Prospectus and Statement of Additional Information of Goldman BRIC Fund

EX-99.(17)(a)

Prospectus

GOLDMAN SACHS FUNDAMENTAL EMERGING

MARKETS EQUITY FUNDS

July 31, 2015

| ¢ |

|

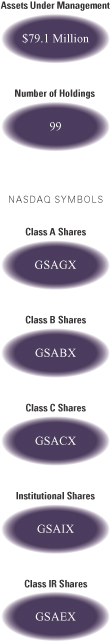

Goldman Sachs Asia Equity Fund |

| |

n |

|

Institutional Shares: GSAIX |

| ¢ |

|

Goldman Sachs BRIC Fund (Brazil, Russia, India, China) |

| |

n |

|

Institutional Shares: GBRIX |

| ¢ |

|

Goldman Sachs Emerging Markets Equity Fund |

| |

n |

|

Institutional Shares: GEMIX |

| ¢ |

|

Goldman Sachs N-11 Equity Fund |

| |

n |

|

Institutional Shares: GSYIX |

THE SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR

DISAPPROVED THESE SECURITIES OR PASSED UPON THE ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

AN INVESTMENT IN A FUND IS NOT A BANK DEPOSIT AND IS NOT INSURED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION OR ANY

OTHER GOVERNMENT AGENCY. AN INVESTMENT IN A FUND INVOLVES INVESTMENT RISKS, AND YOU MAY LOSE MONEY IN A FUND.

Table of Contents

Goldman Sachs Asia Equity

Fund—Summary

Investment Objective

The

Goldman Sachs Asia Equity Fund (the “Fund”) seeks long-term capital appreciation.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts on purchases of

Class A Shares if you and your family invest, or agree to invest in the future, at least $50,000 in Goldman Sachs Funds. More information about these and other discounts is available from your financial professional and in “Shareholder

Guide—Common Questions Applicable to the Purchase of Class A Shares” beginning on page 47 of this Prospectus and “Other Information Regarding Maximum Sales Charge, Purchases, Redemptions, Exchanges and Dividends”

beginning on page B-111 of the Fund’s Statement of Additional Information (“SAI”).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Class A |

|

|

Class C |

|

|

Institutional |

|

|

Class IR |

|

| Shareholder Fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (fees paid directly from your investment) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

|

5.50% |

|

|

|

None |

|

|

|

None |

|

|

|

None |

|

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of original purchase price or

sale proceeds)1 |

|

|

None |

|

|

|

1.00% |

|

|

|

None |

|

|

|

None |

|

|

|

|

|

|

| |

|

Class A |

|

|

Class C |

|

|

Institutional |

|

|

Class IR |

|

| Annual Fund Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (expenses that you pay each year as a percentage of the value of your investment) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Management Fees |

|

|

1.00% |

|

|

|

1.00% |

|

|

|

1.00% |

|

|

|

1.00% |

|

| Distribution and/or Service (12b-1) Fees |

|

|

0.25% |

|

|

|

0.75% |

|

|

|

None |

|

|

|

None |

|

| Other Expenses2 |

|

|

0.98% |

|

|

|

1.24% |

|

|

|

0.86% |

|

|

|

0.99% |

|

| Service Fees |

|

|

Non |

e |

|

|

0.25 |

% |

|

|

Non |

e |

|

|

Non |

e |

| All Other Expenses |

|

|

0.98 |

% |

|

|

0.99 |

% |

|

|

0.86 |

% |

|

|

0.99 |

% |

| Total Annual Fund Operating Expenses |

|

|

2.23% |

|

|

|

2.99% |

|

|

|

1.86% |

|

|

|

1.99% |

|

| Expense Limitation3 |

|

|

(0.51)% |

|

|

|

(0.52)% |

|

|

|

(0.55)% |

|

|

|

(0.55)% |

|

| Total Annual Fund Operating Expenses After Expense Limitation4 |

|

|

1.72% |

|

|

|

2.47% |

|

|

|

1.31% |

|

|

|

1.44% |

|

| 1 |

A contingent deferred sales charge (“CDSC”) of 1% is imposed on Class C Shares redeemed within 12 months of purchase. |

| 2 |

The differences in the “Other Expenses” ratios across the share classes are the result of, among other things, contractual differences in transfer agency fees and the effect of mathematical rounding on the

daily accrual of certain expenses, particularly in respect of small share classes. |

| 3 |

The Investment Adviser has agreed to reduce or limit “Other Expenses” (excluding acquired fund fees and expenses, transfer agency fees and expenses, service fees, taxes, interest, brokerage fees,

shareholder meeting, litigation, indemnification and extraordinary expenses) to 0.254% of the Fund’s average daily net assets through at least July 31, 2016, and prior to such date the Investment Adviser may not terminate the arrangement

without the approval of the Board of Trustees. |

| 4 |

The Fund’s “Total Annual Fund Operating Expenses After Expense Limitation” have been restated to reflect the expense limitation currently in effect. |

Expense Example

This Example is intended to help you

compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in Class A,

Class C, Institutional and/or Class IR Shares of the Fund for the time periods indicated and then redeem all of your Class A, Class C, Institutional and/or Class IR Shares at the end of those periods. The Example also assumes that

your investment has a 5% return each year and that the Fund’s operating expenses remain the same (except that the Example incorporates the expense limitation arrangement for only the first year). Although your actual costs may be higher or

lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1 Year |

|

|

3 Years |

|

|

5 Years |

|

|

10 Years |

|

| Class A Shares |

|

$ |

715 |

|

|

$ |

1,163 |

|

|

$ |

1,635 |

|

|

$ |

2,936 |

|

| Class C Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| – Assuming complete redemption at end of period |

|

$ |

350 |

|

|

$ |

876 |

|

|

$ |

1,527 |

|

|

$ |

3,272 |

|

| – Assuming no redemption |

|

$ |

250 |

|

|

$ |

876 |

|

|

$ |

1,527 |

|

|

$ |

3,272 |

|

| Institutional Shares |

|

$ |

133 |

|

|

$ |

531 |

|

|

$ |

955 |

|

|

$ |

2,135 |

|

| Class IR Shares |

|

$ |

147 |

|

|

$ |

571 |

|

|

$ |

1,022 |

|

|

$ |

2,273 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3

Portfolio Turnover

The Fund pays transaction costs when it buys and sells securities or instruments (i.e., “turns over” its portfolio). A high rate of

portfolio turnover may result in increased transaction costs, including brokerage commissions, which must be borne by the Fund and its shareholders, and is also likely to result in higher short-term capital gains for taxable shareholders. These

costs are not reflected in annual fund operating expenses or in the expense example above, but are reflected in the Fund’s performance. The Fund’s portfolio turnover rate for the fiscal year ended October 31, 2014 was 169% of the

average value of its portfolio.

