Institutional Shares: GPPIX Adminstration Shares: GPPAX

Before you invest, you may want to review the Goldman Sachs Short-Term Conservative Income Fund’s (the “Fund”) Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus and other information about the Fund, including the Statement of Additional Information (“SAI”) and most recent annual reports to shareholders, online at www.gsamfunds.com/summaries. You can also get this information at no cost by calling 800-621-2550 or by sending an e-mail request to gs-funds-document-requests@gs.com. The Fund’s Prospectus and SAI, both dated July 29, 2016, are incorporated by reference into this Summary Prospectus.

| INVESTMENT OBJECTIVE |

The Fund seeks to generate current income and secondarily maintain an emphasis on preservation of capital and liquidity.

| FEES AND EXPENSES OF THE FUND |

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

SHAREHOLDER FEES (fees paid directly from your investment)

| Institutional | Administration | |||

| Maximum Sales Charge (Load) Imposed on |

None | None | ||

| Maximum Deferred Sales Charge (Load) (as a |

None | None | ||

| Maximum Sales Charge (Load) Imposed on Reinvested Dividends |

None | None | ||

| Redemption Fees |

None | None | ||

| Exchange Fees |

None | None |

ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment)

| Institutional | Administration | |||||||

| Management Fees |

0.25 | % | 0.25 | % | ||||

| Distribution and Service (12b-1) Fees |

None | None | ||||||

| Other Expenses |

1.85 | % | 2.19 | % | ||||

| Administration Fees |

No | ne | 0.2 | 5% | ||||

| All Other Expenses1 |

1.8 | 5% | 1.9 | 4% | ||||

| Total Annual Fund Operating Expenses |

2.10 | % | 2.44 | % | ||||

| Fee Waiver and Expense Limitation2 |

(1.94 | )% | (2.03 | )% | ||||

| Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation |

0.16 | % | 0.41 | % | ||||

| 1 | The Fund’s “All Other Expenses” have been restated to reflect expenses expected to be incurred during the current fiscal year. |

| 2 | The Investment Adviser has agreed to (i) waive a portion of its management fee in order to achieve an effective net management fee rate of 0.15% as an annual percentage rate of the Fund’s average daily net assets and (ii) reduce or limit “Other Expenses” (excluding acquired fund fees and expenses, transfer agency fees and expenses, administration fees, taxes, interest, brokerage fees, shareholder meeting, litigation, indemnification and extraordinary expenses) to 0.004% of the Fund’s average daily net assets. Additionally, Goldman Sachs & Co. (“Goldman Sachs”), the Fund’s transfer agent, has agreed to waive a portion of its transfer agency fee (a component of “All Other Expenses”) in order to achieve an effective net transfer agency fee rate of 0.01% as an annual percentage rate of the Fund’s average daily net assets. These arrangements will remain in effect through at least July 29, 2017 and prior to such date the Investment Adviser may not terminate the arrangement without the approval of the Board of Trustees. |

2 SUMMARY PROSPECTUS — GOLDMAN SACHS SHORT-TERM CONSERVATIVE INCOME FUND

| EXPENSE EXAMPLE |

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in Institutional and/or Administration Shares of the Fund for the time periods indicated and then redeem all of your Institutional and/or Administration Shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (except that the Example incorporates the fee waiver and expense limitation arrangements for only the first year). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| 1 Year | 3 Years | 5 Years | 10 Years | |||||||||||||

| Institutional Shares |

$ | 17 | $ | 470 | $ | 950 | $ | 2,277 | ||||||||

| Administration Shares |

$ | 42 | $ | 566 | $ | 1,117 | $ | 2,621 | ||||||||

| PORTFOLIO TURNOVER |

The Fund pays transaction costs when it buys and sells securities or instruments (i.e., “turns over” its portfolio). A high rate of portfolio turnover may result in increased transaction costs, which must be borne by the Fund and its shareholders, and is also likely to result in higher short-term capital gains for taxable shareholders. These costs are not reflected in annual fund operating expenses or in the expense example above, but are reflected in the Fund’s performance. The Fund’s portfolio turnover for the fiscal year ended March 31, 2016 was 39% of the average value of its portfolio.

