReturnHeading |

Goldman Sachs High Yield Fund—Summary

|

|

| Objective [Heading] |

rr_ObjectiveHeading |

Investment Objective

|

|

| Objective, Primary [Text Block] |

rr_ObjectivePrimaryTextBlock |

The Goldman Sachs High Yield Fund (the “Fund”) seeks a high level of current income and may also consider the potential for capital appreciation.

|

|

| Expense [Heading] |

rr_ExpenseHeading |

Fees and Expenses of the Fund

|

|

| Expense Narrative [Text Block] |

rr_ExpenseNarrativeTextBlock |

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts on purchases of Class A or Class T Shares if you invest at least $100,000 or $250,000, respectively, in Goldman Sachs Funds. More information about these and other discounts is available from your financial professional and in “Shareholder Guide—Common Questions Applicable to the Purchase of Class A Shares” beginning on page 71 and “Shareholder Guide—Common Questions Applicable to the Purchase of Class T Shares” beginning on page 75 and in Appendix C—Additional Information About Sales Charge Variations, Waivers and Discounts on page 120 of the Prospectus and “Other Information Regarding Maximum Sales Charge, Purchases, Redemptions, Exchanges and Dividends” beginning on page B-122 of the Fund’s Statement of Additional Information (“SAI”).

|

|

| Shareholder Fees Caption [Text] |

rr_ShareholderFeesCaption |

Shareholder Fees

(fees paid directly from your investment)

|

|

| Operating Expenses Caption [Text] |

rr_OperatingExpensesCaption |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

|

|

| Fee Waiver or Reimbursement over Assets, Date of Termination |

rr_FeeWaiverOrReimbursementOverAssetsDateOfTermination |

July 28, 2018

|

|

| Portfolio Turnover [Heading] |

rr_PortfolioTurnoverHeading |

Portfolio Turnover

|

|

| Portfolio Turnover [Text Block] |

rr_PortfolioTurnoverTextBlock |

The Fund pays transaction costs when it buys and sells securities or instruments (i.e., “turns over” its portfolio). A high rate of portfolio turnover may result in increased transaction costs, which must be borne by the Fund and its shareholders, and is also likely to result in higher short-term capital gains for taxable shareholders. These costs are not reflected in annual fund operating expenses or in the expense example above, but are reflected in the Fund’s performance. The Fund’s portfolio turnover rate for the fiscal year ended March 31, 2017 was 93% of the average value of its portfolio.

|

|

| Portfolio Turnover, Rate |

rr_PortfolioTurnoverRate |

93.00%

|

|

| Expenses Deferred Charges [Text Block] |

rr_ExpensesDeferredChargesTextBlock |

A contingent deferred sales charge ("CDSC") of 1% is imposed on Class C Shares redeemed within 12 months of purchase.

|

|

| Expense Breakpoint Discounts [Text] |

rr_ExpenseBreakpointDiscounts |

You may qualify for sales charge discounts on purchases of Class A or Class T Shares if you invest at least $100,000 or $250,000, respectively, in Goldman Sachs Funds. More information about these and other discounts is available from your financial professional and in “Shareholder Guide—Common Questions Applicable to the Purchase of Class A Shares” beginning on page 71 and “Shareholder Guide—Common Questions Applicable to the Purchase of Class T Shares” beginning on page 75 and in Appendix C—Additional Information About Sales Charge Variations, Waivers and Discounts on page 120 of the Prospectus and “Other Information Regarding Maximum Sales Charge, Purchases, Redemptions, Exchanges and Dividends” beginning on page B-122 of the Fund’s Statement of Additional Information (“SAI”).

|

|

| Other Expenses, New Fund, Based on Estimates [Text] |

rr_OtherExpensesNewFundBasedOnEstimates |

the "Other Expenses" for Class T Shares have been estimated to reflect expenses expected to be incurred during the current fiscal year.

|

|

| Expenses Restated to Reflect Current [Text] |

rr_ExpensesRestatedToReflectCurrent |

The "Other Expenses" for Class R6 Shares have been restated

|

|

| Expenses Not Correlated to Ratio Due to Acquired Fund Fees [Text] |

rr_ExpensesNotCorrelatedToRatioDueToAcquiredFundFees |

The "Total Annual Fund Operating Expenses" do not correlate to the ratios of net and total expenses to average net assets provided in the Financial Highlights, which reflect the operating expenses of the Fund and do not include "Acquired Fund Fees and Expenses."

|

|

| Expense Example [Heading] |

rr_ExpenseExampleHeading |

Expense Example

|

|

| Expense Example Narrative [Text Block] |

rr_ExpenseExampleNarrativeTextBlock |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in Class A, Class C, Institutional, Service, Investor, Class R, Class R6 and/or Class T Shares of the Fund for the time periods indicated and then redeem all of your Class A, Class C, Institutional, Service, Investor, Class R, Class R6 and/or Class T Shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (except that the Example incorporates the fee waiver and expense limitation arrangements for only the first year). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| Expense Example by, Year, Caption [Text] |

rr_ExpenseExampleByYearCaption |

Assuming complete redemption at end of period

|

|

| Expense Example, No Redemption, By Year, Caption [Text] |

rr_ExpenseExampleNoRedemptionByYearCaption |

Assuming no redemption

|

|

| Strategy [Heading] |

rr_StrategyHeading |

Principal Strategy

|

|

| Strategy Narrative [Text Block] |

rr_StrategyNarrativeTextBlock |

The Fund invests, under normal circumstances, at least 80% of its net assets plus any borrowings for investment purposes (measured at the time of purchase) (“Net Assets”) in high-yield, fixed income securities that, at the time of purchase, are non-investment grade securities. Non-investment grade securities are securities rated BB+, Ba1 or below by a nationally recognized statistical rating organization (“NRSRO”), or, if unrated, determined by the Investment Adviser to be of comparable credit quality, and are commonly referred to as “junk bonds.” The Fund may invest in all types of fixed income securities, including loan participations.