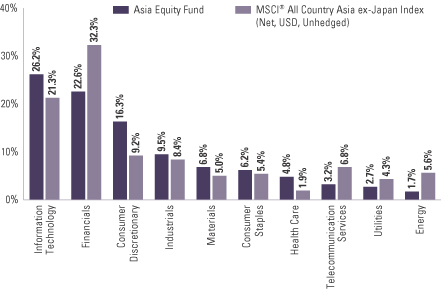

Principal Strategy

The Fund invests, under normal circumstances, at least 80% of its net assets plus any borrowings for investment purposes (measured at the time of purchase)

(“Net Assets”) in a diversified portfolio of equity investments in Asian issuers (excluding Japanese issuers). Such equity investments may include exchange-traded funds (“ETFs”), futures and other instruments with similar

economic exposures. An Asian issuer is any company that either:

| ¢ |

|

Has a class of its securities whose principal securities market is in one or more Asian countries; |

| ¢ |

|

Is organized under the laws of, or has a principal office in, an Asian country; |

| ¢ |

|

Derives 50% or more of its total revenue from goods produced, sales made or services provided in one or more Asian countries; or |

| ¢ |

|

Maintains 50% or more of its assets in one or more Asian countries. |

The Fund may allocate its assets among the

Asian countries (other than Japan) as determined from time to time by the Investment Adviser.

Allocation of the Fund’s investments is determined by

the Investment Adviser’s assessment of a company’s upside potential and downside risk, how attractive it appears relative to other holdings, and how the addition will impact sector and industry weightings. The largest weightings in the

Fund’s portfolio relative to the benchmark of the Fund are given to companies the Investment Adviser believes have the most upside return potential relative to their contribution to overall portfolio risk. The Fund’s investments are

selected using a strong valuation discipline to purchase what the Investment Adviser believes are well-positioned, cash-generating businesses run by shareholder-oriented management teams.

The Fund may also invest in: (i) equity investments in issuers located in non-Asian countries and Japan; and (ii) fixed income securities, such as

government, corporate and bank debt obligations.

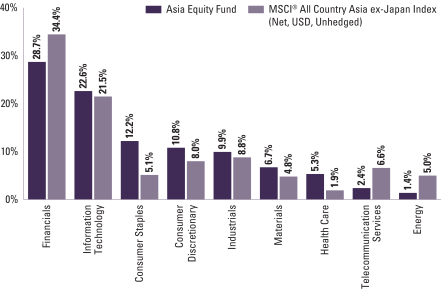

The Fund’s benchmark index is the Morgan Stanley Capital International (MSCI) All Country Asia

ex-Japan Index (Net, USD, Unhedged).

Principal Risks of the Fund

Loss of money is a risk of investing in the Fund. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit

Insurance Corporation (“FDIC”) or any government agency. The Fund should not be relied upon as a complete investment program. There can be no assurance that the Fund will achieve its investment objective. Investments in the Fund involve

substantial risks which prospective investors should consider carefully before investing.

Asia Risk. Investing in certain Asian

issuers may involve a higher degree of risk and special considerations not typically associated with investing in issuers from more established economies or securities markets. The Fund’s investments in Asian issuers increases the risks to the

Fund of conditions and developments that may be particular to Asian countries, such as: volatile economic cycles and/or securities markets; adverse changes to exchange rates; social, political, military, regulatory, economic or environmental

developments; or natural disasters.

Foreign and Emerging Countries Risk. Foreign securities may be subject to risk of loss because

of more or less foreign government regulation, less public information and less economic, political and social stability in the countries in which the Fund invests. Loss may also result from the imposition of exchange controls, sanctions,

confiscations and other government restrictions by the United States or other governments, or from problems in registration, settlement or custody. Foreign risk also involves the risk of negative foreign currency rate fluctuations, which may cause

the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. To the

extent the Fund also invests in securities of issuers located in emerging countries, these risks may be more pronounced.

Large Shareholder

Transactions Risk. The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Such large shareholder redemptions may cause the Fund to sell portfolio

securities at times when it would not otherwise do so, which may negatively impact the Fund’s net asset value (“NAV”) and liquidity. Similarly, large Fund share purchases may adversely affect the Fund’s performance to the extent

that the Fund is delayed in investing new cash and is required to maintain a larger cash position than it ordinarily would. These transactions may also accelerate the realization of taxable income to shareholders if such sales of investments

resulted in gains, and may also increase transaction costs. In addition, a large redemption could result in the Fund’s current expenses being allocated over a smaller asset base, leading to an increase in the Fund’s expense ratio.

4

Liquidity Risk. The

Fund may make investments that are illiquid or that may become less liquid in response to market developments or adverse investor perceptions. Illiquid investments may be more difficult to value. Liquidity risk may also refer to the risk that the

Fund will not be able to pay redemption proceeds within the allowable time period because of unusual market conditions, an unusually high volume of redemption requests, or other reasons. To meet redemption requests, the Fund may be forced to sell

securities at an unfavorable time and/or under unfavorable conditions.

Market Risk. The value of the securities in which the Fund

invests may go up or down in response to the prospects of individual companies, particular sectors or governments and/or general economic conditions throughout the world due to increasingly interconnected global economies and financial markets.

Mid-Cap and Small-Cap Risk. Investments in mid-capitalization and small-capitalization companies involve greater risks than those

associated with larger, more established companies. These securities may be subject to more abrupt or erratic price movements and may lack sufficient market liquidity, and these issuers often face greater business risks.

Stock Risk. Stock prices have historically risen and fallen in periodic cycles. U.S. and foreign stock markets have experienced

periods of substantial price volatility in the past and may do so again in the future.

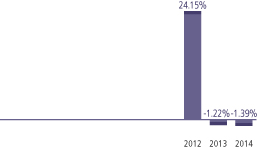

Performance

The bar chart and table below provide an indication of the risks of investing in the Fund by showing: (a) changes in the performance of the Fund’s

Class A Shares from year to year; and (b) how the average annual total returns of the Fund’s Class A, Class C and Institutional Shares compare to those of a broad-based securities market index. The Fund’s past

performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available at no cost at www.gsamfunds.com/performance or by calling the appropriate phone

number on the back cover of this Prospectus.

Because Class IR Shares did not have a full calendar year of operations as of the date of this Prospectus, the

figures shown provide performance for the other share classes of the Fund. Class IR Shares would have annual returns substantially similar to those of the other share classes shown because Class IR Shares represent interests in the same portfolio of

securities. Annual returns would differ only to the extent Class IR Shares have different expenses.

The bar chart (including “Best Quarter” and

“Worst Quarter” information) does not reflect the sales loads applicable to Class A Shares. If the sales loads were reflected, returns would be less. Performance reflects applicable fee waivers and/or expense limitations in effect

during the periods shown.

|

|

|

|

|

| TOTAL RETURN |

|

CALENDAR YEAR (CLASS A) |

|

|

| The total return for Class A Shares for the 6-month period ended June 30, 2015 was

