| Concorde Wealth Management Fund | ||||||||||||||||||||||||||||||||||||||||

| Concorde Wealth Management Fund | ||||||||||||||||||||||||||||||||||||||||

| Investment Objective: | ||||||||||||||||||||||||||||||||||||||||

The Concorde Wealth Management Fund (the “FUND”) seeks total return, from both appreciation of value and generation of current income, within the context of preservation of capital.

| ||||||||||||||||||||||||||||||||||||||||

| Fees and Expenses of the Fund: | ||||||||||||||||||||||||||||||||||||||||

This table describes the fees and expenses that you may pay if you buy and hold shares of the FUND:

| ||||||||||||||||||||||||||||||||||||||||

| SHAREHOLDER FEES (fees paid directly from your investment) | ||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||

| ANNUAL FUND OPERATING EXPENSES (expenses that you pay each year as a percentage of the value of your investment) | ||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||

| Example: | ||||||||||||||||||||||||||||||||||||||||

This Example is intended to help you compare the cost of investing in the FUND with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the FUND for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the FUND’s operating expenses remain the same.

| ||||||||||||||||||||||||||||||||||||||||

| Although your actual costs may be higher or lower, based on these assumptions, your costs would be: | ||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||

| Portfolio Turnover : | ||||||||||||||||||||||||||||||||||||||||

The FUND pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when FUND shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the FUND’s performance. During the most recent fiscal year, the FUND’s portfolio turnover rate was 40% of the average value of its portfolio.

| ||||||||||||||||||||||||||||||||||||||||

| Principal Investment Strategies: | ||||||||||||||||||||||||||||||||||||||||

Under normal conditions, the FUND invests primarily in a portfolio of (i) equity securities that the FUND believes are undervalued, (ii) debt securities that offer appropriate current returns that are commensurate with related risks and (iii) private equity, based on risk and return attributes as dictated by broad market and economic conditions. The FUND may invest in other investment companies or pooled vehicles that are consistent with these characteristics. Investing in both public and non-public securities, which collectively comprise the overall construction of the FUND’s holdings, is key to the core objective of total return, from both appreciation of value and generation of current income, within the context of preservation of capital. The FUND is non-diversified, which means that it may invest a significant portion of its assets in the securities of a single issuer or small number of issuers. The FUND normally invests approximately 40% to 60% of its total assets in equity securities and 40% to 60% in fixed income securities. Under normal circumstances, equity securities will represent at least 25% of total assets, and fixed income securities may represent as much as 75%, but not less than 25% of total assets. The FUND will evaluate the split between equity securities and fixed income securities on an ongoing basis to determine the appropriate split. The FUND may invest up to 15% of its assets in high-yield bonds that are below investment grade. Equity securities include domestic and foreign common and preferred stock, convertible debt securities, American Depositary Receipts (“ADRs”), Global Depository Receipts (“GDRs”), real estate investment trusts (“REITs”), royalty trusts, master limited partnerships (“MLPs”) and exchange traded funds (“ETFs”). The FUND may invest in emerging market securities. The FUND may also invest in private placements in these types of securities. The FUND may invest in securities issued by companies of any market capitalization, including small- and mid-capitalization companies. The FUND may invest up to 100% of its portfolio in the securities of these companies. In equity securities, the FUND focuses on identifying the fundamental intrinsic value of a company taken as a whole, and buying securities that are below that intrinsic value and selling when approaching or above the intrinsic value. The FUND acts to ensure that its investments in private equity fit within the context of capital preservation by applying the same intrinsic value approach to both private and public companies. The intrinsic value approach focuses on fundamental business factors such as a company’s earning power, cash flow, balance sheet, franchise or brand value, proprietary market position assets, including intellectual property, and competitive advantages which drive the long-term performance of the company. As a result, the FUND’s private equity investments could be opportunistic, in the sense of being underpriced in comparison to its intrinsic or potential upside value, or defensive, in the sense of offering favorable characteristics to current market or economic conditions (for example, inflation). In debt and fixed income securities, the FUND may invest in investment grade and non-investment grade debt securities, including non-investment grade securities (commonly called “junk bonds”), or unrated debt securities determined by Concorde Financial Corporation (the “Advisor”) to be of comparable quality. The FUND focuses on debt and bond securities that offer appropriate current returns that are commensurate with related interest rate and default risks. The FUND may also invest in private placements in these types of securities. The FUND invests in debt securities that have a maturity that is between 1 and 15 years. Under normal circumstances, the FUND’s portfolio will have an average dollar weighted maturity between 3 and 15 years and an average duration of 2 to 5 years. Duration is a measurement of price sensitivity to interest rate changes. The FUND will invest opportunistically in either equity or debt securities, and may be wholly invested in either equity or debt securities as determined by the Advisor. The type of private equity investments in which the FUND invests includes private investments in public companies, investments in private companies in need of capital, and investments in private equity companies whose principal business is to invest in, lend capital to or provide services to privately held companies. The Advisor may sell a security or reduce its position if it has reached its target price, its present reward to risk ratio is unattractive, it is overvalued, or the security subsequently fails to meet initial investment criteria.