The Fund may invest up to 25% of its total assets in obligations of domestic and foreign issuers which are denominated in currencies other than the U.S. dollar and in securities of issuers located in emerging countries denominated in any currency. However, to the extent that the Investment Adviser has entered into transactions that are intended to hedge the Fund’s position in a non-dollar denominated obligation against currency risk, such obligation will not be counted when calculating compliance with the 25% limitation on obligations in non-U.S. currency.

Under normal market conditions, the Fund may invest up to 20% of its Net Assets in investment grade fixed income securities, including securities issued or guaranteed by the U.S. government, its agencies, instrumentalities or sponsored enterprises (“U.S. Government Securities”).

The Fund may invest in derivatives, including (i) credit default swap indices (or CDX) for hedging purposes or to seek to increase total return, and (ii) interest rate futures, forwards and swaps to manage the portfolio’s duration.

The Fund’s target duration range under normal interest rate conditions is expected to approximate that of the Bloomberg Barclays U.S. High-Yield 2% Issuer Capped Bond Index, plus or minus 2.5 years, and over the last five years ended June 30, 2017, the duration of this Index has ranged between 3.85 and 4.41 years. “Duration” is a measure of a debt security’s price sensitivity to changes in interest rates. The longer the duration of the Fund (or an individual debt security), the more sensitive its market price to changes in interest rates. For example, if market interest rates increase by 1%, the market price of a debt security with a positive duration of 3 will generally decrease by approximately 3%. Conversely, a 1% decline in market interest rates will generally result in an increase of approximately 3% of that security’s market price.

The Fund’s portfolio managers seek to build a portfolio consisting of their “best ideas” across the high yield securities market consistent with the Fund’s overall risk budget and the views of the Investment Adviser’s Global Fixed Income top-down teams. As market conditions change, the volatility and attractiveness of sectors, securities and strategies can change as well. To optimize the Fund’s risk/return potential within its long-term risk budget, the portfolio managers may dynamically adjust the mix of top-down and bottom-up strategies in the Fund’s portfolio.

The Fund’s benchmark index is the Bloomberg Barclays U.S. High-Yield 2% Issuer Capped Bond Index.

|

|

| Risk [Heading] |

rr_RiskHeading |

Principal Risks of the Fund

|

|

| Risk Narrative [Text Block] |

rr_RiskNarrativeTextBlock |

Loss of money is a risk of investing in the Fund. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any government agency. The Fund should not be relied upon as a complete investment program. There can be no assurance that the Fund will achieve its investment objective. Investments in the Fund involve substantial risks which prospective investors should consider carefully before investing.- Credit/Default Risk. An issuer or guarantor of fixed income securities or instruments held by the Fund (which may have low credit ratings) may default on its obligation to pay interest and repay principal or default on any other obligation. Additionally, the credit quality of securities may deteriorate rapidly, which may impair the Fund’s liquidity and cause significant deterioration in net asset value (“NAV”). These risks are more pronounced in connection with the Fund’s investments in non-investment grade fixed income securities.

- Derivatives Risk. The Fund’s use of credit default swap indices (or CDX), interest rate futures, forwards and swaps and other derivative instruments may result in losses. These instruments, which may pose risks in addition to and greater than those associated with investing directly in securities, currencies or other instruments, may be illiquid or less liquid, volatile, difficult to price and leveraged so that small changes in the value of underlying instruments may produce disproportionate losses to the Fund. Derivatives are also subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligations. The use of derivatives is a highly specialized activity that involves investment techniques and risks different from those associated with investments in more traditional securities and instruments. In December 2015, the SEC proposed new regulations relating to a mutual fund’s use of derivatives and related instruments. If these or other regulations are adopted, they could significantly limit or impact the Fund’s ability to invest in derivatives and other instruments and adversely affect the Fund’s performance and ability to pursue its investment objectives.

- Foreign Risk. Foreign securities may be subject to risk of loss because of more or less foreign government regulation, less public information and less economic, political and social stability in the countries in which the Fund invests. The imposition of exchange controls, sanctions, confiscations, trade restrictions (including tariffs) and other government restrictions by the United States or other governments, or from problems in share registration, settlement or custody, may also result in losses. Foreign risk also involves the risk of negative foreign currency rate fluctuations, which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time.

- Interest Rate Risk. When interest rates increase, fixed income securities or instruments held by the Fund will generally decline in value. Long-term fixed income securities or instruments will normally have more price volatility because of this risk than short-term fixed income securities or instruments. The risks associated with increasing interest rates are heightened given that interest rate are near historic lows, but may be expected to increase in the future with unpredictable effects on the markets and the Fund’s investments. Fluctuations in interest rates may also affect the liquidity of fixed income securities and instruments held by the Fund.

- Large Shareholder Transactions Risk. The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Such large shareholder redemptions may cause the Fund to sell portfolio securities at times when it would not otherwise do so, which may negatively impact the Fund’s NAV and liquidity. Similarly, large Fund share purchases may adversely affect the Fund’s performance to the extent that the Fund is delayed in investing new cash and is required to maintain a larger cash position than it ordinarily would. These transactions may also accelerate the realization of taxable income to shareholders if such sales of investments resulted in gains, and may also increase transaction costs. In addition, a large redemption could result in the Fund’s current expenses being allocated over a smaller asset base, leading to an increase in the Fund’s expense ratio.

