UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x |

Preliminary Proxy Statement | |

| ¨ |

Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ¨ |

Definitive Proxy Statement | |

| ¨ |

Definitive Additional Materials | |

| ¨ |

Soliciting Material Under Rule 14a-12 | |

GOLDMAN SACHS TRUST

(Name of Registrant as Specified In Its Charter)

(none)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x |

No fee required. | |||

| ¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ¨ |

Fee paid previously with preliminary materials: | |||

| ¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

GOLDMAN SACHS TRUST

71 South Wacker Drive

Chicago, Illinois 60606

July [•], 2014

Dear Shareholder:

You are cordially invited to attend a Special Meeting (the “Meeting”) of the Goldman Sachs Trust (the “Trust”) to be held on September 9, 2014, at 4:00 p.m. (Eastern time), at the offices of Goldman Sachs Asset Management, L.P. (“GSAM”), located at 30 Hudson Street, 21st Floor—Room N2, Jersey City, New Jersey, 07302. Please note that if you plan to attend the Meeting, photographic identification will be required for admission.

At this important meeting, you will be asked to consider and act upon the following proposals. Each proposal is to be voted upon by all Shareholders of the Goldman Sachs Rising Dividend Growth Fund (the “Fund”), a series of the Trust:

| Proposal 1. | To approve a new sub-advisory agreement for the Fund between GSAM and Dividend Assets Capital, LLC (“DAC” or the “Sub-Adviser”); and | |

| Proposal 2. | To transact such other business as may properly come before the Meeting or any postponement or adjournment thereof. | |

DAC currently serves as the sub-adviser to the Fund and provides the day-to-day advice regarding the Fund’s portfolio transactions. Subject to Shareholder approval, the existing owners of DAC intend to transfer ownership of DAC to an employee stock ownership program (“ESOP”) (the “ESOP Transaction”). DAC is currently owned by a small group of individuals comprised of the senior management of DAC. As part of its succession planning initiatives, DAC’s management has decided to implement the ESOP as a means to transition its ownership over a broader base of DAC’s employees. As described more fully below, the ESOP Transaction could be deemed to terminate the current sub-advisory agreement for the Fund between GSAM and DAC, and therefore Shareholders are being asked to approve the Proposed Sub-Advisory Agreement to ensure that the existing sub-advisory services can continue after the ESOP Transaction.

A formal Notice of Special Meeting and Proxy Statement setting forth in detail the matters to come before the Meeting are attached to this letter, and a proxy card is enclosed for your use. You should read the Proxy Statement carefully.

WHETHER OR NOT YOU PLAN TO BE PRESENT AT THE MEETING, YOUR VOTE IS VERY IMPORTANT. The Board of Trustees of the Trust recommends that you vote “FOR” Proposal 1. However, before you vote, please read the Proxy Statement for a complete description of the proposals. If you do not plan to be present at the Meeting, you can vote by signing, dating and returning the enclosed proxy card promptly or by using the Internet or telephone voting options as described on your proxy card. If you have any questions regarding the proxy materials, please contact the Trust at 1-800-621-2550. Your prompt response will mean that you can avoid receiving follow-up phone calls or mailings.

Sincerely,

July [•], 2014

James A. McNamara

President

1

PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY

CARD IN THE ENCLOSED ENVELOPE OR USE THE INTERNET OR TELEPHONE VOTING

OPTIONS TO CAST YOUR VOTE AS SOON AS POSSIBLE TO ENSURE A QUORUM FOR THE

MEETING. YOUR VOTE IS IMPORTANT. THANK YOU IN ADVANCE FOR YOUR VOTE AND

CONTINUED SUPPORT.

2

Important Information to Help You Understand and Vote on Proposal 1 – Questions and Answers

The following questions and answers provide an overview of the matters on which you are being asked to vote. The accompanying Proxy Statement contains more detailed information about each proposal, and we encourage you to read it in its entirety before voting. Your vote is important.

| Q: | What is the purpose of this proxy solicitation? |

| A: | The purpose of this proxy solicitation is to ask Shareholders of the Fund to approve a new sub-advisory agreement for the Fund between GSAM and DAC (the “Proposed Sub-Advisory Agreement”). |

| Q: | Why am I being asked to approve the Proposed Sub-Advisory Agreement? |

| A: | DAC currently serves as the sub-adviser to the Fund and provides the day-to-day advice regarding the Fund’s portfolio transactions. DAC makes the investment decisions for the Fund and places purchase and sale orders for the Fund’s portfolio transactions in the U.S. and foreign markets. DAC has informed the Fund and GSAM that, subject to Shareholder approval, the existing owners of DAC intend enter into the ESOP Transaction. DAC is currently owned by a small group of individuals comprised of the senior management of DAC, a few of whom are approaching retirement age. As part of its succession planning initiatives, DAC’s management has decided to implement the ESOP as a means to transition its ownership over a broader base of DAC’s employees. To effectuate this transaction, DAC intends to form a company that will serve as a holding company of DAC’s membership interests. The holding company will, in turn, sell its stock to the ESOP. The foregoing transaction will be effected by DAC first redeeming the shares of the existing owners in exchange for cash received from a senior bank loan and/or certain promissory notes between DAC and its current owners (collectively, these obligations are referred to herein as the “Notes”). In conjunction with the foregoing, the holding company will own 100% of the outstanding membership interests of DAC and will sell its stock to the ESOP. Over time, the ESOP will allocate shares of DAC that it owns to the employees of DAC. The structure of the ESOP Transaction carries with it certain tax benefits that should assist DAC in retiring the Notes. DAC has advised the Fund and GSAM that it believes the ESOP Transaction is the most effective and efficient strategy to achieve its succession planning objectives. |

The Fund is subject to the Investment Company Act of 1940, as amended (the “1940 Act”), which effectively provides in Section 15 that any investment management agreement, including any sub-advisory agreement, must terminate automatically upon its “assignment.” As used in the 1940 Act, the term “assignment” includes any transfer of a controlling block of outstanding voting securities of an investment adviser, including a sub-adviser. Such a transfer is often referred to as a “Change of Control Event.” The ESOP Transaction could be deemed a Change of Control Event, because a controlling block of outstanding voting securities of DAC will be transferred to the ESOP. In order to ensure that the existing sub-advisory services can continue after the ESOP Transaction, the Board has approved the Proposed Sub-Advisory Agreement. Shareholders are asked to approve the Proposed Sub-Advisory Agreement.

| Q: | Will the Proposed Sub-Advisory Agreement change how the Fund is managed by DAC? |

| A: | No, it is not anticipated that the Proposed Sub-Advisory Agreement will result in any changes to the portfolio management services of the Fund that are provided by DAC. |

| Q. | Will the Proposed Sub-Advisory Agreement change the fee received by DAC? |

| A: | No, the Proposed Sub-Advisory Agreement will not change the fee received by DAC and will not affect the fees borne by Shareholders. |

3

Additional Questions and Answers Relating to the Proxy

| Q: | What are the Board’s recommendations? |

| A: | The Board recommends that all Shareholders vote “FOR” Proposal 1. |

| Q: | What happens if Shareholders do not approve the Proposed Sub-Advisory Agreement? |

| A: | If Shareholders of the Fund do not approve the Proposed Sub-Advisory Agreement, DAC has informed the Fund and GSAM that the ESOP Transaction would not occur, and therefore DAC would continue to serve as Sub-Adviser to the Fund under the Current Sub-Advisory Agreement and GSAM, DAC and the Board may need to consider other options. In light of the current ownership structure of DAC, it is possible that a similar proxy proposal could be put to Shareholders in the future if Shareholders of the Fund do not approve the Proposed Sub-Advisory Agreement. As noted above, DAC has advised the Fund and GSAM that it believes the ESOP Transaction is the most effective and efficient strategy to achieve its succession planning objectives. In addition, GSAM believes it is in the best interests of the Fund and its Shareholders for DAC to continue to serve as Sub-Adviser to the Fund, and therefore believes that Shareholders of the Fund should approve the Proposed Sub-Advisory Agreement. |

| Q. | Who will pay the expenses associated with the proxy statement and solicitation? |

| A. | DAC will pay the expenses associated with the proxy statement and solicitation, except for legal costs, which will be paid by GSAM. The Fund will not pay any expenses associated with the proxy statement and solicitation. |

| Q. | Will my vote make a difference? |

| A. | Yes! Your vote is needed to ensure that the Proposal 1 can be acted upon. We encourage all Shareholders to participate in the governance of their Fund. Additionally, your immediate response on the enclosed proxy card, on the Internet or over the phone, each as discussed immediately below, will help save the costs of any further solicitations. Your vote is important! |

| Q: | How can I vote? |

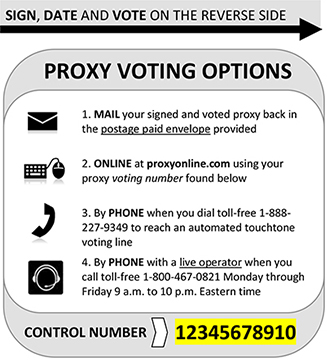

| A: | Shareholders can vote in any one of four ways: |

| • | By mailing the enclosed proxy card after signing and dating; |

| • | Over the Internet by going to the website indicated on your proxy card; |

| • | By telephone, with a toll free call to the number on your proxy card; or |

| • | In person at the Meeting. |

We encourage you to vote over the Internet by going to the website provided on your enclosed proxy card, or by telephone by calling the toll-free number on your enclosed proxy card, in each case using the voting control number that appears on your proxy card. However, whichever method you choose, please take the time to read the Proxy Statement before you vote.