| ||||||||||||||||||||||||||||||||||||||||

| Principal Risks: | ||||||||||||||||||||||||||||||||||||||||

As with all mutual funds, there is the risk that you could lose all or a portion of your investment in the FUND. An investment in the FUND is not a deposit in a bank and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. The following are the principal risks that could affect the value of your investment. American Depositary Receipts and Global Depository Receipts Risk. ADRs and GDRs may be subject to some of the same risks as direct investment in foreign companies, which includes international trade, currency, political, regulatory and diplomatic risks. In a sponsored ADR arrangement, the foreign issuer assumes the obligation to pay some or all of the depositary’s transaction fees. Under an unsponsored ADR arrangement, the foreign issuer assumes no obligations and the depositary’s transaction fees are paid directly by the ADR holders. Because unsponsored ADR arrangements are organized independently and without the cooperation of the issuer of the underlying securities, available information concerning the foreign issuer may not be as current as for sponsored ADRs, and voting rights with respect to the deposited securities are not passed through. GDRs can involve currency risk since, unlike ADRs, they may not be U.S. dollar-denominated. Convertible Securities Risk. A convertible security is a fixed-income security (a debt instrument or a preferred stock) which may be converted at a stated price within a specified period of time into a certain quantity of the common stock of the same or a different issuer. Convertible securities are senior to common stock in an issuer’s capital structure, but they are subordinated to any senior debt securities. While providing a fixed-income stream (generally higher in yield than the income derivable from common stock but lower than that afforded by a similar non-convertible security), a convertible security also gives an investor the opportunity, through its conversion feature, to participate in the capital appreciation of the issuing company depending upon a market price advance in the convertible security’s underlying common stock. Debt/Fixed Income Securities Risk. An increase in interest rates typically causes a fall in the value of the debt securities in which the FUND may invest. The value of your investment in the FUND may change in response to changes in the credit ratings of the FUND’s portfolio of debt securities. Interest rates in the United States are at, or near, historic lows, which may increase the Fund’s exposure to risks associated with rising interest rates. Moreover, rising interest rates or lack of market participants may lead to decreased liquidity in the bond and loan markets, making it more difficult for the FUND to sell its holdings at a time when the FUND’s manager might wish to sell. Lower rated securities (“junk bonds”) are generally subject to greater risk of loss of your money than higher rated securities. Debt securities are also subject to prepayment risk when interest rates decrease. Prepayment risk is the risk that the borrower will prepay some or all of the principal owed to the issuer. If prepayment occurs, the FUND may have to replace the security by investing the proceeds in a less attractive security. Emerging Markets Risk. The FUND may invest in emerging markets, which may carry more risk than investing in developed foreign markets. Risks associated with investing in emerging markets include limited information about companies in these countries, greater political and economic uncertainties compared to developed foreign markets, underdeveloped securities markets and legal systems, potentially high inflation rates, and the influence of foreign governments over the private sector. Equity and General Market Risk. Common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value. The stock market may experience declines or stocks in the FUND’s portfolio may not meet the financial expectations of the FUND or other market participants. The FUND’s net asset value (“NAV”) and investment return will fluctuate based upon changes in the value of its portfolio securities. Exchange Traded Fund Risk. ETFs may trade at a discount to the aggregate value of the underlying securities and although expense ratios for ETFs are generally low, frequent trading of ETFs by the FUND can generate brokerage expenses. Shareholders of the FUND will indirectly be subject to the fees and expenses of the individual ETFs in which the FUND invests, in addition to the FUND’s own fees and expenses. Foreign Securities Risk. The FUND may invest in foreign securities and, if so, it will be subject to risks associated with foreign markets, such as adverse political, currency, social and economic developments; accounting standards or governmental supervision that are not consistent with that to which U.S. companies are subject; limited information about foreign companies; less liquidity in foreign markets; and less protection. High Yield Risk. The FUND’s investment program permits it to invest in non-investment grade debt obligations, sometimes referred to as “junk bonds” (hereinafter referred to as “lower-quality securities”). Lower-quality securities are those securities that are rated lower than investment grade and unrated securities believed by the Advisor to be of comparable quality. Although these securities generally offer higher yields than investment grade securities with similar maturities, lower-quality securities involve greater risks, including the possibility of default or bankruptcy. In general, they are regarded to be more speculative with respect to the issuer’s capacity to pay interest and repay principal. Investments in Other Investment Companies Risk. Shareholders of the FUND will indirectly be subject to the fees and expenses of the other investment companies in which the FUND invests and these fees and expenses are in addition to the fees and expenses that FUND shareholders directly bear