- Liquidity Risk. The Fund may make investments that are illiquid or that may become less liquid in response to market developments or adverse investor perceptions. Illiquid investments may be more difficult to value. Liquidity risk may also refer to the risk that the Fund will not be able to pay redemption proceeds within the allowable time period because of unusual market conditions, an unusually high volume of redemption requests or other reasons. To meet redemption requests, the Fund may be forced to sell securities at an unfavorable time and/or under unfavorable conditions. Liquidity risk may be the result of, among other things, the reduced number and capacity of traditional market participants to make a market in fixed income securities or the lack of an active market. The potential for liquidity risk may be magnified by a rising interest rate environment or other circumstances where investor redemptions from fixed income mutual funds may be higher than normal, potentially causing increased supply in the market due to selling activity.

- Loan-Related Investments Risk. In addition to risks generally associated with debt investments, loan-related investments such as loan participations and assignments are subject to other risks. Although a loan obligation may be fully collateralized at the time of acquisition, the collateral may decline in value, be relatively illiquid, or lose all or substantially all of its value subsequent to investment. Many loan investments are subject to legal or contractual restrictions on resale and may be relatively illiquid and difficult to value. There is less readily available, reliable information about most loan investments than is the case for many other types of securities. Substantial increases in interest rates may cause an increase in loan obligation defaults. With respect to loan participations, the Fund may not always have direct recourse against a borrower if the borrower fails to pay scheduled principal and/or interest; may be subject to greater delays, expenses and risks than if the Fund had purchased a direct obligation of the borrower; and may be regarded as the creditor of the agent lender (rather than the borrower), subjecting the Fund to the creditworthiness of that lender as well. Investors in loans, such as the Fund, may not be entitled to rely on the anti-fraud protections of the federal securities laws, although they may be entitled to certain contractual remedies. The market for loan obligations may be subject to irregular trading activity, wide bid/ask spreads and extended trade settlement periods. Because transactions in many loans are subject to extended trade settlement periods, the Fund may not receive the proceeds from the sale of a loan for a period after the sale. As a result, sale proceeds related to the sale of loans may not be available to make additional investments or to meet the Fund’s redemption obligations for a period after the sale of the loans, and, as a result, the Fund may have to sell other investments or engage in borrowing transactions, such as borrowing from its credit facility, if necessary to raise cash to meet its obligations.

Senior loans hold the most senior position in the capital structure of a business entity, and are typically secured with specific collateral, but are nevertheless usually rated below investment grade. Because second lien loans are subordinated or unsecured and thus lower in priority of payment to senior loans, they are subject to the additional risk that the cash flow of the borrower and property securing the loan or debt, if any, may be insufficient to meet scheduled payments after giving effect to the senior secured obligations of the borrower. Second lien loans generally have greater price volatility than senior loans and may be less liquid. - Non-Investment Grade Fixed Income Securities Risk. Non-investment grade fixed income securities and unrated securities of comparable credit quality (commonly known as “junk bonds”) are considered speculative and are subject to the increased risk of an issuer’s inability to meet principal and interest payment obligations. These securities may be subject to greater price volatility due to such factors as specific issuer developments, interest rate sensitivity, negative perceptions of the junk bond markets generally and less liquidity.

|

|

| Risk Lose Money [Text] |

rr_RiskLoseMoney |

Loss of money is a risk of investing in the Fund.

|

|

| Risk Not Insured Depository Institution [Text] |

rr_RiskNotInsuredDepositoryInstitution |

An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any government agency.