| Q: | I plan to vote by mail. How should I sign my proxy card? |

| A: | Please see the instructions at the end of the Notice of Special Meeting, which is enclosed. |

4

| Q: | I plan to vote over the Internet. How does Internet voting work? |

| A: | To vote over the Internet, please log on to the website indicated on your proxy card and follow the instructions provided on the voting website. |

| Q: | I plan to vote by telephone. How does telephone voting work? |

| A: | To vote by telephone, please call toll free the number on your proxy card from within the United States and follow the instructions provided during your call. |

| Q: | Whom should I call with questions? |

| A: | If you have any additional questions about the Proxy Statement or the upcoming Meeting, please contact the Trust at 1-800-621-2550. |

| Q: | What is the relationship between the proxy solicitor, AST Fund Solutions, LLC, and the Trust? |

| A: | GSAM has retained an outside firm that specializes in proxy solicitation to assist with the proxy solicitation process, including the mailing of this Proxy Statement, the collection of the proxies, and with any necessary follow up. A proxy solicitor may contact Shareholders on behalf of the Trust, but is not permitted to use personal information about Shareholders for other purposes. |

THE ATTACHED PROXY STATEMENT CONTAINS MORE DETAILED INFORMATION ABOUT THE

PROPOSALS. PLEASE READ IT CAREFULLY. YOUR VOTE IS IMPORTANT.

5

GOLDMAN SACHS TRUST

71 South Wacker Drive

Chicago, Illinois 60606

NOTICE OF SPECIAL MEETING

To Be Held On September 9, 2014

July [•], 2014

To the Shareholders of the Goldman Sachs Trust (the “Trust”):

A Special Meeting (the “Meeting”) of the Trust will be held on September 9, 2014, at 4:00 p.m. (Eastern time), at the offices of Goldman Sachs Asset Management, L.P. (“GSAM”), located at 30 Hudson Street, 21st Floor—Room N2, Jersey City, New Jersey, 07302 for the following purposes:

| Proposal 1. | To approve a new sub-advisory agreement for the Goldman Sachs Rising Dividend Growth Fund (the “Fund”) between GSAM and Dividend Assets Capital, LLC; and | |

| Proposal 2. | To transact such other business as may properly come before the Meeting or any postponement or adjournment thereof. | |

The matters referred to above are discussed in the Proxy Statement attached to this Notice. Each Shareholder is invited to attend the Meeting in person. Please note that if you plan to attend the Meeting, photographic identification will be required for admission. If you will not be present at the Meeting, we urge you to sign, date and promptly return the enclosed proxy card in the envelope provided, which is addressed for your convenience and needs no postage if mailed in the United States. You may also vote easily and quickly by Internet or by telephone. In order to avoid any further solicitation, we ask your cooperation in returning your proxy promptly.

By Order of the Board of Trustees

of Goldman Sachs Trust

July [•], 2014

Caroline Kraus

Secretary

YOUR VOTE IS IMPORTANT

NO MATTER HOW MANY SHARES YOU OWN

To secure the largest possible representation at the Meeting, please mark your proxy card, sign it, date it, and return it in the postage paid envelope provided (unless you are voting by Internet or by telephone). If you sign, date and return a proxy card but give no voting instructions, your shares will be voted “FOR” the proposal indicated on the card. If you prefer, you may instead vote via the Internet or by telephone. To vote in this manner, you should refer to the directions below.

To vote via the Internet, please access the website found on your proxy card and follow the on-screen instructions on the website.

To vote by telephone, please call the toll-free number found on your proxy card from within the United States, and follow the recorded instructions (Shareholders outside the United States should vote via the Internet or by submitting a proxy card instead).

You may revoke your proxy at any time at or before the Meeting, by submitting to the Secretary of the Trust at the Trust’s principal executive offices a written notice of revocation or subsequently executed proxy or by attending the Meeting and electing to vote in person.

2

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general guidelines for signing proxy cards may be of assistance to you and will help avoid the time and expense to the Trust involved in validating your vote if you fail to sign your proxy card properly.

1. Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card.

2. Joint Accounts: Either party may sign, but the name of the party signing should conform exactly to the name shown in the registration on the proxy card.

3. All Other Accounts: The capacity of the individual signing the proxy card should be indicated unless it is reflected in the form of registration. For example:

| Registration | Valid Signature | |

| Corporate Accounts |

||

| (1) ABC Corp. ................................................................................ | ABC Corp. | |

| John Doe, Treasurer | ||

| (2) ABC Corp ................................................................................. | John Doe, Treasurer | |

| (3) ABC Corp. c/o John Doe, Treasurer ......................................... | John Doe | |

| (4) ABC Corp. Profit Sharing Plan ................................................. | John Doe, Trustee | |

| Partnership Accounts |

||

| (1) The XYZ Partnership ................................................................. | Jane B. Smith, Partner | |

| (2) Smith and Jones, Limited Partnership ....................................... | Jane B. Smith, General Partner | |

| Trust Accounts |

||

| (1) ABC Trust Account ................................................................... | Jane B. Doe, Trustee | |

| (2) Jane B. Doe, Trustee u/t/d 12/18/98 .......................................... | Jane B. Doe | |

| Custodial or Estate Accounts |

||

| (1) John B. Smith, Cust. f/b/o | ||

| John B. Smith Jr. UGMA/UTMA ............................................. | John B. Smith | |

| (2) Estate of John B. Smith ............................................................. | John B. Smith, Jr., Executor | |

3

| Page | ||||

| 5 | ||||

| 7 | ||||

| 10 | ||||

| 11 | ||||

| 15 | ||||

| 15 | ||||

| 15 | ||||

| A-1 | ||||

| B-1 | ||||

| EXHIBIT C ADDITIONAL INFORMATION ABOUT DIVIDEND ASSETS CAPITAL, LLC |

C-1 | |||

| EXHIBIT D ADDITIONAL INFORMATION ABOUT GOLDMAN SACHS ASSET MANAGEMENT, L.P. |

D-1 | |||

4

OF

GOLDMAN SACHS TRUST

71 South Wacker Drive

Chicago, Illinois 60606

PROXY STATEMENT

July [•], 2014

This Proxy Statement is furnished in connection with the solicitation of proxies by and on behalf of the Board of Trustees of the Goldman Sachs Trust (the “Trust”) for use at the Trust’s Special Meeting to be held at the offices of Goldman Sachs Asset Management, L.P. (“GSAM” or “Investment Adviser”), located at 30 Hudson Street, 21st Floor—Room N2, Jersey City, New Jersey, 07302 on September 9, 2014, at 4:00 (Eastern time), or any postponement or adjournment thereof, for the purposes set forth in the accompanying Notice of Special Meeting. Such meeting and any postponement or adjournment thereof is referred to as the “Meeting.” Please note that if you plan to attend the Meeting, photographic identification will be required for admission. This Proxy Statement, the accompanying Notice of Special Meeting, and the accompanying proxy card (or, if applicable, the appropriate notice of where to access these materials) are being mailed to Shareholders on or about July [•], 2014.