| PRINCIPAL STRATEGY |

The Fund pursues its investment objective by investing in a broad range of high quality, U.S. dollar-denominated money market and other fixed income instruments, including obligations issued or guaranteed by the U.S. Government, its agencies, authorities, instrumentalities or sponsored enterprises (“U.S. Government Securities”), obligations of U.S. banks, corporate notes, commercial paper and other short-term obligations of U.S. companies, states, municipalities and other entities, fixed and floating rate asset-backed securities and repurchase agreements. The Fund may also invest in U.S. dollar-denominated obligations issued or guaranteed by foreign banks, companies and governments or their agencies, authorities, instrumentalities or sponsored enterprises. The Fund will not invest in mortgage-backed securities or derivatives.

In pursuing the Fund’s investment objective, the Investment Adviser will seek to enhance the Fund’s return by identifying those high quality, U.S. dollar-denominated money market and other fixed income instruments that are within the maturity guidelines discussed below and that the Investment Adviser believes offer attractive yields relative to other similar securities, consistent with preservation of capital and liquidity.

The Fund will concentrate its investments in the financial services group of industries. Therefore, under normal circumstances, the Fund will invest more than 25% of its total assets in securities issued by companies in the financial services group of industries and repurchase agreements secured by such obligations. The Fund may, however, invest less than 25% of its total assets in this group of industries as a temporary defensive position.

The Fund’s benchmark index is the Bank of America Merrill Lynch 3-6 Month U.S. Treasury Bill Index.

| CREDIT QUALITY GUIDELINES |

The Fund will invest at least 85% of its total assets in securities (or the issuers of such securities) that are rated, at the time of purchase, in the highest short-term credit rating category by at least one nationally recognized statistical rating organization (“NRSRO”) (A-1, P-1, or F1 by Standard & Poor’s Ratings Services (“Standard & Poor’s”), Moody’s Investors Service, Inc. (“Moody’s”) or Fitch Ratings, Inc. (“Fitch”), respectively), or, if such securities only maintain long term ratings or are unrated, determined by the Investment Adviser to be of comparable credit quality at the time of purchase. The remainder of the Fund’s investments will carry a minimum short-term credit rating of A-2, P-2, or F2 by Standard & Poor’s, Moody’s or Fitch, respectively, at the time of purchase, or, if such securities only maintain long term ratings or are unrated, determined by the Investment Adviser to be of comparable credit quality at the time of purchase. The Fund may also rely on the credit quality of a guarantee or demand feature in determining the credit quality of a security supported by the guarantee or demand feature.

| MATURITY GUIDELINES |

Except for floating rate and variable rate securities, the Fund will invest in securities that have remaining maturities of two years or less at the time of purchase, with limited exceptions where a security has maturity shortening features (e.g., demand features). Floating rate and variable rate securities must have remaining maturities of three years or less at the time of purchase, with limited exceptions where a security has maturity shortening features (e.g., demand features). The Fund will maintain a dollar-weighted average portfolio maturity (“WAM”) that does not exceed approximately nine months and a dollar-weighted average portfolio life (“WAL”) that does not exceed approximately one year.

THE FUND IS NOT A MONEY MARKET FUND AND DOES NOT ATTEMPT TO MAINTAIN A STABLE NET ASSET VALUE.

| INVESTMENT PHILOSOPHY |

The Fund is managed to seek to generate current income and secondarily maintain an emphasis on preservation of capital and liquidity. The Investment Adviser follows a conservative, risk-managed investment process.

