Putnam VT Multi-Cap Value Fund

Before you invest, you may wish to review the fund’s prospectus, which contains more information about the fund and its risks. You may obtain the prospectus and other information about the fund, including the statement of additional information (SAI) and most recent reports to shareholders, at no cost by visiting putnam.com/individual/annuities, calling 1-800-225-1581, or e-mailing Putnam at funddocuments@putnam.com.

The fund’s prospectus and SAI, both dated 4/30/16, are incorporated by reference into this summary prospectus.

Fund summary

Goal

Putnam VT Multi-Cap Value Fund seeks capital appreciation and, as a secondary objective, current income.

Fees and expenses

The following table describes the fees and expenses you may pay if you buy and hold shares of the fund. The fees and expenses information does not reflect insurance-related charges or expenses borne by contract holders indirectly investing in the fund. If it did, expenses would be higher.

Annual fund operating expenses

(expenses you pay each year as a percentage of the value of your investment)

| Distribution | Total annual | |||

| Management | and service | Other | fund operating | |

| Share class | fees | (12b-1) fees | expenses | expenses |

| Class IA | 0.55% | N/A | 0.22% | 0.77% |

| Class IB | 0.55% | 0.25% | 0.22% | 1.02% |

Example

The following hypothetical example is intended to help you compare the cost of investing in the fund with the cost of investing in other funds. The example does not reflect insurance-related charges or expenses. If it did, expenses would be higher. It assumes that you invest $10,000 in the fund for the time periods indicated and then redeem or hold all your shares at the end of those periods. It assumes a 5% return on your investment each year and that the fund’s operating expenses remain the same. Your actual costs may be higher or lower.

| Share class | 1 year | 3 years | 5 years | 10 years |

| Class IA | $79 | $246 | $428 | $954 |

| Class IB | $104 | $325 | $563 | $1,248 |

Portfolio turnover

The fund pays transaction-related costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or the above example, affect fund performance. The fund’s turnover rate in the most recent fiscal year was 82%.

Investments, risks, and performance

Investments

We invest mainly in common stocks of U.S. companies of any size, with a focus on value stocks. Value stocks are issued by companies that we believe are currently undervalued by the market. If we are correct and other investors ultimately recognize the value of the company, the price of its stock may rise. We may consider, among other factors, a company’s valuation, financial strength, growth potential, competitive position in its industry, projected future earnings, cash flows and dividends when deciding whether to buy or sell investments.

Risks

It is important to understand that you can lose money by investing in the fund.

The value of stocks in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including both general financial market conditions and factors related to a specific company or industry. Value stocks may fail to rebound, and the market may not favor value-style investing. These risks are generally greater for small and midsize companies.

The fund may not achieve its goal, and it is not intended to be a complete investment program. An investment in the fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

| Summary prospectus of the Trust 1 |

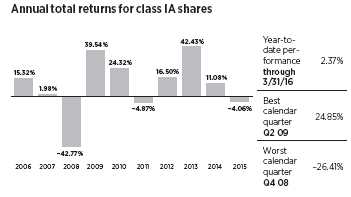

Performance

The performance information below gives some indication of the risks associated with an investment in the fund by showing the fund’s performance year to year and over time. However, prior to becoming Putnam VT Multi- Cap Value Fund on September 1, 2010, the fund (as Putnam VT Mid-Cap Value Fund) invested at least 80% of its net assets in midsize companies, and the performance information below may have differed if the fund had instead pursued a multi-cap value investment strategy during the time periods presented. The performance information does not reflect insurance-related charges or expenses. If it did, performance would be lower. Please remember that past performance is not necessarily an indication of future results.

Average annual total returns

(for periods ending 12/31/15)

| Share class | 1 year | 5 years | 10 years |

| Class IA | –4.06% | 10.96% | 6.99% |

| Class IB | –4.27% | 10.69% | 6.72% |

| Russell 3000 Value Index | |||

| (no deduction for fees or expenses) | –4.13% | 10.98% | 6.11% |

Your fund’s management

Investment advisor

Putnam Investment Management, LLC

Portfolio manager

James Polk, Portfolio Manager, portfolio manager of the fund since 2004

Purchase and sale of fund shares

Fund shares are offered to separate accounts of various insurers. The fund requires no minimum investment, but insurers may require minimum investments from those purchasing variable insurance products for which the fund is an underlying investment option. Insurers may purchase or sell shares on behalf of separate accounts by submitting an order to Putnam Retail Management any day the New York Stock Exchange (NYSE) is open. Some restrictions may apply.

Tax information

Generally, owners of variable insurance contracts are not taxed currently on income or gains realized with respect to such contracts. However, some distributions from such contracts may be taxable at ordinary income tax rates and distributions to contract owners younger than 59½ may be subject to a 10% penalty tax. For more information, please see the prospectus (or other offering document) for your variable insurance contract.

Payments to insurance companies

The fund is offered as an underlying investment option for variable insurance contracts. The fund and its related companies may make payments to the sponsoring insurance company (or its affiliates) and dealers for distribution and/or other services. These payments may create an incentive for the insurance company to include the fund, rather than another investment, as an option in its products and may create a conflict of interest for dealers in recommending the fund over another investment. The prospectus (or other offering document) for your variable insurance contract may contain additional information about these payments.

Additional information is available at putnam.com/individual/ annuities, by calling 1-800-225-1581, or by e-mailing Putnam at funddocuments@putnam.com.

| File No. 811-05346 | VTBP075 300457 4/16 |

| 2 | Summary prospectus of the Trust |