11.06%. Best Quarter

Q2 ‘09 +31.18%

Worst Quarter

Q3 ‘08 –25.68% |

|

|

5

|

|

|

|

|

|

|

|

|

AVERAGE ANNUAL TOTAL RETURN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the period ended December 31, 2014 |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

|

Since

Inception |

|

| Class A Shares (Inception 7/8/94) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Returns Before Taxes |

|

|

–4.60% |

|

|

|

2.93% |

|

|

|

5.57% |

|

|

|

2.15% |

|

| Returns After Taxes on Distributions |

|

|

–4.38% |

|

|

|

3.04% |

|

|

|

5.65% |

|

|

|

2.15% |

|

| Returns After Taxes on Distributions and Sale of Fund Shares |

|

|

–2.38% |

|

|

|

2.50% |

|

|

|

4.82% |

|

|

|

1.87% |

|

| MSCI All Country Asia ex-Japan Index (Net, USD, Unhedged; reflects no deduction for fees or expenses)* |

|

|

4.80% |

|

|

|

5.50% |

|

|

|

9.39% |

|

|

|

N/A |

|

| Class C Shares (Inception 8/15/97) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Returns Before Taxes |

|

|

–0.73% |

|

|

|

3.32% |

|

|

|

5.36% |

|

|

|

1.37% |

|

| MSCI All Country Asia ex-Japan Index (Net, USD, Unhedged; reflects no deduction for fees or expenses)* |

|

|

4.80% |

|

|

|

5.50% |

|

|

|

9.39% |

|

|

|

N/A |

|

| Institutional Shares (Inception 2/2/96) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Returns Before Taxes |

|

|

1.34% |

|

|

|

4.51% |

|

|

|

6.59% |

|

|

|

2.19% |

|

| MSCI All Country Asia ex-Japan Index (Net, USD, Unhedged; reflects no deduction for fees or expenses)* |

|

|

4.80% |

|

|

|

5.50% |

|

|

|

9.39% |

|

|

|

N/A |

|

| * |

Performance for the Morgan Stanley Capital International (MSCI) All Country Asia ex-Japan Index (Net, USD, Unhedged) is provided since 2001. |

The after-tax returns are for Class A Shares only. The after-tax returns for Class C and Institutional Shares will vary. After-tax returns are

calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In

addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

Portfolio Management

Goldman Sachs Asset Management International is the investment adviser for the Fund (the “Investment Adviser” or “GSAMI”).

Portfolio Managers: Alina Chiew, CFA, Managing Director, has managed the Fund since 2011; and Kevin Ohn, CFA, Managing Director, has managed

the Fund since 2013.

Buying and Selling Fund Shares

The minimum initial investment for Class A and Class C Shares is, generally, $1,000. The minimum initial investment for Institutional Shares is, generally,

$1,000,000 for individual or certain institutional investors, alone or in combination with other assets under the management of the Investment Adviser and its affiliates. There is no minimum for initial purchases of Class IR Shares. Those share

classes with a minimum initial investment requirement do not impose it on certain employee benefit plans, and Institutional Shares do not impose it on certain investment advisers investing on behalf of other accounts.

The minimum subsequent investment for Class A and Class C shareholders is $50, except for certain employee benefit plans, for which there is no minimum.

There is no minimum subsequent investment for Institutional or Class IR shareholders.

You may purchase and redeem (sell) shares of the Fund on any business

day through certain banks, trust companies, brokers, dealers, investment advisers and other financial institutions (“Authorized Institutions”).

Tax Information

For important tax information, please see

“Tax Information” on page 21 of this Prospectus.

Payments to Broker-Dealers and Other Financial Intermediaries

For important information about financial intermediary compensation, please see “Payments to Broker-Dealers and Other Financial Intermediaries” on

page 21 of this Prospectus.

6

Goldman Sachs BRIC Fund

(Brazil, Russia, India, China)—Summary

Investment Objective

The

Goldman Sachs BRIC Fund (the “Fund”) seeks long-term capital appreciation.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts on purchases of

Class A Shares if you and your family invest, or agree to invest in the future, at least $50,000 in Goldman Sachs Funds. More information about these and other discounts is available from your financial professional and in “Shareholder

Guide—Common Questions Applicable to the Purchase of Class A Shares” beginning on page 47 of this Prospectus and “Other Information Regarding Maximum Sales Charge, Purchases, Redemptions, Exchanges and Dividends”

beginning on page B-111 of the Fund’s Statement of Additional Information (“SAI”).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Class A |

|

|

Class C |

|

|

Institutional |

|

|

Class IR |

|

| Shareholder Fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (fees paid directly from your investment) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

|

5.50% |

|

|

|

None |

|

|

|

None |

|

|

|

None |

|

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of original purchase price or sale

proceeds)1 |

|

|

None |

|

|

|

1.00% |

|

|

|

None |

|

|

|

None |

|

|

|

|

|

|

| |

|

Class A |

|

|

Class C |

|

|

Institutional |

|

|

Class IR |

|

| Annual Fund Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (expenses that you pay each year as a percentage of the value of your investment) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Management Fees |

|

|

1.30% |

|

|

|

1.30% |

|

|

|

1.30% |

|

|

|

1.30% |

|

| Distribution and/or Service (12b-1) Fees |

|

|

0.25% |

|

|

|

0.75% |

|

|

|

None |

|

|

|

None |

|

| Other Expenses2 |

|

|

0.48% |

|

|

|

0.73% |

|

|

|

0.32% |

|

|

|

0.48% |

|

| Service Fees |

|

|

Non |

e |

|

|

0.25 |

% |

|

|

Non |

e |

|

|

Non |

e |

| All Other Expenses |

|

|

0.48 |

% |

|

|

0.48 |

% |

|

|

0.32 |

% |

|

|

0.48 |

% |

| Acquired fund fee and expenses |

|

|

0.01% |

|

|

|

0.01% |

|

|

|

0.01% |

|

|

|

0.01% |

|

| Total Annual Fund Operating Expenses |

|

|

2.04% |

|

|

|

2.79% |

|

|

|

1.63% |

|

|

|

1.79% |

|

| Fee Waiver and Expense Limitation3,4 |

|

|

(0.38)% |

|

|

|

(0.38)% |

|

|

|

(0.37)% |

|

|

|

(0.38)% |

|

| Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation3,5 |

|

|

1.66% |

|

|

|

2.41% |

|

|

|

1.26% |

|

|

|

1.41% |

|

| 1 |

A contingent deferred sales charge (“CDSC”) of 1% is imposed on Class C Shares redeemed within 12 months of purchase. |

| 2 |

The differences in the “Other Expenses” ratios across the share classes are the result of, among other things, contractual differences in transfer agency fees and the effect of mathematical rounding on the

daily accrual of certain expenses, particularly in respect of small share classes. |

| 3 |

The “Total Annual Fund Operating Expenses” do not correlate to the ratios of net and total expenses to average net assets provided in the Financial Highlights, which reflect the operating expenses of the

Fund and do not include “Acquired Fund Fees and Expenses.” |

| 4 |

The Investment Adviser has agreed to (i) waive a portion of its management fees in order to achieve an effective net management fee rate of 1.04% as an annual percentage rate of the average daily net assets of the

Fund; and (ii) reduce or limit “Other Expenses” (excluding acquired fund fees and expenses, transfer agency fees and expenses, service fees, taxes, interest, brokerage fees, shareholder meeting, litigation, indemnification and

extraordinary expenses) to 0.174% of the Fund’s average daily net assets. These arrangements will remain in effect through at least July 31, 2016, and prior to such date, the Investment Adviser may not terminate the arrangement without the

approval of the Board of Trustees. |

| 5 |

The Fund’s “Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation” have been restated to reflect the fee waiver and expense limitation currently in effect. |

Expense Example

This Example is intended to help you

compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in Class A,

Class C, Institutional and/or Class IR Shares of the Fund for the time periods indicated and then redeem all of your Class A, Class C, Institutional and/or Class IR Shares at the end of those periods. The Example also

assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same (except

7

that the Example incorporates the fee waiver and expense limitation arrangements for only the first year).

Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1 Year |

|

|

3 Years |

|

|

5 Years |

|

|

10 Years |

|

| Class A Shares |

|

$ |

710 |

|

|

$ |

1,121 |

|

|

$ |

1,557 |

|

|

$ |

2,764 |

|

| Class C Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| – Assuming complete redemption at end of period |

|

$ |

344 |

|

|

$ |

830 |

|

|

$ |

1,442 |

|

|

$ |

3,095 |

|

| – Assuming no redemption |

|

$ |

244 |

|

|

$ |

830 |

|

|

$ |

1,442 |

|

|

$ |

3,095 |

|

| Institutional Shares |

|

$ |

129 |

|

|

$ |

479 |

|

|

$ |

854 |

|

|

$ |

1,906 |

|

| Class IR Shares |

|

$ |

144 |

|

|

$ |

527 |

|

|

$ |

936 |

|

|

$ |

2,078 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Portfolio Turnover

The Fund

pays transaction costs when it buys and sells securities or instruments (i.e., “turns over” its portfolio). A high rate of portfolio turnover may result in increased transaction costs, including brokerage commissions, which

must be borne by the Fund and its shareholders, and is also likely to result in higher short-term capital gains for taxable shareholders. These costs are not reflected in annual fund operating expenses or in the expense example above, but are

reflected in the Fund’s performance. The Fund’s portfolio turnover rate for the fiscal year ended October 31, 2014 was 64% of the average value of its portfolio.

Principal Strategy

The Fund invests, under normal circumstances, at least 80% of its net assets plus any borrowings for investment purposes (measured at the time of purchase)

(“Net Assets”) in a portfolio of equity investments in Brazil, Russia, India and China (“BRIC countries”) or in issuers that participate in the markets of the BRIC countries. Such equity investments may include exchange-traded

funds (“ETFs”), futures and other instruments with similar economic exposures.

An issuer participates in the markets of the BRIC countries if the

issuer:

| ¢ |

|

Has a class of its securities whose principal securities market is in a BRIC country; |

| ¢ |

|

Is organized under the laws of, or has a principal office in, a BRIC country; or |

| ¢ |

|

Maintains 50% or more of its assets in one or more BRIC countries. |

Under normal circumstances, the Fund

maintains investments in at least four emerging countries: Brazil, Russia, India and China. Generally, the Fund may invest in issuers that expose the Fund to the prevailing economic circumstances and factors present in the BRIC countries. The Fund

may also invest in other emerging country issuers, in addition to BRIC country issuers.

Allocation of the Fund’s investments is determined by the

Investment Adviser’s assessment of a company’s upside potential and downside risk, how attractive it appears relative to other holdings, and how the addition will impact sector and industry weightings. The largest weightings in the

Fund’s portfolio relative to the benchmark of the Fund are given to companies the Investment Adviser believes have the most upside return potential relative to their contribution to overall portfolio risk. The Fund’s investments are

selected using a strong valuation discipline to purchase what the Investment Adviser believes are well-positioned, cash-generating businesses run by shareholder-oriented management teams.

The Fund may also invest in: (i) fixed income securities of private and government emerging country issuers; and (ii) equity and fixed income

securities, such as government, corporate and bank debt obligations, of developed country issuers.

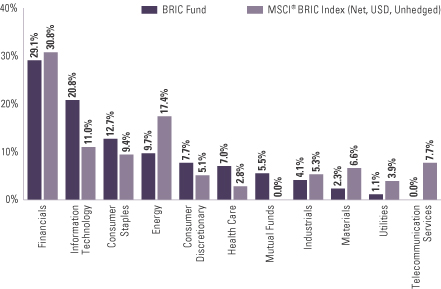

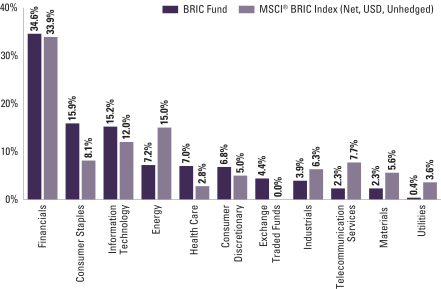

The Fund’s benchmark index is the Morgan Stanley

Capital International (MSCI) BRIC Index (Net, USD, Unhedged).

THE FUND IS NON-DIVERSIFIED UNDER THE INVESTMENT COMPANY ACT OF 1940, AS AMENDED

(“INVESTMENT COMPANY ACT”), AND MAY INVEST A LARGER PERCENTAGE OF ITS ASSETS IN FEWER ISSUERS THAN DIVERSIFIED MUTUAL FUNDS.

Principal Risks

of the Fund

Loss of money is a risk of investing in the Fund. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the

Federal Deposit Insurance Corporation (“FDIC”) or any government agency. The Fund should not be relied upon as a complete investment program. There can be no assurance that the Fund will achieve its investment objective. Investments in the

Fund involve substantial risks which prospective investors should consider carefully before investing.

BRIC Risk. The Fund’s

investment exposure to the BRIC countries will subject the Fund, to a greater extent than if investments were not made in those countries, to the risks of conditions and events that may be particular to those countries, such as: volatile economic

cycles and/or securities markets; adverse exchange rates; social, political, regulatory, economic or environmental events; or natural disasters. The economies, industries, securities and currency markets of Brazil, Russia, India and China may be

adversely affected by

8

protectionist trade policies, slow economic activity worldwide, political and social instability, environmental

events and natural disasters, regional and global conflicts, terrorism and war, including actions that are contrary to the interests of the U.S.

Foreign and Emerging Countries Risk. Foreign securities may be subject to risk of loss because of more or less foreign government

regulation, less public information and less economic, political and social stability in the countries in which the Fund invests. Loss may also result from the imposition of exchange controls, sanctions, confiscations and other government

restrictions by the United States or other governments, or from problems in registration, settlement or custody. Foreign risk also involves the risk of negative foreign currency rate fluctuations, which may cause the value of securities denominated

in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency exchange rates may fluctuate significantly over short periods of time. To the extent the Fund also invests in

securities of issuers located in emerging countries, these risks may be more pronounced.

Large Shareholder Transactions

Risk. The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Such large shareholder redemptions may cause the Fund to sell portfolio securities at

times when it would not otherwise do so, which may negatively impact the Fund’s net asset value (“NAV”) and liquidity. Similarly, large Fund share purchases may adversely affect the Fund’s performance to the extent that the Fund

is delayed in investing new cash and is required to maintain a larger cash position than it ordinarily would. These transactions may also accelerate the realization of taxable income to shareholders if such sales of investments resulted in gains,

and may also increase transaction costs. In addition, a large redemption could result in the Fund’s current expenses being allocated over a smaller asset base, leading to an increase in the Fund’s expense ratio.

Liquidity Risk. The Fund may make investments that are illiquid or that may become less liquid in response to market developments or

adverse investor perceptions. Illiquid investments may be more difficult to value. Liquidity risk may also refer to the risk that the Fund will not be able to pay redemption proceeds within the allowable time period because of unusual market

conditions, an unusually high volume of redemption requests, or other reasons. To meet redemption requests, the Fund may be forced to sell securities at an unfavorable time and/or under unfavorable conditions.