|

|

| Bar Chart and Performance Table [Heading] |

rr_BarChartAndPerformanceTableHeading |

Performance

|

|

| Performance Narrative [Text Block] |

rr_PerformanceNarrativeTextBlock |

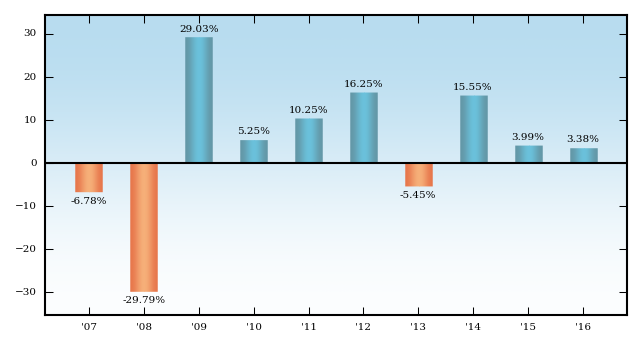

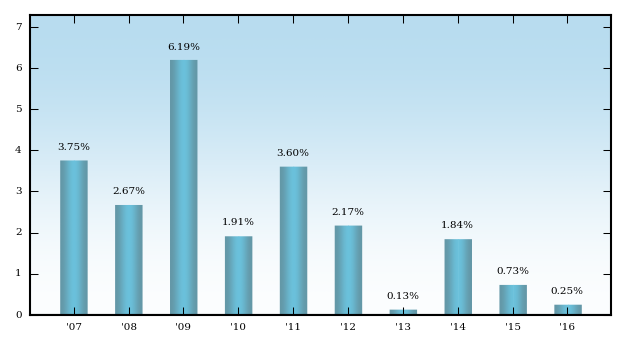

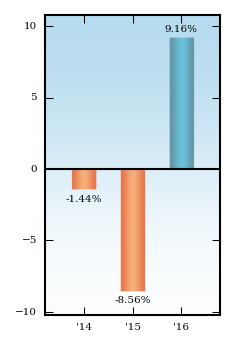

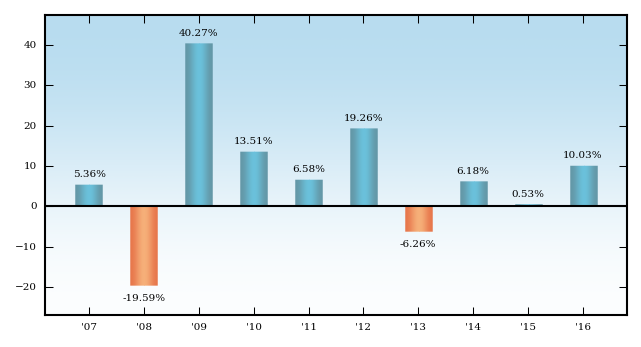

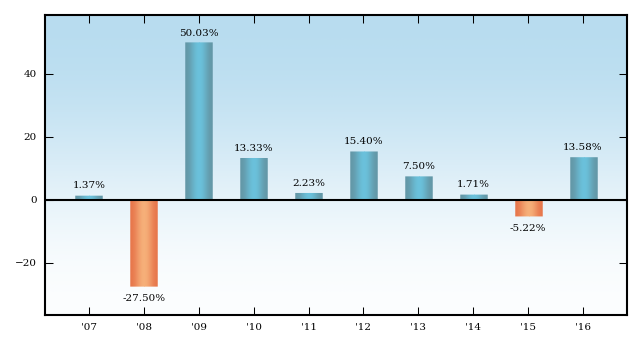

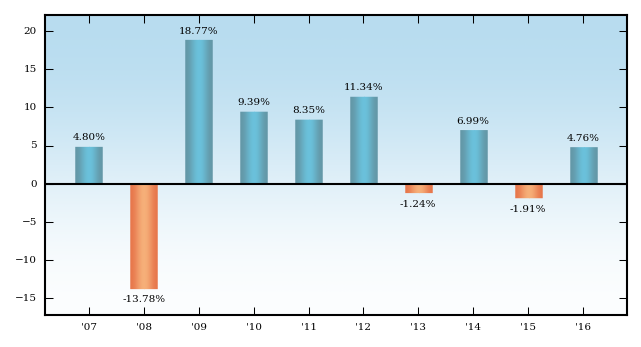

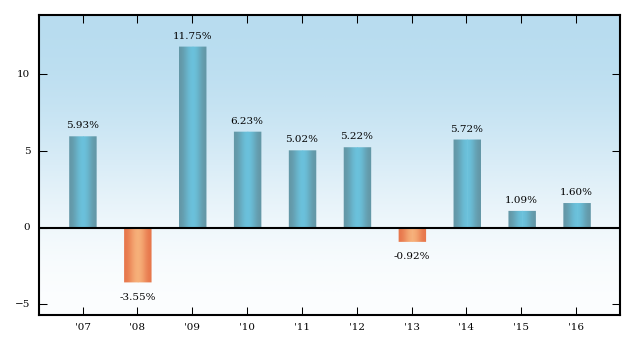

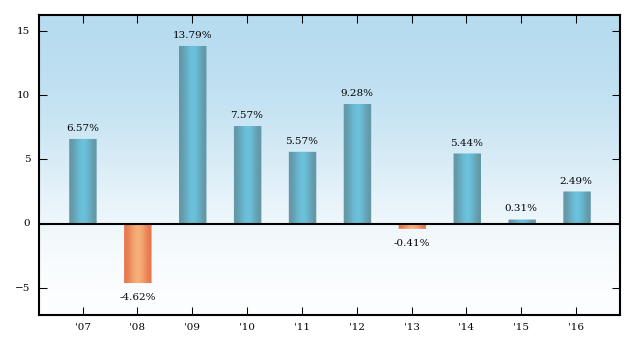

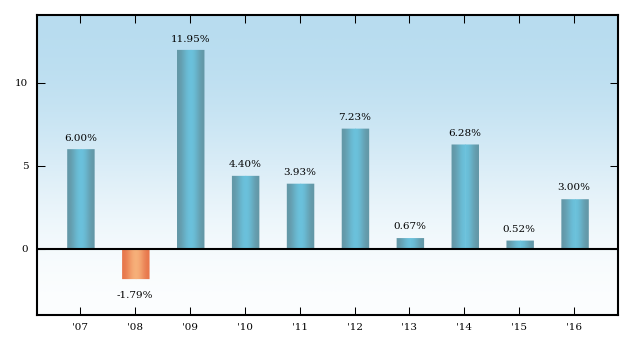

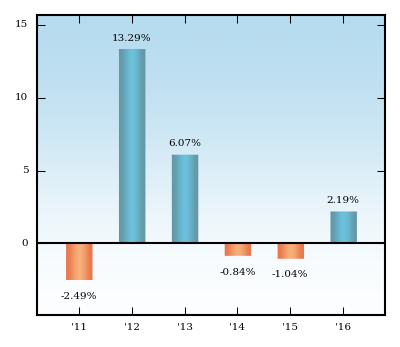

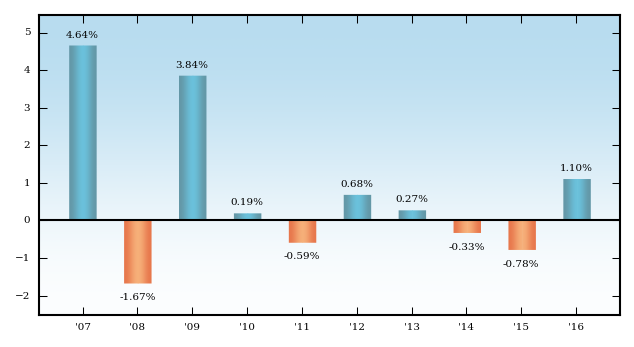

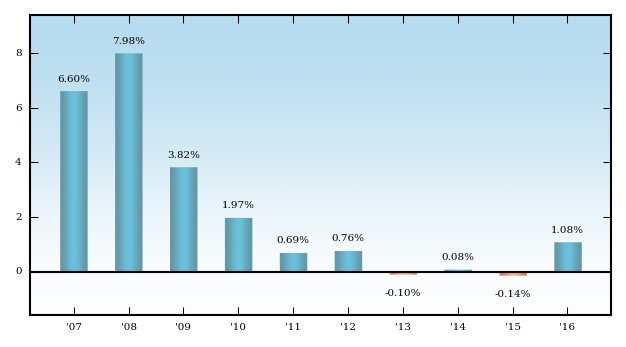

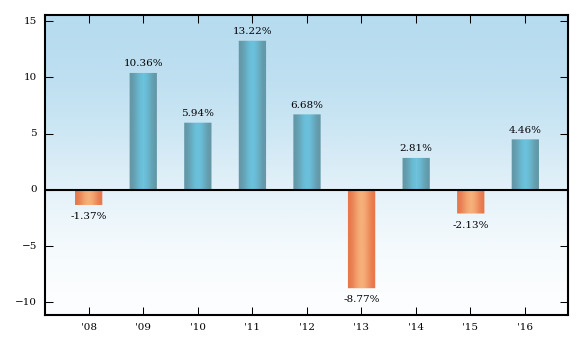

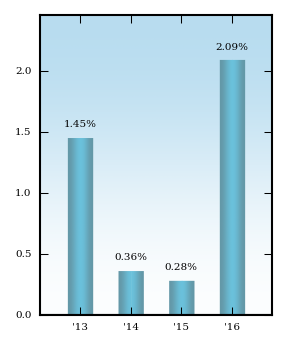

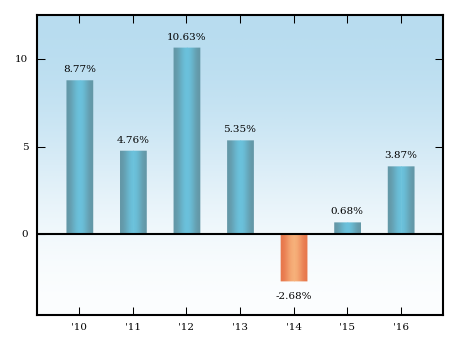

The bar chart and table below provide an indication of the risks of investing in the Fund by showing: (a) changes in the performance of the Fund’s Class A Shares from year to year; and (b) how the average annual total returns of the Fund’s Class A, Class C, Institutional, Service, Investor, Class R, Class R6 and Class T Shares compare to those of a broad-based securities market index. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available at no cost at www.gsamfunds.com/performance or by calling the appropriate phone number on the back cover of the Prospectus.

The bar chart (including “Best Quarter” and “Worst Quarter” information) does not reflect the sales loads applicable to Class A Shares. If the sales loads were reflected, returns would be less. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown.

|

|

| Performance Information Illustrates Variability of Returns [Text] |

rr_PerformanceInformationIllustratesVariabilityOfReturns |

The bar chart and table below provide an indication of the risks of investing in the Fund by showing: (a) changes in the performance of the Fund’s Class A Shares from year to year; and (b) how the average annual total returns of the Fund’s Class A, Class C, Institutional, Service, Investor, Class R, Class R6 and Class T Shares compare to those of a broad-based securities market index.

|

|

| Performance One Year or Less [Text] |

rr_PerformanceOneYearOrLess |