The Trustees have fixed the close of business on June 30, 2014 as the record date for the determination of Shareholders entitled to notice of, and to vote at, the Meeting (the “Record Date”). Shareholders of record of the Trust on the Record Date are entitled to one vote per whole share at the Meeting, and Shareholders of record of fractional shares are entitled to a proportionate fractional vote. As of the Record Date, the Goldman Sachs Rising Dividend Growth Fund, a series of the Trust (the “Fund”), had [•] shares of beneficial interest outstanding. Exhibit A to this Proxy Statement sets forth the persons who owned beneficially more than 5% of any class of the Fund as of May 30, 2014. As of May 30, 2014, the Trustees and Officers of the Trust as a group owned less than 1% of the outstanding shares of beneficial interest of each class of the Fund.

It is expected that the solicitation of proxies will be primarily by mail. The Trust’s officers, personnel of the Fund’s investment adviser and transfer agent and any authorized proxy solicitation agent, may also solicit proxies by telephone, facsimile, Internet or in person. If the Trust records votes through the Internet or by telephone, it will use procedures designed to authenticate Shareholders’ identities, to allow Shareholders to authorize the voting of their shares in accordance with their instructions, and to confirm that their identities have been properly recorded.

Dividend Assets Capital, LLC, the Fund’s sub-adviser (“DAC” or “Sub-Adviser”) will pay the expenses associated with this Proxy Statement and solicitation, except for legal costs, which will be paid by GSAM. The Fund will not pay any expenses associated with the proxy statement and solicitation. GSAM has engaged AST Fund Solutions, LLC (“AST”), an independent proxy solicitation firm, to assist in the distribution of the proxy materials and the solicitation and tabulation of proxies. The cost of AST’s services with respect to this solicitation is estimated to be approximately $500,000, plus reasonable out-of-pocket expenses.

To vote by mail, sign, date and promptly return the enclosed proxy card in the accompanying postage pre-paid envelope. To vote by Internet or telephone, please use the control number on your proxy card and follow the instructions as described on your proxy card. If you have any questions regarding the proxy materials, please contact the Trust at 1-800-621-2550. If the enclosed proxy card is properly executed and received prior to the Meeting and has not been revoked, the shares represented thereby will be voted in accordance with the

5

instructions marked on the returned proxy card or, if no instructions are marked on the returned proxy card, the proxy card will be voted: “FOR” Proposal 1; and in the discretion of the persons named as proxies, in connection with any other matter that may properly come before the Meeting or any adjournment(s) or postponement(s) thereof.

Any person giving a proxy may revoke it at any time before it is exercised by submitting to the Secretary of the Trust at the Trust’s principal executive offices a written notice of revocation or subsequently executed proxy or by attending the Meeting and electing to vote in person.

If (i) you are a member of a household in which multiple Shareholders of the Trust share the same address, (ii) your shares are held in “street name” and (iii) your broker or bank has received consent to household material, then your broker or bank may have sent to your household only one copy of this Proxy Statement or the Notice of Internet Availability of Proxy Materials, unless your broker or bank previously received contrary instructions from a Shareholder in your household. If you are part of a household that has received only one copy of this Proxy Statement or the Notice of Internet Availability of Proxy Materials, the Trust will deliver promptly a separate copy of this Proxy Statement or the Notice of Internet Availability of Proxy Materials to you upon written or oral request. To receive a separate copy of this Proxy Statement or the Notice of Internet Availability of Proxy Materials, please contact the Trust by calling toll free 1-800-621-2550 or by mail at Goldman Sachs Funds, P.O. Box 06050, Chicago, Illinois 60606-6306. If your shares are held with certain banks, trust companies, brokers, dealers, investment advisers and other financial intermediaries (each, an “Authorized Institution”) and you would like to receive a separate copy of future proxy statements, notices of internet availability of proxy materials, prospectuses or annual reports or you are now receiving multiple copies of these documents and would like to receive a single copy in the future, please contact your Authorized Institution.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE SPECIAL MEETING TO BE HELD ON SEPTEMBER [•], 2014

This Proxy Statement is available online at www.proxyvote.com (please have the control number found on your proxy card ready when you visit this website). IN ADDITION, COPIES OF THE FUND’S MOST RECENT ANNUAL AND SEMI-ANNUAL REPORTS, INCLUDING FINANCIAL STATEMENTS, HAVE PREVIOUSLY BEEN MAILED TO SHAREHOLDERS. THE TRUST WILL FURNISH TO ANY SHAREHOLDER UPON REQUEST, WITHOUT CHARGE, AN ADDITIONAL COPY OF THE FUND’S MOST RECENT ANNUAL REPORT AND SUBSEQUENT SEMI-ANNUAL REPORT TO SHAREHOLDERS. ANNUAL REPORTS AND SEMI-ANNUAL REPORTS TO SHAREHOLDERS MAY ALSO BE OBTAINED BY WRITING TO: GOLDMAN SACHS TRUST, P.O. BOX 06050, CHICAGO, ILLINOIS 60606-6306; OR BY TELEPHONE TOLL-FREE AT: 1-800-621-2550.

6

TO APPROVE THE PROPOSED SUB-ADVISORY AGREEMENT

Introduction

Shareholders of the Fund are asked to approve a new sub-advisory agreement for the Fund between GSAM and DAC (the “Proposed Sub-Advisory Agreement”). DAC currently serves as the Sub-Adviser to the Fund pursuant to the existing Sub-Advisory Agreement, dated as of February 27, 2012, by and between GSAM and DAC (the “Current Sub-Advisory Agreement”) and provides the day-to-day advice regarding the Fund’s portfolio transactions. DAC makes the investment decisions for the Fund and places purchase and sale orders for the Fund’s portfolio transactions in the U.S. and foreign markets. DAC has informed the Fund and GSAM that, subject to Shareholder approval, the existing owners of DAC intend to transfer ownership of DAC to an employee stock ownership program (“ESOP”) (the “ESOP Transaction”).

DAC is currently owned by a small group of individuals comprised of the senior management of DAC, a few of whom are approaching retirement age. As part of its succession planning initiatives, DAC’s management has decided to implement the ESOP as a means to transition its ownership over a broader base of DAC’s employees. To effectuate this transaction, DAC intends to form a company that will serve as a holding company of DAC’s membership interests. The holding company will, in turn, sell its stock to the ESOP. The foregoing transaction will be effected by DAC first redeeming the shares of the existing owners in exchange for cash received from a senior bank loan and/or certain promissory notes between DAC and its current owners (collectively, these obligations are referred to herein as the “Notes”). In conjunction with the foregoing, the holding company will own 100% of the outstanding membership interests of DAC and will sell its stock to the ESOP. Over time, the ESOP will allocate shares of DAC that it owns to the employees of DAC. The structure of the ESOP carries with it certain tax benefits that should assist DAC in retiring the Notes. DAC has advised the Fund and GSAM that it believes the ESOP is the most effective and efficient strategy to achieve its succession planning objectives.

The Fund is subject to the Investment Company Act of 1940, as amended (the “1940 Act”), which effectively provides in Section 15 that any investment management agreement, including any sub-advisory agreement, must terminate automatically upon its “assignment.” As used in the 1940 Act, the term “assignment” includes any transfer of a controlling block of outstanding voting securities of an investment adviser, including a sub-adviser. Such a transfer is often referred to as a “Change of Control Event.” The ESOP Transaction could be deemed a Change of Control Event, because a controlling block of outstanding voting securities of DAC will be transferred to the ESOP. Therefore, the transfer of the outstanding voting securities of DAC into the ESOP pursuant to the ESOP Transaction could be deemed to terminate the Current Sub-Advisory Agreement. In order to allow the existing sub-advisory services provided by DAC to continue after the ESOP Transaction, the Board of Trustees of the Trust (the “Board”) has approved the Proposed Sub-Advisory Agreement.

If approved by Shareholders, the Proposed Sub-Advisory Agreement would become effective upon the ESOP Transaction. If Shareholders of the Fund do not approve the Proposed Sub-Advisory Agreement, DAC has informed the Fund and GSAM that the ESOP Transaction would not occur, and therefore DAC would continue to serve as Sub-Adviser to the Fund under the Current Sub-Advisory Agreement and GSAM, DAC and the Board may need to consider other options. In light of the current ownership structure of DAC, it is possible that a similar proxy proposal could be put to Shareholders in the future if Shareholders of the Fund do not approve the Proposed Sub-Advisory Agreement. As noted above, DAC has advised the Fund and GSAM that it believes the ESOP Transaction is the most effective and efficient strategy to achieve its succession planning objectives. In addition, GSAM believes it is in the best interests of the Fund and its Shareholders for DAC to continue to serve as Sub-Adviser to the Fund, and therefore believes that Shareholders of the Fund should approve the Proposed Sub-Advisory Agreement.