Market Risk. The value of the securities in which the Fund invests may go up or down in response to the prospects of individual

companies, particular sectors or governments and/or general economic conditions throughout the world due to increasingly interconnected global economies and financial markets.

Non-Diversification Risk. The Fund is non-diversified, meaning that it is permitted to invest a larger percentage of its assets in

fewer issuers than diversified mutual funds. Thus, the Fund may be more susceptible to adverse developments affecting any single issuer held in its portfolio, and may be more susceptible to greater losses because of these developments.

Sector Risk. To the extent the Fund invests a significant amount of its assets in one or more sectors, such as the financial services

or telecommunications sectors, the Fund will be subject to greater risk of loss as a result of adverse economic, business or other developments than if its investments were diversified across different sectors.

Stock Risk. Stock prices have historically risen and fallen in periodic cycles. U.S. and foreign stock markets have experienced

periods of substantial price volatility in the past and may do so again in the future.

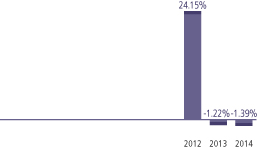

Performance

The bar chart and table below provide an indication of the risks of investing in the Fund by showing: (a) changes in the performance of the Fund’s

Class A Shares from year to year; and (b) how the average annual total returns of the Fund’s Class A, Class C, Institutional and Class IR Shares compare to those of a broad-based securities market index. The Fund’s

past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available at no cost at www.gsamfunds.com/performance or by calling the appropriate

phone number on the back cover of this Prospectus.

9

The bar chart (including “Best

Quarter” and “Worst Quarter” information) does not reflect the sales loads applicable to Class A Shares. If the sales loads were reflected, returns would be less. Performance reflects applicable fee waivers and/or expense

limitations in effect during the periods shown.

|

|

|

|

|

| TOTAL RETURN |

|

CALENDAR YEAR (CLASS A) |

|

|

| The total return for Class A Shares for the 6-month period ended June 30, 2015 was

10.04%. Best Quarter

Q2 ‘09 +44.38%

Worst Quarter Q3 ‘08 –34.71% |

|

|

|

|

|

|

|

|

|

|

|

AVERAGE ANNUAL TOTAL RETURN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the period ended December 31, 2014 |

|

1 Year |

|

|

5 Years |

|

|

Since

Inception |

|

| Class A Shares (Inception 6/30/06) |

|

|

|

|

|

|

|

|

|

|

|

|

| Returns Before Taxes |

|

|

–9.22% |

|

|

|

–3.61% |

|

|

|

2.78% |

|

| Returns After Taxes on Distributions |

|

|

–9.22% |

|

|

|

–3.62% |

|

|

|

2.58% |

|

| Returns After Taxes on Distributions and Sale of Fund Shares |

|

|

–5.09% |

|

|

|

–2.62% |

|

|

|

2.22% |

|

| MSCI BRIC Index (Net, USD, Unhedged; reflects no deduction for fees or expenses) |

|

|

–2.85% |

|

|

|

–1.92% |

|

|

|

4.60% |

|

| Class C Shares (Inception 6/30/06) |

|

|

|

|

|

|

|

|

|

|

|

|

| Returns Before Taxes |

|

|

–5.60% |

|

|

|

–3.25% |

|

|

|

2.68% |

|

| MSCI BRIC Index (Net, USD, Unhedged; reflects no deduction for fees or expenses) |

|

|

–2.85% |

|

|

|

–1.92% |

|

|

|

4.60% |

|

| Institutional Shares (Inception 6/30/06) |

|

|

|

|

|

|

|

|

|

|

|

|

| Returns Before Taxes |

|

|

–3.57% |

|

|

|

–2.13% |

|

|

|

3.87% |

|

| MSCI BRIC Index (Net, USD, Unhedged; reflects no deduction for fees

or expenses) |

|

|

–2.85% |

|

|

|

–1.92% |

|

|

|

4.60% |

|

| Class IR Shares (Inception 8/31/10) |

|

|

|

|

|

|

|

|

|

|

|

|

| Returns Before Taxes |

|

|

–3.74% |

|

|

|

N/A |

|

|

|

–1.59% |

|

| MSCI BRIC Index (Net, USD, Unhedged; reflects no deduction for fees

or expenses) |

|

|

–2.85% |

|

|

|

N/A |

|

|

|

–1.22% |

|

The after-tax returns are for Class A Shares only. The after-tax returns for Class C, Institutional and Class IR

Shares will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation

and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

Portfolio Management

Goldman Sachs Asset Management International is the investment adviser for the Fund (the “Investment Adviser” or “GSAMI”).

Portfolio Managers: Prashant Khemka, Managing Director, has managed the Fund since 2015; and Basak Yavuz, CFA, Executive Director, has managed

the Fund since 2015.

Buying and Selling Fund Shares

The minimum initial investment for Class A and Class C Shares is, generally, $1,000. The minimum initial investment for Institutional Shares is, generally,

$1,000,000 for individual or certain institutional investors, alone or in combination with other assets under the management of the Investment Adviser and its affiliates. There is no minimum for initial purchases of Class IR Shares. Those share

classes with a minimum initial investment requirement do not impose it on certain employee benefit plans, and Institutional Shares do not impose it on certain investment advisers investing on behalf of other accounts.

The minimum subsequent investment for Class A and Class C shareholders is $50, except for certain employee benefit plans, for which there is no minimum.

There is no minimum subsequent investment for Institutional or Class IR shareholders.

10

You may purchase and redeem (sell) shares of the Fund on any business day through certain banks, trust companies,

brokers, dealers, investment advisers and other financial institutions (“Authorized Institutions”).

Tax Information

For important tax information, please see “Tax Information” on page 21 of this Prospectus.

Payments to Broker-Dealers and Other Financial Intermediaries

For important information about financial intermediary compensation, please see “Payments to Broker-Dealers and Other Financial Intermediaries” on

page 21 of this Prospectus.

11

Goldman Sachs Emerging

Markets Equity Fund—Summary

Investment Objective

The

Goldman Sachs Emerging Markets Equity Fund (the “Fund”) seeks long-term capital appreciation.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts on purchases of

Class A Shares if you and your family invest, or agree to invest in the future, at least $50,000 in Goldman Sachs Funds. More information about these and other discounts is available from your financial professional and in “Shareholder