Global fixed income markets are constantly evolving and are highly diverse—with a large number of countries, currencies, sectors, issuers and securities. We believe that inefficiencies in these complex markets cause bond prices to diverge from their fair value. To capitalize on these inefficiencies and generate consistent risk-adjusted performance, we believe it is critical to:

| ¡ | Thoughtfully combine diversified sources of return by employing multiple strategies |

3 SUMMARY PROSPECTUS — GOLDMAN SACHS SHORT-TERM CONSERVATIVE INCOME FUND

| ¡ | Take a global perspective to uncover relative value opportunities |

| ¡ | Employ focused specialist teams to identify short-term mispricings and incorporate long-term views |

| ¡ | Emphasize a risk-aware approach as we view risk management as both an offensive and defensive tool |

| ¡ | Build a strong team of skilled investors who excel on behalf of our clients |

| PRINCIPAL RISKS OF THE FUND |

Loss of money is a risk of investing in the Fund. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (“FDIC”) or any other government agency. The Fund should not be relied upon as a complete investment program. There can be no assurance that the Fund will achieve its investment objective. Investments in the Fund involve substantial risks which prospective investors should consider carefully before investing.

Asset-Backed and Receivables-Backed Securities Risk. The Fund may invest in asset-backed and receivables-backed securities whose principal and interest payments are collateralized by pools of assets such as auto loans, credit card receivables, leases, installment contracts and personal property. Asset-backed securities are subject to certain additional risks, including “extension risk” (i.e., in periods of rising interest rates, issuers may pay principal later than expected) and “prepayment risk” (i.e., in periods of declining interest rates, issuers may pay principal more quickly than expected, causing the Fund to reinvest proceeds at lower prevailing interest rates). These risks are generally greater for longer-term asset-backed securities. Asset-backed securities are subject to various other risks, including the risk that private insurers fail to meet their obligations, the risk of unexpectedly high rates of default on the assets backing the securities and the risks associated with the nature and servicing of the assets backing the securities. Asset-backed securities may not have the benefit of a security interest in collateral comparable to that of mortgage assets, resulting in additional credit risk.

Credit/Default Risk. An issuer or guarantor of fixed income securities or instruments held by the Fund, or a bank or other financial institution that has entered into a repurchase agreement with the Fund, may default on its obligation to pay interest and repay principal or default on any other obligation. Additionally, the credit quality of securities may deteriorate rapidly, which may impair the Fund’s liquidity and cause significant deterioration in net asset value (“NAV”).

Financial Services Sector Risk. An adverse development in the financial services sector, including U.S. and foreign banks, broker-dealers, insurance companies, finance companies (e.g., automobile finance) and related asset-backed securities, may affect the value of the Fund’s investments more than if the Fund were not invested to such a degree in this sector. Companies in the financial services sector may be particularly susceptible to certain economic factors such as interest rate changes, fiscal, regulatory and monetary policy and general economic cycles.

Floating and Variable Rate Obligations Risk. For floating and variable rate obligations, there may be a lag between an actual change in the underlying interest rate benchmark and the reset time for an interest payment of such an obligation, which could harm or benefit the Fund, depending on the interest rate environment or other circumstances. In a rising interest rate environment, for example, a floating or variable rate obligation that does not reset immediately would prevent the Fund from taking full advantage of rising interest rates in a timely manner. However, in a declining interest rate environment, the Fund may benefit from a lag due to an obligation’s interest rate payment not being immediately impacted by a decline in interest rates.

Certain floating and variable rate obligations have an interest rate floor feature, which prevents the interest rate payable by the security from dropping below a specified level as compared to a reference interest rate (the “reference rate”), such as LIBOR. Such a floor protects the Fund from losses resulting from a decrease in the reference rate below the specified level. However, if the reference rate is below the floor, there will be a lag between a rise in the reference rate and a rise in the interest rate payable by the obligation, and the Fund may not benefit from increasing interest rates for a significant amount of time.