As of the date of the Prospectus, Class T Shares have not commenced operations.

|

|

| Performance Availability Website Address [Text] |

rr_PerformanceAvailabilityWebSiteAddress |

www.gsamfunds.com/performance

|

|

| Performance Past Does Not Indicate Future [Text] |

rr_PerformancePastDoesNotIndicateFuture |

The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future.

|

|

| Bar Chart [Heading] |

rr_BarChartHeading |

TOTAL RETURN CALENDAR YEAR (CLASS A)

|

|

| Bar Chart Does Not Reflect Sales Loads [Text] |

rr_BarChartDoesNotReflectSalesLoads |

The bar chart (including “Best Quarter” and “Worst Quarter” information) does not reflect the sales loads applicable to Class A Shares. If the sales loads were reflected, returns would be less.

|

|

| Bar Chart Closing [Text Block] |

rr_BarChartClosingTextBlock |

The total return for Class A Shares for the six-month period ended

June 30, 2017 was 3.86%.

Best Quarter

Q2 ‘09 +18.40%

Worst Quarter

Q4 ‘08 –18.79%

|

|

| Performance Table Heading |

rr_PerformanceTableHeading |

AVERAGE ANNUAL TOTAL RETURN

For the period ended December 31, 2016

|

|

| Performance Table Does Reflect Sales Loads |

rr_PerformanceTableDoesReflectSalesLoads |

Performance has not been adjusted to reflect the lower maximum sales charge (load) imposed on purchases of Class T Shares. Class T Shares would have had higher returns because: (i) Class A Shares and Class T Shares represent interests in the same portfolio of securities; and (ii) Class T Shares impose a lower maximum sales charge (load) on purchases.

|

|

| Performance Table Uses Highest Federal Rate |

rr_PerformanceTableUsesHighestFederalRate |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes.

|

|

| Performance Table Not Relevant to Tax Deferred |

rr_PerformanceTableNotRelevantToTaxDeferred |

Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

|

|

| Performance Table One Class of after Tax Shown [Text] |

rr_PerformanceTableOneClassOfAfterTaxShown |

The after-tax returns are for Class A Shares only. The after-tax returns for Class C, Institutional, Service, Investor and Class T Shares, and returns for Class R and Class R6 Shares (which are offered exclusively to employee benefit plans), will vary.