Guide—Common Questions Applicable to the Purchase of Class A Shares” beginning on page 47 of this Prospectus and “Other Information Regarding Maximum Sales Charge, Purchases, Redemptions, Exchanges and Dividends”

beginning on page B-111 of the Fund’s Statement of Additional Information (“SAI”).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Class A |

|

|

Class C |

|

|

Institutional |

|

|

Service |

|

|

Class IR |

|

|

Class R6 |

|

| Shareholder Fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (fees paid directly from your investment) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

|

5.50% |

|

|

|

None |

|

|

|

None |

|

|

|

None |

|

|

|

None |

|

|

|

None |

|

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of original purchase price or

sale proceeds)1 |

|

|

None |

|

|

|

1.00% |

|

|

|

None |

|

|

|

None |

|

|

|

None |

|

|

|

None |

|

| |

|

Class A |

|

|

Class C |

|

|

Institutional |

|

|

Service |

|

|

Class IR |

|

|

Class R6 |

|

| Annual Fund Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (expenses that you pay each year as a percentage of the value of your investment) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Management Fees |

|

|

1.20% |

|

|

|

1.20% |

|

|

|

1.20% |

|

|

|

1.20% |

|

|

|

1.20% |

|

|

|

1.20% |

|

| Distribution and/or Service (12b-1) Fees |

|

|

0.25% |

|

|

|

0.75% |

|

|

|

None |

|

|

|

0.25% |

|

|

|

None |

|

|

|

None |

|

| Other Expenses2 |

|

|

0.48% |

|

|

|

0.73% |

|

|

|

0.33% |

|

|

|

0.58% |

|

|

|

0.48% |

|

|

|

0.31% |

|

| Service Fees |

|

|

Non |

e |

|

|

0.25 |

% |

|

|

Non |

e |

|

|

Non |

e |

|

|

Non |

e |

|

|

Non |

e |

| Shareholder Administration Fees |

|

|

Non |

e |

|

|

Non |

e |

|

|

Non |

e |

|

|

0.25 |

% |

|

|

Non |

e |

|

|

Non |

e |

| All Other Expenses |

|

|

0.48 |

% |

|

|

0.48 |

% |

|

|

0.33 |

% |

|

|

0.33 |

% |

|

|

0.48 |

% |

|

|

0.31 |

% |

| Acquired Fund Fees and Expenses |

|

|

0.01% |

|

|

|

0.01% |

|

|

|

0.01% |

|

|

|

0.01% |

|

|

|

0.01% |

|

|

|

0.01% |

|

| Total Annual Fund Operating Expenses |

|

|

1.94% |

|

|

|

2.69% |

|

|

|

1.54% |

|

|

|

2.04% |

|

|

|

1.69% |

|

|

|

1.52% |

|

| Fee Waiver and Expense Limitaion3,4 |

|

|

(0.30)% |

|

|

|

(0.29)% |

|

|

|

(0.30)% |

|

|

|

(0.29)% |

|

|

|

(0.29)% |

|

|

|

(0.30)% |

|

| Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation3,5 |

|

|

1.64% |

|

|

|

2.40% |

|

|

|

1.24% |

|

|

|

1.75% |

|

|

|

1.40% |

|

|

|

1.22% |

|

| 1 |

A contingent deferred sales charge (“CDSC”) of 1% is imposed on Class C Shares redeemed within 12 months of purchase. |

| 2 |

The differences in the “Other Expenses” ratios across the share classes are the result of, among other things, contractual differences in transfer agency fees and the effect of mathematical rounding on the

daily accrual of certain expenses, particularly in respect of small share classes. The “Other Expenses” for Class R6 Shares have been estimated to reflect expenses expected to be incurred during the current fiscal year.

|

| 3 |

The “Total Annual Fund Operating Expenses” do not correlate to the ratios of net and total expenses to average net assets provided in the Financial Highlights, which reflect the operating expenses of the

Fund and do not include “Acquired Fund Fees and Expenses.” |

| 4 |

The Investment Adviser has agreed to (i) waive a portion of its management fees in order to achieve an effective net management fee rate of 1.02% as an annual percentage rate of the average daily net assets of the

Fund; and (ii) reduce or limit “Other Expenses” (excluding acquired fund fees and expenses, transfer agency fees and expenses, service fees, shareholder administration fees, taxes, interest, brokerage fees, shareholder meeting, litigation,

indemnification and extraordinary expenses) to 0.194% of the Fund’s average daily net assets. These arrangements will remain in effect through at least July 31, 2016, and prior to such date, the Investment Adviser may not terminate the

arrangement without the approval of the Board of Trustees. |

| 5 |

The Fund’s “Total Annual Fund Operating Expenses After Fee Waiver and Expense Limitation” have been restated to reflect the fee waiver and expense limitation currently in effect. |

Expense Example

This Example is intended to help you

compare the cost of investing in the Fund with the cost of investing in other mutual funds.

The Example assumes that you invest $10,000 in Class A,

Class C, Institutional, Service, Class IR and/or Class R6 Shares of the Fund for the time periods indicated and then redeem all of your Class A, Class C, Institutional, Service, Class IR and/or Class R6 Shares at the end of those

periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating

12

expenses remain the same (except that the Example incorporates the fee waiver and expense limitation arrangements

for only the first year). Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

1 Year |

|

|

3 Years |

|

|

5 Years |

|

|

10 Years |

|

| Class A Shares |

|

$ |

708 |

|

|

$ |

1,098 |

|

|

$ |

1,513 |

|

|

$ |

2,667 |

|

| Class C Shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| – Assumingcomplete redemption at end of period |

|

$ |

343 |

|

|

$ |

808 |

|

|

$ |

1,399 |

|

|

$ |

3,001 |

|

| – Assumingno redemption |

|

$ |

243 |

|

|

$ |

808 |

|

|

$ |

1,399 |

|

|

$ |

3,001 |

|

| Institutional Shares |

|

$ |

126 |

|

|

$ |

457 |

|

|

$ |

811 |

|

|

$ |

1,810 |

|

| Service Shares |

|

$ |

178 |

|

|

$ |

612 |

|

|

$ |

1,072 |

|

|

$ |

2,346 |

|

| Class IR Shares |

|

$ |

143 |

|

|

$ |

505 |

|

|

$ |

891 |

|

|

$ |

1,974 |

|

| Class R6 Shares |

|

$ |

124 |

|

|

$ |

451 |

|

|

$ |

801 |

|

|

$ |

1,787 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Portfolio Turnover

The Fund

pays transaction costs when it buys and sells securities or instruments (i.e., “turns over” its portfolio). A high rate of portfolio turnover may result in increased transaction costs, including brokerage commissions, which

must be borne by the Fund and its shareholders, and is also likely to result in higher short-term capital gains for taxable shareholders. These costs are not reflected in annual fund operating expenses or in the expense example above, but are

reflected in the Fund’s performance. The Fund’s portfolio turnover rate for the fiscal year ended October 31, 2014 was 114% of the average value of its portfolio.

Principal Strategy

The Fund invests, under normal circumstances, at least 80% of its net assets plus any borrowings for investment purposes (measured at the time of purchase)

(“Net Assets”) in a diversified portfolio of equity investments in emerging country issuers. Such equity investments may include exchange-traded funds (“ETFs”), futures and other instruments with similar economic exposures. The

Investment Adviser may consider classifications by the World Bank, the International Finance Corporation, the United Nations (and its agencies) or the Fund’s benchmark index provider in determining whether a country is emerging or developed.

Emerging countries are generally located in Africa, Asia, the Middle East, Eastern Europe and Central and South America.