Comparison of Current Sub-Advisory Agreement and Proposed Sub-Advisory Agreement

The description of the Proposed Sub-Advisory Agreement that follows is qualified in its entirety by reference to the copy of the form of the Proposed Sub-Advisory Agreement included in Exhibit B. The Proposed Sub-Advisory Agreement is materially identical to the Current Sub-Advisory Agreement, except for the effective date and duration provisions.

7

No changes to the fee schedule for the Fund are proposed in connection with Proposal 1. GSAM, and not the Fund, is responsible for paying any fees due under the Current and Proposed Sub-Advisory Agreements. Under both the Current and Proposed Sub-Advisory Agreements, DAC is entitled to a fee, accrued daily and paid each calendar quarter, equal to the following annual percentage rates of the Fund’s average daily net assets:

| Average Daily Net Assets |

||||

| First $1 billion |

0.200 | % | ||

| Next $1 billion |

0.181 | % | ||

| Next $3 billion |

0.171 | % | ||

| Next $3 billion |

0.168 | % | ||

| Over $8 billion |

0.165 | % |

Prior to July 1, 2014, under the Current Sub-Advisory Agreement, DAC was entitled to a fee, accrued daily and paid each calendar quarter, at the annual rate of 0.20% of the Fund’s average daily net assets. For the fiscal year ended October 31, 2013, GSAM paid DAC an aggregate of $2,588,420 in fees pursuant to the Current Sub-Advisory Agreement. Exhibit C provides information regarding the principal executive officers of DAC.

No changes to the services provided by DAC as specified under the Current Sub-Advisory Agreement are contemplated in connection with the Proposed Sub-Advisory Agreement. Both the Current and Proposed Sub-Advisory Agreements appoint DAC to act as the Sub-Adviser to the Fund and provide the Fund with investment research, advice and supervision and furnish a continuous investment program for and manage the investment and reinvestment of the assets of the Fund. In this regard, the Sub-Adviser determines in its discretion the securities, cash and other financial instruments to be purchased, retained or sold for the Fund.

In addition, no changes to the limitation of liabilities and indemnification as specified under the Current Sub-Advisory Agreement are contemplated in connection with the Proposed Sub-Advisory Agreement. Both the Current and Proposed Sub-Advisory Agreements provide that DAC will not be liable for any losses, claims, damages, liabilities or litigation (including legal and other expenses) suffered by GSAM or the Trust as a result of any error of judgment by DAC with respect to the Fund, except that DAC will remain liable for, and will indemnify the Trust, GSAM and their affiliated persons against, any losses suffered: (a) as a result of the willful misconduct, bad faith, or negligence by DAC; (b) as a result of any untrue statement or alleged untrue statement of a material fact contained in the registration statement, proxy materials, reports, advertisements, sales literature or other materials pertaining to the Fund, or any material fact omitted therefrom, if such a statement or omission was made in reliance upon and in conformity with written information furnished by DAC; or (c) as a result of the failure of DAC to execute portfolio transactions according to the requirements of applicable law.

After an initial term until June 30, 2012, the Current Sub-Advisory Agreement provides that it would continue in full force and effect from year to year thereafter so long as such continuance is specifically approved at least annually (a) by the vote of a majority of those Trustees of the Trust who are not parties to the Current Sub-Advisory Agreement or interested persons of any such party, cast in person at a meeting called for the purpose of voting on such approval, and (b) by the Trustees of the Trust or by vote of a majority of the outstanding voting securities of the Fund voting separately; provided further, that if the Shareholders fail to approve the Current Sub-Advisory Agreement as provided in the Current Sub-Advisory Agreement, DAC may continue to serve in the manner and to the extent permitted by the 1940 Act and the rules and regulations thereunder. The Proposed Sub-Advisory Agreement provides for the same terms with respect to term and continuation as the Proposed Sub-Advisory Agreement, except that the initial term will be until June 30, 2015.

The Current Sub-Advisory Agreement may be terminated at any time, without the payment of any penalty, (a) by vote of a majority of the Trustees of the Trust or by a vote of a majority of the outstanding voting securities of the Fund, (b) by GSAM on 60 days written notice to DAC or (c) by DAC at any time without the payment of any penalty on not less than 90 days written notice to GSAM and the Trust. In addition, the Current Sub-Advisory Agreement states that it may not be terminated by DAC during the 24-month period immediately following the effective date. The Current Sub-Advisory Agreement also automatically terminates in the event of its assignment or

8

the assignment of the Fund’s investment management agreement. The Proposed Sub-Advisory Agreement provides for the same terms with respect to termination as the Current Sub-Advisory Agreement, except that it does not contain a provision prohibiting DAC from terminating the Proposed Sub-Advisory Agreement during the 24-month period immediately following the effective date.

The Current Sub-Advisory Agreement was last approved by the initial shareholder of the Fund prior to its commencement of operations on February 17, 2012, and was last approved by the Board at a meeting held on June 11-12, 2014.

Information Regarding GSAM

GSAM has the overall responsibility, subject to oversight by the Board, to oversee sub-advisers, including DAC, and recommend their hiring, termination and replacement. Under the management agreement, dated as of April 30, 1997, between the Trust, on behalf of the Fund, and GSAM (the “Management Agreement”), GSAM is entitled to a management fee, accrued daily and paid monthly, equal to following annual percentage rates of the Fund’s average daily net assets:

| Average Daily Net Assets |

||||

| First $1 billion |

0.75 | % | ||

| Next $1 billion |

0.68 | % | ||

| Next $3 billion |

0.64 | % | ||

| Next $3 billion |

0.63 | % | ||

| Over $8 billion |

0.62 | % |

As of February 28, 2014, GSAM has agreed to reduce or limit certain “Other Expenses” (excluding acquired fund fees and expenses, transfer agency fees and expenses, taxes, interest, brokerage fees, shareholder meeting, litigation, indemnification, and extraordinary expenses) to 0.014% of the Fund’s average daily net assets through at least February 28, 2015, and prior to such date GSAM may not terminate the arrangement without the approval of the Board. The expense limitation may be modified or terminated by GSAM at its discretion and without Shareholder approval after such date, although GSAM does not presently intend to do so.

For the fiscal year ended October 31, 2013, the Fund paid GSAM an aggregate of $10,479,020 in fees pursuant to the Management Agreement, and made no payments to affiliated brokers. For the same period, Goldman, Sachs & Co. (“Goldman Sachs”), as the exclusive distributor of shares of the Fund, retained approximately $637,956 in commissions on sales of the Fund, and received an aggregate of $1,886,157 in fees from the Fund for the services rendered to the Trust by Goldman Sachs as transfer agent and the assumption by Goldman Sachs of the expenses related thereto. Exhibit D provides information regarding the principal executive officers and general partner of GSAM, and regarding each officer or director of the Fund who is an officer, employee, director, general partner or shareholder of GSAM or Goldman Sachs. GSAM is a wholly-owned subsidiary of The Goldman Sachs Group, Inc., located at 200 West Street, New York, NY 10282, and an affiliate of Goldman Sachs.

Board Consideration of the Proposed Sub-Advisory Agreement

Based upon its review, and after consideration of such factors and information it considered relevant, the Board, including a majority of the trustees who are not deemed to be “interested persons” (as defined in the 1940 Act) of the Trust (the “Independent Trustees”) present at its June 11-12, 2014 meeting, approved the Proposed Sub-Advisory Agreement and voted to recommend to Shareholders that they approve Proposal 1. The Board is therefore recommending that the Fund’s Shareholders vote “FOR” Proposal 1 to approve the Proposed Sub-Advisory Agreement, as discussed in this Proxy Statement. For more information on the factors considered by the Board, please see the section entitled “Factors Considered by the Board.”

THE TRUSTEES UNANIMOUSLY RECOMMEND THAT YOU VOTE IN FAVOR OF PROPOSAL 1.

9

TO TRANSACT SUCH OTHER BUSINESS AS MAY PROPERLY COME BEFORE THE MEETING OR

ANY POSTPONEMENT OR ADJOURNMENT THEREOF

The management of the Trust does not know of any other matters to be brought before the Meeting. If such matters are properly brought before the Meeting, proxies that do not contain specific instructions to the contrary will be voted in accordance with the judgment of the person or persons acting thereunder.