in connection with the FUND’s own operations. In addition, shareholders will be exposed to the investment risks associated with investments in other investment companies. Liquidity Risk. Certain securities held by the FUND may be difficult (or impossible) to sell at the time and at the price the FUND would like. As a result, the FUND may have to hold these securities longer than it would like and may forego other investment opportunities. There is the possibility that the FUND may lose money or be prevented from realizing capital gains if it cannot sell a security at a particular time and price. Master Limited Partnership Risk. Securities of MLPs are listed and traded on U.S. securities exchanges. The value of an MLP fluctuates based predominately on its financial performance, as well as changes in overall market conditions. Investments in MLPs involve risks that differ from investments in common stocks, including risks related to the fact that investors have limited control of and limited rights to vote on matters affecting the MLP; risks related to potential conflicts of interest between the MLP and the MLP’s general partner; cash flow risks; dilution risks; and risks related to the general partner’s right to require investors to sell their holdings at an undesirable time or price. In addition, MLPs may be subject to state taxation in certain jurisdictions, which may reduce the amount of income an MLP pays to its investors. The securities of certain MLPs may trade in lower volumes due to their smaller capitalizations and may be subject to more abrupt or erratic price movements and lower market liquidity. MLPs are generally considered interest-rate sensitive investments. During periods of interest rate volatility, these investments may not provide attractive returns. In addition, if the tax treatment of an MLP changes, the FUND’s after-tax return from its MLP investment would be materially reduced. Non-Diversification Risk. Because the FUND is non-diversified (meaning that compared to diversified mutual funds, the FUND may invest a greater percentage of its assets in a particular issuer), the FUND’s shares may be more susceptible to adverse changes in the value of a particular security than would be the shares of a diversified mutual fund. Thus, the FUND is more sensitive to economic, business and political changes which may result in greater price fluctuations of the FUND’s shares. Private Equity Risk. The sale or transfer of private equity investments may be limited or prohibited by contract or law. Private equity securities are generally fair valued as they are not traded frequently. The FUND may be required to hold such positions for several years, if not longer, regardless of valuation, which may cause the FUND to be less liquid. Private Placement Risk. The FUND may invest in privately issued securities of domestic common and preferred stock, convertible debt securities, ADRs and REITs, including those which may be resold only in accordance with Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”). Privately issued securities are restricted securities that are not publicly traded. Delay or difficulty in selling such securities may result in a loss to the FUND. Privately issued securities and other restricted securities will have the effect of increasing the level of FUND illiquidity to the extent that the FUND finds it difficult to sell these securities when the Advisor believes it is desirable to do so, especially under adverse market or economic conditions or in the event of adverse changes in the financial condition of the issuer, and the prices realized could be less than those originally paid or less than the fair market value. At times, the illiquidity of the market, as well as the lack of publicly available information regarding these securities also may make it difficult to determine the fair value of such securities for purposes of computing the net asset value of the FUND. Real Estate Investment Trust and Real Estate Risk. The value of the FUND’s investments in REITs may change in response to changes in the real estate market such as declines in the value of real estate, lack of available capital or financing opportunities, and increases in property taxes or operating costs. Royalty Trust Risk. Royalty trusts are subject to cash-flow fluctuations and revenue decreases due to a sustained decline in demand for crude oil, natural gas and refined petroleum products, risks related to economic conditions, higher taxes or other regulatory actions that increase costs for royalty trusts. Furthermore, royalty trusts do not guarantee minimum distributions or even return of capital. If the assets underlying a royalty trust do not perform as expected, the royalty trust may reduce or even eliminate distributions. The declaration of such distributions generally depends upon various factors, including operating performance and financial condition of the royalty trust and general economic conditions. Security Selection Risk. The Advisor may misjudge the risk and/or return potential of a security. This misjudgment can result in a loss or a significant deviation relative to its benchmarks. Smaller and Medium Capitalization Company Risk. Securities of smaller and medium-sized companies may be more volatile and more difficult to liquidate during market downturns than securities of larger companies. Additionally the price of smaller companies may decline more in response to selling pressures. Style Risk. The Advisor follows an investing style that favors value investments. The value investing style may, over time, go in and out of favor. At times when the value investing style is out of favor, the FUND may underperform other funds that use different investing styles. Investors should be prepared to tolerate volatility in FUND returns. The FUND is a suitable investment only for those investors who have long-term investment goals. Prospective investors who are uncomfortable with an investment that will fluctuate in value should not invest in the FUND.