Foreign Risk. Foreign securities may be subject to risk of loss because of more or less foreign government regulation, less public information and less economic, political and social stability in the countries in which the Fund invests. Loss may also result from the imposition of exchange controls, sanctions, confiscations and other government restrictions by the United States and other governments, or from problems in registration, settlement or custody. In addition, the Fund will be subject to the risk that an issuer of non-U.S. sovereign debt or the governmental authorities that control the repayment of the debt may be unable or unwilling to repay the principal or interest when due.

Industry Concentration Risk. The Fund concentrates its investments in the financial services group of industries, which has historically experienced substantial price volatility. This concentration subjects the Fund to greater risk of loss as a result of adverse economic, business, political, environmental or other developments than if its investments were diversified across different industries.

Interest Rate Risk. When interest rates increase, fixed income securities or instruments held by the Fund will generally decline in value. Long-term fixed income securities or instruments will normally have more price volatility because of this risk than short-term fixed income securities or instruments. The risks associated with increasing interest rates are heightened given that interest rates are near historic lows, but may be expected to increase in the future with unpredictable effects on the markets and the Fund’s investments.

Large Shareholder Transactions Risk. The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Such large shareholder redemptions may cause the Fund to sell portfolio securities at times when it would not otherwise do so,

4 SUMMARY PROSPECTUS — GOLDMAN SACHS SHORT-TERM CONSERVATIVE INCOME FUND

which may negatively impact the Fund’s NAV and liquidity. Similarly, large Fund share purchases may adversely affect the Fund’s performance to the extent that the Fund is delayed in investing new cash and is required to maintain a larger cash position than it ordinarily would. These transactions may also accelerate the realization of taxable income to shareholders if such sales of investments resulted in gains, and may also increase transaction costs. In addition, a large redemption could result in the Fund’s current expenses being allocated over a smaller asset base, leading to an increase in the Fund’s expense ratio.

Liquidity Risk. The Fund may make investments that are illiquid or that may become less liquid in response to market developments or adverse investor perceptions. Illiquid investments may be more difficult to value. Liquidity risk may also refer to the risk that the Fund will not be able to pay redemption proceeds within the allowable time period because of unusual market conditions, an unusually high volume of redemption requests, or other reasons. To meet redemption requests, the Fund may be forced to sell securities at an unfavorable time and/or under unfavorable conditions. Liquidity risk may be the result of, among other things, the reduced number and capacity of traditional market participants to make a market in fixed income securities or the lack of an active market. The potential for liquidity risk may be magnified by a rising interest rate environment or other circumstances where investor redemptions from fixed income mutual funds may be higher than normal, potentially causing increased supply in the market due to selling activity.

Market Risk. The market value of the securities in which the Fund invests may go up or down in response to the prospects of individual companies, particular sectors or governments and/or general economic conditions throughout the world due to increasingly interconnected global economies and financial markets.

Municipal Securities Risk. Municipal securities are subject to credit/default risk, interest rate risk and certain additional risks. The Fund may be more sensitive to adverse economic, business or political developments if it invests a substantial portion of its assets in the bonds of similar projects (such as those relating to education, health care, housing, transportation, and utilities), industrial development bonds, or in particular types of municipal securities (such as general obligation bonds, private activity bonds and moral obligation bonds). Generally, municipalities continue to experience difficulties in the current economic and political environment.

NAV Risk. The net asset value of the Fund and the value of your investment will fluctuate.

U.S. Government Securities Risk. The U.S. government may not provide financial support to U.S. government agencies, instrumentalities or sponsored enterprises if it is not obligated to do so by law. U.S. Government Securities issued by the Federal National Mortgage Association (“Fannie Mae”), Federal Home Loan Mortgage Corporation (“Freddie Mac”) and Federal Home Loan Banks are neither issued nor guaranteed by the U.S. Treasury and, therefore, are not backed by the full faith and credit of the United States. The maximum potential liability of the issuers of some U.S. Government Securities held by the Fund may greatly exceed their current resources, including any legal right to support from the U.S. Treasury. It is possible that issuers of U.S. Government Securities will not have the funds to meet their payment obligations in the future.