10

FACTORS CONSIDERED BY THE BOARD

Background

The Goldman Sachs Rising Dividend Growth Fund (the “Fund”) is an investment portfolio of Goldman Sachs Trust (the “Trust”). The Board of Trustees (the “Board” or the “Trustees”) oversees the management of the Trust and reviews the investment performance and expenses of the Fund at regularly scheduled meetings held during the year. In addition, the Board determines annually whether to approve the continuance of the sub-advisory agreement (the “Current Sub-Advisory Agreement”) between Goldman Sachs Asset Management, L.P. (the “Investment Adviser”) and Dividend Assets Capital, LLC (the “Sub-Adviser,” together with the Investment Adviser, the “Advisers”) on behalf of the Fund.

At a meeting held on June 11-12, 2014 (the “Annual Meeting”), the Trustees, including those Trustees who are not parties to the Fund’s investment management agreement or the Current Sub-Advisory Agreement or “interested persons” (as defined in the Investment Company Act of 1940, as amended (the “1940 Act”)) of any party thereto (the “Independent Trustees”), were asked to approve the continuation of the Current Sub-Advisory Agreement until June 30, 2015. In connection with that proposal, the Trustees were asked to approve an amendment to the Current Sub-Advisory Agreement to introduce breakpoints in the sub-advisory fee rate payable by the Adviser to the Sub-Adviser. At the Annual Meeting, the Board also considered a proposed transaction expected to result in a change in ownership of the Sub-Adviser. This change in ownership would take place by existing shareholders of the Sub-Adviser transferring ownership of the Sub-Adviser to an employee stock ownership program that would serve to transition the ownership of the Sub-Adviser from its founders to the next generation of employees (the “ESOP Transaction”). The Trustees noted that a change in the ownership of a fund’s investment adviser or sub-adviser results in the assignment and automatic termination of the fund’s advisory or sub-advisory agreement, as applicable. Accordingly, the Board noted that a new sub-advisory agreement must be approved by the Trustees and the Fund’s shareholders in order for the Sub-Adviser to continue to serve as sub-adviser to the Fund after completion of the ESOP Transaction (the “New Sub-Advisory Agreement,” together with the Current Sub-Advisory Agreement, the “Sub-Advisory Agreements”).

11

The advisory contract review process undertaken by the Trustees spans the course of the year and culminates with the Annual Meeting. To assist the Trustees in their deliberations, the Trustees have established a Contract Review Committee (the “Committee”) comprised of the Independent Trustees. The Committee held four meetings over the course of the year since the Current Agreement was last approved. At Committee meetings, regularly scheduled Board or other committee meetings, and/or the Annual Meeting, the Board or the Independent Trustees, as applicable, considered matters relating to the services provided to the Fund by the Sub-Adviser. In conjunction with these meetings, the Trustees received written materials and oral presentations on the topics covered, and were advised by their independent legal counsel regarding their responsibilities and other regulatory requirements related to the approval and continuation of mutual fund investment management agreements under applicable law. The Trustees concluded that the New Sub-Advisory Agreement and the continuation of the Current Sub-Advisory Agreement, as amended, should be approved on behalf of the Fund. In reaching this determination, the Trustees relied on the information provided by the Advisers, as well as their interaction with the Sub-Adviser at prior meetings. In addition, in determining to approve the New Sub-Advisory Agreement, the Trustees considered the effect of the ESOP Transaction and noted that the ESOP Transaction was not expected to impact the services provided by the Sub-Adviser to the Fund.

Nature, Extent and Quality of the Services Provided Under the Sub-Advisory Agreements and Investment Performance

In evaluating the Sub-Advisory Agreements at the Meeting, the Trustees relied upon materials furnished and presentations made by the Investment Adviser. In evaluating the nature, extent and quality of services provided by the Sub-Adviser, the Trustees considered information on the services provided to the Fund by the Sub-Adviser, including information about the Sub-Adviser’s (a) personnel and organizational structure; (b) experience in dividend growth investing

12

and track record in managing the Fund; (c) policies and procedures in place to address potential conflicts of interest; and (d) compliance program and code of ethics. The Trustees noted that the Fund’s predecessor (the “Predecessor Fund”) commenced operations in March 2004 and had been reorganized into the Fund as a series of the Trust in February 2012. They noted the Predecessor Fund’s operations and investment performance since its inception and the Fund’s operations and investment performance since the reorganization. The Trustees reviewed the services provided to the Fund under the Current Sub-Advisory Agreement, and noted that the Predecessor Fund was also managed by the Sub-Adviser. They observed that the Predecessor Fund’s performance record had only two years of negative returns since its inception. They also observed that the Fund had placed in the first quartile of its peer group for the ten-year period, in the third quartile for the three- and five-year periods, and in the fourth quartile for the one-year period, and had outperformed its benchmark index for the ten-year period and underperformed for the one-, three-, and five-year periods ended March 31, 2014. The Trustees noted that although the Fund had underperformed its peer group and benchmark index for the one-, three-, and five-year periods ended March 31, 2014, the Fund’s peer group and benchmark were broad-based and, accordingly, were imperfect measures for evaluating a fund that focused on dividend-paying stocks.

Costs of Services Provided

The Trustees reviewed the terms of the Sub-Advisory Agreements, including the proposed fee schedule for the Sub-Adviser. They considered that, effective July 1, 2014, the Advisers had agreed to introduce breakpoints in the sub-advisory fee rate payable under the Sub-Advisory Agreements at the following annual percentage rates of the average daily net assets of the Fund:

| Average Daily Net Assets |

Sub-Advisory Fee Annual Rate | |

| First $1 Billion |

0.200% | |

| Next $1 Billion |

0.181% | |

| Next $3 Billion |

0.171% | |

| Next $3 Billion |

0.168% | |

| Over $8 Billion |

0.165% |

13

The Trustees noted that the Sub-Adviser’s compensation is paid by the Investment Adviser, not by the Fund, and that adjustments in the Sub-Adviser’s fee schedule do not change the fees incurred by the Fund for advisory services. They noted that the effect of the breakpoints was to provide the Investment Adviser with additional net revenue for the services provided to the Fund, including oversight and administration of the Sub-Adviser. They also observed that the Investment Adviser’s fee was already subject to breakpoints at the same asset levels as those proposed for the Sub-Adviser and that the proposal would maintain the Sub-Adviser’s fee as a constant percentage of the Investment Adviser’s fee at all asset levels.

Conclusion

In connection with their consideration of the Sub-Advisory Agreements, the Trustees gave weight to each of the factors described above, but did not identify any particular factor controlling their decisions. After deliberation and consideration of the information provided, the Trustees concluded, in the exercise of their business judgment, that the sub-advisory fee to be paid by the Investment Adviser to the Sub-Adviser with respect to the Fund is reasonable in light of the services to be provided by the Sub-Adviser and the Fund’s reasonably foreseeable asset levels. The Trustees unanimously concluded that the Sub-Adviser’s continued management likely would benefit the Fund and its shareholders, and that the Sub-Advisory Agreements should be approved and continued, as applicable, until June 30, 2015, with the New Sub-Advisory Agreement being subject to the approval of the Fund’s shareholders.

14

A quorum for the transaction of business at the Meeting is established by the presence, in person or by proxy, of holders representing one-third of the votes entitled to be cast at the Meeting, but any lesser number will be sufficient for adjournments. If a proxy card is properly executed and returned accompanied by instructions to withhold authority, the shares represented thereby will be considered to be present at the Meeting for purposes of determining the existence of a quorum for the transaction of business but will not be counted in favor of Proposal 1. The adoption of Proposal 1 requires an affirmative vote of the lesser of: (i) 67% or more of the voting securities of the applicable Fund that are present at the meeting or represented by proxy, if holders of shares representing more than 50% of the outstanding voting securities of the Fund are present or represented by proxy; or (ii) more than 50% of the outstanding voting securities of the Fund (a “1940 Act Majority”).