| ||||||||||||||||||||||||||||||||||||||||

| Performance: | ||||||||||||||||||||||||||||||||||||||||

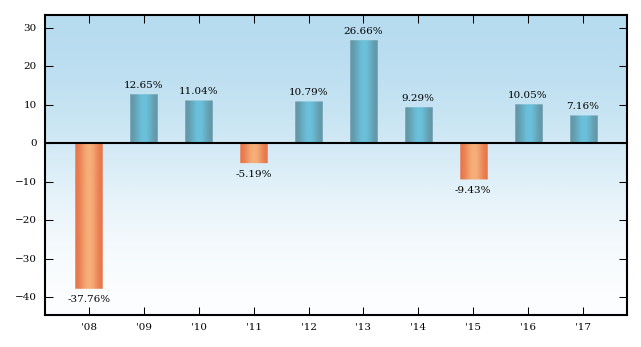

The following bar chart and performance table provide some indication of the risks of investing in the FUND by showing changes in the FUND’s performance from year to year and by showing how the FUND’s average annual returns for 1, 5 and 10 years compare with those of a broad measure of market performance, as well as additional indices whose compositions are comparable to the FUND’s holdings. The FUND’s past performance (before and after taxes) is not necessarily an indication of how the FUND will perform in the future. Pursuant to a Plan of Acquisition and Liquidation between the FUND and the Concorde Value Fund (the “Predecessor Fund”), the FUND acquired all of the assets and liabilities of the Predecessor Fund in exchange for shares of the FUND after the close of business on July 22, 2016 (the “Reorganization”). As a result of the Reorganization, the FUND is the accounting successor of the Predecessor Fund. The historical performance information shown below reflects, for the period prior to the Reorganization, the performance of the Predecessor Fund, and has not been restated to reflect any differences in the expenses of the Predecessor Fund. Historical performance of the FUND may have been different if its current investment objective and principal investment strategies had been in place prior to the Reorganization. The returns of the Predecessor Fund should not be considered predictive or representative of results the FUND may experience under its current investment objective and, principal investment strategies.

| ||||||||||||||||||||||||||||||||||||||||

| Calendar Year Total Returns as of 12/31 | ||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||

During the 10-year period shown on the bar chart, the FUND’s highest total return for a quarter was 15.33% (quarter ended June 30, 2009) and the lowest total return for a quarter was -22.51% (quarter ended December 31, 2008).

| ||||||||||||||||||||||||||||||||||||||||

| Average Annual Total Returns (for the period ended December 31, 2017) | ||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||

The after-tax returns are calculated using the historical highest individual federal stated income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and the after-tax returns shown are not relevant to investors who hold their FUND shares through tax deferred arrangements, such as 401(k) plans or individual retirement accounts. The FUND’s returns after taxes on distributions and sale of fund shares may be higher than the other return figures for the same period due to a tax benefit of realizing a capital loss upon the sale of FUND shares. The Concorde Wealth Management Blended Index consists of 45% equities represented by the Russell 1000 Value Index, 45% bonds represented by the Bloomberg Barclays Intermediate Aggregate Bond Index, 5% short-term investments represented by Bank of America Merrill Lynch 1-3 Year Treasuries, and 5% commodities represented by Bloomberg Barclays U.S. Treasury Inflation Protection Security. The Russell 1000 Value Index measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. The Bloomberg Barclays U.S. Aggregate Bond Index measures the investment grade, U.S. dollar denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage backed securities (agency fixed-rate and hybrid ARM pass throughs), asset-backed securities, and commercial mortgage-backed securities. The Russell 1000 Value Index is replacing the Russell 3000 Index because the FUND believes that this index better reflects the FUND’s holdings for comparison reasons. One cannot invest directly in an index.

| ||||||||||||||||||||||||||||||||||||||||