|

|

| Performance Table Narrative |

rr_PerformanceTableNarrativeTextBlock |

The after-tax returns are for Class A Shares only. The after-tax returns for Class C, Institutional, Service, Investor and Class T Shares, and returns for Class R and Class R6 Shares (which are offered exclusively to employee benefit plans), will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

|

|

| Goldman Sachs High Yield Fund | Class A |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

4.50%

|

|

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of original purchase price or sale proceeds) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

[1] |

| Redemption Fee (as a percentage of amount redeemed, imposed on the redemption of shares held for 60 calendar days or less) |

rr_RedemptionFeeOverRedemption |

2.00%

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.67%

|

|

| Distribution and/or Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Service Fees |

rr_Component1OtherExpensesOverAssets |

none

|

|

| Shareholder Administration Fees |

rr_Component2OtherExpensesOverAssets |

none

|

|

| All Other Expenses |

rr_Component3OtherExpensesOverAssets |

0.15%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.15%

|

[2] |

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

1.08%

|

[3] |

| Fee Waiver and Expense Limitation |

rr_FeeWaiverOrReimbursementOverAssets |

(0.03%)

|

[4] |

| Total Annual Fund Operating Expenses |

rr_NetExpensesOverAssets |

1.05%

|

[3],[5] |

| Expense Breakpoint, Minimum Investment Required [Amount] |

rr_ExpenseBreakpointMinimumInvestmentRequiredAmount |

$ 100,000

|

|

| 1 Year |

rr_ExpenseExampleYear01 |

552

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

775

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

1,016

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

$ 1,705

|

|

| 2007 |

rr_AnnualReturn2007 |

1.37%

|

|

| 2008 |

rr_AnnualReturn2008 |

(27.50%)

|

|

| 2009 |

rr_AnnualReturn2009 |

50.03%

|

|

| 2010 |

rr_AnnualReturn2010 |

13.33%

|

|

| 2011 |

rr_AnnualReturn2011 |

2.23%

|

|

| 2012 |

rr_AnnualReturn2012 |

15.40%

|

|

| 2013 |

rr_AnnualReturn2013 |

7.50%

|

|

| 2014 |

rr_AnnualReturn2014 |

1.71%

|

|

| 2015 |

rr_AnnualReturn2015 |

(5.22%)

|

|

| 2016 |

rr_AnnualReturn2016 |

13.58%

|

|

| Year to Date Return, Label |

rr_YearToDateReturnLabel |

total return

|

|

| Bar Chart, Year to Date Return, Date |

rr_BarChartYearToDateReturnDate |

Jun. 30, 2017

|

|

| Bar Chart, Year to Date Return |

rr_BarChartYearToDateReturn |

3.86%

|

|

| Highest Quarterly Return, Label |

rr_HighestQuarterlyReturnLabel |

Best Quarter

|

|

| Highest Quarterly Return, Date |

rr_BarChartHighestQuarterlyReturnDate |

Jun. 30, 2009

|

|

| Highest Quarterly Return |

rr_BarChartHighestQuarterlyReturn |

18.40%

|

|

| Lowest Quarterly Return, Label |

rr_LowestQuarterlyReturnLabel |

Worst Quarter

|

|

| Lowest Quarterly Return, Date |

rr_BarChartLowestQuarterlyReturnDate |

Dec. 31, 2008

|

|

| Lowest Quarterly Return |

rr_BarChartLowestQuarterlyReturn |

(18.79%)

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

8.55%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

5.36%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

5.18%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

6.01%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 01, 1997

|

|

| Goldman Sachs High Yield Fund | Class C |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of original purchase price or sale proceeds) |

rr_MaximumDeferredSalesChargeOverOther |

1.00%

|

[1] |

| Redemption Fee (as a percentage of amount redeemed, imposed on the redemption of shares held for 60 calendar days or less) |

rr_RedemptionFeeOverRedemption |

2.00%

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.67%

|

|

| Distribution and/or Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.75%

|

|

| Service Fees |

rr_Component1OtherExpensesOverAssets |

0.25%

|

|

| Shareholder Administration Fees |

rr_Component2OtherExpensesOverAssets |

none

|

|

| All Other Expenses |

rr_Component3OtherExpensesOverAssets |

0.15%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.40%

|

[2] |

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

1.83%

|

[3] |

| Fee Waiver and Expense Limitation |

rr_FeeWaiverOrReimbursementOverAssets |

(0.03%)

|

[4] |

| Total Annual Fund Operating Expenses |

rr_NetExpensesOverAssets |

1.80%

|

[3],[5] |

| 1 Year |

rr_ExpenseExampleYear01 |

$ 283

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

573

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

988

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

2,145

|

|

| 1 Year |

rr_ExpenseExampleNoRedemptionYear01 |

183

|

|

| 3 Years |

rr_ExpenseExampleNoRedemptionYear03 |

573

|

|

| 5 Years |

rr_ExpenseExampleNoRedemptionYear05 |

988

|

|

| 10 Years |

rr_ExpenseExampleNoRedemptionYear10 |

$ 2,145

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

11.51%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

5.51%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

4.87%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

5.49%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 15, 1997

|

|

| Goldman Sachs High Yield Fund | Institutional |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of original purchase price or sale proceeds) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