Brokers who hold shares in street name for customers have discretionary authority to vote on “routine” proposals when they have not received instructions from the beneficial owners of those shares. Broker “non-votes” are shares held in an account with an Authorized Institution for which the broker indicates that instructions have not been received from the beneficial owners or other persons entitled to vote, and the broker does not have discretionary voting authority. Broker non-votes, if any, will not be counted as shares present for purposes of determining whether a quorum is present, and will not be voted for or against any adjournment or Proposal. Abstentions, if any, will be counted as shares present for purposes of determining whether a quorum is present, but will not be voted for or against any adjournment or Proposal. Accordingly, abstentions effectively will be a vote against Proposal 1, for which the required vote is a 1940 Act Majority.

In the event that at the time any session of the Meeting is called to order a quorum is not present in person or by proxy, the persons named as proxies may vote those proxies which have been received to adjourn the Meeting to a later date. In the event that a quorum is present but sufficient votes in favor of Proposal 1 have not been received, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies with respect to such proposal. If a quorum is present, any such adjournment will require the affirmative vote of a majority of the votes cast, and the persons named as proxies will vote those proxies which they are entitled to vote in favor of Proposal 1 in favor of such an adjournment, and will vote those proxies required to be voted against Proposal 1 against any such adjournment. Subject to the foregoing, the Meeting may be adjourned and re-adjourned without further notice to Shareholders.

The Trust is not required and does not intend to hold a meeting of Shareholders each year. Instead, meetings will be held only when and if required by law or as otherwise determined by the Board. Any Shareholder desiring to present a proposal for consideration at the next meeting of Shareholders of the Fund must submit the proposal in writing, so that it is received by the Fund within a reasonable time before any meeting. The proposals should be sent to the Trust at its address stated on the first page of this Proxy Statement.

Investment Adviser

Goldman Sachs Asset Management, L.P.

200 West Street

New York, New York 10282

Sub-Adviser

Dividend Assets Capital, LLC

58 Riverwalk Boulevard, Building 2, Suite A

Ridgeland, SC 29936

15

Distributor

Goldman, Sachs & Co.

200 West Street

New York, NY10282

July [•], 2014

Shareholders who do not expect to be present at the Meeting and who wish to have their shares voted are requested to vote by mail, Internet or telephone. If you choose to vote by mail, please sign and date the enclosed proxy card and return it in the enclosed envelope. No postage is required if mailed in the United States. If you choose to vote by Internet or telephone, please use the control number on the proxy card and follow the instructions on the proxy card. If you have any questions regarding the proxy materials please contact the Trust at 1-800-621-2550.

16

FIVE PERCENT SHAREHOLDERS

As of May 30, 2014, the following persons or entities owned beneficially or of record more than 5% of the outstanding shares, as applicable, of any class of the Fund:

| Class |

Shareholder Name and Address* |

Number of Shares |

Percentage of Class | |||

| Class A Shares | Charles Schwab & Co., Inc., Special Custody Acct. FBO Customers, Attn: Mutual Funds, 211 Main Street, San Francisco, CA 94105-1905. | 3,237,461.62 | 6.28% | |||

| Class A Shares | UBS Financial Services Inc., Attn Dept Manager, 1000 Harbor Blvd, 5th Floor, Weehawken, NJ 07086-6761. | 5,825,716.40 | 11.30% | |||

| Class A Shares | National Financial Services LLC, FBO Customers, Attn: Mutual Funds Dept, 4th Fl, 499 Washington Blvd., Jersey City, NJ 07310-2010. | 3,625,278.05 | 7.03% | |||

| Class A Shares | LPL Financial Corporation, 9785 Towne Centre Drive, San Diego, CA 92121-1968. | 3,293,905.25 | 6.39% | |||

| Class A Shares | American Enterprise Investment Services, 707 2nd Ave South, Minneapolis, MN 55402. | 18,752,298.51 | 36.38% | |||

| Class C Shares | Merrill Lynch Pierce Fenner & Smith, FBO its Customers, Attn: Service Team Goldman Sachs Funds, 4800 Deer Lake Dr. East, 3rd Fl., Jacksonville, FL 32246-6484. | 3,927,256.95 | 15.10% | |||

| Class C Shares | First Clearing, LLC, Special Custody Account FBO Customer, 2801 Market St., Saint Louis, MO 63103-2523. | 3,421,880.23 | 13.16% | |||

| Class C Shares | Morgan Stanley & Co., Harborside Financial Center, Plaza II 3rd Floor, Jersey City, NJ 07311. | 4,344,916.27 | 16.71% | |||

| Class C Shares | American Enterprise Investment Services, 707 2nd Ave South, Minneapolis, MN 55402. | 3,530,812.54 | 13.58% | |||

| Class C Shares | Raymond James & Associates, Omnibus for Mutual Funds, 880 Carillon Parkway, St. Petersburg, FL 33716-1102. | 5,847,949.81 | 22.49% | |||

| Class IR Shares | LPL Financial Corporation, 9785 Towne Centre Drive, San Diego, CA 92121-1968. | 6,436,136.68 | 38.08% | |||

| Class IR Shares | Pershing LLC, PO Box 2052, Jersey City, NJ 07303-2052. | 1,586,589.75 | 9.39% | |||

| Class IR Shares | Raymond James & Associates, Omnibus for Mutual Funds, 880 Carillon Parkway, St. Petersburg, FL 33716-1102. | 8,526,204.17 | 50.45% | |||

| Class R Shares | Merrill Lynch Pierce Fenner & Smith, FBO its Customers, Attn: Service Team Goldman Sachs Funds, 4800 Deer Lake Dr. East, 3rd Fl., Jacksonville, FL 32246-6484. | 250,739.51 | 80.64% | |||

| Institutional Shares | Merrill Lynch Pierce Fenner & Smith, FBO its Customers, Attn: Service Team Goldman Sachs Funds, 4800 Deer Lake Dr. East, 3rd Fl., Jacksonville, FL 32246-6484. | 13,407,353.69 | 24.05% | |||

| Institutional Shares | First Clearing, LLC, Special Custody Account FBO Customer, 2801 Market St., Saint Louis, MO 63103-2523. | 6,197,636.82 | 11.12% | |||

| Institutional Shares | Morgan Stanley & Co., Attn: Mutual Fund Operations, One New York Plaza, Fl 12, New York, NY 10004-1901. | 13,129,277.87 | 23.55% | |||

| Institutional Shares | National Financial Services LLC, FBO Customers, Attn: Mutual Funds Dept, 4th Fl, 499 Washington Blvd., Jersey City, NJ 07310-2010. | 3,734,636.02 | 6.70% | |||

| Institutional Shares | Charles Schwab & Co., Inc., Special Custody Acct. FBO Customers, Attn: Mutual Funds, 211 Main Street, San Francisco, CA 94105-1905. | 9,275,272.22 | 16.64% | |||

| Institutional Shares | Goldman Sachs & Co., FBO Omnibus 660, 295 Chipeta Way, Salt Lake City, UT 84108-1285 | 3,118,703.00 | 5.59% | |||

| * | The entity set forth in this column is the shareholder of record and may be deemed to be the beneficial owner of certain of the shares listed for certain purposes under the securities laws, although the entity generally does not have an economic interest in these shares and would ordinarily disclaim any beneficial ownership therein. |

A-1

PROPOSED SUB-ADVISORY AGREEMENT

SUB-ADVISORY AGREEMENT

BETWEEN

GOLDMAN SACHS ASSET MANAGEMENT, L.P.

and

DIVIDEND ASSETS CAPITAL, LLC

GOLDMAN SACHS RISING DIVIDEND GROWTH FUND

THIS SUB-ADVISORY AGREEMENT (“Agreement”) is made as of , 2014 (the “Effective Date”) by and between GOLDMAN SACHS ASSET MANAGEMENT, L.P. (“Investment Manager”) and DIVIDEND ASSETS CAPITAL, LLC (“Sub-Adviser”).