An emerging country issuer is any

company that either:

| ¢ |

|

Has a class of its securities whose principal securities market is in an emerging country; |

| ¢ |

|

Is organized under the laws of, or has a principal office in, an emerging country; |

| ¢ |

|

Derives 50% or more of its total revenue from goods produced, sales made or services provided in one or more emerging countries; or |

| ¢ |

|

Maintains 50% or more of its assets in one or more emerging countries. |

Under normal circumstances, the Fund

maintains investments in at least six emerging countries, and will not invest more than 35% of its Net Assets in securities of issuers in any one emerging country. Allocation of the Fund’s investments is determined by the Investment

Adviser’s assessment of a company’s upside potential and downside risk, how attractive it appears relative to other holdings, and how the addition will impact sector and industry weightings. The largest weightings in the Fund’s

portfolio relative to the benchmark of the Fund are given to companies the Investment Adviser believes have the most upside return potential relative to their contribution to overall portfolio risk. The Fund’s investments are selected using a

strong valuation discipline to purchase what the Investment Adviser believes are well-positioned, cash-generating businesses run by shareholder-oriented management teams.

The Fund may invest in: (i) fixed income securities of private and government emerging country issuers; and (ii) equity and fixed income securities,

such as government, corporate and bank debt obligations, of developed country issuers.

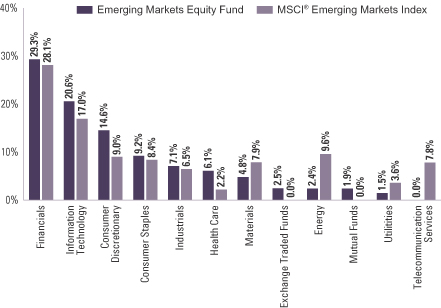

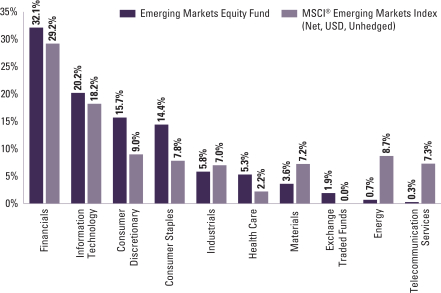

The Fund’s benchmark index is the Morgan Stanley Capital

International (MSCI) Emerging Markets Index (Net, USD, Unhedged).

Principal Risks of the Fund

Loss of money is a risk of investing in the Fund. An investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit

Insurance Corporation (“FDIC”) or any government agency. The Fund should not be relied upon as a complete investment program. There can be no assurance that the Fund will achieve its investment objective. Investments in the Fund involve

substantial risks which prospective investors should consider carefully before investing.

Foreign and Emerging Countries

Risk. Foreign securities may be subject to risk of loss because of more or less foreign government regulation, less public information and less economic, political and social stability in the countries in which the Fund invests.

Loss may also result from the imposition of exchange controls, sanctions, confiscations and other government restrictions by the United

13

States or other governments, or from problems in registration, settlement or custody. Foreign risk also involves

the risk of negative foreign currency rate fluctuations, which may cause the value of securities denominated in such foreign currency (or other instruments through which the Fund has exposure to foreign currencies) to decline in value. Currency

exchange rates may fluctuate significantly over short periods of time. To the extent the Fund also invests in securities of issuers located in emerging countries, these risks may be more pronounced.

The Fund may invest heavily in issuers located in Brazil, Russia, India and China, and therefore may be particularly exposed to the economies, industries,

securities and currency markets of these four countries, which may be adversely affected by protectionist trade policies, slow economic activity worldwide, political and social instability, environmental events and natural disasters, regional and

global conflicts, terrorism and war, including actions that are contrary to the interests of the U.S.

Large Shareholder Transactions

Risk. The Fund may experience adverse effects when certain large shareholders purchase or redeem large amounts of shares of the Fund. Such large shareholder redemptions may cause the Fund to sell portfolio securities at

times when it would not otherwise do so, which may negatively impact the Fund’s net asset value (“NAV”) and liquidity. Similarly, large Fund share purchases may adversely affect the Fund’s performance to the extent that the Fund

is delayed in investing new cash and is required to maintain a larger cash position than it ordinarily would. These transactions may also accelerate the realization of taxable income to shareholders if such sales of investments resulted in gains,

and may also increase transaction costs. In addition, a large redemption could result in the Fund’s current expenses being allocated over a smaller asset base, leading to an increase in the Fund’s expense ratio.

Liquidity Risk. The Fund may make investments that are illiquid or that may become less liquid in response to market developments or

adverse investor perceptions. Illiquid investments may be more difficult to value. Liquidity risk may also refer to the risk that the Fund will not be able to pay redemption proceeds within the allowable time period because of unusual market

conditions, an unusually high volume of redemption requests, or other reasons. To meet redemption requests, the Fund may be forced to sell securities at an unfavorable time and/or under unfavorable conditions.

Market Risk. The value of the securities in which the Fund invests may go up or down in response to the prospects of individual

companies, particular sectors or governments and/or general economic conditions throughout the world due to increasingly interconnected global economies and financial markets.

Sector Risk. To the extent the Fund invests a significant amount of its assets in one or more sectors, such as the financial services

or telecommunications sectors, the Fund will be subject to greater risk of loss as a result of adverse economic, business or other developments than if its investments were diversified across different sectors.

Stock Risk. Stock prices have historically risen and fallen in periodic cycles. U.S. and foreign stock markets have experienced

periods of substantial price volatility in the past and may do so again in the future.

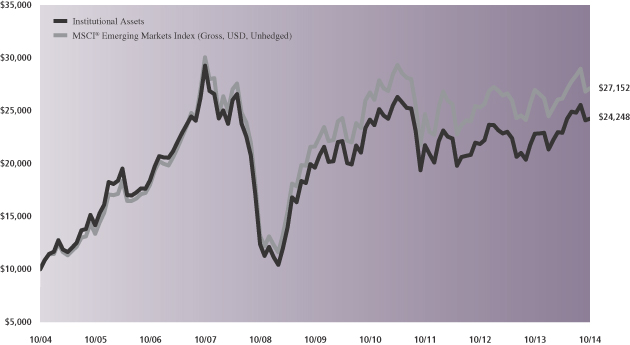

Performance

The bar chart and table below provide an indication of the risks of investing in the Fund by showing: (a) changes in the performance of the Fund’s

Institutional Shares from year to year; and (b) how the average annual total returns of the Fund’s Class A, Class C, Institutional, Service, Class IR and Class R6 Shares compare to those of a broad-based securities

market index. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Updated performance information is available at no cost at www.gsamfunds.com/performance or

by calling the appropriate phone number on the back cover of this Prospectus. Performance reflects applicable fee waivers and/or expense limitations in effect during the periods shown.

|

|

|

|

|

| TOTAL RETURN |

|

CALENDAR YEAR (INSTITUTIONAL) |

|

|

| The total return for Institutional Shares for the 6-month period ended June 30, 2015 was