[1] |

| Redemption Fee (as a percentage of amount redeemed, imposed on the redemption of shares held for 60 calendar days or less) |

rr_RedemptionFeeOverRedemption |

2.00%

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.67%

|

|

| Distribution and/or Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Service Fees |

rr_Component1OtherExpensesOverAssets |

none

|

|

| Shareholder Administration Fees |

rr_Component2OtherExpensesOverAssets |

none

|

|

| All Other Expenses |

rr_Component3OtherExpensesOverAssets |

0.06%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.06%

|

[2] |

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

0.74%

|

[3] |

| Fee Waiver and Expense Limitation |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[4] |

| Total Annual Fund Operating Expenses |

rr_NetExpensesOverAssets |

0.74%

|

[3],[5] |

| 1 Year |

rr_ExpenseExampleYear01 |

$ 76

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

237

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

411

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

$ 918

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

13.76%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

6.65%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

6.02%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

6.64%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 01, 1997

|

|

| Goldman Sachs High Yield Fund | Service |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of original purchase price or sale proceeds) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

[1] |

| Redemption Fee (as a percentage of amount redeemed, imposed on the redemption of shares held for 60 calendar days or less) |

rr_RedemptionFeeOverRedemption |

2.00%

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.67%

|

|

| Distribution and/or Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Service Fees |

rr_Component1OtherExpensesOverAssets |

none

|

|

| Shareholder Administration Fees |

rr_Component2OtherExpensesOverAssets |

0.25%

|

|

| All Other Expenses |

rr_Component3OtherExpensesOverAssets |

0.06%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.31%

|

[2] |

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

1.24%

|

[3] |

| Fee Waiver and Expense Limitation |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[4] |

| Total Annual Fund Operating Expenses |

rr_NetExpensesOverAssets |

1.24%

|

[3],[5] |

| 1 Year |

rr_ExpenseExampleYear01 |

$ 126

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

393

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

681

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

$ 1,500

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

13.22%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

6.16%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

5.50%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

6.11%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 01, 1997

|

|

| Goldman Sachs High Yield Fund | Investor |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of original purchase price or sale proceeds) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

[1] |

| Redemption Fee (as a percentage of amount redeemed, imposed on the redemption of shares held for 60 calendar days or less) |

rr_RedemptionFeeOverRedemption |

2.00%

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.67%

|

|

| Distribution and/or Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Service Fees |

rr_Component1OtherExpensesOverAssets |

none

|

|

| Shareholder Administration Fees |

rr_Component2OtherExpensesOverAssets |

none

|

|

| All Other Expenses |

rr_Component3OtherExpensesOverAssets |

0.15%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.15%

|

[2] |

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

0.83%

|

[3] |

| Fee Waiver and Expense Limitation |

rr_FeeWaiverOrReimbursementOverAssets |

(0.03%)

|

[4] |

| Total Annual Fund Operating Expenses |

rr_NetExpensesOverAssets |

0.80%

|

[3],[5] |

| 1 Year |

rr_ExpenseExampleYear01 |

$ 82

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

262

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

458

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

$ 1,023

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

13.84%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

6.59%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

6.39%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Nov. 30, 2007

|

|

| Goldman Sachs High Yield Fund | Class R |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of original purchase price or sale proceeds) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

[1] |

| Redemption Fee (as a percentage of amount redeemed, imposed on the redemption of shares held for 60 calendar days or less) |

rr_RedemptionFeeOverRedemption |

2.00%

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.67%

|

|

| Distribution and/or Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.50%

|

|

| Service Fees |

rr_Component1OtherExpensesOverAssets |

none

|

|

| Shareholder Administration Fees |

rr_Component2OtherExpensesOverAssets |

none

|

|

| All Other Expenses |

rr_Component3OtherExpensesOverAssets |

0.15%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.15%

|

[2] |

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

1.33%

|

[3] |

| Fee Waiver and Expense Limitation |

rr_FeeWaiverOrReimbursementOverAssets |

(0.03%)

|

[4] |

| Total Annual Fund Operating Expenses |

rr_NetExpensesOverAssets |

1.30%

|

[3],[5] |

| 1 Year |

rr_ExpenseExampleYear01 |

$ 132

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

418

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

726

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

$ 1,599

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

13.12%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

6.03%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

5.83%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Nov. 30, 2007

|

|

| Goldman Sachs High Yield Fund | Class R6 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

none

|

|

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of original purchase price or sale proceeds) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

[1] |

| Redemption Fee (as a percentage of amount redeemed, imposed on the redemption of shares held for 60 calendar days or less) |

rr_RedemptionFeeOverRedemption |

2.00%

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.67%

|

|

| Distribution and/or Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

none

|

|

| Service Fees |

rr_Component1OtherExpensesOverAssets |

none

|

|

| Shareholder Administration Fees |

rr_Component2OtherExpensesOverAssets |

none

|

|

| All Other Expenses |

rr_Component3OtherExpensesOverAssets |

0.05%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.05%

|

[2] |

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

0.73%

|

[3] |

| Fee Waiver and Expense Limitation |

rr_FeeWaiverOrReimbursementOverAssets |

none

|

[4] |

| Total Annual Fund Operating Expenses |

rr_NetExpensesOverAssets |

0.73%

|

[3],[5] |

| 1 Year |

rr_ExpenseExampleYear01 |

$ 75

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

233

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

406

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

$ 906

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

13.77%

|

[6] |

| 5 Years |

rr_AverageAnnualReturnYear05 |

6.68%

|

[6] |

| 10 Years |

rr_AverageAnnualReturnYear10 |

6.03%

|

[6] |

| Since Inception |

rr_AverageAnnualReturnSinceInception |

6.65%

|

[6] |

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Jul. 31, 2015

|

[6] |

| Goldman Sachs High Yield Fund | Class T |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

rr_MaximumSalesChargeImposedOnPurchasesOverOfferingPrice |

2.50%

|

|

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of original purchase price or sale proceeds) |

rr_MaximumDeferredSalesChargeOverOther |

none

|

[1] |

| Redemption Fee (as a percentage of amount redeemed, imposed on the redemption of shares held for 60 calendar days or less) |