WHEREAS, Goldman Sachs Trust, a Delaware statutory trust (“Trust”), is registered as an open-end management investment company under the Investment Company Act of 1940, as amended (“1940 Act”); and

WHEREAS, pursuant to a Management Agreement (“Management Agreement”) by and between the Trust and the Investment Manager, a copy of which has been provided to Sub-Adviser, the Trust has appointed the Investment Manager to furnish investment advisory and other services to the Trust on behalf of Goldman Sachs Rising Dividend Growth Fund, a series of the Trust (“Fund”); and

WHEREAS, the Management Agreement authorizes the Investment Manager to provide, either directly or through third parties, investment advisory services with respect to the Fund; and

WHEREAS, subject to the terms and provisions of this Agreement, the Investment Manager desires to retain the Sub-Adviser to furnish sub-investment advisory services on behalf of the Fund; and

WHEREAS, this Agreement and the Sub-Adviser have been approved by the vote of the initial shareholder of the Fund, and by the vote of a majority of those members of the Trust’s Board of Trustees who are not interested persons of the Investment Manager or the Sub-Adviser, cast in person at a meeting called for the purpose of voting on such approval;

NOW, THEREFORE, in consideration of the premises and mutual covenants herein contained, it is agreed between the parties hereto as follows:

1. Engagement of the Sub-Adviser. The Investment Manager hereby engages the services of the Sub-Adviser in furtherance of the Management Agreement with the Trust on behalf of the Fund. Pursuant to this Agreement and subject to the supervision and oversight of the Investment Manager, the Sub-Adviser shall provide the Fund with investment research, advice and supervision and will furnish a continuous investment program for and manage the investment and reinvestment of the assets of the Fund. In this regard, the Sub-Adviser shall determine in its discretion the securities, cash and other financial instruments to be purchased, retained or sold for the Fund. The Sub-Adviser shall provide the Investment Manager and the Trust with records concerning its activities which the Investment Manager or the Trust is required to maintain, and shall render regular reports to the Investment Manager and to the

B-1

Officers and Trustees of the Trust concerning its discharge of its responsibilities under this Agreement. Unless the Investment Manager or the Trust instructs otherwise in writing, the Sub-Adviser is authorized to exercise tender and exchange offers and to vote proxies and corporate actions on behalf of the Fund, each as the Sub-Adviser determines is in the best interest of the Fund; provided that, to the extent Investment Manager is affiliated with a bank holding company, the Investment Manager will not provide instruction to the Sub-Adviser on how to vote securities of any U.S. bank holding company (as that term is defined in the Bank Holding Company Act of 1956, as amended). The Sub-Adviser shall vote proxies in accordance with its Proxy Voting Policy, a copy of which has been provided to the Investment Manager. The Sub-Adviser shall discharge the foregoing responsibilities subject to the supervision of the Officers and the Trustees of the Trust and in compliance with (i) the 1940 Act and the Investment Advisers Act of 1940, as amended (“Advisers Act”), and the rules and regulations adopted under each from time to time; (ii) the diversification requirements of Subchapter M of the Internal Revenue Code of 1986, as amended (the “Internal Revenue Code”); (iii) all other applicable federal and state laws and regulations; (iv) the Trust’s Declaration of Trust and Amended and Restated By-Laws, as each may be amended from time to time; (v) the objectives, policies and limitations for the Fund set forth in the Fund’s registration statement under the 1940 Act as amended from time to time and provided to the Sub-Adviser (“Registration Statement”); and (vi) the guidelines, policies and procedures adopted by the Trust’s Board of Trustees or implemented by the Investment Manager with respect to the Fund or to the Sub-Adviser’s activities under this Agreement and provided to the Sub-Adviser in writing (“Board/Investment Manager Procedures”). The Sub-Adviser shall maintain compliance procedures and operational processes for the Fund that are reasonably designed to ensure the Fund’s compliance with the foregoing. The Sub-Adviser shall also maintain compliance procedures and operational processes that it reasonably believes are adequate to ensure its compliance with the applicable law. No supervisory activity undertaken by the Investment Manager shall limit the Sub-Adviser’s full responsibility for any of the foregoing.

The Sub-Adviser accepts its engagement under this Section 1 and agrees, at its own expense, to render the services set forth herein and to provide the office space, furnishings, equipment and personnel required by it to perform such services on the terms and for the compensation provided in this Agreement; provided, however, that the Sub-Adviser shall not be required to pay the cost (including taxes, brokerage commissions and other transaction costs, if any) of securities and other instruments purchased, held or sold for the Fund or any other expenses except as specified in this Agreement. The Sub-Adviser shall not consult with any other sub-investment adviser for the Fund or the Trust (if any) concerning transactions for the Fund or the Trust in securities or other assets.

2. Fund Transactions. In connection with purchases and sales of portfolio securities for the account of the Fund, neither the Sub-Adviser nor any of its partners, officers or employees shall act as principal, except as otherwise permitted by the 1940 Act. The Sub-Adviser or its agents shall arrange for the placing of orders for the purchase and sale of portfolio securities and other instruments for the Fund’s account either directly with the issuer or with any broker or dealer, foreign currency dealer, futures commission merchant or other party (including affiliates of the Investment Manager and the Sub-Adviser) selected by the Sub-Adviser. In the selection of such brokers or dealers (including affiliates of the Investment Manager and the Sub-Adviser) and the placing of such orders the Sub-Adviser is directed at all times to seek for the

B-2

Fund the most favorable execution and net price available. It is also understood that it may be desirable for the Fund that the Sub-Adviser have access to supplemental investment and market research and security and economic analyses that are consistent with Section 28(e) of the Securities Exchange Act of 1934, as amended (the “1934 Act”), and are provided by brokers who may execute brokerage transactions at a higher cost to the Fund than may result when allocating brokerage to other brokers on the basis of seeking the most favorable price and efficient execution. Therefore, subject to such conditions and limitations as may be established by the Investment Manager from time to time, if any, the Sub-Adviser is authorized to consider such services provided to the Fund and other accounts over which the Sub-Adviser or any of its affiliates exercises investment discretion and to place orders for the purchase and sale of securities for the Fund with such brokers, if the Sub-Adviser determines in good faith that the amount of commissions for executing such portfolio transactions is reasonable in relation to the value of the brokerage and research services provided by such brokers, subject to review by the Investment Manager and the Trust’s Board of Trustees from time to time with respect to the extent and continuation of this practice. It is understood that the services provided by such brokers may be useful to the Sub-Adviser in connection with its services to other clients. The Sub-Adviser may, on occasions when it deems the purchase or sale of a security to be in the best interests of the Fund as well as its other clients, aggregate, to the extent permitted by applicable laws, rules and regulations, the securities to be sold or purchased in order to obtain the best net price and the most favorable execution. In such event, allocation of the securities so purchased or sold, as well as the expenses incurred in the transaction, shall be made by the Sub-Adviser in the manner it considers to be the most equitable and consistent with its obligations to the Fund and to such other clients. The Board may adopt policies and procedures that modify and/or restrict the Sub-Adviser’s authority regarding the execution of the Fund’s portfolio transactions provided herein. Notwithstanding the foregoing, the Sub-Adviser may execute, or cause to be executed, portfolio investment transactions with affiliates of the Investment Manager or the Sub-Adviser only to the extent that the Sub-Adviser maintains compliance procedures and operational processes with respect to such affiliated transactions that are reasonably designed to ensure the Fund’s compliance with the Board/Investment Manager Procedures, the Registration Statement and applicable law, including the 1940 Act and the Internal Revenue Code.

The Sub-Adviser may execute on behalf of the Fund certain agreements, instruments and documents in connection with the services performed by it under this Agreement. These may include, without limitation, brokerage agreements, clearing agreements, account documentation, and any other agreements, documents or instruments the Sub-Adviser reasonably believes are appropriate or desirable in performing its duties under this Agreement.

3. Compensation of the Sub-Adviser. For all services to be rendered and payments made as provided in this Agreement, the Investment Manager shall pay the Sub-Adviser, in arrears, each calendar quarter a fee at an annual rate equal to the percentage of the average daily net assets of the Fund set forth with respect to the Fund on Annex A. The “average daily net assets” of the Fund shall be determined on the basis set forth in the Fund’s prospectus(es) or otherwise consistent with the 1940 Act and the rules and regulations thereunder.

B-3

The fee for any calendar quarter during which this Agreement is in effect for less than the entire quarter shall be pro-rated based on the number of days during such quarter that the Agreement was in effect.

4. Delivery of Information, Reports and Certain Notifications. The Investment Manager agrees to furnish to the Sub-Adviser current prospectuses, statements of additional information, proxy statements, reports to shareholders, financial statements, charter documents and such other information with regard to the affairs of the Fund as the Sub-Adviser may reasonably request.

The Sub-Adviser shall report regularly on a timely basis to the Investment Manager and to the Board of Trustees of the Trust and shall make appropriate persons available for the purpose of reviewing with representatives of the Investment Manager and the Board of Trustees on a regular basis at reasonable times the management of the Fund, the performance of the Fund in relation to standard industry indices and the Fund’s own performance benchmark, and general conditions affecting the marketplace. The Sub-Adviser agrees to render to the Investment Manager such other periodic and special reports on a timely basis regarding its activities under this Agreement as the Investment Manager may reasonably request.