7.90%. Best Quarter

Q2 ‘09 +36.68%

Worst Quarter Q4 ‘08 –29.14% |

|

|

14

|

|

|

|

|

|

|

|

|

AVERAGE ANNUAL TOTAL RETURN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the period ended December 31, 2014 |

|

1 Year |

|

|

5 Years |

|

|

10 Years |

|

|

Since

Inception |

|

| Class A Shares (Inception 12/15/97) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Returns Before Taxes |

|

|

–4.60% |

|

|

|

–0.06% |

|

|

|

6.29% |

|

|

|

5.84% |

|

| Returns After Taxes on Distributions |

|

|

–4.48% |

|

|

|

0.09% |

|

|

|

5.57% |

|

|

|

5.30% |

|

| Returns After Taxes on Distributions and Sale of Fund Shares |

|

|

–2.48% |

|

|

|

0.15% |

|

|

|

5.24% |

|

|

|

4.89% |

|

| MSCI Emerging Markets Index (Net, USD, Unhedged; reflects no deduction

for fees or expenses) |

|

|

–2.19% |

|

|

|

1.78% |

|

|

|

8.40% |

|

|

|

6.78% |

|

| Class C Shares (Inception 12/15/97) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Returns Before Taxes |

|

|

–0.93% |

|

|

|

0.30% |

|

|

|

6.09% |

|

|

|

5.51% |

|

| MSCI Emerging Markets Index (Net, USD, Unhedged; reflects no deduction

for fees or expenses) |

|

|

–2.19% |

|

|

|

1.78% |

|

|

|

8.40% |

|

|

|

6.78% |

|

| Institutional Shares (Inception 12/15/97) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Returns Before Taxes |

|

|

1.26% |

|

|

|

1.47% |

|

|

|

7.32% |

|

|

|

6.73% |

|

| MSCI Emerging Markets Index (Net, USD, Unhedged; reflects no deduction

for fees or expenses) |

|

|

–2.19% |

|

|

|

1.78% |

|

|

|

8.40% |

|

|

|

6.78% |

|

| Service Shares (Inception 12/15/97) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Returns Before Taxes |

|

|

0.75% |

|

|

|

0.96% |

|

|

|

6.78% |

|

|

|

6.08% |

|

| MSCI Emerging Markets Index (Net, USD, Unhedged; reflects no deduction

for fees or expenses) |

|

|

–2.19% |

|

|

|

1.78% |

|

|

|

8.40% |

|

|

|

6.78% |

|

| Class IR Shares (Inception 8/31/10) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Returns Before Taxes |

|

|

1.15% |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

2.12% |

|

| MSCI Emerging Markets Index (Net, USD, Unhedged; reflects no deduction

for fees or expenses) |

|

|

–2.19% |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

2.13% |

|

| Class R6 Shares (Inception 7/31/15)* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Returns |

|

|

1.26% |

|

|

|

1.47% |

|

|

|

7.32% |

|

|

|

6.73% |

|

| MSCI Emerging Markets Index (Net, USD, Unhedged; reflects no deduction for fees or expenses) |

|

|

–2.19% |

|

|

|

1.78% |

|

|

|

8.40% |

|

|

|

6.78% |

|

| * |

Class R6 Shares commenced operations on July 31, 2015. Prior to that date, the performance of the Class R6 Shares is that of the Institutional Shares. Performance prior to July 31, 2015 has not been

adjusted to reflect the lower expenses of Class R6 Shares. Class R6 Shares would have had similar returns (because these share classes represent interests in the same portfolio of securities) that differed only to the extent that Class R6 Shares and

Institutional Shares have different expenses. |

The after-tax returns are for Class A Shares only. The after-tax returns for

Class C, Institutional, Service and Class IR Shares, and returns for Class R6 Shares (which are offered exclusively to employee benefit plans), will vary. After-tax returns are calculated using the historical highest individual federal marginal

income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who

hold Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts.

Portfolio Management

Goldman Sachs Asset Management International is the investment adviser for the Fund (the “Investment Adviser” or “GSAMI”).

Portfolio Managers: Prashant Khemka, Managing Director, has managed the Fund since 2015; and Basak Yavuz, CFA, Executive Director, has managed

the Fund since 2015.

Buying and Selling Fund Shares

The minimum initial investment for Class A and Class C Shares is, generally, $1,000. The minimum initial investment for Institutional Shares is, generally,

$1,000,000 for individual or certain institutional investors, alone or in combination with other assets under the management of the Investment Adviser and its affiliates. There is no minimum for initial purchases of Class IR or Class R6

Shares. Those share classes with a minimum initial investment requirement do not impose it on certain employee benefit plans, and Institutional Shares do not impose it on certain investment advisers investing on behalf of other accounts.

The minimum subsequent investment for Class A and Class C shareholders is $50, except for certain employee benefit plans, for which there is no minimum.

There is no minimum subsequent investment for Institutional, Class IR or Class R6 shareholders.

The Fund does not impose minimum purchase requirements

for initial or subsequent investments in Service Shares, although an Authorized Institution (as defined below) may impose such minimums and/or establish other requirements such as a minimum account balance.

You may purchase and redeem (sell) shares of the Fund on any business day through certain banks, trust companies, brokers, dealers, investment advisers and

other financial institutions (“Authorized Institutions”).

Tax Information

For important tax information, please see “Tax Information” on page 21 of this Prospectus.

Payments to Broker-Dealers and Other Financial Intermediaries

For important information about financial intermediary compensation, please see “Payments to Broker-Dealers and Other Financial Intermediaries” on

page 21 of this Prospectus.

15

Goldman Sachs N-11 Equity

Fund—Summary

Investment Objective

The

Goldman Sachs N-11 Equity Fund (the “Fund”) seeks long-term capital appreciation.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. You may qualify for sales charge discounts on purchases of

Class A Shares if you and your family invest, or agree to invest in the future, at least $50,000 in Goldman Sachs Funds. More information about these and other discounts is available from your financial professional and in “Shareholder

Guide—Common Questions Applicable to the Purchase of Class A Shares” beginning on page 47 of this Prospectus and “Other Information Regarding Maximum Sales Charge, Purchases, Redemptions, Exchanges and Dividends”

beginning on page B-111 of the Fund’s Statement of Additional Information (“SAI”).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Class A |

|

|

Class C |

|

|

Institutional |

|

|

Class IR |

|

| Shareholder Fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (fees paid directly from your investment) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Maximum Sales Charge (Load) Imposed on Purchases (as a percentage of offering price) |

|

|

5.50% |

|

|

|

None |

|

|

|

None |

|

|

|

None |

|

| Maximum Deferred Sales Charge (Load) (as a percentage of the lower of original purchase price or

sale proceeds)1 |

|

|

None |

|

|

|

1.00% |

|

|

|

None |

|

|

|

None |

|

|

|

|

|

|

| |

|

Class A |

|

|

Class C |

|

|

Institutional |

|

|

Class IR |

|

| Annual Fund Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (expenses that you pay each year as a percentage of the value of your investment) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Management Fees |

|

|

1.30% |

|

|

|

1.30% |

|

|

|

1.30% |

|

|

|

1.30% |

|

| Distribution and/or Service (12b-1) Fees |

|

|

0.25% |

|

|

|

0.75% |

|

|

|

None |

|

|

|

None |

|

| Other Expenses2 |

|

|

0.52% |

|

|

|

0.77% |

|

|

|

0.37% |

|

|

|

0.51% |

|

| Service Fees |

|

|

Non |

e |

|

|

0.25 |

% |

|

|

Non |

e |

|

|

Non |

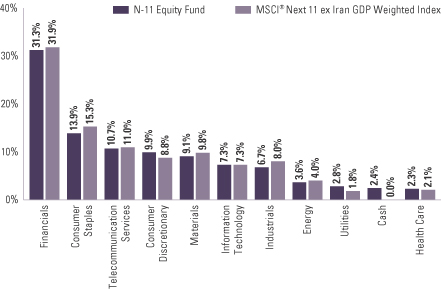

e |