rr_RedemptionFeeOverRedemption |

2.00%

|

|

| Management Fees |

rr_ManagementFeesOverAssets |

0.67%

|

|

| Distribution and/or Service (12b-1) Fees |

rr_DistributionAndService12b1FeesOverAssets |

0.25%

|

|

| Service Fees |

rr_Component1OtherExpensesOverAssets |

none

|

|

| Shareholder Administration Fees |

rr_Component2OtherExpensesOverAssets |

none

|

|

| All Other Expenses |

rr_Component3OtherExpensesOverAssets |

0.15%

|

|

| Other Expenses |

rr_OtherExpensesOverAssets |

0.15%

|

[2] |

| Acquired Fund Fees and Expenses |

rr_AcquiredFundFeesAndExpensesOverAssets |

0.01%

|

|

| Total Annual Fund Operating Expenses |

rr_ExpensesOverAssets |

1.08%

|

[3] |

| Fee Waiver and Expense Limitation |

rr_FeeWaiverOrReimbursementOverAssets |

(0.03%)

|

[4] |

| Total Annual Fund Operating Expenses |

rr_NetExpensesOverAssets |

1.05%

|

[3],[5] |

| Expense Breakpoint, Minimum Investment Required [Amount] |

rr_ExpenseBreakpointMinimumInvestmentRequiredAmount |

$ 250,000

|

|

| 1 Year |

rr_ExpenseExampleYear01 |

354

|

|

| 3 Years |

rr_ExpenseExampleYear03 |

582

|

|

| 5 Years |

rr_ExpenseExampleYear05 |

828

|

|

| 10 Years |

rr_ExpenseExampleYear10 |

$ 1,532

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

8.55%

|

[7] |

| 5 Years |

rr_AverageAnnualReturnYear05 |

5.36%

|

[7] |

| 10 Years |

rr_AverageAnnualReturnYear10 |

5.18%

|

[7] |

| Since Inception |

rr_AverageAnnualReturnSinceInception |

6.01%

|

[7] |

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Jul. 28, 2017

|

[7] |

| Goldman Sachs High Yield Fund | Returns After Taxes on Distributions | Class A |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

6.18%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

2.54%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

2.30%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

2.84%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 01, 1997

|

|

| Goldman Sachs High Yield Fund | Returns After Taxes on Distributions and Sale of Fund Shares | Class A |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

4.88%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

3.01%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

2.81%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

3.22%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 01, 1997

|

|

| Goldman Sachs High Yield Fund | Bloomberg Barclays U.S. High-Yield 2% Issuer Capped Bond Index (reflects no deduction for fees or expenses) | Class A |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

17.08%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

7.36%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

7.55%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

6.84%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 01, 1997

|

|

| Goldman Sachs High Yield Fund | Bloomberg Barclays U.S. High-Yield 2% Issuer Capped Bond Index (reflects no deduction for fees or expenses) | Class C |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

17.08%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

7.36%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

7.55%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

6.89%

|

[8] |

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 15, 1997

|

|

| Goldman Sachs High Yield Fund | Bloomberg Barclays U.S. High-Yield 2% Issuer Capped Bond Index (reflects no deduction for fees or expenses) | Institutional |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

17.08%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

7.36%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

7.55%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

6.84%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 01, 1997

|

|

| Goldman Sachs High Yield Fund | Bloomberg Barclays U.S. High-Yield 2% Issuer Capped Bond Index (reflects no deduction for fees or expenses) | Service |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

17.08%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

7.36%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

7.55%

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

6.84%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Aug. 01, 1997

|

|

| Goldman Sachs High Yield Fund | Bloomberg Barclays U.S. High-Yield 2% Issuer Capped Bond Index (reflects no deduction for fees or expenses) | Investor |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

17.08%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

7.36%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

8.11%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Nov. 30, 2007

|

|

| Goldman Sachs High Yield Fund | Bloomberg Barclays U.S. High-Yield 2% Issuer Capped Bond Index (reflects no deduction for fees or expenses) | Class R |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

17.08%

|

|

| 5 Years |

rr_AverageAnnualReturnYear05 |

7.36%

|

|

| 10 Years |

rr_AverageAnnualReturnYear10 |

|

|

| Since Inception |

rr_AverageAnnualReturnSinceInception |

8.11%

|

|

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Nov. 30, 2007

|

|

| Goldman Sachs High Yield Fund | Bloomberg Barclays U.S. High-Yield 2% Issuer Capped Bond Index (reflects no deduction for fees or expenses) | Class R6 |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

17.08%

|

[6] |

| 5 Years |

rr_AverageAnnualReturnYear05 |

7.36%

|

[6] |

| 10 Years |

rr_AverageAnnualReturnYear10 |

7.55%

|

[6] |

| Since Inception |

rr_AverageAnnualReturnSinceInception |

6.84%

|

[6] |

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Jul. 31, 2015

|

[6] |

| Goldman Sachs High Yield Fund | Bloomberg Barclays U.S. High-Yield 2% Issuer Capped Bond Index (reflects no deduction for fees or expenses) | Class T |

|

|

|

| Risk/Return: |

rr_RiskReturnAbstract |

|

|

| 1 Year |

rr_AverageAnnualReturnYear01 |

17.08%

|

[7] |

| 5 Years |

rr_AverageAnnualReturnYear05 |

7.36%

|

[7] |

| 10 Years |

rr_AverageAnnualReturnYear10 |

7.55%

|

[7] |

| Since Inception |

rr_AverageAnnualReturnSinceInception |

6.84%

|

[7] |

| Inception Date |

rr_AverageAnnualReturnInceptionDate |

Jul. 28, 2017

|

[7] |

|

|