The Sub-Adviser agrees to cooperate with and provide reasonable assistance to the Investment Manager, the Fund, the Fund’s custodian, the Fund’s pricing agents and all other agents, representatives and service providers of the Fund and the Investment Manager, and to provide the foregoing persons such information with respect to the Fund as they may reasonably request from time to time in the performance of their obligations; provide prompt responses to reasonable requests made by such persons; and establish and maintain appropriate operational programs, procedures and interfaces with such persons so as to promote the efficient exchange of information and compliance with applicable laws, rules and regulations, and the guidelines, policies and procedures adopted or implemented with respect to the Fund.

The Sub-Adviser shall advise the Fund’s custodian and the Investment Manager on a prompt basis of each purchase and sale of a portfolio security specifying the name of the issuer, the description and amount of shares of the security purchased, the market price, commission and gross or net price, trade date, settlement date and identity of the effecting broker or dealer and such other information as may reasonably be required. The Sub-Adviser shall arrange for the transmission to the custodian and accounting agent on a daily basis such confirmation, trade tickets, and other documents and information as may be reasonably necessary to enable the custodian and accounting agent to perform their administrative and recordkeeping responsibilities with respect to the Fund. The Sub-Adviser shall, upon request, provide reasonable assistance to the Fund’s administrator or Investment Manager in determining or confirming the value of any portfolio securities or other assets of the Fund for which the administrator seeks assistance from or which the administrator identifies for review by the Sub-Adviser. From time to time as the Trustees of the Trust or the Investment Manager may reasonably request, the Sub-Adviser shall furnish to the Trust’s Trustees and officers reports on portfolio transactions and reports on issuers of securities held in the portfolio, all in such detail as the Trust or the Investment Manager may reasonably request.

B-4

In addition, the Sub-Adviser shall assist the Fund and the Investment Manager in complying with the provisions of the Sarbanes-Oxley Act of 2002 and shall, if requested, provide certifications in the form reasonably requested by the Fund relating to the Sub-Adviser’s services under this Agreement.

The Sub-Adviser shall notify the Investment Manager promptly upon detection of any breach of any of the Fund’s policies, guidelines or procedures and of any violation of any applicable law or regulation, including the 1940 Act and Subchapter M of the Internal Revenue Code, relating to the Fund’s assets under its management. The Sub-Adviser shall also notify the Investment Manager promptly upon detection of any material violations of the Sub-Adviser’s own compliance policies and procedures that relate to its management of the Fund or its activities as investment adviser generally, to the extent such violation could be considered material to the Sub-Adviser’s advisory clients.

The Sub-Adviser represents and warrants to the Investment Manager that: (a) it is registered as an investment adviser under the Advisers Act and is registered or licensed as an investment adviser under the laws of all jurisdictions in which its activities require it to be so registered or licensed; (b) it will use its reasonable best efforts to maintain each such registration or license in effect at all times during the term of this Agreement; and (c) it is duly organized and validly existing, and is authorized to enter into this Agreement and to perform its obligations hereunder. The Sub-Adviser shall promptly notify the Investment Manager and the Trust in writing of the occurrence of any of the following events: (w) any of the foregoing representations and warranties becomes untrue after the execution of this Agreement; (x) the Sub-Adviser becomes aware that it is subject to any statutory disqualification that prevents the Sub-Adviser from serving as an investment adviser pursuant to this Agreement; (y) the Sub-Adviser shall have been served or otherwise becomes aware of any action, suit, proceeding, inquiry or investigation applicable to it, at law or in equity, before or by any court, public board or body, involving the affairs of the Fund; and (z) the President or Chief Compliance Officer of the Sub-Adviser or any portfolio manager of the Fund shall have changed. The Sub-Adviser further agrees to notify the Investment Manager and the Trust promptly if any statement regarding the Sub-Adviser contained in the Trust’s Registration Statement with respect to the Fund, or any amendment or supplement thereto, becomes untrue or incomplete in any material respect.

The Sub-Adviser shall maintain errors and omission insurance coverage and fidelity insurance coverage, each in such amounts as agreed upon from time to time by the Investment Manager and the Sub-Adviser, and from insurance providers that are in the business of regularly providing insurance coverage to investment advisers. In no event shall the Sub-Adviser’s errors and omissions insurance coverage be less than $1 million or the Sub-Adviser’s fidelity insurance coverage be less than $1 million. The Sub-Adviser shall provide prior written notice to the Investment Manager (i) of any material changes in its insurance policies or insurance coverage; or (ii) if any material claims will be made on its insurance policies. Furthermore, it shall upon request provide to the Investment Manager any information it may reasonably require concerning the amount of or scope of such insurance.

The Investment Manager represents and warrants to the Sub-Adviser that: (a) it has received a copy of each of Part 1 and Part 2 of the Sub-Adviser’s Form ADV; (b) it has full corporate power and authority to enter into this Agreement (including the power and authority to

B-5

appoint the Sub-Adviser hereunder) and to carry out its terms; and (c) as of the date of this Agreement, the Fund is either (i) excluded from the definition of the term “pool” under Section 4.5 of the General Regulations under the Commodity Exchange Act (“Rule 4.5”), or (ii) a qualifying entity under Rule 4.5(b) for which a notice of eligibility has been filed.

5. Status of the Sub-Adviser. The Sub-Adviser shall be deemed to be an independent contractor and shall, unless otherwise expressly provided or authorized, have no authority to act for or represent the Investment Manager or the Fund in any way or otherwise be deemed an agent of the Investment Manager or the Fund.

Subject to the limitations set forth in the immediately following paragraph of this Section 5, the Investment Manager represents that it and the Trust understand that the Sub-Adviser now acts, shall continue to act, or may act in the future as investment adviser or investment sub-adviser to fiduciary and other managed accounts, and that the Investment Manager and the Trust have no objection to the Sub-Adviser so acting, provided that the Sub-Adviser duly performs all obligations under this Agreement.

The Investment Manager and the Trust understand that the Sub-Adviser may give advice and take action with respect to any of its other clients or for its own account which may differ from the timing or nature of action taken by the Sub-Adviser with respect to the Fund. Nothing in this Agreement imposes upon the Sub-Adviser any obligation to purchase or sell or to recommend for purchase or sale, with respect to the Fund, any security which the Sub-Adviser or its partners, officers, employees or affiliates may purchase or sell for its or their own account(s) or for the account of any other client.

6. Certain Records. The Sub-Adviser agrees to maintain, in the form and for the period required by Rule 31a-2 under the 1940 Act, all records relating to the Sub-Adviser’s services under this Agreement and the Fund’s investments made by the Sub-Adviser as are required by Section 31 under the 1940 Act, and rules and regulations thereunder, and by other applicable legal provisions, including the Advisers Act and the 1934 Act and to preserve such records for the periods and in the manner required by that Section, and those rules, regulations and legal provisions. Any records required to be maintained and preserved pursuant to the provisions of Rule 31a-1 and Rule 31a-2 promulgated under the 1940 Act which are prepared or maintained by the Sub-Adviser on behalf of the Fund are the property of the Fund and shall be surrendered promptly to the Fund or the Investment Manager on request.

The Sub-Adviser agrees that all accounts, books and other records maintained and preserved by it as required hereby shall be subject at any time, and from time to time, to such reasonable periodic, special and other examinations by the Securities and Exchange Commission, the Fund’s auditors, the Fund or any representative of the Fund, the Investment Manager, or any governmental agency or other instrumentality having regulatory authority over the Fund.

7. Reference to the Sub-Adviser. The Investment Manager and the Trust are authorized to publish and distribute any information, including but not limited to registration statements, advertising or promotional material, regarding the provision of sub-investment advisory services by the Sub-Adviser pursuant to this Agreement and to use in advertising,

B-6

publicity or otherwise the name of the Sub-Adviser, or any trade name, trademark, trade device, service mark, symbol or logo of the Sub-Adviser, without the prior written consent of the Sub-Adviser. In addition, the Investment Manager may distribute information regarding the provision of sub-investment advisory services by the Sub-Adviser to the Trust’s Board of Trustees without the prior written consent of the Sub-Adviser. The Investment Manager shall provide copies of such items to the Sub-Adviser within a reasonable time following such use, publication or distribution.