| PERFORMANCE |

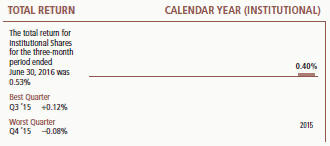

The bar chart and table below provide an indication of the risks of investing in the Fund by showing: (a) changes in the performance of the Fund’s Institutional Shares from year to year; and (b) how the average annual total returns of the Fund’s Institutional and Administration Shares compare to those of a broad-based securities market index. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available at no cost at www.gsamfunds.com/performance or by calling the appropriate phone number on the back cover of the Prospectus.

Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown.

AVERAGE ANNUAL TOTAL RETURN

| For the period ended December 31, 2015 |

1 Year | Since Inception |

||||||

| Institutional Shares (Inception 2/28/14) |

||||||||

| Returns Before Taxes |

0.40% | 0.36% | ||||||

| Returns After Taxes on Distributions |

0.18% | 0.18% | ||||||

| Returns After Taxes on Distributions and Sale of Fund Shares |

0.23% | 0.19% | ||||||

| Administration Shares (Inception 2/28/14) |

||||||||

| Returns Before Taxes |

0.15% | 0.12% | ||||||

| Bank of America Merrill Lynch 3-6 Month U.S. Treasury Bill Index |

0.12% | 0.10% | ||||||

The after-tax returns are for Institutional Shares only. The after-tax returns for Administration Shares will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

5 SUMMARY PROSPECTUS — GOLDMAN SACHS SHORT-TERM CONSERVATIVE INCOME FUND

| PORTFOLIO MANAGEMENT |

Goldman Sachs Asset Management, L.P. is the investment adviser for the Fund (the “Investment Adviser” or “GSAM”).

Portfolio Managers: Dave Fishman, Managing Director, Co-Head of Liquidity Solutions, has managed the Fund since 2014; and John Olivo, Managing Director, Global Head of Short Duration, has managed the Fund since 2016.

| BUYING AND SELLING FUND SHARES |

The minimum initial investment for Institutional Shares is, generally, $1,000,000 for individual or certain institutional investors, alone or in combination with other assets under the management of the Investment Adviser and its affiliates. Institutional Shares do not impose the minimum initial investment requirement on certain employee benefit plans and investment advisers investing on behalf of other accounts. There is no minimum subsequent investment for Institutional shareholders.

The Fund does not impose minimum purchase requirements for initial or subsequent investments in Administration Shares, although an Authorized Institution (as defined below) may impose such minimums and/or establish other requirements such as a minimum account balance.

You may purchase and redeem (sell) shares of the Fund on any business day through certain banks, trust companies, brokers, dealers, investment advisers and other financial institutions (“Authorized Institutions”).

| TAX INFORMATION |

The Fund’s distributions are taxable, and will be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred arrangement, such as a 401(k) plan or an individual retirement account. Investments through tax-deferred arrangements may become taxable upon withdrawal from such arrangements.

| PAYMENTS TO BROKER-DEALERS AND OTHER FINANCIAL INTERMEDIARIES |

If you purchase the Fund through an Authorized Institution, the Fund and/or its related companies may pay the Authorized Institution for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the Authorized Institution and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your Authorized Institution’s website for more information.

6 SUMMARY PROSPECTUS — GOLDMAN SACHS SHORT-TERM CONSERVATIVE INCOME FUND

[THIS PAGE LEFT INTENTIONALLY BLANK]

7 SUMMARY PROSPECTUS — GOLDMAN SACHS SHORT-TERM CONSERVATIVE INCOME FUND

[THIS PAGE LEFT INTENTIONALLY BLANK]

8 SUMMARY PROSPECTUS — GOLDMAN SACHS SHORT-TERM CONSERVATIVE INCOME FUND

LIMMATSUM1-16